Attached files

| file | filename |

|---|---|

| 8-K - 8-K - XPO Logistics, Inc. | d493997d8k.htm |

| EX-99.2 - EX-99.2 - XPO Logistics, Inc. | d493997dex992.htm |

Exhibit 99.1

Management Presentation

February 27, 2013

Disclaimer

This presentation contains, and XPO Logistics, Inc. (the “Company”) may from time to time make, written or oral “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, made in this presentation that address activities, events or developments that the Company expects or anticipates will or may occur in the future, including such thingsas future capital expenditures (including the amount and nature thereof), finding suitable merger or acquisition candidates, expansion and growth of the Company’s business and operations, the Company’s 2013 outlook, and other such matters, are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments as well as other factors it believes are appropriate in the circumstances. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “may,”“will,”“should,”“expect,” “intend,”“plan,”“anticipate,”“believe,”“estimate,”“predict,”“potential” or “continue” or the negative of these terms or other comparable terms. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements. Factors that could adversely affect actual results and performance include, among others, economic conditions generally; competition; the Company’s ability to find suitable acquisition candidates and execute its acquisition strategy; the Company’s ability to raise capital; the Company’s ability to attract and retain key employees to execute its growth strategy; the Company’s ability to develop and implement a suitable information technology system; the Company’s ability to maintain positive relationships with its network of third-party transportation providers; litigation; and governmental regulation. Additional factors that could cause actual results to differ materially from those projected in the forward-looking statements can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, and in the Company’s other filings with the Securities and Exchange Commission (the “SEC”). This presentation should beread inconjunction with the Company’s filings with the SEC,which are available to thepublicover the Internet at www.sec.gov and the Company’s website www.xpologistics.com. All forward-looking statements made in this presentation speak only as of the date of this presentation. All forward-looking statements made in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligation to update any such forward-looking statements, including its 2013 outlook.

A Large Market Opportunity

Worldwide logistics: >$3 trillion U.S. logistics: >$1 trillion U.S. trucking: ~$350 billion U.S. truck brokerage ~$50 billion

Sources: American Trucking Association, Armstrong & Associates, EVE Partners LLC

Truck Brokerage Growing at 2x to 3x GDP

ƒ Long-term outsourcing trend

ƒ Brokers add efficiency to both shippers and carriers

– Shippers gain access to thousands of carriers

– Carriers gain access to millions of loads

ƒ 85% of shipments are not presently handled by brokers

ƒ $300 billion untapped opportunity

We expect 15% penetration to increase

Sources: American Trucking Association, Armstrong & Associates

Brokerage Is a Highly Fragmented Market

ƒ More than 10,000 licensed brokers in the U.S.

ƒ Only about 25 brokers with more than $200 million in revenue

ƒ Large potential acquisition universe

ƒ Lack of working capital can motivate sellers

Source: Armstrong & Associates

The XPO Growth Strategy

ƒ Build a multi-billion dollar, non-asset, 3PL business in the transportation industry

– Acquire attractive companies that are highly scalable

– Open cold-starts in prime recruitment areas

– Significantly scale up and optimize operations

ƒ Instill a passionate, world-class culture of customer service

On track or ahead of plan with all parts of the strategy

Major Accomplishments in 14 Months

ƒ Completed six strategic acquisitions

ƒ Opened 17 cold-starts, eight of them in truck brokerage

ƒ Increased overall headcount from 208 to more than 900

ƒ Added over 550 sales and carrier procurement personnel

ƒ Built up national operations center to 202 employees

Grew footprint to 60 locations

Major Accomplishments in 14 Months

ƒ Implemented leading edge training programs

ƒ Introduced scalable IT platform and two major upgrades

ƒ Established national accounts program

ƒ Raised $289 million in common stock and convertible debt

ƒ Dynamic team culture, hungry for growth

Foundation in place for a much larger company

Strategy Part One: Acquisitions

ƒ Capitalize on attractive acquisition universe

– Primarily truck brokerage and expedite

ƒ Aggressively expand sales force

ƒ Connect to entire organization via XPO technology

ƒ Draw on shared carrier capacity

ƒ Cross-sell services company-wide

ƒ Gain carriers, customers, lane and pricing histories with each acquisition

Acquired Covered Logistics

ƒ Third-party logistics provider of freight brokerage services

ƒ 7-year-old business, acquired in February 2013

ƒ 2012 revenue of $27 million

ƒ Highly scalable, with deep roots in the industry

ƒ Retained management to lead Illinois and Texas branches

ƒ Strong customer relationships in manufacturing, postal, consumer, and oil and gas sectors

