Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CORTLAND BANCORP INC | d358011d8k.htm |

Exhibit 99.1

| Annual Shareholders' Meeting May 22, 2012 |

| Chief Financial Officer |

| Corporate Profile December 31, 2011 March 31, 2012 Total Assets $520 Million Branches 14 Employees 165 Shares Outstanding 4.5 Million Share Price $6.80 $7.95 Book Value $10.10 $10.53 |

| Condensed Statements of Income (Amounts in Thousands) |

| Non-Interest Income |

| Balance Sheet Composition |

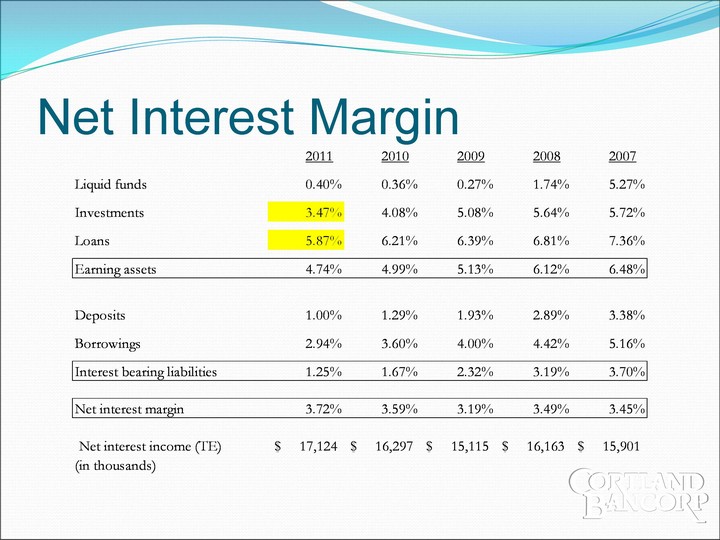

| Net Interest Margin |

| Net Interest Margin |

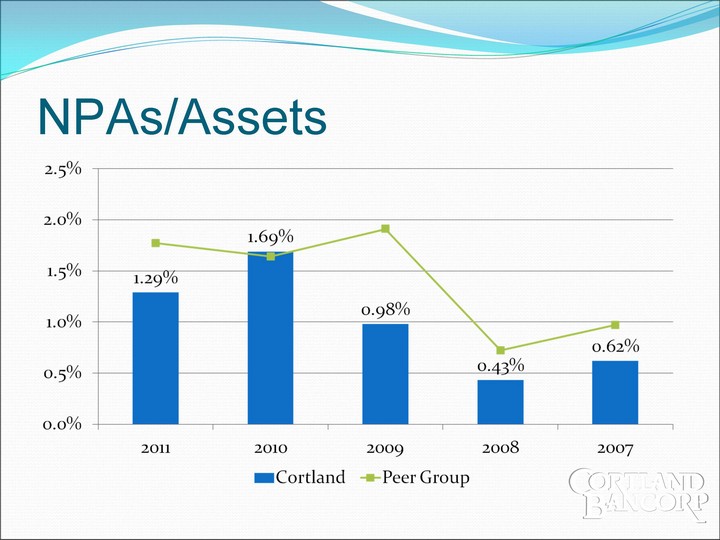

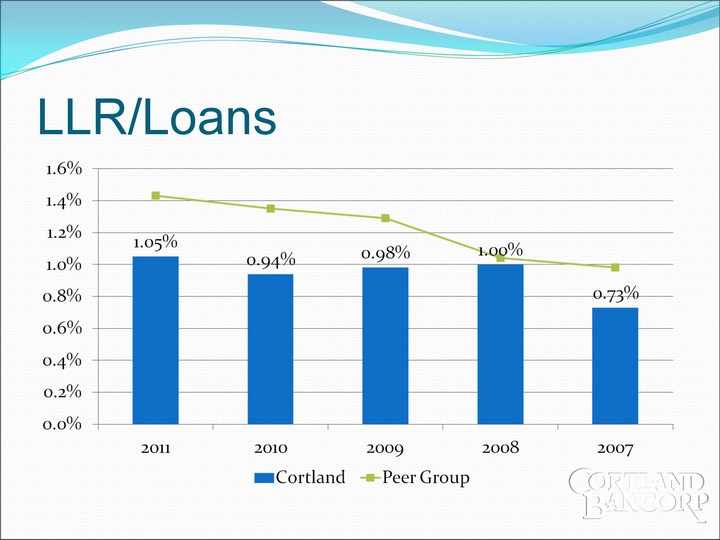

| Credit Quality |

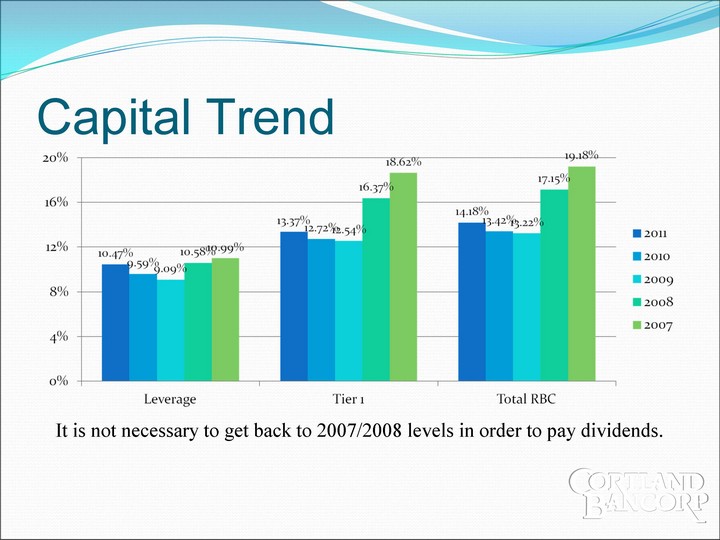

| Capital Adequacy Prior year cushion $22.4 million $24.7 million $12.6 million How much capital is needed to pass a regulatory stress test if it was imposed upon Cortland? How much cushion is needed to absorb any asset quality or investment issues remaining in this post-recessionary period? Any excess may be available for dividends and share repurchases. + $3.6 million |

| Capital Trend It is not necessary to get back to 2007/2008 levels in order to pay dividends. |

| First Quarter Results |

| Focus Balance sheet management - Net Interest Margin low rate environment; rising rate horizon Earnings - Mortgage banking expansion - addition of retail; continuation of wholesale Asset Quality - Underwriting standards - in loan growth scenario Capital - Retain earnings to achieve "new" capital standards |

| President and Chief Executive Officer |

| 2011 Highlights Investor Relations Wholesale Lending New Products and Services Community Reinvestment Lending and Deposit Growth Credit Quality Regulatory Environment Looking Forward |

