Attached files

| file | filename |

|---|---|

| 8-K - AMERICAN CAMPUS COMMUNITIES, INC. 8-K - AMERICAN CAMPUS COMMUNITIES INC | a50305531.htm |

AMERICAN CAMPUS COMMUNITIES REITWeek 2012 Investor Presentation June 2012 Exhibit 99.1

AMERICAN CAMPUS COMMUNITIES :: 1 Investment Rationale :: Barrett Honors College | Tempe, AZ Vista del Campo | Irvine, CA Vista del Sol | Tempe, AZ Strong Industry Fundamentals with Recession Resiliency “Best in Class” Company Disciplined and Diversified Investment Strategy in a Highly Fragmented Growth Sector Premier Proprietary Operating Platform Consistent Financial Performance Supported by a Conservative Balance Sheet

AMERICAN CAMPUS COMMUNITIES :: 2 Strong Industry Fundamentals :: Between 2009 – 2020, college enrollment is projected to increase by 13% to approximately 23 million students Increasing percentage of high school students are attending college Students are taking longer than 4 years to complete their degree with only 29% graduating from public university within 4 years Universities served by ACC only provide housing for 23% of total enrollment on average 1950’s – 1960’s on-campus residence halls need to be replaced due to obsolescence Budgetary constraints in many states create private sector investment opportunities for both on and off-campus housing Highly fragmented ownership of student housing with few well-capitalized companies and / or proficient, specialized operators Strong industry demographics drive resilient operating results and opportunities for growth Strong Demand Limited Supply Growth Opportunities

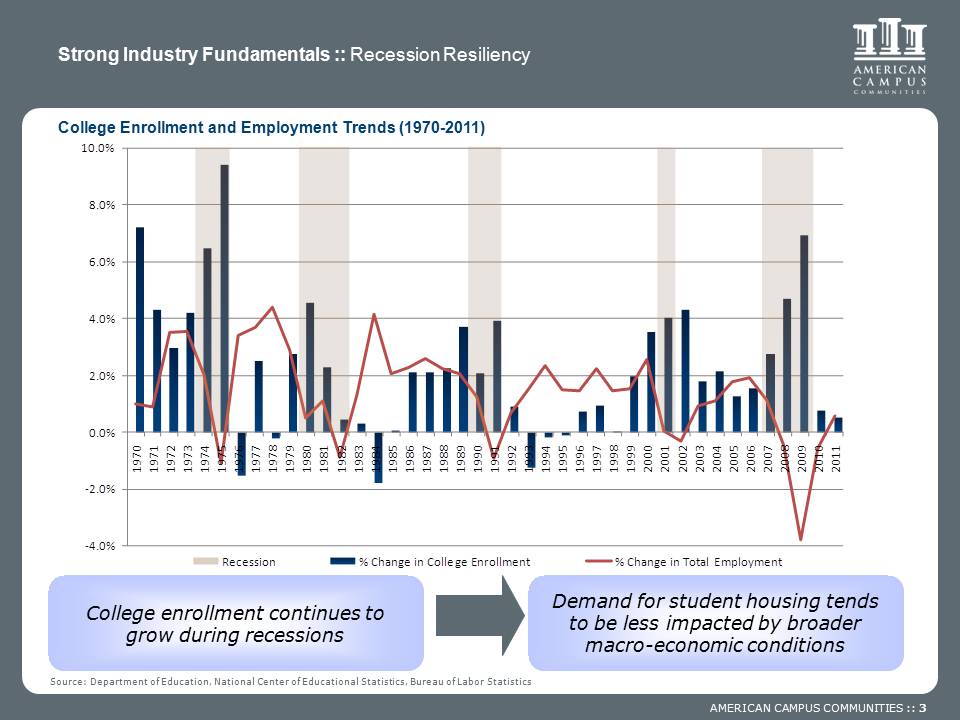

AMERICAN CAMPUS COMMUNITIES :: 3 Strong Industry Fundamentals :: Recession Resiliency College Enrollment and Employment Trends (1970-2011) Source: Department of Education, National Center of Educational Statistics, Bureau of Labor Statistics College enrollment continues to grow during recessions Demand for student housing tends to be less impacted by broader macro-economic conditions

AMERICAN CAMPUS COMMUNITIES :: 4 “Best in Class” Company :: ACC is the “Best in Class” company in the student housing industry –Industry leading operational and financial results –Proven track record of successfully integrating acquisitions and developments –Successfully increased the size of the portfolio from 16 to 123 properties while generating average annual same store NOI growth of 5.3% during the 7 years since the IPO –Achieved same store occupancy growth, rental rate increases and NOI growth in each year since the IPO –Same store portfolio occupancy achieved each fall since IPO has averaged 97.9% –Franchise name in sector and University partner of choice –Best positioned balance sheet –Consistently maintained low leverage and minimal balances on credit facility while growing portfolio –Stock performance since IPO –Outperformed Morgan Stanley REIT Index, Multi-Family Composite(1), student housing peers, NASDAQ, Dow Jones, and S&P 500 Barrett Honors College | Tempe, AZ Callaway Villas | College Station, TX University Centre | Newark, NJ (1) Multifamily Apartment Composite includes AEC, AIV, AVB, BRE, CLP, CPT, EQR, ESS, HME, MAA, PPS, UDR.

AMERICAN CAMPUS COMMUNITIES :: 5 Disciplined and Diversified Investment Strategy :: Disciplined Investment Criteria Close proximity to campus Product differentiation and strategic positioning Student housing submarkets with barriers to entry Undermanaged / underperforming assets offering NOI upside Diversified Investment Strategy Acquisitions Off-Campus Development On-Campus Development - American Campus Equity (ACE®) Callaway Villas | College Station, TX Vista del Campo Norte | Irvine, CA Vista del Sol | Tempe, AZ

AMERICAN CAMPUS COMMUNITIES :: 6 Disciplined and Diversified Investment Strategy :: New Store Growth Acquisitions(1) 5 Core properties with an average distance to campus of 0.2 miles 2 Undermanaged / Repositioned properties Fall 2011 - Fall 2013 28 assets | $1.1 billion Developments Class A in A+ location with distance to campus of less than 0.1 miles Differentiated products Meaningful Quality Growth Consistent with Investment Criteria 7 21 (1) Reflects Acquisitions as of June 11, 2012

