Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kennedy-Wilson Holdings, Inc. | d314298d8k.htm |

| EX-99.1 - PRESS RELEASE - Kennedy-Wilson Holdings, Inc. | d314298dex991.htm |

Exhibit 99.2

Fourth Quarter 2011 Supplemental Financial Information

TABLE OF CONTENTS

Pro-Rata Consolidated

Statements of Operations: 3

Year ended 12/31/2011 and 12/31/2010 (Non-GAAP)

Adjusted EBITDA (Non-GAAP) 4

EBITDA by Segment (Non-GAAP) 5

Balance Sheet 6

Capitalization Summary 7

Investment Account Comparison 8

Investment Account Summary 9

Operating Performance Summary: Multifamily 10

Operating Performance Summary: Office 11

Operating Performance Summary: Loans, Loan Pools 12

Operating Performance Summary: Residential, Other 13

Debt Schedule 14

Note about Non-GAAP financial information included in this presentation

In addition to the results reported in accordance with U.S. generally accepted accounting principles (“GAAP”) included within this presentation, Kennedy Wilson Holdings, Inc. (“Kennedy Wilson”) has provided certain information, which includes non-GAAP financial measures (pro-rata consolidated statements of operation, EBITDA and Adjusted

[GRAPHIC APPEARS HERE]

EBITDA). Such information is reconciled to its closest GAAP measure in accordance with the rules of the Securities and Exchange Commission and is included within this presentation. Management believes that these non-GAAP financial measures are useful to both management and Kennedy Wilson’s shareholders in their analysis of the business and operating performance of Kennedy Wilson. Management also uses this information for operational planning and decision-making purposes. Non-GAAP financial measures are not and should not be considered a substitute for any GAAP measures. Additionally, non-GAAP financial measures as presented by Kennedy Wilson may not be comparable to similarly titled measures reported by other companies.

| 2 |

|

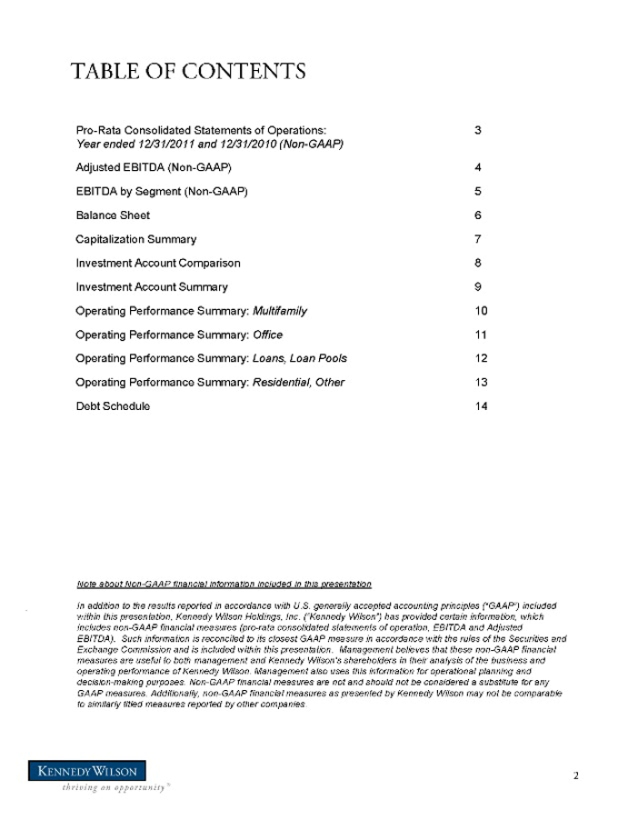

PRO-RATA CONSOLIDATED STATEMENTS OF OPERATIONS

Year ended December 31, 2011 and 2010 (Non-GAAP)

FOR THE YEAR ENDED

December 31, 2011 December 31, 2010

Pro Rata Pro Rata

Unconsolidated Unconsolidated

Consolidated Investments Proforma Total Consolidated Investments Proforma Total

Revenue

Management and leasing fees $ 27,116,000 $—$ 27,116,000 $ 21,330,000 $—$ 21,330,000

Commissions 29,960,000—29,960,000 11,734,000—11,734,000

Sale of real estate 417,000 39,804,000 40,221,000 13,472,000 3,751,000 17,223,000

Rental and other income 5,140,000 54,760,000 59,900,000 4,000,000 34,869,000 38,869,000

Interest income—12,492,000 12,492,000—14,425,000 14,425,000

Total revenue 62,633,000 107,056,000 169,689,000 50,536,000 53,045,000 103,581,000

Operating expenses

Commission and marketing expenses 3,965,000—3,965,000 3,186,000—3,186,000

Compensation and related expenses 41,129,000 700,000 41,829,000 38,155,000—38,155,000

Merger-related compensation and related expenses—— 2,225,000—2,225,000

Cost of real estate sold 397,000 33,400,000 33,797,000 11,526,000 2,473,000 13,999,000

