Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - FORCE MINERALS CORP | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - FORCE MINERALS CORP | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - FORCE MINERALS CORP | ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - FORCE MINERALS CORP | ex32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended November 30, 2012 | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _________ to ________ | |

| Commission file number: 000-52494 |

| Force Energy Corp. | |

| (Exact name of registrant as specified in its charter) | |

| Nevada | 98-0462664 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 1400 16th Street, Suite 400, Denver, CO | 80202 |

| (Address of principal executive offices) | (Zip Code) |

|

Registrant’s telephone number: 720-470-1414 |

|

|

Securities registered under Section 12(b) of the Exchange Act:

| |

| Title of each class | Name of each exchange on which registered |

| none | not applicable |

|

Securities registered under Section 12(g) of the Exchange Act:

| |

| Title of class | |

| none | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [ ] No [X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $831,549

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 105,416,987 common shares as of November 30, 2012.

| 1 |

| 2 |

PART I

Company Overview

We are currently engaged in the business of identifying, evaluating, and qualifying potential natural gas and oil wells; investing in interests in those wells with the goal of producing commercially marketable quantities of oil and natural gas. We have recently expanded our business model to include the exploration of mineral claims for rare earth minerals.

The Hayter Well

We presently hold a 50% working interest of the County Line Energy Corp. interest in the Hayter Well located in Alberta, Canada.

County Line Energy Corp. is the operator of the Hayter well. The Hayter well has been cased and cemented in anticipation of the completion of the drill program. County Line plans to enter the Hayter well, perforate the potential pay zones and conduct regular production testing of the zones. Should the testing confirm adequate oil reserves and potential economic flow rates, County Line is expected to install adequate pumping equipment and other surface facilities in anticipation of the projected flow rates. Currently, there are no known oil reserves on the Hayter well.

We have not incurred any development costs on the Hayter Well for the year ended November 30, 2012. We do not anticipate immediate attention to this project, as our time and effort currently is focused on our Zoro 1 Mineral Claim.

Competition

The oil and gas industry is very competitive. We compete with numerous individuals and companies, including many major oil and gas companies, which have substantially greater technical, financial and operational resources and staffs. Accordingly, there is a high degree of competition for desirable oil and gas interests, suitable properties for drilling operations and necessary drilling equipment, as well as for access to funds. We cannot predict if the necessary funds can be raised or that any projected work will be completed.

Compliance with Government Regulation

We are required to obtain licenses and permits from various governmental authorities. We anticipate that we will be able to obtain all necessary licenses and permits to carry on the activities which we intend to conduct, and that we intend to comply in all material respects with the terms of such licenses and permits.

If we proceed with the development of our current and future properties, we anticipate that we will be subject to increased governmental regulation. Matters subject to regulation include discharge permits for drilling operations, drilling and abandonment bonds, reports concerning operations, the spacing of wells, and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. The production, handling, storage, transportation and disposal of oil and gas, byproducts thereof, and other substances and materials produced or used in connection with oil and gas operations are also subject to regulation under federal, state, local and foreign laws and regulations relating primarily to the protection of human health and the environment. As we have not proceeded to the development of our properties, we have not incurred any expenditures related to complying with such laws, or for remediation of existing environmental contamination. The requirements imposed by such laws and regulations are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

| 3 |

Zoro 1 Mineral Claim

On July 6, 2010, we entered into an option agreement with Dalton Dupasquier, pursuant to which Mr. Dupasquier has granted to us the sole and exclusive right and option, exercisable in the manner described below, to acquire a 100% net undivided interest in the property known as the Zoro 1 mineral claim, located near the East Shore of Wekusko Lake in west-central Manitoba, Canada.

| Amount of Payment | Date Payment is Due | Additional Notes | ||||||||

| $ | 59,600 | July 6, 2010 | This amount was paid. | |||||||

| $ | 80,000 | June 15, 2011 | This amount was paid in 1,000,000 shares of common stock. | |||||||

| $ | 200,500 | June 15, 2012 | This amount was agreed to be paid in $50,500 and 7,500,000 shares of common stock. We have paid $50,500 and issued 7,500,000 shares of common stock. | |||||||

| $ | 403,560 | June 15, 2013 | ||||||||

During the year ended November 30 2012, we incurred $8,639 of exploration expenditures on the property.

We have no rights to the Zoro 1 mineral claim unless and until we exercise the option.

We acquired the option to explore the potential for deposits of lithium on the Zoro 1 mineral claim. According to the United States Geological Survey (USGS), global end-use markets for lithium include ceramics and glass, batteries, lubricating greases, air treatment, continuous casting and primary aluminum production. Batteries, especially rechargeable batteries, are the market for lithium compounds with the largest growth potential as major automobile companies pursue the development of lithium batteries to power hybrid electric cars.

In September 2009, we received a Technical Report on the Zoro 1 mineral claim. The report was authored by Mr. Mark Fedikow, PhD., P.Eng. of Mount Morgan Resources Ltd. The objectives of the report were to summarize the geology, review the historic ore reserves, and economic potential of the spodumene-bearing dykes delineated on the property and their surrounding geological environment.

An historic reserve estimate for Lithium oxide (Li2O) has been calculated on limited drilling on a single dyke on the Zoro 1 mineral claim. Drill indicated spodumene reserves coupled with data from trenching have been calculated with a total undiluted tonnage given as 1,727,550 at 0.945% Li2O. However, the historic data upon which the resource of 1,727,550 tons grading 0.945% Li2O was based is not dispositive. When the historic work was done, there was no “Qualified Person” in place, assay labs were not ISO Certified and insufficient drilling was undertaken to define the resource. It therefore became necessary to conduct more exploration activities to support the limited historic data available.

There are seven zoned pegmatite dykes on the Zoro 1 mineral claim. An exploration team explored the main dyke, located the additional seven trenches that had historically been noted on the Zoro 1 claim and produced a geologic map of each trench. Once areas of interest were located, the crew cleaned out the trenches and used a pick and shovel method to look at rocks to find pegmatite. They then took channel samples using a rock saw on historic trenches hosting pegmatite.

While exploring the main and additional seven dykes on the project area the crew identified several additional trenches that had not been noted in previous exploration programs. These findings suggest a potential for a greater amount of resource to be spread across the property, and give further encouragement for more detailed exploration.

| 4 |

Altogether 170 channel samples were sent for assay at Activation Laboratories in Ancaster, Ontario. The samples were analyzed to confirm historical lithium assays, and to assess the pegmatite for rare earth elements, including gold, rubidium, niobium, tantalum, tin, tungsten, and beryllium, all of which add to the prospectivity and economic viability of the Zoro 1 property.

Analysis of the channel samples collected from historic trenches in the pegmatite target has confirmed that a significant zone of lithium mineralization is present on the Zoro 1 claim. Analytical results are summarized in Table 1, which is attached to our annual report as Exhibit 99.2 that we filed with the Securities and Exchange Commission on February 23, 2012.

With the current and future importance of lithium and the mineralized zone at Zoro 1, we are now preparing for the next phase of our exploration program. This phase, which will require a drill program, will assess the third dimension of the deposit and its historic resource, and determine the economic viability of mining the resource.

