Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DOT HILL SYSTEMS CORP | d316474d8k.htm |

| EX-99.1 - PRESS RELEASE - DOT HILL SYSTEMS CORP | d316474dex991.htm |

NASDAQ: HILL

NASDAQ: HILL

Dot Hill Systems: 2007 –

2011

Key Financial Metrics

0

0

Exhibit 99.2 |

NASDAQ: HILL

NASDAQ: HILL

Cautionary Language and Forward-Looking Statements

This presentation contains “forward-looking statements”

and “forward-looking information”, which may include, but is

not limited to, statements with respect to the future financial or

operating performance of Dot Hill, estimated operating expenses, Dot

Hill’s future prospects and the implementation of Dot Hill’s transition strategy. Often, but not always, forward-looking

information can be identified by the use of words such as “plans”,

“expects”, “is expected”, “is expecting”, “budget”,

“scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes”, or variations (including negative variations) of such

words and phrases, or state that certain actions, events or results

“may”, “could”, “would”, “might”, or “will”

be taken, occur or

be achieved. The purpose of forward-looking information is to provide the

reader with information about management’s expectations and plans

for Dot Hill. Readers are cautioned that forward-looking information involves known and unknown

risks, uncertainties and other factors which may cause the actual results,

performance or achievements of Dot Hill to be materially different

from any future results, performance or achievements expressed or implied by the forward-looking

information. Such factors include, among others, the risk that Dot

Hill’s next-generation products may not achieve market

acceptance, Dot Hill’s expense reduction and resource allocation plans

may not continue to have the anticipated positive effects on Dot

Hill’s financial results, the risks associated with macroeconomic factors that are outside of Dot Hill’s control, the

fact that no Dot Hill customer agreements provide for mandatory minimum

purchase requirements, the risk that one or more of Dot Hill’s

OEM or other customers may cancel or reduce orders, not order as forecasted or terminate their agreements with

Dot Hill, the risk that Dot Hill’s new products may not prove to be

popular, the risk that one or more of Dot Hill’s suppliers or

subcontractors may fail to perform or may terminate their agreements

with Dot Hill, unforeseen technological, intellectual property,

personnel or engineering issues, and the additional risks set forth in the Forms 10-K and 10-Q most recently filed with

the Securities and Exchange Commission by Dot Hill. Although Dot

Hill has attempted to identify statements containing

important factors that could cause actual actions, event or results to differ

materially from those described in forward-looking information,

there may be other factors that cause actions, events or results to differ from those anticipated, estimated or

intended. Forward-looking information contained herein are made as of the

date of this document based on the opinions and estimates of

management on the date statements containing such forward looking information are made, and Dot Hill

disclaims any obligation to update any forward-looking information,

whether as a result of new information, estimates or opinions, future

events or results or otherwise. There can be no assurance that

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those anticipated in such information. Accordingly,

readers should not place undue reliance on forward looking information.

1

1

Safe Harbor

Safe Harbor

March 14, 2012

March 14, 2012 |

NASDAQ: HILL

NASDAQ: HILL

About Non-GAAP Financial Measures

About Non-GAAP Financial Measures

2

2

The Company’s non-GAAP financial measures exclude the impact of

stock-based compensation expense, intangible asset amortization,

restructuring and severance charges, legal settlement gains or losses,

charges or credits for contingent consideration adjustments, charges

for impairment of goodwill and long-lived assets, contra-revenue

charges from the grant or extension of customer warrants, specific and

significant warranty claims arising from a supplier’s defective

products, charges and acquisition costs for Cloverleaf and

Ciprico’s assets, and effects of foreign currency gains or losses.

In

addition,

as

a

result

of

exiting

our

relationship

with

NetApp

on

or

about

November

30,

2010, the Company will also be presenting standalone non-GAAP revenue and

gross margin

metrics

excluding

the

historical

revenue

and

gross

margin

attributable

to

NetApp

in order to better compare revenue from its continuing business.

