Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ONVIA INC | d519264d8k.htm |

Exhibit 10.1

MEDICAL DENTAL BUILDING

FIRST AMENDMENT TO LEASE

Onvia, Inc.

THIS FIRST AMENDMENT TO LEASE AGREEMENT (this “Amendment”) is made effective as of the 4th of April, 2013 (the “Effective Date”) between GRE 509 OLIVE LLC, a Washington limited liability company (“Landlord”), and ONVIA, INC., a Delaware corporation (“Tenant”), with reference to the following:

RECITALS

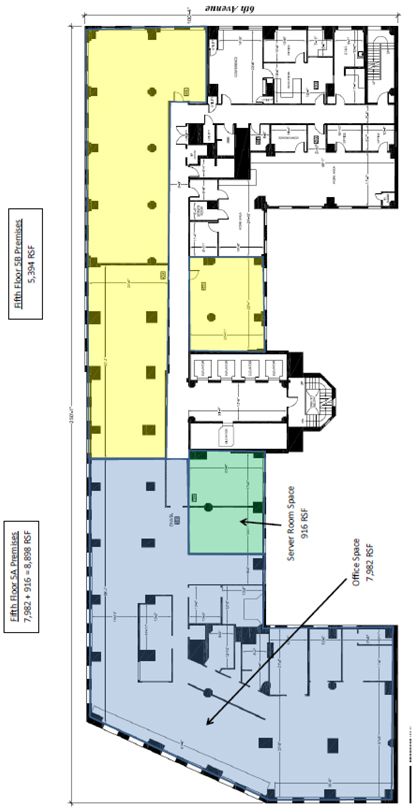

A. Landlord and Tenant are the parties to that certain Lease dated July 31, 2007, with all addenda, exhibits, and amendments thereto (collectively, the “Original Lease”) demising certain premises (the “Premises”) commonly known as Suites 400 and 501 on the Fourth and Fifth Floors, respectively, of the Building commonly known as the Medical Dental Building, having a street address of 509 Olive Way, Seattle, King County, Washington, which Premises contain (i) 20,708 rentable square feet (“RSF”) on the Fourth Floor (the “Fourth Floor Premises”), plus (ii) 8,898 RSF on the Fifth Floor as depicted on Exhibit “A” attached hereto (the “Fifth Floor 5A Premises”), plus (iii) 5,394 RSF also on the Fifth Floor as depicted on Exhibit “A” attached hereto (the “Fifth Floor 5B Premises”), for a total of 35,000 RSF of space, all of which is located on real property more particularly described in the Original Lease.

B. The parties now wish to amend the Original Lease set forth hereinbelow, effective as of the Effective Date set forth above. The Original Lease, as amended hereby, is collectively referred to as the “Lease.”

C. Capitalized terms used herein shall have their meanings set forth in the Original Lease, except as otherwise defined herein.

Accordingly, in consideration of the foregoing and the mutual covenants herein contained, it is hereby agreed as follows:

AGREEMENT

1. Recitals. The foregoing recitals are incorporated herewith as if fully set forth herein.

2. Extension of Initial Term. The original Expiration Date of the Lease is November 30, 2015. The Initial Term of the Lease is hereby extended for an additional period of sixty-five (65) months, so that the new Expiration Date shall be April 30, 2021.

3. Reduction in Premises Area. Effective as of the date that is thirty (30) days after mutual execution of this Amendment (the “First Reduction Date”), the Premises area shall be decreased to constitute only the Fourth Floor Premises (20,708 RSF) and the Fifth Floor 5A Premises (8,898 RSF), for a total of 29,606 RSF, and Tenant shall surrender and return to Landlord the Fifth Floor 5B Premises (5,394 RSF) in its current “as-is” condition, broom clean, and with all of Tenant’s furniture, trade fixtures, and equipment removed therefrom. Landlord shall install at its sole cost a Building-standard demising wall required to separate the Fifth Floor 5B Premises from the remaining Fifth Floor 5A Premises within sixty (60) days after the First Reduction Date.

