Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - CLOUD PEAK ENERGY INC. | a2202182zex-31_1.htm |

| EX-32.2 - EX-32.2 - CLOUD PEAK ENERGY INC. | a2202182zex-32_2.htm |

| EX-32.1 - EX-32.1 - CLOUD PEAK ENERGY INC. | a2202182zex-32_1.htm |

| EX-31.2 - EX-31.2 - CLOUD PEAK ENERGY INC. | a2202182zex-31_2.htm |

| EX-23.1 - EX-23.1 - CLOUD PEAK ENERGY INC. | a2202182zex-23_1.htm |

| EX-23.2 - EX-23.2 - CLOUD PEAK ENERGY INC. | a2202182zex-23_2.htm |

| EX-21.1 - EX-21.1 - CLOUD PEAK ENERGY INC. | a2202182zex-21_1.htm |

| EX-10.48 - EX-10.48 - CLOUD PEAK ENERGY INC. | a2202182zex-10_48.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number: 001-34547

Cloud Peak Energy Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

26-3088162 (I.R.S. Employer Identification No.) |

|

505 S. Gillette Ave., Gillette, Wyoming (Address of principal executive offices) |

82716 (Zip Code) |

(307) 687-6000

(Registrant's telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities

Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No ý

As of June 30, 2010, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $418 million based on the closing price of the registrant's common stock as reported that day on the New York Stock Exchange of $13.26 per share. In determining this figure, the registrant has assumed that all of its directors and executive officers are affiliates. Such assumptions should not be deemed conclusive for any other purpose.

Number of shares outstanding of each of the registrant's classes of common stock, as of January 31, 2011: common stock, par value $0.01 per share 60,877,517 shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement to be filed with the Securities and Exchange Commission in connection with the registrant's 2011 annual meeting of stockholders (the "Proxy Statement") are incorporated by reference into Part III hereof. Other documents incorporated by reference in this report are listed in the Exhibit Index of this Form 10-K.

i

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by forward-looking words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "should," "will," "would" or similar words. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. There may be events in the future, however, that we are not able to predict accurately or control. The factors listed under "Risk Factors," as well as any cautionary language in this report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Additional factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

- •

- future economic conditions;

- •

- the contract prices we receive for coal and our customers' ability to honor contract terms;

- •

- market demand for domestic and foreign coal, electricity and steel;

- •

- safety and environmental laws and regulations, including those directly affecting our coal mining and production, and

those affecting our customers' coal usage, gaseous emissions or ash handling as well as related costs and liabilities;

- •

- future legislation, changes in regulations or governmental policies or changes in interpretations thereof, and third-party

regulatory challenges, including with respect to carbon emissions, safety standards and regulatory processes and approvals required to lease and obtain permits for coal mining operations or to

transport coal to domestic and foreign customers;

- •

- our ability to produce coal at existing and planned volumes and costs;

- •

- the availability and cost of coal reserve acquisitions and surface rights and our ability to successfully acquire new coal

reserves and surface rights at attractive prices and in a timely manner;

- •

- the impact of our initial public offering, related transactions and recent secondary offering, including resulting tax

implications and changes to our valuation allowance on our deferred tax assets;

- •

- our assumptions regarding payments arising under the Tax Receivable Agreement and other agreements related to our initial

public offering;

- •

- our plans and objectives for future operations and the development of additional coal reserves or acquisition

opportunities;

- •

- our relationships with, and other conditions affecting, our customers, including economic conditions and the credit

performance and credit risks associated with our customers;

- •

- timing of reductions or increases in customer coal inventories;

- •

- risks inherent to surface coal mining;

- •

- weather conditions or catastrophic weather-related damage;

- •

- changes in energy policy;

1

- •

- competition;

- •

- the availability and cost of competing energy resources, including changes in the price of crude oil and natural gas

generally, as well as subsidies to encourage use of alternative energy sources;

- •

- railroad, export terminal capacity and other transportation performance, costs and availability;

- •

- disruptions in delivery or changes in pricing from third-party vendors of raw materials and other consumables which are

necessary for our operations, such as explosives, petroleum-based fuel, tires, steel and rubber;

- •

- our assumptions concerning coal reserve estimates;

- •

- the terms of Cloud Peak Energy Resources LLC's indebtedness;

- •

- changes in costs that we incur as a stand-alone, public company as compared to our expectations;

- •

- inaccurately estimating the costs or timing of our reclamation and mine closure obligations;

- •

- liquidity constraints, including those resulting from the cost or unavailability of financing due to credit market

conditions;

- •

- our liquidity, results of operations and financial condition, including amounts of working capital that are available; and

- •

- other factors, including those discussed in "Risk Factors."

2

GLOSSARY FOR SELECTED MINING TERMS

Anthracite. Anthracite is the highest rank coal. It is hard, shiny (or lustrous), has a high heat content and little moisture. Anthracite is used in residential and commercial heating as well as a mix of industrial applications. Some waste products from anthracite piles are used in energy generation.

Appalachian region. Coal producing area in Alabama, eastern Kentucky, Maryland, Ohio, Pennsylvania, Tennessee, Virginia and West Virginia. The Appalachian region is divided into the northern, central and southern Appalachian regions.

Ash. Inorganic material consisting of iron, alumina, sodium and other incombustible matter that are contained in coal. The composition of the ash can affect the burning characteristics of coal.

Assigned reserves. Reserves that are committed to our surface mine operations with operating mining equipment and plant facilities. All our reported reserves are considered to be assigned reserves.

Bituminous coal. The most common type of coal that is between sub-bituminous and anthracite in rank. Bituminous coals produced from the central and eastern U.S. coal fields typically have moisture content less than 20% by weight and heating value of 10,500 to 14,000 Btus.

BLM. Department of the Interior, Bureau of Land Management.

BNSF. Burlington Northern Santa Fe Railroad.

British thermal unit,or "Btu." A measure of the thermal energy required to raise the temperature of one pound of pure liquid water one degree Fahrenheit at the temperature at which water has its greatest density (39 degrees Fahrenheit).

CAIR. Clean Air Interstate Rule.

Carbon dioxide, or CO2. A gaseous chemical compound that is generated as a by-product of the combustion of fossil fuels, including coal, or the burning of vegetable matter, among other process.

Coal seam. Coal deposits occur in layers typically separated by layers of rock. Each layer is called a "seam." A coal seam can vary in thickness from inches to a hundred feet or more.

Coalbed methane. Also referred to as CBM or coalbed natural gas (CBNG). Coalbed methane is methane gas formed during the coalification process and stored within the coal seam.

Coke. A hard, dry carbon substance produced by heating coal to a very high temperature in the absence of air. Coke is used in the manufacture of iron and steel.

Compliance coal. Coal that when combusted emits no greater than 1.2 pounds of sulfur dioxide per million Btus and requires no blending or sulfur-reduction technology to comply with current sulfur dioxide emissions under the Clean Air Act.

Dragline. A large excavating machine used in the surface mining process to remove overburden. A dragline has a large bucket suspended from the end of a boom, which may be 275 feet long or larger. The bucket is suspended by cables and capable of scooping up significant amounts of overburden as it is pulled across the excavation area. The dragline, which can "walk" on large pontoon-like "feet," is one of the largest land-based machines in the world.

EIA. Energy Information Administration.

EIS. Environmental impact statement.

3

Force majeure. An event not anticipated as of the date of the applicable contract, which is not within the reasonable control of the party affected by such event, which partially or entirely prevents such party's ability to perform its contractual obligations. During the duration of such force majeure but for no longer period, the obligations of the party affected by the event may be excused to the extent required.

Fossil fuel. A hydrocarbon such as coal, petroleum or natural gas that may be used as a fuel.

