Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED SURGICAL PARTNERS INTERNATIONAL INC | d422817d8k.htm |

October 2012

Exhibit 99.1 |

2

SAFE HARBOR STATEMENT

This presentation contains forward-looking statements,

including those regarding United Surgical Partners

International, Inc. and the services it provides. Investors

are cautioned not to place an undue reliance on these

forward-looking statements, which will speak only as of

the date of this presentation. United Surgical Partners

International, Inc. undertakes no obligation to publicly

revise these forward-looking statements. |

3

NON-GAAP MEASUREMENT

We

have

used

the

non-GAAP

financial

measurement

term

“EBITDA.”

EBITDA

is calculated as operating income plus net gain (loss) on deconsolidations,

disposals, impairments and depreciation and amortization. USPI uses EBITDA

and EBITDA less noncontrolling interests as analytical indicators for

purposes of allocating resources and assessing performance. EBITDA is

commonly used as an analytical indicator within the health care industry and

also serves as a measure of leverage

capacity

and

debt

service

ability.

EBITDA

should

not

be

considered

as

a

measure of financial performance under generally accepted accounting principles,

and the items excluded from EBITDA could be significant components in

understanding and assessing financial performance.

Because EBITDA is not a measurement determined in accordance with

generally

accepted

accounting

principles

and

is

thus

susceptible

to

varying

calculation methods, EBITDA as presented by USPI may not be comparable to

similarly titled measures of other companies. |

4

$2.0+bn

of

revenues

under

management

–

200+

facilities

that

will

perform

over

900,000

cases

by over 8,800 physician utilizers

High quality, low cost provider of surgical services

Leading operator

in an attractive

industry segment

Proven management

team

Attractive business

and payor mix

KEY HIGHLIGHTS

High margin, elective procedures with over half of revenue from orthopedic

specialties 75% private insurance; operating discipline yields bad debt

expense of ~2% of revenues Two-thirds of our facilities are owned in a

partnership with and partially owned by various not- for-profit

healthcare systems (hospital partners) Provides long-term strategic

stability in the market place with strong brand reputation and

stability

Working

with

existing

partners

(physician

and

hospitals)

to

grow

market

share

and

enhance

strategic

positioning

Adjusted EBITDA CAGR of 10% from 2007 to 2011

Cumulative Free Cash Flow of $229 million from 2009 to 2011

June YTD 2012 EBITDA up 9% to $96m from $89m in 2011

Majority of USPI’s senior management has been with the Company over 10

years Consistent financial

performance

Focused on key

strategic markets with

significant share

Unique JV

partnership

strategy

1.

Consolidated

Adjusted

EBITDA

less

noncontrolling

interest

2.

Consolidated FCF calculated as adjusted EBITDA less capital expenditures, cash

interest, cash taxes and change in working capital (defined as increases

(decreases) in cash from changes in operating assets and liabilities, net effects from purchases of new businesses)