-1-

4. Revised Minimum Monthly Rent.

a. Monthly Rent as to the entire original Premises shall be abated in full during the month of January 2013.

b. Notwithstanding the surrender and vacation of the Fifth Floor 5B Premises and the occurrence of the First Reduction Date, Tenant shall continue to be responsible for Minimum Monthly Rent and all Additional Rent as to the Fifth Floor 5B Premises through June 30, 2013.

c. On and after January 1, 2013, and for the remainder of the Initial Term, the Minimum Monthly Rent payable by Tenant as to the remaining Premises is hereby revised as follows:

| Period |

Premises Area (RSF) |

Annual Minimum Rental Rate Per RSF |

Minimum Monthly Rent |

|||||||||

| 1/1/13 – 1/31/13* |

35,000 | Abated | Abated | |||||||||

| 2/1/13 – 6/30/13 |

35,000 | $ | 26.50 | $ | 77,291.67 | |||||||

| 7/1/13 – 12/31/13 |

29,606 | $ | 26.50 | $ | 65,379.92 | |||||||

| 1/1/14 – 1/31/14* |

29,606 | Abated | Abated | |||||||||

| 2/1/14 – 12/31/14 |

29,606 | $ | 27.25 | $ | 67,230.29 | |||||||

| 1/1/15 – 1/31/15* |

29,606 | Abated | Abated | |||||||||

| 2/1/15 – 12/31/15 |

29,606 | $ | 28.00 | $ | 69,080.67 | |||||||

| 1/1/16 – 1/31/16* |

29,606 | Abated | Abated | |||||||||

| 2/1/16 – 12/31/16 |

29,606 | $ | 28.75 | $ | 70,931.04 | |||||||

| 1/1/17 – 12/31/17 |

29,606 | $ | 29.50 | $ | 72,781.42 | |||||||

| 1/1/18 – 12/31/18 |

29,606 | $ | 30.25 | $ | 74,631.79 | |||||||

| 1/1/19 – 12/31/19 |

29,606 | $ | 31.00 | $ | 76,482.17 | |||||||

| 1/1/20 – 12/31/20 |

29,606 | $ | 31.75 | $ | 78,332.54 | |||||||

| 1/1/21 – 4/30/21 |

29,606 | $ | 32.50 | $ | 80,182.92 | |||||||

Any payments received in excess of the payment schedule above shall remain on Tenants account as a credit and shall be applied to future charges as they become due.

* These months, along with the month of January 2013, are hereinafter referred to as “Rent Abatement Months.”

5. Tenant’s Pro Rata Share. On and after the First Reduction Date, Tenant’s Pro Rata Share defined in Paragraph H of the Basic Lease Provisions shall be decreased to 10.1%.

6. Base Year. Tenant’s Base Year shall, as of the Effective Date, be revised to be calendar year 2013.

7. Space Reduction Option. Provided that Tenant is not in default beyond applicable notice and cure periods at the time of Tenant’s exercise notice described below, Tenant shall have an ongoing one-time right to further reduce the Premises area by giving back all or a portion of the Fifth Floor 5A Premises (8,898 RSF) (the “Reduction Option” or “Reduction Premises”). If Tenant is not giving back all of the Fifth Floor 5A Premises, excluding the existing server room as described below, the Reduction Premises will be in a location that is reasonably acceptable to both Tenant and Landlord and such location that Landlord can separately demise from the premises at its sole cost. The effective date thereof (the “Second Reduction Date”) shall be a date selected by Tenant that is on or after November 30, 2015. Tenant may exercise its Reduction Option by delivering to Landlord written notice of Tenant’s intention to exercise such option at least twelve (12) months prior to Tenant’s proposed Second Reduction Date.

