Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SmartStop Self Storage, Inc. | d303639d8k.htm |

Update From the

CEO February 23, 2012

Hosted By

H. MICHAEL SCHWARTZ

Chairman and CEO

Exhibit 99.1 |

2

Disclaimer

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this material, other than historical facts, may be considered

forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”) and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward looking statements to be

covered by the applicable safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act and Section 21E of the Exchange Act, as

applicable. Such statements include, in particular, statements about our plans,

strategies, and prospects and are subject to certain risks and uncertainties, including known

and unknown risks, which could cause actual results to differ materially from those

projected or anticipated. Therefore, such statements are not intended to be a guarantee

of our performance in future periods. Such forward-looking statements can generally be identified by our use

of forward-looking terminology such as “may,” “will,”

“expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or

other similar words. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date this report is filed

with the Securities and Exchange Commission. We cannot guarantee the accuracy of any

such forward looking statements contained in this material, and we do not intend to publicly update or revise any

forward-looking statements, whether as a result of new information, future events, or

otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other factors

and are based on a number of assumptions involving judgments with respect to, among

other things, future economic, competitive, and market conditions, all of which are

difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our

ability to meet such forward-looking statements, including our ability to generate

positive cash flow from operations and provide distributions to stockholders, and our

ability to find suitable investment properties, may be significantly hindered.

All forward-looking statements should be read in light of the risks identified in our

prospectus and supplements. |

3

Strategic Storage Trust, Inc.

First and only publicly registered non-traded REIT focused on

self storage

Sponsor was ranked 8

th

in Mini-Storage Messenger’s Top Operators

List in 2011

As of 12/31/11 SSTI wholly owns 91 properties in 17 states and

Ontario, Canada with 60,000 units and approximately 7.5 million

rentable square feet

Closed approximately $245 Million in acquisitions in 2011

About Us |

4

Agenda

Financial Update

Portfolio Update

Where MFFO Comes From

Self Storage -

It’s Just Different |

5

Total Assets by Quarter

Financial Update |

6

Total Revenues by Quarter

Financial Update |

7

G&A Per Property by Quarter

G&A Per Property

Q3

2009

$16,313

Q3

2010

$14,527

(11% decrease)

Q3

2011

$6,466

(55% decrease)

(1)

For the three month periods ended June 30, 2011 and September 30, 2011, the Advisor

permanently waived certain reimbursable indirect costs. Financial Update

|

8

Agenda

Financial Update

Portfolio Update

Where MFFO Comes From

Self Storage -

It’s Just Different |

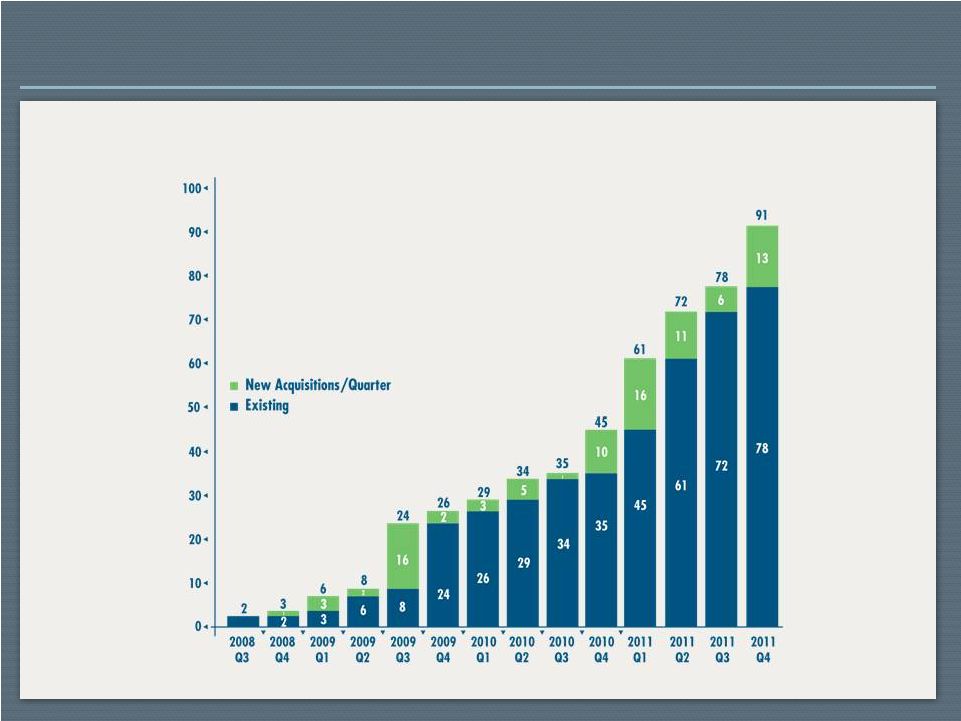

9

Wholly Owned Properties by Quarter

Portfolio Update

Through December 31, 2011 |

10

Square Footage by State (as of 12/31/11)