General and administrative 14,455,000 1,300,000 15,755,000 11,314,000—11,314,000

Depreciation and amortization 2,798,000 13,900,000 16,698,000 1,618,000 10,054,000 11,672,000

Rental operating expenses 3,308,000 20,900,000 24,208,000 1,913,000 14,959,000 16,872,000

Total operating expenses 66,052,000 70,200,000 136,252,000 69,937,000 27,486,000 97,423,000

Equity in joint venture income 12,507,000(12,507,000)—10,548,000(10,548,000) -

Interest income from loan pool

participations and notes receivable 7,886,000(7,886,000)—11,855,000(11,855,000) -

Operating income 16,974,000 16,463,000 33,437,000 3,002,000 3,156,000 6,158,000

Non-operating income (expense)

Interest income 2,306,000(2,306,000)—854,000(854,000) -

Remeasurement gain 6,348,000 5,800,000 12,148,000 2,108,000—2,108,000

Fair value gain—4,296,000 4,296,000—6,200,000 6,200,000

Gain on extinguishment of debt—1,100,000 1,100,000 16,670,000 5,300,000 21,970,000

Loss on extinguishment of debt—-(4,788,000)(4,788,000)

Interest expense(20,507,000)(23,453,000)(43,960,000)(7,634,000)(13,802,000)(21,436,000)

Other non-operating expenses -(1,900,000)(1,900,000)—-

Income before benefit from (provision for) income taxes 5,121,000—5,121,000 10,212,000—10,212,000

Benefit from (provision for) income taxes 2,014,000—2,014,000(3,727,000) -(3,727,000)

Income from continuing operations 7,135,000—7,135,000 6,485,000—6,485,000

Income from discontinued operations, net of

income taxes 8,000—8,000——

Gain from sale of real estate, net of income taxes 335,000—335,000——

Net income $ 7,478,000 $—$ 7,478,000 $ 6,485,000 $—$ 6,485,000

| 3 |

|

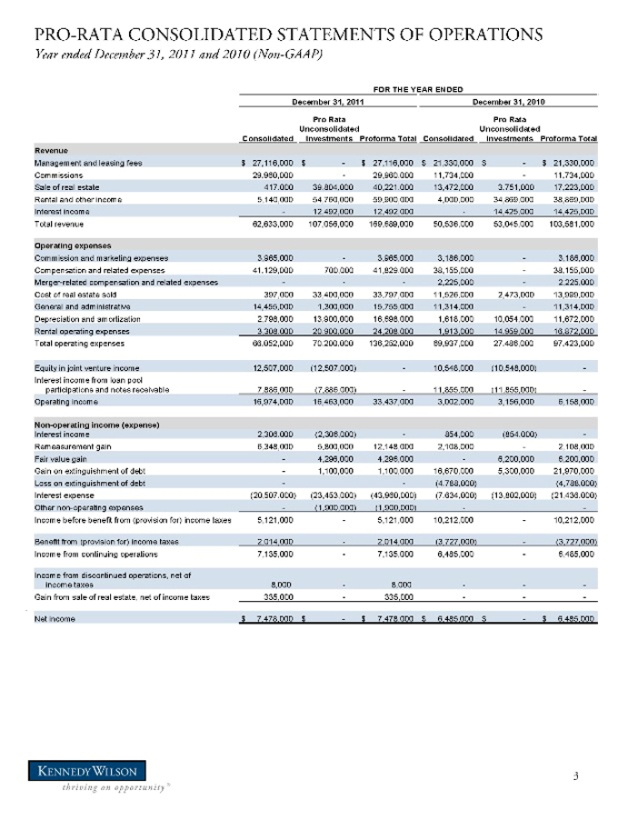

ADJUSTED EBITDA (Non-GAAP)

December 31,

2011 2010 2009

Net income (loss) $7,478,000 $6,485,000($9,657,000)

Add back:

Interest expense 20,507,000 7,634,000 13,174,000

Kennedy Wilson’s share of interest expense included in investment in

joint ventures 23,453,000 13,802,000 10,468,000

Depreciation and amortization 2,798,000 1,618,000 1,122,000

Kennedy Wilson’s share of depreciation and amortization included in

investment in joint ventures 13,900,000 10,054,000 7,474,000

Loss on early extinguishment of corporate debt—4,788,000 -

Income taxes(2,014,000) 3,727,000(3,961,000)

