Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SCHULMAN A INC | shlm20130306.htm |

Proposed A. Schulman & Ferro Combination March 6, 2013 Exhibit 99.1

Cautionary Note on Forward-Looking Statements A number of the matters discussed in this document that are not historical or current facts deal with potential future circumstances and developments and may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historic or current facts and relate to future events and expectations. Forward-looking statements contain such words as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements are based on management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which management is unable to predict or control, that may cause actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking statements. Important factors that could cause actual results to differ materially from those suggested by these forward-looking statements, and that could adversely affect the Company’s future financial performance, include, but are not limited to, the following: • worldwide and regional economic, business and political conditions, including continuing economic uncertainties in some or all of the Company’s major product markets or countries where the Company has operations; • the effectiveness of the Company’s efforts to improve operating margins through sales growth, price increases, productivity gains, and improved purchasing techniques; • competitive factors, including intense price competition; • fluctuations in the value of currencies in major areas where the Company operates; • volatility of prices and availability of the supply of energy and raw materials that are critical to the manufacture of the Company’s products, particularly plastic resins derived from oil and natural gas; • changes in customer demand and requirements; • effectiveness of the Company to achieve the level of cost savings, productivity improvements, growth and other benefits anticipated from acquisitions, joint ventures and restructuring initiatives including any proposed combination with Ferro Corporation; • escalation in the cost of providing employee health care; • uncertainties regarding the resolution of pending and future litigation and other claims; • the performance of the global automotive market; and • further adverse changes in economic or industry conditions, including global supply and demand conditions and prices for products. The risks and uncertainties identified above are not the only risks the Company faces. Additional risk factors that could affect the Company’s performance are set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 2012. In addition, risks and uncertainties not presently known to the Company or that it believes to be immaterial also may adversely affect the Company. Should any known or unknown risks or uncertainties develop into actual events, or underlying assumptions prove inaccurate, these developments could have material adverse effects on the Company’s business, financial condition and results of operations. 2

