Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - BLUEGREEN VACATIONS CORP | bxg-20171231xex32_2.htm |

| EX-32.1 - EX-32.1 - BLUEGREEN VACATIONS CORP | bxg-20171231xex32_1.htm |

| EX-31.2 - EX-31.2 - BLUEGREEN VACATIONS CORP | bxg-20171231xex31_2.htm |

| EX-31.1 - EX-31.1 - BLUEGREEN VACATIONS CORP | bxg-20171231xex31_1.htm |

| EX-21.1 - EX-21.1 - BLUEGREEN VACATIONS CORP | bxg-20171231xex21_1.htm |

| EX-10.75 - EX-10.75 - BLUEGREEN VACATIONS CORP | bxg-20171231xex10_75.htm |

| EX-3.2 - EX-3.2 - BLUEGREEN VACATIONS CORP | bxg-20171231xex3_2.htm |

| EX-3.1 - EX-3.1 - BLUEGREEN VACATIONS CORP | bxg-20171231xex3_1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission file number 0-19292

BLUEGREEN VACATIONS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

Florida |

|

03-0300793 |

|

|

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

|

|

incorporation or organization) |

|

Identification No.) |

|

4960 Conference Way North, Suite 100, Boca Raton, Florida 33431

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (561) 912-8000

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, $.01 par value |

|

New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

Smaller reporting company ☐ |

|

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The initial public offering of the registrant’s common stock was consummated on November 17, 2017. Prior to that time, the registrant’s common stock was not publicly traded and was held solely by a wholly owned subsidiary of BBX Capital Corporation. Accordingly, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter) was zero.

As of March 1, 2018, there were 74,734,455 shares of the registrant’s common stock, $.01 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2018 Annual Meeting of Shareholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, are incorporated by reference into Part III of this Annual Report on Form 10-K.

BLUEGREEN VACATIONS CORPORATION

FORM 10-K TABLE OF CONTENTS

YEAR ENDED DECEMBER 31, 2017

|

|

|

|

|

|

|

Page |

|

|

|

|

|

Item 1. |

6 | |

|

Item 1A. |

24 | |

|

Item 1B. |

43 | |

|

Item 2. |

43 | |

|

Item 3. |

43 | |

|

Item 4. |

44 | |

|

|

|

|

|

Item 5. |

45 | |

|

Item 6. |

47 | |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

48 |

|

Item 7A. |

74 | |

|

Item 8. |

75 | |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

112 |

|

Item 9A. |

112 | |

|

Item 9B. |

112 | |

|

|

|

|

|

Item 10. |

113 | |

|

Item 11. |

113 | |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

113 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

113 |

|

Item 14. |

113 | |

|

|

|

|

|

Item 15. |

113 | |

|

|

|

|

| 126 | ||

2

EXPLANATORY NOTE

The initial public offering of our common stock was consummated on November 17, 2017. In the initial public offering, we sold 3,736,723 shares of our common stock at the public offering price of $14.00 per share, less underwriting discounts and commissions, and BBX Capital Corporation (NYSE: BBX) (“BBX Capital”), our sole shareholder prior to the initial public offering, sold, as selling shareholder, 3,736,722 shares of our common stock, including 974,797 shares sold on December 5, 2017 pursuant to the underwriters exercise of its option to purchase additional shares, at the public offering price of $14.00 per share, less underwriting discounts and commissions. BBX Capital continues to own approximately 90% of our outstanding common stock. Our common stock began trading on the New York Stock Exchange (the “NYSE”) on November 17, 2017 under the symbol “BXG.”

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements include all statements that do not relate strictly to historical or current facts and can be identified by the use of words such as “anticipates,” “estimates,” “expects,” “intends,” “plans,” “believes,” “projects,” “predicts,” “seeks,” “will,” “should,” “would,” “may,” “could,” “outlook,” “potential,” and similar expressions or words and phrases of similar import. Forward-looking statements include, among others, statements relating to our future financial performance, our business prospects and strategy, anticipated financial position, liquidity and capital needs and other similar matters. These statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those expressed in, or implied by, the forward-looking statements as a result of various factors, including, among others:

|

· |

adverse trends or disruptions in economic conditions generally or in the vacation ownership, vacation rental and travel industries; |

|

· |

adverse changes to, or interruptions in, business relationships, including the expiration or termination of our management contracts, exchange networks or other strategic alliances; |

|

· |

the risks of the real estate market and the risks associated with real estate development, including a decline in real estate values and a deterioration of other conditions relating to the real estate market and real estate development; |

|

· |

our ability to maintain an optimal inventory of vacation ownership interests (“VOIs”) for sale; |

|

· |

the availability of financing and our ability to sell, securitize or borrow against our consumer loans; |

|

· |

decreased demand from prospective purchasers of VOIs; |

|

· |

adverse events or trends in vacation destinations and regions where the resorts in our network are located; |

|

· |

our indebtedness may impact our financial condition and results of operations, and the terms of our indebtedness may limit, among other things, our activities and ability to pay dividends, and we may not comply with the terms of our indebtedness; |

|

· |

changes in our senior management; |

|

· |

our ability to comply with regulations applicable to the vacation ownership industry; |

3

|

· |

our ability to successfully implement our growth strategy or maintain or expand our capital light business relationships or activities; |

|

· |

our ability to compete effectively in the highly competitive vacation ownership industry; |

|

· |

risks associated with, and the impact of, regulatory examinations or audits of our operations, and the costs associated with regulatory compliance; |

|

· |

our customers’ compliance with their payment obligations under financing provided by us, and the impact of defaults on our operating results and liquidity position; |

|

· |

the ratings of third-party rating agencies, including the impact of any downgrade on our ability to obtain, renew or extend credit facilities, or otherwise raise funds; |

|

· |

changes in our business model and marketing efforts, plans or strategies, which may cause marketing expenses to increase or adversely impact our revenue, operating results and financial condition; |

|

· |

the impact of the resale market for VOIs on our business, operating results and financial condition; |

|

· |

risks associated with our relationships with third-party developers, including that third-party developers who provide VOIs to be sold by us pursuant to fee-based services or just-in-time arrangements may not provide VOIs when planned and that third-party developers may not fulfill their obligations to us or to the homeowners associations that maintain the resorts they developed; |

|

· |

risks associated with legal and other regulatory proceedings, including claims of noncompliance with applicable regulations or for development related defects, and the impact they may have on our financial condition and operating results; |

|

· |

audits of our or our subsidiaries’ tax returns, including that they may result in the imposition of additional taxes; |

|

· |

environmental liabilities, including claims with respect to mold or hazardous or toxic substances, and their impact on our financial condition and operating results; |

|

· |

our ability to maintain the integrity of internal or customer data, the failure of which could result in damage to our reputation and/or subject us to costs, fines or lawsuits; |

|

· |

risks related to potential business expansion that we may pursue, including that we may not pursue such expansion when or to the extent anticipated or at all, and any such expansion may involve significant costs and the incurrence of significant indebtedness and may not be successful; |

|

· |

the updating of, and developments with respect to, technology, including the cost involved in updating our technology and the impact that any failure to keep pace with developments in technology could have on our operations or competitive position; and |

|

· |

other risks and uncertainties inherent to our business, the vacation ownership industry and the ownership of our common stock, including those discussed in the “Risk Factors” section of, and elsewhere in, this Annual Report on Form 10-K. |

These and other risks and uncertainties disclosed in this Annual Report on Form 10-K are not necessarily all of the important factors that could cause our actual results to differ materially from those expressed in any of the forward-looking statements. Other unknown or unpredictable factors could cause our actual results to differ materially from those expressed in any of the forward-looking statements. In addition, past performance may not be indicative of future results, and comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, and all such information should only be viewed as historical data.

4

Given these uncertainties, you are cautioned not to place undue reliance on forward-looking statements, and you should read this Annual Report on Form 10-K with the understanding that actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect. We qualify all forward-looking statements by these cautionary statements.

