Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CenterState Bank Corp | d396748d8k.htm |

Raymond James

2012 Bank Conference

August 14, 2012, Presented by Ernie Pinner, Jim Antal & John Corbett

Exhibit 99.1 |

This

presentation contains forward-looking statements, as defined by Federal Securities

Laws, relating to present or future trends or factors affecting the operations, markets and

products

of

CenterState

Banks,

Inc.

(CSFL).

These

statements

are

provided

to

assist

in

the

understanding of future financial performance. Any such statements are based on current

expectations and involve a number of risks and uncertainties. For a discussion of factors

that may cause such forward-looking statements to differ materially from actual

results, please refer to CSFL’s most recent Form 10-Q and Form 10-K filed

with the Securities Exchange Commission.

CSFL undertakes no obligation to release revisions to these forward-looking statements or

reflect events or circumstances after the date of this presentation.

Forward Looking Statement

2

2 |

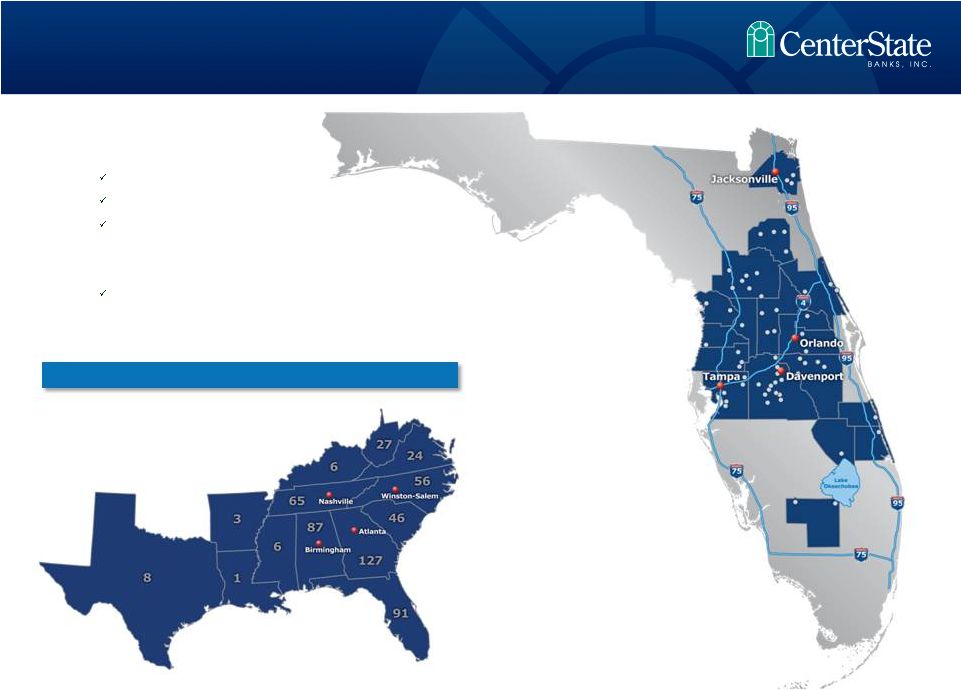

Data as

of 6/30/12 •

Headquartered in Davenport, FL

$2.4 billion in assets

$1.5 billion in loans

$2.1 billion in deposits

•

Company formed: June 2000

1 Subsidiary Bank

Corporate Overview

3

Correspondent Banking Market |

•

CAPITAL

-

Total

Risk-Based

Capital

Ratio

–

17.8%

•

LIQUIDITY

-

Loans

/

Assets

-

60%

•

LOANS WITH THIRD PARTY PROTECTION –

38%

23%

of loans are covered by loss sharing agreements with the FDIC

15%

are subject to “Put Back”

agreements with TD Bank or The Hartford Insurance Co.

•

ASSETS WITH THIRD PARTY PROTECTION –

46%

*

37% -

Backed by the United States

9% -

Backed by TD or The Hartford

•

LOW CONCENTRATION LEVELS

**

CRE at

101%

of capital vs. 300% guidance

CD&L at

20%

of capital vs. 100% guidance

* Includes cash and cash equivalents, AFS securities issued by U.S. Government Sponsored

Entities, FDIC covered assets, and FHLB and FRB stock. **Excludes FDIC covered

loans Conservative Balance Sheet

4 |

5

Ocala National Bank

Olde Cypress Community Bank

Independent National Bank of Ocala

Community National Bank of Bartow

Central Florida State Bank

First Guaranty Bank & Trust Co.

