Attached files

| file | filename |

|---|---|

| EX-99.2 - CORPORATE STRATEGY PRESENTATION - TRANSATLANTIC PETROLEUM LTD. | d374244dex992.htm |

| 8-K - FORM 8-K - TRANSATLANTIC PETROLEUM LTD. | d374244d8k.htm |

Annual General

Meeting June 28, 2012

Exhibit 99.1 |

Forward Looking

Statements Outlooks,

projections,

estimates,

targets,

and

business

plans

in

this

presentation

or

any

related

subsequent

discussions

are

forward-looking

statements.

Actual

future

results,

including

TransAtlantic

Petroleum

Ltd.’s

own

production

growth

and

mix;

financial

results;

the

amount

and

mix

of

capital

expenditures;

resource

additions

and

recoveries;

finding

and

development

costs;

project

and

drilling

plans,

timing,

costs,

and

capacitie

s; revenue

enhancements

and

cost

efficiencies;

industry

margins;

margin

enhancements

and

integration

benefits;

and

the

impact

of

technology

could

differ

materially

due

to

a

number

of

factors.

These

include

changes

in

long-term

oil

or

gas

prices

or

other

market

conditions

affecting

the

oil,

gas,

and

petrochemical

industries;

reservoir

performance;

timely

completion

of

development

projects;

war

and

other

political

or

security

disturbances;

changes

in

law

or

government

regulation;

the

outcome

of

commercial

negotiations;

the

actions

of

competitors;

unexpected

technological

developments;

the

occurrence

and

duration

of

economic

recessions;

unforeseen

technical

difficulties;

and

other

factors

discussed

here

and

under

the

heading

“Risk

Factors"

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011

and

our

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

March

31,

2012

available

at

our

website

at

www.transatlanticpetroleum.com

and

www.sec.gov.

See

also

TransAtlantic’s

2011

audited

financial

statements

and

the

accompanying

management

discussion

and

analysis.

Forward-looking

statements

are

based

on

management’s

knowledge

and

reasonable

expectations

on

the

date

hereof,

and

we

assume

no

duty

to

update

these

statements

as

of

any

future

date.

The

information

set

forth

in

this

presentation

does

not

constitute

an

offer,

solicitation

or

recommendation

to

sell

or

an

offer

to

buy

any

securities

of

the

Company.

The

information

published

herein

is

provided

for

informational

purposes

only.

The

Company

makes

no

representation

that

the

information

and

opinions

expressed

herein

are

accurate,

complete

or

current.

The

information

contained

herein

is

current

as

of

the

date

hereof,

but

may

become

outdated

or

subsequently

may

change.

Nothing

contained

herein

constitutes

financial,

legal,

tax,

or

other

advice.

The

SEC

has

generally

permitted

oil

and

gas

companies,

in

their

filings

with

the

SEC,

to

disclose

only

proved

reserves

that

a

company

has

demonstrated

by

actual

production

or

conclusive

formation

tests

to

be

economically

and

legally

producible

under

existing

economic

and

operating

conditions.

We

may

use

the

terms

“estimated

ultimate

recovery,”

“EUR,”

“probable,”

“possible,”

and

“non-proven”

reserves,

“prospective

resources”

or

“upside”

or

other

descriptions

of

volumes

of

resources

or

reserves

potentially

recoverable

through

additional

drilling

or recovery

techniques

that

the

SEC’s

guidelines

may

prohibit

us

from

including

in

filings

with

the

SEC.

These

estimates

are

by

their

nature

more

speculative

than

estimates

of

proved

reserves

and

accordingly

are

subject

to

substantially

greater

risk

of

being

actually

realized

by

the

Company.

There

is

no

certainty

that

any

portion

of

estimated

prospective

resources

will

be

discovered.

If

discovered,

there

is

no

certainty

that

it

will

be

commercially

viable

to

produce

any

portion

of

the

estimated

prospective

resources.

BOE

is

derived

by

converting

natural

gas

to

oil

in

the

ratio

of

six

thousand

cubic

feet

(Mcf)

of

natural

gas

to

one

barrel

(bbl)

of

oil.

Boe

may

be

misleading,

particularly

if

used

in

isolation.

A

BOE

conversion

ratio

of

6

Mcf:

1

bbl

is

based

on

an

energy

equivalency

conversion

method

primarily

applicable

at

the

burner

tip

and

does

not

represent

a

value

equivalency

at

the

wellhead.