We plan to continue to explore the Zoro 1 mineral claim using the Exploration Recommendations outlined by Dr. Fedikow in the NI 43-101 Technical Report, which are set forth below along with a table of recommended expenditures.

Initially, the Zoro 1 pegmatites should be the focus of the following exploration approaches. These are as follows:

| 1. | Trench rehabilitation including overburden stripping and washing. |

| 2. | Geologic mapping of individual trenches at a scale of 1:20. |

| 3. | Detailed geological mapping at a scale appropriate to document relevant features on the property. This will include the seven pegmatite dykes, trench locations, historic drill collars and geological attributes of the dykes. It is likely this mapping will be undertaken at a scale of 1:1000. |

| 4. | Trench and channel sampling should be undertaken to confirm historic assay results. |

| 5. | Re-log historic drill core as possible. |

| 6. | A grid should be re-established on the property and an attempt made to tie-in the collar locations of all previous drilling. This information would help to structure new diamond drill programs. Initially, an attempt should be made to re-construct the historic grid although it is unlikely this will be possible given the length of time that has elapsed since the grid was first cut. |

| 7. | The geochemistry of the spodumene with particular relevance to iron content should be evaluated. Albite-rich portions of the pegmatite should be assayed for tantalum, tin, and niobium values. Altered and mineralized wallrocks should be assayed for gold particularly where the mineral assemblage of pyrrhotite, chalcopyrite and arsenopyrite are observed. Any subsequent drill program should be accompanied by a multi-element geochemical approach to assaying core including assays for gold. This will be followed up with assays for specific metals that may be present in the pegmatite dykes. The new assay program should be accompanied by a quality assurance and quality control program. |

| 8. | Diamond drilling should initially target Dyke No. 1 with the aim of ascertaining the physical size and extent of this dyke. Additional drilling will be necessary in the vicinity of the six remaining known dykes as well as any additional lithium-bearing pegmatite uncovered during exploration on the remainder of the property. |

| 5 |

| Trench Rehabilitation, Geologic Mapping and Assays (Four Weeks) | ||||

| 1. Trench stripping, excavation and washing: | $ | 15,000.00 | ||

| 2. Field technician: $250.00/day: | $ | 7,000.00 | ||

| 3. General Laborers (n=2): $150.00/day: | $ | 8,400.00 | ||

| 4. Geologist: $400.00/day: | $ | 11,200.00 | ||

| 5. Assays (n=100 @ $50.00/sample): | $ | 5,000.00 | ||

| Drill Program | ||||

| 6. Mobilization/Demobilization of equipment and crews: | $ | 10,000.00 | ||

| 7. Two Thousand metres of NQ coring: | $ | 250,000.00 | ||

| 8. Moves between holes: | $ | 25,000.00 | ||

| 9. Core trays and survey tool: | $ | 8,000.00 | ||

| 10. Room and board @ $150.00/day for 60 days: | $ | 18,000.00 | ||

| 11. Communications and freight: | $ | 10,000.00 | ||

| 12. Helicopter: | $ | 40,000.00 | ||

| 13. Helicopter fuel: | $ | 7,500.00 | ||

| 14. Geologist @ $400.00/day for 60 days: | $ | 24,000.00 | ||

| 15. Geologist Room and Board @ $150.00/day: | $ | 9,000.00 | ||

| 16. Geologist Transportation/Mobilization/Demobilization/Site access: | $ | 5,000.00 | ||

| 17. Assays @$50.00/sample for 300 samples: | $ | 15,000.00 | ||

| 18. Report preparation: | $ | 7,500.00 | ||

| Sub-total: | $ | 475,600.00 | ||

| Contingency @ 10%: | $ | 47,560 | ||

| Total: | $ | 523,160.00 | ||

Anticipated Cash Requirements

We estimate that our general operating expenses for the next twelve month period to be as follows:

| Estimated Funding Required During the Next Twelve Months | ||||

| Expenses | Amount | |||

| Management fees | $ | 150,000 | ||

| Exploration expenses | $ | 523,160 | ||

| Zoro 1 mineral property payment | $ | 94,958 | ||

| Professional fees | $ | 120,000 | ||

| General administrative expenses | $ | 80,000 | ||

| Total | $ | 968,118 | ||

To date, we have had negative cash flows from operations and we have been dependent on sales of our equity securities and debt financing to meet our cash requirements. We expect this situation to continue for the foreseeable future. We anticipate that we will have negative cash flows during the next twelve month period.

| 6 |

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of our claim. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and enter into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in not receiving an adequate return on invested capital.

Compliance with Government Regulation

We are required to obtain licenses and permits from various governmental authorities. These permits or licenses may include water and surface use permits, occupation permits, fire permits, and timber permits. Prior to being issued the various permits or licenses, the applicant must file a detailed work plan with the applicable government agency. Permits are issued on the basis of the work plan submitted and approved by the governing agency. Additional work on a given mineral property or a significant change in the nature of the work to be completed would require an amendment to the original permit or license.

As part of the permit or licensing requirements, the applicant may be required to post an environmental reclamation bond in respect to the work to be carried out on the mineral property. The amount of such bond is determined by the amount and nature of the work proposed by the applicant. The amount of a bond may also be increased with increased levels of development on the property.

We anticipate that we will be able to obtain all necessary licenses and permits to carry on the activities which we intend to conduct, and that we intend to comply in all material respects with the terms of such licenses and permits.

On January 18, 2012, we received a call from the Natural Resource Officer in Snow Lake and were informed that our drill permit has been approved. We believe this is excellent news as we are able to continue with the next phase of our work program. As of the date of this Annual Report, however, we have not yet commenced the next phase of our exploration program.

Employees

Currently our only employee is Tim DeHerrera. We do not expect any material changes in the number of employees over the next twelve month period. We anticipate that we will be conducting most of our business through agreements with consultants and third parties.

Subsidiaries

We have two wholly owned subsidiaries, FRC Exploration Ltd. (a British Columbia Corporation) and Nuance Exploration Ltd. (a British Columbia Corporation).

| 7 |

Executive Offices

Our executive offices are located at 1400 16th Street, Suite 400, Denver, CO 80202. We lease our head office in Denver Colorado at a rate of $119.00 month. Our head office is a business center. Our current premises are adequate for our current operations and we do not anticipate that we will require additional premises in the foreseeable future.

The Hayter Well

Purchase of Interest in the Hayter Well

On August 1, 2006, County Line Energy Corp. (“County Line”) signed a participation agreement with Black Creek Resources Ltd. (“BCR”) in which County Line acquired the right to become the operator and drill the Hayter well (10D Hayter 10-8-40-1 W4M) located in Alberta, Canada. In order to exercise that interest and acquire the rights to drill the Hayter well, County Line agreed to pay 100% of all costs associated with the seismic option agreement and pay 100% of the funds required to purchase rights to any existing seismic on the property which may be for sale and or shoot additional 2D and 3D on the property as required, pursuant to standard industry costs and practices.

Pursuant to a Participation Agreement dated December 21, 2006 between Black Creek Resources Ltd (“BCR”) and Nuance Exploration Ltd. (“NEL”), a wholly owned subsidiary of the Company, we acquired a 100% ownership in the interpretation of 3D seismic data covering four sections of certain land located in the province of Alberta, Canada by paying $82,650 for the purpose of acquiring and interpreting the seismic data. On October 15, 2007, prior to the evaluation of the 3D seismic data, County Line sold to BCR its 100% interest in the subject property and received as consideration a non-interest bearing promissory note for $111,144 (CDN$110,000) to be repaid by November 30, 2007.

