Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-27975

Mattersight Corporation

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

36-4304577 |

|

(State or other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

200 W. Madison Street, Suite 3100

Chicago, Illinois 60606

(Address of Registrant’s Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (877) 235-6925

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, par value $0.01 per share |

|

NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Annual Report on Form 10-K or any amendment to this Annual Report on Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

o |

Accelerated filer |

|

o |

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

o (Do not check if a smaller reporting company) |

Smaller reporting company |

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of Common Stock held by non-affiliates of the registrant, based upon the closing price per share of registrant’s Common Stock on June 30, 2015, as reported by The NASDAQ Stock Market LLC, is approximately $86,674,835.

The registrant met the “accelerated filer” requirements as of the end of its fiscal year pursuant to Rule 12b-2 of the Securities Exchange Act of 1934, as amended. However, pursuant to Rule 12b-2 and SEC Release No. 33-8876, the registrant (as a smaller reporting company transitioning to the larger reporting company system based on its public float as of June 30, 2015) is not required to satisfy the larger reporting company requirements until its first Quarterly Report on Form 10-Q for the 2016 fiscal year and thus is eligible to check the “Smaller Reporting Company” box on the cover of this Annual Report on Form 10-K.

The number of shares of the registrant’s Common Stock outstanding as of February 25, 2016 was 26,593,994.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Mattersight’s Proxy Statement for its 2016 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission within 120 days after the end of Mattersight’s fiscal year, are incorporated herein by reference into Part III where indicated; provided, that if such Proxy Statement is not filed with the Securities and Exchange Commission within 120 days after the fiscal year end covered by this Annual Report on Form 10-K, an amendment to this Annual Report on Form 10-K shall be filed no later than the end of such 120-day period.

PART I

|

Item |

|

|

|

Page |

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 1A. |

|

|

4 |

|

|

Item 1B. |

|

|

10 |

|

|

Item 2. |

|

|

10 |

|

|

Item 3. |

|

|

10 |

|

|

Item 4. |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

10 |

|

|

Item 6. |

|

|

13 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

14 |

|

Item 7A. |

|

|

26 |

|

|

Item 8. |

|

|

27 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

60 |

|

Item 9A. |

|

|

60 |

|

|

Item 9B. |

|

|

61 |

|

|

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

62 |

|

|

Item 11. |

|

|

63 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

63 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

64 |

|

Item 14. |

|

|

64 |

|

|

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

65 |

|

|

|

66 |

|||

|

|

I-1 |

|||

Overview

Mattersight Corporation (together with its subsidiaries and predecessors, “Mattersight,” “we,” “us,” or the “Company”) is a leader in behavioral analytics and a pioneer in personality-based software products. Using a stack of innovative, patented applications, including predictive behavioral routing, performance management, quality assurance, and predictive analytics (collectively, “Behavioral Analytics”), Mattersight analyzes and predicts customer behavior based on the language exchanged between agents and customers during brand interactions. These insights are then used to facilitate more effective and effortless customer conversations, which, in turn, drive increased customer satisfaction and retention, employee engagement, and operating efficiency. Mattersight’s analytics are based on millions of proprietary algorithms and the application of unique behavioral models. Mattersight’s solutions have influenced hundreds of millions of shorter, more satisfying customer interactions for leading companies in the healthcare, insurance, financial services, technology, telecommunications, cable, utilities, education, hospitality, and government industries.

The Company’s multi-channel technology captures the unstructured data of voice interactions (conversations), related customer and employee data, and employee desktop activity, and applies millions of proprietary algorithms against those interactions. Each interaction contains hundreds of attributes that get scored and ultimately detect patterns of behavior or business process that provide the transparency and predictability necessary to enhance revenue, improve the customer experience, improve efficiency, and predict and navigate outcomes. Adaptive across industries, programs, and industry-specific processes, the Company’s Behavioral Analytics offerings enable its clients to drive measurable economic benefit through the improvement of contact center performance, customer satisfaction and retention, fraud reduction, and streamlined back office operations. Specifically, through its Behavioral Analytics offerings, Mattersight helps its clients:

|

|

· |

Identify optimal customer/employee behavioral pairing for call routing; |

|

|

· |

Identify and understand customer personality; |

|

|

· |

Automatically measure customer satisfaction and agent performance on every analyzed call; |

|

|

· |

Improve rapport between agent and customer; |

|

|

· |

Reduce call handle times while improving customer satisfaction; |

|

|

· |

Identify opportunities to improve self-service applications; |

|

|

· |

Improve cross-sell and up-sell success rates; |

|

|

· |

Improve the efficiency and effectiveness of collection efforts; |

|

|

· |

Measure and improve supervisor effectiveness and coaching; |

|

|

· |

Improve agent effectiveness by analyzing key attributes of desktop usage; |

|

|

· |

Predict likelihood of customer attrition; |

|

|

· |

Predict customer satisfaction and Net Promoter Scores® without customer surveys; |

|

|

· |

Predict likelihood of debt repayment; |

|

|

· |

Predict likelihood of a sale or cross-sell; and |

|

|

· |

Identify fraudulent callers and improve authentication processes. |

Mattersight’s mission is to help brands have more effective and effortless conversations with their customers. Using a suite of innovative personality-based software applications, Mattersight can analyze and predict customer behavior based on the language exchanged during service and sales interactions. The Company operates a highly scalable, flexible, and adaptive application platform to enable clients to implement and operate these applications.

1

Through the sale of its services featuring these applications, the Company generates the following types of revenue:

Subscription Revenue

Subscription revenue consists of revenue derived from Mattersight’s Behavioral Analytics service offerings, including predictive behavioral routing, performance management, quality assurance, predictive analytics, and marketing managed services revenue derived from the performance of services on a continual basis.

Subscription revenue is based on a number of factors, such as the number of users to whom the Company provides one or more of its Behavioral Analytics offerings, the type and number of Behavioral Analytics offerings deployed to the client, and in some cases, the number of hours of calls analyzed during the relevant month of the subscription period. Subscription periods generally range from three to five years after the go-live date or, in cases where the Company contracts with a client for a short-term pilot of a Behavioral Analytics offering prior to committing to a longer subscription period, if any, the subscription or pilot periods generally range from three to twelve months after the go-live date. This revenue is recognized over the applicable subscription period as the service is performed for the client.

Other Revenue

Other revenue consists of deployment revenue, professional services revenue, and reimbursed expenses revenue.

Deployment revenue consists of planning, deployment, and training fees derived from Behavioral Analytics contracts. These fees, which are considered to be installation fees related to Behavioral Analytics subscription contracts, are deferred until the installation is complete and are then recognized over the applicable subscription or pilot period. Installation costs incurred are deferred up to an amount not to exceed the amount of deferred installation revenue and additional amounts that are recoverable based on the contractual arrangement. These costs are included in prepaid expenses and other long-term assets. Such costs are amortized over the subscription period. Costs in excess of the foregoing revenue amount are expensed in the period incurred.

