Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - FORCE MINERALS CORP | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - FORCE MINERALS CORP | ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - FORCE MINERALS CORP | ex32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

| For the fiscal year ended November 30, 2010 | ||

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT | |

| For the transition period from _________ to ________ | ||

| Commission file number: 000-52494 |

|

Force Energy Corp.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

98-0462664

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

1400 16th Street, Suite 400, Denver, CO

|

80202

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number: 720-470-1414

|

|

Securities registered under Section 12(b) of the Exchange Act:

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

None

|

not applicable

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

|

|

Title of each class

|

|

|

Common Stock, $0.001 par value

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the proceeding past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Not Available

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 51,237,267 as of February 22, 2010.

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

| 3 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 12 | ||

| 12 | ||

|

PART II

|

||

| 12 | ||

| 15 | ||

| 15 | ||

| 25 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| 29 | ||

|

PART III

|

||

| 29 | ||

| 32 | ||

| 35 | ||

| 36 | ||

| 36 | ||

|

PART IV

|

||

| Item 15. | Exhibits, Financial Statement Schedules | 37 |

PART I

Item 1. Business

Company Overview

We are currently engaged in the business of identifying, evaluating, and qualifying potential natural gas and oil wells; investing in interests in those wells with the goal of producing commercially marketable quantities of oil and natural gas. We have recently expanded our business model to include the exploration of mineral properties.

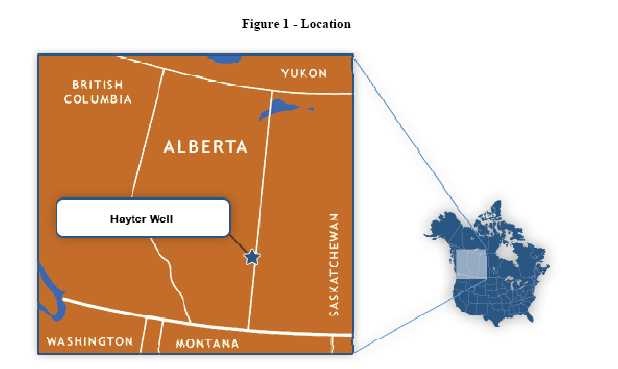

The Hayter Well

We presently hold a 50% working interest of the County Line Energy Corp. interest in the Hayter Well located in Alberta, Canada.

County Line Energy Corp. is the operator of the Hayter well. As of the date of this annual report, the Hayter well has been cased and cemented in anticipation of the completion of the drill program. County Line plans to enter the Hayter well, perforate the potential pay zones and conduct regular production testing of the zones. Should the testing confirm adequate oil reserves and potential economic flow rates, County Line is expected to install adequate pumping equipment and other surface facilities in anticipation of the projected flow rates. Currently, there are no known oil reserves on the Hayter well.

Competition

The oil and gas industry is very competitive. We compete with numerous individuals and companies, including many major oil and gas companies, which have substantially greater technical, financial and operational resources and staffs. Accordingly, there is a high degree of competition for desirable oil and gas interests, suitable properties for drilling operations and necessary drilling equipment, as well as for access to funds. We cannot predict if the necessary funds can be raised or that any projected work will be completed.

Compliance with Government Regulation

We are required to obtain licenses and permits from various governmental authorities. We anticipate that we will be able to obtain all necessary licenses and permits to carry on the activities which we intend to conduct, and that we intend to comply in all material respects with the terms of such licenses and permits.

If we proceed with the development of our current and future properties, we anticipate that we will be subject to increased governmental regulation. Matters subject to regulation include discharge permits for drilling operations, drilling and abandonment bonds, reports concerning operations, the spacing of wells, and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. The production, handling, storage, transportation and disposal of oil and gas, byproducts thereof, and other substances and materials produced or used in connection with oil and gas operations are also subject to regulation under federal, state, local and foreign laws and regulations relating primarily to the protection of human health and the environment. As we have not proceeded to the development of our properties, we have not incurred any expenditures related to complying with such laws, or for remediation of existing environmental contamination. The requirements imposed by such laws and regulations are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Zoro 1 Mineral Claim

On July 6, 2010, we entered into an option agreement with Dalton Dupasquier, pursuant to which Mr. Dupasquier has granted to us the sole and exclusive right and option, exercisable in the manner described below, to acquire a 100% net undivided interest in the property known as the Zoro 1 mineral claim, located near the East Shore of Wekusko Lake in west-central Manitoba, Canada.

|

Amount of Payment

|

Date Payment is Due

|

|

$59,600

|

July 6, 2010 (paid)

|

|

$94,958

|

June 15, 2011

|

|

$189,915

|

June 15, 2012

|

|

$379,831

|

June 15, 2013

|

We have no rights to the Zoro 1 mineral claim unless and until we exercise the option. We acquired the option to explore the potential for deposits of lithium on the Zoro 1 mineral claim.

We acquired the option to explore the potential for deposits of lithium on the Zoro 1 mineral claim. According to the United States Geological Survey (USGS), global end-use markets for lithium include ceramics and glass, batteries, lubricating greases, air treatment, continuous casting and primary aluminum production. Batteries, especially rechargeable batteries, are the market for lithium compounds with the largest growth potential as major automobile companies pursue the development of lithium batteries to power hybrid electric cars.

In September 2009, we received a NI 43-101 Technical Report on the Zoro 1 mineral claim. The report was authored by Mr. Mark Fedikow, PhD., P.Eng. of Mount Morgan Resources Ltd. The objectives of the NI 43-101 report were to summarize the geology, review the historic ore reserves, and economic potential of the spodumene-bearing dykes delineated on the property and their surrounding geological environment.

An historic reserve estimate for Lithium oxide (Li2O) has been calculated on limited drilling on a single dyke on the Zoro 1 mineral claim. Drill indicated spodumene reserves coupled with data from trenching have been calculated with a total undiluted tonnage given as 1,727,550 at 0.945% Li2O.

There are seven zoned pegmatite dykes on the Zoro 1 mineral claim. We plan to explore the Zoro 1 mineral claim using the Exploration Recommendations outlined by Dr. Fedikow in the NI 43-101 Technical Report, which are set forth below along with a table of recommended expenditures.