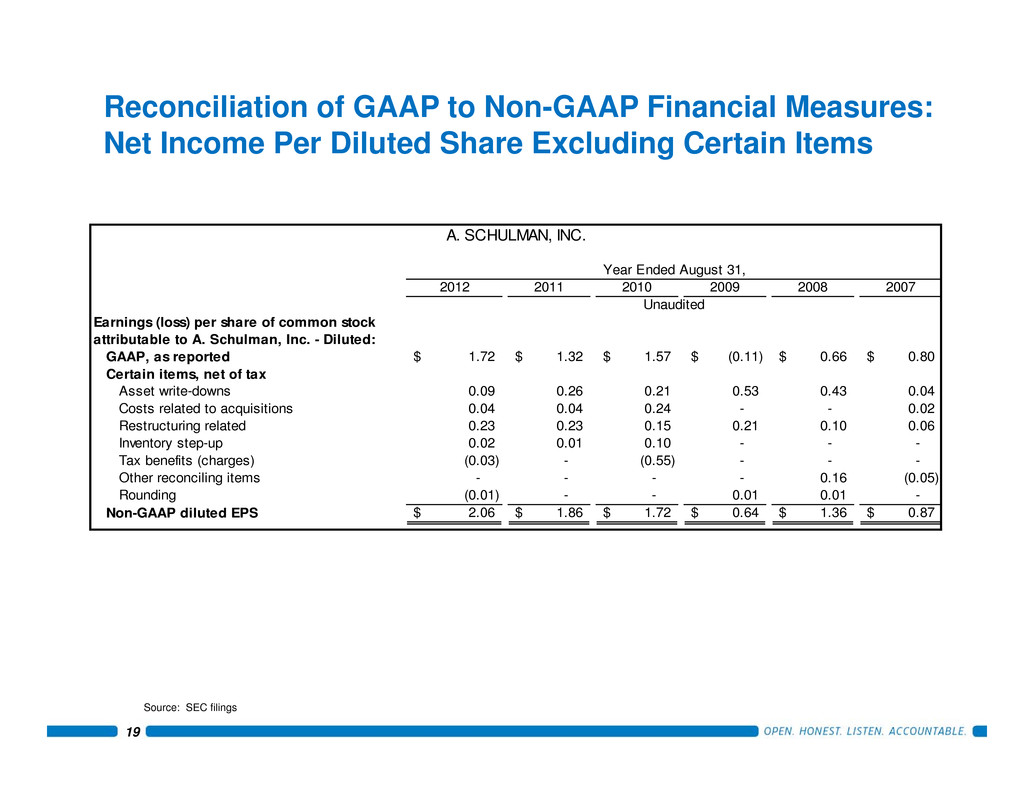

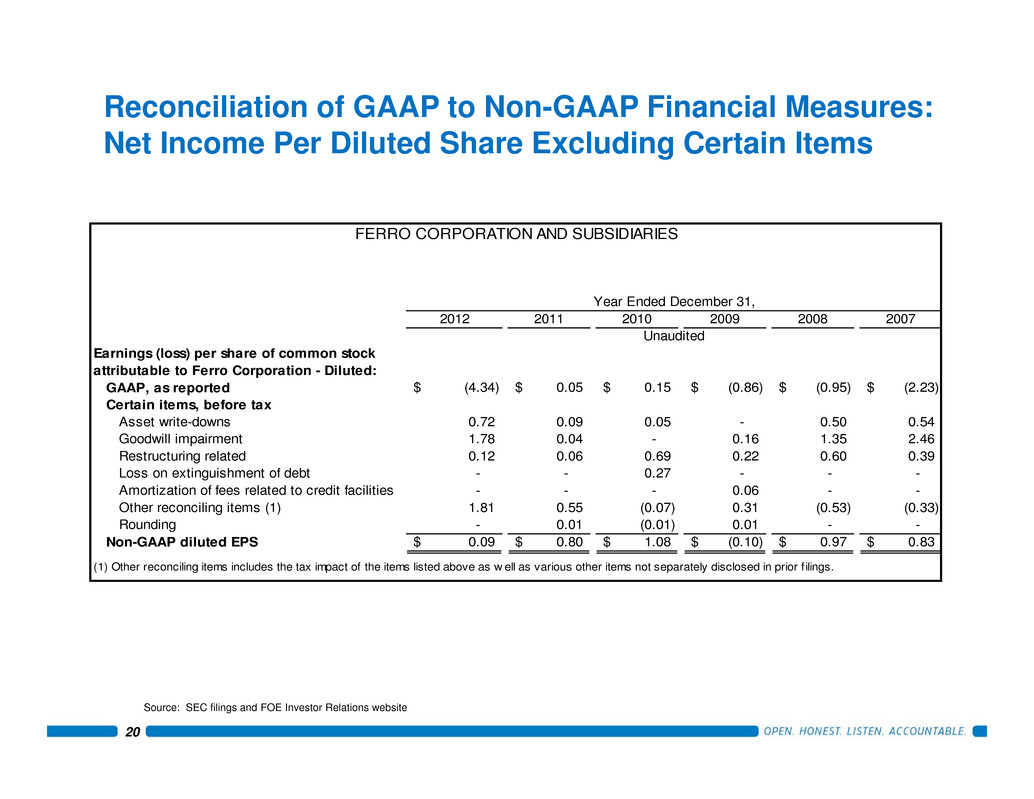

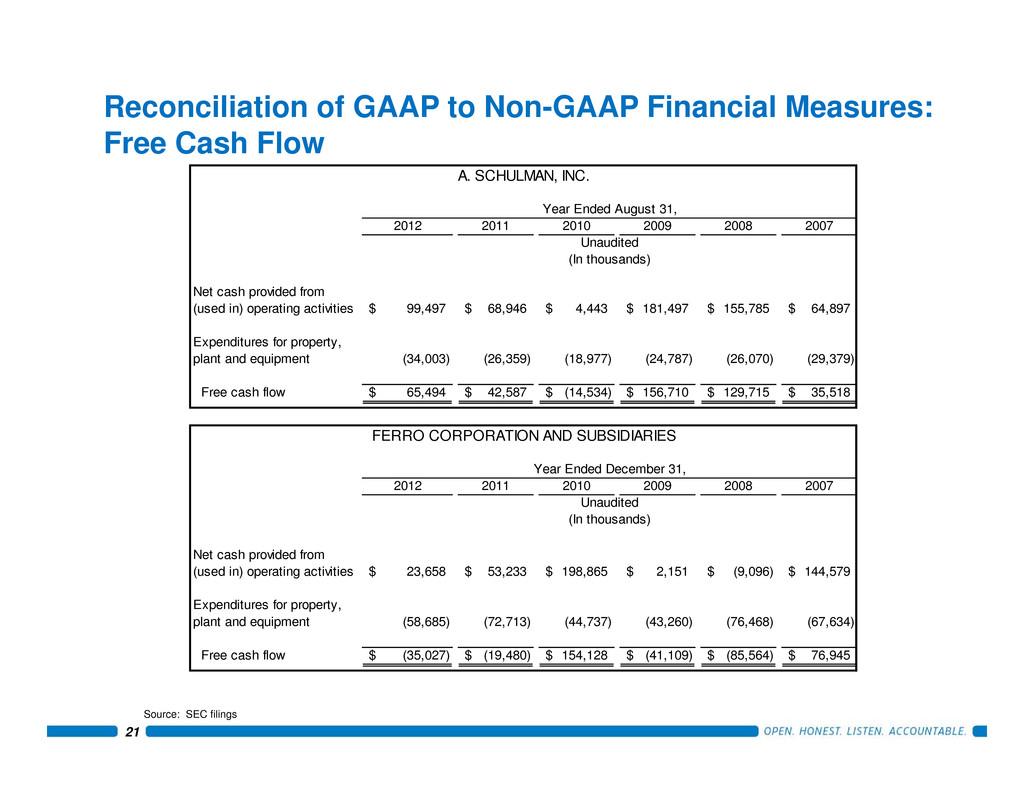

• This presentation includes certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States ("GAAP"). These non-GAAP financial measures include: net income per diluted share excluding certain items and free cash flow. However, non- GAAP measures are not in accordance with, nor are they a substitute for, GAAP measures, and tables included in the appendix reconcile each non-GAAP financial measure with the most directly comparable GAAP financial measure. The most directly comparable GAAP financial measures for these purposes are net income per diluted share and net cash provided from (used in) operating activities. The Company's non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures, and should be read only in conjunction with the Company's consolidated financial statements prepared in accordance with GAAP. • The Company uses these non-GAAP financial measures to make decisions, assess performance and allocate resources, and the Company believes that these non-GAAP financial measures are useful to investors for financial analysis. • While the Company believes that these non-GAAP financial measures provide useful supplemental information to investors, there are very significant limitations associated with their use. These non-GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company's competitors and may not be directly comparable to similarly titled measures of the Company's competitors due to potential differences in the exact method of calculation. The Company compensates for these limitations by using these non-GAAP financial measures as supplements to GAAP financial measures and by reviewing the reconciliations of the non-GAAP financial measures to their most comparable GAAP financial measures. 3 Use of Non-GAAP Financial Measures