1

2 |

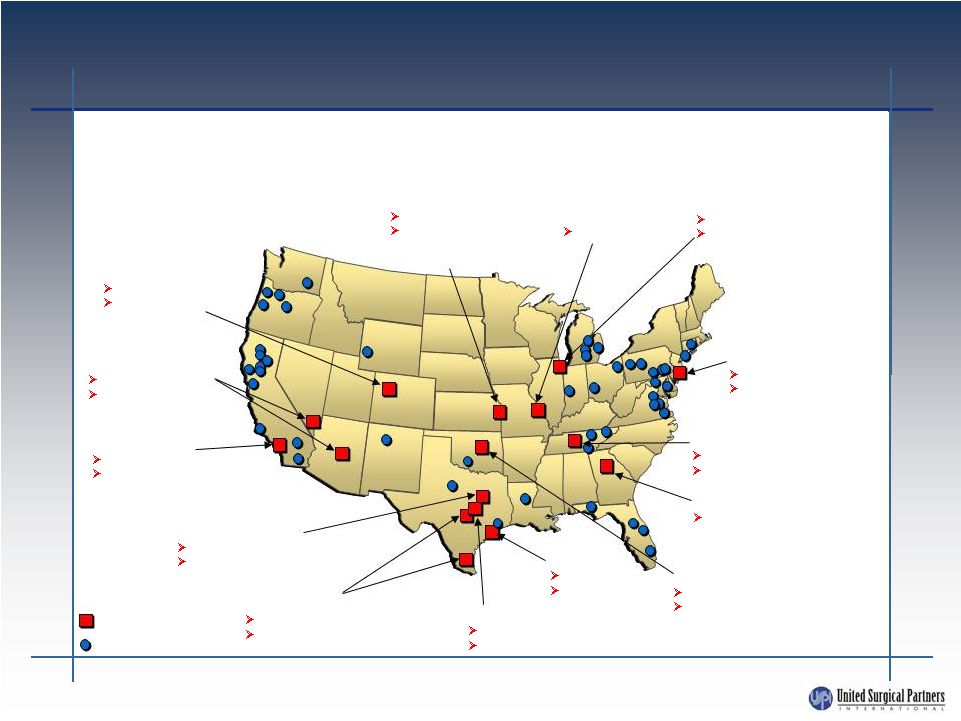

5

KEY MARKETS

Major Market

Facilities

USPI operates 204 facilities in 25 states

Denver

6 facilities

Centura Health

Partnership

Oklahoma City

1 facility

INTEGRIS Health

Partnership

St. Louis

18 facilities

New Jersey

10 facilities

Meridian Health

Partnership

Nashville

22 facilities

St. Thomas Partnership

Atlanta

6 facilities

Houston

19 facilities

Memorial

Hermann

Partnership

Austin

4 facilities

Seton Partnership

San Antonio/Corpus Christi

3 facilities

CHRISTUS Health Partnership

Dallas/Ft. Worth

30 facilities

Baylor Health Care

System Partnership

Phoenix/Las Vegas

11 facilities

Dignity Health

Partnership

Los Angeles

6 facilities

Dignity Health

Partnership

Kansas City

6 facilities

North Kansas City

Hospital Ascension

Partnership

Chicago

5 facilities

NorthShore University

HealthSystem, Adventist

Partnership |

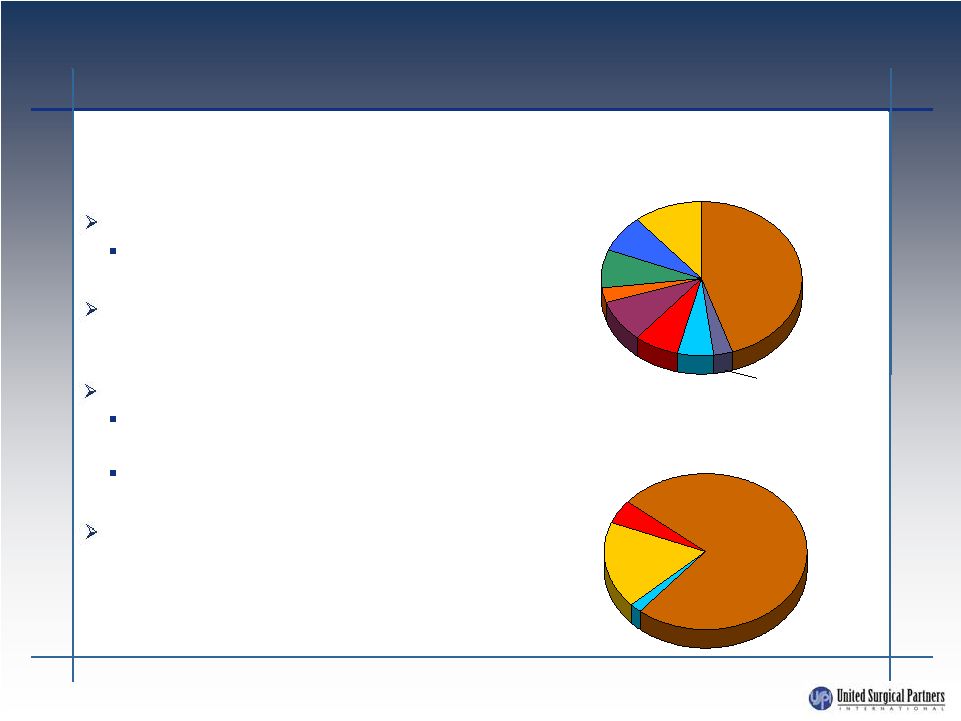

6

FAVORABLE REVENUE AND PAYOR

MIX

High margin, elective procedures

56% of revenue mix from orthopedic

and pain management

Diversification of specialties insulates USPI

from negative utilization and specialty pricing

changes

75% private insurance

Insurance companies favor low cost

providers

Modest exposure to government

reimbursement fluctuations

Reliable payors and operating discipline yields

bad debt expense of ~2% of revenues and

receivable days outstanding is under 35 days

Low risk cash flows from high margin

specialties and reliable payors:

Orthopedic

Gynecology

ENT

GI

Cosmetic

Ophthalmology

Medical/Other

Pain Mgmt

11%

11%

45%

45%

3%

3%

6%

6%

7%

7%

9%

9%

8%

8%

3%

3%

8%

8%

2011 U.S. Revenue Mix

Private

Insurance

Self-pay

18%

18%

75%

75%

2%

2%

2011 U.S. Payor Mix

Government

General

5%

5%

Other |

7

STRONG FINANCIAL AND OPERATING

PERFORMANCE POST LBO

72 acquisitions

20 de novo facility development

15 new Health System Partners