On November 30, 2007, County Line did not repay the amounts owing pursuant to the promissory note and NEL and County Line entered into a Participation Agreement whereby NEL accepted a 20% interest of the Grantor’s working interest in the County Line 10D Hayter 10-8-40-1 W4M well as full and final settlement of the promissory note. Pursuant to the terms of the Participation agreement NEL agreed to assume 20% of all revenues, costs and expenses associated with the project.

During our first fiscal quarter of 2009 we advanced $23,938 (CDN$29,000) to County Line Energy Corp for costs and expenses associated with the Hayter Well as an unsecured loan. On October 16, 2009 we entered into an amendment to our participation agreement with County Line pursuant to which we acquired an additional 30% working interest in the Hayter Well in consideration of a release by Force from all amounts owed by County Line to Force. Following our entry into the amended participation agreement we now hold a 50% working interest in the County Line Energy Corp. interest in the Hayter Well.

We have not incurred any development costs on the Hayter Well for the year ended November 30, 2012.

| 8 |

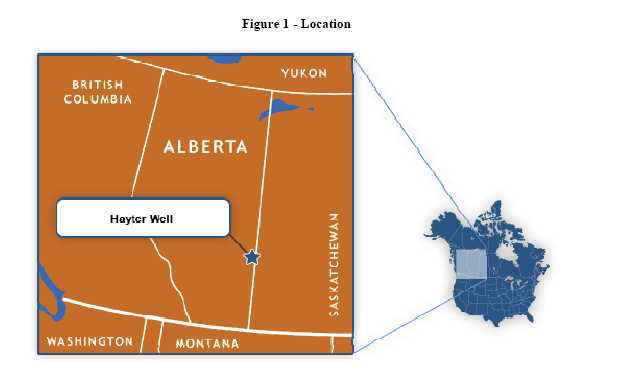

Location of Hayter Well

Force Energy Corp. has a 50% working interest of the County Line Energy Corp. interest in the Hayter Well (10D Hayter 10-8-40-1 W4M) located in Alberta, Canada. The well was spudded in January 2007 and drilled to a total depth. The well logs revealed a gas zone of 4 to 5 meters of thickness in a shallow zone and a heavy oil pay zone of 2 meters of thickness in the target Dina Sand zone.

County Line completed a $650,000 3D seismic program covering nine sections of land in pursuit of a potential multi well heavy oil drilling opportunity. The geological model was based on interpretation from a previous well, which produced 16,000 barrels of heavy oil. The seismic program was designed to determine whether the structure found in this well existed to a larger extent on the subject property. The 3D seismic revealed an extremely large anomaly with similar characteristics. The nature of this large anomaly suggested that a multi well drilling opportunity might exist.

County Line Energy Corp. is the operator of the Hayter well. The Hayter well has been cased and cemented in anticipation of the completion of the drill program. County Line plans to enter the Hayter well, perforate the potential pay zone(s) and conduct regular production testing of the zone(s). Should the testing confirm adequate oil reserves and potential economic flow rates, County Line is expected to install adequate pumping equipment and other surface facilities in anticipation of the projected flow rates. Currently, there are no known oil reserves on the Hayter well.

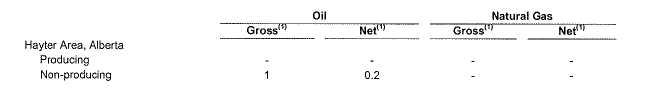

Oil and Gas Properties and Wells

On March 9, 2009, Force received a report on reserves data for the Hayter Well prepared by its independent engineers, Chapman Petroleum Engineering Ltd.

| 9 |

The following table sets forth the number of wells in which the Company held a working interest as at November 30, 2009:

The Company has not since the beginning of its most recently completed fiscal year, filed any annual estimates of proved oil and gas reserves with any federal agencies. As at November 30, 2012, the 50% working interest of the Hayter Well was recorded at $135,427.

Zoro 1 Mineral Claim

Property Description and Access

The Zoro 1 property is located near the east shore of Wekusko Lake (Figure 4.1) in west-central Manitoba, approximately 25 km east of the mining community of Snow Lake, 249 km southeast of Thompson and 571 km north-northeast of Winnipeg. Provincial Road 393 occurs 23 km to the northwest. The pegmatite dykes are located northwest of the northwest corner of a small pot hole Lake east of the east shore of Wekusko Lake. The small historic gold mining community of Herb Lake is located about 10 km southwest of the property.

Access to the property is by boat from Bartlett’s Landing accessed from Provincial Road 392 and then by All Terrain Vehicle to the property along a trail and/or by helicopter from Snow Lake, Manitoba. The nearest road link is a seasonal road on the east side of Wekusko Lake that accesses the village of Herb Lake Landing and Provincial Highway 392 to the south. A rail link is located at Wekusko siding approximately 20 km south of Herb Lake Landing.

The property is located within NTS map sheet 63J/13SE (latitude: 54⁰51.27’ and longitude: 99⁰38.46’; Township 68N; Range 15WPM).

| 10 |

The Zoro 1 property is covered by one claim, the Zoro 1 (P1993F). The property is 52 hectares in area and was recorded March 14, 1994, under the name of Dalton Bruce Dupasquier. The claim is in good standing.

History of the Zoro 1 mineral claim

The pegmatite dykes are located on the north side of a small lake between Roberts Lake and the south end of Crowduck Bay. Early in 1953, Cs No. 3-10, 12 (P 26973-80, 82), S.R. No. 1-6 (P 7877-82) and Linda 1 (P 26983) were staked by Mrs. Johanna Stoltz, Eric Stoltz, Carl Stoltz and Edwin Stoltz, and Key No. 1-4, 8-14 (P 27159-62, 27226-27, 27164-68) were staked by John Tikkanen, Hjalmar Peterson, and Loren Fredeen. These were cancelled the following year.

Lit Nos. 11-5 (P 31758-62) was staked by J.J. Johnson in 1954. In 1955 Lit Nos. 6-1l8 (P 35014-26) were added by J.A. Syme. All the Lit claims were assigned to Green Bay Uranium Limited in 1956 which changed its name to Green Bay Mining & Exploration Ltd. Early in 1956, before drilling commenced, samples containing more than 2% Li2O and containing no contaminating accessory lithium minerals and no high iron content were reported. A shipment of 136 kg (300 lbs.) of spodumene was sent to Ottawa for testing in 1956. This sample assayed 1.19% Li2O, with minor NbO5. Ore dressing tests concluded that good liberation and separation could not be effected.

Over 6096 m (20 000 ft.) of diamond drilling was done on Lit No. 1-4, with at least 3048 m (10 000 ft.) of this on the main dyke. Results of the drilling on dykes 1, 3, 5 and 7 were reported to be "promising". Assays of 2.42% to 7.28% Li2O were reported from Dyke 5. Dyke 5 was apparently 305 m long x 12 m wide (1000 x 40 ft.); Dyke No. 7, over 457 m x 24 m (1500 x 80 ft.). Several of the holes went deeper than 305 m (1000 ft.). Drilling on Lit 10, 16 and 17 amounted to 1950 m (6399 ft.). Gold was also found on the property, with a 3.3 kg (7.25 lb.) sample across 3.4 m (11 ft.) yielding $5.95 gold at $35.00 equating to approximately 0.17 ounces per ton gold.

