Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Guidance Software, Inc. | d385137d8k.htm |

Exhibit 10.1

OFFICE LEASE AGREEMENT

BY AND BETWEEN

1055 EAST COLORADO - PASADENA, CA, L.P.,

a Delaware limited partnership

as Landlord

and

GUIDANCE SOFTWARE, INC.,

a Delaware corporation

as Tenant

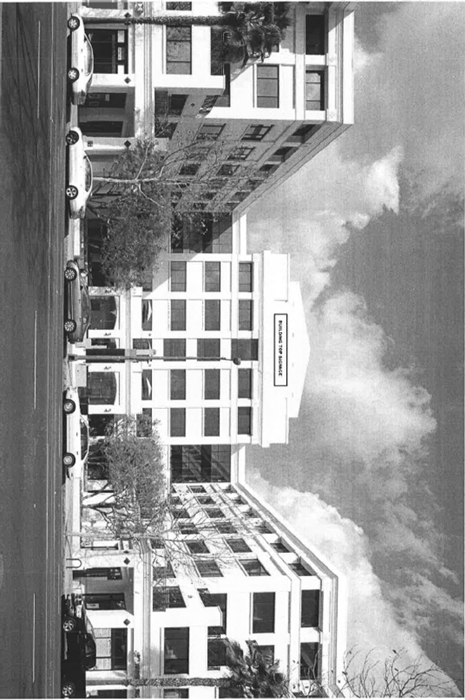

1055 East Colorado Boulevard

Pasadena, California 91006

TABLE OF CONTENTS

| Page | ||||

| ARTICLE I SPECIAL DEFINITIONS |

1 | |||

| ARTICLE II PREMISES |

3 | |||

| ARTICLE III TERM |

10 | |||

| ARTICLE IV BASE RENT |

11 | |||

| ARTICLE V OPERATING CHARGES AND REAL ESTATE TAXES |

12 | |||

| ARTICLE VI USE OF PREMISES |

15 | |||

| ARTICLE VII ASSIGNMENT AND SUBLETTING |

16 | |||

| ARTICLE VIII MAINTENANCE AND REPAIRS |

19 | |||

| ARTICLE IX ALTERATIONS |

20 | |||

| ARTICLE X SIGNS |

21 | |||

| ARTICLE XI SECURITY DEPOSIT |

22 | |||

| ARTICLE XII INSPECTION |

24 | |||

| ARTICLE XIII INSURANCE |

25 | |||

| ARTICLE XIV SERVICES AND UTILITIES |

26 | |||

| ARTICLE XV LIABILITY OF LANDLORD |

29 | |||

| ARTICLE XVI RULES |

30 | |||

| ARTICLE XVII DAMAGE OR DESTRUCTION |

31 | |||

| ARTICLE XVIII CONDEMNATION |

32 | |||

| ARTICLE XIX DEFAULT |

32 | |||

| ARTICLE XX BANKRUPTCY |

34 | |||

| ARTICLE XXI SUBORDINATION |

34 | |||

| ARTICLE XXII HOLDING OVER |

36 | |||

| ARTICLE XXIII COVENANTS OF LANDLORD |

36 | |||

| ARTICLE XXIV PARKING |

36 | |||

| ARTICLE XXV GENERAL PROVISIONS |

38 | |||

RIDER 1 - General Definitions

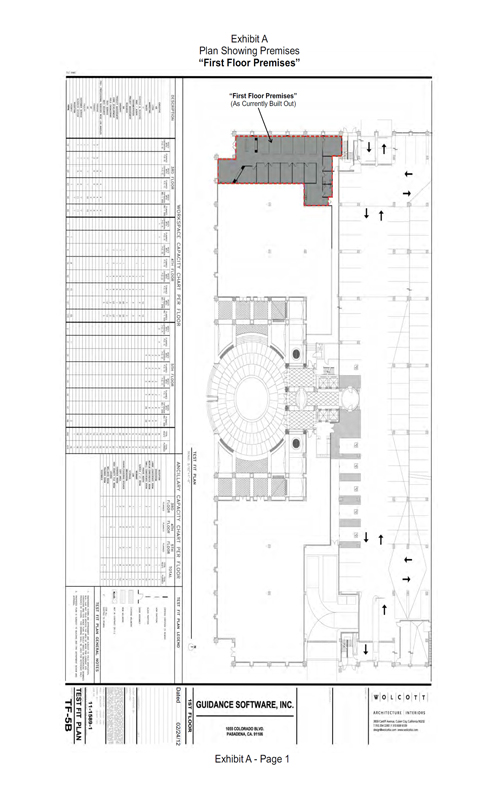

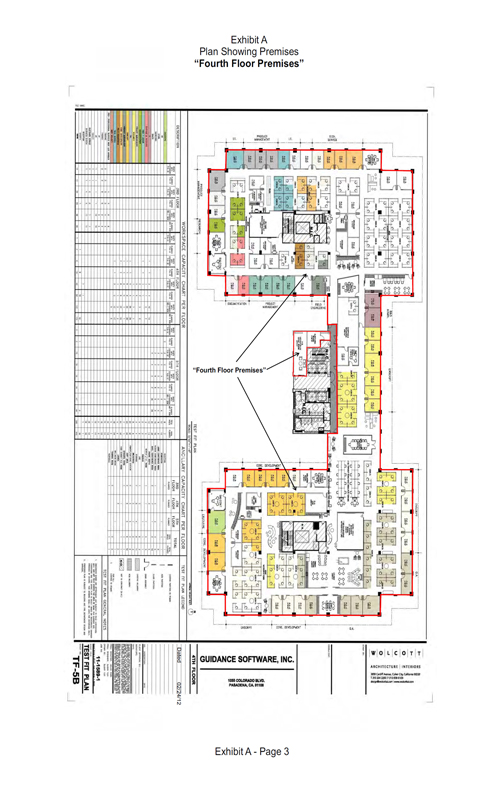

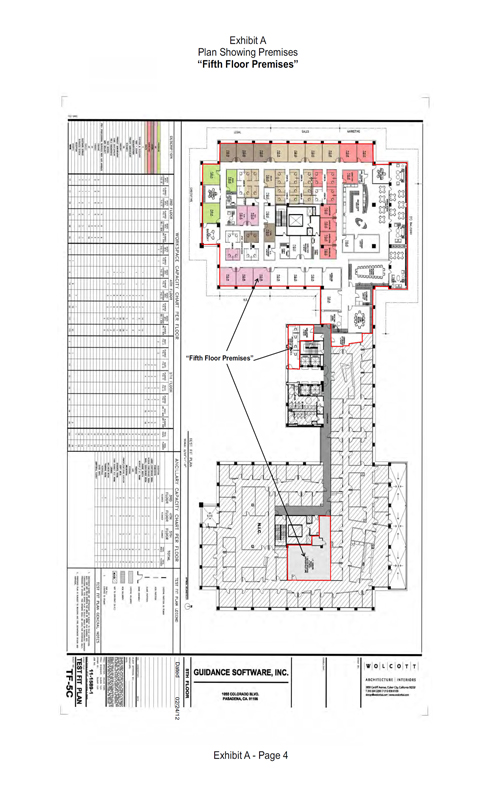

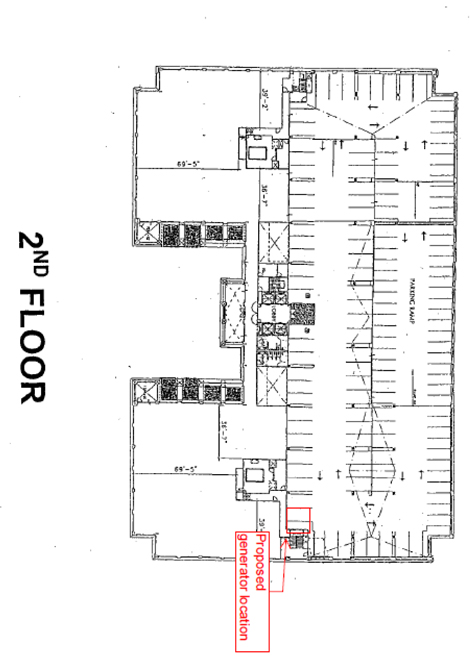

| EXHIBIT A | — | Plan Showing Premises | ||

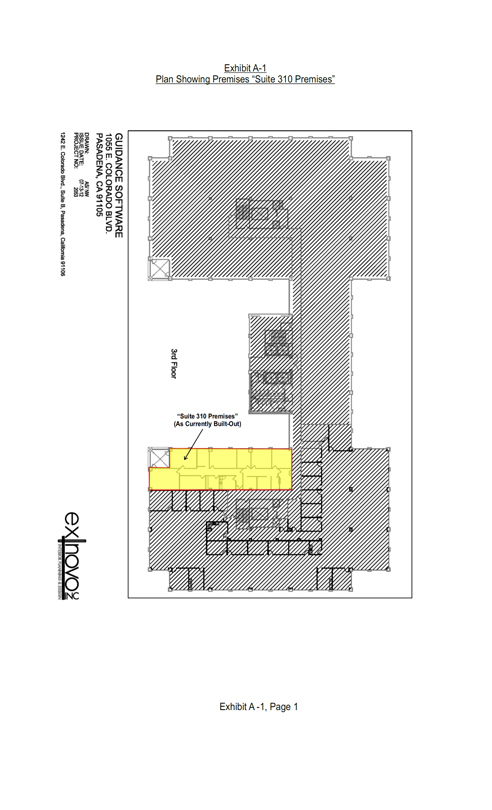

| EXHIBIT A-1 | — | Plan Showing Suite 310 Premises | ||

| EXHIBIT B | — | Tenant’s Work | ||

| EXHIBIT B-1 | — | Condition of Premises | ||

| EXHIBIT C | — | Rules and Regulations | ||

| EXHIBIT D | — | [Intentionally Omitted] | ||

| EXHIBIT E | — | HVAC Specifications | ||

| EXHIBIT F | — | Janitorial Specifications | ||

| EXHIBIT G | — | Generator Location and Specifications | ||

| EXHIBIT H | — | Subordination, Attornment and Non-Disturbance Agreement | ||

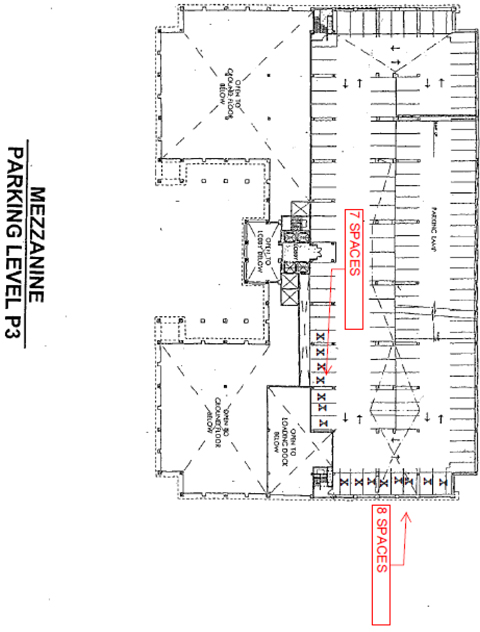

| EXHIBIT I | — | Location of Tenant’s Reserved Parking Spaces | ||

| EXHIBIT J | — | Location of Building Sign |

-i-

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT (this “Lease”) is dated as of the day of , 2012, and is being executed and entered into by and between 1055 EAST COLORADO - PASADENA, CA, L.P., a Delaware limited partnership previously having the name “Wells REIT – Pasadena, CA, L.P.” (“Landlord”), and GUIDANCE SOFTWARE, INC., a Delaware corporation (“Tenant”).

ARTICLE I

SPECIAL DEFINITIONS

1.1 Base Rent: Subject to the rental deferral provided in Section 2.3(b) of this Lease and the rental abatement provided in Section 4.1(b) hereof, the annual amount set forth in the following table:

| Period |

Monthly Installment |

Annualized Amount * |

||||||

| 8/1/2013 to 7/31/2014 |

$ | 208,296.00 | $ | 2,499,552.00 | ||||

| 8/1/2014 to 7/31/2015 |

$ | 214,544.88 | $ | 2,574,538.56 | ||||

| 8/1/2015 to 7/31/2016 |

$ | 220,981.23 | $ | 2,651,774.76 | ||||

| 8/1/2016 to 7/31/2017 |

$ | 227,610.67 | $ | 2,731,328.04 | ||||

| 8/1/2017 to 7/31/2018 |

$ | 234,438.99 | $ | 2,813,267.88 | ||||

| 8/1/2018 to 7/31/2019 |

$ | 241,472.16 | $ | 2,897,665.92 | ||||

| 8/1/2019 to 7/31/2020 |

$ | 248,716.32 | $ | 2,984,595.84 | ||||

| 8/1/2020 to 7/31/2021 |

$ | 256,177.81 | $ | 3,074,133.72 | ||||

| 8/1/2021 to 7/31/2022 |

$ | 263,863.14 | $ | 3,166,357.68 | ||||

| 8/1/2022 to 7/31/2023 |

$ | 271,779.03 | $ | 3,261,348.36 | ||||

| 8/1/2023 to 5/31/2024 |

$ | 279,932.40 | $ | 3,359,188.80 | ||||

| * | Based on twelve (12) full calendar months. |

1.2 Broker(s): CB Richard Ellis (“Landlord’s Broker”); and CresaPartners (“Tenant’s Broker”).

1.3 Building: A five-story building commonly known as 1055 East Colorado Boulevard, located in Pasadena, California and containing approximately 175,840 square feet of total rentable area (“Total Area”), which includes the entirety of the office and commercial space of the Building.

1.4 Building Hours: 8:00 a.m. to 6:00 p.m. Monday through Friday (excluding Holidays) and 9:00 a.m. to 1:00 p.m. on Saturday (excluding Holidays).