Professional services revenue primarily consists of fees charged to the Company’s clients to provide post-deployment follow-on consulting services, which include custom data analysis, the implementation of enhancements, and training, as well as fees generated from the Company’s operational consulting services. The professional services are performed for the Company’s clients on a fixed-fee or time-and-materials basis. Revenue is recognized as the services are performed, with performance generally assessed on the ratio of actual hours incurred to-date compared with the total estimated hours over the entire term of the contract.

Reimbursed expenses revenue includes billable costs related to travel and other out-of-pocket expenses incurred while performing services for the Company’s clients. An equivalent amount of reimbursable expenses is included in total cost of other revenue.

Business Segments

The Company operates in a single business segment, focused primarily on Behavioral Analytics. Financial information concerning our business segment is included in “Financial Statements and Supplementary Data” Part II, Item 8 of this Annual Report on Form 10-K.

International Operations

The Company’s services are currently delivered to clients in the United States, however prior to November 2015, the Company had also delivered services to a client in the United Kingdom. The Company’s revenue is and has been recognized in the Company’s U.S. entity. The Company’s long-lived assets are and have been predominately located in the United States and consist of equipment, software, furniture and fixtures, and leasehold improvements (net of accumulated depreciation and amortization).

Methods of Distribution

Our subscription and other revenue are generated by direct contractual relationships with our clients.

2

General

Our ability to protect our software, methodologies, and other intellectual property is important to our success and our competitive position. We view as proprietary the software (including source code), algorithms, analyses, and other ideas, concepts, and developments that we create in order to provide, improve, and enhance our service offerings, as well as the work product we create in the course of providing services for clients. We seek to protect our intellectual property rights in these developments and work product by relying on a combination of patent, copyright, trademark, and trade secret law, and confidentiality and non-disclosure agreements with our employees and third parties.

Patents

As of December 31, 2015, we held twenty-two U.S. patents and one European patent and have applied for over twenty additional patents. These patents cover a broad range of our analytics capabilities, including methods for analyzing language to assess customer personality, routing customers based on personality in real time, optimizing routing to improve agent performance, and analyzing data to improve employee performance. Our issued patents will expire between 2025 and 2034.

Trademarks

We have obtained U.S. federal trademark registration for the MATTERSIGHT word mark and our tagline “The Chemistry of Conversation”. We believe that the registration of the MATTERSIGHT word mark and tagline in the United States is material to our operations.

Licenses

A majority of our clients require that we grant to them licenses in and to the intellectual property rights associated with the work product we create in the course of providing services. In some cases, our clients require assignment of ownership in the intellectual property rights to such work product, typically where such work product incorporates their confidential information or would provide them some competitive advantage in their industry. Absent an agreement to the contrary, each assignment of ownership in intellectual property rights would result in our inability to reuse the relevant work product with other clients. As a result, it is our practice to retain the rights in the underlying core intellectual property on which such work product is based, including methodologies, workplans, and software, as well as residual know-how. If we are unable to retain such rights, it is our policy to obtain from our clients a broad license to sell service offerings using such work product to other clients.

Seasonality

We typically experience modest increases in revenue and earnings from our healthcare clients during the fourth quarter due to annual healthcare enrollment periods and increased claims processing at year-end. Any other seasonal impact to our revenue and earnings is limited, as a significant portion of our revenue is earned through our Behavioral Analytics subscription services, which is a recurring annual revenue stream.

Clients

During fiscal year 2015, our five and ten largest clients accounted for 73% and 89% of our total revenue, respectively. During fiscal year 2014, our five and ten largest clients accounted for 75% and 91% of our total revenue, respectively. During fiscal year 2013, our five and ten largest clients accounted for 69% and 90% of our total revenue, respectively. In fiscal year 2015, there were three clients that accounted for 10% or more of total revenue: United HealthCare Services, Inc.; Progressive Casualty Insurance Company; and CVS Caremark Corporation, which accounted for 31%, 15%, and 13% of total revenue, respectively. In fiscal year 2014, there were three clients that accounted for 10% or more of total revenue: United HealthCare Services, Inc.; Progressive Casualty Insurance Company; and Health Care Service Corporation, which accounted for 25%, 20%, and 11% of total revenue, respectively. In fiscal year 2013, there were four clients that accounted for 10% or more of total revenue: Vangent, Inc.; Progressive Casualty Insurance Company; Allstate Insurance Company; and United HealthCare Services, Inc., which accounted for 21%, 15%, 13%, and 11% of total revenue, respectively. For fiscal years 2015, 2014, and 2013, nine, seven, and nine clients, respectively, each accounted for over $1 million of total revenue. See “Note Two—Summary of Significant Accounting Policies” of the “Notes to Consolidated Financial Statements” included in Part II Item 8 of this Annual Report on Form 10-K.

3

Although we view the manner in which we provide Behavioral Analytics, and its benefits, to be unique, we nonetheless operate in a highly competitive and rapidly changing market and compete with a variety of organizations that offer services that may be viewed as similar to ours. These competitive organizations include data analytics solutions providers, voice recording and voice analytic services providers and software licensors, call routing solution providers, and strategic consulting firms. We believe that few competitors offer the full range and depth of services that we can provide, but they may compete with us on individual factors such as expertise, price, or capacity.

Many of our competitors have longer operating histories, more clients, longer relationships with their clients, greater brand or name recognition, and significantly greater financial, technical, marketing, and public relations resources than we do. As a result, our competitors may be in a better position to respond quickly to new or emerging technologies and changes in client requirements. They may also develop and promote their products and services more effectively than we do. New market entrants also pose a threat to our business. Existing or future competitors may develop or offer solutions that are comparable or superior to ours at a lower price.

Environmental Issues

There are no known material compliance issues regarding the Company with any Federal, state, or local environmental regulations.

Employees

As of December 31, 2015, we employed 241 persons, none of whom is represented by a union. We consider our employee relations to be good.

Available Information and Other

Our principal internet address is www.Mattersight.com. Our Annual, Quarterly, and Current Reports on Forms 10-K, 10-Q, and 8-K, and any amendments thereto, as well as the Forms 3, 4, and 5 beneficial ownership reports filed with respect to our stock, are made available free of charge on our website as soon as reasonably practicable after the reports have been filed with, or furnished to, the Securities and Exchange Commission (“SEC”). However, the information found on our website is not part of this or any other report filed by us with the SEC. These reports may also be obtained at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Information regarding the operation of the SEC’s public reference room may be obtained by calling the SEC at (800) SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy statements, and other information regarding SEC registrants, including Mattersight.