GW. Gigawatts.

Highwalls. The unexcavated face of exposed overburden and coal in a surface mine.

Incident rate or IR. The rate of injury occurrence, as determined by the Mine Safety and Health Administration, or MSHA, based on 200,000 hours of employee exposure and calculated as follows:

IR = (number of cases × 200,000) / hours of employee exposure.

LBA. Lease by Application. Before a mining company can obtain new coal leases on federal land, the company must nominate lands for lease. The Bureau of Land Management, or BLM, then reviews the proposed tract to ensure maximum coal recovery. It also requires completion of a detailed environmental assessment or an environmental impact statement, and then schedules a competitive lease sale. Lease sales must meet fair market value as determined by the BLM. The process is known as Lease by Application. After a lease is awarded, the BLM also has the responsibility to assure development of the resource is conducted in a fashion that achieves maximum economic recovery.

LBM. Lease by Modification. A process of acquiring federal coal through a non-competitive leasing process. An LBM is used in circumstances where a lessee is seeking to modify an existing federal coal lease by adding less than 960 acres in a configuration that is deemed non-competitive to other coal operators.

Lbs SO2/mmBtu. Pounds of sulfur dioxide emitted per million Btu of heat generated.

Lignite. The lowest rank of coal. It is brownish-black with a high moisture content commonly above 35% by weight and heating value commonly less than 8,000 Btu.

LMU. Logical Mining Unit. A combination of contiguous federal coal leases that allows the production of coal from any of the individual leases within the LMU to be used to meet the continuous operation requirements for the entire LMU.

Metallurgical coal. The various grades of coal suitable for carbonization to make coke for steel manufacture. Also known as "met" coal, it possesses four important qualities: volatility, which affects coke yield; the level of impurities, which affects coke quality; composition, which affects coke strength; and basic characteristics, which affect coke oven safety. Metallurgical coal has a particularly high Btu, but low ash content.

MSHA. Mine Safety and Health Administration.

NAAQ. National Ambient Air Quality.

NOx. Nitrogen oxides. NOx represents both nitrogen dioxide (NO2) and nitrogen trioxide (NO3) , which are gases formed in high temperature environments, such as coal combustion. It is a harmful pollutant that contributes to acid rain and is a precursor of ozone.

Non-reserve coal deposits. Non-reserve coal deposits are coal bearing bodies that have been sufficiently sampled and analyzed in trenches, outcrops, drilling and underground workings to assume continuity between sample points, and therefore warrant further exploration work. However, this coal

4

does not qualify as commercially viable coal reserves as prescribed by the Securities and Exchange Commission, or SEC, standards until a final comprehensive evaluation based on unit cost per ton, recoverability and other material factors concludes legal and economic feasibility. Non-reserve coal deposits may be classified as such by either limited property control or geologic limitation, or both.

QSO. Qualified Surface Owner. A status attributed by the BLM to a certain class of surface owners of split estate lands which allows the QSO to prohibit leasing of federal coal without their explicit consent.

Overburden. Layers of earth and rock covering a coal seam. In surface mining operations, overburden is removed prior to coal extraction.

PRB. Powder River Basin. Coal producing area in northeastern Wyoming and southeastern Montana.

Preparation plant. Usually located on a mine site, although one plant may serve several mines. A preparation plant is a facility for crushing, sizing and washing coal to prepare it for use by a particular customer. The washing process separates higher ash coal and may also remove some of the coal's sulfur content.

Probable reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Proven reserves. Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

Reclamation. The process of restoring land to its prior condition, productive use or other permitted condition following mining activities. The process commonly includes "recontouring" or reshaping the land to its approximate original appearance, restoring topsoil and planting native grass and shrubs. Reclamation operations are typically conducted concurrently with mining operations. Reclamation is closely regulated by both state and federal laws.

Reserve. That part of a mineral deposit that could be economically and legally extracted or produced at the time of the reserve determination.

Riparian habitat. Areas adjacent to rivers and streams with a differing density, diversity and productivity of plant and animal species relative to nearby uplands.

Riverine habitat. A habitat occurring along a river.

Scrubber. Any of several forms of chemical physical devices which operate to control sulfur compounds formed during coal combustion. An example of a scrubber is a flue gas desulfurization unit.

SMCRA. Surface Mining Control and Reclamation Act of 1977.

Spoil-piles. Pile used for any dumping of waste material or overburden material, particularly used during the dragline method of mining.

5

Steam coal. Coal used by power plants and industrial steam boilers to produce electricity or process steam. It generally is lower in Btu heat content and higher in volatile matter than metallurgical coal.

Sub-bituminous coal. Black coal that ranks between lignite and bituminous coal. Sub-bituminous coal produced from the PRB has a moisture content between 20% to over 30% by weight, and its heat content ranges from 8,000 to 9,500 Btus.

Sulfur. One of the elements present in varying quantities in coal that contributes to environmental degradation when coal is burned. Sulfur dioxide (SO2) is produced as a gaseous by-product of coal combustion.

Sulfur dioxide emission allowance. A tradable authorization to emit sulfur dioxide. Under Title IV of the Clean Air Act, one allowance permits the emission of one ton of sulfur dioxide.

Surface mine. A mine in which the coal lies near the surface and can be extracted by removing the covering layer of soil overburden. Surface mines are also known as open-pit mines.

Tons. A "short" or net ton is equal to 2,000 pounds. A "long" or British ton is 2,240 pounds. A "metric" tonne is approximately 2,205 pounds. The short ton is the unit of measure referred to in this document.

Truck-and-shovel mining. Similar forms of mining where large shovels or front-end loaders are used to remove overburden, which is used to backfill pits after the coal is removed. Smaller shovels load coal in haul trucks for transportation to the preparation plant or rail loading facilities.

Union Pacific or UP. Union Pacific Railroad.

Note: In this document, unless the context otherwise requires, references to:

- •

- "Cloud Peak Energy," "we,"

"us," "our" or the "Company" refer collectively to Cloud

Peak Energy Inc., a Delaware corporation, which was incorporated on July 31, 2008 in preparation for an initial public offering, and its consolidated subsidiary, CPE Resources, together

with the businesses that CPE Resources operates;

- •

- "CPE Resources" refers to Cloud Peak Energy Resources LLC, a

Delaware limited liability company, formerly known as Rio Tinto Sage LLC, which is the operating company for our business, and of which Cloud Peak Energy Inc. is the sole member;

- •

- "IPO Structuring Agreements" refers to the following agreements entered

into in connection with our initial public offering: The master separation agreement, the acquisition agreement, the assignment agreement, the agency contract, the promissory note, the employee

matters agreement, the escrow agreement, the CPE Resources limited liability company agreement, the management services agreement, registration rights agreement, the Rio Tinto Energy America coal

supply agreement, the software license agreement, the tax receivable agreement, the trademark assignment agreement, the trademark license agreement, and the transition services agreement. For a

description of our agreements with Rio Tinto and its affiliates, refer to the information included under the caption Certain Relationships and Related Transactions in our Proxy Statement to be

distributed to our stockholders in connection with our 2011 annual meeting. We refer generally to the transactions we entered into in connection with these IPO Structuring Agreements as IPO

structuring transactions or structuring transactions. See "Initial Public Offering, Related IPO Structuring Transactions, and Secondary Offering" in Note 2 of Notes to Consolidated Financial

Statements in Item 8; and

- •

- "Rio Tinto" refers to Rio Tinto plc and Rio Tinto Limited and their direct and indirect subsidiaries, including Rio Tinto Energy America Inc. ("RTEA"), our predecessor for accounting purposes; Kennecott Management Services Company ("KMS"); and Rio Tinto America Inc. ("RTA"), which is the owner of RTEA and KMS.