EBITDA 66,122,000 48,108,000 18,620,000

Merger-related compensation expense—2,225,000 16,120,000

Stock-based compensation 5,055,000 8,094,000 2,314,000

Adjusted EBITDA $71,177,000 $58,427,000 $37,054,000

| 4 |

|

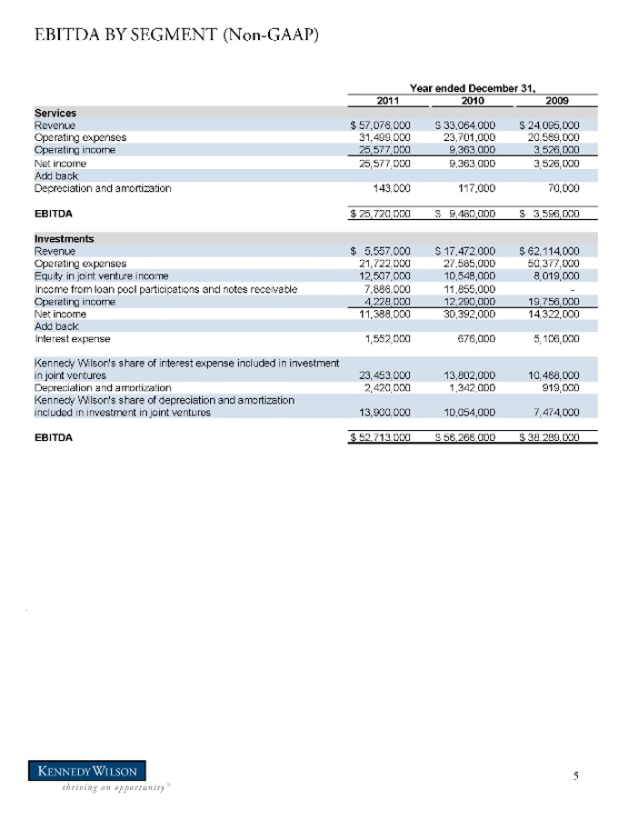

EBITDA BY SEGMENT (Non-GAAP)

Year ended December 31,

2011 2010 2009

Services

Revenue $ 57,076,000 $ 33,064,000 $ 24,095,000

Operating expenses 31,499,000 23,701,000 20,569,000

Operating income 25,577,000 9,363,000 3,526,000

Net income 25,577,000 9,363,000 3,526,000

Add back:

Depreciation and amortization 143,000 117,000 70,000

EBITDA $ 25,720,000 $ 9,480,000 $ 3,596,000

Investments

Revenue $ 5,557,000 $ 17,472,000 $ 62,114,000

Operating expenses 21,722,000 27,585,000 50,377,000

Equity in joint venture income 12,507,000 10,548,000 8,019,000

Income from loan pool participations and notes receivable 7,886,000 11,855,000 -

Operating income 4,228,000 12,290,000 19,756,000

Net income 11,388,000 30,392,000 14,322,000

Add back:

