Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TRANSATLANTIC PETROLEUM LTD. | d374244d8k.htm |

| EX-99.1 - TRANSATLANTIC PETROLEUM LTD. INVESTOR PRESENTATION - TRANSATLANTIC PETROLEUM LTD. | d374244dex991.htm |

Annual General

Meeting Chairman’s Strategy Overview

June 28, 2012

Exhibit 99.2 |

Forward Looking

Statements Outlooks,

projections,

estimates,

targets,

and

business

plans

in

this

presentation

or

any

related

subsequent

discussions

are

forward-looking

statements.

Actual

future

results,

including

TransAtlantic

Petroleum

Ltd.’s

own

production

growth

and

mix;

financial

results;

the

amount

and

mix

of

capital

expenditures;

resource

additions

and

recoveries;

finding

and

development

costs;

project

and

drilling

plans,

timing,

costs,

and

capacitie

s; revenue

enhancements

and

cost

efficiencies;

industry

margins;

margin

enhancements

and

integration

benefits;

and

the

impact

of

technology

could

differ

materially

due

to

a

number

of

factors.

These

include

changes

in

long-term

oil

or

gas

prices

or

other

market

conditions

affecting

the

oil,

gas,

and

petrochemical

industries;

reservoir

performance;

timely

completion

of

development

projects;

war

and

other

political

or

security

disturbances;

changes

in

law

or

government

regulation;

the

outcome

of

commercial

negotiations;

the

actions

of

competitors;

unexpected

technological

developments;

the

occurrence

and

duration

of

economic

recessions;

unforeseen

technical

difficulties;

and

other

factors

discussed

here

and

under

the

heading

“Risk

Factors"

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011

and

our

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

March

31,

2012

available

at

our

website

at

www.transatlanticpetroleum.com

and

www.sec.gov.

See

also

TransAtlantic’s

2011

audited

financial

statements

and

the

accompanying

management

discussion

and

analysis.

Forward-looking

statements

are

based

on

management’s

knowledge

and

reasonable

expectations

on

the

date

hereof,

and

we

assume

no

duty

to

update

these

statements

as

of

any

future

date.

The

information

set

forth

in

this

presentation

does

not

constitute

an

offer,

solicitation

or

recommendation

to

sell

or

an

offer

to

buy

any

securities

of

the

Company.

The

information

published

herein

is

provided

for

informational

purposes

only.

The

Company

makes

no

representation

that

the

information

and

opinions

expressed

herein

are

accurate,

complete

or

current.

The

information

contained

herein

is

current

as

of

the

date

hereof,

but

may

become

outdated

or

subsequently

may

change.

Nothing

contained

herein

constitutes

financial,

legal,

tax,

or

other

advice.

The

SEC

has

generally

permitted

oil

and

gas

companies,

in

their

filings

with

the

SEC,

to

disclose

only

proved

reserves

that

a

company

has

demonstrated

by

actual

production

or

conclusive

formation

tests

to

be

economically

and

legally

producible

under

existing

economic

and

operating

conditions.

We

may

use

the

terms

“estimated

ultimate

recovery,”

“EUR,”

“probable,”

“possible,”

and

“non-proven”

reserves,

“prospective

resources”

or

“upside”

or

other

descriptions

of

volumes

of

resources

or

reserves

potentially

recoverable

through

additional

drilling

or recovery

techniques

that

the

SEC’s

guidelines

may

prohibit

us

from

including

in

filings

with

the

SEC.

These

estimates

are

by

their

nature

more

speculative

than

estimates

of

proved

reserves

and

accordingly

are

subject

to

substantially

greater

risk

of

being

actually

realized

by

the

Company.

There

is

no

certainty

that

any

portion

of

estimated

prospective

resources

will

be

discovered.

If

discovered,

there

is

no

certainty

that

it

will

be

commercially

viable

to

produce

any

portion

of

the

estimated

prospective

resources.