6

Overview

Cloud Peak Energy Inc. is the third largest producer of coal in the U.S. and in the Powder River Basin, or PRB, based on our 2010 coal production of 95.3 million tons. We had revenues from our continuing operations of $1.4 billion in 2010. We operate some of the safest mines in the industry. According to Mine Safety and Health Administration, or MSHA, data, in 2010 we had one of the lowest employee all injury incident rate among the ten largest U.S. coal producing companies. We operate solely in the PRB, the lowest cost coal producing region of the major coal producing regions in the U.S., and operate two of the four largest coal mines in the region and in the U.S. Our operations include three wholly-owned surface coal mines, two of which are in Wyoming and one of which is in Montana. We also own a 50% interest in a fourth surface coal mine in Montana. We produce sub-bituminous steam coal with low sulfur content and sell our coal primarily to domestic electric utilities, supplying approximately 47 customers with over 108 domestic plants. We do not produce any metallurgical coal. Steam coal is primarily consumed by electric utilities and industrial consumers as fuel for electricity generation. In 2010, the coal we produced generated approximately 4% of the electricity produced in the U.S. As of December 31, 2010, we controlled approximately 970 million tons of proven and probable reserves.

Cloud Peak Energy Inc., a Delaware corporation organized on July 31, 2008, is a holding company that manages its wholly-owned consolidated subsidiary CPE Resources, but has no business operations or material assets other than its ownership interest as of December 31, 2010 of 100% of the common membership units in CPE Resources as discussed more fully in "History" below. Our only source of cash flow from operations will be distributions from CPE Resources pursuant to the CPE Resources limited liability company agreement. We also receive management fees pursuant to a management services agreement between us and CPE Resources as reimbursement of certain administrative expenses.

History

Our business operations are conducted by CPE Resources, formerly known as Rio Tinto Sage LLC, a Delaware limited liability company formed as a wholly-owned subsidiary of RTEA on August 19, 2008. RTEA is our predecessor for accounting purposes. RTEA, a Delaware corporation, formerly known as Kennecott Coal Company, was formed as a wholly-owned subsidiary of Rio Tinto America on March 1, 1993. Between 1993 and 1998, RTEA acquired the Antelope, Colowyo, Jacobs Ranch and Spring Creek coal mines and the Cordero and Caballo Rojo coal mines, which are operated together as the Cordero Rojo coal mine, and a 50% interest in the Decker coal mine, which is operated by a third-party mine operator. In December 2008, RTEA contributed Rio Tinto America's western U.S. coal business to CPE Resources (other than the Colowyo mine, which is now owned indirectly by Rio Tinto America). On October 1, 2009, CPE Resources sold the Jacobs Ranch mine to Arch Coal, Inc. and distributed the proceeds to Rio Tinto. On November 19, 2009, Cloud Peak Energy Inc. acquired from RTEA approximately 51.0% of the common membership units in CPE Resources in exchange for a promissory note and the SEC declared effective Cloud Peak Energy Inc.'s Registration Statement on Form S-1 (File No. 333-161293) for its initial public offering, or IPO. As a result of these transactions, Cloud Peak Energy Inc. became the sole managing member of CPE Resources with a controlling interest in CPE Resources and its subsidiaries. Cloud Peak Energy Inc. used the proceeds from the IPO to repay the promissory note upon the completion of the IPO on November 25, 2009.

On December 15, 2010, Cloud Peak Energy Inc. priced a secondary offering of 29,400,000 shares of its common stock on behalf of Rio Tinto (the "Secondary Offering"). In connection with the

7

Secondary Offering, we exchanged 29,400,000 shares of common stock for the common membership units of CPE Resources held by Rio Tinto and completed the Secondary Offering, resulting in a divestiture of 100% of Rio Tinto's holdings in CPE Resources. As a result of this transaction, CPE Resources is now a wholly-owned subsidiary of Cloud Peak Energy Inc.

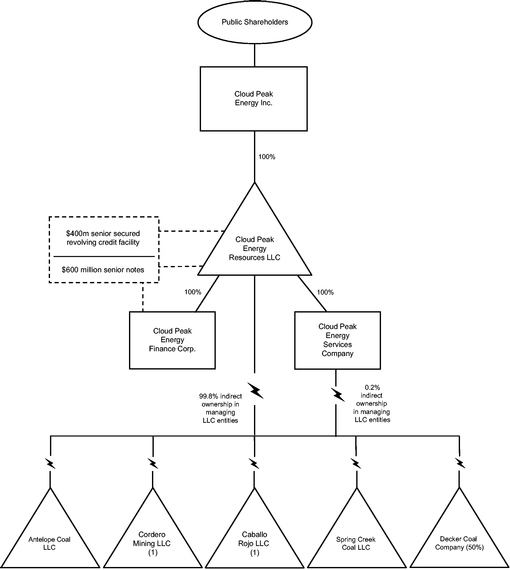

The following condensed diagram depicts our organizational structure as of December 31, 2010:

- (1)

- Operated together as the Cordero Rojo mine.

Coal Characteristics

In general, coal of all geological compositions is characterized by end use. Heat value and sulfur content are the most important variables in the profitable marketing and transportation of steam coal. We mine, process and market low sulfur content, sub-bituminous steam coal, the characteristics of which are described below. Because we operate only in the PRB, which does not have metallurgical coal, we produce only steam coal.

8

Heat Value

The heat value of coal is commonly measured in British thermal units, or "Btus." Sub-bituminous coal from the PRB has a typical heat value that ranges from 8,000 to 9,500 Btus. Sub-bituminous coal from the PRB is used primarily by electric utilities and by some industrial customers for steam generation. Coal found in other regions in the U.S., including the eastern and midwestern regions, tends to have a higher heat value than coal found in the PRB.

Sulfur Content

Federal and state environmental regulations, including regulations that limit the amount of sulfur dioxide that may be emitted as a result of combustion, have affected and may continue to affect the demand for certain types of coal. The sulfur content of coal can vary from seam to seam and within a single seam. The chemical composition and concentration of sulfur in coal affects the amount of sulfur dioxide produced in combustion. Coal-fired power plants can comply with sulfur dioxide emissions regulations by burning coal with low sulfur content, blending coals with various sulfur contents, purchasing emission allowances on the open market and/or using sulfur-reduction technology. PRB coal typically has a lower sulfur content than eastern U.S. coal and generally emits no greater than 0.8 pounds of sulfur dioxide per million Btus. All of our reserves are compliance coal under the Clean Air Act.

Higher sulfur noncompliance coal can be burned in plants equipped with sulfur-reduction technology, such as scrubbers, which can reduce sulfur dioxide emissions by up to 90%, and in facilities that blend compliance and noncompliance coal. In 2009, out of utilities with a coal generating capacity of approximately 314 GW, utilities accounting for a capacity of over 168 GW had been retrofitted with scrubbers. Furthermore, all new coal-fired generation plants built in the U.S. are expected to use some type of sulfur-reduction technology. The demand or price for lower sulfur coal may decrease with widespread implementation of sulfur-reduction technology.

Other

Ash is the inorganic residue remaining after the combustion of coal. As with sulfur content, ash content varies from seam to seam. Ash content is an important characteristic of coal because it impacts boiler performance and electric generating plants must handle and dispose of ash following combustion. The ash content of PRB coals is generally low, representing approximately 5% to 10% by weight. The composition of the ash, including the proportion of sodium oxide, as well as the ash and fusion temperatures are important characteristics of coal and help determine the suitability of the coal to end users. In limited cases, customer requirements at the Spring Creek mine have required, and may continue to require, the addition of earthen materials to dilute the sodium oxide content of the post-combustion ash of the coal.

