Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - CenterState Bank Corp | d351888d8k.htm |

Investor Presentation

First Quarter 2012

Exhibit 99.1 |

This presentation contains forward-looking statements, as defined by Federal

Securities

Laws,

relating

to

present

or

future

trends

or

factors

affecting

the

operations, markets and products of CenterState Banks, Inc. (CSFL). These

statements

are

provided

to

assist

in

the

understanding

of

future

financial

performance. Any such statements are based on current expectations and involve a

number of risks and uncertainties. For a discussion of factors that may

cause such forward-looking statements to differ materially from actual

results, please refer to CSFL’s most recent Form 10-Q and Form

10-K filed with the Securities Exchange Commission.

CSFL undertakes no obligation to release revisions to these forward-looking

statements or reflect events or circumstances after the date of this

presentation. Forward Looking Statement

2 |

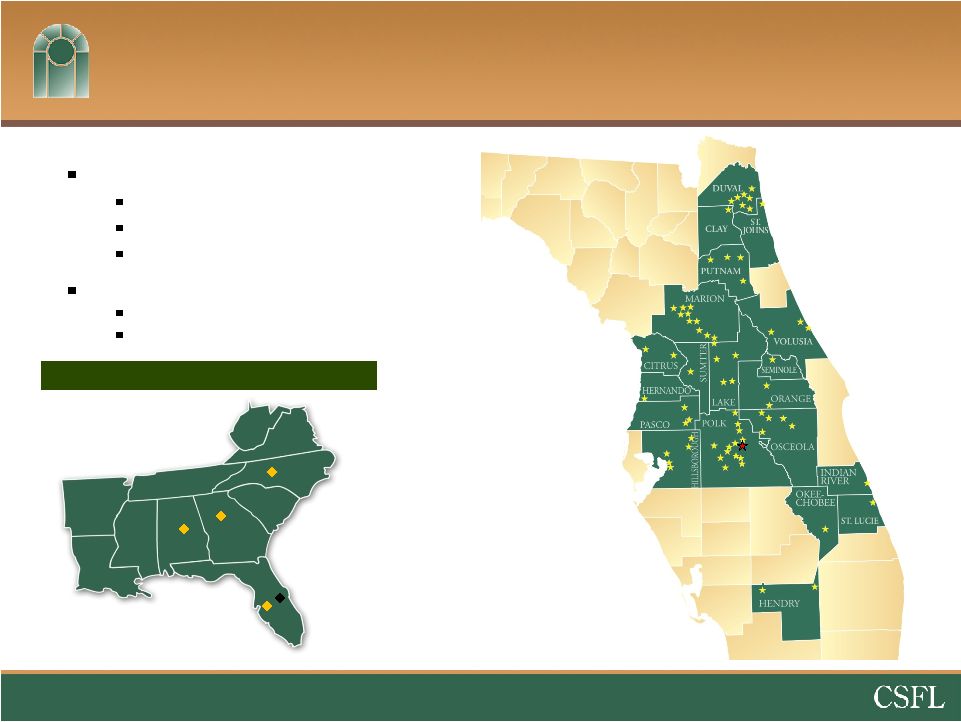

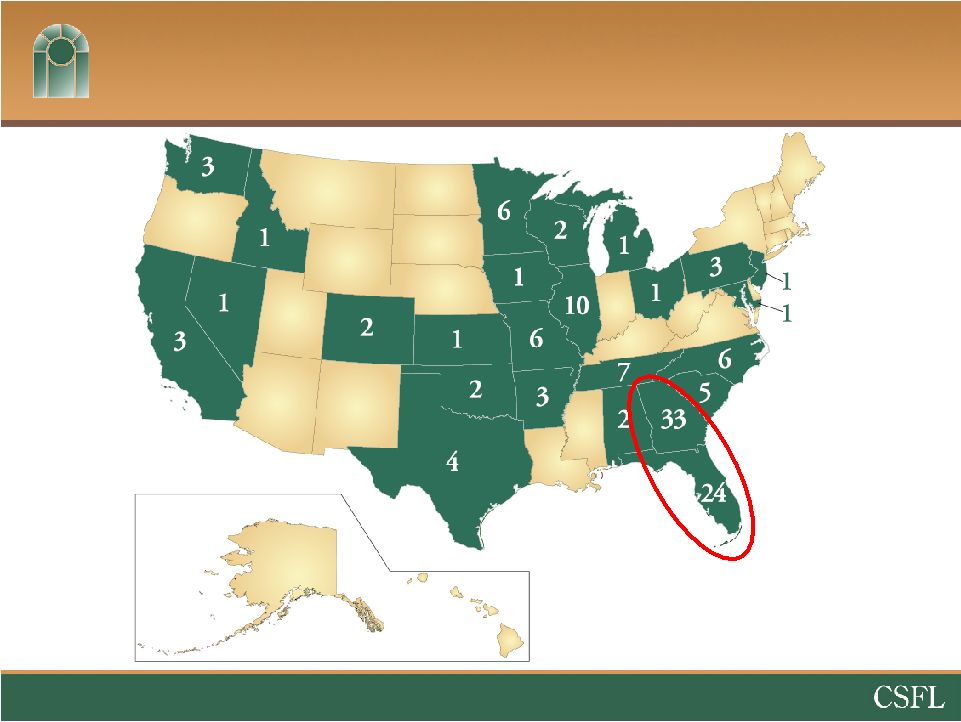

Birmingham

Atlanta

Winston-Salem

Tamp

a

Winter Haven

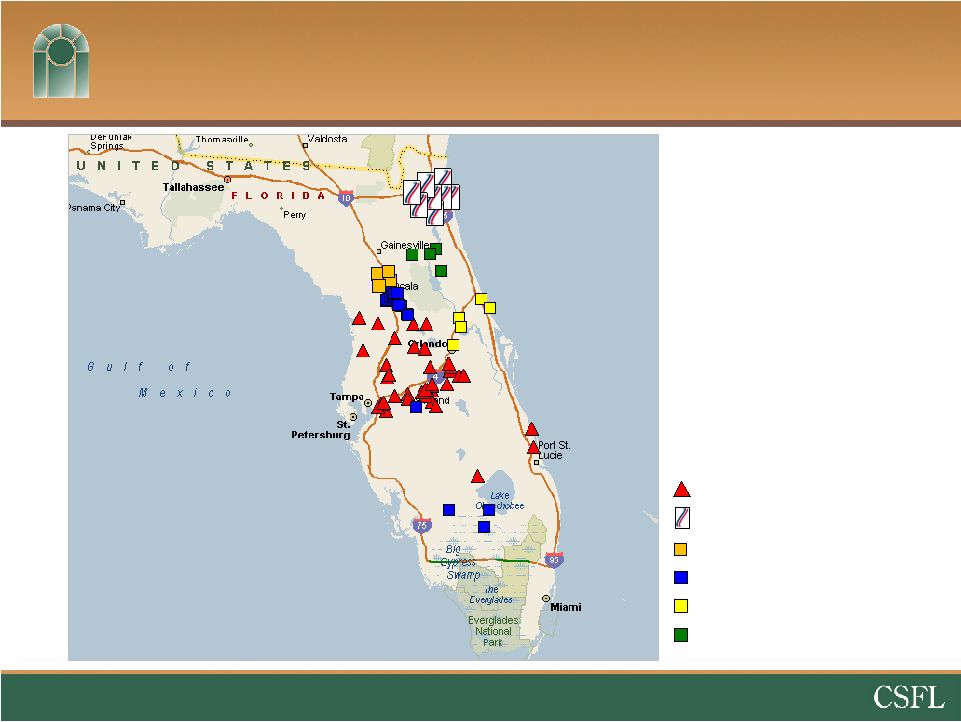

Corporate Overview

3

Correspondent Banking market

Data as of 3/31/12

Headquartered in Davenport, FL

$2.5 billion in assets

$1.5 billion in loans

$2.1 billion in deposits

Company formed: June 2000

2 Subsidiary Banks

Valrico merger in 2012 |

Conservative Balance Sheet

•

CAPITAL -

Total Risk-Based Capital Ratio –

17.6%

•

LIQUIDITY -

Loans / Assets -

58%

•

LOANS WITH THIRD PARTY PROTECTION –

40%

2

•

24%

of loans are covered by loss sharing agreements with the FDIC

•

16%

are subject to “Put Back”

agreements with TD Bank or The Hartford

Insurance Co.

•

