Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d486089d8k.htm |

| EX-99.1 - EX-99.1 - ENCORE CAPITAL GROUP INC | d486089dex991.htm |

$115

MILLION CONVERTIBLE BOND ISSUANCE

February 13, 2013

Exhibit 99.2 |

1

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words

“may,” “believe,”

“projects,”

“expects,”

“anticipates”

or the negation thereof, or similar expressions, constitute

“forward- looking statements”

within the meaning of the Private Securities Litigation Reform Act of

1995 (the “Reform Act”). These statements may include, but are not

limited to, statements regarding our future operating results and growth.

For all “forward-looking statements,” Encore Capital Group,

Inc. (the “Company”) claims the protection of the safe harbor for

forward-looking statements contained in the Reform Act. Such

forward-looking statements involve risks, uncertainties and other

factors which may cause actual results, performance or achievements of the

Company and its subsidiaries to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. These risks, uncertainties and other factors

are discussed in the reports filed by the Company with the Securities and

Exchange Commission, including the most recent reports on Forms 10-K,

10-Q and 8-K, each as it may be amended from time to time. The

Company disclaims any intent or obligation to update these forward-looking

statements. |

IN THE 4

QUARTER OF 2012, WE RAISED $115 MILLION THROUGH

THE ISSUANCE OF A CONVERTIBLE BOND

2

Encore

issued

a

convertible

bond

to

Qualified

Institutional

Buyers,

raising

$115

million

(1)

at

an

annual coupon of 3.0%, with a conversion premium of 25.0% above the stock price at

issue ($31.5625)

(2)

Simultaneously with the issuance of the convertible bond:

Encore purchased a bond hedge in the over-the-counter equity derivatives

market (effectively repurchasing the call-option embedded in the

convertible bond) Encore

sold

warrants

at

75.0%

above

the

stock

price

at

issue

($44.1875)

(2)

–

The purchased call options are considered integrated with the convertible bond

from a tax perspective and, as a result, the cost of the options is

deductible for tax purposes –

The sold warrants expire 3 months after the bond hedge

Concurrent

with

the

transaction,

Encore

repurchased

shares

worth

$25

million

pursuant

to

a

share repurchase program

Overview of the Offering

A

B

3

1.

Comprised of a $100 million offering on November 27, 2012 and a $15 million

overallotment option exercised on December 6, 2012 2.

