Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEW JERSEY RESOURCES CORP | d366011d8k.htm |

New Jersey

Resources A Premium Company Delivering Premium Results

New York Financial Community

June 13, 2012

Exhibit 99.1 |

2

Certain statements contained in this presentation are forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

can also be identified by the use of forward-looking terminology such as “may,”

“intend,” “expect,” or “continue” or comparable terminology and are made based upon management’s

current expectations and beliefs as of this date concerning future developments and their

potential effect upon New Jersey Resources (NJR or the Company). There can be no assurance

that future developments will be in accordance with management’s expectations or that the

effect of future developments on the Company will be those anticipated by management. NJR

cautions persons reading or hearing this presentation that the assumptions that form the basis

for forward-looking statements regarding NJR's net financial earnings (NFE) guidance for

the 2012 fiscal year, the contributions to NFE by New Jersey Natural Gas Company (NJNG), NJR

Clean Energy Ventures (NJRCEV), NJR Energy Services (NJRES) , the Company's Energy

Holdings segment and NJR Home Services, expected contribution by new customers of New

Jersey Natural Gas Company (NJNG) to utility gross margin, expected number of new

customers of NJNG, the completion of NJRCEV's planned solar projects in fiscal 2012, estimated

capital expenditures in fiscal 2012 by NJNG and NJRCEV, and NJ’s Energy Master Plan

include many factors that are beyond the Company’s ability to control or estimate

precisely. The factors that could cause actual results to differ materially from NJR’s expectations

include, but are not limited to, weather and economic conditions; demographic changes in the NJNG

service territory and their effect on NJNG's customer growth; volatility of natural gas and

other commodity prices and their impact on NJNG customer usage, NJNG's incentive programs,

NJRES' operations and on the Company's risk management efforts; changes in rating agency

requirements and/or credit ratings and their effect on availability and cost of capital to the

Company; the impact of volatility in the credit markets; the ability to comply with debt

covenants; the impact to the asset values and resulting higher costs and funding obligations of NJR's

pension and postemployment benefit plans as a result of downturns in the financial markets, a

lower discount rate, and impacts associated with the Patient Protection and Affordable Care

Act; accounting effects and other risks associated with hedging activities and use of

derivatives contracts; commercial and wholesale credit risks, including the availability of creditworthy

customers and counterparties, liquidity in the wholesale energy trading market and the

Company’s ability to recover all of NJRES’ funds in the MF Global liquidation proceedings; the ability

to obtain governmental approvals and/or financing for the construction, development and

operation of certain non-regulated energy investments; risks associated with the management o

the Company's joint ventures and partnerships; risks associated with our investments in solar

energy projects, including the availability of regulatory and tax incentives, logistical risks and

potential delays related to construction, permitting, regulatory approvals and electric grid

interconnection, the availability of viable projects and NJR's eligibility for federal investment tax

credits (ITC), the future market for Solar Renewable Energy Certificates and operational risks

related to projects in service; timing of qualifying for ITCs due to delays or failures to complete

planned solar energy projects and the resulting effect on our effective tax rate and earnings;

the level and rate at which NJNG's costs and expenses are incurred and the extent to which

they are allowed to be recovered from customers through the regulatory process; access to

adequate supplies of natural gas and dependence on third-party storage and transportation

facilities for natural gas supply; operating risks incidental to handling, storing,

transporting and providing customers with natural gas; risks related to our employee workforce; the

regulatory and pricing policies of federal and state regulatory agencies; the costs of

compliance with the proposed regulatory framework for over-the-counter derivatives; the costs of

compliance with present and future environmental laws, including potential climate

change-related legislation; risks related to changes in accounting standards; the disallowance of

recovery of environmental-related expenditures and other regulatory changes;

environmental-related and other litigation and other uncertainties; and the impact of natural disasters,

terrorist activities, and other extreme events.

The

aforementioned

factors

are

detailed

in

the

“Risk

Factors”

sections

of

our

Annual

Report

on

Form

10-K

filed

on

November

23,

2011,

as

filed

with

the

Securities

and

Exchange

Commission

(SEC)

and

which

is

available

on

the

SEC’s

website

at

sec.gov.

NJR

disclaims

any

obligation

to

update

and

revise

statements

contained

in

these

materials

based

on

new

information or otherwise.

Regarding Forward-Looking Statements |

Disclaimer

Regarding Non-GAAP Financial Measures 3

Management uses net financial earnings and utility gross margin as supplemental measures to other GAAP

results to provide a more complete understanding of the company’s performance. Management

believes these non-GAAP measures are more reflective of the company’s business model,

provide transparency to investors and enable period-to-period comparability

of

financial

performance.

For

a

full

discussion

of

our

non-GAAP

financial

measures,

please

see

Item

7

of

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

September

30,

2011,

filed

on

November

23,

2011.

This presentation includes the non-GAAP measures net financial earnings (losses) and

utility gross margin. As an indicator of the company’s operating performance, these

measures should not be considered an alternative to, or more meaningful than, GAAP measures

such as cash flow, net income, operating income or earnings per share. Net financial

earnings (losses) exclude unrealized gains or losses on derivative instruments related to the company’s unregulated subsidiaries and certain realized gains and losses

on derivative instruments related to natural gas that has been placed into storage at NJRES.

