Attached files

| file | filename |

|---|---|

| EX-32.2 - SECTION 906 CERT - CAMERON WAY - ONVIA INC | way906cert.htm |

| EX-31.2 - SECTION 302 CERT - CAMERON WAY - ONVIA INC | way302cert.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCTG FIRM - ONVIA INC | consent2009.htm |

| EX-31.1 - SECTION 302 CERT - MIKE PICKETT - ONVIA INC | pickett302cert.htm |

| EX-32.1 - SECTION 906 CERT - MIKE PICKETT - ONVIA INC | pickett906cert.htm |

| EX-10.11 - SEPARATION AGREEMENT - MIKE TANNOURJI - ONVIA INC | miketseparation.htm |

| EX-10.12 - 2010 VARIABLE COMP PLAN - IRV ALPERT - ONVIA INC | alpert2010incentive.htm |

| EX-10.13 - 2010 VARIABLE COMP PLAN - MICHAEL BALSAM - ONVIA INC | balsam2010incentive.htm |

| EX-10.10 - 2010 MANAGEMENT INCENTIVE PLAN - ONVIA INC | mip2010.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2009

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number 000-29609

ONVIA, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

91-1859172

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

509 Olive Way, Suite 400, Seattle, Washington 98101

(Address of Principal Executive Offices)

(206) 282-5170

(Registrant’s Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of exchange on which registered

|

|

|

Common Stock, $.0001 par value per share

|

The NASDAQ Capital Market

|

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant, based on the closing price on June 30, 2009, as reported on the NASDAQ Capital Market, was $29,514,978.

The number of shares of the registrant’s common stock outstanding at March 1, 2010 was 8,283,270.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement related to its 2010 annual stockholders’ meeting to be filed subsequently are incorporated by reference into Part III of this Form 10-K

ONVIA, INC.

FORM 10-K

For the Year Ended December 31, 2009

INDEX

|

PAGE

|

||

|

PART 1.

|

||

|

ITEM 1.

|

BUSINESS

|

1

|

|

ITEM 1A.

|

RISK FACTORS

|

8

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

13

|

|

ITEM 2.

|

PROPERTIES

|

13

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

14

|

|

ITEM.4.

|

REMOVED AND RESERVED

|

|

|

PART II.

|

||

|

ITEM 5.

|

MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

16

|

|

ITEM 6.

|

SELECTED CONSOLIDATED FINANCIAL DATA

|

19

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

20

|

|

ITEM 7A.

|

QUANTITIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

28

|

|

ITEM 8.

|

CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

30

|

|

CONSOLIDATED BALANCE SHEETS

|

30

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) / INCOME

|

31

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

32

|

|

|

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

|

33

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

34

|

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

47

|

|

ITEM 9A(T).

|

CONTROLS AND PROCEDURES

|

47

|

|

ITEM 9B.

|

OTHER INFORMATION

|

48

|

|

PART III.

|

||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

49

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

49

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

49

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

49

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

49

|

|

PART IV.

|

||

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

50

|

|

SIGNATURES

|

52

|

PART I

CAUTIONARY STATEMENT

In addition to the historical information contained herein, the discussion and analysis in this report contains forward-looking statements. When used in this discussion, the words “believes,” “anticipates,” “may,” “will,” “should,” “expects,” “plans,” “estimates,” “predicts,” “potential,” “continue,” “intends” or the negative of these and similar expressions are intended to identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements include, but are not limited to, statements about our plans, objectives, expectations and intentions and are subject to risks and uncertainties that could cause actual results to differ materially from those expected or implied by these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the factors described under “Risk Factors” and elsewhere in this report. Onvia undertakes no obligation to publicly release any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of anticipated events. Readers are urged, however, to review the factors and risks described in reports Onvia files from time to time with the Securities and Exchange Commission.

In this report, we rely on and refer to information and statistics regarding the markets for various products. We obtained this information from third-party sources, discussions with our customers and our own estimates. We believe that these third-party sources are reliable, but we have not independently verified them and there can be no assurance that they are accurate.

|

ITEM 1.

|

BUSINESS

|

In this report, the words “we,” “our,” “us,” “Onvia,” or the “Company” refer to Onvia, Inc. and its wholly owned subsidiary.

Company Overview

We are a leading provider of gBusiness information products and research tools that help companies plan, market and sell to targeted markets throughout the United States, or U.S. The gBusiness market is defined as the market funded by federal, state and local government spending. Our products and research tools focus on federal, state, local and educational purchasing entities, and on early stage commercial and residential infrastructure projects. Our information helps clients proactively track what government agencies plan to purchase, what they actually purchase, and who they purchase from. This allows our clients to identify new market opportunities, analyze market trends, and obtain useful information about their competitors. Historically, comprehensive market intelligence was only available to large companies with the resources to perform the research and store the data themselves, or companies that could afford to hire outside firms to perform the research for them. Our processes, which collect and organize transactional information into actionable market intelligence, have enabled us to make the same high-value sales intelligence affordable to businesses of all sizes. We believe our business solutions provide our clients with a distinct competitive advantage.

Our information products and research tools leverage our database, which has been compiled over the last ten years, and includes comprehensive, historical and real-time information on public and private infrastructure activities unavailable elsewhere in the marketplace. Our database provides information on approximately 5 million procurement related records connected to over 275,000 companies from across approximately 89,000 government agencies and purchasing offices nationwide. Thousands of records are added, formatted and classified within our database each day.

Transparency and open government initiatives continue to be a key topic for federal, state and local officials. In response to this market demand, we launched Recovery.org to provide visibility into how federal funds distributed under the American Recovery and Reinvestment Act (“the Recovery Act”) are flowing into local communities. By the end of December 2009, Recovery.org was tracking more than 57,000 projects and an aggregate of $181 billion in government stimulus spending. Recovery.org also attracted the attention of major business media during the year, including National Public Radio, CNN, BusinessWeek, Bloomberg and USA Today. Our Recovery.org website and the recognition of major business media outlets have enhanced our position as an authoritative source for government spending analytics.

1

Most of our revenues are currently generated from three main business channels: subscriptions, content licenses, and management reports. Subscription-based services are typically prepaid, have a minimum term of one year and revenues are recognized ratably over the term of the subscription. Subscriptions are priced based upon the geographic range, nature of content purchased and, with respect to certain products, the number of users or number of records purchased.

Revenue from content licenses is generated from clients who resell our business content data to their customers. Content license contracts are generally multi-year arrangements that are invoiced on a monthly or quarterly basis, and these agreements typically have a higher annual contract value, or ACV, than our subscription-based services. ACV represents the aggregate annual contract value of our client base. Revenue from content license agreements is recognized ratably over the term of the agreement.

