Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Consorteum Holdings, Inc. | v301824_ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Consorteum Holdings, Inc. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - Consorteum Holdings, Inc. | v301824_ex31-2.htm |

| EX-10.1 - EXHIBIT 10.1 - Consorteum Holdings, Inc. | v301824_ex10-1.htm |

| EX-32 - EXHIBIT 32 - Consorteum Holdings, Inc. | v301824_ex32.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934 FOR THE QUARTERLY PERIOD ENDED DECEMBER 31, 2011

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934 FOR THE TRANSITION PERIOD FROM ______________ TO ______________

COMMISSION FILE NUMBER: 000-53153

Consorteum Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 45-2671583 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

916 Southwood Blvd, Incline Village, Nevada 89451

(Address of Principal Executive Offices, including Zip Code)

(888) 702-3410

(Registrant’s Telephone Number, including Area Code)

101 Church Street, Suite 14, Los Gatos, California 95030

(Former Name, Former Address, and Former Fiscal Year,

if Changed Since Last Report)

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ¨ No x .

As of February 17, 2012, the Company had 304,147,714 shares of common stock issued and outstanding.

CONSORTEUM HOLDINGS, INC.

FORM 10-Q

FOR THE QUARTER ENDED DECEMBER 31, 2011

TABLE OF CONTENTS

| PART I – FINANCIAL INFORMATION | 3 |

| ITEM 1 – FINANCIAL STATEMENTS | 3 |

| ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 13 |

| ITEM 3 – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 19 |

| ITEM 4 – CONTROLS AND PROCEDURES | 19 |

| PART II – OTHER INFORMATION | 21 |

| ITEM 1 – LEGAL PROCEEDINGS | 21 |

| ITEM 1A – RISK FACTORS | 21 |

| ITEM 2 – UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 21 |

| ITEM 3 – DEFAULTS UPON SENIOR SECURITIES | 21 |

| ITEM 4 – (REMOVED AND RESERVED) | 21 |

| ITEM 5 – OTHER INFORMATION | 21 |

| ITEM 6 – EXHIBITS | 21 |

| 2 |

Consorteum Holdings, Inc.

(A Development-Stage Company)

CONSOLIDATED BALANCE SHEETS

| December 31, | June 30, | |||||||

| 2011 | 2011 | |||||||

| ASSETS | (unaudited) | |||||||

| Current Assets: | ||||||||

| Cash | $ | - | $ | 3,641 | ||||

| Deferred finance charges | 4,515 | 8,394 | ||||||

| Total current assets | 4,515 | 12,035 | ||||||

| Property and equipment, net of accumulated depreciation | 3,335 | 3,938 | ||||||

| Total assets | $ | 7,850 | $ | 15,973 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | 373,142 | 364,432 | ||||||

| Accrued expenses | 411,139 | 381,046 | ||||||

| Bank indebtedness | 165,901 | 158,307 | ||||||

| Loans payable | 973,998 | 948,149 | ||||||

| Convertible promissory notes | 3,008,979 | 163,235 | ||||||

| Due to stockholders | 1,129 | 523 | ||||||

| Total current liabilities | 4,934,288 | 2,015,692 | ||||||

| Convertible promissory notes, net of current portion | - | 407,998 | ||||||

| Total liabilities | 4,934,288 | 2,423,690 | ||||||

| Stockholders' Deficit: | ||||||||

| Preferred stock A, $0.001 par value, 5,000,000 shares authorized: 5,000,000 and zero issued and outstanding as of December 31, 2011 and June 30, 2011, respectively | 5,000 | - | ||||||

| Preferred stock B, $0.001 par value, 15,000,000 shares authorized: 14,000,000 and zero issued and outstanding as of December 31, 2011 and June 30, 2011, respectively | 14,000 | - | ||||||

| Common stock; $.001 par value; 500,000,000 shares authorized; 304,147,714 issued and outstanding | 304,148 | 304,148 | ||||||

| Collateralized shares issued | (137,500 | ) | (137,500 | ) | ||||

| Additional paid-in capital | 3,297,446 | 3,135,529 | ||||||

| Accumulated other comprehensive loss | (115,553 | ) | (171,509 | ) | ||||

| Deficit accumulated during prior development activities | (5,538,385 | ) | (5,538,385 | ) | ||||

| Deficit accumulated during the development stage | (2,755,594 | ) | - | |||||

| Total stockholders’ deficit | (4,926,438 | ) | (2,407,717 | ) | ||||

| Total liabilities and stockholders’ deficit | $ | 7,850 | $ | 15,973 | ||||

See Notes to Unaudited Consolidated Financial Statements.

| 3 |

Consorteum Holdings, Inc.

(A Development-Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| Three Months ended | Six Months ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Revenues | $ | - | $ | - | $ | - | $ | - | ||||||||

| Operating expenses | ||||||||||||||||

| Selling, general and administrative | 298,760 | 162,762 | 527,117 | 232,504 | ||||||||||||

| Total operating expenses | 298,760 | 162,762 | 527,117 | 232,504 | ||||||||||||

| Operating loss | (298,760 | ) | (162,762 | ) | (527,117 | ) | (232,504 | ) | ||||||||

| Interest expense | (86,171 | ) | (72,693 | ) | (149,831 | ) | (122,439 | ) | ||||||||

| Net loss | (384,931 | ) | (235,455 | ) | (676,948 | ) | (354,943 | ) | ||||||||

| Foreign currency translation adjustment | (148,412 | ) | (43,011 | ) | (55,956 | ) | (89,147 | ) | ||||||||

| Comprehensive loss | $ | (533,343 | ) | $ | (278,466 | ) | $ | (732,904 | ) | $ | (444,090 | ) | ||||

| Basic and diluted loss per common share | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Basic and diluted weighted average common shares outstanding | 304,147,714 | 144,292,663 | 304,147,714 | 120,949,276 | ||||||||||||

See Notes to Unaudited Consolidated Financial Statements.

| 4 |

Consorteum Holdings, Inc.

(A Development Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| Six Months Ended December 31, 2011 | Six Months Ended December 31, 2010 | Cumulative from Inception (November 7, 2005) through December 31, 2011 | ||||||||||

| Cash flows from operating activities: | ||||||||||||

| Net loss | $ | (676,947 | ) | $ | (354,943 | ) | $ | (6,215,332 | ) | |||

| Depreciation | 590 | 806 | 15,562 | |||||||||

| Gain on forgiveness or restructuring of debt | - | (11,604 | ) | (385,567 | ) | |||||||

| Amortization of debt discount | 15,938 | - | 15,938 | |||||||||

| Amortization of deferred finance charges | 3,623 | 21,866 | 54,618 | |||||||||

| Stock-based compensation | 37,917 | 21,000 | 100,917 | |||||||||

| Fair value of preferred shares issued for services | 138,000 | - | 138,000 | |||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Other receivable | - | (2,002 | ) | 8,423 | ||||||||

