Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K INVESTOR DAY - WEST PHARMACEUTICAL SERVICES INC | form8k.htm |

Welcome and Introductions

Presentation Background and Agenda

Presentation Background and Agenda

Donald E. Morel Jr., Ph.D.

Chairman and Chief Executive Officer

© 2012 by West Pharmaceutical Services, Inc., Lionville, PA.

All rights reserved. This material is protected by copyright. No part of it may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.

All trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.

All trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

Safe Harbor Statement

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995

This presentation and any accompanying management commentary contain “forward-looking statements”

as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to statements about expected financial results for 2012 and future years.

as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to statements about expected financial results for 2012 and future years.

Each of these estimates is based on preliminary information, and actual results could differ from these

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in

our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual

Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or

supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially

from those estimated or predicted in the forward-looking statements. You should evaluate any statement

in light of these important factors. Except as required by law or regulation, we undertake no obligation to

publicly update any forward-looking statements, whether as a result of new information, future events,

or otherwise.

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in

our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual

Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or

supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially

from those estimated or predicted in the forward-looking statements. You should evaluate any statement

in light of these important factors. Except as required by law or regulation, we undertake no obligation to

publicly update any forward-looking statements, whether as a result of new information, future events,

or otherwise.

Non-GAAP Financial Measures

Certain financial measures included in these presentation materials, and which may be referred to in

management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted

Accounting Principles) financial measures. Please refer to the “Non-GAAP Financial Measures” and

“Notes to Non-GAAP Financial Measures” at the end of these materials for more information. Non-GAAP

financial measures should not be considered in isolation or as an alternative to such measures

determined in accordance with GAAP.

management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted

Accounting Principles) financial measures. Please refer to the “Non-GAAP Financial Measures” and

“Notes to Non-GAAP Financial Measures” at the end of these materials for more information. Non-GAAP

financial measures should not be considered in isolation or as an alternative to such measures

determined in accordance with GAAP.

2

Agenda

Introductory Remarks Don Morel

Chairman and Chief Executive Officer

Chairman and Chief Executive Officer

Pharmaceutical Markets Update Mike Schaefers

Vice President, Marketing-Europe

Vice President, Marketing-Europe

Pharmaceutical Packaging Systems Jeff Hunt

President, Pharmaceutical Packaging Systems

President, Pharmaceutical Packaging Systems

Asian Growth and Expansion Warwick Bedwell

President, Asia-Pacific Region

President, Asia-Pacific Region

West NovaPure® Components Fran DeGrazio

Vice President, Marketing and Strategic

Business Development-Americas

Vice President, Marketing and Strategic

Business Development-Americas

Pharmaceutical Delivery Systems John Paproski

President, Pharmaceutical Delivery Systems

President, Pharmaceutical Delivery Systems

Self-Injection Systems Bart Burgess

Manager, Business Development

Manager, Business Development

Daikyo Crystal Zenith® Scott Young

Director, Crystal Zenith Products

Director, Crystal Zenith Products

Closing Remarks Don Morel

3

Pharmaceutical Packaging Systems

Pharmaceutical Delivery Systems

• A globally diverse manufacturer of products

used primarily in containing and administering

small-volume parenteral drugs

used primarily in containing and administering

small-volume parenteral drugs

• Strong competitive position

§ Diversified customer base

§ Proprietary technology

§ Global footprint

§ Significant barriers to entry

• Stability with growth potential

§ Proprietary Products

§ Geographic Expansion

• Financial strength to invest

§ Reliable operating cash flow

§ Well capitalized

4

Who We Are

The West Transition

• Founded in Philadelphia (1923) and listed on NYSE since 1980

• Initiated strategic transformation in 2001 to become a leading global supplier

of value-added pharmaceutical packaging systems and components

of value-added pharmaceutical packaging systems and components

5

‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11

2002

$420 M

$420 M

2011

$1.2 B

$1.2 B

Kinston

recovery

Sale of

CCI

CCI

Sale of

Drug

Drug

Delivery

Acquired

Tech Group,

Medimop

Tech Group,

Medimop

Began

Eur/Asia

expansion

expansion

Acquired

Pharma

Pen

Pharma

Pen

Acquired

Normandy

Normandy

Acquired

LaModel

LaModel

China

plastics

completed

plastics

completed

Global

Quality

Initiative

Quality

Initiative

China

rubber

begun

rubber

begun

Sales and Income from Continuing Operations

$ millions

6

• Global economic conditions remain unsettled

• Global pharmaceutical revenue and unit growth will vary by region

• Further consolidation is expected

• Unknown: Status and impact of US healthcare legislation

• Tougher regulatory enforcement

• Our customers are under pressure to produce earnings growth from

merger “synergies” while key products are facing patent expiration and

new product pipelines remain thin

merger “synergies” while key products are facing patent expiration and

new product pipelines remain thin

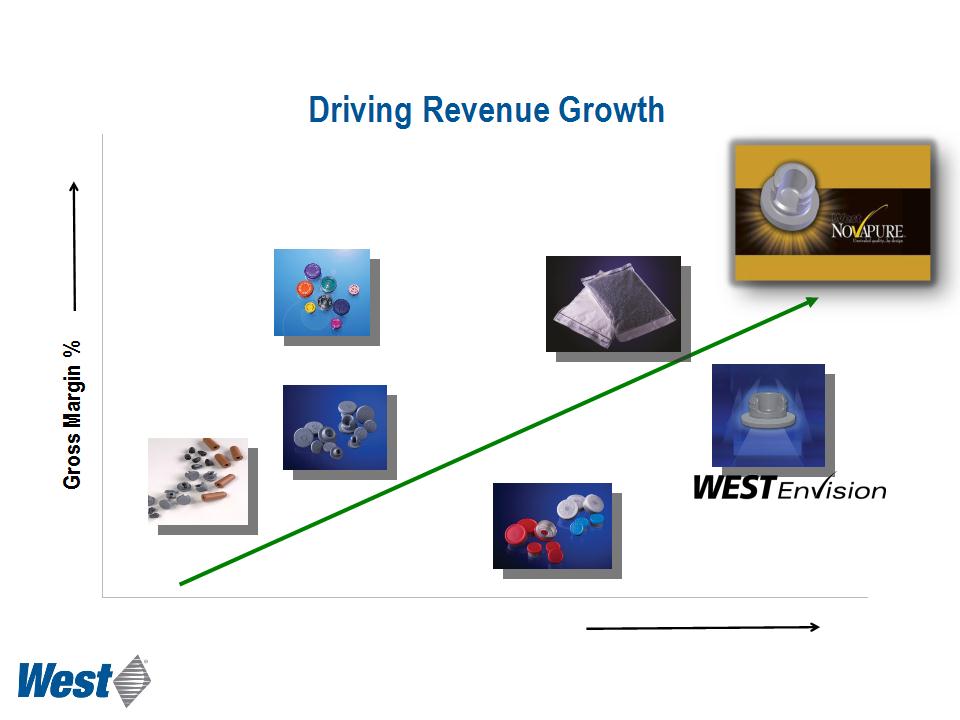

• Our challenge: How do we grow revenues in this environment?