Moisture content of coal varies by the type of coal and the region where it is mined. In general, high moisture content is associated with lower heat values and generally makes the coal more expensive to transport. Moisture content in coal, on an as-sold basis, can range from approximately 2% to over 35% of the coal's weight. PRB coals have typical moisture content of 25% to 35%.

Trace elements within coal that are of primary concern are mercury, for health and environmental reasons, and chlorine, for utility plant performance. Trace elements of mercury and chlorine in PRB coal are relatively low compared to other coal regions. However, the low chlorine content of PRB coal is associated with the emission of elemental mercury, which is difficult to remove with conventional pollution control devices.

9

Coal Mining Methods

Surface Mining

All of our mines are surface mining operations utilizing both dragline and truck-and-shovel mining methods. Surface mining is used when coal is found relatively close to the surface. Surface mining typically involves the removal of topsoil, and drilling and blasting the overburden (earth and rock covering the coal) with explosives. The overburden is then removed with draglines, trucks, shovels and dozers. Trucks and shovels then remove the coal. The final step involves replacing the overburden and topsoil after the coal has been excavated, reestablishing vegetation and plant life into the natural habitat and making other changes designed to provide local community benefits. We typically recover 92% or more of the economic coal seam for the mines we operate.

Coal Preparation and Blending

Depending on coal quality and customer requirements, in almost all cases the coal from our mines is crushed and shipped directly from our mines to the customer. Typically, no other preparation is needed for a saleable product. However, depending on the specific quality characteristics of the coal and the needs of the customer, blending different types of coals may be required at the customer's plant. Coals of various sulfur and ash contents can be mixed or "blended" to meet the specific combustion and environmental needs of customers. All of our coal can be blended with coal from other coal producers. Spring Creek's location and the high Btu content of its coal make its coal better suited than our other products for export and transportation to the northeastern U.S. coal markets for blending by the customer with coal sourced from other markets to achieve a suitable overall product.

Mining Operations

We operate solely in the PRB. Two of the mines we operate are located in Wyoming and one is located in Montana. We also own a 50% non-operating interest in the Decker mine, which is located in Montana and operated by a third-party mine operator. We currently own the majority of the equipment utilized in our mining operations, excluding the Decker mine. We employ preventative maintenance and rebuild programs and upgrade our equipment as part of our efforts to ensure that it is productive, well-maintained and cost-competitive. Our maintenance programs also utilize procedures designed to enhance the efficiencies of our operations. The following table provides summary information regarding our mines as of December 31, 2010.

| |

|

|

|

|

|

Tons Sold (in millions) |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

2010 As Delivered Average | |||||||||||||||||||||||

| |

Annual Maximum Production Capacity(1) |

||||||||||||||||||||||||

Mine

|

Btu per lb |

Ash Content(2) |

Sulfur Content | 2010 | 2009 | 2008 | |||||||||||||||||||

| |

(million tons) |

|

(%) |

(%) |

(lbs SO2/mmBtu) |

(million tons) |

|||||||||||||||||||

Antelope |

42 | 8,858 | 5.4 | 0.26 | 0.59 | 35.9 | 34.0 | 35.8 | |||||||||||||||||

Cordero Rojo |

65 | 8,389 | 5.4 | 0.31 | 0.74 | 38.5 | 39.3 | 40.0 | |||||||||||||||||

Spring Creek |

24 | 9,262 | 5.2 | 0.32 | 0.69 | 19.3 | 17.6 | 17.9 | |||||||||||||||||

Decker(3) |

16 | 9,482 | 4.5 | 0.42 | 0.89 | 1.5 | 2.3 | 3.3 | |||||||||||||||||

Other(4) |

N/A | N/A | N/A | N/A | N/A | 1.7 | 10.1 | 8.1 | |||||||||||||||||

Total |

96.9 | 103.3 | 105.1 | ||||||||||||||||||||||

- (1)

- Based

on the respective mine's current air quality permit restrictions.

- (2)

- Post-combustion ash from Spring Creek coal contains an average of approximately 8% sodium oxide. Earthen materials can be selectively blended with the coal within the crushing facility to

10

reduce the post-combustion sodium level and enable the production of a range of products tailored for customers requiring lower sodium levels.

- (3)

- Tons

sold numbers reflect our 50% interest in the Decker mine.

- (4)

- The tonnage shown for "Other" represents our purchases from third-party sources that we have resold, including coal we have purchased and resold from the Jacobs Ranch mine, which our predecessor used to own. See "—Customers and Coal Contracts—Broker Sales and Third-Party Sources."

All of our operations utilize dragline and truck-and-shovel mining methods. Our Antelope and Cordero Rojo mines are served by the BNSF and UP railroads. Our Spring Creek mine and the Decker mine are served solely by the BNSF railroad.

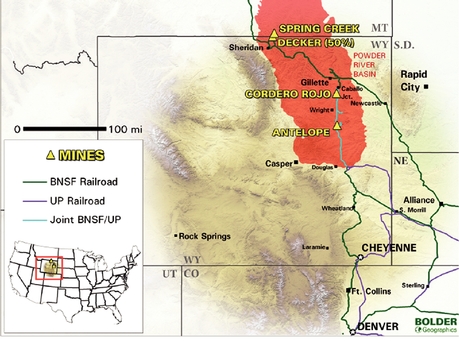

The following map shows the locations of our mining operations:

Antelope Mine

The Antelope mine is located in the southern end of the PRB approximately 60 miles south of Gillette, Wyoming. The mine extracts steam coal from the Anderson and Canyon Seams, with up to 44 and 36 feet, respectively, in thickness. We have nominated as an LBA, a large coal tract adjacent to our existing operation. The BLM will determine if the tract will be leased, and if so, the final boundaries of, and the coal tonnage for, this tract. Acquisition of this tract would facilitate access to approximately 80 million tons of non-reserve coal deposits that we control. We currently expect the BLM will schedule this LBA for bid sometime in 2011, subject to the outcome of legal challenges filed in 2010 against the BLM and the Secretary of the Interior by environmental organizations with respect to the EIS and other matters associated with the West Antelope II LBA. Other potential large areas of unleased coal north and west of the mine are available for nomination by us or other mining operations or persons.

11

Cordero Rojo Mine

The Cordero Rojo mine is located approximately 25 miles south of Gillette, Wyoming. The mine extracts steam coal from the Wyodak Seam, which ranges from approximately 55 to 70 feet in thickness. We have nominated as an LBA a large coal tract adjacent to our existing operation, which we now believe the BLM will schedule for lease in 2011 or 2012. The BLM will determine if the tract will be leased, and if so, the final boundaries of, and the coal tonnage for, this tract. Significant areas of unleased coal are potentially available for nomination by us or other mining operations or persons adjacent to our current operations.

Spring Creek Mine

The Spring Creek mine is located in Montana approximately 35 miles north of Sheridan, Wyoming. The mine extracts steam coal from the Anderson-Dietz Seam, which averages approximately 80 feet in thickness. The location of the mine relative to the Great Lakes is attractive to our customers in the northeast because of lower transportation costs. The location of the Spring Creek mine also provides access to export terminals in the Pacific northwest, providing an advantage relative to other PRB mines. As a result, interest from foreign buyers in coal from our Spring Creek mine continues, and, in 2010, we shipped approximately 3.3 million tons of Spring Creek coal through the Westshore terminal. In June 2010, we entered into a Modified Coal Lease (the "Lease Modification") with the BLM. The Lease Modification modified Coal Lease MTM-069782 (the "Existing Lease") and added approximately 48 million tons of proven and probable reserves to the Existing Lease.