Revenue from the sale of management information reports is recognized upon delivery of the report to the client, or, if report refreshes are included, ratably over the service period. Pricing for management information reports is generally based on one, or a combination of, the following: the number of records included in the report; the geographic range of the report; or a flat fee based on the type of report. We also generate revenue from document download services and list rental services, and these fees are recognized upon delivery of the document or list.

Onvia was incorporated in January 2000 in the state of Delaware. Our principal corporate office is located in Seattle, Washington. On April 30, 2009, we transferred our securities from The NASDAQ Global Market to The NASDAQ Capital Market. Our securities continue to trade under the symbol ONVI.

Industry Background

Since early 2009, government spending on goods and services has accelerated dramatically and now represents over 40% of the GDP of the United States. Government spending on goods and services, or gBusiness, is one area of the economy that continues to see growth, and we believe this growth will continue for the foreseeable future. Government is increasingly involved in business through spending, legislation, regulation, and public-private partnerships. The gBusiness marketplace exceeds $5 trillion in government expenditures annually, and continues to grow as the federal government becomes more involved in industries like energy, manufacturing, financial services and healthcare, among others. Traditional government-sponsored job creation methods rely on investment in infrastructure to stem the unemployment rate, and state budget shortfalls will require tax increases in the coming years, resulting in even more government spending. Progressive enterprises are recognizing the substantial opportunity and the significant challenges presented by this market and are developing their own gBusiness strategies to take advantage of this new revenue opportunity. Businesses are finding that they are competitively disadvantaged if they are not actively pursuing a gBusiness strategy.

Over 3.4 million businesses compete for opportunities within this highly competitive gBusiness marketplace and identifying qualified business partners and prospects is essential to a company’s success. Identifying relevant projects and partners can be difficult and companies spend a substantial amount of time and effort to locate and research new partners and opportunities to grow their gBusiness segments. The Internet provides short-term visibility into government and private sector contracting information for both government agencies and businesses alike, but does not provide the on-demand intelligence required to guide strategic decisions.

Often, revenue opportunities are included within the specification documents behind the request for proposal, or RFP, and request for quote, or RFQ, documents. Without tools to quickly identify the pertinent information, businesses must read the entire RFP or RFQ to determine if it offers opportunities relevant to their business. Even after a new business opportunity is identified, many companies do not have enough information about the project to prequalify the opportunity, such as decision maker information, the purchasing history of the government agency or project owner, and who competes for similar projects. This information is useful not only for companies contracting directly with the project owner, but also for subcontractors that would like to compete for work on awarded contracts. This information is rarely available from one source, and may not be available at all for historical projects.

Our comprehensive database contains much of this relevant decision making information on both a historical and real-time basis and thousands of records are added to our database each day. Much of the information in our database is linked, so clients can quickly research information relevant to a particular project in one centralized location. Clients can also perform customized searches on both the public record and within the project specification documents to identify relevant opportunities using any number of variables, such as publication date, geographic location and contract value, among others. Using our database and tools, our clients spend less time on research and more time preparing winning proposals, establishing relationships, and executing contracts.

2

Products and Services

Our products and services provide access to our proprietary Onvia Online Database of project specific information and provide clients specialized tools for analyzing information relevant to their businesses. We expect to continue to expand our content and develop new database analysis tools to meet the needs of existing clients as well as potential new categories of clients.

We leverage technology, tools and business processes to research, classify and publish actionable public and private sector opportunities from public and private sources. Through an automated process, we link related records within our database, prequalify business opportunities for clients based upon the client’s profile, and provide access to information in a timely manner, generally within 24 hours of public release. Our database contains information on the largest industry verticals, with a focus on the infrastructure verticals, which include:

|

·

|

Architecture and Engineering

|

|

·

|

Construction and Building Supplies

|

|

·

|

IT / Telecommunications

|

|

·

|

Professional Services

|

|

·

|

Operations and Maintenance Services

|

|

·

|

Transportation

|

|

·

|

Healthcare

|

|

·

|

Water and Energy / Alternative Energy

|

Within these verticals we provide hard-to-find content, presented with a comprehensive view of a project throughout the most critical phases of the procurement lifecycle. These transactional records include:

|

·

|

Advance Notices – alerts businesses of projects in the early stages of the development process, before the bid or RFP is released in its final form, or before final zoning and planning board approval;

|

|

·

|

RFPs, RFQs, and related amendments;

|

|

·

|

Planholders and Bidders Lists – provides competitive intelligence by presenting a list of competitors that have acquired plans, specifications, bidding documents and/or proposals for specific projects in the active bid or proposal stage, and a list of competitors who submit bids for prime contracts with the owner of the project;

|

|

·

|

Bid Results and Awards Information – notifies businesses of awarded bids, providing information for use in their own sales and marketing activities; and

|

|

·

|

Grants – supplies federal grant information critical to businesses tracking or applying for publicly-funded projects.

|

Our business solutions are comprised of the following products:

Onvia Online Database

Onvia Online Database is our flagship gBusiness product and is intended to enable businesses of all sizes to effectively compete in the government procurement marketplace. This product provides rich search functionality on our proprietary database of local, state and federal government agency purchasing information. Users of the database can research project histories, agency purchasing trends, agency buyer contact information, agency relationships with existing vendors, contract awardees, and evaluate pricing for goods and services. Subscribers to Onvia Online Database also receive customized daily email notifications about relevant business opportunities based upon their subscription profile. Onvia Online Database provides information necessary to qualify opportunities, improve decision making, prepare tailored bids, and manage agency relationships, all of which should improve the success rates of our clients in obtaining new procurement awards.

In February 2008, we expanded our business solutions to include information on the commercial and residential development market. Initially, we separately marketed this offering as Onvia Planning and Construction to provide early stage project information on commercial and residential development projects. After the launch of our new technology platform in late 2009, the integration of this information with our Onvia Online Database was simplified and, as a result, we now include this information as part of the Onvia Online Database offering. We believe inclusion of this information in our flagship product will improve client satisfaction and should improve retention rates. This market intelligence information is comprehensive, covering the most populous 85 metropolitan areas within the United States. Our database of over 160,000 commercial and residential records provides a detailed overview of the commercial and residential marketplace. This market intelligence can be leveraged to identify business expansion opportunities and growth markets, evaluate overall market conditions, forecast demand for specific products and services, and align personnel and resources with future opportunities. At the tactical level, this information helps companies identify upcoming projects and sales opportunities by monitoring land use planning and zoning information. New and updated land use activities can be tracked with daily customized alerts delivered directly to our clients’ inbox. Clients can research projects and the companies associated with each project, and track permit approval and project status as the engagement progresses. The company and project information can be used to build relationships with corporate decision makers and planning officials to be in a good position to act upon future opportunities.

3

The Onvia Guide

Onvia Guide subscribers receive the same customized daily email notifications about relevant business opportunities that subscribers to the Onvia Online Database product receive, without the user interface to research information in our database. This product is an affordable entry level option for our clients.

