Attached files

| file | filename |

|---|---|

| 8-K - U.S. CONCRETE, INC. 8-K - U.S. CONCRETE, INC. | usconcrete8k.htm |

Exhibit 99.1

Investor Presentation

KeyBanc Capital Markets

KeyBanc Capital Markets

2012 Basic Materials & Packaging Conference

September 12, 2012

September 12, 2012

Forward-Looking Statements

Certain statements provided in this presentation, including those that express a belief, expectation or intention and those that are not of historical fact, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve a number of risks and uncertainties and are intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These risks and uncertainties may cause actual results to differ materially from expected results and are described in detail in filings made by U.S. Concrete, Inc. (the Company) with the Securities and Exchange Commission, including the Companys Annual Report on Form 10-K for the year ended December 31, 2011 and subsequent Quarterly Reports.

The forward-looking statements speak only as of the date of this presentation. Investors are cautioned not to rely unduly on them. Many of these forward-looking statements are based on expectations and assumptions about future events that may prove to be inaccurate. The Companys management considers these expectations and assumptions to be reasonable, but they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Companys control. The Company undertakes no obligation to update these statements unless required by applicable securities laws.

Certain statements provided in this presentation, including those that express a belief, expectation or intention and those that are not of historical fact, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve a number of risks and uncertainties and are intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These risks and uncertainties may cause actual results to differ materially from expected results and are described in detail in filings made by U.S. Concrete, Inc. (the Company) with the Securities and Exchange Commission, including the Companys Annual Report on Form 10-K for the year ended December 31, 2011 and subsequent Quarterly Reports.

The forward-looking statements speak only as of the date of this presentation. Investors are cautioned not to rely unduly on them. Many of these forward-looking statements are based on expectations and assumptions about future events that may prove to be inaccurate. The Companys management considers these expectations and assumptions to be reasonable, but they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Companys control. The Company undertakes no obligation to update these statements unless required by applicable securities laws.

Company Overview

Top 10 Producer of

Ready-Mixed Concrete in the U.S.

Ready-mixed concrete

4.0 million cubic yards in 2011

95 fixed and 12 portable concrete plants

Leading market position in 4 regions

Aggregates

7 aggregate and sand and gravel operations

1 recycle aggregate facility

Ready-mixed concrete

4.0 million cubic yards in 2011

95 fixed and 12 portable concrete plants

Leading market position in 4 regions

Aggregates

7 aggregate and sand and gravel operations

1 recycle aggregate facility

Revenue by Business Segment

($ millions)

2010 Revenue

$56

$400

2011 Revenue

$67

$428

Note: Ready-mixed and related products revenue net of intercompany sales

($ millions)

2010 Revenue

$56

$400

2011 Revenue

$67

$428

Note: Ready-mixed and related products revenue net of intercompany sales

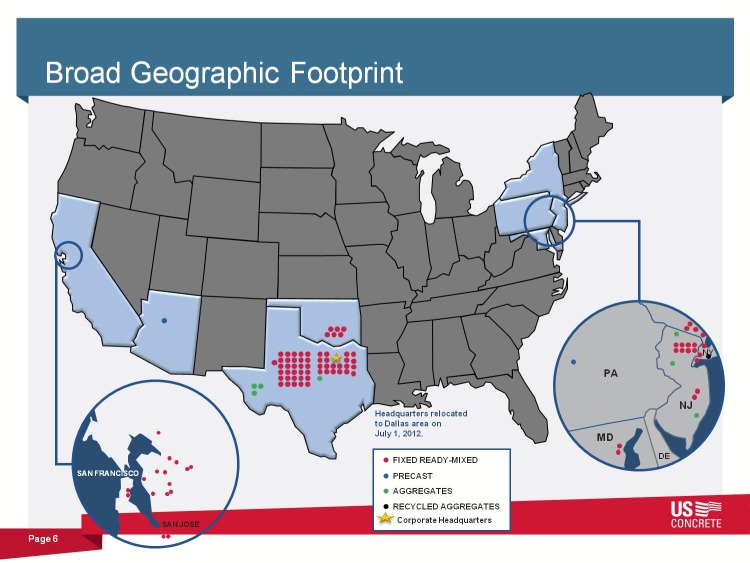

Broad Geographic Footprint

Headquarters relocated to Dallas area on July 1, 2012.

FIXED READY-MIXED

PRECAST

AGGREGATES

RECYCLED AGGREGATES

Corporate Headquarters

Headquarters relocated to Dallas area on July 1, 2012.