Volatility associated with the change in value of these financial and physical commodity

contracts is reported in the income statement in the current period. In order to manage its business, NJR views its results without the impacts of the unrealized

gains and losses, and certain realized gains and losses, caused by changes in value of these

financial instruments and physical commodity contracts prior to the completion of the

planned transaction because it shows changes in value currently as opposed to when the planned transaction ultimately is settled. NJNG’s utility gross margin represents

the results of revenues less natural gas costs, sales and other taxes and regulatory rider

expenses, which are key components of the company’s operations that move in relation

to each other. |

4

Celebrating 60 years of service

Total Revenue

$3.2 million

Net Income

$351,ooo

Assets

$28.4 million

Dividends Paid

$66,391

Total Customers

90,000 |

Consistent

Results +

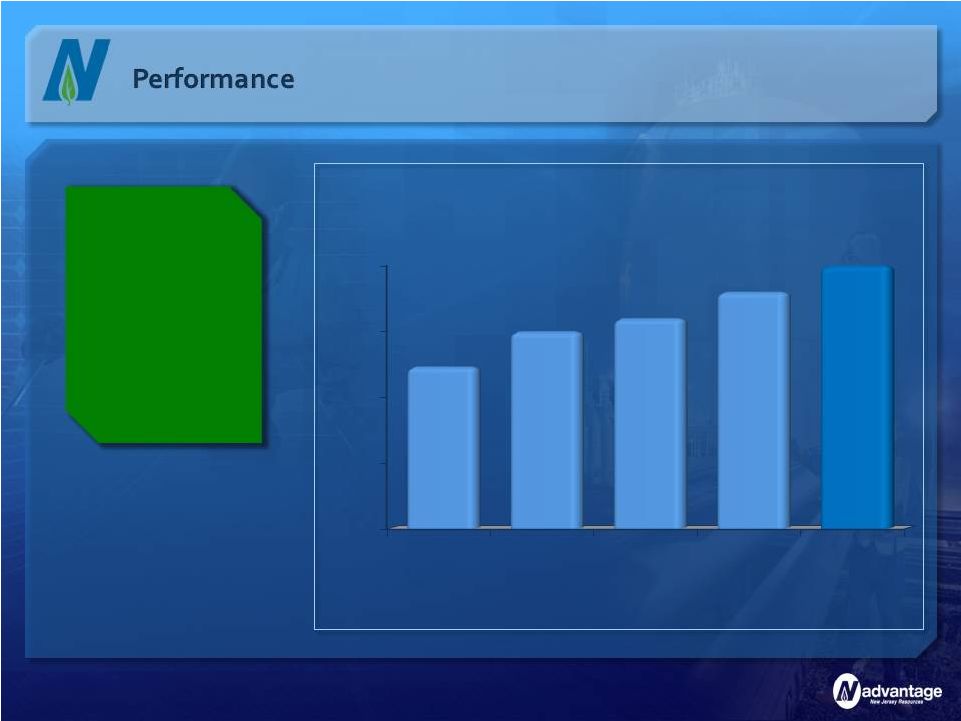

Higher Net Financial Earnings (NFE) for the six months ended March 31, 2012

$2.88 vs. $2.33 last year, a 24 percent increase

+

NFE

guidance

reaffirmed

–

range

of

$2.60

to

$2.80

per

share

Two decades of improved financial performance

+

Increased dividend 5.6 percent effective January 3, 2012

Attractive yield of 3.5 percent

+

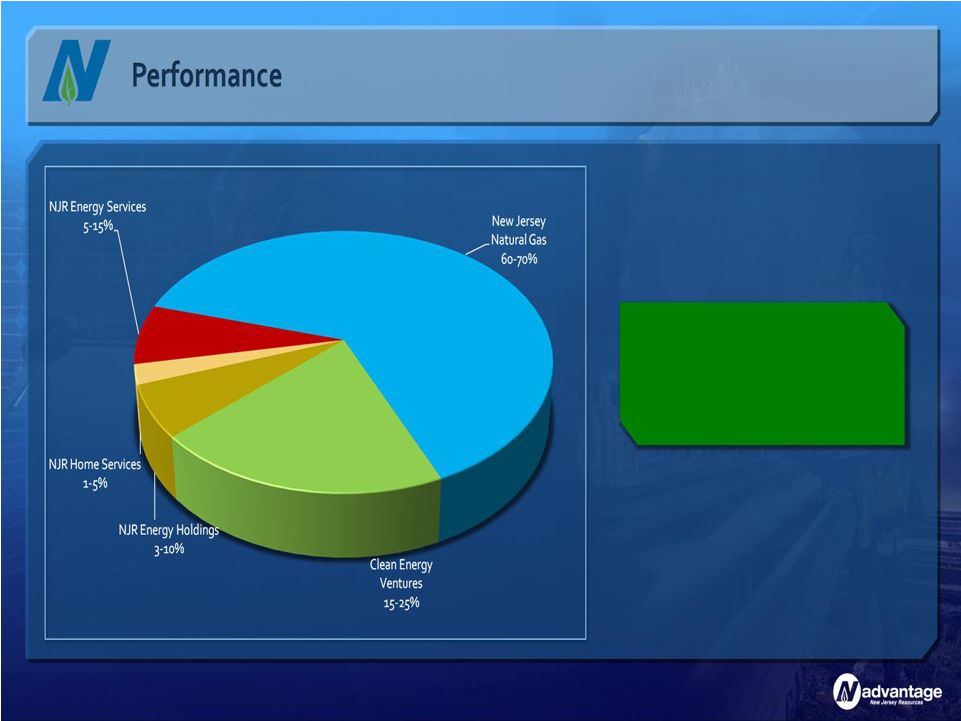

Strong results driven by core regulated utility

60 percent of total earnings from New Jersey Natural Gas

+

Positive earnings contributions from unregulated subsidiaries

Strong results from NJR Clean Energy Ventures

5 |

Our Business

Model We focus on the fundamentals

We

have

a

record

of

consistently

delivering

premium

earnings

and

dividend

growth

Natural Gas Distribution

Steady customer growth

Infrastructure investment

opportunities

Regulatory incentives

Clean Energy and Retail

Services

Residential solar programs

Commercial rooftop and

ground-mounted solar projects

Service contracts, installations

and repair services

Wholesale Energy Services

Energy marketer

Asset management services

Midstream investments

6

+

Energy Infrastructure, Asset Management and Services

+

Disciplined Capital Allocation

+

Strong Financial Profile

+

Diverse Stakeholder Relationships |

The NJNG

Advantage Primarily residential and commercial customer base

Net plant, property and equipment of nearly $1.2

billion

Collaborative regulatory relations

Strong record of system safety and customer

satisfaction

We will achieve the half million customer

milestone in

the summer of 2012 7 |

3,492 new

customers in the first six months of fiscal 2012, a 14 percent increase over fiscal

2011 261 existing customer heat conversions

Customer growth through March 2012 to add

about $1.9 million of utility gross margin

annually

Conversion breakdown:

68 percent oil

25 percent electric

7 percent propane

Estimate 12,000 to 14,000 new customers over

the

next

two

years

–

a

1.3

percent

growth

rate

Steady Customer Growth

Strong demographics to support customer growth

8

New Customer Breakdown

Conversions

59%

New

Construction

41%

Gross Margin Contribution

Residential

63%

Commercial

33%

Existing

4% |

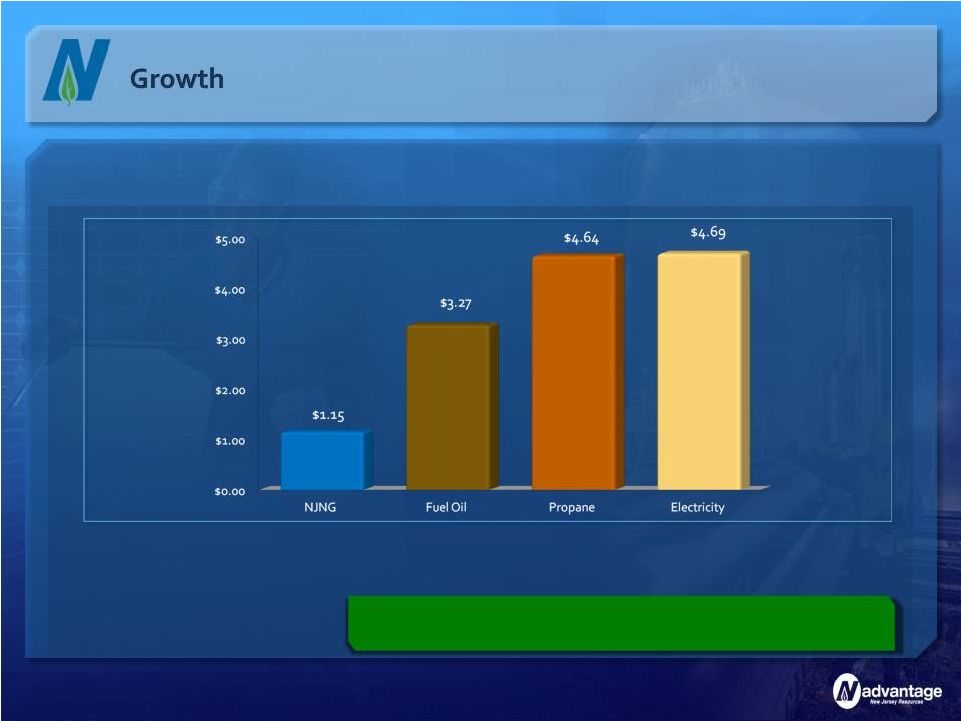

Value for

Customers Source: US Energy Information Administration

Data as of March 2012. Based on 100,000

comparable BTUs

9

We have a strong price advantage in our service territory |

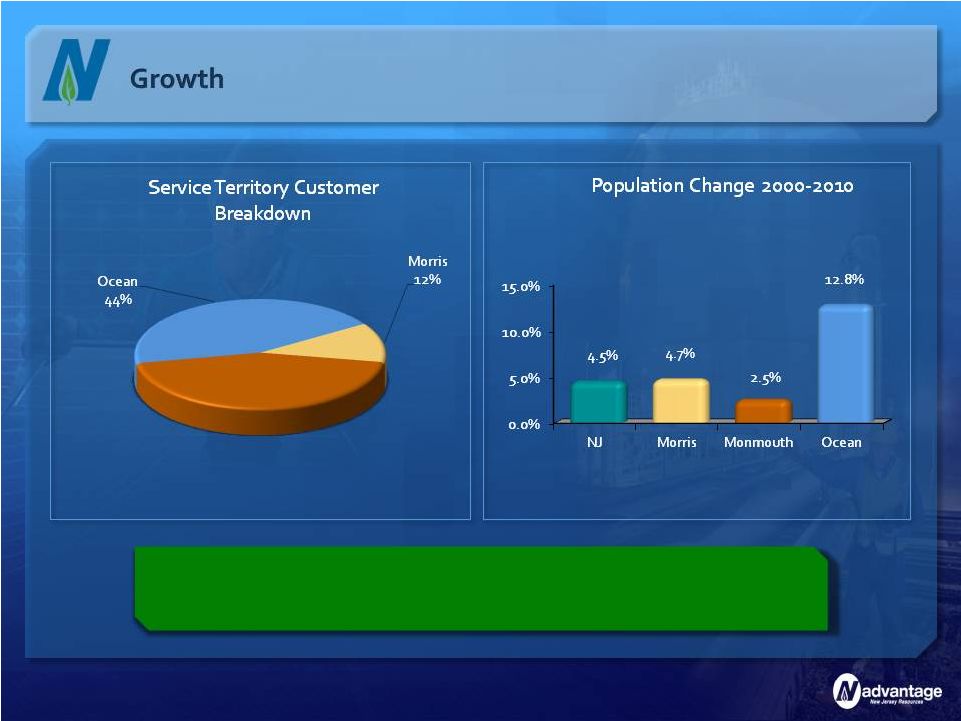

A Growing

Service Area 10

Monmouth

44%

Our service territory is among the fastest growing in the state with

Ocean County accounting for half our growth |

Future New