The stock price at issue was $25.25

1

2

TH |

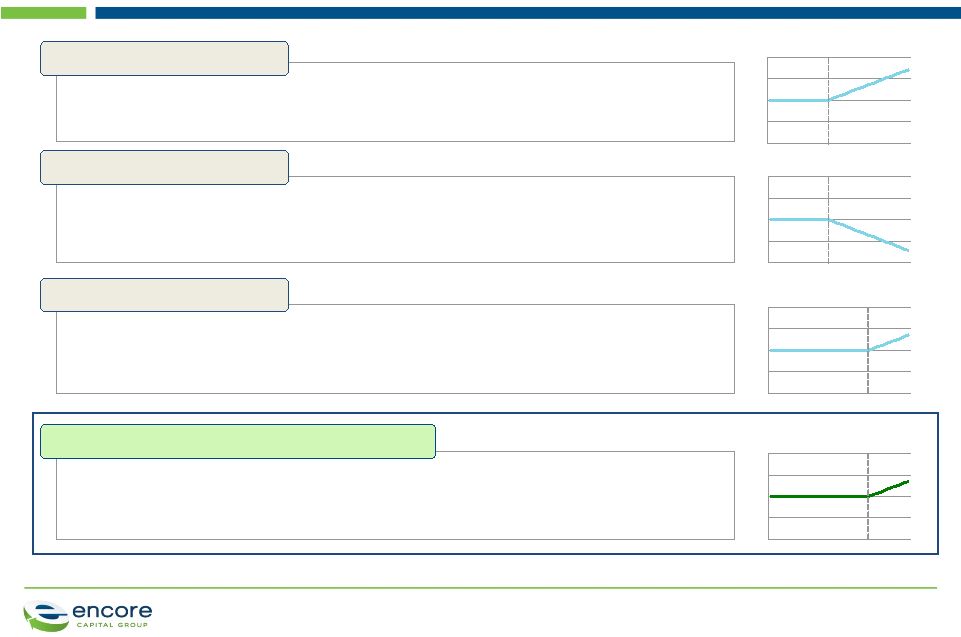

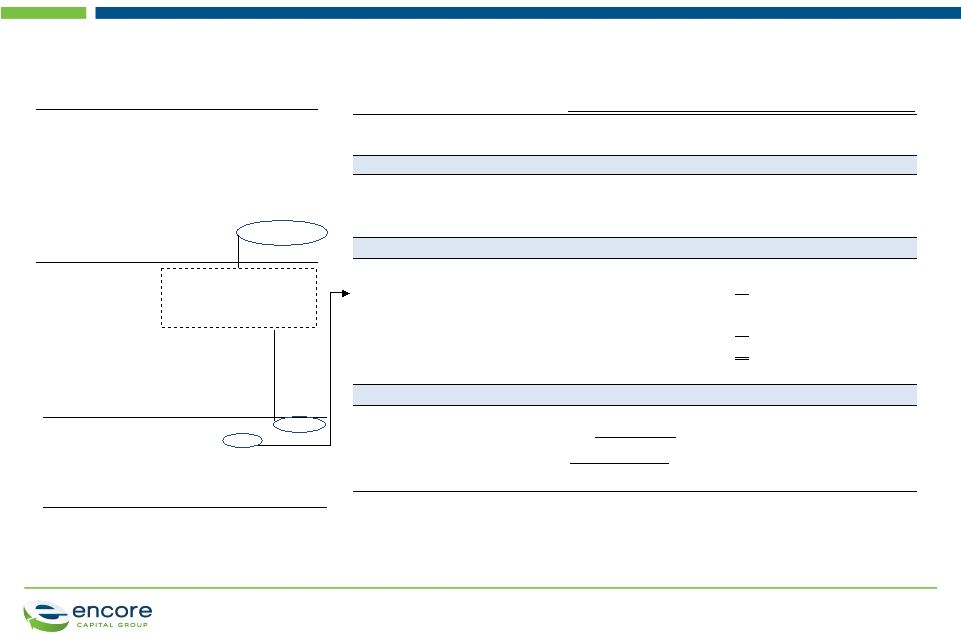

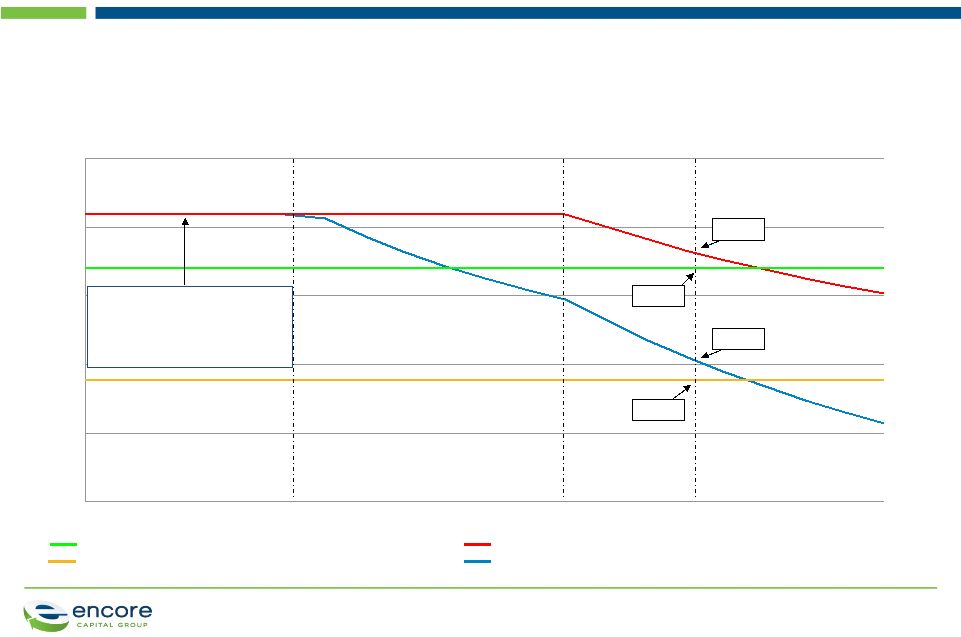

THE COMBINATION OF THE CONVERTIBLE BOND WITH A BOND HEDGE PLUS

WARRANTS EFFECTIVELY INCREASED THE CONVERSION PREMIUM TO 75%

3

•

Encore issued a convertible bond with a conversion price of $31.5625 (25% above

stock price at issue) –

With net share settlement, if the stock price is above the conversion price at

maturity, Encore would deliver the original issue amount in cash and the

incremental value above the conversion price in shares •

Encore purchased a bond hedge in the over-the-counter derivatives market

(i.e., Encore purchased back the call option embedded in the convertible

bond) –

If the stock price is above the conversion price at maturity, Encore would receive