Business Environment

7

Summary Results

$ millions, except per-share data

$ millions, except per-share data

|

|

Three Months Ended

March 31,

|

|

|

2012

|

2011

|

|

|

|

|

|

|

Net Sales

|

$ 316.3

|

$ 295.4

|

|

Gross Profit

|

101.1

|

88.0

|

|

Reported Operating Profit

|

41.7

|

28.8

|

|

Adjusted Operating Profit (1)

|

42.3

|

30.7

|

|

Reported Diluted EPS

|

$ 0.81

|

$ 0.56

|

|

Adjusted Diluted EPS(1)

|

$ 0.83

|

$ 0.60

|

(1) These are Non-GAAP measurements. For an explanation and reconciliation of these items, see “Cautionary Statement”

(Slide 2) and “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” (see slides 93 - 95)

(Slide 2) and “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” (see slides 93 - 95)

8

Business Segments

2011 Revenues

($ millions)

Delivery Systems

Packaging Systems

• Established leadership

• High market shares

• Steady growth in base

9

$ 857

$337

|

Pharmaceutical Packaging

Systems |

|

|

Business Unit Focus

• Small-volume parenteral packaging

• Large-volume parenteral packaging

• Prefillable syringe components

• Disposable medical device components

• Diagnostic, dental, veterinary packaging

Jeff Hunt

President

10

Our Growth Strategy

|

Pharmaceutical Packaging

Systems |

|

|

• Generate incremental value per unit

• Leverage changing regulatory environment

• Global quality initiative

• Optimize manufacturing productivity

• Strategic acquisitions

• Geographic expansion

11

|

Pharmaceutical Delivery

Systems (How drugs are administered)

|

|

|

Business Unit Focus

• Safety systems (B.Safe®, NovaGuard™,

Eris™)

Eris™)

• Reconstitution systems - Medimop

• Crystal Zenith® prefillable syringe systems

• Advanced injection systems (SmartDose®

and ConfiDose®)

and ConfiDose®)

• Tech Group contract manufacturing

The Eris safety syringe system is not currently available in the United States.

John Paproski

President

12

Our Growth Strategy

• Concentrate on systems for unmet market needs

• Build market share in multi-component systems

for drug administration utilizing Daikyo Crystal

Zenith as a platform technology

for drug administration utilizing Daikyo Crystal

Zenith as a platform technology

• Production supported by existing design, multi-

material molding, and assembly capabilities

material molding, and assembly capabilities

• Expand through innovation and strategic

technology acquisitions

technology acquisitions

|

Pharmaceutical Delivery

Systems |

|

|

13

• Our global position

• Strength of the franchise

• Key therapeutic catgeories and growth drivers

• New product pipeline and opportunities

• Risk factors

• Strong, experienced management team

• Substantial progress since 2010

Key Take-aways

14

Global Pharmaceutical Market Updates

Mike Schaefers, Ph.D.

Vice President, Marketing, Europe

15

• Global pharmaceutical revenue growth slowing down

§ CAGR ‘11 - ‘15 of 3% - 6%

§ Developed markets with moderate growth of 0 - 4%

§ “Pharmerging markets” ( BRIC, MENA) with increases of 12 - 17%

§ While unit growth remains moderate

• Dynamic growth in “Pharmerging markets” fueled by

§ Increase in skilled workforce and education level

§ Improvements in infrastructure and access to medicines

§ Lifestyle changes trigger chronic diseases

Global Pharmaceutical Market Trends

IMS, The Global Use of Medicines, May 2011, IMS Health Report 2011

16

• Globalization and consolidation of pharma industry

progressing

progressing

• Trend towards outsourcing of production to contract

manufacturer or partner in India and China

manufacturer or partner in India and China

• Growing regulatory pressure and closer scrutiny of new

products

products

• Recent drug recalls have led to shortages of injectable drugs

• Quality by Design (QbD), combination products and CFR 820

influencing industry’s mindset

influencing industry’s mindset

17

Global Pharmaceutical Market Trends

• Paradigm shift from batch production to small scale

manufacturing driven by diversity and clinical trial needs

manufacturing driven by diversity and clinical trial needs

• Price cuts and reimbursement restrictions in developed

markets

markets

• Patent cliff and lack of “blockbuster” drug innovations

• M&A shaping leading pharma companies and continuing

as the new R&D

as the new R&D

• Focus on “total cost of ownership”

