Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PACIFIC PREMIER BANCORP INC | a12-24028_18k.htm |

| EX-2.1 - EX-2.1 - PACIFIC PREMIER BANCORP INC | a12-24028_1ex2d1.htm |

| EX-99.1 - EX-99.1 - PACIFIC PREMIER BANCORP INC | a12-24028_1ex99d1.htm |

Exhibit 99.2

|

|

Acquisition of First Associations Bank Investor Presentation October 15, 2012 1 |

|

|

Forward-Looking Statements and Where to Find Additional Information Forward Looking Statements This investor presentation may contain forward-looking statements regarding Pacific Premier Bancorp, Inc. (“PPBI”), including its wholly owned subsidiary Pacific Premier Bank, First Associations Bank (“FAB”) and the proposed acquisition. These statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such risks and uncertainties include, but are not limited to, the following factors: the expected cost savings, synergies and other financial benefits from the acquisition might not be realized within the expected time frames or at all; governmental approval of the acquisition may not be obtained or adverse regulatory conditions may be imposed in connection with governmental approvals of the acquisition; conditions to the closing of the acquisition may not be satisfied; and the shareholders of FAB may fail to approve the consummation of the acquisition. Annualized, pro forma, projected and estimated numbers in this investor presentation are used for illustrative purposes only, are not forecasts and may not reflect actual results. PPBI and FAB undertake no obligation to revise or publicly release any revision or update to these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made. Notice to FAB Shareholders This investor presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed acquisition transaction, a registration statement on Form S-4 will be filed with the Securities and Exchange Commission (“SEC”) by PPBI. The registration statement will contain a proxy statement/prospectus to be distributed to the shareholders of FAB in connection with their vote on the acquisition. SHAREHOLDERS OF FAB ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION. The final proxy statement/prospectus will be mailed to shareholders of FAB. Investors and security holders will be able to obtain the documents free of charge at the SEC's website, www.sec.gov. In addition, documents filed with the SEC by PPBI will be available free of charge by accessing PPBI’s website at www.ppbi.com or by writing PPBI at 1600 Sunflower Ave., 2nd Floor, Costa Mesa, California 92626, Attention: Investor Relations, or by writing FAB at 12001 N. Central Expressway, Suite 1165, Dallas, Texas 75243, Attention: Corporate Secretary. The directors, executive officers and certain other members of management and employees of PPBI may be deemed to be participants in the solicitation of proxies in favor of the acquisition from the shareholders of FAB. Information about the directors and executive officers of PPBI is included in the proxy statement for its 2012 annual meeting of PPBI shareholders, which was filed with the SEC on April 16, 2012. The directors, executive officers and certain other members of management and employees of FAB may also be deemed to be participants in the solicitation of proxies in favor of the acquisition from the shareholders of FAB. Information about the directors and executive officers of FAB will be included in the proxy statement/prospectus for the acquisition. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed acquisition when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. |

|

|

Transaction Rationale 3 Strategic Rationale Valuable source of long-term low-cost core deposits Improves PPBI’s deposit mix and enhances franchise value Deposit platform and balance sheet liquidity will provide additional funding for PPBI’s continued loan growth Niche depository focused business model serving the homeowners associations (“HOAs”) and HOA management companies nationwide Financially Attractive Pricing multiples below other recent comparable transactions FAB is a highly efficient banking organization with consistent profitability Limited credit risk due to clean balance sheet and small loan portfolio size, which results in a minimal fair value accounting mark Combined company is better positioned to drive long-term earnings per share growth Structure and Team FAB will operate as a separate division of Pacific Premier Bank (“PPB”) PPBI will retain all FAB employees and has entered into employment agreements with key executive officers that will become effective upon consummation of the acquisition Associations, Inc. (“Associa”), the largest HOA management company in the United States, will enter into a five (5) year Depository Services Agreement with PPB upon consummation of the acquisition The largest FAB shareholder and current FAB director, John Carona, is expected to join PPBI’s and PPB’s Board of Directors. Mr. Carona is also the CEO and majority owner of Associa |

|

|

Overview of First Associations Bank 4 Source: SNL Financial FAB regulatory call report data as of 9/30/2012 Overview of First Associations Bank Established in 2007 to serve the banking needs of HOAs and HOA management companies Clientele located in 17 states FAB’s business model is highly efficient and leverages online technology tools that provide HOA management companies the ability to streamline operations through data integration and seamless information reporting Deposit and treasury management products include web based funds management, online ACH services, online homeowner payment options, integrated third party lockbox services and remote deposit capture Relationship with Associa, the largest HOA management company in the United States Meaningful opportunity for PPBI to redeploy FAB’s excess funding, which is currently invested in municipal bonds and mortgage backed securities Balance Sheet (9/30/2012) Assets $356.2 million Securities $313.9 million Gross Loans $18.8 million Noninterest-Bearing Deposits $81.5 million Total Deposits $305.5 million Tangible Common Equity $45.9 million Performance Metrics (9/30/2012) Efficiency Ratio (MRQ) 52.4% Cost of Deposits (MRQ) 0.23% Pre-Tax Return on Average Assets (LTM) 1.37% Pre-Tax Income (LTM) $4.7 million Non-Performing Assets / Total Assets 0.00% Loans / Deposits 6.2% Non-Int. Bearing Deposits / Total Deposits 26.7% Non-CDs / Total Deposits 92.9% Corporate Overview Headquarters Dallas, Texas CEO Michael A. Kowalski Employees (Full Time Equivalent) 12 Corporation Type S-Corporation |

