Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SmartStop Self Storage, Inc. | d400618d8k.htm |

August 21, 2012

H. MICHAEL SCHWARTZ

President, CEO

Strategic Storage Trust, Inc.

KEN MORRISON

President

Strategic Storage Property Management

Presented by

Exhibit 99.1 |

2

Disclaimers and Risk Factors

Disclaimers

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this material, other than historical facts, may be considered

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward

looking statements to be covered by the applicable safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act,

as applicable. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and

uncertainties, including known and unknown risks, which could cause actual results to differ

materially from those projected or anticipated. Therefore, such statements are not intended to

be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology

such as “may,”

“expect,”

“intend,”

“anticipate,”

“estimate,”

“believe,”

“continue,”

or other similar words. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date this report is filed with the

Securities and Exchange Commission. We cannot guarantee the accuracy of any such forward

looking statements contained in this material, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other factors and are

based on a number of assumptions involving judgments with respect to,

among

other

things,

future

economic,

competitive,

and

market

conditions,

all

of

which

are

difficult

or

impossible

to

predict

accurately.

To

the

extent

that

our assumptions

differ

from

actual

results,

our

ability

to

meet

such

forward-looking

statements,

including

our

ability

to

generate

positive

cash

flow

from

operations

and provide distributions

to stockholders, and our ability to find suitable investment properties, may be significantly

hindered. All forward-looking statements should be read in light of the risks

identified in our prospectus and supplements.

Risk Factors

•

See our Form 10-K and recent Form 10-Q for specific risks associated with an investment in

Strategic Storage Trust, Inc.. •

As of December 31, 2011, our accumulated deficit was approximately $43 million, and we anticipate that

our operations will not be profitable in 2012. •

No

public

market

currently

exists

for

shares

of

our

common

stock

and

we

may

not

list

our

shares

on

a

national

securities

exchange

before

three

to

five

years

after

completion of this

offering,

if

at

all.

It

may

be

difficult

sell

your

shares. If

sell

your

shares,

it

will

likely

be

at

a

substantial

discount.

•

We have paid distributions from sources other than our cash flows from operations, including from the

net proceeds from our initial public offering. We are not prohibited from undertaking such

activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our

distributions. Until

we generate

operating

cash

flows

sufficient

to

pay

distributions

to

you,

we

may

pay

distributions

from

the

net

proceeds

of

this

offering

or

from

borrowings in anticipation of

future

cash flows.

We also may be required to sell assets or issue new securities for cash in order to pay

distributions. Any such actions could reduce the amount of capital we ultimately invest in

assets and negatively impact the amount of income available for future distributions.

•

We have no employees and must depend on our advisor to select investments and conduct our operations,

and there is no guarantee that our advisor will devote adequate time or resources to us.

•

Our board of directors may change any of our investment objectives, including our focus on self

storage facilities. •

We will pay substantial fees and expenses to our advisor, its affiliates and participating

broker-dealers, which will reduce cash available for investment and distribution.

•

There are substantial conflicts of interest among us and our sponsor, advisor, property manager and

dealer manager. •

We

may

fail

to

remain

qualified

as

a

REIT,

which

could

adversely

affect

our

operations

and

our

ability

to

make

distributions.

•

We

may

incur

substantial

debt,

which

could

hinder

our

ability

to

pay

distributions

to

our

stockholders

or

could

decrease

the

value

of

your

investment.

•

Future distribution declarations are at the sole discretion of our board of directors and are not

guaranteed. Since our inception, our cumulative distributions have exceeded cumulative GAAP

earnings. We cannot assure you that we will achieve any of our investment objectives.

