Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Philip Morris International Inc. | d336703d8k.htm |

| EX-99.2 - CONFERENCE CALL TRANSCRIPT DATED APRIL 19, 2012 - Philip Morris International Inc. | d336703dex992.htm |

| EX-99.1 - PHILIP MORRIS INTERNATIONAL INC. PRESS RELEASE DATED APRIL 19, 2012 - Philip Morris International Inc. | d336703dex991.htm |

2012

First-Quarter Results April 19, 2012

Exhibit 99.3 |

2

Introduction

Unless otherwise stated, we will be talking about results for the first-

quarter 2012 and comparing them with the same period in 2011

References to PMI volumes refer to PMI shipment data, unless

otherwise stated

Industry volume and market shares are the latest data available from

a number of internal and external sources

Organic volume refers to volume excluding acquisitions

Net revenues exclude excise taxes

OCI stands for Operating Companies Income, which is defined as

operating income before general corporate expenses and the

amortization of intangibles. OCI growth rates are on an adjusted

basis, which excludes asset impairment, exit and other costs

Data tables showing adjustments to net revenues and OCI for

currency, acquisitions, asset impairment, exit and other costs, free

cash flow calculations, adjustments to EPS, and reconciliations to

U.S. GAAP measures are at the end of today’s webcast slides and

are posted on our web site |

3

Forward-Looking and Cautionary Statements

This presentation and related discussion contain forward-looking statements. Achievement of

projected results is subject to risks, uncertainties and inaccurate assumptions, and PMI is

identifying important factors that, individually or in the aggregate, could cause actual results to

differ materially from those contained in any forward-looking statements made by PMI PMI’s business risks include: significant increases in cigarette-related taxes; the

imposition of discriminatory excise tax structures; fluctuations in customer inventory levels

due to increases in product taxes and prices; increasing marketing and regulatory restrictions,

often with the goal of preventing the use of tobacco products; health concerns relating to the

use of tobacco products and exposure to environmental tobacco smoke; litigation related to

tobacco use; intense competition; the effects of global and individual country economic,

regulatory and political developments; changes in adult smoker behavior; lost revenues as a

result of counterfeiting, contraband and cross-border purchases; governmental

investigations; unfavorable currency exchange rates and currency devaluations; adverse changes

in applicable corporate tax laws; adverse changes in the cost and quality of tobacco and other

agricultural products and raw materials; and the integrity of its information systems.

PMI’s future profitability may also be adversely affected should it be unsuccessful in its

attempts to produce products with the potential to reduce the risk of smoking-related

diseases; if it is unable to successfully introduce new products, promote brand equity, enter

new markets or improve its margins through increased prices and productivity gains; if it is

unable to expand its brand portfolio internally or through acquisitions and the development of

strategic business relationships; or if it is unable to attract and retain the best global

talent PMI is further subject to other risks detailed from time to time in its publicly filed

documents, including the Form 10-K for the year ended December 31, 2011. PMI cautions that

the foregoing list of important factors is not a complete discussion of all potential risks and

uncertainties. PMI does not undertake to update any forward-looking statement that it may

make from time to time, except in the normal course of its public disclosure obligations |

