Attached files

| file | filename |

|---|---|

| 8-K - HORIZON BANCORP INC /IN/ | hb_8k0503.htm |

EXHIBIT 99.1

Filed by Horizon Bancorp (0-10792)

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Heartland Bancshares, Inc

Welcome Shareholders

Horizon’s

2012

Annual Meeting

Forward-Looking Statements

This presentation may contain forward-looking statements regarding the financial

performance, business, and future operations of Horizon Bancorp and its affiliates

(collectively, “Horizon”). For these statements, Horizon claims the protection of the safe

harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements provide current expectations or

forecasts of future events and are not guarantees of future results or performance. As a

result, undue reliance should not be placed on these forward-looking statements, which

speak only as of the date hereof.

performance, business, and future operations of Horizon Bancorp and its affiliates

(collectively, “Horizon”). For these statements, Horizon claims the protection of the safe

harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements provide current expectations or

forecasts of future events and are not guarantees of future results or performance. As a

result, undue reliance should not be placed on these forward-looking statements, which

speak only as of the date hereof.

We have tried, wherever possible, to identify such statements by using words such as

“anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar

expressions, and although management believes that the expectations reflected in such

forward-looking statements are accurate and reasonable, actual results may differ

materially from those expressed or implied in such statements. Risks and uncertainties

that could cause our actual results to differ materially include those set forth in “Item 1A

Risk Factors” of Part I of Horizon’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2011. Statements in this presentation should be considered in

conjunction with such risk factors and the other information publicly available about

Horizon, including the information in the filings we make with the Securities and

Exchange Commission.

“anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar

expressions, and although management believes that the expectations reflected in such

forward-looking statements are accurate and reasonable, actual results may differ

materially from those expressed or implied in such statements. Risks and uncertainties

that could cause our actual results to differ materially include those set forth in “Item 1A

Risk Factors” of Part I of Horizon’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2011. Statements in this presentation should be considered in

conjunction with such risk factors and the other information publicly available about

Horizon, including the information in the filings we make with the Securities and

Exchange Commission.

Horizon does not undertake, and specifically disclaims any obligation, to publicly release

any updates to any forward-looking statement to reflect events or circumstances

occurring or arising after the date on which the forward-looking statement is made, or to

reflect the occurrence of unanticipated events, except to the extent required by law.

any updates to any forward-looking statement to reflect events or circumstances

occurring or arising after the date on which the forward-looking statement is made, or to

reflect the occurrence of unanticipated events, except to the extent required by law.

Thomas H. Edwards

President & Chief Operating Officer

Horizon’s Sound Credit Culture

and

Asset Quality

Sound Credit Culture

• Team of Seasoned Underwriters

– Average Tenure > 20 years

• Primarily an In-Market and Full Recourse Lender

• Predominately a Secured Lender

• Retail & Business Focus

– Average Commercial Loan Size Approximately $225,000

– Sweet Spot - Retail and Business Focus

• We Manage Lending Limits

– House Limit $10 million

– Legal Limit > $20 million

– Seven Loan Relationships with Balances > $5 million

• Independent Loan Review

Investment Portfolio is Managed for

Liquidity - Not Yield

Liquidity - Not Yield

Primary Focus

• Agencies

• Municipal

− General Obligation

− National in Scope

− Diversify Risk

− $10 Million Maximum Per State (Except IN)