Initially, the Zoro 1 pegmatites should be the focus of the following exploration approaches. These are as follows:

|

1.

|

Trench rehabilitation including overburden stripping and washing.

|

|

2.

|

Geologic mapping of individual trenches at a scale of 1:20.

|

|

3.

|

Detailed geological mapping at a scale appropriate to document relevant features on the property. This will include the seven pegmatite dykes, trench locations, historic drill collars and geological attributes of the dykes. It is likely this mapping will be undertaken at a scale of 1:1000.

|

|

4.

|

Trench and channel sampling should be undertaken to confirm historic assay results.

|

|

5.

|

Re-log historic drill core as possible.

|

|

6.

|

A grid should be re-established on the property and an attempt made to tie-in the collar locations of all previous drilling. This information would help to structure new diamond drill programs. Initially, an attempt should be made to re-construct the historic grid although it is unlikely this will be possible given the length of time that has elapsed since the grid was first cut.

|

|

7.

|

The geochemistry of the spodumene with particular relevance to iron content should be evaluated. Albite-rich portions of the pegmatite should be assayed for tantalum, tin, and niobium values. Altered and mineralized wallrocks should be assayed for gold particularly where the mineral assemblage of pyrrhotite, chalcopyrite and arsenopyrite are observed. Any subsequent drill program should be accompanied by a multi-element geochemical approach to assaying core including assays for gold. This will be followed up with assays for specific metals that may be present in the pegmatite dykes. The new assay program should be accompanied by a quality assurance and quality control program.

|

|

8.

|

Diamond drilling should initially target Dyke No. 1 with the aim of ascertaining the physical size and extent of this dyke. Additional drilling will be necessary in the vicinity of the six remaining known dykes as well as any additional lithium-bearing pegmatite uncovered during exploration on the remainder of the property.

|

|

Trench Rehabilitation, Geologic Mapping and Assays (Four Weeks)

|

||

|

1. Trench stripping, excavation and washing:

|

$ | 15,000.00 |

|

2. Field technician: $250.00/day:

|

$ | 7,000.00 |

|

3. General Laborers (n=2): $150.00/day:

|

$ | 8,400.00 |

|

4. Geologist: $400.00/day:

|

$ | 11,200.00 |

|

5. Assays (n=100 @ $50.00/sample):

|

$ | 5,000.00 |

|

Drill Program

|

||

|

6. Mobilization/Demobilization of equipment and crews:

|

$ | 10,000.00 |

|

7. Two Thousand metres of NQ coring:

|

$ | 250,000.00 |

|

8. Moves between holes:

|

$ | 25,000.00 |

|

9. Core trays and survey tool:

|

$ | 8,000.00 |

|

10. Room and board @ $150.00/day for 60 days:

|

$ | 18,000.00 |

|

11. Communications and freight:

|

$ | 10,000.00 |

|

12. Helicopter:

|

$ | 40,000.00 |

|

13. Helicopter fuel:

|

$ | 7,500.00 |

|

14. Geologist @ $400.00/day for 60 days:

|

$ | 24,000.00 |

|

15. Geologist Room and Board @ $150.00/day:

|

$ | 9,000.00 |

|

16. Geologist Transportation/Mobilization/Demobilization/Site access:

|

$ | 5,000.00 |

|

17. Assays @$50.00/sample for 300 samples:

|

$ | 15,000.00 |

|

18. Report preparation:

|

$ | 7,500.00 |

|

Sub-total:

|

$ | 475,600.00 |

|

Contingency @ 10%:

|

$ | 47,560 |

|

Total:

|

$ | 523,160.00 |

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of our claim. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and enter into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in not receiving an adequate return on invested capital.

Compliance with Government Regulation

We are required to obtain licenses and permits from various governmental authorities. We anticipate that we will be able to obtain all necessary licenses and permits to carry on the activities which we intend to conduct, and that we intend to comply in all material respects with the terms of such licenses and permits.

If we proceed with the development of our current and future properties, we anticipate that we will be subject to increased governmental regulation. Matters subject to regulation include discharge permits for drilling operations, drilling and abandonment bonds, reports concerning operations, the spacing of wells, and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. The production, handling, storage, transportation and disposal of oil and gas, byproducts thereof, and other substances and materials produced or used in connection with oil and gas operations are also subject to regulation under federal, state, local and foreign laws and regulations relating primarily to the protection of human health and the environment. As we have not proceeded to the development of our properties, we have not incurred any expenditures related to complying with such laws, or for remediation of existing environmental contamination. The requirements imposed by such laws and regulations are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Employees

Currently our only employees is Tim DeHerrera. We do not expect any material changes in the number of employees over the next twelve month period. We anticipate that we will be conducting most of our business through agreements with consultants and third parties.

Subsidiaries

We have two wholly owned subsidiaries, FRC Exploration Ltd. (a British Columbia Corporation) and Nuance Exploration Ltd. (a British Columbia Corporation).

Item 1A. Risk Factors.

A smaller reporting company is not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments

A smaller reporting company is not required to provide the information required by this Item.

Item 2. Properties

Executive Offices

Our executive offices are located at 1400 16th Street, Suite 400, Denver, CO 80202. We lease our head office in Denver Colorado at a rate of $119.00 month. Our head office is a business center. Our current premises are adequate for our current operations and we do not anticipate that we will require additional premises in the foreseeable future.

The Hayter Well

Purchase of Interest in the Hayter Well

On August 1, 2006, County Line Energy Corp. (“County Line”) signed a participation agreement with Black Creek Resources Ltd. (“BCR”) in which County Line acquired the right to become the operator and drill the Hayter well (10D Hayter 10-8-40-1 W4M) located in Alberta, Canada. In order to exercise that interest and acquire the rights to drill the Hayter well, County Line agreed to pay 100% of all costs associated with the seismic option agreement and pay 100% of the funds required to purchase rights to any existing seismic on the property which may be for sale and or shoot additional 2D and 3D on the property as required, pursuant to standard industry costs and practices.

Pursuant to a Participation Agreement dated December 21, 2006 between Black Creek Resources Ltd (“BCR”) and Nuance Exploration Ltd. (“NEL”), a wholly owned subsidiary of the Company, we acquired a 100% ownership in the interpretation of 3D seismic data covering four sections of certain land located in the province of Alberta, Canada by paying $82,650 for the purpose of acquiring and interpreting the seismic data. On October 15, 2007, prior to the evaluation of the 3D seismic data, County Line sold to BCR its 100% interest in the subject property and received as consideration a non-interest bearing promissory note for $111,144 (CDN$110,000) to be repaid by November 30, 2007.