Forward-looking statements speak only as of the date of this Annual Report on Form 10-K.

Terms Used in this Annual Report on Form 10-K

Except as otherwise noted or where the context requires otherwise, references in this Annual Report on Form 10-K to “Bluegreen Vacations,” “Bluegreen,” “the Company,” “we,” “us” and “our” refer to Bluegreen Vacations Corporation, together with its consolidated subsidiaries.

References to “Adjusted EBITDA” means earnings, or net income, before taking into account interest income (excluding interest earned on VOI notes receivable), interest expense (excluding interest expense incurred on debt secured by our VOI notes receivable), income and franchise taxes, loss (gain) on assets held for sale, depreciation and amortization, amounts attributable to the non-controlling interest in Bluegreen/Big Cedar Vacations, LLC (“Bluegreen/Big Cedar”) (in which we own a 51% interest), and items that we believe are not representative of ongoing operating results. For purposes of the Adjusted EBITDA calculation, no adjustments were made for interest income earned on our VOI notes receivable or the interest expense incurred on debt that is secured by such notes receivable because they are both considered to be part of the operations of our business. Refer to “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business and Financial Metrics Used by Management” for further discussion of Adjusted EBITDA and certain other financial metrics which we believe represent important operations measures.

Market and Industry Data

Market and industry data used in this Annual Report on Form 10-K have been obtained from our internal surveys, industry publications, unpublished industry data and estimates, discussions with industry sources and other currently available information. The sources for this data include, without limitation, the American Resort Development Association. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such information. We have not independently verified such data. Similarly, our internal surveys, while believed by us to be reliable, have not been verified by any independent sources. Accordingly, such data may not prove to be accurate. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements contained in this Annual Report on Form 10-K, as described above.

Trademarks, Service Marks and Trade Names

We own or have rights to use a number of registered and common law trademarks, trade names and service marks in connection with our business, including, but not limited to, Bluegreen, Bluegreen Resorts, Bluegreen Vacations, Bluegreen Traveler Plus, Bluegreen Vacation Club, Bluegreen Wilderness Club at Big Cedar and the Bluegreen Logo. This Annual Report on Form 10-K also refers to trademarks, trade names and service marks of other organizations. Without limiting the generality of the preceding sentence, World Golf Village is registered by World Golf Foundation, Inc.; Big Cedar and Bass Pro Shops are registered by Bass Pro Trademarks, LP; Ascend, Ascend Hotel Collection, Ascend Resort Collection, Choice Privileges, Comfort Inn, Comfort Suites, Quality, Sleep Inn, Clarion, Cambria, MainStay Suites, Econo Lodge and Rodeway Inn are registered by Choice Hotels International, Inc.; and Suburban Extended Stay Hotel is registered by Suburban Franchise Systems, Inc. All trademarks, service marks or trade names referred to in this Annual Report on Form 10-K are the property of their respective holders. Solely for convenience, the trademarks, trade names and service marks referred to in this Annual Report on Form 10-K appear without the ® and ™ symbols, but such references are not intended to indicate in any way that we or the owner will not assert, to the fullest extent under applicable law, all rights to such trademarks, trade names and service marks.

5

Our Business

We are a leading vacation ownership company that markets and sells VOIs and manages resorts in top leisure and urban destinations. Our resort network includes 43 Club Resorts (resorts in which owners in the Bluegreen Vacation Club (“Vacation Club”) have the right to use most of the units in connection with their VOI ownership) and 24 Club Associate Resorts (resorts in which owners in our Vacation Club have the right to use a limited number of units in connection with their VOI ownership). Our Club Resorts and Club Associate Resorts are primarily located in popular, high-volume, “drive-to” vacation locations, including Orlando, Las Vegas, Myrtle Beach and Charleston, among others. Through our points-based system, the approximately 213,000 owners in our Vacation Club have the flexibility to stay at units available at any of our resorts and have access to almost 11,000 other hotels and resorts through partnerships and exchange networks. We have a robust sales and marketing platform supported by exclusive marketing relationships with nationally-recognized consumer brands, such as Bass Pro and Choice Hotels. These marketing relationships drive sales within our core demographic, which is described below.

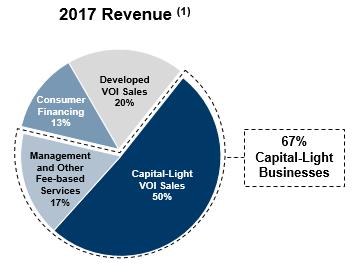

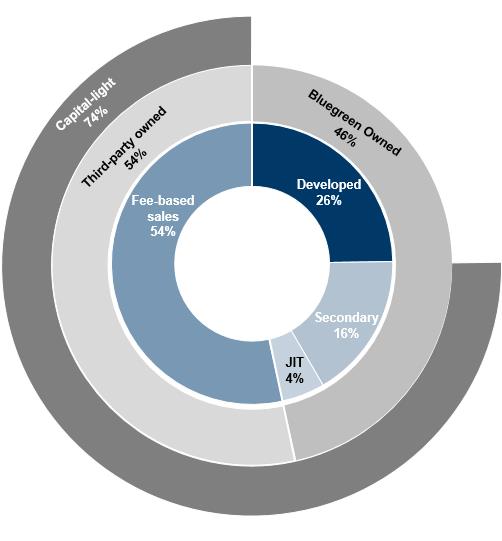

Prior to 2009, our vacation ownership business consisted solely of the sale of VOIs in resorts that we developed or acquired (“developed VOI sales”). While we continue to conduct such sales and development activities, we now also derive a significant portion of our revenue from our capital-light business model, which utilizes our expertise and infrastructure to generate both VOI sales and recurring revenue from third parties without the significant capital investment generally associated with the development and acquisition of resorts. Our capital-light business activities include sales of VOIs owned by third-party developers pursuant to which we are paid a commission (“fee-based sales”) and sales of VOIs that we purchase under just-in-time (“JIT”) arrangements with third-party developers or from secondary market sources. In addition, we provide resorts and resort developers with other fee-based services, including resort management, mortgage servicing, title services and construction management. We also offer financing to qualified VOI purchasers, which generates significant interest income.

|

(1) |

Excludes “Other Income, Net.” |

Our Vacation Club has grown from approximately 170,000 owners as of December 31, 2012 to approximately 213,000 owners as of December 31, 2017. We primarily serve a demographic underpenetrated within the vacation ownership industry, as the typical Vacation Club owner has an average annual household income of approximately $77,000 as compared to an industry average of $90,000. According to U.S. census data, households with an annual income of $50,000 to $100,000 represent the largest percentage of the total population (approximately 29%). We believe our ability to effectively scale our transaction size to suit our customer, as well as our high-quality, conveniently-located, “drive-to” resorts are attractive to our core target demographic.

6

Our History

We were organized in 1985 as a Massachusetts corporation named Patten Corporation, primarily focused on retail land sales to consumers. In 1994, we entered into the vacation ownership industry. In 1996, we changed our name to Bluegreen Corporation. From 1986 through April 2, 2013, our common stock was publicly listed and traded on the NYSE. On April 2, 2013, Woodbridge Holdings, LLC (“Woodbridge”), a wholly owned subsidiary of BBX Capital, acquired all of the shares of our common stock not previously owned by it, and we became a wholly-owned subsidiary of Woodbridge. BBX Capital (NYSE: BBX) is a Florida-based publicly traded diversified holding company. On March 10, 2014, we were redomiciled from a Massachusetts corporation to a Florida corporation. On September 25, 2017, we changed our name to Bluegreen Vacations Corporation.