Decker Mine

The Decker mine is located immediately to the southeast of our Spring Creek mine in Montana. We own a non-operating 50% interest in the mine. The Decker mine is a union based operation; however, we do not employ any of the Decker mine employees. A third party operates the Decker mine for us and the other 50% owner and markets the steam coal out of the Decker mine. There are two principal seams at West Decker, Dietz 1 and Dietz 2, with typical thicknesses of 51 and 16 feet, respectively, and three seams at East Decker, Dietz 1 Upper, Dietz 1 Lower and Dietz 2, with typical thicknesses of 27, 17 and 16 feet, respectively. In April 2010, the Decker mine entered into a coal sales contract that will extend production and mine life into 2013. The operator continues to seek commercial market opportunities for additional leased and permitted coal tonnage at the Decker mine.

Customers and Coal Contracts

We focus on building long-term relationships with customers through our reliable performance and commitment to customer service. We supply coal to over 47 electric utilities and over 91% of our sales were to customers with an investment grade credit rating as of December 31, 2010. Furthermore, over 72% of our 2010 sales were to customers with whom we have had relationships for more than 10 years.

Sales and Marketing

We have a team of experienced sales, marketing and customer service individuals. To help develop and maintain the relationships we have with our customers, we have divided the department into three teams:

- •

- Sales and Marketing, which focuses on traditional requests for proposals, constituting the majority of our sales;

- •

- Marketing and Pricing, which provides industry insight, recommends pricing strategies and participates in the spot market;

and

- •

- Customer Service, which provides contract and after-sales support to our customers.

As of December 31, 2010, we had 17 employees in our sales and marketing department.

12

Customers

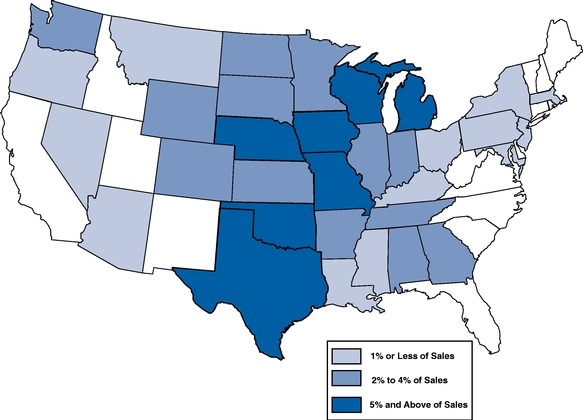

Our primary customers are domestic utility companies with over 108 plants primarily located in the mid-west and south central U.S. Our coal supplies fueled approximately 4% of the electricity generated in the U.S. in 2010. During 2010, approximately 49% of our revenues were derived from our top ten customers. No customer accounted for 10% or more of our revenues in 2010. The following map shows the percentage of our shipped tons of coal by state of destination during 2010 from coal produced at the three mines we own and operate. We also exported approximately 4% of the tons produced at these mines in 2010.

Long-term Coal Sales Agreements

As is customary in the coal industry, we generally enter into fixed price, fixed volume supply contracts of one- to five-year terms with many of our customers. Multiple year contracts usually have specific and possibly different volume and pricing arrangements for each year of the contract. As of December 31, 2010, approximately 64% of our committed tons were associated with contracts that had three years or more remaining on their term. Most of our supply contracts include a fixed price for the term of the agreement or a pre-determined escalation in price for each year. Some of our agreements that extend for a four- or five-year term or longer may include a variable pricing system. These contracts allow customers to secure a supply for their future needs and provide us with greater predictability of sales volume and sales price. For the year ended December 31, 2010, approximately 97% of our revenues were derived from long-term supply contracts with a term of one year or greater. While most of our sales contracts are for terms of one to five years, some are as short as one to six months, and other contracts have terms longer than ten years.

Our coal is primarily sold on a mine-specific basis to utility customers through a request-for-proposal process. The terms of our coal sales agreements result from competitive bidding and extensive negotiations with customers. Consequently, the terms of these contracts vary by customer,

13

including base price adjustment features, price re-opener terms, coal quality requirements, quantity parameters, permitted sources of supply, impact of future regulatory changes, extension options, force majeure, termination, assignment and other provisions.

Our supply contracts typically contain provisions to adjust the base price due to new statutes, ordinances or regulations that affect our costs related to performance of the agreement. Additionally, some of our contracts contain provisions that allow for the recovery of costs affected by modifications or changes in the interpretations or application of any applicable statute by local, state or federal government authorities. These provisions only apply to the base price of coal contained in these supply contracts. In some circumstances, a significant adjustment in base price can lead to termination of the contract.

Price re-opener and index provisions, which can be either renegotiated or based on a fixed formula, are present in certain contracts covering future tonnage commitments. These provisions may allow either party to commence a renegotiation of the contract price at a pre-determined time. Price re-opener provisions may automatically set a new price based on prevailing market price or, in some instances, require us to negotiate a new price, sometimes between a specified range of prices. In some agreements, if the parties do not agree on a new price, either party has an option to terminate the contract. Under some of our contracts, we have the right to match lower prices offered to our customers by other suppliers. In addition, some of our contracts contain clauses that may allow customers to terminate the contract in the event of certain changes in environmental laws and regulations.

Quality and volumes for the coal are stipulated in coal sales agreements. In most cases, the annual pricing and volume obligations are fixed, although, in some cases, the volume specified may vary depending on the quality of the coal. Some customers are allowed to vary the amount of coal taken under the contract. Most of our coal sales agreements contain provisions requiring us to deliver coal within certain ranges for specific coal characteristics, such as heat content, sulfur, ash and ash fusion temperature. Failure to meet these specifications can result in economic penalties, suspension or cancellation of shipments or termination of the contracts. Many of our contracts contain clauses that require us and our customers to maintain a certain level of creditworthiness or provide appropriate credit enhancement upon request. The failure to do so can result in a suspension of shipments under the contract.

Our coal sales agreements also typically contain force majeure provisions allowing temporary suspension of performance by us or our customers for the duration of specified events beyond the control of the affected party, including events such as strikes, adverse mining conditions, mine closures or serious transportation problems that affect us or unanticipated plant outages that may affect the buyer. Our contracts generally provide that in the event a force majeure circumstance exceeds a certain time period (e.g., 60-90 days), the unaffected party may have the option to terminate the transaction or transactions under the agreement. Some contracts stipulate that this tonnage can be made up by mutual agreement or at the discretion of the buyer.

Agreements between our customers and the railroads servicing our mines may also contain force majeure provisions. Generally, our coal sales agreements allow our customer to suspend performance in the event that the railroad fails to provide its services due to circumstances that would constitute a force majeure.

In some of our contracts, we have a right of substitution, allowing us to provide coal from different mines, including third-party mines, as long as the replacement coal meets quality specifications and will be sold at the same delivered cost.

Generally, under the terms of our coal sales agreements, we agree to indemnify or reimburse our customers for damage to their or their rail carrier's equipment while on our property, other than from

14

their own negligence, and for damage to our customer's equipment due to non-coal materials being included with our coal before leaving our property.

Broker Sales and Third-Party Sources

From time to time, we purchase coal through brokers to cover any shortfalls under our supply agreements and sell to brokers any excess produced coal.

Our subsidiary, Spring Creek Coal LLC, was a party to a broker sales contract under which it had agreed to sell purchased coal to a wholesale power generation company. In 1978, our Spring Creek subsidiary entered into a long-term coal sales contract to underpin the establishment of the Spring Creek mine. When we acquired the Spring Creek mine in 1993, the contract had been amended to allow the mine to meet its delivery requirements from long-term purchase contracts entered into with two separate mines (one of which was the Jacobs Ranch mine which we subsequently acquired in 1998 and sold in 2009). Due to the nature of the broker sales contract and the market conditions at the time the respective agreements were all executed, our selling price for the coal was higher than our purchasing price. Under this contract, we sold approximately 6.8 million tons per year. This broker sales contract contributed $13.7 million of revenues in 2010. The contract expired following final deliveries under the contract in the first quarter of 2010. See Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations—Overview."

