Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Diamond Foods Inc | d438235dex991.htm |

| 8-K - FORM 8-K - Diamond Foods Inc | d438235d8k.htm |

November 14, 2012

Diamond Foods Restatement and First

Three Quarters of Fiscal 2012 Earnings Call

Supplemental Materials

Exhibit 99.2 |

1

Important Information

This presentation includes forward-looking statements, including statements

about our future financial and operating performance and results, fiscal

2012 financial results, bolstering internal controls and remediating

material weaknesses. These forward-looking statements are based on our assumptions,

expectations and projections about future events only as of the date of this

presentation, and we make such forward-looking statements pursuant to

the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Many of our forward-looking statements include

discussions of trends and anticipated developments under the “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” sections of the periodic reports that we file

with the SEC. We use the words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan,” “seek,” “may” and other similar expressions to

identify forward-looking statements that discuss our future expectations,

contain projections of our results of operations or financial condition or

state other “forward-looking” information. You also should carefully

consider other cautionary statements elsewhere in this presentation and in other

documents we file from time to time with the SEC. We do not undertake any

obligation to update forward-looking statements to reflect events or

circumstances occurring after the date of this presentation. Actual results may differ

materially from what we currently expect because of many risks and uncertainties,

such as: uncertainty about the need to file additional periodic

reports and financial information in connection with our restatement

disclosures; risks relating to our leverage and its effect on our ability to respond to changes in

our business, markets and industry; increase in the cost of our debt; ability to

raise additional capital and possible dilutive impact of raising such

capital; risks relating to litigation and regulatory proceedings; risks

related to our current inability to timely file

required periodic reports under the Securities Exchange Act of 1934, as amended, and any resulting delisting of Diamond’s common stock on the Nasdaq Global Select

Market; uncertainties relating to relations with growers; availability and cost

of walnuts and other raw materials; increasing competition and possible

loss of key customers; and general economic and capital markets

conditions. Diamond Foods separately reports financial results using non-GAAP financial

measures; a reconciliation of Diamond’s financial results determined in

accordance with GAAP can be found in our press release. |

Fiscal 2010 and 2011 Restatement |

3

Background on Restatement

•

On November 1, 2011 Diamond announced that its Audit Committee had initiated an

investigation into certain payments to walnut growers.

•

On February 8, 2012, Diamond announced that their Audit Committee concluded that

a “continuity” payment

made

to

growers

in

August

2010

of

approximately

$20

million

and

a

“momentum”

payment

made to growers in September 2011 of approximately $60 million were not accounted

for in the correct periods.

•

As a result, the Audit Committee determined that a restatement of financial

reports for fiscal 2010 and 2011 was required. In addition, the

Audit Committee identified material weaknesses in the Company’s

internal control over financial reporting. •

Since the February 2012 announcement, Diamond has undertaken a broad and thorough

restatement process.

–

A complete re-audit of entire company financials for fiscal 2010 and

2011 –

Restatement required review of quarterly walnut cost estimates across fiscal

2010 and 2011 •

Material

weaknesses

were

identified

in

three

areas:

control

environment;

walnut

grower

accounting;