| Loans/Deposits |

| Loan Composition |

| Deposit Composition |

| NPAs/Assets |

| LLR/Loans |

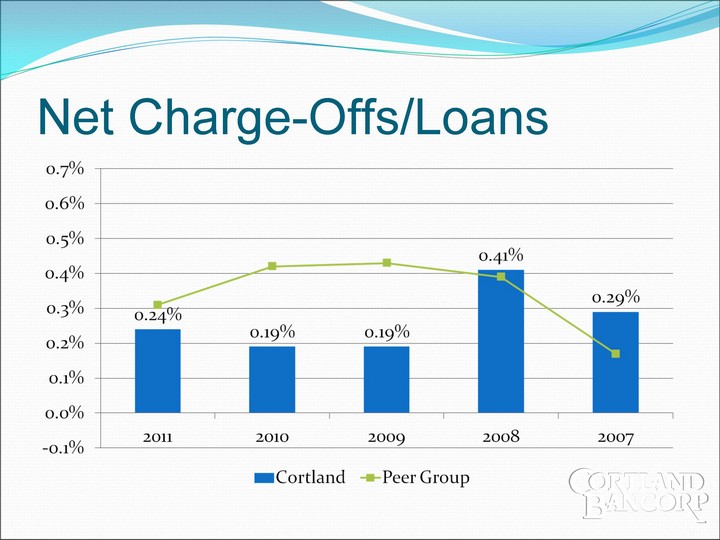

| Net Charge-Offs/Loans |

| Non-Interest Income/Average Assets |

| ROAA |

| ROAE |

| Net Interest Margin |

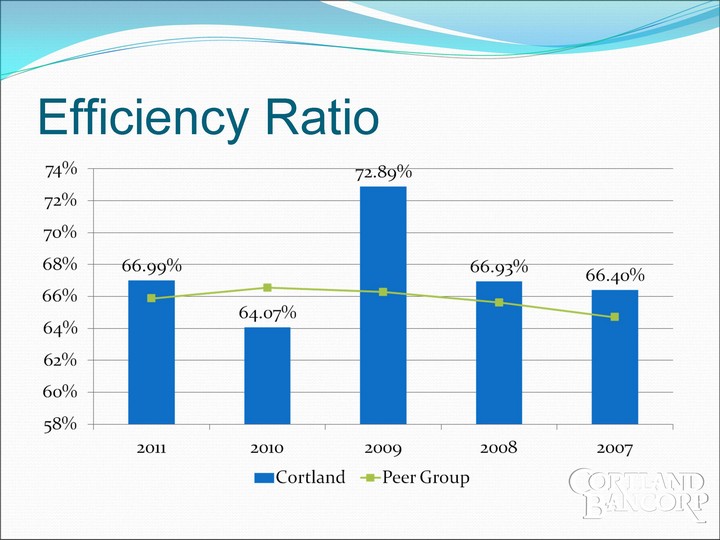

| Efficiency Ratio |

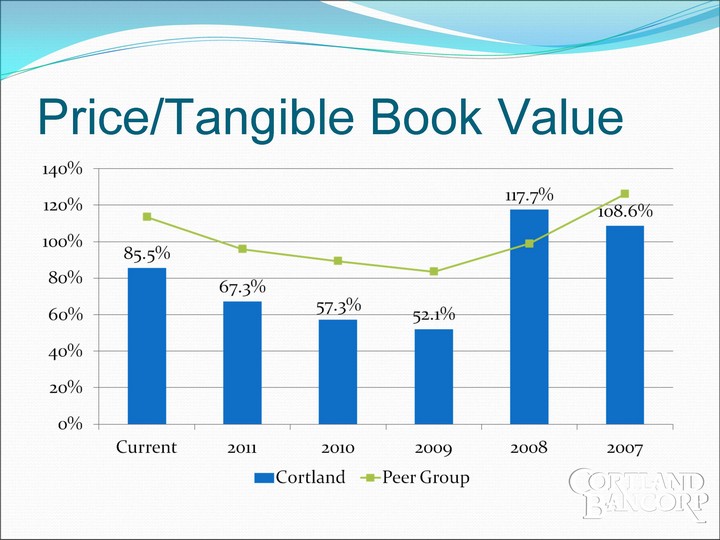

| Price/Tangible Book Value |

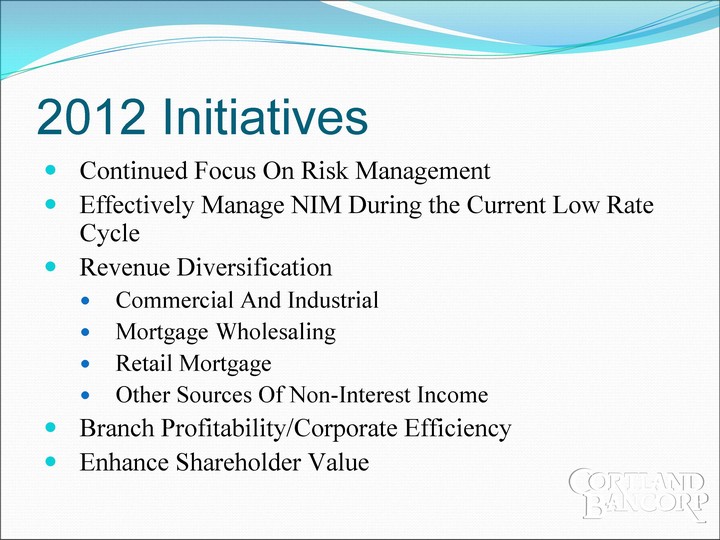

| 2012 Initiatives Continued Focus On Risk Management Effectively Manage NIM During the Current Low Rate Cycle Revenue Diversification Commercial And Industrial Mortgage Wholesaling Retail Mortgage Other Sources Of Non-Interest Income Branch Profitability/Corporate Efficiency Enhance Shareholder Value |