Facility revenue CAGR of 15% from 2006 to 2011

Positive each of the past 5 years

Same facility revenue + 6% for 2011

Same facility revenue +6% for first half of 2012

Facility EBITDA CAGR of 14% from 2006 to 2011

Same facility margin increased 34 bps to 31.6% in 2011

25% SWB as a % of revenue

3% G&A as a % of system-wide revenue

Installed decision support system

Improved quality management system

EHR Investment

30 facilities divested

75% of revenue from top 10 markets

Expansion

Facility revenue growth

Facility EBITDA margin

Cost management

System enhancements

Portfolio management |

8

U.S. INDUSTRY OVERVIEW

ASCs have been widely successful and are a significant presence in

the U.S. healthcare delivery system

Advantages in patient safety and physician efficiency are meaningful

Significant savings to patients, government and commercial payors

Typically a savings to commercial insurers

Medicare savings >40%

Medicare beneficiary savings >50%

Able to reduce overall healthcare costs and manage need for surgical

services in an integrated care environment

Industry poised for consolidation

Top ten companies own less than 20%

Growth of new facilities has slowed in recent years |

9

FRAGMENTED MARKET

Further consolidation likely within the industry and USPI is well-positioned

to capitalize

There are over 375 surgery center chains that own 2 or more ASCs.

Top ten companies still own less than 20%

Some ASCs and ASC companies choosing to sell in face of current headwinds

From

2000

–

2009,

the

percentage

of

ASCs

owned

by

a

multi-facility

chain

increased from 22% to 35%

Source: SDI’s Outpatient Surgery Center Profiling Solution

Multi-facility

Independent

USPI facilities

2009

6,181

2,170

(35%)

4,011

(65%)

2008

5,876

2,136

(36%)

3,740

(64%)

2006

5,349

1,341

(25%)

4,008

(75%)

2004

3,957

984

(25%)

2,973

(75%)

2002

3,570

787

(22%)

2,783

(78%)

2000

3,172

704

(22%)

2,468

(78%)