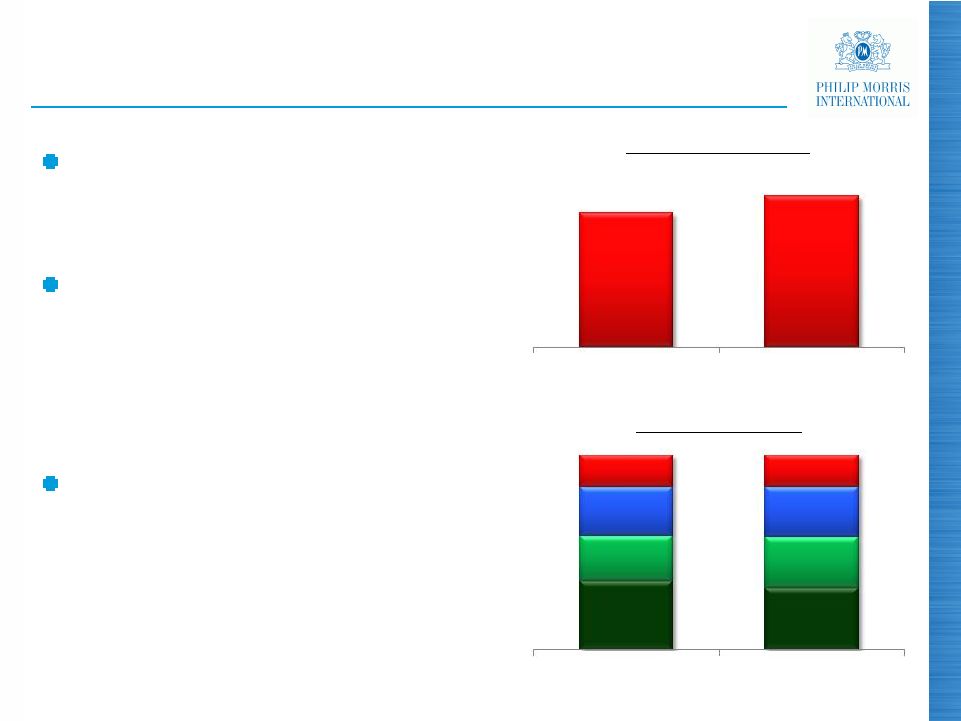

Excellent First-Quarter 2012 Results

(a)

Excluding currency and acquisitions

(b)

Excluding currency

Source: PMI Financials

(a)

(a)

4

(%)

Growth Q1, 2012 vs. Q1, 2011

(b)

5.3

10.9

14.2

19.8

0

20

Organic Cigarette

Volume

Net

Revenues

Adjusted

OCI

Adjusted Diluted

EPS |

5

2012 EPS Guidance

Q1 results confirm our very strong business momentum

Difficult comparison in Q2, 2012, due to the exceptional

circumstances in Japan in 2011

Forecast currency headwind of 15 cents at prevailing

exchange rates

Revised reported diluted EPS guidance for 2012 is $5.20

to $5.30, compared to $4.85 in 2011

On a currency-neutral basis, our revised guidance

maintains a forecast growth rate of approximately 10% to

12%, compared to adjusted diluted EPS of $4.88 in 2011

Source: PMI Financials and PMI forecasts |

6

Excise Tax Environment Remains Reasonable

No disruptively large excise tax increases in any key

markets

Structural improvements continue with increase in the

relative importance of the specific element |

7

Favorable Pricing and Volume/Mix Variances in

Q1, 2012

Note: Variances at OCI level

Source: PMI Financials

($ million)

369

224

0

400

Price

Volume/Mix |

Strong

First-Quarter 2012 Organic Volume (%)

Source: PMI Financials

Organic Cigarette Volume Growth Q1, 2012 vs. Q1, 2011

8

EU

12.4

3.4

(1.5)

2.9

5.3

(5)

15

Asia

EEMA

LA&C

Total PMI |

Source: PMI Financials

All Top Ten PMI Brands Grew Volume in Q1, 2012

Volume Growth (Q1, 2012 vs. Q1, 2011)

(units billion)

9

0

4 |

Growing Market Share in Key Markets

Note: Historical data adjusted for pro forma inclusion of business combination with

Fortune Tobacco Corporation in the Philippines Source: PMI Financials and PMI

estimates 10

Top 30 PMI OCI Markets

(%)

35.5

36.6

37.3

34

38

2010

2011

Q1, 2012 |

11

Growth Q1, 2012 vs. Q1, 2011

(a)

Excluding currency and acquisitions

Source: PMI Financials

Asia: Our Principal Growth Engine

Solid economic

environment

Growing adult population

Increasing consumer

purchasing power

(a)