18

Global Pharmaceutical Market Trends

• But growth opportunities remain, such as

• Pharmerging markets

• Generics

• BioTech, speciality drugs and biosimilars products

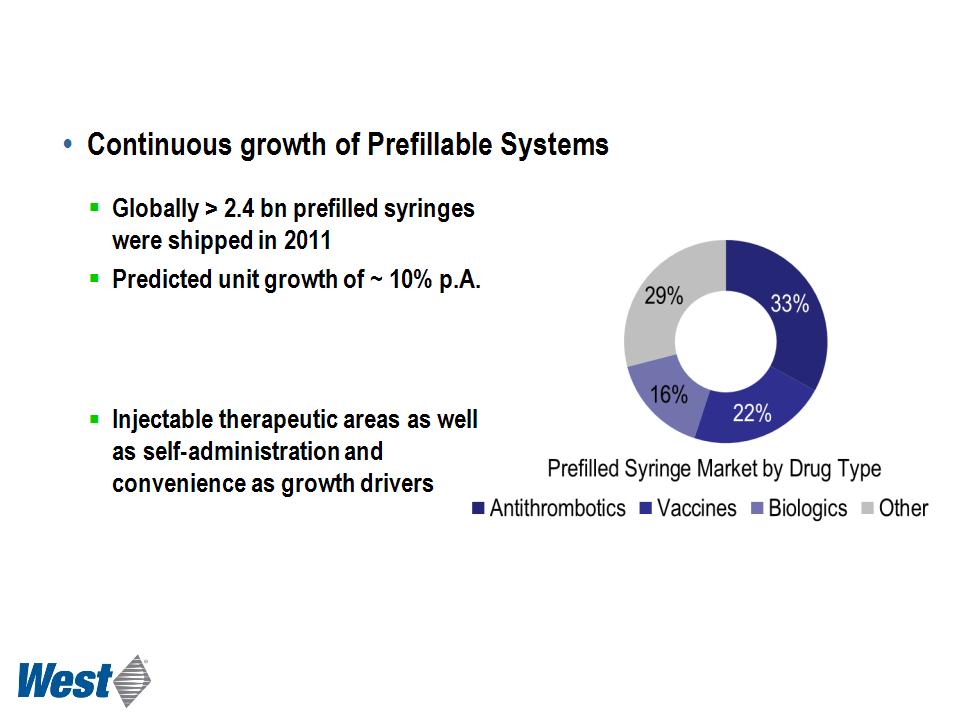

• Continuously expanding prefillable systems market

• Trend towards injection devices

§ Enabling new treatment and application options

§ Allowing home administration

§ Powerful lifecycle management tools

19

Global Pharmaceutical Market Trends

• Generics

• $142 billion in global branded drug products losing patent protection

in the near future

in the near future

• Significant policy changes encourage use of generics

§ Affordable Care Act in US

§ Drug price cuts in i.e. China, Japan, Spain, Italy

§ Cost benefit evaluations of new medicines

• Generics will exceed 20% of drug spending in most developed markets

IMS, The Global Use of Medicines, May 2011, IMS Health Report 2011

20

Global Pharmaceutical Market Trends

• Sales from commercialized biotech drugs are on the rise

• Revenue CAGR of 6% - 9% over the next several years

§ Strong pipelines for biologic products

§ Increase in long-acting or depot injections

• Technical constraints of new biologics drive need for innovative

injectable packaging and delivery solutions

injectable packaging and delivery solutions

21

Global Pharmaceutical Market Trends

• Biosimilar regulations and affordability

• More and more patents of biologic drugs expire

§ Major target for cost savings in health care

• Leading pharma companies such as Merck, Teva, Novartis

established biosimilar divisions

established biosimilar divisions

• Mature European markets for biosimilars

§ Clear approval path but low adoption rates

• Strong biosimilar business in emerging markets

§ Less stringent regulations

• Awaiting US legislation on biosimilars and new EU mAb legislation

• Delivery devices are key differentiator for biosimilars

22

Global Pharmaceutical Market Trends

• Parenterals continue to be important for administering

biopharmaceuticals

biopharmaceuticals

• Oral delivery

§ Poor bioavailability due to challenges posed by the

gastrointestinal tract

gastrointestinal tract

• Nasal delivery

§ Potential safety issues for large molecules due to need for

permeation enhancers to deliver sufficient dose

permeation enhancers to deliver sufficient dose

• Pulmonary delivery

§ Potential safety issues with delivering through lung

§ Low bioavailability

• Transdermal delivery

§ Limitations in delivering the therapeutic dose through skin

23

Global Pharmaceutical Market Trends

• Extra Protection for Parenterals against Generic Threat

Scrip 100, 2011 Special Report

24

Global Pharmaceutical Market Trends

• Therapeutic areas Oncology, Diabetes, Autoimmune ( RA, MS,

etc.) and Vaccines driving parenteral growth

etc.) and Vaccines driving parenteral growth

• High unmet medical need

• High cost burden of diseases

• New drugs enabled through biotechnology

• Innovative container and delivery systems allowing new

treatment options

treatment options

• Patient access expanded

• Funding redirected from other areas where low-cost generics

will be available

will be available

25

Global Pharmaceutical Market Trends

|

Category

|

Key Customers

|

Projected

Growth |

|

Diabetes

|

|

4 - 7 %

|

|

Oncology

|

|

5 - 8 %

|

|

Vaccines

|

|

> 10 %

|

|

Autoimmune

|

|

6 - 9 %

|

• Therapeutic Category Growth Drivers

IMS, The Global Use of Medicines, May 2011, market & research.com

26

Global Pharmaceutical Market Trends

Requirements

West Solutions

• Therapeutic Targets and West Solution Portfolio - A Perfect Match

Therapeutic Targets

• Stability of demanding pharmaceuticals/

biopharmaceuticals

biopharmaceuticals

• Manage silicone sensitivity of proteins

• Solutions to avoid glass delamination

and breakage

and breakage

• Need for lifecycle management, product

and brand differentiation

and brand differentiation

• Health care worker/ patient safety

• Human factors

• Trend towards self-administration

• Efficient and cost effective therapies

• High value pharma packaging

• In-depth understanding of container

closure and device interaction

closure and device interaction

• Proprietary, innovative delivery

systems

systems

• Concept to commercialization solutions

• Risk assessment and risk mitigation

strategies

strategies

27

Greystone 2012 PFS Report; Market Intelligence

§ Cartridge based devices gain