FIXED READY-MIXED

PRECAST

AGGREGATES

RECYCLED AGGREGATES

Corporate Headquarters

Quality Asset Base

107 ready mixed concrete plants produced 4.0 million cubic yards of concrete in 2011

Over 60 million tons of owned and leased reserves

2 precast concrete plants generated $24 million of revenue in 2011

800+ ready-mixed concrete trucks

1 aggregate recycle operation

$29 million book value of owned real estate

107 ready mixed concrete plants produced 4.0 million cubic yards of concrete in 2011

Over 60 million tons of owned and leased reserves

2 precast concrete plants generated $24 million of revenue in 2011

800+ ready-mixed concrete trucks

1 aggregate recycle operation

$29 million book value of owned real estate

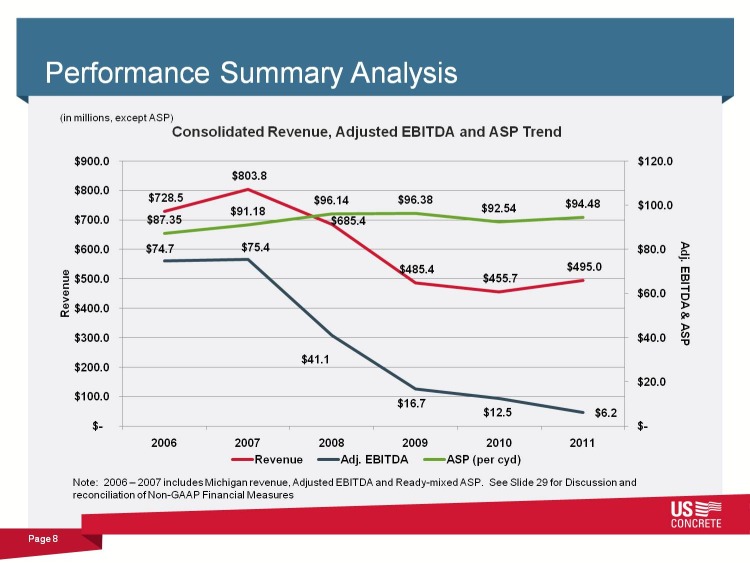

Performance Summary Analysis

(in millions, except ASP)

Consolidated Revenue, Adjusted EBITDA and ASP Trend

Adj. EBITDA & ASP

Revenue

Note: 2006 2007 includes Michigan revenue, Adjusted EBITDA and Ready-mixed ASP. See Slide 29 for Discussion and reconciliation of Non-GAAP Financial Measures

(in millions, except ASP)

Consolidated Revenue, Adjusted EBITDA and ASP Trend

Adj. EBITDA & ASP

Revenue

Note: 2006 2007 includes Michigan revenue, Adjusted EBITDA and Ready-mixed ASP. See Slide 29 for Discussion and reconciliation of Non-GAAP Financial Measures

