Attached files

| file | filename |

|---|---|

| 8-K - AMERICAN CAMPUS COMMUNITIES, INC. 8-K - AMERICAN CAMPUS COMMUNITIES INC | a50352268.htm |

| EX-99.1 - EXHIBIT 99.1 - AMERICAN CAMPUS COMMUNITIES INC | a50352268ex99-1.htm |

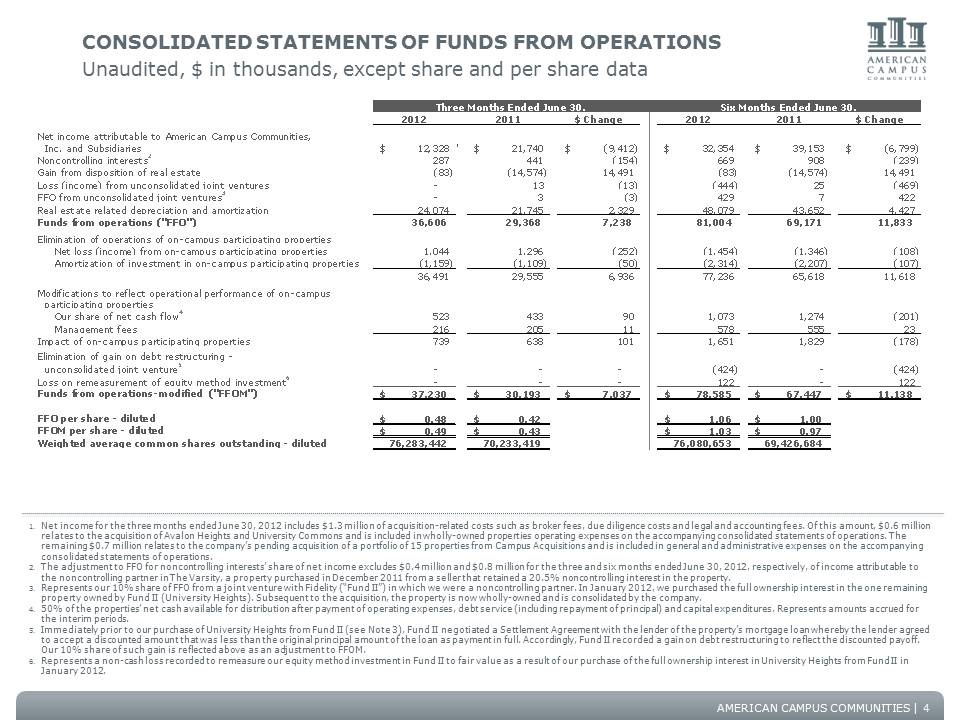

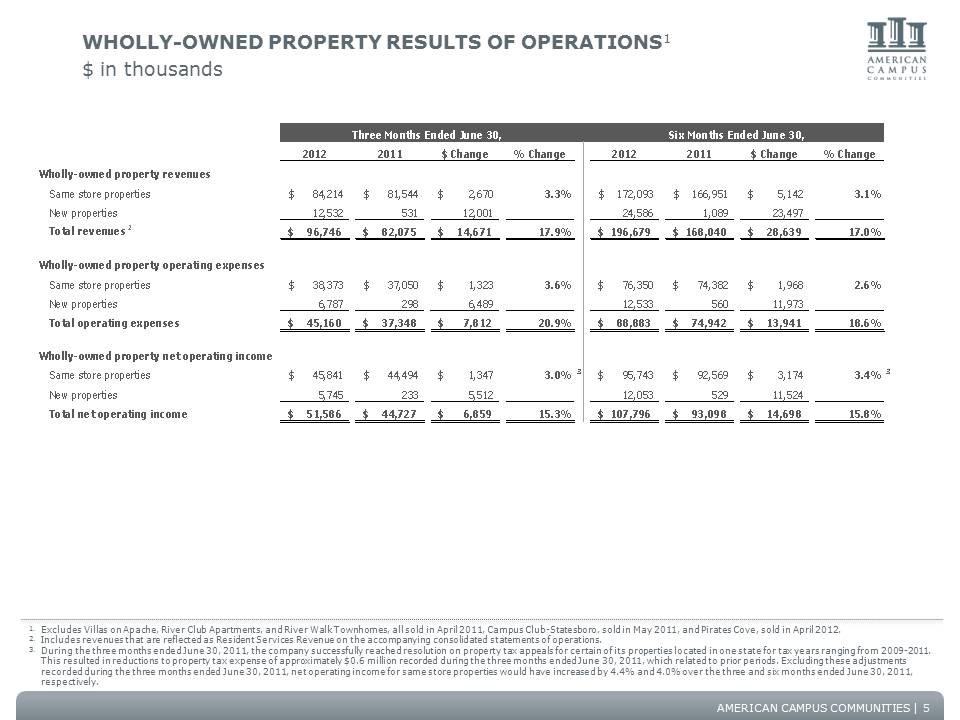

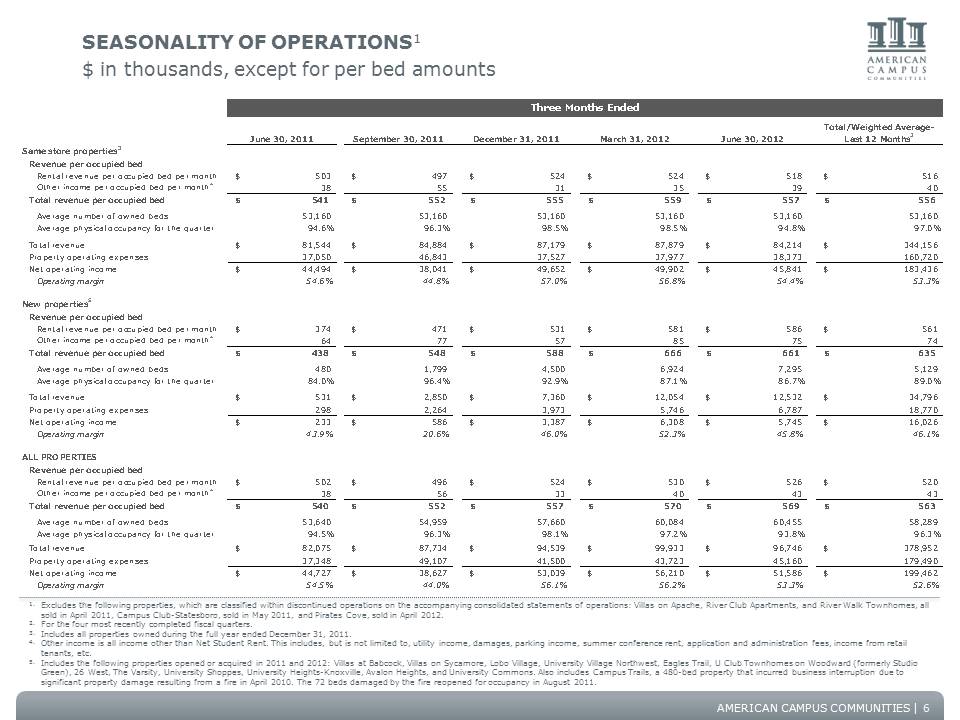

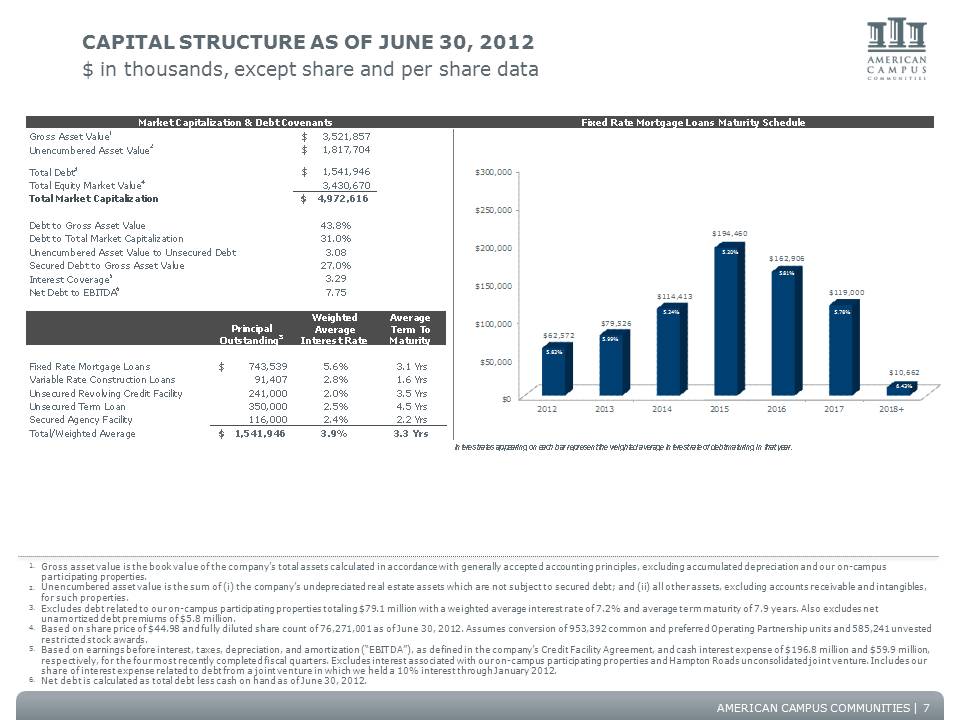

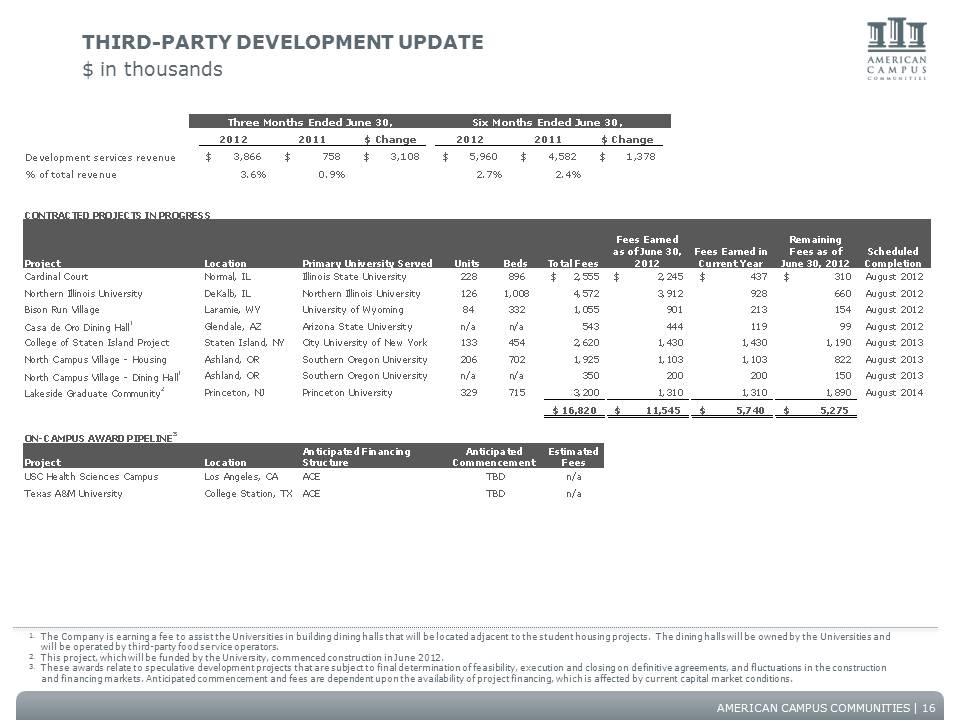

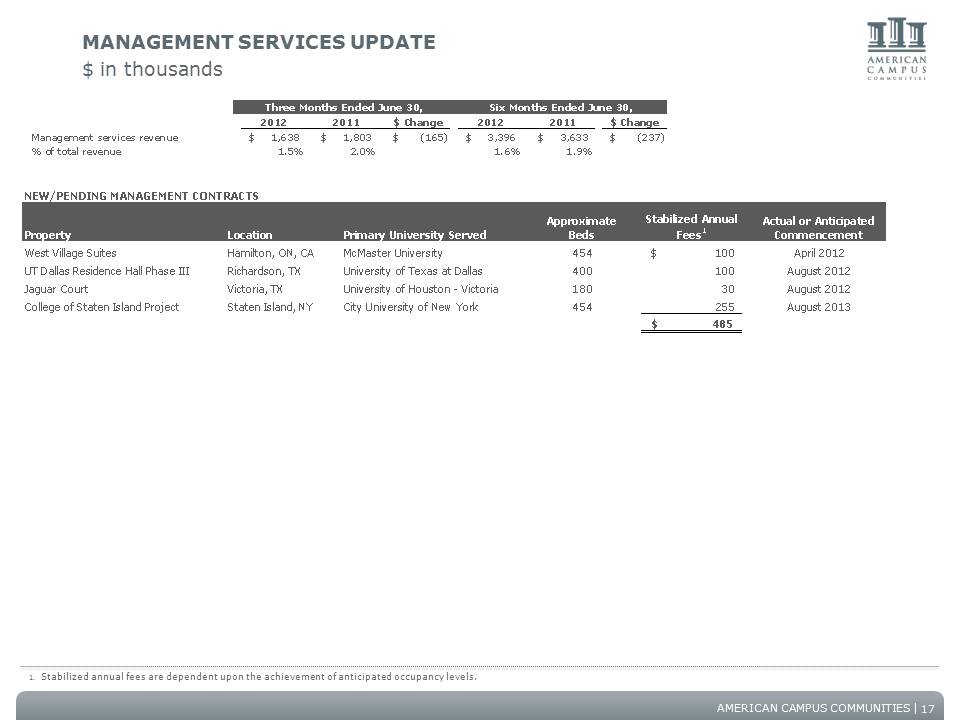

Exhibit 99.2

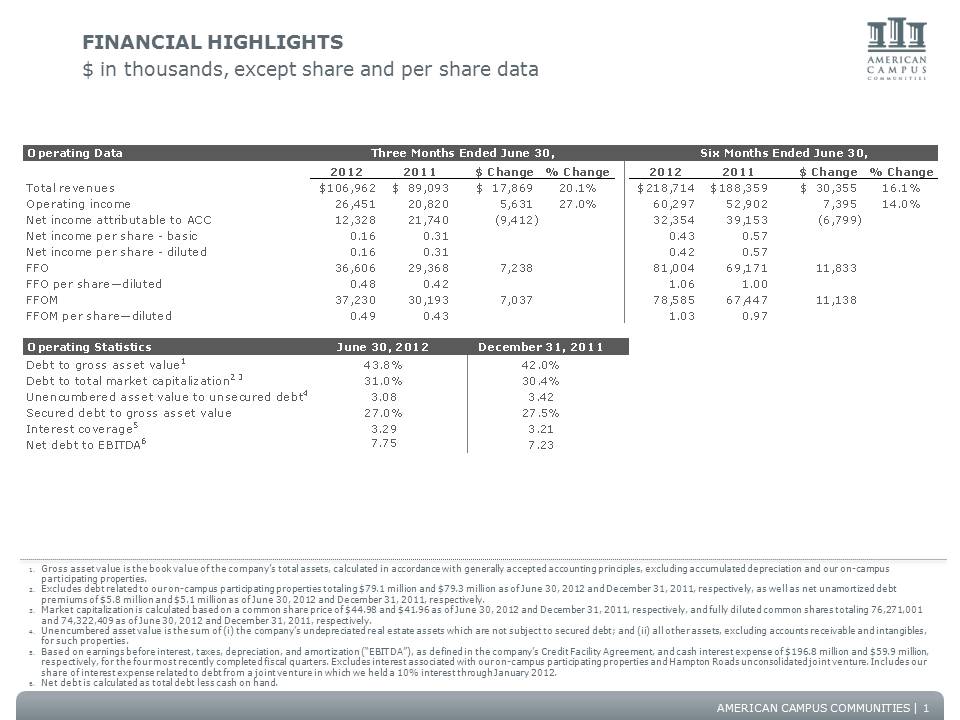

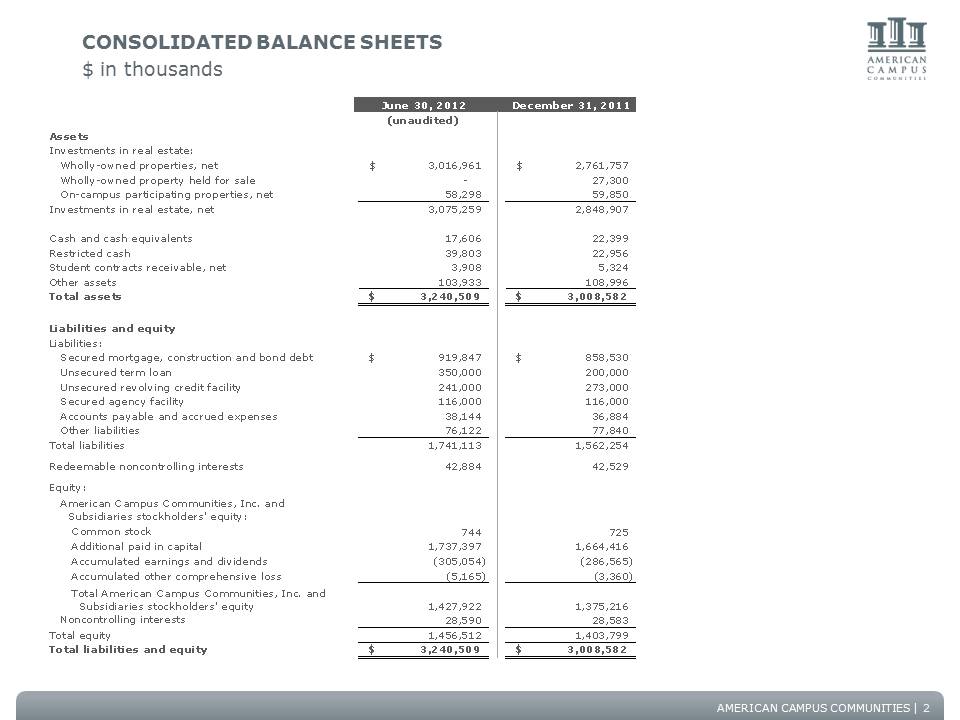

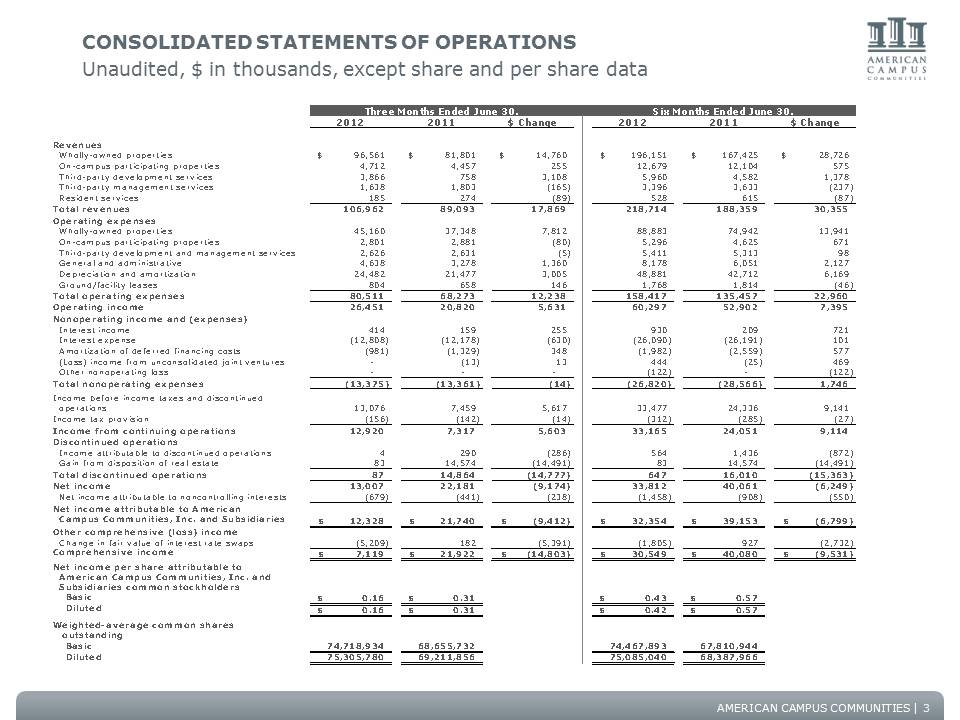

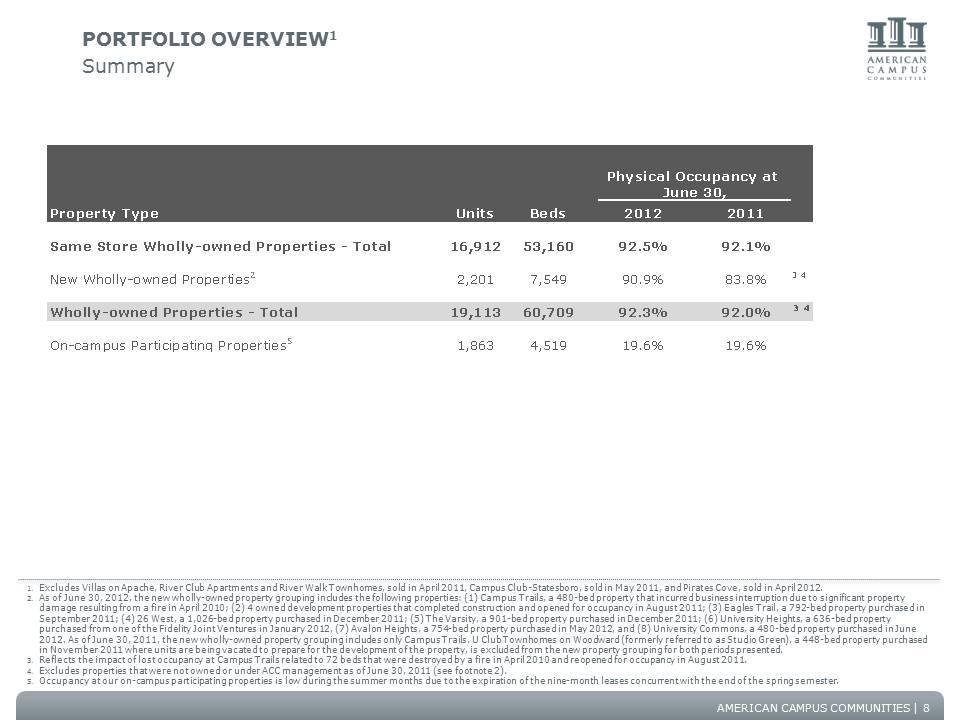

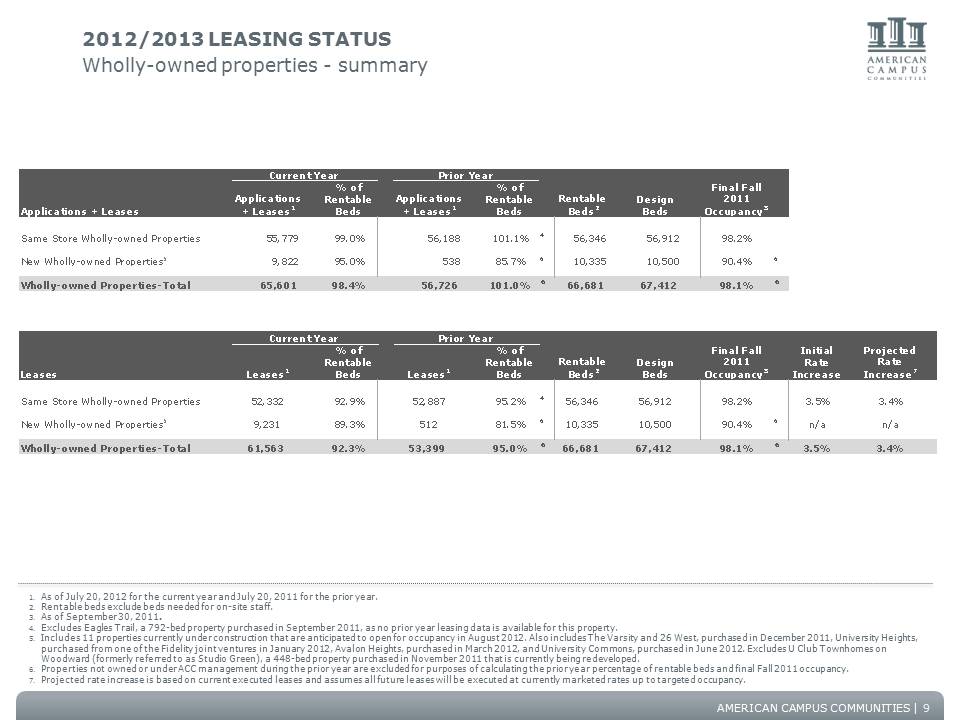

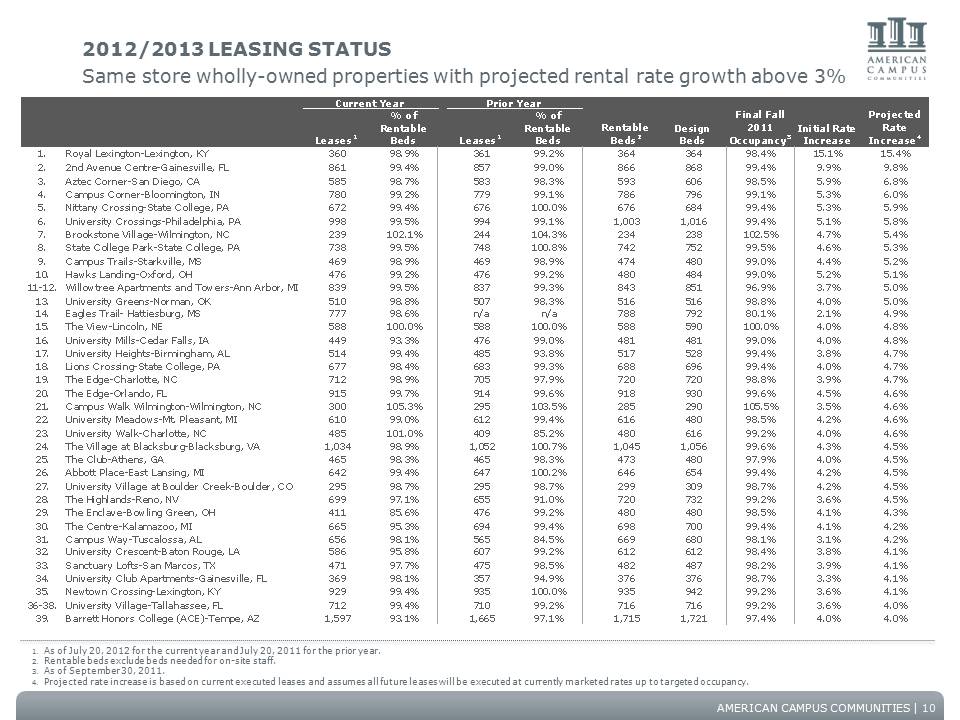

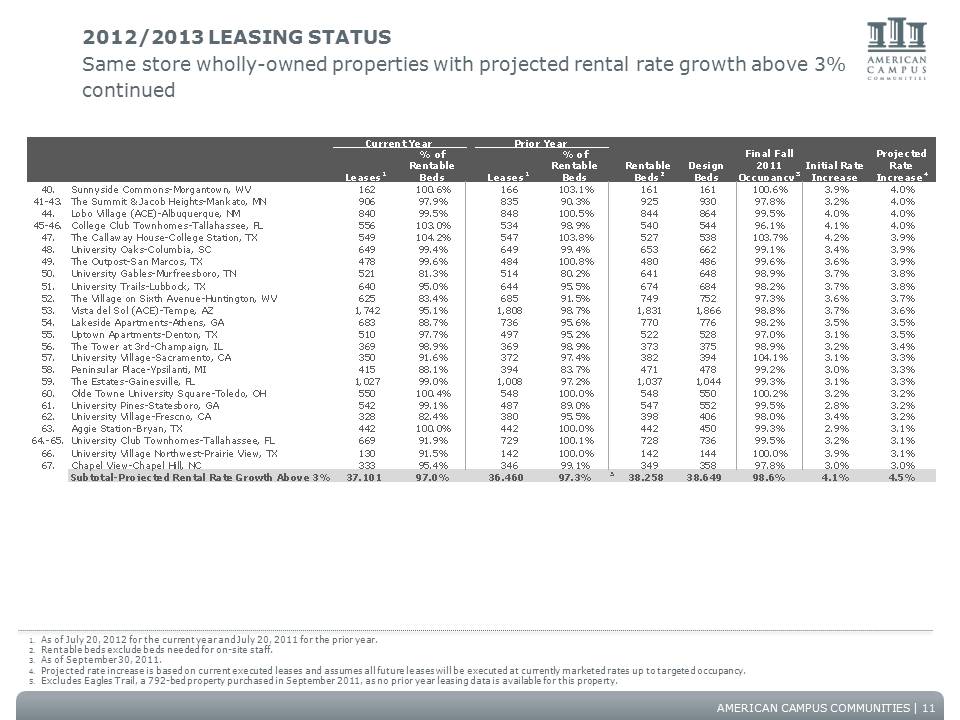

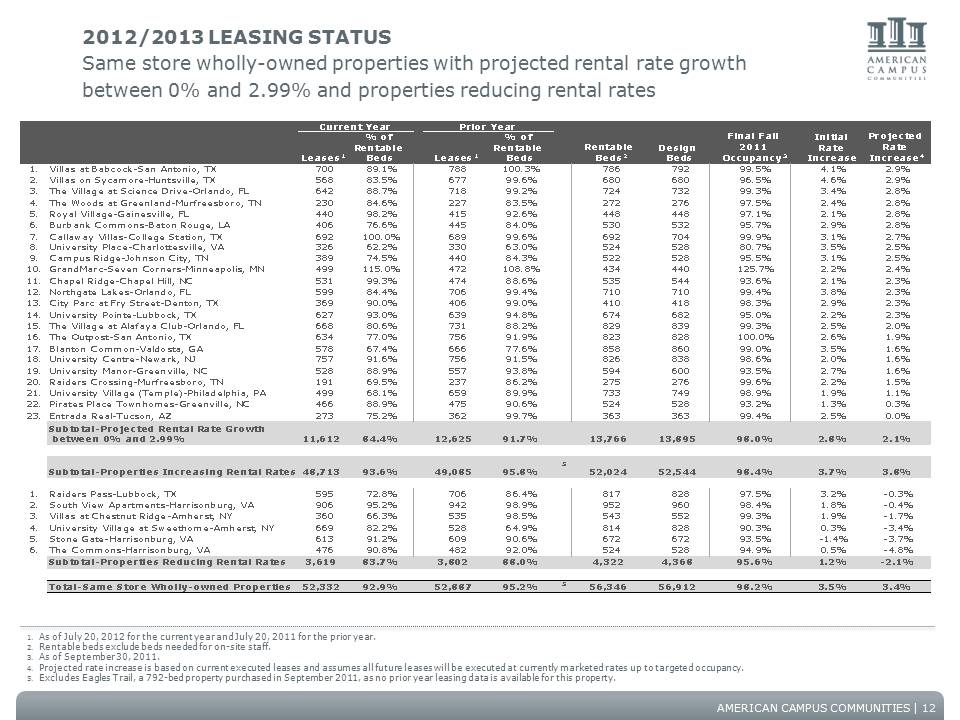

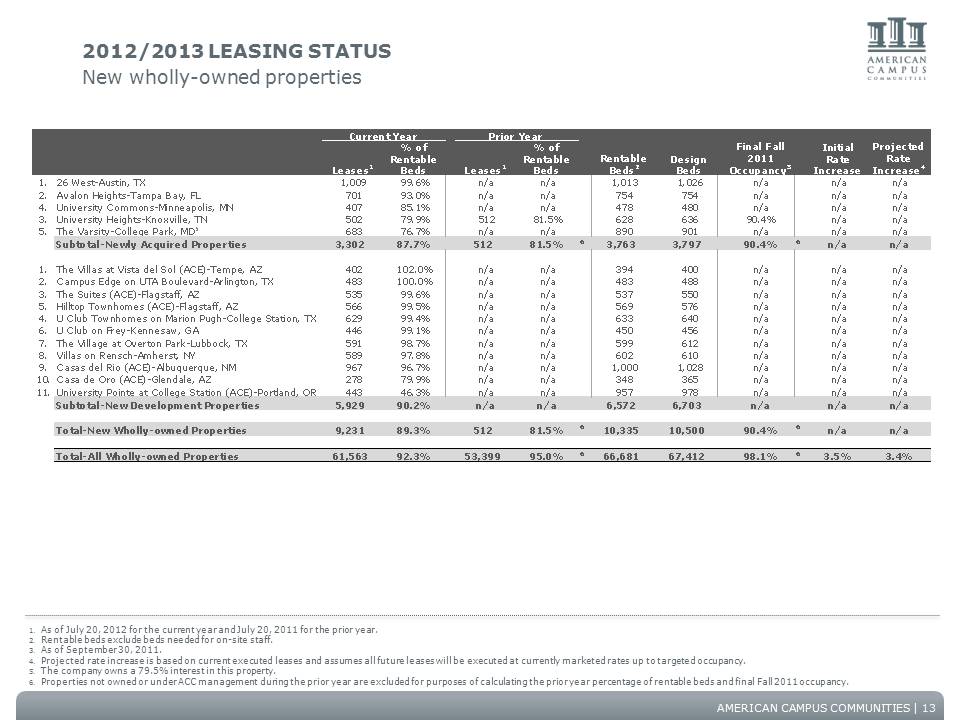

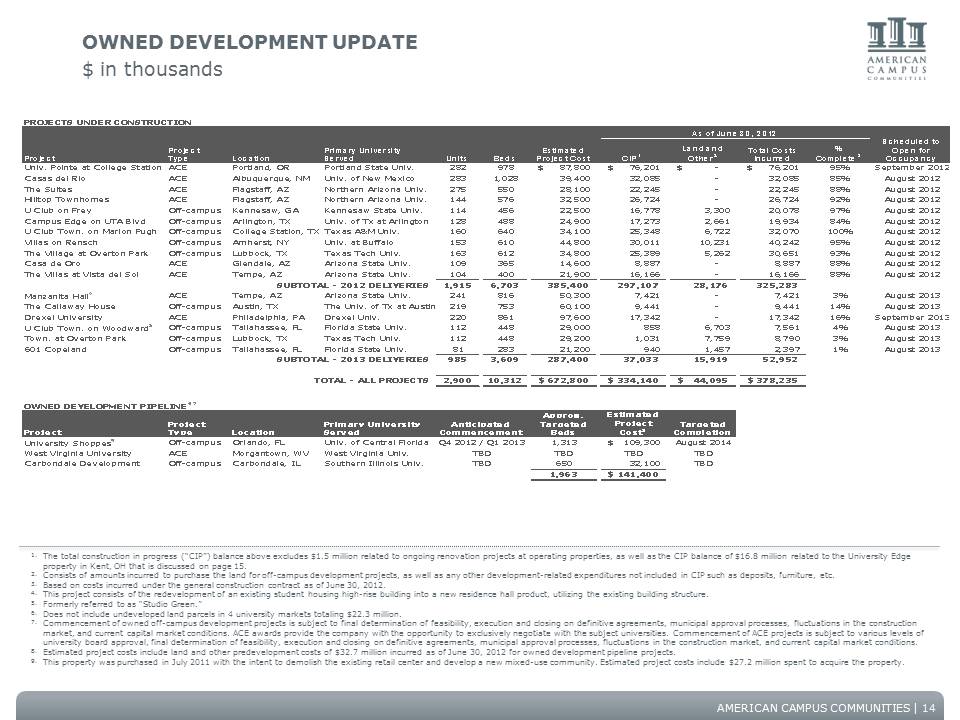

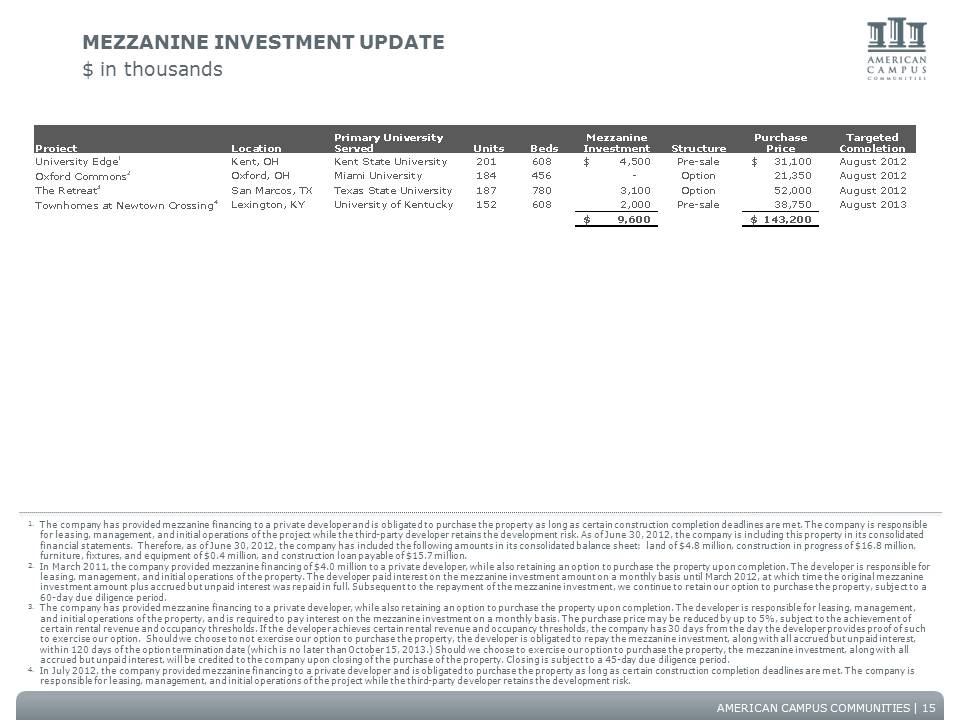

AMERICAN CAMPUS COMMUNITIES BRINGING Supplemental Analyst Package 2Q-2012 July 24, 2012 QUALITY TOGETHER AMERICAN CAMPUS COMMUNITIES TABLE OF CONTENTS Financial Highlights 1Consolidated Balance Sheets 2Consolidated Statements of Operations 3Consolidated Statements of Funds from Operations 4Wholly-owned Property Results of Operations 5Seasonality of Operations 6Capital Structure 7Portfolio Overview 82012/ 2013 Leasing Status - Summary 92012/ 2013 Leasing Status - By Property 10Owned Development Update 14Mezzanine Investment Update 15Third-party Development Update 16Management Services Update 17Investor Information AMERICAN CAMPUS COMMUNITIES FINANCIAL HIGHLIGHTS $ in thousands, except share and per share data 1.Gross asset value is the book value of the company’s total assets, calculated in accordance with generally accepted accounting principles, excluding accumulated depreciation and our on-campus participating properties. 2.Excludes debt related to our on-campus participating properties totaling $79.1 million and $79.3 million as of June 30, 2012 and December 31, 2011, respectively, as well as net unamortized debt premiums of $5.8 million and $5.1 million as of June 30, 2012 and December 31, 2011, respectively. 3.Market capitalization is calculated based on a common share price of $44.98 and $41.96 as of June 30, 2012 and December 31, 2011, respectively, and fully diluted common shares totaling 76,271,001 and 74,322,409 as of June 30, 2012 and December 31, 2011, respectively. 4.Unencumbered asset value is the sum of (i) the company’s undepreciated real estate assets which are not subject to secured debt; and (ii) all other assets, excluding accounts receivable and intangibles, for such properties. 5.Based on earnings before interest, taxes, depreciation, and amortization (“EBITDA”), as defined in the company’s Credit Facility Agreement, and cash interest expense of $196.8 million and $59.9 million, respectively, for the four most recently completed fiscal quarters. Excludes interest associated with our on-campus participating properties and Hampton Roads unconsolidated joint venture. Includes our share of interest expense related to debt from a joint venture in which we held a 10% interest through January 2012. 6.Net debt is calculated as total debt less cash on hand. 1 Operating Data20122011$ Change% Change20122011$ Change% ChangeTotal revenues106,962$ 89,093$ 17,869$ 20.1%218,714$ 188,359$ 30,355$ 16.1% Operating income26,451 20,820 5,631 27.0%60,297 52,902 7,395 14.0% Net income attributable to ACC12,328 21,740 (9,412) 32,354 39,153 (6,799) Net income per share - basic0.16 0.31 0.43 0.57 Net income per share - diluted0.16 0.31 0.42 0.57 FFO 36,606 29,368 7,238 81,004 69,171 11,833 FFO per share—diluted 0.48 0.42 1.06 1.00 FFOM 37,230 30,193 7,037 78,585 67,447 11,138 FFOM per share—diluted 0.49 0.43 1.03 0.97 Operating StatisticsDebt to gross asset value1Debt to total market capitalization2 3Unencumbered asset value to unsecured debt4Secured debt to gross asset valueInterest coverage5Net debt to EBITDA67.23Six Months Ended June 30, June 30, 201231.0% 3.29December 31, 201130.4% 3.21Three Months Ended June 30,42.0%43.8% 7.753.0827.0% 3.4227.5% AMERICAN CAMPUS COMMUNITIES CONSOLIDATED BALANCE SHEETS $ in thousands June 30, 2012December 31, 2011(unaudited) AssetsInvestments in real estate: Wholly-owned properties, net3,016,961$ 2,761,757$ Wholly-owned property held for sale- 27,300On-campus participating properties, net58,29859,850Investments in real estate, net3,075,2592,848,907Cash and cash equivalents17,60622,399Restricted cash 39,80322,956Student contracts receivable, net3,9085,324Other assets103,933108,996Total assets3,240,509$ 3,008,582$ Liabilities and equityLiabilities: Secured mortgage, construction and bond debt919,847$ 858,530$ Unsecured term loan350,000 200,000 Unsecured revolving credit facility241,000 273,000 Secured agency facility116,000 116,000 Accounts payable and accrued expenses38,14436,884Other liabilities76,12277,840Total liabilities1,741,1131,562,254Redeemable noncontrolling interests42,88442,529Equity: American Campus Communities, Inc. and Subsidiaries stockholders' equity: Common stock744725Additional paid in capital1,737,3971,664,416Accumulated earnings and dividends(305,054)(286,565) Accumulated other comprehensive loss(5,165)(3,360) 1,427,9221,375,216Noncontrolling interests28,59028,583Total equity1,456,5121,403,799Total liabilities and equity3,240,509$ 3,008,582$ Total American Campus Communities, Inc. and Subsidiaries stockholders' equity 2 AMERICAN CAMPUS