Management Reports

In addition to subscription services, we also offer a number of custom management information reports. These reports are generally one-time deliverables and revenue is recognized upon delivery, or, if report refreshes are included, ratably over the service period.

|

·

|

Term Contracts – Provide clients actionable sales information on term or continuing service contracts pending renewal at public agencies. These reports identify what contracts exist, when they are coming up for renewal, who the incumbent is and who the buyers are. With this report, our clients are able to perform an early evaluation of the opportunity so they can be more competitive with their proposals to increase their public sector business.

|

|

·

|

Contact Lists – Provide clients a comprehensive list of decision makers, agency procurement officers and zoning officials that can be used to develop relationships and identify potential business partners.

|

|

·

|

Market Opportunity Reports – Provide clients market intelligence needed for strategic planning and marketing, such as:

|

|

o

|

Year-over-year growth rates by market or category to help understand buying trends;

|

|

o

|

Market growth rates to assist in business planning;

|

|

o

|

Distribution of state and local opportunities by sales territory to help allocate resources;

|

|

o

|

Competitive analysis; and

|

|

o

|

Seasonality and buying trends.

|

|

·

|

Winning Proposals Library – Compare and contrast winning proposals submitted by competing firms in order to gain competitive insights. Provides insight into how other companies position their qualifications and personnel, structure and format persuasive proposals, incorporate supporting materials, price goods and services, and differentiate themselves from their competitors.

|

Strategy

Our mission is to be the competitive advantage that powers sales and marketing results through actionable information and insight. Key elements of our strategy include:

|

·

|

Expand the valuable content included in the database: Historically, we have collected hard to find information types to increase the value of content to clients such as planholders lists, bidder lists, and agency decision maker lists. In 2008 we introduced private sector commercial and residential development information dating back to January 2007. By expanding the coverage of current and historical information, we believe our content will be applicable to broader market segments, and should improve retention of our existing client base.

|

|

·

|

Enhance our existing information products and research tools: Over the last several years, we have introduced new tools to enhance the access to information contained in our database and tools to improve the relevance of the information returned from searches against our database. Since 2005, we have offered Onvia Online Database; we continue to develop new core technologies, including a comprehensive new user interface which combines access to public and private sector data. In 2010, we plan to enhance our product offering through the introduction of new tools and content that further improves our clients’ ability to tailor the information to the needs of their business, and simplify the process of doing business in the gBusiness marketplace. We expect that this will increase the satisfaction of our existing clients, thereby increasing retention rates, and broaden the appeal of our products to potential new categories of clients.

|

|

·

|

Understand client needs: We are committed to intimately understanding the needs of our clients and the gBusiness marketplace. We will continually solicit feedback from our clients to understand their needs, specifically as they relate to new information requirements in the ever-changing gBusiness marketplace and the current economic landscape. We will leverage this feedback to guide the development of innovative new tools and content.

|

|

·

|

Target prospects with high lifetime value: We intend to focus our marketing efforts toward reaching the prospects that fit a high value profile which ultimately leads to higher lifetime value. Our history also shows that organizations with certain firmographic characteristics tend to subscribe to the most valuable products and services, and have higher client satisfaction. If we are effective in targeting these companies, we expect that retention rates and the long-term profitability of our clients will improve.

|

4

Clients

We service our clients through two separate business channels: client subscriptions and content licenses. Client subscriptions are sold directly to the end user of the business intelligence. At December 31, 2009, we had approximately 8,100 subscribing clients. Client subscriptions contributed approximately 86% of our revenue in 2009 and 2008 and 85% in 2007. The annual contract value of client subscribers was approximately $24.1 million, $19.8 million and $17.6 million at December 31, 2009, 2008 and 2007, respectively.

Our second business channel, content licenses, represents clients who resell our business intelligence to their customers. These clients represented approximately 10%, 11% and 12% of our revenue in 2009, 2008 and 2007, respectively. The annual contract value of our content license clients was approximately $1.9 million, $2.2 million and $2.4 million at December 31, 2009, 2008 and 2007, respectively.

We also generate revenue from fees charged for one-time management reports, document download services, and list rental services; these fees represented 4% of revenue in 2009 and 3% of revenue in both 2008 and 2007.

Sales Strategy

The primary objectives of our sales strategy for 2010 are to increase annual contract value, client retention and new client acquisition. To achieve these objectives we intend to:

|

|

·

|

Introduce new products that supplement our existing offering and appeal to potential new prospects;

|

|

|

·

|

Implement a higher touch contact strategy, particularly for our first year clients, to understand each client’s specific needs and to ensure that they are properly trained on how to best leverage our services to meet those needs;

|

|

|

·

|

Increase the specialization of account management resources (by vertical and segment) and reduce the number of accounts each representative manages to deliver greater client service and increase client satisfaction; and

|

|

|

·

|

Implement a new lead qualifying and routing process to identify ideal prospects and route them to the acquisition resources with the most knowledge of each prospect’s industry and demography.

|

Our 2010 sales strategy also has strong emphasis on performance management processes around forecasting, managing activities, and prioritizing activity around at risk clients.

Marketing Strategy

We deploy an integrated approach to marketing by incorporating email direct marketing, collateral, online search engine marketing, event marketing, public relations, and by supporting sales tools.

Client retention and upgrade marketing are an integral part of our marketing strategy. Marketing programs are intended to keep our name and solutions in front of our clients and prospective clients in a relevant and meaningful way, through newsletters, new product updates, gBusiness best practices, webinars, blogs, and personalized renewal reminders, among others.

5

In 2009, we focused our marketing efforts on generating high quality sales leads at the lowest cost, while providing the sales tools to support high-value sales. We accomplished this by leveraging publicity generated around the Recovery Act and through the development of the website www.Recovery.org. We refined our online marketing programs and website to drive more qualified leads from people using search engines to identify revenue opportunities.

In 2010, lead generation efforts will focus on increasing efficiency through driving more highly qualified, targeted companies as leads. We will continue to supplement this effort with more sophisticated client relationship management, relationship marketing communications, analytics, tracking and reporting as we did in 2009. The 2010 marketing strategy will center on the growth in the gBusiness market as more companies seek revenue from government agencies, and as companies that do not have a government business strategy will find themselves at a distinct disadvantage against their competitors in the market.

Agency Relationships

Agency partners bring value through source contributed content and by providing referrals of their business suppliers. As of December 31, 2009, we had approximately 400 active partner agencies in key metropolitan areas nationwide. We continue to sign a variety of government agencies including cities, counties, housing authorities, transportation authorities and school districts.