On November 30, 2007, County Line did not repay the amounts owing pursuant to the promissory note and NEL and County Line entered into a Participation Agreement whereby NEL accepted a 20% interest of the Grantor’s working interest in the County Line 10D Hayter 10-8-40-1 W4M well as full and final settlement of the promissory note. Pursuant to the terms of the Participation agreement NEL agreed to assume 20% of all revenues, costs and expenses associated with the project.

During our first fiscal quarter of 2009 we advanced $23,938 (CDN$29,000) to County Line Energy Corp for costs and expenses associated with the Hayter Well as an unsecured loan. On October 16, 2009 we entered into an amendment to our participation agreement with County Line pursuant to which we acquired an additional 30% working interest in the Hayter Well in consideration of a release by Force from all amounts owed by County Line to Force. Following our entry into the amended participation agreement we now hold a 50% working interest in the County Line Energy Corp. interest in the Hayter Well.

Location of Hayter Well

Force Energy Corp. has a 50% working interest of the County Line Energy Corp. interest in the Hayter Well (10D Hayter 10-8-40-1 W4M) located in Alberta, Canada. The well was spudded in January 2007 and drilled to a total depth. The well logs revealed a gas zone of 4 to 5 meters of thickness in a shallow zone and a heavy oil pay zone of 2 meters of thickness in the target Dina Sand zone.

County Line completed a $650,000 3D seismic program covering nine sections of land in pursuit of a potential multi well heavy oil drilling opportunity. The geological model was based on interpretation from a previous well, which produced 16,000 barrels of heavy oil. The seismic program was designed to determine whether the structure found in this well existed to a larger extent on the subject property. The 3D seismic revealed an extremely large anomaly with similar characteristics. The nature of this large anomaly suggested that a multi well drilling opportunity might exist.

County Line Energy Corp. is the operator of the Hayter well. As of the date of this report, the Hayter well has been cased and cemented in anticipation of the completion of the drill program. County Line plans to enter the Hayter well, perforate the potential pay zone(s) and conduct regular production testing of the zone(s). Should the testing confirm adequate oil reserves and potential economic flow rates, County Line is expected to install adequate pumping equipment and other surface facilities in anticipation of the projected flow rates. Currently, there are no known oil reserves on the Hayter well.

On March 9, 2009, Force received a report on reserves data for the Hayter Well prepared by its independent engineers. The reserves data are estimates of proved reserves and probable reserves and related future net revenue as at November 30, 2008.

On October 16, 2009 we entered into an amendment to our participation agreement with County Line Energy Corp. pursuant to which we acquired an additional 30% working interest in the Hayter Well in consideration of a release by Force from all amounts owed by County Line to Force. Following our entry into the amended participation agreement we now hold a 50% working interest of the County Line Energy Corp. interest in the Hayter Well.

Oil and Gas Properties and Wells

On March 9, 2009, Force received a report on reserves data for the Hayter Well prepared by its independent engineers, Chapman Petroleum Engineering Ltd.

The following table sets forth the number of wells in which the Company held a working interest as at November 30, 2009:

|

Oil

|

Natural Gas

|

|||

|

Hayter Area, Alberta

|

Gross

|

Net

|

Gross

|

Net

|

|

Producing

|

-

|

-

|

-

|

-

|

|

Non-producing

|

1

|

0.2

|

-

|

-

|

The Company has not since the beginning of its most recently completed fiscal year, filed any annual estimates of proved oil and gas reserves with any federal agencies. As at November 30, 2009, the Company had a 50% working interest in one well in the Hayter Area of Alberta.

Zoro 1 Mineral Claim

Property Description and Access

The Zoro 1 property is located near the east shore of Wekusko Lake (Figure 4.1) in west-central Manitoba, approximately 25 km east of the mining community of Snow Lake, 249 km southeast of Thompson and 571 km north-northeast of Winnipeg. Provincial Road 393 occurs 23 km to the northwest. The pegmatite dykes are located northwest of the northwest corner of a small pot hole Lake east of the east shore of Wekusko Lake. The small historic gold mining community of Herb Lake is located about 10 km southwest of the property.

Access to the property is by boat from Bartlett’s Landing accessed from Provincial Road 392 and then by All Terrain Vehicle to the property along a trail and/or by helicopter from Snow Lake, Manitoba. The nearest road link is a seasonal road on the east side of Wekusko Lake that accesses the village of Herb Lake Landing and Provincial Highway 392 to the south. A rail link is located at Wekusko siding approximately 20 km south of Herb Lake Landing.

The property is located within NTS map sheet 63J/13SE (latitude: 54⁰51.27’ and longitude: 99⁰38.46’; Township 68N; Range 15WPM).

The Zoro 1 property is covered by one claim, the Zoro 1 (P1993F). The property is 52 hectares in area and was recorded March 14, 1994, under the name of Dalton Bruce Dupasquier. The claim is in good standing.

History of the Zoro 1 mineral claim

The pegmatite dykes are located on the north side of a small lake between Roberts Lake and the south end of Crowduck Bay. Early in 1953, Cs No. 3-10, 12 (P 26973-80, 82), S.R. No. 1-6 (P 7877-82) and Linda 1 (P 26983) were staked by Mrs. Johanna Stoltz, Eric Stoltz, Carl Stoltz and Edwin Stoltz, and Key No. 1-4, 8-14 (P 27159-62, 27226-27, 27164-68) were staked by John Tikkanen, Hjalmar Peterson, and Loren Fredeen. These were cancelled the following year.

Lit Nos. 11-5 (P 31758-62) was staked by J.J. Johnson in 1954. In 1955 Lit Nos. 6-1l8 (P 35014-26) were added by J.A. Syme. All the Lit claims were assigned to Green Bay Uranium Limited in 1956 which changed its name to Green Bay Mining & Exploration Ltd. Early in 1956, before drilling commenced, samples containing more than 2% Li2O and containing no contaminating accessory lithium minerals and no high iron content were reported. A shipment of 136 kg (300 lbs.) of spodumene was sent to Ottawa for testing in 1956. This sample assayed 1.19% Li2O, with minor NbO5. Ore dressing tests concluded that good liberation and separation could not be effected.