1.5 Expiration Date: 11:59 p.m. (local time at the Building) on May 31, 2024.

1.6 Holidays: New Year’s Day, President’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day (and the day after Thanksgiving) and Christmas Day.

1.7 Improvements Allowance: $5,237,400.00 (comprised of $60 per rentable square foot for the entire Premises (including the First Floor Premises) plus a special additional allowance of $30,000.00 for the First Floor Premises (the “Special Additional Allowance”)).

1.8 Landlord Notice Address: c/o Piedmont Management, Inc., 11695 Johns Creek Parkway, Suite 350, Johns Creek, Georgia 30097, Attention: Asset Manager – West Region.

1.9 Landlord Payment Address: 1055 East Colorado - Pasadena, CA, L.P., Dept 3043, Los Angeles, CA 90084-3043.

1.10 Lease Term: One hundred thirty (130) months (such period sometimes referred to herein as the “Initial Term”), subject to Sections 3.3 and 3.4.

1.11 Operating Charges Base Year: Calendar year 2013.

1.12 Parking Charge: Tenant shall be required to pay for a minimum of 130 parking spaces throughout the Lease Term (or, if the rentable area of the Premises is increased or decreased in

1

accordance with the terms hereof, 1.5 spaces per 1,000 rentable square feet of the Premises). Tenant may elect to use, and if it so elects shall pay for, additional parking spaces up to the Parking Allotment specified below.

1.13 Parking Allotment: 347 parking spaces, of which 15 parking spaces may, at Tenant’s option, consist of single covered reserved parking spaces marked for use by Tenant’s employees and/or visitors in accordance with Sections 24.1 and 24.2 hereinbelow; provided, however, if the rentable area of the Premises is increased or decreased in accordance with the terms hereof, the Parking Allotment shall be calculated at 4 parking spaces per 1,000 rentable square feet of the Premises.

1.14 Premises: Landlord and Tenant hereby agree that the Premises contains 86,790 rentable square feet consisting of (a) a portion of the first floor of the Building containing 3,200 rentable square feet in the approximate location shown on Page 1 of Exhibit A hereto (the “First Floor Premises”) (b) a portion of the third floor of the Building containing 17,101 rentable square feet in the approximate location shown on Page 2 of Exhibit A hereto (the “Suite 300 Premises”), (c) the entire fourth floor of the Building containing 45,641 rentable square feet in the approximate location shown on Page 3 of Exhibit A hereto (the “Fourth Floor Premises”), and (d) a portion of the fifth floor of the Building containing 20,848 rentable square feet in the approximate location shown on Page 4 of Exhibit A hereto (the “Fifth Floor Premises”), subject to the provisions of Sections 2.2, 2.4 and 2.5. The purpose of Exhibit A hereto is to show the approximate location of the Premises, and the parties acknowledge that the leasehold improvements shown thereon are not those existing in the Premises as of the date of this Lease. Notwithstanding the foregoing: (i) the inclusion of First Floor Premises in the Premises is subject to the provisions set forth below in subsections (b) and (c) of Section 2.2 and subsection (b)(ii)(C) of Section 2.3; and (ii) the inclusion of the Suite 300 Premises in the Premises is subject to the provisions set forth below in subsection (b) of Section 2.2 and subsection (b)(ii)(A) of Section 2.3.

1.15 Real Estate Taxes Base Year: Calendar year 2013.

1.16 Rent Commencement Date: August 1, 2013.

1.17 Security Deposit Amount: $1,200,000.00, subject to the provisions of Article XI.

1.18 Tenant Notice Address:

Prior to Rent Commencement Date:

| Guidance Software, Inc. 215 Marengo Avenue, 2nd Floor Pasadena, CA 91101 Attn: General Counsel | ||

| With a copy to: | Guidance Software, Inc. 215 Marengo Avenue, 2nd Floor Pasadena, CA 91101 Attn: Facilities Manager | |

| With a copy to: | Jackson DeMarco Tidus & Peckenpaugh 2030 Main Street, 12th Floor Irvine, CA 92614 Attn: Steven J. Dettmann, Esq. | |

After Rent Commencement Date:

| Guidance Software, Inc. 1055 East Colorado Boulevard, 4th Floor Pasadena, CA 91106 Attn: General Counsel | ||

| With a copy to: | Guidance Software, Inc 1055 East Colorado Boulevard, 4th Floor Pasadena, CA 91106 Attn: Facilities Manager | |

| With a copy to: | Jackson DeMarco Tidus & Peckenpaugh 2030 Main Street, 12th Floor Irvine, CA 92614 Attn: Steven J. Dettmann, Esq. | |