accounts payable and accrued expenses. Diamond has taken actions to correct

material weaknesses. –

For

a

complete

discussion

of

material

weaknesses

and

remediation

steps

see

Item

9A

–

Management’s Report on Internal Control Over Financial Reporting in the

10-K/A filed on November 14, 2012. |

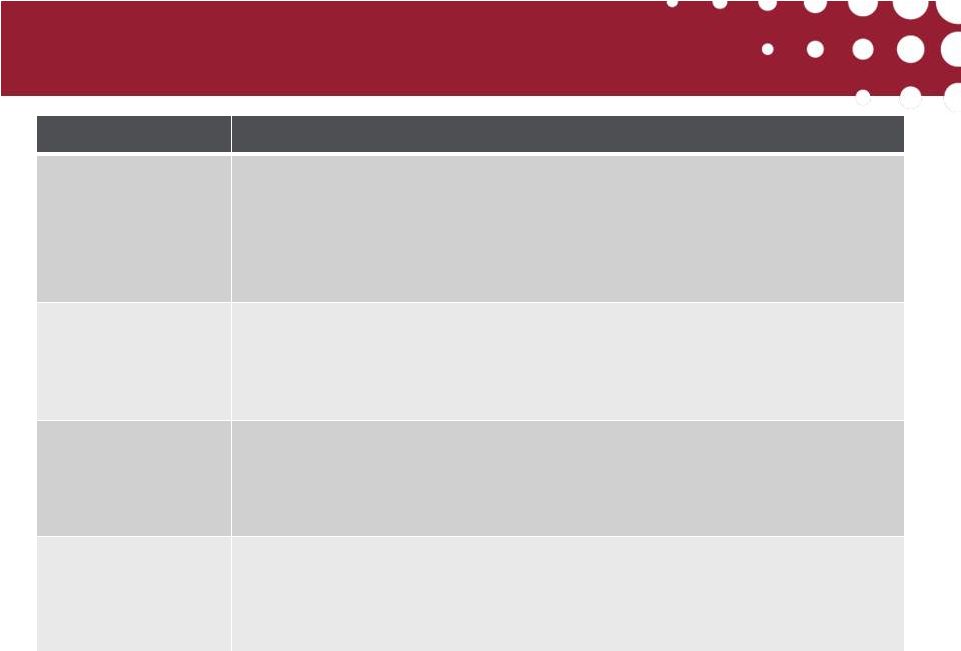

4

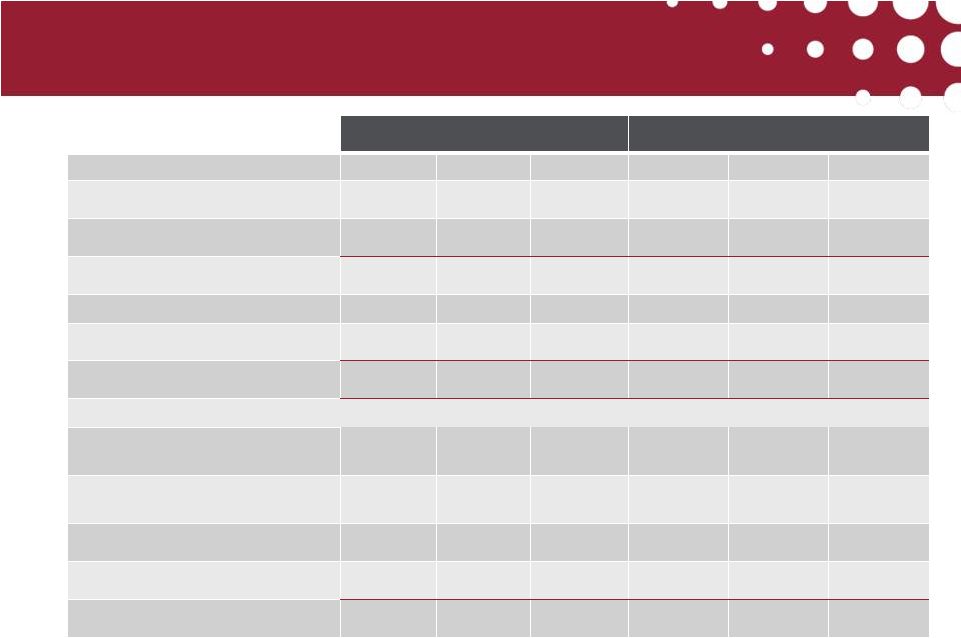

Where to Find Restated Financial Information (I)

Period Restated

Filing

Full Year Fiscal 2011,

and 4

th

quarter

2011 Form 10-K/A (the “10-K/A”). Consolidated balance sheet, statement of operations and

statement of cash flows for the years ended July 31, 2010 and July 31, 2011,

reflecting effects of the restatement are provided in Note 15 to the

consolidated financial statements contained in the 10-K/A.

Selected, unaudited quarterly information for each quarterly period in fiscal

2011 is provided in

Note

16

to

the

consolidated

financial

statements

contained

in

the 10-K/A.

Fiscal 2011,

3

rd

quarter

2012

10-Q

for

3

rd

quarter,

reporting

results

for

that

period

and

restated

results

for

the

comparable period in fiscal 2011.

Selected, unaudited quarterly information for each quarterly period in fiscal

2011 is provided in

Note

16

to

the

consolidated

financial

statements

contained

in

the 10-K/A.

Fiscal 2011,

2

nd

quarter

2012

10-Q

for

2

nd

quarter,

reporting

results

for

that

period

and

restated

results

for

the

comparable period in fiscal 2011.