BOE

is

derived

by

converting

natural

gas

to

oil

in

the

ratio

of

six

thousand

cubic

feet

(Mcf)

of

natural

gas

to

one

barrel

(bbl)

of

oil.

Boe

may

be

misleading,

particularly

if

used

in

isolation.

A

BOE

conversion

ratio

of

6

Mcf:

1

bbl

is

based

on

an

energy

equivalency

conversion

method

primarily

applicable

at

the

burner

tip

and

does

not

represent

a

value

equivalency

at

the

wellhead.

2 |

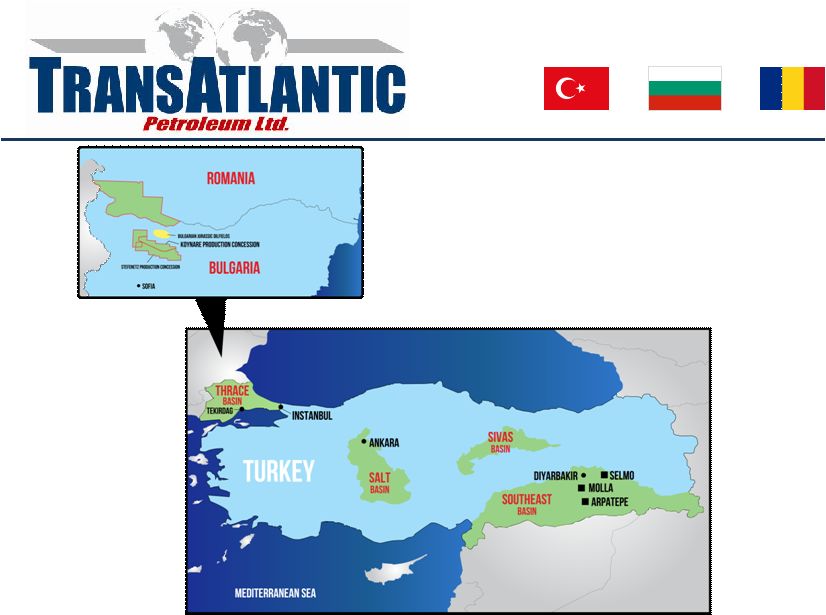

What Was the

Plan? 3

Identify

countries

with

the

Right

Rock...

•

Compared

only

to

its

neighbor’s

geology,

Turkey’s

rocks

are

less

exciting

and

thus they

have

been

underexplored.

•

Compared

to

geology

in

North

America

the

cup

is

full

(with

application

of

technology).

...and

the

Right

Government

•

Turkey

has

fair

and

balanced

government

that

is

bureaucratic

and

pro-business.

•

Good

fiscal

terms:

12.5%

royalty,

no

production

tax,

20%

corporate

income

tax.

•

Attractive

lease/license

terms.

Large

acreage

blocks

with

very

manageable

work

commitments.

No

production

sharing

agreements.

Bring

North

American-style

oilfield

services

and

pricing

•

Turkey’s

legacy

oilfield

services

equipment

had

limited

capabilities

to

drill

targets

deeper

than

7,000

feet

(2,100

meters).

•

No

in-country

stimulation

equipment

and

less

than

10

fracs

ever

executed.

•

No

in-county

natural

gas

compression. |

Making

Great

Progress,

But

Still

Plenty

of

Road

Ahead

4

Thrace

Basin

Proof

of

Concept

Program

Moving

Into

Development

Mode

•

Proved

the

formations

are

conducive

to

frac.

•

Added

1,000

additional

meters

of

gas

saturated

sands

to

opportunity

set

through deep

testing.

Zones

below

~2,500

meters

are

not

looking

viable.

•

First

multi-zone

and

multi-stage

fracs

showing

promise.

•

Completion

activity

to

increase

during

second

half

of

2012

as

development

program begins to ramp up.