2 |

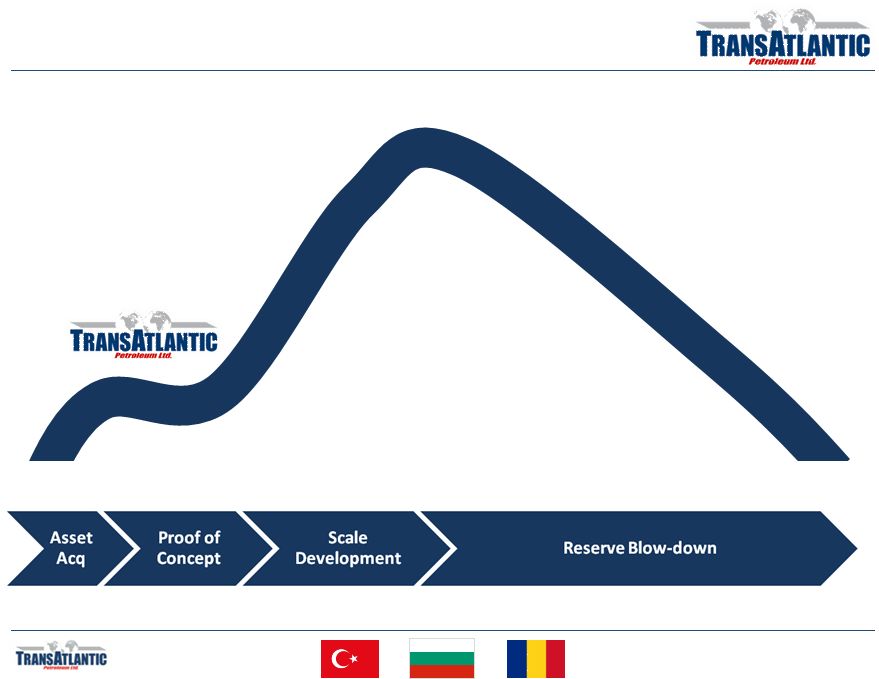

Oil and Gas Life

Cycle: Still Early Innings 3 |

Road Has Been

Bumpy, But Still Holding Above Peers 4

Peer group inclusion factors: Publicly-traded company on 1/1/2008, meaningful onshore

presence in Eastern Europe, Middle East, and/or North Africa |

5

Portfolio Overview |

Portfolio

Overview 6 |

Portfolio

Overview 7

Thrace Basin Development Taking Shape

•

Proved

the

rock

is

conducive

to

frac.

•

Deep

program

has

identified

an

additional

~1,000

meters

of

gas

saturated

sands.

•

Gearing

up

for

continuous

drill-and-frac

program

beginning

during

2H12.

New Resource Play Concepts in the Southeast

•

Goksu

discovery

showing

similar

properties

to

Mississippian

Lime

play

in

the

U.S.

•

Dadas

shale

evaluation

process

ongoing

and

picking

up

pace.

Offset

activity

could help

accelerate

the

learning

curve

process.

•

Horizontal

concept

on

Gaziantap

license.

Near-Term High Impact Exploration

•

Idil

block

holds

several

structures,

confirmed

with

recent

seismic.

Only

area

of

Turkey

with

same

drilling

targets

as

prolific

fields

in

Iraq

and

Syria.

•

Large

structure

identified

on

Gurun

license.

Longer-term Optionality

•

Bulgarian

and

Romanian

shales.

