Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MGIC INVESTMENT CORP | a13-6748_38k.htm |

Exhibit 99.1

|

|

Investor Presentation March 2013 MGIC Investment Corporation (NYSE: MTG) |

|

|

2 Forward Looking Statements Forward-Looking Statements and Risk Factors Our revenues and losses may be affected by the risk factors discussed at the end of this presentation, which should be considered integral to this presentation. These factors may also cause actual results to differ materially from the results contemplated by forward looking statements that we may make. Forward looking statements consist of statements which relate to matters other than historical fact, including matters that inherently refer to future events. Among others, statements that include words such as we “believe”, “anticipate”, or “expect”, or words of similar import, are forward looking statements. We are not undertaking any obligation to update any forward looking statements or other statements we may make even though these statements may be affected by events or circumstances occurring after the forward looking statements or other statements were made. No reader of this presentation should rely on the fact that such statements are current at any time other than the time at which this presentation was given. |

|

|

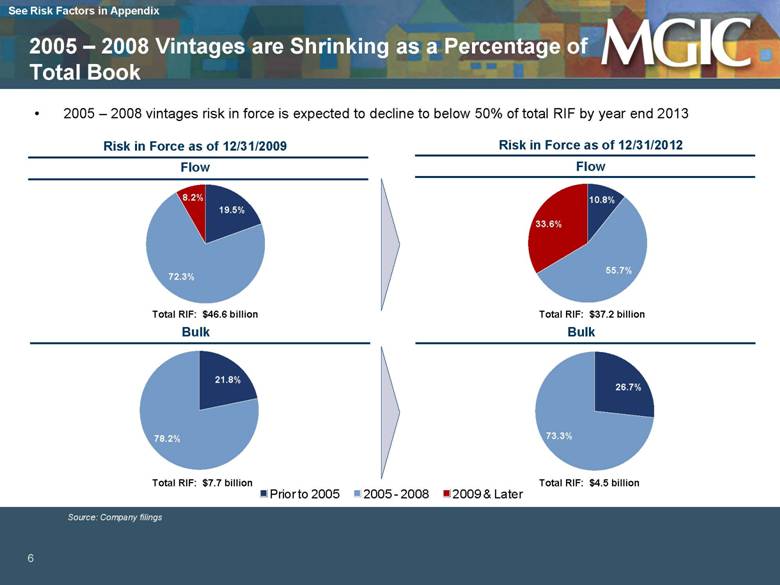

3 Levered to improving macroeconomic and housing conditions Strong financial position relative to expected losses Pre-crisis vintage losses declining on an absolute basis 2005 – 2008 vintages are expected to represent less than 50% of RIF by year end 2013 Greater certainty with regards to litigation Established market player positioned to take advantage of current environment Leading player in high IRR monthly/annual premium market Attractive returns on new business, which are expected to be ~20% “Golden Age” of credit quality Significant growth opportunities Growing demand for low down-payment lending FHA pullback creating opportunity Expected single premium market decline New customers See Risk Factors in Appendix The MGIC Investment Opportunity |

|

|

4 1 Source: S&P Case-Shiller Composite – 20 City Seasonally Adjusted Index. ² Seasonally-adjusted delinquency rate for mortgage loans on one-to-four-unit residential properties as reported by the Mortgage Bankers Association National Delinquency Survey. 3 Months’ Supply of Homes for Sale per National Association of Realtors. 4 Source: Fiserv, LPS, GS Mortgage Strategy. Improving Home Prices EXCEL SOURCE copied at 16-Apr-10 12:24:35: MGICMKT\2010\Capital Raise materials\Excel\30 Yr Mortgage Rates_v3.xls (Chart1) Monthly Supply of Homes for Sale Decline³ (in months) EXCEL SOURCE copied at 16-Apr-10 12:36:11: MGICMKT\2010\Capital Raise materials\Excel\MICA Feb 2010 data_v5.xls (Chart1) MGICMKT\2010\Capital Raise materials\Excel\MICA Feb 2010 data_v6.xls (Chart1) EXCEL SOURCE copied at 15-Apr-10 08:12:38: MGICMKT\2010\Capital Raise materials\Excel\30 Yr Mortgage Rates_v4.xls (Chart1) EXCEL SOURCE copied at 18-Apr-10 10:06:11: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\HAMP Trials Started.xls (Chart1) Declining Number of Underwater Mortgages by LTV4 (mm) See Risk Factors in Appendix Declining Delinquency Rates2 Improving Macroeconomic and Housing Conditions S&P Case-Shiller Housing Price Index, YoY% Change¹ 0 2 4 6 8 10 12 2007 2008 2009 2010 2011 2012 LTV 100 - 110 LTV 110 - 125 LTV 125 - 150 LTV >150 (30)% (20)% (10)% 0% 10% 20% Jan - 06 Feb - 07 Apr - 08 Jun - 09 Jul - 10 Sep - 11 Nov - 12 - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 Jan - 06 Jan - 07 Jan - 08 Jan - 09 Jan - 10 Jan - 11 Jan - 12 Jan - 13 0% 2% 4% 6% 8% 10% 12% 1Q06 1Q07 1Q08 1Q09 1Q10 1Q11 1Q12 3Q12 |

|

|

2009 5 Private MI NIW ($ in billions) Recovery in housing market and growing origination volumes Continuing near-term home refinancing Re-emergence of purchase market where MI penetration is higher Pullback of FHA through higher pricing and other changes Entry of new players (e.g., Essent, NMI, Arch) signals continued viability and role of private mortgage insurance going forward Strengthened underwriting and scalable, cost-efficient operating platforms Level of New Business EXCEL SOURCE copied at 16-Apr-10 02:50:06: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\Mortgage Originations_04.xls (Chart1) EXCEL SOURCE copied at 19-Apr-10 02:05:49: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\FHA Market Share.xls (Mkt Share of Insured Originatio) See Risk Factors in Appendix EXCEL SOURCE copied at 19-Apr-10 07:06:43: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\FHA Charts_v1.xls (FICO) Growth Drivers for Private MI Private MI Penetration (incl. HARP)1 4.3% 4.5% 8.7% 12.6% 12.4% 6.4% 6.1% 7.8% 9.3% 5.6% 2010 2012 2008 2007 2006 2005 2004 2003 2011 Growth Outlook for Private Mortgage Insurance is Strong Source: Inside Mortgage Finance. Bar chart excludes HARP. HARP breakout not available for 2009 – 2010. 1 MI Penetration includes HARP from 2009 onwards (date HARP began) calculated as total private MI NIW divided by dollar value of mortgage originations. $405 $264 $268 $266 $ 357 $ 193 $ 82 $ 70 $ 73 $ 131 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 |

|

|

6 Risk in Force as of 12/31/2009 Risk in Force as of 12/31/2012 Bulk EXCEL SOURCE copied at 15-Apr-10 07:13:47: MGICMKT\2010\Capital Raise materials\Excel\Cost Effective Platform to Drive Profitable Growth_03.xls (Claims Paying ResourceS) EXCEL SOURCE copied at 17-Apr-10 05:34:04: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\Market Share_v9.xls (Chart1 (2)) See Risk Factors in Appendix Bulk Flow Flow Total RIF: $46.6 billion Total RIF: $37.2 billion Total RIF: $7.7 billion Total RIF: $4.5 billion 2005 – 2008 vintages risk in force is expected to decline to below 50% of total RIF by year end 2013 2005 – 2008 Vintages are Shrinking as a Percentage of Total Book Source: Company filings 26.7% 73.3% 0.0% 10.8% 55.7% 33.6% 21.8% 78.2% 0.0% Prior to 2005 2005 - 2008 2009 & Later 21.8% 78.2% 0.0% |

|

|

7 Quarterly New Notices See Risk Factors in Appendix Cure rates on notice with “No Prior Delinquencies” lower than “Prior Delinquencies” 20 – 25% cure rate differential for notices received since 2007¹ Annual Notices from “No Prior Delinquencies” declined 98,586 from peak or ~75% Represent ~24% of current default inventory Selected Commentary Quarterly Default Inventory Quarterly Claims Received Improved Performance of Existing Book Source: Company data ¹ Delta represents flow business only. Bulk business delta is 10-15%. 0 10,000 20,000 30,000 40,000 50,000 2005 2006 2007 2008 2009 2010 2011 2012 No Prior Delinquencies Prior Delinquencies 0 3,000 6,000 9,000 12,000 15,000 18,000 2005 2006 2007 2008 2009 2010 2011 2012 0 50,000 100,000 150,000 200,000 250,000 300,000 2005 2006 2007 2008 2009 2010 2011 2012 |