• A. Schulman, Inc. (“SHLM”) is an international supplier of designed and engineered compounds, color concentrates, resins, and size reduction services, which are used in a variety of consumer, packaging, industrial, and automotive applications • Corporate headquarters in Akron, Ohio • Reported net sales of $2.2B for fiscal year ended August 31, 2012 • 34 manufacturing facilities • Approximately 3,300 associates • Founded in 1928 by Alex Schulman • Global presence since mid-1950’s • Public in 1972 4 A. Schulman, Inc. Overview

• Specialty chemical and attribute provider of masterbatch solutions, niche engineered plastics, custom color technologies, specialty powders and size reduction • Global footprint to maximize growth opportunities • Growth Playbook which focuses on adjacent markets, new products & technologies and cross selling • Proven track record of acquisitions to drive growth and restructuring programs to optimize cost structure • Unbroken track record of dividends since going public in 1972 • Experienced management team SHLM Investment Highlights 5

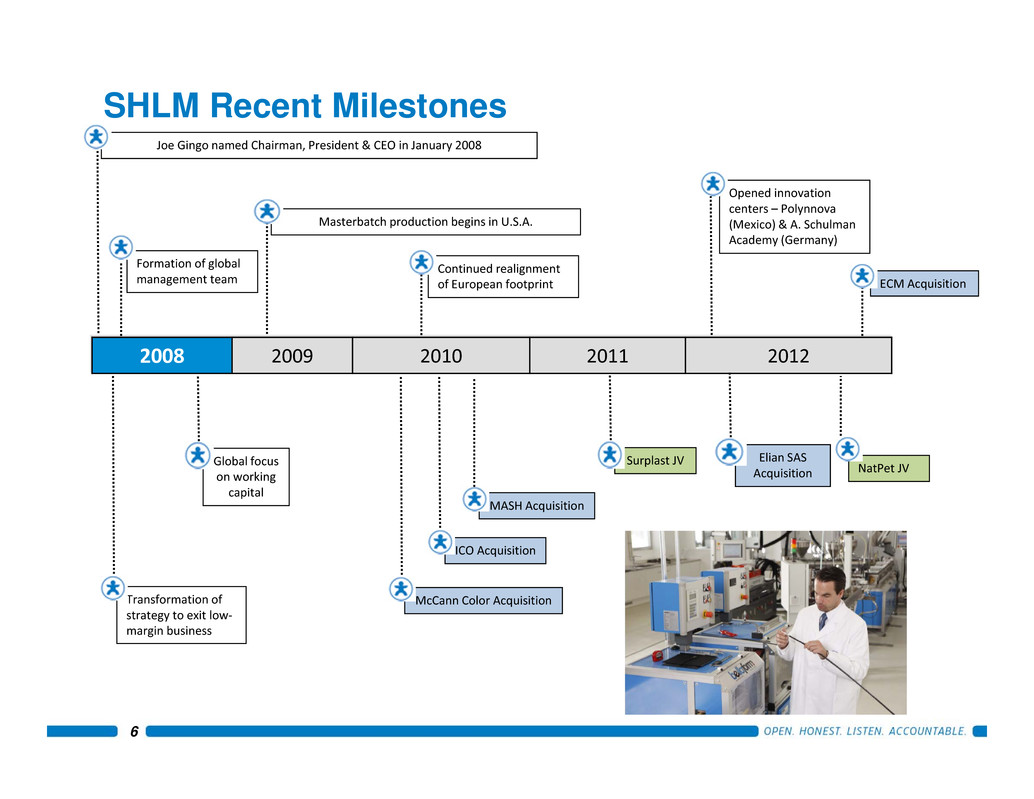

SHLM Recent Milestones Joe Gingo named Chairman, President & CEO in January 2008 Masterbatch production begins in U.S.A. McCann Color Acquisition ICO Acquisition MASH Acquisition Surplast JV 2008 2009 2010 2011 2012 Formation of global management team NatPet JV Continued realignment of European footprint Elian SAS Acquisition Global focus on working capital Transformation of strategy to exit low‐ margin business Opened innovation centers – Polynnova (Mexico) & A. Schulman Academy (Germany) ECM Acquisition 6

7 Track Record of Successful Consolidations, Restructurings & Acquisitions Since 2008 • Consolidations & Restructuring • U.S. – Closed 4 plants, sold 2 plants • (Part of EP restructuring efforts) • Australia – Closed 1 plant • Italy – Closed 1 plant, right sized 1 plant • France – Closed 1 plant • U.K. – Right sized 1 plant • Acquisitions • ICO – Publicly traded entity (Global) • McCann (U.S.) • Mash (Brazil) • Surplast (Argentina - Majority Position) • Elian (France) • ECM (U.S.)