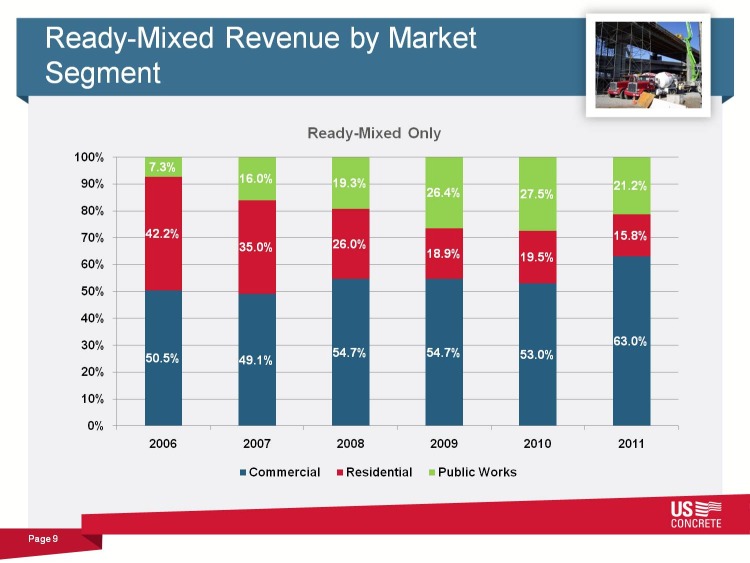

Ready-Mixed Revenue by Market Segment

Ready-Mixed Only

Ready-Mixed Only

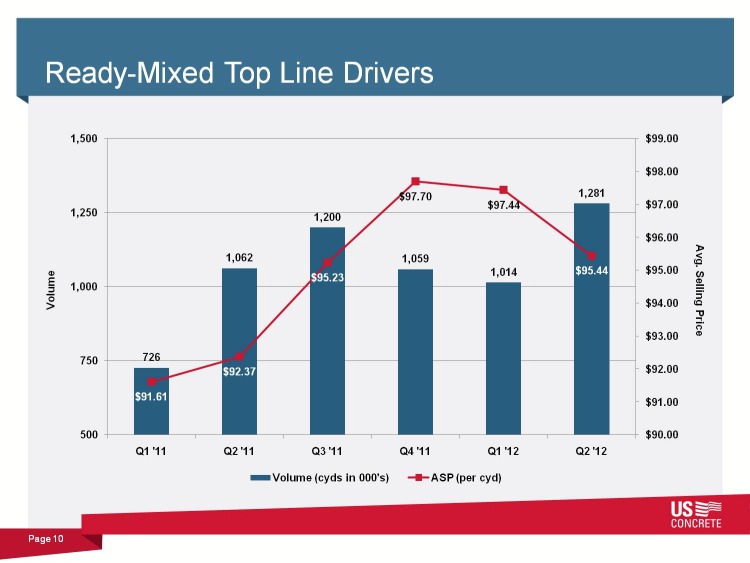

Ready-Mixed Top Line Drivers

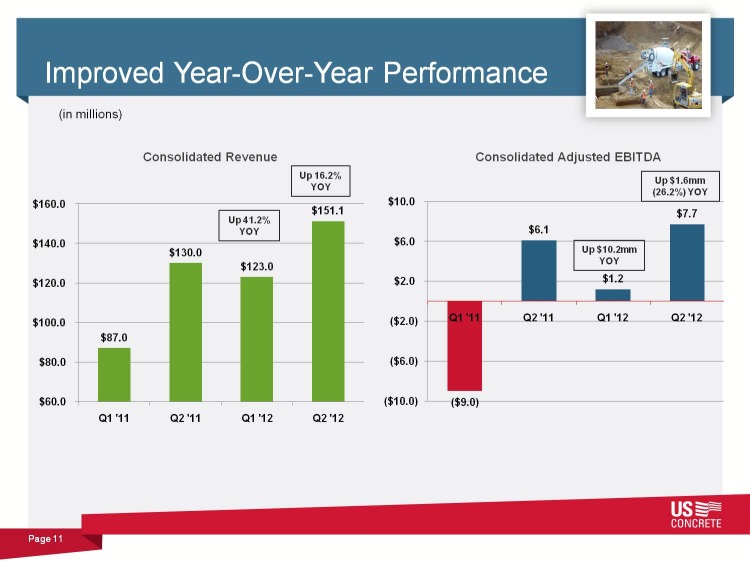

Improved Year-Over-Year Performance

(in millions)

Consolidated Revenue

Consolidated Adjusted EBITDA

Up 41.2% YOY

Up 16.2% YOY

Up $10.2mm YOY

Up $1.6mm (26.2%) YOY

(in millions)

Consolidated Revenue

Consolidated Adjusted EBITDA

Up 41.2% YOY

Up 16.2% YOY

Up $10.2mm YOY

Up $1.6mm (26.2%) YOY

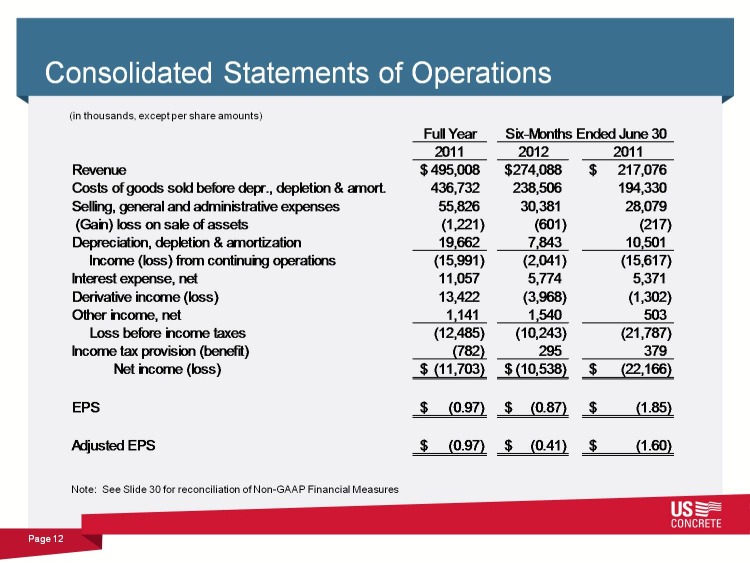

Consolidated Statements of Operations

(in thousands, except per share amounts)

Note: See Slide 30 for reconciliation of Non-GAAP Financial Measures

(in thousands, except per share amounts)