|

|

8 Flow New Notice Activity by Vintage EXCEL SOURCE copied at 16-Apr-10 07:28:14: CASAEQUITY\Forecast v3.xls (Notices1) EXCEL SOURCE copied at 16-Apr-10 07:35:34: CASAEQUITY\Forecast v3.xls (Notices1 (3)) EXCEL SOURCE copied at 16-Apr-10 07:45:45: CASAEQUITY\Forecast v3.xls (Notices1 (4)) EXCEL SOURCE copied at 16-Apr-10 07:51:54: CASAEQUITY\Forecast v3.xls (Notices1 (5)) See Risk Factors in Appendix Updated New Notice Activity by Vintage Improving Source: Company data 0 5,000 10,000 15,000 20,000 25,000 2008 - Q1 2008 - Q3 2009 - Q1 2009 - Q3 2010 - Q1 2010 - Q3 2011 - Q1 2011 - Q3 2012 - Q1 2012 - Q3 New Notices Notice Quarter 2002 2003 2004 2005 2006 2007 2008 2009 |

|

|

9 Level of New Business EXCEL SOURCE copied at 16-Apr-10 02:50:06: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\Mortgage Originations_04.xls (Chart1) EXCEL SOURCE copied at 19-Apr-10 02:05:49: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\FHA Market Share.xls (Mkt Share of Insured Originatio) See Risk Factors in Appendix EXCEL SOURCE copied at 19-Apr-10 07:06:43: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\FHA Charts_v1.xls (FICO) Lifetime cure rates historically have averaged 91%¹ Cure Rates Have Improved Across the Full Spectrum Source: Company data ¹ Company average from 1988 - 2003. ² Excludes bulk transactions, rescissions and denials. Cure Rate Development by Notice Date (as of 12/31/12)² 15 % 25 % 35 % 45 % 55 % 65 % 75 % 85 % 95 % Jan - 02 Jan - 03 Jan - 04 Jan - 05 Jan - 06 Jan - 07 Jan - 08 Jan - 09 Jan - 10 Jan - 11 Jan - 12 1 Month 2 Month 3 Month 6 Month 12 Month 24 Month |

|

|

10 Base Case Scenario Key Assumptions Annual home price appreciation for years 2013 - 2017 of 3%, 4%, 4%, 3%, and 4%, respectively Annual employment growth (in millions) for years 2013-2017 of 1.9, 3.3, 3.6, 2.7, and 1.3, respectively Future rescission and claim settlement effects of $600 million; settlement with Countrywide is assumed and reflected No provision for any adverse development from any other contingencies Captive reinsurance loss recovery offset by future ceded premium Premiums: $162 billion in force, 52 bps average net premium yield, 82% average persistency (Actual 12/31/12 persistency is 79.8%) Investment income offsets operating expense Combined Insurance Entities Runoff Scenario Results at 12/31/2012¹ Cash and Investments $4.9 billion² Net Premiums Collected 3.6³ Net Claims Paid (7.1)³ Excess Claims Paying Resources $1.4 billion Under a stress scenario, excess claims paying resources would decline by $0.6bn4 See Risk Factors in Appendix Combined Insurance Operations of MGIC Investment Corporation, Estimated Base Case Excess Claims Paying Resources as of December 31, 2012 18 Source: Company data ¹ Assumes investment income offsets operating expenses. Assumes no new insurance written after 12/31/12. Includes expected future cash flows on existing insurance in force as of 12/31/12. ² Cash and investments held by MGIC Investment’s combined insurance operations at 12/31/12. ³ Represents the gross cash flows, which are not present valued. 4 Stress scenario assumes cure rates held flat from 2012 to 2014. |

|

|

11 One of the Leading Market Players¹ Highly Efficient and Low Cost Platform² EXCEL SOURCE copied at 15-Apr-10 07:13:47: MGICMKT\2010\Capital Raise materials\Excel\Cost Effective Platform to Drive Profitable Growth_03.xls (Claims Paying ResourceS) FY 2012 GAAP Expense Ratios EXCEL SOURCE copied at 17-Apr-10 05:34:04: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\Market Share_v9.xls (Chart1 (2)) Strong relationships with key customers Standardized rescission guidelines based on feedback from clients Updated underwriting guidelines to simplify customer interface with MGIC Leading presence among customers outside of top 10 lenders which are harder to access by new entrants 75% of NIW in 2012 from non-top 10 lenders Established sales force with long term relationships with key customers Focused on higher return monthly premium business, in which MGIC estimates its market share is 22% See Risk Factors in Appendix MGIC is Well Positioned to Take Advantage of the Current Environment ¹ Source: Inside Mortgage Finance. MGIC market share represents share of 2012 new insurance written by private mortgage insurers, excluding HARP. ² For Radian and GNW, expense ratio represents MI business only. 15% 27% 27% MGIC RDN GNW |

|

|

12 Strong franchise with leading presence with non-top 10 lenders, which has not eroded due to increased focus from competitors See Risk Factors in Appendix NIW by Customer Size MGIC 2012 NIW Annualized Opportunity for MGIC¹ Customer A $1 $1,129² Customer B 0 1,005² Customer C 167 395³ Customer D 0 1384 Customer E 30 120³ Customer F 24 112² Customer G 5 67² Total $227 $2,966 New Customer Opportunities ($mm) Diversified Customer Base with Substantial Future Growth Opportunities Source: Company data, Inside Mortgage Finance ¹ Annualized Opportunity represents estimated annual NIW per lender. ² Assumes 2012 originations per IMF * 8% average mortgage insurance penetration rate * 18% market share. ³ Assumes 2011 NIW and increases by 67%, the national average growth rate from 2011 to 2012. 4 New account opportunity. Assumes 2012 originations per IMF * 8% average mortgage insurance penetration rate * 18% market share. 18.7 % 18.4 % 17.2 % 19.9 % 5.6 % 6.2 % 5.7 % 5.0 % 75.7 % 75.5 % 77.0 % 75.1 % 2009 2010 2011 2012 Top 5 Lenders Top 6 - 10 Lenders Other |

|

|

13 Min FICO = 660 Max LTV = 97% (min 700 FICO); 95% all other FICOs Max DTI = 45% Cash-out Refinance (Max LTV = 85%, Min FICO = 720, Max DTI = 41%) Restrictions: Attached housing, condominiums and cooperatives ineligible in West Palm Beach, FL, Ft. Lauderdale, FL, Miami, FL and Las Vegas, NV Lender could comply with MGIC, or GSE documentation and other secondary guidelines in addition to the above requirements See Risk Factors in Appendix Current Underwriting Guidelines Tighter Underwriting Standards Drive Highly Profitable New Business Source: Company data 15.7 % 12.6 % 13.4 % 5.4 % 14.1 % 2.9 % 15.3 % 1.1 % 1999 2005 2009 1999 2006 2010 1999 2007 2011 1999 2008 2012 After 4 Years After 3 Years After 2 Years After 1 Year 125.1 % 228.8 % 172.4 % 113.3 % Vintage |

|

|

14 See Risk Factors in Appendix Performance Statistics¹ NIW by FICO Score Total 2009 – 2012 NIW: $70.6 bn 2009 – 2012 Vintages are Extremely High Quality Source: Company data ¹ Average premium rate, incurred loss ratio and paid loss ratio through 12/31/12; default rate as of 12/31/12. 740+ 71% 680 - 739 27% 620 - 679 2% Vintage 2009 2010 2011 2012 2009-2012 Avg. Premium 61 bps 62 bps 60 bps 57 bps 60 bps Rate Default 1.7 % 0.6 % 0.3 % 0.0 % 0.5 % Rate Incurred 5.4 2.9 1.0 8.3 Loss Ratio 12.6 Paid Loss 6.7 1.8 0.2 0.0 3.9 Ratio |