ASSETS WITH THIRD PARTY PROTECTION –

50%

1,2

•

41%

-

Backed by the United States

•

9%

-

Backed by TD or The Hartford

•

LOW CONCENTRATION LEVELS (excludes FDIC covered loans)

•

CRE at 109%

of capital vs. 300% guidance

•

CD&L at 25%

of capital vs. 100% guidance

4

1.

Includes

cash

and

cash

equivalents,

AFS

securities

issued

by

U.S.

Government

Sponsored

Entities, FDIC covered assets, and FHLB and FRB stock.

2. Data as of 3/31/12 |

Opportunistic through the Crisis

5

1) FDIC Acquisitions

•

Ocala National Bank

•

Olde Cypress Community Bank

•

Independent National Bank of Ocala

•

Community National Bank of Bartow

•

Central Florida State Bank

•

First Guaranty Bank & Trust Co.

3) New Fee-Based Business Lines

•

Correspondent Banking Division

•

Prepaid Card Division

•

Wealth Management Division

•

Trust Department

2) Non –

FDIC Acquisitions

•

TD Bank divesture in Putnam

•

Federal Trust Acquisition from

The Hartford Insurance

Company

4) Strategic Expansion &

Management Lift-Outs

•

Vero Beach

•

Okeechobee

•

Jacksonville |

Recent M&A Transactions

6

Source: SNL Financial

Legacy CSFL Branch

First Guaranty Bank (FDIC)

Central FL State Bank (FDIC)

Three FDIC Acquisitions (3Q 2010)

Federal Trust Acquisition (Nov 2011)

TD Branch Acquisition (Jan 2011)

Jacksonville |

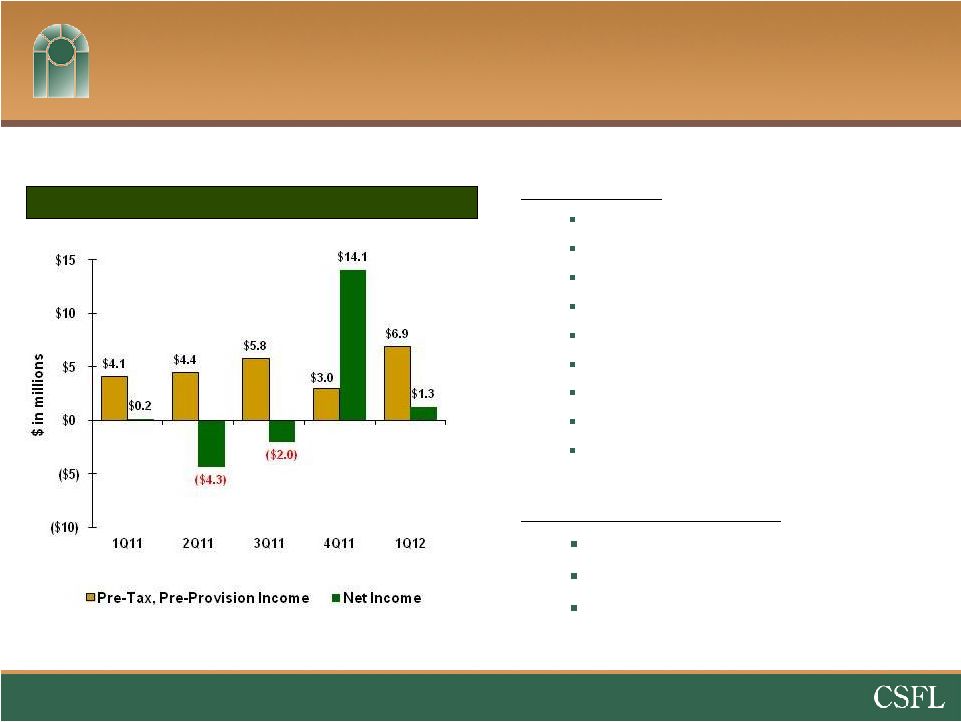

7

Profitability Metrics

PTPP & Net Income –

trailing 5 quarters

1. Pre-tax pre-provision income (“PTPP”) is a non-GAAP measure that if defined as income (loss) before

income tax excluding provision for loan losses, gain on sale of available for sale

securities, other credit related costs including losses on repossessed real

estate and other assets, other foreclosure related expenses., and

non-recurring items. 1Q12 Results:

$0.04/sh on $1.3M net income

Margin expansion to 4.03%

Lower provision expense

Higher bond sales revenue

Gain on sale of AFS securities –

$602K

Bargain purchase gain –

$453K –

Belleview

Goodwill + other intangibles –

FGB

Acquisition related expenses –

$1.9M

PTPP improvement

Profitability Components:

Credit Cost

Net Interest Margin

Operating Efficiencies

1 |

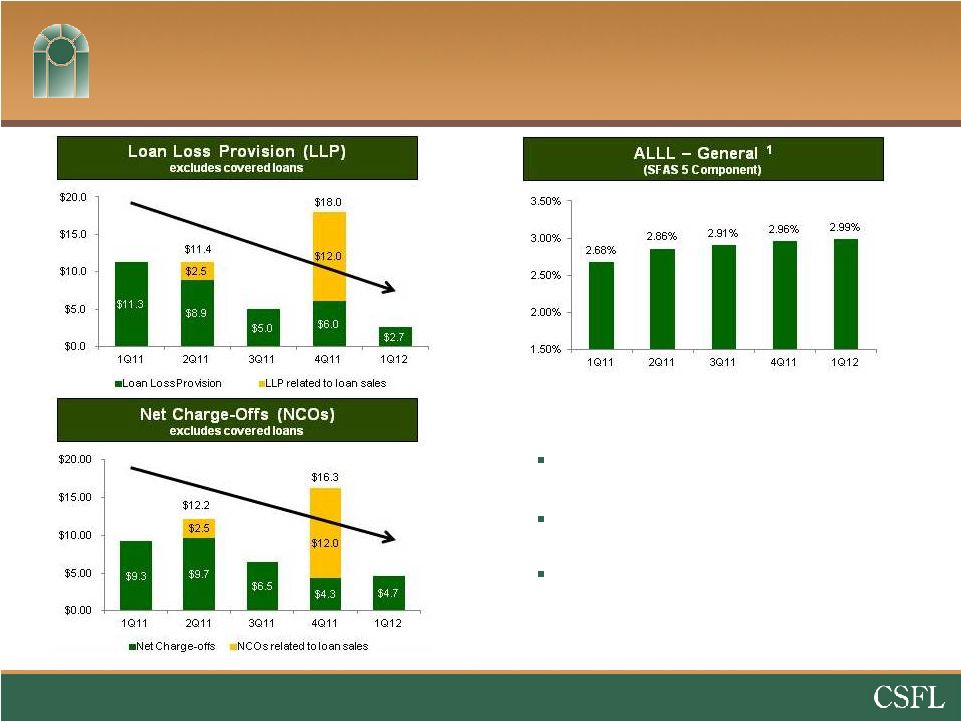

Credit Cost

8

1. Excludes FDIC covered loans and loans with putback options.

Provision expense trending downward

Net charge-offs trending downward

General allowance for loan losses

(SFAS 5 component) –

steady |

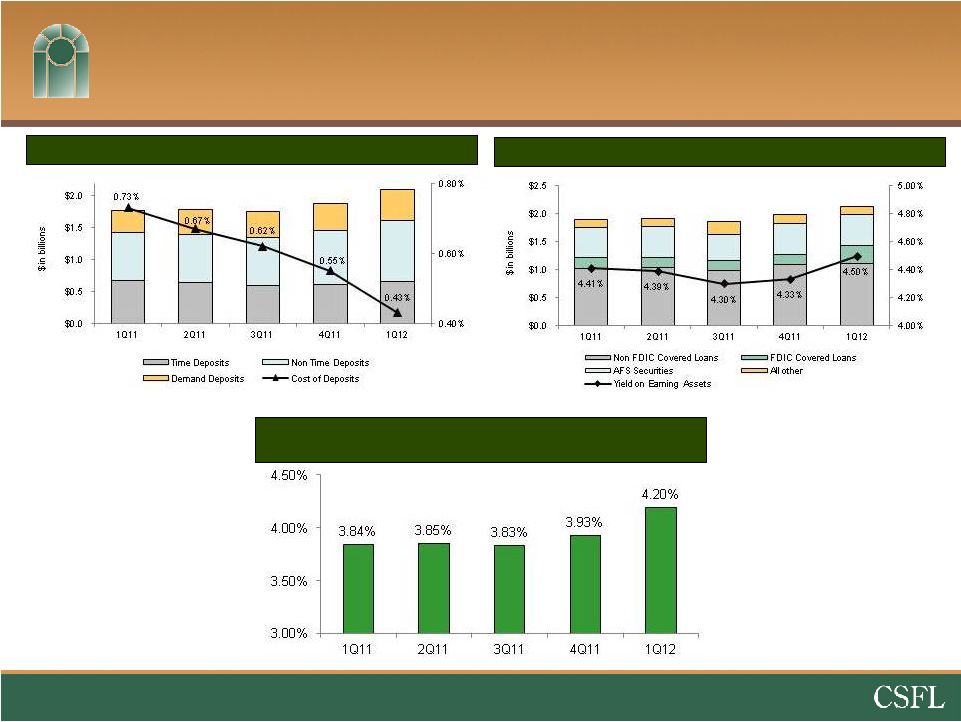

9

Net Interest Margin

Costs of Deposits

Yield on Interest Earning Assets

Net Interest Margin %

(excluding Correspondent Division) |

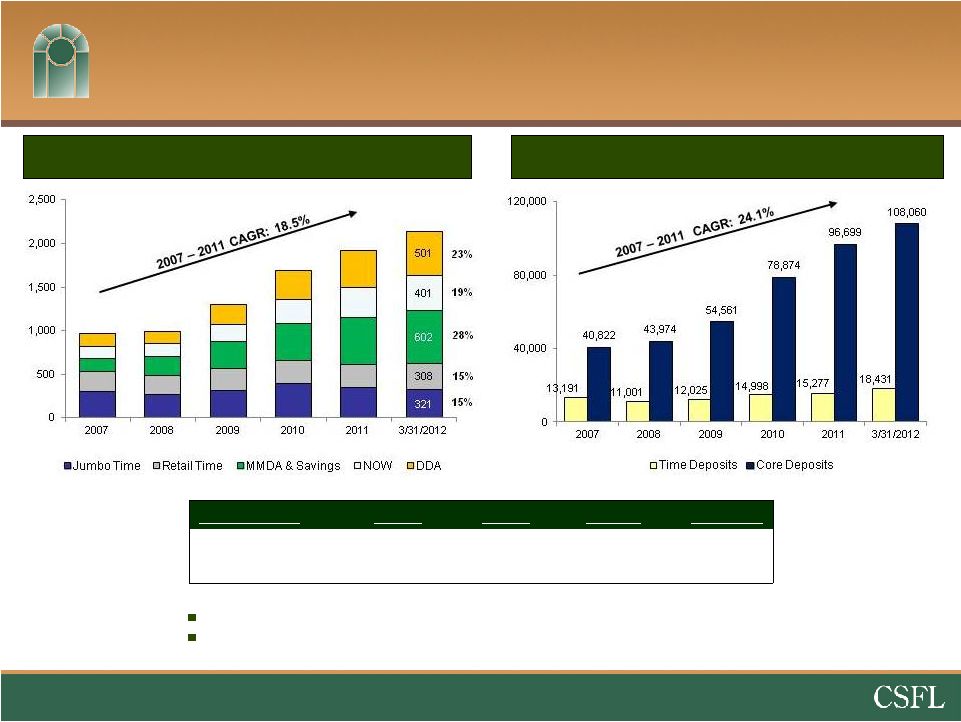

Building Franchise Value

with Core Deposits

Value of core deposits not fully realized in this low rate environment.

Approximately 126,491 total accounts -

$16,861 average balance per account

Core deposits defined as non-time deposits.

Total Deposits ($MM)

Number of Deposit Accounts

10

DDA and NOW

3/31/11

3/31/12

Change

% Change

Balance

$689MM

$902MM

$213MM

31%

No. of Accounts

67,859