COMMUNITIES CONSOLIDATED STATEMENTS OF OPERATIONS Unaudited, $ in thousands, except share and per share data 3 On-campus participating properties4,7124,457255 12,67912,104575 Third-party development services3,8667583,108 5,9604,5821,378 Third-party management services1,6381,803(165) 3,3963,633(Resident services185274(89) 528615(Total revenues106,96289,09317,869218,714188,35930,355Operating expenses Wholly-owned properties45,16037,3487,812 88,88374,94213,941 On-campus participating properties2,8012,881(80) 5,2964,625671 Third-party development and management services2,6262,631(5) 5,4115,31398 General and administrative4,6383,2781,360 8,1786,0512,127 Depreciation and amortization24,48221,4773,005 48,88142,7126,169 Ground/facility leases804658146 1,7681,814(Total operating expenses80,51168,27312,238158,417135,45722,960Operating income 26,45120,8205,63160,29752,9027,395Nonoperating income and (expenses) Interest income414159255 930209721 Interest expense(12,808)(12,178)(630) (26,090)(26,191)Amortization of deferred financing costs(981)(1,329)348 (1,982)(2,559)(Loss) income from unconsolidated joint ventures- (13)13 444(25)Other nonoperating loss- - - (122)- Total nonoperating expenses(13,375)(13,361)(14)(26,820)(28,566)before income taxes and discontinued operations13,0767,4595,61733,47724,3369,141Income tax provision(156) (142) (14) (312) (285) Income from continuing operations12,9207,3175,603 33,16524,0519,114 Discontinued operations Income attributable to discontinued operations4 290(286) 564 1,436(Gain from disposition of real estate83 14,574(14,491) 83 14,574(Total discontinued operations8714,864(14,777)64716,010(Net income13,00722,181(9,174)33,81240,061(Net income attributable to noncontrolling interests(679) (441) (238) (1,458) (908) Net income attributable to American Campus Communities, Inc. and Subsidiaries12,328$ 21,740$ (9,412)$ 32,354$ 39,153$ 6,799)$ Other comprehensive (loss) income Change in fair value of interest rate swaps(5,209)182(5,391) (1,805)927(Comprehensive income7,119$ 21,922$ (14,803)$ 30,549$ 40,080$ 9,531)$ Net income per share attributable to American Campus Communities, Inc. and Subsidiaries common stockholders Basic0.16$ 0.31$ 0.43$ 0.57$ Diluted0.16$ 0.31$ 0.42$ 0.57$ Weighted-average common shares outstanding Basic74,718,934 68,655,732 74,467,893 67,810,944 Diluted75,305,78069,211,85675,085,04068,387,966Three AMERICAN CAMPUS COMMUNITIES CONSOLIDATED STATEMENTS OF FUNDS FROM OPERATIONS Unaudited, $ in thousands, except share and per share data 1.Net income for the three months ended June 30, 2012 includes $1.3 million of acquisition-related costs such as broker fees, due diligence costs and legal and accounting fees. Of this amount, $0.6 million relates to the acquisition of Avalon Heights and University Commons and is included in wholly-owned properties operating expenses on the accompanying consolidated statements of operations. The remaining $0.7 million relates to the company’s pending acquisition of a portfolio of 15 properties from Campus Acquisitions and is included in general and administrative expenses on the accompanying consolidated statements of operations. 2.The adjustment to FFO for noncontrolling interests’ share of net income excludes $0.4 million and $0.8 million for the three and six months ended June 30, 2012, respectively, of income attributable to the noncontrolling partner in The Varsity, a property purchased in December 2011 from a seller that retained a 20.5% noncontrolling interest in the property. 3.Represents our 10% share of FFO from a joint venture with Fidelity (“Fund II”) in which we were a noncontrolling partner. In January 2012, we purchased the full ownership interest in the one remaining property owned by Fund II (University Heights). Subsequent to the acquisition, the property is now wholly-owned and is consolidated by the company. 4.50% of the properties’ net cash available for distribution after payment of operating expenses, debt service (including repayment of principal) and capital expenditures. Represents amounts accrued for the interim periods. 5.Immediately prior to our purchase of University Heights from Fund II (see Note 3), Fund II negotiated a Settlement Agreement with the lender of the property’s mortgage loan whereby the lender agreed to accept a discounted amount that was less than the original principal amount of the loan as payment in full. Accordingly, Fund II recorded a gain on debt restructuring to reflect the discounted payoff. Our 10% share of such gain is reflected above as an adjustment to FFOM. 6.Represents a non-cash loss recorded to remeasure our equity method investment in Fund II to fair value as a result of our purchase of the full ownership interest in University Heights from Fund II in January 2012. 