|

|

Year NIW Earned Premium Losses Incurred Loss Ratio 2009 $ 19,400 $339 $43 13% 2010 12,700 162 9 6 2011 14,300 109 3 3 2012 24,100 55 <1 1 Total $665 $55 8% 15 Illustrative Returns on New Business Premium Rate as a % of Insurance in-force 60bps Lifetime Claims Incidence 2 % Persistency 80 % Risk to Capital 17.5 x Investment Income (After-Tax) 3 % Loss Ratio 20 Expense Ratio 20 Combined Ratio 40 After-tax IRR (unlevered)¹ 20 % Profitability to Date Of Newer Books through 12/31/12 ($mm)2 Potential for Attractive Returns on New Business Source: Company data Note: Financial data as of 12/31/2012. 1 Assumes 35% tax rate on underwriting income. 2 As determined by coverage effective date. See Risk Factors in Appendix IRR does not reflect benefit of NOLs |

|

|

16 Level of New Business EXCEL SOURCE copied at 16-Apr-10 02:50:06: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\Mortgage Originations_04.xls (Chart1) EXCEL SOURCE copied at 19-Apr-10 02:05:49: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\FHA Market Share.xls (Mkt Share of Insured Originatio) See Risk Factors in Appendix EXCEL SOURCE copied at 19-Apr-10 07:06:43: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\FHA Charts_v1.xls (FICO) $71 billion of new insurance written from 2009 - 2012 Strong trajectory of NIW since 2010, with earnings ramp to expected future profitability Several drivers should support continued growth Demand for low down-payment lending FHA retrenchment Expected decline in single premium market New customers MGIC Primary NIW Re-emerging from Historic Lows Source: Company data Note: Excludes HARP. ($ in billions) $6.4 $5.9 $4.6 $3.0 $1.8 $2.7 $3.5 $4.3 $3.0 $3.1 $3.9 $4.2 $4.2 $5.9 $7.0 $7.0 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 |

|

|

17 See Risk Factors in Appendix Demand Pipeline Strong For Low Down Payment Lending Sources: Joint Center for Housing Studies, Harvard, PEW Research Center and FBR Research Household Formations Are Projected to Increase 30% of home purchasers are 1st time home buyers who typically lack a 20% down payment 64% of ALL home purchasers (excluding refinancings) have a down payment of less than 20% 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1995 - 2000 2000 - 2005 2006 2007 2008 2009 2010 2011 JCHS Low Projection, 2010 - 20 |

|

|

18 Pricing by FICO Score for 95% LTV Policies¹ FHA announced its third premium increase within a year, effective April 2013 Removal of ability to cancel FHA coverage beginning June 2013 Capital reserves at FHA continued to fall through 2012 and are below minimum required levels Level of New Business EXCEL SOURCE copied at 16-Apr-10 02:50:06: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\Mortgage Originations_04.xls (Chart1) EXCEL SOURCE copied at 19-Apr-10 02:05:49: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\FHA Market Share.xls (Mkt Share of Insured Originatio) See Risk Factors in Appendix EXCEL SOURCE copied at 19-Apr-10 07:06:43: MGICMKT\2010\Capital Raise materials\Roadshow\Excel\FHA Charts_v1.xls (FICO) Low Down Payment MI Market Share ($bn)² FICO Score FHA After Price Change MGIC Credit Tiered Price Difference in Monthly Payment 760 and > $1,180 $1,071 $109 Less 740 – 759 $1,180 $1,085 $95 Less 720 – 739 $1,180 $1,099 $81 Less 700 - 719 $1,180 $1,147 $33 Less 680 - 699 $1,180 $1,162 $18 Less 660 - 679 $1,180 $1,222 $42 More Private MI Gaining Share from FHA ¹ Source: Inside Mortgage Finance, Company data. MGIC, subject to change based upon changes to LLPAs, MI and MIP premium rates, and other third party costs Assumes $220,000 Purchase Price, Owner Occupied, 30 Year FRM Rate of 3.75% for FHA; Conventional rate 3.875 – 4.125%, GSE Adverse Market Fee of 25 basis points considered, GSE Loan Level Price Adjusters considered, FHA Upfront Premium is added to loan amount. All other closing costs and third party fees are the same. ² Source: Inside Mortgage Finance. Excludes HARP. Private MI NIW ($bn)² 77 % 40 % 15 % 16 % 23 % 32 % 64 % 23 % 60 % 85 % 84 % 77 % 68 % 36 % 2007 2008 2009 2010 2011 2012 95 - '07 Avg. Private MI FHA / VA |

|

|

19 See Risk Factors in Appendix Tax Benefits Highlights MGIC has total deferred tax assets of $997 million offset by a $966 million valuation allowance Net operating losses of $2.5 billion to be used against future taxable income Ability to realize tax benefits ultimately depends on existence of sufficient taxable income and no change of control Key Observations Sufficient cash to service Holding Company liquidity needs for the next 4 years Excess claims paying resources of $1.4 billion IRR on new business of ~20% Expense ratio of 15% among lowest in industry Financial Highlights Source: Company data |

|

|

20 Levered to improving macroeconomic and housing conditions Strong financial position relative to expected losses Pre-crisis vintage losses declining on an absolute basis 2005 – 2008 vintages are expected to represent less than 50% of RIF by year end 2013 Greater certainty with regards to litigation Established market player positioned to take advantage of current environment Leading player in high IRR monthly/annual premium market Attractive returns on new business, which are expected to be ~20% “Golden Age” of credit quality Significant growth opportunities Growing demand for low down-payment lending FHA pullback creating opportunity Expected single premium market decline New customers See Risk Factors in Appendix The MGIC Investment Opportunity |

