Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mattersight Corp | d393544d8k.htm |

| EX-99.1 - PRESS RELEASE - Mattersight Corp | d393544dex991.htm |

Mattersight

Q2 2012 Earnings Webinar

August 8, 2012

Exhibit 99.2 |

2

Safe Harbor Language

During today’s call we will be making both historical and

forward-looking statements in order to help you better

understand our business. These forward-looking statements

include references to our plans, intentions, expectations,

beliefs, strategies and objectives. Any forward-looking

statements speak only as of today’s date. In addition, these

forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ

materially from those stated or implied by the forward-

looking statements. The risks and uncertainties associated

with our business are highlighted in our filings with the SEC,

including our Annual Report filed on Form 10-K for the year

ended December 31, 2011, our quarterly reports on Form

10-Q, as well as our press release issued earlier today.

Mattersight undertakes no obligation to publicly update or

revise any forward-looking statements in this call. Also, be

advised that this call is being recorded and is copyrighted by

Mattersight Corporation. |

Q2

Overview •

Strong Positives

Exceeded all of our internal forecasts with $19.4m in bookings

Achieved record backlog of $104.6m

Increased Subscription Revenues 32%, year/year

Grew our pilot activity ~5x year/year

Created $100m+ opportunities in our near term pipeline

Cultivated numerous strategic partnership dialogues

Set up return to sequential growth in Q3 and Q4

Added strong players to our team

Signed $10m Line of Credit with Silicon Valley Bank

•

Disappointments

Delivery delays are slowing our projected revenue ramp

3 |

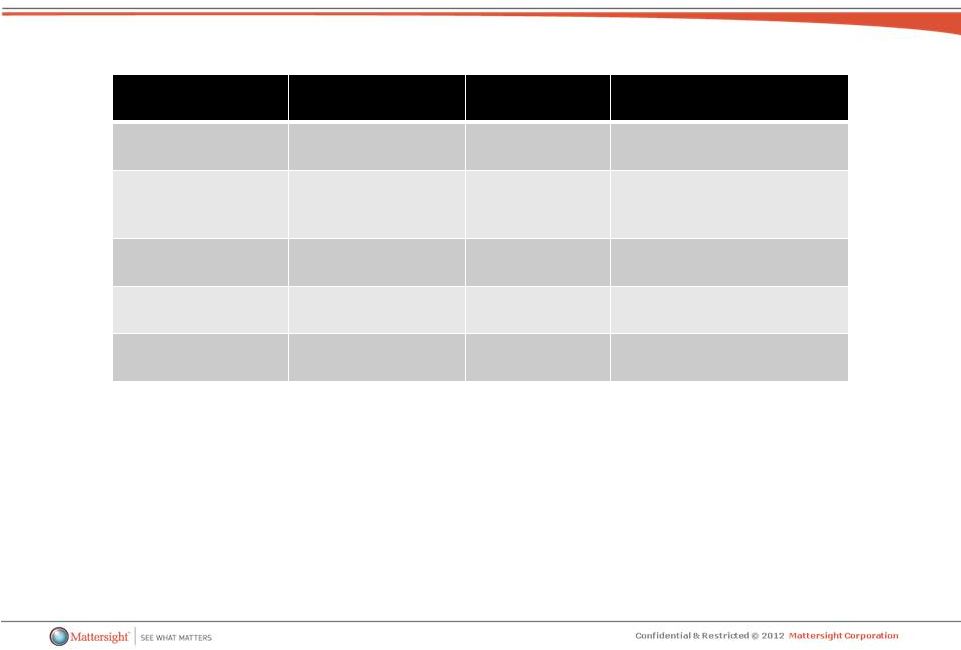

$19.4m in Q2

Bookings

Deal

Type

Application

Customer

Type

Industry

Company Overview

Pilot

Guest Assistance

New Logo

Hospitality

Large Multinational Hotel

Chain

Pilot

Enrollment

Analysis

New Logo

Education

Private Sector Ed

Company

Expansion

New Business Unit

New

Healthcare

Very Large PBM

Expansion

New Application

Existing

Healthcare

Large HMO

Renewal /

Expansion

Collections

Existing

Financial

Services

Financial Services

Renewal

Customer Care

Existing

Healthcare

Pharma Company

4 |

Record Managed

Services Backlog 5

$58.9

$84.5

$80.1

$100.0

$102.3

$96.3

$94.6

$104.6

$50.0

$60.0

$70.0

$80.0

$90.0

$100.0

$110.0

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012 |

Record Pilot

Activity 6

Added 5 new Pilots and 1 Pilot ended without conversion |

Q2 Pilots

7

Industry

Application

Customer

Type

Comments

Hospitality

Service

New

Improved Efficiency and

Guest Experience

Education

Enrollment

Analytics

New

Combines Voice & Desktop

Data to Predict Student

Outcomes

Healthcare

Predictive Routing

Existing

Improving Customer

Experience

Financial Services

Real Time Analytics

Existing

First Real Time Application

Publishing

Multichannel

Analytics

Existing

Second Pilot of

Multichannel Analytics |

Q2 Revenue

Discussion 8

Q2 Sequential Revenue Change Discussion

$500k related to the previously discussed loss of client

$200k of Subscription Revs

$300k of Termination Payments (classed as Sub Revs)

