Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VWR Funding, Inc. | d423649d8k.htm |

Exhibit 99.1

| Deutsche Bank Leveraged Finance Conference October 10, 2012 VWR Confidential |

| Safe Harbor / Non-GAAP Measures Any statements made in this presentation about future operating results or other future events are forward-looking statements under the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from such forward-looking statements. A discussion of factors that could cause actual results or events to vary is contained in the Appendix to this presentation and in the SEC filings of VWR International's parent company, VWR Funding, Inc. During this presentation, we will be referring to certain financial measures not prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"), including Adjusted EBITDA and Net Debt. Reconciliations of these non-GAAP financial measures to the most closely comparable GAAP presentation are contained in the Appendix to this presentation. VWR Confidential 2 |

| Company Overview Net Sales by Segment (1) 24% 21% 3% 52% VWR Confidential 3 A leader in the global lab supply industry providing distribution services to a highly fragmented supply chain Provides next-day delivery to most locations worldwide from 30 strategically located distribution centers Products distributed include chemicals, glassware, equipment, instruments, protective clothing and other assorted laboratory products Provides value-added services to top customers including managing on-site storerooms, providing technical services and consolidating third party spending Note: Net Sales by segment and Net Sales by product is based on 2011A financial statements (1) Asia Pacific and North America combined for reporting purposes VWR Overview |

| A Leader in Attractive Laboratory Supply Market VWR Confidential Favorable growth characteristics: 2% - 5% revenue growth per year Favorable competitive structure: Leading position in key global markets Highly fragmented industry with substantial room for consolidation Customers' increasing focus on: Efficient, cost effective procurement Reduced investment Complementary services The research world is changing: Scale and global reach matter $36 Billion Global Lab Supply Industry Stable & attractive industry characteristics with promising growth prospects Source: Trade association data and management estimates 16% 36% 18% 18% 12% 16% 36% 18% 18% 12% 4 |

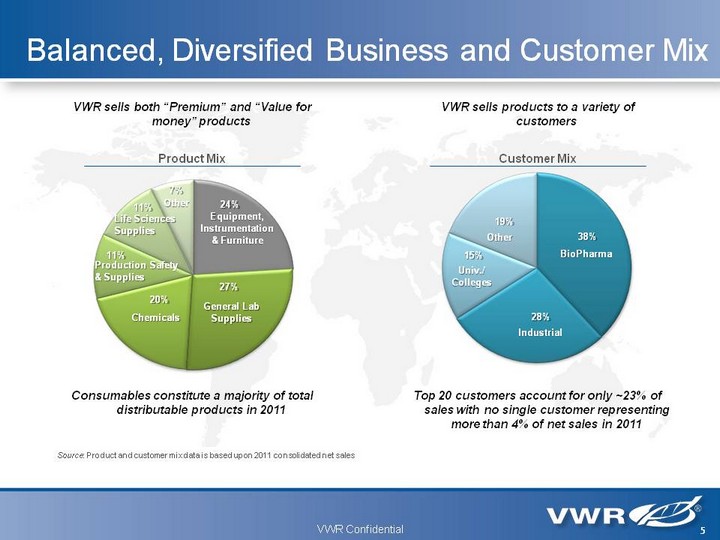

| Balanced, Diversified Business and Customer Mix VWR Confidential Chemicals 20% General Lab Supplies 27% Equipment, Instrumentation & Furniture 24% Production Safety & Supplies 11% Life Sciences Supplies 7% Other 11% BioPharma 38% Industrial 28% Univ./ Colleges 15% Other 19% Product Mix Customer Mix 5 VWR sells both "Premium" and "Value for money" products VWR sells products to a variety of customers Consumables constitute a majority of total distributable products in 2011 Top 20 customers account for only ~23% of sales with no single customer representing more than 4% of net sales in 2011 Source: Product and customer mix data is based upon 2011 consolidated net sales |