49

64

87

141

161

165 |

POSITIONED FOR REFORM

OPPORTUNITIES

Post-reform, positioned to play an important role in managing increased need

for surgical services due to coverage of previously uninsured lives

Health System Partnerships

Physician

Partners

Professional Management

USPI is proven,

trusted partner

USPI involvement

can alleviate

historical distrust of

hospitals

USPI can help

provide targeted

solutions for

strategic

positioning

JV model in place

Commitment to highest level of quality service

Comfort regarding proper utilization of brand

Ability to assist with out-of-hospital strategies

Proven ability to execute and operate low

cost, high quality facilities

Proven ability in managing professional

partnerships

Opportunities

for USPI to

assist with

enhancement

of strategic

network

capabilities

Access to

Capital

In a rapidly

changing

environment,

ability to enhance

speed to market

with new models

where there are

capital

constraints

10 |

11

HEALTHCARE SYSTEM PARTNERS

Benefits

to

Healthcare

Systems

Leverage USPI’s operational expertise

and singular focus

Provides a strategy to promote

physician alignment and strategic

network capabilities

Provides defensive mechanism to

maintain short-stay surgical business

Provides capital and spreads risk

through USPI and physicians’

investment

Provides an opportunity to expand in

new markets at lower capital outlay

than a hospital

Benefits to USPI

Provides long-term strategic

stability in the marketplace

Provides brand, image,

reputation and credibility

Accelerates growth

Enhances relationships with

managed care payors

143 facilities are in a partnership with a healthcare system

|

12

HEALTHCARE SYSTEM PARTNERS

USPI’s strategy of partnering with not-for-profit healthcare

systems aligns the Company’s facilities with strong