For delivery during the year ended December 31, 2010, we purchased 1.7 million tons through brokers and third-party sources.

Transportation

Transportation can be one of the largest components of a purchaser's total cost. Coal used for domestic consumption is generally sold free on board (FOB) at the mine or nearest loading facility, and the purchaser of the coal normally bears the transportation costs and risk of loss in the event of a problem. Most electric generators arrange long-term shipping contracts with rail or barge companies to assure stable delivery costs. Our mines are served by the BNSF and UP railways. In limited circumstances, we sell coal on a delivered basis where we arrange and pay for the freight and charge our customers on a cost plus basis for this service.

Suppliers

Principal supplies used in our business include heavy mobile equipment, petroleum-based fuels, explosives, tires, steel and other raw materials, as well as spare parts and other consumables used in the mining process. We use third-party suppliers for a portion of our equipment rebuilds and repairs, drilling services and construction. We use sole source suppliers for certain parts of our business such as dragline shovel parts and services and tires. We believe adequate substitute suppliers are available. For further discussion of our suppliers, see Item 1A "Risk Factors—Risks Related to Our Business and Industry—Increases in the cost of supplies, or the inability to obtain a sufficient quantity of those supplies, could increase our operating expenses, disrupt or delay our production and materially and adversely affect our profitability."

We historically relied on various Rio Tinto supply contracts to obtain some of our key consumables. Since our November 2009 IPO, we are not a party to any Rio Tinto supply contracts other than those transferred to us as part of the IPO. While some of our heavy mobile equipment supplies and equipment are still being delivered under purchase orders entered into prior to our IPO, in particular certain heavy mobile equipment and tires, we have since entered into new supply contracts to replace the Rio Tinto supply contracts.

15

Competition

The coal industry is highly competitive. We compete directly with all coal producers and indirectly with other energy producers throughout the U.S. and, for our export sales, internationally. The most important factors on which we compete with other coal producers are coal price, coal quality and characteristics, costs incurred by our customers to transport the coal, customer service and the reliability of supply. Demand for coal and the prices that we will be able to obtain for our coal are closely linked to coal consumption patterns of the domestic electric generation industry and international consumers. These coal consumption patterns are influenced by factors beyond our control, including the supply and demand for domestic and foreign electricity, domestic and foreign governmental regulations and taxes, environmental and other regulatory changes, technological developments, the price and availability of other fuels, such as natural gas and crude oil, and the availability, and subsidies designed to encourage greater use of, alternative energy sources, including hydroelectric, nuclear, wind and solar power, all of which can decrease demand for coal.

Because most of the coal in the vicinity of our mines is owned by the U.S. federal government, we compete with other coal producers operating in the PRB for additional coal through the LBA process. This process is competitive and we expect the competition for LBAs to remain strong.

Employees

As of December 31, 2010, we had 1,524 full-time employees. None of our employees are currently parties to collective bargaining agreements. We hold a 50% interest in the Decker mine in Montana, which is a union-based operation operated by a third-party mine operator. However, we do not employ any of the Decker mine employees. We believe that we have good relations with our employees. As of December 31, 2010, we had 250 external contractors, on a full-time equivalent basis.

Executive Officers of the Company

Set forth below is information concerning our current executive officers.

Name

|

Age | Position(s) | |||

|---|---|---|---|---|---|

| Colin Marshall | 46 | President, Chief Executive Officer and Director | |||

| Michael Barrett | 42 | Executive Vice President and Chief Financial Officer | |||

| Gary Rivenes | 40 | Executive Vice President and Chief Operating Officer | |||

| Cary Martin | 58 | Senior Vice President, Human Resources | |||

| Todd Myers | 47 | Senior Vice President, Business Development | |||

| James Orchard | 50 | Senior Vice President, Marketing and Government Affairs | |||

| Bryan Pechersky | 40 | Senior Vice President and General Counsel | |||

| A. Nick Taylor | 60 | Senior Vice President, Technical Services | |||

| Heath Hill | 40 | Vice President and Chief Accounting Officer | |||

Colin Marshall has served as our President, Chief Executive Officer and a director since July 2008. Previously, he served as the President and Chief Executive Officer of Rio Tinto Energy America Inc. ("RTEA"), an indirect subsidiary of Rio Tinto plc and the former parent company of Cloud Peak Energy Resources LLC, from June 2006 until November 2009. From March 2004 to May 2006, Mr. Marshall served as General Manager of Rio Tinto's Pilbara Iron's west Pilbara iron ore operations in Tom Price, West Australia, from June 2001 to March 2004, he served as General Manager of RTEA's Cordero Rojo mine in Wyoming and from August 2000 to June 2001, he served as Operations Manager of RTEA's Cordero Rojo mine. Mr. Marshall worked for Rio Tinto plc in London as an analyst in the Business Evaluation Department from 1992 to 1996. From 1996 to 2000, he was Finance Director of the Rio Tinto Pacific Coal business unit based in Brisbane Australia. Mr. Marshall received his

16

bachelor of engineering degree and his master's degree in mechanical engineering from Brunel University and his master of business administration from the London Business School.

Michael Barrett has served as our Executive Vice President and Chief Financial Officer since September 2008. Previously, he served as Chief Financial Officer of RTEA from April 2007 until November 2009, and as Acting Chief Financial Officer of RTEA from January 2007 to March 2007. From November 2004 to April 2007, Mr. Barrett served as Director, Finance & Commercial Analysis of RTEA, and from December 2001 to November 2004, he served as Principal Business Analyst of Rio Tinto Iron Ore's new business development group. From May 1997 to May 2000, Mr. Barrett worked as a Senior Business Analyst for WMC Resources Ltd, a mining company, and was Chief Financial Officer and Finance Director of Medtech Ltd. and Auxcis Ltd., two technology companies listed on the Australian stock exchange, from May 2000 to December 2001. From August 1991 to May 1997, he held positions with PricewaterhouseCoopers in England and Australia. Mr. Barrett received his bachelor's degree with joint honors in economics and accounting from Southampton University and is a Chartered Accountant.

Gary Rivenes has served as our Executive Vice President and Chief Operating Officer since October 2009. Previously, he served as Vice President, Operations, of RTEA from December 2008 until November 2009, and as Acting Vice President, Operations, of RTEA from January 2008 to November 2008. From September 2007 to December 2007, Mr. Rivenes served as General Manager for RTEA's Jacobs Ranch mine, from October 2006 to September 2007, he served as General Manager for RTEA's Antelope mine and from November 2003 to September 2006, he served as Manager, Mine Operations for RTEA's Antelope mine. Prior to that, he worked for RTEA in a variety of operational and technical positions for RTEA's Antelope, Colowyo and Jacobs Ranch mines since 1992. Mr. Rivenes holds a bachelor of science in mining engineering from Montana College of Mineral, Science & Technology.

Cary Martin has served as our Senior Vice President of Human Resources since October 2009. Previously, he served as Vice President / Corporate Officer of Human Resources for OGE Energy Corp., an electric utility and natural gas processing holding company from September 2006 until March 2008, and as a Segment Vice President for several different divisions of SPX Corporation, an international multi-industry manufacturing and services company from December 1999 until May 2006. In these capacities, Mr. Martin's responsibilities included oversight of employee and labor relations, workforce planning, employee development, compensation administration, policies and procedures and other responsibilities that are common for a human resources executive. From 1982 until 1999, Mr. Martin served in various management and officer positions for industries ranging from medical facilities to cable manufacturers. Mr. Martin received his bachelor's degree in Business Administration from the University of Missouri and his master's degree in Management Sciences from St. Louis University.