Note: See Slide 30 for reconciliation of Non-GAAP Financial Measures

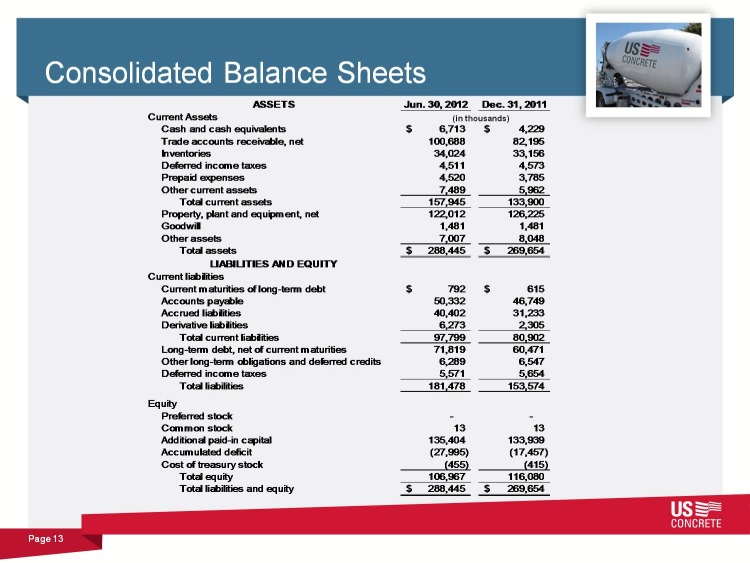

Consolidated Balance Sheets

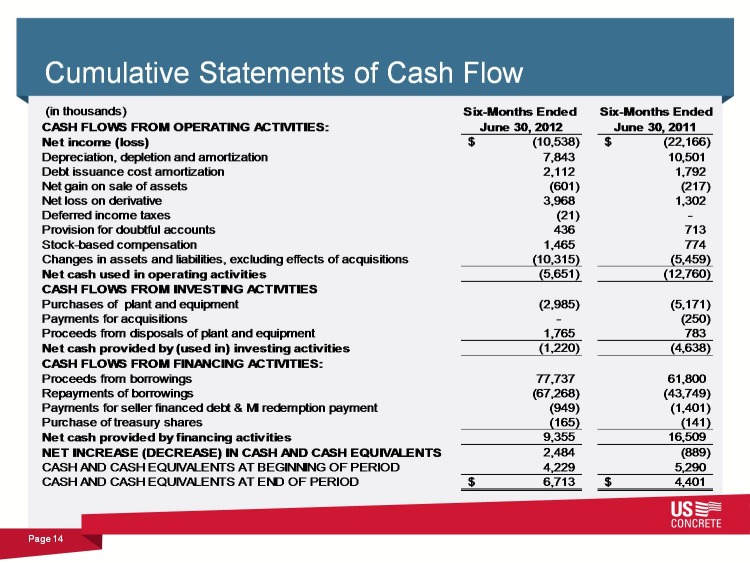

Cumulative Statements of Cash Flow

Industry Overview

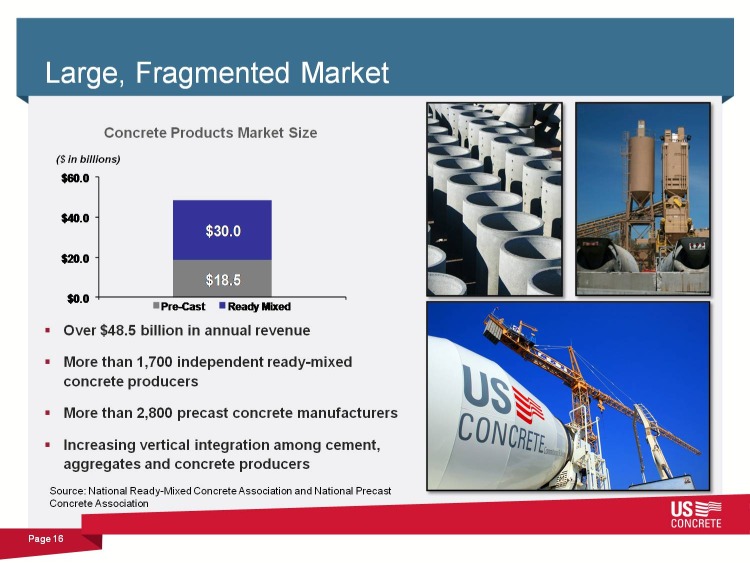

Large, Fragmented Market

Over $48.5 billion in annual revenue

More than 1,700 independent ready-mixed concrete producers

More than 2,800 precast concrete manufacturers

Increasing vertical integration among cement, aggregates and concrete producers

Over $48.5 billion in annual revenue

More than 1,700 independent ready-mixed concrete producers

More than 2,800 precast concrete manufacturers

Increasing vertical integration among cement, aggregates and concrete producers

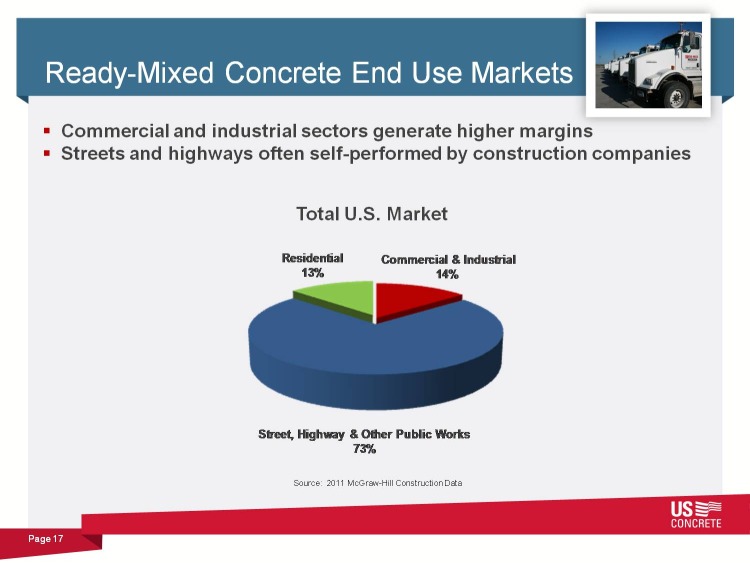

Ready-Mixed Concrete End Use Markets

Commercial and industrial sectors generate higher margins

Streets and highways often self-performed by construction companies

Total U.S. Market

Commercial and industrial sectors generate higher margins

Streets and highways often self-performed by construction companies

Total U.S. Market

Company Strategy and Focus

Our Mission, Values and Principles

Our Mission is to become the preferred provider of ready-mix concrete and aggregate products in selective markets we serve

Safety

Integrity

Operational Excellence

Sustainability

Environmental Stewardship

Innovation

Quality

Productivity

Customer Resource

The Strategic Plan supports the Companys Mission and Core Values and is tied to its Operating Principles and annual incentive plan

Our Mission is to become the preferred provider of ready-mix concrete and aggregate products in selective markets we serve

Safety

Integrity

Operational Excellence

Sustainability

Environmental Stewardship

Innovation

Quality

Productivity

Customer Resource

The Strategic Plan supports the Companys Mission and Core Values and is tied to its Operating Principles and annual incentive plan

Our Focus Today

Continue to aggressively manage through current economic cycle

Closely monitor liquidity

Limit capital spending to internally generated cash flow

Evaluate assets, business units and opportunities

Ensure assets are delivering appropriate returns

Develop plan to improve or divest of underperforming operations

Stick to our knitting

Maximize value of our existing operations

Focus on value-added products, customer service, operating efficiency and price leadership

Pursue Strategic Development Opportunities

Look to businesses that enhance existing position

Utilize creative structures to limit capital investment required

Continue to aggressively manage through current economic cycle

Closely monitor liquidity

Limit capital spending to internally generated cash flow

Evaluate assets, business units and opportunities

Ensure assets are delivering appropriate returns

Develop plan to improve or divest of underperforming operations

Stick to our knitting

Maximize value of our existing operations

Focus on value-added products, customer service, operating efficiency and price leadership