Over 6096 m (20 000 ft.) of diamond drilling was done on Lit No. 1-4, with at least 3048 m (10 000 ft.) of this on the main dyke. Results of the drilling on dykes 1, 3, 5 and 7 were reported to be "promising". Assays of 2.42% to 7.28% Li2O were reported from Dyke 5. Dyke 5 was apparently 305 m long x 12 m wide (1000 x 40 ft.); Dyke No. 7, over 457 m x 24 m (1500 x 80 ft.). Several of the holes went deeper than 305 m (1000 ft.). Drilling on Lit 10, 16 and 17 amounted to 1950 m (6399 ft.). Gold was also found on the property, with a 3.3 kg (7.25 lb.) sample across 3.4 m (11 ft.) yielding $5.95 gold at $35.00 equating to approximately 0.17 ounces per ton gold.

Lithium tonnage estimates vary. An unsubstantiated visual estimate in September 1956 suggested up to 9-11 million tonnes (10-12 million tons) of Li2O occur on the entire group. In mid-March the main dyke was estimated to contain 18 million tonnes (2 million tons) grading 1.4% Li2O to a depth of 305 m (1000 ft.) in the main dyke. A reserve estimate of 1 815 000 tonnes grading 1.4% Li2O was 15 reported by Bannatyne (1985). In 1957, the estimate was revised to 1.72 million tonnes averaging 1.3% Li2O or 2.72 million tonnes (3.0 million tons) at l.0% Li2O in the main dyke (Mulligan, 1957a, 1957b). By March 1958, 12 different tonnage estimates had been made. Also by that time, a permanent camp and a 4-mile road into the property had been built. Plans for a heavy media separation plant on the property were being prepared by the Lummus Co. of New York together with Knowles Associates and the Colorado School of Mines.

No further work on the property is known since 1957. The claims were assigned to J.A. Syme in 1963. The Zoro 1 claim is currently listed under the name of Dalton Bruce Dupasquier.

Reserve Estimate

An historic reserve estimate for Li2O has been calculated on limited drilling on a single dyke on the Zoro 1 mineral claim. Drill indicated spodumene reserves coupled with data from trenching have been calculated with a total undiluted tonnage given as 1,727,550 at 0.945% Li2O.

The Zoro 1 mineral claim hosts multiple rare metal spodumene pegmatite dykes. The main mass of spodumene-bearing zones exposed in seven main trenches has not been fully delineated and a recommended exploration program will assess the geological characteristics of the dykes on the property. Trench rehabilitation, new sampling from the trenches and diamond drilling and a thorough assay/analytical approach accompanied by a quality assurance and quality control program is recommended. Rare and precious metal contents in the pegmatite, not considered in the historic exploration and development program, can also be assessed in this manner.

Item 3. Legal Proceedings

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. (Removed and Reserved)

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “FORC.”

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCBB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

Fiscal Year Ending November 30, 2010

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

November 30, 2010

|

0.36

|

0.10

|

||

|

August 31, 2010

|

0.28

|

0.10

|

||

|

May 31, 2010

|

0.33

|

0.20

|

||

|

February 28, 2010

|

0.43

|

0.25

|

||

|

Fiscal Year Ending November 30, 2009

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

November 30, 2009

|

0.54

|

0.21

|

||

|

August 31, 2009

|

0.47

|

0.22

|

||

|

May 31, 2009

|

0.58

|

0.35

|

||

|

February 28, 2009

|

0.66

|

0.30

|

||

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of December 3, 2010, we had 51,237,267 shares of our common stock issued and outstanding, held by thirty one (31) shareholders of record.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

|

1.

|

we would not be able to pay our debts as they become due in the usual course of business, or;

|

|

2.

|

our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

|

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Recent Sales of Unregistered Securities

The information set forth below relates to our issuances of securities without registration under the Securities Act of 1933 during the reporting period which were not previously included in a Quarterly Report on Form 10-Q or Current Report on Form 8-K.

On July 9, 2010, we issued 500,000 common shares at $0.20 per share for gross proceeds of $100,000.

On July 23, 2010, we issued 2,500,000 common shares pursuant to an employment contract with our President. The fair value of the shares issued was $550,000.

On August 4, 2010, we issued 643,267 common shares pursuant to a debt settlement agreement, in settlement of amounts owing to our former president in the amount of $160,817.

On August 11, 2010, we issued 250,000 common shares for aggregate proceeds of $50,000.

The above issuances were made pursuant to Regulation S of the 1933 Act. Each purchaser represented to us that the purchaser was a Non-US Person as defined in Regulation S. We did not engage in a distribution of this offering in the United States. Each purchaser represented their intention to acquire the securities for investment only and not with a view toward distribution. All purchasers were given adequate access to sufficient information about us to make an informed investment decision. None of the securities were sold through an underwriter and accordingly, there were no underwriting discounts or commissions involved. The selling stockholders named in this prospectus include all of the purchasers who purchased shares pursuant to this Regulation S offering.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Results of Operations for the Years Ended November 30, 2010 and 2009

Plan of Operation

Discussion of our financial condition and results of operations should be read in conjunction with our audited financial statements and the notes thereto included elsewhere in this annual report prepared in accordance with accounting principles generally accepted in the United States. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those anticipated in these forward-looking statements.

We are currently engaged in the business of identifying, evaluating, and qualifying potential natural gas and oil wells and mineral properties; investing in interests in those wells with the goal of producing commercially marketable quantities of oil and natural gas and lithium. The majority of our business is derived from projects identified by our principals. Our strategy is to identify low to moderate risk oil and natural gas reserves by reviewing and reprocessing previously recorded seismic data with a view to a deeper target in our analysis than when the data was originally recorded. This approach allows us to evaluate potential oil and natural gas sites for development without the operational and financial commitment which would be required to record new seismic data on comparable sites. By entering into participation agreements with companies which have possession of such seismic data, our operational costs are limited to the cost of analysis until such time as we have identified reserves for development. We intend to increase our staff and expand our operations into these areas of activity should we establish sufficient cash flows in the next twelve months to support these activities.

County Line Energy Corp. is the operator of the Hayter well. As of the date of this annual report, the Hayter well has been cased and cemented in anticipation of the completion of the drill program. County Line plans to enter the Hayter well, perforate the potential pay zone(s) and conduct regular production testing of the zone(s). Should the testing confirm adequate oil reserves and potential economic flow rates, County Line is expected to install adequate pumping equipment and other surface facilities in anticipation of the projected flow rates. Currently, there are no known oil reserves on the Hayter well.