the incremental value above the conversion price in shares from the bond

hedge counterparties •

Encore

sold

a

warrant

with

a

strike

price

of

$44.1875

(75%

above

stock

price

at

issue)

in

the

over-the-counter

derivatives market

–

If the stock price is above the warrant strike price at maturity, Encore would

deliver the incremental value above the warrant strike price in shares to

the warrant counterparties •

In

effect,

it

is

as

if

Encore

had

issued

a

convertible

bond

with

a

conversion

price

of

$44.1875

(the

warrant

strike price)

–

If the stock price is above the warrant strike price at maturity, Encore will

deliver the original issue amount in

cash

and

the

incremental

value

above

the

warrant

strike

price

in

shares

Step 1: Issue Convertible Bond

Step 2: Purchase Bond Hedge

Step 3: Sell Warrants

Net Effect: Convertible with Bond Hedge + Warrants

1. Value measured as a percentage of par

Value Delivered by Encore at Maturity

(1)

5

8

10

13

15

100%

Stock Price

$31.5625

5

8

10

13

15

0%

Stock Price

$31.5625

5

8

10

13

15

0%

Stock Price

$44.1875

5

8

10

13

15

100%

Stock Price

$44.1875 |

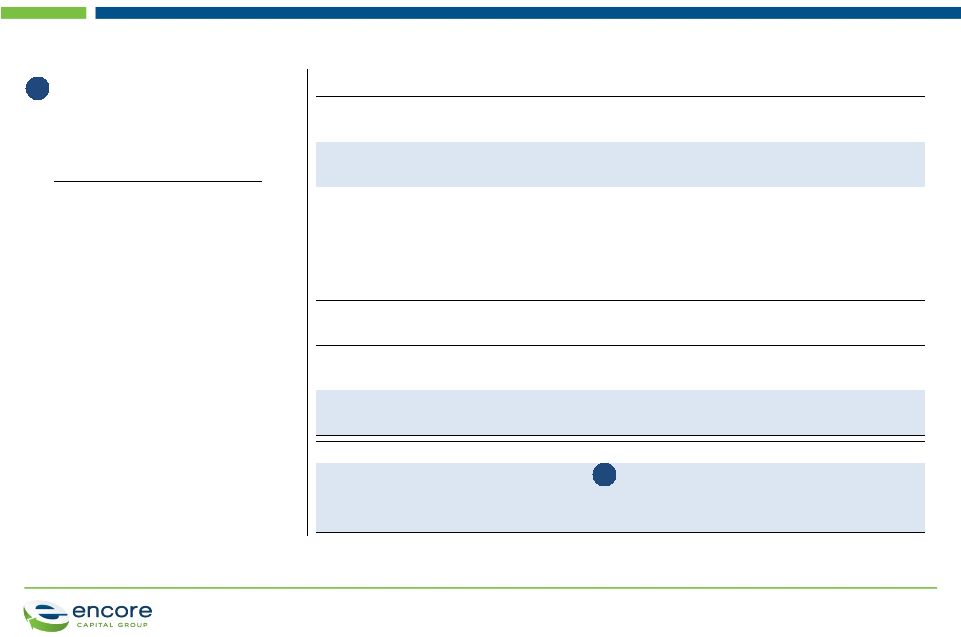

THE BOND HEDGE IS TREATED AS EQUITY FOR ACCOUNTING

PURPOSES AND HAS TAX BENEFITS

4

Tax Considerations

Bond Hedge Plus Warrants Accounting

Net Share Settled Convertible Accounting

Description

Balance Sheet

Income Statement

Net Share Settlement

Accounting Method

Encore pays par in cash

and delivers shares for the

in-the-money amount of

the conversion option

•

Balance sheet: Debt

plus option

•

Interest expense:

Straight debt cost

•

EPS dilution: Treasury

stock method

•

The debt component is the estimated

fair value, as of the issuance date, of a

similar bond without the conversion

feature

–

The remainder is additional paid-

in capital

•

The debt component is subsequently

accreted to par over its expected life,

with interest expense that reflects the

convertible coupon plus amortization

of the bond discount

•

Illustration: Convertible coupon is

3.0%, straight cost of debt is 6.0%,

maturity is 5 years, and issue size is

$115 million

–

The debt component is initially

recorded at $100.3 million

(present value of cash flows

discounted at the straight cost of

debt), with the remaining $14.7

million recorded as a component

of equity

–

The end of year 1 value of the

debt component is $100.3 million

+ $2.6 million amortization of

bond discount

=

$102.9

million

(1)

•

Interest expense is calculated as

follows:

–

Year 1 interest expense is $6.1

million, cash interest = $3.5

million and amortization of bond

discount is

$2.6

million

(1)

•

The Treasury stock method is used to

determine shares added to total

shares outstanding

–

This is only applicable when the

stock trades above the conversion

price of $31.5625

•

The purchased call options (bond hedge) reduce equity and the sold warrants

increase equity; equity is reduced by the net amount –

The purchased call options and sold warrants are identified as equity pursuant to

EITF 00-19 –

The bond hedge and warrants premium are not expensed and they are not marked to

market •

The purchased call options are ignored for EPS purposes

•

The sold warrants are accounted for pursuant to the Treasury Stock Method

•

The Convertible Bond is treated as debt issued at a discount (convertible face

value minus cost of bond hedge) •

The discount is amortized as interest expense over the life of the bond

•

This results in deductions being taken at Encore’s straight cost of debt (on

the accreted balance sheet liability) •

The proceeds from the sold warrants are tax-free

1.

Refer to page 5 and Appendix A for bond amortization schedule

|

Debt

Accretion Schedule Year

Interest

(1)

Coupon

Payment

Amort. of

Discount

EOP Debt

Balance

(2)

A

B

C

D

6.0%*D

(t-1)

3.0%*Par

A + B

D

(t-1)

+C

0

100.3

1

6.1

(3.5)

2.6

102.9

2

6.2

(3.5)

2.8

105.7

3

6.4

(3.5)

2.9

108.6

4

6.6

(3.5)

3.1

111.7

5

6.8

(3.5)

3.3

0.0

D

(t-1)

: Previous period accounting debt balance

Assumptions

Base Offering Size

$115.0 million

Maturity (Years)

5

Convertible Coupon

3.00%

Conversion Premium

25.0%

Straight Debt Cost

6.00%

Bond Component

$100.3 million

Tax Rate

39.0%

THE ACCOUNTING RULES RESULT IN A DIFFERENCE BETWEEN

CASH AND REPORTED INTEREST EXPENSE

5

1.

Interest calculated on a semi-annual basis

2.

End of Period (“EOP”) accounting debt balance is net of the net any

paydown on the convertible bond; refer to Appendix A for additional

calculation detail Present Value of convertible

bond cash flows discounted

at the equivalent cost of

straight debt

Accounting Overview of Settlement

Net Share Settled

What Happens Upon Conversion?

Par

paid

in

cash

and

(Conversion

Value

-

Par)

delivered

in

stock

Upfront Balance Sheet

Debt

100.3

Equity component

14.7

Interest Expense in Year 1 (Annualized)

Convertible coupon (cash interest expense)

3.5

Accretion (non-cash interest expense)

2.6

Total interest expense

6.1

Tax benefit

(2.4)

After-tax interest expense

3.7

EPS Calculation

Method

Debt and Equity

: Coupon + Accretion deducted from earnings

Shares Outstanding

: In-the-money amount included in share count under

treasury

stock

method

(underlying

shares

x

(current

share

price

-

conversion

price) / current share price)

Description

Interest Expense |

THE STRUCTURE RESULTS IN A FAVORABLE AFTER-TAX INTEREST

RATE

6

Pre-tax Interest Rate Calculation

•

# of semi-annual payments: 10

•

Semi-annual coupon: $1.73 million

•

Upfront proceeds: $103.4 million

•

Maturity value: $115 million

Annualized IRR: 5.33%

1

1.