4 20122011$ Change20122011$ income attributable to American Campus Communities, Inc. and Subsidiaries12,328$ 121,740$ (9,412)$ 32,354$ Noncontrolling interests2287 441 (154) Gain from disposition of real estate(83) (14,574) 14,491 Loss (income) from unconsolidated joint ventures- 13 (13) (FFO from unconsolidated joint ventures3- 3 (3) Real estate related depreciation and amortization24,074 21,745 2,329 48,079 Funds from operations ("FFO")36,606 29,368 7,238 81,004 Elimination of operations of on-campus participating propertiesNet loss (income) from on-campus participating properties1,044 1,296 (252) (1,454) Amortization of investment in on-campus participating properties(1,159) (1,109) (50) (2,314) 36,491 29,555 6,936 77,236 Modifications to reflect operational performance of on-campus participating propertiesOur share of net cash flow4523 433 90 1,073 Management fees216 205 11 Impact of on-campus participating properties739 638 101 1,651 Elimination of gain on debt restructuring - unconsolidated joint venture5- - - (Loss on remeasurement of equity method investment6- - - Funds from operations-modified ("FFOM")37,230$ 30,193$ 7,037$ 78,585$ FFO per share - diluted0.48$ 0.42$ 1.06$ FFOM per share - diluted0.49$ 0.43$ 1.03$ Weighted average common shares outstanding - diluted76,283,442 70,233,419 76,080,653 Three Months Ended June 30, AMERICAN CAMPUS COMMUNITIES WHOLLY-OWNED PROPERTY RESULTS OF OPERATIONS1 $ in thousands 1.Excludes Villas on Apache, River Club Apartments, and River Walk Townhomes, all sold in April 2011, Campus Club-Statesboro, sold in May 2011, and Pirates Cove, sold in April 2012. 2.Includes revenues that are reflected as Resident Services Revenue on the accompanying consolidated statements of operations. 3.During the three months ended June 30, 2011, the company successfully reached resolution on property tax appeals for certain of its properties located in one state for tax years ranging from 2009-2011. This resulted in reductions to property tax expense of approximately $0.6 million recorded during the three months ended June 30, 2011, which related to prior periods. Excluding these adjustments recorded during the three months ended June 30, 2011, net operating income for same store properties would have increased by 4.4% and 4.0% over the three and six months ended June 30, 2011, respectively. 5 20122011$ Change% Change20122011$ Change% owned property revenuesSame store properties84,214$ 81,544$ 2,670$ 3.3%172,093$ 166,951$ 5,142$ New properties 12,532 531 12,001 24,586 1,089 23,497 Total revenues 296,746$ 82,075$ 14,671$ 17.9%196,679$ 168,040$ 28,639$ Wholly-owned property operating expensesSame store properties38,373$ 37,050$ 1,323$ 3.6%76,350$ 74,382$ 1,968$ New properties 6,787 298 6,489 12,533 560 11,973 Total operating expenses45,160$ 37,348$ 7,812$ 20.9%88,883$ 74,942$ 13,941$ Wholly-owned property net operating incomeSame store properties45,841$ 44,494$ 1,347$ 3.0%395,743$ 92,569$ 3,174$ properties 5,745 233 5,512 12,053 529 11,524 Total net operating income51,586$ 44,727$ 6,859$ 15.3%107,796$ 93,098$ 14,698$ Three Months Ended June 30,Six Months Ended June 30, AMERICAN CAMPUS COMMUNITIES SEASONALITY OF OPERATIONS1 $ in thousands, except for per bed amounts 1.Excludes the following properties, which are classified within discontinued operations on the accompanying consolidated statements of operations: Villas on Apache, River Club Apartments, and River Walk Townhomes, all sold in April 2011, Campus Club-Statesboro, sold in May 2011, and Pirates Cove, sold in April 2012. 2.For the four most recently completed fiscal quarters. 3.Includes all properties owned during the full year ended December 31, 2011. 4.Other income is all income other than Net Student Rent. This includes, but is not limited to, utility income, damages, parking income, summer conference rent, application and administration fees, income from retail tenants, etc. 5.Includes the following properties opened or acquired in 2011 and 2012: Villas at Babcock, Villas on Sycamore, Lobo Village, University Village Northwest, Eagles Trail, U Club Townhomes on Woodward (formerly Studio Green), 26 West, The Varsity, University Shoppes, University Heights-Knoxville, Avalon Heights, and University Commons. Also includes Campus Trails, a 480-bed property that incurred business interruption due to significant property damage resulting from a fire in April 2010. The 72 beds damaged by the fire reopened for occupancy in August 2011. 6 June 30, 2011September 30, 2011December 31, 2011March 31, store properties3Revenue per occupied bedRental revenue per occupied bed per month503$ 497$ 524$ 524$ Other income per occupied bed per month4385531353940Total revenue per occupied bed541$ 552$ 555$ 559$ Average number of owned beds53,160 53,160 53,160 Average physical occupancy for the quarter94.6%96.3%98.5%Total revenue81,544$ 84,884$ 87,179$ 87,879$ Property operating expenses37,05046,84337,52737,97738,373160,720Net operating income44,494$ 38,041$ 49,652$ 49,902$ Operating margin54.6%44.8%57.0%New properties5Revenue per occupied bedRental revenue per occupied bed per month374$ 471$ 531$ 581$ Other income per occupied bed per month4647757857574Total revenue per occupied bed438$ 548$ 588$ 666$ Average number of owned beds480 1,799 4,500 Average physical occupancy for the quarter84.0%96.4%92.9%Total revenue531$ 2,850$ 7,360$ 12,054$ Property operating expenses2982,2643,9735,7466,78718,770Net operating income233$ 586$ 3,387$ 6,308$ Operating margin43.9%20.6%46.0%ALL PROPERTIES Revenue per occupied bedRental revenue per occupied bed per month502$ 496$ 524$ 530$ Other income per occupied bed per month4385633404343Total revenue per occupied bed540$ 552$ 557$ 570$ Average number of owned beds53,640 54,959 57,660 Average physical occupancy for the quarter94.5%96.3%98.1%Total revenue82,075$ 87,734$ 94,539$ 99,933$ Property operating expenses37,34849,10741,50043,72345,160179,490Net operating income44,727$ 38,627$ 53,039$ 56,210$ Operating margin54.5%44.0%56.1% AMERICAN CAMPUS COMMUNITIES CAPITAL STRUCTURE AS OF JUNE 30, 2012 $ in thousands, except share and per share data 1.Gross asset value is the book value of the company’s total assets calculated in accordance with generally accepted accounting principles, excluding accumulated depreciation and our on-campus participating properties. 