Lithium tonnage estimates vary. An unsubstantiated visual estimate in September 1956 suggested up to 9-11 million tonnes (10-12 million tons) of Li2O occur on the entire group. In mid-March the main dyke was estimated to contain 18 million tonnes (2 million tons) grading 1.4% Li2O to a depth of 305 m (1000 ft.) in the main dyke. A reserve estimate of 1 815 000 tonnes grading 1.4% Li2O was 15 reported by Bannatyne (1985). In 1957, the estimate was revised to 1.72 million tonnes averaging 1.3% Li2O or 2.72 million tonnes (3.0 million tons) at l.0% Li2O in the main dyke (Mulligan, 1957a, 1957b). By March 1958, 12 different tonnage estimates had been made. Also by that time, a permanent camp and a 4-mile road into the property had been built. Plans for a heavy media separation plant on the property were being prepared by the Lummus Co. of New York together with Knowles Associates and the Colorado School of Mines.

No further work on the property is known since 1957. The claims were assigned to J.A. Syme in 1963. The Zoro 1 claim is currently listed under the name of Dalton Bruce Dupasquier.

Reserve Estimate

An historic reserve estimate for Li2O has been calculated on limited drilling on a single dyke on the Zoro 1 mineral claim. Drill indicated spodumene reserves coupled with data from trenching have been calculated with a total undiluted tonnage given as 1,727,550 at 0.945% Li2O.

The Zoro 1 mineral claim hosts multiple rare metal spodumene pegmatite dykes. The main mass of spodumene-bearing zones exposed in seven main trenches has not been fully delineated and a recommended exploration program will assess the geological characteristics of the dykes on the property. Trench rehabilitation, new sampling from the trenches and diamond drilling and a thorough assay/analytical approach accompanied by a quality assurance and quality control program is recommended. Rare and precious metal contents in the pegmatite, not considered in the historic exploration and development program, can also be assessed in this manner.

| 11 |

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. Mine Safety Disclosures

N/A

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is quoted under the symbol “FORC” on the OTCBB operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the OTCQB operated by OTC Markets Group, Inc. Few market makers continue to participate in the OTCBB system because of high fees charged by FINRA. Consequently, market makers that once quoted our shares on the OTCBB system may no longer be posting a quotation for our shares. As of the date of this report, however, our shares are quoted by several market makers on the OTCQB. The criteria for listing on either the OTCBB or OTCQB are similar and include that we remain current in our SEC reporting.

Only a limited market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our company.

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending November 30, 2012 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| November 30, 2012 | .032 | .008 | ||||||||

| August 31, 2012 | .022 | .006 | ||||||||

| May 31, 2012 | .035 | .011 | ||||||||

| February 29, 2012 | .082 | .016 | ||||||||

| Fiscal Year Ending November 30, 2011 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| November 30, 2011 | 0.04 | 0.02 | ||||||||

| August 31, 2011 | 0.08 | 0.03 | ||||||||

| May 31, 2011 | 0.22 | 0.07 | ||||||||

| February 28, 2011 | 0.27 | 0.17 | ||||||||

| 12 |

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of November 30, 2012, we had 105,416,987 shares of our common stock issued and outstanding, held by eighty six (86) shareholders of record.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

| 1. | we would not be able to pay our debts as they become due in the usual course of business, or; |

| 2. | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Recent Sales of Unregistered Securities

The information set forth below relates to our issuances of securities without registration under the Securities Act of 1933 during the reporting period.

| 13 |

Between April 9, 2012 and April 23, 2012, we issued 2,486,549 common shares pursuant to the conversion of a note payable falling due on July 3, 2012.

On May 5, 2012, we issued 2,691,926 common shares pursuant to a consultancy agreement with Primary Capital LLC

On June 12, 2012, we issued 7,500,000 common shares pursuant to the Zoro mineral property option agreement.

On June 13, 2012, we issued 3,000,000 common shares in settlement of a $30,000 advance payable.

Between July 9, 2012 and August 14, 2012, we issued an aggregate of 6,956,813 common shares upon the conversion of the convertible note payable falling due on October 6, 2012.

On July 17, 2012, we issued 7,500,000 common shares pursuant to an employment agreement with the President of the Company.

On September 5, 2012, we issued 3,000,000 common shares pursuant to a consultancy agreement.

Between September 20, 2012 and November 23, 2012, we issued an aggregate of 14,344,432 common shares upon the conversion of the convertible note payable falling due on May 10, 2013.

On September 26, 2012, we issued 3,000,000 common shares pursuant to a consultancy agreement.

Subsequent to the year end we issued 3,333,333 common shares pursuant to the partial conversion of a note payable falling due on July 3, 2012.

The above issuances were made pursuant to Regulation S of the 1933 Act. Each purchaser represented to us that the purchaser was a Non-US Person as defined in Regulation S. We did not engage in a distribution of this offering in the United States. Each purchaser represented their intention to acquire the securities for investment only and not with a view toward distribution. All purchasers were given adequate access to sufficient information about us to make an informed investment decision. None of the securities were sold through an underwriter and accordingly, there were no underwriting discounts or commissions involved. The selling stockholders named in this prospectus include all of the purchasers who purchased shares pursuant to this Regulation S offering.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

| 14 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Results of Operations

The following summary of our results of operations should be read in conjunction with our audited financial statements for the year ended November 30, 2012, which are included herein.

Our operating results for the years ended November 30, 2011 and 2012 are summarized as follows:

| Years Ended | ||||||||

| November 30, | ||||||||

| 2011 | 2012 | |||||||

| Revenue | $ | — | $ | — | ||||

| Operating Expenses | 462,799 | 660,180 | ||||||

| Net Loss | 502,867 | 1,072,264 | ||||||

Revenues

We have not earned any revenues to date, and do not anticipate earning revenues until such time as we are able to locate oil and gas potential on our well or exploit minerals on our mineral claim. All of our oil and gas prospects are undeveloped. We anticipate that we will have to address the cash shortfall through additional equity financings in the future. We can offer no assurance, however, that such financings will be available on terms acceptable to our company.

| 15 |

Expenses

Our expenses for the years ended November 30, 2011 and 2012 are outlined in the table below:

| Year Ended November 30, 2011 | Year Ended November 30, 2012 | |||||||

| Expenses | ||||||||

| Accounting and audit fees | $ | 20,175 | $ | 22,825 | ||||

| Accretion of ARO | 1,965 | 2,238 | ||||||

| Bank charges | 1,639 | 1,176 | ||||||

| Consulting fees | — | 213,439 | ||||||

| Investor relations | 10,000 | — | ||||||

| Legal fees | 20,667 | 28,514 | ||||||

| Management fees | 293,225 | 234,825 | ||||||

| Mineral property exploration costs | 55,611 | 8,939 | ||||||

| Office expenses | 6,481 | 4,771 | ||||||

| Rent | 2,673 | 3,113 | ||||||

| Tax, penalties and Interest | 42,489 | 421 | ||||||

| Transfer and filing fees | 7,874 | 2,657 | ||||||

| Travel | — | 2,135 | ||||||

| Write-off of oil and gas costs | — | 135,427 | ||||||

| Total | 462,799 | 660,180 | ||||||

Our expenses increased in fiscal year 2012 as compared to fiscal year 2011. The increase in our expenses for the year ended November 30, 2012 was due mainly to increased consulting fees, and write-offs of oil and gas costs.