| Accounts payable | 22,342 | (7,140 | ) | 2,998,504 | ||||||||

| Accrued Expenses | 36,719 | (33,264 | ) | 36,719 | ||||||||

| Accrued interest | 149,831 | - | 336,440 | |||||||||

| Net cash used in operating activities | (271,987 | ) | (365,281 | ) | (2,330,797 | ) | ||||||

| Cash flows from financing activities: | ||||||||||||

| Proceeds from loans | - | 194,460 | 1,881,472 | |||||||||

| Repayment of loans | - | (58,961 | ) | (217,811 | ) | |||||||

| Proceeds from bank indebtness | - | 3,536 | 141,691 | |||||||||

| Repayment of bank indebtness | - | (9,527 | ) | (16,392 | ) | |||||||

| Deferred finance chargers | - | (12,432 | ) | |||||||||

| Proceeds from stockholders' advances | 626 | 61,016 | 1,711,045 | |||||||||

| Proceeds from the issuance of convertible promissory notes | 267,747 | 385,226 | 392,048 | |||||||||

| Net cash provided by financing activities | 268,373 | 532,141 | 2,695,239 | |||||||||

| Effect of exchange rate on cash | (27 | ) | (520 | ) | (68,091 | ) | ||||||

| Net decrease in cash | (3,641 | ) | 166,340 | - | ||||||||

| Cash, beginning of period | 3,641 | 9,110 | - | |||||||||

| Cash, end of period | $ | - | $ | 175,450 | $ | - | ||||||

| Supplemental disclosures of cash flow information: | ||||||||||||

| Cash paid for interest | $ | - | $ | - | $ | - | ||||||

| Cash paid for income taxes | $ | - | $ | - | $ | - | ||||||

| Non-cash investing and financing activities: | ||||||||||||

| Fair value of convertible notes issued related to acquisition | $ | 2,073,646 | $ | - | $ | 2,073,646 | ||||||

See Notes to Unaudited Consolidated Financial Statements.

| 5 |

Consorteum Holdings, Inc.

STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT)

From Inception ( November 7, 2007 to December 31, 2011

(A Development Stage Company)

| Deficit accumulated | Deficit accumulated | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated Other | during prior | during prior | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series A Preferred Stock | Series B Preferred Stock | Common Stock | Discount on | Collateralized | Treasury | Additional | Comprehensive | development | development | Stockholders' | ||||||||||||||||||||||||||||||||||||||||||||||

| Shares | $ | Shares | $ | Shares | $ | Common Stock | Shares Issued | Stock | Paid-in Capital | Income (loss) | activities | activities | Equity (Deficit) | |||||||||||||||||||||||||||||||||||||||||||

| Ending balance, June 30, 2011 | - | $ | - | - | $ | - | 304,147,714 | $ | 304,148 | $ | - | $ | (137,500 | ) | $ | - | $ | 3,135,529 | $ | (171,509 | ) | $ | (5,538,385 | ) | $ | - | $ | (2,407,717 | ) | |||||||||||||||||||||||||||

| Fair value of preferred stock issued for services | - | - | 14,000,000 | 14,000 | - | - | - | - | - | 124,000 | - | - | - | 138,000 | ||||||||||||||||||||||||||||||||||||||||||

| Distributions | 5,000,000 | 5,000 | - | - | - | - | - | - | - | - | - | (2,078,646 | ) | (2,073,646 | ) | |||||||||||||||||||||||||||||||||||||||||

| Stock option expense | - | - | - | - | - | - | - | - | - | 37,917 | - | - | - | 37,917 | ||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | - | - | - | 55,956 | - | - | 55,956 | ||||||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | - | - | - | - | - | (676,948 | ) | (676,948 | ) | ||||||||||||||||||||||||||||||||||||||||

| Ending balance, December 31, 2011 | 5,000,000 | $ | 5,000 | 14,000,000 | $ | 14,000 | 304,147,714 | $ | 304,148 | $ | - | $ | (137,500 | ) | $ | - | $ | 3,297,446 | $ | (115,553 | ) | $ | (5,538,385 | ) | $ | (2,755,594 | ) | $ | (4,926,438 | ) | ||||||||||||||||||||||||||

See Notes to Unaudited Consolidated Financial Statements.

| 6 |

Consorteum Holdings, Inc.

(A DEVELOPMENT-STAGE COMPANY)

Notes to Consolidated Financial Statements

(Unaudited)

| 1. | Organization, Development-Stage Activities, and Going Concern Considerations |

Organization

Consorteum Holdings, Inc. (“Holdings” and subsequent to the reverse merger, the “Company”), formerly known as Implex Corporation, was incorporated in the State of Nevada on November 7, 2005. On April 9, 2009, Holdings changed its name to Consorteum Holdings, Inc.

As discussed in Note 10, on June 6, 2011, the Company entered into an asset purchase agreement, as amended, with Media Exchange Group, Inc. (“MEXI”) pursuant to which the Company agreed to buy, transfer and assign to the Company, and MEXI agreed to sell all of the rights, title and interests to, and agreements relating to, its digital trading card business and platform, as well as all other intangible assets of the business in exchange for the Company assuming an aggregate principal and accrued interest amount of approximately $2.1 million of indebtedness of MEXI in accordance with the terms of that certain assignment and assumption agreement executed on June 6, 2011. On July 14, 2011, the Company completed its due diligence and finalized the asset purchase agreement with MEXI. A majority shareholder of MEXI and the former Chief Executive Officer, Director and Chairman of the Board of MEXI (who resigned on June 3, 2011) organized the asset purchase agreement with MEXI. In addition, the control persons of MEXI were effectively issued five (5) million shares of Series A Preferred Stock (see Note 10), which have super voting rights, causing such persons to have voting control of the Company. Accordingly, the transaction is deemed consummated between two entities under common control and the transfer of assets was recorded at historical cost. MEXI’s right, title and interest to, and agreements relating to, its digital trading card business and platform were valued at the historical cost basis of zero since MEXI’s activities were related to research and development. However, in connection with the acquisition, the Company assumed convertible notes amounting to $2,073,646 of MEXI (principal and accrued interest as of December 2011), and accordingly, recorded a corresponding charge in the deficit accumulated during the development stage in the accompanying consolidated balance sheet at December 31, 2011.

Development-Stage Activities, Going Concern Considerations and Management’s Plans

On or about July 14, 2011, we changed our date of inception as a result of the change in business for accounting of our development-stage activities under Accounting Standards Codification (“ASC”) 915 “Development Stage Entities”. Activities prior to such date are included in development activities and the historical accumulated losses are segregated in the accompanying consolidated balance sheet in stockholders’ deficit. The results of the current development-stage activities since inception (July 14, 2011) approximate the results for the six months ended December 31, 2011. We are a development-stage company with no commercial revenues achieved to date. The Company has limited cash, a working capital deficit and has sustained losses. The Company requires additional capital to complete its acquisition of Tarsin, Inc., to complete its development activities and to market customers for its technologies. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

We secured working capital of approximately $268,000 during the six months ended December 31, 2011. Subsequent to such date, we raised additional capital totaling $180,000; such proceeds were used to pay the working capital needs of Tarsin, Inc. until the acquisition agreement was finalized. We require additional equity or debt financing to meet our obligations as they become due. In the event that such financing is not secured, the Company will not be able to satisfy its liabilities. Furthermore, certain debt is overdue and is secured by all assets of the Company. Management is attempting to restructure some of its debt and secure additional financing to satisfy its existing obligations and provide for sufficient working capital to meet its future obligations but there are no guarantees that it will be able to do so.