On November 17, 2017, we consummated the initial public offering of our common stock. In the initial public offering, we sold 3,736,723 shares of our common stock at the public offering price of $14.00 per share, less underwriting discounts and commissions, and BBX Capital, as selling shareholder, sold 3,736,722 shares of our common stock, including 974,797 shares sold on December 5, 2017 pursuant to the underwriters exercise of its option to purchase additional shares, at the public offering price of $14.00 per share, less underwriting discounts and commissions. BBX Capital continues to own approximately 90% of our outstanding common stock. Our common stock began trading on the NYSE on November 17, 2017 under the symbol “BXG.”

Our Reportable Segments

We report our results of operations through two reportable segments: (i) Sales of VOIs and financing; (ii) resort operations and club management.

Our sales of VOIs and financing segment includes our marketing and sales activities related to the VOIs that we own, our sale of VOIs through fee-for-service arrangements with third-party developers, our provision of consumer financing in connection with sales of VOIs that we own, and our provision of title services through a wholly-owned subsidiary.

Our resort operations and club management includes our provision of management services to our Vacation Club and to a majority of the homeowners associations (“HOAs”) of the resorts within our Vacation Club. In connection with those services, we also provide club reservation services, services to owners and billing and collections services to our Vacation Club and certain HOAs. Additionally, we generate revenue within our resort operations and club management section from our Traveler Plus program, food and beverage and other retail operations, our provision of rental services to third parties, and our management of construction activities of certain of our fee-based clients.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 14 (Segment Reporting) to our audited consolidated financial statements included in Item 8 of this Annual Report on Form 10-K for additional information regarding our reportable segments.

Our Products

Vacation Ownership Interests

Since entering the vacation ownership industry in 1994, we have generated over 627,000 VOI sales transactions, including over 124,000 fee-based sales transactions. Our Vacation Club owners receive an annual or biennial allotment of “points” in perpetuity (supported by an underlying deeded VOI held in trust for the owner) that may be used to stay at any of our 43 Club Resorts and 24 Club Associate Resorts. Vacation Club owners can use their points to stay in resorts for varying lengths of time, starting at a minimum of two nights. The number of points required for a stay at a resort varies depending on a variety of factors, including resort location, size of the unit, vacation season and the days of the week. Under this system, Vacation Club owners can select vacations according to their schedules, space needs and available points. Subject to certain restrictions and fees, Vacation Club owners are typically allowed to carry over any unused points for one year and to “borrow” points from the next year. Vacation Club owners may also take advantage of various other lodging and vacation opportunities available to them as described under “Value Proposition” below.

7

Each of our Club Resorts and Club Associate Resorts is managed by an HOA, which is governed by a board of directors or trustees. This board hires a management company to which it delegates many of the rights and responsibilities of the HOA, including landscaping, security, housekeeping, garbage collection, utilities, insurance procurement, laundry and repairs and maintenance. Vacation Club owners pay annual maintenance fees which cover the costs of operating all the resorts in the Vacation Club system, including fees for real estate taxes and reserves for capital improvements. If a Vacation Club owner does not pay such charges, his or her use rights may be suspended and ultimately terminated, subject to the applicable lender’s first mortgage lien, if any, on such owner’s VOI. We provide management services to 48 resorts and the Vacation Club through contractual arrangements with HOAs. We have a 100% renewal rate on management contracts from our Club Resorts.

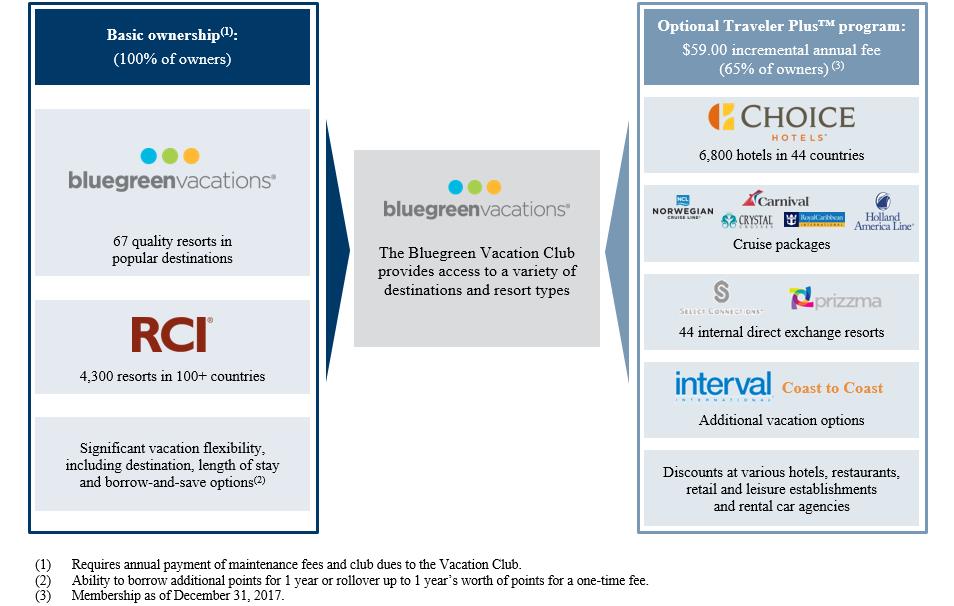

“Value Proposition”

Our Vacation Club’s points-based platform offers owners significant flexibility. As reflected in the chart below, basic Vacation Club ownership entitles owners to use their points to stay at any of our 43 Club Resorts and 24 Club Associate Resorts, as well as to access more than 4,300 resorts available through the Resort Condominiums International, LLC (“RCI”) exchange network. For a nominal annual fee and transaction fees, Vacation Club owners can join and utilize our Traveler Plus program, which enables them to use their points to access an additional 44 direct exchange resorts, for other vacation experiences, such as cruises. Vacation Club owners can convert their Vacation Club points into Choice Privileges points. Choice Privileges points can be used for stays in Choice Hotels. In addition, Traveler Plus members can directly use their Vacation Club points for stays in Choice Hotels’ Ascend Hotel Collection properties, a network of historic and boutique hotels in the United States, Canada, Scandinavia and Latin America. Overall, there are approximately 6,800 hotels in the Choice Hotels network, located in more than 44 countries and territories, and Choice Hotels’ brands include the Ascend Hotel Collection, Comfort Inn, Comfort Suites, Quality, Sleep Inn, Clarion, Cambria Hotels and Suites, MainStay Suites, Suburban Extended Stay Hotel, Econo Lodge and Rodeway Inn. We continuously seek new ways to add value for our Vacation Club owners, including enhanced product offerings, new resort locations, broader vacation experiences and further technological innovation, all of which are designed to increase guest satisfaction.

8

Approximately 65% of Vacation Club owners are enrolled in Traveler Plus. During the year ended December 31, 2017, approximately 8% of Vacation Club owners utilized the RCI exchange network.

Vacation Club Resort Locations and Amenities

As shown in the map below, our Vacation Club resorts are primarily located on the U.S. East Coast and Midwest. The 44 direct-exchange resorts available to Traveler Plus members are concentrated along the West Coast and Hawaii. Together, this provides a broad offering across the United States and the Caribbean.

9

![[MISSING IMAGE: c477136_location.jpg]](bxg-20171231x10kg003.jpg)

Vacation Club resorts are primarily “drive-to” resort destinations and approximately 85% of our Vacation Club owners live within a four-hour drive of at least one of our resorts. Our resorts are located in popular vacation destinations, such as Florida, South Carolina, North Carolina, Tennessee, Virginia and Nevada, and represent a diverse mix of resort and urban destinations, allowing Vacation Club owners the ability to customize their vacation experience. In addition, we offer our Vacation Club owners access to Caribbean locations, including Aruba.

Our resort network offers a diverse mix of experiences and accommodations. Unlike some of our competitors that maintain static brand design standards across resorts and geographies, we seek to design resorts that capture the uniqueness of a particular location. Our distinctive resorts are designed to create an authentic experience and connection to their unique and varied locations.