networks of physicians and hospitals that are prominent in their

communities and known for providing high quality care

|

13

GROWTH STRATEGY

Work with existing partners (physicians and hospitals) to grow market

share and enhance strategic positioning

Poised to react to current economic conditions and legislative

changes

Acquisition of troubled facilities

Selective acquisition of strong facilities

Selective de novo development

Selective acquisition of multi-facility companies

Selectively enter new markets with existing or new partners

Attractive demographics and/or payor characteristics

Prominent health system that embraces physician

alignment

strategy

Prominent physicians who are influential in the market

|

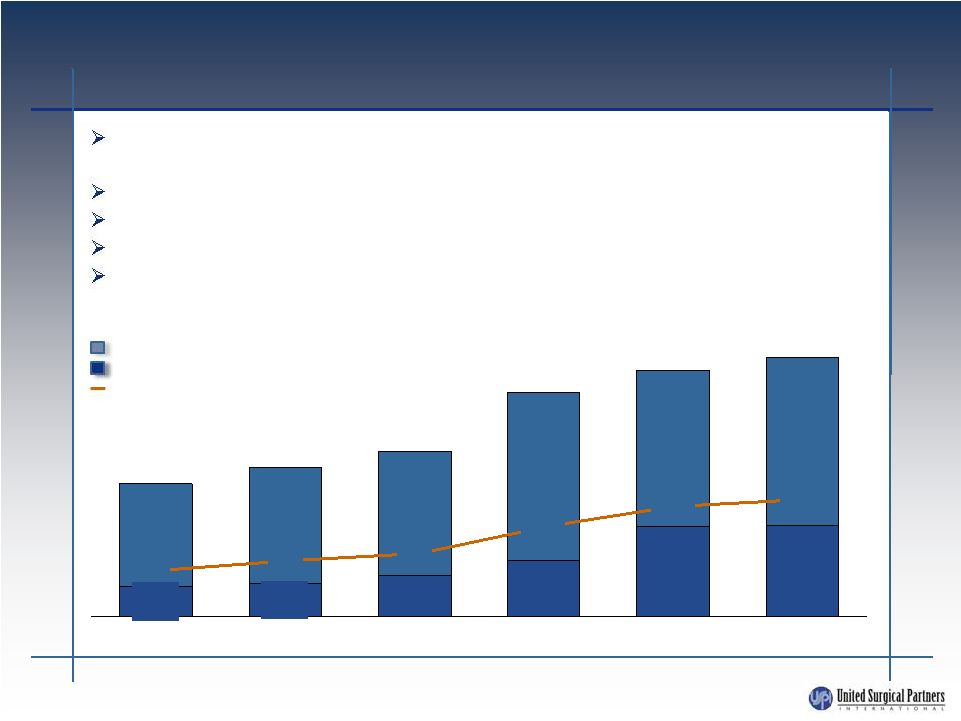

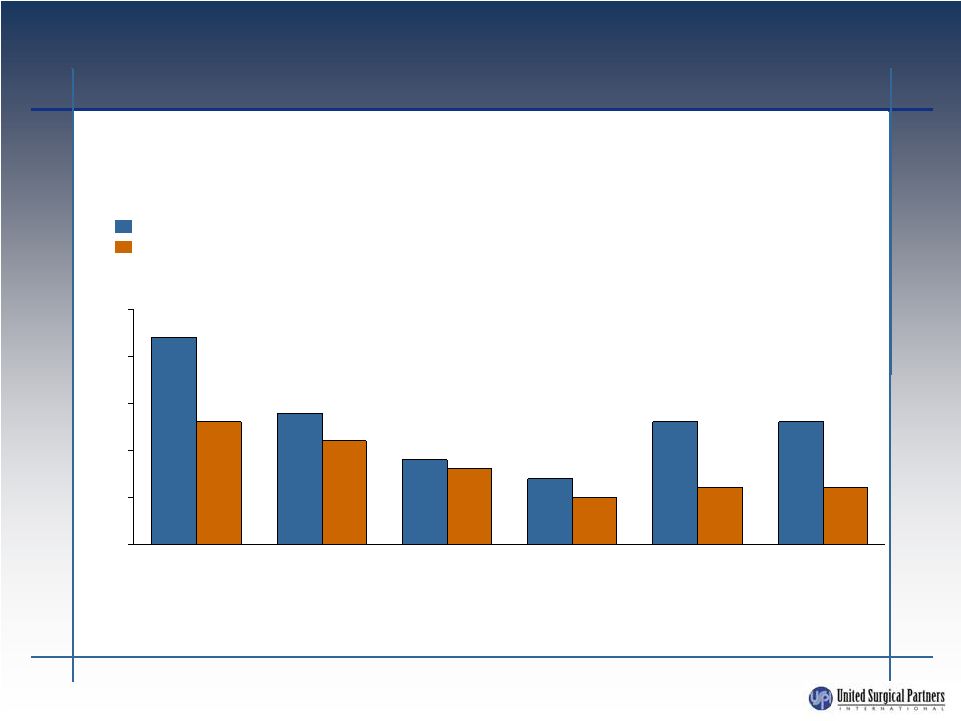

14

SUSTAINED REVENUE GROWTH

Systemwide revenue growth and U.S. same facility revenue growth

U.S.

Facilities

operated

152

161

165

185

200

202

13%

13%

7%

9%

14%

22%

6%

6%

5%

8%

11%

13%

0%

5%

10%

15%

20%

25%

2007

2008

2009

2010

2012

YTD

2011

U.S. same facility revenue growth

Systemwide revenue growth |

15

U.S. ADJUSTED EBITDA BRIDGE

Note: See last page for Footnotes to U.S. Adjusted EBITDA Bridge

Unaudited Pro Forma

Years Ended December 31,

($ in thousands)

2009

2010

2011

2011 As Adjusted

Operating Income

178,176

$

194,611

$

233,659

$

233,659

$

Depreciation and Amortization

24,432

22,493

21,177

21,177

EBITDA

202,608

$

217,104

$

254,836

$

254,836

$

Net income attributable to noncontrolling interests

(65,313)

(60,240)

(69,779)

(69,779)

EBITDA less noncontrolling interests

137,295

$

156,864

$

185,057

$

185,057

$

Net (gain) loss on deconsolidations, disposals and impairments

29,162

6,378

(1,529)

(1,529)