importance for biologic drug

delivery

importance for biologic drug

delivery

28

Global Pharmaceutical Market Trends

Providing Solutions to a Changing Market

29

• Significant growth potential for generics and biosimilars

in developed countries and emerging markets

in developed countries and emerging markets

• Proactive support of lifecycle management activities at

pharma/ biotech

pharma/ biotech

§ Product and brand differentiation through West solutions

• Support generic and biosimilars customers globally with

differentiated product and solution offering

differentiated product and solution offering

§ Enable “Speed to Market” and compliance to stringent regulatory

requirements for developed markets

requirements for developed markets

§ Dedicated offerings for mid-tier and domestic emerging markets

§ Biosimilars retain originator packaging

§ Delivery devices are key differentiator for biosimilars

The Potential of Generics and Biosimilars

30

• West is well positioned for future growth

• Focus on strongly growing therapeutic categories diabetes/insulin,

vaccines, oncology and AIID

vaccines, oncology and AIID

• Importance of parenterals and biological drugs in these categories

• Growing need for high value pharma and world class packaging

• Growth opportunities through proprietary delivery devices

• Perfect match between requirements of targeted therapeutic categories

and West´s solution portfolio

and West´s solution portfolio

• Leveraging the potential of generic and biosimilars market

Summary

31

Pharmaceutical Packaging Systems Overview

Jeff Hunt

President

Pharmaceutical Packaging Systems

32

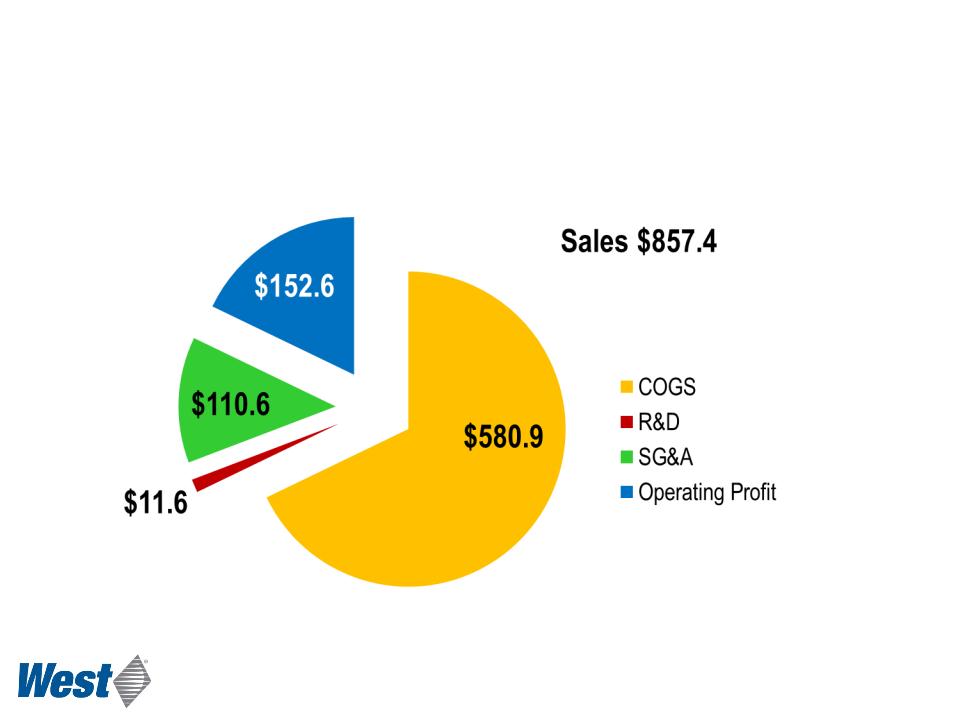

|

Pharmaceutical Packaging Systems

|

|

|

2011

Revenues

Revenues

$857 million

Pharmaceutical Packaging Systems

2011 Operating Results

2011 Operating Results

34

• Create profitable and sustainable growth platforms

• Strengthen market leadership position via innovation

• Accelerate growth through:

• Value-added products

• Geographic expansion

• Optimize global profitability

Strategic Objectives

35

Market & Growth Drivers

Pharmaceutical Systems Products

Pharmaceutical Systems Products

Safety

NovaGuard™

Medimop

Market Needs

Silicone-free

Daikyo CZ

PFS

Systems Solution

NovaPure®

Westar® RU

Lined seals

Ready Pack™

Regulatory

VeriSure™

CCS™

TrimTec®

Material Science

Quality

Vision inspection

cGMP

Demographics/Convenience

Auto-injectors

Electronic Patch Pump

Reconstitution

Growth Platforms

Safety & Admin Systems

Prefillable Syringe Systems

Advanced Injection Systems

Injectable Container Solutions

36

Long-Term Outlook

• Long-range plan delivers $300 million of incremental sales

and $100 million operating profit

and $100 million operating profit

• High-value products and prefilled syringe components

• Optimize supply chain and manufacturing operations

• Global expansion in China and India

37

Asia Pacific Region

Warwick Bedwell

President, Asia Pacific

38

Markets in Asia Pacific

• 50+% of the World’s population

• Fastest growing in the World, GDP 6.7% growth in 20111

• Rising healthcare spend and urbanization

• Focus of global healthcare/pharmaceutical industry

§ Large & growing population with increasing level of disposable income

§ Improving access to medicines

§ Aging populations e.g. China driving demand for greater healthcare investment

§ Increased prevalence of chronic lifestyle diseases

§ Lower cost region for manufacturing and outsourcing2,3

1 EIU Dec 2010 2 PWC 2010 3EIU Aug 2011

39

AP Pharma Markets by 2015

• Region (incl. Japan) will represent close to 1/3 global sales1

• China alone expected to bring over 1/4 global growth1

• Within APAC China, India, Indonesia and Vietnam will outpace all other

countries in growth1

countries in growth1

• Markets look attractive for biosimilar penetration2

§ Strong local industry and relatively lax regulatory systems

• Local players are strong within self pay markets while MNCs are strong

in reimbursed markets2

in reimbursed markets2

• Original/Branded generic products continue to comprise the majority

within most APJ markets2

within most APJ markets2

1 IMS Health Market Prognosis Oct 2011 2 IMS Health, MIDAS MAT June 2011

40

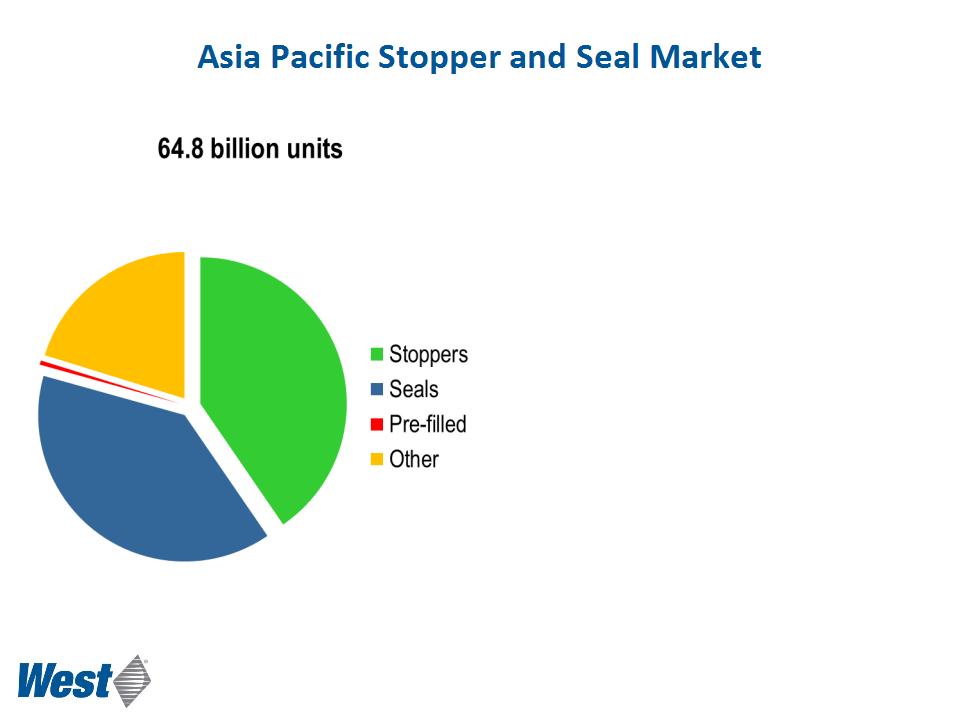

• Annual consumption growing >15%

with India and China as market drivers

with India and China as market drivers

• 6.5 billion IV infusions p.a.