•

Turkish

exploration

acreage

(Sivas,

Adana,

other). |

8

Thrace Basin |

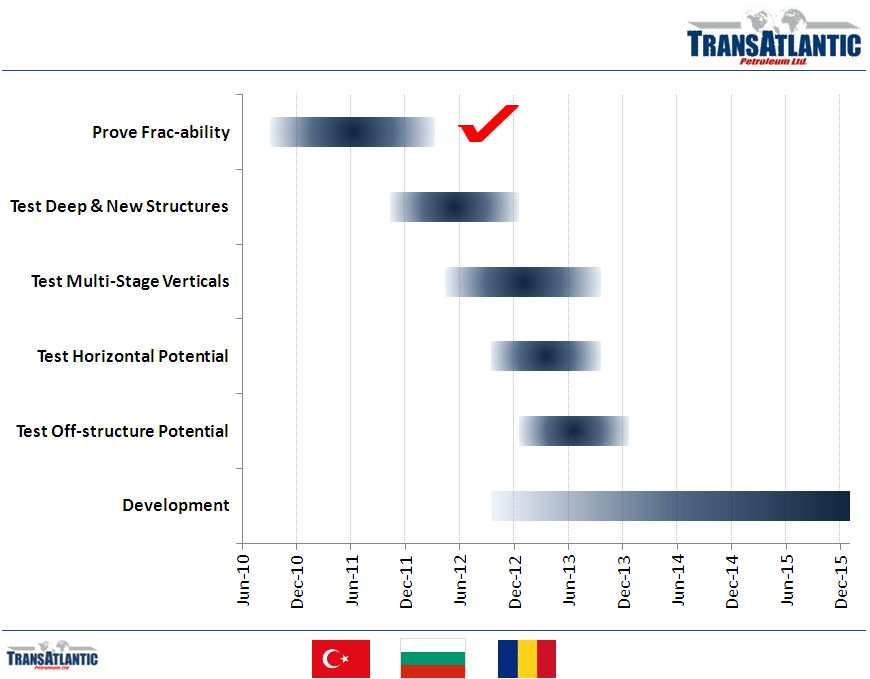

Thrace Basin Frac

Program: Play Concept & Strategy 9

Play Concept

•

Thick, stacked, blanket sands with significant gas in place.

•

Extensive well control from shallow production

•

Thermally mature, but largely untested, source rocks provide substantial unconventional

potential with the application of modern drilling and completion methods.

Assessment Strategy

1.

Prove rock is conducive to frac using low cost re-entries of existing shallow

wellbores. a.

Identify and test various zones (approximately 2,500-6,500 feet or 750-2,000

meters). b.

Determine appropriate mix of fluid and horsepower.

c.

Test multiple zone completions.

2.

Test deeper potential and additional structures with new wellbores

a.

Identify and test deeper zones (approximately 5,000-13,000 feet or 1,500-4,000

meters). b.

Test additional structures (Pancarkoy-1, Suleymaniye-2).

c.

Define opportunity set (number of productive zones, commingling potential, etc.).

3.

Test multi-stage vertical fracs

4.

Evaluate individual zone productivity for horizontal potential and test if/where

applicable. 5.

Evaluate off-structure (stratigraphic) potential of blanket sands.

In Process

In Process

In Process

In Process

Commencing

TBD

TBD |

Thrace Basin

Frac Program: Play Concept & Strategy 10

Overview

•

Unconventional targets from

approximately 1,000 meters (~3,300

feet) to 4,000 meters (~13,100 feet).

•

Early activity provided support that

conventional sands to 1,500 meters

(~5,000 feet) were viable targets

with economic recoveries.

•

Deep activity to-date has expanded

the opportunity set with an

additional 1,000 meters (~3,300

feet) of gas saturated sands shown

to be productive.

•

Testing indicating that targets below

approximately 2,500 meters (~8,200

feet) are tight and water prone.

•

Finishing fourth deep well with

results expected to provide enough

detail to begin transition to

development program in the

Tekirdag Field Area. |

Thrace Basin

Frac Program: Mezardere Members 11 |

Thrace Basin

Frac Program: Type Curve Scenarios 12

•

3 cases/scenarios forecasted using 60 day average, normalized rate from 7 single

stage fracs

•

Average IP for the 7 fracs is 1,800 Mcf/d

•

Base Case is 330 MMcf, Average recovery of the 3 cases is ~370 MMcf

•

Production data thus far indicates steep initial decline with an

average hyperbolic

exponent of 1.3

Decline Curve Parameters and Scenarios

Case

EUR (MMcf)

b

Di

Qi

Low

250

1.1

91%

1,800

Base

330

1.3

89%

1,800

High

520

1.6

86%

1,800

Average

367

1.3

89%

1,800

Internal prospective resource estimates prepared 2/28/12 and evaluated by a registered

professional engineer in accordance with NI 51-101 guidelines and the COGE Handbook |

Thrace Basin

Frac Program: Type Curve Economics 13

Cost Assumptions:

•

Well preparation, pre-frac diagnostics, one stage frac, and testing: $330k gross

•

Additional $400k gross investment to drill and case a 1,000m well. Each additional stage

expected to cost $90k per stage.