Technology

We support our operations and business solutions using an advanced technology platform designed to serve a large and rapidly increasing volume of web traffic in a reliable and efficient manner without critical failures. Our systems are designed to:

|

|

•

|

Provide fast, secure and highly available visitor access to our web site;

|

|

|

•

|

Validate and process client requests promptly and accurately;

|

|

|

•

|

Provide timely, comprehensive and accurate management-reporting capabilities;

|

|

|

•

|

Accommodate upgrades to features on our websites;

|

|

|

•

|

Scale to accommodate growth in our operations; and

|

|

|

•

|

Provide redundancy in case of component system failures.

|

Our systems use a combination of proprietary technologies and commercially available licensed technologies. The backbone of our technology infrastructure consists of database servers running Microsoft SQL Server on HP/Proliant class server hardware. The front end consists of multiple, redundant web servers that are expandable as operations grow.

Our web servers, database servers, transaction-processing servers and other core systems that conduct essential business operations are housed at a third-party offsite co-location facility. Our co-location vendor provides 24x7 monitoring and engineering support in a climate-controlled and physically secure environment and our on-call operations personnel have 24x7 access to the facility. Our data center has redundant communication lines from multiple Internet service providers and has its own emergency power and backup systems. We house most non-critical systems such as development servers, quality assurance servers, and internal application servers at our headquarters in Seattle.

In addition to maintaining responsibility for the technical architecture, security and uptime of our business solutions, our technology department works closely with the sales and marketing departments to ensure that client feedback for new features is incorporated into new products and services.

Competition

The market for comprehensive intelligence on the infrastructure marketplace is underserved. Competitors include, to a limited extent, bid aggregators, industry analysts and government e-procurement platforms.

6

Our current and potential competitors include, but are not limited to, the following:

|

|

•

|

Information companies that target specific verticals also covered by our services, such as McGraw-Hill, Contractors Register and Input; and

|

|

|

•

|

Lead generation and bid matching companies such as FedMarket.com, BidNet and GovernmentBids.com.

|

We may face additional competition in the future as well-funded companies pursue new government procurement and private sector database products and services. We must differentiate ourselves by expanding our database, developing products and services with high switching costs, and maintaining a loyal base of repeat clients. To achieve this we must continually enhance our content and sources, and provide our clients with relevant, customized views of our database to achieve these objectives.

We believe that the principal competitive factors affecting our market include, but are not limited to, breadth, depth and timeliness of content, content quality, base of existing clients, and client service. In order to excel at these principal competitive factors, we strive to achieve a superior understanding of our clients, offer greater value in content and services and sustain a more efficient operating model. We also mitigate some potential competitive pressures by selling our content to some competitors for redistribution to their clients. We believe that our current database offering compares favorably to select offerings available in the marketplace today based on the depth and history of our information, breadth of content types, and daily updates.

Seasonality

New client acquisition is subject to some modest seasonal fluctuations. The third quarter has historically been our slowest quarter for new client acquisition. The construction industry is our single largest market and historically these prospects are fulfilling contracts during the summer months and not prospecting for new work, which causes acquisition of new clients to be slower in these months. For this reason, it may not be possible to compare the performance of our business by consecutive quarters, and our quarterly results should be considered on the basis of results for the whole year or by comparing results in a quarter with the results in the same quarter for the previous year.

Intellectual Property Rights

Our future success depends in part on intellectual property rights, proprietary rights, and technology. We rely on a combination of copyright, trademark and trade secret laws, employee and third-party nondisclosure agreements and other methods to protect our proprietary rights. We seek to protect our internally developed products, documentation, and other written materials under trade secret and copyright laws, which afford only limited protection. We cannot ensure that any of our proprietary rights will be viable or of value in the future since the validity, enforceability and type of protection of proprietary rights in Internet-related industries is uncertain and still evolving.

We license and will continue to license certain products integral to services from third parties, including products that are integrated with internally developed products and used jointly to provide key content and services. These third-party product licenses may not continue to be available on commercially reasonable terms and we may not be able to successfully integrate such third-party products into our solutions.

We presently have no issued U.S. patents. It is possible that we may not develop future proprietary products or technologies that are patentable and that the patents of others will seriously harm our ability to do business.

We own the following registered trademarks in the U.S. Patent and Trademark Office: ONVIA, ONVIA and Design (current logo with orange circular design), ONVIA DOMINION, DEMANDSTAR, DEMANDSTAR.COM, QUOTEWIRE, BIDWIRE, and E-JOURNAL OF COMMERCE. We also own the following registered trademarks in Canada: ONVIA, ONVIA.COM, and ONVIA.COM and Design.

Employees

As of March 1, 2010, we had 174 employees working in the following departments: 98 in sales and marketing, 39 in research, which are included in cost of sales, 20 in technology and development and 17 in general and administrative.

None of our employees are represented by a union or collective bargaining agreement. We have never had a work stoppage and consider relations with our employees to be good.

7

Geographic Financial Information

During the years ended December 31, 2009, 2008 and 2007, all of our revenues were generated from clients located in the United States. All of our long lived assets are located in the United States.

Available Information

We file with and furnish to the Securities and Exchange Commission, or SEC, periodic reports, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and information statements, and other information, along with amendments to such reports. Our SEC filings are posted on the SEC’s Web site at http://www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Materials that we file with the SEC are also available at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. Information regarding the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. Our annual report on Form 10-K, all other reports and amendments filed with or furnished to the SEC, and our Code of Business Ethics and Conduct are available on the “About Onvia” section of our website at www.onvia.com as soon as reasonably practicable after we have filed them with, or furnish them to, the SEC.

|

ITEM 1A.

|

RISK FACTORS

|

In addition to other information in this Report, the following risk factors should be carefully considered in evaluating our business because such factors may have a significant impact on our business, results of operations and financial condition and could cause our stock price to decline. As a result of the risk factors set forth below and elsewhere in this Report, and the risks discussed in our other Securities and Exchange Commission filings, actual results could differ materially from historical results or those projected in any forward-looking statements.

Risks related to our growth strategy

Increased sales to clients who are new to the public sector may impact our first year retention rates.

The collapse of the commercial development sector and the increase in government spending under the Recovery Act, have increased interest in public sector projects. Companies who have never participated in the public sector are investing in resources, such as Onvia’s services, to help them compete in this marketplace. If or when the private sector recovers, or if companies new to the public sector do not have success in this marketplace, companies new to the public sector may not continue their investment in Onvia’s services and our retention rates may suffer.

Weakness in the U.S. economy, and in the commercial-residential housing market specifically, could drive reduced spending by our clients and prospective clients on business intelligence services.

The majority of our clients are small to medium sized businesses operating within the infrastructure verticals, which include industries that are negatively impacted by a slowdown in the commercial and residential development market, such as building & construction and architecture & engineering. Broad economic downturns typically have a greater impact on small and medium sized businesses than on larger entities. The economic downturn in these industries could cause our clients and prospective clients to reduce their spending on market intelligence, which would slow our revenue growth.

Continued weakness in the U.S. economy may negatively impact our client retention rates.