84,595

16,736

25% |

Operating Expenses as a % of Average Assets

(excluding credit costs, nonrecurring items, and Correspondent Division)

Operating Efficiencies

11

Efficiency Ratio –

Total Company

Opportunities through:

Leverage

Cost Efficiencies

Non-Interest Expense as a % of Average Assets*

All Florida-based

Banks Nationwide Banks (Assets $100M –

$10B)

*Source: The Hovde Group |

12

Efficiency Steps

First

Quarter

2012

Second

Quarter

2012

•Close & consolidate 4 FDIC acquired branches

•Close & consolidate 7 FDIC acquired branches

•Complete 2 systems conversions

•Merge Valrico State Bank into the Lead Bank

Third

Quarter

2012

•Restructure retail checking product offering

•Evaluate underperforming Legacy branches |

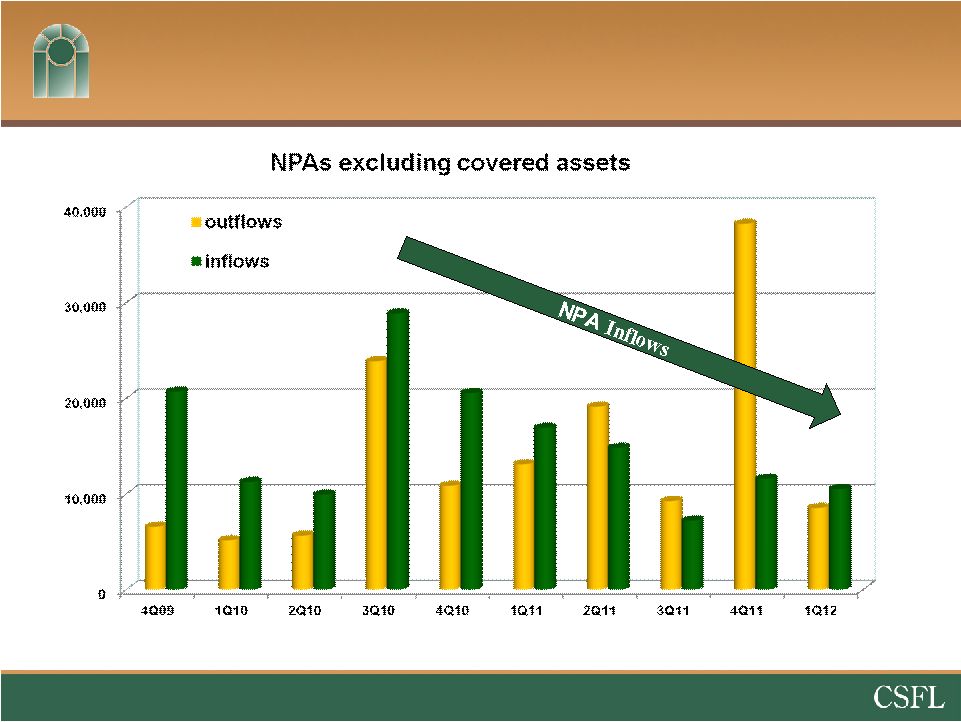

13

NPA Inflows -

Slowing Down |

Credit Quality Trends

NPAs / Loans & OREO (%)

Problem Loan Trends ($MM)

Source: SNL Financial and Company filings. Peer information updated

quarterly Nonperforming assets include 90 days or more past due.

Southeastern peers include ABCB, BTFG, GRNB, PNFP, RNST, SCBT, UBSH and UCBI.

Florida peers include all banks headquartered in Florida , opened no later

than 12/31/2005 and total assets between $500 million and $5 billion.