Selected, unaudited quarterly information for each quarterly period in fiscal

2011 is provided in

Note

16

to

the

consolidated

financial

statements

contained

in

the 10-K/A.

Fiscal 2011,

1

st

quarter

2012

10-Q

for

1

st

quarter,

reporting

results

for

that

period

and

restated

results

for

the

comparable period in fiscal 2011.

Selected, unaudited quarterly information for each quarterly period in fiscal

2011 is provided in

Note

16

to

the

consolidated

financial

statements

contained

in

the 10-K/A.

Please refer to our full periodic reports for complete information

|

5

Where to Find Restated Financial Information (II)

Period Restated

Filing

Full year fiscal 2010, and

4

quarter

10-K/A. Consolidated balance sheet, statement of operations and

statement of cash flows for the years ended July 31, 2010 and July 31, 2011,

reflecting

effects

of

the

restatement

are

provided

in

Note

15

to

the

consolidated financial statements contained in the 10-K/A.

Selected, unaudited quarterly information for each quarterly period in

fiscal

2010

is

provided

in

Note

16

to

the

consolidated

financial

statements

contained in the 10-K/A.

Fiscal 2010, 3

quarter

Selected, unaudited quarterly information for each quarterly period in

fiscal

2010

is

provided

in

Note

16

to

the

consolidated

financial

statements

contained in the 10-K/A.

Fiscal 2010, 2

quarter

Selected, unaudited quarterly information for each quarterly period in

fiscal

2010

is

provided

in

Note

16

to

the

consolidated

financial

statements

contained in the 10-K/A.