The current economic slowdown is far-reaching and is having severe adverse impacts on businesses of all sizes. Many smaller, less capitalized businesses have already failed. If the downturn persists, it is possible that this will extend to larger, better capitalized businesses as well. If a significant number of our existing clients were to fail, or to cut back on operating expenses by eliminating services perceived as non-essential, our client retention rates would be adversely impacted, which would slow our revenue growth.

We may not be able to meet projected renewal rates.

Our ability to continually enhance our products and services to provide relevant information to our clients, appropriately classify and distribute information, provide excellent client service, maintain competitive pricing and meet our clients’ expectations for source coverage and new content will significantly impact their satisfaction with our products and services and will impact their decision to renew. If we are unable to meet our clients’ expectations, renewal rates and projected growth and profitability will suffer.

8

We may be required to increase sales and marketing expenses in order to achieve revenue goals.

If existing or planned marketing initiatives do not drive sufficient sales leads, we may be required to increase spending on new and untested marketing initiatives to deliver adequate leads to our sales team in order to achieve revenue goals, and our operating results may suffer.

Achieving our sales goals also depends in part on increasing the number of new clients generated by our acquisition sales team. We plan to increase new client acquisition by improving the productivity of each of our sales representatives through performance management and by delivering more highly qualified leads through our marketing efforts. We have hired new sales leadership and have invested in new sales tools to increase productivity; however, if we do not achieve the desired productivity increases, we may be required to increase headcount to a greater extent than planned, which would increase operating expenses and may adversely impact operating results.

We may not be able to increase subscribership to high value products.

We expect that a significant portion of future growth will come from increasing annual contract value per client, and we expect this to be driven by increased adoption of our high value products. Subscribers to our high value products have higher annual contract value, higher renewal rates and provide greater lifetime value to us. Failure to increase subscribership to these products would limit our future growth and adversely affect our results of operations.

We may fail to attract, hire and retain sales associates who can effectively communicate the benefits of our products to our clients and prospects, and they may be unable to achieve expected sales targets.

In order to achieve projected revenue growth rates, our sales teams must be able to effectively communicate the benefits of our products to existing and potential clients. We expect to see increases in client retention rates and in new client acquisition revenue and our sales goals are aggressive. If we are unable to retain current sales associates and attract and hire new sales associates with the appropriate skills, we may not be able to achieve projected sales targets and revenue growth rates.

If we cannot effectively satisfy clients across all targeted industry verticals, we may decide to target fewer industries, and as a result, may lose clients.

If we find that retention and acquisition rates in any of our focused verticals are not meeting expectations due to lack of bid-flow or for other reasons, we may choose to specialize in fewer industry verticals to improve client satisfaction and retention in the remaining verticals. As a result, we may lose clients in the non-core verticals. A more targeted focus on these core verticals may not generate the expected level of increased retention and acquisition.

Our competitors may develop similar technologies that are more broadly accepted in the marketplace.

The functionality in the Onvia Online Database is robust, and we expect that if adoption of this product is in line with our expectations that competitors may introduce products with similar functionality. If competitors introduce products with similar functionality or are able to more effectively market and price their products for broad customer acceptance, new client acquisition and existing client retention would be adversely impacted. If we are unable to enhance functionality or increase marketing efforts to offset challenges from competitors, we may lose market share.

Rapid advances in technology and new mediums for distributing information may diminish the value of our service offerings.

Our business model is predicated on providing low cost access and analysis of hard to find public and private sector information. Information in general is quickly becoming more accessible at a low cost as new distribution mediums, such as blogs, and new search technologies are developed. We may be unable to keep up with the rapid advances in information collection, and new technologies and mediums may be developed that commoditize the value of our services. If this were to occur, our revenues would suffer.

9

Risks related to our new product strategy

We may fail to introduce new content and products that are broadly accepted by clients, and there may be delays in the introduction of these tools and products.

We expect to introduce new content in 2010. If client acceptance and adoption of these new products is below our expectations, projected growth rates and client acquisition and retention goals may not be achieved, and financial results would be harmed. We expect to utilize internally developed technology and technology licensed from third parties for the development of new tools and content. If we are unable to develop or acquire the required technology on time, or at all, or if the launch of these new products is delayed for any other reason beyond our anticipated launch dates, projected growth rates may not be achieved.

We may be unable to control the cost of ongoing content collection or the cost of collecting new content types to support new product offerings.

We will need to identify cost effective sources and develop efficient collection processes for new content types required to support new product development plans. If we are unable to find new ways to collect content efficiently, and aggregate new content types in a cost effective manner, gross margins may decline.

We may improperly price new product offerings for broad client acceptance.

We may implement price increases with respect to some of our existing products in 2010. We have developed pricing strategies for our existing products, and will be required to develop new pricing strategies for planned new product launches. If existing clients do not perceive that the pricing of our products is commensurate with the value they receive from the products, or if our sales staff is unable to communicate the value of the products, particularly in light of the current economic climate, new client adoption and existing client retention would be adversely impacted.

We may overestimate the value of sales intelligence to companies in the infrastructure marketplace.

We believe there is a large unmet market need for robust public and private sector sales and marketing information. Our business model assumes that clients will pay an annual fee for this information and we expect increases in the annual value of these contracts in the near-term and long-term. If we have overestimated the value of this information, we will not achieve our forecasted revenue goals.

Financial, economic and market risks

We may be required to withhold common shares to cover tax withholding upon exercise of certain executive stock options and settle the obligations with the Internal Revenue Service, which would negatively impact our cash flow in the future.

On March 7, 2001, our board of directors granted an executive stock option for 302,979 shares at $2.662 per share. This option includes a feature that allows the executive, at his election, to surrender shares subject to the option to satisfy any tax withholding obligations resulting from the exercise of his options. This option expires on March 6, 2011. If the executive exercises this right, a cash outlay by our company would be required to settle the executive's tax withholding obligation and our cash flow would be negatively impacted. The timing and amount of this potential cash outlay for taxes cannot be reasonably estimated until the transaction date, if and when it occurs.

We may not be able to generate positive cash flows from operations.

We have not yet demonstrated that we are able to generate positive cash flow from operations on a consistent year over year and quarter over quarter basis, and our business is subject to some seasonal fluctuations. Due to these seasonal fluctuations and limited performance history on client adoption of new products, we may not be able to achieve positive cash flow from operations in the near-term.

Our quarterly financial results are subject to fluctuations that may make it difficult to forecast future performance.

We have experienced some seasonal fluctuations in our business, reflecting a combination of seasonal trends for the services and products we offer, as well as seasonal trends in the buying habits of target business clients and government agencies. Operating results may continue to vary significantly from quarter to quarter, making it difficult to formulate meaningful comparisons of results between quarters. Our limited operating history and evolving business model further contribute to the difficulty of making meaningful quarterly comparisons. A significant portion of our subscription revenue for a particular quarter is derived from transactions that are initiated in previous quarters, because revenue is recognized ratably over the subscription term.