TD Bank divesture in Putnam

Federal Trust Acquisition

from The Hartford

Insurance Company Opportunistic through the Crisis

5

Correspondent Banking Division

Prepaid Card Division

Wealth Management Division

Trust Department

Vero Beach

Okeechobee

Jacksonville

Non –

FDIC Acquisitions

FDIC Acquisitions

New Fee-Based Business Lines

Strategic Expansion & Management Lift-Outs |

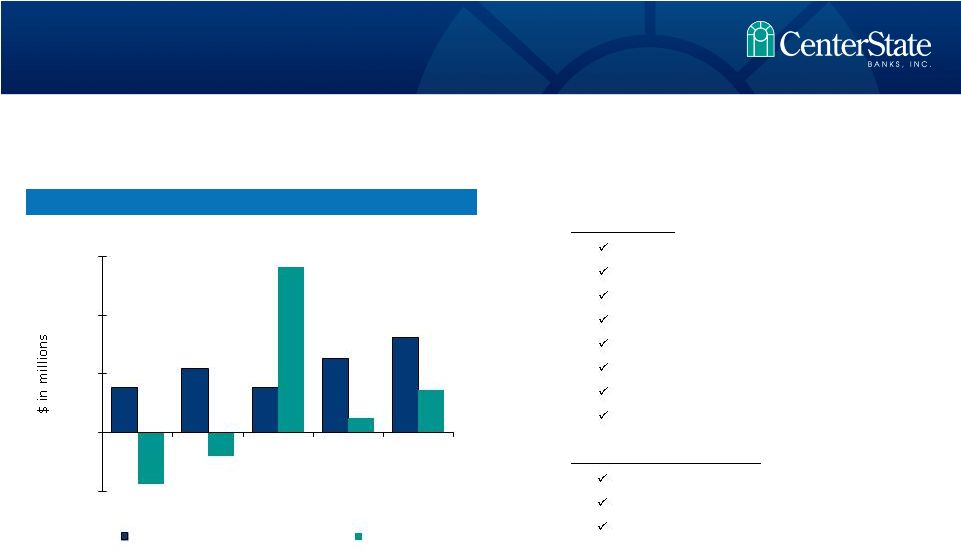

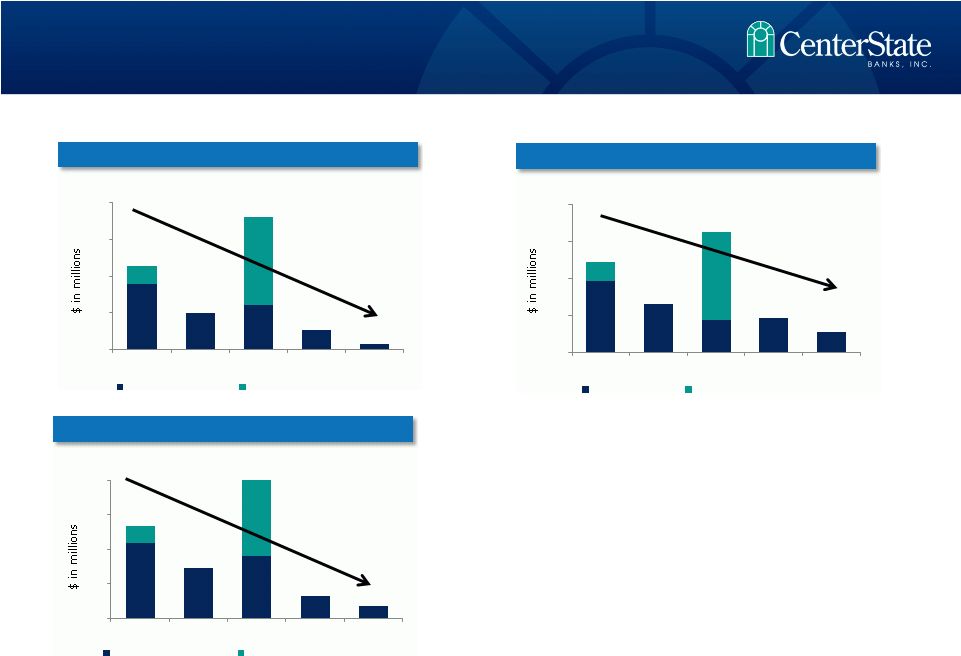

PTPP

1

&

Net

Income

•

2Q12

Results:

$0.12/sh on $3.7M net income

Margin expansion to 4.33% (4.19%)

Improved credit metrics

Lower loan loss provision expense

Higher bond sales revenue

Loan growth

Branch consolidation & efficiency results

PTPP improvement

•

Profitability

Components:

Credit Cost

Net Interest Margin

Operating Efficiencies

Profitability Metrics

$3.9

$5.5

$3.8

$6.3

$8.1

($4.3)

($2.0)

$14.1

$1.3

$3.7

$(5)

$-

$5

$10

$15

2Q11

3Q11

4Q11

1Q12

2Q12

Net Income

Pre-Tax, Pre-Provision Income

1. Pre-tax pre-provision income (“PTPP”) is a non-GAAP

measure that if defined as income (loss) before income tax excluding provision for loan losses, gain on sale of available

for sale securities, other credit related costs including losses on repossessed real estate and

other assets, other foreclosure related expenses., and non-recurring items.

6 |

Excludes FDIC

covered loans •

Provision expense trending downward

•

Net charge-offs trending downward

•

Total credit cost trending downward

Credit Cost

7

Loan Loss Provision (LLP)

Net Charge-Offs (NCOs)

Total Credit Costs

$10.9

$7.3

$9.0

$3.3

$1.8

All other credit cost

LLP related to loan sales

$2.5

$12.0

2Q11

3Q11

4Q11

1Q12

2Q12

$-

$5

$10

$15

$20

$21.0

$13.4

$16.3

$12.2

$2.5

$12.0

$9.7

$6.5

$4.3

$4.7

$2.7

2Q11

3Q11

4Q11

1Q12

2Q12

-offs

Net Charge

NCOs related to loan sales

$-

$5

$10

$15

$20

2Q11

3Q11

4Q11

1Q12

2Q12

Loan Loss Provision

LLP related to loan sales

$-

$5

$10

$15

$20

$8.9

$5.0

$6.0

$2.7

$0.8

$2.5

$12.0

$18.0

$11.4 |

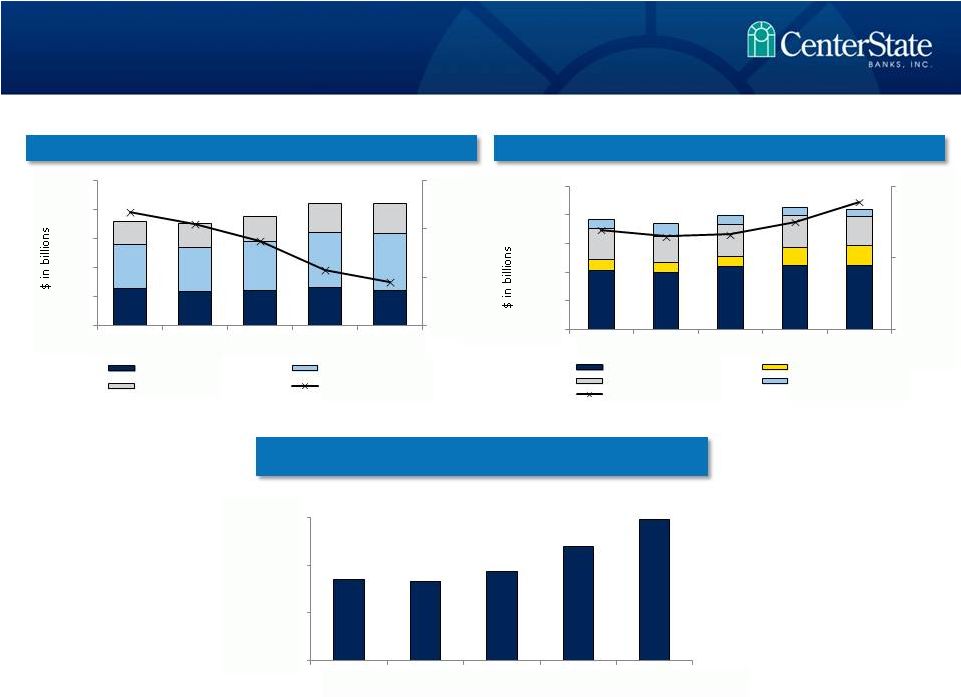

Covered Loans

- Average Yields

Covered Loans –

Average Balances

Non-Covered Loans –

Average Balance

Loans –

Yields and Averages

Non-Covered Loans –

Average Yields

* Adjusted for a catch-up item relating to one loan pool.