Pursue Strategic Development Opportunities

Look to businesses that enhance existing position

Utilize creative structures to limit capital investment required

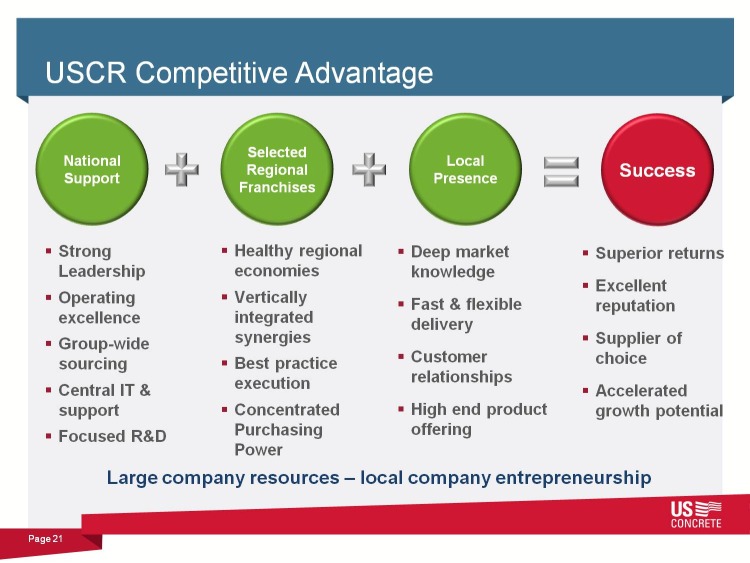

USCR Competitive Advantage

National Support

Strong Leadership

Operating excellence

Group-wide sourcing

Central IT & support

Focused R&D

Selected Regional Franchises

Healthy regional economies

Vertically integrated synergies

Best practice execution

Concentrated Purchasing Power

Local Presence

Deep market knowledge

Fast & flexible delivery

Customer relationships

High end product offering

Success

Superior returns

Excellent reputation

Supplier of choice

Accelerated growth potential

Large company resources local company entrepreneurship

National Support

Strong Leadership

Operating excellence

Group-wide sourcing

Central IT & support

Focused R&D

Selected Regional Franchises

Healthy regional economies

Vertically integrated synergies

Best practice execution

Concentrated Purchasing Power

Local Presence

Deep market knowledge

Fast & flexible delivery

Customer relationships

High end product offering

Success

Superior returns

Excellent reputation

Supplier of choice

Accelerated growth potential

Large company resources local company entrepreneurship

Industry Realities

Significant Changes at USCR

Increased decentralization

Tighter control over pricing by GMs

Reduced corporate office overhead

Increased vertical integration

Increased focus on product development

Increased focus on aggregate strategy

Important Changes in the Marketplace

Growing demand in Green market

Continued over capacity in ready-mixed market

Slow economic growth during planning horizon

Noteworthy Changes in the Competitive Environment

Increased downstream vertical integration of cement producers

Strategic acquirers remain on the sideline

Some smaller competitors reaching capitulation

Need for pricing discipline by publicly traded materials companies

Summary

Volume and EBITDA have exhibited robust growth in H1 2012

Future will involve slow volume growth and more EBITDA growth

Corporate overhead not supportable at this level of profitability

Adding key operating managers will materially improve performance

Significant Changes at USCR

Increased decentralization

Tighter control over pricing by GMs

Reduced corporate office overhead

Increased vertical integration

Increased focus on product development

Increased focus on aggregate strategy

Important Changes in the Marketplace

Growing demand in Green market

Continued over capacity in ready-mixed market

Slow economic growth during planning horizon

Noteworthy Changes in the Competitive Environment

Increased downstream vertical integration of cement producers

Strategic acquirers remain on the sideline

Some smaller competitors reaching capitulation

Need for pricing discipline by publicly traded materials companies

Summary

Volume and EBITDA have exhibited robust growth in H1 2012

Future will involve slow volume growth and more EBITDA growth

Corporate overhead not supportable at this level of profitability

Adding key operating managers will materially improve performance

Change the Point of Sale

Owner/Developer

Construction Buying Hierarchy

Architect

Engineer

General contractor

Concrete contractor

Concrete Supplier

Targeted Point of Sale

Provides opportunity to promote value and service

Change specification to our advantage

Differentiate from the competition

While price remains a factor, limits competitors

Benefits

Sale based on value, not price

Realize higher margins

Enhance customer loyalty

Traditional Industry Point of Sale

Purchasing decision based on relationships, quality, on-time delivery

Price is the overriding deciding factor

Highly competitive

Limited opportunity to differentiate product or service

Owner/Developer

Construction Buying Hierarchy

Architect

Engineer

General contractor

Concrete contractor

Concrete Supplier

Targeted Point of Sale

Provides opportunity to promote value and service

Change specification to our advantage

Differentiate from the competition

While price remains a factor, limits competitors

Benefits

Sale based on value, not price

Realize higher margins

Enhance customer loyalty

Traditional Industry Point of Sale

Purchasing decision based on relationships, quality, on-time delivery

Price is the overriding deciding factor

Highly competitive

Limited opportunity to differentiate product or service

Sustainable Development Today

Sustainable construction is not a passing fad

Membership in the U.S. Green building Council has increased from fewer than 100 to over 18,000 in the past decade

Over 155,000 building professionals are LEED certified

Demand for green building materials is forecasted to grow at an accelerated rate

Sustainable construction is not a passing fad

Membership in the U.S. Green building Council has increased from fewer than 100 to over 18,000 in the past decade