Mattersight was incorporated in Delaware in May 1999. Our executive office is currently located at 200 W. Madison Street, Suite 3100, Chicago, Illinois 60606 and our main telephone number is (877) 235-6925.

There are a number of risks and uncertainties that could adversely affect our business and our overall financial performance. In addition to the matters discussed elsewhere in this Annual Report on Form 10-K, we believe the more significant of such risks and uncertainties include the following:

We have not realized an operating profit in sixteen years and there is no guarantee that we will realize an operating profit in the foreseeable future.

As of December 31, 2015, we had an accumulated deficit of $242.1 million. We expect to continue to use cash and incur operating expenses to support our growth, including costs associated with recruiting, training, and managing our sales force, costs to develop and acquire new technology, and promotional costs associated with reaching new clients. These investments, which typically are made in advance of revenue, may not yield an offsetting increase in revenue. As a result of these factors, our future revenue and income potential is uncertain. Even if we achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress our value and could impair our ability to raise capital, expand our business, maintain our product development efforts, diversify our product offerings, or continue our operations. A decline in our value could also cause you to lose all or part of your investment.

4

Our financial results are subject to significant fluctuations because of many factors, any of which could adversely affect our stock price.

In some future periods, our operating results may be below the expectations of public market analysts and investors. In this event, the price of our publicly-traded securities may fall. Our revenue and operating results may vary significantly due to a number of factors, many of which are not in our control. We may incur an impairment of goodwill and long-lived assets if our financial results are adversely impacted by these factors and we continue to incur financial losses or our stock price declines. These factors include:

|

|

· |

Our ability to continue to grow our revenue and meet anticipated growth targets; |

|

|

· |

Our ability to maintain our current relationships, and develop new relationships, with clients, service providers, and business partners; |

|

|

· |

Unanticipated cancellations or deferrals of, or reductions in the scope of, our major Behavioral Analytics contracts; |

|

|

· |

The length of the sales cycle associated with our solutions; |

|

|

· |

Our ability to successfully introduce new, and upgrade our existing, service offerings for clients; |

|

|

· |

Our ability to respond effectively to competition; |

|

|

· |

The mix of our service offerings sold in any period; |

|

|

· |

The cost and potential outcomes of litigation, which could have a material adverse effect on our business; |

|

|

· |

Future accounting pronouncements or changes in our accounting policies; and |

|

|

· |

General economic conditions. |

If we are unable to address these risks, our business, results of operations, and prospects could suffer.

We depend on a limited number of clients for a significant portion of our revenue, and the loss of a significant client or a substantial decline in the size or scope of deployments for a significant client, could have a material adverse effect on our business.

We derive, and expect to continue to derive for the foreseeable future, a significant portion of our total revenue from a limited number of clients. See “Clients” in Part I Item 1 and “Year Ended December 31, 2015 Compared with the Year Ended December 31, 2014” included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II Item 7 of this Annual Report on Form 10-K for more information on the portion of our total revenue derived from these clients. To the extent that any significant client uses less of our services or terminates its relationship with us, as may occur as clients respond to conditions affecting their own businesses, our total revenue could decline substantially and that could significantly harm our business. In addition, because a high percentage of our revenue is dependent on a relatively small number of clients, delayed payments by a few of our larger clients could result in a reduction of our available cash, which in turn may cause fluctuation in our Days Sales Outstanding.

We depend on good relations with our clients, and any harm to these good relations may materially and adversely affect our business and our ability to compete effectively.

To attract and retain clients, we depend to a large extent on our relationships with our clients and our reputation for high quality analytics and related services. If a client is not satisfied with our services, it may be damaging to our reputation and business. Any defects or errors in our services or solutions or failure to meet our clients’ expectations could result in:

|

|

· |

Delayed or lost revenue; |

|

|

· |

Obligations to provide additional services to a client at a reduced fee or at no charge; |

|

|

· |

Negative publicity, which could damage our reputation and adversely affect our ability to attract or retain clients; and |

|

|

· |

Claims for damages against us, regardless of our responsibility for such failure. |

If we fail to meet our contractual obligations with our clients, then we could be subject to legal liability or loss of clients. Although our contracts include provisions to limit our exposure to legal claims related to the services and solutions we provide, these provisions may not protect us, or protect us sufficiently, in all cases.

5

We must maintain our reputation and expand our name recognition to remain competitive.

We believe that establishing and maintaining a good reputation and brand name is critical for attracting and expanding our targeted client base and we are investing substantially in marketing in order to expand our name recognition in the marketplace for our services and solutions. If potential clients do not know the types of solutions we provide, or if our reputation is damaged, then we may become less competitive or lose our market share. Promotion and enhancement of our name and brand will depend largely on both the efficacy of our relatively nascent marketing efforts and our success in providing high quality services, software, and solutions, neither of which can be assured.

Our clients use our solutions for critical applications. If clients do not perceive our solutions to be effective or of higher quality than those available from our competitors, or if our solutions result in errors, defects, or other performance problems, then our brand name and reputation could be materially and adversely affected, we could lose potential sales and existing customers, including through early termination of our contracts, our ability to operate our business may be impaired, and our business may suffer.

Our industry is very competitive and, if we fail to compete successfully, our market share and business will be adversely affected.

We operate in a highly competitive and rapidly changing market and compete with a variety of organizations that offer services that may be viewed as similar to ours. These competitive organizations include data analytics solutions providers, voice recording and voice analytic service providers and software licensors, call routing solution providers, and strategic consulting firms. We compete with these organizations on factors such as expertise, price, and capacity.

Many of our competitors have longer operating histories, more clients, longer relationships with their clients, greater brand or name recognition, more registered patents, and significantly greater financial, technical, marketing, and public relations resources than we do. As a result, our competitors may be in a better position to respond quickly to new or emerging technologies and changes in client requirements. They may also develop and promote their products and services more effectively than we do. New market entrants also pose a threat to our business. Existing or future competitors may develop or offer solutions that are comparable or superior to ours at a lower price.

In addition, if one or more of our competitors were to merge or partner with another of our competitors, the change in the competitive landscape could adversely affect our ability to compete effectively. We may also lose clients that merge with or are acquired by companies using a competitor's offering or an internally-developed tool. If we cannot compete successfully against our current and future competitors, our business may be harmed.

We must keep pace with the rapid rate of innovation in our industry in order to build our business.

The data analytics market, and particularly behavioral analytics, is relatively new and rapidly evolving. Our future business depends in part upon continued growth in the acceptance and use of Behavioral Analytics by our current and prospective clients. Their acceptance and usage in turn may depend upon factors such as: the actual or perceived benefits of adoption of Behavioral Analytics and related methodologies and technologies, including the predictability of a meaningful return on investment, cost efficiencies, or other measurable economic benefits; the actual or perceived reliability, scalability, ease of use, and access to such new technologies and methodologies; and the willingness to adopt new business methods. Furthermore, our future growth depends on our continuing ability to innovate in the field of data analytics and to incorporate emerging industry standards.