Our resorts typically feature condominium-style accommodations with amenities such as fully equipped kitchens, entertainment centers and in-room laundry facilities. Many resorts feature a clubhouse (including a pool, game room, lounge), hotel-type staff and concierge services.

We also own a 51% interest in Bluegreen/Big Cedar Vacations, which develops, markets and sells VOIs at three premier wilderness-themed resorts adjacent to Table Rock Lake near Branson, Missouri: The Bluegreen Wilderness Club at Big Cedar, The Cliffs at Long Creek and Paradise Point. The remaining 49% interest in Bluegreen/Big Cedar Vacations is held by Big Cedar, LLC (“BC LLC”), an affiliate of Bass Pro. As a result of our controlling interest in Bluegreen/Big Cedar Vacations, our consolidated financial statements include the results of operations and financial condition of Bluegreen/Big Cedar Vacations.

Located next to the luxury Big Cedar Lodge, The Bluegreen Wilderness Club is a 40-acre resort overlooking Table Rock Lake with sprawling views of the surrounding Ozarks. Vacation Club owners enjoy a variety of amenities, including a 9,000 square foot clubhouse, lazy river and rock-climbing wall, in addition to full access to the amenities and activities of Big Cedar Lodge. The Cliffs at Long Creek offers fully furnished homes that can accommodate up to 13 people while providing access to a clubhouse and amenities at The Bluegreen Wilderness Club. Paradise Point offers spacious vacation villas with direct access to Table Rock Lake and the Bass Pro Long Creek Marina.