14 |

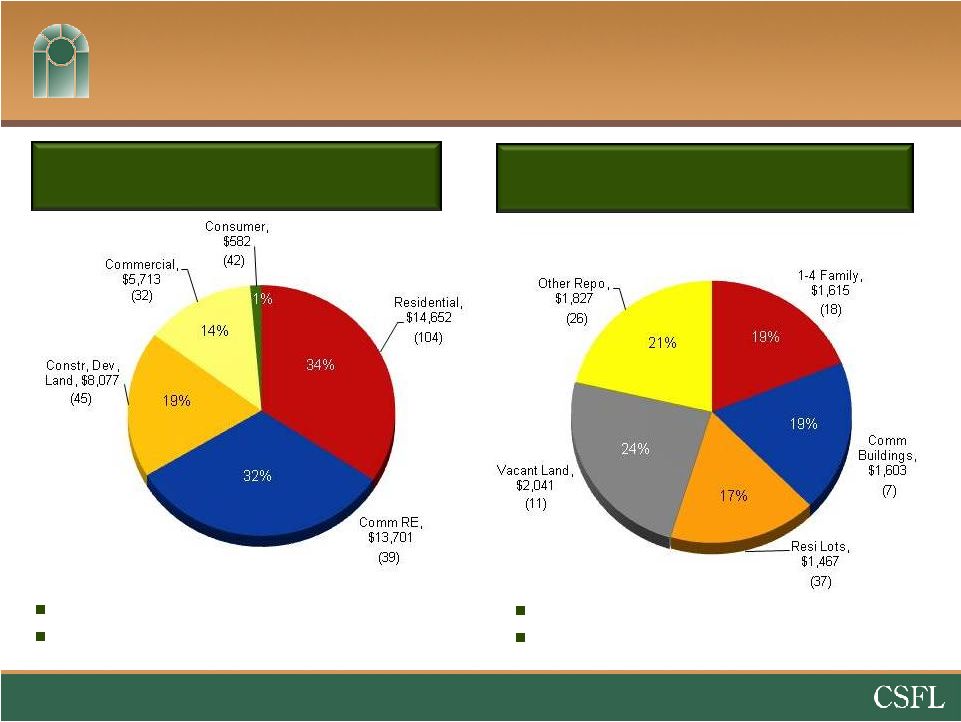

Non-Performing Loans

($M)

$8,553M

OREO & Repos are carried at 49% of

Unpaid Principal Balance

15

Data as of 3/31/12

NPA Breakout

(excluding FDIC covered assets)

OREO & Repo

($M)

$42,725M (3.85% of Gross Loans)