Over 155,000 building professionals are LEED certified

Demand for green building materials is forecasted to grow at an accelerated rate

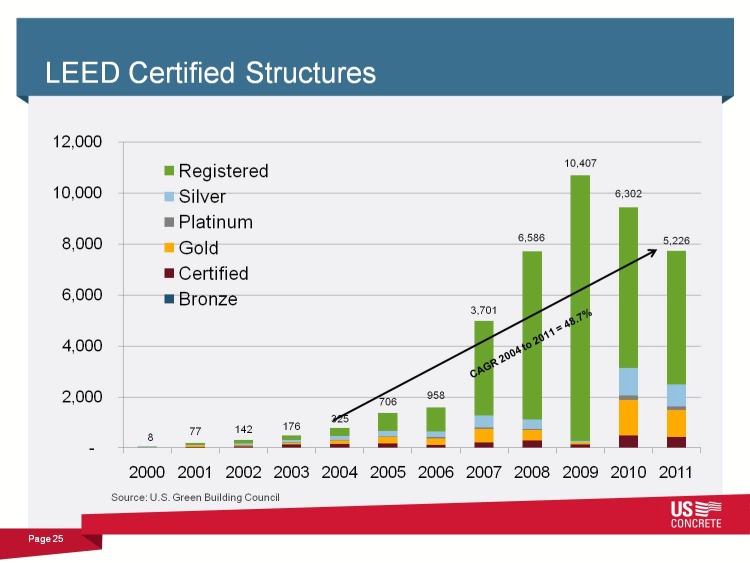

LEED Certified Structures

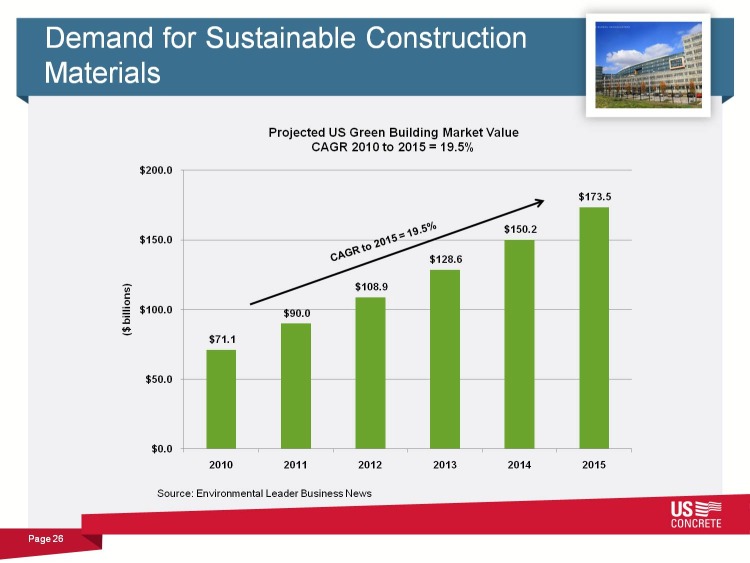

Demand for Sustainable Construction Materials

Projected US Green Building Market Value

CAGR 2010 to 2015 = 19.5%

CAGR to 2015 = 19.5%

Source: Environmental Leader Business News

Projected US Green Building Market Value

CAGR 2010 to 2015 = 19.5%

CAGR to 2015 = 19.5%

Source: Environmental Leader Business News

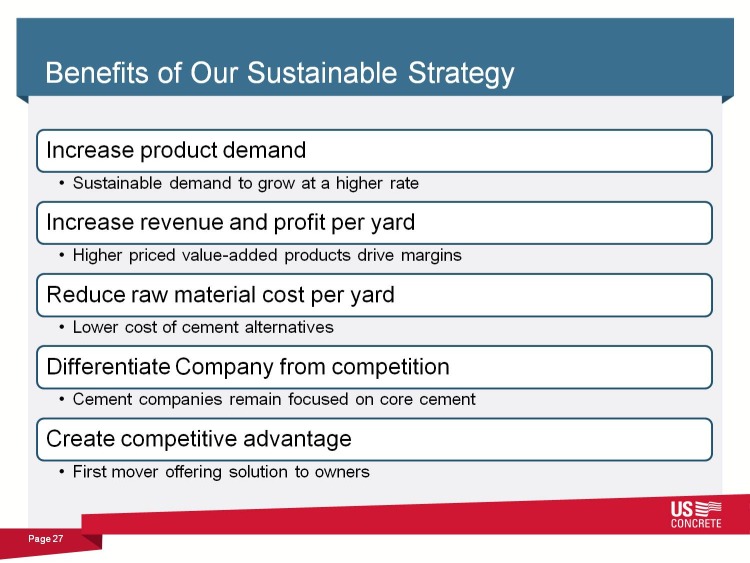

Benefits of Our Sustainable Strategy

Increase product demand

Sustainable demand to grow at a higher rate

Increase revenue and profit per yard

Higher priced value-added products drive margins

Reduce raw material cost per yard

Lower cost of cement alternatives

Differentiate Company from competition

Cement companies remain focused on core cement

Create competitive advantage

First mover offering solution to owners

Increase product demand

Sustainable demand to grow at a higher rate

Increase revenue and profit per yard

Higher priced value-added products drive margins

Reduce raw material cost per yard

Lower cost of cement alternatives

Differentiate Company from competition

Cement companies remain focused on core cement

Create competitive advantage

First mover offering solution to owners

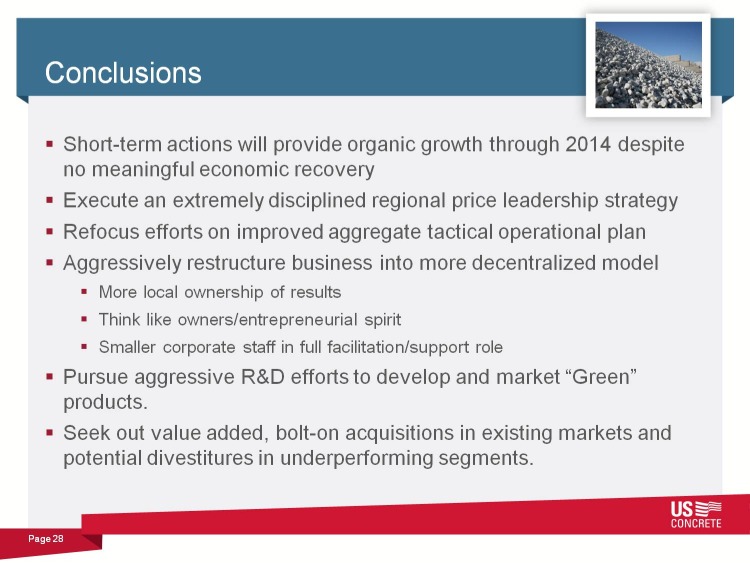

Conclusions

Short-term actions will provide organic growth through 2014 despite no meaningful economic recovery

Execute an extremely disciplined regional price leadership strategy

Refocus efforts on improved aggregate tactical operational plan

Aggressively restructure business into more decentralized model

More local ownership of results

Think like owners/entrepreneurial spirit

Smaller corporate staff in full facilitation/support role

Pursue aggressive R&D efforts to develop and market Green products.