(a)

(%)

Organic

Cigarette

Volume

0

12.4

16.3

23.7

25

Revenues

Adjusted

OCI

Net |

12

PMI Market Share Variance

Q1, 2012 vs. Q1, 2011

Source: PMI estimates and PMI Financials

Indonesia: Premium Brands Lead the Way

Total industry volume up at

double-digit rate in Q1,

2012

Full-year industry volume

growth forecast in 6% to

8% range

PMI volume increased

24.9% in Q1, 2012

Tremendous market share

momentum, with 3.5 share

points gained in Q1, 2012,

to reach 33.4%

(pp)

0

1.9

1.1

0.5

2

Premium

Mid

-Price

Low-Price |

PMI Market Share

Japan: Building off a Higher Base

Industry volume underlying

trend: more moderate decline of

approximately 2% forecast in

2012

PMI Q1, 2012 market share of

28.0% impacted by significant

trade purchases of new JT

products in March

Lark

Hybrid

One

100’s

reached

0.4% market share in March

Marlboro

and

Lark

remain

strong, and we have a full

pipeline of innovative new

launches planned

(%)

Source: PMI estimates and Tobacco Institute of Japan

13

25.6

28.2

28.0

24

30

Q1

2011

Q4

2011

Q1

2012 |

14

Source: Hankook Research

Korea: Pricing to Boost Profitability

Price increase on Marlboro,

Parliament

and Lark

from

2,500 Won to 2,700 Won

per pack in February

Preliminary indications that

we have given back, as

expected, a large part of

our share gain from

previous temporary price

advantage

PMI Market Share

Q1

2011

Jan

Feb

Mar

2012

(%)

22.6

17.8

20.8

17.7

0

25 |

15

Growth Q1, 2012 vs. Q1, 2011

(a)

Excluding currency and acquisitions

Source: PMI Financials

EEMA: Strong Contribution from Volume, Mix

and Pricing

Strong volume growth led by

Algeria, Saudi Arabia and

Turkey, partly offset by

Egypt

Favorable mix as consumers

trade up to premium and

mid-price brands

Price increases a key driver

of higher profitability

Continued investments

behind

Marlboro

and

other

key brands, notably in

Russia

(%)

Organic

Cigarette

Volume

(a)

(a)

3.4

12.6

18.0

0

20

Net

Revenues

Adjusted

OCI |

16

Source: PMI Financials and Nielsen

Turkey: PMI Momentum Continues

Strong economy has

enabled market to absorb

Q4, 2011, tax-driven price

increases

Our volume increased

nearly 10% in Q1, 2012

We continued our strong

share performance and

mix has improved behind

Parliament

and Muratti

Premium

Mid

Low

PMI Market Share

Total PMI

(%) |

Price Segments (%)

Russia: Share Gains, Investment Continues

Source: Nielsen

17

PMI Market Share (%)

Consumer up-trading

continuing despite price

increases

PMI gaining share thanks

to strength of:

-

Parliament

-

Bond Street

-

Next

Continued investment in

Marlboro

and other key

brands

Premium

Mid

Low

Super-

Low

25.5

26.2

YTD Feb

2011

YTD Feb

2012

35.2

31.8

23.2

25.7

25.1

25.9

16.5

16.6

YTD Feb

2011

YTD Feb

2012 |

18

Growth Q1, 2012 vs. Q1, 2011

(a)

Excluding currency

Source: PMI estimates and PMI Financials

EU: An Improved Overall Performance

Total industry volume

declined by a modest 1.3%

despite weak economic

conditions notably in Greece

and Spain

Continued L&M

and

Chesterfield

share growth

Organic cigarette volume

decline of 1.5% is best PMI

quarterly performance in

many years

Price increases driving growth

in net revenues and adjusted

OCI

(a)

(a)

(%)

Organic

Cigarette

Volume

(3)