Growth Playbook 8 • Front End Collaborative Partners • Innovation Centers • A. Schulman Academy (Germany) • Polynnova (Mexico) • New Products • Adjacent Markets • Enhancing Mix • Cross Selling • Optimize Pricing/Sourcing/Value Selling • Geographic Expansion/Added Capacity • Joint Ventures Bernard Rzepka, GM & COO - EMEA discussed innovation at the opening of A. Schulman Academy in Kerpen, Germany. This biodegradable plastic toothbrush is the result of successful collaboration between Frisetta, A. Schulman, and API SpA based in Italy.

SHLM v. FOE – Stock Trend Chart 9 SHLM: Record High $33.40 on February 12, 2013 -75% 201220112010200920082007 60% 40% 20% 0% -20% -40% -60% -80% FOE -67% SHLM +45% 3/4/133/1/13 Source: Bloomberg Public Announcement of SHLM Offer Creates Over 30% Increase in FOE Share Price on March 4, 2013

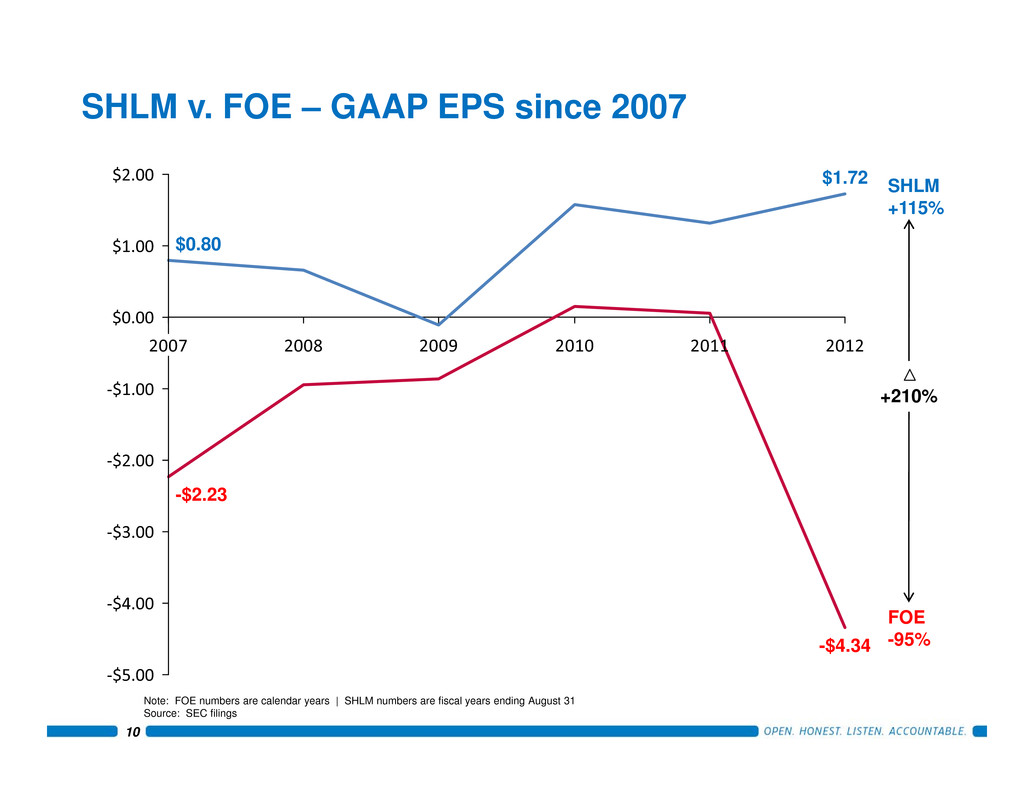

SHLM v. FOE – GAAP EPS since 2007 2007 2008 2009 2010 2011 2012 $1.00 $0.00 ‐$1.00 ‐$2.00 ‐$3.00 ‐$4.00 ‐$5.00 $2.00 FOE -95% SHLM +115% -$4.34 $1.72 $0.80 -$2.23 Note: FOE numbers are calendar years | SHLM numbers are fiscal years ending August 31 10 Source: SEC filings +210%