10

Our current and future levels of operating expenses and capital expenditures are based largely on our growth plans and estimates of future revenue. These expenditure levels are, to a large extent, fixed in the short term. We may not be able to adjust spending in a timely manner to compensate for any unexpected revenue shortfall, and any significant shortfall in revenue relative to planned expenditures could harm our business and results of operations.

We implemented anti-takeover provisions that may discourage takeover attempts and depress the market price of our stock.

Provisions of our certificate of incorporation and bylaws, as well as provisions of Delaware law, the state of our incorporation, can have the effect of making it difficult for a third-party to acquire us, even if doing so would be beneficial to our stockholders. These provisions include:

|

|

•

|

the classification of our Board of Directors into three classes so that the directors serve staggered three-year terms, which may make it difficult for a potential acquirer to gain control of our Board;

|

|

|

•

|

authorizing the issuance of shares of undesignated preferred stock without a vote of stockholders; and

|

|

|

•

|

non-cumulative voting for the election of directors.

|

In addition, in 2002, our Board of Directors adopted a Stockholders’ Rights Agreement, designed to protect stockholder interests in the event of an unsolicited takeover attempt by distributing one preferred stock purchase right for each outstanding share of common stock. The Stockholders’ Rights Agreement may make it more difficult for a third-party to acquire us.

Operational risks

We may not effectively implement new technologies and new product functionality could fail to perform as designed.

We periodically release products that employ new search technologies and complex database architecture in new and innovative ways. These technologies are usually built in house, or purchased from third party vendors and reengineered to meet our operational needs. If the creative application of these technologies does not work as planned or if we implement these new technologies poorly or in incompatible ways, our new products and services may not function properly, delivery of our products could be disrupted or delayed and our client retention and new client acquisition may suffer.

System failures could cause an interruption in the services of our network and impact our ability to compile information and deliver our products to clients.

Any system failure that causes an interruption in the service of our suite of products, disrupts our ability to aggregate, organize and publish new content, or reduces timely access to and delivery of our content could result in client dissatisfaction, which would impact client acquisition and retention rates. Further, prolonged or ongoing performance problems on our web sites or our application servers, which support bid creation and distribution, could damage our reputation and result in the permanent loss of clients. In the past, system interruptions have made our web sites and application servers totally unavailable, slowed their response time or prevented us from making service available to clients. These problems may occur again in the future.

We may not have sufficient business interruption insurance to cover losses from major interruptions. We deployed our primary business application servers to a secure offsite facility with backup utility power and redundant Internet connectivity in 2008. Our current disaster recovery systems are designed to ensure that a portion of our Information Technology and Research department functions will be operational in the event of a local building disaster so that delivery of our products will not be significantly interrupted. Our disaster recovery plan is not yet finalized to include automated failover of product distribution-related systems, requiring some manual intervention to complete the failover process which could result in prolonged service interruptions and ultimately lower client satisfaction.

11

Our current technology infrastructure and network software systems may be unable to accommodate our anticipated growth, and we may require a significant investment in these systems to accommodate performance and storage requirements of new and planned products.

Expansion of the historical content contained in our Onvia Online Database and future product offerings have and will place significant additional demands on the network and on our database. We add thousands of records to our database each day, which has required us to expand the storage capacity of the database. If new content types or product introductions change current network and database requirements or if growth in client base exceeds our expectations, we may be required to make significant investments to upgrade our systems to accommodate such changes, which could negatively impact our cash flows and results of operations. We may not be successful in our efforts to upgrade our systems, or if we do successfully upgrade our systems, we may not do so on time and within budget. Failure to achieve a stable technological platform in time to handle increasing network traffic may discourage potential clients from using our network.

We may not be able to retain the services of our executive officers, directors, senior managers and other key employees, which would harm our business.

Our business and operations are substantially dependent on the performance of senior management, directors and key employees. The loss and inability to replace any of these employees or directors would likely harm our business.

Political, social or environmental conditions in off-shore locations may impact the collection and delivery of our content and/or development of new products.

Portions of our content are aggregated and/or formatted by off-shore vendors. Delivery of that content may be impacted by local political, social or environmental conditions, which may result in delayed delivery to clients resulting in client dissatisfaction.

We also outsource portions of the development of new products to off-shore vendors. Political, social or environmental conditions in those locations may result in delays of new product introductions.

We may be unable to effectively monitor and prevent unauthorized redistribution of our published information.

In the past we have identified a number of entities that have redistributed proprietary information without authorization and against our terms of use. We have been and will continue to be aggressive about monitoring and combating such unauthorized use, and are considering technological avenues for blocking such users from our database. However, if we fail to effectively combat such unauthorized use, our business could be harmed.

Our services and products depend upon the continued availability of licensed technology from third parties, and we may not be able to obtain those licenses on commercially reasonable terms, or at all.

We license, and will continue to license, technology integral to our services and products from third parties. If we are unable to acquire or retain key third-party product licenses or integrate the related third-party products into our network services, our service and product development may be delayed. We also expect to acquire new licenses in the future as our business grows and technology evolves. We may not be able to obtain these licenses on commercially reasonable terms, or at all.

Increased blocking of our emails could negatively impact client satisfaction with our products and could inhibit the effectiveness of our marketing efforts.

Portions of our content are currently delivered in the form of an attached file via email. Some network administrators could flag and block emails from us due to increased filtering of email attachments as a result of the threat of email borne viruses or unwanted “spam” or for other reasons. We also conduct marketing campaigns to our customer base and occasionally these campaigns are done via email. Excessive filtering of our emails could negatively impact client satisfaction and could inhibit our marketing efforts.

Regulatory, judicial or legislative risks

Any settlement or claim awarded against us in our ongoing litigation matters could negatively impact operating results.

We are defending against the litigation matters as detailed in the legal proceedings section in Item 3 of Part I of this Report. We have directors and officers insurance of $30 million that would cover defense costs and any award or settlement, less a deductible of $250,000, in the securities class action suit. While we believe we have a strong defense in this case, we cannot be certain that the outcome of the case will be favorable to us. A settlement or award in this or other potential suits could negatively impact our operating results. It is also possible that defense of this and future claims may result in a significant diversion of management attention.

12

Future regulations could be enacted that either directly restrict our business or indirectly impact our business by limiting the growth of e-commerce.

We are subject to laws and regulations governing the Internet and e-commerce. These laws and regulations may cover privacy, content, taxation, data protection, copyrights, electronic contracts and other communications, consumer protection, unencumbered Internet access to our services, the design and operations of websites, and the characteristics and quality of products and services. If enacted, unfavorable laws and regulations could limit the market for our services and offerings. Although many regulations might not apply to the business directly, we expect that laws regulating the collection or processing of personal or consumer information could indirectly affect our business. It is possible that legislation could expose companies involved in e-commerce to restrictions or liability, which could limit the growth of e-commerce generally. Legislation could hinder the growth in Internet use and decrease our acceptance as a medium for communication and commerce. If laws were enacted that made our products taxable at the state level, we may be required to pass those additional taxes along to our customers, which would increase the overall cost of our product to our end users and could impact the buying decisions of existing and potential new clients.