|

|

Transaction Overview Transaction Value: Consideration Detail: Due Diligence: Anticipated Closing: Exchange Ratio: $53.7 million, including consideration payable to FAB common shareholders and option and warrant holders Fixed exchange ratio of 0.646x which would result in 1,279,419 shares of PPBI common stock to be issued to FAB shareholders (2) Late Q4 2012 or early Q1 2013 Completed; including extensive review of securities, loans, deposits and operations $50.2 million payable to FAB common shareholders consisting of approximately 75% cash / 25% PPBI common stock (1) $37.6 million in cash $12.5 million in PPBI common stock (2) $3.5 million in cash payable to FAB option and warrant holders Required Approvals: Customary regulatory approvals and approval of FAB shareholders Transaction value and consideration mix % will change based on the fluctuation in PPBI’s common stock price, the change in the value of FAB’s investment securities portfolio and the total FAB transaction costs The exchange ratio was calculated based on a 5-day average closing PPBI common stock price of $9.80 immediately before announcement of the acquisition Other Considerations: PPB to enter into an amendment to FAB’s current Depository Services Agreement with Associa providing for a five (5) year term 5 (1) (2) |

|

|

Attractive Pro Forma Deposit Franchise 6 Source: PPBI earnings release data and SNL Financial FAB regulatory call report data, each as of 9/30/2012 Note: Pro Forma does not include purchase accounting or merger related adjustments Strengthens PPBI’s deposit franchise with low-cost long-term funding platform (FAB cost of deposits was 0.23% during 2012 Q3) PPBI has $113.5 million CDs that will mature in 2012 Q4, with weighted average cost of 1.05% The acquisition would reduce PPBI’s loan / deposit ratio from 96.5% to pro forma 73.5%, as of 9/30/2012 PPBI (9/30/2012) FAB (9/30/2012) Pro Forma (9/30/2012) Non-Interest-Bearing Demand 24.4% NOW & Int.-Bearing Demand 6.5% MMDA 25.8% Savings 6.7% Retail CDs 31.5% Jumbo CDs 5.1% Non-Interest-Bearing Demand 23.6% NOW & Int.-Bearing Demand 1.3% MMDA 19.5% Savings 9.0% Retail CDs 39.8% Jumbo CDs 6.8% 9/30/2012 Balance ($000s) % of Total Deposits Non-Interest-Bearing Demand 81,448 $ 26.7% NOW & Int.-Bearing Demand 66,607 $ 21.8% MMDA 135,712 $ 44.4% Savings - $ 0.0% Retail CDs 21,453 $ 7.0% Jumbo CDs 255 $ 0.1% Total Deposits 305,475 $ 100.0% Non-CDs 283,767 $ 92.9% CDs 21,708 $ 7.1% Cost of Deposits 0.23% Cost of Interest-Bearing Deposits 0.32% Gross Loans / Deposits 6.2% Non-Interest-Bearing Demand 26.7% NOW & Int.-Bearing Demand 21.8% MMDA 44.4% Retail CDs 7.0% Jumbo CDs 0.1% 9/30/2012 Balance ($000s) % of Total Deposits Non-Interest-Bearing Demand 211,410 $ 23.6% NOW & Int.-Bearing Demand 11,684 $ 1.3% MMDA 174,375 $ 19.5% Savings 80,419 $ 9.0% Retail CDs 356,808 $ 39.8% Jumbo CDs 61,174 $ 6.8% Total Deposits 895,870 $ 100.0% Non-CDs 477,888 $ 53.3% CDs 417,982 $ 46.7% Cost of Deposits 0.64% Cost of Interest-Bearing Deposits 0.84% Gross Loans / Deposits 96.5% 9/30/2012 Balance ($000s) % of Total Deposits Non-Interest-Bearing Demand 292,858 $ 24.4% NOW & Int.-Bearing Demand 78,291 $ 6.5% MMDA 310,087 $ 25.8% Savings 80,419 $ 6.7% Retail CDs 378,261 $ 31.5% Jumbo CDs 61,429 $ 5.1% Total Deposits 1,201,345 $ 100.0% Non-CDs 761,655 $ 63.4% CDs 439,690 $ 36.6% Cost of Deposits 0.53% Cost of Interest-Bearing Deposits 0.71% Gross Loans / Deposits 73.5% |