6

Net

Revenues

Adjusted

OCI

(1.5)

5.3

3.7 |

PMI Market Share (%)

Spain: Difficult Economic Conditions

(a) “Youth”

refers to Spain’s working population under 25 years old

Note: Chest.

is Chesterfield

Source: Eurostat and PMI estimates

19

Unemployment

(a)

(%)

Unemployment continues to

increase, putting pressure on

total cigarette market volume

PMI market share was down

0.2 points in Q1, 2012, to

30.2%, in spite of an

improvement in Chesterfield

Following recent excise tax

increases, PMI raised prices

by €0.25/pack

Total PMI

Other

L&M

Chest.

Marlboro

Overall

Youth

Feb

2011

Feb

2012

Feb

2011

Feb

2012

14.1

13.9

8.1

8.9

6.7

6.5

30.4

30.2

Q1

2011

Q1

2012

20.6

44.0

23.6

50.5 |

Chesterfield

Share

of

Total

Tobacco

Italy: Profitability Remains Strong

Source: PMI estimates

20

PMI Market Share

Higher prices and a weaker

economy led to a 6.1% decline

in cigarette industry volume in

Q1, 2012, partly offset by the

growth of fine cut

Some consumer down-trading to

low-price cigarettes and fine cut

Launch

of

Chesterfield

in

fine

cut

in Q2, 2011, has provided PMI

with leadership in fine cut

PMI portfolio in international low-

price segment strengthened

through launch in Q1, 2012, of

Philip Morris Selection

Cigarettes

Fine Cut

Cigarettes

Fine Cut

55

50

30

(%)

Q1

2011

Q1

2012

Q1

2011

Q1

2012

4.9

(%)

2011

3.6

3.6

3.5

3.3

3.3

1.6

3.6

3.8

4.0

4.5

0

5

Q1

Q2

Q3

Q4

Q1

2012

53.5

0.3

52.6

28.3

0 |

Germany: PMI Share Growth Continues

(a)

Young

Adult

Smokers:

Legal

Age

(minimum

18)

–

24

years

old

Source: PMI estimates and PMI Market Research

21

Total industry volume up 3.1% in

Q1, 2012, helped by a decline in

illicit trade

Marlboro

first

in

market

with

new

retail prices

New

Marlboro

marketing

campaign showing promising

results: YAS

(a)

share up 5 points

to 20%

L&M

growth continues unabated:

market share up a further 1.2

points in Q1, 2012

PMI share of fine cut market

grew 0.9 points to 15.8%

PMI Market Share (%)

Total PMI

Other

L&M

Marlboro

21.2

20.4

10.0

11.2

4.5

4.3

35.7

35.9

Q1

2011

Q1

2012 |

Latin

America & Canada: Solid Contribution to PMI Growth

Volume growth, driven by:

Share and market growth in

Argentina

Favorable timing and trade

movements in Mexico

Marlboro

share:

Argentina +1.0pp to 24.8%

Brazil

Colombia

Mexico +4.0pp to 54.3%

22

Growth Q1, 2012 vs. Q1, 2011

(%)

(a) Excluding currency

Source: PMI Financials and PMI estimates

-

0.5pp to 6.8%

+1.5pp to 5.8%

Organic

Cigarette

Volume

(a)

(a)

2.9

5.4

4.0

6

Net

Revenues

Adjusted

OCI

0 |

23

PMI Intensifying Efforts to Combat Illicit Trade

(a)