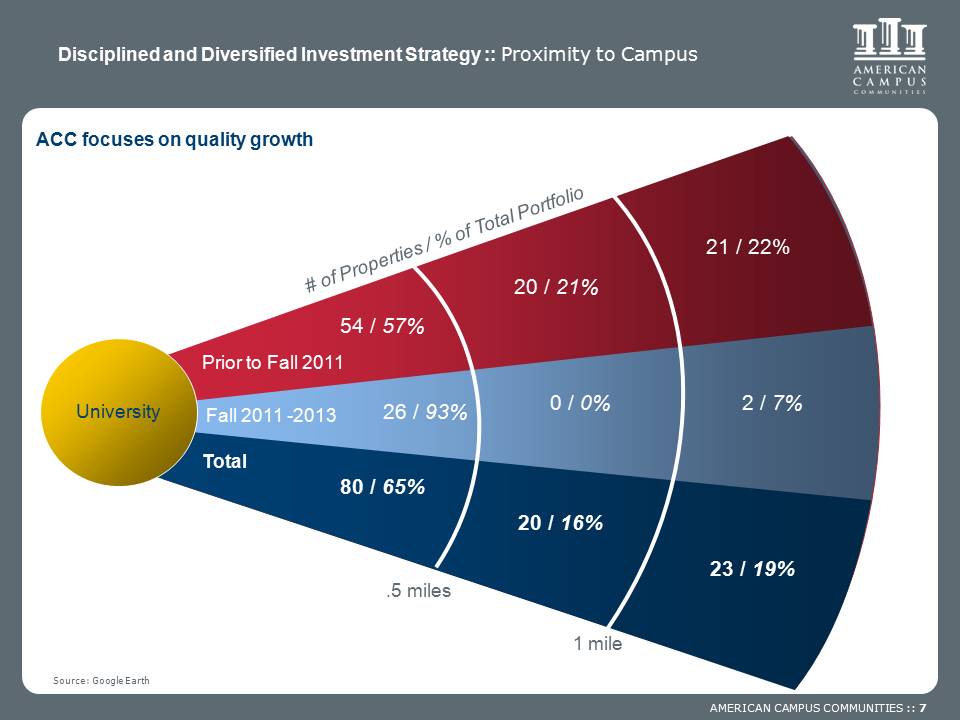

AMERICAN CAMPUS COMMUNITIES :: 7 Source: Google Earth Disciplined and Diversified Investment Strategy :: Proximity to Campus ACC focuses on quality growth University 54 / 57% Prior to Fall 2011 Fall 2011 -2013 Total .5 miles 1 mile 20 / 21% 21 / 22% 26 / 93% 0 / 0% 2 / 7% 80 / 65% 20 / 16% 23 / 19%

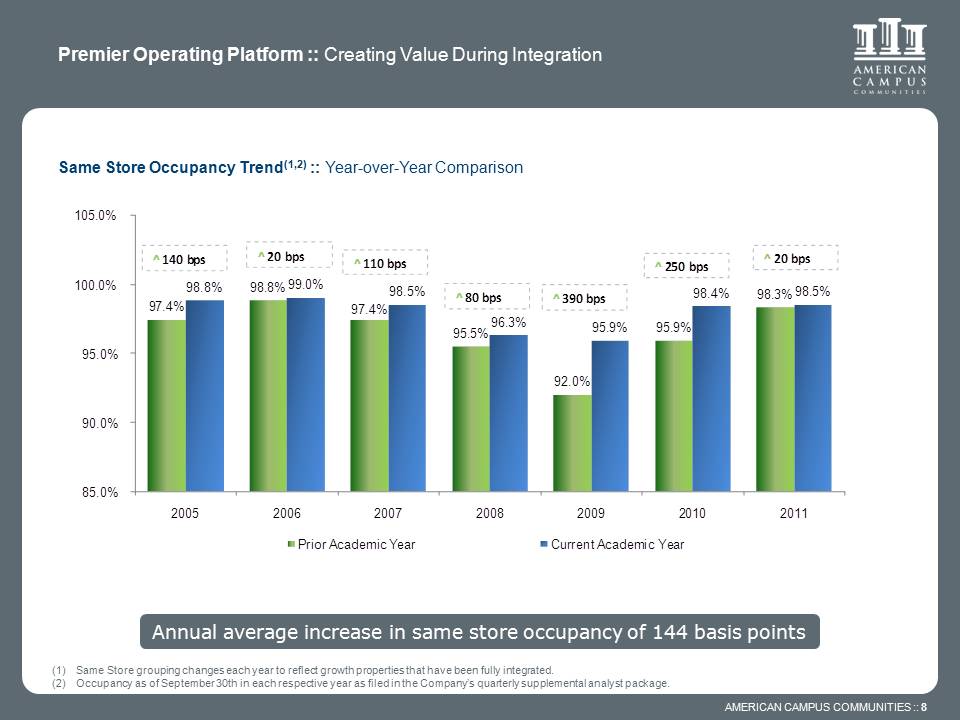

AMERICAN CAMPUS COMMUNITIES :: 8 Premier Operating Platform :: Creating Value During Integration Same Store Occupancy Trend(1,2) :: Year-over-Year Comparison (1)Same Store grouping changes each year to reflect growth properties that have been fully integrated. (2)Occupancy as of September 30th in each respective year as filed in the Company’s quarterly supplemental analyst package. Annual average increase in same store occupancy of 144 basis points 97.4% 98.8% 97.4% 95.5% 92.0% 95.9% 98.3% 98.8% 99.0% 98.5% 96.3% 95.9% 98.4% 98.5% 85.0% 90.0% 95.0% 100.0% 105.0% 2005 2006 2007 2008 2009 2010 2011 Prior Academic YearCurrent Academic Year^20 bps^110 bps^80 bps^390 bps^250 bps^140 bps^20 bps