Interest expense 1,552,000 676,000 5,106,000

Kennedy Wilson’s share of interest expense included in investment

in joint ventures 23,453,000 13,802,000 10,468,000

Depreciation and amortization 2,420,000 1,342,000 919,000

Kennedy Wilson’s share of depreciation and amortization

included in investment in joint ventures 13,900,000 10,054,000 7,474,000

EBITDA $ 52,713,000 $ 56,266,000 $ 38,289,000

| 5 |

|

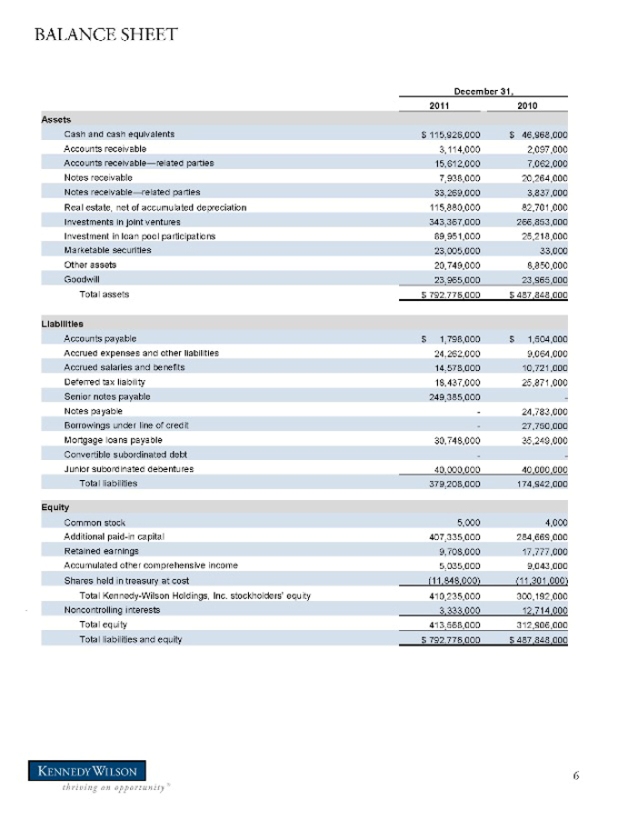

BALANCE SHEET

December 31,

2011 2010

Assets

Cash and cash equivalents $ 115,926,000 $ 46,968,000

Accounts receivable 3,114,000 2,097,000

Accounts receivable—related parties 15,612,000 7,062,000

Notes receivable 7,938,000 20,264,000

Notes receivable—related parties 33,269,000 3,837,000

Real estate, net of accumulated depreciation 115,880,000 82,701,000

Investments in joint ventures 343,367,000 266,853,000

Investment in loan pool participations 89,951,000 25,218,000

Marketable securities 23,005,000 33,000

Other assets 20,749,000 8,850,000

Goodwill 23,965,000 23,965,000

Total assets $ 792,776,000 $ 487,848,000

Liabilities

Accounts payable $ 1,798,000 $ 1,504,000

Accrued expenses and other liabilities 24,262,000 9,064,000

Accrued salaries and benefits 14,578,000 10,721,000

Deferred tax liability 18,437,000 25,871,000

Senior notes payable 249,385,000 -

Notes payable—24,783,000

Borrowings under line of credit—27,750,000

Mortgage loans payable 30,748,000 35,249,000

Convertible subordinated debt—-

Junior subordinated debentures 40,000,000 40,000,000

Total liabilities 379,208,000 174,942,000

Equity

Common stock 5,000 4,000

Additional paid-in capital 407,335,000 284,669,000

Retained earnings 9,708,000 17,777,000

Accumulated other comprehensive income 5,035,000 9,043,000

Shares held in treasury at cost(11,848,000)(11,301,000)

Total Kennedy-Wilson Holdings, Inc. stockholders’ equity 410,235,000 300,192,000

Noncontrolling interests 3,333,000 12,714,000

Total equity 413,568,000 312,906,000

Total liabilities and equity $ 792,776,000 $ 487,848,000

[GRAPHIC APPEARS HERE]

| 6 |

|

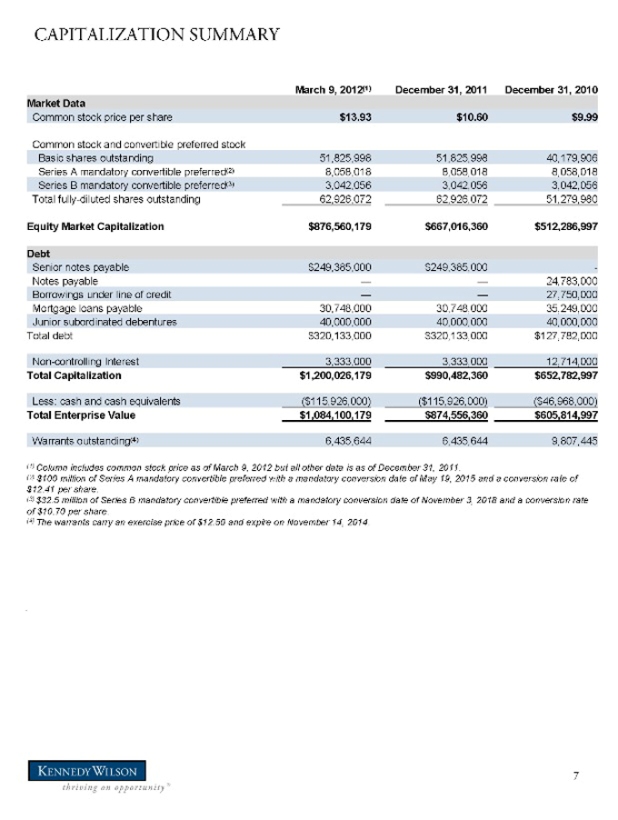

CAPITALIZATION SUMMARY

March 9, 2012(1) December 31, 2011 December 31, 2010

Market Data

Common stock price per share $13.93 $10.60 $9.99

Common stock and convertible preferred stock

Basic shares outstanding 51,825,998 51,825,998 40,179,906

Series A mandatory convertible preferred(2) 8,058,018 8,058,018 8,058,018

Series B mandatory convertible preferred(3) 3,042,056 3,042,056 3,042,056

Total fully-diluted shares outstanding 62,926,072 62,926,072 51,279,980

Equity Market Capitalization $876,560,179 $667,016,360 $512,286,997

Debt

Senior notes payable $249,385,000 $249,385,000 -

Notes payable — — 24,783,000

Borrowings under line of credit — — 27,750,000

Mortgage loans payable 30,748,000 30,748,000 35,249,000

Junior subordinated debentures 40,000,000 40,000,000 40,000,000

Total debt $320,133,000 $320,133,000 $127,782,000

Non-controlling Interest 3,333,000 3,333,000 12,714,000

Total Capitalization $1,200,026,179 $990,482,360 $652,782,997

Less: cash and cash equivalents($115,926,000)($115,926,000)($46,968,000)

Total Enterprise Value $1,084,100,179 $874,556,360 $605,814,997

Warrants outstanding(4) 6,435,644 6,435,644 9,807,445

| (1) |

|

Column includes common stock price as of March 9, 2012 but all other data is as of December 31, 2011. |

| (2) |

|

$100 million of Series A mandatory convertible preferred with a mandatory conversion date of May 19, 2015 and a conversion rate of $12.41 per share. |

| (3) |

|

$32.5 million of Series B mandatory convertible preferred with a mandatory conversion date of November 3, 2018 and a conversion rate of $10.70 per share. |

| (4) |

|

The warrants carry an exercise price of $12.50 and expire on November 14, 2014. |