|

|

21 Appendix – MGIC Risk Factors Appendix |

|

|

22 Some factors in this section are forward-looking statements. For a discussion of those statements, see “Cautionary Statement About Forward-Looking Statements”. Capital requirements may prevent us from continuing to write new insurance on an uninterrupted basis. The insurance laws of 16 jurisdictions, including Wisconsin, our domiciliary state, require a mortgage insurer to maintain a minimum amount of statutory capital relative to the risk in force (or a similar measure) in order for the mortgage insurer to continue to write new business. We refer to these requirements as the “Capital Requirements.” New insurance written in the jurisdictions that have Capital Requirements represented approximately 50% of new insurance written in 2011 and 2012. While formulations of minimum capital vary among jurisdictions, the most common formulation allows for a maximum risk-to-capital ratio of 25 to 1. A risk-to-capital ratio will increase if the percentage decrease in capital exceeds the percentage decrease in insured risk. Therefore, as capital decreases, the same dollar decrease in capital will cause a greater percentage decrease in capital and a greater increase in the risk-to-capital ratio. Wisconsin does not regulate capital by using a risk-to-capital measure but instead requires a minimum policyholder position (“MPP”). The “policyholder position” of a mortgage insurer is its net worth or surplus, contingency reserve and a portion of the reserves for unearned premiums. At December 31, 2012, MGIC’s risk-to-capital ratio was 44.7 to 1, exceeding the maximum allowed by many jurisdictions, and its policyholder position was $640 million below the required MPP of $1.2 billion. We expect MGIC’s risk-to-capital ratio to increase above its December 31, 2012 level. At December 31, 2012, the risk-to-capital ratio of our combined insurance operations (which includes reinsurance affiliates) was 47.8 to 1. A higher risk-to-capital ratio on a combined basis may indicate that, in order for MGIC or MIC to continue to utilize reinsurance arrangements with its subsidiaries or subsidiaries of our holding company, additional capital contributions to the reinsurance affiliates could be needed. These reinsurance arrangements permit MGIC and MIC to write insurance with a higher coverage percentage than they could on their own under certain state-specific requirements. Statement of Statutory Accounting Principles No. 101 (“SSAP No. 101”) became effective January 1, 2012 and prescribed new standards for determining the amount of deferred tax assets that can be recognized as admitted assets for determining statutory capital. Under a permitted practice effective September 30, 2012 and until further notice, the Office of the Commissioner of Insurance of the State of Wisconsin (“OCI”) has approved MGIC to report its net deferred tax asset as an admitted asset in an amount not to exceed 10% of surplus as regards policyholders, notwithstanding contrary provisions of SSAP No. 101. At December 31, 2012, had MGIC calculated its net deferred tax assets based on the provisions of SSAP No. 101, no deferred tax assets would have been admitted. Pursuant to the permitted practice, deferred tax assets of $63 million were included in statutory capital. Although MGIC does not meet the Capital Requirements of Wisconsin, the OCI has waived them until December 31, 2013. In place of the Capital Requirements, the OCI Order containing the waiver of Capital Requirements (the “OCI Order”) provides that MGIC can write new business as long as it maintains regulatory capital that the OCI determines is reasonably in excess of a level that would constitute a financially hazardous condition. The OCI Order requires MGIC Investment Corporation, through the earlier of December 31, 2013 and the termination of the OCI Order (the “Covered Period”), to make cash equity contributions to MGIC as may be necessary so that its “Liquid Assets” are at least $1 billion (this portion of the OCI Order is referred to as the “Keepwell Provision”). “Liquid Assets”, which include those of MGIC as well as those held in certain of our subsidiaries, including our Australian subsidiaries, but excluding MIC and its reinsurance affiliates, are the sum of (i) the aggregate cash and cash equivalents, (ii) fair market value of investments and (iii) assets held in trusts supporting the obligations of captive mortgage reinsurers to MGIC. As of December 31, 2012, “Liquid Assets” were approximately $4.8 billion. Although we do not expect that MGIC’s Liquid Assets will fall below $1 billion during the Covered Period, we do expect the amount of Liquid Assets to continue to decline materially after December 31, 2012 and through the end of the Covered Period as MGIC’s claim payments and other uses of cash continue to exceed cash generated from operations. You should read the rest of these risk factors for additional information about factors that could negatively affect MGIC’s Liquid Assets. The OCI, in its sole discretion, may modify, terminate or extend its waiver of Capital Requirements, although any modification or extension of the Keepwell Provision requires our written consent. If the OCI modifies or terminates its waiver, or if it fails to renew its waiver upon expiration, depending on the circumstances, MGIC could be prevented from writing new business in all jurisdictions if MGIC does not comply with the Capital Requirements. We cannot assure you that MGIC could obtain the additional capital necessary to comply with the Capital Requirements. At present, the amount of additional capital we would need to comply with the Capital Requirements would be substantial. See “— Our shareholders’ in our company may be diluted by additional capital that we raise or if the holders of our outstanding convertible debt convert that debt into shares of our common stock.” If MGIC were prevented from writing new business in all jurisdictions, our insurance operations in MGIC would be in run-off (meaning no new loans would be insured but loans previously insured would continue to be covered, with premiums continuing to be received and losses continuing to be paid on those loans) until MGIC either met the Capital Requirements or obtained a necessary waiver to allow it to once again write new business. Furthermore, if the OCI revokes or fails to renew MGIC’s waiver, MIC’s ability to write new business would be severely limited because approval by Fannie Mae and Freddie Mac of MIC (discussed below) is conditioned upon the continued effectiveness of the OCI Order. MGIC applied for waivers in the other jurisdictions with Capital Requirements and, at this time, has active waivers from seven of them. MIC is writing new business in the jurisdictions where MGIC does not have active waivers. As a result, MGIC and MIC are collectively writing business on a nationwide basis. State insurance departments, in their sole discretion, may modify, terminate or extend their waivers of Capital Requirements. If an insurance department other than the OCI modifies or terminates its waiver, or if it fails to grant a waiver or renew its waiver after expiration, depending on the circumstances, MGIC could be prevented from writing new business in that particular jurisdiction. Also, depending on the level of losses that MGIC experiences in the future, it is possible that regulatory action by one or more jurisdictions, including those that do not have specific Capital Requirements, may prevent MGIC from continuing to write new insurance in that jurisdiction. As discussed below, under certain conditions, this business would be written in MIC. You should read the rest of these risk factors for additional information about factors that could negatively affect MGIC’s statutory capital and compliance with Capital Requirements. MGIC Risk Factors Risk Related to Our Business |

|

|

23 MGIC’s failure to meet the Capital Requirements to insure new business does not necessarily mean that MGIC does not have sufficient resources to pay claims on its insurance liabilities. While we believe that MGIC has sufficient claims paying resources to meet its claim obligations on its insurance in force on a timely basis, we cannot assure you that the events that led to MGIC failing to meet Capital Requirements would not also result in it not having sufficient claims paying resources. Furthermore, our estimates of MGIC’s claims paying resources and claim obligations are based on various assumptions. These assumptions include the timing of the receipt of claims on loans in our delinquency inventory and future claims that we anticipate will ultimately be received, our anticipated rescission activity, premiums, housing values and unemployment rates. These assumptions are subject to inherent uncertainty and require judgment by management. Current conditions in the domestic economy make the assumptions about when anticipated claims will be received, housing values, and unemployment rates highly volatile in the sense that there is a wide range of reasonably possible outcomes. Our anticipated rescission activity is also subject to inherent uncertainty due to the difficulty of predicting the amount of claims that will be rescinded and the outcome of any legal proceedings or settlement discussions related to rescissions. You should read the rest of these risk factors for additional information about factors that could negatively affect MGIC’s claims paying resources. As part of our longstanding plan to write new business in MIC, a direct subsidiary of MGIC, MGIC has made capital contributions to MIC. As of December 31, 2012, MIC had statutory capital of $448 million. In the third quarter of 2012, we began writing new mortgage insurance in MIC, on the same policy terms as MGIC, in those jurisdictions where we did not have active waivers of Capital Requirements for MGIC. In the second half of 2012, MIC’s new insurance written was $2.4 billion, which includes business from certain jurisdictions for which new insurance is again being written in MGIC after it received the necessary waivers. We are currently writing new mortgage insurance in MIC in Florida, Idaho, Missouri, New Jersey, New York, North Carolina, Ohio and Puerto Rico. Approximately 19% of new insurance written in 2011 and 2012 was from jurisdictions in which MIC is currently writing business. We project MIC can write 100% of our new insurance for at least five years if MGIC is unable to write new business. This projection is based on the 18:1 risk-to-capital limitation prescribed by Freddie Mac’s approval of MIC (discussed below) and assumes the mix and level of new insurance written in the future would be the same as we wrote in 2012. It also assumes MIC’s GSE eligibility would extend throughout this period. If we had to write substantially more of our business in MIC and our levels of new insurance written were to increase materially, MIC may require additional capital to stay below Freddie Mac’s prescribed risk-to-capital limitation or a waiver of that limitation may be required. MIC is licensed to write business in all jurisdictions and, subject to the conditions and restrictions discussed below, has received the necessary approvals from GSEs and the OCI to write business in all of the jurisdictions that have not waived their Capital Requirements for MGIC. Under an agreement in place with Fannie Mae, as amended November 30, 2012, MIC will be eligible to write mortgage insurance through December 31, 2013, in those jurisdictions (other than Wisconsin) in which MGIC cannot write new insurance due to MGIC’s failure to meet Capital Requirements and to obtain a waiver of them. MIC is also approved to write mortgage insurance for 60 days in jurisdictions that do not have Capital Requirements if a jurisdiction notifies MGIC that, due to its financial condition, it may no longer write new business. The agreement provides that Fannie Mae may, in its discretion, extend such approval to no later than December 31, 2013. The agreement with Fannie Mae, including certain conditions and restrictions to its continued effectiveness, is summarized more fully in, and included as an exhibit to, our Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on November 30, 2012. Such conditions include the continued effectiveness of the OCI Order and the continued applicability of the Keepwell Provision of the OCI Order. Under a letter from Freddie Mac that was amended and restated as of November 30, 2012, Freddie Mac approved MIC to write business only in those jurisdictions (other than Wisconsin) where either (a) MGIC is unable to write business because it does not meet the Capital Requirements and does not obtain waivers of them, or (b) MGIC received notice that it may not write business because of that jurisdiction’s view of MGIC’s financial condition. This approval of MIC, which may be withdrawn at any time, expires December 31, 2013, or earlier if a financial examination by the OCI determines that there is a reasonable probability that MGIC will be unable to honor claim obligations at any time in the five years after the examination, or if MGIC fails to honor claim payments. The approval from Freddie Mac, including certain conditions and restrictions to its continued effectiveness, is summarized more fully in, and included as an exhibit to, our Form 8-K filed with the SEC on November 30, 2012. Such conditions include requirements that MIC not exceed a risk-to-capital ratio of 18:1 (at December 31, 2012, MIC’s risk-to-capital ratio was 1.2 to 1); MGIC and MIC comply with all terms and conditions of the OCI Order; the OCI Order remain effective; we contribute $100 million to MGIC on or before December 3, 2012 (which we did); MGIC enter into and comply with the payment terms of the settlement agreement with Freddie Mac and the Federal Housing Finance Agency (“FHFA”) dated December 1, 2012; the OCI issue the order described in the next paragraph (which it did); and MIC provide MGIC access to the capital of MIC in an amount necessary for MGIC to maintain sufficient liquidity to satisfy its obligations under insurance policies issued by MGIC. On November 29, 2012, the OCI issued an order, effective until December 31, 2013, establishing a procedure for MIC to pay a dividend to MGIC if either of the following two events occurs: (1) an OCI examination determines that there is a reasonable probability that MGIC will be unable to honor its policy obligations at any time during the five years after the examination, or (2) MGIC fails to honor its policy obligations that it in good faith believes are valid. If one of these events occurs, the OCI is to conduct a review (to be completed within 60 days after the triggering event) to determine the maximum single dividend MIC could prudently pay to MGIC for the benefit of MGIC’s policyholders, taking account of the interests of MIC’s policyholders and the general public and certain standards for dividends imposed by Wisconsin law. Upon the completion of the review, the OCI will authorize, and MIC will pay, such a dividend within 30 days. We cannot assure you that the GSEs will approve or continue to approve MIC to write new business in all jurisdictions in which MGIC is unable to do so. If one GSE does not approve MIC in all jurisdictions in which MGIC is unable to write new business, MIC may be able to write insurance on loans that will be sold to the other GSE or retained by private investors. However, because lenders may not know which GSE will purchase their loans until mortgage insurance has been procured, lenders may be unwilling to procure mortgage insurance from MIC. Furthermore, if we are unable to write business on a nationwide basis utilizing a combination of MGIC and MIC, lenders may be unwilling to procure insurance from us anywhere. In addition, new insurance written can be influenced by a lender’s assessment of the financial strength of our insurance operations. In this regard, see “— Competition or changes in our relationships with our customers could reduce our revenues or increase our losses.” MGIC Risk Factors Risk Related to Our Business |