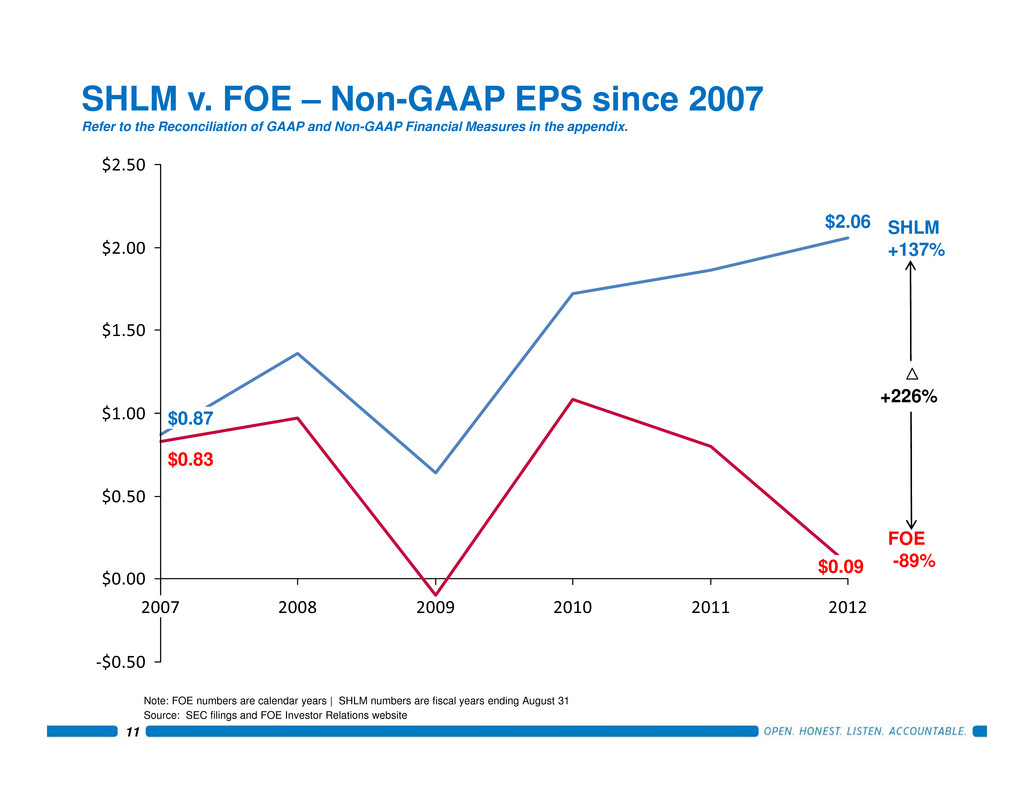

11 SHLM v. FOE – Non-GAAP EPS since 2007 Refer to the Reconciliation of GAAP and Non-GAAP Financial Measures in the appendix. ‐$0.50 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 2007 2008 2009 2010 2011 2012 $0.87 $2.06 $0.83 FOE -89% SHLM +137% $0.09 Note: FOE numbers are calendar years | SHLM numbers are fiscal years ending August 31 Source: SEC filings and FOE Investor Relations website +226%