Our access to new content from governmental entities and other third parties may be restricted if bid aggregation on the Internet is restricted by law or regulations.

We aggregate new information from various public data sources and do not have exclusive access to this content. We cannot ensure that these data sources will continue to be available in the future. Moreover, public disclosure laws, which require governmental entities to produce bid information directly to members of the public, may negatively impact our business and reduce the value of our services to clients. The loss or the unavailability of data sources in the future, or the loss of right to distribute some of the data sources, would harm our business.

Our proprietary bid aggregation technology is integral to our success. If the process of bid aggregation becomes regulated in the future and our process for acquiring government bids is no longer cost-effective, our business will be significantly harmed. If new regulations restricting our ability to charge a fee for public bid information are enacted, our business will be significantly harmed.

Utilization of our net operating loss, or NOL, carryforwards may be subject to annual limitations provided by the Internal Revenue Service code.

We have substantial net operating loss carryforwards that could be used to offset future tax liabilities once we begin to generate taxable income. Utilization of these NOLs may be subject to a substantial limitation due to ownership change limitations provided by Section 382 of the Internal Revenue Code of 1986, which may limit the amount of NOL carryforwards that can be utilized annually to offset future taxable income and tax, respectively. Limitations on the utilization of these NOLs could adversely impact future operating results and cash flows.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

None.

|

ITEM 2.

|

PROPERTIES

|

Our headquarters are located in Seattle, Washington. In January, 2008, we relocated our corporate headquarters and we now lease approximately 35,000 square feet in two floors of a sixteen-story office complex located at 509 Olive Way, Seattle, Washington. Prior to this, we leased 29,785 square feet in two floors of a four-story office complex in our former corporate headquarters building. We believe the new space is adequate to meet current and near term capacity requirements. The lease on our current office space expires in October 2015.

13

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

For a discussion regarding our legal proceedings, please refer to the “Legal Proceedings” section of Note 11, “Commitments and Contingencies”, in the Notes to Consolidated Financial Statements in this Report, which is incorporated herein by reference.

EXECUTIVE OFFICERS OF THE REGISTRANT

The executive officers of the Company are as follows:

|

Name

|

Age

|

Position

|

|

Irvine N. Alpert

|

58

|

Executive Vice President

|

|

Michael S. Balsam

|

41

|

Chief Strategy Officer

|

|

Eric T. Gillespie

|

41

|

Senior Vice President

|

|

Michael D. Pickett

|

62

|

Chief Executive Officer, President and Chairman of the Board

|

|

Michael J. Tannourji

|

42

|

Former Senior Vice President, Sales and Marketing

|

|

Cameron S. Way

|

38

|

Chief Financial Officer

|

Irvine N. Alpert has served as Executive Vice President of the Company since July 2001. From February 1995 to July 2001, Mr. Alpert was the founder and Chief Executive Officer of ProjectGuides, Inc., an architecture, engineering, and construction market information service, which was acquired by Onvia in June 2001. From 1993 to 1995, Mr. Alpert served as President of RCI Environmental, Inc., a regional construction company.

Michael S. Balsam has served as Chief Strategy Officer of the Company since January 2010. Prior to becoming Chief Strategy Officer, Mr. Balsam served as Chief Solutions Officer of the Company from November 2008 to December 2009, Vice President of Products and Services from January 2005 to November 2008, Director of Product Management from November 2002 to December 2004, and Product Marketing Manager from June 2001 to November 2002.

Eric T. Gillespie has served as Senior Vice President of the Company since July 2008. Prior to becoming Senior Vice President, Mr. Gillespie served as Chief Information Officer of the Company from May 2007 to June 2008. From October 2004 to May 2007 Mr. Gillespie served as Executive Vice President and Chief Operating Officer of The Patent Board, a provider of best practices research tools and metrics for patent analysis and intellectual property investment. From October 1999 to October 2004, Mr. Gillespie served as Vice President, Managing Director of SBI Group, formerly Scient, a technology strategy and services firm.

Michael D. Pickett has served as director of the Company since February 1999, as Chief Executive Officer and Chief Executive Officer and Chairman of the Board of the Company from February 1999 to August 2000 and since April 2001, and as President since September 2004. Mr. Pickett also served as President and Chief Operating Officer of the Company from August 2000 to April 2001. From July 1999 to August 2000, Mr. Pickett served as Chief Executive Officer of Hardware.com, Inc., an online source for total home improvement solutions, which was acquired by the Company in September 2000. From July 1997 to March 1999, Mr. Pickett was Chairman and Chief Executive Office of Technology Solutions Network, LLC, a provider of turnkey technology solutions for small businesses. From October 1983 to February 1996, Mr. Pickett served in a variety of positions and most recently as Chairman, Chief Executive Officer, and President of Merisel, Inc., a wholesale distributor of computer hardware and software products and a provider of logistics services.

Michael J. Tannourji served as Senior Vice President, Sales of the Company from November 2007 to February 2010. We ended our employment relationship with Mr. Tannourji in February 2010. Mr. Tannourji’s departure was not due to any disagreements with the Company’s management or the Board. From May 2005 to September 2007, Mr. Tannourji served as Vice President National Sales & Service BIS of Experian, Inc., a global information services company. From January 2004 to December 2004, Mr. Tannourji served as Vice President/Leader Vertical Markets, and from September 1999 to December 2003, Mr. Tannourji served as Assistant Vice President Global & Major Customers, of Dun & Bradstreet, a global information services company.

14

Cameron S. Way has served as Chief Financial Officer of the Company since April 2008. Mr. Way served as Chief Accounting Officer of the Company from June 2005 to April 2008, Controller from September 2001 to June 2005, Assistant Controller from December 2000 to September 2001, and finance manager from August 1999 to December 2000. Mr. Way was an audit manager with PricewaterhouseCoopers LLP from January 1999 to August 1999 prior to joining the Company.

There are no family relationships between any directors or executive officers of the Company.

15

PART II

|

ITEM 5.

|

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Information

Our common stock currently trades on the NASDAQ Capital Market under the symbol “ONVI.” The table below lists the high and low closing prices per share of our common stock for each quarterly period during the past two fiscal years as reported on the NASDAQ Global Market and, since April 2009, on the NASDAQ Capital Market.

|

Closing Price Range

|

||||||||

|

of Common Stock

|

||||||||

|

High

|

Low

|

|||||||

|

Year ended December 31, 2008

|

||||||||

|

First Quarter

|

$ | 8.42 | $ | 6.43 | ||||

|

Second Quarter

|

6.68 | 5.03 | ||||||

|

Third Quarter

|

5.00 | 4.15 | ||||||

|

Fourth Quarter

|

4.50 | 3.14 | ||||||

|

Year ended December 31, 2009

|

||||||||

|

First Quarter

|

$ | 4.50 | $ | 2.90 | ||||

|

Second Quarter

|

5.89 | 3.31 | ||||||

|

Third Quarter

|

6.17 | 5.20 | ||||||

|

Fourth Quarter

|

8.00 | 5.50 | ||||||

Holders

As of March 1, 2010, there were approximately 465 holders of record of Onvia common stock. The number of recordholders was determined from the records of the Company’s transfer agent and does not include the number of persons whose stock is held in nominee or “street name” accounts through brokers.