We cannot assure that we will be successful in anticipating or responding to these challenges on a timely or competitive basis or at all, or that our ideas and solutions will be successful in the marketplace. In addition, new or disruptive technologies and methodologies by our competitors may make our service or solution offerings uncompetitive. Any of these circumstances could significantly harm our business and financial results.

6

Because our services and solutions are sophisticated, we must devote significant time and effort to our sales and installation processes, with significant risk of loss if we are not successful.

Because our services and solutions are not simple, mass-market items with which our potential clients are already familiar, it is necessary for us to devote significant time and effort to the process of educating our potential clients about the benefits and value of our services and solutions as part of the sales process. In addition, because our services and solutions are sophisticated and in most cases are not readily usable by clients without our assistance in integration and configuration, training, and/or analysis, we must devote significant time during the installation and subscription process in order to ensure that our services and solutions are successfully deployed. These efforts increase the time and difficulty of completing transactions, make it more difficult to efficiently deploy our limited resources, and create risk that we will have invested in an opportunity that ultimately does not come to fruition. If we are unable to demonstrate the benefits and value of our services and solutions to clients and efficiently convert our sales leads into successful sales and installations, our results of operations may be adversely affected.

The unauthorized disclosure of the confidential customer data that we maintain could result in a significant loss of business and subject us to substantial liability.

In providing Behavioral Analytics, we record and analyze telephone calls and other interactions between our clients’ call center and back office agents and their customers. These interactions may contain numerous references to highly sensitive confidential or personally-identifiable data of the customers of our clients, and many of our clients are required to comply with Federal and state laws concerning privacy and security, such as the Health Insurance Portability and Accountability Act of 1996 and the Gramm-Leach-Bliley Act of 1999. In addition, we have made certain contractual commitments to our clients regarding this confidential data.

In light of the highly-confidential information that we record and maintain, our clients require that we agree not to limit our liability in the event of a security breach resulting in the loss of, or unauthorized access to, personally-identifiable or other confidential data. As a result, the disclosure or loss of such data despite the extensive precautions we undertake could result in the considerable diminution of our business and prospects and could subject us to substantial liability.

In addition, the laws, regulations, and industry standards governing these matters are changing rapidly. It is possible that the resources we devote to comply with such laws, regulations, and industry standards, and our clients’ particular requirements, could increase materially. In our contracts, we generally agree to indemnify our clients for expenses and liabilities resulting from unauthorized access to or disclosure of confidential data, such as those arising from data breach notification requirements. These indemnity obligations are generally not subject to contractual limitations on liability. As a result, the amount of liability we could incur in connection with these indemnity obligations could exceed the revenue we receive from the client under the applicable contract.

Our financial results could be adversely affected by economic and political conditions and the effects of these conditions on our clients’ businesses and levels of business activity.

Economic and political conditions in the United States affect our clients’ businesses and the markets they serve. A severe and/or prolonged economic downturn or a negative or uncertain political climate could adversely affect our clients’ financial conditions and the levels of business activity of our clients and the industries we serve. This may reduce demand for our services or depress pricing of those services and have a material adverse effect on our results of operations. In addition, these economic conditions may cause our clients to delay payments for services we have provided to them, resulting in a negative impact to our cash flow. If we are unable to successfully anticipate changing economic and political conditions, then we may be unable to effectively plan for and respond to those changes, and our business could be negatively affected.

We rely heavily on our senior management team for the success of our business.

Given the highly specialized nature of our services, senior management must have a thorough understanding of our service offerings as well as the skills and experience necessary to manage the organization. If one or more members of our senior management team leaves and we cannot replace them with a suitable candidate quickly, then we could experience difficulty in managing our business properly, and this could harm our business prospects, client relationships, employee morale, and results of operations.

7

Our ability to recruit talented professionals and retain our existing professionals is critical to the success of our business.

We believe that our success depends substantially on our ability to attract, train, motivate, and retain highly skilled management, strategic, technical, product development, data analysis, and other key professional employees. Our business straddles the information-technology and data analytics services industries, which are people-intensive and face shortages of qualified personnel, especially those with specialized skills or experience. We compete with other companies to recruit and hire from this limited pool, particularly in Austin, Texas, the location of our research and development team, and in Chicago, Illinois, the location of our data science and analytics teams.

If we cannot hire and retain qualified personnel, or if a significant number of our current employees should leave, and we have difficulty replacing such persons, then we could potentially suffer the loss of client relationships or new business opportunities and our business could be seriously harmed. In addition, there is no guarantee that the employee and client non-solicitation and non-competition agreements we have entered into with our senior professionals would deter them from departing us for our competitors or that such agreements would be upheld and enforced by a court or other arbiter across all jurisdictions where we engage in business.

We have a limited ability to protect our intellectual property rights, which are important to our success and competitive position.

Our ability to protect our software, algorithms, databases, methodologies, and other intellectual property is important to our success and our competitive position. We view as proprietary the software (including source code), algorithms, databases, analysis, and other ideas, concepts, and developments that we create in order to provide, improve, and enhance our service offerings, as well as the work product we create in the course of providing services for clients. We seek to protect our intellectual property rights in these developments and work product by applying for patents, copyrights, and trademarks, as appropriate, as well as by enforcing applicable trade secret laws and contractual restrictions on scope of use, disclosure, copying, reverse engineering, and assignment.

Despite our efforts to protect our intellectual property rights from unauthorized use or disclosure, others may attempt to disclose, obtain, or use our rights. The steps we take may not be adequate to prevent or deter infringement or other misappropriation of our intellectual property rights. In addition, we may not detect unauthorized use of, or take timely and effective actions to enforce and protect, our intellectual property rights. Furthermore, our efforts to enforce our intellectual property rights may be met with defenses, counterclaims, and countersuits attacking the validity and enforceability of our intellectual property rights or alleging that we infringe the counterclaimant's own intellectual property. Third parties may challenge the validity or ownership of our intellectual property, and these challenges could cause us to lose our rights, in whole or in part, to our intellectual property or narrow the scope of our rights such that they no longer provide meaningful protection.

We may be required to obtain licenses from others to refine, develop, market, and deliver current and new services and solutions. There can be no assurance that we will be able to obtain any of these licenses on commercially reasonable terms or at all, or that rights granted by these licenses ultimately will be valid and enforceable.

If we fail to meaningfully protect our intellectual property, our business, brand, operating results, and financial condition could be materially harmed.

Others could claim that our services, products, or solutions infringe upon their intellectual property rights or violate contractual protections.