• Emerging PFS and cartridge markets

• Est. in 2010 that globally 285 million diabetics,

over 50% in AP

over 50% in AP

§ 92 million in China

§ 51 million in India

• Highly fragmented

§ 60+ competing manufacturers

of stoppers

of stoppers

§ 100+ competing manufacturers

of seals

of seals

• Quality and technology improving

§ Increasing regulatory requirements

§ Quality segment to grow faster

Ref: IMS Report 2011, Frost & Sullivan Report 2010,

LEK 2009, Local intelligence

LEK 2009, Local intelligence

41

West in Asia Pacific

• Region Business Objectives - “Double+ in 5”

• Region Operations Objectives - Selectively invest for growth

Do best what

matters most

to customers

matters most

to customers

Market assessment

and prioritization,

WCSO/SFE and

GKAM

and prioritization,

WCSO/SFE and

GKAM

Core Business Strategies

42

China Strategic Rationale

• Largest global pharma market in volume and 3rd in value

§ 60% of total APAC injectables

§ More Drugs to be reimbursed

§ Foreign players are challenging domestic stronghold in generics

§ Increase in alliances of domestic companies with MNCs

• Business strategy

§ Defend and build share of MNCs/branded generics

§ Capture market share from local players

§ Best performance to price ratio

§ Reduce COGs and introduce “total cost of ownership” concept

§ Provide “best-in-class” service and quality

43

India Strategic Rationale

• Key location to drive growth

§ Large market at USD 25b (>50% export) and 15.7% CAGR to 2015

§ Generic production - Western markets

§ Asia Pacific and MENA markets

• Business strategy

§ Defend and build share of MNCs/branded generics

§ Support generic producers with short lead times/flexible

trading terms

trading terms

§ Build regional capacity and enable growth in Singapore for HVPs

§ Augment Singapore capacity

44

Region Operations Strategy

Singapore

1.HVP Focus

2.AP market & special items

3.R&D hub & technical center

China IV Plastic

1.Global supply

China Elastomer

2.China Market,

Efficiency focus

Efficiency focus

India Elastomer

1.Domestic standard

products & MNC support

2.ROW standard product

India Metal

1.AP market support

•

45

Summary

West in Asia Pacific

West in Asia Pacific

• Forecast mid-term market outperformance in sales and solid

operating profit

operating profit

• Making the strategic investments to meet regional growth

and competition

and competition

• China and India are key to future regional and global growth

46

NovaPure® Components

Fran DeGrazio

Vice President, Marketing &

Strategic Business Development

47

Industry Challenges in Respect

to Packaging Component Issues

to Packaging Component Issues

• Total cost of ownership is too high

• Packaging component quality is too variable

• Pharma industry understanding and perspective is needed

• Transparency of information should be improved

• Requirements by regulatory agencies are more stringent

• Biotech products have increased environmental sensitivity

• Risk must be minimized across the board

48

Revenue Opportunity ($ per unit)

Plungers and

Sleeve Stoppers

Sleeve Stoppers

Stoppers

Seals

RU Seals

Westar® RU

Standard Products

High-Value Products

49

Industry Desires These Features

|

|

|

Competitive

Offerings |

|

Process designed using QbD principles

|

þ

|

ý

|

|

Knowledge management

|

þ

|

ý

|

|

Shortened lead times

|

þ

|

ý

|

|

Global sourcing

|

þ

|

ý

|

|

Paradigm shift in quality specification

|

þ

|

ý

|

|

24/7 access to technical information

|

þ

|

ý

|

|

Minimized drug compatibility issues

|

þ

|

ý

|

50

Lower Filling Line Rejection Rate for

NovaPure Components

NovaPure Components

51

3.0%

0.5% - 1.0%

Typical rejection rate

at pharma company

at pharma company

1.5%

Westar RS +

Envision

Envision

NovaPure

Cost of Ownership Case Study

Benefit /Cost Relationship

Benefit /Cost Relationship

52

Accelerating Adoption of West NovaPure Components

Drugs already on

the market

the market

Seeding for drugs

in development

in development

53

Expected NovaPure Growth

54

Like FluroTec, Westar and other fundamental improvements in

pharma packaging, NovaPure growth is expected to be long-

lasting and persistent

pharma packaging, NovaPure growth is expected to be long-

lasting and persistent

Why NovaPure Components?

Lower Total

Cost of

Ownership

Cost of

Ownership

Improved

Transparency

Transparency

Hidden Costs

55

Pharmaceutical Delivery Systems

John Paproski

President

Pharmaceutical Delivery systems

56

|

Pharmaceutical Delivery Systems

|

|

|

2011

Revenues:

$337 million

57

Pharmaceutical Delivery Systems

2011 Operating Results

2011 Operating Results

58

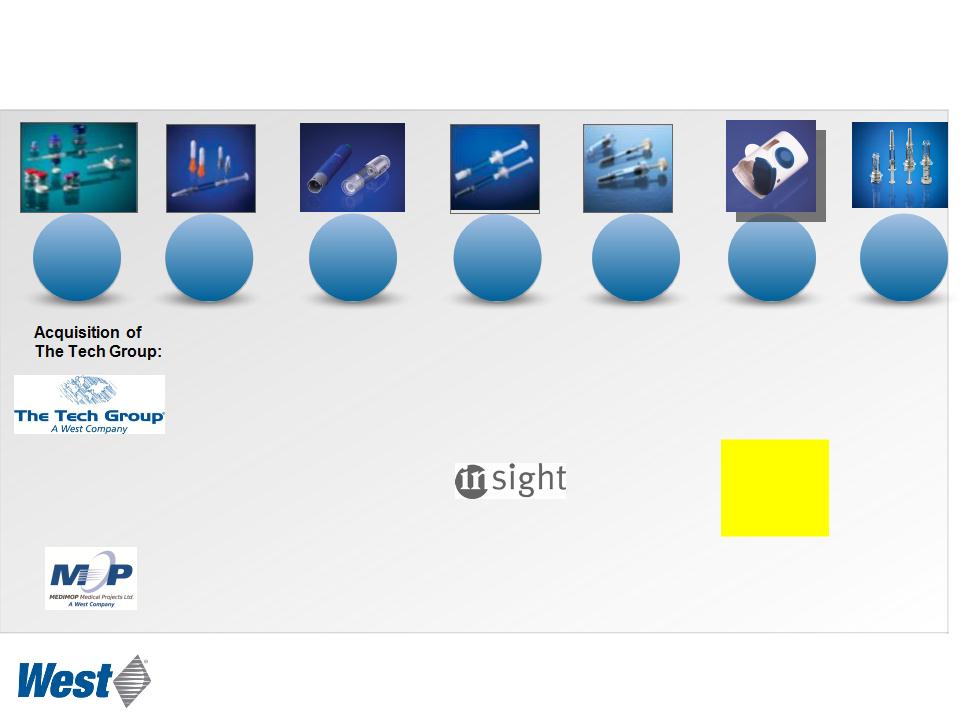

Contract Manufacturing

• 2011 sales: $264 million

• 20 million injection devices pa

• >1.3 billion plastic components for

Insulin Pens

Insulin Pens

Proprietary Products

• 2011 sales: $73 million

• Reconstitution, CZ systems,

syringe safety, self-injection

syringe safety, self-injection

• >50 million reconstitution systems

• >100 million needle safety systems

Synergies

• Marketing

• Engineering

• Project management

• Manufacturing

• Capacity

A Proven Track Record for Device Manufacture

59

Acquisition of

Medimop:

Administration

Systems

Medimop:

Administration

Systems

2005

Licensing of

NovaGuard™:

Safety

System

NovaGuard™:

Safety

System

2006

Acquisition of

PharmaPen:

Auto-injector

PharmaPen:

Auto-injector

2007

Daikyo CZ

Insert

Needle

License:

Prefillable

Syringe

Systems

Insert

Needle

License:

Prefillable

Syringe

Systems

2008

Acquisition

of Plastef:

Prefillable

Syringe

Safety

of Plastef:

Prefillable

Syringe

Safety

2009

Acquisition

of LaModel:

Electronic

Patch

Injector

of LaModel:

Electronic

Patch

Injector

2010

Marketing

agreement

agreement

Product

Development

Development

Formation of

PDS division

PDS division

Portfolio Expansion to Meet Market Needs

Acquisition

of B.safe:

Prefilled

syringe

safety

of B.safe:

Prefilled

syringe

safety

2011

60

Positioned to Respond to Market Trends

• Continuing growth in Injectable therapies

§ Remains preferred route for biologics

§ Prefilled systems (2.4 billion in 2011 growth of 10% p.a.)

• Growth of combination products

§ Drugs with Injection device quadrupled in last decade (from 15 to 60 )

§ Driven by self injection, lifecycle management, competition

• Growth in biosimilars

§ Innovators: differentiation and lifecycle extension through devices

§ Generic companies need a functional copy with minimal investment

*Ref: Greystone report, April 2012: Prefilled syringes to 2016

61

Biotherapeutic Drug Delivery Remains our Focus

• Proteins

• High concentrations

• Large molecules are more sensitive

• Stability tested on drug and device

• Cold chain to maintain potency

• Combination Products

• In 2010, 33% of pharmaceutical

development pipeline were biologics

development pipeline were biologics

• Portion of top 100 products**:

|

2000

|

2008

|

2012

|

|

11%

|

28%

|

50%

|

* Tufts study, 2010

** Evaluate Pharma, April 2010

62

Subcutaneous RA drugs: A Competitive Market

2000

2008

2002

2004

2006

2010

Enbrel®

Humira®

Simponi®

Cimzia®

Smartject®

Vial “pack”

Kineret®

PFS (extended flange) (40mg/0.8ml)

Humira® Pen

PFS 50mg (extended flange)

PFS 25 mg

SureClick™

PFS ( with optional Simpleject reusable auto-injector)

PFS (20mg/0.4ml)

Orencia®

2012

PFS - Subcutaneous

PFS / Needle Safety

Ergonomic PFS

Source: Donna French, PhD, Genentech

63

Challenges Faced by Biotech Companies

• Glass issues

§ Functional, quality, breakage

§ Trend towards plastics

• Increased sensitivity to various materials

§ Silicone oil, tungsten, extractables

• Increased demand for high-dose biologics

§ Driving drug product viscosities and dose volumes higher

§ Competition within therapeutic classes making IV delivery unattractive

• Increased FDA scrutiny on combination products

§ Devices considered earlier in process

**Ref: HRA survey for West at PDA, April 2012

64

Need for an Integrated Drug Delivery System

65

West Provides Integrated Solutions from Concept to Patient

Discovery

(ideation)

Concept

Development

Product &

Process

Development

Process

Development

Industrialization

Life cycle

management

management

66

Well Positioned to Partner with our Customers

• Extensive product portfolio

• Internal capabilities combined with Industry collaboration

• Building on established market position and experience

• Focus on the patient and the needs for an integrated system

approach

approach

• Proactive support for customers’ need for combination products

CZ and SmartDose are examples to showcase these capabilities….

67

Self-Injection Systems

Bart Burgess

Principle, Business Development

68

A Platform Partner for Self-Injection Systems

• West ConfiDose®

§ Auto-injector platform for delivery from 1mL long glass or CZ PFS

§ Expanding system offerings to meet new identified market needs

• West SmartDose®

§ Electronic patch injector system incorporating a proprietary CZ container

§ Addressing the needs of high-dose biologics and high-value products

• Dose Family

§ Combining device innovations and primary container expertise

§ Expanding range of systems through acquisition and innovation

SmartDose® is a registered trademark of Medimop Medical Projects Ltd.

69

SmartDose® Electronic Patch Injector

Platform Technology*

Platform Technology*

§ Designed for subcutaneous delivery - 2.5 mL and 3.5 mL versions in development

§ Uses Daikyo CZ prefilled cartridge

§ Focuses on the user experience

§ Integrated needle safety

§ Simple push-button operation

§ Electronically controlled delivery profile

§ Freedom-to-operate clearance

§ Capitalizes on several emerging needs:

§ Higher doses may be needed for efficacy

§ New entrants to competitive therapeutic areas need self-injection convenience

*For investigational use only by our pharmaceutical and biotechnology development partners.