The Company’s consolidated financial statements are presented on a going concern basis, which contemplates the realization of assets and discharge of liabilities in the normal course of business. The accompanying consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the inability of the Company to continue as a going concern.

The foregoing unaudited financial statements have been prepared in accordance with U.S generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, these financial statements do not include all of the disclosures required by GAAP for complete financial statements. These unaudited interim financial statements should be read in conjunction with the audited financial statements for the year ended June 30, 2011. In the opinion of management, the unaudited interim financial statements furnished herein include adjustments, all of which are of a normal recurring nature, necessary for a fair statement of the results for all the interim periods presented. Operating results for the three and six-month periods ending December 31, 2011 are not necessarily indicative of the results that may be expected for the year ended June 30, 2012.

| 7 |

| 2. | Summary of Significant Accounting Policies |

The accounting policies of the Company are in accordance with GAAP, and their basis of application is consistent with that of the previous year. Set forth below are the Company’s significant accounting policies:

Basis of Presentation

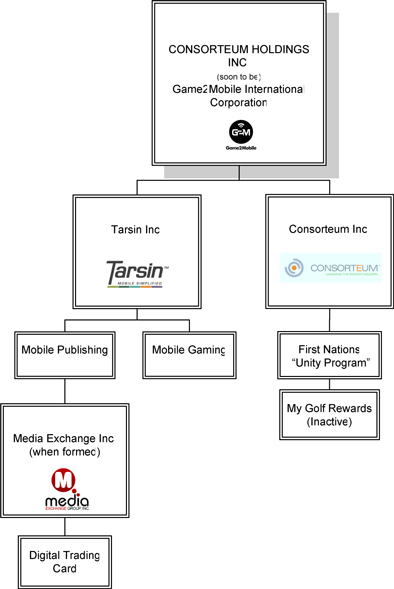

The consolidated financial statements include the accounts of Consorteum Holdings, Inc., Consorteum Inc., and our inactive subsidiary My Golf Rewards Canada, Inc. All significant intercompany balances and transactions are eliminated in consolidation into Consorteum Holdings Inc. The merger of Holdings and Consorteum Sub has been recorded as a recapitalization of Holdings, with the net assets of Consorteum Sub and Holdings brought forward at their historical bases and represents a continuation of the financial statements of Consorteum Sub. The substance of the Company’s share issuance and the reorganization is a transaction which results in Consorteum becoming a listed public entity through Holdings’ acquisition of Consorteum’s net assets.

Convertible Debt with Beneficial Conversion Features

Convertible debt is accounted for under the guidelines established by ASC 470 “Debt with Conversion and Other Options” and ASC 740 “Beneficial Conversion Features”. The Company records a beneficial conversion feature (“BCF”) related to the issuance of convertible debt that has conversion features at fixed or adjustable rates that are in-the-money when issued and records the fair value of warrants issued with those instruments. The BCF for the convertible instruments is recognized and measured by allocating a portion of the proceeds to warrants and as a reduction to the carrying amount of the convertible instrument equal to the intrinsic value of the conversion features, both of which the balance are credited to paid-in-capital.

The Company calculates the fair value of warrants issued, if any, with the convertible instruments using the Black-Scholes valuation method, using the same assumptions used for valuing employee options for purposes of ASC 718 “Compensation – Stock Compensation”, except that the contractual life of the warrant is used. Under these guidelines, the Company allocates the value of the proceeds received from a convertible debt transaction between the conversion feature and any other detachable instruments (such as warrants) on a relative fair value basis. The allocated fair value is recorded as a debt discount or premium and is amortized over the expected term of the convertible debt to interest expense. For a conversion price change of a convertible debt issue, the additional intrinsic value of the debt conversion feature, calculated as the number of additional shares issuable due to a conversion price change multiplied by the previous conversion price, is recorded as additional debt discount and amortized over the remaining life of the debt.

Convertible Debt with Adjustable Conversion Options

Convertible debt which contains rights that allow the holders to adjust their conversion price in the event the Company issues common stock at a price per share below their conversion price or the instrument by its terms converts principal into a variable number of shares with no floor price. Accordingly, the provisions of ASC 815 “Derivatives and Hedging” (“ASC 815”) apply and must be evaluated by us. ASC 815 applies to any freestanding financial instruments or embedded features that have the characteristics of a derivative and to any freestanding financial instruments that are potentially settled in an entity’s own common stock. These conversion features are bifurcated and recorded at fair value at each reporting date using the Black Sholes valuation model.

Recent Accounting Pronouncements

The FASB issues Accounting Standards Updates (“ASUs”) to amend the authoritative literature in the ASC. There have been a number of ASUs to date that amend the original text of the ASC. Except for the ASUs listed above, those issued to date either (i) provide supplemental guidance, (ii) are technical corrections, (iii) are not applicable to the Company or (iv) are not expected to have a significant impact on the Company.

| 3. | Fair Value Measurements |

The Company adopted ASC 820 “Fair Value Measurements and Disclosures”. ASC 820 clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or a liability. As a basis for considering such assumptions, ASC 820 establishes a three-tier value hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value as follows:

Level 1 - Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 - Other inputs that are directly or indirectly observable in the marketplace.

Level 3 - Unobservable inputs which are supported by little or no market activity.

| 8 |

The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Cash, bank indebtedness (Level 1), due to stockholders, loans payable and convertible promissory notes (Level 2) are reflected in the balance sheets at carrying value, which approximates fair value due to the short-term nature of these instruments. The Company does not have any Level 3 assets or liabilities.

| 4. | Accrued Liabilities |

Accrued liabilities as of December 31, 2011 and June 30, 2011, respectively, were made up of the following categories:

| 12/31/2011 | 6/30/2011 | |||||||

| Salaries, wages and benefits | $ | 120,327 | $ | 27,000 | ||||

| Professional services | 275,714 | 328,374 | ||||||

| Other | 15,099 | 25,672 | ||||||

| $ | 411,139 | $ | 381,046 | |||||

| 5. | Bank Indebtedness |

Bank indebtedness is comprised of a Royal Bank of Canada (“RBC”) demand term loan and an operating credit facility. Starting July 2008, the loan was repayable on a monthly basis at $1,792 plus interest, at RBC’s prime rate plus 2% per annum. The loan was scheduled to mature in June 2013. The loan is secured by a general security agreement signed by the Company constituting a first ranking security interest in all personal properties of the Company and personal guarantees from certain stockholders.