2.Unencumbered asset value is the sum of (i) the company’s undepreciated real estate assets which are not subject to secured debt; and (ii) all other assets, excluding accounts receivable and intangibles, for such properties. 3.Excludes debt related to our on-campus participating properties totaling $79.1 million with a weighted average interest rate of 7.2% and average term maturity of 7.9 years. Also excludes net unamortized debt premiums of $5.8 million. 4.Based on share price of $44.98 and fully diluted share count of 76,271,001 as of June 30, 2012. Assumes conversion of 953,392 common and preferred Operating Partnership units and 585,241 unvested restricted stock awards. 5.Based on earnings before interest, taxes, depreciation, and amortization (“EBITDA”), as defined in the company’s Credit Facility Agreement, and cash interest expense of $196.8 million and $59.9 million, respectively, for the four most recently completed fiscal quarters. Excludes interest associated with our on-campus participating properties and Hampton Roads unconsolidated joint venture. Includes our share of interest expense related to debt from a joint venture in which we held a 10% interest through January 2012. 6.Net debt is calculated as total debt less cash on hand as of June 30, 2012. 7 AMERICAN CAMPUS COMMUNITIES PORTFOLIO OVERVIEW1 Summary 1.Excludes Villas on Apache, River Club Apartments and River Walk Townhomes, sold in April 2011, Campus Club-Statesboro, sold in May 2011, and Pirates Cove, sold in April 2012. 2.As of June 30, 2012, the new wholly-owned property grouping includes the following properties: (1) Campus Trails, a 480-bed property that incurred business interruption due to significant property damage resulting from a fire in April 2010; (2) 4 owned development properties that completed construction and opened for occupancy in August 2011; (3) Eagles Trail, a 792-bed property purchased in September 2011; (4) 26 West, a 1,026-bed property purchased in December 2011; (5) The Varsity, a 901-bed property purchased in December 2011; (6) University Heights, a 636-bed property purchased from one of the Fidelity Joint Ventures in January 2012, (7) Avalon Heights, a 754-bed property purchased in May 2012, and (8) University Commons, a 480-bed property purchased in June 2012. As of June 30, 2011, the new wholly-owned property grouping includes only Campus Trails. U Club Townhomes on Woodward (formerly referred to as Studio Green), a 448-bed property purchased in November 2011 where units are being vacated to prepare for the development of the property, is excluded from the new property grouping for both periods presented. 3.Reflects the impact of lost occupancy at Campus Trails related to 72 beds that were destroyed by a fire in April 2010 and reopened for occupancy in August 2011. 4.Excludes properties that were not owned or under ACC management as of June 30, 2011 (see footnote 2). 5.Occupancy at our on-campus participating properties is low during the summer months due to the expiration of the nine-month leases concurrent with the end of the spring semester. 8 UnitsBeds20122011Same Store Wholly-owned Properties - Total16,91253,16092.5%92.1% New Wholly-owned Properties22,2017,54990.9%83.8%3 4Wholly-owned Properties - Total19,11360,70992.3%92.0%3 4On-campus Participating Properties5 1,8634,51919.6%19.6% Physical Occupancy at June 30, Property Type AMERICAN CAMPUS COMMUNITIES 2012/2013 LEASING STATUS Wholly-owned properties - summary Applications + LeasesApplications + Leases1% of Rentable BedsApplications + Leases1% of Rentable BedsRentableBeds2Design BedsFinal Fall 2011 Occupancy3Same Store Wholly-owned Properties55,779 99.0%56,188 101.1%456,346 56,912 98.2% New Wholly-owned Properties59,822 95.0%538 85.7%610,335 10,500 90.4%6Wholly-owned Properties-Total65,601 98.4%56,726 101.0%666,681 67,412 98.1%6LeasesLeases1% of Rentable BedsLeases1% of Rentable BedsRentableBeds2Design BedsFinal Fall 2011 Occupancy3Initial Rate IncreaseProjected Store Wholly-owned Properties52,33292.9%52,88795.2%456,34656,91298.2%3.5%New Wholly-owned Properties59,23189.3%51281.5%610,33510,50090.4%6n/an/owned Properties-Total61,56392.3%53,39995.0%666,68167,41298.1%63.5%Current YearPrior YearCurrent YearPrior Year 1.As of July 20, 2012 for the current year and July 20, 2011 for the prior year. 2.Rentable beds exclude beds needed for on-site staff. 3.As of September 30, 2011. 4.Excludes Eagles Trail, a 792-bed property purchased in September 2011, as no prior year leasing data is available for this property. 5.Includes 11 properties currently under construction that are anticipated to open for occupancy in August 2012. Also includes The Varsity and 26 West, purchased in December 2011, University Heights, purchased from one of the Fidelity joint ventures in January 2012, Avalon Heights, purchased in March 2012, and University Commons, purchased in June 2012. Excludes U Club Townhomes on Woodward (formerly referred to as Studio Green), a 448-bed property purchased in November 2011 that is currently being redeveloped. 6.Properties not owned or under ACC management during the prior year are excluded for purposes of calculating the prior year percentage of rentable beds and final Fall 2011 occupancy. 7.Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy. 9 AMERICAN CAMPUS COMMUNITIES Leases1% of Rentable BedsLeases1% of Rentable Beds1.Royal Lexington-Lexington, KY36098.9%36199.2%36436498.4%2.2nd Avenue Centre-Gainesville, FL86199.4%85799.0%86686899.4%3.Aztec Corner-San Diego, CA58598.7%58398.3%59360698.5%4.Campus Corner-Bloomington, IN78099.2%77999.1%78679699.1%5.Nittany Crossing-State College, PA67299.4%676100.0%67668499.4%6.University Crossings-Philadelphia, PA99899.5%99499.1%1,0031,01699.4%7.Brookstone Village-Wilmington, NC239102.1%244104.3%234238102.5%8.State College Park-State College, PA73899.5%748100.8%74275299.5%9.Campus Trails-Starkville, MS46998.9%46998.9%47448099.0%10.Hawks Landing-Oxford, OH47699.2%47699.2%48048499.0%11-12.Willowtree Apartments and Towers-Ann Arbor, MI83999.5%83799.3%84385196.9%13.University Greens-Norman, OK51098.8%50798.3%51651698.8%14.Eagles Trail- Hattiesburg, MS77798.6%n/an/a78879280.1%15.The View-Lincoln, NE588100.0%588100.0%588590100.0%16.University Mills-Cedar Falls, IA44993.3%47699.0%48148199.0%17.University Heights-Birmingham, AL51499.4%48593.8%51752899.4%18.Lions Crossing-State College, PA67798.4%68399.3%68869699.4%19.The Edge-Charlotte, NC71298.9%70597.9%72072098.8%20.The Edge-Orlando, FL91599.7%91499.6%91893099.6%21.Campus Walk Wilmington-Wilmington, NC300105.3%295103.5%285290105.5%22.University Meadows-Mt. Pleasant, MI61099.0%61299.4%61648098.5%23.University Walk-Charlotte, NC485101.0%40985.2%48061699.2%24.The Village at Blacksburg-Blacksburg, VA1,03498.9%1,052100.7%1,0451,05699.6%25.The Club-Athens, GA46598.3%46598.3%47348097.9%26.Abbott Place-East Lansing, MI64299.4%647100.2%64665499.4%27.University Village at Boulder Creek-Boulder, CO29598.7%29598.7%29930998.7%28.The Highlands-Reno, NV69997.1%65591.0%72073299.2%29.The Enclave-Bowling Green, OH41185.6%47699.2%48048098.5%30.The Centre-Kalamazoo, MI66595.3%69499.4%69870099.4%31.Campus Way-Tuscalossa, AL65698.1%56584.5%66968098.1%32.University Crescent-Baton Rouge, LA58695.8%60799.2%61261298.4%33.Sanctuary Lofts-San Marcos, TX47197.7%47598.5%48248798.2%34.University Club Apartments-Gainesville, FL36998.1%35794.9%37637698.7%35.Newtown Crossing-Lexington, KY92999.4%935100.0%93594299.2%36-38.University Village-Tallahassee, FL71299.4%71099.2%71671699.2%39.Barrett Honors College (ACE)-Tempe, AZ1,59793.1%1,66597.1%1,7151,72197.4%Current YearPrior YearProjected IncreaseFinal Fall 2011 Occupancy3Design BedsRentable Beds22012/2013 LEASING STATUS Same store wholly-owned properties with projected rental rate growth above 3% 1.As of July 20, 2012 for the current year and July 20, 2011 for the prior year. 2.Rentable beds exclude beds needed for on-site staff. 3.As of September 30, 2011. 4.Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy. 10 AMERICAN CAMPUS COMMUNITIES Leases1% of Rentable BedsLeases1% of Rentable Beds40.Sunnyside Commons-Morgantown, WV162100.6%166103.1%161161100.6%41-43.The Summit & Jacob Heights-Mankato, MN90697.9%83590.3%92593097.8%44.Lobo Village (ACE)-Albuquerque, NM84099.5%848100.5%84486499.5%45-46.College Club Townhomes-Tallahassee, FL556103.0%53498.9%54054496.1%47.The Callaway House-College Station, TX549104.2%547103.8%527538103.7%48.University Oaks-Columbia, SC64999.4%64999.4%65366299.1%49.The Outpost-San Marcos, TX47899.6%484100.8%48048699.6%50.University Gables-Murfreesboro, TN52181.3%51480.2%64164898.9%51.University Trails-Lubbock, TX64095.0%64495.5%67468498.2%52.The Village on Sixth Avenue-Huntington, WV62583.4%68591.5%74975297.3%53.Vista del Sol (ACE)-Tempe, AZ1,74295.1%1,80898.7%1,8311,86698.8%54.Lakeside Apartments-Athens, GA68388.7%73695.6%77077698.2%55.Uptown Apartments-Denton, TX51097.7%49795.2%52252897.0%56.The Tower at 3rd-Champaign, IL36998.9%36998.9%37337598.9%57.University Village-Sacramento, CA35091.6%37297.4%382394104.1%58.Peninsular Place-Ypsilanti, MI41588.1%39483.7%47147899.2%59.The Estates-Gainesville, FL1,02799.0%1,00897.2%1,0371,04499.3%60.Olde Towne University Square-Toledo, OH550100.4%548100.0%548550100.2%61.University Pines-Statesboro, GA54299.1%48789.0%54755299.5%62.University Village-Frescno, CA32882.4%38095.5%39840698.0%63.Aggie Station-Bryan, TX442100.0%442100.0%44245099.3%64.-65.University Club Townhomes-Tallahassee, FL66991.9%729100.1%72873699.5%66.University Village Northwest-Prairie View, TX13091.5%142100.0%142144100.0%67.Chapel View-Chapel Hill, NC33395.4%34699.1%34935897.8%Subtotal-Projected Rental Rate Growth Above 3%37,10197.0%36,46097.3%538,25838,64998.6%YearPrior YearRentable Beds2Design BedsFinal Fall 2011 Occupancy3Initial 2013 LEASING STATUS Same store wholly-owned properties with projected rental rate growth above 3% continued 1.As of July 20, 2012 for the current year and July 20, 2011 for the prior year. 2.Rentable beds exclude beds needed for on-site staff. 3.As of September 30, 2011. 4.Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy. 5.Excludes Eagles Trail, a 792-bed property purchased in September 2011, as no prior year leasing data is available for this property. 