•

Gas price = $7.42/mcf

•

Base case recovery and decline parameters were used for each stage in New Drill cases

Remarks:

•

All re-entry cases payout in 1.5 months, recovering approximately 65 MMcf gross in the

first 2 months •

Approximately 20 re-entry candidates have been identified

•

The Low Case for a new drill with single stage still nets $280k NPV10 with a 0.9 ROI

Single Stage Re-Entry Economics

Case

NPV10

($M)*

ROI

Payout

(Mos)

Low

$450

3.3

1.5

Base

600

4.4

1.5

High

890

6.5

1.5

Average

$650

4.8

1.5

New Drill Economics –

Base Case Forecast

Case

NPV10

($M)*

ROI

Payout

(Mos)

1 Stage

$435

1.4

5.8

2 Stage

1,220

3.6

4.2

3 Stage

1,940

5.1

3.7

Average

$1,200

3.4

4.6

Internal prospective resource estimates prepared 2/28/12 and evaluated by a registered

professional engineer in accordance with NI 51-101 guidelines and the COGE Handbook

* Net to TransAtlantic’s 41.5% working interest

* Net to TransAtlantic’s 41.5% working interest |

Thrace Basin

Frac Program: Assessment Timeline 14 |

Thrace Basin

Frac Program: Assessment Limitations 15

Stimulation Equipment

•

Currently only a single frac spread in-country. If utilized to test deep Thrace

targets or to stimulate zones in southeast Turkey then the equipment is not

available for repeat development program completions in the Tekirdag area.

•

Viking’s second frac crew expected to be available during the first quarter of

2013. Additional equipment possible with further success.

Winter Weather Can Slow You Down

•

Winter conditions (wet) can inhibit activity, most notably pad construction and

equipment moves.

•

During assessment periods with activity contingent upon recent wells, can add

meaningful time between wells.

•

Development program allows advanced preparation of wellpads and logistics

planning for drilling and completion materials. |

16

Southeast Turkey |

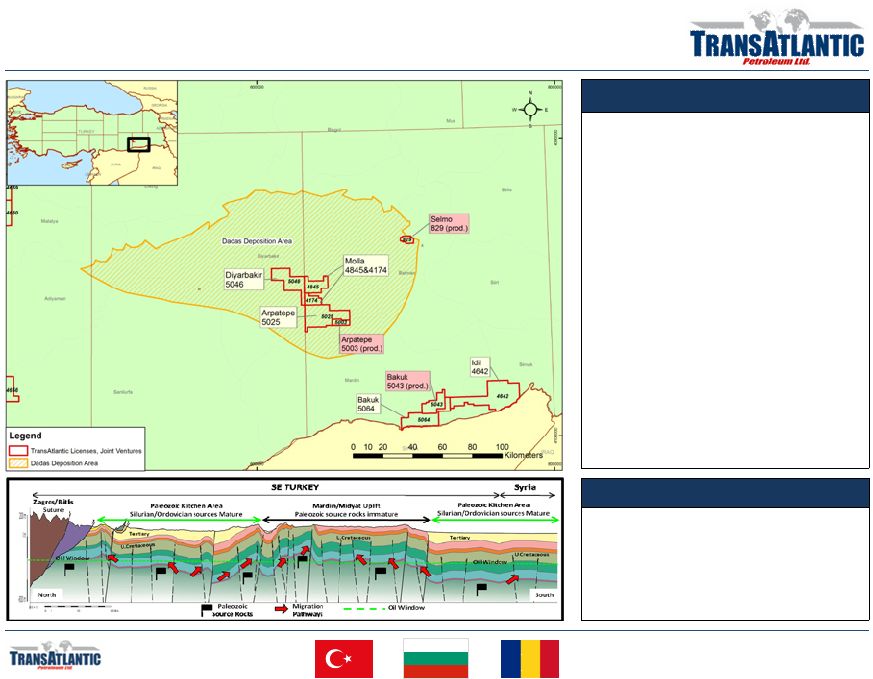

17

Overview

•

Extension of prolific Iraqi and Syrian oil

trends. Houses Turkey’s most

productive fields including

TransAtlantic’s Selmo field.

•

Conventional oil production provides

low decline base.

•

Conventional and unconventional

upside opportunities including large

shale play potential. Numerous large

anticlines identified.

•

Bedinan, Dadas, Hazro, and Mardin

targets.

•

Existing production reasonably well

removed from border.

•

Recent seismic shoot at Idil block along

Syrian border. Drilling expected later in

2012.