Estimated globally at 600 billion cigarettes

Significant volume and profitability opportunities for PMI

from potential reduction

PMI cooperating with authorities worldwide

Canada, Germany and Romania are recent examples of

successful reductions in illicit trade

(a) Illicit trade refers to domestic non-duty paid products

Source: PMI estimates |

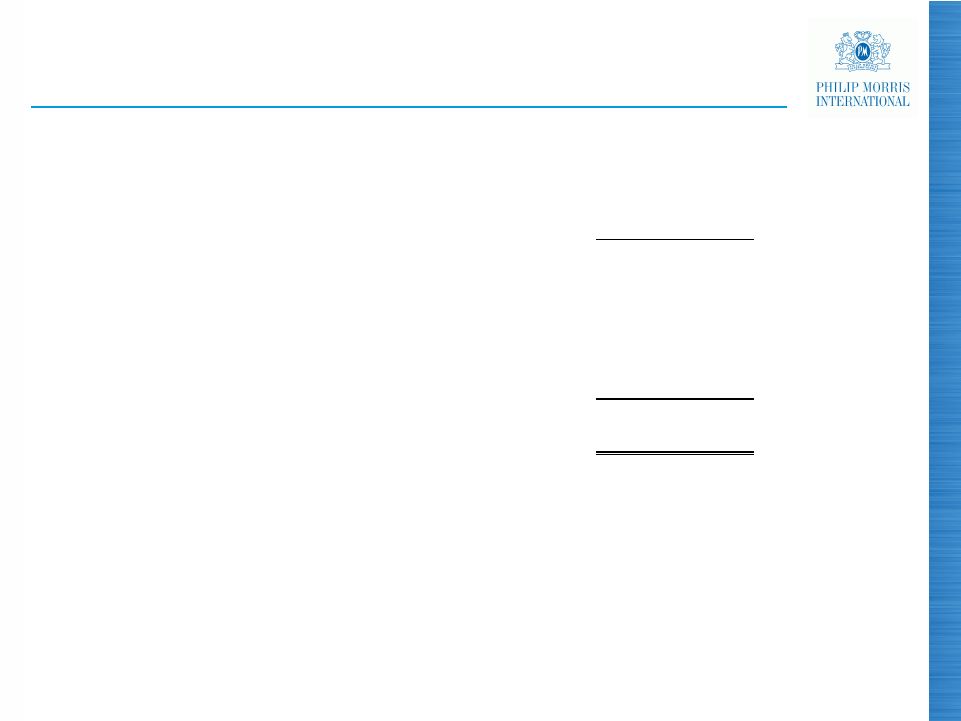

24

Free Cash Flow

(a)

Impacted by Working Capital

Requirements

(a)

Free cash flow equals net cash provided by operating activities less capital

expenditures Source: PMI Financials

($ million)

245

(742)

(68)

2,236

1,671

Q1

2011

Net

Earnings

Working Capital

and Other

Capital

Expenditures

Q1

2012 |

25

Generous Returns to Shareholders

In the first quarter of 2012, PMI spent $1.5 billion to

repurchase 18.1 million shares. Target for 2012 is $6

billion

Since 2008 spin, 432.1 million shares repurchased at an

average price of $52.88

Our annualized dividend of $3.08 per share generated a

yield of 3.5% on April 13, 2012

Since the spin, dividend rate increased by 67.4%

Source: PMI Financials |

Superior Shareholder Returns

Tobacco

Peer Group

Company

Peer Group

March 28, 2008 –

April 13, 2012

Note: Peer groups represent the market weighted average return of the group. PMI

pro forma for additional $0.46 per share dividend paid in April 2008 impacts

the period March 28, 2008 – April 13, 2012. Exchange rates are as of

March 28, 2008, January 1, 2012 and April 13, 2012. A list of the Tobacco

and Company Peer Groups is available in the reconciliation section Source:

FactSet, compiled by Centerview January 1, 2012 –

April 13, 2012

Tobacco

Peer Group

Company

Peer Group

FTSE 100

26

1.4%

4.8%

10.3%

11.0%

12.9%

FTSE 100

S&P 500

PMI

(7.9)%

15.4%

24.6%

55.3%

107.7%

S&P 500

PMI |

27

Conclusion

Excellent results in the first quarter of 2012

Very strong organic volume and consumer up-trading in

non-OECD markets

Key

brands

performing

very

well,

led

by

Marlboro

and

Parliament

Expect to deliver against our currency-neutral long-term

target of 10% to 12% growth in adjusted diluted EPS in

2012

Confident about our outlook for remainder of year,

notwithstanding the difficult comparison in the second

quarter due to Japan |

2012

First-Quarter Results Questions & Answers

|

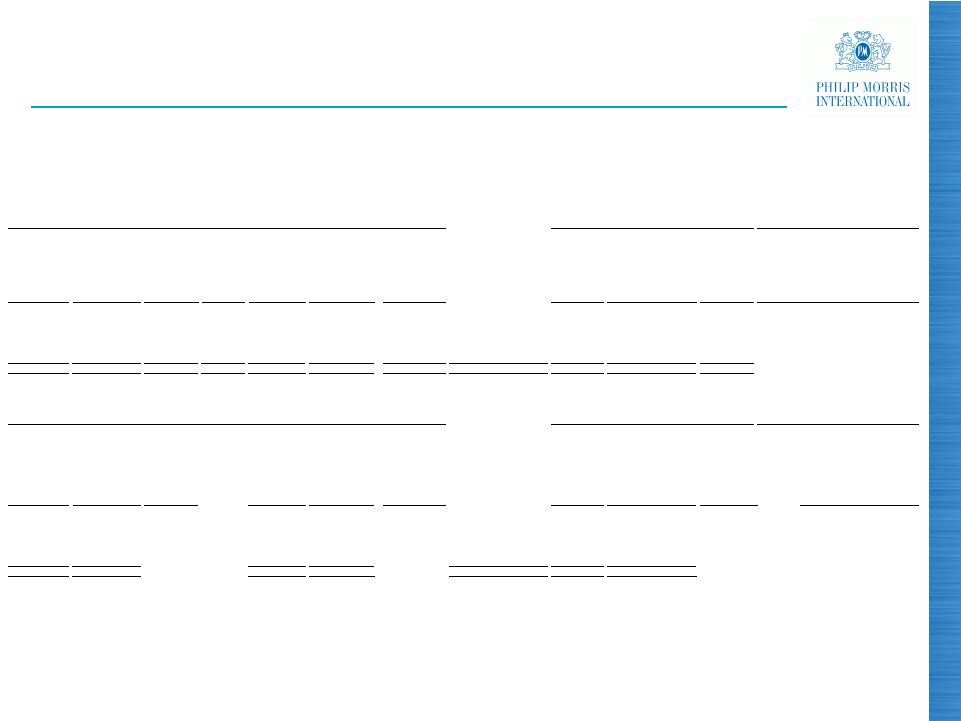

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Quarters Ended March 31,

($ in millions)

(Unaudited)

29

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

6,470

$

4,417

$

2,053

$

(54)

$

2,107

$

-

$

2,107

$

European Union

6,415

$

4,414

$

2,001

$

2.6%

5.3%

5.3%

4,069

2,234

1,835

(73)

1,908

9

1,899

EEMA

3,671

1,984

1,687

8.8%

13.1%

12.6%

5,177

2,400

2,777

74

2,703

1

2,702

Asia

4,288

1,965

2,323

19.5%

16.4%

16.3%

2,306

1,523

783

(39)

822

-

822

Latin America & Canada

2,156

1,376

780

0.4%

5.4%

5.4%

18,022

$

10,574

$

7,448

$

(92)

$

7,540

$

10

$

7,530

$

PMI Total

16,530

$

9,739

$

6,791

$

9.7%

11.0%

10.9%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

1,030

$

(25)

$

1,055

$

-

$

1,055

$

European Union

1,006

$

2.4%

4.9%

4.9%

810

(44)

854

-

854

EEMA

722

12.2%

18.3%

18.3%

1,407

53

1,354

-

1,354

Asia

1,093

28.7%

23.9%

23.9%

237

(17)

254

-

254

Latin America & Canada

251

(5.6)%

1.2%

1.2%

3,484

$

(33)