10

Vacation Club Resorts

|

|

||||||||

|

|

Club Resorts |

Location |

Total |

Managed |

Fee-Based |

Sales |

||

|

1 |

Cibola Vista Resort and Spa |

Peoria, Arizona |

288 |

✓ |

✓ |

|||

|

2 |

La Cabana Beach Resort & Casino(4) |

Oranjestad, Aruba |

449 |

✓ |

||||

|

3 |

The Club at Big Bear Village |

Big Bear Lake, California |

38 |

✓ |

✓ |

|||

|

4 |

The Innsbruck Aspen |

Aspen, Colorado |

17 |

✓ |

||||

|

5 |

Via Roma Beach Resort |

Bradenton Beach, Florida |

28 |

✓ |

||||

|

6 |

Daytona SeaBreeze |

Daytona Beach Shores, Florida |

78 |

✓ |

✓ |

|||

|

7 |

Resort Sixty-Six |

Holmes Beach, Florida |

28 |

✓ |

||||

|

8 |

The Hammocks at Marathon |

Marathon, Florida |

58 |

✓ |

||||

|

9 |

The Fountains |

Orlando, Florida |

745 |

✓ |

✓ |

✓ |

||

|

10 |

Orlando’s Sunshine Resort I & II |

Orlando, Florida |

84 |

✓ |

||||

|

11 |

Casa del Mar Beach Resort |

Ormond Beach, Florida |

118 |

✓ |

||||

|

12 |

Grande Villas at World Golf Village & |

St. Augustine, Florida |

214 |

✓ |

✓ |

|||

|

13 |

Bluegreen at Tradewinds |

St. Pete Beach, Florida |

162 |

✓ |

✓ |

✓ |

||

|

14 |

Solara Surfside |

Surfside, Florida |

60 |

✓ |

✓ |

|||

|

15 |

Studio Homes at Ellis Square |

Savannah, Georgia |

28 |

✓ |

✓ |

✓ |

||

|

16 |

The Hotel Blake |

Chicago, Illinois |

162 |

✓ |

✓ |

|||

|

17 |

Bluegreen Club La Pension |

New Orleans, Louisiana |

64 |

✓ |

✓ |

|||

|

18 |

The Soundings Seaside Resort |

Dennis Port, Massachusetts |

69 |

✓ |

✓ |

|||

|

19 |

Mountain Run at Boyne |

Boyne Falls, Michigan |

204 |

✓ |

✓ |

|||

|

20 |

The Falls Village |

Branson, Missouri |

293 |

✓ |

✓ |

|||

|

21 |

Paradise Point Resort(5) |

Hollister, Missouri |

150 |

✓ |

||||

|

22 |

Bluegreen Wilderness Club at Big Cedar(5) |

Ridgedale, Missouri |

427 |

✓ |

✓ |

|||

|

23 |

The Cliffs at Long Creek(5) |

Ridgedale, Missouri |

62 |

✓ |

||||

|

24 |

Bluegreen Club 36 |

Las Vegas, Nevada |

478 |

✓ |

✓ |

|||

|

25 |

South Mountain Resort |

Lincoln, New Hampshire |

110 |

✓ |

✓ |

✓ |

||

|

26 |

Blue Ridge Village |

Banner Elk, North Carolina |

132 |

✓ |

||||

|

27 |

Club Lodges at Trillium |

Cashiers, North Carolina |

30 |

✓ |

✓ |

|||

|

28 |

The Suites at Hershey |

Hershey, Pennsylvania |

78 |

✓ |

||||

|

29 |

The Lodge Alley Inn |

Charleston, South Carolina |

90 |

✓ |

✓ |

|||

|

30 |

King 583 |

Charleston, South Carolina |

50 |

✓ |

✓ |

|||

|

31 |

Carolina Grande |

Myrtle Beach, South Carolina |

118 |

✓ |

✓ |

|||

|

32 |

Harbour Lights |

Myrtle Beach, South Carolina |

324 |

✓ |

✓ |

|||

|

33 |

Horizon at 77th |

Myrtle Beach, South Carolina |

88 |

✓ |

✓ |

|||

|

34 |

SeaGlass Tower |

Myrtle Beach, South Carolina |

136 |

✓ |

||||

|

35 |

Shore Crest Vacation Villas I & II |

North Myrtle Beach, South Carolina |

240 |

✓ |

✓ |

|||

|

36 |

MountainLoft I & II |

Gatlinburg, Tennessee |

394 |

✓ |

✓ |

|||

|

37 |

Laurel Crest |

Pigeon Forge, Tennessee |

298 |

✓ |

✓ |

|||

|

38 |

Shenandoah Crossing |

Gordonsville, Virginia |

128 |

✓ |

✓ |

|||

|

39 |

Bluegreen Wilderness Traveler at Shenandoah |

Gordonsville, Virginia |

145 |

✓ |

||||

|

40 |

BG Patrick Henry Square |

Williamsburg, Virginia |

91 |

✓ |

✓ |

✓ |

||

|

41 |

Parkside Williamsburg Resort |

Williamsburg, Virginia |

89 |

✓ |

✓ |

|||

|

42 |

Bluegreen Odyssey Dells |

Wisconsin Dells, Wisconsin |

92 |

✓ |

||||

|

43 |

Christmas Mountain Village |

Wisconsin Dells, Wisconsin |

381 |

✓ |

✓ |

|||

|

|

Total Units |

7,318 |

11

|

|

||||||

|

|

Club Associate Resorts |

Location |

Managed |

Fee-Based |

||

|

1 |

Paradise Isle Resort |

Gulf Shores, Alabama |

||||

|

2 |

Shoreline Towers Resort |

Gulf Shores, Alabama |

||||

|

3 |

Dolphin Beach Club |

Daytona Beach Shores, Florida |

✓ |

|||

|

4 |

Fantasy Island Resort II |

Daytona Beach Shores, Florida |

✓ |

|||

|

5 |

Mariner’s Boathouse and Beach Resort |

Fort Myers Beach, Florida |

||||

|

6 |

Tropical Sands Resort |

Fort Myers Beach, Florida |

||||

|

7 |

Windward Passage Resort |

Fort Myers Beach, Florida |

||||

|

8 |

Gulfstream Manor |

Gulfstream, Florida |

✓ |

|||

|

9 |

Outrigger Beach Club |

Ormond Beach, Florida |

||||

|

10 |

Landmark Holiday Beach Resort |

Panama City Beach, Florida |

||||

|

11 |

Ocean Towers Beach Club |

Panama City Beach, Florida |

||||

|

12 |

Panama City Resort & Club |

Panama City Beach, Florida |

||||

|

13 |

Surfrider Beach Club |

Sanibel Island, Florida |

||||

|

14 |

Petit Crest Villas and Golf Club Villas at Big Canoe |

Marble Hill, Georgia |

||||

|

15 |

Pono Kai Resort |

Kapaa (Kauai), Hawaii |

||||

|

16 |

The Breakers Resort |

Dennis Port, Massachusetts |

✓ |

✓ |

||

|

17 |

Lake Condominiums at Big Sky |

Big Sky, Montana |

||||

|

18 |

Foxrun Townhouses |

Lake Lure, North Carolina |

||||

|

19 |

Sandcastle Village II |

New Bern, North Carolina |

||||

|

20 |

Waterwood Townhouses |

New Bern, North Carolina |

||||

|

21 |

Bluegreen at Atlantic Palace |

Atlantic City, New Jersey |

||||

|

22 |

The Manhattan Club |

New York, New York |

✓ |

|||

|

23 |

Players Club |

Hilton Head Island, South Carolina |

||||

|

24 |

Blue Water Resort at Cable Beach(6) |

Nassau, Bahamas |

✓ |

✓ |

|

(1) |

Represents the total number of units at the Club Resort. Owners in the Vacation Club have the right to use most of the units at each Club Resort in connection with their VOI ownership. |

|

(2) |

This resort is managed by Bluegreen Resorts Management, Inc., our wholly-owned subsidiary (“Bluegreen Resorts Management”). |

|

(3) |

This resort, or a portion thereof, was developed by third-parties, and we have sold VOIs on their behalf or have arrangements to acquire such VOIs as part of our capital-light business strategy. |

|

(4) |

This resort is managed by Casa Grande Cooperative Association I, which has contracted with Bluegreen Resorts Management to provide management consulting services to the resort. The services provided by Bluegreen Resorts Management to this resort pursuant to such agreement are similar in nature to, but less extensive than, the services provided by us or our subsidiaries to the other resorts listed in the table as “Managed by Us.” |

|

(5) |

This resort is developed, marketed and sold by Bluegreen/Big Cedar Vacations. |

|

(6) |

This resort is currently closed for renovation in order to repair hurricane damage. |

|

(7) |

In addition to the sales centers listed in the table, we also operate additional sales centers in Myrtle Beach, South Carolina; Memphis, Tennessee and Sevierville, Tennessee, each of which is in close proximity to several of our resorts. |

Marketing and Sale of Inventory

VOI sales are typically generated by attracting prospective customers to tour a resort and attend a sales presentation. Our sales and marketing platform utilizes a variety of methods to generate new owner prospects, drive tour flow and sell VOIs in our Vacation Club. We utilize marketing alliances with nationally-recognized brands, which provide exclusive access to venues which target consumers generally matching our core demographic. In addition, we source sales prospects through programs which generate leads at high-traffic venues and in high-density tourist locations and events, as well as from telemarketing and referrals from existing owners and exchangers and renters staying at our properties.

Many of our programs involve the sale of a discounted vacation package that typically includes a two to three night stay in close proximity to one of our resort sales offices and requires participation in a sales presentation (a sales tour). Vacation packages are typically sold either in retail establishments, such as Bass Pro stores and outlet malls, or via telemarketing. During the year ended December 31, 2017, we sold over 245,000 vacation packages and 48% of our VOI sales were derived from vacation packages. As of December 31, 2017, we had a pipeline of over 199,000 vacation packages sold, which typically convert to tours at a rate of 54%.

12

We have an exclusive marketing agreement with Bass Pro, a nationally-recognized retailer of fishing, marine, hunting, camping and sports gear, that provides us with the right to market and sell vacation packages at kiosks in each of Bass Pro’s retail locations. As of December 31, 2017, we sold vacation packages in 68 of Bass Pro’s stores. Bass Pro has a loyal customer base that strongly matches our core demographic. Under the agreement, we also have the right to market VOIs in Bass Pro catalogs and on its website, and to access Bass Pro’s customer database. In exchange, we compensate Bass Pro based on VOI sales generated through the program. No compensation is paid to Bass Pro under the agreement on sales made at Bluegreen/Big Cedar Vacations’ resorts. During the years ended December 31, 2017, 2016 and 2015, VOI sales to prospects and leads generated by the agreement with Bass Pro accounted for approximately 15%, 16% and 20%, respectively, of our VOI sales volume. Our marketing alliance with Bass Pro originated in 2000, has been renewed twice and currently runs through 2025.

We have an exclusive strategic relationship with Choice Hotels that covers several areas of our business, including a sales and marketing alliance that enables us to leverage Choice Hotels’ brands, customer relationships and marketing channels to sell vacation packages. Vacation packages are sold through customer reservation calls transferred to us from Choice and through outbound telemarketing methods utilizing Choice’s customer database. In addition, 36 of our resorts are part of Choice’s Ascend Hotel Collection, which provides us with the opportunity to market to Choice Hotel guests staying at our resorts. Our strategic relationship with Choice Hotels originated in 2013 and was extended in August 2017 for a term of 15 years, with an additional 15-year renewal term thereafter unless either party elects not to renew the arrangement.

In addition, we generate leads and sell vacation packages through our relationships with various other retail operators and entertainment providers. As of December 31, 2017, we had kiosks in 19 outlet malls, strategically selected based on proximity to major vacation destinations and strong foot traffic of consumers matching our core target demographic. We generate vacation package sales from these kiosks. We also generate leads at malls, outlets and high-density locations or events, where contact information for sales prospects is obtained through raffles, giveaways and other attractions. We then seek to sell vacation packages to such prospects, including through telemarketing efforts by us or third-party vendors. As of December 31, 2017, we had lead generation operations in over 500 locations.

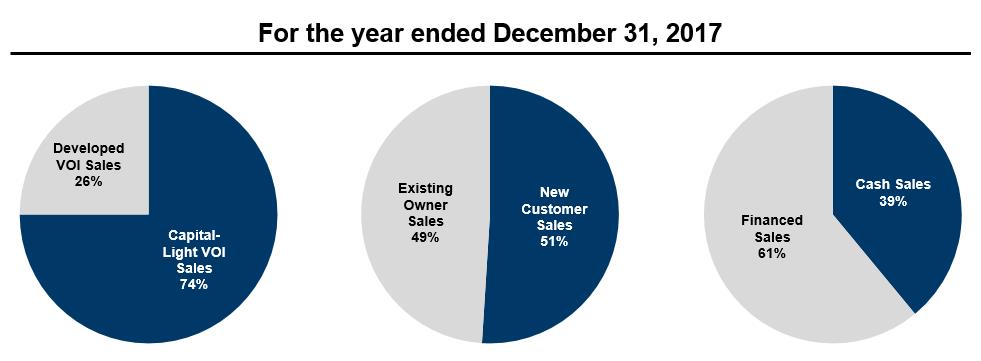

We believe that our diverse strategic marketing alliances (including those with Bass Pro, Choice Hotels and other retail operators and entertainment providers) deliver a strategic advantage over certain competitors that rely primarily on relationships with their affiliated hotel brands to drive lead generation and new owner growth. We have experience in identifying marketing partners with brands that attract our targeted owner demographic and building successful marketing relationships with those partners. We also attempt to structure these marketing alliances to compensate our partners with success-based payments, rather than flat fees for the use of their brand or facilities for lead generation. We believe that the variety in our marketing relationships has facilitated a healthy mix of new owner sales vs. existing owner sales that compare favorably to our competitors. During the year ended December 31, 2017, 51% of our VOI sales were to new owners.