1.19 Tenant’s Proportionate Share: 49.36% for Operating Charges and Real Estate Taxes.

2

ARTICLE II

PREMISES

2.1 Tenant leases the Premises from Landlord for the term and upon the conditions and covenants set forth in this Lease. Landlord shall not have the right to relocate Tenant during the Lease Term and any Extension Term. Except as may otherwise be expressly provided in this Lease, the lease of the Premises does not include the right to use the roof, mechanical rooms, electrical closets, janitorial closets, telephone rooms, parking areas or non-common or non-public areas of any portion of the Building, whether or not any such areas are located within the Premises. However, Tenant, at no additional charge to Tenant during the Term of the Lease and any Extension Term, shall have the exclusive right to use the balconies located on the fourth and fifth floors of the Building and accessible solely through the Fourth Floor Premises and the Fifth Floor Premises, respectively (collectively, the “Balconies”), and the non-exclusive right to use the following: (1) the plenums, risers, electrical closets, telephone rooms, ducts or pipes on or serving the floor on which the Premises are located (other than those existing installed facilities within or outside the Premises, or such future installed facilities outside the Premises, that are dedicated for another tenant’s exclusive use and provided Tenant shall have such utilization in no greater proportion than the ratio by which the square feet of rentable area in the Premises compares to the square feet of rentable area in the Building) in accordance with any commercially reasonable riser management plan for the Building and plans and specifications to be approved by Landlord, which approval shall not be unreasonably withheld, delayed or conditioned, and provided that Tenant shall not be charged for the use of existing risers, and Landlord shall not unreasonably withhold, condition or delay its approval of the installation of new risers at Tenant’s expense; (2) the Parking Facilities in accordance with Article XXIV and all Common Areas in the Building; and (3) any mechanical rooms, electrical closets and telephone rooms located within the Premises and other parts of the Building (including the Building’s main point of entry) reasonably needed for the installation of Tenant’s communication and data processing, cabling and connectivity, and for the purpose for which they were intended, but only with Landlord’s prior consent, which consent shall not be unreasonably withheld, delayed or conditioned (except to the extent that such rooms and closets contain no system, wiring or other item related to either the Building Structure and Systems or to a structure or system of any tenant or occupant other than Tenant, in which case no such prior consent of Landlord shall be required for use by Tenant’s on-site, properly licensed, trained technicians or Tenant’s employees, consultants and contractors) and strictly in accordance with Landlord’s commercially reasonable rules, regulations and requirements in connection therewith. Tenant’s rights in respect of the Balconies shall be on the following terms and conditions: (a) Tenant, and not Landlord, shall be responsible for any damage or liability of any kind or for any injury to or death of persons arising on or about the Balconies and to provide liability insurance coverage in respect thereof, to the same extent and upon the same terms and conditions as if the same were a part of the Premises; (b) Tenant shall be solely responsible to provide janitorial service in respect of any cleaning of the Balconies and to keep any and all personal property of Tenant thereon in good order and repair; and (c) Tenant’s use of the Balconies is subject to all applicable Laws and to all obligations of Tenant under this Lease in respect of the Premises. Any delay in Landlord’s delivery of possession of the Premises shall not make this Lease void or voidable, nor shall Landlord be liable to Tenant for any loss or damage resulting therefrom, subject to the provisions of Section 2.3(b) hereof; provided that upon the Rent Commencement Date and subject to any abatements described in Section 2.3(b) and 4.1(b), Tenant shall be required to commence payment of Base Rent only in respect of that portion of the Premises for which possession has been delivered to Tenant, determined in the proportion to the rentable area thereof bears to entire rentable area of the Premises.

2.2 The parties shall have the rights and obligations provided in this Section in respect of those certain premises located on the third floor of the Building known as Suite 310 and containing an agreed 3,605 rentable square feet in the approximate location shown on Exhibit A-1 hereto (the “Suite 310 Premises”), upon and subject to the following terms and conditions:

(a) The Suite 310 Premises are currently occupied by Hutton & Wilson (“Existing Suite 310 Tenant”) pursuant to an existing lease (as amended to date, the “Existing Suite 310 Lease”) that has a fixed term expiring January 31, 2016. Within three (3) days after full execution and delivery of this Lease, Landlord shall deliver to the Existing Suite 310 Tenant (with a concurrent copy to Tenant) a written lease termination agreement (the “Suite 310 LTA”) in respect of the Existing Suite 310 Lease providing as follows: (i) the term of the Existing Suite 310 Lease would end and terminate as of January 31, 2013, by which date the Existing Suite 310 Tenant would vacate the Suite 310 Premises; (ii) Landlord would pay to the Existing Suite 310 Tenant the sum of $60,000.00; (iii) the Existing Suite 310 Tenant would acknowledge that no amount is due from Landlord in respect of a tenant allowance that had been available to Tenant under the Existing Suite 310 Lease but was not used; and (iv) such agreement would otherwise be upon terms and conditions reasonably satisfactory to Landlord. Landlord shall give Tenant notice if and when the Suite 310 LTA has been fully executed and delivered (the “Suite 310 LTA Execution Notice”).

3

(b) Provided and on condition that Landlord delivers the Suite 310 LTA Execution Notice to Tenant no later than July 31, 2012 (the “Outside Suite 310 Date”) the following terms and conditions shall apply:

(i) The Suite 310 Premises shall automatically be included in the Premises covered by this Lease, the First Floor Premises shall automatically be removed from the Premises covered by this Lease, and the following amendments to this Lease shall apply:

(A) Each of the Base Rents for the Lease Term shall be increased by an amount equal to the scheduled Base Rent set forth in Section 1.1, multiplied by a fraction, the numerator of which is 405 (the increase in rentable square feet by substituting the Suite 310 Premises in place of the First Floor Premises) and the denominator of which is 86,790 (the total rentable square foot area of the Premises on which the Base Rent schedule in Section 1.1 was determined);

(B) The Parking Allotment shall increase from 347 to 349, and the minimum number of parking spaces for which the Parking Charge is due shall increase from 130 to 131 parking spaces;

(C) Tenant’s Proportionate Share shall be increased to 49.59% in accordance with the calculation described in Section 5.2(a); and

(D) The Improvements Allowance shall be decreased by $5,700.00 (which is a net amount calculated by (I) increasing the Improvement Allowance by $24,300.00 with respect to the net increase in total area of the Premises, and (II) decreasing the Improvement Allowance by $30,000.00 with respect to the removal of the Special Additional Allowance).

(ii) Notwithstanding the provisions of subsection (i) above, Tenant shall have the right and option (the “First Floor Option”), to be exercised by written notice given to Landlord not later than the thirtieth (30th) day following Tenant’s receipt of the Suite 310 LTA Execution Notice (the “First Floor Option Expiration Date”), to cause the First Floor Premises to remain part of the Premises covered by this Lease. If Tenant exercises the First Floor Option, the First Floor Premises shall continue to be included as a portion of the Premises, and the terms of this Lease shall be further amended as follows:

(A) Each of the Base Rents for the Lease Term shall be further increased (in addition to the increase provided in subsection (b)(i)(A) of this Section) by an amount equal to the scheduled Base Rent set forth in Section 1.1, multiplied by a fraction, the numerator of which is 3,200 (rentable square feet of the First Floor Premises) and the denominator of which is 86,790 (the total square foot area of the Premises on which the Base Rent schedule in Section 1.1 was determined);

(B) The Parking Allotment shall increase from 349 to 362, and the minimum number of parking spaces for which the Parking Charge is due shall increase from 131 to 136 parking spaces;

(C) Tenant’s Proportionate Share shall be increased to 51.41% in accordance with the calculation described in Section 5.2(a); and

(D) The Improvements Allowance shall be increased by $222,000 (which is a sum calculated by (I) increasing the Improvement Allowance by $192,000.00 with respect to the increase in total area of the Premises, and (II) increasing the Improvement Allowance by the Special Additional Allowance of $30,000.00 for the First Floor Premises described in Section 1.7).

(iii) Promptly following the date by which Tenant must exercise its First Floor Option, Landlord and Tenant shall enter into a commercially reasonable written amendment to this Lease confirming the terms, conditions and provisions applicable by reason of the provisions of this subsection (b). The failure of Landlord and Tenant to timely execute such amendment shall not negate the exercise of the First Floor Option.

(c) If Landlord fails to deliver the Suite 310 LTA Execution Notice to Tenant by the Outside Suite 310 Date, then Tenant shall have a right to expand the Premises to include the Suite 310 Premises (the “Suite 310 Expansion Right”) as provided in this subsection. Tenant may exercise the Suite 310 Expansion Right by written notice to Landlord (“Suite 310 Expansion Notice”) given not later than March 31, 2015, in which event the Suite 310 Premises shall be included in the Premises covered by this Lease, subject to and upon the following terms and conditions:

4

(i) Rentals and charges shall commence to be payable in respect of the Suite 310 Premises on the date (the “Expansion Rent Commencement Date”) that is the first to occur of (A) the 121st day following the date on which the Suite 310 Premises are delivered by Landlord to Tenant and (B) the date upon which Tenant commences business operations in any portion of the Suite 310 Premises.

(ii) Effective from and after the Expansion Rent Commencement Date, the Base Rent shall be increased by an amount equal to the product of the rentable area of the Suite 310 Premises multiplied by the per rentable square foot amount from time to time payable in respect of the Premises originally demised pursuant to this Lease (and excluding any ROFO Space), so that Tenant will then commence and thereafter continue to pay Base Rent in respect of the Suite 310 Premises at the same escalated rate per rentable square foot as is in effect from time to time for the Premises originally demised hereunder.

(iii) Effective from and after the Expansion Rent Commencement Date, Tenant’s Proportionate Share shall be increased by reference to increase in the rentable area of the Premises resulting from the addition of the Suite 310 Premises, and Tenant shall pay increases in Operating Charges and Real Estate Taxes in respect of the Suite 310 Premises using the same Operating Charges Base Year and Real Estate Taxes Base Year applicable in respect of the Premises originally demised hereunder.