As of the date of this annual report the status of our agreements respecting our oil and gas and mineral properties is as follows:

|

(i)

|

Hayter Well. We presently hold a 50% working interest of the County Line Energy Corp. interest in the Hayter Well located in Alberta, Canada.

County Line Energy Corp. is the operator of the Hayter well. As of the date of this annual report, the Hayter well has been cased and cemented in anticipation of the completion of the drill program. County Line plans to enter the Hayter well, perforate the potential pay zones and conduct regular production testing of the zones. Should the testing confirm adequate oil reserves and potential economic flow rates, County Line is expected to install adequate pumping equipment and other surface facilities in anticipation of the projected flow rates. Currently, there are no known oil reserves on the Hayter well.

|

|

On March 9, 2009, Force received a report on reserves data for the Hayter Well prepared by its independent engineers. The report was prepared in accordance with the standards set out in the Canadian Oil and Gas Evaluation Handbook (COGE handbook).

|

|

(ii)

|

Zoro 1 Mineral Claim. On July 6, 2010, we entered into an option agreement with Dalton Dupasquier, pursuant to which Mr. Dupasquier has granted to us the sole and exclusive right and option, exercisable in the manner described below, to acquire a 100% net undivided interest in the property known as the Zoro 1 mineral claim, located near the East Shore of Wekusko Lake in west-central Manitoba, Canada.

|

|

Amount of Payment

|

Date Payment is Due

|

|

$59,600

|

July 6, 2010 (paid)

|

|

$94,958

|

June 15, 2011

|

|

$189,915

|

June 15, 2012

|

|

$379,831

|

June 15, 2013

|

We have no rights to the Zoro 1 mineral claim unless and until we exercise the option. We acquired the option to explore the potential for deposits of lithium on the Zoro 1 mineral claim.

We acquired the option to explore the potential for deposits of lithium on the Zoro 1 mineral claim. According to the United States Geological Survey (USGS), global end-use markets for lithium include ceramics and glass, batteries, lubricating greases, air treatment, continuous casting and primary aluminum production. Batteries, especially rechargeable batteries, are the market for lithium compounds with the largest growth potential as major automobile companies pursue the development of lithium batteries to power hybrid electric cars.

In September 2009, we received a NI 43-101 Technical Report on the Zoro 1 mineral claim. The report was authored by Mr. Mark Fedikow, PhD., P.Eng. of Mount Morgan Resources Ltd. The objectives of the NI 43-101 report were to summarize the geology, review the historic ore reserves, and economic potential of the spodumene-bearing dykes delineated on the property and their surrounding geological environment.

An historic reserve estimate for Lithium oxide (Li2O) has been calculated on limited drilling on a single dyke on the Zoro 1 mineral claim. Drill indicated spodumene reserves coupled with data from trenching have been calculated with a total undiluted tonnage given as 1,727,550 at 0.945% Li2O.

There are seven zoned pegmatite dykes on the Zoro 1 mineral claim. We plan to explore the Zoro 1 mineral claim using the Exploration Recommendations outlined by Dr. Fedikow in the NI 43-101 Technical Report, which are set forth in our Company Overview of Part 1.

We did not earn any revenues during the year ended November 30, 2010. We do not anticipate earning revenues until identifiable reserves are discovered and exploited from the Hayter well, Zoro 1 mineral claim, or from any other properties or projects in which we hold a working or direct interest.

Anticipated Cash Requirements

We estimate that our general operating expenses for the next twelve month period to be as follows:

|

Estimated Funding Required During the Next Twelve Months

|

||

|

Expenses

|

Amount

|

|

|

Management fees

|

$ | 150,000 |

|

Exploration expenses

|

$ | 523,160 |

|

Zoro 1 mineral property payment

|

$ | 94,958 |

|

Professional fees

|

$ | 120,000 |

|

General administrative expenses

|

$ | 80,000 |

|

Total

|

$ | 968,118 |

To date, we have had negative cash flows from operations and we have been dependent on sales of our equity securities and debt financing to meet our cash requirements. We expect this situation to continue for the foreseeable future. We anticipate that we will have negative cash flows during the next twelve month period.

Results of Operations

The following summary of our results of operations should be read in conjunction with our audited financial statements for the year ended November 30, 2010 which are included herein.

Our operating results for the years ended November 30, 2010 and 2009 are summarized as follows:

|

Years Ended

November 30, |

||||||

|

2010

|

2009

|

|||||

|

Revenue

|

$ | - | $ | - | ||

|

Operating Expenses

|

1,123,149 | 393,845 | ||||

|

Net Loss

|

$ | 1,111,452 | $ | 403,082 | ||

Revenues

We have not earned any revenues to date, and do not anticipate earning revenues until such time as we encounter commercially productive oil or gas reservoirs on our oil and gas prospects. All of our oil and gas prospects are undeveloped. The significant reduction in the price of oil following the global economic crises has materially affected our anticipated revenue stream from our property interests. As a result of the current low price of oil, our company will continue to incur expenses in excess of the revenues generated from our properties. We anticipate that we will have to address the cash shortfall through additional equity financings in the future. We can offer no assurance, however, that such financings will be available on terms acceptable to our company. We also intend to generate additional funds in the future through increased output following our company’s plan to increase the number of wells on our producing properties.

Expenses

Our expenses for the years ended November 30, 2010 and 2009 are outlined in the table below:

|

Years Ended

November 30, |

||||

|

2010

|

2009

|

|||

|

Accounting and audit fees

|

90,916

|

90,936

|

||

|

Accretion Expense

|

1,626

|

1,328

|

||

|

Bank charges

|

532

|

1,061

|

||

|

Consulting fees

|

-

|

-

|

||

|

Depreciation

|

1,741

|

2,328

|

||

|

Exploration Expenses

|

-

|

15,000

|

||

|

Investor relations

|

-

|

18,284

|

||

|

Legal fees

|

31,956

|

45,190

|

||

|

Management fees

Mineral Property Costs

|

508,050

59,600

|

189,000

|

||

|

Office expenses

|

9,329

|

16,599

|

||

|

Rent

|

7,084

|

18,836

|

||

|

Tax penalties and interest

|

-

|

(50,000)

|

||

|

Transfer and filing fees

|

11,437

|

22,877

|

||

|

Travel

|

839

|

2,406

|

||

|

Write-off of Oil and Gas Costs

|

398,039

|

20,000

|

||

|

Total Expenses

|

$

|

1,123,149

|

$

|

393,845

|

Our expenses increased by 285% in fiscal 2010 as compared to fiscal 2009. The increase in our expenses for the year ended November 30, 2010 was due mainly to increased Management Fees and Write-off costs associated with writing off oil and gas properties.