In addition to attracting new customers, we also seek to sell additional VOI points to our existing Vacation Club owners. These sales generally have lower marketing costs and result in higher operating margins than sales generated through other marketing channels. During the years ended December 31, 2017, 2016 and 2015 sales to existing Vacation Club owners accounted for 49%, 46% and 48%, respectively, of our system-wide sales of VOIs, net. We target a balanced mix of new customer and existing Vacation Club owner sales to drive sustainable long-term growth. The number of owners in our Vacation Club has increased at a 5% CAGR between 2012 and 2017, from approximately 170,000 owners as of December 31, 2012 to approximately 213,000 owners as of December 31, 2017.

We operate 23 sales offices, typically located adjacent to our resorts and staffed with sales representatives and sales managers. As of December 31, 2017, we had over 3,000 employees dedicated to VOI sales and marketing. We utilize a uniform sales process, offer ongoing training for our sales personnel and maintain strict quality control policies. During the year ended December 31, 2017, 91% of our sales were generated from 16 of our sales offices, which focus on both new customer and existing Vacation Club owner sales. Our remaining 7 sales offices are primarily focused on sales to existing Vacation Club owners staying at the respective resort. In addition, we utilize our telesales operations to sell VOIs to Vacation Club owners.

13

Flexible Business Model

Our business model is designed to give us flexibility to capitalize on opportunities and adapt to changing market environments. We have the ability to adjust our targeted mix of capital-light vs. developed VOI sales, sales to new customers vs. existing Vacation Club owners, and cash vs. financed sales. While we may pursue opportunities that impact our short-term results, our long-term goal is to achieve sustained growth while maximizing earnings and cash flow.

Note: Cash sales represent the portion of our system-wide sales of VOIs, net that is received from the customer in cash within 30 days of purchase.

VOI Sales Mix

Our VOI sales include:

|

· |

Fee-based sales of VOIs owned by third-party developers pursuant to which we are paid a commission; |

|

· |

JIT sales of VOIs we acquire from third-party developers in close proximity to when we intend to sell such VOIs; |

|

· |

Secondary market sales of VOIs we acquire from HOAs or other owners; and |

|

· |

Developed VOI sales, or sales of VOIs in resorts that we develop or acquire (excluding inventory acquired pursuant to JIT and secondary market arrangements). |

14

Fee-Based Sales

We offer sales and marketing services to third-party developers for a commission. Under these fee-based sales arrangements, which are typically entered into on a non-committed basis, we sell the third-party developers’ VOIs as Vacation Club interests through our sales and marketing platform. We also provide third-party developers with administrative services, periodic reporting and analytics through our proprietary software platform. We seek to structure the fee for these services to cover selling and marketing costs, plus an operating profit. Historically we have targeted a commission rate of 65% to 75% of the VOI sales price. Notes receivable originated in connection with fee-based sales are held by the third-party developer and, in certain cases, are serviced by us for an additional fee. In connection with fee-based sales, we are not at risk for development financing and have no capital requirements, thereby increasing return on invested capital, or ROIC. We also typically obtain the HOA management contract associated with these resorts.

Just-In-Time (JIT) Sales

We enter into JIT inventory acquisition agreements with third-party developers that allow us to buy VOI inventory in close proximity to when we intend to sell such VOIs. While we typically enter into such arrangements on a non-committed basis, we may engage in committed arrangements under certain circumstances. Similar to fee-based sales, JIT sales do not expose us to risk for development financing. However, unlike fee-based sales, we hold the consumer finance receivables originated in connection with JIT sales. While JIT sales accounted for only 4% of system-wide sales of VOIs, net for the year ended December 31, 2017, JIT arrangements are often entered into in connection with fee-based sales arrangements.

Secondary Market Sales

We acquire VOI inventory from HOAs and other owners generally on a non-committed basis. These VOIs are typically obtained by the applicable HOA through foreclosure or termination in connection with HOA maintenance fee defaults. Accordingly, we generally purchase VOIs from secondary market sources at a greater discount to retail price compared to developed VOI sales and JIT sales. During the year ended December 31, 2017, secondary market sales accounted for 16% of our system-wide sales of VOIs, net.

Developed VOI Sales

Developed VOI sales are sales of VOIs in resorts that we have developed or acquired (excluding inventory acquired pursuant to JIT and secondary market arrangements). During the year ended December 31, 2017, developed VOI sales

15

accounted for 26% of our system-wide sales of VOIs, net. We hold the notes receivable originated in connection with developed VOI sales. We also typically obtain the HOA management contract associated with these resorts.

Future VOI Sales

Completed VOI inventory increases or decreases from period to period due to the acquisition of inventory through JIT and secondary market arrangements, development of new VOI units, reacquisition of VOIs through notes receivable defaults and changes to sales prices and completed sales. As of December 31, 2017 and 2016 we owned completed VOI inventory (excluding units not currently being marketed as VOIs, including model units) and had access to additional completed VOI inventory through fee-based and JIT arrangements as follows (dollars are in thousands and represent the then-estimated retail sales value):

|

|

||||||

|

|

As of December 31, |

|||||

|

Inventory Source |

2017 |

2016 |

||||

|

Owned completed VOI inventory |

$ |

754,961 |

$ |

548,076 | ||

|

Inventory accessible through fee-based |

||||||

|

and JIT arrangements |

401,906 | 503,820 | ||||

|

Total |

$ |

1,156,867 |

$ |

1,051,896 | ||

Based on current estimates and expectations, we believe this inventory, combined with inventory being developed by us or our third-party developer clients, and inventory that we may reacquire in connection with mortgage and maintenance fee defaults, can support our VOI sales at our current levels for over three years. We maintain relationships with numerous third-party developers and expect additional fee-based and JIT relationships to continue to provide high-quality VOI inventory to support our sales efforts. In addition, we are focused on strategically expanding our inventory through development at five of our resorts over the next several years. We intend to continue to strategically evaluate opportunities to develop or acquire VOI inventory in key strategic markets where we identify growing demand and have already established marketing and sales networks.

During the years ended December 31, 2017 and 2016, the estimated retail sales value and cash purchase price of the VOIs we acquired through secondary market arrangements were as follows (dollars in thousands):

|

|

||||||

|

|

Years Ended December 31, |

|||||

|

|

2017 |

2016 |

||||

|

Estimated retail sales value |

|

$ |

243,084 |

|

$ |

169,848 |

|

Cash purchase price |

|

$ |

12,721 |

|

$ |

7,555 |

In addition to inventory acquired through secondary market arrangements and in connection with notes receivable defaults, we expect to acquire inventory through six JIT arrangements during 2018, four of which provide for committed purchases for 2018, and development activities. Development activities currently consist primarily of additional VOI units being developed at The Cliffs at Long Creek in Ridgedale, Missouri, and at the Fountains in Orlando, Florida.

Management and Other Fee-Based Services

We earn recurring management fees for providing services to HOAs. These management services include oversight of housekeeping services, maintenance and certain accounting and administrative functions. We believe our management contracts yield highly predictable cash flows that do not have the traditional risks associated with hotel management contracts that are linked to daily rate or occupancy. Our management contracts are typically structured as “cost-plus” management fees, which means we generally earn fees equal to 10% to 12% of the costs to operate the applicable resort and have an initial term of three years with automatic one-year renewals. As of December 31, 2017, we provided management services to 48 resorts. We also earn recurring management fees for providing services to the Vacation Club. These services include managing the reservation system and providing owner billing and collection services. Our management contract with the Vacation Club provides for reimbursement of our costs plus a fee equal

16

to $10 per VOI owner. We may seek to expand our management services business, including to provide hospitality management services to hotels for third parties.