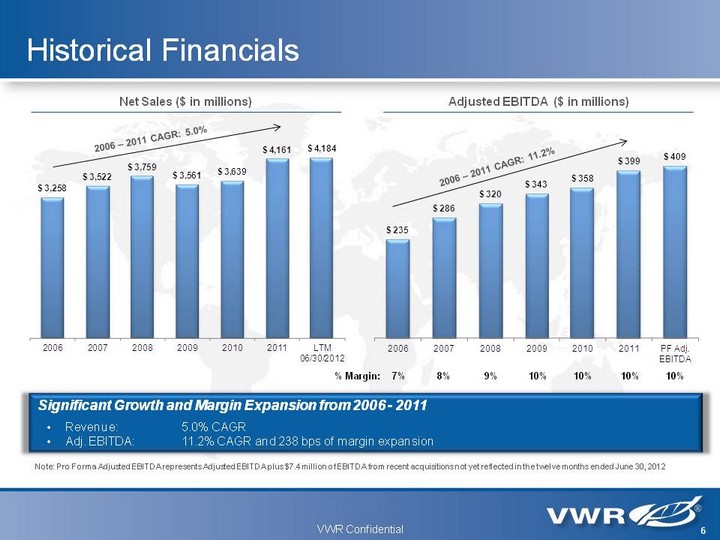

| Net Sales ($ in millions) Adjusted EBITDA ($ in millions) Historical Financials % Margin: 7% 8% 9% 10% 10% 10% 10% 2006 - 2011 CAGR: 5.0% 2006 - 2011 CAGR: 11.2% Significant Growth and Margin Expansion from 2006 - 2011 Revenue: 5.0% CAGR Adj. EBITDA: 11.2% CAGR and 238 bps of margin expansion VWR Confidential 6 Note: Pro Forma Adjusted EBITDA represents Adjusted EBITDA plus $7.4 million of EBITDA from recent acquisitions not yet reflected in the twelve months ended June 30, 2012 |

| Manuel Brock-Benz appointed interim CEO Manuel has been with the company many years and is well suited to lead the company through its next phase of growth Anticipate no changes to existing strategy, and we will continue our goal to deleverage the company Recent Acquisition Sovereign Group: A distributor of lab products with distribution centers and sales organizations in Brazil and Argentina. KLEN International's Mining Business: Based in Perth Australia, manufactures and distributes products used by labs that serve the precious metals mining industry Recent Highlights VWR Confidential Recent Financing Transactions April 2012 - Amend & Extend: Amended Senior Secured Credit Facility & Extended the maturity on a portion of the facilities Of the $250M revolving credit commitments, $241.25 was converted into extended revolving credit commitments. Interest on the extended commitments is currently LIBOR +375 and the final maturity is the earlier of, April 3, 2016 or 91 days prior to the non-extended term loan maturity date Obtained a $243.7 million extension of the $598 USD term loan facility (interest LIBOR +425) and a €481.2 million extension of the € 583.5 EUR term loan facility (interest LIBOR +450) The final maturity of the extended term loans is April 3, 2017 September 2012 - Senior Note Refinancing: Refinanced the $713M 10.25% senior notes due 2015 with $750M 7.25% new senior notes maturing 2017 7 Note: Proforma for the Senior note refinancing |

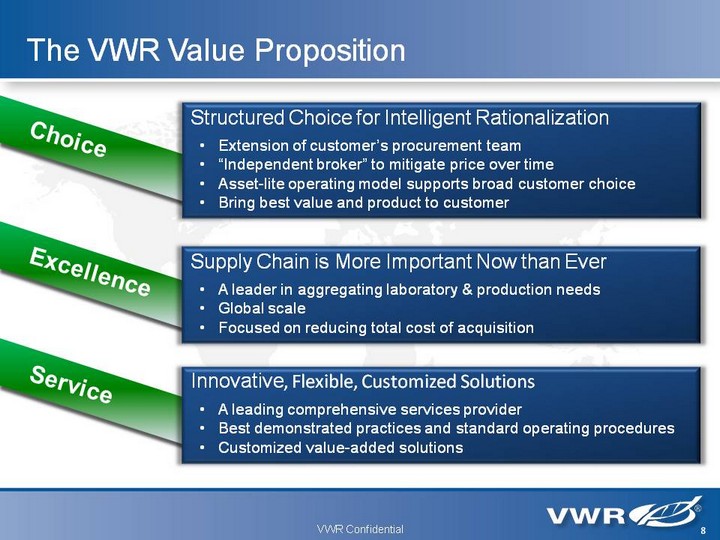

| The VWR Value Proposition Supply Chain is More Important Now than Ever A leader in aggregating laboratory & production needs Global scale Focused on reducing total cost of acquisition Innovative, Flexible, Customized Solutions A leading comprehensive services provider Best demonstrated practices and standard operating procedures Customized value-added solutions Choice Structured Choice for Intelligent Rationalization Extension of customer's procurement team "Independent broker" to mitigate price over time Asset-lite operating model supports broad customer choice Bring best value and product to customer Excellence Service 8 VWR Confidential |