Please refer to our full periodic reports for complete information

Note: 1

quarter

of fiscal 2010 did not require restatement

th

rd

nd

st |

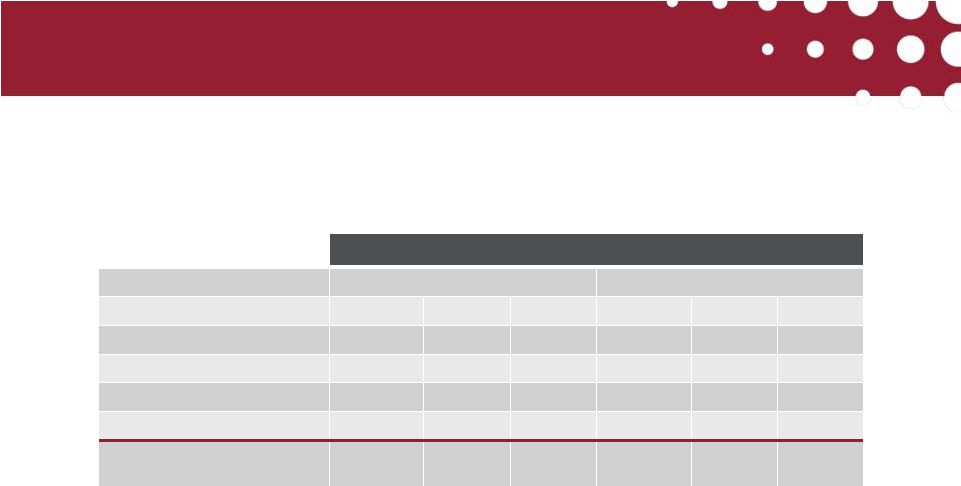

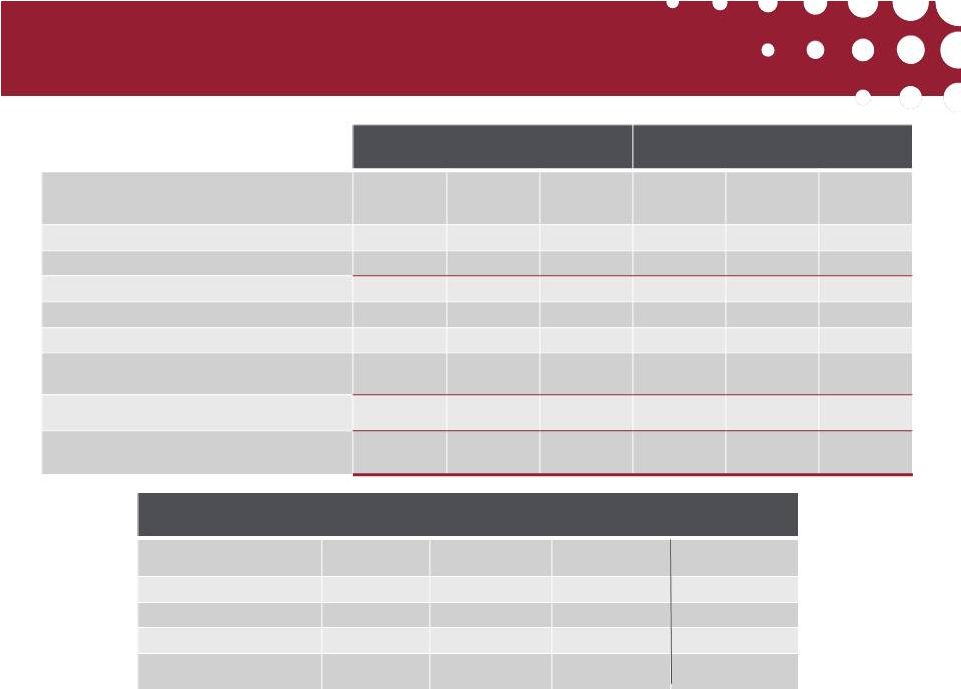

6

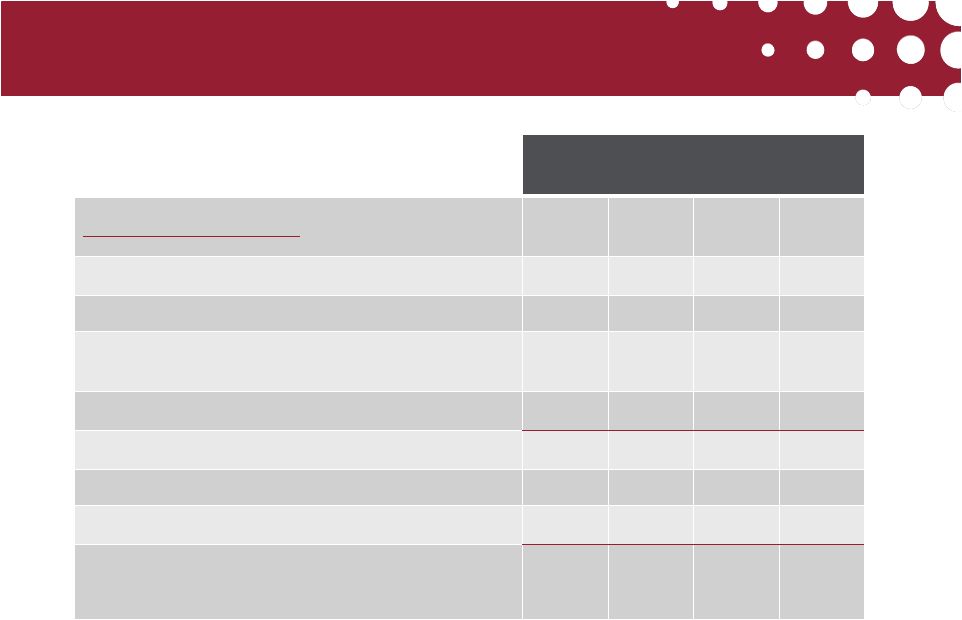

Summary of Restatement Impacts on

2010 and 2011 Income

($ millions)