We or our clients may be subject to claims that our services, products, or solutions, or the products of our software providers or other alliance partners, infringe upon the intellectual property rights of others. Any such infringement claims may result in substantial costs, divert management attention and other resources, harm our reputation, and prevent us from offering some services, products, or solutions. A successful infringement claim against us could materially and adversely affect our business.

In our contracts with clients, we agree to indemnify our clients for expenses and liabilities resulting from claimed infringement by our services, products, or solutions, in most cases excluding third-party components, of the intellectual property rights of others. In some instances, the amount of these indemnity obligations may be greater than the revenue we receive from the client under the applicable contract. In addition, we may develop work product in connection with specific projects for our clients. Although our contracts with our clients generally provide that we retain the ownership rights to our work product, it is possible that clients may assert rights to, and seek to limit our ability to resell or reuse, our work product. Furthermore, in some cases we assign to clients the copyright and, at times, other intellectual property rights, in and to some aspects of the software, documentation, or other work product developed for these clients in connection with these projects, which limits our ability to resell or reuse this intellectual property.

8

Increasing government regulation could cause us to lose clients or impair our business.

We are subject not only to laws and regulations applicable to businesses generally, but we are also subject to certain U.S. and foreign laws and regulations applicable to our service offerings, including, but not limited to, those related to data privacy and security, electronic commerce, and call recording. Laws and regulations enacted in the United States, both at the state and federal level, as well as significant new rules issued with respect thereto, impose substantial requirements relating to the privacy and security of personal data, as well as the reporting of breaches with respect to personal data. Legislation that may be enacted in the future may add further requirements in these and other areas. In addition, we may be affected indirectly by legislation that impacts our existing and prospective clients, who may pass along to us by contract their legal obligations in these and other areas. Any such laws and regulations therefore could affect our existing business relationships or prevent us from obtaining new clients.

It may be difficult for us to access debt or equity markets to meet our financial needs.

In the event, for any reason, we need to raise additional funds in the future, through public or private debt or equity financings, such funds may not be available or may not be available on terms favorable to us. Additionally, the terms of our credit facility with Silicon Valley Bank limits our ability to enter into a public or private debt financing. The failure by us to obtain such financing, if needed, may have a material adverse effect upon our business, financial condition, results of operations, and prospects.

The market price of our common stock is likely to be volatile and could subject us to litigation.

The trading price of our common stock has been, and is likely to continue to be, volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control. In addition, the trading prices of the securities of technology companies in general have been highly volatile, and the volatility in market price and trading volume of securities is often unrelated or disproportionate to the financial performance of the companies issuing the securities. In addition to the factors discussed in this "Risk Factors" section and elsewhere in this Annual Report on Form 10-K, factors affecting the market price of our common stock include:

|

|

· |

actual or anticipated changes in our earnings or fluctuations in our operating results or in the expectations of securities analysts; |

|

|

· |

price and volume fluctuations in the overall stock market from time to time; |

|

|

· |

significant volatility in the market price and trading volume of comparable companies; |

|

|

· |

changes in the market perception of behavioral and personality-based software products generally or in the effectiveness of our solutions in particular; |

|

|

· |

announcements of technological innovations, new products, strategic alliances, or significant agreements by us or by our competitors; |

|

|

· |

litigation involving us; |

|

|

· |

investors' general perception of us; |

|

|

· |

changes in general economic, industry, and market conditions and trends; and |

|

|

· |

recruitment or departure of key personnel. |

In addition, if the market for technology stocks or the stock market in general experiences uneven investor confidence, the market price of our common stock could decline for reasons unrelated to our business, operating results or financial condition. The market price of our common stock might also decline in reaction to events that affect other companies within, or outside, our industry even if these events do not directly affect us. Some companies that have experienced volatility in the trading price of their stock have been the subject of securities class action litigation. If we are the subject of such litigation, it could result in substantial costs and a diversion of our management's attention and resources from our business.

Because we do not anticipate paying any cash dividends on our common stock in the foreseeable future, capital appreciation, if any, will be your sole source of gains and you may never receive a return on your investment.

You should not rely on an investment in our common stock to provide dividend income. We have not declared or paid cash dividends on our common stock to date. In addition, the terms of our credit facility with Silicon Valley Bank, and any future debt agreements may, preclude us from paying dividends. As a result, capital appreciation, if any, of our common stock will be your sole source of gain for the foreseeable future. Investors seeking cash dividends should not purchase our common stock.

9

We identified a material weakness in our internal control over financial reporting, and our business and stock price may be adversely affected if we do not adequately address this weakness or if we have other material weaknesses or significant deficiencies in our internal control over financial reporting in the future.

As described in our Management’s Annual Report on Internal Control Over Financial Reporting at Item 9A of this Annual Report on Form 10-K, we identified a material weakness in our internal control over financial reporting as of December 31, 2015. The existence of this or one or more other material weaknesses or significant deficiencies could result in errors in our financial statements, and substantial costs and resources may be required to rectify any internal control deficiencies. If we cannot produce reliable financial reports, investors could lose confidence in our reported financial information, the market price of our stock could decline significantly, we may be unable to obtain additional financing to operate and expand our business and our business and financial condition could be harmed.

Our operating results may be negatively affected if we are required to collect sales tax or other transaction taxes on all or a portion of sales in jurisdictions where we are currently not collecting and reporting tax.

We have historically collected sales and other transaction taxes as required. Current economic and political conditions make sales and other transaction tax laws in many state, local, and foreign jurisdictions subject to reassessment and change. If a taxing authority were to successfully assert that we have not properly collected sales or other transaction taxes, or if sales or other transaction tax laws or the interpretation thereof were to change, and we were unable to enforce the terms of our contracts with customers that give us the right to reimbursement for assessed sales taxes, we could incur significant tax liabilities. Increased taxability of our products and services could increase our administrative costs, discourage clients from purchasing our products and services, or otherwise substantially harm our business and results of operations.

Not applicable.

Our principal physical properties employed in our business consist of our leased office facilities in Chicago, Illinois; Edina, Minnesota; and Austin, Texas. Our executive offices are located at 200 West Madison Street, Suite 3100, Chicago, Illinois 60606. The initial lease term for this property, which became effective on July 1, 2015, terminates on July 31, 2022. The lease includes one five-year renewal option.

Our total employable space is approximately 44,000 square feet. We do not own any real estate. We believe that our leased facilities are appropriate for our current business requirements.

From time to time, the Company has been subject to legal claims arising in connection with its business and the results of these claims, when they arise, cannot be predicted with certainty. There are no asserted claims against the Company that, in the opinion of management, if adversely decided, would have a material effect on the Company’s business, financial position, results of operations, or prospects.

Not applicable.

PART II.