Other Expenses

We paid more in interest expenses for the year ended November 30, 2012 than in the prior year ended 2011,which was the primary basis for total other expenses of $341,484 for the year ended November 30, 2012 as compared with $42,089 for the prior year.

Loss

We incurred a net loss of $1,072,264 for the year ended November 12, 2012, as compared with a net loss of $502,867 for the year ended November 30, 2011.

| 16 |

Liquidity And Capital Resources

| Working Capital | ||||||||

| November 30, 2011 | November 30, 2012 | |||||||

| Current Assets | $ | 17,512 | $ | 35,442 | ||||

| Current Liabilities | 309,585 | 442,056 | ||||||

| Working Capital (deficit) | (292,073) | (406,614 | ) |

| Cash Flows | ||||||||

| Year Ended | Year Ended | |||||||

| November 30, 2011 | November 30, 2012 | |||||||

| Cash used in Operating Activities | $ | 184,623 | $ | 215,380 | ||||

| Cash used in Investing Activities | — | 50,499 | ||||||

| Cash provided by Financing Activities | 201,875 | 283,845 | ||||||

| Net Increase (Decrease) in Cash | 16,529 | 19,049 |

Cash Used In Operating Activities

We used cash in operating activities in the amount of $215,380 during the year ended November 30, 2012. Our comprehensive loss of $1,073,628 for the year ended November 30, 2012 was the primary reason for our negative operating cash flow.

Cash Used In Investing Activities

We used cash in investing activities in the amount of $50,499 during the year ended November 30, 2012, in connection with the option on our mineral property.

Cash from Financing Activities

We generated $283,845 in cash from financing activities during the year ended November 30, 2012. Most of our cash from financing activities, $337,500, resulted from cash received from convertible notes that we issued during the year. These convertible notes are unsecured, bear interest at 8% per annum, and are convertible into shares of our common stock at roughly 50% of the market price of our common stock.

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. Capital may not continue to be available if necessary to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

| 17 |

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

Off Balance Sheet Arrangements

As of November 30, 2012, there were no off balance sheet arrangements.

Going Concern

At November 30, 2012, we have a working capital deficit of $406,614. We have yet to achieve profitable operations, have accumulated losses of $3,905,711 since our inception and expect to incur further losses in the development of our business, all of which casts substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that we will be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available or on acceptable terms, if at all.

Critical Accounting Policies

The consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America and are stated in US dollars. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates, which may have been made using careful judgment. Actual results may vary from these estimates. The financial statements have, in management’s opinion, been properly prepared within the framework of the significant accounting policies summarized below:

Development Stage Activities

The Company is a development exploration stage company. All losses accumulated since inception have been considered as part of the Company’s development stage activities. The Company is subject to several categories of risk associated with its development stage activities. Natural gas and oil exploration and production is a speculative business, and involves a high degree of risk. Among the factors that have a direct bearing on the Company’s prospects are uncertainties inherent in estimating natural gas and oil reserves, future hydrocarbon production, and cash flows, particularly with respect to wells that have not been fully tested and with wells having limited production histories; access to additional capital; changes in the price of natural gas and oil; availability and cost of services and equipment; and the presence of competitors with greater financial resources and capacity.

Principles of Consolidation

These consolidated financial statements include the accounts of the Force Energy Corp and its wholly-owned subsidiaries, FRC Exploration Ltd. (a BC Corporation) (“FRC”) and Nuance Exploration Ltd. (a BC Corporation) (“NEL”). All significant inter-company balances and transactions have been eliminated.

| 18 |

Foreign Currency Translation

The reporting currency is the U.S. dollar. The functional currency of the Company is the local currency, the Canadian dollar. The financial statements of the Company are translated into United States dollars in accordance with ASC 830, FOREIGN CURRENCY MATTERS, using year-end rates of exchange for assets and liabilities, and average rates of exchange for the period for revenues, costs, and expenses and historical rates for equity. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. At November 30, 2012 and 2011, the cumulative translation adjustment of $6,027 and $7,397, respectively, was classified as an item of other comprehensive income in the stockholders' equity (deficit) section of the consolidated balance sheets. For the years ended November 30, 2012 and 2011, the foreign currency translation adjustment to accumulated other comprehensive income was $1,364 and $928, respectively.

Oil and Gas Properties

The Company follows the full cost method of accounting for oil and gas operations whereby all costs of exploring for and developing oil and gas reserves are initially capitalized on a country-by-country (cost centre) basis. Such costs include land acquisition costs, geological and geophysical expenses, carrying charges on non-producing properties, costs of drilling and overhead charges directly related to acquisition and exploration activities.

Costs capitalized, together with the costs of production equipment, are depleted and amortized on the unit-of-production method based on the estimated gross proved reserves. Petroleum products and reserves are converted to a common unit of measure, using 6 MCF of natural gas to one barrel of oil.

Costs of acquiring and evaluating unproved properties are initially excluded from depletion calculations. These unevaluated properties are assessed periodically to ascertain whether impairment has occurred. When proved reserves are assigned or the property is considered to be impaired, the cost of the property or the amount of the impairment is added to costs subject to depletion calculations.

If capitalized costs, less related accumulated amortization and deferred income taxes, exceed the “full cost ceiling” the excess is expensed in the period such excess occurs. The “full cost ceiling” is determined based on the present value of estimated future net revenues attributed to proved reserves, using current prices less estimated future expenditures plus the lower of cost and fair value of unproved properties within the cost centre.

Proceeds from a sale of petroleum and natural gas properties are applied against capitalized costs, with no gain or loss recognized, unless such a sale would alter the relationship between capitalized costs and proved reserves of oil and gas attributable to a cost centre.

Impairment of Long-lived Assets

The carrying value of intangible assets and other long-lived assets are reviewed on a regular basis for the existence of facts or circumstances that may suggest impairment. The Company recognizes impairment when the sum of the expected undiscounted future cash flows is less than the carrying amount of the asset. Impairment losses, if any, are measured as the excess of the carrying amount of the asset over its estimated fair value. Impairment on the properties with unproved reserves is evaluated by considering criteria such as future drilling plans for the properties, the results of geographic and geologic data related to the unproved properties and the remaining term of the property leases.

| 19 |

Asset Retirement Obligations

Asset retirement obligations (“ARO”) associated with the retirement of a tangible long-lived asset, including natural gas and oil properties, are recognized as liabilities in the period in which it is incurred and becomes determinable, with an offsetting increase in the carrying amount of the associated assets. The cost of tangible long-lived assets, including the initially recognized ARO, is depleted, such that the cost of the ARO is recognized over the useful life of the assets. The ARO is recorded at fair value, and accretion expense is recognized over time as the discounted fair value is accreted to the expected settlement value. The fair value of the ARO is measured using expected future cash flow, discounted at the Company’s credit-adjusted risk-free interest rate.