Twelve Months ended July 31

2011

2010

Restatement Item

Revenue

Cost

Net

Revenue

Cost

Net

Walnut payments

-

+$35.6

-$35.6

-

+$18.3

-$18.3

Timing of expense recognition

-

+$5.0

-$5.0

-

+$0.1

-$0.1

Other items

+$0.8

-$0.4

+$1.2

+$2.2

+$0.8

+$1.4

Tax Impact

-

-$15.8

+$15.8

-

-$6.5

+$6.5

Total Impact

+$0.8

+$24.4

-$23.6

+$2.2

+$12.7

-$10.5 |

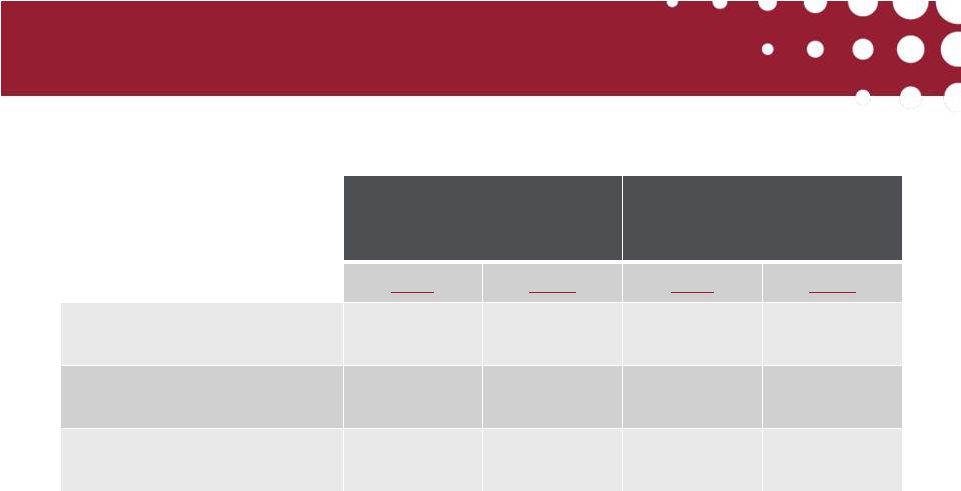

7

Twelve Months

ended July 31

(Restated)

Twelve Months

ended July 31

(Previously Reported)

2011

2010

2011

2010

Gross Margin

22.4%

21.2%

26.0%

23.7%

Adjusted EBIT Margin*

8.4%

7.5%

12.1%

10.0%

Adjusted EBITDA Margin**

11.5%

10.0%

15.1%

12.5%

Fiscal 2010 and 2011 Key Financial Ratios

*Non-GAAP, adjusted EBIT is defined as net income before interest expense,

income taxes, stock-based compensation, acquisition and integration

expenses, costs associated with audit committee restatement and certain SG&A costs.

**Non-GAAP, adjusted EBITDA is defined as net income before interest expense,

income taxes, stock-based compensation, depreciation,

amortization, acquisition and integration expenses, costs associated with

audit committee restatement and certain SG&A costs. |

8

Organizational Changes to Bolster

Controls and Oversight

•

New executive leadership

–

Appointed food and beverage industry veteran Brian Driscoll, President and

CEO •

New leadership in finance organization

–

Hired Mark Hair, SVP Finance and Controller

o

10 years with Deloitte and 7 years in forensic accounting with

StoneTurn

Group LLP

•

Strengthened Board of Directors

–

Added five experienced Board members including two new members of the audit

committee

o

Alison Davis, former CFO of Barclays Global Investors and 16 years in consulting

with A.T. Kearney and McKinsey (Audit Committee)

o

Nigel Rees, VP and Controller of McKesson Corporation (Audit Committee)