Liquidity And Capital Resources

|

Working Capital

|

|||||||

|

November 30, 2010

|

November 30, 2009

|

Percentage

Increase / |

|||||

|

Current Assets

|

$

|

238

|

$

|

163,674

|

(687.7%)

|

||

|

Current Liabilities

|

$

|

57,214

|

$

|

172,348

|

(300.0%)

|

||

|

Working Capital (deficit)

|

$

|

(56,976)

|

$

|

(8,674)

|

650. 0%

|

|

Cash Flows

|

|||||||

|

Year Ended

November 30, 2010 |

Year Ended

November 30, 2009 |

Percentage

Increase / |

|||||

|

Cash used in Operating Activities

|

$

|

(349,307)

|

|

$

|

(392,219)

|

11.0%

|

|

|

Cash used in Investing Activities

|

$

|

(29,304)

|

|

$

|

(205,563)

|

(700.0%)

|

|

|

Cash provided by Financing Activities

|

$

|

150,000

|

$

|

252,000

|

(40.5%)

|

||

|

Net Increase (Decrease) in Cash

|

$

|

(162,594)

|

|

$

|

(296,482)

|

(182.3%)

|

We anticipate that we will incur approximately $873,160 for operating expenses, including, legal, accounting and audit expenses associated with our reporting requirements as a public company under the Exchange Act during the next twelve months.

Cash Used In Operating Activities

We used cash in operating activities in the amount of $349,307 during the year ended November 30, 2010 and $392,219 during the year ended November 30, 2009. Cash used in operating activities was funded by cash from financing activities.

Cash From Investing Activities

Net cash used in investing activities totaled $29,304 during the year ended November 30, 2010 as compared to cash used in investing activities of $205,563 during the year ended November 30, 2009.

Cash from Financing Activities

We generated $150,000 cash from financing activities during the year ended November 30, 2010 compared to cash from financing activities in the amount of $252,000 during the year ended November 30, 2009.

Liquidity and Capital Resources

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. Capital may not continue to be available if necessary to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

Off Balance Sheet Arrangements

As of November 30, 2010, there were no off balance sheet arrangements.

Going Concern

Due to our being an exploration stage company and not having generated revenues, in their report on our audited financial statements for the year ended November 30, 20010, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern.

We have historically incurred losses, and through November 30, 2010 have incurred losses of $2,389,744 since our inception. Because of these historical losses, we will require additional working capital to develop our business operations. We intend to raise additional working capital through private placements, public offerings, bank financing and/or advances from related parties or shareholder loans.

The continuation of our business is dependent upon obtaining further financing and achieving a break even or profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current or future stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

There are no assurances that we will be able to either achieve a level of revenues adequate to generate sufficient cash flow from operations, or obtain additional financing through either private placements, public offerings and/or bank financing necessary to support our working capital requirements. To the extent that funds generated from operations and any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on terms acceptable to us. If adequate working capital is not available we may not increase our operations or continue with our exploration or development plan.

These conditions raise substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might be necessary should we be unable to continue as a going concern.

Critical Accounting Policies

The consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America and are stated in US dollars. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates, which may have been made using careful judgment. Actual results may vary from these estimates. The financial statements have, in management’s opinion, been properly prepared within the framework of the significant accounting policies summarized below:

Development Stage Activities

The Company is a development exploration stage company. All losses accumulated since inception have been considered as part of the Company’s development stage activities. The Company is subject to several categories of risk associated with its development stage activities. Natural gas and oil exploration and production is a speculative business, and involves a high degree of risk. Among the factors that have a direct bearing on the Company’s prospects are uncertainties inherent in estimating natural gas and oil reserves, future hydrocarbon production, and cash flows, particularly with respect to wells that have not been fully tested and with wells having limited production histories; access to additional capital; changes in the price of natural gas and oil; availability and cost of services and equipment; and the presence of competitors with greater financial resources and capacity.

Principles of Consolidation

These consolidated financial statements include the accounts of the Force Energy Corp and its wholly-owned subsidiaries, FRC Exploration Ltd. (a BC Corporation) (“FRC”) and Nuance Exploration Ltd. (a BC Corporation) (“NEL”). All significant inter-company balances and transactions have been eliminated.

Foreign Currency Translation

The Company’s functional currency is the Canadian dollar as substantially all of the Company’s operations are in Canada. The Company uses the United States dollar as its reporting currency for consistency with registrants of the Securities and Exchange Commission (“SEC”).

Assets and liabilities denominated in a foreign currency are translated at the exchange rate in effect at the balance sheet date and share capital accounts are translated at historical rates. Income statement accounts are translated at the average rates of exchange prevailing during the period. Translation adjustments from the use of different exchange rates from period to period are included in the Accumulated Other Comprehensive Income account in Stockholder’s Equity, if applicable. Transactions undertaken in currencies other than the functional currency of the entity are translated using the exchange rate in effect as of the transaction date. Any exchange gains and losses are included in the Statement of Operations and Comprehensive Loss.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation is provided on the straight-line method over the estimated useful lives of the assets, which are generally 2 to 5 years. The cost of repairs and maintenance is charged to expense as incurred. Expenditures for property betterments and renewals are capitalized. Upon sale or other disposition of a depreciable asset, cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in other income (expense).

Oil and Gas Properties

The Company follows the full cost method of accounting for oil and gas operations whereby all costs of exploring for and developing oil and gas reserves are initially capitalized on a country-by-country (cost centre) basis. Such costs include land acquisition costs, geological and geophysical expenses, carrying charges on non-producing properties, costs of drilling and overhead charges directly related to acquisition and exploration activities.

Costs capitalized, together with the costs of production equipment, are depleted and amortized on the unit-of-production method based on the estimated gross proved reserves. Petroleum products and reserves are converted to a common unit of measure, using 6 MCF of natural gas to one barrel of oil.