− Reduced Position in High Risk States

Loans Past Due 30 to 89 Days

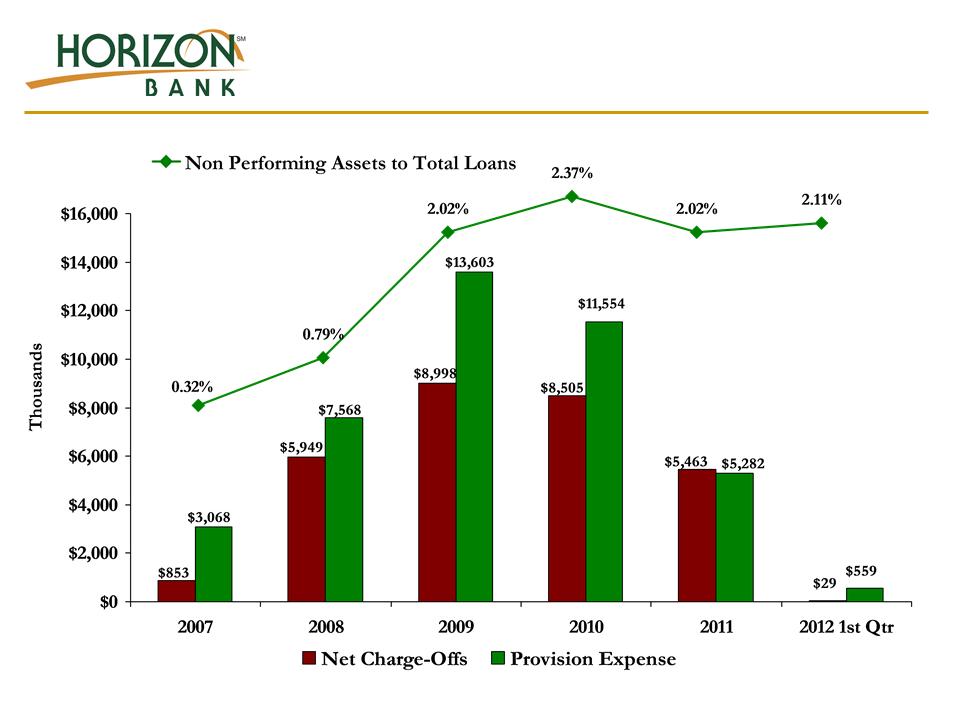

Provision Expense Declining

As Non-Performing Loans Stabilize

As Non-Performing Loans Stabilize

Source: FDIC Uniform Bank Performance Reports as of 12/31/11. Peer is a custom group of 16 publicly traded banks headquartered in the

state of Indiana. National peer group consists of insured commercial banks having assets between 1 billion and 3 billion.

state of Indiana. National peer group consists of insured commercial banks having assets between 1 billion and 3 billion.

1st

Qtr.

Qtr.

Non-Performing Loans Plus OREO to Gross Loans Plus OREO

Craig M. Dwight

Chief Executive Officer

A Company on the Move

Horizon’s Story

Financial Strength

Consistent Performance

Superior Returns

Stable Growth

Financial Strength

Consistent Performance

Superior Returns

Stable Growth

Corporate Profile

• Shares Outstanding 4.9 Million

• Market Cap (1) $125.0 Million

• Total Assets (2) $1.5 Billion

• Total Deposits (2) $1.1 Billion

• Locations 24

• Ownership (2)

– Insiders 10%

– Employee Benefit Plans 16%

– Institutional & Mutual Funds 21%

(1) Based on price at the close of business on April 30, 2012 at $25.17 per common share

(2) Total assets, deposits and inside ownership as of March 31, 2012

24 Current Locations

State of the Banking Industry

&

Economic Outlook

Regional Earnings are Improving

|

Year

|

Indiana

|

Michigan

|

|

2011

|

$486.7

|

$260.0

|

|

2010

|

$267.8

|

-$321.0

|

|

2009

|

-$101.5

|

-$663.0

|

|

2008

|

-$ 57.2

|

-$2,128.7

|

|

2007

|

$442.8

|

$895.7

|

In Millions

Source: UBPR for States of IN & MI, represents aggregate earnings for all banks in each state

Source: www.fdic.gov - YTD 2012 through April 20th actual 17 failed banks annualized pace for 2012 is 51 failed banks

Total # Banks Failed 2000 to YTD 2012 = 492

Total # Banks Failed 1980 to 1992 =2,870

Economic Outlook

Slow Growth

Slow Growth

• Eleven Straight Quarters of Increasing Economic

Activity

• Slow GDP Growth - 2% to 3% Per Annum

• Fed Funds Rate - to be Maintained at

Exceptionally Low Levels through 2014

• Declining Unemployment Rates

• Declining Loan Default Rates

• Election Year - Expect No Major Changes

Horizon’s Financial Strength,

Consistent Performance &

Stable Growth

Consistent Performance &

Stable Growth

CAGR 10.65%

Source: Uniform Bank Performance Reports. Indiana and Michigan are state averages for all insured

commercial banks. National is all insured commercial banks with assets between $1 billion and $3 billion.

commercial banks. National is all insured commercial banks with assets between $1 billion and $3 billion.