o

R. Dean Hollis, former President and COO ConAgra Consumer Foods and

International Division and Oaktree Advisor

o

Matt Wilson, Oaktree Managing Director

o

Bill

Tos, Walnut Grower

–

Separated Chairman and CEO roles |

First Three Quarters of Fiscal 2012 and

Fiscal 2011 (Restated) |

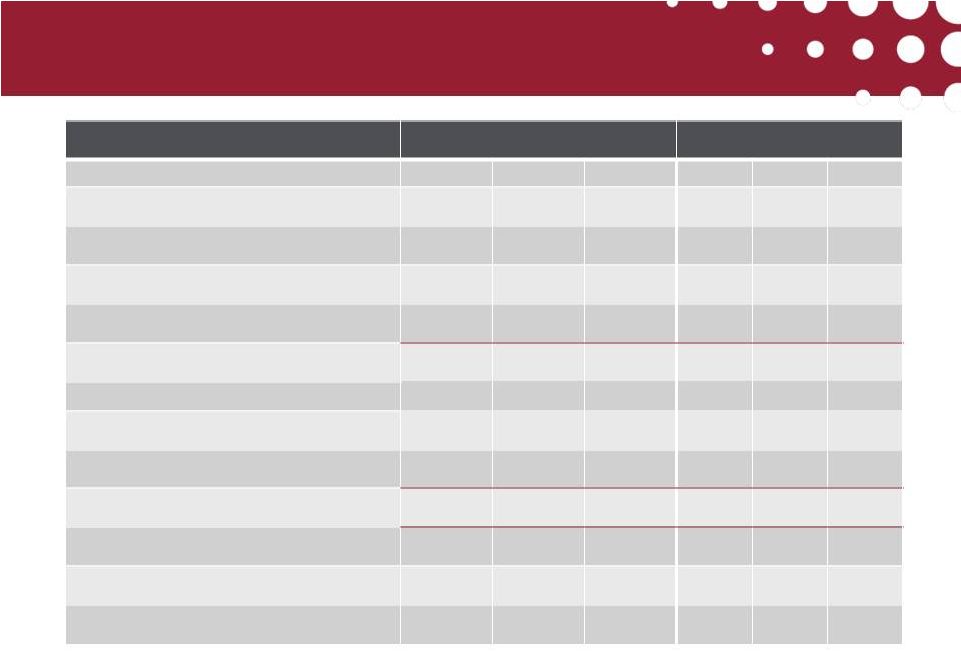

10

2012 and Restated 2011

Net Sales by Product Line

FY 2012

FY 2011 (Restated)

($ thousands)

Q1

Q2

Q3

Q1

Q2

Q3

Snack

$ 157,122

$ 141,818

147,653

$ 137,056

$ 134,183

$

134,799

and Retail In-

98,112

94,677

49,127

90,190

80,711

46,983

Retail

International Non-

American Ingredient/Food Service/Other

Retail

Total Net Sales

$

Culinary

shell

Total

255,234

236,495

196,780

227,246

214,894

181,782

Retail

21,444

21,025

4,174

21,015

36,793

31,368

North

10,715

4,831

6,731

3,800

5,157

9,916

Total

Non-

32,159

25,856

10,905

24,815

41,950

41,284

$287,393

$262,351

$207,685

$252,061

$256,844

$223,066

Year-

over-

Year

Comparison

(% change)

Q1

Q2

Q3

Q3

YTD

Snack

14.6%

5.7%

9.5%

10.0%

Culinary

and Retail In-

shell

8.8%

17.3%

4.6%

11.0%

Total

Non-

Retail

29.6%

38.4%

73.6%

-36.2%

Total Net Sales

14.0%

2.1%

6.9%

3.5%

-

-

- |

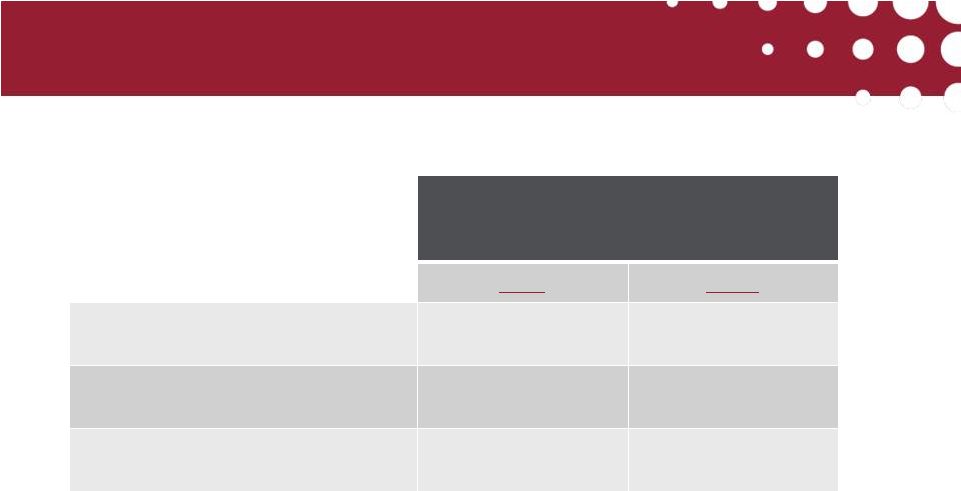

11

Three Quarters

ended April 30th

(Restated)

2012

2011*

Gross Margin

18.2%

22.9%

Adjusted EBIT Margin**

4.8%

9.2%

Adjusted EBITDA Margin***

7.8%

12.2%

First Three Quarters of Fiscal 2012 and 2011

Key Financial Ratios

*Restated

**Non-GAAP, adjusted EBIT is defined as net income before interest expense,

income taxes, stock-based compensation, acquisition and integration

expenses, costs associated with audit committee restatement and certain SG&A costs.