As of December 31, 2011 the demand term loan and the operating line of credit were both in default and demands for full repayment have been made. The Company has been unable to meet any repayment terms and accordingly in 2010 RBC commenced legal proceedings in Toronto, Canada to recover the full balance allegedly due. The legal proceedings have also named two stock holders as defendants under guarantees in writing by both individuals. As of December 31, 2011 the Company has reached a tentative agreement to settle the liability for a total of CAN$165,901 (translated into approximately US$148,064) inclusive of all interest, penalties and costs. The parties are currently negotiating the additional final terms and conditions. (See “Legal Proceedings.”)

| 6. | Loans Payable and Convertible Promissory Notes |

Loans payable are as follows:

| December 31, | June 30, | |||||||

| 2011 | 2011 | |||||||

| Loans payable, bearing interest at rates between 0% and 18% per annum. Interest payable monthly. These loans are past due, unsecured and payable on demand. Accrued interest at December 31, 2011 and June 30, 2011 was $89,316 and $90,926 respectively. | ||||||||

| Total Loans payable | $ | 973,998 | $ | 948,149 | ||||

| Convertible promissory notes, bearing interest between 5% and 18% per annum, maturing between December 2008 and December 2012. Interest payable at maturity; accrued interest at December 31, 2011 and June 30, 2011 was $74,566 and $45,679, respectively. The promissory notes are convertible at any time at the option of the holder into shares of common stock at a rate ranging from $0.008 to $0.025. | $ | 877,464 | $ | 587,171 | ||||

| Less: unamortized discount | $ | - | $ | (15,938 | ) | |||

| Convertible promissory notes assumed in accordance with asset purchase agreement with Media Exchange Group bearing interest between 5% to 8% per annum, convertible into shares of common stock at rates ranging from $0.01 to $0.05. Accrued interest at December 31, 2011 was $350,863. These convertible promissory notes are past due and payable on demand. | $ | 2,131,515 | $ | - | ||||

| Less: short-term portion | $ | (3,008,979 | ) | $ | (163,235 | ) | ||

| Convertible promissory notes, long-term portion | $ | - | $ | 407,998 | ||||

The Company received approximately $0 and $194,000 from the issuance of loans payable during the six months ended December 31, 2011 and 2010, respectively. During the six months ended December 31, 2011 and 2010 the Company raised approximately $268,000 and $385,000, respectively. The convertible promissory notes issued during the six months ended December 31, 2011 have conversion prices ranging from $0.008 to $0.025, interest rates ranging from 5-8% and maturity dates prior to December 31, 2012. In connection with $114,000 of these convertible promissory notes, the Company issued 325,000 warrants. The Company valued the warrants using the Black-Scholes pricing model and determined there was no significant intrinsic value to the warrants. Accordingly, a discount on the related debt was not recognized.

| 9 |

The Company made principal repayments on loans payable of approximately $0 and $59,000 during the six months ended December 31, 2011 and 2010, respectively.

The Company issued 32,500,000 shares of its common stock to satisfy obligations under certain loans payable aggregating approximately $69,000 during the year ended June 30, 2011. The Company did not issue any shares to satisfy obligations under certain loans payable during the six months ended December 31, 2011.

During the six months ended December 31, 2011, there has been inconsequential movement in stockholder advances. During the six months ended December 31, 2010, the Company received stockholder advances, net of repayments of approximately $30,000. In addition, during the same period, the Company issued 42,083,333 shares for the reduction in stockholder advances of approximately $168,000.

The Company recognized interest expense of $86,171, $72,693, $149,831 and $122,439 during the three and six months ended December 31, 2011 and 2010, respectively.

| 7. | Due to Stockholders |

The amounts due to stockholders are non-interest bearing, unsecured and have no fixed terms of repayment. Through June 30, 2011, stockholders advanced to the Company approximately $1.7 million and the Company repaid $1.4 million. In addition the Company issued 73,160,999 shares of its common stock at a fair value of approximately $261,000 to satisfy certain of its obligations to such stockholders. There has been insignificant movement in stockholder loans for the six months ended December 31, 2011.

| 8. | Certain Related Party Transactions |

The Company pays some of the members of its management team through companies owned or controlled by those individuals. The payments are to the Company’s benefit and in connection with its operations, and, accordingly, are not required to be disclosed separately. Management plans to pay its employees using a payroll processing company in the near future, whereby the Company will withhold and pay employer taxes in the normal course of business in lieu of payment using contractor status for payments.

The Company’s Board of Directors approved four (4) employment agreements with key executives, which provide for salaries, the issuances of Series A and/or Series B preferred stock, and the grant of stock options which vest over the terms of the contracts, among other benefits.

In connection therewith, future annual salaries under employment contracts as of December 31, 2011 are as follows for the fiscal year end indicated:

| Fiscal year end 2012 | $ | 362,500 | ||

| Fiscal year end 2013 | 725,000 | |||

| Fiscal year end 2014 | 725,000 | |||

| Fiscal year end 2015 | 725,000 | |||

| Fiscal year end 2016 | 725,000 | |||

| Thereafter | 302,083 | |||

| Total | $ | 3,564,583 |

| 9. | Stockholders’ Deficit |

Common Stock

There was no common stock issued during the six months ended December 31, 2011.

Preferred Stock

Authorizations and Designations

As of December 31, 2011, the Company has 100,000,000 preferred shares authorized, having a par value of $.001 per share.

On June 3, 2010, the Company’s Board of Directors authorized the creation of 40,000,000 shares of its Series A Preferred Stock, par value $.001 per share with voting rights of 2 to 1 (the “Series A Preferred Shares”). The Series A Preferred carry conversion rights into common stock at a ratio of one to one. The Company designated a Series A preferred stock in contemplation of a financing, however no stock was ever issued. The amendment of the Articles of Incorporation was withdrawn for the Series A Preferred by the Company on December 5, 2011 with the Nevada Secretary of State, as approved by the directors.

In November 2011, the Board of Directors approved an amendment of the Company’s Articles of Incorporation, whereby the designations of Series A and Series B preferred stock were established, and fixed the number of Series A preferred shares to be issued at 5,000,000 and the number of Series B preferred shares to be issued at 15,000,000.

The rights and privileges of the Series A shares consist of super voting rights at 200 votes per share held, conversion rights on a one-to-one basis with common stock, and a liquidation preference as described below.

The rights and privileges of the Series B shares consist of voting rights equal to one vote per share held, conversion rights equal to Series A and liquidation preference as described below.

Upon any liquidation, dissolution, or winding up of the Company, whether voluntary or involuntary, before any distribution or payment shall be made to the holders of any common stock or Series B Preferred Stock, the holders of the Series A Preferred Stock shall be entitled to be paid out of the assets of the Company an amount per share of Series A Preferred Stock equal to the product of (i) the original amount paid by the holder thereof for each share of Series A Preferred Stock owned by such holder as of the effective date of such liquidation, multiplied by (ii) the number of shares of Series A Preferred Stock owned of record by such holder as of the liquidation date (as adjusted for any combinations, splits, recapitalization and the like with respect to such shares). The Series B Preferred Stock is next in liquidation preference after the Series A Preferred Stock, and is computed consistently with the formula above for the Series A Preferred Stock.

| 10 |

Commitments and Issuances

On July 8, 2011, the Company’s Board of Directors authorized the designations and the issuance of 5,000,000 shares of the Series A Preferred Stock to Joseph R. Cellura its CEO, to be issued in connection with the acquisition of MEXI. Furthermore, the Company’s Board of Directors authorized the issuance of 4,000,000 shares of the Company’s Series B Preferred stock to Mr. Cellura in connection with his employment agreement. As discussed above, such designations were filed and later withdrawn, and a new amendment made in December 2011which was authorized on November 22, 2011, by the Company’s Board of Directors, as discussed in the preceding paragraph. As of December 31, 2011, such shares have not been issued by the Company. However, these shares are deemed issued and outstanding as of December 31, 2011, because the certificates are simply to be printed and issued by management.