(iv) Effective upon the Expansion Rent Commencement Date, the Parking Allotment (and minimum parking spaces in Section 1.12) shall be increased in proportion to the increase in the rentable area of the Premises resulting from the addition of the Suite 310 Premises (the “Suite 310 Parking Increase”).

(v) In addition to the terms and conditions set forth in this Section 2.2(c) in connection with Suite 310 Expansion Right, Landlord shall make available to Tenant the following improvements allowance, Base Rent abatement and Parking Allotment concessions in respect of the Suite 310 Premises:

(A) An improvements allowance equal to the product of (I) the rentable area of the Suite 310 Premises, multiplied by (II) $60.00 per rentable square foot, multiplied by (III) a fraction (the “Expansion Calculation Fraction”), the numerator of which is the number of months in the period beginning upon the Expansion Rent Commencement Date and ending upon the Expiration Date originally provided herein (including a fraction for any partial month in such period) and the denominator of which is 130. Such improvements allowance shall be payable to Tenant upon and subject to the same terms and conditions herein set forth for the Improvements Allowance provided in Section 4 of Exhibit B hereto, except that references in such Section to “Tenant’s Work” shall mean and be construed as references to Alterations performed by Tenant to the Suite 310 Premises and the outside date applicable for purposes of subsection (4) of such Section shall be the last day of the twenty-ninth (29th) full calendar month following the Expansion Rent Commencement Date. For example, if the Expansion Rent Commencement Date occurs on June 1, 2016, the number of months remaining through the Expiration Date for the Suite 310 Premises shall be 96 months which shall be numerator of the Expansion Calculation Fraction, and the denominator thereof shall be 130 based on the number of months for the original Lease Term (that is, 96/130ths), and therefore the improvements allowance for the Suite 310 Premises shall be (x) 3,605 rentable square feet multiplied by (y) $60.00 per rentable square foot multiplied by (z) 96/130ths which equates to an allowance equal to $159,729.23.

(B) Base Rent abatement equal to fourteen (14) months multiplied by the Expansion Calculation Fraction, rounded to the nearest number of days based upon a thirty (30) days month, and taken at the times provided below. For example, if the Expansion Rent Commencement Date occurs on June 1, 2016, the Base Rent abatement in respect of the Suite 310 Expansion Right (the “Suite 310 Base Rent Abatement”) shall be fourteen (14) months multiplied by 96/130ths which equates to ten (10) months, ten (10) and 20/130th days, which rounds to ten (10) months and ten (10) days. The Suite 310 Base Rent Abatement shall be taken in the following calendar months after the Expansion Rent Commencement Date: (i) as to four (4) months thereof, in months two (2) through five (5), inclusive; (ii) as to the excess of the number of full and any partial calendar months of Suite 310 Base Rent Abatement over (8) months, beginning in month thirteen (13) and continuing thereafter for such number of full and partial calendar months; and (iii) as to four (4) months thereof, in months sixty-one (61) through sixty-four (64), inclusive. For example, if the Expansion Rent Commencement Date occurs on June 1, 2016, the Suite 310 Base Rent Abatement shall be taken in the following calendar months after the

5

Expansion Rent Commencement Date: (A) in months two (2) through five (5), inclusive; (B) in month thirteen (13) and fourteen, and in the first ten (10) days of month fifteen (15); and (C) in months sixty-one (61) through sixty-four (64), inclusive.

(C) A fifty percent (50%) reduction in the amount of the parking charges payable by Tenant in respect of the Suite 310 Parking Increase for a period equal to twenty-four (24) months multiplied by the Expansion Calculation Fraction, rounded to the nearest number of days based upon a thirty (30) days month, beginning upon the Expansion Rent Commencement Date. For example, if the Expansion Rent Commencement Date occurs on June 1, 2016, such reduction in parking charges shall begin upon the Expansion Rent Commencement Date and continue for a period of twenty-four (24) months multiplied by 96/130ths which equates to seventeen (17) months, twenty-one (21) and 90/130th days, which rounds to seventeen (17) months, twenty-two (22) days.

(vi) Tenant shall accept the Suite 310 Premises in “AS-IS” condition (subject to the obligations of Landlord set forth in this Lease to maintain and repair the Premises and the Building Structure and Systems), and Landlord shall have no obligation whatsoever to prepare the same for use by Tenant, or pay or reimburse Tenant for any costs or expenses incurred in connection with the remodeling or alteration thereof, except for the improvements allowance specified above.

(vii) From and after the delivery of the Suite 310 Premises to Tenant and continuing for the remainder of the Lease Term, the same shall be and constitute a part of the Premises covered by this Lease.

(viii) Promptly following the giving of the Suite 310 Expansion Notice, Landlord and Tenant shall enter into a commercially reasonable written amendment to this Lease confirming the terms, conditions and provisions applicable by reason of the provisions of this subsection (c). The failure of Landlord and Tenant to timely execute such amendment shall not negate the exercise of the rights arising by reason of the giving of the Suite 310 Expansion Notice.

(ix) The Suite 310 Expansion Right shall be available only provided, and on condition that: (A) Tenant is not in default under this Lease beyond applicable notice and cure periods, either at the time the Suite 310 Expansion Notice is given or, at Landlord’s option, upon the date the Suite 310 Premises would otherwise be delivered to Tenant; and (B) the Tenant under this Lease shall be and have been at all times during the Lease Term either (x) the entity originally named as the Tenant in this Lease or (y) a Permitted Assignee (as defined in Section 7.2(c)); and (C) Tenant and its Permitted Transferees (as defined in Section 7.2(c)) are physically and personally occupying not less than fifty percent (50%) of the rentable area of the Premises (and no portion of the Premises occupied by any subtenant other than a Permitted Transferee shall be considered to be so occupied by Tenant).

2.3 (a) The Fourth Floor Premises and the Fifth Floor Premises are currently vacant, and Landlord shall deliver possession thereof to Tenant not later than October 1, 2012 (the “First Delivery Date”).

(b) The Suite 300 Premises, the Suite 310 Premises and the First Floor Premises are currently occupied by existing tenants. Landlord agrees to advise the existing tenant of the Suite 300 Premises, promptly following the full execution and delivery of this Lease, that Landlord will not renew or extend the term of such tenant’s lease. If Tenant exercises the First Floor Option, Landlord agrees to promptly advise the existing tenant of the First Floor Premises that Landlord will not renew or extend the term of such tenant’s lease. Landlord shall undertake diligent efforts to recover possession of the Currently Occupied Premises (as defined below) from the tenants therein, including the filing and diligent pursuit to conclusion of an unlawful detainer action as needed, and Landlord shall deliver possession of the Currently Occupied Premises to Tenant on the earliest practicable date, which the parties intend be on or before February 1, 2013 or such later date as Landlord recovers possession from such tenants (the “Second Delivery Date”). For purposes of this Section, the term “Currently Occupied Premises” shall mean and include the following: (x) the Suite 300 Premises; (y) if the Suite 310 Premises is added to the Premises pursuant to Section 2.2(b), the Suite 310 Premises, and (z) if the First Floor Option is exercised, the First Floor Premises. For purposes of this Lease, the “Initial Premises” shall mean and include the Currently Occupied Premises, the Fourth Floor Premises and the Fifth Floor Premises. If Landlord fails to deliver possession of the Currently Occupied Premises to Tenant by February 1, 2013, then:

(i) Upon the Rent Commencement Date, Tenant shall be required to commence payment of Base Rent only in respect of the Fourth Floor Premises and the Fifth Floor Premises, determined in the proportion that the rentable area thereof bears to entire rentable area of the Premises.

6

(ii) Commencement of payment of Base Rent in respect to the Currently Occupied Premises shall be deferred following the Rent Commencement Date for (a) a period equal to two (2) times the number of days between February 1, 2013 and March 31, 2013 or, if earlier, the date that Landlord delivers possession of the Currently Occupied Premises to Tenant; plus (b) if the Currently Occupied Premises have not been delivered to Tenant by March 31, 2013, a period equal to three (3) times the number of days between April 1, 2013 and June 30, 2013 (the “Currently Occupied Premises Outside Date”). Such deferral shall be in addition to, and not in lieu of, any free rental period described in Section 4.1(b).

(iii) In the event that Landlord shall fail to deliver possession of any portion of the Currently Occupied Premises to Tenant by the Currently Occupied Premises Outside Date, Tenant, at Tenant’s election, shall have the right to terminate the Lease in connection with such portion of the Currently Occupied Premises by providing notice to Landlord any time after the Currently Occupied Premises Outside Date of Tenant’s election to terminate this Lease with respect thereto. If Tenant provides said termination notice to Landlord with respect to:

(A) The Suite 300 Premises, then (I) Landlord and Tenant shall be released, as of such stated termination date, of all obligations under this Lease in connection with the Suite 300 Premises (with a proportionate reduction in the Base Rent, Improvements Allowance [with such reduction to be made by taking into account the Special Additional Allowance], Parking Allotment, minimum Parking Charge, and Tenant’s Proportionate Share), and (II) to compensate Tenant for the costs of locating and securing a lease for suitable alternative office space in place of the Suite 300 Premises, Landlord shall pay to Tenant the sum of Six Hundred Forty Thousand Dollars ($640,000.00);

(B) The Suite 310 Premises (if the Suite 310 Premises is added to the Premises pursuant to Section 2.2(b)), then (I) Landlord and Tenant shall be released, as of such stated termination date, of all obligations under this Lease in connection with the Suite 310 Premises (with a proportionate reduction in the Base Rent, Improvements Allowance [with such reduction to be made by taking into account the Special Additional Allowance], Parking Allotment, minimum Parking Charge, and Tenant’s Proportionate Share), and (II) to compensate Tenant for the costs of locating and securing a lease for suitable alternative office space in place of the Suite 310 Premises, Landlord shall pay to Tenant the sum of Sixty Thousand Dollars ($60,000.00); and

(C) The First Floor Premises (except where the Suite 310 Premises is added to the Premises pursuant to Section 2.2(b) and Tenant thereafter fails to timely exercise its First Floor Option), then Landlord and Tenant shall be released, as of such stated termination date, of all obligations under this Lease in connection with the First Floor Premises (with a proportionate reduction in the Base Rent, Improvements Allowance [with such reduction to include the entire $30,000 Special Additional Allowance], Parking Allotment, minimum Parking Charge, and Tenant’s Proportionate Share).