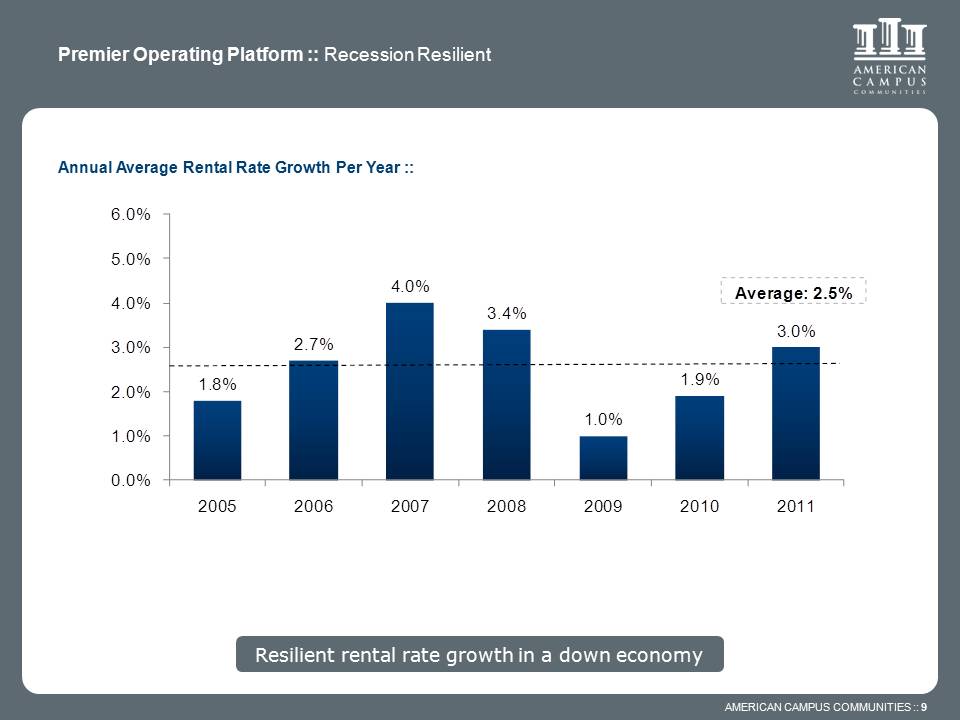

AMERICAN CAMPUS COMMUNITIES :: 9 Premier Operating Platform :: Recession Resilient Annual Average Rental Rate Growth Per Year :: Resilient rental rate growth in a down economy 1.8% 2.7%4.0%3.4%1.0%1.9%3.0%0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 2005200620072008200920102011Average: 2.5%

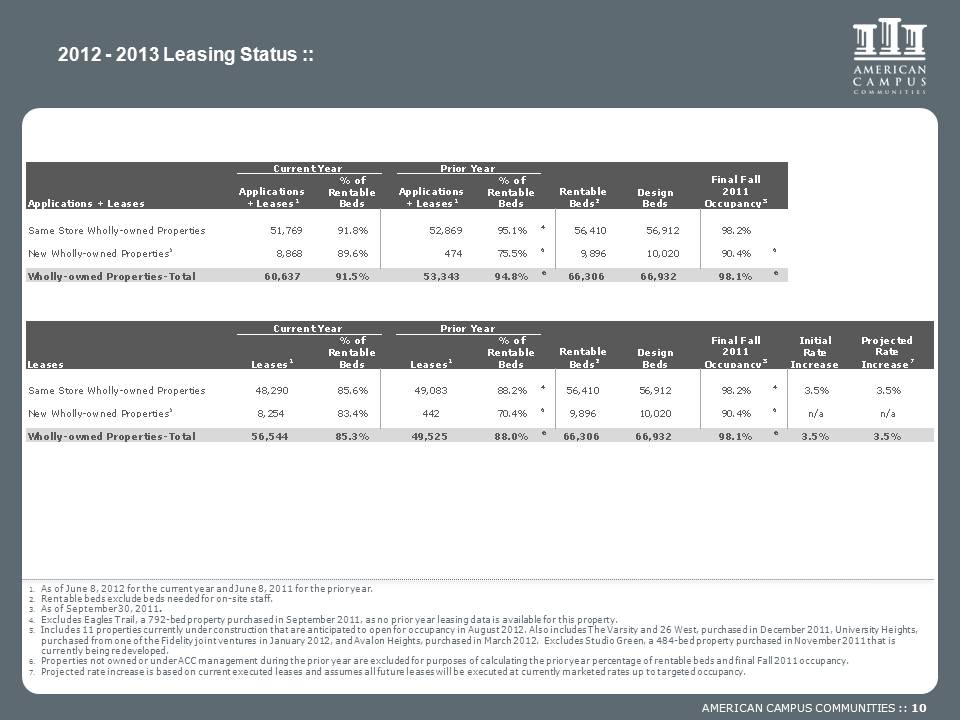

2012 - 2013 Leasing Status :: Applications + LeasesApplications + Leases1% of Rentable BedsApplications + Leases1% of Rentable BedsRentableBeds2Design BedsFinal Fall 2011 Occupancy3Same Store Wholly-owned Properties 51,769 91.8% 52,869 95.1% 456,410 56,912 98.2% New Wholly-owned Properties 58,868 8 9.6% 474 75.5% 69,896 10,020 90.4% 6 Wholly-owned Properties-Total 60,637 91.5% 53,343 94.8% 666,306 66,932 98.1%6LeasesLeases1% of Rentable BedsLeases1% of Rentable BedsRentableBeds2Design BedsFinal Fall 2011 Occupancy3Initial Rate IncreaseProjected Rate Increase7Same Store Wholly-owned Properties 48,290 85.6% 49,083 88.2% 456,410 56,912 98.2% 43.5% 3.5% New Wholly-owned Properties 58,254 83.4% 44 270.4% 69,896 10,020 90.4% 6 n/an/aWholly-owned Properties-Total 56,544 85.3% 49,525 88.0% 666,306 66,932 98.1% 63.5% 3.5% Current YearPrior YearCurrent YearPrior Year1.As of June 8, 2012 for the current year and June 8, 2011 for the prior year. 2.Rentable beds exclude beds needed for on-site staff. 3.As of September 30, 2011. 4.Excludes Eagles Trail, a 792-bed property purchased in September 2011, as no prior year leasing data is available for this property. 5.Includes 11 properties currently under construction that are anticipated to open for occupancy in August 2012. Also includes The Varsity and 26 West, purchased in December 2011, University Heights, purchased from one of the Fidelity joint ventures in January 2012, and Avalon Heights, purchased in March 2012. Excludes Studio Green, a 484-bed property purchased in November 2011 that is currently being redeveloped. 6.Properties not owned or under ACC management during the prior year are excluded for purposes of calculating the prior year percentage of rentable beds and final Fall 2011 occupancy. 7.Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy.