$

3,517

$

-

$

3,517

$

PMI Total

3,072

$

13.4%

14.5%

14.5%

2012

2011

% Change in Reported Operating

Companies Income

2012

2011

% Change in Reported Net Revenues

excluding Excise Taxes |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Quarters Ended March

31, ($ in millions)

(Unaudited)

30

Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

1,030

$

-

$

1,030

$

(25)

$

1,055

$

-

$

1,055

$

European Union

1,006

$

(11)

$

1,017

$

1.3%

3.7%

3.7%

810

-

810

(44)

854

-

854

EEMA

722

(2)

724

11.9%

18.0%

18.0%

1,407

-

1,407

53

1,354

-

1,354

Asia

1,093

(2)

1,095

28.5%

23.7%

23.7%

237

(8)

245

(17)

262

-

262

Latin America & Canada

251

(1)

252

(2.8)%

4.0%

4.0%

3,484

$

(8)

$

3,492

$

(33)

$

3,525

$

-

$

3,525

$

PMI Total

3,072

$

(16)

$

3,088

$

13.1%

14.2%

14.2%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(a)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

1,055

$

2,107

$

50.1%

1,055

$

2,107

$

50.1%

European Union

1,017

$

2,001

$

50.8%

(0.7)

(0.7)

854

1,908

44.8%

854

1,899

45.0%

EEMA

724

1,687

42.9%

1.9

2.1

1,354

2,703

50.1%

1,354

2,702

50.1%

Asia

1,095

2,323

47.1%

3.0

3.0

262

822

31.9%

262

822

31.9%

Latin America & Canada

252

780

32.3%

(0.4)

(0.4)

3,525

$

7,540

$

46.8%

3,525

$

7,530

$

46.8%

PMI Total

3,088

$

6,791

$

45.5%

1.3

1.3

2011

2012

2011

2012

% Change in Adjusted Operating

Companies Income

(a)

For

the

calculation

of

net

revenues

excluding

excise

taxes,

currency

and

acquisitions,

refer

to

previous

slide |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Quarters Ended March 31,

(Unaudited)

31

2012

2011

% Change

Reported Diluted EPS

1.25

$

1.06

$

17.9%

Adjustments:

Asset impairment and exit costs

-

0.01

Tax items

-

(0.01)

Adjusted Diluted EPS

1.25

$

1.06

$

17.9%

Less:

Currency impact

(0.02)

Adjusted Diluted EPS, excluding Currency

1.27

$

1.06

$

19.8% |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS

For the Year Ended December 31,

(Unaudited)

32

2011

Reported Diluted EPS

4.85

$

Adjustments:

Asset impairment and exit costs

0.05

Tax items

(0.02)

Adjusted Diluted EPS

4.88

$

|

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation

of

Operating

Cash

Flow

to

Free

Cash

Flow

and

Free

Cash

Flow,

excluding

Currency

For the Quarters Ended March 31,

($ in millions)

(Unaudited)

(a) Operating Cash Flow

33

For the Quarters Ended

March 31,

2012

2011

% Change

Net cash provided by operating activities

(a)

1,898

$

2,395

$

(20.8)%

Less:

Capital expenditures

227

159

Free cash flow

1,671

$

2,236

$

(25.3)%

Less:

Currency impact

(50)

Free cash flow, excluding currency

1,721

$

2,236

$

(23.0)% |

PMI

Peer Groups Bayer

BAT

Coca-Cola

Diageo

GlaxoSmithKline

Heineken

Imperial Tobacco

Johnson & Johnson

Kraft

McDonald’s

Nestlé

Novartis

PepsiCo

Pfizer

Roche

Unilever

Vodafone

Altria

BAT

Imperial Tobacco

Japan Tobacco

Lorillard

Reynolds American

Company Peer Group

Tobacco Peer Group

34 |

2012

First-Quarter Results April 19, 2012 |