Attached files

| file | filename |

|---|---|

| 8-K - BLUEGREEN VACATIONS CORP | i00425_bxg-8k.htm |

0 Provides seller - financing to credit qualified Bluegreen timeshare customers to facilitate sales and earn net interest profits. In - house servicing of all receivables including certain fee - based service clients; centralized at our Boca Raton, FL headquarters. Bluegreen has been servicing loans for over 20 years. Our Mortgage management team has a combined 158 years of servicing experience, with an average tenure of 16 years with Bluegreen. Resorts Notes Receivable Outstanding ($ in millions) Finance Business $0 $200 $400 $600 $800 $1,000 $944 $812 $705 $614 $573 $0 $2 $24 $47 $61 Fee - Based Service Clients Bluegreen

1 Bluegreen VOI Delinquency Performance (1) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Total Delinquent 90 Days Delinquent 60 Days Delinquent 31 Days Delinquent (1) Excludes introductory products

2 Portfolio Performance (1) • Estimated (1) Excludes introductory products Percentage of o utstanding loans Percentage of outstanding principal balance over 30 days past due Originations Pre - 12/15/08 (loans not credit scored at origination) 55.5% 3.53% Originations 12/15/08 – 12/31/09 (loans must meet minimum FICO® requirement of 500) 9.6% 3.21% Originations 1/1/10 – 9/30/12 (loans must meet minimum FICO® requirement of 575 ) 34.9% 1.95% Total 100% 2.95% 2008/2009/2010 Originations - VOI Default Comparison Percentage defaulted Loans originated 1/1/08 – 12/14/08 22.77% (as of 9/30/11) Loans originated 12/15/08 – 12/31/09 13.99% (as of 9/30/12) Loans originated 1/1/10 – 12/31/10 8.80% * (as of 9/30/12) (1 ST 33 months) VOI Delinquency Breakdown: As of September 30, 2012

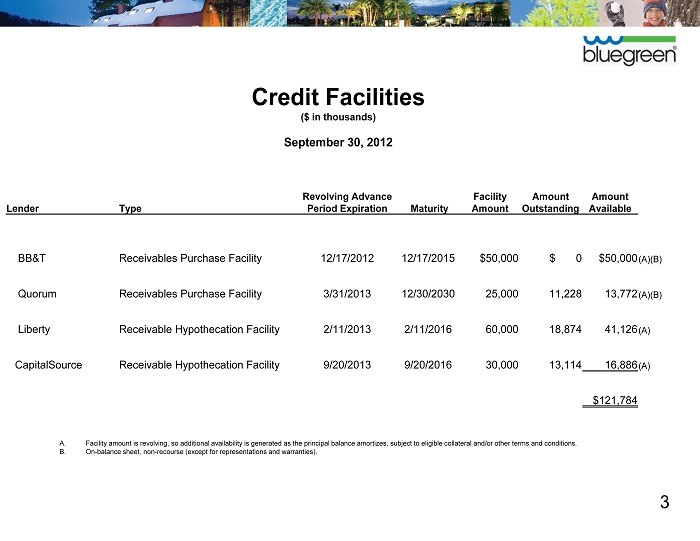

3 Credit Facilities ($ in thousands) September 30, 2012 Lender Type Facility Amount Amount Outstanding Amount Available Revolving Advance Period Expiration Maturity BB&T Receivables Purchase Facility 12/17/2012 12/17/2015 $50,000 $ 0 $50,000 (A)(B ) Quorum Receivables Purchase Facility 3/31/2013 12/30/2030 25,000 11,228 13,772 (A)(B) Liberty Receivable Hypothecation Facility 2/11/2013 2/11/2016 60,000 18,874 41,126 (A ) CapitalSource Receivable Hypothecation Facility 9/20/2013 9/20/2016 30,000 13,114 16,886 (A ) $121,784 A. Facility amount is revolving, so additional availability is generated as the principal balance amortizes, subject to eligible co llateral and/or other terms and conditions. B. On - balance sheet, non - recourse (except for representations and warranties).