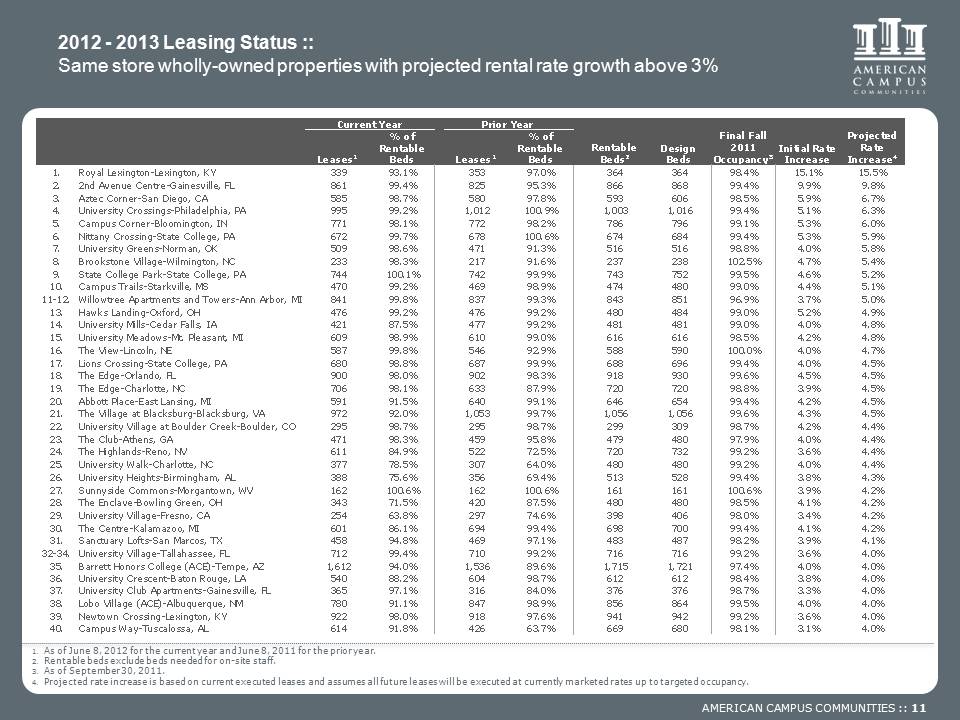

AMERICAN CAMPUS COMMUNITIES :: 11 2012 - 2013 Leasing Status :: Same store wholly-owned properties with projected rental rate growth above 3% Leases1% of Rentable BedsLeases1% of Rentable Beds1.Royal Lexington-Lexington, KY 339 93.1% 353 97.0% 364 364 98.4% 15.1% 15.5% 2.2nd Avenue Centre-Gainesville, FL 861 99.4% 825 95.3% 866 868 99.4% 9.9% 9.8% 3.Aztec Corner-San Diego, CA 585 98.7% 580 97.8% 593 606 98.5% 5.9% 6.7% 4.University Crossings-Philadelphia, PA 995 99.2% 1,012 100.9% 1,003 1,016 99.4% 5.1% 6.3% 5. Campus Corner-Bloomington, IN 771 98.1% 772 98.2% 786 796 99.1% 5.3% 6.0% 6.Nittany Crossing-State College, PA 672 99.7% 678 100.6% 674 684 99.4% 5.3% 5.9% 7. University Greens-Norman, OK 509 98.6% 471 91.3% 516 516 98.8% 4.0% 5.8% 8. Brookstone Village-Wilmington, NC 233 98.3% 217 91.6% 237 238 102.5% 4.7% 5.4% 9. State College Park-State College, PA 744 100.1% 742 99.9% 743 752 99.5% 4.6% 5.2% 10. Campus Trails-Starkville, MS 470 99.2% 469 98.9% 474 480 99.0% 4.4% 5.1% 11-12. Willowtree Apartments and Towers-Ann Arbor, MI 841 99.8% 837 99.3% 843 851 96.9% 3.7% 5.0% 13. Hawks Landing-Oxford, OH 476 99.2% 476 99.2% 480 484 99.0% 5.2% 4.9% 14. University Mills-Cedar Falls, IA4 218 7.5% 477 99.2% 481 481 99.0% 4.0% 4.8% 15. University Meadows-Mt. Pleasant, MI 609 98.9% 610 99.0% 616 616 98.5% 4.2% 4.8% 16. The View-Lincoln, NE 587 99.8% 546 92.9% 588 590 100.0% 4.0% 4.7% 17. Lions Crossing-State College, PA 680 98.8% 687 99.9% 688 696 99.4% 4.0% 4.5% 18. The Edge-Orlando, FL 900 98.0% 902 98.3% 918 930 99.6% 4.5% 4.5% 19. The Edge-Charlotte, NC 706 98.1% 633 87.9% 720 720 98.8% 3.9% 4.5%20.Abbott Place-East Lansing, MI 591 91.5% 640 99.1% 646 654 99.4% 4.2% 4.5% 21. The Village at Blacksburg-Blacksburg, VA 972 92.0% 1,053 99.7% 1,056 1,056 99.6% 4.3% 4.5% 22. University Village at Boulder Creek-Boulder, CO 295 98.7% 295 98.7% 299 309 98.7% 4.2% 4.4% 23. The Club-Athens, GA 471 98.3% 459 95.8% 479 480 97.9% 4.0% 4.4% 24. The Highlands-Reno, NV 611 84.9% 522 72.5% 720 732 99.2% 3.6% 4.4% 25. University Walk-Charlotte, NC 377 78.5% 307 64.0% 480 480 99.2% 4.0% 4.4% 26. University Heights-Birmingham, AL 388 75.6% 356 69.4% 513 528 99.4% 3.8% 4.3% 27. Sunnyside Commons-Morgantown, WV 162 100.6% 162 100.6% 161 161 100.6% 3.9% 4.2% 28. The Enclave-Bowling Green, OH 343 71.5% 420 87.5% 480 480 98.5% 4.1% 4.2% 29. University Village-Fresno, CA 254 63.8% 297 74.6% 398 406 98.0% 3.4% 4.2% 30. The Centre-Kalamazoo, MI60186.1%69499.4% 698 700 99.4% 4.1% 4.2% 31. Sanctuary Lofts-San Marcos, TX 458 94.8% 469 97.1% 483 487 98.2% 3.9% 4.1% 32-34. University Village-Tallahassee, FL 712 99.4% 710 99.2% 716 716 99.2% 3.6% 4.0% 35. Barrett Honors College (ACE)-Tempe, AZ 1,612 94.0% 1,536 89.6% 1,715 1,721 97.4% 4.0% 4.0% 36. University Crescent-Baton Rouge, LA 540 88.2% 604 98.7% 612 612 98.4% 3.8% 4.0% 37. University Club Apartments-Gainesville, FL 365 97.1% 316 84.0% 376 376 98.7% 3.3% 4.0% 38. Lobo Village (ACE)-Albuquerque, NM 780 91.1% 847 98.9% 856 864 99.5% 4.0% 4.0% 39. Newtown Crossing-Lexington, KY 922 98.0% 918 97.6% 941 942 99.2% 3.6% 4.0% 40. Campus Way-Tuscalossa, AL 614 91.8% 426 63.7% 669 680 98.1% 3.1% 4.0% Current Year Prior Year Projected Rate Increase 4 Initial Rate Increase Final Fall 2011 Occupancy 3 Design Beds Rentable Beds 21. As of June 8, 2012 for the current year and June 8, 2011 for the prior year. 2. Rentable beds exclude beds needed for on-site staff. 3. As of September 30, 2011. 4. Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy.