Construction Potential New Customers = 90,000

Sources: Arthur D. Little, Harte Hanks and NJNG

11

+

New residential construction

market improving

Based on NJ Builders Association

(NJBA) data, Ocean County produced

the State’s highest annual average

number of building permits (3,500)

during the 2000 decade

Rutgers University forecasts

approximately 10,000 newly

constructed homes for the three-year

period 2013-2015

Through March 2012, residential new

construction represented 34% of all new

customer additions and 25% of total

margin

2013 -

2017 |

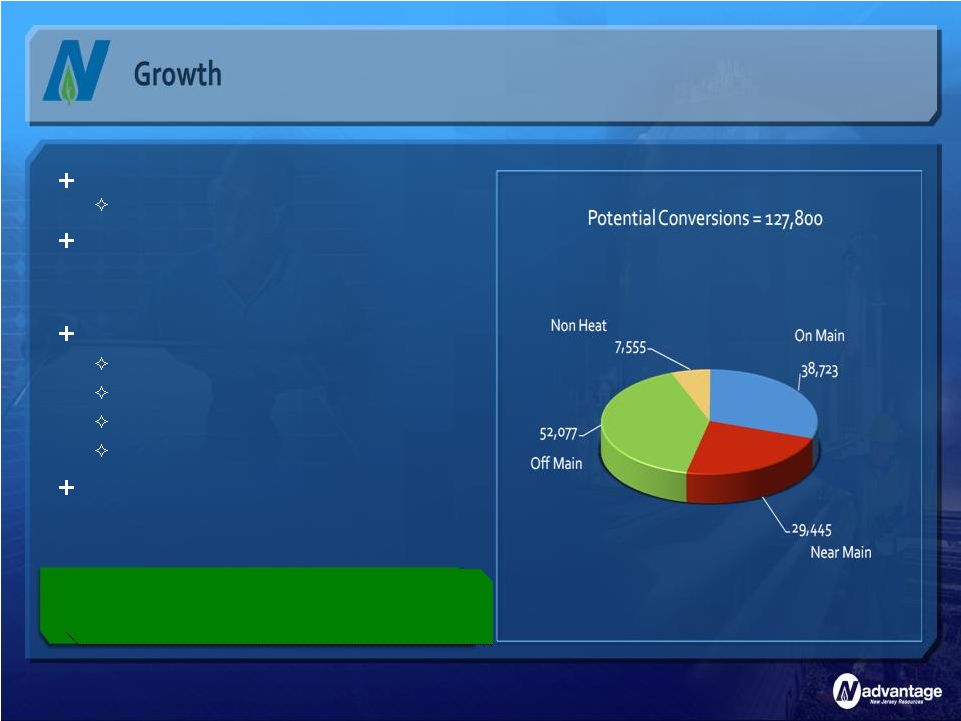

Identify and

target areas for conversion Proximity to existing natural gas lines

Aggressive marketing to communities

using a mix of fuels including oil,

electric and propane

To encourage conversions:

Fuel cost comparisons

Rebates and incentives

Partner with contractors

Direct marketing

Long-term conversion growth outlook is

strong

Robust Conversion Markets

With our new construction and conversion outlook,

we see a potential of about 210,000 new customers

12 |

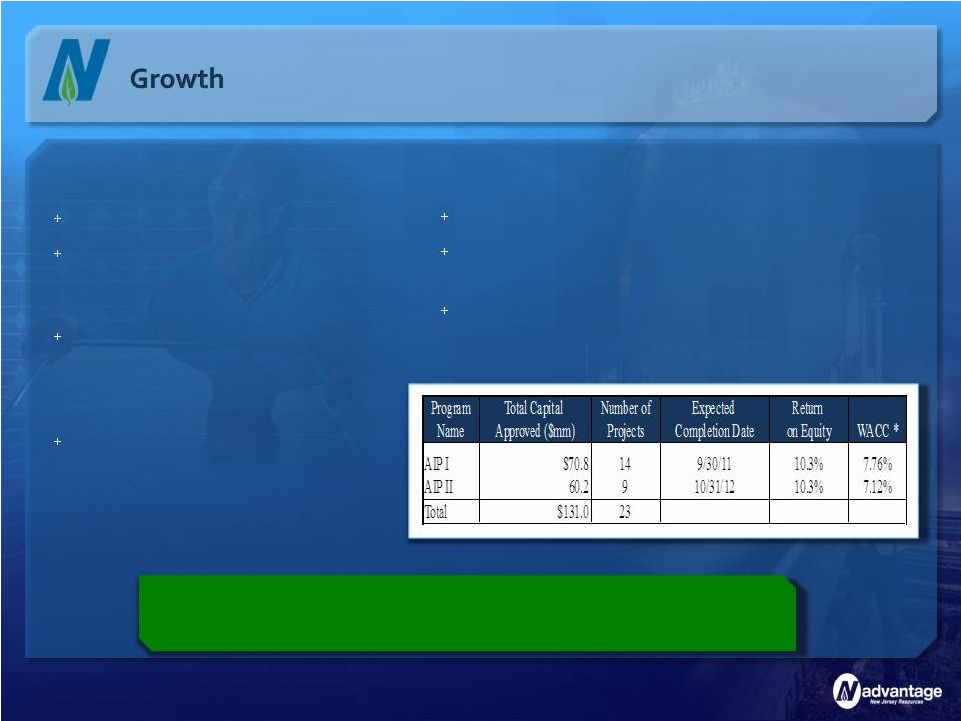

Conservation

Incentive Program Regulatory Update

Accelerated Infrastructure Programs (AIP)

Constructive regulatory environment and support of public policy

objectives

creates

potential

growth

investment

opportunities

for

NJNG

13

Customers have reduced usage and

saved over $219 million since

inception in 2006

Filed for a 2.4 percent increase to its

CIP rate to be effective October 1,

2012, due to significantly warmer-

than-normal winter weather

Protects NJNG from declining usage and

weather; encourages customer

conservation

In place through September 30, 2013

Project spending:

Accelerated capital projects support system reliability

and helps strengthen the state’s economy

Phase II approved on March 30, 2011 |

Safety

Acceleration and Facility Enhancement (SAFE) Program 14

Infrastructure Investment Opportunities

NJ Energy Master Plan supports increased use of natural gas

as well as enhancements to system infrastructure

Filed with the BPU on March 20, 2012 to replace approximately 343 miles of

unprotected steel and cast iron distribution main

Possible $204 million investment over a five-year period

Seeking annual recovery of costs at NJNG’s weighted average cost of capital of

7.76 percent

AFUDC accounting treatment similar to successful AIP programs

Should create approximately 2,100 jobs |

System

Reliability 15

NJNG average response time ranked in the top

quartile nationally and best in New Jersey in 2011 |

+

Over 6 million meters read

+

More than 1 million customer calls

handled

+

Invested almost $96 million to support

customer growth and system reliability

+

Lowest number of BPU complaints per

1,000 customers for 19 consecutive years

through March 31, 2012

+

Highest in Customer Satisfaction With

Residential Natural Gas Service in the

Eastern U.S. among Large Utilities

Customer Satisfaction

Continuously working to meet

customer expectations

16

Rolling 12-months through March31, 2012

New Jersey Natural Gas received the highest numerical score among

large utilities in the Eastern U.S. in the proprietary J.D.

Power and Associates 2011 Gas Utility Residential Customer

Satisfaction Study SM

.

Study based on 62,711 online interviews ranking 10

providers

in

the

Eastern

U.S.

(CT,

DC,

MD,

MA,

NH,

NJ,

NY,

PA,

RI,

VA).

Proprietary

study results are based on experiences and perceptions of

consumers surveyed September

2010

-

July

2011.

Your

experiences

may

vary.