| 7 |

|

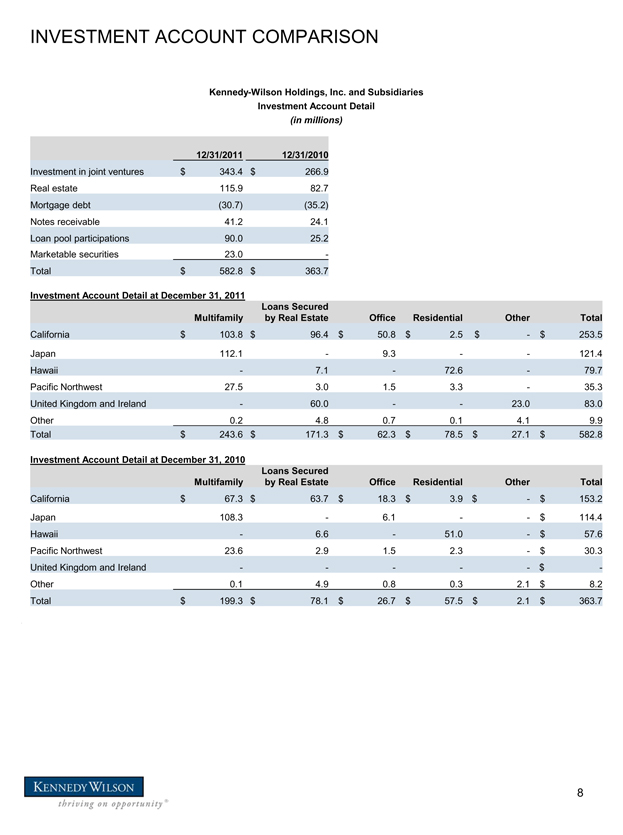

INVESTMENT ACCOUNT COMPARISON

Kennedy-Wilson Holdings, Inc. and Subsidiaries Investment Account Detail

(in millions)

12/31/2011 12/31/2010

Investment in joint ventures $ 343.4 $ 266.9 Real estate 115.9 82.7 Mortgage debt (30.7) (35.2) Notes receivable 41.2 24.1 Loan pool participations 90.0 25.2 Marketable securities 23.0 -Total $ 582.8 $ 363.7

Investment Account Detail at December 31, 2011

Loans Secured

Multifamily by Real Estate Office Residential Other Total

California $ 103.8 $ 96.4 $ 50.8 $ 2.5 $ - $ 253.5

Japan 112.1 - 9.3 - - 121.4 Hawaii - 7.1 - 72.6 - 79.7 Pacific Northwest 27.5 3.0 1.5 3.3 - 35.3 United Kingdom and Ireland - 60.0 - - 23.0 83.0 Other 0.2 4.8 0.7 0.1 4.1 9.9 Total $ 243.6 $ 171.3 $ 62.3 $ 78.5 $ 27.1 $ 582.8

Investment Account Detail at December 31, 2010

Loans Secured

Multifamily by Real Estate Office Residential Other Total

California $ 67.3 $ 63.7 $ 18.3 $ 3.9 $ - $ 153.2 Japan 108.3 - 6.1 - - $ 114.4 Hawaii - 6.6 - 51.0 - $ 57.6 Pacific Northwest 23.6 2.9 1.5 2.3 - $ 30.3 United Kingdom and Ireland - - - - - $ -Other 0.1 4.9 0.8 0.3 2.1 $ 8.2 Total $ 199.3 $ 78.1 $ 26.7 $ 57.5 $ 2.1 $ 363.7

8

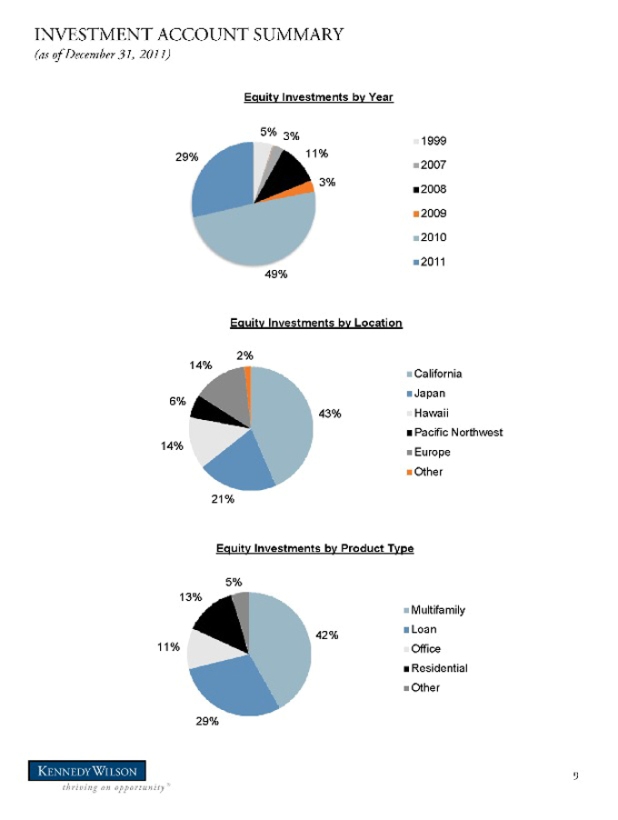

INVESTMENT ACCOUNT SUMMARY

(as of December 31, 2011)