***Non-GAAP, adjusted EBITDA is defined as net income before interest

expense, income taxes, stock-based compensation, depreciation,

amortization, acquisition and integration expenses, costs associated with

audit committee restatement and certain SG&A costs. |

12

2012 and Restated 2011

Quarterly Income Statement

12

($ thousands, except per share numbers)

Q1

Q2

Q3

Q1

Q2

Q3

Net sales

$287,393

$262,351

$207,685

$252,061

$256,844

Cost of sales

226,086

220,429

173,457

195,953

197,866

170,576

Gross profit

61,307

41,922

34,228

56,108

58,978

52,490

Operating expenses:

Selling, general and administrative

29,455

34,304

33,260

23,289

24,052

24,229

Advertising

12,716

11,638

7,200

12,469

10,170

11,723

Acquisition and integration related expenses

17,214

12,091

11,336

579

1,023

5,946

Total operating expenses

59,385

58,033

51,796

36,337

35,245

41,898

Income (Loss) from operations

1,922

(16,111)

(17,568 )

19,771

23,733

10,592

Interest expense, net

5,761

6,471

7,701

6,117

5,992

5,941

Income (Loss) before income taxes

(3,839)

(22,582)

(25,269)

13,654

17,741

4,651

Income taxes (Benefit)

(14,640)

(2,398)

18,748

4,372

6,643

1,300

Net income (Loss)

$10,801

($20,184)

($44,017)

$9,282

$11,098

Earnings (loss) per share:

Basic

$0.49

($0.93)

($2.02)

$0.42

$0.51

$0.15

Diluted

$0.47

($0.93)

($2.02)

$0.42

$0.49

$0.15

Shares used to compute earnings per share:

Basic

21,668

21,724

21,752

21,489

21,565

21,604

Diluted

22,567

21,724

21,752

21,933

22,212

22,332

Dividends declared per share

$0.045

$0.045

$

-

$0.045

$0.045

$0.045

FY 2012

FY 2011 (Restated)

$223,066

$ 3,351 |

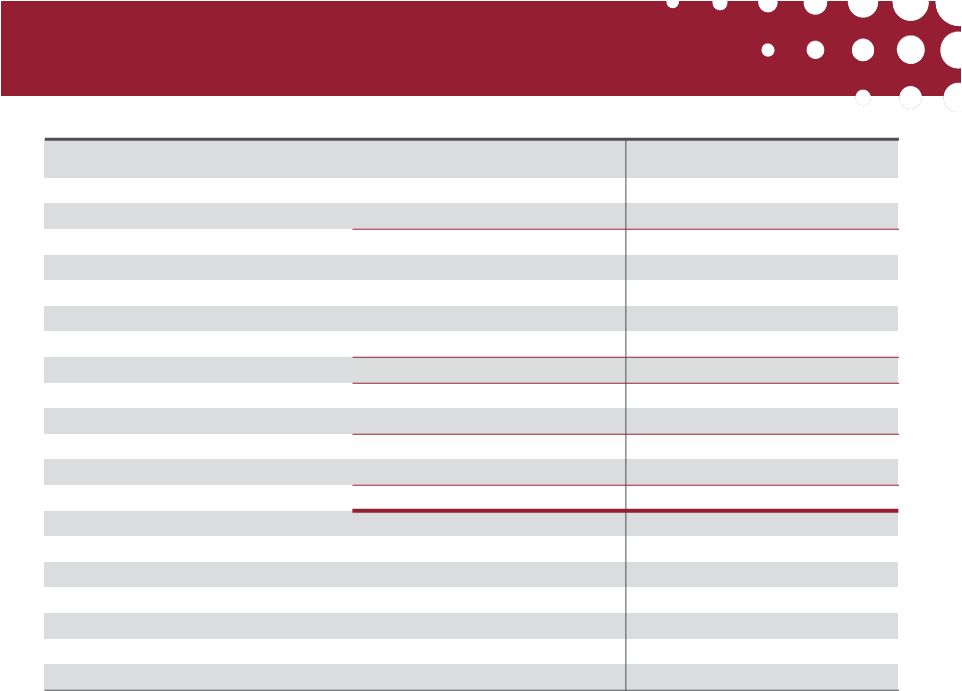

13

Quarterly Adjusted EBITDA

Fiscal 2012

Fiscal 2011 (Restated)

($ thousands)

Q1

Q2

Q3

Q1

Q2

Q3

Net income (loss)

$10,801

($20,184)

($44,017)

$9,282

$11,098

$3,351

Income taxes (benefit)

(14,640)

(2,398)

18,748

4,372

6,643

1,300

Income (loss) before income taxes

(3,839)

(22,582)

(25,269)