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities. |

Our common stock, par value $0.01 per share (“Common Stock”), is traded on the NASDAQ Global Market under the symbol MATR. The following table sets forth, for the periods indicated, the quarterly high and low sales prices of our Common Stock on the NASDAQ Global Market.

10

|

|

|

High |

|

|

Low |

|

||

|

Fiscal Year 2015 |

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

$ |

8.10 |

|

|

$ |

6.25 |

|

|

Third Quarter |

|

|

8.00 |

|

|

|

5.59 |

|

|

Second Quarter |

|

|

7.49 |

|

|

|

5.56 |

|

|

First Quarter |

|

|

7.50 |

|

|

|

4.75 |

|

|

Fiscal Year 2014 |

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

$ |

6.62 |

|

|

$ |

5.01 |

|

|

Third Quarter |

|

|

6.25 |

|

|

|

4.41 |

|

|

Second Quarter |

|

|

7.21 |

|

|

|

4.66 |

|

|

First Quarter |

|

|

7.85 |

|

|

|

4.75 |

|

There were approximately 108 owners of record of Common Stock as of February 25, 2016. The last reported sale price of the Common Stock on the NASDAQ Global Market on February 25, 2016 was $4.24.

See “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” included in Part III Item 12 of this Annual Report on Form 10-K for more information about securities authorized for issuance under our various compensation plans.

Sale of Unregistered Securities

On June 4, 2014, Partners for Growth IV, L.P. (“PfG”) elected to partially exercise a warrant by exchanging 57,196 of its total 129,032 shares of Common Stock issuable upon exercise of the warrant through a cashless exercise on the terms provided in the applicable warrant agreement. As a result, the Company issued 35,862 shares of Common Stock to PfG on June 4, 2014, and 71,836 shares of Common Stock remained issuable upon exercise of the warrant as of June 4, 2014. On September 29, 2015, PfG fully exercised its remaining warrant through a cashless exercise on the terms provided in the applicable warrant agreement. As a result, the Company issued 46,689 shares of Common Stock to PfG, in full settlement of the warrant.

On June 4, 2014, PfG Equity Investors, LLC elected to partially exercise a warrant by exchanging 4,945 of its total 10,322 shares of Common Stock issuable upon exercise of the warrant through a through a cashless exercise on the terms provided in the applicable warrant agreement. As a result, the Company issued 3,100 shares of Common Stock to PfG Equity Investors, LLC on June 4, 2014 and 5,377 shares of Common Stock remained issuable upon exercise of the warrant as of June 4, 2014. On September 29, 2015, PfG Equity Investors, LLC fully exercised its remaining warrant through a cashless exercise on the terms provided in the applicable warrant agreement. As a result, the Company issued 3,495 shares of Common Stock to PfG Equity Investors, LLC, in full settlement of the warrant.

The shares of Common Stock issued upon exercise of the warrants were not registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities law and were issued pursuant to Section 3(a)(9) of the Securities Act.

11

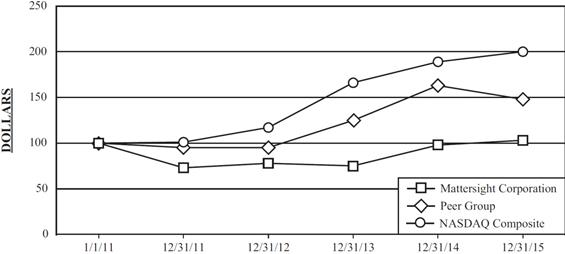

The following graph compares the cumulative total stockholder return on Common Stock with the cumulative total return of (i) a peer group of other publicly-traded information-technology consulting companies selected by the Company (the “Peer Group Index”), and (ii) the NASDAQ Global Market Index. Cumulative total stockholder return is based on the period from January 1, 2011 through the Company’s fiscal year end on Thursday, December 31, 2015. The comparison assumes that $100 was invested on January 1, 2011 in each of Mattersight Common Stock, the Peer Group Index, and the NASDAQ Global Market Index, and that any and all dividends were reinvested.

Comparative Cumulative Total Return for Mattersight Corporation,

Peer Group Index, and NASDAQ Global Market Index

|

|

|

1/1/11 |

|

|

12/31/11 |

|

|

12/31/12 |

|

|

12/31/13 |

|

|

12/31/14 |

|

|

12/31/15 |

|

||||||

|

Mattersight Common Stock |

|

$ |

100.00 |

|

|

$ |

72.66 |

|

|

$ |

77.66 |

|

|

$ |

74.84 |

|

|

$ |

97.66 |

|

|

$ |

102.50 |

|

|

Peer Group Index(1) |

|

|

100.00 |

|

|

|

94.61 |

|

|

|

94.89 |

|

|

|

125.31 |

|

|

|

163.46 |

|

|

|

147.77 |

|

|

NASDAQ Global Market Index |

|

|

100.00 |

|

|

|

100.62 |

|

|

|

116.97 |

|

|

|

166.27 |

|

|

|

188.90 |

|

|

|

200.15 |

|

|

(1) |

The Peer Group Index consists of Verint Systems, Inc. and Nice Systems Limited. |

Repurchase of Equity Securities

The following table provides information relating to the Company’s repurchase of shares of its Common Stock in the fourth quarter of 2015. These repurchases reflect shares withheld upon vesting of restricted stock to satisfy tax-withholding obligations.

|

Period |

|

Total Number of Shares Purchased |

|

|

Average Price Paid Per Share |

|

||

|

October 1, 2015 – October 31, 2015 |

|

|

— |

|

|

$ |

— |

|

|

November 1, 2015 – November 30, 2015 |

|

|

17,087 |

|

|

$ |

7.09 |

|

|

December 1, 2015 – December 31, 2015 |

|

|

— |

|

|

$ |

— |

|

|

Total |

|

|

17,087 |

|

|

$ |

7.09 |

|

Dividends

Historically, we have not paid cash dividends on our Common Stock, and we do not expect to do so in the future. Under the terms of its certificate of designations, our 7% Series B Convertible Preferred Stock (the “Series B Stock”) accrues dividends at a rate of 7% per year, payable semi-annually in January and July if declared by the Company’s Board of Directors. If not declared, unpaid dividends are cumulative and accrue at the rate of 7% per annum. The Board of Directors did not declare a dividend payment on the Series B Stock, which was accrued, for each of the dividend periods from July 1, 2012 through December 31, 2015 (the aggregate amount of these dividends was approximately $2.1 million). Payment of future dividends on the Series B Stock will be determined by the Company’s Board of Directors based on the Company’s outlook and macroeconomic conditions.

12

The amount of each dividend accrual would decrease by any conversions of the Series B Stock into Common Stock, as Series B Stock conversions require us to pay accrued but unpaid dividends at the time of conversion. Conversions of Series B Stock became permissible at the option of the holder after June 19, 2002. For further discussion see “Liquidity and Capital Resources” included in Part II, Item 7 of this Annual Report on Form 10-K.