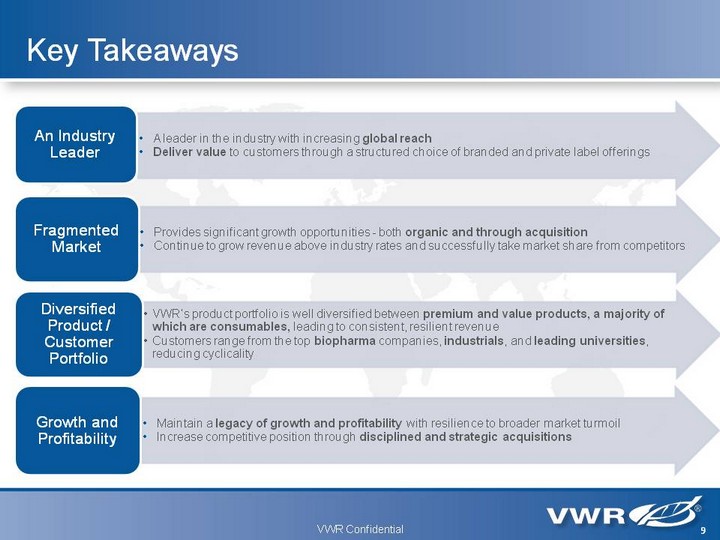

| Key Takeaways VWR Confidential 9 |

| VWR Confidential Key Investment Highlights 10 |

| Key Investment Highlights Leader in the Attractive Laboratory Supply Market Balanced and Diversified Business and Customer Mix Unparalleled Global Footprint Solid Organic Growth Opportunities Proven Track Record of Acquisitions and Successful Integrations Strong De-Leveraging Profile Experienced Management Team VWR Confidential 11 |

| Unparalleled Global Footprint Approximately 8,200 employees around the World 4,100 in NA 3,100 in EU 1,000 in Asia-Pac Geographical range at MDP buyout Geographic range from acquisitions since 2007 Export territory (ex-embargoed countries) 12 Distribution Centers In 2011, aggregate net sales from operations in Germany, France, the UK, Belgium and Switzerland comprised 65% of total European Lab net sales while aggregate net sales from operations in Spain, Italy, Ireland and Portugal comprised only 11% of total European Lab net sales VWR Confidential |

| Proven Track Record of Acquisitions and Successful Integrations 13 VWR Confidential Year Acquisitions Type of Acquisition 2007 Bie & Berntsen Tuck-In 2007 Omnilabo BV Tuck-In 2008 Jencons Tuck-In 2008 Spektrum New Market 2008 Omnilab AG Tuck-In 2009 X-treme Geek Tuck-In / Product Growth 2009 OneMed Lab Tuck-In 2010 Labart New Market 2010 ANZ Lab New Market 2011 AMRESCO Product Growth 2011 Alfalab Tuck-In 2011 Trenka Product Growth 2011 BioExpress Tuck-In 2011 Anachemia New Market / Product Growth 2011 LabPartner New Market 2011 PBI Tuck-In 2012 VITRUM New Market 2012 basan Product Growth/ New Market VWR has successfully acquired and integrated $313 million of acquisitions since 2007 Existing geographic range |

| VWR Confidential Strong De-Leveraging Profile Net Debt / Adjusted EBITDA (1) Adjusted EBITDA / Cash Interest (1) Available Liquidity (2) Total Debt / (Adjusted EBITDA - Capex) (1) ($ in mm) (1) LTM 6/30/12 values based on Pro Forma Adjusted EBITDA of $408.7mm. LTM 6/30/12 Net and Total Debt values are not pro forma for new debt offering (2) Available liquidity = Cash + revolver capacity+ AR Facility Availability 9.5x 8.4x 7.7 x 7.1x 6.4x 6.3x Total: Senior: 14 |