Portfolio Update

91 properties

17 states, 1 province

60,140 units

7.5 million SF

7.6%

4.3%

5.0%

3.3%

11.1%

12.5%

1.9%

0.9%

19.8%

0.9%

1.3%

5.4%

3.5%

5.3%

3.6%

10.1%

2.4%

1.1% |

11

Homeland Portfolio

•

Homeland Portfolio Summary

Purchase Price: $80 Million

Net Rentable Sq. Ft.: 1 Million

Total Properties: 12

Total Units: 8,000

Off Market Transaction

Year Built: 2006 -

2009

Purchase Per Sq. Ft: $80

46% Occupancy –

Lease Up

Acquisition Dec. 46.2% SF

Jan. 47.3% SF

Feb. 14

th

48.0% SF

Seasonality

in

Storage

Industry

–

February

is

one

of

the

worst

months |

12

Homeland Portfolio

Homeland Portfolio Summary

New –

built between 2006 –

2009

Retail

locations

–

Good

visibility

and

access

Climate

Controlled

Units

–

79%

of

area

Management

platform

integration

–

Website

payment

system, customer care call center, inventory tracking

Now 19 Properties in Atlanta

Management Efficiencies (economies of scale)

Product Leader in Market |

13

Homeland Portfolio

Atlanta District Map |

14

Homeland Portfolio

Kennesaw, GA

Sharpsburg, GA

Berkeley, GA

Peachtree, GA

Breckenridge, GA

West Oak Pkwy, GA |

15

Homeland Portfolio

Austell, GA

Sandy Springs, GA

Smyrna, GA

Lawrenceville, GA

Monument, FL

Timuquana, FL |

16

Agenda

Financial Update

Portfolio Update

Where MFFO Comes From

Self Storage -

It’s Just Different |

17

Where MFFO Comes From

Understanding Modified Funds From Operations

Net Income

+

depreciation

+

amortization

Funds From Operations (FFO)

non cash items

Not all MFFO is created equal

+

acquisition fees and expenses

+

impairments

+

marketable securities losses

+

hedging strategy losses

=

Modified FFO |

18

Where MFFO Comes From

•

Relative Risk

•

Smoothing of Results

•

Mezzanine Loans

•

Point in Time vs. Trending

•

Cash Drag

•

Other Intangibles |

19

Agenda

Financial Update

Portfolio Update

Where MFFO Comes From

Self Storage -

It’s Just Different |

20

Self Storage –

It’s Just Different

Seasonality of Occupancy

•

Self storage occupancy rates show seasonal variability

•

Household moves account for approximately half of self

storage rentals

•

The spring and summer months are the typical moving

seasons with 11% -

13% of moves occurring each month

compared to 8% or less for other months

•

Spring and Summer occupancy rates are higher than

late Fall and Winter

•

Seasonal variability in occupancy is typically between

2% and 5% driven largely by seasonal moving

•

Difficult to Compare Quarter by Quarter Results

The seasonal nature of moving activity drives

variability in self storage occupancy.

*Sources:

Self Storage Association 2010 Almanac; American Moving and Storage Association Winter

2009 “Industry Trends” Percentage of Total Yearly Moves by Month

|

21

Self Storage –

It’s Just Different

Adding Value Tenant vs. Owner |

22

Increasing Revenues

Tenant Insurance

Rental Increases

Truck Rentals

Ancillary Revenues

Web Based Sales

Self Storage –

It’s Just Different

Adding Value |

23

•

Reaching Critical Mass

•

Decreasing Expenses

•

Property Insurance

•

Utility Management and Energy Conservation

•

Fixed vs. Variable Expenses

•

National Contracts

•

Property Management

•

Cross Marketing Efficiencies

Self Storage –

It’s Just Different

Economies of Scale |

24

Recap

Financial Update

Continuing to Grow

Portfolio Update

$80 Million Homeland Portfolio

Where MFFO Comes From

MFFO is Not Just a Yes or No Answer

Self Storage –

It’s Just Different

Added Value |

Financial

Professionals 877-327-3485

Investment Information

strategicstoragetrust.com

Self Storage Rentals

smartstopselfstorage.com

Select Capital Corporation

(Member FINRA and SIPC)

Dealer Manager for SSTI

866.699.5338 |