2008

2009

2010

2011

As Measured By Return On Average Assets

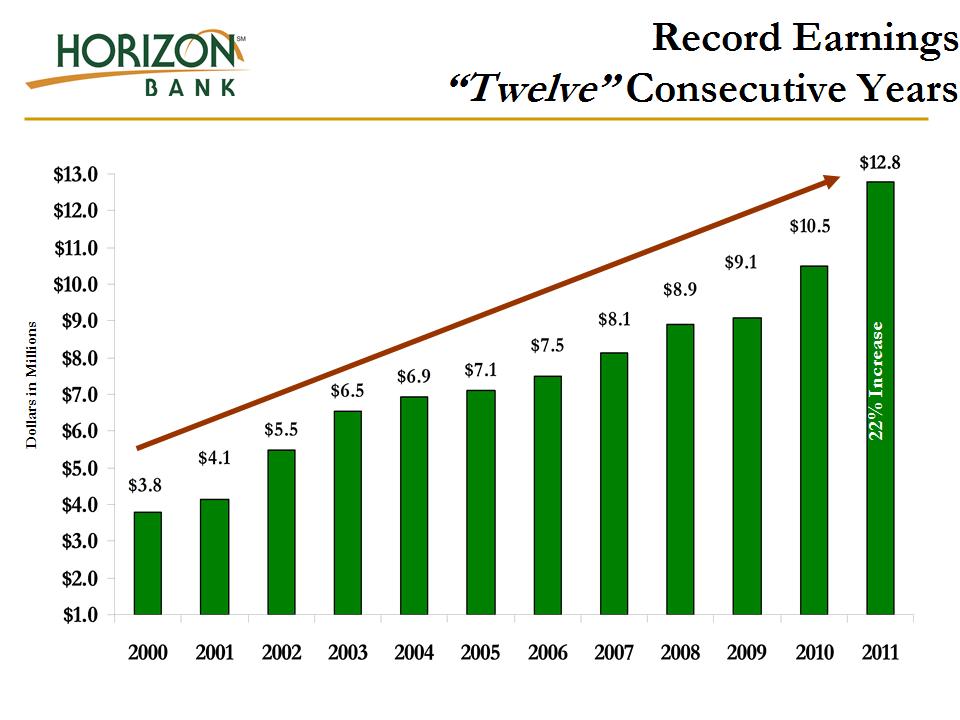

Record Earnings First Quarter 2012

Core Funding CAGR 7.19%

Loans CAGR 8.04%

A Company on the Move

&

Culture Aligned with Shareholders’

Interests

&

Culture Aligned with Shareholders’

Interests

1999

2004

2005

2012

Mortgage

Warehousing

Established

Warehousing

Established

Entered St.