13,654

17,741

4,651

Other expense, net

-

-

-

-

-

-

Interest expense, net

5,761

6,471

7,701

6,117

5,992

5,941

Income (loss) from operations

1,922

(16,111)

(17,568)

19,771

23,733

10,592

Acquisition and integration related

expenses

17,214

12,091

11,336

579

1,023

5,946

Certain selling, general and

administrative costs

2,016

10,710

7,863

-

-

-

Stock-based compensation expense

1,902

2,949

2,291

1,772

2,104

1,739

Depreciation and amortization

7,180

7,353

7,702

7,472

7,506

7,321

Adjusted EBITDA

$30,234

$16,992

$11,624

$29,594

$34,366

$25,598

1

Non-GAAP, adjusted EBITDA is defined as income before interest expense,

income taxes, stock-based compensation, depreciation,

amortization, acquisition and integration expenses, costs associated with

audit committee restatement and certain SG&A costs. |

14

Expense Adjustments in

First Three Quarters of Fiscal 2012

$ millions

Fiscal 2012

Description of Expense

Q1

Q2

Q3

Q3

YTD

Acquisition

and

integration

related

expenses

1

$17.2

$12.1

$11.3

$40.6

Audit committee investigation, restatement

and related expenses

2

0.2

10.7

5.7

16.6

Other expenses

3

1.8

-

2.6

4.4

Subtotal

2.0

10.7

8.3

21.0

Forbearance costs

4

-

-

1.0

1.0

TOTAL

$19.2

$22.8

$20.6

$62.6

1

Pringles and Kettle related

2

Included in SG&A in the financial statements; includes certain audit,

consulting, and legal fees 3

Included in SG&A in the financial statements; includes certain legal costs,

cash and stock based retention bonuses, severance, and other related

costs 4

Included in interest expense in the financial statements

14 |

15

Reconciliation of Income to Non-GAAP EPS

* Includes shares associated with participating securities

Fiscal 2012

Fiscal 2011 (Restated)

($ thousands, except per share amounts)

Q1

Q2

Q3

Q1

Q2

Q3

GAAP income

(loss)before income taxes

($3,839)

($22,582)

($25,269)

$13,654

$17,741

$4,651

Adjustments to exclude acquisition

and

integration related expenses

17,214

12,091

11,336

579

1,023

5,946

Adjustments to exclude certain

SG&A costs

2,016

10,710

8,309

-

-

-

Adjustments to exclude forbearance fee

-

-

1,006

-

-

-

Non

-GAAP income (loss) before income taxes

15,391

219

(4,618)

14,233

18,764

10,597

GAAP income taxes / (benefit)

(14,640)

(2,398)

18,748

4,372

6,643

1,300

Tax effect of Non-GAAP adjustments

13,686

2,384

(18,462)

(1,651)

(3,055)

1,284

Non

-GAAP income taxes / (benefit)

(954)

(14)

286

2,721

3,588

2,584

Non

-GAAP net income (loss)

$16,345

$233

($4,904)

$11,512

$15,176

$8,013

Non

-GAAP EPS-diluted

$0.71

$0.01

($0.22)

$0.52

$0.67

$0.35

Shares used in computing

Non

-GAAP EPS-diluted *

22,932

22,056

22,108

22,343

22,622

22,726 |

16

Key Drivers of Financial Performance in

First Three Quarters of Fiscal 2012

•

Significant decline in walnut crop receipts led to a 36 percent decrease in

non-retail revenue in the first three quarters of fiscal 2012, which

contributed to a substantial drop in gross margin for the company between

fiscal 2011 and fiscal 2012. –

Plants operating below capacity

•

Increase in average walnut cost per pound in excess of 50 percent led to gross

margin compression as price increases lagged commodity cost rises.

•

Additional pressure on other commodities (e.g. pecans, peanuts, cashews, oil)

also impacted snack portfolio.

•

Emerald and Kettle experienced high levels of promotional spending.

•

Emerald SKU proliferation drove high operating costs in plants.

•

Gross margin also impacted by high manufacturing/supply chain operating costs

due to nut product line complexity and excess capacity in nut and Kettle

U.S. facilities. |

17

Guidance for Full-Year Fiscal 2012

•

Net sales expected to be between $975 and $980 million

•

Snack sales expected to be between $600 and $605 million

•

Culinary sales expected to be between $290 and $295 million

•

Gross margin expected to be between 18.0% to 18.5%

•

Adjusted EBITDA expected to be between $78 and $81 million

|