Equity Investments by Year

5% 3% 1999

29% 11%

2007

3% 2008

2009

2010

2011

49%

[GRAPHIC APPEARS HERE]

Equity Investments by Location

2%

14% California

6% Japan

43% Hawaii

Pacific Northwest

14% Europe

Other

21%

Equity Investments by Product Type

5%

13%

Multifamily

42% Loan

11% Office

Residential

Other

[GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE] [GRAPHIC APPEARS HERE]

29%

9

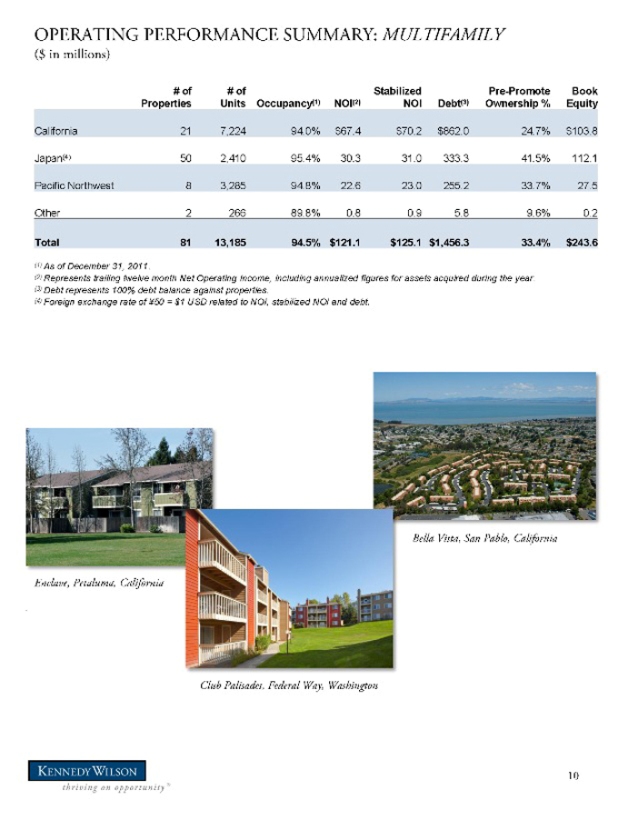

OPERATING PERFORMANCE SUMMARY: MULTIFAMILY

($ in millions)

# of # of Stabilized Pre-Promote Book

Properties Units Occupancy(1) NOI(2) NOI Debt(3) Ownership % Equity

California 21 7,224 94.0% $67.4 $70.2 $862.0 24.7% $103.8

Japan(4) 50 2,410 95.4% 30.3 31.0 333.3 41.5% 112.1

Pacific Northwest 8 3,285 94.8% 22.6 23.0 255.2 33.7% 27.5

Other 2 266 89.8% 0.8 0.9 5.8 9.6% 0.2

Total 81 13,185 94.5% $121.1 $125.1 $1,456.3 33.4% $243.6

| (1) |

|

As of December 31, 2011. |

| (2) |

|

Represents trailing twelve month Net Operating Income, including annualized figures for assets acquired during the year. |

| (3) |

|

Debt represents 100% debt balance against properties. |

| (4) |

|

Foreign exchange rate of ¥50 = $1 USD related to NOI, stabilized NOI and debt. |

Enclave, Petaluma, California

Bella Vista, San Pablo, California

Club Palisades, Federal Way, Washington

10

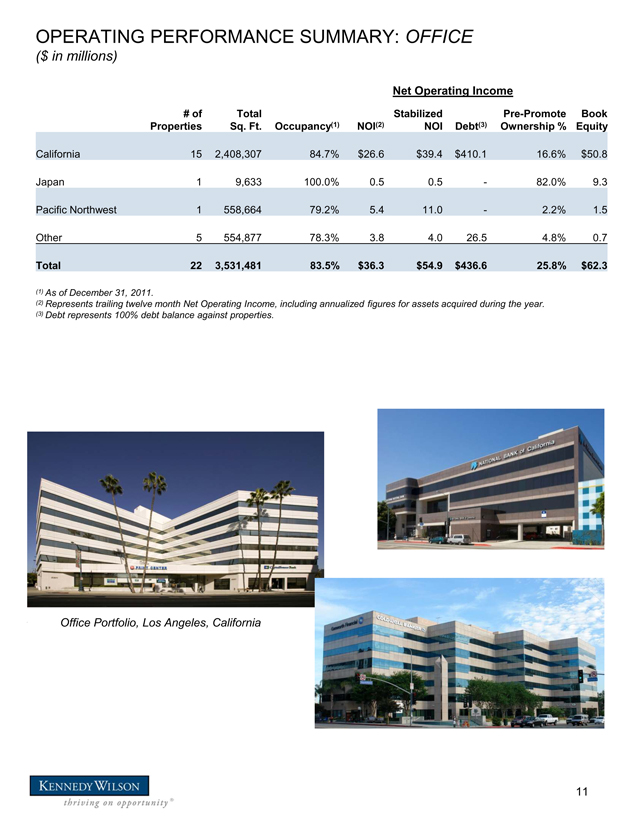

OPERATING PERFORMANCE SUMMARY: OFFICE

($ in millions)