NPLs are carried at 78% of Unpaid

Principal Balance |

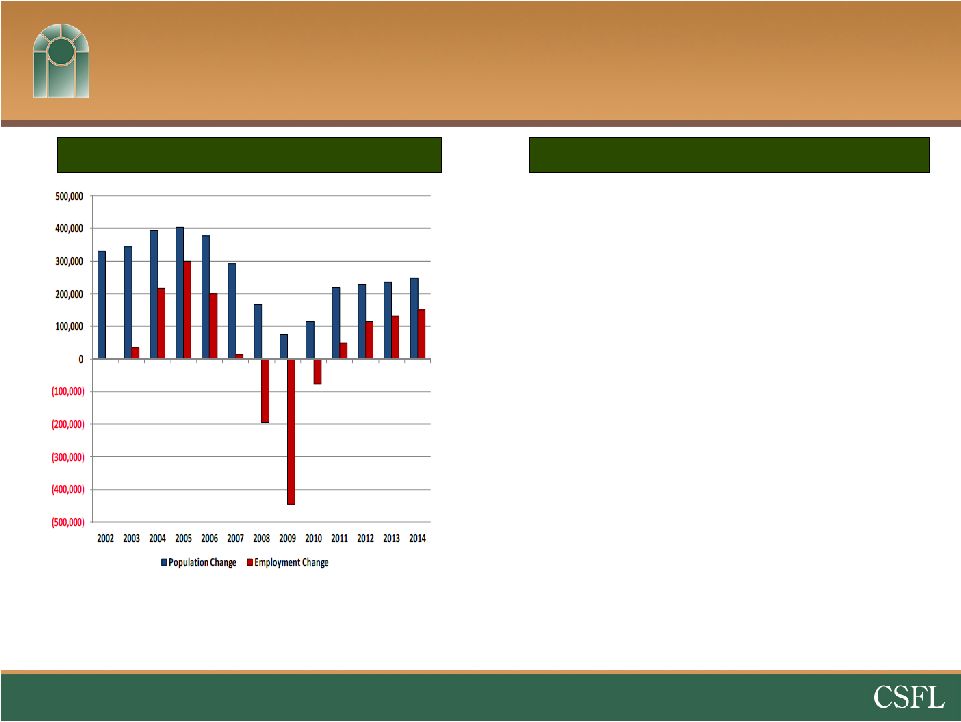

Florida Economy Slowly Recovering

16

Source: The Florida Legislature Office of Economic and Demographic Research & US

Bureau of Labor Statistics

Unemployment at 9.0%, down from

12% -

seventeen consecutive months

of job growth after losing jobs for

three years

Florida Unemployment Rate

Florida Median Home Price

Median home prices for existing homes

have been essentially flat since January

2009 (38 Months) |

17

Population Growth

Returns to Florida in 2011

•

Florida’s population grew by 256,000

between 4-1-2010 and 7-1-2011 –

Higher

than most anticipated

•Over half of the US population growth

occurred in 5 sunbelt states –

CA, TX, FL,

GA & NC

•Lower Florida home prices are attracting

baby boom buyers from the Midwest and

Northeast as housing conditions improve

in those markets

Florida Population & Employment

Things to Consider

Source: Fishkind & Associates, Inc., US Census Bureau

|

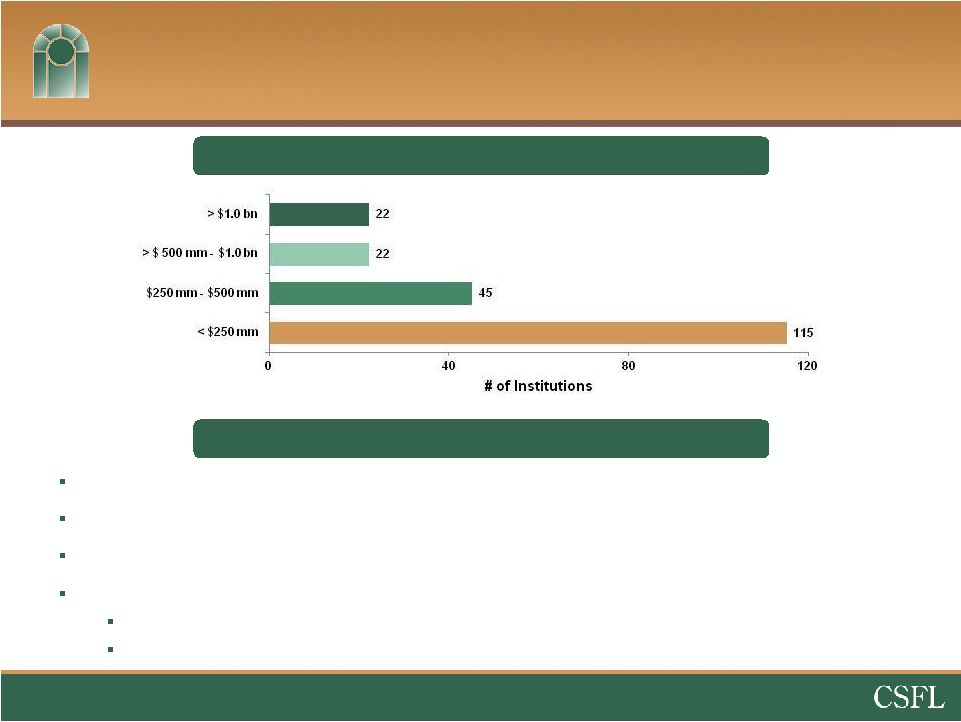

CSFL: Best Positioned Florida Consolidator

Disproportionate number of sellers versus very few buyers

CSFL

is

one

of

five

major

exchange

traded

banks

headquartered

in

FL

with

assets

greater

than

$1.0

billion

Proven experience through 8 successful acquisitions in the past 3 years

The number of small, distressed Florida institutions remains

high 98 banks with a Texas ratio > 50%

77 of those banks have assets less than $500 million

CSFL’

s Advantage

Source: SNL Financial

Data as of 3/31/12 or MRQ

FL Banks: Distribution of Banks by Assets

18 |

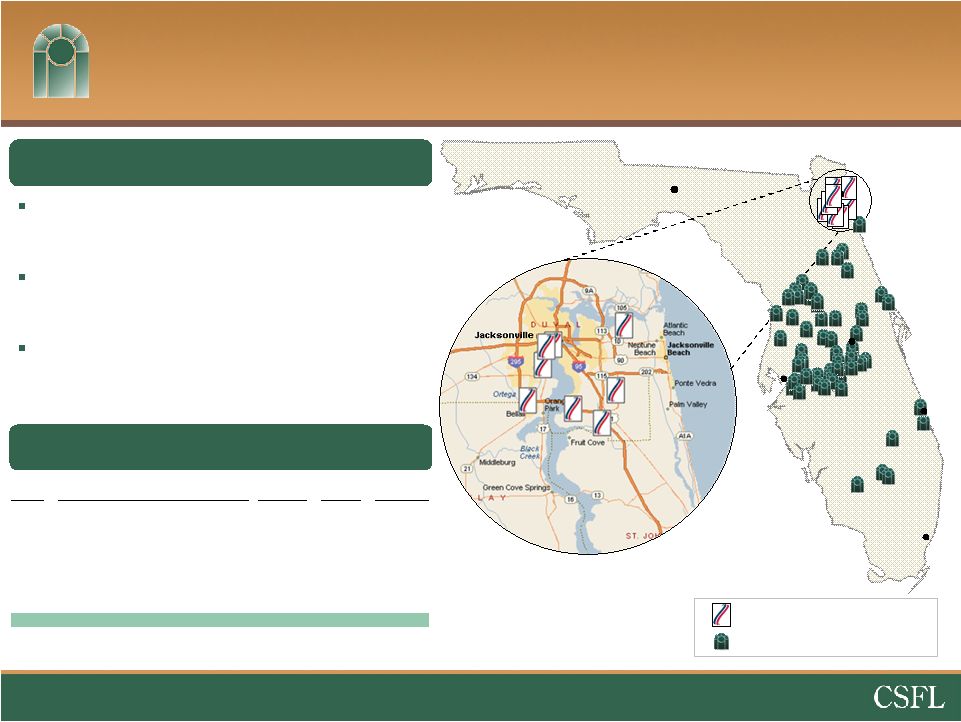

Overview of

First Guaranty Bank and Trust Company of Jacksonville

65 year old bank headquartered in

Jacksonville, FL

2

nd

largest community bank in Duval County,

behind Jacksonville Bancorp, Inc.

Profitable Trust Services includes

approximately 300 relationships and $140

million in assets under management

Overview

Deposits

Market

Rank

Institution

($mm)

Share

Branches

1

Bank of America Corp.

$21,097

50.8

%

24

2

EverBank Financial Corp.

9,009

21.7

5

3

Wells Fargo & Co.

4,943

11.9

40

4

SunTrust Banks Inc.

1,518

3.7

21

5

Banco Bilbao Vizcaya Argentaria SA

803

1.9

14

6

Regions Financial Corp.

730

1.8

16

7

Jacksonville Bancorp Inc.