•

We

encourage

you

to

review

our

SEC

filings

at

www.sec.gov.

to

you

“will,” |

Strategic Storage Trust,

Inc. About Us

•

First and only publicly registered non-traded REIT focused

on self storage

•

Sponsor was ranked

8 in Mini-Storage Messenger’s Top

Operators List in 2011

•

As of 8/20/12, SSTI wholly owns 100 properties in 17 states

and Ontario, Canada with approximately 64,780 units and

approximately 8.1 million rentable square feet

th |

4

Agenda

•

Financial Snapshot

•

Running a Self Storage Company |

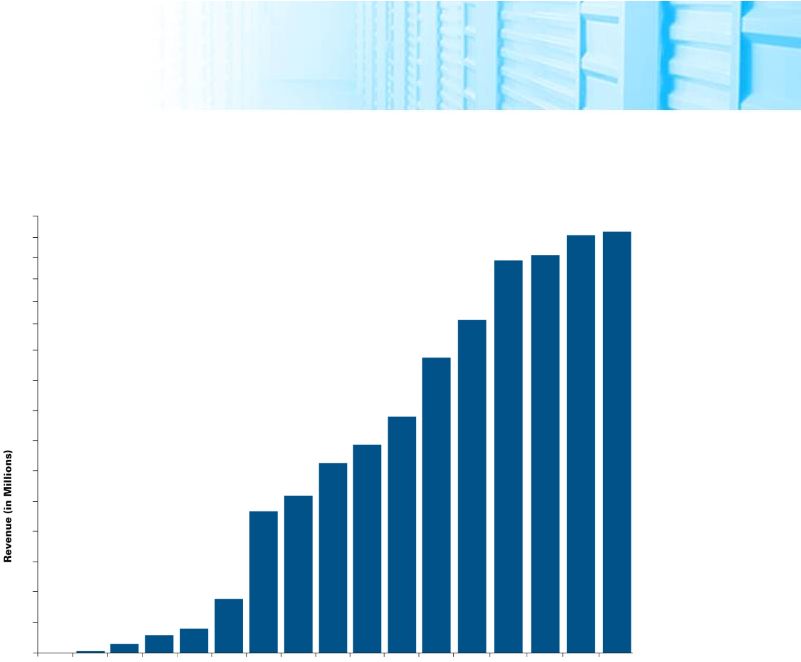

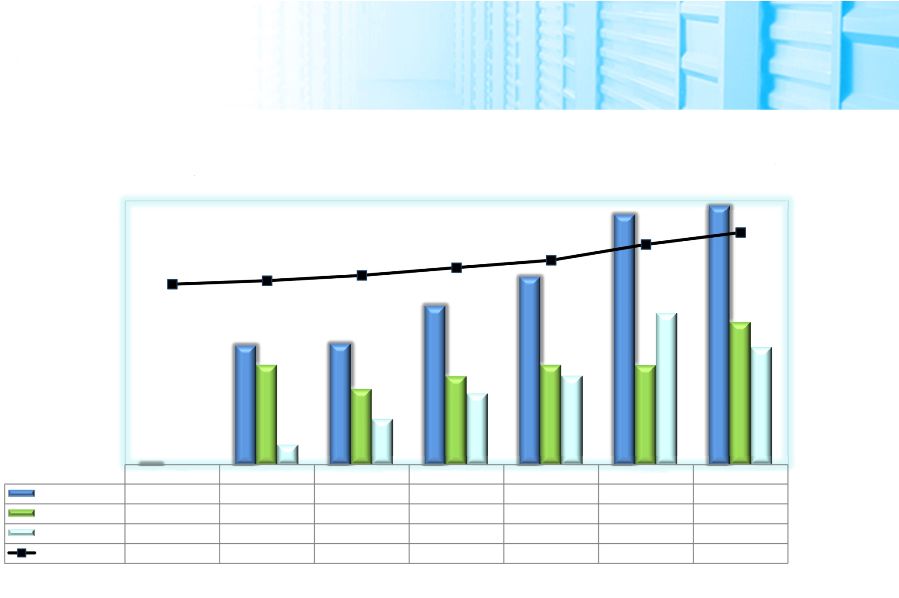

Financial Update

Total Assets by Quarter

600

575

550

525

500

475

450

425

400

375

350

325

300

275

250

225

200

175

150

125

100

75

50

25

0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

$0.2

$2.8

$13.2

$19.8

$34.1

$50.6

$185.2

$203.7

$220.3

$242.6

$289.0

$307.4

$385.9

$423.3

$467.0

$550.4

$543.9

$585.6

2008

2008

2008

2008

2009

2009

2009

2009

2010

2010

2010

2010

2011

2011

2011

2011

2012

2012 |

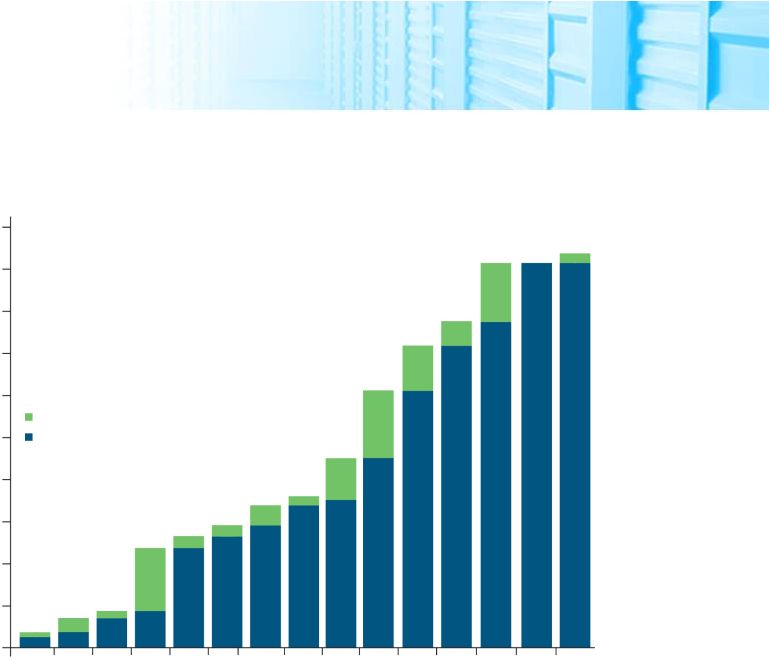

6

Total Revenues by Quarter

Financial Update

16

15

14

13

12

10

11

9

8

7

6

5

4

3

2

1

0

Q2

2008

Q3

2008

Q4

2008

Q1

2009

Q2

2009