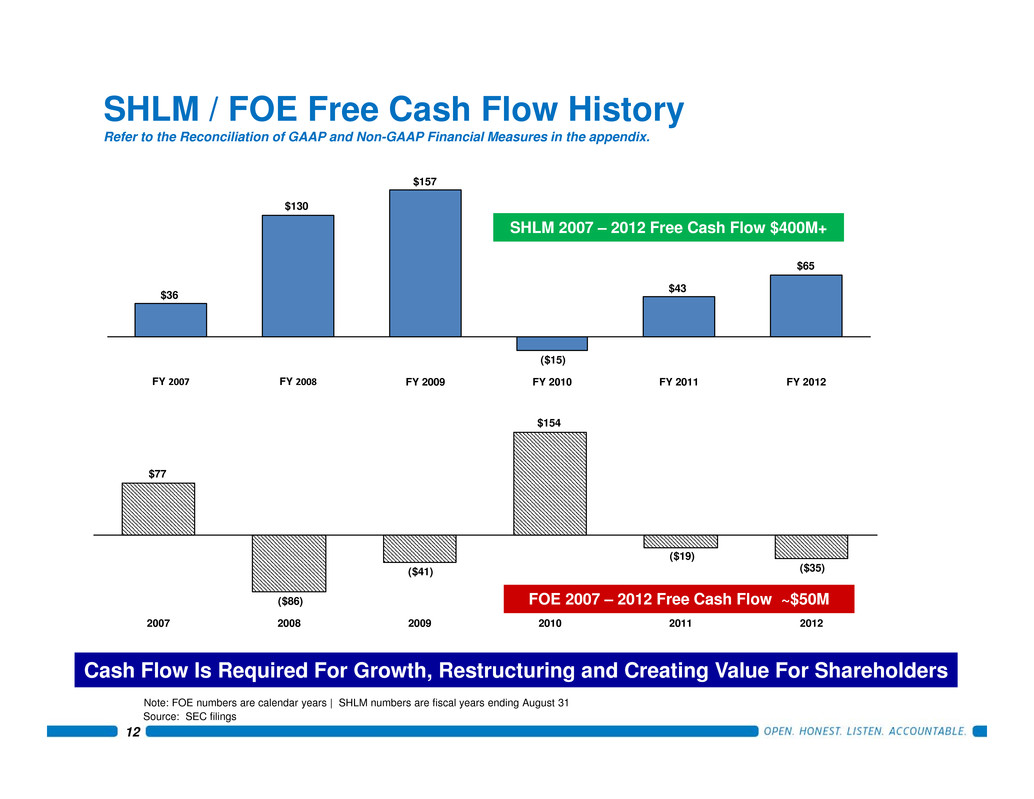

12 SHLM / FOE Free Cash Flow History Refer to the Reconciliation of GAAP and Non-GAAP Financial Measures in the appendix. $65 $43 ($15) $157 $130 $36 FY 2012FY 2011FY 2010FY 2009FY 2008FY 2007 SHLM 2007 – 2012 Free Cash Flow $400M+ ($35) ($19) $154 ($41) ($86) $77 201220112010200920082007 FOE 2007 – 2012 Free Cash Flow ~$50M Cash Flow Is Required For Growth, Restructuring and Creating Value For Shareholders Note: FOE numbers are calendar years | SHLM numbers are fiscal years ending August 31 Source: SEC filings

• Recognized Leaders In Specialty Chemicals with Value-Added Product Lines • Complementary Competencies • Complementary Markets & Applications • Similar Business Model (B2B) • Technical & Consultative Sales Approach • Recognized leaders in applications & technical expertise • Combined Company Achieves Balanced Geographic Coverage • Merger Enables Ferro To Achieve Profitable Scale Quickly with Less Risk • A. Schulman Has A Proven Ability To Execute Reorganization, Growth & Acquisitions Over The Past 5 Years • Larger Market Cap = Better Street Visibility & Access To Competitive Capital • Organizational Capabilities Spread Over Larger Base • Accelerated Global Growth 13 Benefits of Combined Company Enhances Shareholder Value & Provides Additional Earnings

14 Vertical Integration Consolidation Growth Platform Note: Pharmaceuticals is not aligned with A. Schulman Pigments & Additives A. Schulman Porcelain & Tile Coating Polymers Electronic Materials Ferro’s Capabilities Polymer Expertise Custom Attributes Provider Particle Engineering / Size Reduction Product Formulation Growth Platform Complementary (Polymeric Binder) Aligned Aligned Aligned Surface Chemistry Aligned Aligned Formulation Knowledge Aligned & ComplementaryAligned Aligned Market Applications Aligned Aligned & Complementary Markets & Applications Complementary Markets & Applications Complementary Markets & Applications ComplementaryComplementary Engineered Attributes Aligned & Complementary Core Competencies Aligned Aligned Aligned N/A Engineered Attributes Aligned

15 Key Market Comparison 2/3 of Markets Have Direct Alignment FOE SHLM FOE data = FY11 SHLM data = FY11 and top 80% of SHLM customers Building & Construction 8% Electronics & Electrical 7% Agriculture 6%Custom services 5% Personal Care & Hygiene 1% Mobility 20% Other 18% Packaging 32% Sports, Leisure & Home 3% Building & Renovation 29% Electronics 28% Major Appliances 7% Household Furnishings 7% Transportation 9% Industrial 5% Other 13%

16 Restructuring Targets 10 10 85 7 70 2014 2015 15 Plastics Integration 50 50 Ferro Corp Consol Pricing/Sourcing/Selling 4 8 9 2013 42‐47 25‐30 2 7 Ferro 2015 50 2014 50 2013 25‐30 Combined Company Projected SavingsFOE Projected Savings When cost savings and synergies are fully implemented, SHLM estimates annual savings of $35M over and above previously announced FOE targets Projected Annual SHLM Synergies Source: FOE press release on February 6, 2013 and SHLM internal estimates