522

1.3

9

8

Toronto-Dominion Bank

373

0.9

5

9

First Guaranty B&TC Co. of Jacksonville

362

0.9

8

10

Fifth Third Bancorp

353

0.9

7

Deposit Market Share –

Duval County

Source: SNL Financial

Deposit data as of 6/30/11

VERO

BEACH

ORLANDO

TALLAHASSEE

JACKSONVILLE

TAMPA

MIAMI

First Guaranty Branch (8)

CenterState Branch (57)

19 |

Summary

20

Lifetime local bankers with common lineage and vision

Nearly all of the recent growth is guaranteed by the United

States Government or a major financial institution

Senior management added in anticipation of growth

Focus on efficiencies in 2012

A consolidator of banks |

21

Banks with Texas Ratio over 200%

44%

Source: SNL Financial

Data as of 3/31/12 or MRQ |

Appendix |

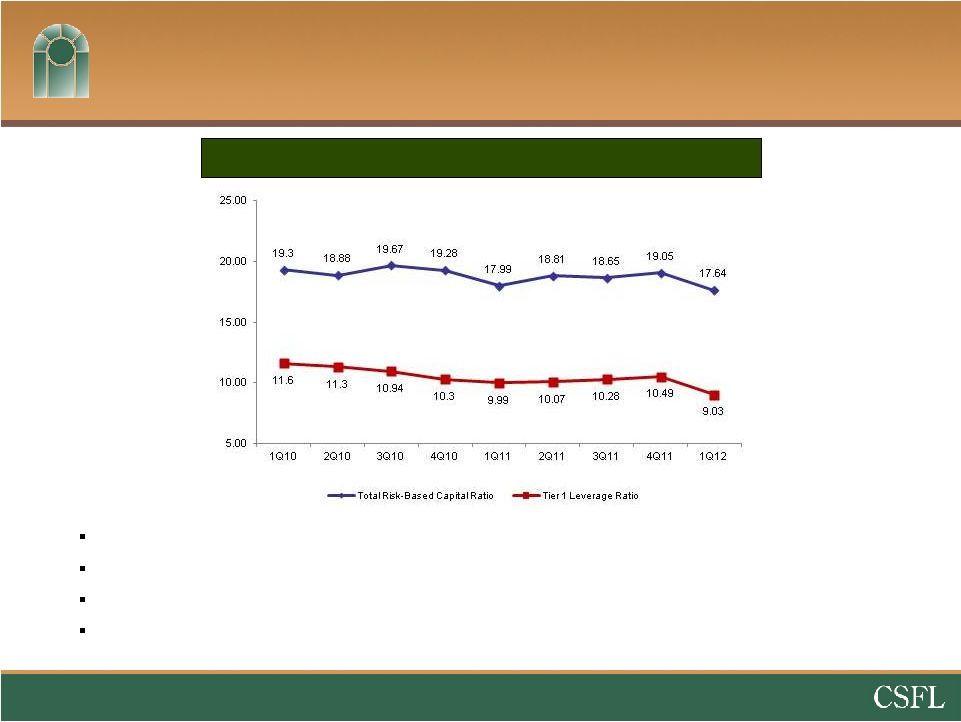

Capital

Total Risk-Based & Tier 1 Leverage

22

Two successful capital raises in 2009 and 2010 totaling $114 million

First

publicly

traded

bank

in

Florida

to

successfully

complete

a

capital

raise

during

financial

crisis

in

2009

Over

50

“Blue

Chip”

active

institutional

investors

–

Average

daily

volume

over

50,000

shares

Institutions committed to capitalize additional FDIC accretive transactions

|

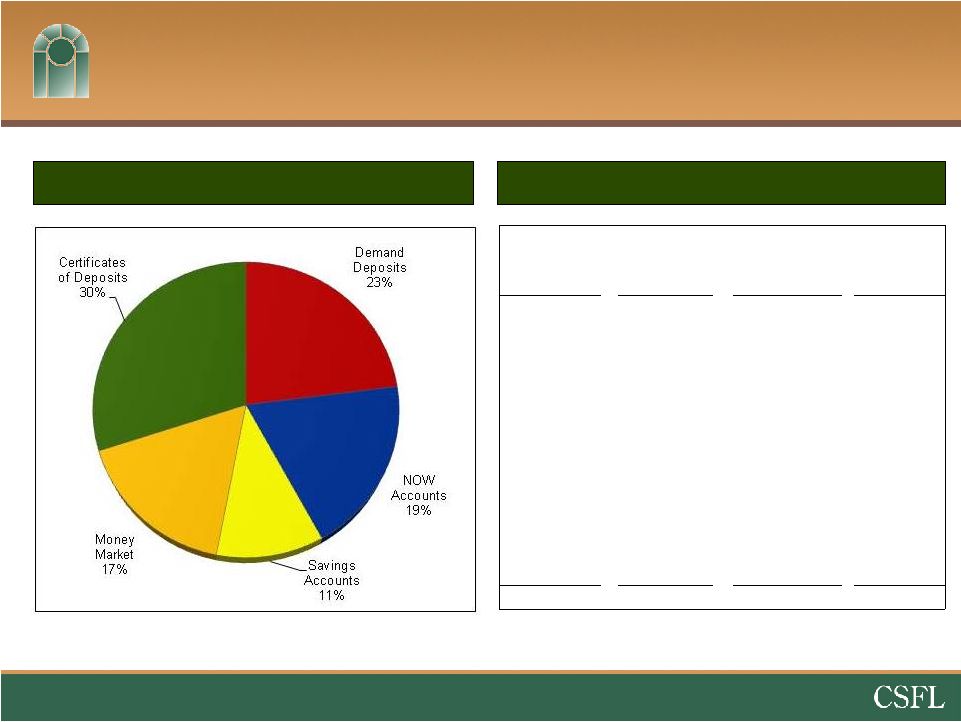

Total Deposit Portfolio

(at 3/31/12)

Total Deposits by Type (%)