Derivative Liabilities and Classification

Free-standing financial instruments (or embedded derivatives) indexed to the Company’s common stock are evaluated to properly classify such instruments within equity or as liabilities in our financial statements. Accordingly, the classification of an instrument indexed to our stock, which is carried as a liability, must be reassessed at each balance sheet date. If the classification changes as a result of events during a reporting period, the instrument is reclassified as of the date of the event that caused the reclassification. There is no limit on the number of times a contract may be reclassified.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and loss carry-forwards and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of a change in tax rules on deferred tax assets and liabilities is recognized in operations in the year of change. A valuation allowance is recorded when it is “more likely-than-not” that a deferred tax asset will not be realized.

Basic Loss per Share

Basic loss per share is computed using the weighted average number of shares outstanding during the period. Diluted earnings per share are computed similar to basic income per share except that the denominator is increased to include the number of common stock equivalents. Common stock equivalents represent the dilutive effect of the assumed exercise of any outstanding stock equivalents, using the treasury stock method, at either the beginning of the respective period presented or the date of issuance, whichever is later, and only if the common stock equivalents are considered dilutive based upon the Company’s net income (loss) position at the calculation date. There are no common stock equivalents outstanding and, thus, diluted and basic loss per share are the same.

Comprehensive Income

Comprehensive income (loss) is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, ASC 220, Comprehensive income (loss) requires that all items that are required to be recognized under current accounting standards as components of comprehensive income be reported in a financial statement that is displayed with the same prominence as other financial statements. For the years presented, the Company's comprehensive income (loss) includes net income (loss) and foreign currency translation adjustments and is presented in the consolidated statements of changes in operations.

| 20 |

Recently Issued Accounting Pronouncements

Adopted

In May 2011, the FASB issued ASU 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (IFRS) of Fair Value Measurement – Topic 820.” ASU 2011-04 is intended to provide a consistent definition of fair value and improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP and IFRS. The amendments include those that clarify the FASB’s intent about the application of existing fair value measurement and disclosure requirements, as well as those that change a particular principle or requirement for measuring fair value or for disclosing information about fair value measurements. This update is effective for annual and interim periods beginning after December 15, 2011. The adoption of this ASU did not have a material impact on our financial statements.

The FASB issued Accounting Standards Update (ASU) No. 2012-02—Intangibles—Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment, on July 27, 2012, to simplify the testing for a drop in value of intangible assets such as trademarks, patents, and distribution rights. The amended standard reduces the cost of accounting for indefinite-lived intangible assets, especially in cases where the likelihood of impairment is low. The changes permit businesses and other organizations to first use

subjective criteria to determine if an intangible asset has lost value. The amendments to U.S. GAAP will be effective for fiscal years starting after September 15, 2012. Early adoption is permitted. The adoption of this ASU did not have a material impact on our financial statements.

Not Adopted

In December 2011, the FASB issued ASU No. 2011-11: Balance Sheet (topic 210): Disclosures about Offsetting Assets and Liabilities, which requires new disclosure requirements mandating that entities disclose both gross and net information about instruments and transactions eligible for offset in the statement of financial position as well as instruments and transactions subject to an agreement similar to a master netting arrangement. In addition, the standard requires disclosure of collateral received and posted in connection with master netting agreements or similar arrangements. This ASU is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. Entities should provide the disclosures required retrospectively for all comparative periods presented. We are currently evaluating the impact of adopting ASU 2011-11 on the financial statements.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force), the American Institute of Certified Public Accountants, and the United States Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company’s present or future financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

| 21 |

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

Audited Financial Statements:

| 22 |

To the Board of Directors and Stockholders

Force Energy Corp.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

We have audited the accompanying consolidated balance sheets of Force Energy Corp. (“the Company”) as of November 30, 2012 and the related consolidated statements of operations and comprehensive loss, changes in stockholders’ deficit and cash flows for the year ended November 30, 2012 and from November 1, 2006 (date of inception) through November 30, 2012. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits. The financial statements of the Company as of November 30, 2011, and for the period from November 1, 2006 (date of inception) through November 30, 2011, before the restatement described in Note 16, were audited by other auditors, whose report, dated February 20, 2012, expressed an unqualified opinion on those financial statements.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company, at November 30, 2012, and the results of its operations and its cash flows for the years ended November 30, 2012 and from inception (November 1, 2006) through to November 30, 2012, in conformity with accounting principles generally accepted in the United States of America.

We also audited the adjustments described in Note 16 that were applied to restate the 2011 financial statements. In our opinion, such adjustments are appropriate and have been properly applied.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As described in Note 1 to the consolidated financial statements, the Company has incurred net losses since inception and has an accumulated deficit at November 30, 2012. These and other factors discussed therein raise a substantial doubt about the ability of the Company to continue as a going concern. Management’s plans in regard to those matters are also described in Note 1. The Company’s ability to achieve its plans with regard to those matters, which may be necessary to permit the realization of assets and satisfaction of liabilities in the ordinary course of business, is uncertain. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Anton & Chia, LLP

Newport Beach, California

February 28, 2013

| F-1 |

FORCE ENERGY CORP.

(A Development Stage Company)

November 30, 2012 and November 30, 2011

| 2012 | 2011 As Restated | |||||||

| (Note 16) | ||||||||

| ASSETS | ||||||||

| Current | ||||||||

| Cash | $ | 35,442 | $ | 16,393 | ||||

| Prepaid expenses | — | 1,119 | ||||||

| Total Current Assets | 35,442 | 17,512 | ||||||

| Oil and gas properties, full cost method of accounting | ||||||||

| Unproved properties | — | 135,427 | ||||||

| Mineral property option | 340,099 | 139,600 | ||||||

| Total Assets | $ | 375,541 | $ | 292,539 | ||||

| LIABILITIES | ||||||||

| Current | ||||||||

| Accounts payable and accrued liabilities | $ | 43,713 | $ | 48,871 | ||||

| Advances payable | 20,000 | 50,000 | ||||||

| Due to related parties | 4,625 | 625 | ||||||

| Convertible notes payable, net of discount | 315,518 | 81,089 | ||||||

| Derivative liabilities | 58,200 | 129,000 | ||||||

| Total Current Liabilities | 442,056 | 309,585 | ||||||

| Asset retirement obligation | 16,845 | 13,524 | ||||||

| Total Liabilities | 458,901 | 323,109 | ||||||

| Commitments | ||||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Preferred stock, $0.001 par value 10,000,000 shares authorized, none outstanding | ||||||||

| Common stock, $0.001 par value 750,000,000 shares authorized 105,416,987 shares issued (November 30, 2011, - 54,937,267 shares issued) | 105,417 | 54,937 | ||||||

| Additional paid in capital | 3,812,334 | 2,826,176 | ||||||

| Deferred stock compensation | (95,400 | ) | (79,600 | ) | ||||

| Accumulated other comprehensive income | 6,027 | 7,391 | ||||||

| Deficit accumulated during the development stage | (3,911,738 | ) | (2,839,474 | ) | ||||

| Total Stockholders’ Deficit | (83,360 | ) | (30,570 | ) | ||||

| Total Liabilities and Stockholders’ Deficit | $ | 375,541 | $ | 292,539 | ||||

See accompanying notes to the Consolidated Financial Statements.

| F-2 |

FORCE ENERGY CORP.