(iv) In the event that Landlord shall fail to deliver possession of the Currently Occupied Premises to Tenant by the Currently Occupied Premises Outside Date, Tenant, at Tenant’s election, shall have the right to terminate the Lease in connection with the entire Premises by providing notice to Landlord any time after the Currently Occupied Premises Outside Date, as of the date stated in said Tenant’s notice, and Landlord and Tenant shall be released of all obligations in connection with the Premises as of such stated termination date; except that Landlord shall pay to Tenant all out-of-pocket costs and expenses incurred by Tenant with respect to design and construction of the Tenant’s Work through the Currently Occupied Premises Outside Date in an amount of up to Two Million Five Hundred Thousand Dollars ($2,500,000.00).

(c) Landlord shall deliver the Premises to Tenant in broom-clean condition and subject to and in accordance with the terms and conditions set forth in Exhibit B-1 hereto.

(d) From and after the First Delivery Date, in the Fourth Floor Premises and the Fifth Floor Premises, and from and after the Second Delivery Date, in the Currently Occupied Premises, Tenant shall have the right to undertake and pursue Tenant’s Work and installation of its cabling and furnishings, fixtures and equipment. Tenant shall not be required to pay any Base Rent or charges under this Lease from the First Delivery Date and Second Delivery Date through the Rent Commencement Date, other than as provided in Section 4.1(c).

(e) Notwithstanding anything to the contrary contained in this Lease, in no event shall Tenant move any of its employees into the Premises or commence any business operations therein or therefrom prior to June 1, 2013. Landlord agrees that Tenant’s employees that occupy or are present in the Premises prior to June 1, 2013 in connection with Tenant’s Work and installation of its cabling and

7

furnishings, fixtures and equipment, shall not be deemed a commencement of Tenant’s business operations or trigger the Early Operating Period as defined in Section 4.1(c) below.

2.4 Tenant shall have a onetime right (the “Contraction Right”) to reduce the size of the Premises by giving back to Landlord the entirety of the Premises then covered by this Lease and located on the third floor of the Building (the “Third Floor Premises”), effective as of May 31, 2021 (the “Contraction Date”), upon and subject to the following terms and conditions:

(a) Tenant shall exercise the Contraction Right by written notice (the “Contraction Notice”) delivered to Landlord not later than May 31, 2020 and by paying to Landlord, not later than June 30, 2020, the sum of $778,437.52 or, if the Third Floor Premises is other than 17,101 rentable square feet as the result of the addition of the Suite 310 Premises or any ROFO Space or otherwise, a sum equal to $45.52 times the rentable square footage of the Third Floor Premises (the “Contraction Payment”). Tenant’s exercise of the Contraction Right shall be effective only provided, and on condition that, the Contraction Payment is made by such date.

(b) In the event that Tenant effectively exercises the Contraction Right as set forth above: (i) Tenant shall surrender possession of the Third Floor Premises to Landlord not later than the Contraction Date, in the manner provided in this Lease for the surrender of the Premises at the expiration of the Lease Term; (ii) Base Rent shall cease to be payable in respect of the Third Floor Premises upon the Contraction Date or, if later, the date Tenant so surrenders possession of the Third Floor Premises to Landlord, and thereafter the Base Rent payable hereunder shall be reduced in the proportion that the rentable area of the Third Floor Premises bears to the entire rentable area of the Premises; (iii) the obligation of Tenant to pay a share of increases in Operating Charges and Real Estate Taxes in respect of the Third Floor Premises shall cease as of the later of such dates; and (iv) the Security Deposit Amount shall immediately be reduced based on the proportion that the rentable area of the Third Floor Premises bears to the entire rentable area of the Premises. In connection with the exercise of the Contraction Right, Landlord and Tenant shall promptly enter into a commercially reasonable written amendment to this Lease confirming the terms, conditions and provisions applicable by reason of the exercise of such right, as determined in accordance herewith. The failure of Landlord and Tenant to timely execute such amendment shall not negate the exercise of the Contraction Right.

(c) The Contraction Right shall be available only provided, and on condition that: (i) Tenant is not in default with respect to the payment of Base Rent, additional rent or other sum due and owing under this Lease beyond applicable notice and cure periods, either at the time Tenant gives the Contraction Notice or, at Landlord’s option, upon the Contraction Date; and (ii) the Tenant under this Lease shall be either (A) the entity originally named as the Tenant in this Lease or (B) a Permitted Assignee. Subject to the due and timely exercise of the Contraction Right, and subject to satisfaction of the above conditions, acceptance of the Contraction Payment by Landlord shall constitute the parties’ irrevocable modification of the Expiration Date with respect to the Third Floor Premises.

2.5 Tenant shall have a right of first offer to lease (the “ROFO”) in respect of certain premises located on the third and fifth floors of the Building, upon and subject to the following terms and conditions:

(a) If any premises located on the third floor or the fifth floor of the Building is or will become Available (as defined below) within eighty-four (84) months following the Rent Commencement Date, Landlord shall make a written offer to Tenant (a “Landlord ROFO Notice”) to lease to Tenant such space (“ROFO Space”). For this purpose, premises shall not be considered to be “Available” if the same are subject to a written expansion right, renewal right, right of first offer or refusal, or similar right in favor of a third party that was granted by Landlord prior to the execution of this Lease by Landlord and Tenant, including any realization of such written contractual right on a negotiated basis (rather than by formal exercise of its right by the third party) (the “Superior Rights”). Landlord hereby warrants that the only Superior Rights are as follows: (i) the rights of Hutton & Wilson in respect of Suite 310 consisting of approximately 3,605 rentable square feet; (ii) the rights of United States of America (Department of Labor-GSA) in respect of Suite 320 consisting of approximately 3,557 rentable square feet; (iii) the rights of Evolution Robotics, Inc. in respect of Suite 340 consisting of approximately 11,109 rentable square feet; (iv) the right of the City of Pasadena in respect of Suite 350 consisting of approximately 9,862 rentable square feet; and (v) the rights of Premier Office Centers, LLC in respect of Suite 500 consisting of approximately 19,480 rentable square feet. With regard to an existing tenant or occupant (or an affiliate thereof) of premises located on the third or fifth floor of the Building who does not have Superior Rights to extend or renew its lease (an “Incumbent Tenant”), Landlord shall be required to deliver to Tenant a Landlord ROFO Notice for such Incumbent Tenant’s premises prior to offering the Incumbent Tenant any extension or renewal with respect to such space; provided that such Landlord ROFO Notice shall not be delivered to Tenant prior to the date that is thirteen (13) months prior to the date such ROFO Space is to become available to Tenant. If, after receiving such Landlord ROFO Notice concerning the Incumbent Tenant’s premises, Tenant fails to duly and timely give Tenant’s Exercise Notice in respect

8

thereof as provided below, Landlord may negotiate a renewal or extension with the Incumbent Tenant, whereupon such renewal or extension shall constitute Superior Rights.

(b) Each Landlord ROFO Notice shall set forth the following: (i) the available ROFO Space (and the Parking Allotment attributable to the ROFO Space shall be determined by reference to the area of such space in accordance with Section 1.13 hereof); (ii) the availability date (or estimated availability date) thereof; (iii) the Base Rent (including any annual escalations therein); and (iv) those other economic and business terms (specifically any tenant improvement allowance and concessions, such as any rent abatement, which Landlord is offering the marketplace or other tenants for other space in the Building, or which other landlords are offering in the marketplace for comparable spaces in comparable buildings) on which Landlord intends to offer the ROFO Space to the marketplace (taking into account that the term pursuant to which Tenant has the right to lease the ROFO Space hereunder may differ from the lease term that Landlord intends to offer to third parties); provided, however, if Tenant’s Exercise Notice (as defined below) is given within the first twelve (12) months following the Rent Commencement Date, the ROFO Space shall be leased to Tenant on the same effective economic terms (including but not limited to the Base Rent) as provided for in this Lease for the Premises originally demised hereunder, determined on a per square foot basis, and with an improvements allowance determined by reference to the per rentable square foot Improvements Allowance provided in Section 1.7 hereunder, in the proportion that the period from rental commencement on the ROFO Space to the Expiration Date bears to the period from the Rent Commencement Date to the Expiration Date.