Total Deposits Detail

23

Deposit Type

Number of

Deposits

3/31/12

Balance

Avg Deposit

Balance

Demand

Deposits

41,528

$ 501 MM

$12,500

NOW

Accounts

43,067

$ 401 MM

$9,300

Savings

Deposits

19,523

$ 247 MM

$12,700

Money

Market

3,942

$ 355 MM

$90,000

Certificates of

Deposit

18,431

$ 629 MM

$34,100

Total

126,491

$ 1,920 MM

$16,900 |

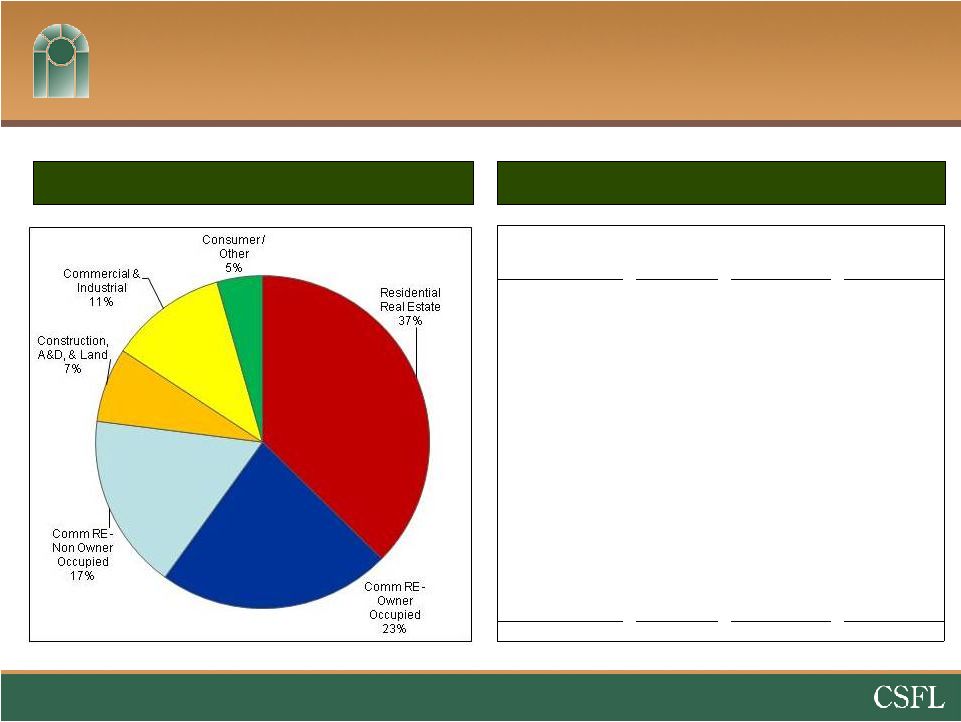

Total Loan Portfolio

(at 3/31/12, excluding FDIC covered assets)

Total Loans by Type (%)

Total Loans Detail

24

Loan Type

No. of

Loans

3/31/12

Balance

Avg Loan

Balance

Residential Real

Estate

3,822

$ 414 MM

$108,200

CRE-Owner

Occupied

763

$ 254 MM

$332,900

CRE-Non Owner

Occupied

470

$ 186 MM

$395,700

Construction,

A&D, & Land

498

$ 80 MM

$161,200

Commercial &

Industrial

1,033

$ 126 MM

$121,700

Consumer & All

Other

2,867

$ 49 MM

$17,400

Total

9,453

$ 1,109 MM

$117,300 |

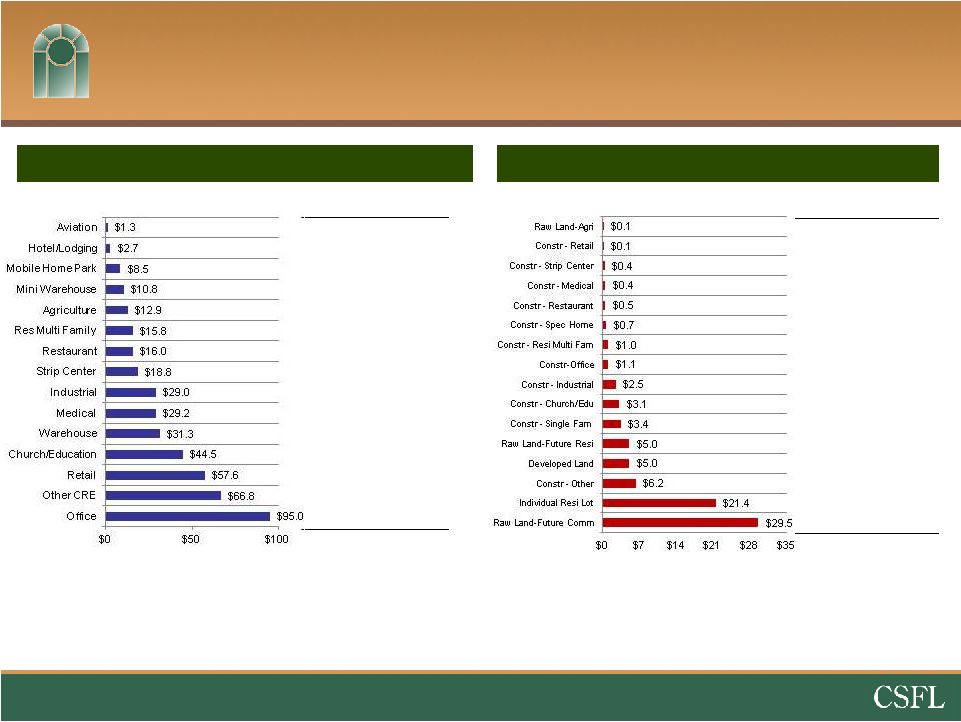

Commercial Real Estate by Type ($MM)

Construction Loans by Type ($MM)

CRE Concentrations

(as of 3/31/12, excluding FDIC acquired loans)

25

C&D concentration –

25% vs. 100%

•

58% Owner Occupied

CRE concentration –

109% vs. 300%

% of Total

Loans

Avg. Loan

Amount ($000)

0.3%

$425

0.6%

$683

1.9%

$941

2.4%

$718

2.9%

$216

3.6%

$206

3.6%

$432

4.3%

$417

6.6%

$392

6.6%

$583

7.1%

$434

10.1%

$542

13.1%

$324

15.2%

$321

21.6%

$298

100.0%

$357

% of Total

Loans

Avg. Loan

Amt ($000)

0.1%

$68

0.1%

$70

0.5%

$366

0.5%

$440

0.6%

$485

0.8%

$170

1.3%

$1,050

1.3%

$1,064

3.1%

$2,454

3.9%

$1,555

4.2%

$242

6.2%

$355

6.2%

$416

7.7%

$365

26.7%

$65

36.8%

$301

100.0%

$161 |