(A Development Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

for the years ended November 31, 2012 and November 30, 2011 and

for the period from November 1, 2006 (Date of Inception)

to November 30, 2012

| November 1, | ||||||||||||

| 2006 (Date of | ||||||||||||

| Years Ended | Inception) to | |||||||||||

| November 30, | November 30, | |||||||||||

| 2012 | 2011 As Restated | 2012 | ||||||||||

| (Note 16) | (cumulative) | |||||||||||

| Expenses | ||||||||||||

| Accounting and audit fees | $ | 22,825 | $ | 20,175 | $ | 309,946 | ||||||

| Accretion of ARO | 2,238 | 1,965 | 7,157 | |||||||||

| Bank charges | 1,176 | 1,639 | 5,443 | |||||||||

| Consulting fees | 213,439 | — | 621,939 | |||||||||

| Depreciation | — | — | 4,651 | |||||||||

| Investor relations | — | 10,000 | 61,443 | |||||||||

| Legal fees | 28,514 | 20,667 | 221,319 | |||||||||

| Management fees – Note 7 | 234,825 | 293,225 | 1,382,600 | |||||||||

| Mineral property exploration costs | 8,639 | 55,611 | 64,250 | |||||||||

| Office expenses | 4,771 | 6,481 | 44,193 | |||||||||

| Oil and gas exploration costs | — | — | 15,000 | |||||||||

| Rent | 3,113 | 2,673 | 46,814 | |||||||||

| Tax penalties and interest | 421 | 42,489 | 42,910 | |||||||||

| Transfer and filing fees | 2,657 | 7,874 | 81,402 | |||||||||

| Travel | 2,135 | — | 12,476 | |||||||||

| Write-off of oil and gas costs | 135,427 | — | 553,466 | |||||||||

| Loss before other items | (660,180 | ) | (462,799 | ) | (3,475,009 | ) | ||||||

| Other items: | ||||||||||||

| Debt forgiveness | — | — | 15,286 | |||||||||

| Loss on settlement of advance payable | (30,000 | ) | — | (30,000 | ) | |||||||

| Change in fair value of derivative liability | (40,600 | ) | 2,000 | |||||||||

| Interest expense | (341,484 | ) | (42,089 | ) | (422,173 | ) | ||||||

| Interest income | — | 21 | 158 | |||||||||

| Net loss for the period | (1,072,264 | ) | (502,867 | ) | (3,911,738 | ) | ||||||

| Foreign exchange gain (loss) | (1,364 | ) | 928 | 6,027 | ||||||||

| Comprehensive loss for the period | $ | (1,073,628 | ) | $ | (501,939 | ) | $ | (3,905,711 | ) | |||

| Basic loss per share | $ | (0.01 | ) | $ | (0.01 | ) | ||||||

| Weighted average number of shares outstanding | 70,979,728 | 52,972,335 | ||||||||||

See accompanying notes to the Consolidated Financial Statements.

| F-3 |

FORCE ENERGY CORP.

(A Development Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

for the years ended November 31, 2012 and November 30, 2011 and

for the period from November 1, 2006 (Date of Inception)

to November 30, 2012, 2012

| Period from | ||||||||||||

| November 1, | ||||||||||||

| 2006 (Date of | ||||||||||||

| Years Ended | Inception) to | |||||||||||

| November 30 | November 30 | |||||||||||

| 2012 | 2011 As Restated | 2012 | ||||||||||

| (Note 16) | (cumulative) | |||||||||||

| Operating Activities: | ||||||||||||

| Net loss for the period | $ | (1,073,628 | ) | $ | (501,939 | ) | $ | (3,905,711 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||

| Accrued interest | 32,723 | 5,750 | 38,473 | |||||||||

| Interest expense - beneficial conversion feature of convertible note and advance payable | 127,000 | — | 127,000 | |||||||||

| Accretion and elimination of discount on convertible notes | 211,761 | 36,339 | 248,100 | |||||||||

| Revaluation of derivative liability to fair value | 40,600 | (2,000 | ) | 38,600 | ||||||||

| Consulting fees paid in stock | 178,338 | — | 583,338 | |||||||||

| Share based compensation | 134,200 | 215,600 | 729,600 | |||||||||

| Debt forgiveness | — | — | (15,286 | ) | ||||||||

| Accretion of ARO | 2,238 | 1,965 | 7,154 | |||||||||

| Depreciation | — | — | 4,651 | |||||||||

| Write-off of oil and gas costs | 135,427 | — | 553,466 | |||||||||

| Changes in non-cash working capital items related to operations: | ||||||||||||

| Prepaid expenses | 1,119 | (881 | ) | — | ||||||||

| Advance payable | — | 50,000 | 50,000 | |||||||||

| Accounts payable and accrued liabilities | (5,158 | ) | 10,543 | 19,671 | ||||||||

| Net cash used in operating activities | (215,380 | ) | (184,623 | ) | (1,520,944 | ) | ||||||

| Investing Activities: | ||||||||||||

| Acquisition of property and equipment | — | — | (4,651 | ) | ||||||||

| Acquisition of mineral property option | (50,499 | ) | — | (110,099 | ) | |||||||

| Acquisition and development costs of oil and gas properties | — | — | (387,517 | ) | ||||||||

| Net cash used in investing activities | (50,499 | ) | — | (502,267 | ) | |||||||

| Financing Activities: | ||||||||||||

| Capital stock issued | — | 50,000 | 1,419,000 | |||||||||

| Convertible note payable | 337,500 | 170,000 | 507,500 | |||||||||

| Due to related parties | 4,000 | (18,125 | ) | 165,442 | ||||||||

| Settlement of Convertible note payable | (57,655 | ) | — | (57,655 | ) | |||||||

| Cash acquired on reverse acquisition | — | — | 37,058 | |||||||||

| Net cash provided by financing activities | 283,845 | 201,875 | 2,071,345 | |||||||||

| Effect of foreign currency translation | 1,083 | (723 | ) | (12,692 | ) | |||||||

| Increase (in cash) during the period | 19,049 | 16,529 | 35,442 | |||||||||

| Cash, (Bank indebtedness) beginning of the period | 16,393 | (136 | ) | — | ||||||||

| Cash, end of the period | $ | 35,442 | $ | 16,393 | $ | 35,442 | ||||||

Supplemental Disclosure with Respect to Cash Flows – Note 13

See accompanying notes to the Consolidated Financial Statements.

| F-4 |

FORCE ENERGY CORP.