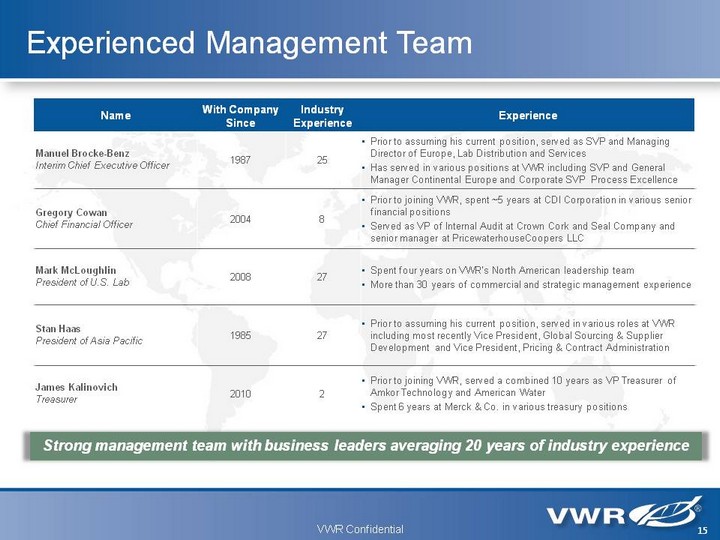

| 15 Experienced Management Team Name With Company Since Industry Experience Experience Manuel Brocke-Benz Interim Chief Executive Officer 1987 25 Prior to assuming his current position, served as SVP and Managing Director of Europe, Lab Distribution and Services Has served in various positions at VWR including SVP and General Manager Continental Europe and Corporate SVP Process Excellence Gregory Cowan Chief Financial Officer 2004 8 Prior to joining VWR, spent ~5 years at CDI Corporation in various senior financial positions Served as VP of Internal Audit at Crown Cork and Seal Company and senior manager at PricewaterhouseCoopers LLC Mark McLoughlin President of U.S. Lab 2008 27 Spent four years on VWR's North American leadership team More than 30 years of commercial and strategic management experience Stan Haas President of Asia Pacific 1985 27 Prior to assuming his current position, served in various roles at VWR including most recently Vice President, Global Sourcing & Supplier Development and Vice President, Pricing & Contract Administration James Kalinovich Treasurer 2010 2 Prior to joining VWR, served a combined 10 years as VP Treasurer of Amkor Technology and American Water Spent 6 years at Merck & Co. in various treasury positions Strong management team with business leaders averaging 20 years of industry experience VWR Confidential |

| 16 Appendix VWR Confidential |

| Varietal Distribution Holdings, LLC (Holdings) VWR Investors, Inc. (Parent) VWR Funding, Inc. (Issuer) VWR International, LLC VWR International Holdings, Inc. Domestic Subsidiaries International Subsidiaries Summary Corporate Structure 17 VWR Confidential |

| A-1 Appendix A-1 Forward-Looking Information Statement All statements included in or made during this presentation other than statements of historical fact may constitute forward-looking statements within the meaning of the federal securities laws. Although we believe that our assumptions made in connection with the forward-looking statements are reasonable, there can be no assurances that the assumptions and expectations will prove to be correct. The following are among the factors that could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements: actions by, and our ability to maintain existing business relationships and practices with, suppliers, customers, carriers and other third parties; loss of any of our key executive officers; our ability to consummate and integrate potential acquisitions; the effect of political, economic and financial market conditions, inflation and interest rates worldwide; the effect of changes in laws and regulations, including changes in accounting standards, trade, tax, price controls and other regulatory matters; increased competition from other companies in our industry and our ability to retain or increase our market shares in the principal geographical areas in which we operate; foreign currency exchange rate fluctuations; and our ability to generate sufficient funds to meet our debt obligations, capital expenditure program requirements, ongoing operating costs, acquisition financing and working capital needs. Any such forward-looking statements should be considered in light of such important factors and in conjunction with VWR Funding, Inc.'s (the "Company") SEC filings, including its Annual Report on Form 10- K for the year ended December 31, 2011 VWR Confidential |

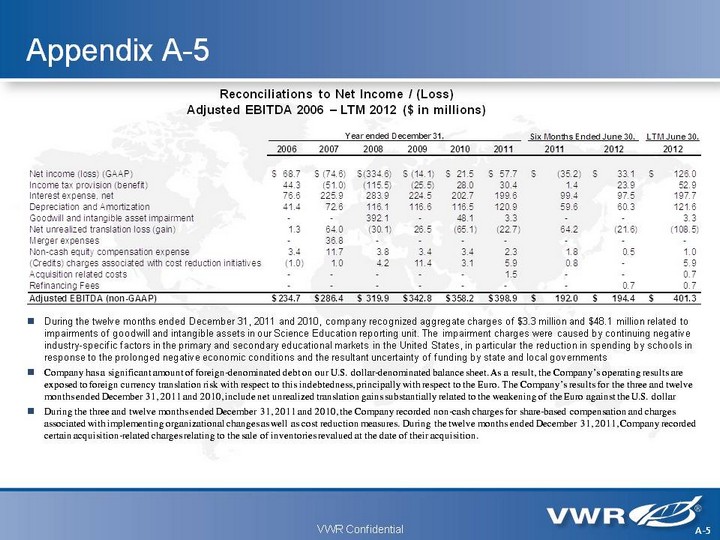

| A-2 Appendix A-2 This presentation contains a discussion of certain financial measures which are not in conformity with generally accepted accounting principles in the United States of America ("GAAP"), as described below. References to "Adjusted EBITDA" This presentation contains a discussion of earnings before interest, taxes, depreciation and amortization ("EBITDA"), as adjusted for certain items described below ("Adjusted EBITDA"). Adjusted EBITDA is a non-GAAP financial measure, and should not be considered as an alternative to net income (loss) or any other GAAP measure of performance or liquidity. Net income (loss) is the most comparable GAAP measure of our operating results presented in the Company's condensed consolidated financial statements. The table presented on Appendix A-5 reconciles Adjusted EBITDA to net income (loss) for the periods covered in this presentation. Our calculation of Adjusted EBITDA eliminates the effect of charges primarily associated with financing decisions, tax regulations and capital investments and certain other items as further described on Appendix A-5. Adjusted EBITDA is a key financial metric used by the Company's investors and management to evaluate and measure the Company's operating performance. VWR Confidential |