** Adjusted for non-accrual upgrades

8

$184

$176

$168

$309

$337

$248

$231

$218

$429

$488

$-

$100

$200

$300

$400

$500

2Q11

3Q11

4Q11

1Q12

2Q12

Carrying Balance

Unpaid Principal Balance

5.51%

6.21%

6.80%

6.74%

6.91%

4.75%

5.75%

6.75%

7.75%

2Q11

3Q11

4Q11

1Q12

2Q12*

$1,033

$991

$1,100

$1,117

$1,122

$850

$950

$1,050

$1,150

2Q11

3Q11

4Q11

1Q12

2Q12

5.39%

5.42%

5.21%

5.23%

5.20%

5.10%

5.20%

5.30%

5.40%

5.50%

2Q11

3Q11

4Q11

1Q12

2Q12** |

8

Costs of Deposits

Yield on Interest Earning Assets

Net Interest Margin

(excluding Correspondent Division)

Net Interest Margin

9

0.67%

0.62%

0.55%

0.43%

0.38%

0.20%

0.40%

0.60%

0.80%

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

2Q11

3Q11

4Q11

1Q12

2Q12

Time Deposits

Non Time Deposits

Demand Deposits

Cost of Deposits

4.39%

4.30%

4.33%

4.50%

4.78%

3.00%

4.00%

5.00%

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

2Q11

3Q11

4Q11

1Q12

2Q12

Non FDIC Covered Loans

FDIC Covered Loans

AFS Securities

All other

Yield on Earning Assets

3.85%

3.83%

3.93%

4.20%

4.48%

3.00%

3.50%

4.00%

4.50%

2Q11

3Q11

4Q11

1Q12

2Q12 |

24%

20%

28%

12%

16%

•

Value of core deposits not fully realized in this low rate environment.

•

Approximately

123,010

total

accounts

-

$16,715

average

balance

per

account

Core deposits defined as non-time deposits.

Total Deposits

Number of Deposit Accounts

9

DDA and NOW

6/30/11

6/30/12

Change

% Change

Balance

$706MM

$910MM

$204MM

29%

No. of Accounts

66,930

84,615

17,685

26%

Building Franchise Value with Core Deposits

10

0

500

1,000

1,500

2,000

2,500

2007

2008

2009

2010

2011

6/30/12

Time Deposits

MMDA

Savings

NOW

DDA

13,191

11,001

12,025

14,998

15,277

16,005

40,822

43,974

54,561

78,874

96,699

107,005

0

40,000

80,000

120,000

2007

2008

2009

2010

2011

6/30/2012

Time Deposits

Core Deposits

577

326

243

409

501 |

10

Opportunities through:

•

Leverage

•

Cost Efficiencies

Efficiency Ratio

Operating Efficiencies

94%

90%

101%

84%

81%

82%

79%

88%

78%

74%

60%

70%

80%

90%

100%

110%

2Q11

3Q11

4Q11

1Q12

2Q12

Efficiency Ratio*

Efficiency ratio, excluding credit costs**

11

* Efficiency Ratio is defined as follows: [non-interest expense – merger related

expenses – other nonrecurring expense] / [net interest income + non-interest income – gain

**Efficiency Ratio, excluding credit costs is defined as follows: [non-interest

expense – merger related expenses – credit costs – CDI amortization - other nonrecurring

expense] / [net interest income (fully tax equivalent) + non-interest income – gain on

sale of AFS securities – nonrecurring income]

on sale of AFS securities – nonrecurring income] |

11

Branch Consolidation –

15 ( 11 FDIC / 4 Legacy)