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

$0.02

$0.3

$0.6

$0.8

$1.8

$4.7

$5.2

$6.3

$6.9

$7.8

$9.8

$11.4

$13.9

$14.3

$15.4

$15.7 |

Financial Update

G&A Per Property by Quarter

G&A Per Property

Q2

2009

$58,095

Q2

2010

$21,177

(63.5%

decrease)

Q2

2011

$7,600

(64.1% decrease)

Q2

2012

$6,737

(11.3% decrease) |

8

Portfolio Update

Wholly Owned Properties by Quarter

100

90

80

70

60

50

40

20

30

34

10

6

0

3

8

29

26

24

35

45

78

72

61

91

91

92

Q1

Q4

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

2012

2012

2011

2011

2011

2011

2010

2010

2010

2010

2009

2009

2009

2009

2008

New Acquisitions/Quarter

Existing

1

3

2

16

2

3

5

1

10

16

11

6

13

1

91

91

78

72

61

45

35

34

29

26

24

8

6

3

2 |

Rentable Square Feet by

State (as of 6/30/12)

Portfolio Update

7.5%

4.2%

5.0%

3.2%

11.0%

12.4%

1.9%

0.9%

19.6%

0.9%

1.3%

5.3%

4.5%

NJ

5.2%

3.6%

FL

10.0%

2.4%

1.1%

92 properties

17 states, 1 province

61,010 units

7.5 million SF

National Training Office

Regional Office

District Office

Home Office/Regional Office |

10

Portfolio Update

1990 NW Federal Hwy. 1

Stuart, Florida

Units:

370

Year:

2004

Net Rentable:

51,500 SF

Acres:

2.51

6195 South Kanner Hwy.

Stuart, Florida

Units:

380

Year:

2008

Net Rentable:

54,700 SF

Acres:

7.74

782 King George Blvd.

Savannah, Georgia

Units:

450

Year:

2001

Net Rentable:

67,100 SF

Acres:

4.71

Stockade Portfolio |

Portfolio Update

1060 King George Blvd.

Savannah, Georgia

Units:

590

Year:

2002

Net Rentable:

68,700 SF

Acres:

4.53

298 Red Cedar St.

Bluffton, South Carolina

Units:

660

Year:

2008

Net Rentable:

78,900 SF

Acres:

4.37

Stockade Portfolio

512 Percival Rd.

Columbia, South Carolina

Units:

490

Year:

2003

Net Rentable:

65,400 SF

Acres:

3.76 |

12

Portfolio Update

120 Northpoint Dr.

Lexington, South Carolina

Units:

Year:

Net Rentable:

Acres:

890 St Peters Church Rd.

Lexington, South Carolina

Units:

250

Year:

2010

Net Rentable:

35,400 SF

Acres:

4.37

Stockade Portfolio

86,500 SF

5.00

580

1998/2003 |

13

Running a Self Storage Operation

•

Branding Initiatives

•

People

•

Technology

•

Increasing Net Operating Income

•

Results |

14

Branding Initiatives

Technology To Compete In Today’s Marketplace

Branding is Important

Competitive Edge in a Unique Industry

Market Leader Has Less Than 5% Market Share

85% of Operators Own 1-2 Stores

Small Operators Cannot Afford the Marketing and

•

•

• |

15

SmartStop

Jingle

SmartStop

Intro

SmartStop®Commercial

Branding Initiatives

®

®

® |

16

Branding Initiatives

Advertising

•

Radio

•

Movie Theatres

•

Internet Yellow Pages and Mobile Ads

•

Print Ads and Directories

•

Direct Mail |

17

Social Media and More

•

Twitter

–

Increasing followers

•

Facebook

–

1,726 “Likes”

= exposure to over 1 million friends

of friends

•

YouTube

–

Maintains all our jingles for viewing

•

Blog

–

84 human interest stories published since May

•

Google+

-

New platform brings pictorial brand awareness

•

Mobile

Friendly

–

easy

access

to

web

•

SmartStop App

–

500+

downloads

®

Branding Initiatives |

Branding

Initiatives Before

After

SmartStop

–

Hollywood

-

Memphis,Tennessee |

Branding

Initiatives Before

After

SmartStop

–

State

Rd.

84

–

Weston, Florida |

Running a Self Storage

Operation •

Branding Initiatives

•

People

•

Technology

•

Increasing Net Operating Income

•

Results |

People

•

Regional Directors

•

District Managers

•

Property Managers

•

Director of Training

•

Revenue Manager

*270+ Employees and Growing

"Hire good, smart people and train them well"

* Members of our Property Management team are employees of Strategic Storage Property Management, LLC.