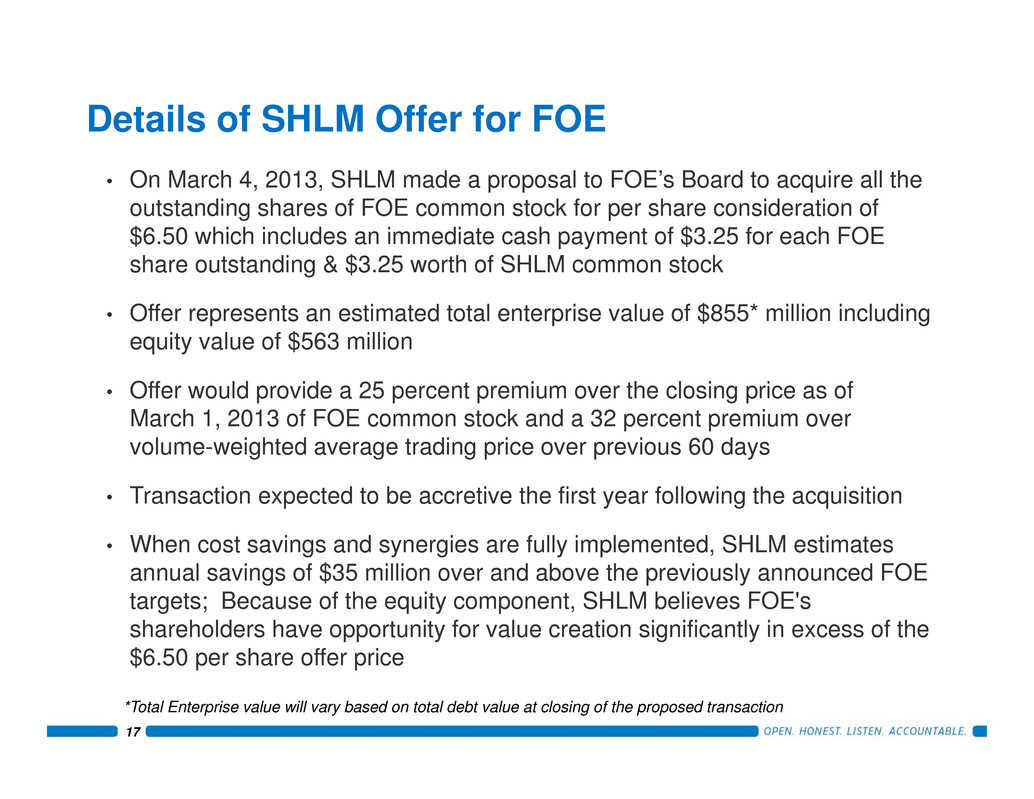

Details of SHLM Offer for FOE • On March 4, 2013, SHLM made a proposal to FOE’s Board to acquire all the outstanding shares of FOE common stock for per share consideration of $6.50 which includes an immediate cash payment of $3.25 for each FOE share outstanding & $3.25 worth of SHLM common stock • Offer represents an estimated total enterprise value of $855* million including equity value of $563 million • Offer would provide a 25 percent premium over the closing price as of March 1, 2013 of FOE common stock and a 32 percent premium over volume-weighted average trading price over previous 60 days • Transaction expected to be accretive the first year following the acquisition • When cost savings and synergies are fully implemented, SHLM estimates annual savings of $35 million over and above the previously announced FOE targets; Because of the equity component, SHLM believes FOE's shareholders have opportunity for value creation significantly in excess of the $6.50 per share offer price 17 *Total Enterprise value will vary based on total debt value at closing of the proposed transaction

Appendix

19 Reconciliation of GAAP to Non-GAAP Financial Measures: Net Income Per Diluted Share Excluding Certain Items 2012 2011 2010 2009 2008 2007 Earnings (loss) per share of common stock attributable to A. Schulman, Inc. - Diluted: GAAP, as reported 1.72$ 1.32$ 1.57$ (0.11)$ 0.66$ 0.80$ Certain items, net of tax Asset write-downs 0.09 0.26 0.21 0.53 0.43 0.04 Costs related to acquisitions 0.04 0.04 0.24 - - 0.02 Restructuring related 0.23 0.23 0.15 0.21 0.10 0.06 Inventory step-up 0.02 0.01 0.10 - - - Tax benefits (charges) (0.03) - (0.55) - - - Other reconciling items - - - - 0.16 (0.05) Rounding (0.01) - - 0.01 0.01 - Non-GAAP diluted EPS 2.06$ 1.86$ 1.72$ 0.64$ 1.36$ 0.87$ A. SCHULMAN, INC. Year Ended August 31, Unaudited Source: SEC filings

20 Reconciliation of GAAP to Non-GAAP Financial Measures: Net Income Per Diluted Share Excluding Certain Items 2012 2011 2010 2009 2008 2007 Earnings (loss) per share of common stock attributable to Ferro Corporation - Diluted: GAAP, as reported (4.34)$ 0.05$ 0.15$ (0.86)$ (0.95)$ (2.23)$ Certain items, before tax Asset write-downs 0.72 0.09 0.05 - 0.50 0.54 Goodwill impairment 1.78 0.04 - 0.16 1.35 2.46 Restructuring related 0.12 0.06 0.69 0.22 0.60 0.39 Loss on extinguishment of debt - - 0.27 - - - Amortization of fees related to credit facilities - - - 0.06 - - Other reconciling items (1) 1.81 0.55 (0.07) 0.31 (0.53) (0.33) Rounding - 0.01 (0.01) 0.01 - - Non-GAAP diluted EPS 0.09$ 0.80$ 1.08$ (0.10)$ 0.97$ 0.83$ Unaudited (1) Other reconciling items includes the tax impact of the items listed above as w ell as various other items not separately disclosed in prior f ilings. FERRO CORPORATION AND SUBSIDIARIES Year Ended December 31, Source: SEC filings and FOE Investor Relations website