(c) Tenant shall have the right to lease all, and not less than all, of the ROFO Space described in any Landlord ROFO Notice by written notice to Landlord (“Tenant’s Exercise Notice”) given not later than ten (10) days after such Landlord ROFO Notice is given. If the ROFO is not timely exercised by Tenant as to any ROFO Space the first time such space is presented to Tenant pursuant to a Landlord ROFO Notice (or if the conditions set forth in subsection (e) of this Section shall not be satisfied as of the date that Landlord would otherwise have given a Landlord ROFO Notice in respect of any ROFO Space), the ROFO shall thereupon terminate as to such ROFO Space, and Landlord may thereafter lease the ROFO Space without notice to Tenant and free of any right of Tenant. Landlord and Tenant may agree to a lease of the ROFO Space upon such other terms and conditions as they may determine to be mutually agreeable, but no request for the consideration of other terms or negotiations in respect thereof shall extend the date by which Tenant’s Exercise Notice must be given, other than as may be provided in a written agreement executed and delivered by both parties.

(d) If Tenant effectively exercises the ROFO for any ROFO Space, such ROFO Space shall be added to the Premises under the same terms and conditions covered by this Lease except for the following terms and conditions: (i) the Base Rent for the ROFO Space shall be as set forth in the applicable Landlord ROFO Notice, with the Base Year for purposes of determining the share of Operating Charges and Real Estate Taxes attributable to the ROFO Space to be the calendar year in which the lease of the ROFO Space commences (except that Tenant shall have no obligation to pay its share of Operating Charges and Real Estate Taxes increases attributable to the ROFO Space during the initial twelve (12) months of the term for the leased ROFO Space), and the Security Deposit Amount then in effect shall be increased in the proportion that the monthly Base Rent for the ROFO Space bears to the monthly Base Rent for the Premises hereunder prior to the addition of the ROFO Space, and the leasing of the ROFO shall include any concessions specified in the Landlord ROFO Notice; (ii) rentals and charges shall commence to be payable in respect of the ROFO Space on the first to occur of (A) the 121st day following the date on which the ROFO Space is delivered by Landlord to Tenant and (B) the date upon which Tenant commences business operations in any portion of the ROFO Space; (iii) Tenant shall accept the ROFO Space in “AS-IS” condition (subject to the obligations of Landlord set forth in this Lease to maintain and repair the Premises and the Building Structure and Systems), and Landlord shall have no obligation whatsoever to prepare the same for use by Tenant, or pay or reimburse Tenant for any costs or expenses incurred in connection with the remodeling or alteration thereof, except for any tenant improvement allowance specified in the Landlord ROFO Notice; and (iv) from and after the lease of the ROFO Space commences and continuing for the remainder of the Lease Term, the same shall be and constitute a part of the Premises covered by this Lease. If Tenant has exercised a ROFO in accordance with the terms hereof, Landlord and Tenant shall promptly enter into a commercially reasonable written amendment to this Lease confirming the terms, conditions and provisions applicable to Tenant’s lease of the ROFO Space. The failure of Landlord and Tenant to timely execute such amendment shall not negate the exercise of the ROFO.

(e) The ROFO shall be available only provided, and on condition that: (i) Tenant is not in default under this Lease beyond applicable notice and cure periods, either at the time Landlord would otherwise have given a Landlord ROFO Notice, at the time Tenant gives Tenant’s Exercise Notice or, at Landlord’s option, upon the date the ROFO Space would otherwise be delivered to Tenant; and (ii) the Tenant under this Lease shall be and have been at all times during the Lease Term either (A) the entity originally named as the Tenant in this Lease or (B) a Permitted Assignee; and (iii) Tenant and its Permitted Transferees are physically and personally occupying not less than fifty percent (50%) of the

9

rentable area of the Premises (and no portion of the Premises occupied by any subtenant other than a Permitted Transferee shall be considered to be so occupied by Tenant).

ARTICLE III

TERM

3.1 All of the provisions of this Lease shall be in full force and effect from and after the date this Lease is mutually executed by and delivered to Landlord and Tenant. The Lease Term shall commence on the Rent Commencement Date and expire at 11:59 P.M. on the Expiration Date set forth in Section 1.5, subject to the provisions of Sections 3.3 and 3.4 below. The entry by Tenant and its employees, consultants and contractors onto the Premises prior to commencement of the Lease Term shall be upon and subject to all of the terms and conditions set forth in the Lease other than payment of rents and charges that, under the terms of this Lease, are payable only upon or following the Rent Commencement Date.

3.2 [Intentionally omitted.]

3.3 Tenant shall have a one-time right to terminate this Lease (the “Early Termination Right”), effective upon and as of May 31, 2021 (the “Early Termination Date”), upon and subject to the following terms and conditions:

(a) Tenant shall exercise the Early Termination Right by written notice (the “Early Termination Notice”) delivered to Landlord not later than May 31, 2020 and by paying to Landlord, not later than June 30, 2020, the sum of $3,950,680.80 or, if the Premises is other than 86,790 rentable square feet as the result of the addition of the Suite 310 Premises or any ROFO Space or otherwise, a sum equal to $45.52 times the rentable square footage of the Premises (the “Termination Payment”). Tenant’s exercise of the Early Termination Right shall be effective only provided, and on condition that, such Termination Payment is made by such date.

(b) In the event that Tenant exercises the Early Termination Right as set forth herein, the Lease Term of this Lease shall end and terminate as of the Early Termination Date, in the same manner as if the same were the Expiration Date originally set forth herein.

(c) The Early Termination Right shall be available only provided, and on condition that: (i) Tenant is not in default with respect to the payment of Base Rent, additional rent or other sum due and owing under this Lease beyond applicable notice and cure periods, either at the time Tenant gives the Early Termination Notice or, at Landlord’s option, upon the Early Termination Date; and (ii) the Tenant under this Lease shall be either (A) the entity originally named as the Tenant in this Lease or (B) a Permitted Assignee. Subject to the due and timely exercise of the Early Termination Right, and subject to satisfaction of the above conditions, acceptance of the Termination Payment by Landlord shall constitute the parties’ irrevocable modification of the Expiration Date with respect to the Premises.

3.4 Tenant shall have two (2) options to extend the Lease Term of this Lease (each, an “Extension Option”), each for a period of five (5) years (each, an “Extension Term”), upon and subject to the following terms and conditions:

(a) Tenant shall exercise an Extension Option by written notice (the “Extension Notice”) delivered to Landlord not earlier than sixteen (16) months nor later than twelve (12) months prior to (i) the Expiration Date (in the case of the first Extension Option), or (ii) the end of the first Extension Term (in the case of the second Extension Option). If an Extension Option is not so exercised, all Extension Options shall thereupon expire and terminate.

(b) The Base Rent payable during any Extension Period shall be equal to the then “Prevailing Market Terms,” which shall mean the base rent (including any base rent escalations) at which tenants are leasing non-subleased, non-encumbered, non-equity space, for a comparable lease term and otherwise upon the terms applicable to the lease of the Premises under this Lease, in arm’s length transactions in the Pasadena Central Business District that involved tenants comparable to Tenant in terms of size, credit quality and stature and are in buildings comparable to the Building, as follows (the “Comparable Buildings”): 2 N. Lake Avenue, 35 N. Lake Avenue; 155 N. Lake Avenue; 300 N. Lake Avenue; 301 N. Lake Avenue; 225 S. Lake Avenue; 251 S. Lake Avenue and 888 E. Walnut Street. The determination of Prevailing Market Terms shall include establishing a new base year for increases in Operating Expenses and Real Estate Taxes and determining whether there will be any “cap” on Operating Expenses during the Extension Term. The determination of Prevailing Market Terms shall be made by reference to market transactions occurring or entered into during the nine (9) months prior to Tenant’s delivery of the Extension Notice and shall determine a base rent net of leasehold improvement allowances, leasing commissions, free rent and other concessions such as abated parking charges, moving allowances, and similar credits (and no such allowances, commissions, free rent or other concessions shall be available to Tenant or payable by Landlord under this Lease in respect of the Extension Option), taking

10

into account the annual three percent (3%) increases in Base Rent required pursuant to subsection (d) of this Section. Landlord shall give Tenant written notice of the Prevailing Market Terms, including yearly escalations, within thirty (30) days after Landlord’s receipt of the Extension Notice. If Tenant disagrees with Landlord’s determination of the Prevailing Market Terms, Tenant shall notify Landlord of such disagreement within twenty (20) days after receipt of Landlord’s determination of the Prevailing Market Terms, which notice shall set forth Tenant’s determination of the Prevailing Market Terms. If Tenant fails to so notify Landlord of Tenant’s disagreement and Tenant’s determination of Prevailing Market Terms within said 20-day time period, Landlord’s determination of the Prevailing Market Terms shall be binding on Tenant. If Tenant notifies Landlord within said 20-day time period that Landlord’s determination of the Prevailing Market Terms is not acceptable to Tenant together with Tenant’s determination of Prevailing Market Terms, Landlord and Tenant shall, during the thirty (30) day period after Tenant’s notice, attempt to agree on the Prevailing Market Terms. If Landlord and Tenant are unable to agree during said 30-day time period, Tenant, at Tenant’s option exercised by written notice to Landlord not later than three (3) Business Days following the end of said 30-day period, shall either: (A) accept Landlord’s determination of the Prevailing Market Terms or (B) submit both parties’ determination of Prevailing Market Terms to binding appraisal as provided below. If Tenant fails to so notify Landlord of Tenant’s election under the preceding sentence within such 3-Business Day period, Tenant shall be deemed to have elected to submit the determination of Prevailing Market Terms to binding appraisal.