Costs of acquiring and evaluating unproved properties are initially excluded from depletion calculations. These unevaluated properties are assessed periodically to ascertain whether impairment has occurred. When proved reserves are assigned or the property is considered to be impaired, the cost of the property or the amount of the impairment is added to costs subject to depletion calculations.

If capitalized costs, less related accumulated amortization and deferred income taxes, exceed the “full cost ceiling” the excess is expensed in the period such excess occurs. The “full cost ceiling” is determined based on the present value of estimated future net revenues attributed to proved reserves, using current prices less estimated future expenditures plus the lower of cost and fair value of unproved properties within the cost centre.

Proceeds from a sale of petroleum and natural gas properties are applied against capitalized costs, with no gain or loss recognized, unless such a sale would alter the relationship between capitalized costs and proved reserves of oil and gas attributable to a cost centre.

Impairment of Long-lived Assets

The carrying value of intangible assets and other long-lived assets are reviewed on a regular basis for the existence of facts or circumstances that may suggest impairment. The Company recognizes impairment when the sum of the expected undiscounted future cash flows is less than the carrying amount of the asset. Impairment losses, if any, are measured as the excess of the carrying amount of the asset over its estimated fair value. Impairment on the properties with unproved reserves is evaluated by considering criteria such as future drilling plans for the properties, the results of geographic and geologic data related to the unproved properties and the remaining term of the property leases.

Asset Retirement Obligations

Asset retirement obligations (“ARO”) associated with the retirement of a tangible long-lived asset, including natural gas and oil properties, are recognized as liabilities in the period in which it is incurred and becomes determinable, with an offsetting increase in the carrying amount of the associated assets. The cost of tangible long-lived assets, including the initially recognized ARO, is depleted, such that the cost of the ARO is recognized over the useful life of the assets. The ARO is recorded at fair value, and accretion expense is recognized over time as the discounted fair value is accreted to the expected settlement value. The fair value of the ARO is measured using expected future cash flow, discounted at the Company’s credit-adjusted risk-free interest rate.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and loss carry-forwards and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of a change in tax rules on deferred tax assets and liabilities is recognized in operations in the year of change. A valuation allowance is recorded when it is “more likely-than-not” that a deferred tax asset will not be realized.

Basic Loss per Share

Basic loss per share is computed using the weighted average number of shares outstanding during the period. Diluted earnings per share are computed similar to basic income per share except that the denominator is increased to include the number of common stock equivalents. Common stock equivalents represent the dilutive effect of the assumed exercise of any outstanding stock equivalents, using the treasury stock method, at either the beginning of the respective period presented or the date of issuance, whichever is later, and only if the common stock equivalents are considered dilutive based upon the Company’s net income (loss) position at the calculation date. There are no common stock equivalents outstanding and, thus, diluted and basic loss per share are the same.

Comprehensive Income

The Company is required to report comprehensive income, which includes net loss as well as changes in equity from non-owner sources.

Recently Issued Accounting Pronouncements

On December 1, 2009 the Company adopted the guidance in Accounting Standards Codification (“ASC”) 805, “Business Combinations”. ASC 805 establishes principles and requirements for how the acquirer in a business combination (i) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquired business; (ii) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and (iii) determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. The adoption of this statement had no effect on the Company’s reported financial position or results of operations.

On December 1, 2009, the Company adopted the newly ratified guidance which is part of ASC 815-40, “Contracts in Entity’s Own Equity”. ASC 815-40 provides guidance for determining whether an equity-linked financial instrument (or embedded feature) is indexed to an entity’s own stock. The adoption of this statement had no effect on the Company’s reported financial position or results of operations.

On December 1, 2009, the Company became subject to revised reporting requirements relating to oil and natural gas reserves that a company holds, which were prescribed by the SEC. Included in the new rule entitled ―Modernization of Oil and Gas Reporting Requirements”, are the following changes: 1) permitting use of new technologies to determine proved reserves, if those technologies have been demonstrated empirically to lead to reliable conclusions about reserve volumes; 2) enabling companies to additionally disclose their probable and possible reserves to investors, in addition to their proved reserves; 3) allowing previously excluded resources, such as oil sands, to be classified as oil and natural gas reserves rather than mining reserves; 4) requiring companies to report the independence and qualifications of a preparer or auditor, based on current Society of Petroleum Engineers criteria; 5) requiring the filing of reports for companies that rely on a third party to prepare reserve estimates or conduct a reserve audit; and 6) requiring companies to report oil and natural gas reserves using an average price based upon the prior 12-month period, rather than year-end prices. The new reporting requirements are applicable to registration statements filed on or after January 1, 2010, and for annual reports on Form 10K for fiscal years ending on or after December 31, 2009. As at August 31, 2010, the Company has no proved or probable reserves and is therefore not subject to the reporting requirement. The adoption of these reporting requirements will result in increased disclosures to the financial statements once the Company has proved and probable reserves.

On December 1, 2009 Accounting Standards Update (ASU) No. 2010-03 ― “Oil and Gas Reserve Estimation and Disclosures.” became effective for the Company. The guidance requires additional disclosures to be made relating to current oil and gas reserve estimation. The adoption of these reporting requirements will result in increased disclosures to the financial statements once the Company has proved and probable reserves.

In April 2010, the FASB issued ASU No. 2010-17, "Revenue Recognition - Milestone Method (Topic 605): Milestone Method of Revenue Recognition" (codified within ASC 605 - Revenue Recognition). ASU 2010-17 provides guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research or development transactions. ASU 2010-17 is effective for interim and annual periods beginning after June 15, 2010. The adoption of this statement had no effect on the Company’s reported financial position or results of operations.

In March 2010, the FASB issued ASU No. 2010-11, "Derivatives and Hedging (Topic 815): Scope Exception Related to Embedded Credit Derivatives" (codified within ASC 815 - Derivatives and Hedging). ASU 2010-11 improves disclosures originally required under SFAS No. 161. ASU 2010-11 is effective for interim and annual periods beginning after June 15, 2010. The adoption of this statement had no effect on the Company’s reported financial position or results of operations.

