Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jones Lang LaSalle Income Property Trust, Inc. | d389200d8k.htm |

| EX-99.1 - PRESS RELEASE - Jones Lang LaSalle Income Property Trust, Inc. | d389200dex991.htm |

Supplemental Information

Second Quarter

Earnings Call

2012

Exhibit 99.2 |

Market & Financial Overview |

As of

Q2 2012 The Jones Lang LaSalle Property Clocks

Notional capital values based on rents and yields for Grade A space in CBD or

equivalent. In local currency. 3

Americas

EMEA

Asia Pacific

Prime Offices -

Capital Value Clock, Q2 2011 v Q2 2012

Capital Value

growth slowing

Capital Value

growth

accelerating

Capital Values

bottoming out

Capital Values

falling

Q2 2011

Atlanta, Dallas

Chicago, Toronto

Beijing

Sao Paulo, Washington DC

Amsterdam

New York, Moscow

Singapore

San

Francisco

Los

Angeles

Berlin,

Stockholm Shanghai

Hong Kong

Brussels,

Seoul

Madrid,

Tokyo

Paris,

Sydney Mumbai

London

Frankfurt,

Milan Shanghai, Hong

Kong, Paris

Capital Value

growth slowing

Capital Value

growth

accelerating

Capital Values

bottoming out

Capital Values

falling

Q2 2012

Tokyo

Mumbai, Mexico

City

Sydney

Beijing

Singapore, Amsterdam,

Chicago, Washington

DC

Berlin,

Toronto

Madrid

Frankfurt

Moscow

Milan,

Sao

Paulo

London

New

York

Los

Angeles,

San

Francisco

Atlanta

Dallas

Seoul, Brussels, Detroit

Detroit, Mexico

City

SM

Stockholm |

Prime Offices –

Rental Clock, Q2 2011 v Q2 2012

Q2 2012

As of Q2 2012

The Jones Lang LaSalle Property Clocks

Based

on

rents

for

Grade

A

space

in

CBD

or

equivalent.

In

local

currency.

Q2 2011

4

Americas

EMEA

Asia Pacific

Rental Value

growth slowing

Rental Value

growth

accelerating

Rental Values

bottoming out

Rental Values

falling

Rental Value

growth slowing

Rental Value

growth

accelerating

Rental Values

bottoming out

Rental Values

falling

Dubai

Dallas

Frankfurt, Milan

Johannesburg

Detroit

San

Francisco

New

York,

Beijing Atlanta, Chicago

Rome, Tokyo

Los

Angeles, Brussels

Sao

Paulo,

Moscow

Mumbai

Mexico

City

Hong

Kong

Singapore

Shanghai

Sydney, Berlin, Paris

Seoul

London

Madrid

Amsterdam

Washington

DC

Stockholm

Toronto

Singapore

Hong

Kong

Seoul, Tokyo, Los

Angeles

Dallas

Beijing

Shanghai

Dubai

Madrid

Brussels, Detroit

Frankfurt, Milan, Rome

Chicago,

Atlanta Johannesburg,

Stockholm, Toronto

Berlin, Moscow

London, Sao

Paulo

Paris

Amsterdam

San

Francisco

New

York,

Mexico

City,

Mumbai Washington

DC

Sydney

SM |

Q2 Selected Business Wins and Expansions

5

Americas

EMEA

Asia Pacific

Global

-

Bank of America –

39M sf

-

Education Management Corporation –

6.6M sf

-

EuroHypo

Portfolio,

U.S.

–

$760M

-

150

N.

Michigan,

Chicago

–

$102M

-

Sitex –

STRS Ohio JV, U.S. –

$140M

-

Hotel Lola, New York –

$116M

-

601

Lexington

Ave.,

New

York

–

490K

sf

-

2000

Duke

Street,

Alexandria,

Va.