The Company believes

that these non-GAAP financial measures provide meaningful supplemental

information to both management and investors that is indicative of the

Company’s core operating results and facilitates comparison of

operating results across reporting periods. The Company used these

non-GAAP measures when evaluating its financial results as well as

for internal resource management, planning and forecasting purposes. These

non-GAAP measures should not be viewed in isolation from or as a

substitute for the Company’s financial results in accordance with

GAAP. A reconciliation of GAAP to non-GAAP measures is attached to

this presentation. |

NASDAQ: HILL

NASDAQ: HILL

3

3

Non-GAAP Revenue -

Non-GAAP Revenue -

2007-2011

2007-2011

March 14, 2012

March 14, 2012

Note: NetApp Revenue ($K) + Revenue ($K) excl. NetApp = Total non-GAAP Revenue

($K) |

NASDAQ: HILL

NASDAQ: HILL

4

4

March 14, 2012

March 14, 2012

Non-GAAP Gross Margin $ -

Non-GAAP Gross Margin $ -

2007-2011

2007-2011

Note: NetApp Gross Margin ($K) + Gross Margin ($K) excl. NetApp = Total

non-GAAP Gross Margin ($K) |

NASDAQ: HILL

NASDAQ: HILL

5

5

March 14, 2012

March 14, 2012

Non-GAAP Gross Margin % -

Non-GAAP Gross Margin % -

2007-2011

2007-2011 |

NASDAQ: HILL

NASDAQ: HILL

6

6

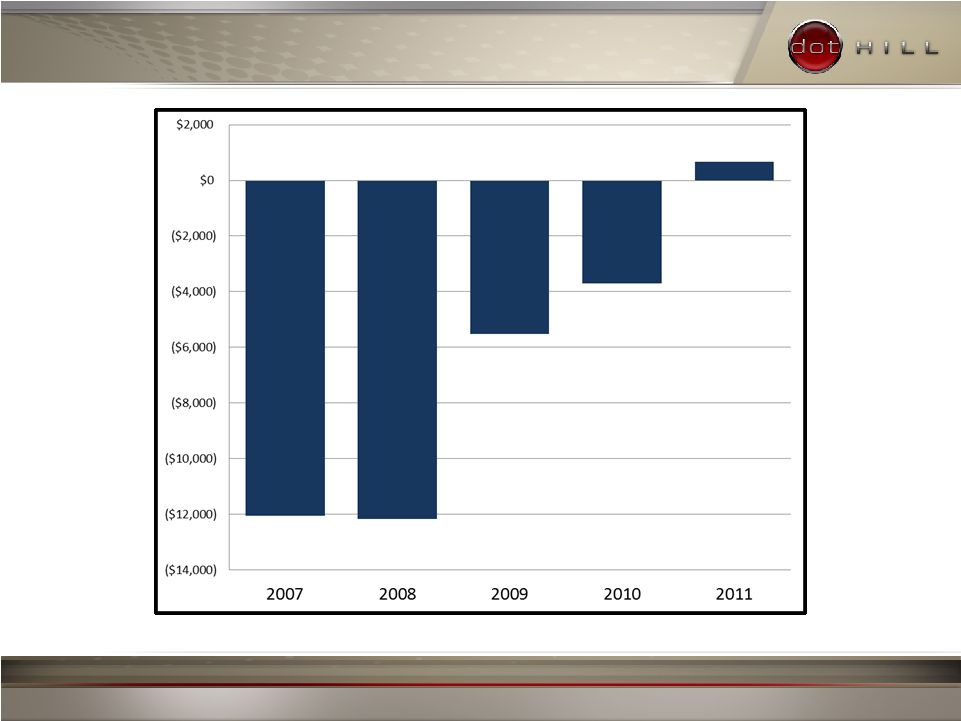

Non-GAAP EBITDA ($K) -

Non-GAAP EBITDA ($K) -

2007-2011

2007-2011 |

NASDAQ: HILL

NASDAQ: HILL

7

7

March 14, 2012

March 14, 2012

Cash ($K) -

Cash ($K) -

2007-2011

2007-2011 |

NASDAQ: HILL

NASDAQ: HILL

GAAP to non-GAAP Reconciliation

8

8 |

NASDAQ: HILL

NASDAQ: HILL

9

9

March 14, 2012

March 14, 2012

GAAP to non-GAAP Reconciliation

GAAP to non-GAAP Reconciliation

2007

2008

2009

2010

2011

Net revenue, as reported

207,095

$

272,879

$

234,383

$

252,494

$

197,461

$

Effect of warrants

-

(2,282)