Dadas Shale

•

Upper Silurian (Woodford equivalent)

•

Roughly equal in size to the Barnett.

•

Source rock for conventional fields.

•

Limited test work to-date. Early work

indicates oil, liquids and gas windows.

Turkey: Southeast |

Southeast

–

Dadas

Shale

Overview

18

Dadas

Shale Characteristics

•

Devonian-Silurian age .

•

Areal extent similar to the core area of the Barnett shale.

•

Basal member (Dadas

1) is the primary oil source rock for regional

hydrocarbon production.

•

Indications of oil window (south) transitioning to gas window (north).

•

TransAtlantic’s acreage primarily in expected oil and liquids windows.

Goksu-1R Core Analysis

•

Approximately 30 feet of core taken (2010).

•

Vertical depth: 8,350 feet (2,500 meters)

•

Total Organic Content: 7-9%

•

Porosity: 0.5-6.0%

•

T

max

:

435°

C

•

R

0

: 0.7-0.8%

Shale Comparison

Attribute

Dadas

Woodford

Eagle Ford

Bakken

Age

Silurian

Silurian

Cretaceous

Mississippian

Depth (ft)

7,000-10,000

6,000-14,500

4,000-14,000

8,000-11,000

Gross Thickness

300-800

300-400

100-350

150

TOC (%)

3.0-12.0

6.0-6.5

4.0-5.5

6.0-8.0

T

max

(°

C)

350-460

300-400

425-455

420-430

R

0

(%)

0.5-1.0%

1.1-3.0%

0.5-2.6%

0.4-1.7%

Porosity (%)

0.5-10%

3-12%

4-15%

8-12%

Permeability

0.3-1.0 md

0.2 md

<0.13 md

0.005-0.2 md

Oil Gravity (API)

40-60

30-65

40-60

40-45

EUR (Mboe)

TBD

150-2,000

300-1,500

500-1,500 |

Southeast

–

Dadas

Shale

Isopach

19

TransAtlantic’s

Molla Field

TransAtlantic’s

Arpatepe Field

TransAtlantic’s

Selmo Field

TransAtlantic

Recent License

Award |

Southeast

–

Dadas

Shale

Industry

Interest

20

Shell/TPAO

Dadas Joint Venture

TransAtlantic’s

Molla Field

TransAtlantic’s

Arpatepe Field

TransAtlantic’s

Selmo Field

TransAtlantic

New Exploration

License

Anatolia Energy

Dadas Core

TPAO

Dadas Test Well

TransAtlantic’s

Bahar-1

TransAtlantic’s

Goksu 1 & 2 |

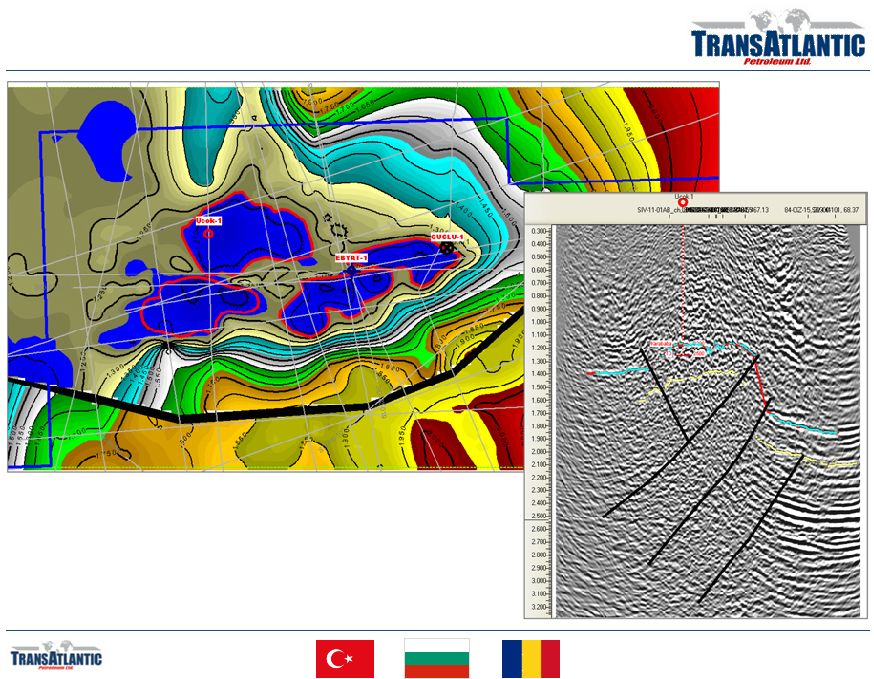

Southeast

– Molla/Goksu

21

Concept Overview

•

Previously

by-passed

pay

zone.