–

208K

sf

-

Blackstone

Portfolio,

London

–

£415M

-

The

Rock,

Amsterdam

–

€132M

-

SEGRO

Industrial

Portfolio,

UK

–

£204M

-

AXA

Portfolio,

Germany

–

990K

sf

-

Beisheim Center, Berlin –

754K sf

-

Kievit Building, Antwerp –

118K sf

-

Kilcarberry, Dublin –

240K sf

-

Chiswick Park, UK –

215K sf

-

Pertamina, Indonesia –

2.8M sf

-

Centro

Retail

Trust,

Australia

–

AUD

690M

-

Hougang Plaza, Singapore –

SGD 119M

-

Movenpick

Phuket,

Thailand

–

$93M

-

Mirae

Asset

Tower,

Shanghai

–

932K

sf

-

Siam Commercial Bank, Bangkok –

4.4M sf

-

Johnson

Controls,

Hong

Kong

–

55K

sf

-

New

Zealand

Shopping

Centres

–

330K

sf

-

Procter & Gamble –

60 countries

-

BBVA Compass –

45M sf

-

Logica –

6M sf |

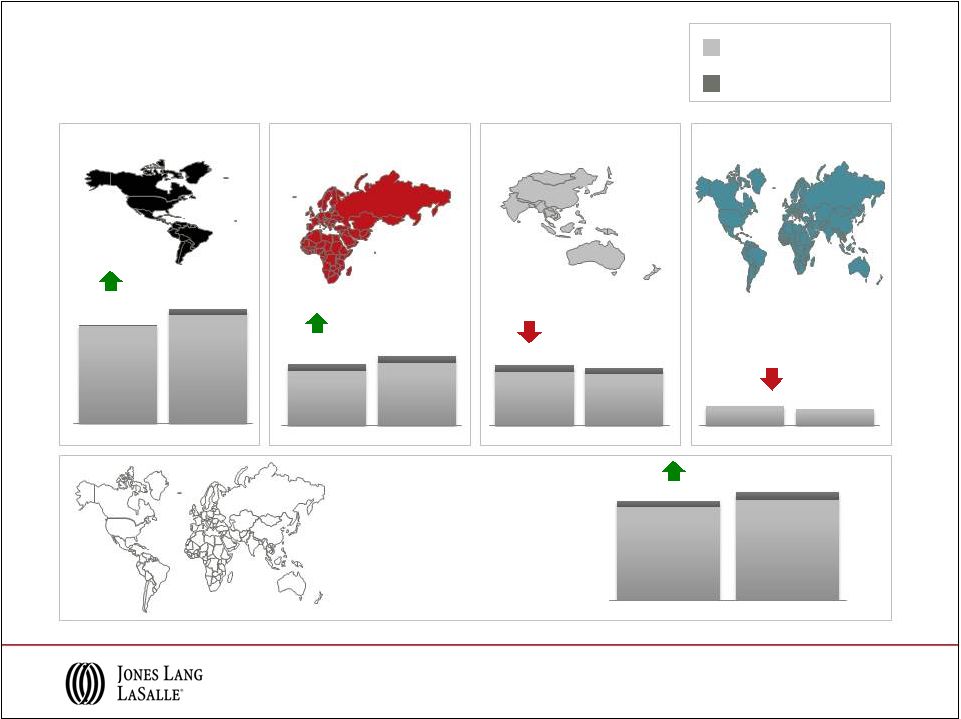

($ in

billions) Global Capital Flows for Investment Sales

* EMEA: In US$ terms, unchanged in Euro terms.

Source: Jones Lang LaSalle, July 2012

Direct Commercial Real Estate Investment, 2005-2012

2012 volumes expected to be approximately $400 billion, broadly in line with robust

2011 6

0

50

100

150

200

250

300

350

2005

2006

2007

2008

2009

2010

2011

2012 Projection

Q2 projection updates:

Americas:

down

10%

from

previous

forecast

EMEA:

unchanged

Asia

Pacific:

unchanged

Americas

EMEA

Asia Pacific |

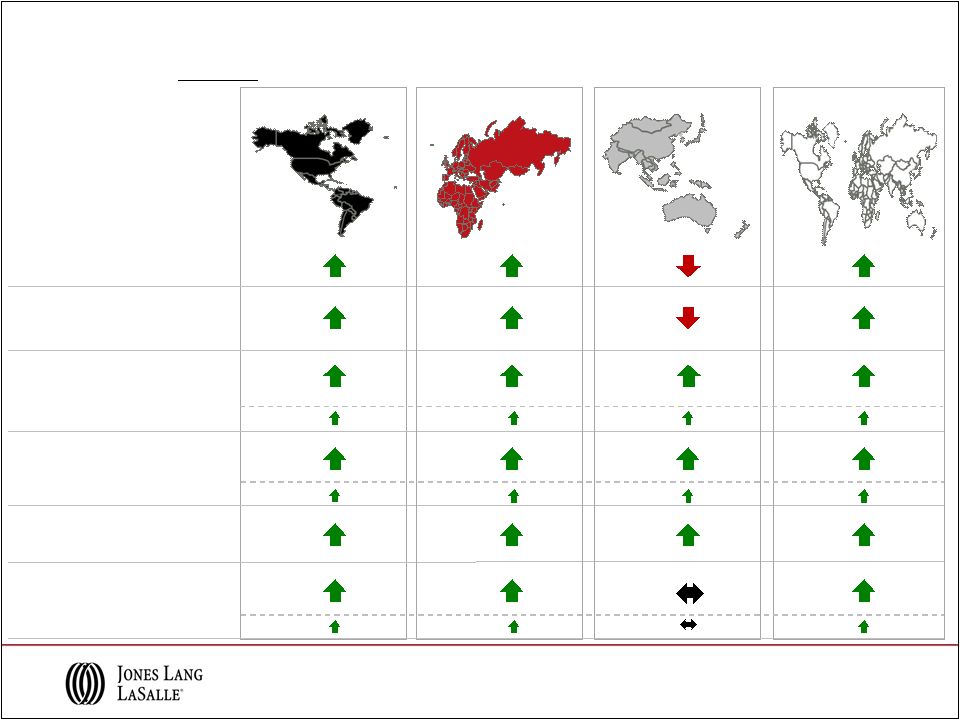

+

10-20% Capital Values

Rental Values

+ 5-10%

+ 0-5%

-

0-5%

-

5-10%

Boston, Toronto

Shanghai, Tokyo, Moscow

Frankfurt, Stockholm, Paris*, London*

Chicago, Los Angeles, New York*

Sydney, Mumbai, Sao Paulo

+ 20%

Moscow, Toronto, Mexico City

Shanghai, Tokyo

Stockholm, Sao Paulo

Boston , Los Angeles

Frankfurt, Paris*, London*

Hong Kong, Sydney, Mumbai

Provisional. *New York –

Midtown, London –

West End, Paris -

CBD. Nominal rates in local currency.

Source: Jones Lang LaSalle, July 2012

-

10-20%

Madrid, Dubai

Washington DC, Brussels

New York*, Chicago

Washington DC, Brussels

Dubai, Singapore

Hong Kong, Singapore

Beijing, San Francisco

Madrid

Beijing, San Francisco

Mexico City

7

Prime Offices –

Projected Changes in Values, 2012 |

Financial Information |

9

Q2 2012 Revenue Performance

Note: Equity earnings of $4.1M in 2011 are included in segment results, however, are

excluded from Consolidated totals. There were no equity earnings in the

second quarter 2012. Year-over-year increases shown “fee”-based have been calculated using fee

revenue, which excludes gross contract costs.

Consolidated

($ in millions; % change in USD)

17% (12% fee)

14% (14% fee)

5% (3% fee)

14%

9% (7% fee)

$408.1

$348.4

$249.2

$218.0

$204.6

$214.5

$921.3

$845.3

Fee revenue

Gross contract costs

Americas

EMEA

Asia Pacific

LIM

$346.7

$386.6

$189.1

$183.6

$68.6

$59.3

$195.1

$222.6

$795.3

$852.2

2011

2012

2011

2012

2011

2012

2011

2012

2011

2012 |

10

YTD 2012 Revenue Performance

Note: Equity earnings of $2.2M and $11.8M in 2011 and 2012, respectively, are included

in segment results, however, are excluded from Consolidated totals.

Year-over-year increases shown “fee”-based have been calculated using fee revenue, which

excludes gross contract costs.

Americas

EMEA

Asia Pacific

LIM

Consolidated

($ in millions; % change in USD)

19% (13% fee)

20% (19% fee)

3% (5% fee)

4%

13% (11% fee)

$754.4

$636.5

$462.4

$386.1

$391.0

$379.9

$1,734.7

$1,533.1

Fee revenue

Gross contract costs

2011

2012

2011

2012

2011

2012

2011

2012

2011

2012

$633.1

$715.7

$342.6

$409.4

$329.9

$345.1

$132.8

$138.6

$1,436.2

$1,597.1 |

11

Q2 2012 Real Estate Services Revenue

Asia Pacific

($ in millions; % change in USD

over June QTD 2011)

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Fee Revenue

Project & Development

Services

Fee Revenue

Advisory, Consulting &

Other

Total RES Operating

Revenue

Fee Revenue

$187.0

$42.1

$107.4

$45.1

$26.8

9%

34%

38%

11%

8%

18%

$66.4

$49.8

$37.9

$52.4

$42.8

$249.3

10%

31%

10%

13%

9%

14%

$45.6

$23.8

$93.1

$19.2

$22.8

$204.5

7%

30%

5%

5%

1%

5%

$299.0

$115.7

$238.4

$116.7

$92.4

$862.2

6%

12%

19%

9%

7%

11%

Total RES

$86.1

13%

$75.0

$37.9

$199.0

10%

9%

11%

$44.9

$25.8

$87.0

11%

11%

10%

$386.9

12%

$183.5

$222.7

$793.1

14%

3%

8%

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). Fee revenue presentation of

Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross

contract costs.

