Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CLOUD PEAK ENERGY INC. | a12-15686_18k.htm |

| EX-2.3 - EX-2.3 - CLOUD PEAK ENERGY INC. | a12-15686_1ex2d3.htm |

| EX-2.1 - EX-2.1 - CLOUD PEAK ENERGY INC. | a12-15686_1ex2d1.htm |

| EX-2.2 - EX-2.2 - CLOUD PEAK ENERGY INC. | a12-15686_1ex2d2.htm |

| EX-99.1 - EX-99.1 - CLOUD PEAK ENERGY INC. | a12-15686_1ex99d1.htm |

Exhibit 99.2

|

|

Cloud Peak Energy Completes Northern PRB Acquisition July 2, 2012 |

|

|

1 Cloud Peak Energy Inc. Financial Data Cloud Peak Energy Inc. is the sole owner of Cloud Peak Energy Resources LLC. Unless expressly stated otherwise in this presentation, all financial data included herein is consolidated financial data of Cloud Peak Energy Inc. Cautionary Note Regarding Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are not statements of historical facts and often contain words such as “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “estimate,” “seek,” “could,” “should,” “intend,” “potential,” or words of similar meaning. Forward-looking statements are based on management's current expectations or beliefs, as well as assumptions and estimates regarding our company, industry, economic conditions, government regulations and energy policies and other factors. Forward-looking statements may include, for example, (1) our current estimates of the quantity and quality of the acquired coal assets and evaluation of such coal for any inclusion in the company’s reported reserves, (2) any future development, production and/or marketing of this coal, (3) anticipated additional West Coast export terminal capacity and the timing of any such additional capacity, (4) Asian export demand, (5) business development and growth initiatives and strategies; (6) potential synergies of this transaction, and (7) other statements regarding this transaction and our plans, strategies, prospects and expectations concerning our business, industry, economic conditions, operating results, financial condition and other matters that do not relate strictly to historical facts. These statements are subject to significant risks, uncertainties, and assumptions that are difficult to predict and could cause actual results to differ materially from those expressed or implied in the forward-looking statements, including the risks that (i) sufficient additional West Coast terminal capacity is not developed at all or in a timely manner, (ii) Asian export demand and domestic demand for PRB coal weakens, (iii) the coal leases from Chevron and CONSOL terminate if we fail to meet minimum future production requirements, (iv) future development and operating costs significantly exceed our expectations, or (v) anticipated synergies are not achieved. For a discussion of some of the additional factors that could adversely affect our future results or the anticipated benefits of this transaction, refer to the risk factors described from time to time in the reports and registration statements we file with the Securities and Exchange Commission (“SEC”), including those in Item 1A - Risk Factors in our most recent Form 10-K and any updates thereto in our Forms 10-Q and current reports on Forms 8-K. There may be other risks and uncertainties that are not currently known to us or that we currently believe are not material. We make forward-looking statements based on currently available information, and we assume no obligation to, and expressly disclaim any obligation to, update or revise publicly any forward-looking statements made in this presentation, whether as a result of new information, future events or otherwise, except as required by law. |

|

|

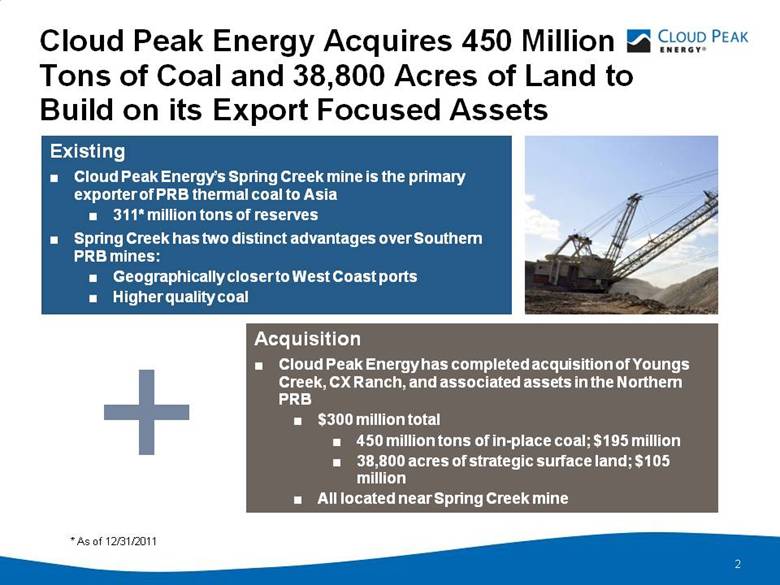

Cloud Peak Energy Acquires 450 Million Tons of Coal and 38,800 Acres of Land to Build on its Export Focused Assets 2 Acquisition Cloud Peak Energy has completed acquisition of Youngs Creek, CX Ranch, and associated assets in the Northern PRB $300 million total 450 million tons of in-place coal; $195 million 38,800 acres of strategic surface land; $105 million All located near Spring Creek mine + Existing Cloud Peak Energy’s Spring Creek mine is the primary exporter of PRB thermal coal to Asia 311* million tons of reserves Spring Creek has two distinct advantages over Southern PRB mines: Geographically closer to West Coast ports Higher quality coal * As of 12/31/2011 |