•

Parallel,

vertically

oriented

natural

fracture

system.

•

Vertical

well

results

highly

dependent

upon

intersecting

a

fracture

and

the

ultimate

volume

capacity

of

the

fracture

itself.

•

Horizontal

concept

to

connect

vertical

fracture

system

in

similar

fashion

to

the

horizontal

Mississippian

Lime

play

in

Oklahoma

and Kansas. |

Southeast

– Molla/Goksu –

Goksu 2 Production

22 |

23

Near-Term

High-Impact

Exploration |

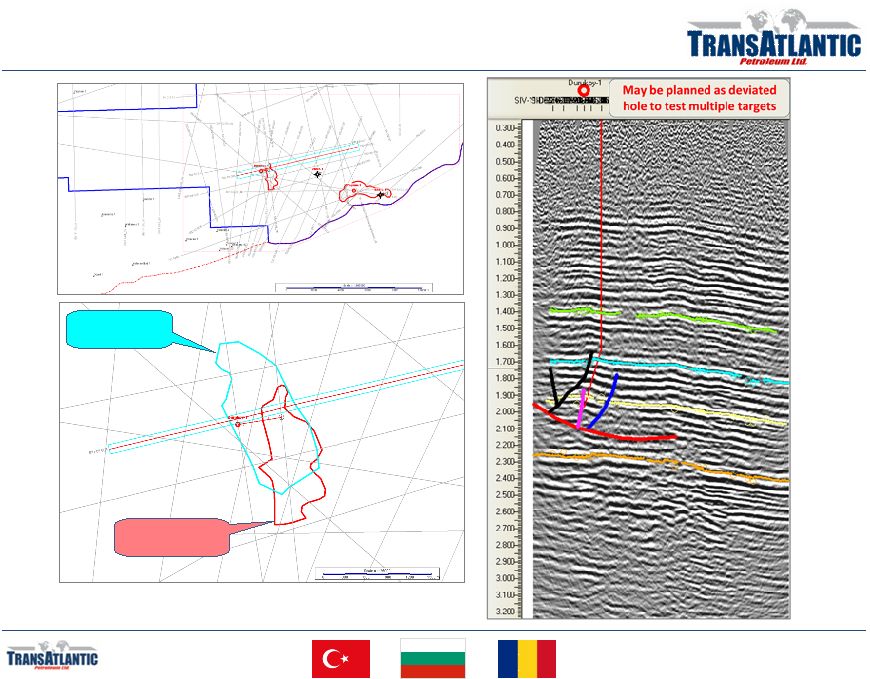

Exploration:

Idil License - Southeast Turkey

24

Overview

•

Extension of prolific Iraqi and Syrian oil

trends. One of only a handful of

Turkish licenses with similar targets as

those seen in Syria and Northern Iraq.

•

High risk, high potential reward targets

identified with application of improved

seismic technology.

•

Unrisked potential greater than 100

MMbbls

(1)

.

•

Smaller target to spud during 4Q12.

•

Larger target to spud in 2013 after

winter conditions ebb.

(1) Internal estimate -

represents potentially recoverable

hydrocarbons from undiscovered accumulation(s) which

are subject to both risk of discovery and development. |

Exploration:

Idil

License

–

2D

Seismic

Lines

25 |

Exploration:

Idil License – Seismic Quality Improvement

26

2008 Single Receiver Line

Conventional Acquisition

(Post-stack Migration)

2012 Dual Receiver Line

Combined Sweep Acquisition

(Pre-stack Migration) |

Exploration:

Idil License – Ebyat Anticline (Ukok-1)

27 |

Exploration:

Idil License – South Area (Durukoy-1)

28

Cudi Closure:

400 acres

Mardin Closure:

250 acres |

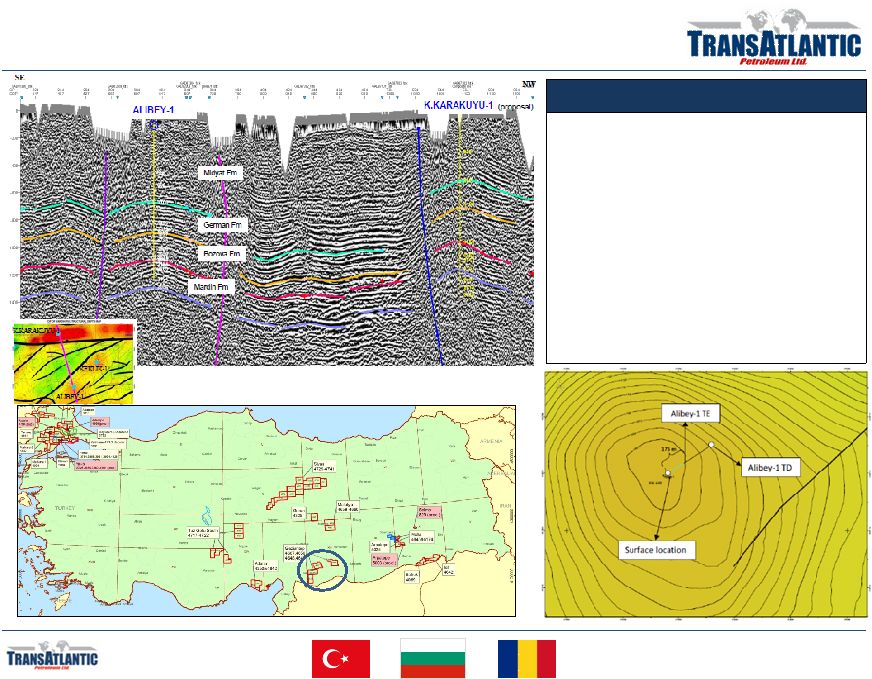

Exploration:

Gurun License - Central Turkey (Konak-1)

29

Overview

•

Large structure identified.

•

High-risk, high potential reward. Single

well should assess structure’s viability

as a target.

•

Activity expected during 3Q12. |

Exploration:

Gaziantap License – S. Central (Alibey-1H)

30

Overview (Alibey-1H)

•

Re-entry of vertical oil show well.

•

Mardin target with similar geologic

characteristics as those seen at

Molla/Goksu and the horizontal

Mississippian Lime play in Oklahoma and

Kansas.

•

Spud expected during 3Q12. |

31

Longer-Term Optionality |

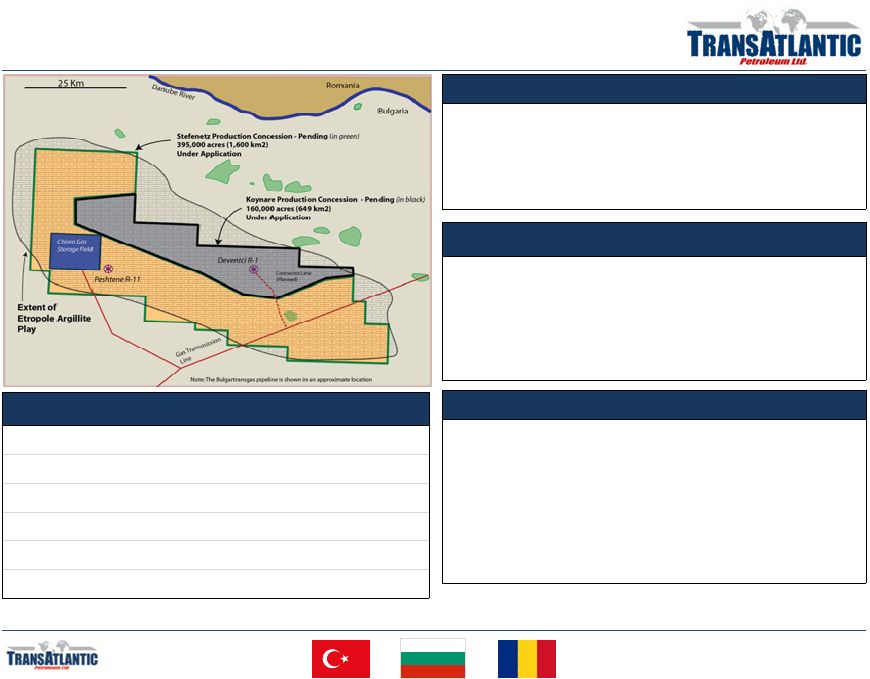

Bulgaria

32

Overview

•

The A-Lovech exploration license covers approximately

565,000 acres (2,288 square kilometers) in NW Bulgaria.