West markets SmartDose technology as an integrated system with drug filling and final

assembly performed by the pharmaceutical customer.

West markets SmartDose technology as an integrated system with drug filling and final

assembly performed by the pharmaceutical customer.

70

Self Injection Systems Portfolio

4.0

Future SmartDose

Iterations

Iterations

SmartDose 3.5

SmartDose 2.5

ConfiDose 1.2mL

ConfiDose 1mL

ConfiDose 1.5mL

Additional Platform

Expansions Coming Soon…

Expansions Coming Soon…

71

An Example of a Fully Integrated System

72

Daikyo Crystal Zenith®

Scott Young, Ph.D.

Director, Crystal Zenith Products

73

Daikyo Crystal Zenith® is a registered trademark of Daikyo Seiko, Ltd.

Daikyo Crystal Zenith technology is licensed from Daikyo Seiko, Ltd.

Vials and

bulk containers

Prefillable Syringe

From drug discovery to self-injection system

Self-injection System*

Discovery

CZ Solutions Across the Product Lifecycle

*For investigational use only by our pharmaceutical or biotechnology

development partners.

development partners.

74

Daikyo Crystal Zenith Product Approvals

hyaluronic acid

MRI contrast

media

media

bone cement

6 Contrast Media

5 MRI

2 Hyaluronic Acid

1 Calcitonin

1 Proton Pump

Inhibitor

Inhibitor

fluconazole

oncology

anticoagulant

2 oncology

1 acyclovir

hyaluronic acid

3 oncology

API Container

Japan

MHLW

Europe

EMEA

US

FDA

Calcitonin

Bone

cement

Zometa

Hyaluronic

acid

75

• Highly break resistant

• Superior quality

§ Reduced Particles vs glass

§ Reduced cosmetic defects

§ 100% vision inspection, including needle

• No Silicone oil for system lubricity

• Tungsten and glue free

• Compatible with filling lines

• Consistent functionality

• Tight dimensional tolerances

• Maintains integrity with fill volumes >1mL

• Recent completion of extra capacity in Scottsdale AZ

76

Orange color indicates Flurotec® film coverage

Complete coverage with

inert film on drug

contact surfaces

inert film on drug

contact surfaces

Flurotec Film

• Patent Protection from Daikyo Seiko

• Trade Secret Molding / Processing

• Silicone-Free System

Daikyo Crystal Zenith Syringe Barrel

• Custom Formulated Resin exclusive to

Daikyo Seiko

Daikyo Seiko

• IP Filed on CZ 1ml-IN Process

• Other IP on packaging / designs

Daikyo Crystal Zenith Competitive Advantage

Fully laminated

piston

piston

Inside-laminated

tip cap

tip cap

Tungsten residue

Breakage

Silicone oil

variability

variability

Auto-injector

failure

failure

Cosmetic defects

Particles

Potential Glass Syringe Risk Areas

78

Pharmaceutical Market View of Risk Mitigation

• FDA cautionary statement; potential results of glass particles*:

§ Vascular events

§ Foreign body granuloma

§ Local injection site reactions

§ Increased immunogenicity

• Multiple companies evaluating CZ at various phases

§ In 2011 Rx360 surveyed companies and found

§ 28% had recalls

§ They estimated industry cost of recalls at $100MM

§ In a recent study, 48% of survey respondents indicated that their

company was evaluating plastic options

company was evaluating plastic options

Source: D. Jaworski, CDER, Presentation from PDA Glass Conference, May 2011

79

|

Action Associated with

Breakage Issue |

Associated Costs

|

Total Cost

|

|

Investigation and inspection

of issues, complaints and syringe products |

· Field complaints inquiry

· Investigation and resources

· Inspection

|

> $50 Million

|

|

Loss of market share

|

Loss of sales until re-launch, and loss of 5%

of share at market price post re-launch for year 1 |

> $50 Million

|

|

Replacement of drug

product, components and delivery system after re-launch |

2 million units at $100 each

|

> $200 Million

|

|

Pipeline Assessment: Drugs

in Phase II/III clinical trials |

200,000 units x approx. $100 each cost

(assuming 1/10 total production)

|

>$20 Million

|

|

Significant impacts on product supply, market confidence, brand value

|

Not estimable

|

|

Illustrative Estimates of Costs Associated with Drug Recalls

80

1mL Long Insert Needle Syringe

Ready for Commercial Supply

Ready for Commercial Supply

• Validated, sterile product

• Scottsdale capability at 6 million unit per annum

§ Expandable to 20+ million units in existing space

§ Plans to add capacity in US and IRE as needed in future

• Vetter collaboration

§ Combining expertise to establish a full service provider for

high-value biopharmaceutical drug product processing

high-value biopharmaceutical drug product processing

§ Installation of dedicated Crystal Zenith syringe fill and finish equipment

81

Summary

• Pharma customers and regulatory

personnel are demanding Daikyo

Crystal Zenith to reduce recalls due to

glass defects.

personnel are demanding Daikyo

Crystal Zenith to reduce recalls due to

glass defects.

• Daikyo Crystal Zenith vial and syringe

systems are a global market-proven

option.

systems are a global market-proven

option.

We believe that all of our major

biologic customers are evaluating

Daikyo Crystal Zenith.

biologic customers are evaluating

Daikyo Crystal Zenith.

Wrap-up

Don Morel

Chairman and CEO

83

2010 - Present

Strategic Execution

Strategic Execution

• Revenue and earnings growth

• Capacity investments for new markets and

products

products

§ Envision and NovaPure components

§ Daikyo Crystal Zenith and SmartDose

• Improved management bench strength

• Maintained strong balance sheet

84

Our Long-Term Focus

• Expand and strengthen packaging franchise

§ The Global Quality Initiative

§ Capacity expansion in key markets

§ Technology and product acquisitions

• Invest to ensure proprietary product success

• Conservative Financial Management

§ Operating cash flow

§ Prudent spending: discretionary SG&A and Capex

§ A strong balance sheet

85

Five-Year Growth Opportunity

2016 Strategic Planning Goals:

• Sales: $0.7 billion to $0.8 billion

• Operating margin: 20%

2016 Strategic Planning Goals:

• Sales of $1.0 billion to $1.1 billion

• Operating margin: 20%

|

Pharmaceutical

Packaging Systems

|

|

|

|

Pharmaceutical

Delivery Systems

|

|

|

Consolidated 2016 Strategic Planning Goals

2016 Sales: $1.7 to $1.9 billion

2016 Operating Margin: 19%

86

Selected Risk Factors

• Eurozone economic uncertainty

• Healthcare reform (U.S.)