In addition to HOA and club management services, which provide a recurring stream of revenue, we provide other fee-based services that produce revenues without the significant capital investment generally associated with the development and acquisition of resorts. These services include, but are not limited to, title and escrow services for fees in connection with the closing of VOI sales, servicing notes receivable held by third parties, typically for a fee equal to 1.5% to 2.5% of the principal balance of the serviced portfolio, and construction management services for third-party developers, typically for fees equal to 3% of the cost of construction of the project. We also receive revenues from retail and food and beverage outlets at certain resorts.

Customer Financing

We generally offer qualified purchasers financing for up to 90% of the purchase price of VOIs. The typical financing provides for a term of ten years and a fixed interest rate that is determined by the FICO score of the borrower, and the amount of the down payment and existing ownership. Purchasers may receive an additional 1% discount in the interest rate by participating in our pre-authorized payment plan. As of December 31, 2017, 95% of our serviced VOI notes receivable participated in our pre-authorized payment plan. During the year ended December 31, 2017, the weighted-average interest rate on our VOI notes receivable was 15.3%. Our typical VOI note receivable has a term of ten years, has a fixed interest rate, is fully amortizing in equal installments, and may be prepaid without penalty.

VOI purchasers are generally required to make a down payment of at least 10% of the sales price. As part of our continued efforts to manage operating cash flows, we incentivize our sales associates to encourage cash sales and higher down payments on financed sales, with a target of 40-45% of the VOI sales price collected in cash. We also promote a point-of-sale credit card program sponsored by a third-party financial institution. As a result of these efforts, we have increased both the percentage of sales that are fully paid in cash and the average down payment on financed sales. Including down payments received on financed sales, approximately 39% of our system-wide sales of VOIs, net during the year ended December 31, 2017 were paid in cash within approximately 30 days from the contract date.

See “Sales/Financing of Receivables” below for additional information regarding our receivable financing activities.

Loan Underwriting

We generally do not originate financing to customers with FICO scores below 575. We may provide financing to customers with no FICO score if the customer makes a minimum required down payment of 20%. For loans made during 2017, the borrowers’ weighted-average FICO score after a 30-day, “same as cash” period from the point of sale was 724. Further information is set forth in the following table:

|

|

||

|

FICO Score |

Percentage of originated and |

|

|

<600 |

2.0% |

|

|

600 - 699 |

33.0% |

|

|

700+ |

65.0% |

|

(1) |

Excludes loans for which the obligor did not have a FICO score. For 2017, approximately 1% of our VOI notes receivable related to financing provided to borrowers with no FICO score. |

Collection Policies

Financed VOI sales originated by us typically utilize a note and mortgage. Collection efforts related to these VOI loans are managed by us. Our collectors are incentivized through a performance-based compensation program.

We generally make collection efforts with respect to Vacation Club owners with outstanding loans secured by their VOI by mail, telephone and in certain cases, email (as early as 15 days past due). Telephone contact generally commences when an account is as few as approximately ten days past due. At 30 days past due, we mail a collection

17

letter to the owner, if a U.S. resident, advising that if the loan is not brought current, the delinquency will be reported to a credit reporting agency. At 60 days past due, we mail a letter to the owner advising that he or she may be prohibited from making future reservations for lodging at a resort. At 90 days past due, we stop the accrual of, and reverse previously accrued but unpaid, interest on the note receivable and mail a notice informing the owner that unless the delinquency is cured within 30 days, we will terminate the underlying VOI ownership. If an owner fails to bring the account current within the given timeframe, the loan is defaulted and the owner’s VOI is terminated. In that case, we mail a final letter, typically at approximately 120 days past due, notifying the owner of the loan default and the termination of his or her beneficial interest in the VOI property. Thereafter, we seek to resell the VOI to a new purchaser.

Allowance for Credit Losses

Under vacation ownership accounting rules, we estimate uncollectible VOI notes receivable based on historical amounts for similar VOI notes receivable and do not consider the value of the underlying collateral. We hold large pools of homogeneous VOI notes receivable and assess uncollectibility based on pools of receivables. In estimating future credit losses, we evaluate a combination of factors, including a static pool analysis, the aging of the respective receivables, current default trends, prepayment rates by origination year and the borrowers’ FICO scores.

Substantially all defaulted VOI notes receivable result in the holder of such receivable acquiring the related VOI that secured such receivable, typically soon after default and at little or no cost. The reacquired VOI is then available for resale in the normal course of business.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information about the performance of our notes receivable portfolio.

Sales/Financing of Receivables

Our ability to sell or borrow against our VOI notes receivable has historically been an important factor in meeting our liquidity requirements. The vacation ownership business generally involves sales where a buyer is only required to pay 10% of the purchase price up front, while at the same time selling and marketing expenses related to such sales are primarily cash expenses that exceed the down payment amount. For the year ended December 31, 2017, our sales and marketing expenses totaled approximately 52% of system-wide sales of VOIs, net. Accordingly, having facilities for the sale or hypothecation of VOI notes receivable, along with periodic term securitization transactions, has been a critical factor in meeting our short and long-term cash needs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information about our VOI notes receivable purchase facilities and term securitizations.

Receivables Servicing

Receivables servicing includes collecting payments from borrowers and remitting the funds to the owners, lenders or investors in such receivables, accounting for principal and interest on such receivables, making advances when required, contacting delinquent borrowers, terminating a Vacation Club ownership in the event that defaults are not timely remedied and performing other administrative duties.

We receive fees for servicing our securitized notes receivable and these fees are included as a component of interest income. Additionally, we earn servicing fee income from third-party developers in connection with our servicing of their loan portfolios under certain fee-based services arrangements, which is netted against the cost of our mortgage servicing operations.

18

Our Core Operating and Growth Strategies

Grow VOI sales

Our goal is to utilize our sales and marketing platform to continue our strong history of VOI sales growth through the expansion of existing alliances, continued development of new marketing programs and additional VOI sales to our existing Vacation Club owners. We believe there are a number of opportunities within our existing marketing alliances to drive future growth, including the expansion of our marketing efforts with Bass Pro to include programs focused on Bass Pro’s e-commerce platform. In addition, through our agreement with Choice Hotels, we plan to enhance our marketing program through further penetration of Choice Hotels’ digital and call-transfer programs. In addition to existing programs, we plan to utilize our sales and marketing expertise to continue to identify unique marketing relationships with nationally-recognized brands that resonate with our core demographic. In addition, we actively seek to sell additional VOI points to our existing Vacation Club owners, which typically involve significantly lower marketing costs and have higher conversion rates compared to sales to new customers. We are also committed to continually expanding and updating our sales offices to more effectively convert tours generated from our marketing programs into sales. In addition, we seek to identify high traffic resorts where we believe increased investment in sales office infrastructure will yield strong sales results.

Continue to enhance our Vacation Club experience

We believe our Vacation Club offers owners exceptional value. Our Vacation Club offers owners access to our 43 Club Resorts and 24 Club Associate Resorts in premier vacation destinations, as well as access to approximately 11,000 other hotels and resorts and other vacation experiences, such as cruises, through partnerships and exchange networks. We continuously seek new ways to add value and flexibility to our Vacation Club membership and enhance the vacation experience of our Vacation Club owners, including the addition of new destinations, the expansion of our exchange programs and the addition of new partnerships to offer increased vacation options. We also continuously seek to improve our technology, including websites and applications, to enhance our Vacation Club owners’ experiences. We believe this focus, combined with our high-quality customer service, will continue to enhance the Vacation Club experience, driving sales to new owners and additional sales to existing Vacation Club owners.

Grow our high-margin, cash generating businesses

We seek to continue to grow our ancillary businesses, including resort management, title services and loan servicing. We believe these businesses can grow with little additional investment in infrastructure and potentially produce high-margin revenues.