-2-

Tenant’s exercise notice shall set forth the Second Reduction Date, and Tenant shall include therewith an amount (the “Second Reduction Fee”) equal to the unamortized amount as of the Second Reduction Date of the sum of (i) brokerage commissions paid or incurred by Landlord in connection with this Amendment attributable to the Reduction Premises (amortization period calculated from December 1, 2015 – April 30, 2021), (ii) the Refurbishment Allowance paid or incurred by Landlord prorated to the Reduction Premises (amortization period calculated from December 1, 2015 – April 30, 2021), and (iii) all abated Rent applicable to the Reduction Premises for the Rent Abatement Months that would have been payable had Minimum Rent been charged during such months at the rates in effect for the remainder of each applicable term; all of which costs shall be amortized at 0.0% interest over the remainder of the Initial Term from the date of each abated month. By example; if Tenant, exercises Tenant’s Space Reduction Option and gives up 7,982 RSF effective December 31, 2017, and has used the full Refurbishment Allowance, Tenant will pay a Second Reduction Fee equal to $100,491.10. Effective on the Second Reduction Date, the Premises area shall be decreased to constitute the Fourth Floor Premises (20,708 RSF), and Tenant shall surrender and return to Landlord all or a portion of the Fifth Floor 5A Premises (8,898 RSF) in its then-current “as-is” condition, broom clean, and with all of Tenant’s furniture, trade fixtures, and equipment removed therefrom. On and after the Second Reduction Date, appropriate changes shall be made to the Revised Minimum Monthly Rent and Tenant’s Pro Rata Share to reflect the new Premises Area (RSF) and Minimum Monthly Rent. Tenant’s Reduction Option shall automatically become null and void upon the earlier to occur of: (1) the occurrence of any uncured event of default by Tenant of any monetary obligation hereunder, (2) the termination of Tenant’s right to possession of the Premises due to any uncured default by Tenant under the Lease, (3) the failure of Tenant to timely or properly exercise its Reduction Option as aforesaid, (4) any expansion in the size of the Premises, or (5) any further extension or renewal of the Term hereof. Notwithstanding anything herein to the contrary, Tenant shall be entitled to exclude from the Reduction Premises the existing server room (approximately 916 RSF) located in its current location on the Fifth Floor 5A Premises and shall have the right to continue to lease and access via a multi-tenant common area corridor the server room through the remaining term at the same Annual Minimum Rental Rate per RSF established under the Revised Minimum Monthly Rent schedule set forth in Section 4(c) above.

8. Extension Option. Tenant shall retain its Option to Extend under Section 3.2 and 3.3 of the Original Lease.

9. Tenant’s Early Termination Option. Notwithstanding anything to the contrary herein or in the Original Lease, during the Initial Term only, provided Tenant is not, at the time of notice or the time of early termination, in material default beyond applicable notice and cure periods of this Lease, and provided further that all or substantially all of the equity or ownership interests in the entity constituting Tenant or all or substantially all of the assets of Tenant are sold or otherwise transferred to or acquired by a third party (the “Successor”), and such Successor thereafter elects not to maintain any office or other physical presence in the Seattle-Bellevue area, Tenant or the Successor (as applicable) shall have a one-time right (the “Early Termination Option”) to terminate this Lease in its entirety early, effective as of a date chosen by Tenant that is at least twelve (12) months after the date of Tenant’s exercise notice described below (the “Early Termination Date”); provided further that in no event may the Early Termination Date occur earlier than December 1, 2017. Tenant’s exercise notice shall specify the Early Termination Date and shall provide evidence reasonably acceptable to Landlord establishing that the requirements in the first sentence of this paragraph have been met. Within thirty (30) days after the date of Tenant’s exercise notice, Tenant shall pay to Landlord an amount (the “Early Termination Fee”) equal to the greater of (x) seventy percent (70%) of the NPV (discounted at an annual rate of 8.0%) of the Minimum Rent otherwise due and payable from Tenant for the remainder of the Initial Term (by example; if Tenant occupies 29,606 RSF and the Early Termination Date is December 31, 2018 Tenant shall pay an Early Termination Fee equal to $1,395,000), or (y) Minimum Rent otherwise due and payable from Tenant during the final twelve (12) calendar months of the Initial Term (by example; if Tenant occupies