10%

$408.4

$16.3 |

12

Q2 2012 Real Estate Services Revenue

Asia Pacific

($ in millions; % change in local currency

over June QTD 2011)

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Fee Revenue

Project & Development

Services

Fee Revenue

Advisory, Consulting &

Other

Total RES Operating

Revenue

Fee Revenue

$187.0

$42.1

$107.4

$45.1

$26.8

$408.4

10%

37%

40%

12%

8%

19%

$66.4

$49.8

$37.9

$52.4

$42.8

$249.3

20%

39%

18%

25%

18%

24%

$45.6

$23.8

$93.1

$19.2

$22.8

$204.5

3%

27%

9%

2%

4%

1%

$299.0

$115.7

$238.4

$116.7

$92.4

$862.2

10%

17%

22%

16%

11%

15%

Total RES

$86.1

15%

$75.0

$37.9

$199.0

18%

12%

15%

$44.9

12%

$16.3

$25.8

$87.0

20%

18%

15%

$386.9

13%

$183.5

$222.7

$793.1

23%

1%

12%

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). Fee revenue presentation of

Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross

contract costs. |

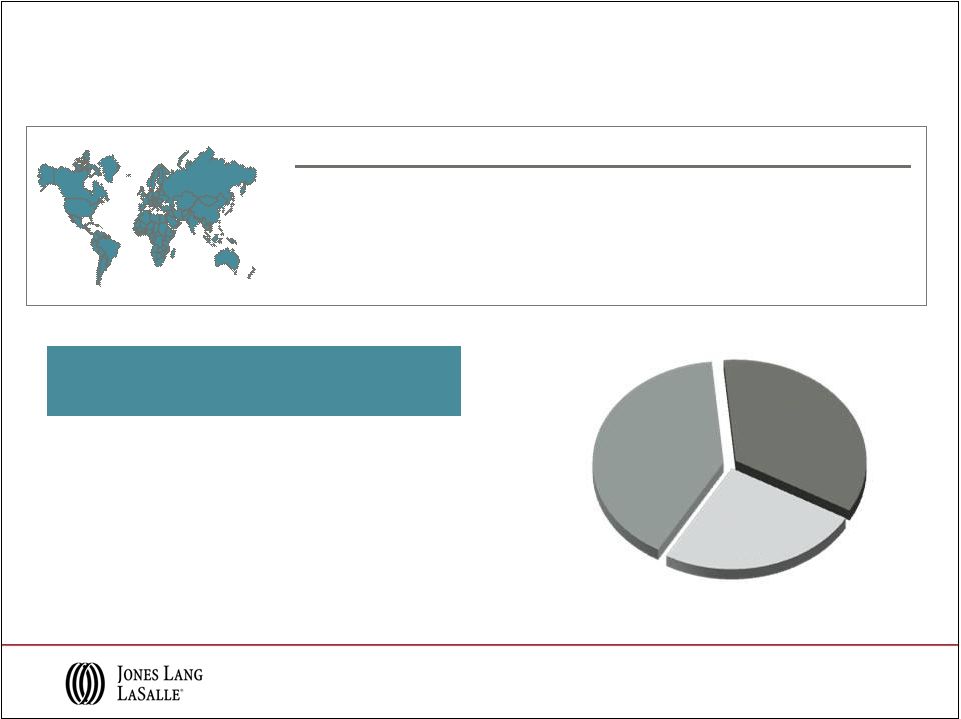

LaSalle Investment Management

Note: AUM data reported on a one-quarter lag.

H1 2012 Highlights

AUM by Fund type

($ in billions)

13

Product

Assets Under

Management

($ in billions)

Average

Performance

Private Equity

U.K.