On July 8, 2011, the Company’s Board of Directors authorized the issuance of 4,000,000 shares of the Company’s Series B Preferred Stock to Craig Fielding the CEO of Consorteum Inc., a wholly-owned subsidiary of the Company, as part of his compensation in accordance with the terms of his employment agreement. However, the preferred stock was not available to be issued at that time. Since the consideration was communicated on July 8, 2011, management recorded the estimated compensation at the time of commitment. On December 1, 2011, the contract was formally executed and the authorization of the Series B Preferred Stock effected. As of December 31, 2011 such shares have not been issued by the Company. However, these shares are deemed issued and outstanding as of December 31, 2011, because the certificates are simply to be printed and issued by management.

The 8,000,000 Series B Preferred shares described in the two preceding paragraphs were valued at $0.012 on the date of commitment based on the market value of the Company’s common stock, and as a result, the Company recorded $96,000 of compensation expense which is included in selling, general and administrative expense during the six months ended December 31, 2011.

On December 1, 2011, the Board of Directors approved employment contracts with two additional employees. In connection therewith, the two employees were granted 4,000,000 and 2,000,000 shares of Series B Preferred stock, respectively, which were fully vested on the date of commitment. The 6,000,000 preferred shares were valued at $0.007 on the date of issuance based on the market value of the Company’s common stock, and as a result, the Company recorded $42,000 of compensation expense which is included in selling, general and administrative expense during the three and six months ended December 31, 2011. These shares are deemed issued and outstanding as of December 31, 2011, because the certificates are simply to be printed and issued by management.

Warrants

During fiscal 2009, the Company issued 4,140,000 warrants having an exercise price of $0.001 per share of common stock, expiring December 31, 2012. Such warrants were issued to stockholders pursuant to an equity offering.

During fiscal 2011, the Company issued 2,067,184 warrants having an exercise price of $0.015 per share of common stock, expiring in May 2016. Such warrants were issued in connection with an issuance of a convertible promissory note amounting to approximately $124,000.

During the six months ended December 31, 2011, the Company issued 325,000 five-year warrants having an exercise price of $0.025 per share of common stock. Such warrants were issued in connection with an issuance of a convertible note amounting to $114,000. The Company determined that there was no intrinsic value associated with the granting of these warrants associated with this convertible note.

Options

On September 19, 2009, at a meeting of the Board of Directors, the Company granted 2,500,000 non-qualified stock options to various employees.

There were no stock options issued prior to June 30, 2009.

The Company has a commitment to issue 500,000 stock options to a private investor as a bonus for a loan, and a further 50,000 stock options to an individual as a finder’s fee which commitments were made on January 12, 2010. As at June 30, 2010, these options had not been issued. These stock options granted have been replaced by the issue of common shares in an equivalent number at the then current market price of $0.003 per share during fiscal 2011.

During the six months ended December 31, 2011, the Company granted 20,000,000 options to purchase common stock to executives in accordance with employment agreements entered into during the period. The options vest as follows: 20% vest immediately, and 20% each year thereafter, thus becoming fully vested after four years. The options have a 10 year life and an exercise price of $0.007 and was valued at $140,000.. The fair value of stock options granted was estimated at the date of grant to be $0.007 using the Black-Scholes option pricing model. The Company used the following assumptions for determining the fair value of options granted under the Black-Scholes option pricing model: volatility of 346%, expected life of 6.5 years, risk free interest rate of 97%, market price per share of $0.007, and no dividends.

At December 31, 2011 and June 30, 2011, respectively, the Company recorded $37,917 and $0 option expense, and there was $102,083 and $0 unrecognized expense associated with the issuance of stock options.

| 11 |

| 10. | Acquisition |

Asset Purchase Agreement- Media Exchange Group, Inc.

On June 6, 2011, the Company entered into an asset purchase agreement (the “Consorteum Purchase Agreement”) with MEXI pursuant to which the Company agreed to buy, and MEXI agreed to sell all of the rights, title and interests to, and agreements relating to, its digital trading card business and platform as well as all other intangible assets of the business in exchange for the Company assuming an aggregate principal and accrued interest amount of approximately $2.1 million of indebtedness of MEXI in accordance with the terms of that certain assignment and assumption agreement executed on June 6, 2011. At that time, the Company approved the issuance of 5 million shares of Series A Preferred Stock, with super voting rights (as discussed in Note 8) such that the shareholders of MEXI control the combined companies upon close. Accordingly, the transaction is deemed consummated between two entities under common control and the transfer of assets was recorded at historical cost. MEXI’s right, title and interest to, and agreements relating to, its digital trading card business and platform were valued at the historical cost basis of zero since MEXI’s activities were related to research and development. However, in connection with the acquisition, the Company assumed convertible notes amounting to $2,073,646 of MEXI (principal and accrued interest as of December 2011), and accordingly, recorded a corresponding charge in the deficit accumulated during the development stage in the accompanying consolidated balance sheet at December 31, 2011. The Company did not ascribe a fair value to the Series A Preferred Stock since the acquisition resulted in net liabilities assumed under carryover basis of accounting, with no capital contributed at the time of the close of the acquisition.

On June 6, 2011, the Company and MEXI entered into an amendment agreement (the “Amendment Agreement”) to the Consorteum Purchase Agreement pursuant to which the parties agreed, among other things, that the obligations of the Parties to consummate the transactions contemplated by the Purchase Agreement were subject to (i) the approval of the Board of Directors of each of the parties, and (ii) the completion of the assignment of the Assumed Liabilities (including receipt of all the necessary consents of the holders of all outstanding indebtedness of MEXI).

On July 14, 2011, the Company completed its due diligence and finalized the asset purchase agreement with MEXI. A majority shareholder of MEXI and the former Chief Executive Officer, Director and Chairman of the Board of MEXI (who resigned on June 3, 2011) organized the asset purchase agreement with MEXI.

As discussed in Note 8, on July 8, 2011, the former Chief Executive Officer of MEXI assumed the position of the Chairman and Chief Executive Officer of the Company and, in accordance with the Board of Director’s authorization, was promised 4,000,000 shares of Consorteum’s Series B Preferred Stock as part of his compensation in accordance with the terms of his employment contract.