Visit

jdpower.com. |

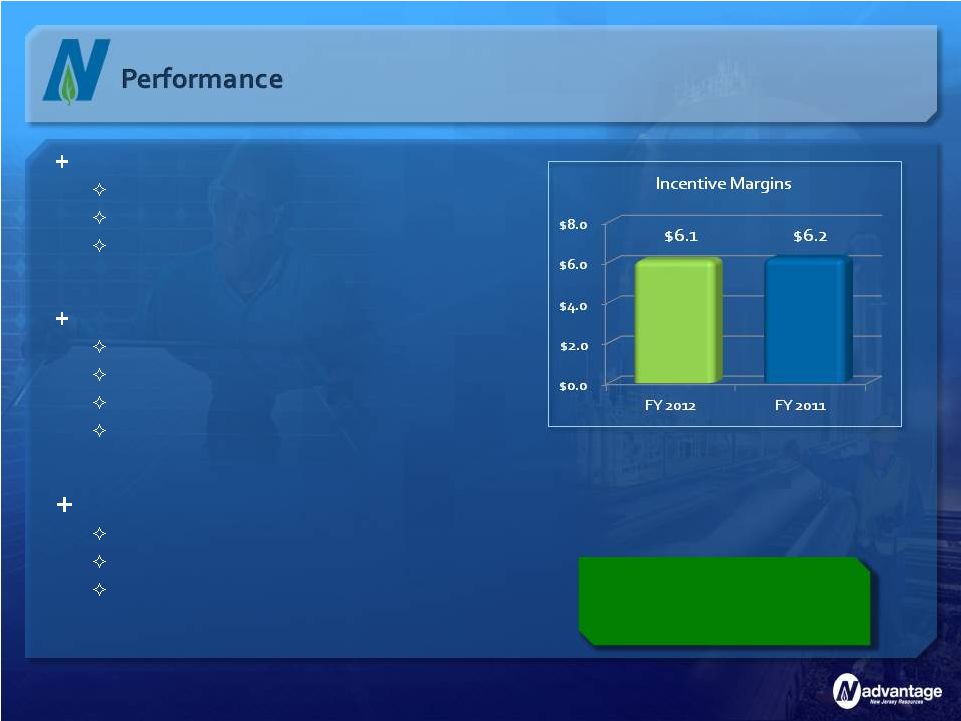

Off-system

sales and capacity release In place since 1992

Optimization of capacity and supply contracts

Sharing formula of 85 percent customer; 15 percent

NJNG

Storage Incentive (SI)

In place since 2004

Promotes long-term price stability

Promotes efficient contract utilization

Sharing formula of 80 percent customer; 20 percent

NJNG

Financial Risk Management (FRM)

In place since 1997

Promote application of risk management tools

Sharing formula of 85 percent customer; 15 percent

NJNG

Regulatory Incentives

Since inception customers have saved over

$573 million with total earnings of $1.85 per

share, an average of $.08 annually

Incentive programs in place

through October 2015

17 |

Consistent

with our core energy strategy Meaningful earnings growth opportunities

Competitively priced electricity for customers

Strong legislative commitment to solar in NJ

Supports NJ’s Energy Master Plan

Our Clean Energy Advantage

Clean energy investments

contributed $22 million to

NFE in the first six months

of fiscal 2012

18 |

Anticipated

legislation in support of New Jersey’s solar industry is pending for vote in both

State Assembly and Senate

Governor supporting solar industry for environmental,

job creation and energy cost benefits to New Jersey

Renewable portfolio standard (RPS) significantly

increased starting in energy year 2014

Solar alternative compliance payments (SACP)

reduced to better reflect current market

conditions

Pending Solar Legislation

NJR targeting $70 to $90 million

of clean energy investments

annually

19 |

Overview

of

New

Jersey’s

Clean

Energy

Initiatives

(GWhrs)

Current proposed legislation supports

a

sustainable

solar

industry

in

New

Jersey

20 |

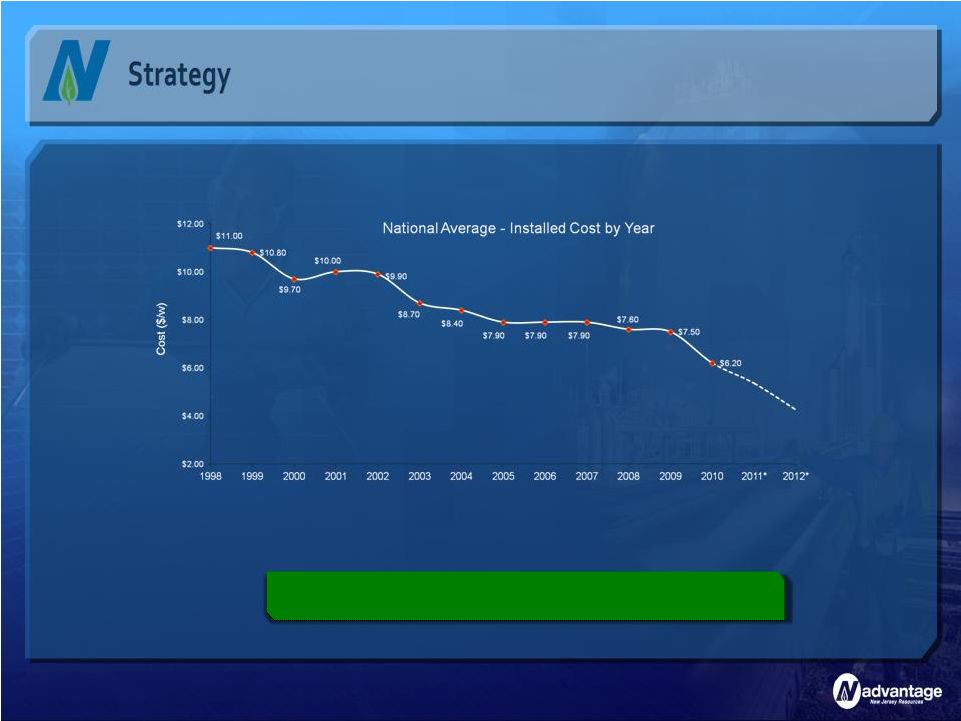

Declining

Solar Material Costs 21

Solar

industry

costs

are

reducing

to

competitive

levels

Source: Lawrence Berkeley National Laboratory

(Behind

the meter weighted average installed cost)