$400k related to run off of Amortized Deployment Revenues

$100k related to seasonally lower Subscription usage

Impact of Implementation Delays

Initial Desktop Analytics implementations have been more

complex and have taken longer than was anticipated

These delays negatively impacted Q2 Subscription

Revenues by ~$400k

These delays are expected to negatively impact Q3

Subscription Revenues by ~$500k

The impact of these delays will begin to abate in Q4 with

the negative impact estimated to be ~$200k |

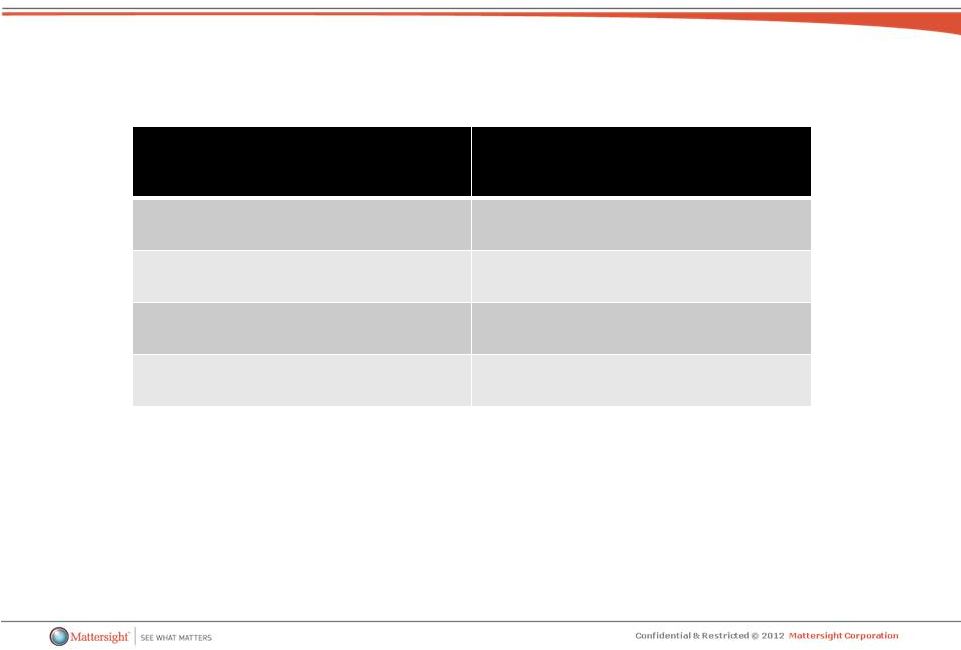

Significant

Opportunities are Emerging in Pipeline Over the Next Three Quarters

9

Deal

Type

Bookings Opportunities

Existing Accounts

25m –

70m

Pilot Conversions

10m –

25m

Direct to Deployments

0m –

5m

Total

35m –

100m

The majority of these opportunities are targeted for Q4 and Q1 2013

Pursuing numerous large expansions at existing Health Care accounts, including one

large $50m+ deal

Estimated Range Of |

Emerging

Strategic Opportunities Potential Strategic

Partner

Strategic Focus

Business Value

Strategic

Significance

Large Education

Company

Route Calls Based on Real

Time Personality and

Engagement Analytics

Increase Conversion Rates

Real Time Analytics and

Routing

Large Education

Company

Analyze On Line Student

Discussion Threads

Improve Student Outcomes

and Regulatory Compliance

Increase Our Value to Ed

Companies;

Apply Analytics to Text;

Create New Revenue

Stream

Premier Management

Consulting Firm

Create “Survey-Less”

Net

Promoter Scores

Increase Usage of Net

Promoter Scores (NPS)

Build Our Reputation in

Predictive Customer

Models

Emerging Video Hiring

Platform Company

Apply Our Algorithms to

Recorded Interview Content

Improve Hiring Outcomes

Create New Application

Area

Top 5 University

Analyze On Line Student

Discussion Threads

Improve Teacher Effectiveness

Credentialize Us

in Ed

Space Highly Recognized

Boutique Consulting

Firm

Apply Advanced Analytics to

Education

Increase Use of Analytics in

Education

Credentialize Us

in Ed

Space 10 |

Building

Team •

Added Mark Iserloth as CFO

25 years experience

12 years of relevant CFO experience with Software Companies

Strong educational pedigree and reputation in the Chicago

Tech community

•

Account Executive Hires

Added 2 in Q2

Added 1 to date in Q3

Currently have 19 Quota Carriers

11 |

Balance Sheet

Management •

Uses of Cash in Q2 Included

Funding Operating Loss

$2.8m use of cash due to timing of customer prepayments and

the amortization of deferred revenues

•

Based on Our Increasing Momentum and the Attractiveness

of the Opportunity, We Will Continue to Invest Aggressively

in Sales, Marketing and Product Development

•

Cash Management Strategies

Push for customer prepayments

Use Line of Credit as needed

12 |

Revenue

Outlook 13

•

Q3 Guidance

100% Sold to $8.3M

Range

of

$8.0M

-

$8.3M

•

Q4 Outlook

100% Sold to $9.2M

Range

of

$8.7M

-

$9.2M |

Summary

•

Leader in an Emerging Big Data Market

•

Highly Differentiated Product

•

Products and Delivery Model Analytics Drives Significant

Tangible ROI

•

Pipeline Continues to Strengthen

•

Numerous Interesting Strategic Dialogues Emerging

14 |

15

Thank You

•

Kelly Conway

847.582.7200

•

Mark Iserloth

312.454.3613

kelly.conway@mattersight.com

mark.iserloth@mattersight.com |