Increase sales and operating efficiencies across all customer touch-points

We actively seek to improve our operational execution across all aspects of our business. In our sales and marketing platform, we utilize a variety of screening methods and data-driven analyses to attract high-quality prospects to our sales offices in an effort to increase Volume Per Guest (“VPG”), an important measure of sales efficiency. We also continue to test new and innovative methods to generate sales prospects with a focus on increasing cost efficiency. In connection with our management services and consumer financing activities, we will continue to leverage our size, infrastructure and expertise to increase operating efficiency and profitability. In addition, as we expand, we expect to gain further operational efficiencies by streamlining our support operations, such as call centers, customer service, administration and information technology.

Maintain operational flexibility while growing our business

We believe we have built a flexible business model that allows us to capitalize on opportunities and quickly adapt to changing market environments. We intend to continue to pursue growth through a balanced mix of capital-light sales vs. developed VOI sales, sales to new customers vs. sales to existing Vacation Club owners and cash sales vs. financed sales. While we may from time to time pursue opportunities that impact our short-term results, our long-term goal is to achieve sustained growth while maximizing earnings and cash flow.

19

Pursue strategic transactions

As part of our growth strategy, we may seek acquisitions of other VOI companies, resort assets, sales and marketing platforms, management companies and contracts, and other assets, properties and businesses, including where we believe significant synergies and cost savings may be available. We may choose to pursue acquisitions directly or in partnership with third-party developers or others, including pursuant to arrangements where third-party developers purchase the resort assets and we sell the VOIs in the acquired resort on a commission basis. We have a long history of successfully identifying, acquiring and integrating complementary businesses, and we believe our flexible sales and marketing platform enables us to complete these transactions in a variety of economic conditions.

Industry Overview

The vacation ownership, or timeshare, industry is one of the fastest growing segments of the global travel and tourism sector. By purchasing a VOI, the purchaser typically acquires either (i) a fee simple interest in a property (or collection of properties) providing annual usage rights at the owner’s home resort (where the owner’s VOI is deeded), or (ii) an annual or biennial allotment of points that can be redeemed for stays at properties included in the vacation ownership company’s resort network or for other vacation options available through exchange programs. Compared to hotel rooms, vacation ownership units typically offer more spacious floor plans and residential features, such as living rooms, fully equipped kitchens and dining areas. Compared to owning a vacation home in its entirety, the key advantages of vacation ownership products typically include a lower up-front acquisition cost and annual expenses, resort-style features and services and, often, an established infrastructure to exchange usage rights for stays across multiple locations.

The vacation ownership industry was historically highly fragmented, with a large number of local and regional resort developers and operators having small resort portfolios of varying quality. We believe that growth in the vacation ownership industry has been driven by increased interest from resort developers and globally-recognized lodging and entertainment brands, increased interest from consumers seeking flexible vacation options, continued product evolution and geographic expansion. In 2016, more than 9.2 million families (approximately 6.9% of U.S. households) owned at least one VOI and VOI sales have grown 800% over the last 30 years.

While the majority of VOI owners are over the age of 45, new owners are, on average, approximately 5 years younger. VOI owners have an average annual household income of $81,000 and 84% of VOI owners own their own home.

Regulation

The vacation ownership and real estate industries are subject to extensive and complex governmental regulation. We are subject to various federal, state, local and foreign environmental, zoning, consumer protection and other laws, rules and regulations, including those regarding the acquisition, marketing and sale of real estate and VOIs, as well as various aspects of our financing operations. At the federal level, the Federal Trade Commission has taken an active regulatory role through the Federal Trade Commission Act, which prohibits unfair or deceptive acts or unfair competition in interstate commerce. In addition, many states have what are known as “Little FTC Acts” that apply to intrastate activity.

In addition to the laws applicable to our customer financing and other operations discussed below, we are or may be subject to the Fair Housing Act and various other federal laws, rules and regulations. We are also subject to various foreign laws with respect to La Cabana Beach Resort and Casino in Oranjestad, Aruba and Blue Water Resort at Cable Beach in Nassau, Bahamas. Additionally, in the future, VOIs may be deemed to be securities subject to regulation as such, which could have a material adverse effect on our business. The cost of complying with applicable laws and regulations may be significant and we may not maintain compliance at all times with all applicable laws, including those discussed below. Any failure to comply with current or future applicable laws or regulations could have a material adverse effect on us.

Our vacation ownership resorts are subject to various regulatory requirements, including state and local approvals. The laws of most states require us to file a detailed offering statement describing our business and all material aspects of the project and sale of VOIs with a designated state authority. In addition, when required by state law, we provide our VOI purchasers with a public disclosure statement that contains, among other items, detailed information about

20

the applicable resort, the surrounding vicinity and the purchaser’s rights and obligations as a VOI owner. Laws in each state where we sell VOIs generally grant the purchaser of a VOI the right to cancel a purchase contract at any time within a specified rescission period following the earlier of the date the contract was signed or the date the purchaser received the last of the documents required to be provided by us. Most states have other laws that regulate our activities, including real estate licensure requirements, sellers of travel licensure requirements, anti-fraud laws, telemarketing laws, prize, gift and sweepstakes laws, and labor laws.

Under various federal, state and local laws, ordinances and regulations, the owner of real property is generally liable for the costs of removal or remediation of certain hazardous or toxic substances located on or in, or emanating from, the property, as well as related costs of investigation and property damage. These laws often impose liability without regard to whether the property owner knew of the presence of such hazardous or toxic substances. The presence of these substances, or the failure to properly remediate these substances, may adversely affect a property owner’s ability to sell or lease a property or to borrow using the real property as collateral. Other federal and state laws require the removal or encapsulation of asbestos-containing material when such material is in poor condition or in the event of construction, demolition, remodeling or renovation. Other statutes may require the removal of underground storage tanks. Noncompliance with any of these and other environmental, health or safety requirements may result in the need to cease or alter operations or development at a property. In addition, certain state and local laws may impose liability on property developers with respect to construction defects discovered on the property or repairs made by future owners of such property. Under these laws, we may be required to pay for repairs to the developed property. The development, management and operation of our resorts are also subject to the Americans with Disabilities Act.

Our marketing, sales and customer financing activities are also subject to extensive regulation, which can include, but is not limited to: the Truth-in-Lending Act and Regulation Z; the Fair Housing Act; the Fair Debt Collection Practices Act; the Equal Credit Opportunity Act and Regulation B; the Electronic Funds Transfer Act and Regulation E; the Home Mortgage Disclosure Act and Regulation C; the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”); Unfair or Deceptive Acts or Practices and Regulation AA; the Patriot Act; the Right to Financial Privacy Act; the Gramm-Leach-Bliley Act; the Fair and Accurate Credit Transactions Act; and anti-money laundering laws. The Dodd-Frank Act contains significant changes to the regulation of financial institutions and related entities, including the creation of new federal regulatory agencies, and the granting of additional authorities and responsibilities to existing regulatory agencies to identify and address emerging systemic risks posed by the activities of financial services firms. The Consumer Financial Protection Bureau (the “CFPB”) is one such regulatory agency created pursuant to the Dodd-Frank Act. The CFPB’s mandate is to protect consumers by carrying out federal consumer financial laws and to publish rules and forms that facilitate understanding of the financial implications of the transactions consumers enter into. Consistent with this mission, the CFPB amended Regulations X and Z to establish new disclosure requirements and forms pursuant to Regulation Z for most closed-end consumer credit transactions secured by real property. The practical impact upon us is the requirement to use a new Integrated Mortgage Disclosure Statement in lieu of the separate Good Faith Estimate and Closing Statement. No assurance can be given that we will be in compliance with the Dodd-Frank Act or other applicable laws or that compliance with these rules or the promulgation of additional standards by the CFPB will not have an adverse impact on our business. In addition, our term securitization transactions must comply with certain requirements of the Dodd-Frank Act, including risk retention rules.

Our management of, and dealings with, HOAs, including our purchase of defaulted inventory from HOAs in connection with our secondary market arrangements, is subject to state laws and resort rules and regulations, including those with respect to the establishment of budgets and expenditures, rule-making and the imposition of maintenance assessments.