(c) In the event Tenant elects (or is deemed to have elected) to submit the determination of the Prevailing Market Terms to binding appraisal, Landlord and Tenant shall each, within ten (10) days after such election, by written notice to the other, appoint an independent and qualified M.A.I. appraiser with not less than ten (10) years’ experience with office leases in the area in which the Building is located. Each of such appraisers shall, within twenty (20) days after appointment, give written notice to both parties of the appraiser’s determination of Prevailing Market Terms. During the ten-day period after the appraisers’ determinations, Landlord and Tenant shall meet and confer and attempt to agree upon the Prevailing Market Terms. If they are unable to agree, the two appraisers shall appoint an independent M.A.I. appraiser with not less than ten (10) years experience with office leases in the area in which the Building is located or, if the appraisers cannot agree on an independent appraiser, either may apply to the Court of general jurisdiction of the County in which the Building is located for the designation of an appraiser meeting the foregoing qualifications. Within thirty (30) days after appointment, the third appraiser shall advise the parties in writing of his or her determination of Prevailing Market Terms, which determination shall be not less than the amount indicated by Tenant’s appointed appraiser nor more than the amount indicated by the Landlord’s appointed appraiser, and which determination of Base Rent shall be binding upon the parties. Each party shall pay the fees and expenses of the appraiser appointed by it and one-half of the fees and expenses of the third appraiser, if any.

(d) Any and each Extension Period shall be on the same terms and conditions set forth herein, except that: (i) Tenant shall accept the Premises in its “AS-IS” condition (subject to any obligations by Landlord to maintain or repair the Premises as set forth in the Lease) and Landlord shall have no obligation to remodel the same or provide any allowance or other reimbursement for any remodeling by Tenant; (ii) Tenant may exercise the Extension Option only with respect to either (A) all of the Premises, or (B) all of the Fourth Floor Premises, the Fifth Floor Premises and any other premises then covered by this Lease and located on the fifth floor of the Building; (iii) Tenant shall not have any right to terminate this Lease during the Extension Period; (iv) Base Rent shall be adjusted annually at a rate of three percent (3%); and (v) each Extension Option, once exercised, cannot be exercised again. In connection with the exercise of an Extension Option, Landlord and Tenant shall enter into a written amendment to this Lease on commercially reasonable terms confirming the terms, conditions and provisions applicable to the Extension Period, as determined in accordance herewith. Neither Tenant’s nor Landlord’s failure to execute such amendment shall negate or otherwise affect the exercise of the Extension Option.

(e) Each Extension Option shall be available only provided, and on condition that, at the time Tenant gives the Extension Notice: (i) Tenant is not in default under this Lease beyond applicable notice and cure periods; and (ii) the Tenant under this Lease shall be either (A) the entity originally named as the Tenant in this Lease or (B) a Permitted Assignee; and (iii) Tenant and its Permitted Transferees are physically and personally occupying not less than fifty percent (50%) of the rentable area of the Premises (and no portion of the Premises occupied by any subtenant other than a Permitted Transferee shall be considered to be so occupied by Tenant).

ARTICLE IV

BASE RENT

4.1 (a) From and after the Rent Commencement Date, Tenant shall pay the Base Rent in equal monthly installments in advance on the first day of each month during the Lease Term, subject to the provisions of Section 4.1(b) below.

11

(b) Notwithstanding the foregoing, Tenant shall not be required to pay Base Rent to Landlord in respect of the Initial Premises (as defined in Section 2.3(b) above) for the following months of the Lease Term: (i) months two (2) through six (6), inclusive; (ii) months thirteen (13) through seventeen (17), inclusive; and (iii) months ninety-five (95) through ninety-eight (98), inclusive (for an aggregate of fourteen (14) months). The abatement of Base Rent attributable to portions of the Premises other than the Initial Premises shall be as follows: (A) if the Suite 310 Premises shall have been added to the Premises by reason of exercise of the Suite 310 Expansion Option, in accordance with the abatement applicable pursuant to Section 2.2(c)(v)(B); and (B) if any ROFO Space shall have been added to the Premises by reason of exercise of the any ROFO, in accordance with the abatement, if any, applicable pursuant to Section 2.5(b)(iv).

(c) In the event that Tenant commences to conduct business operations in any portion of the Premises after June 1, 2013 (Tenant acknowledging that it is not permitted to commence such operation prior to such date) and prior to the Rent Commencement Date, Tenant shall pay to Landlord, during the period that Tenant is so operating (the “Early Operating Period”) and in lieu of any Base Rent, an amount equal to $0.84 per month per rentable square foot of the portion of the Premises in which such operations are conducted (the “Early Operating Period Rent”), with the Early Operating Period Rent to be prorated for any partial month of such early operation.

4.2 Concurrently with Tenant’s execution of this Lease, Tenant shall pay an amount equal to one (1) monthly installment of the Base Rent payable for the first month of the Lease Term in the amount of $208,296.00 (the “First Month’s Rent”), which amount shall be credited toward the monthly installment of Base Rent payable for the first full calendar month of the Lease Term. If the Rent Commencement Date is not the first day of a month, then the Base Rent from the Rent Commencement Date until the first day of the following month shall be prorated on a per diem basis at the rate of one-thirtieth (1/30th) of the monthly installment of the Base Rent payable for the first month of the Lease Term, and Tenant shall pay such prorated installment of the Base Rent on the Rent Commencement Date.

4.3 All sums payable by Tenant under this Lease shall be paid to Landlord in legal tender of the United States, without setoff, deduction or demand, at the Landlord Payment Address, or to such other party or such other address as Landlord may designate in writing. Without limiting the generality of the foregoing, Tenant acknowledges and agrees that, following a notice to Tenant of any default, any payment in partial or full payment of any outstanding amount under this Lease shall only be made personally to the address specified in such notice of default, or in such other manner as such notice may direct. Landlord’s acceptance of rent after it shall have become due and payable shall not excuse a delay upon any subsequent occasion or constitute a waiver of any of Landlord’s rights hereunder. If any sum payable by Tenant under this Lease is paid by check which is returned due to insufficient funds, stop payment order, or otherwise, then: (a) such event shall be treated as a failure to pay such sum when due; and (b) in addition to all other rights and remedies of Landlord hereunder, Landlord shall be entitled (i) to impose a returned check charge of Fifty Dollars ($50.00) to cover Landlord’s administrative expenses and overhead for processing, and (ii) to require that all future payments be remitted by wire transfer, money order, or cashier’s or certified check.

4.4 Landlord and Tenant agree that no rental or other payment for the use or occupancy of the Premises is or shall be based in whole or in part on the net income or profits derived by any person or entity from the Building or the Premises. Tenant will not enter into any sublease, license, concession or other agreement for any use or occupancy of the Premises which provides for a rental or other payment for such use or occupancy based in whole or in part on the net income or profits derived by any person or entity from the Premises so leased, used or occupied. Nothing in the foregoing sentence, however, shall be construed as permitting or constituting Landlord’s approval of any sublease, license, concession, or other use or occupancy agreement not otherwise approved by Landlord in accordance with the provisions of Article VII.

ARTICLE V

OPERATING CHARGES AND REAL ESTATE TAXES

5.1 For purposes of this Article V, the term “Building” shall be deemed to include the Land, the roof of the Building and any physical extensions therefrom, any driveways, sidewalks, landscaping, alleys and parking facilities in the Building or on the Land, and all other areas, facilities, improvements and appurtenances relating to any of the foregoing. If the Building is operated as part of a complex of buildings or in conjunction with other buildings or parcels of land, Landlord shall prorate the common expenses and costs with respect to each such building or parcel of land in its sole but reasonable judgment.

5.2 (a) From and after August 1, 2014, Tenant shall pay as additional rent Tenant’s Proportionate Share of the amount, if any, by which Operating Charges for each calendar year falling entirely or partly within the Lease Term exceed the Operating Charges Base Amount. Tenant’s Proportionate Share with respect to Operating Charges set forth in Article I has been calculated to be that

12

percentage which is equal to a fraction, the numerator of which is the number of square feet of rentable area in the Premises as set forth in Section 1.14, and the denominator of which is the number of square feet of Total Area in the Building as set forth in Section 1.3 herein.

(b) If the average occupancy rate for the Building during any calendar year (including the Operating Charges Base Year) is less than ninety-five percent (95%), or if any tenant is separately paying for (or does not require) electricity, janitorial or other utilities or services furnished to its premises, then Landlord shall include in Operating Charges for such year (including the Operating Charges Base Year) all additional expenses, as commercially reasonably estimated by Landlord on a basis consistent with any such estimates included for prior years, which would have been incurred during such year if such average occupancy rate had been ninety-five percent (95%) and if Landlord paid for such utilities or services furnished to such premises.

(c) Tenant shall make estimated monthly payments to Landlord on account of the amount by which Operating Charges that are expected to be incurred during each calendar year (or portion thereof) would exceed the Operating Charges Base Amount, subject to Section 5.2(d) below. No later than July 1, 2014, and thereafter annually at the beginning of each calendar year, Landlord shall submit a reasonably detailed written statement setting forth Landlord’s reasonable estimate of such excess and Tenant’s Proportionate Share thereof. Tenant shall pay to Landlord on the first day of each month following receipt of such statement, until Tenant’s receipt of the succeeding annual statement, an amount equal to one-twelfth (1/12) of each such share (estimated on an annual basis without proration pursuant to Section 5.4). Not more than twice during any calendar year, Landlord may revise Landlord’s estimate and adjust Tenant’s monthly payments to reflect Landlord’s revised estimate. Within one hundred twenty (120) days after the end of each calendar year, or as soon thereafter as is feasible, Landlord shall submit to Tenant a written Reconciliation Statement for Operating Charges. If such Reconciliation Statement indicates that the aggregate amount of such estimated payments exceeds Tenant’s actual liability, then Landlord shall credit the net overpayment toward Tenant’s next installment(s) of rent due under this Lease, or, if the Lease Term has expired or will expire before such credit can be fully applied, or if Tenant is not otherwise liable to Landlord for further payment, Landlord shall reimburse Tenant for the amount of such overpayment within thirty (30) days. If such Reconciliation Statement indicates that Tenant’s actual liability exceeds the aggregate amount of such estimated payments, then Tenant shall pay the amount of such excess as additional rent within thirty (30) days of delivery of such Reconciliation Statement.