Joseph Michigan

Market

Joseph Michigan

Market

Entered South

Bend and

Elkhart Market

Bend and

Elkhart Market

Acquired

Alliance Bank

Alliance Bank

Entered Lake

County

Market

County

Market

Acquired

American

Trust Bank

American

Trust Bank

Entered

Kalamazoo

Michigan Market

Kalamazoo

Michigan Market

Entered

Indianapolis

Market

Indianapolis

Market

Announced

The

Acquisition Of

Heartland

Bank

The

Acquisition Of

Heartland

Bank

2010

2006

2002

2003

Acquired

Anchor

Mortgage

Anchor

Mortgage

2008

International

Liquidity Crisis

Liquidity Crisis

Mortgage

Loan

Originators

Loan

Originators

6

16

26

Full Service

Branches

Branches

9

14

24

Commercial

Loan

Officers

Loan

Officers

8

15

15

Recent Milestones

• Established New Wealth Mgmt. Office in Indianapolis

in the 4th Qtr. 2011

in the 4th Qtr. 2011

• Reached One Billion Dollars in Total Deposits in 2011

• Opened Two New Full Service Branches - 1st Qtr. 2012

• Announced Acquisition of Heartland - 1st Qtr. 2012

• Plans to Open Loan and Deposit Production Office in

Indianapolis - 2nd Qtr. 2012

Indianapolis - 2nd Qtr. 2012

Culture of Accountability

• Measurement

– Profit and Loss Statements for All Departments

– Performance Scorecards

• Semi-annual Performance Reviews

– Coaching Opportunity

– Progress Update

• Bi-Monthly Departmental Strategic Meetings

• Six Sigma - Customer Focused

• Recognize and Reward Success

• We are Aligned with Shareholders’ Interests

Continuous Expectation to Improve

• Minimum Expectation is for Each Department to

Beat Last Year’s Performance

Beat Last Year’s Performance

– Financial Results

– Internal Processes

– Productivity

• Utilize Third Parties

– To Test Critical Thinking and Strategies

– To Seek New Ideas

– Asset Liability/Enterprise Risk Management/Efficiency/

Acquisitions / Loan Review / Allowance Methodology

Acquisitions / Loan Review / Allowance Methodology

• Benchmark to Best Practices

Proven Enterprise Risk Management

(“ERM”)

(“ERM”)

• Single Bank Charter

• Diversified Loan Portfolio

– 1/3 Commercial; 1/3 Mortgage; 1/3 Consumer

– Low In-House Loan Approval Limits

• Centralized Data Processing & Loan Documentation

• ERM Dash Board Report

– Measures Against Internal Targets & Best Practices

– Quantifies Risk

Balanced & Counter-Cyclical

Business Model

Business Model

#1 - Business Banking

#2 - Retail Banking

#3 - Retail Mortgage Banking

#4 - Wealth Management

#5 - Mortgage Warehousing

Revenue Streams that are Counter-Cyclical to

Varying Economic Cycles

Varying Economic Cycles

We Listen and Communicate

• If We Do Not Know - We Cannot Improve

• Excellent, Participatory & Engaged Board of

Directors

Directors

• Surveys - Shareholders, Customers & Employees

• All Company Learning Conference

• Quarterly Company Conference Calls

• CEO Outreach Meetings

• Third Parities & Consultants

• Independent Board Presentations

Proven Growth Strategy

• People First

– 24/7 Recruitment Effort

– Experienced Community Bankers

– Retention

• De Novo Branching

– Breakeven Within First 18 Months

– Traditional Banking at its Best

• Acquisitions

– Branch

– Whole Bank

– FDIC

Grand Rapids

Franklin

Heartland Community Bank

Additional Information Relating to

the Heartland Merger

the Heartland Merger

• In connection with Horizon’s proposed acquisition of Heartland Bancshares, Inc. (“Heartland”), Horizon

will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Heartland

and a Prospectus of Horizon, as well as other relevant documents concerning the proposed transaction.

SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY

STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND

ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION.

will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Heartland

and a Prospectus of Horizon, as well as other relevant documents concerning the proposed transaction.

SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY

STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND

ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION.

• The final proxy statement/prospectus will be mailed to shareholders of Heartland. The proxy

statement/prospectus and other relevant materials (when they become available), and any other documents

Horizon has filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In

addition, investors and security holders may obtain free copies of the documents Horizon has filed with the

SEC by contacting Mary McColl, Shareholder Relations Officer, 515 Franklin Square, Michigan City,

Indiana 46360, telephone: (219)874-9272 or on Horizon’s website at www.accesshorizon.com under the tab

“Investor Relations” and then under the heading “Information Requested.” The information available

through Horizon’s website is not and shall not be deemed part of this presentation or incorporated by

reference into other filings Horizon makes with the SEC.

statement/prospectus and other relevant materials (when they become available), and any other documents

Horizon has filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In

addition, investors and security holders may obtain free copies of the documents Horizon has filed with the

SEC by contacting Mary McColl, Shareholder Relations Officer, 515 Franklin Square, Michigan City,

Indiana 46360, telephone: (219)874-9272 or on Horizon’s website at www.accesshorizon.com under the tab

“Investor Relations” and then under the heading “Information Requested.” The information available

through Horizon’s website is not and shall not be deemed part of this presentation or incorporated by

reference into other filings Horizon makes with the SEC.

• Horizon and certain of its directors and executive officers may be deemed to be participants in the

solicitation of proxies from the shareholders of Heartland in connection with the proposed merger.

Information about the directors and executive officers of Horizon is set forth in the proxy statement for

Horizon’s 2012 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 23, 2012.

solicitation of proxies from the shareholders of Heartland in connection with the proposed merger.