During fiscal year 2012, the Company repurchased 19,758 shares of Series B Stock and paid accrued and unpaid dividends of two thousand dollars in connection with such purchase.

Equity Compensation Information

See Part III, Item 12 of this Annual Report on Form 10-K for information regarding shares of Common Stock that may be issued under the Company’s existing equity compensation plans.

The following tables summarize our selected consolidated financial data. This information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the Consolidated Financial Statements of the Company and notes thereto, which are included elsewhere in this Annual Report on Form 10-K. The selected consolidated financial data in this section is not intended to replace the Consolidated Financial Statements of the Company and the notes thereto. Our historical results are not necessarily indicative of our future results.

|

|

|

(In thousands, except per share data)(1) |

|

|||||||||||||||||

|

|

|

December 31, 2015 |

|

|

December 31, 2014 |

|

|

December 31, 2013 |

|

|

December 31, 2012 |

|

|

December31, 2011 |

|

|||||

|

Total revenue |

|

$ |

39,912 |

|

|

$ |

30,319 |

|

|

$ |

34,494 |

|

|

$ |

33,863 |

|

|

$ |

29,095 |

|

|

Loss from continuing operations |

|

$ |

(15,681 |

) |

|

$ |

(14,232 |

) |

|

$ |

(11,172 |

) |

|

$ |

(15,470 |

) |

|

$ |

(10,560 |

) |

|

Net (loss) income available to common stockholders |

|

$ |

(16,269 |

) |

|

$ |

(14,821 |

) |

|

$ |

(11,761 |

) |

|

$ |

(15,881 |

) |

|

$ |

10,553 |

|

|

Basic loss from continuing operations per share |

|

$ |

(0.70 |

) |

|

$ |

(0.74 |

) |

|

$ |

(0.70 |

) |

|

$ |

(1.01 |

) |

|

$ |

(1.29 |

) |

|

Total assets |

|

$ |

40,402 |

|

|

$ |

32,078 |

|

|

$ |

30,749 |

|

|

$ |

31,362 |

|

|

$ |

49,265 |

|

|

Long-term obligations |

|

$ |

8,900 |

|

|

$ |

3,990 |

|

|

$ |

4,473 |

|

|

$ |

3,605 |

|

|

$ |

4,437 |

|

|

Series B Stock |

|

$ |

8,388 |

|

|

$ |

8,406 |

|

|

$ |

8,411 |

|

|

$ |

8,411 |

|

|

$ |

8,521 |

|

|

Capital leases |

|

$ |

3,433 |

|

|

$ |

2,813 |

|

|

$ |

2,832 |

|

|

$ |

2,305 |

|

|

$ |

2,823 |

|

|

(1) |

See “Note One—Description of Business” and “Note Two—Summary of Significant Accounting Policies” of the “Notes to Consolidated Financial Statements” included in Part II Item 8 of this Annual Report on Form 10-K for business discussion. |

13

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the “Selected Financial Data” and the consolidated financial statements and notes thereto included elsewhere in this Annual Report on Form 10-K.

Overview

We are a leader in behavioral analytics and a pioneer in personality-based software products. Using a stack of innovative, patented applications, Mattersight analyzes and predicts customer behavior based on the language exchanged between agents and customers during brand interactions. These insights are then used to facilitate more effective and effortless customer conversations, which, in turn, drive increased customer satisfaction and retention, employee engagement, and operating efficiency.

Key Metrics

We regularly review the following key metrics to evaluate our business, measure our performance, identify trends in our business, prepare financial projections, and make strategic decisions.

ACV Bookings. We calculate the annual contract value (“ACV”) of new incremental bookings based on the estimated subscription revenue and other revenue for a customer contract executed in the quarter, actual growth in the account beyond the original booking, and any committed future growth. We regularly review ACV bookings on a rolling four quarter basis and also review the percentage of ACV bookings generated by new customers. Our management uses this as a measure of the effectiveness of our sales and marketing investment, and as a proxy for future revenue growth.

Annualized Revenues in Deployment. We calculate the annualized revenues in deployment as the ACV bookings for which we have not yet recognized revenue because the services are still in the process of being deployed to the customer. Once the services go live for a particular contract, the amount of annualized revenues in deployment for that contract moves to annualized revenues. Our management uses this as a measure of the average time to deploy our bookings and as a proxy for future revenue growth.

Annualized Book of Business. We calculate the annualized book of business as the sum of our quarterly revenue (annualized) and our annualized revenue in deployment. Our management uses this as a proxy for future revenue growth.

Gross Margin. We calculate gross margin as the difference between our total revenue and the total cost of revenue, divided by total revenue, expressed as a percentage. Our management uses this as a measure of the efficiency of our service delivery organization.

Performance Highlights

The following table presents our performance on the key metrics for the periods presented:

|

|

|

For the Fiscal Year Ended 2015 |

|

|||||||||||||||||

|

|

|

(in millions, except percentage data) |

|

|||||||||||||||||

|

|

|

1st Quarter |

|

|

2nd Quarter |

|

|

3rd Quarter |

|

|

4th Quarter |

|

|

Year |

|

|||||

|

ACV Bookings |

|

$ 3.1 |

|

|

$ 5.8 |

|

|

$ 6.9 |

|

|

|

$ 7.0 |

|

|

$22.7 |

|

||||

|

Rolling 4 Quarters ACV Bookings |

|

$17.1 |

|

|

|

$19.0 |

|

|

$22.6 |

|

|

$22.7 |

|

|

$22.7 |

|

||||

|

% of Rolling 4 Quarters ACV Bookings generated by new customers |

|

|

27 |

% |

|

|

46 |

% |

|

|

42 |

% |

|

|

50 |

% |

|

|

50 |

% |

|

Annualized Revenues in Deployment |

|

$ 8.1 |

|

|

|

$10.0 |

|

|

$11.7 |

|

|

$15.1 |

|

|

$15.1 |

|

||||

|

Annualized Book of Business |

|

$45.3 |

|

|

|

$49.0 |

|

|

$53.6 |

|

|

$56.6 |

|

|

$56.6 |

|

||||

|

Gross Margin |

|

|

72 |

% |

|

|

73 |

% |

|

|

76 |

% |

|

|

72 |

% |

|

|

73 |

% |

Change in Presentation

During fiscal year 2015, Mattersight reclassified certain expenses, which had been previously reported within selling, marketing and development, to distinguish between (i) research and development and (ii) sales and marketing expenses.