and/or Strategic Storage Holdings, LLC. |

22

People

•

This is a retail establishment

-

Closed just 3 days out of the year

•

Standardized sales training

-

Lead conversion

-

Making the sale

-

Upselling |

23

Running a Self Storage Operation

•

Branding Initiatives

•

People

•

Technology

•

Increasing Net Operating Income

•

Results |

24

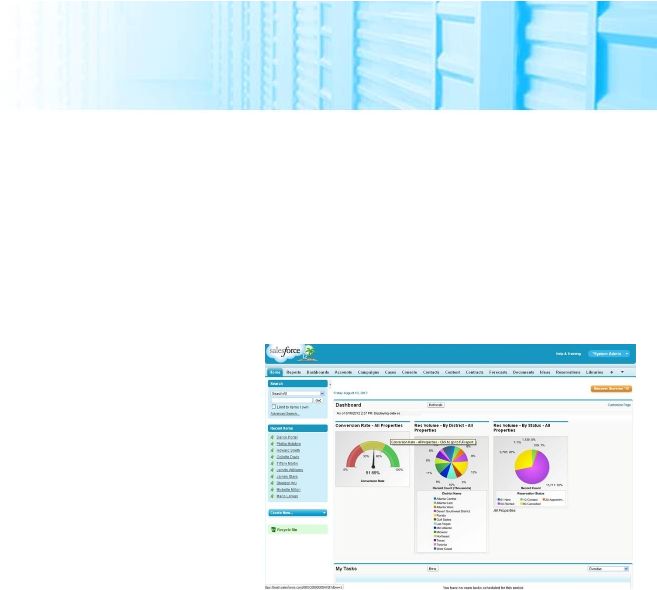

Technology

•

Real time Analytics Dashboard

•

Logic-based operating system for dynamic unit pricing

-

Over 10,000 price changes this year

•

Lead management

-

Improved lead conversion |

25

Running a Self Storage Operation

•

Branding Initiatives

•

People

•

Technology

•

Increasing Net Operating Income

•

Results |

Increasing NOI

Increasing Revenues

•

Increase Occupancy

•

Increasing Rates Based on Dynamic Unit Pricing

-

Existing Tenants

-

Face Rates

•

Tenant Insurance

•

Lead Conversion

•

Convenience Fees

•

Auxiliary Sales

-

Locks and Boxes

-

Truck Rents |

27

Increasing NOI

Reducing Expenses

•

Fixed vs. Variable Costs

•

Economies of Scale

•

National Pricing Power |

28

Running a Self Storage Operation

•

Branding Initiatives

•

People

•

Technology

•

Increasing Net Operating Income

•

Results |

29

Results

3,000

2,500

2,000

1,500

1,000

500

-

(500)

Same

Store

Occupancy

-

Jan

-

Jun

2012

84.0%

82.0%

80.0%

78.0%

76.0%

74.0%

72.0%

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Jun-12

Move Ins

Move Outs

Net

*2011 Occ Sq Ft (%)

2012 Occ Sq Ft (%)

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Jun-12

1,135

1,270

(135)

76.1%

76.5%

1,379

1,427

(48)

76.4%

77.0%

1,818

1,626

192

76.6%

77.5%

2,099

1,572

527

77.2%

78.8%

2,492

1,707

785

77.4%

80.7%

2,634

1,821

813

77.7%

82.5%

* Note: Highest occupancy achieved in 2011 was 79.1% on 7/31/11 |

30

Results

Same Store Revenue -

Year Over Year

$4,500,000

$4,000,000

$3,500,000

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$1,000,000

$500,000

$-

Feb

Mar

Apr

May

June

2012 Revenue

2011 Revenue

$3,096,000

$3,031,000

$3,521,000

$3,382,000

$3,508,000

$3,372,000

$3,766,000

$3,614,000

$3,813,000

$3,659,000

$3,901,000

$3,708,000

2.14%

4.11%

4.03%

4.21%

4.21%

5.20%

Revenue Variance (%)

Jan |

Results

600

550

500

450

400

350

300

250

200

150

100

50

0

Dec-11*

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Jun-12

Move Ins

Move Outs

Net

Occ Sq Ft (%)

1

0

1

46.30%

269

225

44

47.30%

273

170

103

48.80%

359

199

160

51.00%

425

225

200

53.10%

567

224

343

57.60%

587

322

265

61.00%

70.00%

65.00%

60.00%

55.00%

50.00%

45.00%

40.00%

35.00%

30.00%

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

-5.00%

* Dec-11 data is upon acquisition (12/27/11)

Former Homeland Stores -

Jan -

Jun 2012 |

32

Questions? |

Recap

•

Branding Initiatives

–

This is a Branded Retail Operation

•

People

•

Technology

•

Increasing NOI

•

Results

Yes, Technology can make you

money

Because we

can

It's working

Hire good people and train them

well |

August 21,

2012 Presented by

H. MICHAEL SCHWARTZ

President, CEO

Strategic Storage Trust, Inc.

KEN MORRISON

President

Strategic Storage Property Management |