Todd Myers has served as our Senior Vice President, Business Development since July 2010. Previously, he served as President of Westmoreland Coal Sales Company. Prior to that, Mr. Myers served in other senior leadership positions with Westmoreland Coal Sales Company in marketing and business development during two periods dating to 1989. In his various capacities with Westmoreland, Mr. Myers's responsibilities included developing and implementing corporate merger and acquisition strategies, divesting coal related assets, negotiating complex transactions and other responsibilities generally attributable to the management of coal businesses. Mr. Myers also spent five years with RDI Consulting, a leading consulting firm in the energy industry, where he led the energy and environment consulting practice. In 1987, Mr. Myers served as a staff assistant in the U.S. House of Representatives. Mr. Myers earned his bachelor of arts in political science from Pennsylvania State University in University Park, Pennsylvania, and his masters in international management from the Thunderbird Graduate School of Global Management in Glendale, Arizona.

17

James Orchard has served as our Senior Vice President, Marketing and Government Affairs since October 2009. Previously, he served as Vice President, Marketing and Sustainable Development for RTEA from March 2008 until November 2009. From January 2005 to March 2008, Mr. Orchard was Director of Customer Service for RTEA. Prior to that he worked for Rio Tinto's Aluminum division in Australia and New Zealand for over 17 years, where he held a number of technical, operating, process improvement and marketing positions, including as manager of Metal Products from January 2001 to January 2005. Mr. Orchard graduated from the University of New South Wales with a bachelor of science and a PhD in industrial chemistry.

Bryan Pechersky has served as our Senior Vice President and General Counsel since January 2010. Previously, Mr. Pechersky was Senior Vice President, General Counsel and Secretary for Harte-Hanks, Inc., a worldwide, direct and targeted marketing company from March 2007 to January 2010. Prior to that, he also served as Senior Vice President, Secretary and Senior Corporate Counsel for Blockbuster Inc., a global movie and game entertainment retailer from October 2005 to March 2007, and was Deputy General Counsel and Secretary for Unocal Corporation, an international energy company acquired by Chevron Corporation in 2005, from March 2004 until October 2005. While in these capacities, Mr. Pechersky's responsibilities included advising corporate clients regarding various legal, regulatory and compliance matters, transactions and other responsibilities that are common for a general counsel and corporate secretary. Mr. Pechersky was in private practice for approximately seven years with the international law firm Vinson & Elkins LLP before joining Unocal Corporation. Mr. Pechersky also served as a Law Clerk to the Hon. Loretta A. Preska, Chief Judge of the U.S. District Court for the Southern District of New York in 1995 and 1996. Mr. Pechersky earned his bachelor's degree and Juris Doctorate from the University of Texas, Austin, Texas.

A. Nick Taylor has served as our Senior Vice President, Technical Services since October 2009. Previously, he served as RTEA's Vice President of Technical Services & Business Improvement Process from October 2005 until November 2009. Prior to that, Mr. Taylor worked for Rio Tinto Technical Services in Sydney providing advice to Rio Tinto mining operations worldwide from 1992 to 2005, at its Bougainville Copper operations in New Guinea from 1980 to 1981, and at its Rossing Uranium operations in Namibia from 1976 to 1980. Additionally, he worked for Nchanga Consolidated Copper Mines in Zambia from 1973 to 1976, and as a mining consultant in Australia between 1981 and 1992. Mr. Taylor graduated from the University of Wales with a bachelor of science degree in mineral exploitation.

Heath Hill has served as our Vice President and Chief Accounting Officer since September 2010. Previously, Mr. Hill served in various capacities with PricewaterhouseCoopers LLP, our independent public accountants, from September 1998 to September 2010, including Senior Manager from September 2006 to September 2010, and Manager from September 2003 to September 2006. While with PricewaterhouseCoopers LLP, Mr. Hill's responsibilities included assurance services primarily related to SEC registrants, including annual audits of financial statements and internal controls, public debt offerings and IPO transactions. From June 2003 to June 2005 he held a position with PricewaterhouseCoopers in Germany serving US registrants throughout Europe. Mr. Hill earned his bachelor's degree in accounting from the University of Northern Colorado.

Environmental and Other Regulatory Matters

Federal, state and local authorities regulate the U.S. coal mining industry with respect to matters such as employee health and safety, permitting and licensing requirements, air quality standards, water pollution, plant and wildlife protection, the reclamation and restoration of mining properties after mining has been completed, the discharge of materials into the environment and the effects of mining on surface and groundwater quality and availability. These laws and regulations have had, and will continue to have, a significant effect on our production costs and our competitive position. Future laws, regulations or orders, as well as future interpretations and more rigorous enforcement of existing laws,

18

regulations or orders, may require substantial increases in equipment and operating costs and delays, interruptions or a termination of operations, the extent of which we cannot predict. Future laws, regulations or orders, including those relating to global climate change, may also cause coal to become a less attractive fuel source, thereby reducing coal's share of the market for fuels and other energy sources used to generate electricity. As a result, future laws, regulations or orders may adversely affect our mining operations, cost structure or our customers' demand for coal.

We are committed to conducting our mining operations in compliance with all applicable federal, state and local laws and regulations. As an example, all of the mines we operate are certified to the international standard for environmental management systems (ISO 14001). Our industry is highly regulated and the laws and regulations which apply to our operations are extensive, change frequently, and tend to become stricter over time. We have procedures in place, which are designed to enable us to comply with these laws and regulations. We believe we are substantially in compliance with applicable laws and regulations. However, we cannot assure you that we have been or will be at all times in complete compliance.

Mining Permits and Approvals

Numerous governmental permits or approvals are required for mining operations. When we apply for these permits and approvals, we may be required to prepare and present data to federal, state or local authorities pertaining to the effect or impact that any proposed production or processing of coal may have upon the environment. For example, in order to obtain a federal coal lease, an EIS must be prepared to assist the BLM in determining the potential environmental impact of lease issuance, including any direct and indirect effects from the mining, transportation and burning of coal. Recently, particular attention has been focused on the impact of the production and usage of coal on global climate change, which resulted in extensive comments from environmental groups on the EIS prepared in connection with the West Antelope II LBA, and subsequent legal challenges were filed in 2010 against the BLM and the Secretary of the Interior with respect to this LBA, which we have nominated. This may result in further delays or an inability to obtain this lease. Future nominations or lease applications may also be subject to delays or challenges, which may result in difficulties in obtaining other leases. The authorization, permitting and implementation requirements imposed by federal, state and local authorities may be costly and time consuming and may limit or delay commencement or continuation of mining operations. In the states where we operate, the applicable laws and regulations also provide that a mining permit or modification can be delayed, refused or revoked if officers, directors, shareholders with specified interests or certain other affiliated entities with specified interests in the applicant or permittee have, or are affiliated with another entity that has, outstanding permit violations. Thus, past or ongoing violations of applicable laws and regulations by these interested persons and entities could provide a basis to revoke our existing permits and to deny the issuance of additional permits.

In order to obtain mining permits and approvals from federal and state regulatory authorities, mine operators must submit a reclamation plan for restoring, upon the completion of mining operations, the mined property to its prior condition, productive use or other permitted condition. Typically, we submit the necessary permit applications several months or even years before we plan to begin mining a new area. Some of our required permits are becoming increasingly difficult and expensive to obtain, and the application review processes are taking longer to complete and increasingly becoming subject to challenge.