•

All acreage is prospective for the Etropole shale formation.

•

Proximal to existing natural gas infrastructure.

•

Attractive terms: 2.5%-30% royalty and 10% corporate tax.

Koynare (Deventci)

•

160,000 acres (648 square kilometers)

•

Conventional gas discovery in the Jurassic-aged Orzirovo.

•

Deventci R-1, is currently producing ~250 Mcf/d on a limited

test basis. Waiting on award of production license. Surface

casing set on Deventci-R2.

•

Seeking a development partner.

Bulgaria’s Energy Profile

2010 Population:

7,561,910

2010 GDP:

$47.7 billion

2010 Oil Consumption:

91.0 Mbbls/d

2010 Oil Production:

2.9 Mbbls/d

2010 Nat Gas Consumption:

211 MMcf/d

2010 Nat Gas Production:

0 MMcf/d

Source: The World Bank, CIA World Factbook & Energy Information Administration

Peshtene R-11

•

November 2011 drilled a ~10,500 foot (3,200 meter)

exploration well to core and test the Etropole formation.

•

Core currently being evaluated.

•

Rock properties similar to prolific US shale plays, with more

favorable terms (royalty and taxes) and commodity pricing.

•

Etropole position is estimated to hold gross unrisked best

estimate prospective resources of 11 Tcfe

(1)

.

•

Awaiting revision(s) to recent Parliamentary legislation.

(1) Internal estimate prepared as of November 2010 -

represents potentially

recoverable hydrocarbons from undiscovered accumulation(s) which

are subject to

both risk of discovery and development. |

Romania

33

Overview

•

50% interest in 1,000,000 acres (400,000 with

unconventional potential)

•

Sterling Resources-operated joint venture. Seeking

additional joint venture partner(s).

•

Prospective for Silurian shale (natural gas). Also holds

Jurassic oil potential.

•

Awarded license for Phase 2 Exploration Period.

•

Remaining commitment of 200 km 2D seismic to be shot

during 2012.

•

Chevron has acquired exploration licenses straddling the

eastern Bulgarian/Romanian border.

Romania’s Energy Profile

2010 Population:

21,449,980

2010 GDP:

$161.6 billion

2010 Oil Consumption:

196.0 Mbbls/d

2010 Oil Production:

107.1 Mbbls/d

2010 Nat Gas Consumption:

1,247 MMcf/d

2010 Nat Gas Production:

1,025 MMcf/d

Source: The World Bank, CIA World Factbook & Energy Information Administration

(EIA) |

Sivas Basin

– Central Turkey

34

Overview

•

Large, unexplored basin. Only one well

ever drilled.

•

Basin-edge analysis shows source rock,

reservoir rock and seal rock potential.

•

Exploration Agreement with Shell

covering TransAtlantic’s 1.6 million

acres.

2012 work program: Seismic and

aeromagnetic studies.

2013 work program: Up to two

wells, contingent upon seismic and

aeromag. |

Hedge

Profile 35

As

of

3/31/2012 |

PV10

Reconciliation 36

The

PV-10

value

of

the

estimated

future

net

revenue

are

not

intended

to

represent

the

current

market

value

of

the

estimated

oil

and

natural

gas

reserves

we

own.

Management

believes

that

the

presentation

of

PV-10,

while

not

a

financial

measure

in

accordance

with

U.S.

GAAP,

provides

useful

information

to

investors

because

it

is

widely

used

by

professional

analysts

and

sophisticated

investors

in

evaluating

oil

and

natural

gas

companies.

Because

many

factors

that

are

unique

to

each

individual

company

impact

the

amount

of

future

income

taxes

estimated

to

be

paid,

the

use

of

a

pre-tax

measure

is

valuable

when

comparing

companies

based

on

reserves.

PV-10

is

not

a

measure

of

financial

or

operating

performance

under

U.S.

GAAP.

PV-10

should

not

be

considered

as

an

alternative

to

the

standardized

measure

as

defined

under

U.S.

GAAP.

The

following

table

provides

a

reconciliation

of

our

PV10

to

our

standardized

measure:

US $ thousands

Total PV 10:

$645,837

Future income taxes:

(171,592)

Discount of future income taxes at 10% per annum:

57,522

Standardized measure:

$531,797 |