(A Development Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ DEFICIT

for the period from November 1, 2006 (Date of Inception) to November 30, 2012

| Deficit | ||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Additional | Deferred | During the | ||||||||||||||||||||||

| Common Shares | Paid-in | Stock | Development | |||||||||||||||||||||

| Number | Par Value | Capital | Compensation | Stage | Total | |||||||||||||||||||

| Capital stock issued for cash – at $0.005 | 23,000,000 | $ | 23,000 | $ | 92,000 | $ | — | $ | — | $ | 115,000 | |||||||||||||

| Less: commissions | — | — | (8,000 | ) | — | — | (8,000 | ) | ||||||||||||||||

| Net loss and comprehensive loss for the period | — | — | — | — | (8,944 | ) | (8,944 | ) | ||||||||||||||||

| Balance, November 30, 2006 | 23,000,000 | 23,000 | 84,000 | — | (8,944 | ) | 98,056 | |||||||||||||||||

| Pursuant to agreement of merger and plan of reorganization | 21,354,000 | 21,354 | (24,058 | ) | — | — | (2,704 | ) | ||||||||||||||||

| Capital stock issued for cash – at $0.25 | 240,000 | 240 | 59,760 | — | — | 60,000 | ||||||||||||||||||

| – at $0.50 | 100,000 | 100 | 49,900 | — | — | 50,000 | ||||||||||||||||||

| Net loss and comprehensive loss for the year | — | — | — | — | (79,859 | ) | (79,859 | ) | ||||||||||||||||

| Balance November 30, 2007 | 44,694,000 | 44,694 | 169,602 | — | (88,803 | ) | 125,493 | |||||||||||||||||

| Capital stock issued for cash – at $0.75 | 1,000,000 | 1,000 | 749,000 | — | — | 750,000 | ||||||||||||||||||

| Pursuant to consulting service agreements – at $1.35 | 300,000 | 300 | 404,700 | — | — | 405,000 | ||||||||||||||||||

| Net loss and comprehensive loss for the year | — | — | — | — | (786,407 | ) | (786,407 | ) | ||||||||||||||||

| Balance November 30, 2008 | 45,994,000 | 45,994 | 1,323,302 | — | (875,210 | ) | 494,086 | |||||||||||||||||

| Capital stock issued for cash – at 0.28 | 900,000 | 900 | 251,100 | — | — | 252,000 | ||||||||||||||||||

| Capital stock issued for oil and gas property – Note 7(b) | 450,000 | 450 | 143,550 | — | — | 144,000 | ||||||||||||||||||

| Net loss and comprehensive loss for the year | — | — | — | — | (403,082 | ) | (403,082 | ) | ||||||||||||||||

| Balance November 30, 2009 | 47,344,000 | $ | 47,344 | $ | 1,717,952 | $ | — | $ | (1,278,292 | ) | $ | 487,004 | ||||||||||||

(cont’d)

See accompanying notes to the Consolidated Financial Statements.

| F-5 |

FORCE ENERGY CORP.

(A Development Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ DEFICIT

for the period from November 1, 2006 (Date of Inception) to November 30, 2012

| Deficit | ||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Additional | Deferred | During the | ||||||||||||||||||||||

| Common Shares | Paid-in | Stock | Development | |||||||||||||||||||||

| Number | Par Value | Capital | Compensation | Stage | Total | |||||||||||||||||||

| Balance November 30, 2009 | 47,344,000 | $ | 47,344 | $ | 1,717,952 | $ | — | $ | (1,278,292 | ) | $ | 487,004 | ||||||||||||

| Capital stock issued for cash – at 0.20 | 500,000 | 500 | 99,500 | — | — | 100,000 | ||||||||||||||||||

| Capital stock issued pursuant to management services contract – at 0.22 | 2,500,000 | 2,500 | 547,500 | (264,000 | ) | — | 286,000 | |||||||||||||||||

| Capital stock issued for debt settlement – at 0.25 | 643,267 | 643 | 160,174 | — | — | 160,817 | ||||||||||||||||||

| Capital stock issued for cash – at 0.20 | 250,000 | 250 | 49,750 | — | — | 50,000 | ||||||||||||||||||

| Amortization of deferred compensation | — | — | — | 93,800 | — | 93,800 | ||||||||||||||||||

| Net loss and comprehensive loss for the year | — | — | — | — | (1,051,852 | ) | (1,051,852 | ) | ||||||||||||||||

| Balance November 30, 2010 | 51,237,267 | 51,237 | 2,574,876 | (170,200 | ) | (2,330,144 | ) | 125,769 | ||||||||||||||||

| Capital stock issued for cash – at 0.25 | 200,000 | 200 | 49,800 | — | — | 50,000 | ||||||||||||||||||

| Capital stock issued pursuant to mineral property option agreement – at 0.08 | 1,000,000 | 1,000 | 79,000 | — | — | 80,000 | ||||||||||||||||||

| Capital stock issued pursuant to management services contract – at 0.05 | 2,500,000 | 2,500 | 122,500 | (125,000 | ) | — | — | |||||||||||||||||

| Amortization of deferred compensation | — | — | — | 215,600 | — | 215,600 | ||||||||||||||||||

| Net loss and comprehensive loss for the year | — | — | — | — | (501,939 | ) | (501,939 | ) | ||||||||||||||||

| Balance November 30, 2011 | 54,937,267 | $ | 54,937 | $ | 2,826,176 | $ | (79,600 | ) | $ | (2,832,083 | ) | $ | (30,570 | ) | ||||||||||

| (As Restated) | ||||||||||||||||||||||||

See accompanying notes to the Consolidated Financial Statements.

| F-6 |

FORCE ENERGY CORP.

(A Development Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ DEFICIT

for the period from November 1, 2006 (Date of Inception) to November 30, 2012

| Deficit | ||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Additional | Deferred | During the | ||||||||||||||||||||||

| Common Shares | Paid-in | Stock | Development | |||||||||||||||||||||

| Number | Par Value | Capital | Compensation | Stage | Total | |||||||||||||||||||

| Balance November 30, 2011 | 54,937,267 | $ | 54,937 | $ | 2,826,176 | $ | (79,600 | ) | $ | (2,832,083 | ) | $ | (30,570 | ) | ||||||||||

| (As Restated) | ||||||||||||||||||||||||

| Intrinsic value of the beneficial conversion feature of the convertible notes payable (Note 8) | — | — | 97,000 | — | — | 97,000 | ||||||||||||||||||

| Capital stock issued upon settlement of convertible note payable | 2,486,549 | 2,487 | 62,813 | — | — | 65,300 | ||||||||||||||||||

| Capital stock issued upon settlement of convertible note payable | 6,956,813 | 6,957 | 68,643 | — | — | 75,600 | ||||||||||||||||||

| Capital stock issued upon settlement of convertible note payable | 14,344,432 | 14,344 | 246,056 | — | — | 260,400 | ||||||||||||||||||

| Capital stock issued upon conversion of advance payable to common stock at $0.02 | 3,000,000 | 3,000 | 57,000 | — | — | 60,000 | ||||||||||||||||||

| Capital stock issued pursuant to consultancy agreement at $0.02 | 2,691,926 | 2,692 | 51,146 | — | — | 53,838 | ||||||||||||||||||

| Capital stock issued pursuant to consultancy agreement at $0.0208 | 6,000,000 | 6,000 | 118,500 | — | — | 124,500 | ||||||||||||||||||

| Capital stock issued pursuant to management services contract at $0.02 | 7,500,000 | 7,500 | 142,500 | (150,000 | ) | — | — | |||||||||||||||||

| Capital stock issued for mineral property option agreement at $0.02 | 7,500,000 | 7,500 | 142,500 | — | — | 150,000 | ||||||||||||||||||

| Amortization of deferred compensation | — | — | — | 134,200 | — | 134,200 | ||||||||||||||||||