(d) Notwithstanding anything to the contrary contained in the Lease, for purposes of calculating Tenant’s Proportionate Share of Operating Charges, the amount of the Controllable Operating Charges (as defined below) shall not be increased by more than five percent (5%) per year on a cumulative basis, determined in the manner provided below. Accordingly, for 2014 and each subsequent calendar year of the Term, the amount of the Controllable Operating Charges used for purposes of such calculation shall not be greater than the Controllable Operating Charges for the 2013 calendar year (the “Initial Amount”) multiplied by a number of factors of 1.05 equal to the number of calendar years from 2013 to the year for which Controllable Operating Charges are being determined. For example, the amount of the Controllable Operating Charges used in calculating Tenant’s Proportionate Share of Operating Charges shall not be greater than the following amounts: in 2014, the Initial Amount times 1.05; in 2015, the Initial Amount times 1.05 times 1.05; in 2016, the Initial Amount times 1.05 times 1.05 times 1.05; etc. The term “Controllable Operating Charges” shall mean all Operating Charges except for utilities and insurance paid and incurred by Landlord for the Building and the Land.

5.3 (a) From and after August 1, 2014, Tenant shall pay as additional rent Tenant’s Proportionate Share of the amount by which Real Estate Taxes exceed the Real Estate Taxes Base Amount, subject to the provisions set forth in Section 5.5 herein. Tenant’s Proportionate Share with respect to Real Estate Taxes set forth in Article I has been calculated to be that percentage which is equal to a fraction, the numerator of which is the number of square feet of rentable area in the Premises as set forth in Section 1.14, and the denominator of which is the number of square feet of Total Area in the Building as set forth in Section 1.3 herein. Tenant shall not initiate or participate in any contest of Real Estate Taxes without Landlord’s prior written consent. Landlord represents to Tenant that the Real Estate Taxes Base Amount is not presently affected by a Proposition 8 reduction.

(b) Tenant shall make estimated monthly payments to Landlord on account of the amount by which Real Estate Taxes that are expected to be incurred during each calendar year would exceed the Real Estate Taxes Base Amount. No later than July 1, 2014, and thereafter annually at the beginning of each calendar year, Landlord shall submit a reasonably detailed written statement setting forth Landlord’s commercially reasonable estimate of such amount and Tenant’s Proportionate Share thereof. Tenant shall pay to Landlord on the first day of each month following receipt of such statement, until Tenant’s receipt of the succeeding annual statement, an amount equal to one-twelfth (1/12) of such share (estimated on an annual basis without proration pursuant to Section 5.4). Not more than twice during any calendar year, Landlord may revise Landlord’s estimate and adjust Tenant’s monthly

13

payments to reflect Landlord’s revised estimate. Within one hundred twenty (120) days after the end of each calendar year, or as soon thereafter as is feasible, Landlord shall submit to Tenant a written Reconciliation Statement for Real Estate Taxes showing (1) Tenant’s Proportionate Share of the amount, if any, by which Real Estate Taxes incurred during the preceding calendar year exceeded the Real Estate Taxes Base Amount, and (2) the aggregate amount of Tenant’s estimated payments made during such year. If such Reconciliation Statement indicates that the aggregate amount of such estimated payments exceeds Tenant’s actual liability, then Landlord shall credit the net overpayment toward Tenant’s next installment(s) of rent due under this Lease, or, if the Lease Term hereof has expired or will expire before such credit can be fully applied, of if Tenant is not otherwise liable for further payment, Landlord shall reimburse Tenant for the amount of such overpayment within thirty (30) days. If such Reconciliation Statement indicates that Tenant’s actual liability exceeds the aggregate amount of such estimated payments, then Tenant shall pay the amount of such excess as additional rent within thirty (30) days of delivery of such Reconciliation Statement.

(c) Prior to any reassessment of the Building and Land by reason of a Change of Ownership (as defined below in Section 5.5), the following provisions shall apply only in the event that a Proposition 8 reduction in the taxable value of real property affects Real Estate Taxes during either the Real Estate Taxes Base Year or any subsequent year prior to such a reassessment:

(i) If a Proposition 8 reduction is in effect during the Real Estate Taxes Base Year, then the amount due from Tenant pursuant to this Lease in respect of any subsequent year for increases in Real Estate Taxes shall be determined by reference to the Real Estate Taxes for such subsequent year (as billed by reference to the assessed valuation for such year) whether the assessment for such year continues to reflect any portion of the Proposition 8 reduction or is made in some other manner; provided, however, that the property taxes and assessments component of Real Estate Taxes shall not exceed the Maximum Tax Increase Amount. For purposes of this subsection (c)(i), the term “Maximum Tax Increase Amount” shall mean the cumulative increase in property taxes and assessments (a component of Real Estate Taxes) over the Base Year amount, as determined by application of the Proposition 13 formula pursuant to which the property tax assessments are calculated in reference to a “taxable value of real property” (as provided in California Revenue and Tax Code Section 51) equal to the sum of (a) the Proposition 13 base year value for the Land and Building, plus (b) cumulative increases in property value of no greater than two percent (2%) per annum over the Proposition 13 base year value.

(ii) If no Proposition 8 reduction is in effect during the Real Estate Taxes Base Year, but a Proposition 8 reduction is subsequently obtained by Landlord, then the Real Estate Taxes shall be calculated by taking into account such Proposition 8 reduction; provided, however, that in calculating the amount of Real Estate Taxes, Landlord shall be permitted to include costs and expenses incurred by Landlord in securing and maintaining such Proposition 8 reduction.

In no event shall any reduction of the Real Estate Taxes for any year below the amount of the Real Estate Taxes Base Amount, whether by reason of a Proposition 8 reduction or otherwise, result in any reduction in the Base Rent or any credit or payment being due Tenant with respect to Base Rent or other amount due from Tenant to Landlord under this Lease.

(d) Notwithstanding the foregoing provisions of this Section, Landlord may elect, at its option, to allocate any gross receipts or other direct or indirect levy or assessment on rents or income from the Property by reference to the amount thereof attributable to payments made by Tenant under this Lease, and, if Landlord has so elected, Real Estate Taxes shall not include the gross receipts or other taxes allocated in such manner.

5.4 If the Lease Term commences or expires on a day other than the first day or the last day of a calendar year, respectively, then Tenant’s liabilities pursuant to this Article for such calendar year shall be apportioned by multiplying the respective amount of Tenant’s Proportionate Share thereof for the full calendar year by a fraction, the numerator of which is the number of days during such calendar year falling within the Lease Term, and the denominator of which is three hundred sixty-five (365).

5.5 With regard to a transaction constituting a “change in ownership” of the Building and Land under the terms of Proposition 13 (as adopted by the voters of the State of California in the June 1978 election) and related laws and regulations (a “Change in Ownership”), the terms set forth in this Section shall apply to any increase in Real Estate Taxes resulting from the reassessment (the “Reassessment Subject to Limitation”) made by reason of the any and each Change in Ownership occurring during the period of five (5) years beginning on the Rent Commencement Date (the “Exclusion Period”).

(a) For purposes of this Section, the term “Excluded Prop 13 Increase” shall mean that portion of the Real Estate Taxes during the Exclusion Period, as calculated immediately following the Reassessment Subject to Limitation, which is attributable solely to the Reassessment Subject to Limitation. Accordingly, the Excluded Prop 13 Increase shall not extend to or include any portion of the Real Estate Taxes, as calculated immediately following the Reassessment Subject to Limitation, that is:

14

(i) attributable to the assessed valuation of the Premises prior to the Reassessment Subject to Limitation; or (ii) attributable to the annual inflationary increase in real property assessed valuation (which inflationary increase is, as of the date hereof, 2% per year).

(b) Subject to the provisions of subsection (c) of this Section, the amount payable by Tenant under this Lease in respect of Real Estate Taxes during the Exclusion Period shall not include any portion of the Excluded Prop 13 Increase.

(c) Upon notice to Tenant, Landlord shall have the right to eliminate the effect of the foregoing provisions of this Section relating to the Excluded Prop 13 Increase attributable to a Reassessment Subject to Limitation by payment to Tenant of an amount (the “Tax Exclusion Recapture Payment”) equal to the amount of the Excluded Prop 13 Increase attributable to each full or partial month remaining in the Exclusion Period as of the date of such payment to Tenant, discounted to present value at a rate of six percent (6%) per annum. For purposes of calculating the amount of the Tax Exclusion Recapture Payment, it shall be assumed that the tax rate and rate of annual inflationary increases in assessed valuation (which inflationary increase is, as of the date hereof, 2% per year), as in effect upon the date of the payment, will continue for the remainder of the Exclusion Period.

ARTICLE VI

USE OF PREMISES