Assumes

Encore’s

effective

tax

rate

of

39%

and

implied

cost

of

straight

debt

at

6.0%;

refer

to

Appendix

A

for

additional

calculation detail

Convertible Terms

Offering Size

$115.0 million

Ranking

Senior Unsecured

Coupon

3.00%

Conversion Premium

25.00%

Share Price at Issuance

$25.25

Conversion Price

$31.5625

Maturity

5 Years

Settlement Method

Net Share Settlement

Call Protection

Non-Call Life

Bond Hedge Plus Warrants

With Overlay

Maturity

5 Years

Bond Hedge Strike (%) / Bond Hedge Strike ($)

25.0% / $31.5625

Warrant Strike (%) / Warrant Strike ($)

75.0% / $44.1875

Net Premium / % of Proceeds

$11.6 million / 10.1%

Net Proceeds

$103.4 million

Implied effective pre-tax interest rate on proceeds

(including cost of Bond Hedge and Warrants)

5.33%

Implied effective after-tax interest rate on proceeds

(1)

3.03%

1 |

EPS

Accretion

/

Dilution

Analysis

(1), (2)

Net Share Settled

$million, unless otherwise stated

FY12

Illustrative

Annual Impact

(4)

Stock Price Assumption ($)

$25.25

$50.50

GAAP Income from Continuing Operations

78.6

157.1

Pro Forma Adjustments

After-Tax Cash Interest Expense from Convertible Bond

(2.1)

(2.1)

After-Tax Amortization Expense

(1.6)

(1.6)

After-Tax Interest Savings from Debt Paydown

1.8

-

Adjusted GAAP Income from Continuing Operations

76.7

153.4

Adjusted

Non-GAAP

Income

from

Continuing

Operations

(5)

78.3

155.0

Stock Price ($)

$25.25

$50.50

Conversion Price ($)

$31.56

$31.56

Warrants Strike Price ($)

$44.19

$44.19

Fully Diluted Shares Outstanding (million)

25.8

25.8

Pro Forma Adjustments

Share Dilution from Base Convertible (million)

-

1.4

Share Dilution from Warrants (million)

-

0.5

Shares Repurchased (million)

(1.0)

(1.0)

Adjusted Fully Diluted Shares (million)

24.8

26.7

GAAP EPS from Continuing Operations ($)

$3.04

$6.08

Illustrative Pro Forma GAAP Accounting EPS from Continuing Operations ($)

$3.09

$5.75

Illustrative Accretion / Dilution (%)

1.6%

(5.4%)

Illustrative

Pro

Forma

Non-GAAP

Accounting

EPS

from

Continuing

Operations

($)

(5)

$3.15

$5.81

Illustrative

Pro

Forma

Non-GAAP

Economic

EPS

from

Continuing

Operations

($)

(5), (6)

$3.15

$6.13

Assumptions

Stock Price at Issue

$25.25

Illustrative Stock Price

$50.50

Wgt. Avg. Diluted Shrs Outstanding

25.8 million

Illustrative Annual EPS

$6.08

Interest Rate on Existing Revolver

4.0%

Share Repurchase Amount

$25.0 million

Paydown of Revolver with Proceeds

$74.5 million

Tax Rate

39.0%

Convertible Terms

Offering Size

$115 million

Convertible Coupon

3.00%

Conversion Premium

25.0%

Maturity

5 Years

Conversion Price

$31.56

Underlying Shares

3.6 million

Bond Component

$100.3 million

Assumed Straight Debt Cost

6.00%

Bond Hedge Plus Warrants

Bond Hedge Premium

19.70%

Bond Hedge Strike Price

$31.56

Warrants Strike Price

$44.19

Net Premium (cost)