-3-

29,606 RSF a fee equal to $947,392). If Tenant elects to terminate this Lease early as provided herein, the Early Termination Date shall operate as if that date were the time originally fixed for the expiration or termination of this Lease and this Lease shall come to an end with the same force and effect as if such Early Termination Date were the date herein provided for the normal expiration hereof. Further, all provisions of this Lease that are to become effective on the termination of this Lease shall become operative or effective on the Early Termination Date. Tenant’s Early Termination Option shall automatically become null and void upon the earlier to occur of: (1) the occurrence of any uncured event of default by Tenant of any monetary obligation hereunder, (2) the termination of Tenant’s right to possession of the Premises due to any uncured default by Tenant under the Lease, (3) any assignment or transfer, by operation of law or otherwise, of any of Tenant’s interest in this Lease, or any subletting by Tenant of all or any portion of the Premises other than to a Permitted Transferee as defined in Article 19 of the Original Lease, (4) the failure of Tenant to timely or properly exercise its Early Termination Option as aforesaid, (5) any expansion in the size of the Premises, or (6) any extension or renewal of the Term hereof. The Early Termination Option is personal to the originally-named Tenant hereunder and may not be exercised or be assigned, voluntarily or involuntarily, by or to any person or entity other than such Tenant or a Permitted Transferee in connection with an assignment of Tenant’s entire interest in the Lease, and is not assignable separate and apart from this Lease.

10. Refurbishment Allowance. Landlord shall pay to Tenant a “Refurbishment Allowance” of $7.50 per RSF of the Premises then being leased by Tenant, to be used by Tenant for costs associated with Tenant Changes (as such term is defined in Paragraph 8.3 of the Original Lease) made to the Premises on or after December 1, 2015 (including but not limited to costs associated with preparation of applicable plans and drawings, architectural and engineering fees, hard and soft costs of construction, project management fees, permits, governmental fees and inspections, WSST, and preparation of as-built record documentation. If Tenant is not then in uncured default under this Lease, Landlord shall reimburse the Refurbishment Allowance within fifteen (15) days after the request of Tenant, not requested more frequently than monthly, provided that Tenant has: (i) constructed such Tenant Changes in substantial accordance with mutually-approved plans, specifications, and drawings, (ii) furnished Landlord an affidavit from Tenant listing all contractors, subcontractors and suppliers whom Tenant has contracted with in connection with the Tenant Changes, (iii) fully paid for all of the Tenant Changes and provided a certificate from an officer of Tenant stating same and setting forth the total amount that was spent thereon, and (iv) furnished Landlord original, valid, unconditional mechanic’s lien release from Tenant’s general contractor and as reasonably requested by Landlord for other subcontractors and suppliers who performed work or furnished supplies for or in connection with the Tenant Changes. Any unused portion of the Refurbishment Allowance remaining after March 1, 2016 may be applied at Tenant’s discretion toward Rent thereafter coming due under the Lease. Tenant hereby waives any right to use any remaining unused portion of the Tenant Allowance described in Paragraph 7 of Exhibit “C” to the Original Lease.

11. Adjustments to Letter of Credit Amount. Pursuant to Paragraph 11.1 of the Original Lease, Tenant has supplied to Landlord a Letter of Credit in the amount of $89,678.30. Within three (3) business days after mutual execution hereof, Tenant shall deposit with Landlord a new Letter of Credit in the amount $100,000, which amount shall be subject to further increases on the dates set forth below:

| Date |

Required Letter of Credit Amount |

|||

| Five (5) business days after mutual execution of the First Amendment |

$ | 100,000 | ||

| 1/1/14 |

$ | 125,000 | ||

| 1/1/15 |

$ | 150,000 | ||

-4-

12. Amendment to Parking. Paragraph S of the Basic Lease Provisions in the Original Lease is hereby deleted in its entirety and replaced by the following:

| S. | Parking: | Tenant shall have the ongoing right, but not the obligation, to obtain up to twenty-six (26) unreserved monthly parking space permits in the underground parking garage serving the Building. Tenant shall pay market rates then being charged by the operator thereof and all taxes applicable thereto for each such monthly parking permit thus obtained by it. |

13. Termination of ROFO Rights. As of the Effective Date, Tenant’s ROFO rights set forth in Paragraph 1.5 of the Original Lease are hereby deleted in their entirety and shall have no further or effect.