|

|

24 The amount of insurance we write could be adversely affected if the definition of Qualified Residential Mortgage results in a reduction of the number of low down payment loans available to be insured or if lenders and investors select alternatives to private mortgage insurance. The financial reform legislation that was passed in July 2010 (the “Dodd-Frank Act” or “Dodd-Frank”) requires a securitizer to retain at least 5% of the risk associated with mortgage loans that are securitized, and in some cases the retained risk may be allocated between the securitizer and the lender that originated the loan. This risk retention requirement does not apply to mortgage loans that are Qualified Residential Mortgages (“QRMs”) or that are insured by the Federal Housing Administration (“FHA”) or another federal agency. In March 2011, federal regulators requested public comments on a proposed risk retention rule that includes a definition of QRM. The proposed definition of QRM contains many underwriting requirements, including a maximum loan-to-value ratio (“LTV”) of 80% on a home purchase transaction, a prohibition on seller contributions toward a borrower’s down payment or closing costs, and certain limits on a borrower’s debt-to-income ratio. The LTV is to be calculated without including mortgage insurance. None of our new risk written in 2012 was on loans that would qualify as QRMs under the March 2011 proposed rules. The regulators also requested public comments regarding an alternative QRM definition, the underwriting requirements of which would allow loans with a maximum LTV of 90% and higher debt-to-income ratios than allowed under the proposed QRM definition, and that may consider mortgage insurance in determining whether the LTV requirement is met. We estimate that approximately 22% of our new risk written in 2012 was on loans that would have met the alternative QRM definition. The regulators also requested that the public comments include information that may be used to assess whether mortgage insurance reduces the risk of default. We submitted a comment letter, including studies to the effect that mortgage insurance reduces the risk of default. Under the proposed rule, because of the capital support provided by the U.S. government, the GSEs satisfy the Dodd-Frank risk-retention requirements while they are in conservatorship. Therefore, under the proposed rule, lenders that originate loans that are sold to the GSEs while they are in conservatorship would not be required to retain risk associated with those loans. The public comment period for the proposed rule expired in August 2011. At this time we do not know when a final rule will be issued, although it was not expected that the final QRM rule would be issued until the final rule defining Qualified Mortgages (“QMs”) (discussed below) was issued. The Consumer Financial Protection Bureau (the “CFPB”) issued the final QM rule on January 10, 2013. Depending on, among other things, (a) the final definition of QRM and its requirements for LTV, seller contributions and debt-to-income ratio, (b) to what extent, if any, the presence of mortgage insurance would allow for a higher LTV in the definition of QRM, and (c) whether lenders choose mortgage insurance for non-QRM loans, the amount of new insurance that we write may be materially adversely affected. For other factors that could decrease the demand for mortgage insurance, see “— If the volume of low down payment home mortgage originations declines, the amount of insurance that we write could decline, which would reduce our revenues” and “— The implementation of the Basel III capital accord, or other changes to our customers’ capital requirements, may discourage the use of mortgage insurance.” As noted above, on January 10, 2013, the CFPB issued the final rule defining QM, in order to implement laws requiring lenders to consider a borrower’s ability to repay a home loan before extending credit. The QM rule prohibits loans with certain features, such as negative amortization, points and fees in excess of 3% of the loan amount, and terms exceeding 30 years, from being considered QMs. The rule also establishes general underwriting criteria for QMs including that a borrower have a total debt-to-income ratio of less than or equal to 43%. The rule provides a temporary category of QMs that have more flexible underwriting requirements so long as they satisfy the general product feature requirements of QMs and so long as they meet the underwriting requirements of the GSEs or those of the U.S. Department of Housing and Urban Development, Department of Veterans Affairs or Rural Housing Service (collectively, “Other Federal Agencies”). The temporary category of QMs that meet the underwriting requirements of the GSEs or the Other Federal Agencies will phase out when the GSEs or the Other Federal Agencies issue their own qualified mortgage rules, if the GSEs’ conservatorship ends, and in any case after seven years. We expect that most lenders will be reluctant to make loans that do not qualify as QMs because they will not be entitled to the presumptions about compliance with the ability-to-pay requirements. Given the credit characteristics presented to us, we estimate that 99% of our new risk written in 2012 was for mortgages that would have met the QM definition and 91% of our new risk written in 2012 was for mortgages that would have met the QM definition even without the temporary category allowed for mortgages that meet the GSEs’ underwriting requirements. In making these estimates, we have not considered the limitation on points and fees because the information is not available to us. We do not believe such limitation would materially affect the percentage of our new risk written meeting the QM definition. The QM rule is scheduled to become effective in January 2014. Alternatives to private mortgage insurance include: lenders using government mortgage insurance programs, including those of the Federal Housing Administration, or FHA, and the Veterans Administration, lenders and other investors holding mortgages in portfolio and self-insuring, investors using risk mitigation techniques other than private mortgage insurance, using other risk mitigation techniques in conjunction with reduced levels of private mortgage insurance coverage, or accepting credit risk without credit enhancement, and lenders originating mortgages using piggyback structures to avoid private mortgage insurance, such as a first mortgage with an 80% loan-to-value ratio and a second mortgage with a 10%, 15% or 20% loan-to-value ratio (referred to as 80-10-10, 80-15-5 or 80-20 loans, respectively) rather than a first mortgage with a 90%, 95% or 100% loan-to-value ratio that has private mortgage insurance. The FHA substantially increased its market share beginning in 2008, and beginning in 2011, that market share began to gradually decline. We believe that the FHA’s market share increased, in part, because private mortgage insurers tightened their underwriting guidelines (which led to increased utilization of the FHA’s programs) and because of increases in the amount of loan level delivery fees that the GSEs assess on loans (which result in higher costs to borrowers). In addition, federal legislation and programs provided the FHA with greater flexibility in establishing new products and increased the FHA’s competitive position against private mortgage insurers. We believe that the FHA’s current premium pricing, when compared to our current credit-tiered premium pricing (and considering the effects of GSE pricing changes), has allowed us to be more competitive with the FHA than in the recent past for loans with high FICO credit scores. We cannot predict, however, the FHA’s share of new insurance written in the future due to, among other factors, different loan eligibility terms between the FHA and the GSEs; future increases in guarantee fees charged by the GSEs; changes to the FHA’s annual premiums; and the total profitability that may be realized by mortgage lenders from securitizing loans through Ginnie Mae when compared to securitizing loans through Fannie Mae or Freddie Mac. MGIC Risk Factors Risk Related to Our Business |