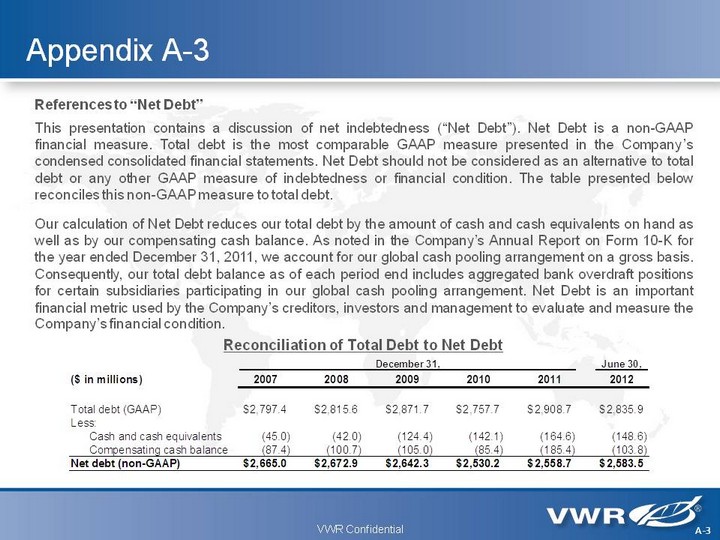

| Appendix A-3 References to "Net Debt" This presentation contains a discussion of net indebtedness ("Net Debt"). Net Debt is a non-GAAP financial measure. Total debt is the most comparable GAAP measure presented in the Company's condensed consolidated financial statements. Net Debt should not be considered as an alternative to total debt or any other GAAP measure of indebtedness or financial condition. The table presented below reconciles this non-GAAP measure to total debt. Our calculation of Net Debt reduces our total debt by the amount of cash and cash equivalents on hand as well as by our compensating cash balance. As noted in the Company's Annual Report on Form 10-K for the year ended December 31, 2011, we account for our global cash pooling arrangement on a gross basis. Consequently, our total debt balance as of each period end includes aggregated bank overdraft positions for certain subsidiaries participating in our global cash pooling arrangement. Net Debt is an important financial metric used by the Company's creditors, investors and management to evaluate and measure the Company's financial condition. Reconciliation of Total Debt to Net Debt A-3 VWR Confidential |

| Appendix A-4 References to "Net Leverage" Management refers to the ratio of Net Debt to Adjusted EBITDA for the last twelve month period as its "Net Leverage" as of a point in time. A financial ratio is not itself a non-GAAP measurement but its calculation includes various non-GAAP measures discussed in Appendix A-2 and A-3. The table below depicts the calculation of Net Leverage for each of the periods referred to in this presentation. A-4 VWR Confidential |

| Appendix A-5 Reconciliations to Net Income / (Loss) Adjusted EBITDA 2006 - LTM 2012 ($ in millions) During the twelve months ended December 31, 2011 and 2010, company recognized aggregate charges of $3.3 million and $48.1 million related to impairments of goodwill and intangible assets in our Science Education reporting unit. The impairment charges were caused by continuing negative industry-specific factors in the primary and secondary educational markets in the United States, in particular the reduction in spending by schools in response to the prolonged negative economic conditions and the resultant uncertainty of funding by state and local governments Company has a significant amount of foreign-denominated debt on our U.S. dollar-denominated balance sheet. As a result, the Company's operating results are exposed to foreign currency translation risk with respect to this indebtedness, principally with respect to the Euro. The Company's results for the three and twelve months ended December 31, 2011 and 2010, include net unrealized translation gains substantially related to the weakening of the Euro against the U.S. dollar During the three and twelve months ended December 31, 2011 and 2010, the Company recorded non-cash charges for share-based compensation and charges associated with implementing organizational changes as well as cost reduction measures. During the twelve months ended December 31, 2011, Company recorded certain acquisition-related charges relating to the sale of inventories revalued at the date of their acquisition. A-5 VWR Confidential |