Net Operating Income

# of Total Stabilized Pre-Promote Book Properties Sq. Ft. Occupancy(1) NOI(2) NOI Debt(3) Ownership % Equity

California 15 2,408,307 84.7% $26.6 $39.4 $410.1 16.6% $50.8 Japan 1 9,633 100.0% 0.5 0.5 - 82.0% 9.3 Pacific Northwest 1 558,664 79.2% 5.4 11.0 - 2.2% 1.5 Other 5 554,877 78.3% 3.8 4.0 26.5 4.8% 0.7

Total 22 3,531,481 83.5% $36.3 $54.9 $436.6 25.8% $62.3

(1) As of December 31, 2011.

(2) Represents trailing twelve month Net Operating Income, including annualized figures for assets acquired during the year. (3) Debt represents 100% debt balance against properties.

Office Portfolio, Los Angeles, California

11

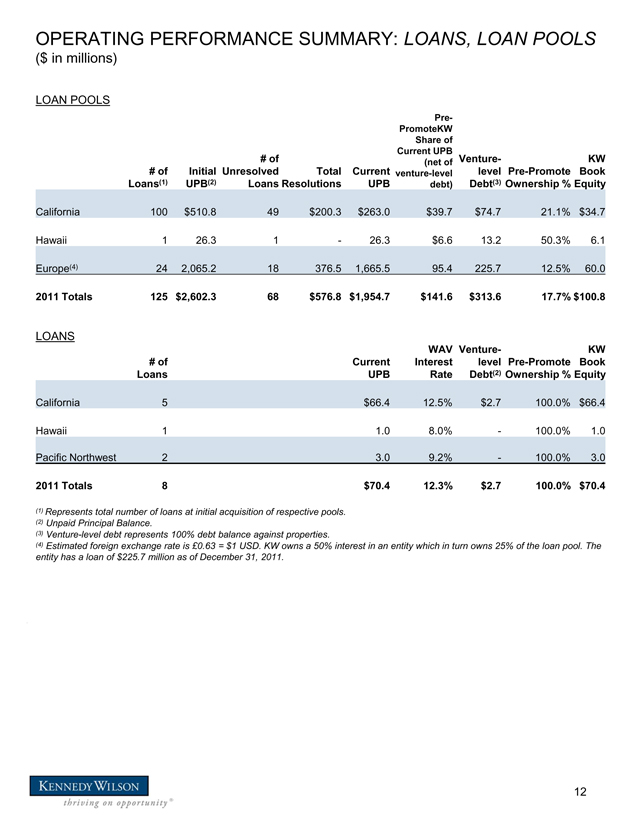

OPERATING PERFORMANCE SUMMARY: LOANS, LOAN POOLS

($ in millions)

LOAN POOLS

Pre-PromoteKW

Share of Current UPB

# of (net of Venture- KW # of Initial Unresolved Total Current venture-level level Pre-Promote Book Loans(1) UPB(2) Loans Resolutions UPB debt) Debt(3) Ownership % Equity

California 100 $510.8 49 $200.3 $263.0 $39.7 $74.7 21.1% $34.7 Hawaii 1 26.3 1 - 26.3 $6.6 13.2 50.3% 6.1 Europe(4) 24 2,065.2 18 376.5 1,665.5 95.4 225.7 12.5% 60.0

2011 Totals 125 $2,602.3 68 $576.8 $1,954.7 $141.6 $313.6 17.7% $100.8

LOANS

WAV Venture- KW # of Current Interest level Pre-Promote Book Loans UPB Rate Debt(2) Ownership % Equity

California 5 $66.4 12.5% $2.7 100.0% $66.4 Hawaii 1 1.0 8.0% - 100.0% 1.0 Pacific Northwest 2 3.0 9.2% - 100.0% 3.0

2011 Totals 8 $70.4 12.3% $2.7 100.0% $70.4

(1) Represents total number of loans at initial acquisition of respective pools. (2) Unpaid Principal Balance.

(3) Venture-level debt represents 100% debt balance against properties.

(4) Estimated foreign exchange rate is £0.63 = $1 USD. KW owns a 50% interest in an entity which in turn owns 25% of the loan pool. The entity has a loan of $225.7 million as of December 31, 2011.