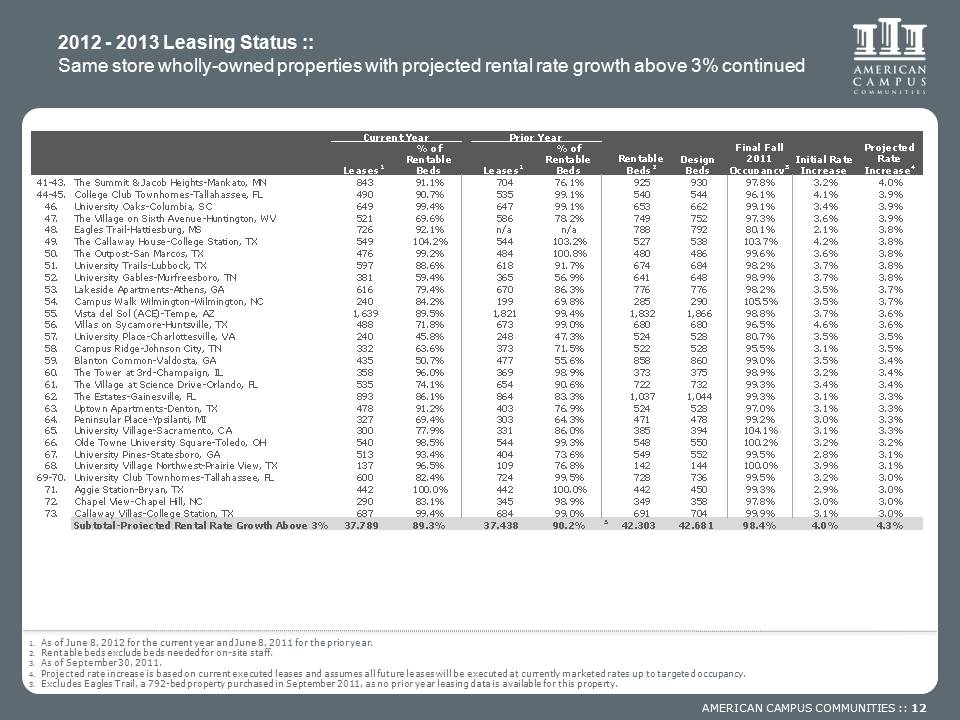

AMERICAN CAMPUS COMMUNITIES :: 12 2012 - 2013 Leasing Status :: Same store wholly-owned properties with projected rental rate growth above 3% continued Leases 1% of Rentable BedsLeases1% of Rentable Beds41-43.The Summit & Jacob Heights-Mankato, MN 843 91.1% 704 76.1% 925 930 97.8% 3.2% 4.0% 44-45. College Club Townhomes-Tallahassee, FL 490 90.7% 535 99.1% 540 544 96.1% 4.1% 3.9% 46. University Oaks-Columbia, SC 649 99.4% 647 99.1% 653 662 99.1% 3.4% 3.9% 47. The Village on Sixth Avenue-Huntington, WV 521 69.6% 586 78.2% 749 752 97.3% 3.6% 3.9% 48. Eagles Trail-Hattiesburg, MS 726 92.1% n/a n/a 788 792 80.1% 2.1% 3.8% 49. The Callaway House-College Station, TX 549 104.2% 544 103.2% 527 538 103.7% 4.2% 3.8% 50. The Outpost-San Marcos, TX 476 99.2% 484 100.8% 480 486 99.6% 3.6% 3.8% 51. University Trails-Lubbock, TX 597 88.6% 618 91.7% 674 684 98.2% 3.7% 3.8% 52. University Gables-Murfreesboro, TN 381 59.4% 365 56.9% 641 648 98.9% 3.7% 3.8% 53. Lakeside Apartments-Athens, GA 616 79.4% 670 86.3% 776 776 98.2% 3.5% 3.7% 54. Campus Walk Wilmington-Wilmington, NC 240 84.2% 199 69.8% 285 290 105.5% 3.5% 3.7% 55. Vista del Sol (ACE)-Tempe, AZ 1,639 89.5% 1,821 99.4% 1,832 1,866 98.8% 3.7% 3.6% 56. Villas on Sycamore-Huntsville, TX 488 71.8% 673 99.0% 680 680 96.5% 4.6% 3.6% 57. University Place-Charlottesville, VA 240 45.8% 248 47.3% 524 528 80.7% 3.5% 3.5% 58. Campus Ridge-Johnson City, TN 332 63.6% 373 71.5% 522 528 95.5% 3.1% 3.5% 59. Blanton Common-Valdosta, GA 435 50.7% 477 55.6% 858 860 99.0% 3.5% 3.4% 60. The Tower at 3rd-Champaign, IL 358 96.0% 369 98.9% 373 375 98.9% 3.2% 3.4% 61. The Village at Science Drive-Orlando, FL 535 74.1% 654 90.6% 722 732 99.3% 3.4% 3.4% 62. The Estates-Gainesville, FL 893 86.1% 864 83.3% 1,037 1,044 99.3% 3.1% 3.3% 63. Uptown Apartments-Denton, TX 478 91.2% 403 76.9% 524 528 97.0% 3.1% 3.3% 64. Peninsular Place-Ypsilanti, MI 327 69.4% 303 64.3% 471 478 99.2% 3.0% 3.3% 65. University Village-Sacramento, CA 300 77.9% 331 86.0% 385 394 104.1% 3.1% 3.3% 66. Olde Towne University Square-Toledo, OH 540 98.5% 544 99.3% 548 550 100.2% 3.2% 3.2% 67. University Pines-Statesboro, GA 513 93.4% 404 73.6% 549 552 99.5% 2.8% 3.1% 68. University Village Northwest-Prairie View, TX 137 96.5% 109 76.8% 142 144 100.0% 3.9% 3.1% 69-70. University Club Townhomes-Tallahassee, FL 600 82.4% 724 99.5% 728 736 99.5% 3.2% 3.0% 71. Aggie Station-Bryan, TX 442 100.0% 442 100.0% 442 450 99.3% 2.9% 3.0% 72. Chapel View-Chapel Hill, NC 290 83.1% 345 98.9% 349 358 97.8% 3.0% 3.0% 73. Callaway Villas-College Station, TX 687 99.4% 684 99.0% 691 704 99.9% 3.1% 3.0% Subtotal-Projected Rental Rate Growth Above 3% 37,789 89.3% 37,438 90.2% 542,303 42,681 98.4% 4.0% 4.3% Projected Rate Increase 4 Current Year Prior Year Rentable Beds 2 Design Beds Final Fall 2011 Occupancy 3 Initial Rate Increase 1. As of June 8, 2012 for the current year and June 8, 2011 for the prior year. 2. Rentable beds exclude beds needed for on-site staff. 3. As of September 30, 2011. 4. Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy. 5. Excludes Eagles Trail, a 792-bed property purchased in September 2011, as no prior year leasing data is available for this property.