10.1%

Net Proceeds

$103.4 million

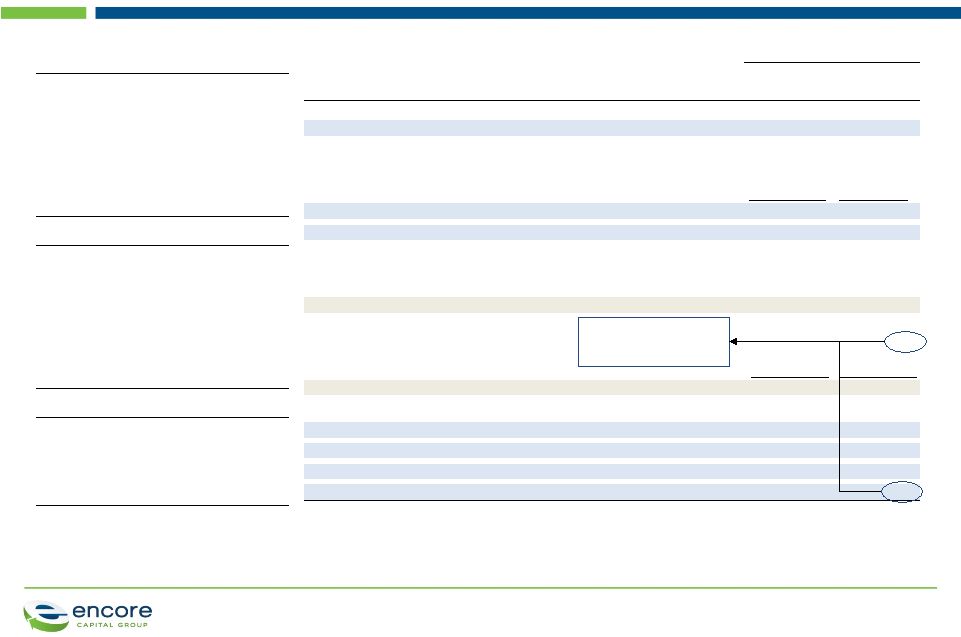

AT AN ILLUSTRATIVE PRICE ABOVE $50 PER SHARE, THERE IS ACCOUNTING

DILUTION, BUT NO ECONOMIC DILUTION DUE TO THE SHARE REPURCHASE

7

Economic EPS excludes

dilution from the base

convertible bond

1.

Pro forma adjustments give effect to the issuance of the convertible bond and the

repurchase of $25 million of common stock 2.

Refer to Appendix B for additional detail on the calculation of EPS

3.

Represents stock price at issuance of convertible bond

4.

Illustrative scenario assumes 100% growth in stock price and income

5.

“Non-GAAP”

EPS excludes the pro forma adjustment for after-tax amortization of bond

discount (non-cash interest expense) 6.

“Economic”

EPS excludes dilution from the base convertible bond

(3) |

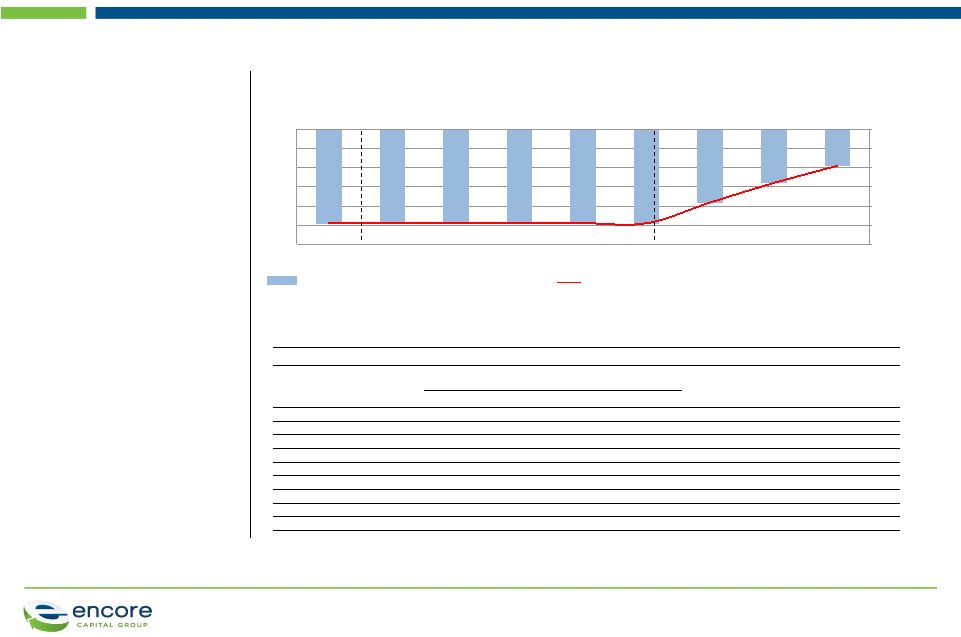

Conversion Price

$31.56

Warrant Strike Price

$44.19

Stock Price ($)

Illustrative Stock Price

$50.50

$5.81

$6.13

$6.08

$5.75

$5.40

$5.60

$5.80

$6.00

$6.20

$6.40

$20

$24

$28

$32

$36

$40

$44

$48

$52

$56

$60

Pre-Transaction Illustrative GAAP EPS

Accounting GAAP EPS of Convertible Bond with Bond Hedge and Warrants

Economic Non-GAAP EPS of Convertible Bond with Bond Hedge and Warrants

Accounting Non-GAAP EPS of Convertible Bond with Bond Hedge and Warrants

Illustrative Diluted EPS Sensitivity Analysis

Accounting vs. Economic EPS ($)