Seek out value added, bolt-on acquisitions in existing markets and potential divestitures in underperforming segments.

Short-term actions will provide organic growth through 2014 despite no meaningful economic recovery

Execute an extremely disciplined regional price leadership strategy

Refocus efforts on improved aggregate tactical operational plan

Aggressively restructure business into more decentralized model

More local ownership of results

Think like owners/entrepreneurial spirit

Smaller corporate staff in full facilitation/support role

Pursue aggressive R&D efforts to develop and market Green products.

Seek out value added, bolt-on acquisitions in existing markets and potential divestitures in underperforming segments.

Disclosure of Non-GAAP Financial Measures

U.S. CONCRETE, INC.

U.S. CONCRETE, INC.

ADDITIONAL STATISTICS

(In thousands, unless otherwise noted; unaudited)

We report our financial results in accordance with generally accepted accounting principles in the United States (GAAP). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the following table for presentations of our adjusted EBITDA, adjusted EBITDA margin for the years 2006 through 2011 and the first six months of 2011 and 2012.

We define adjusted EBITDA as our net income (loss) from continuing operations plus the provision (benefit) for income taxes, net interest expense, depreciation, depletion and amortization, reorganization costs, noncash impairments, noncash loss on asset sales, derivative (income) loss, expenses related to the departure of our former CEO, expenses related to the relocation of our corporate headquarters, less gain on purchase of senior notes. We define adjusted EBITDA margin as the amount determined by dividing adjusted EBITDA by total revenue. We have included adjusted EBITDA and adjusted EBITDA margin in the accompanying tables because they are often used by investors for valuation and for comparing our financial performance with the performance of other building material companies. We also use adjusted EBITDA to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of adjusted EBITDA may not be comparable to similarly titled measures other companies report.

Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP.

We report our financial results in accordance with generally accepted accounting principles in the United States (GAAP). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the following table for presentations of our adjusted EBITDA, adjusted EBITDA margin for the years 2006 through 2011 and the first six months of 2011 and 2012.

We define adjusted EBITDA as our net income (loss) from continuing operations plus the provision (benefit) for income taxes, net interest expense, depreciation, depletion and amortization, reorganization costs, noncash impairments, noncash loss on asset sales, derivative (income) loss, expenses related to the departure of our former CEO, expenses related to the relocation of our corporate headquarters, less gain on purchase of senior notes. We define adjusted EBITDA margin as the amount determined by dividing adjusted EBITDA by total revenue. We have included adjusted EBITDA and adjusted EBITDA margin in the accompanying tables because they are often used by investors for valuation and for comparing our financial performance with the performance of other building material companies. We also use adjusted EBITDA to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of adjusted EBITDA may not be comparable to similarly titled measures other companies report.

Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP.

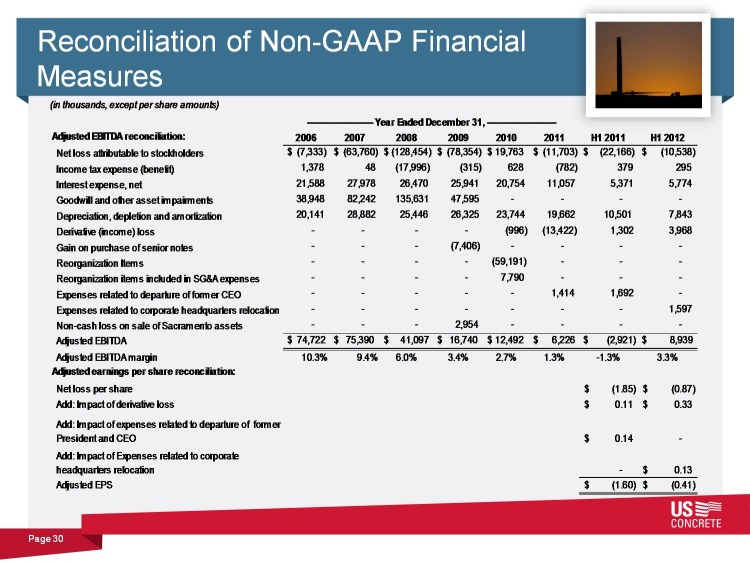

Reconciliation of Non-GAAP Financial Measures

Investor Presentation

KeyBanc Capital Markets

KeyBanc Capital Markets

2012 Basic Materials & Packaging Conference

September 12, 2012

September 12, 2012