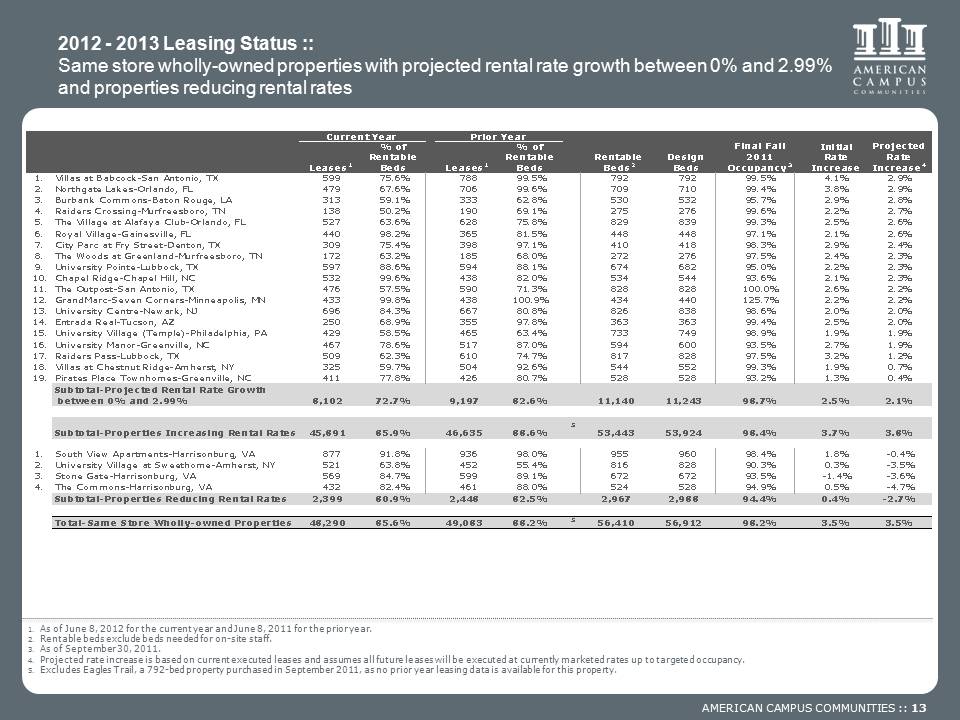

AMERICAN CAMPUS COMMUNITIES :: 13 2012 - 2013 Leasing Status :: Same store wholly-owned properties with projected rental rate growth between 0% and 2.99% and properties reducing rental rates Leases1% of Rentable BedsLeases1% of Rentable Beds1.Villas at Babcock-San Antonio, TX 599 75.6% 788 99.5% 792 792 99.5% 4.1% 2.9% 2. Northgate Lakes-Orlando, FL 479 67.6% 706 99.6% 709 710 99.4% 3.8% 2.9% 3. Burbank Commons-Baton Rouge, LA 313 59.1% 333 62.8% 530 532 95.7% 2.9% 2.8% 4. Raiders Crossing-Murfreesboro, TN 138 50.2% 190 69.1% 275 276 99.6% 2.2% 2.7% 5. The Village at Alafaya Club-Orlando, FL 527 63.6% 628 75.8% 829 839 99.3% 2.5% 2.6% 6. Royal Village-Gainesville, FL 440 98.2% 365 81.5% 448 448 97.1% 2.1% 2.6% 7. City Parc at Fry Street-Denton, TX 309 75.4% 398 97.1% 410 418 98.3% 2.9% 2.4 %8. The Woods at Greenland-Murfreesboro, TN 172 63.2% 185 68.0% 272 276 97.5% 2.4% 2.3% 9. University Pointe-Lubbock, TX 597 88.6% 594 88.1% 674 682 95.0% 2.2% 2.3% 10. Chapel Ridge-Chapel Hill, NC 532 99.6% 438 82.0% 534 544 93.6% 2.1% 2.3% 11. The Outpost-San Antonio, TX 476 57.5% 590 71.3% 828 828 100.0% 2.6% 2.2% 12. GrandMarc-Seven Corners-Minneapolis, MN 433 99.8% 438 100.9% 434 440 125.7% 2.2% 2.2% 13 .University Centre-Newark, NJ 696 84.3% 667 80.8% 826 838 98.6% 2.0% 2.0% 14. Entrada Real-Tucson, AZ 250 68.9% 355 97.8% 363 363 99.4% 2.5% 2.0% 15. University Village (Temple)-Philadelphia, PA 429 58.5% 465 63.4% 733 749 98.9% 1.9% 1.9% 16. University Manor-Greenville, NC 467 78.6% 517 87.0% 594 600 93.5% 2.7% 1.9% 17. Raiders Pass-Lubbock, TX 509 62.3% 610 74.7% 817 828 97.5% 3.2% 1.2% 18. Villas at Chestnut Ridge-Amherst, NY 325 59.7% 504 92.6% 544 552 99.3% 1.9% 0.7% 19. Pirates Place Townhomes-Greenville, NC 411 77.8% 426 80.7% 528 528 93.2% 1.3% 0.4% Subtotal-Projected Rental Rate Growth between 0% and 2.99% 8,102 72.7% 9,197 82.6% 11,140 11,243 98.7% 2.5% 2.1% Subtotal-Properties Increasing Rental Rates 45,891 85.9% 46,635 88.6% 5 53,443 53,924 98.4% 3.7% 3.8% 1. South View Apartments-Harrisonburg, VA 877 91.8% 936 98.0% 955 960 98.4% 1.8%-0.4% 2. University Village at Sweethome-Amherst, NY 521 63.8% 452 55.4% 816 828 90.3% 0.3%-3.5% 3. Stone Gate-Harrisonburg, VA 569 84.7% 599 89.1% 672 672 93.5% -1.4%-3.6% 4. The Commons-Harrisonburg, VA 432 82.4% 461 88.0% 524 528 94.9% 0.5% -4.7% Subtotal-Properties Reducing Rental Rates 2,399 80.9% 2,448 82.5% 2,967 2,988 94.4% 0.4%-2.7% Total-Same Store Wholly-owned Properties 48,290 85.6% 49,083 88.2% 5 56,410 56,912 98.2% 3.5% 3.5% Projected Rate Increase 4 Current YearPrior Year Rentable Beds 2 Design Beds Final Fall 2011 Occupancy 3 Initial Rate Increase1. As of June 8, 2012 for the current year and June 8, 2011 for the prior year. 2. Rentable beds exclude beds needed for on-site staff. 3. As of September 30, 2011. 4. Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy. 5. Excludes Eagles Trail, a 792-bed property purchased in September 2011, as no prior year leasing data is available for this property.