|

|

Coal Assets Acquired 3 Greenfield project 7 miles south of Spring Creek 450 million in-place tons, $195 million 291 million tons in mining permit 267 million tons at 8% royalty rate 9,220 Btu, low sulfur, and lower sodium than Spring Creek Complementary to existing reserves of 311* million tons at Spring Creek mine Multiple development options, production rates, timing and capex Permitted at 6 million tons in 2015, increasing to 14 million tons by 2019 Potential synergies with facilities, equipment, and reserves expansion * As of 12/31/2011 |

|

|

Land Assets Acquired 4 38,800 acres of prime surface land, $105 million Key location connecting Spring Creek and Youngs Creek Will support access for Multiple development options of Youngs Creek Existing Spring Creek mine operations Future Spring Creek mine LBAs Air permits Rail corridors and access |

|

|

Prudent Investment 5 Total purchase price of $300 million, financed from Cloud Peak Energy’s cash balance 450 million tons of in-place coal, of which 291 million tons under Youngs Creek mining permits 267 million tons at 8% royalty rate (vs. 12.5% normal Federal royalty rate) Compares very favorably with recent Wyoming LBA pricing 38,800 acres of critical surface land Adds value to stand-alone Spring Creek mine – air permits, access to previously leased coal Large surface land holding will allow multiple development options for Spring Creek and Youngs Creek Surface land covers Youngs Creek, north to Spring Creek, west onto the Crow Indian Reservation, east to the Decker mine Surface land provides access for potential synergies with existing operations Continued strong and stable balance sheet Acquisition purchase price financed from cash balance No additional debt required Retaining strong liquidity No debt and no employee obligations assumed |

|

|

Development Options 6 Youngs Creek assets complement Spring Creek mine’s existing 311* million ton reserve base There are multiple development options for the combined complex of our Northern PRB assets Examples of options include: Development of Youngs Creek as a stand-alone, large operation Development of Youngs Creek as a feeder operation to Spring Creek’s loadout Development of Youngs Creek as a blend with Spring Creek’s product Numerous different timing scenarios and capital expenditure scenarios – all to be evaluated Synergies between our Northern PRB assets include: Additional coal and capacity to meet export demand Additional coal blending opportunities to meet domestic and export customer needs Timing of capex on Spring Creek mine LBAs in the future Combining development options to maximize loadout capacities and minimize capex Diversity of operating pits * As of 12/31/2011 |

|

|

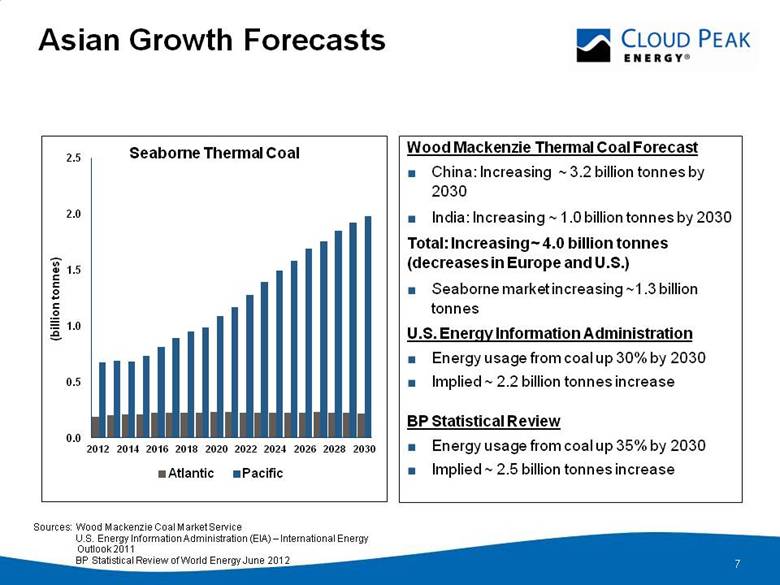

Asian Growth Forecasts 7 Wood Mackenzie Thermal Coal Forecast China: Increasing ~ 3.2 billion tonnes by 2030 India: Increasing ~ 1.0 billion tonnes by 2030 Total: Increasing ~ 4.0 billion tonnes (decreases in Europe and U.S.) Seaborne market increasing ~1.3 billion tonnes U.S. Energy Information Administration Energy usage from coal up 30% by 2030 Implied ~ 2.2 billion tonnes increase BP Statistical Review Energy usage from coal up 35% by 2030 Implied ~ 2.5 billion tonnes increase Seaborne Thermal Coal Sources: Wood Mackenzie Coal Market Service U.S. Energy Information Administration (EIA) – International Energy Outlook 2011 BP Statistical Review of World Energy June 2012 |