Acquisition Agreement- Tarsin, Inc

On October 4, 2011, the Company entered into an Acquisition Agreement (the “Agreement”) with Tarsin (Europe) LTD, a company organized under the laws of the United Kingdom (“Seller”), whereby the Company agreed to purchase 100% of the issued and outstanding shares of Tarsin, Inc., a Nevada corporation (“Tarsin Subsidiary”) from Seller. On November 4, 2011, the Company entered into Amendment No. 1 (the “Amendment”) to the Agreement. Pursuant to the Agreement and the Amendment the Company purchased 100% of the issued and outstanding shares of Tarsin Subsidiary from Seller for: (1) a total of 24,500,000 shares of the Company’s common stock issued at a deemed issuance price of $0.10 per share; and (2) a cash payment of $3,000,000 to Seller as follows: (i) $200,000 no later than January 30, 2012, (ii) $800,000 no later than March 31, 2012, (iii) $1,000,000 no later than July 31, 2012, and (iv) $1,000,000 no later than December 31, 2012. Further, the Company also paid in full the existing outstanding balance owed by Seller on its line of credit established with NAT West in the total amount of $90,000. Until such time as the Company has a market capitalization equal to or greater than $100,000,000, the shares received by Seller are entitled to anti-dilution protection for certain dilutive issuances, not including issuances to employees, consultants, lenders, or other goods or service providers. Pursuant to the Amendment, Seller further agreed to grant to the Company an exclusive, worldwide perpetual license to use, distribute, and sell its CAPSA Mobile Platform technology in consideration for a 12.5% royalty fee calculated on future net revenues from the use of the CAPSA Mobile Platform technology. The Company is further obligated to provide or procure working capital to Tarsin Subsidiary as follows: (1) $300,000 no later than December 31, 2011, and (2) an additional $250,000 no later than March 31, 2012 and (3) an additional $1,150,000 no later than December 31, 2012.

| 11. | Subsequent Events |

Nothing to report.

| 12 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

FORWARD LOOKING STATEMENTS

Our Management’s Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking (within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”)). Forward-looking statements are, by their very nature, uncertain and risky. These risks and uncertainties include the Company’s limited operating history, its limited financial resources, activities of competitors and the presence of new or additional competition, changes in Federal or State laws impacting the Company’s business, international, national and local general economic and market conditions; demographic changes; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other risks that might be detailed from time to time in our filings with the Securities and Exchange Commission (“SEC”).

Although the forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report and in our other reports as we attempt to advise interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

As used in this Quarterly Report, the terms “we,” “us,” and “our,” shall mean Consorteum Holdings, Inc., and our current subsidiaries Consorteum, Inc., (“Consorteum Sub”), and My Golf Rewards Canada, Inc. collectively, unless otherwise indicated. We intend to separately incorporate a third company which will operate as Media Exchange Group, Inc. (“MEXI”) and will become our third wholly owned subsidiary. Tarsin, Inc. (“Tarsin”) will be considered a subsidiary upon successful completion of the acquisition subsequent to December 31, 2011.

OVERVIEW

We are a holding company incorporated in the State of Nevada, with two separate wholly owned subsidiaries. Although each of our subsidiaries has its own specific market focus and has developed its own business plans, they all share a common theme that has at its core, the delivery of digital media across diverse payment transactional platforms that are rapidly converging due to advances in smart phone mobile technology. MEXI, when formed will become our third subsidiary and will operate the digital media and publishing part of our business. Consorteum Inc. will transition its operations and current initiatives under the MEXI corporate structure once formed.

| 13 |

In June 2009, we closed an exchange agreement with Consorteum Sub, pursuant to which we became a holding company and our business was conducted through Consorteum Sub. On June 6, 2011, we acquired the digital trading card business and platform, as well as all other intangible assets of MEXI. On July 14, 2011, the Company completed its due diligence and finalized the asset purchase agreement with MEXI. Finally, on February 21, 2012, pursuant to an acquisition agreed to pursuant to an acquisition agreement entered into with Tarsin (Europe) LTD, a company organized under the laws of the United Kingdom, we acquired Tarsin, as well as an exclusive, worldwide perpetual license to use, distribute, and sell the Capsa Mobile Platform technology (“CAPSA”) of Tarsin (Europe) LTD.

Consorteum Sub brings together its experience in the payment processing and financial transaction markets. Recent advances in technology have enabled smart phones to develop custom applications that will allow the phone to process payments, conduct banking transactions and emulate the traditional role that automated teller machines (ATM) machines now play. We intend to leverage our expertise in mobile applications development to target new opportunities to provide traditional banking and payment services to our customers.

MEXI will initially focus on reaching the 18 to 24 year old market with the introduction of mobile applications for sports and music. We intend to leverage Tarsin’s relationships with 19 of the largest mobile carriers in the world to promote MEXI’s Digital Trading Card and mobile music jukebox. As the mobile applications are adopted by this technically savvy crowd, we hope to promote our entire spectrum of products and brand ourselves as the premier provider of mobile applications in sports betting, entertainment, and financial payment services. As the college student graduates, we can continue to deliver a wide variety of services and products tailored to specific markets. In essence, we have the opportunity to organically grow our customers and expose them to our brand for life.

| 14 |

Tarsin has established capabilities in the mobile handset market which we can use to ensure cross functionality of our mobile applications across a wide variety of handsets. The ability to deliver next generation services to all customers depends on our ability to develop an application that is agnostic to the type of smart phone deployed. The CAPSA platform was developed with the specific purpose of deploying rich multimedia content across diverse handsets. We intend to leverage the initial traction that Tarsin has gained in the mobile sports betting and casino gaming vertical to monetize its applications in branded partnership relationships.

We have spent the past two years validating our business models for the First Nations project and the My Golf Rewards program. The lack of capital to launch these programs has forced us to curtail our sales and marketing activities and to focus on identifying other opportunities in which we could compete for market share and generate revenue. The recent acquisition of MEXI and the agreement to acquire Tarsin add two critical operating companies that will become the foundation for evolving our marketing strategy. Tarsin is now positioned to become a leading developer of mobile gaming on cross platform applications. The CAPSA platform facilitates our ability to develop mobile applications and can be leveraged into many different market verticals. MEXI brings together a strategy of providing digital media to mobile applications. Consorteum Sub brings expertise in the financial payment transaction industry which will be key strength as we monetize our product offerings in the future. We anticipate that in 2012 we will integrate the individual capabilities of all three subsidiaries to deliver to market a series of mobile applications in the gaming, entertainment, sports and mobile financial solutions industries.

LIQUIDITY AND CAPITAL RESOURCES

We had no cash at December 31, 2011. Our working capital deficit amounted to approximately $4.9 million at December 31, 2011.

During the six-month period ended December 31, 2011, we used cash in our operating activities amounting to approximately $272,000. Our cash used in operating activities was comprised of our net loss from continuing operations of approximately $677,000 adjusted for the following:

| · | Amortization of debt discount of approximately $16,000; |

| · | Fair value of preferred shares issued for services of $138,000; |

| · | Amortization of deferred finance charges of approximately $3,600; |

| · | Depreciation of approximately $590; and. |

| · | Stock-based compensation of approximately $38,000. |

Additionally, the following variations in operating assets and liabilities impacted our cash used in operating activity:

| · | An increase in our accounts payable of approximately $22,000; |

| · | An increase in our accrued liabilities of approximately $37,000; and |

| · | An increase of accrued interest of approximately $150,000, resulting from the assumed loans as a result of an acquisition, issuance of new loans during the six months ended December 31, 2011 and the passing of time. |

During the six-month period ended December 31, 2011, we generated cash from financing activities of approximately $268,000, which consists of the proceeds from the issuance of convertible promissory notes.