Impairment of unconsolidated affiliate

-

3,676

-

-

De novo start-up losses

a

-

136

4,009

4,009

Acquisition costs

b

-

2,857

3,314

3,314

Expense related to prior acquisition

c

-

6,000

-

-

Equity compensation

1,951

2,168

1,237

1,237

Management fee

d

2,000

2,000

2,000

2,000

Adjusted EBITDA,

excluding the pro forma effect of recent and pending acquisitions

170,408

$

180,079

$

194,088

$

194,088

$

Titan acquisition (14 facilities)

e

6,239

Acquisition of facility in Hackensack, New Jersey

3,549

Acquisition of facility in San Diego, California

g

599

Acquisition of facility in Midland, Texas

h

546

Acquisition of facility in Phoenix, Arizona

i

518

Titan buy-up (one facility)

4,434

Adjusted EBITDA

k

209,973

$

j

f |

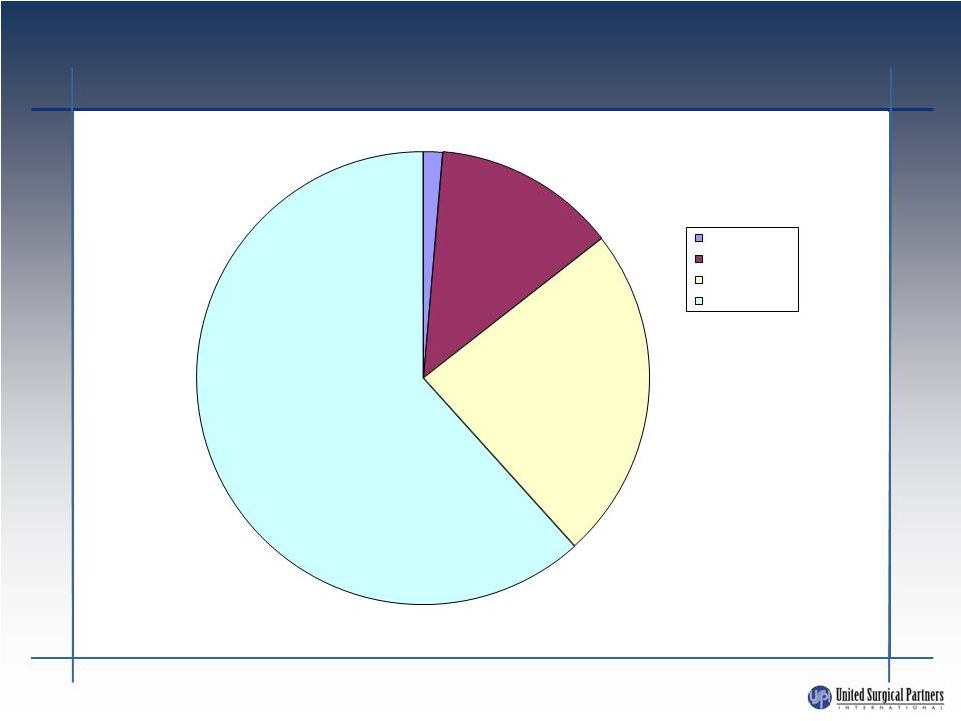

DEBT

MATURITIES Total debt $1.3 billion as of June 30, 2012

16

2%

13%

24%

61%

Next 12 Months

Months 13-36

Months 37-60

Beyond 5 years

$322.8M

$834.6M |

17

SUMMARY

USPI is well positioned: low cost, high quality, high customer

satisfaction provider

Partner with key local not-for-profit hospital systems

Strong partnering capabilities will continue to provide opportunities

for growth, even in difficult times

Focused on key strategic markets with significant market share

Stable revenue growth

Strong equity sponsor in WCAS

Capitalized for growth and flexibility |

18

FOOTNOTES TO U.S. ADJUSTED

EBITDA BRIDGE

a.

Represents the share of operating losses incurred primarily by a hospital located in Phoenix,

Arizona. The hospital opened in June 2010. The Company owns 50% of the hospital and the

remaining 50% is owned by a local not-for-profit hospital partner. This hospital has no physician ownership as it opened after the

Patient Protection and Affordable Care Act was enacted on March 23, 2010, which disallowed physician

ownership in this hospital.

b.