Dividends

No cash dividends were declared for the years ended December 31, 2009 and 2008 nor does Onvia have the intention to pay cash dividends in the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

We currently maintain two active compensation plans that provide for the issuance of our common stock to officers, directors, employees, and consultants. The two active compensation plans consist of the Onvia, Inc. 2008 Equity Incentive Plan, or the 2008 Plan, and the 2000 Employee Stock Purchase Plan, or ESPP, both of which have been approved by stockholders.

We also have outstanding options under the stockholder approved 2000 Directors’ Stock Option Plan, or Directors’ Plan, which expired on February 28, 2010 and under the Amended and Restated 1999 Stock Option Plan, or the 1999 Plan, which was amended and restated in September 2008 as the 2008 Plan. Options outstanding under both the Directors’ Plan and the 1999 Plan will continue to vest and become exercisable according to the original terms of the grant. However, any options that are forfeited from the Directors’ Plan subsequent to the expiration date will not be available for reissuance. Any grants forfeited from the 1999 Plan will be returned to the 2008 Plan and will be available for future issuance.

In August 2009, 49,941 warrants with an exercise price of $9.00 that were originally issued in 1999 for subordinated debt financing expired unexercised.

16

The following table sets forth information regarding outstanding options and shares reserved for future issuance under the 2008 Plan, the 1999 Plan, the Directors’ Plan, and the ESPP as of December 31, 2009.

|

Plan category

|

Number of securities to be issued upon exercise of outstanding options and warrants

|

Weighted average exercise price of outstanding options and warrants

|

Number of securities remaining available for future issuance

|

|||||||||

|

Equity compensation plans approved by security holders

|

||||||||||||

|

Onvia, Inc. 2008 Equity Incentive Plan

|

69,350 | $ | 4.56 | 406,734 | ||||||||

|

Amended and Restated 1999 Stock Option Plan

|

1,765,007 | 7.37 | - | |||||||||

|

2000 Directors' Stock Option Plan

|

53,000 | 50.65 | - | |||||||||

|

Employee Stock Purchase Plan

|

- | N/A | 521,282 | |||||||||

|

Total

|

1,887,357 | $ | 8.48 | 928,016 | ||||||||

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

None.

17

Stock Price Performance Graph

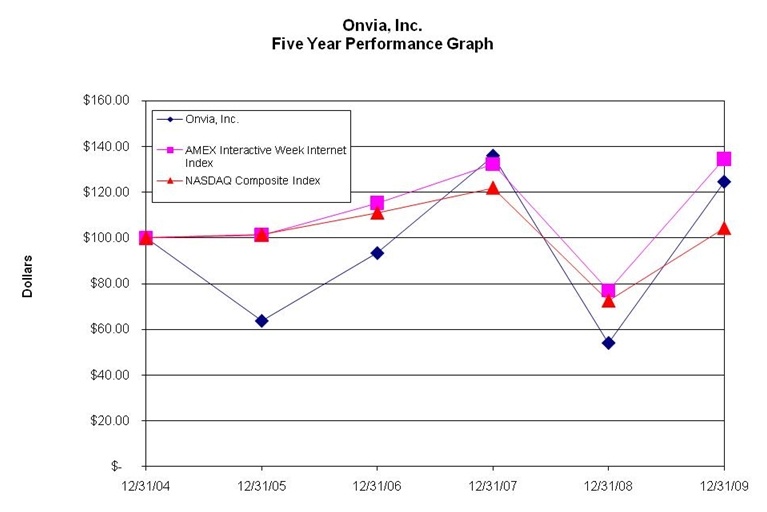

The following graph compares the cumulative total return to stockholders on Onvia’s common stock during the five years ended December 31, 2009 to the cumulative total returns on the NASDAQ Composite Index and the AMEX Interactive Week Internet Index. The comparison assumes $100 was invested on December 31, 2004 in shares of Onvia’s common stock and in each of the indices shown. The stock price performance shown on the following graph is not necessarily indicative of future performance of Onvia’s common stock.

18

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

The following selected consolidated financial data for the fiscal years ended December 31 should be read in conjunction with the consolidated financial statements and related notes of Onvia and its subsidiary included in this and previous Annual Reports on Form 10-K, as well as the section of this and previous Reports entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Historical results are not necessarily indicative of future results.

|

Year Ended December 31,

|

||||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

(in thousands, except per share data)

|

||||||||||||||||||||

|

Consolidated Statements of Operations Data:

|

||||||||||||||||||||

|

Revenue

|

$ | 25,637 | $ | 21,142 | $ | 20,928 | $ | 16,739 | $ | 14,714 | ||||||||||

|

Gross margin

|

20,959 | 16,816 | 17,197 | 13,344 | 11,433 | |||||||||||||||

|

Noncash stock-based compensation (1)

|

449 | 718 | 927 | 1,258 | 84 | |||||||||||||||

|

Idle lease accrual and restructuring charges (2)

|

- | - | (2,653 | ) | (67 | ) | 1,228 | |||||||||||||

|

Total operating expenses

|

21,558 | 20,623 | 17,685 | 19,840 | 19,095 | |||||||||||||||

|

Loss from operations

|

(599 | ) | (3,807 | ) | (488 | ) | (6,496 | ) | (7,662 | ) | ||||||||||

|

Net (loss) / income

|

$ | (547 | ) | $ | (3,374 | ) | $ | 494 | $ | (5,544 | ) | $ | (6,920 | ) | ||||||

|

Unrealized (loss) / gain on available-for-sale securities

|

(4 | ) | - | 6 | 17 | 8 | ||||||||||||||

|

Comprehensive (loss) / income

|

$ | (551 | ) | $ | (3,374 | ) | $ | 500 | $ | (5,527 | ) | $ | (6,912 | ) | ||||||

|

Basic net (loss) / income per common share

|

$ | (0.07 | ) | $ | (0.41 | ) | $ | 0.06 | $ | (0.70 | ) | $ | (0.89 | ) | ||||||

|

Diluted net (loss) / income per common share

|

$ | (0.07 | ) | $ | (0.41 | ) | $ | 0.06 | $ | (0.70 | ) | $ | (0.89 | ) | ||||||

|

Basic weighted average shares outstanding

|