Early Stages of Potential Stacked Resource Plays in Southeast Turkey

•

Mardin

discovery

at

Goksu

showing

indications

of

Mississippian

Lime-style

resource potential.

•

Dadas

shale

testing

increasing.

Evidence

of

productive

potential.

Still

VERY

early

but could be a company and country changer.

Seismic

Identifying

High

Impact

Exploration

Prospects

•

Large

structures

identified

along

Syrian

border,

the

only

area

in

Turkey

with

the

same geologic opportunity set as Syria and northern Iraq.

•

Latest

Thrace

Basin

3D

identified

several

targets

of

varying

size. |

Acknowledging

Our

Mistakes

&

Learning

From

Them

5

Patience is a Virtue

•

Most

international

activity

simply

takes

longer

than

similar

procedures

in

North

America.

Must

plan

for

longer

than

expected

activity

times

and

expect

delays.

•

As

the

only

company

forging

ahead,

we

have

set

the

learning

curve.

No

ability

to

learn

from

what

others

are

doing

to

increase

development

pace.

Knowledge Transfer is Critical to Ensure Staying Power

•

Ex-pats

are

critical

in

early

activity.

But

costs

and

turnover

are

high.

•

Use

ex-pats

to

train

locals

to

impart

a

meaningful

knowledge

transfer

to

locals

that

have

the

best

understanding

of

local

customs

and

standards.

•

Cycle

locals

through

affiliated/sister

companies

in

North

America

to

provide

first

hand experience of technology and pace.

Partner Selection is Critical

•

Pick

partners

that

understand

the

“Win-Win”

concept.

•

Seek

smart

partners

that

generate

their

own

prospects/concepts

and

drive

progress

rather

than

inaction. |

6

The

Way

Forward |

Four Point

Near-Term Plan 7

Viking Sale Proceeds Clean-up Balance Sheet and Simplifies Reporting

•

Significant

reduction

in

outstanding

debt,

including

the

short-term

portion

responsible

for

the

“going

concern”

qualification.

•

Dalea

and

Viking

borrowings

eliminated.

Borrowings

under

revolving

credit

facility

to

be

meaningfully

reduced.

•

Eliminates

process

necessary

for

intercompany

elimination

of

profit.

Reorganize and Restructure Credit Facility

•

Adjust

terms

to

allow

more

flexibility

(upstreaming

of

cash,

transfer

among

subsidiaries, etc).

•

Reduce

administrative

requirements.

Execute Joint Ventures to Bring Forward Unrecognized Value

•

Shift

some

or

most

of

the

cost

burden

of

exploration

to

others.

•

Redeploy

excess

proceeds

to

facilitate

additional

value

capture.

People

–

Right

People

in

the

Right

Spots

•

Continue

to

high-grade

and

optimize

human

capital

in

all

departments.

•

Plan

well

ahead

for

eventual

CEO

transition

to

facilitate

smooth

hand-off. |

Longer-term

Plan 8

Transition Thrace Basin Program To Development

•

Drive

low-risk,

repeatable

production

growth.

•

Robust

gas

price

and

well

productivity

yields

healthy

recycle

ratio

allowing

growth

within cash flow.

Develop Additional Resource Plays

•

Test

and

define

new

resource

potential

in

Turkey,

Bulgaria

and

Romania.

•

Evaluate

under-explored/overlooked

play

concepts

using

a

North

American

viewpoint.

Continue High Impact Exploration

•

Apply

cutting-edge

seismic

to

under-explored

regions.

•

Balance

high-risk

exploration

with

lower-risk

production

growth

to

soften

impact

from unsuccessful ventures.

•

Partner-out risk.

Keep

Concentrated

Focus

While

Seeking

Strategic

New

Step-out

Regions

•

Never

rest

on

our

laurels.

•

Continually

evaluate

neighboring

plays

and

operators

to

allow

swift,

but

selective,

opportunism. |