In May 2010, the FASB (Financial Accounting Standards Board) issued Accounting Standards Update 2010-19 (ASU 2010-19), Foreign Currency (Topic 830): Foreign Currency Issues: Multiple Foreign Currency Exchange Rates. The amendments in this Update are effective as of the announcement date of March 18, 2010. The Company does not expect the provisions of ASU 2010-19 to have any effect on the Company’s reported financial position or results of operations.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

|

Audited Financial Statements:

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To: The Board of Directors and Shareholders

Force Energy Corporation

Denver, Colorado

I have audited the accompanying balance sheet of Force Energy Corporation as of November 30, 2010 and 2009 and the related statements of operations, of shareholders’ equity and of cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion, based on my audit, the financial statements referred to above present fairly, in all material respects, the financial position of Force Energy Corporation as of November 30, 2010 and 2009 and the results of its operations and its cash flows for the years then ended in conformity with United States generally accepted accounting principles.

The Company’s financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company as at November 30, 2010 had not established an ongoing source of revenues sufficient to cover its operating costs and to allow it to continue as a going concern. These factors raise substantial doubt concerning the Company’s ability to continue as a going concern. Its ability to continue as a going concern is dependent on the successful stimulation of sales in order to fund operating losses and become profitable. If the Company is unable to make it profitable, the Company could be forced to cease development of operations. Management cannot provide any assurances that the Company will be successful in its operation. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern

The Company has determined that it is not required to have, nor was I engaged to perform, an audit of the effectiveness of its documented internal controls over financial reporting.

/s/ John Kinross-Kennedy

Certified Public Accountant

Irvine, California

February 16, 2011

FORCE ENERGY CORP.

(A Development Stage Company)

CONSOLIDATED BALANCE SHEETS

November 30, 2010 and 2009

(Stated in US Dollars)

|

2010

|

2009

|

||||

| ASSETS | |||||

|

Current

|

|||||

|

Cash

|

$ | - | $ | 162,458 | |

|

Receivables and prepaid expenses – Note 7

|

238 | 1,216 | |||

| 238 | 163,674 | ||||

|

Property and equipment – Note 4

|

- | 1,741 | |||

|

Oil and gas properties, full cost method of accounting

|

|||||

|

Unproved Properties – Note 5

|

135,427 | 504,162 | |||

| $ | 135,665 | $ | 669,577 | ||

| LIABILITIES | |||||

|

Current

|

|||||

|

Bank overdraft

|

$ | 136 | $ | - | |

|

Accounts payable and accrued liabilities

|

38,328 | 58,798 | |||

|

Due to related parties - Note 7

|

18,750 | 113,550 | |||

| 57,214 | 172,348 | ||||

|

Asset retirement obligation – Note 8

|

12,282 | 10,225 | |||

| 69,496 | 182,573 | ||||

| STOCKHOLDERS’ EQUITY | |||||

|

Preferred stock, $0.001 par value 10,000,000 shares authorized, none outstanding

|

|||||

|

Common stock, $0.001 par value – Note 9 270,000,000 shares authorized

51,237,267 shares issued (November 30, 2009, - 47,344,000 shares issued)

|

51,237 | 47,344 | |||

|

Additional paid in capital

|

2,574,876 | 1,717,952 | |||

|

Deferred stock compensation – Note 7

|

(170,200) | - | |||

|

Deficit accumulated during the development stage

|

(2,389,744) | (1,278,292) | |||

| 66,169 | 487,004 | ||||

| $ | 135,665 | $ | 669,577 | ||

| Nature of Operations and Ability to Continue as a Going Concern – Note 2 | |||||

See accompanying notes to the Financial Statements

FORCE ENERGY CORP.

(A Development Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

for the years ended November 30, 2010 and 2009 and

for the period from November 1, 2006 (Date of Inception)

to November 30, 2010

(Stated in US Dollars)

|

2010

|

2009

|

Period from

November 1, |

|||||||

|

(cumulative)

|

|||||||||

|

Expenses

|

|||||||||

|

Accounting and audit fees

|

$ | 92,916 | $ | 90,936 | $ | 266,946 | |||

|

Accretion expense

|

1,626 | 1,328 | 2,954 | ||||||

|

Bank charges

|

532 | 1,061 | 2,628 | ||||||

|

Consulting fees

|

- | - | 408,500 | ||||||

|

Depreciation

|

1,741 | 2,328 | 4,651 | ||||||

|

Investor relations

|

- | 18,284 | 51,443 | ||||||

|

Legal fees

|

31,956 | 45,190 | 172,138 | ||||||

|

Management fees – Note 6

|

508,050 | 189,000 | 854,500 | ||||||

|

Mineral property option costs

|

59,600 | - | 59,600 | ||||||

|

Office expenses

|

9,329 | 16,599 | 32,941 | ||||||

|

Oil and gas exploration expenses

|

- | 15,000 | 15,000 | ||||||

|

Rent – Note 6

|

7,084 | 18,836 | 41,028 | ||||||

|

Tax penalties and interest

|

- | (50,000) | - | ||||||

|

Transfer and filing fees

|

11,437 | 22,877 | 70,871 | ||||||

|

Travel

|

839 | 2,406 | 10,341 | ||||||

|

Write-off of oil and gas costs – Note 5 (b)

|

398,039 | 20,000 | 418,039 | ||||||

|

Loss before other items

|

(1,123,149 | ) | (393,845) | (2,411,630) | |||||

|

Other items:

|

|||||||||

|

Debt forgiveness

|

14,676 | - | 15,286 | ||||||

|

Foreign exchange gain (loss)

|

(3,116 | ) | (9,237) | 6,463 | |||||

|

Interest income

|

137 | - | 137 | ||||||

| 11,697 | (9,237) | 21,886 | |||||||

|

Net loss and comprehensive loss for the period

|

$ | (1,111,452 | ) | $ | (403,082) | $ | (2,389,744) | ||

|

Basic loss per share

|

$ | (0.01) | $ | (0.01) | |||||

|

Weighted average number of shares outstanding

|

47,475,009 | 46,162,904 | |||||||

See accompanying notes to the Financial Statements

FORCE ENERGY CORP.

(A Development Stage Company)

INTERIM CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

for the period from November 1, 2006 (Date of Inception) to November 30, 2010

(Stated in US Dollars)

|

Common Shares

|

Additional

Paid-in |

Deferred

Stock |

Deficit

Accumulated |

|||||||||||||||

|

Number

|

Par Value

|

Capital

|

Compensation

|

Stage

|

Total

|

|||||||||||||

|

Capital stock issued for cash – at $0.005

|

23,000,000 | $ | 23,000 | $ | 92,000 | $ | - | $ | - | $ | 115,000 | |||||||

|