|

|

25 Changes in the business practices of the GSEs, federal legislation that changes their charters or a restructuring of the GSEs could reduce our revenues or increase our losses. Substantially all of our insurance written is for loans sold to Fannie Mae and Freddie Mac. The business practices of the GSEs affect the entire relationship between them, lenders and mortgage insurers and include: the level of private mortgage insurance coverage, subject to the limitations of the GSEs’ charters (which may be changed by federal legislation), when private mortgage insurance is used as the required credit enhancement on low down payment mortgages, the amount of loan level delivery fees (which result in higher costs to borrowers) that the GSEs assess on loans that require mortgage insurance, whether the GSEs influence the mortgage lender’s selection of the mortgage insurer providing coverage and, if so, any transactions that are related to that selection, the underwriting standards that determine what loans are eligible for purchase by the GSEs, which can affect the quality of the risk insured by the mortgage insurer and the availability of mortgage loans, the terms on which mortgage insurance coverage can be canceled before reaching the cancellation thresholds established by law, the programs established by the GSEs intended to avoid or mitigate loss on insured mortgages and the circumstances in which mortgage servicers must implement such programs, the terms that the GSEs require to be included in mortgage insurance policies for loans that they purchase, and the extent to which the GSEs intervene in mortgage insurers’ rescission practices or rescission settlement practices with lenders. For additional information, see “— Our losses could increase if we do not prevail in proceedings challenging whether our rescissions were proper, we enter into material resolution arrangements or rescission rates decrease faster than we are projecting.” The FHFA is the conservator of the GSEs and has the authority to control and direct their operations. The increased role that the federal government has assumed in the residential mortgage market through the GSE conservatorship may increase the likelihood that the business practices of the GSEs change in ways that have a material adverse effect on us. In addition, these factors may increase the likelihood that the charters of the GSEs are changed by new federal legislation. The Dodd-Frank Act required the U.S. Department of the Treasury to report its recommendations regarding options for ending the conservatorship of the GSEs. This report was released in February 2011 and while it does not provide any definitive timeline for GSE reform, it does recommend using a combination of federal housing policy changes to wind down the GSEs, shrink the government’s footprint in housing finance, and help bring private capital back to the mortgage market. In 2012, Members of Congress introduced several bills intended to scale back the GSEs, however, no legislation was enacted. As a result of the matters referred to above, it is uncertain what role the GSEs, FHA and private capital, including private mortgage insurance, will play in the domestic residential housing finance system in the future or the impact of any such changes on our business. In addition, the timing of the impact on our business is uncertain. Most meaningful changes would require Congressional action to implement and it is difficult to estimate when Congressional action would be final and how long any associated phase-in period may last. The GSEs have different loan purchase programs that allow different levels of mortgage insurance coverage. Under the “charter coverage” program, on certain loans lenders may choose a mortgage insurance coverage percentage that is less than the GSEs’ “standard coverage” and only the minimum required by the GSEs’ charters, with the GSEs paying a lower price for such loans. In 2011 and 2012, nearly all of our volume was on loans with GSE standard coverage. We charge higher premium rates for higher coverage percentages. To the extent lenders selling loans to the GSEs in the future choose charter coverage for loans that we insure, our revenues would be reduced and we could experience other adverse effects. We may not continue to meet the GSEs’ mortgage insurer eligibility requirements. Substantially all of our insurance written is for loans sold to Fannie Mae and Freddie Mac, each of which has mortgage insurer eligibility requirements to maintain the highest level of eligibility, including a financial strength rating of Aa3/AA-. Because MGIC does not meet such financial strength rating requirements of Fannie Mae and Freddie Mac (its financial strength rating from Moody’s is B2 with a negative outlook and from Standard & Poor’s is B- with a negative outlook), MGIC is currently operating with each GSE as an eligible insurer under a remediation plan. We believe that the GSEs view remediation plans as a continuing process of interaction with a mortgage insurer and MGIC will continue to operate under a remediation plan for the foreseeable future. There can be no assurance that MGIC will be able to continue to operate as an eligible mortgage insurer under a remediation plan. In particular, the GSEs are currently in discussions with mortgage insurers regarding their standard mortgage insurer eligibility requirements. We also understand the FHFA and the GSEs are separately developing mortgage insurer capital standards that would replace the use of external credit ratings. The GSEs may include any new eligibility requirements as part of our current remediation plan. MIC’s financial strength rating from Moody’s is Ba3 with a negative outlook and from Standard & Poor’s is B- with a negative outlook Therefore, MIC also does not meet the financial strength rating requirements of the GSEs and is currently operating with each GSE as an eligible insurer under the approvals discussed above. See “— Capital requirements may prevent us from continuing to write new insurance on an uninterrupted basis.” If MGIC or MIC cease to be eligible to insure loans purchased by one or both of the GSEs, it would significantly reduce the volume of our new business writings. MGIC Risk Factors Risk Related to Our Business |