• Supply chain stability

• Timing of new product commercialization

• Currency risk

• Regulatory risk

87

Summary

• A terrific franchise

• Significant growth potential

• The financial strength to invest

• An experienced team

Injectable Container Solutions

Advanced

Injection

Systems

Injection

Systems

Prefillable Syringe Systems

Safety and Administration

Systems

Systems

88

Each and every day

over 100 million

West products are used

to enhance the quality of

healthcare around the world

89

Q & A

90

Non-GAAP Financial Measures(1)

Three Months Ended March 31, 2012 and 2011

Three Months Ended March 31, 2012 and 2011

(in millions, except per share data)

(1) See “Notes to Non-GAAP Financial Measures” (Slides 14-15), “Cautionary Statement” (Slide 2) and see the “Restructuring and Other Items” section and “Supplemental Information and

Notes to Non-GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items.

Notes to Non-GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items.

|

|

As Reported

March 31,

2012

|

Restructuring

and related charges |

Acquisition-

related contingencies |

Discrete

tax items |

Non-GAAP

March 31,

2012

|

|

Operating profit

|

$41.7

|

$0.4

|

$0.2

|

$-

|

$42.3

|

|

Interest expense, net

|

3.9

|

-

|

-

|

-

|

3.9

|

|

Income before income taxes

|

37.8

|

0.4

|

0.2

|

-

|

38.4

|

|

Income tax expense

|

9.8

|

0.1

|

0.1

|

(0.3)

|

9.7

|

|

Equity in net income of affiliated companies

|

1.2

|

-

|

-

|

-

|

1.2

|

|

Net income

|

$29.2

|

$0.3

|

$0.1

|

$0.3

|

$29.9

|

|

|

|

|

|

|

|

|

Net income per diluted share

|

$0.81

|

$0.01

|

$-

|

$0.01

|

$0.83

|

|

|

As Reported

March 31,

2011

|

Restructuring

and related charges |

Discrete

tax items |

Non-GAAP

March 31,

2011

|

|

Operating profit

|

$28.8

|

$1.9

|

$-

|

$30.7

|

|

Interest expense, net

|

4.5

|

-

|

-

|

4.5

|

|

Income before income taxes

|

24.3

|

1.9

|

-

|

26.2

|

|

Income tax expense

|

6.1

|

0.6

|

(0.2)

|

6.5

|

|

Equity in net income of affiliated companies

|

1.4

|

-

|

-

|

1.4

|

|

Net income

|

$19.6

|

$1.3

|

$0.2

|

$21.1

|

|

|

|

|

|

|

|

Net income per diluted share

|

$0.56

|

$0.04

|

$-

|

$0.60

|

NOTES TO NON-GAAP FINANCIAL MEASURES

For additional details, please see today’s press release and Safe Harbor Statement.

For additional details, please see today’s press release and Safe Harbor Statement.

These slides use non-GAAP financial measures. West believes that these non-GAAP measures of financial results provide useful information to

management and investors regarding certain business trends relating to West’s financial condition, results of operations and the Company’s

overall performance. Our executive management team uses adjusted operating profit and adjusted diluted EPS to evaluate the performance of

the Company in terms of profitability and to compare operating results to prior periods. Adjusted operating profit is also used to evaluate

changes in the operating results of each segment and to allocate resources to our segments. The Company believes that the use of these non-

GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing its

financial measures with other companies.

management and investors regarding certain business trends relating to West’s financial condition, results of operations and the Company’s

overall performance. Our executive management team uses adjusted operating profit and adjusted diluted EPS to evaluate the performance of

the Company in terms of profitability and to compare operating results to prior periods. Adjusted operating profit is also used to evaluate

changes in the operating results of each segment and to allocate resources to our segments. The Company believes that the use of these non-

GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing its

financial measures with other companies.

Our executive management does not consider such non-GAAP measures in isolation or as an alternative to such measures determined in

accordance with GAAP. The principal limitation of such non-GAAP financial measures is that they exclude significant expenses and income that

are required by GAAP to be recorded. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by

management about which items are excluded from the non-GAAP financial measures. In order to compensate for these limitations, our executive

management presents its non-GAAP financial measures in connection with its GAAP results. We urge investors and potential investors to review

the reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures, and not rely on any single financial measure

to evaluate the Company’s business.

accordance with GAAP. The principal limitation of such non-GAAP financial measures is that they exclude significant expenses and income that

are required by GAAP to be recorded. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by

management about which items are excluded from the non-GAAP financial measures. In order to compensate for these limitations, our executive

management presents its non-GAAP financial measures in connection with its GAAP results. We urge investors and potential investors to review

the reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures, and not rely on any single financial measure

to evaluate the Company’s business.

In calculating adjusted operating profit and adjusted diluted EPS, we exclude the impact of items that are not considered representative of

ongoing operations. Such items include restructuring and related costs, certain asset impairments, other specifically identified gains or losses,

and discrete income tax items. Reconciliations of these adjusted non-GAAP measures to the comparable GAAP financial measures are included

in the preceding (current and prior-year periods) and succeeding (2012 Guidance) slides.

ongoing operations. Such items include restructuring and related costs, certain asset impairments, other specifically identified gains or losses,

and discrete income tax items. Reconciliations of these adjusted non-GAAP measures to the comparable GAAP financial measures are included

in the preceding (current and prior-year periods) and succeeding (2012 Guidance) slides.

The following is a description of the items excluded from adjusted operating profit and adjusted diluted EPS:

(continued on following slide)

Restructuring and related charges: During the three months ended March 31, 2012, we incurred restructuring and related charges of $0.4 million

associated with the restructuring plan announced in December 2010. Charges associated with the plan for the three months ended March 31, 2012 were

primarily facility closure costs associated with the 2011 closure of a plant in the United States and a reduction of operations at a manufacturing facility in

England

associated with the restructuring plan announced in December 2010. Charges associated with the plan for the three months ended March 31, 2012 were

primarily facility closure costs associated with the 2011 closure of a plant in the United States and a reduction of operations at a manufacturing facility in

England

NOTES TO NON-GAAP FINANCIAL MEASURES

For additional details, please see today’s press release and Safe Harbor Statement.

For additional details, please see today’s press release and Safe Harbor Statement.