* Industry estimate for 2011 and 2012

|

Fiscal 2012 Q2

results: 272 operational in fiscal 2012

Average size: 7.4 kilowatts

$7 million of capital deployed

Capital projection of

approximately $20.5 million in

fiscal 2012

To date, homeowners have

saved over $390,000 on their

electric bills annually

The Sunlight Advantage

Pipeline for residential solar

leases remains strong

Residential

22 |

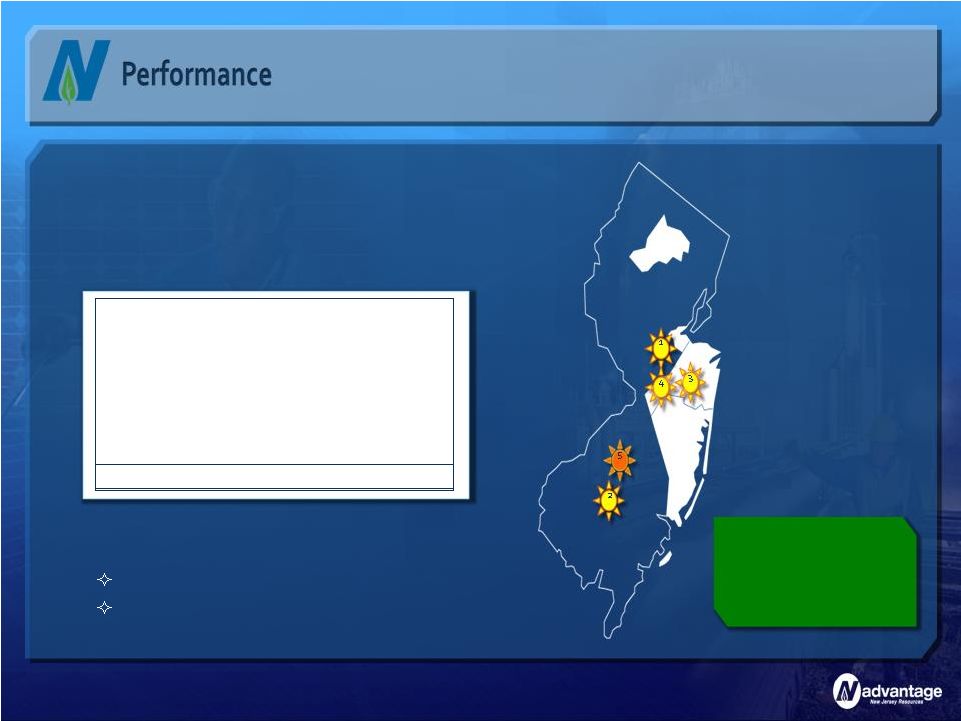

+

Expanding NJR brand beyond traditional service territory

+

Completed projects in fiscal 2011 and 2012:

The Sunlight Advantage

Commercial

+

$96.4 million placed in service in fiscal 2012

+

Medford project announced

$20 million, 6.7 MW project

In service date planned for Q1 fiscal 2013

Additional project

opportunities for

fiscal 2012 and

beyond

23

Project

Capital (MM)

MW

1 -

Adler

2 -

Vineland

3 -

Manalapan

4 -

McGraw Hill

Total

$24.4

22.3

17.2

59.5

$123.4

5.2

4.7

3.6

14.1

27.6 |

+

Changes in volatility and increased shale production have

changed the competitive landscape

Successfully taking advantage of emerging opportunities

Physical participants with a conservative approach

remain profitable

+

Focus on long-option strategy and disciplined risk

management

Provide asset management services to producers

Focus on growing demand for electric generation

and petrochemicals

NJRES NFE

expected to be 5 to

15 percent of fiscal

2012 total

NJR Energy Services |

Midstream

investments contributed $3.8 million in the first six-months of fiscal 2012;

Expected to contribute between 3 and 10 percent of total 2012 NFE

Steckman Ridge

50 percent joint venture with Spectra Energy

Up to 12 Bcf storage facility in southwestern Pennsylvania

66 percent of Steckman Ridge revenue from long-term contracts

Iroquois

5.53 percent ownership in pipeline from Canada to the northeast

NJR Energy Holdings |

Home Services

Advantage Consistently delivers high-quality products and service levels

26

Serves nearly 140,000 customers with Premier

Service Plans, service contracts and equipment

installations

Geographic expansion

Currently marketing in Sussex, Warren and Hunterdon

counties

Fiscal 2011 revenue of more than $36 million, an

18 percent increase over last year

Expected to contribute 1-5 percent of fiscal 2012

NFE |

Delivering

Results 27

($MM)

Company

2012

2011

Change

New Jersey Natural Gas

$70.9

$68.4

$2.5

NJR Energy Services

23.5

19.2

4.3

NJR Clean Energy

22.0

5.2

16.8

NJR Energy Holdings

3.8

3.9

(0.1)