12

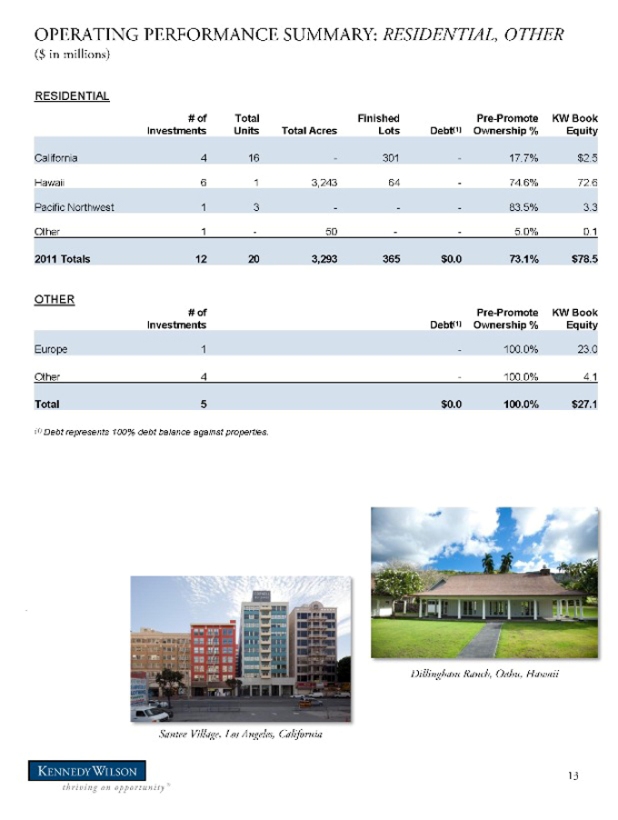

OPERATING PERFORMANCE SUMMARY: RESIDENTIAL, OTHER

($ in millions)

RESIDENTIAL

# of Total Finished Pre-Promote KW Book

Investments Units Total Acres Lots Debt(1) Ownership % Equity

California 4 16—301—17.7% $2.5

Hawaii 6 1 3,243 64—74.6% 72.6

Pacific Northwest 1 3—— 83.5% 3.3

Other 1—50—- 5.0% 0.1

2011 Totals 12 20 3,293 365 $0.0 73.1% $78.5

OTHER

# of Pre-Promote KW Book

Investments Debt(1) Ownership % Equity

Europe 1—100.0% 23.0

Other 4—100.0% 4.1

Total 5 $0.0 100.0% $27.1

| (1) |

|

Debt represents 100% debt balance against properties. |

13

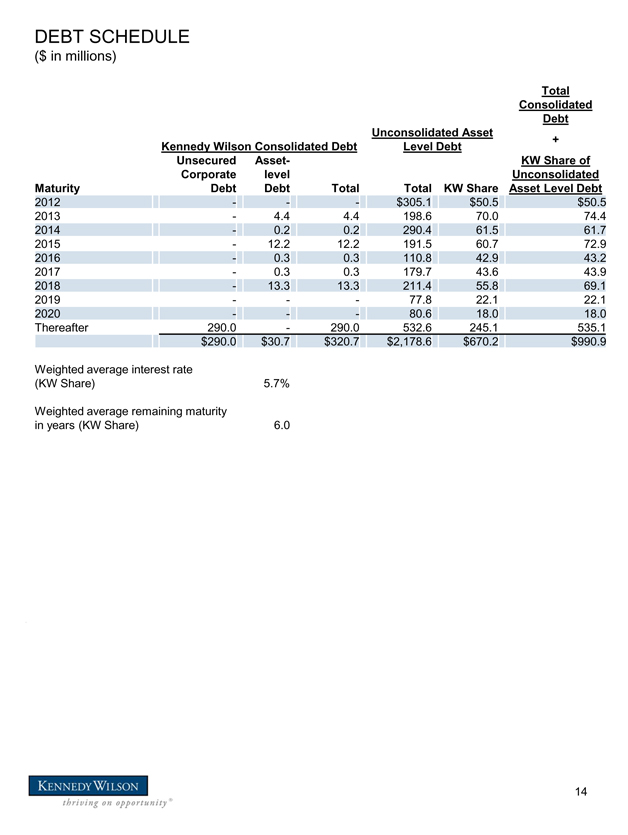

DEBT SCHEDULE

($ in millions)

Total Consolidated Debt Unconsolidated Asset + Kennedy Wilson Consolidated Debt Level Debt Unsecured Asset- KW Share of Corporate level Unconsolidated Maturity Debt Debt Total Total KW Share Asset Level Debt

2012 - - - $305.1 $50.5 $50.5 2013 - 4.4 4.4 198.6 70.0 74.4 2014 - 0.2 0.2 290.4 61.5 61.7 2015 - 12.2 12.2 191.5 60.7 72.9 2016 - 0.3 0.3 110.8 42.9 43.2 2017 - 0.3 0.3 179.7 43.6 43.9 2018 - 13.3 13.3 211.4 55.8 69.1 2019 - - - 77.8 22.1 22.1 2020 - - - 80.6 18.0 18.0 Thereafter 290.0 - 290.0 532.6 245.1 535.1

$290.0 $30.7 $320.7 $2,178.6 $670.2 $990.9

Weighted average interest rate

(KW Share) 5.7%

Weighted average remaining maturity in years (KW Share) 6.0

14