During the six-month period ended December 31, 2010, we used cash in our operating activities amounting to approximately $365,000. Our cash used in operating activities was comprised of our net loss from continuing operations of approximately $355,000 adjusted for the following:

| · | Amortization of deferred financing of approximately $22,000; |

| · | Depreciation of approximately $800. |

| · | Stock issued for services of $21,000; and |

| · | Forgiveness of debt of $11,604. |

Additionally, a decrease in our accounts payable and accrued liabilities expenses of approximately $40,000, resulting from slower payment processing due to our financial condition, impacted our cash used in operating activity during the six months ended December 31, 2010.

| 15 |

During the six-month period ended December 31, 2010, we generated cash from financing activities of approximately $532,000, which consisted of the proceeds from the issuance of promissory notes, loans, and shareholder advances offset by principle payments. There were no significant commitments for the purchase of capital assets or intangible assets, or for operating leases.

We will continue to face significant uncertainty relating to liquidity and intend to continue to search for additional sources of working capital, and to actively search for collaborative partners. Many of our existing contracts and initiatives require capital expenditure by us to move forward and we anticipate that delays will continue if funds are not available.

RESULTS OF OPERATIONS

Three months ended December 31, 2011 vs three months ended December 31, 2010

Consorteum Holdings, Inc.

RESULTS OF OPERATIONS

(unaudited)

| Three Months ended | Dollar | Percentage | ||||||||||||||

| December 31, | Increase/(decrease) | Increase/(decrease) | ||||||||||||||

| 2011 | 2010 | 2011 vs 2010 | 2011 vs 2010 | |||||||||||||

| Revenues | $ | - | $ | - | $ | - | N/A | |||||||||

| Operating expenses | ||||||||||||||||

| Selling, general and administrative | 298,760 | 162,762 | 135,998 | 84 | % | |||||||||||

| Total operating expenses | 298,760 | 162,762 | 135,998 | 84 | % | |||||||||||

| Operating loss | (298,760 | ) | (162,762 | ) | (135,998 | ) | 84 | % | ||||||||

| Interest expense | (86,171 | ) | (72,693 | ) | (13,478 | ) | 19 | % | ||||||||

| Net loss | $ | (384,931 | ) | $ | (235,455 | ) | $ | (149,476 | ) | 63 | % | |||||

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses primarily consist of consultant fees related to marketing programs, which consists mostly of business development and advertising expenses, as well as other general and administrative expenses, including payroll expenses, necessary to support our marketing plans and our operations and legal expenses and professional fees.

The increase in our selling, general, and administrative expenses during the three month period ended December 31, 2011 when compared with the prior period is primarily attributable to increased expenses, mainly compensation expense, professional fees, associated with the July 2011 acquisition, and stock compensation.

Interest Expense

The increase in interest expense during the three month period ended December 31, 2011 when compared with the prior period is primarily due to the issuance of new convertible notes in addition to the convertible notes assumed from the MEXI acquisition

| 16 |

Six months ended December 31, 2011 vs six months ended December 31, 2010

Consorteum Holdings, Inc.

RESULTS OF OPERATIONS

(unaudited)

| Six Months ended | Dollar | Percentage | ||||||||||||||

| December 31, | Increase/(decrease) | Increase/(decrease) | ||||||||||||||

| 2011 | 2010 | 2011 vs 2010 | 2011 vs 2010 | |||||||||||||

| Revenues | $ | - | $ | - | $ | - | N/A | |||||||||

| Operating expenses | ||||||||||||||||

| Selling, general and administrative | 527,117 | 232,504 | 294,613 | 127 | % | |||||||||||

| Total operating expenses | 527,117 | 232,504 | 294,613 | 127 | % | |||||||||||

| Operating loss | (527,117 | ) | (232,504 | ) | (294,613 | ) | 127 | % | ||||||||

| Interest expense | (149,831 | ) | (122,439 | ) | (27,392 | ) | 22 | % | ||||||||

| Net loss | $ | (676,948 | ) | $ | (354,943 | ) | $ | (322,005 | ) | 91 | % | |||||

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses primarily consist of consultant fees related to marketing programs, which consists mostly of business development and advertising expenses, as well as other general and administrative expenses, including payroll expenses, necessary to support our marketing plans and our operations and legal expenses and professional fees.

The increase in our selling, general, and administrative expenses during the six month period ended December 31, 2011 when compared with the prior period is primarily attributable to increased expenses, mainly compensation expense, professional fees, associated with the July 2011 acquisition, and stock compensation.

Interest Expense

The increase in interest expense during the six month period ended December 31, 2011 when compared with the prior period is primarily due to the issuance of new convertible notes in addition to the convertible notes assumed from the MEXI acquisition.

GOING CONCERN

Our consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) assuming that we will continue as a going-concern basis. We have incurred losses since our inception and our ability to continue as a going-concern depends upon our ability to develop profitable operations and to continue to raise adequate financing. Management is actively targeting sources of additional financing which would assure our continuation of operations and pilot programs. In order for us to meet our liabilities as they come due and to continue operations, we remain solely dependent upon our ability to generate such financing.

There can be no assurance that we will be able to raise funds, in which case we would likely be unable to meet our obligations. Should we be unable to realize on our assets and discharge our liabilities in the normal course of business, the net realizable value of our assets may be materially less than the amounts recorded on the balance sheet. Our consolidated financial statements do not include adjustments to amounts and classifications of assets and liabilities that might be necessary should we be unable to continue operations.

The current market conditions and volatility increase the uncertainty of our ability to continue as a going concern given the need to both curtail expenditures and to raise additional funds. We are, and have experienced in the past, negative operating cash flows and needs to invest in continuing pilot projects and operating partnerships which cannot be met from our existing cash balances. We will continue to search for new funds and for new collaborative partners for our projects but anticipate that the current market conditions may impact our ability to source such funds.

| 17 |

CRITICAL ACCOUNTING POLICIES

The SEC defines critical accounting policies as those that are, in management's view, most important to the portrayal of our financial condition and results of operations and those that require significant judgments and estimates.

The discussion and analysis of our financial condition and results of operations is based upon our financial statements which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities. On an on-going basis, we evaluate our estimates including the allowance for doubtful accounts, the salability and recoverability of inventory, income taxes and contingencies. We base our estimates on historical experience and on other assumptions that we believe to be reasonable under the circumstances, the results of which form our basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We cannot predict what future laws and regulations might be passed that could have a material effect on our results of operations. We assess the impact of significant changes in laws and regulations on a regular basis and update the assumptions and estimates used to prepare our financial statements when we deem it necessary.