|

|

26 We have reported net losses for the last six years, expect to continue to report annual net losses, and cannot assure you when we will return to profitability. For the years ended December 31, 2012, 2011, 2010, 2009, 2008 and 2007, we had a net loss of $0.9 billion, $0.5 billion, $0.4 billion, $1.3 billion, $0.5 billion and $1.7 billion, respectively. We currently expect to continue to report annual net losses, the size of which will depend primarily on the amount of our incurred and paid losses from our business written prior to 2009. Our incurred and paid losses are dependent on factors that make prediction of their amounts difficult and any forecasts are subject to significant volatility. Although we currently expect to return to profitability on an annual basis, we cannot assure you when, or if, this will occur. Conditions that could delay our return to profitability include high unemployment rates, low cure rates, low housing values, changes to our current rescission practices and unfavorable resolution of ongoing legal proceedings. You should read the rest of these risk factors for additional information about factors that could increase our net losses in the future. The net losses we have experienced have eroded, and any future net losses will erode, our shareholders’ equity and could result in equity being negative. Our losses could increase if we do not prevail in proceedings challenging whether our rescissions were proper, we enter into material resolution arrangements or rescission rates decrease faster than we are projecting. Prior to 2008, rescissions of coverage on loans were not a material portion of our claims resolved during a year. However, beginning in 2008, our rescissions of coverage on loans have materially mitigated our paid losses. In each of 2009 and 2010, rescissions mitigated our paid losses by approximately $1.2 billion; in 2011, rescissions mitigated our paid losses by approximately $0.6 billion; and in 2012, rescissions mitigated our paid losses by approximately $0.3 billion (in each case, the figure includes amounts that would have either resulted in a claim payment or been charged to a deductible under a bulk or pool policy, and may have been charged to a captive reinsurer). In recent quarters, less than 10% of claims received in a quarter have been resolved by rescissions, down from the peak of approximately 28% in the first half of 2009. Our loss reserving methodology incorporates our estimates of future rescissions and reversals of rescissions. Historically, the number of rescissions that we have reversed has been immaterial. A variance between ultimate actual rescission and reversal rates and our estimates, as a result of the outcome of claims investigations, litigation, settlements or other factors, could materially affect our losses. See “— Because loss reserve estimates are subject to uncertainties and are based on assumptions that are currently very volatile, paid claims may be substantially different than our loss reserves.” We estimate rescissions mitigated our incurred losses by approximately $2.5 billion in 2009 and $0.2 billion in 2010. In 2011, we estimate that rescissions had no significant impact on our losses incurred. All of these figures include the benefit of claims not paid in the period as well as the impact of changes in our estimated expected rescission activity on our loss reserves in the period. In the fourth quarter of 2012, we estimate that our rescission benefit in loss reserves was reduced due to probable rescission settlement agreements and that other rescissions had no significant impact on our losses incurred in 2012. For more information about the rescission benefit in loss reserves, see note 9, “Loss Reserves” to our consolidated financial statements in Item 8 of our annual report on Form 10-K for the year ended December 31, 2012. For more information about the two settlements that we believe are probable, as defined in ASC 450-20, see “— We are involved in legal proceedings and are subject to the risk of additional legal proceedings in the future.” The completion of those settlements, assuming they occur, may encourage other customers to seek remedies against us. If the insured disputes our right to rescind coverage, the outcome of the dispute ultimately would be determined by legal proceedings. Under our policies, legal proceedings disputing our right to rescind coverage may be brought up to three years after the lender has obtained title to the property (typically through a foreclosure) or the property was sold in a sale that we approved, whichever is applicable, although in a few jurisdictions there is a longer time to bring such an action. For the majority of our rescissions since the beginning of 2009 that are not subject to a settlement agreement, this period in which a dispute may be brought has not ended. Until a liability associated with a settlement agreement or litigation becomes probable and can be reasonably estimated, we consider a rescission resolved for financial reporting purposes even though legal proceedings have been initiated and are ongoing. Although it is reasonably possible that, when the proceedings are completed, there will be a determination that we were not entitled to rescind in all cases, we are sometimes unable to make a reasonable estimate or range of estimates of the potential liability. Under ASC 450-20, an estimated loss from such proceedings is accrued for only if we determine that the loss is probable and can be reasonably estimated. Therefore, when establishing our loss reserves, we do not generally include additional loss reserves that would reflect an adverse outcome from ongoing legal proceedings. In April 2011, Freddie Mac advised its servicers that they must obtain its prior approval for rescission settlements and Fannie Mae advised its servicers that they are prohibited from entering into such settlements. In addition, in April 2011, Fannie Mae notified us that we must obtain its prior approval to enter into certain settlements. Since those announcements, the GSEs have approved our settlement agreement with one customer and have rejected settlement agreements that were structured differently. We have reached and implemented settlement agreements that do not require GSE approval, but they have not been material in the aggregate. As noted in “— We are involved in legal proceedings and are subject to the risk of additional legal proceedings in the future”, we have been in mediation with Countrywide Home Loans (“Countrywide”) concerning our dispute regarding rescissions and have made substantial progress in reaching an agreement to settle it. In addition to the proceedings involving Countrywide, we are involved in legal proceedings with respect to rescissions that we do not consider to be collectively material in amount. We continue to discuss with other customers their objections to material rescissions and have reached settlement terms with several of our significant customers. In connection with some of these settlement discussions, we have suspended rescissions related to loans that we believe could be included in potential settlements. As of December 31, 2012, approximately 240 rescissions, representing total potential claim payments of approximately $16 million, were affected by our decision to suspend rescissions for customers other than the two customers for which we consider a settlement agreement probable, as defined in ASC 450-20. Although it is reasonably possible that, when the discussions or legal proceedings with customers regarding rescissions are completed, there will be a conclusion or determination that we were not entitled to rescind in all cases, we are unable to make a reasonable estimate or range of estimates of the potential liability. MGIC Risk Factors Risk Related to Our Business |

|

|

27 We are involved in legal proceedings and are subject to the risk of additional legal proceedings in the future. Consumers continue to bring lawsuits against home mortgage lenders and settlement service providers. Mortgage insurers, including MGIC, have been involved in litigation alleging violations of the anti-referral fee provisions of the Real Estate Settlement Procedures Act, which is commonly known as RESPA, and the notice provisions of the Fair Credit Reporting Act, which is commonly known as FCRA. MGIC’s settlement of class action litigation against it under RESPA became final in October 2003. MGIC settled the named plaintiffs’ claims in litigation against it under FCRA in December 2004, following denial of class certification in June 2004. Since December 2006, class action litigation has been brought against a number of large lenders alleging that their captive mortgage reinsurance arrangements violated RESPA. Beginning in December 2011, MGIC, various mortgage lenders and various other mortgage insurers have been named as defendants in twelve lawsuits, alleged to be class actions, filed in various U.S. District Courts. Three of those cases have previously been dismissed. The complaints in all nine of the remaining cases allege various causes of action related to the captive mortgage reinsurance arrangements of the mortgage lenders, including that the defendants violated RESPA by paying excessive premiums to the lenders’ captive reinsurer in relation to the risk assumed by that captive. MGIC denies any wrongdoing and intends to vigorously defend itself against the allegations in the lawsuits. There can be no assurance that we will not be subject to further litigation under RESPA (or FCRA) or that the outcome of any such litigation, including the lawsuits mentioned above, would not have a material adverse effect on us. Since June 2005, various state and federal regulators have also conducted investigations or requested information regarding captive mortgage reinsurance arrangements, including (1) a request received by MGIC in June 2005 from the New York Department of Financial Services for information regarding captive mortgage reinsurance arrangements and other types of arrangements in which lenders receive compensation; (2) the Minnesota Department of Commerce (the “MN Department”), which regulates insurance, began requesting information in February 2006, regarding captive mortgage reinsurance and certain other matters in response to which MGIC has provided information on several occasions, including as recently as May 2011; (3) various subpoenas received by MGIC beginning in March 2008 from the U.S. Department of Housing and Urban Development (“HUD”), seeking information about captive mortgage reinsurance similar to that requested by the MN Department, but not limited in scope to the state of Minnesota; and (4) correspondence received by MGIC in January 2012 from the CFPB indicating that HUD had transferred authority to the CFPB to investigate captive reinsurance arrangements in the mortgage insurance industry and requesting, among other things, certain information regarding captive mortgage reinsurance transactions in which we participated. In June 2012, we received a Civil Investigative Demand from the CFPB requiring additional information and documentation regarding captive mortgage reinsurance. We have met with, and expect to continue to communicate with, the CFPB to discuss the CID and how to resolve its investigation. MGIC has also filed a petition to modify the CID which petition is currently pending. While MGIC believes it would have strong defenses to any claims the CFPB might bring against it as a result of the investigation, it continues to work with the CFPB to try to resolve the investigation and address any concerns that the CFPB may have about MGIC’s past and current captive reinsurance practices. If MGIC cannot satisfy the CFPB, it is possible that the CFPB would assert various RESPA and possibly other claims against it. Other insurance departments or other officials, including attorneys general, may also seek information about or investigate captive mortgage reinsurance. Various regulators, including the CFPB, state insurance commissioners and state attorneys general may bring actions seeking various forms of relief, including civil penalties and injunctions against violations of RESPA. The insurance law provisions of many states prohibit paying for the referral of insurance business and provide various mechanisms to enforce this prohibition. While we believe our captive reinsurance arrangements are in conformity with applicable laws and regulations, it is not possible to predict the eventual scope, duration or outcome of any such reviews or investigations nor is it possible to predict their effect on us or the mortgage insurance industry. We are subject to comprehensive, detailed regulation by state insurance departments. These regulations are principally designed for the protection of our insured policyholders, rather than for the benefit of investors. Although their scope varies, state insurance laws generally grant broad supervisory powers to agencies or officials to examine insurance companies and enforce rules or exercise discretion affecting almost every significant aspect of the insurance business. Given the recent significant losses incurred by many insurers in the mortgage and financial guaranty industries, our insurance subsidiaries have been subject to heightened scrutiny by insurance regulators. State insurance regulatory authorities could take actions, including changes in capital requirements or termination of waivers of capital requirements, that could have a material adverse effect on us. As noted above, in January 2013, the CFPB issued rules to implement laws requiring mortgage lenders to make ability-to-pay determinations prior to extending credit. We are uncertain whether the CFPB will issue any other rules or regulations that affect our business apart from any action it may take as a result of its investigation of captive mortgage reinsurance. Such rules and regulations could have a material adverse effect on us. In October 2010, a purported class action lawsuit was filed against MGIC in the U.S. District Court for the Western District of Pennsylvania by a loan applicant on whose behalf a now-settled action we previously disclosed had been filed by the U.S. Department of Justice. In this lawsuit, the loan applicant alleged that MGIC discriminated against her and certain proposed class members on the basis of sex and familial status when MGIC underwrote their loans for mortgage insurance. In May 2011, the District Court granted MGIC’s motion to dismiss with respect to all claims except certain Fair Housing Act claims. On November 29, 2012, the District Court granted final approval for a class action settlement of the lawsuit. The settlement created a settlement class of 265 borrowers. Under the terms of the settlement, MGIC deposited $500,000 into an escrow account to fund possible payments to affected borrowers. In addition, MGIC paid the named plaintiff an “incentive fee” of $7,500 and paid class counsels’ fees of $337,500. Any funds remaining in the escrow account after payment of all claims approved under the procedures established by the settlement will be returned to MGIC. We understand several law firms have, among other things, issued press releases to the effect that they are investigating us, including whether the fiduciaries of our 401(k) plan breached their fiduciary duties regarding the plan’s investment in or holding of our common stock or whether we breached other legal or fiduciary obligations to our shareholders. We intend to defend vigorously any proceedings that may result from these investigations. With limited exceptions, our bylaws provide that our officers and 401(k) plan fiduciaries are entitled to indemnification from us for claims against them. MGIC Risk Factors Risk Related to Our Business |