21 Reconciliation of GAAP to Non-GAAP Financial Measures: Free Cash Flow 2012 2011 2010 2009 2008 2007 Net cash provided from (used in) operating activities 99,497$ 68,946$ 4,443$ 181,497$ 155,785$ 64,897$ Expenditures for property, plant and equipment (34,003) (26,359) (18,977) (24,787) (26,070) (29,379) Free cash flow 65,494$ 42,587$ (14,534)$ 156,710$ 129,715$ 35,518$ 2012 2011 2010 2009 2008 2007 Net cash provided from (used in) operating activities 23,658$ 53,233$ 198,865$ 2,151$ (9,096)$ 144,579$ Expenditures for property, plant and equipment (58,685) (72,713) (44,737) (43,260) (76,468) (67,634) Free cash flow (35,027)$ (19,480)$ 154,128$ (41,109)$ (85,564)$ 76,945$ Year Ended August 31, A. SCHULMAN, INC. (In thousands) FERRO CORPORATION AND SUBSIDIARIES Unaudited Unaudited (In thousands) Year Ended December 31, Source: SEC filings

Five Primary Product Families Engineered Plastics (“EP”) • Compounded products for durable goods, appliances, toys, electronics • Niche automotive applications • Build on existing relationships through enhanced technical capabilities and excellent customer service Distribution Services (“DS”) • Break down and distribute large producers’ bulk commodity resins • Provide a full range of products to existing customer base • Distribute specialty resins (e.g. fluoropolymers) Specialty Powders (“SP”) • Compounded resins for rotationally-molded products such as gas & water tanks, kayaks, playground slides and other large product applications • Leverage grinding into both the Masterbatch Solutions and Engineered Plastics businesses • Broad product portfolio of base resins, custom colors and proprietary cross-linked polyethylene formulations Custom Performance Colors (“CPC”) • Custom matched color concentrates for wide range of applications in personal care & hygiene, consumer packaged goods, and outdoor recreational equipment manufactured in thermoplastics and molding processes • High, technical service oriented business with small, custom lots and quick turnaround • Network of dedicated color facilities to service global brand owners Masterbatch Solutions (“MBS”) • Additives and white masterbatches for agricultural films and flexible & rigid packaging for food, consumer and industrial applications • Leveraging expertise and processing know-how in high-value applications • Industry-leading portfolio of additives, whites and blacks 22

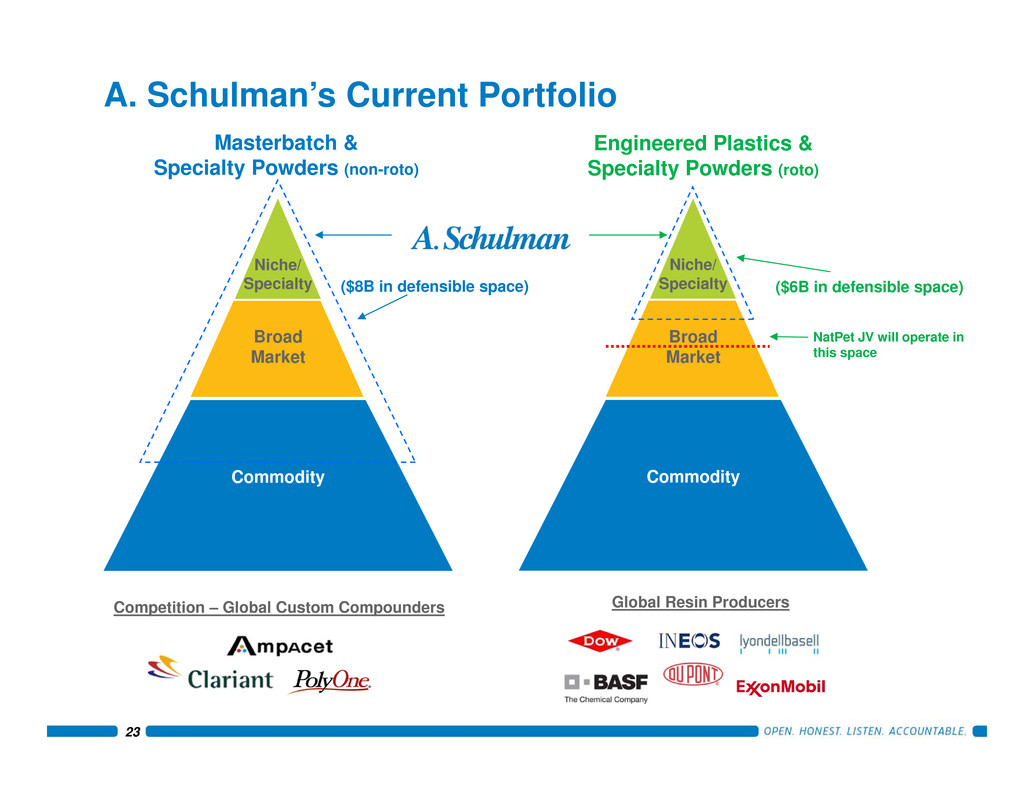

A. Schulman’s Current Portfolio Niche/ Specialty Broad Market Commodity Masterbatch & Specialty Powders (non-roto) Engineered Plastics & Specialty Powders (roto) Niche/ Specialty Broad Market Commodity Competition – Global Custom Compounders Global Resin Producers ($8B in defensible space) ($6B in defensible space) 23 NatPet JV will operate in this space