FROM AN ECONOMIC PERSPECTIVE, SHARE DILUTION RESULTING FROM THE

BASE CONVERTIBLE BOND IS OFFSET BY THE BOND HEDGE

8

Conversion Price

$31.56

Warrant Strike Price

$44.19

Stock Price ($)

Illustrative Stock Price

$50.50

$5.81

$6.13

$6.08

$5.75

Non-GAAP EPS reflects the impact of:

•After-tax cash interest expense on the

convertible bond (excludes after-tax

amortization of the bond discount)

•$25MM share repurchase |

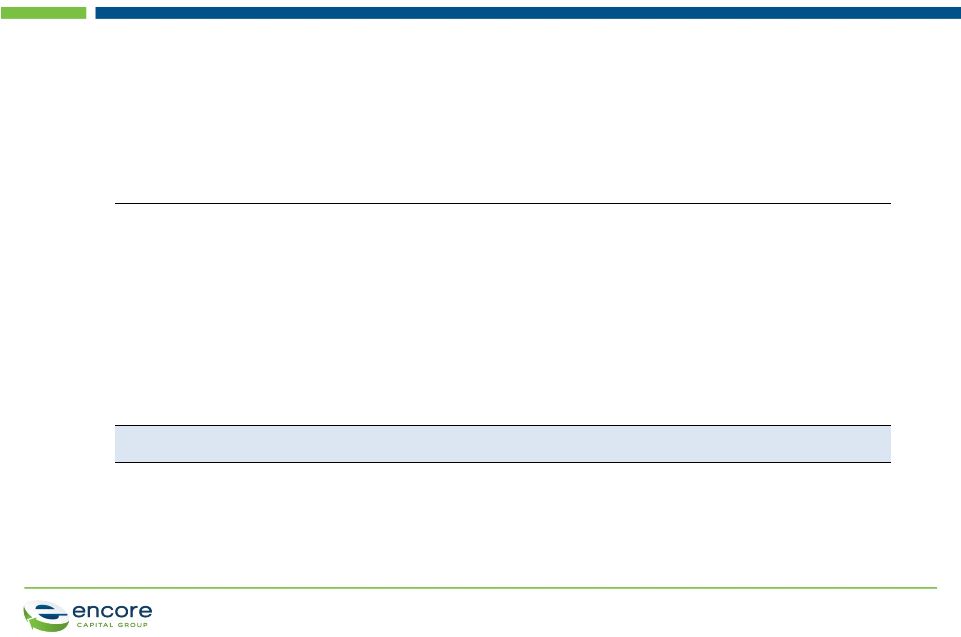

(0.8)

(0.6)

(0.4)

(1.0)

(1.2)

(1.0)

(0.8)

(0.6)

(0.4)

(0.2)

0.0

$29.00

$32.00

$35.00

$38.00

$41.00

$44.00

$47.00

$50.00

$53.00

Stock Price at Conversion

(4.7%)

(3.9%)

(3.1%)

(2.4%)

(1.6%)

(0.8%)

(0.0%)

Net Share Settlement (with Bond Hedge and Warrants)

Net shares issued / (repurchased) as % of Total Shares Outstanding

THE COMBINATION OF THE BOND HEDGE PLUS WARRANTS AND THE SHARE

BUYBACK RESULTS IN A NET REDUCTION IN SHARES OUTSTANDING

9

1.

$25.25 stock price at issuance. 25.8 million weighted average diluted shares

outstanding Net

Change

in

Share

Count

at

Maturity

(1)

In millions

Net Share Settled Convertible

with Bond Hedge and Warrants

•

With the net share settlement

feature, Encore would repay the

original issue amount in cash and

the in-the-money amount above

the warrants strike

price in stock,

reducing the number of shares

issued upon conversion

•

Given the upfront buyback and

the net share settlement option,

Encore’s total shares outstanding

decrease as a result of the

transaction

Conversion Price:

$31.56

Warrant Strike Price:

$44.19

Net

Change

in

Share

Count

at

Maturity

-

Net

Share

Settled

Convertible

with

Bond

Hedge

and

Warrants

alongside

upfront

buyback

3.000% up 25.0%, $44.19 upper strike (75.0% effective premium), $25MM Buyback

A

B

C = Max(0, A-$44.19)

D = B*C

E = D/A

F

G = E -

F

($ per share)