Acquired East Coast Air Charter

ƒ Non-asset logistics provider of expedited air charter brokerage, North Carolina

ƒ 16-year-old business, acquired in February 2013

ƒ 2012 revenue of $43 million

ƒ Proprietary technology in place

ƒ Long-time partner to our expedite division

– Responds to expedite customer demand for air charter

ƒ Rebranding as XPO Air Charter and selling across all divisions

Acquired Turbo Logistics

ƒ 28-year-old business, acquired in October 2012

ƒ Operated in Gainesville (Georgia), Reno, Chicago and Dallas

ƒ $124 million in annual brokerage revenue

ƒ Specializes in Fortune 500 customers

ƒ Growing quickly, led by industry veterans

Acquired Kelron Logistics

ƒ 20-year-old business, acquired in August 2012

ƒ Highly scalable operations in Toronto, Montreal, Vancouver and Cleveland

ƒ $100 million in annual brokerage revenue

ƒ Strong base of over 1,000 customers, mostly tier one

ƒ Extensive carrier and lane histories made available to all brokerage branches

– Similar synergy with CFS and BirdDog acquisitions

Strategy Part Two: Cold-starts

ƒ Opened 17 cold-starts to date

– Eight in truck brokerage, three more than planned

– Eight in freight forwarding

– One in expedite

ƒ Open branches with strong leaders from the industry

ƒ Position in prime recruitment areas

ƒ Scale up rapidly by adding salespeople

Strategy Part Three: Scale and Optimization

ƒ Rapidly expand sales force with aggressive recruiting and on-boarding, including off-site training

ƒ Identify branches capable of mega-growth:

– Charlotte, led by Drew Wilkerson

– Chicago, led by Abtin Hamidi

– Gainesville, led by David Coker and Jeff Battle

ƒ Drive operational efficiency through shared services

ƒ Accelerate sales and marketing

Customers Will Drive Growth

ƒ Diversified customer base of manufacturing, industrial, retail, commercial, life sciences, government-related

ƒ Divisional cross-sell to new and existing customers

ƒ Differentiate as a world-class customer service organization

ƒ Single point of contact for each prospect in our database

– 3 million small to mid-sized companies, 1,000 large players

$50 billion addressable market and growing

Source: EVE Partners LLC

Scalable Technology Platform

ƒ Differentiate XPO through superior technology

ƒ Purchase transportation more efficiently as data pool grows

ƒ Introduced pricing tools in Q3 2012

ƒ Added truck-finding and advanced pricing tools in Q4 2012 with introduction of proprietary freight optimizer software

ƒ 2013 enhancements include LTL upgrades, new carrier algorithms, new customer and carrier portals

CEO Bradley S. Jacobs

Founded and led four highly successful companies

ƒ Amerex Oil Associates: Built one of world’s largest oil brokerage firms

ƒ Hamilton Resources: Grew global oil trading company to ~$1 billion

ƒ United Waste: Created fifth largest solid waste business in North America

ƒ United Rentals: Built world’s largest equipment rental company

United Waste stock outperformed S&P 500 by 5.6x from 1992 to 1997 United Rentals stock outperformed S&P 500 by 2.2x from 1997 to 2007