Information about the directors and executive officers of Horizon is set forth in the proxy statement for

Horizon’s 2012 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 23, 2012.

Heartland’s Corporate Profile

as of December 31, 2011

as of December 31, 2011

• Total Shares Outstanding 1,442,727

• Total Assets $246 Million

• Total Loans $138 Million

• Total Deposits $218 Million

• Branches 6

Heartland’s Locations

Transaction Summary

• Business Combination

• Form of Consideration - Stock for Stock

• Fixed Exchange Ratio at 0.54:1

(Subject to Possible Adjustments Per Definitive Agreement)

• Heartland’s Shareholders Will Own Approximately

16% of Horizon Bancorp

16% of Horizon Bancorp

• Name Retained - “Heartland Community Bank, a

Horizon Bank NA Company”

Horizon Bank NA Company”

Transaction Summary

Continued

Continued

• CEO & EVP Retained

• Heartland will Gain - One Bank Board Seat

• Community Advisory Board will be Established

• Subject to Approval by Regulators & Heartland’s

Shareholders

Shareholders

• Closing Date Targeted for the End of Second

Quarter or Early 3rd Quarter

Quarter or Early 3rd Quarter

Acquisition Improves Shareholder Value

• Strategic Considerations

– Expands Horizon’s Presence into Central Indiana

a Growth Market

– Lowers Geographic Concentration Risk

– Opens the Door for Future Opportunities

– Demonstrates Horizon’s Interest as a Statewide Bank

• Financial Considerations

– Heartland is #1 in Deposit Market Share

– Low Cost of Deposits

– Accretive to Horizon’s Earnings Per Share

– Cost Saves of Approximately 25%

– Revenue Enhancement Opportunities

Indiana Business Research Center

Invest in Horizon

Shareholder Value Plan - Since 2001

• Dividends

– Over 25 Years of Uninterrupted Dividend Payments to

Horizon’s Common Shareholders

Horizon’s Common Shareholders

– Recent Dividend Increases (2011 & 2012)

• Focuses on Improving Liquidity

– 3:2 Stock Split in 2011

– Heartland Acquisition Consideration is Common Stock

• Focuses on Growing Net Book Value

– Stable Earnings Growth Over Time

• Focuses on Qualifying for Major Index, Such as

Russell 2000

Russell 2000

Highly Regarded

In Our Communities

In Our Communities

• Nine out of Ten Customers - Would Refer a Friend

• Best Bank - The News Dispatch Readers Poll - Eleven

out of Last Twelve Years

out of Last Twelve Years

• Best Wealth Management Company - NW Indiana

Business Quarterly

Business Quarterly

• Best Place to Work - NW Indiana Business Quarterly

• Family Friendly Work Policies - Clarian Award

• High Visibility - Volunteerism and Contributions

Highly Regarded

for Financial Performance

for Financial Performance

• Ranked in the Top 200 Community Banks for

Financial Performance - US Banker & ABA Magazines

for the Years -2008, 2009, 2010 & 2011

Financial Performance - US Banker & ABA Magazines

for the Years -2008, 2009, 2010 & 2011

• Horizon Named to KBW Bank Honor Roll

– Only 45 Banks Selected Throughout the United States

– No Annual Loss in the Past Decade

– Honor Roll Banks Typically Outperformed the Market;

Growth, Earnings and Performance Ratios

Growth, Earnings and Performance Ratios

– Includes Names Such as JP Morgan and Wells Fargo

Horizon is an Attractive Value

|

Metric

|

Horizon

Bancorp(1) March 31, 2012

|

Horizon

Bancorp(2) April 30, 2012

|

Median

Indiana

Banks(3)

|

|

Dividend Yield

|

2.8%

|

2.1%

|

1.9%

|

|

Price to Book

|

80.5%

|

109.5%

|

82.0%

|

|

Price to Tangible

Book |

86.6%

|

117.9%

|

90.1%

|

|

Price to Earnings

(LTM) |

7.0x

|

9.5x

|

14.0x

|

(1) All data as of March 31, 2012

(2) Horizon Bancorp data as of March 31, 2012 and Stock Price as of April 30, 2012 at $25.17 per common share

(3) Peer Data Source: KBW Report as of March 2011 Covering Indiana Publicly Traded

Horizon Outperforms Market - Ten Years

Thank You