14. Miscellaneous.

a. Brokers. Landlord and Tenant each represents and warrants to the other that it has not had any dealings with any realtors, brokers or agents in connection with the negotiation of this Amendment, except that Mark Fox and Doug Hanafin of Washington Partners, Inc., represented Tenant in connection with this Amendment and Goodman Real Estate, Inc., represented Landlord in connection with this Amendment (collectively, the “Brokers”) and each party agrees to hold the other harmless from the failure to pay any realtors, brokers or agents (other than the Brokers) and from any cost, expense or liability for any compensation, commission or changes claimed by any other realtors, brokers or agents (other than the Brokers) claiming by, through or on behalf of it with respect to this Amendment and/or the negotiation hereof. Landlord shall pay a leasing commission to Washington Partners, Inc., in connection with this Amendment pursuant to a separate written commission agreement.

b. Full Force and Effect. Except as expressly amended herein, the Lease is unmodified and remains in full force and effect.

c. Status of Lease. As of the date hereof, Tenant acknowledges and agrees that Landlord has performed all obligations required of Landlord under the Lease and that there are no offsets, counterclaims or defenses of Tenant existing against Landlord. Tenant further acknowledges and agrees that no events have occurred that, with the passage of time or the giving of notice, or both, would constitute a basis for an offset, counterclaim, or defense against Landlord, and that the Lease is in full force and effect. Tenant hereby confirms that all alterations, additions and improvements required to be performed by Landlord pursuant to the Lease have been performed by Landlord and were accepted by Tenant.

d. Counterparts. This Amendment may be executed in counterparts, each of which, when combined, shall constitute one single, binding agreement.

[SIGNATURES ON NEXT PAGE]

-5-

IN WITNESS WHEREOF, the parties hereto have executed this Amendment the day and year first above written.

| LANDLORD: | ||

| GRE 509 OLIVE LLC, a Washington limited liability company | ||

| By: | /s/ Kelli Jo Norris | |

| Name: | Kelli Jo Norris | |

| Its: | Authorized Signatory | |

| TENANT: | ||

| ONVIA, INC., a Delaware corporation | ||

| By: | /s/ Cameron S. Way | |

| Name: | Cameron S. Way | |

| Its: | Chief Financial Officer | |

-6-

| STATE OF WASHINGTON | ||||

| ss. | ||||

| COUNTY OF KING |

I certify that I know or have satisfactory evidence that is the person who appeared before me, and said person acknowledged that said person signed this instrument, on oath stated that said person was authorized to execute the instrument and acknowledged it as the of GRE 509 OLIVE LLC, a Washington limited liability company, to be the free and voluntary act of such limited liability company for the uses and purposes mentioned in the instrument.

Dated this day of , 2013.

|

| ||

| (Signature of Notary) | ||

|

| ||

| (Legibly Print or Stamp Name of Notary) | ||

| Notary public in and for the state of Washington, residing at | ||

| My appointment expires | ||

| STATE OF WASHINGTON | ||||

| ss. | ||||

| COUNTY OF KING |

I certify that I know or have satisfactory evidence that is the person who appeared before me, and said person acknowledged that said person signed this instrument, on oath stated that said person was authorized to execute the instrument and acknowledged it as the of ONVIA, INC., a Delaware corporation, to be the free and voluntary act of such corporation for the uses and purposes mentioned in the instrument.

Dated this day of , 2013.

|

| ||

| (Signature of Notary) | ||

|

| ||

| (Legibly Print or Stamp Name of Notary) | ||

| Notary public in and for the state of Washington, residing at | ||

| My appointment expires | ||

-7-

EXHIBIT A

SPACE PLAN FOR THE FIFTH FLOOR

EXHIBIT A