|

|

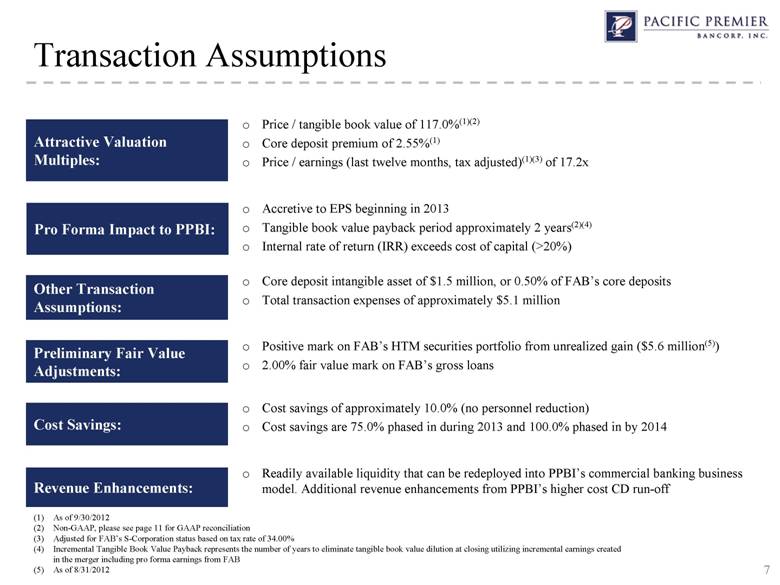

Transaction Assumptions 7 Attractive Valuation Multiples: Preliminary Fair Value Adjustments: Revenue Enhancements: Price / tangible book value of 117.0%(1)(2) Core deposit premium of 2.55%(1) Price / earnings (last twelve months, tax adjusted)(1)(3) of 17.2x Other Transaction Assumptions: Cost Savings: Core deposit intangible asset of $1.5 million, or 0.50% of FAB’s core deposits Total transaction expenses of approximately $5.1 million Positive mark on FAB’s HTM securities portfolio from unrealized gain ($5.6 million(5)) 2.00% fair value mark on FAB’s gross loans Cost savings of approximately 10.0% (no personnel reduction) Cost savings are 75.0% phased in during 2013 and 100.0% phased in by 2014 Readily available liquidity that can be redeployed into PPBI’s commercial banking business model. Additional revenue enhancements from PPBI’s higher cost CD run-off (1) As of 9/30/2012 (2) Non-GAAP, please see page 11 for GAAP reconciliation (3) Adjusted for FAB’s S-Corporation status based on tax rate of 34.00% (4) Incremental Tangible Book Value Payback represents the number of years to eliminate tangible book value dilution at closing utilizing incremental earnings created in the merger including pro forma earnings from FAB Pro Forma Impact to PPBI: Accretive to EPS beginning in 2013 Tangible book value payback period approximately 2 years(2)(4) Internal rate of return (IRR) exceeds cost of capital (>20%) (5) As of 8/31/2012 |

|

|

Pro Forma Capital Ratios 8 (1) Base merger assumptions for FAB as identified on previous slides (2) Non-GAAP, please see page 11 for GAAP reconciliation Financial assumptions for PPBI and FAB as of 9/30/2012 Includes pro forma scenario for PPBI with base merger assumptions for FAB Pro forma PPBI will remain well capitalized PPBI Pro Forma With FAB (1) Tangible Common Equity Ratio(2) 8.94% 7.25% Leverage Ratio 9.58% 7.68% Tier-1 Ratio 11.09% 10.61% Risk Based Capital Ratio 11.94% 11.38% |

|

|

Closing Thoughts 9 Strategically and financially compelling acquisition Provides PPBI long-term low-cost core deposits Substantial synergies with FAB’s deposit funding model and PPBI’s commercial banking model Liquidity from FAB will fund future loan growth and replace high rate CD runoff Minimal credit risk Merger of efficient, profitable institutions with compatible cultures All members of FAB management team are expected to be retained Effective use of capital, enhancing both profitability and shareholder value |

|

|

Appendix 10 |

|

|

Non-GAAP Financial Measures 11 Tangible common equity and tangible book value per share are non-GAAP financial measures derived from GAAP-based amounts. We calculate tangible common equity by excluding the balance of intangible assets from common stockholders’ equity. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which we calculate by dividing common stockholders’ equity by common shares outstanding. We believe that this is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. A reconciliation of the non-GAAP measures of tangible common equity and tangible book value per share to the GAAP measures of common stockholder’s equity and book value per share is set forth. PPBI (1) Pro Forma With FAB (2) Common Stockholders’ Equity $99,886 $109,367 Less: Intangible Assets $2,703 $7,840 Tangible Common Equity $97,183 $101,527 Book Value per Share $9.66 $9.41 Less: Intangible Assets per Share $0.26 $0.67 Tangible Book Value per Share $9.40 $8.74 Total Assets $1,089,336 $1,409,139 Less: Intangible Assets $2,703 $7,840 Tangible Assets $1,086,633 $1,401,299 Tangible Common Equity Ratio 8.94% 7.25% (1) As of 9/30/2012 (2) Base merger assumptions for FAB as identified on previous slides, as of 9/30/2012 Note: Dollars in thousands except per share |