$12.8

Above benchmark

Continental Europe

$4.4

Return: >1x equity

North America

$11.2

Above benchmark

Asia Pacific

$6.8

Return: >1x equity

Public Securities

$11.8

Above benchmark

Total Q2 2012 AUM

$47.0 B

•

Operating income margin of 26.8%, including equity earnings and

incentive fees

•

New fundraising activities in progress as vintage funds mature

•

$1.3 billion of capital invested year to date; good momentum with

strong pipelines versus 2011

Separate

Accounts

$18.9

Fund

Management

$16.3

Public

Securities

$11.8 |

Solid Cash Flows and Balance Sheet Position

•

Healthy position entering

historically strong

second half

•

Low debt cost: H1 2012

net interest expense of

$15 million vs. $18

million in H1 2011

•

Investment grade

balance sheet; Baa2 /

BBB-

(Stable)

H1 2012 Highlights

14

2012

2011

Cash Flows

H1

H1

H2

Cash (used in) from Operations

($123)

($136)

$348

Primary Uses

Capital Expenses

($32)

($36)

($56)

Acquisitions & Deferred

Payment

Obligations

($46)

($235)

($181)

Co-Investment

$21

$0

($46)

Dividends

($9)

($7)

($7)

Net Cash Outflows

($66)

($278)

($290)

Net Share Activity & Other Financing

$9

($6)

($9)

Net Bank Debt (Borrowings) Repayments

($180)

($420)

$49

Balance Sheet

Cash

$115

$96

$184

Short Term Borrowings

$20

$45

$65

Credit Facility

$619

$444

$463

Net Bank Debt

$524

$393

$344

Deferred Business Obligations

$278

$439

$299

Total Net Debt

$802

$832

$643

($ in millions) |

Appendix |

Fee Revenue / Expense Reconciliation

•

Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue

and expense in JLL financial statements have been steadily increasing

•

Margins diluted as gross accounting requirements increase revenue and costs without

corresponding profit •

Business managed on a “fee”

basis to focus on margin expansion in the base business

16

($ in millions)

2012

2011

2012

2011

Consolidated Revenue

921.3

$

845.3

$

1,734.7

$

1,533.1

$

Consolidated Operating Expenses

846.7

773.6

1,636.4

1,449.4

Adjusted Operating Income Margin

8.3%

8.7%

5.9%

5.6%

Gross Contract Costs:

Property & Facility Management

21.3

1.7

38.4

3.3

Project & Development Services

0.2

-

0.3

0.1

Total Gross Contract Costs

21.5

1.7

38.7

3.4

Property & Facility Management

-

-

-

-

Project & Development Services

26.6

22.9

53.0

43.5

Total Gross Contract Costs

26.6

22.9

53.0

43.5

Property & Facility Management

18.1

19.9

40.3

38.6

Project & Development Services

2.9

5.5

5.6

11.4

Total Gross Contract Costs

21.0

25.4

45.9

50.0

Consolidated Fee Revenue

852.2

$

795.3

$

1,597.1

$

1,436.2

$

Consolidated Fee-based Operating Expenses

777.6

$

723.6

$

1,498.8

$

1,352.5

$

Adjusted Operating Income Margin ("fee"-based)

9.0%

9.2%

6.4%

5.9%

YTD

Asia Pacific

Americas

EMEA

Q2

Note: Consolidated revenue and fee revenue exclude equity earnings (losses).

Restructuring and acquisition charges are excluded from operating

expenses. Restructuring and acquisition charges as well as intangible amortization related to the King

Sturge acquisition are excluded from operating expenses when calculating adjusted

operating income margin. |

17

Q2 2012 Adjusted EBITDA* Performance

Americas

EMEA

Asia Pacific

LIM

Consolidated

* Refer

to

slide

22

for

Reconciliation

of

GAAP

Net

Income

to

Adjusted

EBITDA

for

the

three

months

ended

June

30,

2011,

and

2012,

for

details

relative

to

these

adjusted

EBITDA

calculations. Segment EBITDA is calculated by adding the segment’s depreciation

and amortization to its reported operating income, which excludes restructuring and acquisition

charges. Consolidated adjusted EBITDA is the sum of the EBITDA of the four segments

less net income attributable to non-controlling interest. ($ in

millions) $42.0

$48.9

2011

2012

$93.9

$94.1

2011

2012

$24.7

$16.5

2011

2012

$16.4

$10.6

2011

2012

$12.0

$18.6

2011

2012 |

18

YTD 2012 Adjusted EBITDA* Performance

Americas

EMEA

Asia Pacific

LIM

Consolidated

* Refer to slide 22 for Reconciliation of GAAP Net Income to Adjusted EBITDA for the

six months ended June 30, 2011, and 2012, for details relative to these adjusted EBITDA

calculations. Segment EBITDA is calculated by adding the segment’s depreciation

and amortization to its reported operating income, which excludes restructuring and acquisition

charges. Consolidated adjusted EBITDA is the sum of the EBITDA of the four segments

less net income attributable to non-controlling interest. ($ in

millions) $60.6

$70.6

2011

2012

$122.2

148.9

2011

2012

$3.8

$14.3

2011

2012

$33.2

$26.6

2011

2012

$26.0

$38.1

2011

2012 |

19

YTD 2012 Real Estate Services Revenue

Asia Pacific

($ in millions; % change in USD

over June YTD 2011)