-

-

(1,007)

Non-GAAP net revenue

207,095

$

275,161

$

234,383

$

252,494

$

198,468

$

Gross profit, as reported

26,433

$

30,388

$

37,827

$

42,830

$

41,633

$

Effect of stock-based compensation

365

377

382

489

828

Effect of severance costs

50

246

-

37

13

Effect of warrants

-

2,282

-

-

1,007

Effect of gain from insurance recovery

-

-

-

-

(555)

Effect of power supply component failures

-

-

-

-

4,270

Effect of long-lived asset impairment

-

-

-

-

2,928

Effect of intangible asset amortization

1,625

-

-

2,004

2,054

Non-GAAP gross profit

28,473

$

33,293

$

38,209

$

45,360

$

52,178

$

Net loss, as reported

(60,228)

$

(25,765)

$

(13,625)

$

(13,251)

$

(22,024)

$

Effect of currency (gain) loss

(2,220)

(586)

148

(189)

(254)

Effect of stock-based compensation

2,351

2,884

2,825

3,003

5,385

Effect of goodwill impairment

40,725

5,432

-

-

4,140

Effect of contingent consideration

-

-

(649)

(144)

21

Effect of restructuring charge

-

813

2,430

2,196

668

Effect of intangible asset amortization

2,102

1,559

1,136

2,004

2,054

Effect of gain from insurance recovery

-

-

-

-

(555)

Effect of power supply component failures

-

-

-

-

4,270

Effect of long-lived asset impairment

-

-

-

-

2,928

Effect of legal settlement

-

(3,836)

-

-

-

Effect of warrants

-

2,282

-

-

1,007

Effect of severance costs

974

533

-

95

126

Effect of Cloverleaf acquisition costs

-

-

469

314

-

Non-GAAP net income (loss)

(16,296)

$

(16,684)

$

(7,267)

$

(5,972)

$

(2,234)

$

Non-GAAP net income (loss)

(16,296)

$

(16,686)

$

(7,269)

$

(5,972)

$

(2,234)

$

Interest expense

(3)

57

57

36

44

Income tax expense

(177)

191

(40)

213

129

Depreciation

4,428

4,274

1,735

2,028

2,701

Non-GAAP EBITDA

(12,048)

$

(12,164)

$

(5,517)

$

(3,695)

$

640

$

DOT HILL SYSTEMS CORP.

UNAUDITED RECONCILIATION OF CONSOLIDATED NON-GAAP MEASURES

(In thousands, except per share amounts) |

NASDAQ: HILL

NASDAQ: HILL

10

10

March 14, 2012

March 14, 2012

GAAP to non-GAAP Reconciliation –

GAAP to non-GAAP Reconciliation –

excl. NetApp

excl. NetApp

2007

2008

2009

2010

2011

Net revenue, as reported

207,095

$

272,879

$

234,383

$

252,494

$

197,461

$

Effect of warrants

-

(2,282)

-

-

(1,007)

Removal of NetApp

(25,857)

(63,184)

(57,966)

(65,603)

-

Non-GAAP net revenue

181,238

$

211,977

$

176,417

$

186,891

$

198,468

$

Gross profit, as reported

26,433

$

30,388

$

37,827

$

42,830

$

41,633

$

Effect of stock-based compensation

365

377

382

489

828

Effect of severance costs

50

246

-

37

13

Effect of warrants

-

2,282

-

-

1,007

Effect of gain from insurance recovery

-

-

-

-

(555)

Effect of power supply component failures

-

-

-

-

4,270

Effect of long-lived asset impairment

-

-

-

-

2,928

Effect of intangible asset amortization

1,625

-

-

2,004

2,054

Removal of NetApp

(1,216)

(5,019)

(7,604)

(8,540)

-

Non-GAAP gross profit

27,257

$

28,274

$

30,605

$

36,820

$

52,178

$

DOT HILL SYSTEMS CORP.

UNAUDITED RECONCILIATION OF CONSOLIDATED NON-GAAP MEASURES

(In thousands, except per share amounts) |