|

|

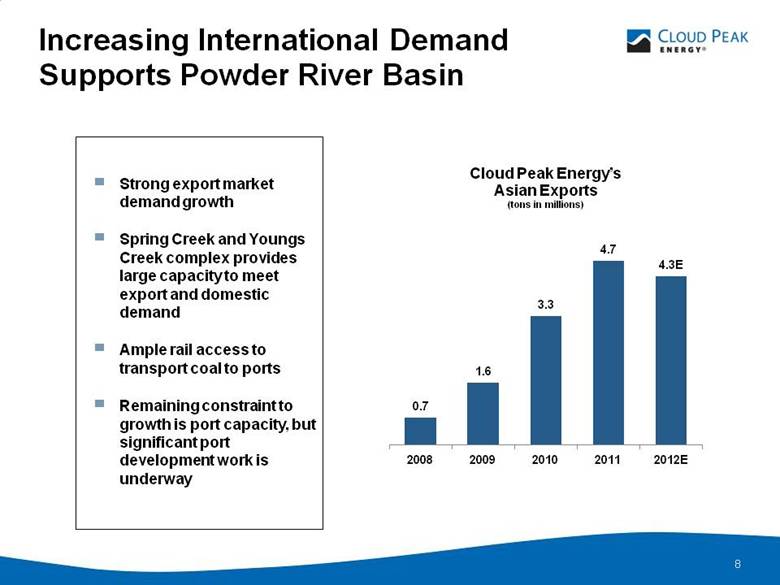

8 Increasing International Demand Supports Powder River Basin 8 8 Strong export market demand growth Spring Creek and Youngs Creek complex provides large capacity to meet export and domestic demand Ample rail access to transport coal to ports Remaining constraint to growth is port capacity, but significant port development work is underway |

|

|

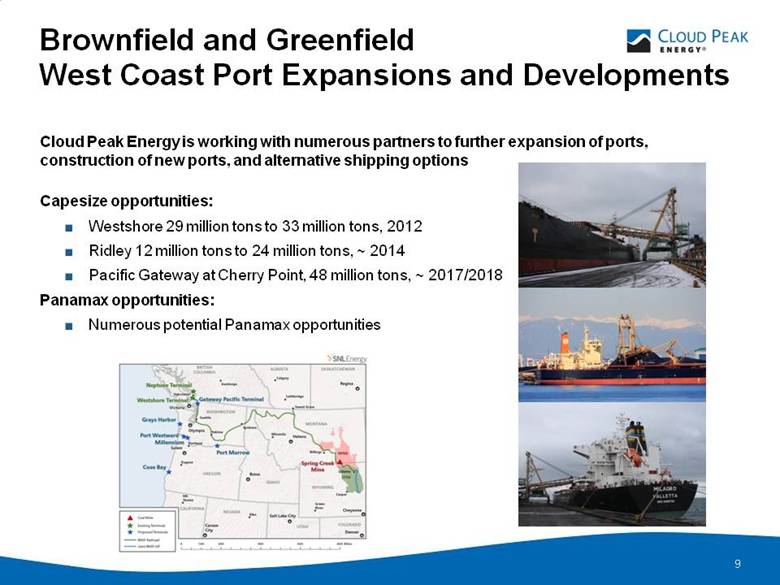

9 Brownfield and Greenfield West Coast Port Expansions and Developments 9 9 Capesize opportunities: Westshore 29 million tons to 33 million tons, 2012 Ridley 12 million tons to 24 million tons, ~ 2014 Pacific Gateway at Cherry Point, 48 million tons, ~ 2017/2018 Panamax opportunities: Numerous potential Panamax opportunities Cloud Peak Energy is working with numerous partners to further expansion of ports, construction of new ports, and alternative shipping options |

|

|

10 Spring Creek and Youngs Creek – Geographic Advantage Spring Creek and Youngs Creek to Westshore ~1,600 miles, approximately 200 miles closer than SPRB |

|

|

Spring Creek and Youngs Creek – Export Quality Advantage 11 Coal quality 9,220 – 9,350 Btu Converts to 4,780 – 4,850 kcal/kg NAR Premium subbituminous coal in the international market 11 4780 – 4850 4544 Average Source: Company estimates |

|

|

12 Strategic Fit and Prudent Investment 12 12 Premier export focused coal assets – geographic and quality advantages over SPRB Spring Creek and Youngs Creek complex adds value to existing Spring Creek operations and development options Acquisition compares favorably with SPRB LBA pricing Well positioned to meet rapidly growing Asian demand Working to create additional export terminal opportunities Evaluate options to develop Spring Creek and Youngs Creek as ports are developed Continued strong balance sheet and low liabilities |