NJR Home Services/Other

(0.8)

(0.5)

(0.3)

Total

$119.4

$96.2

$23.2

NFE per basic share

$2.88

$2.33

$0.55

FYTD March 31, |

A Record of

Consistency NJR currently

estimates net

financial earnings

of $2.60 to $2.80

per basic share in

fiscal 2012

28

$1.50

$1.80

$2.10

$2.40

$2.70

2008

2009

2010

2011

2012

Current

Range

$2.24

$2.40

$2.46

$2.58

$2.60-$2.80

Net Financial Earnings |

2012 Earnings

Guidance Infrastructure-based

businesses expected

to contribute about

90 percent of fiscal

2012 NFE

29 |

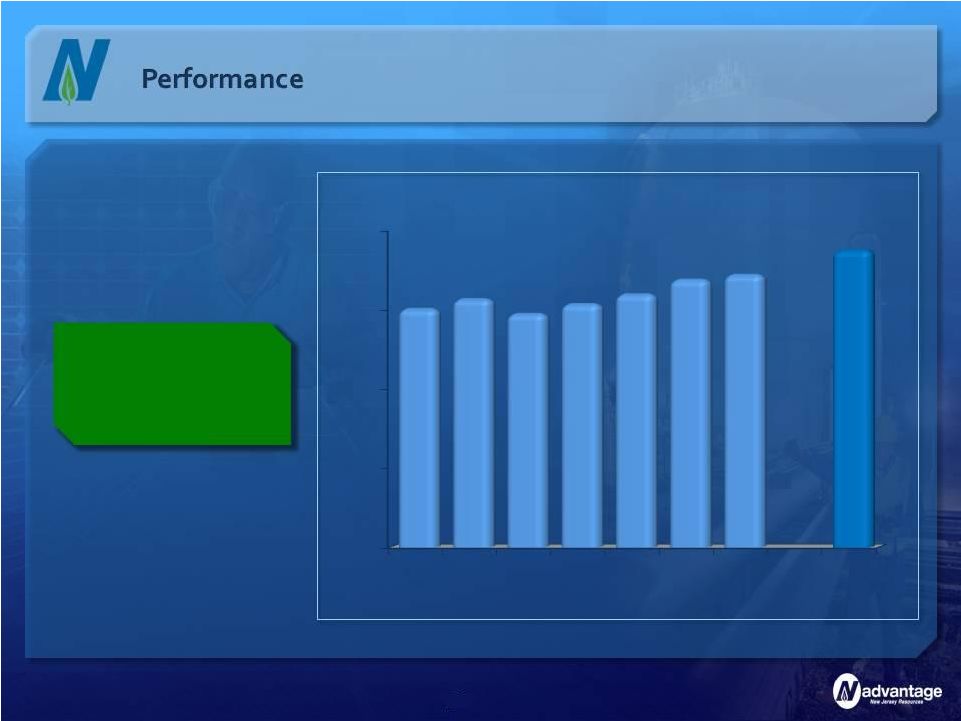

Dividend

Growth 19

dividend

increase in 17 years;

1-year growth rate

of 5.6 percent

compared with 3.7

percent

for peers

* Effective January 3, 2012

** Based on current indicated dividend rates

30

th

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

2007

2008

2009

2010

2011

2012*

$1.01

$1.12

$1.24

$1.36

$1.44

$1.52 |

Payout

Ratio* Strong reinvestment to

support future growth

* Based on NJR Net Financial Earnings

** Peer group average based on 2011 earnings estimates

and indicated dividend from Bloomberg. Peer group:

ATO, GAS, LG, NWN, PNY, SJI, SWX, VVC and WGL

31

0%

16%

33%

49%

65%

2005

2006

2007

2008

2009

2010

2011

Peer Group**

49%

51%

48%

50%

52%

55%

56%

61% |

Capital

Expenditures Capital expenditures support future growth

32

($MM)

Fiscal 2012

2012

2011

Estimate

NJNG

New Customer

$10.8

$10.2

$20.6

System Integrity

11.6

10.8

33.3

AIP Projects

14.9

15.8

49.9

Technology & Other

5.1

6.8

8.4

Cost of Removal

6.8

3.6

9.0

Sub-total NJNG

49.2

47.2

121.2

Clean Energy Ventures

61.9

11.5

103.2

Other Non-Utility

0.3

0.4

0.7

Total

$111.4

$59.1

$225.1

FYTD March 31, |

Delivering

Premium Results We have the fundamentals in place to achieve continued

operational excellence, consistent results and long-term

growth

33

Strategy

Performance

Growth

Core utility provides

majority of

earnings

Pursue

complementary

non-regulated

businesses

Work constructively

with regulators

and policymakers

Maintain strong

financial profile

A track record of

consistent results

Increasing dividend

while maintaining

low payout ratio

Five-year total return

greater than

peer group average

A tradition of

outstanding

customer service

and safety

Core customer

growth

Regulated

infrastructure

opportunities

Clean energy

investments

Retail energy services |

New Jersey

Resources A Premium Company Delivering Premium Results

New York Financial Community

June 13, 2012 |