11 AMERICAN CAMPUS COMMUNITIES Leases1% of Rentable BedsLeases1% of Rentable Beds1.Villas at Babcock-San Antonio, TX70089.1%788100.3%78679299.5%4.1%2.Villas on Sycamore-Huntsville, TX56883.5%67799.6%68068096.5%4.6%3.The Village at Science Drive-Orlando, FL64288.7%71899.2%72473299.3%3.4%4.The Woods at Greenland-Murfreesboro, TN23084.6%22783.5%27227697.5%2.4%5.Royal Village-Gainesville, FL44098.2%41592.6%44844897.1%2.1%6.Burbank Commons-Baton Rouge, LA40676.6%44584.0%53053295.7%2.9%7.Callaway Villas-College Station, TX692100.0%68999.6%69270499.9%3.1%8.University Place-Charlottesville, VA32662.2%33063.0%52452880.7%3.5%9.Campus Ridge-Johnson City, TN38974.5%44084.3%52252895.5%3.1%10.GrandMarc-Seven Corners-Minneapolis, MN499115.0%472108.8%434440125.7%2.2%11.Chapel Ridge-Chapel Hill, NC53199.3%47488.6%53554493.6%2.1%12.Northgate Lakes-Orlando, FL59984.4%70699.4%71071099.4%3.8%13.City Parc at Fry Street-Denton, TX36990.0%40699.0%41041898.3%2.9%14.University Pointe-Lubbock, TX62793.0%63994.8%67468295.0%2.2%15.The Village at Alafaya Club-Orlando, FL66880.6%73188.2%82983999.3%2.5%16.The Outpost-San Antonio, TX63477.0%75691.9%823828100.0%2.6%17.Blanton Common-Valdosta, GA57867.4%66677.6%85886099.0%3.5%18.University Centre-Newark, NJ75791.6%75691.5%82683898.6%2.0%19.University Manor-Greenville, NC52888.9%55793.8%59460093.5%2.7%20.Raiders Crossing-Murfreesboro, TN19169.5%23786.2%27527699.6%2.2%21.University Village (Temple)-Philadelphia, PA49968.1%65989.9%73374998.9%1.9%22.Pirates Place Townhomes-Greenville, NC46688.9%47590.6%52452893.2%1.3%23.Entrada Real-Tucson, AZ27375.2%36299.7%36336399.4%2.5%Subtotal-Projected Rental Rate Growth between 0% and 2.99%11,61284.4%12,62591.7%13,76613,89598.0%2.8%Subtotal-Properties Increasing Rental Rates48,71393.6%49,08595.8% 5 52,02452,54498.4%3.7%1.Raiders Pass-Lubbock, TX59572.8%70686.4%81782897.5%3.2%-2.South View Apartments-Harrisonburg, VA90695.2%94298.9%95296098.4%1.8%-3.Villas at Chestnut Ridge-Amherst, NY36066.3%53598.5%54355299.3%1.9%-4.University Village at Sweethome-Amherst, NY66982.2%52864.9%81482890.3%0.3%-5.Stone Gate-Harrisonburg, VA61391.2%60990.6%67267293.5%-1.4%-6.The Commons-Harrisonburg, VA47690.8%48292.0%52452894.9%0.5%-Subtotal-Properties Reducing Rental Rates3,61983.7%3,80288.0%4,3224,36895.6%1.2%-Total-Same Store Wholly-owned Properties52,33292.9%52,88795.2%5 56,34656,91298.2%3.5%YearPrior YearRentable Beds2Design BedsFinal Fall 2011 Occupancy3Initial Rate Increase 2012/2013 LEASING STATUS Same store wholly-owned properties with projected rental rate growth between 0% and 2.99% and properties reducing rental rates 1.As of July 20, 2012 for the current year and July 20, 2011 for the prior year. 2.Rentable beds exclude beds needed for on-site staff. 3.As of September 30, 2011. 4.Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy. 5.Excludes Eagles Trail, a 792-bed property purchased in September 2011, as no prior year leasing data is available for this property. 12 AMERICAN CAMPUS COMMUNITIES Leases1% of Rentable BedsLeases1% of Rentable Beds1.26 West-Austin, TX1,00999.6%n/an/a1,0131,026n/an/Avalon Heights-Tampa Bay, FL70193.0%n/an/a754754n/an/University Commons-Minneapolis, MN40785.1%n/an/a478480n/an/University Heights-Knoxville, TN50279.9%51281.5%62863690.4%The Varsity-College Park, MD568376.7%n/an/a890901n/an/Newly Acquired Properties3,30287.7%51281.5%63,7633,79790.4%6n/The Villas at Vista del Sol (ACE)-Tempe, AZ402102.0%n/an/a394400n/an/Campus Edge on UTA Boulevard-Arlington, TX483100.0%n/an/a483488n/an/The Suites (ACE)-Flagstaff, AZ53599.6%n/an/a537550n/an/Hilltop Townhomes (ACE)-Flagstaff, AZ56699.5%n/an/a569576n/an/U Club Townhomes on Marion Pugh-College Station, TX62999.4%n/an/a633640n/an/U Club on Frey-Kennesaw, GA44699.1%n/an/a450456n/an/The Village at Overton Park-Lubbock, TX59198.7%n/an/a599612n/an/Villas on Rensch-Amherst, NY58997.8%n/an/a602610n/an/Casas del Rio (ACE)-Albuquerque, NM96796.7%n/an/a1,0001,028n/an/Casa de Oro (ACE)-Glendale, AZ27879.9%n/an/a348365n/an/University Pointe at College Station (ACE)-Portland, OR44346.3%n/an/a957978n/an/New Development Properties5,92990.2%n/an/a6,5726,703n/an/New Wholly-owned Properties9,23189.3%51281.5%610,33510,50090.4%6n/All Wholly-owned Properties61,56392.3%53,39995.0%666,68167,41298.1%63.5%YearPrior YearRentable Beds2Design BedsFinal Fall 2011 Occupancy3Initial Increase 2012/2013 LEASING STATUS New wholly-owned properties 1.As of July 20, 2012 for the current year and July 20, 2011 for the prior year. 2.Rentable beds exclude beds needed for on-site staff. 3.As of September 30, 2011. 4.Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy. 5.The company owns a 79.5% interest in this property. 6.Properties not owned or under ACC management during the prior year are excluded for purposes of calculating the prior year percentage of rentable beds and final Fall 2011 occupancy. 13 AMERICAN CAMPUS COMMUNITIES OWNED DEVELOPMENT UPDATE $ in thousands PROJECTS UNDER CONSTRUCTIONProjectProject TypeLocationPrimary University ServedUnitsBedsCIP1 Land and Other2Total Incurred% Pointe at College StationACEPortland, ORPortland State Univ.28297887,800$ 76,201$ -$ 76,201$ del RioACEAlbuquerque, NMUniv. of New Mexico2831,02839,400 32,085 - 32,085 SuitesACEFlagstaff, AZNorthern Arizona Univ.27555028,100 22,245 - 22,245 TownhomesACEFlagstaff, AZNorthern Arizona Univ.14457632,500 26,724 - 26,724 Club on FreyOff-campusKennesaw, GAKennesaw State Univ.11445622,500 16,778 3,300 20,078 Edge on UTA BlvdOff-campusArlington, TXUniv. of Tx at Arlington12848824,900 17,273 2,661 19,934 Club Town. on Marion PughOff-campusCollege Station, TXTexas A&M Univ.16064034,100 25,348 6,722 32,070 on RenschOff-campusAmherst, NYUniv. at Buffalo15361044,800 30,011 10,231 40,242 Village at Overton ParkOff-campusLubbock, TXTexas Tech Univ.16361234,800 25,389 5,262 30,651 de OroACEGlendale, AZArizona State Univ.10936514,600 8,887 - Villas at Vista del SolACETempe, AZArizona State Univ.10440021,900 16,166 - 16,166 - 2012 DELIVERIES1,9156,703385,400 297,107 28,176 325,283 Manzanita Hall4ACETempe, AZArizona State Univ.24181650,300 7,421 - Callaway HouseOff-campusAustin, TXThe Univ. of Tx at Austin21975360,100 9,441 - UniversityACEPhiladelphia, PADrexel