Highly Skilled Management Team Partial list below

Sean Fernandez

NCR, Avery Dennison, Arrow Electronics

Chief Operating Officer

John Hardig

Stifel Nicolaus, Alex. Brown

Chief Financial Officer

Scott Malat

Goldman Sachs, UBS, JPMorgan Chase

Chief Strategy Officer

Gordon Devens

AutoNation, Skadden Arps

General Counsel

Mario Harik

Oakleaf Waste Management

Chief Information Officer

David Rowe

Echo Global Logistics

Chief Technology Officer

Troy Cooper

United Rentals, United Waste

SVP, Operations

Greg Ritter

C.H. Robinson, Knight Brokerage

SVP, Strategic Accounts

Lou Amo

Electrolux, Union Pacific, Odyssey Logistics

VP, Carrier Procurement

John Tuomala

Compass Group

VP, Talent Management

Marie Fields

C.H. Robinson, American Backhaulers

Director of Training

The full management team can be found on www.xpologistics.com

Financial Overview

Key Financial Statistics

ƒ 2012 revenue of $278.6 million

ƒ Currently in excess of $500 million annual revenue run rate

ƒ Q4 2012 total revenue: $108.5 million* up 146% YOY

– Freight brokerage: $71.1 million – up 760%

– Expedited transportation: $22.1 million – up 9%

– Freight forwarding: $18.5 million – up 10%

ƒ Approximately $250 million cash as of February 1, 2013

| * |

|

Net of intercompany eliminations Source: Company data |

2013 Outlook

ƒ Annual revenue run rate of more than $1 billion as of December 31

ƒ At least $300 million of acquired historical annual revenue

ƒ Positive Q4 2013 EBITDA

ƒ At least three more cold-starts in freight brokerage

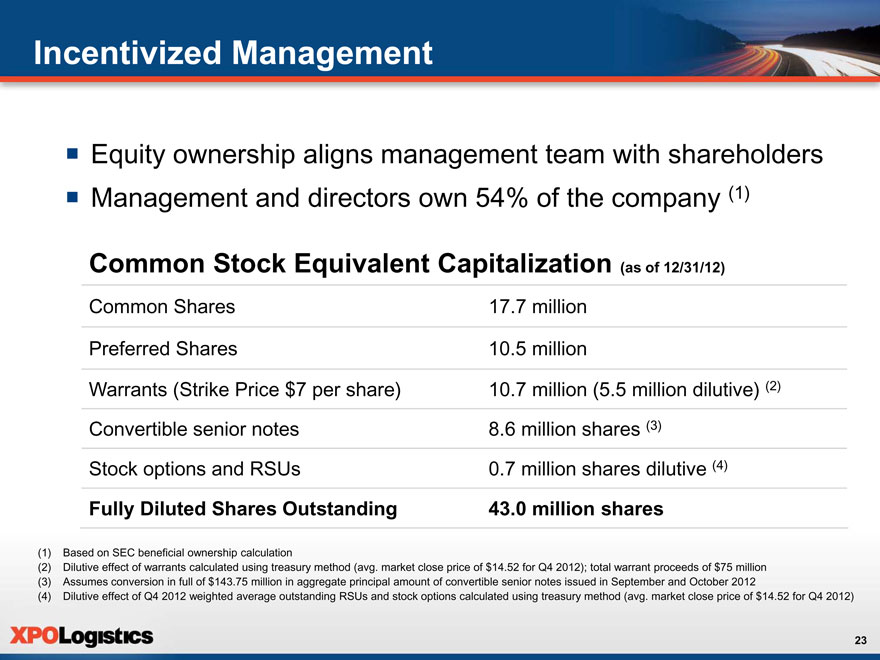

Incentivized Management

ƒ Equity ownership aligns management team with shareholders

ƒ Management and directors own 54% of the company (1)

Common Stock Equivalent Capitalization (as of 12/31/12)

Common Shares 17.7 million

Preferred Shares 10.5 million

Warrants (Strike Price $7 per share) 10.7 million (5.5 million dilutive) (2) Convertible senior notes 8.6 million shares (3) Stock options and RSUs 0.7 million shares dilutive (4)

Fully Diluted Shares Outstanding 43.0 million shares

| (1) |

|

Based on SEC beneficial ownership calculation |

(2) Dilutive effect of warrants calculated using treasury method (avg. market close price of $14.52 for Q4 2012); total warrant proceeds of $75 million (3) Assumes conversion in full of $143.75 million in aggregate principal amount of convertible senior notes issued in September and October 2012

(4) Dilutive effect of Q4 2012 weighted average outstanding RSUs and stock options calculated using treasury method (avg. market close price of $14.52 for Q4 2012)

Conclusion

Strong Fundamentals for Value Creation

ƒ Large, growing, fragmented industry

ƒ Significant growth potential through cold-starts

ƒ Well-defined process to scale up operations

ƒ Passionate, world-class culture of customer service

ƒ Highly skilled management team

ƒ High employee morale due to growth initiatives and culture

ƒ 99% of market available to XPO for penetration