Reduction in Force -

85

Data Processing Conversions -

Complete

Merger of Subsidiaries -

Complete

Events since 1-1-12

Focus on Efficiency and Core Earnings

12 |

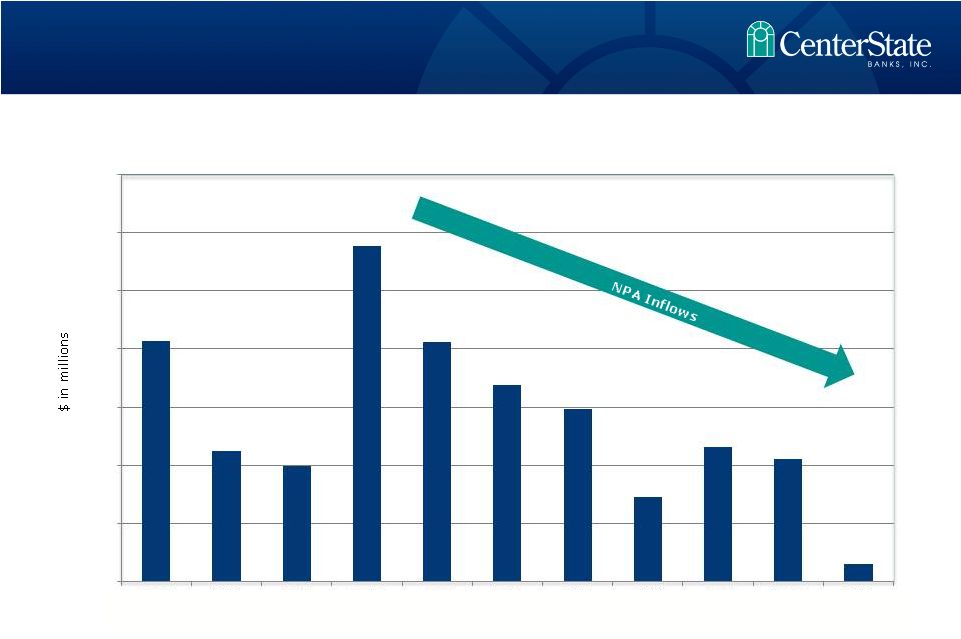

NPA Inflows

– Slowing Down

Excluding FDIC covered assets

$0

$5

$10

$15

$20

$25

$30

$35

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

13 |

NPAs / Loans

& OREO (%) Problem Loan Trends

Source: SNL Financial and Company filings. Peer information updated quarterly

Nonperforming assets include 90 days or more past due.

Southeastern peers include ABCB, BTFG, GRNB, PNFP, RNST, SCBT, UBSH and UCBI.

Florida peers include all banks headquartered in Florida , opened no later than

12/31/2005 and total assets between $500 million and $5 billion.

14

Credit Quality Trends -

Improving

14

$17.3

$10.1

$8.2

$16.3

$7.5

$6.9

$71.6

$66.0

$62.2

$39.0

$42.7

$31.9

$10.7

$12.1

$13.8

$10.3

$8.6

$7.5

$0

$25

$50

$75

$100

$125

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

$8.7

$8.5

$7.1

$6.6

$6.7

$6.8

TDRs accruing only

30 -

89 days past due

90 days and nonaccrual

OREO/ORA

3.47

7.75

9.13

0.00

5.00

10.00

15.00

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

CSFL

Southeastern Peers

Florida Peers |

•

$7,496M

•

OREO & Repos are carried at 45% of Unpaid

Principal Balance

15

Data as of 6/30/12

•

$31,887M (2.83% of Gross Loans)

•

NPLs are carried at 73% of Unpaid Principal Balance

•

Current NPLs at 26%

41%

41%

12%

5%

1%

(28)

(39)

1%

(35)

(93)

(43)

(17)

18%

19%

37%

9%

18%

(23)

(13)

(38)

(6)

NPA Breakout as of June 30, 2012

15

Excluding FDIC covered assets

Residential,

$13,181

Comm RE,

$13,055

Constr, Dev,

Land,

$3,705

Commercial,

$1,498

Consumer,

$448

4 Family,

$1,313

Comm

Buildings,

$1,446

Resi Lots,

$1,335

Vacant Land,

$2,761

Other Repo,

$641

1-

OREO & Repo ($M)

Non-Performing Loans ($M) |

Source:

Florida Realtors 16

•

Median single family home prices are the highest in 34 months

•

Pending home sales are up 19% from last year

•

Average days on the market are down 17% from last year

Florida Housing on the Road to Recovery

16

Single Family Inventory

Months Supply of Inventory

191,254

163,118

112,365

2010

2011

2012

2010

2011

2012

10.0

6.0

11.8 |

19

Loan Trends as of June 30, 2012

17

Excluding FDIC covered assets

Total Pipeline

$-

$50

$100

$150

$200

$250

March-12

April-12

May-12

June-12

$21

$14

$27

$17

$34

$31

$36

$45

$95

$161

$100

$148

Closed Amount

Approved & Accepted

Under Analysis

$-

$20

$40

$60

$80

2Q11

3Q11

4Q11

1Q12

2Q12

$40

$35

$44

$54

$59

New Loan Production |

17

40%

Source: SNL Financial

Data as of 6/30/12 or MRQ

Banks with Texas Ratio over 200%

18 |

18

CSFL Advantages

•

CSFL is one of only six major

exchange traded banks

headquartered in FL with assets

greater than $1.0 billion

•

Proven experience through 8

successful acquisitions in the past 3

years

•

Disproportionate number of sellers

versus very few buyers

•

The number of small, distressed

Florida institutions remains high

CSFL –

Best Positioned Florida Consolidator

Source: SNL Financial

Data as of MRQ available

19 |

20

•

Florida economy improving

•

CSFL metrics improving with better performance anticipated

•

Vision still includes bank consolidations

•

Expect better efficiencies in the near term

•

Lifetime local bankers with common lineage

Summary

20 |

Appendix

|

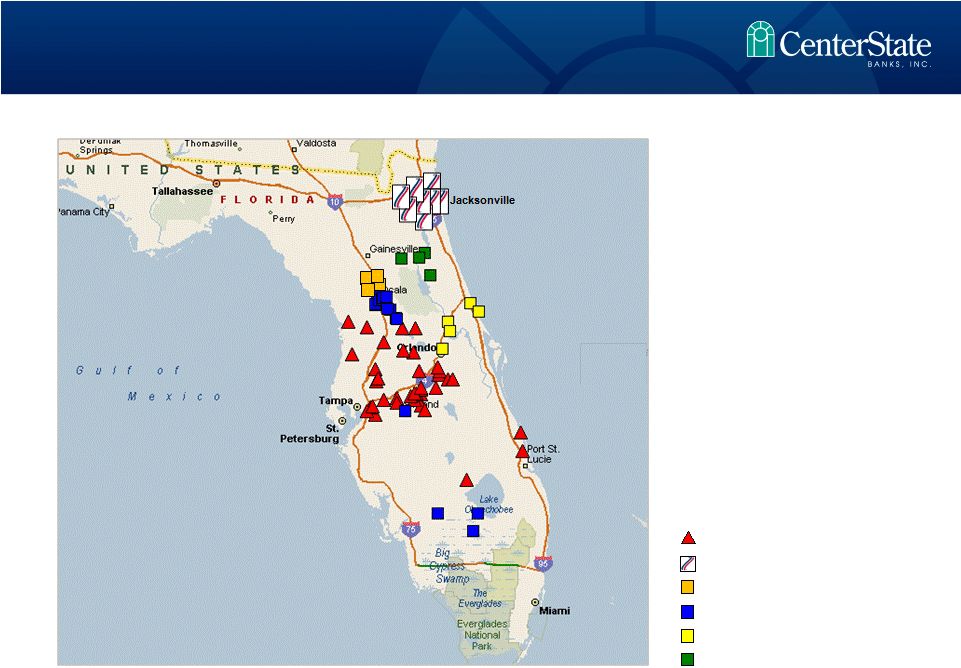

Source: SNL Financial

21

Legacy CSFL Branch

First Guaranty Bank (FDIC)

Central FL State Bank (FDIC)

Three FDIC Acquisitions (3Q 2010)

Federal Trust Acquisition (Nov 2011)

TD Branch Acquisition (Jan 2011)