Univ.22086197,600 17,342 - 17,342 Club Town. on Woodward5Off-campusTallahassee, FLFlorida State Univ.11244829,000 858 6,703 at Overton ParkOff-campusLubbock, TXTexas Tech Univ.11244829,200 1,031 7,759 CopelandOff-campusTallahassee, FLFlorida State Univ.8128321,200 940 1,457 - 2013 DELIVERIES9853,609287,400 37,033 15,919 52,952 TOTAL - ALL PROJECTS2,90010,312672,800$ 334,140$ 44,095$ 378,235$ OWNED DEVELOPMENT PIPELINE6 7ProjectProject TypeLocationPrimary University ServedApprox. Targeted BedsEstimated Project Cost8Targeted CompletionUniversity Shoppes9Off-campusOrlando, FLUniv. of Central Florida1,313109,300$ August 2014West Virginia UniversityACEMorgantown, WVWest Virginia Univ.TBDTBDTBDCarbondale DevelopmentOff-campusCarbondale, ILSouthern Illinois Univ.65032,100 TBD1,963141,400$ Anticipated CommencementTBDAs of June 30, 2012TBDQ4 2012 / Q1 2013Estimated Project Cost 1.The total construction in progress (“CIP”) balance above excludes $1.5 million related to ongoing renovation projects at operating properties, as well as the CIP balance of $16.8 million related to the University Edge property in Kent, OH that is discussed on page 15. 2.Consists of amounts incurred to purchase the land for off-campus development projects, as well as any other development-related expenditures not included in CIP such as deposits, furniture, etc. 3.Based on costs incurred under the general construction contract as of June 30, 2012. 4.This project consists of the redevelopment of an existing student housing high-rise building into a new residence hall product, utilizing the existing building structure. 5.Formerly referred to as “Studio Green.” 6.Does not include undeveloped land parcels in 4 university markets totaling $22.3 million. 7.Commencement of owned off-campus development projects is subject to final determination of feasibility, execution and closing on definitive agreements, municipal approval processes, fluctuations in the construction market, and current capital market conditions. ACE awards provide the company with the opportunity to exclusively negotiate with the subject universities. Commencement of ACE projects is subject to various levels of university board approval, final determination of feasibility, execution and closing on definitive agreements, municipal approval processes, fluctuations in the construction market, and current capital market conditions. 8.Estimated project costs include land and other predevelopment costs of $32.7 million incurred as of June 30, 2012 for owned development pipeline projects. 9.This property was purchased in July 2011 with the intent to demolish the existing retail center and develop a new mixed-use community. Estimated project costs include $27.2 million spent to acquire the property. 14 AMERICAN CAMPUS COMMUNITIES MEZZANINE INVESTMENT UPDATE $ in thousands LocationPrimary University ServedUnitsBedsMezzanine InvestmentStructurePurchase PriceTargeted Edge1Kent, OHKent State University2016084,500$ Pre-sale31,100$ Commons2Oxford, OHMiami University 184456- Option21,350 Retreat3San Marcos, TXTexas State University1877803,100 Option52,000 at Newtown Crossing4Lexington, KYUniversity of Kentucky1526082,000 Pre-sale38,750 143,200$ Project 1.The company has provided mezzanine financing to a private developer and is obligated to purchase the property as long as certain construction completion deadlines are met. The company is responsible for leasing, management, and initial operations of the project while the third-party developer retains the development risk. As of June 30, 2012, the company is including this property in its consolidated financial statements. Therefore, as of June 30, 2012, the company has included the following amounts in its consolidated balance sheet: land of $4.8 million, construction in progress of $16.8 million, furniture, fixtures, and equipment of $0.4 million, and construction loan payable of $15.7 million. 2.In March 2011, the company provided mezzanine financing of $4.0 million to a private developer, while also retaining an option to purchase the property upon completion. The developer is responsible for leasing, management, and initial operations of the property. The developer paid interest on the mezzanine investment amount on a monthly basis until March 2012, at which time the original mezzanine investment amount plus accrued but unpaid interest was repaid in full. Subsequent to the repayment of the mezzanine investment, we continue to retain our option to purchase the property, subject to a 60-day due diligence period. 3.The company has provided mezzanine financing to a private developer, while also retaining an option to purchase the property upon completion. The developer is responsible for leasing, management, and initial operations of the property, and is required to pay interest on the mezzanine investment on a monthly basis. The purchase price may be reduced by up to 5%, subject to the achievement of certain rental revenue and occupancy thresholds. If the developer achieves certain rental revenue and occupancy thresholds, the company has 30 days from the day the developer provides proof of such to exercise our option. Should we choose to not exercise our option to purchase the property, the developer is obligated to repay the mezzanine investment, along with all accrued but unpaid interest, within 120 days of the option termination date (which is no later than October 15, 2013.) Should we choose to exercise our option to purchase the property, the mezzanine investment, along with all accrued but unpaid interest, will be credited to the company upon closing of the purchase of the property. Closing is subject to a 45-day due diligence period. 