Represents transaction expenses and related costs incurred related to our acquisitions of HealthMark

Partners, Inc. in 2010 and Titan Health Corporation primarily in 2011.

c.

Represents payment of fee related to the settlement of a dispute regarding an acquisition of a

facility in 2003.

d.

Represents annual management fees paid to Welsh Carson Anderson & Stowe.

e.

Effective September 1, 2011, we acquired 100% of the equity interests in Titan Health Corporation, or

Titan. We paid cash totaling $43.4 million, net of $5.0 million of cash acquired. Titan has an

equity investment in 14 ambulatory surgery centers. In addition, we paid approximately $14.3 million in cash to

physicians in order to obtain additional ownership in six of these centers. Adjusted EBITDA has been

increased to reflect this acquisition as though it were effective January 1, 2011, by applying

our ownership percentage and management contract earnings formula to the historical financial statements of the

acquiree for the months of 2011 that preceded our acquisition.

f.

Effective December 1, 2011, we paid cash of approximately $23.7 million to acquire a noncontrolling

equity interest and right to manage a facility in Hackensack, New Jersey. Adjusted EBITDA has

been increased to reflect this acquisition as though it were effective January 1, 2011, by applying our

ownership percentage and management contract earnings formula to the historical financial statements

of the acquiree for the months of 2011 that preceded our acquisition.

g.

Effective December 31, 2011, we paid cash of approximately $3.3 million to acquire a controlling

equity interest and right to manage a facility in San Diego, California. Adjusted EBITDA has

been increased to reflect this acquisition as though it were effective January 1, 2011, by applying our ownership percentage

and management contract earnings formula to the historical financial statements of the acquiree for

2011.

h.

Effective February 1, 2012, we paid cash of approximately $3.1 million to acquire a noncontrolling

equity interest and right to manage a facility in Midland, Texas. Adjusted EBITDA has been

increased to reflect this acquisition as though it were effective January 1, 2011, by applying our ownership percentage and

management contract earnings formula to the historical financial statements of the acquiree for

2011.

i.

Effective March 1, 2012, we paid cash of approximately $3.0 million to acquire a noncontrolling

equity interest and right to manage a facility in Phoenix, Arizona. Adjusted EBITDA has been

increased to reflect this acquisition as though it were effective January 1, 2011, by applying our ownership percentage

and management contract earnings formula to the historical financial statements of the acquiree for

2011.

j.

Represents a pending acquisition of additional ownership in a Titan facility in Cherry Hill, New

Jersey. We currently have a minority interest in such facility and have reached an agreement

in principle to acquire a controlling interest for $18.0 million in cash. At this time, we have completed our due diligence and

believe we have completed negotiation of the definitive documentation for the acquisition, but such

documentation remains subject to the approval of certain physicians at the facility and

therefore has not yet been signed. We expect to sign the definitive documentation and close the acquisition by March 31, 2012,

however, we can provide no assurance that acquisition will close by such date, if at all. For

purposes of this offering memorandum, we have assumed such acquisition will be completed, and

therefore Adjusted EBITDA has been increased to reflect this acquisition as though it were effective January 1, 2011, by

applying our ownership percentage and management contract earnings formula to the historical

financial statements of the acquiree for 2011.

k.

Adjusted EBITDA does not reflect two additional acquisition opportunities that are currently pending.

We have substantially completed our due diligence with respect to such acquisitions and are in

active negotiations with the existing owners of such businesses, but have not reached a definitive agreement with the

existing owners. At this time, the Company expects to pay approximately $24.4 million in cash to

complete such acquisitions. Based on diligence completed to date, if such acquisitions were

completed as of January 1, 2011, we estimate that the Adjusted EBITDA contribution from such acquisitions would have been

approximately $2.6 million. However, this estimate is subject to our ongoing diligence review. While

we expect to complete such acquisitions within a few months of the consummation of this

offering, we can provide no assurance that such acquisitions will close during that time, if at all. |