Recent M&A Transactions

21 |

22

•

Two successful capital raises in 2009 and 2010 totaling $114 million

•

First publicly traded bank in Florida to successfully complete a capital raise during

financial crisis in 2009 •

Over

50

“Blue

Chip”

active

institutional

investors

–

Average

daily

volume

over

50,000

shares

•

Institutions committed to capitalize additional FDIC accretive transactions

Capital

22

19.3

18.88

19.67

19.28

17.99

18.81

18.65

19.05

17.64

17.8

11.6

11.3

10.94

10.3

9.99

10.07

10.28

10.49

9.03

9.23

5.00

10.00

15.00

20.00

25.00

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Total Risk-Based Capital Ratio

Tier 1 Leverage Ratio

Total

Risk-Based

&

Tier

1

Leverage |

Total

Deposits by Type Total Deposits Detail

23

Total Deposit Portfolio as of June 30,

2012 23

Demand

Deposits

40,621

$ 501 MM

$12,300

Now Accounts

43,994

$ 409 MM

$9,300

Savings

Deposits

18,950

$ 243 MM

$12,800

Money Market

3,440

$ 326 MM

$94,700

Certificates of

Deposits

16,005

$ 577 MM

$36,100

Total

123,010

$ 2,056 MM

$16,700

Demand

Deposits

24%

NOW

Accounts

20%

Savings

Accounts

12%

Money

Market

16%

Certificates

of Deposits

28%

Deposit Type

No. of

Deposits

Balance

Avg Deposit

Balance |

24

Loan Type

No. of

Loans

Balance

Avg Loan

Balance

Residential Real

Estate

3,943

$ 423 MM

$107,300

CRE-Owner

Occupied

731

$ 272 MM

$372,100

CRE-Non Owner

Occupied

457

$ 189 MM

$413,600

Construction,

A&D, & Land

478

$ 67 MM

$140,200

Commercial &

Industrial

1,146

$ 128 MM

$111,700

Consumer & All

Other

2,743

$ 49 MM

$17,900

Total

9,498

$ 1,128 MM

$118,800

Total Loan Portfolio as of June 30,

2012 24

Excluding FDIC covered assets

Residential

Real Estate

38%

Comm RE -

Owner

Occupied

24%

Comm RE -

Non Owner

Occupied

17%

Construction,

A&D, & Land

6%

Commercial &

Industrial

11%

Consumer /

Other

4%

Total Loans by Type

Total Loans Detail |

25

C&D concentration –

20% vs. 100%

•

59% Owner Occupied

CRE concentration –

101% vs. 300%

% of CRE

Loans

Avg. Loan

Amount

($000)

0.3%

$452

0.6%

$902

2.3%

$628

2.5%

$732

2.8%

$194

3.1%

$238

3.9%

$439

4.6%

$564

6.8%

$506

7.6%

$532

7.7%

$585

11.0%

$602

12.5%

$334

13.8%

$354

20.4%

$296

100.0%

$388

% of CDL

Loans

Avg. Loan

Amt

($000)

0.1%

$67

0.7%

$470

0.9%

$608

1.3%

$215

1.4%

$960

1.6%

$1,057

3.8%

$184

6.5%

$545

7.5%

$296

8.8%

$390

27.9%

$57

39.4%

$296

100.0%

$140

CRE Concentrations as of June 30,

2012 25

Excluding FDIC covered assets

Commercial Real Estate by Type ($MM)

Construction Loans by Type ($MM)

$94.3

$63.7

$57.8

$50.5

$35.7

$35.1

$31.4

$21.4

$18.0

$14.3

$12.8

$11.7

$10.7

$2.7

$1.4

$0

$50

$100

Office

Retail

Other CRE

Church/Education

Medical

Industrial

Warehouse

Restaurant

Strip Center

Agriculture

Res Multi Family

Mobile Home Park

Mini Warehouse

Hotel/Lodging

Aviation

$26.4

$18.7

$5.9

$5.0

$4.4

$2.6

$1.1

$1.0

$0.9

$0.6

$0.5

$0.1

$0

$7

$14

$21

$28

$35

Raw

Land-Future Comm

Individual

Resi

Lot

Raw

Land-Future

Resi

Constr

-

Other

Developed

Land

Constr

-

Single

Fam

Construction-Office

Constr

-

Church/Edu

Constr

-

Spec

Home

Constr

-

Medical

Constr

-

Strip

Center

Raw

Land

-

Agri |