($MM)

$29.00

3.6

$0.00

0.0

0.0

1.0

(1.0)

$32.00

3.6

$0.00

0.0

0.0

1.0

(1.0)

$35.00

3.6

$0.00

0.0

0.0

1.0

(1.0)

$38.00

3.6

$0.00

0.0

0.0

1.0

(1.0)

$41.00

3.6

$0.00

0.0

0.0

1.0

(1.0)

$44.00

3.6

$0.00

0.0

0.0

1.0

(1.0)

$47.00

3.6

$2.81

10.2

0.2

1.0

(0.8)

$50.00

3.6

$5.81

21.2

0.4

1.0

(0.6)

$53.00

3.6

$8.81

32.1

0.6

1.0

(0.4)

Shares

Repurchased

(MM)

Net Shares

Issued

(MM)

In-the-Money Amount incl.

Bond Hedge Plus Warrants

Stock Price At

Conversion

Shares

Underlying

Number of

Shares

(MM) |

After-tax Interest Rate

(1)

$ millions

Year

Interest

(2)

Coupon

Payment

Amortization

of Discount

Debt Proceeds /

Paydown

End of Period

Accounting

Debt Balance

Interest Tax

Shield

Net Cash Flow

A

B

C

D

E

F

B+D+F

6.0%*E

(t-1)

3.0%*Par

A + B

E

(t-1)

+C+D

39.0%*A

0

0.0

103.4

100.3

103.4

1

6.1

(3.5)

2.6

102.9

2.4

(1.1)

2

6.2

(3.5)

2.8

105.7

2.4

(1.0)

3

6.4

(3.5)

2.9

108.6

2.5

(1.0)

4

6.6

(3.5)

3.1

111.7

2.6

(0.9)

5

6.8

(3.5)

3.3

(115.0)

-

2.6

(115.8)

After-tax Interest Rate

3.03%

E

(t-1)

: Previous Period Accounting Debt Balance

APPENDIX A: AFTER-TAX INTEREST RATE CALCULATION DETAIL

10

1.

Amounts may not total due to rounding

2.

Interest calculated on a semi-annual basis

3.

At period 0, the end of period accounting debt balance represents the present

value of the convertible bond cash flows discounted at an implied

straight cost of debt of 6%

(3) |

APPENDIX B: EPS CALCULATION DETAIL

11

1.

Pro forma adjustments give effect to the issuance of the convertible bond and the

repurchase of $25 million of common stock 2.

“Non-GAAP”

EPS excludes the pro forma adjustment for after-tax amortization of bond

discount (non-cash interest expense) 3.

“Economic”

EPS excludes dilution from the base convertible bond

EPS Accretion / (Dilution) Calcluation Detail

$million, unless otherwise stated

Formula

Illustrative

Annual Impact

GAAP Income from Continuing Operations

A

157.1

Pro Forma Adjustments

After-Tax Cash Interest Expense from Convertible Bond

B

(2.1)

After-Tax Amortization Expense

C

(1.6)

After-Tax Interest Savings from Debt Paydown

D

0.0

Adjusted GAAP Income from Continuing Operations

E = A+B+C+D

153.4

Adjusted

Non-GAAP

Income

from

Continuing

Operations

(2)

F = E-C

155.0

Underlying Shares (million)

G

3.6

Stock Price ($)

H

$50.50

Conversion Price ($)

I

$31.56

Warrants Strike Price ($)

J

$44.19

Fully Diluted Shares Outstanding (million)

K

25.8

Pro Forma Adjustments

Share Dilution from Base Convertible (million)

L=G*(H-I)/H

1.4

Share Dilution from Warrants (million)

M=G*(H-J)/H

0.5

Shares Repurchased (million)

N

(1.0)

Adjusted Fully Diluted Shares (million)

O=K+L+M+N

26.7

GAAP EPS from Continuing Operations ($)

P=A/K

6.08

Illustrative Pro Forma GAAP Accounting EPS from Continuing Operations ($)

Q=E/O

5.75

Illustrative Accretion / Dilution (%)

(Q-P)/P

(5.38%)

Illustrative

Pro

Forma

Non-GAAP

Accounting

EPS

from

Continuing

Operations

($)

(2)

F/O

5.81

Illustrative

Pro

Forma

Non-GAAP

Economic

EPS

from

Continuing

Operations

($)

(2), (3)

F/(O-L)

6.13

Net Share Settled

(1) |