|

|

28 We have made substantial progress in reaching an agreement with Countrywide to settle the dispute we have regarding rescissions. Since December 2009, we have been involved in legal proceedings with Countrywide in which Countrywide alleged that MGIC denied valid mortgage insurance claims. (In our SEC reports, we refer to rescissions of insurance and denials of claims collectively as “rescissions” and variations of that term.) In addition to the claim amounts it alleged MGIC had improperly denied, Countrywide contended it was entitled to other damages of almost $700 million as well as exemplary damages. We sought a determination in those proceedings that we were entitled to rescind coverage on the applicable loans. From January 1, 2008 through December 31, 2012, rescissions of coverage on Countrywide-related loans mitigated our paid losses on the order of $445 million. This amount is the amount we estimate we would have paid had the coverage not been rescinded. In addition, in connection with mediation we were holding with Countrywide, we voluntarily suspended rescissions related to loans that we believed could be covered by a settlement. As of December 31, 2012, coverage on approximately 2,150 loans, representing total potential claim payments of approximately $160 million, that we had determined was rescindable was affected by our decision to suspend such rescissions. While there can be no assurance that we will actually enter into a settlement agreement with Countrywide, we have determined that a settlement with Countrywide is probable. We are also discussing a settlement with another customer. We have also determined that it is probable we will reach a settlement of our dispute with this customer. As of December 31, 2012, coverage on approximately 250 loans, representing total potential claim payments of approximately $17 million, was affected by our decision to suspend rescissions for that customer. We are now able to reasonably estimate the probable loss associated with each probable settlement and, as required by ASC 450-20, we have recorded the estimated impact of the two probable settlements referred to above in our financial statements for the quarter ending December 31, 2012. The aggregate impact to loss reserves for the probable settlement agreements was an increase of approximately $100 million. This impact was somewhat offset by impacts to our return premium accrual and premium deficiency reserve. All of these impacts were reflected in the fourth quarter 2012 financial results. If we are not able to reach settlement with Countrywide, we intend to defend MGIC against any related legal proceedings, vigorously. The flow policies at issue with Countrywide are in the same form as the flow policies that we use with all of our customers, and the bulk policies at issue vary from one another, but are generally similar to those used in the majority of our Wall Street bulk transactions. A settlement with Countrywide may encourage other customers to pursue remedies against us. From January 1, 2008 through December 31, 2012, we estimate that total rescissions mitigated our incurred losses by approximately $2.9 billion, which included approximately $2.9 billion of mitigation on paid losses, excluding $0.6 billion that would have been applied to a deductible. At December 31, 2012, we estimate that our total loss reserves were benefited from anticipated rescissions by approximately $0.2 billion. Before paying a claim, we review the loan and servicing files to determine the appropriateness of the claim amount. All of our insurance policies provide that we can reduce or deny a claim if the servicer did not comply with its obligations under our insurance policy, including the requirement to mitigate our loss by performing reasonable loss mitigation efforts or, for example, diligently pursuing a foreclosure or bankruptcy relief in a timely manner. We call such reduction of claims submitted to us “curtailments.” In 2012, curtailments reduced our average claim paid by approximately 4%. In addition, the claims submitted to us sometimes include costs and expenses not covered by our insurance policies, such as mortgage insurance premiums, hazard insurance premiums for periods after the claim date and losses resulting from property damage that has not been repaired. These other adjustments reduced claim amounts by less than the amount of curtailments. After we pay a claim, servicers and insureds sometimes object to our curtailments and other adjustments. We review these objections if they are sent to us within 90 days after the claim was paid. Historically, we have not had material disputes regarding our curtailments or other adjustments. As part of our settlement discussions, Countrywide informed us that they object to approximately $40 million of curtailment and other adjustments. In connection with any settlement agreement with Countrywide, we expect we would enter into a separate agreement with them that would provide for a process to resolve this dispute. However, we do not believe a loss is probable regarding this curtailment dispute and have not accrued any reserves that would reflect an adverse outcome to this dispute. We intend to defend vigorously our position regarding the correctness of these curtailments under our insurance policy. Although we have not had other material objections to our curtailment and adjustment practices, there can be no assurances that we will not face additional challenges to such practices. A non-insurance subsidiary of our holding company is a shareholder of the corporation that operates the Mortgage Electronic Registration System (“MERS”). Our subsidiary, as a shareholder of MERS, has been named as a defendant (along with MERS and its other shareholders) in nine lawsuits asserting various causes of action arising from allegedly improper recording and foreclosure activities by MERS. Three of those lawsuits remain pending and the other six lawsuits have been dismissed without an appeal. The damages sought in the remaining cases are substantial. We deny any wrongdoing and intend to defend ourselves against the allegations in the lawsuits, vigorously. In addition to the matters described above, we are involved in other legal proceedings in the ordinary course of business. In our opinion, based on the facts known at this time, the ultimate resolution of these ordinary course legal proceedings will not have a material adverse effect on our financial position or results of operations. Resolution of our dispute with the Internal Revenue Service could adversely affect us. The Internal Revenue Service (“IRS”) completed examinations of our federal income tax returns for the years 2000 through 2007 and issued assessments for unpaid taxes, interest and penalties related to our treatment of the flow-through income and loss from an investment in a portfolio of residual interests of Real Estate Mortgage Investment Conduits (“REMICs”). This portfolio has been managed and maintained during years prior to, during and subsequent to the examination period. The IRS indicated that it did not believe that, for various reasons, we had established sufficient tax basis in the REMIC residual interests to deduct the losses from taxable income. The IRS assessment related to the REMIC issue is $190.7 million in taxes and penalties. There would also be applicable interest which, when computed on the amount of the assessment, is substantial. Depending on the outcome of this matter, additional state income taxes along with any applicable interest may become due when a final resolution is reached and could also be substantial. We appealed these assessments within the IRS and, in 2007, we made a payment of $65.2 million to the United States Department of the Treasury related to this assessment. In August 2010, we reached a tentative settlement agreement with the IRS which was not finalized. We currently expect to receive a statutory notice of deficiency (commonly referred to as a “90-day letter”) for the disputed amounts after the first quarter of 2013. We would then be required to litigate their validity in order to avoid payment to the IRS of the entire amount assessed. Any such litigation could be lengthy and costly in terms of legal fees and related expenses. We continue to believe that our previously recorded tax provisions and liabilities are appropriate. However, we would need to make appropriate adjustments, which could be material, to our tax provision and liabilities if our view of the probability of success in this matter changes, and the ultimate resolution of this matter could have a material negative impact on our effective tax rate, results of operations, cash flows and statutory capital. In this regard, see “— Capital requirements may prevent us from continuing to write new insurance on an uninterrupted basis.” MGIC Risk Factors Risk Related to Our Business |

|

|