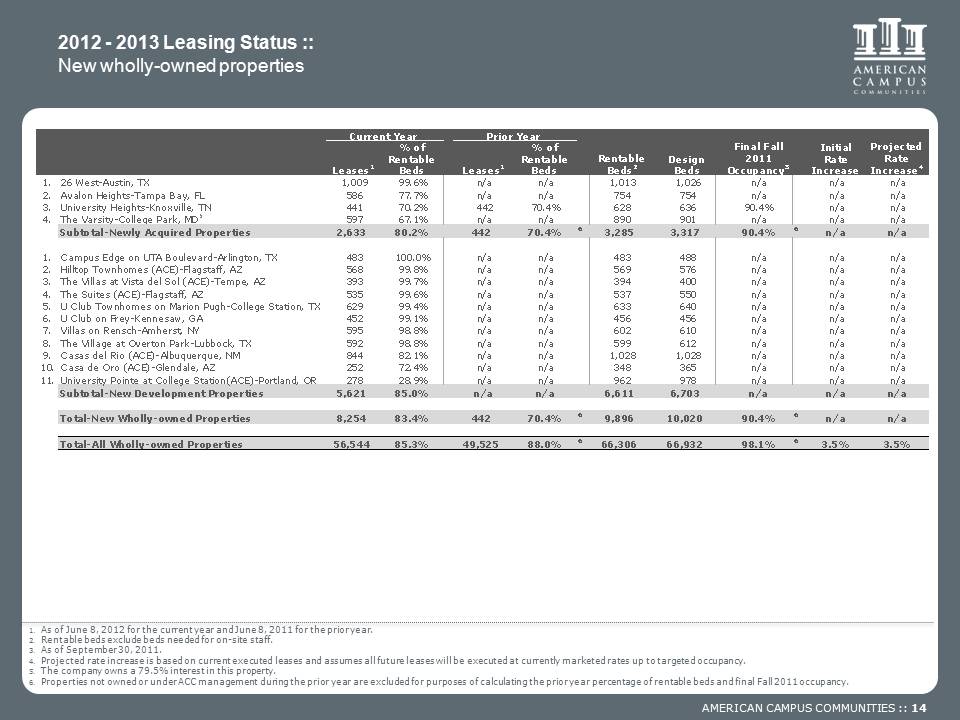

AMERICAN CAMPUS COMMUNITIES :: 14 2012 - 2013 Leasing Status :: New wholly-owned properties Leases1% of Rentable Beds Leases 1% of Rentable Beds 1. 26 West-Austin, TX 1,009 99.6% n/a n/a 1,013 1,026 n/a n/a n/a 2. Avalon Heights-Tampa Bay, FL 586 77.7% n/a n/a 754 754 n/a n/a n/a 3. University Heights-Knoxville, TN 441 70.2% 442 70.4% 628 636 90.4% n/a n/a 4. The Varsity-College Park, MD 559 767.1% n/a n/a 890 901 n/a n/a n/a Subtotal-Newly Acquired Properties 2,633 80.2% 442 70.4% 63,285 3,317 90.4% 6 n/a n/a 1. Campus Edge on UTA Boulevard-Arlington, TX 483 100.0% n/a n/a 483 488 n/a n/a n/a 2. Hilltop Townhomes (ACE)-Flagstaff, AZ 568 99.8% n/a n/a 569 576 n/a n/a n/a 3. The Villas at Vista del Sol (ACE)-Tempe, AZ 393 99.7% n/a n/a 394 400 n/a n/a n/a 4. The Suites (ACE)-Flagstaff, AZ 535 99.6% n/a n/a 537 550 n/a n/a n/a 5. U Club Townhomes on Marion Pugh-College Station, TX 629 99.4% n/a n/a 633 640 n/a n/a n/a 6. U Club on Frey-Kennesaw, GA 452 99.1% n/a n/a 456 456 n/a n/a n/a 7. Villas on Rensch-Amherst, NY 595 98.8% n/a n/a 602 610 n/a n/a n/a 8. The Village at Overton Park-Lubbock, TX 592 98.8% n/a n/a 599 612 n/a n/a n/a 9. Casas del Rio (ACE)-Albuquerque, NM 844 82.1% n/a n/a 1,028 1,028 n/a n/a n/a 10. Casa de Oro (ACE)-Glendale, AZ 252 72.4% n/a n/a 348 365 n/a n/a n/a 11. University Pointe at College Station(ACE)-Portland, OR 278 28.9% n/a n/a 962 978 n/a n/a n/a Subtotal-New Development Properties 5,621 85.0% n/a n/a 6,611 6,703 n/a n/a n/a Total-New Wholly-owned Properties 8,254 83.4% 442 70.4% 69,896 10,020 90.4% 6 n/a n/a Total-All Wholly-owned Properties 56,544 85.3% 49,525 88.0% 666,306 66,932 98.1% 63.5% 3.5% Projected Rate Increase 4 Current YearPrior Year Rentable Beds 2 Design Beds Final Fall 2011 Occupancy 3 Initial Rate Increase 1. As of June 8, 2012 for the current year and June 8, 2011 for the prior year. 2. Rentable beds exclude beds needed for on-site staff. 3. As of September 30, 2011. 4. Projected rate increase is based on current executed leases and assumes all future leases will be executed at currently marketed rates up to targeted occupancy. 5. The company owns a 79.5% interest in this property. 6. Properties not owned or under ACC management during the prior year are excluded for purposes of calculating the prior year percentage of rentable beds and final Fall 2011 occupancy.