4.In July 2012, the company provided mezzanine financing to a private developer and is obligated to purchase the property as long as certain construction completion deadlines are met. The company is responsible for leasing, management, and initial operations of the project while the third-party developer retains the development risk. 15 AMERICAN CAMPUS COMMUNITIES THIRD-PARTY DEVELOPMENT UPDATE $ in thousands 20122011$ Change20122011$ ChangeDevelopment services revenue3,866$ 758$ 3,108$ 5,960$ 4,582$ 1,378$ % of total revenue3.6%0.9%2.7%2.4% Three Months Ended June 30, Six Months Ended June 30, 1.The Company is earning a fee to assist the Universities in building dining halls that will be located adjacent to the student housing projects. The dining halls will be owned by the Universities and will be operated by third-party food service operators. 2.This project, which will be funded by the University, commenced construction in June 2012. 3.These awards relate to speculative development projects that are subject to final determination of feasibility, execution and closing on definitive agreements, and fluctuations in the construction and financing markets. Anticipated commencement and fees are dependent upon the availability of project financing, which is affected by current capital market conditions. 16 CONTRACTED PROJECTS IN PROGRESSProjectUnitsBedsTotal FeesFees Earned as of June 30, 2012Fees CourtNormal, ILIllinois State University2288962,555$ 2,245$ Illinois UniversityDeKalb, ILNorthern Illinois University1261,0084,572 3,912 Run VillageLaramie, WYUniversity of Wyoming843321,055 901 de Oro Dining Hall1Glendale, AZArizona State Universityn/an/a543 444 of Staten Island ProjectStaten Island, NYCity University of New York1334542,620 1,430 Campus Village - HousingAshland, ORSouthern Oregon University2067021,925 1,103 Campus Village - Dining Hall1Ashland, ORSouthern Oregon Universityn/an/a350 200 Graduate Community2Princeton, NJUniversity-fundedPrinceton University3297153,200 1,310 11,545$ ON-CAMPUS AWARD PIPELINE3ProjectEstimated Fees USC Health Sciences CampusLos Angeles, CAACEn/aTexas A&M UniversityCollege Station, TXACEn/aLocationPrimary University ServedAnticipated Financing StructureTBDTBDLocationAnticipated Commencement AMERICAN CAMPUS COMMUNITIES MANAGEMENT SERVICES UPDATE $ in thousands NEW/PENDING MANAGEMENT CONTRACTSPropertyLocationApproximate BedsStabilized Annual Fees1West Village SuitesHamilton, ON, CAMcMaster University454100$ April 2012UT Dallas Residence Hall Phase IIIRichardson, TXUniversity of Texas at Dallas400100 Jaguar CourtVictoria, TXUniversity of Houston - Victoria18030 College of Staten Island ProjectStaten Island, NYCity University of New York454255 485$ August University ServedActual or Anticipated CommencementAugust 20122011$ Change20122011$ ChangeManagement services revenue1,638$ 1,803$ (165)$ 3,396$ 3,633$ (237)$ % of total revenue1.5%2.0%1.6%1.9% Three Months Ended June 30, Six Months Ended June 30, 1.Stabilized annual fees are dependent upon the achievement of anticipated occupancy levels. 17 AMERICAN CAMPUS COMMUNITIES GrafChief Financial OfficerResearch CoverageJeffery Spector / Jana GalanBank of America / Merrill Lynch(646) 855-1363 / (646) 855-3081jeff.spector@baml.com / jana.galan@baml.comMichael Bilerman / Eric WolfeCitigroup Equity Research (212) 816-1383 / (212) 816-5871michael.bilerman@citi.com / eric.wolfe@citi.PerryDeutsche Bank Securities, Inc.(212) 250-4912 john.perry@db.comAndrew McCullochGreen Street Advisors(949) 640-8780 amcculloch@greenstreetadvisors.com Carol KempleHilliard Lyons (502) 588-1839 ckemple@hilliard.comSteve Sakwa / Seth LaughlinISI Group Inc. (212) 446-9462 / (212) 446-9458ssakwa@isigrp.com / slaughlin@isigrp.comAnthony Paolone / Joseph DazioJ.P. Morgan Securities(212) 622-6682 / (212) 622-6416anthony.paolone@jpmorgan.com / joseph.c.DonlanJanney Capital Markets(215) 665-6476ddonlan@janney.comJordan Sadler / Karin FordKeyBanc Capital Markets(917) 368-2280 / (917) 368-2293jsadler@keybanccm.com / kford@keybanccm.Poskon Robert W. Baird & Co., Inc.(703) 821-5782 pposkon@rwbaird.com Alexander Goldfarb / James MilamSandler O'Neill + Partners, L.P.(212) 466-7937 / (212) 466-8066agoldfarb@sandleroneill.com / jmilam@sandleroneill.NussbaumUBS Investment Research(212) 713-2484 ross.nussbaum@ubs.com Investor Relations: Gina CowartVP, Investor Relations and Corporate Marketing(512) 732-1041gcowart@americancampus.com 12700 Hill Country Blvd., Suite T-200Austin, Texas 78738Tel: (512) 732-1000; Fax: (512) 732-2450 www.americancampus.com American Campus Communities, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding American Campus Communities, performance made by such analysts are theirs alone and do not represent the opinions, forecasts or predictions of the company or its management. American Campus Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. Additional InformationCorporate Headquarters: American Campus Communities, Inc. INVESTOR INFORMATION 18 AMERICAN CAMPUS COMMUNITIES FORWARD-LOOKING STATEMENT In addition to historical information, this supplemental package contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates and projections about the industry and markets in which American Campus operates, management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.