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Fee Revenue

Project & Development

Services

Fee Revenue

Advisory, Consulting &

Other

Total RES Operating

Revenue

Fee Revenue

$336.6

$70.0

$213.6

$84.7

$49.7

$754.6

7%

37%

43%

9%

27%

19%

$113.7

$89.1

$75.6

$103.0

$81.1

$462.5

16%

34%

16%

22%

12%

20%

$78.9

$45.4

$189.4

$36.6

$40.6

$390.9

0%

12%

10%

4%

5%

3%

$529.2

$204.5

$478.6

$224.3

$171.4

$1,608.0

8%

21%

24%

12%

14%

15%

Total RES

$175.2

20%

$149.1

$75.6

$399.9

16%

11%

16%

$84.4

$31.0

$50.0

$165.4

22%

15%

13%

$715.9

14%

$345.0

$409.5

$1,470.4

19%

5%

11%

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). Fee revenue presentation of

Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross

contract costs.

8% |

20

YTD 2012 Real Estate Services Revenue

Asia Pacific

($ in millions; % change in local currency

over June YTD 2011)

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Fee Revenue

Project & Development

Services

Fee Revenue

Advisory, Consulting &

Other

Total RES Operating

Revenue

Fee Revenue

$336.6

$70.0

$213.6

$84.7

$49.7

$754.6

7%

39%

44%

10%

24%

20%

$113.7

$89.1

$75.6

$103.0

$81.1

$462.5

24%

40%

22%

30%

18%

27%

$78.9

$45.4

$189.4

$36.6

$40.6

$390.9

3%

11%

11%

0%

5%

5%

$529.2

$204.5

$478.6

$224.3

$171.4

$1,608.0

10%

24%

26%

16%

16%

18%

Total RES

$175.2

21%

$149.1

$75.6

$399.9

22%

12%

18%

$84.4

$31.0

$50.0

$165.4

29%

19%

17%

$715.9

14%

$345.0

$409.5

$1,470.4

26%

6%

14%

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). Fee revenue presentation of

Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross

contract costs.

9% |

21

Reconciliation of GAAP Net Income to Adjusted Net Income

Three Months Ended

June 30,

Six Months Ended

June 30,

($ in millions)

2012

2011

2012

2011

GAAP Net income attributable to common

shareholders

$ 37.2

$ 43.9

$ 51.2

$ 45.4

Shares (in 000s)

44,847

44,473

44,726

44,391

GAAP earnings per share

$ 0.83

$ 0.99

$ 1.14

$ 1.02

GAAP Net income attributable to common

shareholders

$ 37.2

$ 43.9

$ 51.2

$ 45.4

Restructuring and acquisition charges, net

12.4

4.6

19.1

4.6

Intangible amortization, net

1.2

1.2

2.8

1.2

Adjusted net income

$ 50.8

$ 49.7

$ 73.1

$ 51.2

Shares (in 000s)

44,847

44,473

44,726

44,391

Adjusted earnings per share

$ 1.13

$ 1.12

$ 1.63

$ 1.15

and Earnings per Share |

22

Reconciliation of GAAP Net Income to Adjusted EBITDA

Three Months Ended

June 30,

Six Months Ended

June 30,

($ in millions)

2012

2011

2012

2011

GAAP Net income attributable to

common shareholders

$ 37.2

$43.9

$ 51.2

$ 45.4

Interest expense, net of interest

income

7.5

9.6

14.9

17.5

Provision for income taxes

12.8

15.0

17.7

15.5

Depreciation and amortization

20.0

19.3

39.6

37.7

EBITDA

$ 77.5

$ 87.8

$ 123.4

$ 116.1

Restructuring and acquisition

charges

16.6

6.1

25.5

6.1

Adjusted EBITDA

$ 94.1

$ 93.9

$ 149.8

$ 122.2

|