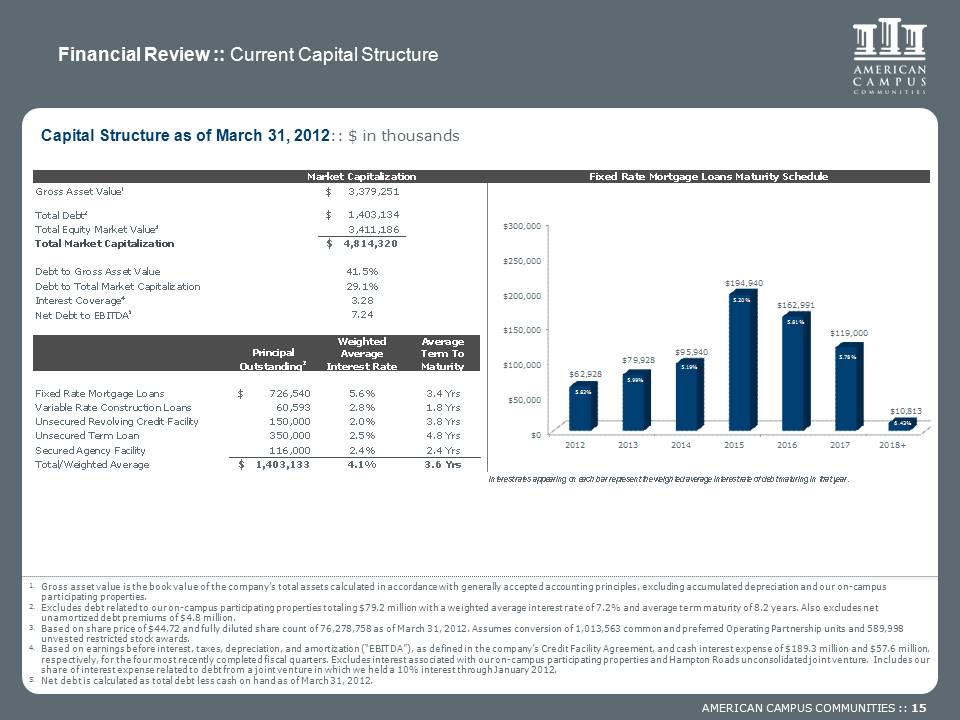

AMERICAN CAMPUS COMMUNITIES :: 15 Financial Review :: Current Capital Structure Capital Structure as of March 31, 2012:: $ in thousands 6.99% 5.99% 5.55% 5.19% 5.20% 5.81% 5.78% 6.43% Gross asset value is the book value of the company’s total assets calculated in accordance with generally accepted accounting principles, excluding accumulated depreciation and our on-campus participating properties. Excludes debt related to our on-campus participating properties totaling $79.2 million with a weighted average interest rate of 7.2% and average term maturity of 8.2 years. Also excludes net unamortized debt premiums of $4.8 million. Based on share price of $44.72 and fully diluted share count of 76,278,758 as of March 31, 2012. Assumes conversion of 1,013,563 common and preferred Operating Partnership units and 589,998 unvested restricted stock awards. Based on earnings before interest, taxes, depreciation, and amortization (“EBITDA”), as defined in the company’s Credit Facility Agreement, and cash interest expense of $189.3 million and $57.6 million, respectively, for the four most recently completed fiscal quarters. Excludes interest associated with our on-campus participating properties and Hampton Roads unconsolidated joint venture. Includes our share of interest expense related to debt from a joint venture in which we held a 10% interest through January 2012. Net debt is calculated as total debt less cash on hand as of March 31, 2012. Market Capitalization Fixed Rate Mortgage Loans Maturity Schedule Gross Asset Value 1 Total Debt 2 Total Equity Market Value 3 Total market Capitalization Debt to Gross Asset Value Debt to Total Market Capitalization Interest Coverage 4 Net Debt to EBITDA 5 $3,379,251 1,403,134 3,411,186 4,814,320 41.5% 29.1% 3.28 7.24 Principal Outstanding 2 Weighted Average Interest Rate Average Term to Maturity Fixed Rate Mortgage Loans Variable Rate Construction Loans Unsecured Revolving Credit Facility Unsecured Term Loan Secured Agency Facility Total/Weighted Average $726,540 5.6% 3.4 Yrs 60,593 150,000 350,000 116,000 1,403,133 2.8% 2.0% 2.5% 2.4% 4.1% 108 308 408 204 3.6 $300,000 250,000 500,000 150,000 100,000 50,000 0 2012 2013 2014 2015 2016 2017 2018+ 62,928 79,928 95,940 194,940 162,991 119,000 10,813 5.82% 5.99% 5.19% 5.20% 5.81% 5.78% 6.43%

AMERICAN CAMPUS COMMUNITIES :: 16 Forward-Looking Statement :: 6.99% 5.99% 5.55% 5.19% 5.20% 5.81% 5.78% 6.43% In addition to historical information, this presentation may contain forward-looking statements under the federal securities law. These statements are based on current expectations, estimates and projections about the industry and markets in which American Campus operates, management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.