14

Beginning in fiscal year 2015, Mattersight began to report subscription revenue (which consists of Behavioral Analytics subscription revenue and marketing managed services revenue) and other revenue (which consists of deployment revenue, professional services revenue, CRM services revenue, and reimbursed expenses revenue). Previously, in fiscal year 2014, Mattersight reported Behavioral Analytics revenue (which consisted of subscription revenue, deployment revenue, and professional services revenue) and other revenue (which consisted of CRM services revenue and marketing managed services revenue). Reimbursed expenses revenue was reported separately.

The Company believes the revised presentation provides a clearer understanding of the Company’s business and revenue streams. The changes in presentation did not have an impact on the Company’s total revenue, total cost of revenue, or total operating expenses. There was no change to the Company’s significant accounting policies. Revenue and expense classifications for fiscal year 2014 and 2013 have been revised to conform to the Company’s current presentation.

Critical Accounting Policies and Estimates

Our management’s discussion and analysis of financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue, and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to the costs and timing of completion of client projects, our ability to collect accounts receivable, and the ability to realize our net deferred tax assets, contingencies, and litigation. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions.

The fiscal year-end dates referenced herein for fiscal years 2015, 2014, and 2013 are December 31, 2015, December 31, 2014, and December 31, 2013, respectively.

We believe the following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition

Subscription Revenue

Subscription revenue consists of revenue derived from Mattersight’s Behavioral Analytics service offerings, including predictive behavioral routing, performance management, quality assurance, predictive analytics, and marketing managed services revenue derived from the performance of services on a continual basis.

Subscription revenue is based on a number of factors, such as the number of users to whom the Company provides one or more of its Behavioral Analytics offerings, the type and number of Behavioral Analytics offerings deployed to the client, and in some cases, the number of hours of calls analyzed during the relevant month of the subscription period. Subscription periods generally range from three to five years after the go-live date or, in cases where the Company contracts with a client for a short-term pilot of a Behavioral Analytics offering prior to committing to a longer subscription period, if any, the subscription or pilot periods generally range from three to twelve months after the go-live date. This revenue is recognized over the applicable subscription period as the service is performed for the client.

Other Revenue

Other revenue consists of deployment revenue, professional services revenue, and reimbursed expenses revenue.

Deployment revenue consists of planning, deployment, and training fees derived from Behavioral Analytics contracts. These fees, which are considered to be installation fees related to Behavioral Analytics subscription contracts, are deferred until the installation is complete and are then recognized over the applicable subscription or pilot period. Installation costs incurred are deferred up to an amount not to exceed the amount of deferred installation revenue and additional amounts that are recoverable based on the contractual arrangement. These costs are included in prepaid expenses and other long-term assets. Such costs are amortized over the subscription period. Costs in excess of the foregoing revenue amount are expensed in the period incurred.

15

Professional services revenue primarily consists of fees charged to the Company’s clients to provide post-deployment follow-on consulting services, which include custom data analysis, the implementation of enhancements, and training, as well as fees generated from the Company’s operational consulting services. The professional services are performed for the Company’s clients on a fixed-fee or time-and-materials basis. Revenue is recognized as the services are performed, with performance generally assessed on the ratio of actual hours incurred to-date compared with the total estimated hours over the entire term of the contract.

Reimbursed expenses revenue includes billable costs related to travel and other out-of-pocket expenses incurred while performing services for the Company’s clients. An equivalent amount of reimbursable expenses is included in total cost of other revenue.

Unearned Revenue

Payments received for Behavioral Analytics contracts in excess of the amount of revenue recognized for these contracts are recorded as unearned revenue until the applicable revenue recognition criteria are met.

Allowance for Doubtful Accounts

The Company maintains allowances for doubtful accounts for estimated losses resulting from clients not paying for unpaid or disputed invoices for contractual services provided. Additional allowances may be required if the financial condition of our clients deteriorates.

Stock Warrants

In accordance with ASC 480-10, Distinguishing Liabilities from Equity, the Company classified certain warrants to purchase Common Stock that do not meet the requirements for classification as equity, as liabilities. Such liabilities are initially recorded at fair value with subsequent changes in fair value recorded as a component of gain or loss on warrant liability on the consolidated statements of operations in each reporting period. Fair value of the warrants was measured using a Monte Carlo option pricing model. See “Note Eighteen—Stock Warrants” of the “Notes to Consolidated Financial Statements” included in Part II Item 8 of this Annual Report on Form 10-K.

Stock-Based Compensation

Stock-based compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense over the vesting period. Determining fair value of stock-based awards at the grant date requires certain assumptions. The Company uses historical information as the basis for the selection of expected life, expected volatility, expected dividend yield assumptions, and anticipated forfeiture rates. The risk-free interest rate is selected based on the yields from U.S. Treasury Strips with a remaining term equal to the expected term of the options being valued.

Goodwill

Goodwill is tested annually for impairment or more frequently if an event or circumstance indicates that an impairment loss may have been incurred. In performing our annual impairment test, we first perform a qualitative assessment to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying value, including goodwill. If it is concluded that this is the case for the reporting unit, we perform a detailed quantitative assessment using a two-step test approach. In the first step, the fair value of the reporting unit is compared with its carrying value. If the fair value exceeds the carrying value, then goodwill is not impaired and no further testing is performed. The second step is performed if the carrying value exceeds the fair value. The implied fair value of the reporting unit’s goodwill must be determined and compared with the carrying value of the goodwill. If the carrying value of a reporting unit’s goodwill exceeds its implied fair value, then an impairment loss equal to the difference will be recorded. The Company currently operates in a single business segment or reporting unit.

In 2015, after completing our annual qualitative review, we concluded that it was not more likely than not that the carrying value of our reporting unit exceeded its fair value. Accordingly, we concluded that further quantitative analysis and testing was not required, and no goodwill impairment charge was required.

There has been no impairment identified as a result of the annual reviews of goodwill as of December 31, 2015 and December 31, 2014. The carrying value of goodwill was $1.0 million as of December 31, 2015 and December 31, 2014.

16

Intangible assets reflect costs related to patent and trademark applications, marketing managed services customer relationships, and the purchase of certain intellectual property rights in 2015. The costs related to patent and trademark applications and the purchase of certain intellectual property are amortized over 120 months. The other intangible assets are fully amortized. The original cost of intangible assets as of December 31, 2015 and December 31, 2014 was $6.7 million and $3.4 million, respectively. Accumulated amortization of intangible assets was $3.4 million as of December 31, 2015 and was $2.8 million as of December 31, 2014. Currently, amortization expense of intangible assets is expected to be $0.5 million annually.

Income Taxes

We have recorded income tax valuation allowances on our net deferred tax assets to account for the unpredictability surrounding the timing of realization of our U.S. and non-U.S. net deferred tax assets due to continuing operating losses. The valuation allowances may be reversed at a point in time when management determines realization of these tax assets has become more likely than not, based on a return to or achieving predictable levels of profitability.