Under some circumstances, substantial fines and penalties, including revocation or suspension of mining permits, may be imposed under the laws described above. Monetary sanctions and, in severe circumstances, criminal sanctions may be imposed for failure to comply with these laws.

19

Surface Mining Control and Reclamation Act

SMCRA establishes mining, environmental protection, reclamation and closure standards for all aspects of surface coal mining. Mining operators must obtain SMCRA permits and permit renewals from the OSM or from the applicable state agency if the state agency has obtained regulatory primacy. A state agency may achieve primacy if the state regulatory agency develops a mining regulatory program that is no less stringent than the federal mining regulatory program under SMCRA. Both Wyoming and Montana, where our mines are located, have achieved primacy to administer the SMCRA program.

SMCRA permit provisions include a complex set of requirements, which include, among other things, coal prospecting, mine plan development, topsoil or growth medium removal and replacement, selective handling of overburden materials, mine pit backfilling and grading, disposal of excess spoil, protection of the hydrologic balance, surface runoff and drainage control, establishment of suitable post mining land uses and re-vegetation. We begin the process of preparing a mining permit application by collecting baseline data to adequately characterize the pre-mining environmental conditions of the permit area. This work is typically conducted by third-party consultants with specialized expertise and typically includes surveys and/or assessments of the following: cultural and historical resources; geology; soils; vegetation; aquatic organisms; wildlife; potential for threatened, endangered or other special status species; surface and ground water hydrology; climatology; riverine and riparian habitat and wetlands. The geologic data and information derived from the surveys and/or assessments are used to develop the mining and reclamation plans presented in the permit application. The mining and reclamation plans address the provisions and performance standards of the state's equivalent SMCRA regulatory program, and are also used to support applications for other authorizations and/or permits required to conduct coal mining activities. Also included in the SMCRA permit application is information used for documenting surface and mineral ownership, variance requests, access roads, bonding information, mining methods, mining phases, other agreements that may relate to coal, other minerals, oil and gas rights, water rights, permitted areas and ownership and control information required to determine compliance with OSM's Applicant Violator System, including the mining and compliance history of officers, directors and principal owners of the entity.

Once a permit application is prepared and submitted to the regulatory agency, it goes through an administrative completeness review and a thorough technical review. Also, before a SMCRA permit is issued, a mine operator must submit a bond or otherwise secure the performance of all reclamation obligations. After the application is submitted, a public notice or advertisement of the proposed permit is required to be given, which begins a notice period that is followed by a public comment period before a permit can be issued. It is not uncommon for a SMCRA mine permit application to take over two years to prepare and review, depending on the size and complexity of the mine, and another two years or even longer for the permit to be issued. The variability in time frame required to prepare the application and issue the permit can be attributed primarily to the various regulatory authorities' discretion in the handling of comments and objections relating to the project received from the general public and other agencies. Also, it is not uncommon for a permit to be delayed as a result of litigation related to the specific permit or another related company's permit.

In addition to the bond requirement for an active or proposed permit, the Abandoned Mine Land Fund, which was created by SMCRA, imposes a fee on all coal produced. The proceeds of the fee are used to restore mines closed or abandoned prior to SMCRA's adoption in 1977. The current fee is $0.315 per ton of coal produced from surface mines. In 2010, we recorded $29.1 million of expense related to these reclamation fees for our three owned and operated mines.

20

Surety Bonds

State laws require a mine operator to secure the performance of its reclamation obligations required under SMCRA through the use of surety bonds or other approved forms of security to cover the costs the state would incur if the mine operator were unable to fulfill its obligations. Prior to the IPO, Rio Tinto served as guarantor of our surety bonds, and our letters of credit were issued under Rio Tinto's pre-existing credit facilities. We have obtained new surety bonds, letters of credit or other credit arrangements and have obtained the full release of Rio Tinto and its affiliates with respect to any existing surety bonds, letters of credit and other guarantees or credit arrangements and such instruments have been accepted as replacements by the appropriate agencies.

As of December 31, 2010, there were approximately $525.0 million in surety bonds outstanding to secure the performance of our reclamation obligations (including our obligations with respect to the Decker mine). In addition, we have a letter of credit for $10.5 million that we use to secure our 50% share of additional reclamation obligations at the Decker mine. At December 31, 2010, we had $182.1 million of restricted cash used as collateral for our surety bonds.

Mine Safety and Health

Stringent health and safety standards have been in effect since Congress enacted the Coal Mine Health and Safety Act of 1969. The Federal Mine Safety and Health Act of 1977 (the "Mine Act"), significantly expanded the enforcement of safety and health standards and imposed safety and health standards on all aspects of mining operations. In addition to federal regulatory programs, all of the states in which we operate also have state programs for mine safety and health regulation and enforcement. Collectively, federal and state safety and health regulation in the coal mining industry is among the most comprehensive and pervasive systems for protection of employee health and safety affecting any segment of U.S. industry. The Mine Act is a strict liability statute that requires mandatory inspections of surface and underground coal mines and requires the issuance of enforcement action when it is believed that a standard has been violated. A penalty is required to be imposed for each cited violation. Negligence and gravity assessments result in a cumulative enforcement scheme that may result in the issuance of withdrawal orders. The Mine Act contains criminal liability provisions. For example, it imposes criminal liability for corporate operators who knowingly or willfully authorize, order or carry out violations. The Mine Act also provides that civil and criminal penalties may be assessed against individual agents, officers and directors who knowingly authorize, order or carry out violations. In addition, criminal liability may be imposed against any person for knowingly falsifying records required to be kept under the Mine Act and standards. Recent underground mine accidents have resulted in, and may continue to result in, state and federal legislatures and regulatory authorities increasing scrutiny of mine safety matters and passing more stringent laws governing mining. For example, in 2006, Congress enacted the Mine Improvement and New Emergency Response Act, which imposed additional burdens on coal operators, including, among other matters, (i) obligations related to (a) the development of new emergency response plans that address post-accident communications, tracking of miners, breathable air, lifelines, training and communication with local emergency response personnel; (b) establishing additional requirements for mine rescue teams; and (c) promptly notifying federal authorities of incidents that pose a reasonable risk of death and (ii) increased penalties for violations of the applicable federal laws and regulations. The penalty regulations promulgated in 2007 as a result of this legislation included new heightened penalty categories for certain types of violations and have resulted in imposition of penalty assessment amounts that doubled between fiscal year 2007 and 2008 in the coal industry and are expected to continue to increase. In the wake of the 2006 legislation, enforcement scrutiny also increased, including more inspection hours at mine sites, increased numbers of inspections and increased issuance of the number and the severity of enforcement actions. Various states also have enacted their own new laws and regulations addressing many of these

21

same subjects. Our compliance with these or any new mine health and safety regulations could increase our mining costs.

We have implemented various internal standards to promote employee health and safety. In addition to these internal standards, we are also Occupational Health and Safety Assessment Series 18001 certified and have voluntarily implemented policies and standards in addition to those required by state or federal regulations that we consider important to the health and safety of our employees. According to MSHA data, in 2009 we had one of the lowest employee all injury incident rate among the ten largest U.S. coal producing companies.

Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981, each coal mine operator must pay federal black lung benefits to claimants who are current and former employees and also make payments to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to January 1, 1970. The trust fund is funded by an excise tax on production of up to $1.10 per ton for deep-mined coal and up to $0.55 per ton for surface-mined coal, neither amount to exceed 4.4% of the gross sales price. The excise tax does not apply to coal shipped outside the U.S. In 2010, we recorded $42.6 million of expense related to this excise tax for our three owned and operated mines.

Clean Air Act