RISK AND UNCERTAINTIES

Factors that could affect the Company's future operating results and cause future results to vary materially from expectations include, but are not limited to, the Company’s limited operating history, its limited financial resources, activities of competitors and the presence of new or additional competition, changes in Federal or State laws impacting the Company’s business, lower than anticipated retail transactions, and inability to control expenses, technology changes in the industry, relationships with processing agencies and networks, changes in its relationship with related parties providing operating services to the Company and general uncertain economic conditions. Negative developments in these or other risk factors could have material adverse effect on the Company's future financial position, results of operations and cash flow.

Impairment of Long Lived Assets

In accordance with ASC 360, “Property plant and equipment,” long lived assets to be held and used are analyzed for impairment whenever events or changes in circumstances indicate that the related carrying amounts may not be recoverable. The Company evaluates at each balance sheet date whether events and circumstances have occurred that indicate possible impairment. If there are indications of impairment, the Company uses future undiscounted cash flows of the related asset or asset grouping over the remaining life in measuring whether the assets are recoverable. In the event such cash flows are not expected to be sufficient to recover the recorded asset values, the assets are written down to their estimated fair value. Long lived assets to be disposed of are reported at the lower of carrying amount or fair value of asset less cost to sell. As described in Note 1 to the Consolidated Financial Statements, the long-lived assets have been valued on a going concern basis. However, substantial doubt exists as to the ability of the Company to continue as a going concern. If the Company closes operations, the asset values may be materially impaired.

Income Taxes

The Company accounts for income taxes in accordance with ASC 740, “Income Taxes.” Deferred tax assets and liabilities are recorded for differences between the financial statement and tax basis of the assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates.

Foreign Currency Translation

In accordance with the provision of ASC 830, “Foreign Currency Matters,” the Company, whose functional currency is the Canadian dollar, translates its balance sheet into U.S. dollars at the prevailing rate at the balance sheet date and translates its revenues and expenses at the average rates prevailing during each reporting period. Net gains or losses resulting from the translation of financial statements are accumulated and charged directly to accumulated comprehensive income or (loss), a component of stockholders' equity or (deficit). Realized gains or losses resulting from foreign currency transactions are included in operations for the period.

| 18 |

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. These estimates are based on management's best knowledge of current events and actions the Company may undertake in the future. Actual results will differ from those estimates. These estimates are reviewed on an ongoing basis and as adjustments become necessary, they are reported in earnings in the period in which they become known.

Comparative Financial Information

Certain financial information for the fiscal 2011 has been reclassified to conform to the financial statement presentation adopted in the current year.

Recent Accounting Pronouncements

The FASB issues ASUs to amend the authoritative literature in ASC. There have been a number of ASUs to date that amend the original text of the ASC. Except for the ASUs listed above, those issued to date either (i) provide supplemental guidance, (ii) are technical corrections, (iii) are not applicable to us, or (iv) are not expected to have a significant impact on us.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 (“Exchange Act”) and are not required to provide the information under this item.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

As of December 31, 2011, the end of the period covered by this report, we conducted, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act in ensuring that information required to be disclosed by us in our reports is recorded, processed, summarized and reported within the required time periods. Based on that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that, as of December 31, 2011, our disclosure controls and procedures were ineffective at the reasonable assurance level in timely alerting him to material information required to be included in our periodic SEC reports as a result of the material weakness in internal control over financial reporting discussed below. Management’s assessment of the effectiveness of internal control over financial reporting is expressed at the level of reasonable assurance because a control system, no matter how well designed and operated, can provide only reasonable, but not absolute, assurance that the control system’s objectives will be met.

Management’s Quarterly Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Exchange Act Rule 13a-15(f). Our internal control system is a process designed by, or under the supervision of, our principal executive and principal financial officer, or persons performing similar functions, and effected by our Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. GAAP.

Our internal control over financial reporting includes policies and procedures that pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect transactions and dispositions of assets; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with U.S. GAAP, and that receipts and expenditures are being made only in accordance with the authorization of our management and directors; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our consolidated financial statements.

Because of inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of our internal control over financial reporting as of December 31, 2011. As a result of its assessment, management identified material weaknesses in our internal control over financial reporting. Based on the weaknesses described below, management concluded that our internal control over financial reporting was not effective as of December 31, 2011.

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. As a result of our assessment, management identified the following material weaknesses in internal control over financial reporting as of December 31, 2011:

| · | While there were internal controls and procedures in place that relate to financial reporting and the prevention and detection of material misstatements, these controls did not meet the required documentation and effectiveness requirements under the Sarbanes-Oxley Act (“SOX”) and therefore, management could not certify that these controls were correctly implemented. As a result, it was management’s opinion that the lack of documentation constituted a material weakness in the financial reporting process. |

| 19 |

| · | Our disclosure controls and procedures were not effective to ensure that information required to be disclosed by us in the reports that we file under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and to ensure that information required to be disclosed by us in the reports that we file under the Exchange Act is accumulated and communicated to our management, including our Chief Financial Officer, as appropriate to allow timely decisions. Inadequate controls include the lack of procedures used for identifying, determining, and calculating required disclosures and other supplementary information requirements. |

| · | There is lack of segregation of duties in financial reporting, as our financial reporting and all accounting functions are performed by one consultant. This weakness is due to our lack of working capital to hire additional staff during the period covered by this report. |

Remediation of Material Weaknesses

We intend to hire additional accounting personnel to assist with financial reporting as soon as our finances will allow. Even with this change, due to the increasing number and complexity of pronouncements, emerging issues and releases, and reporting requirements and regulations, we expect there will continue to be some risk related to financial disclosures. However, the process of identifying risk areas and implementing financial disclosure controls and internal controls over financial reporting required under SOX continues to be complex and subject to significant judgment and may result in the identification in the future of areas where we may need additional resources. Additionally, due to the complexity and judgment involved in this process, we cannot guarantee that the Company will not find or have pointed out to it either by internal or external resources, or by its auditors, additional areas needing improvement or resulting in a future assessment that its controls are or have become ineffective as a result of overlooked or newly created significant deficiencies or unmitigated risks.

Changes in Internal Control over Financial Reporting

There were no significant changes in our internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 20 |

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

In 2010, the Royal Bank of Canada commenced an action in Toronto, Canada against Consorteum Sub to recover amounts allegedly due under bank indebtedness totaling CAD$158,307. Two of our stockholders previously guaranteed the bank indebtedness, and the Royal Bank of Canada has joined these two individuals as defendants in the legal proceedings and is looking to these parties as part of the recovery process. During the quarter ended December 31, 2011, the parties to the litigation have negotiated the preliminary terms for a final settlement in the amount of CAD$158,307, equal to approximately US$148,064. The parties are currently negotiating the additional final terms and conditions of the payment in the amount set out above. (See Note 5)

Item 1A. Risk Factors

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”) and are not required to provide information under this item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

During the six months ended December 31, 2011, we issued a total of 8,000,000 shares of our Series B Preferred Stock as compensation to a total of two affiliate individuals pursuant to respective executive compensation agreements. We received no consideration for these shares. These shares were valued at $0.012 on their date of issuance and, as a result, we recorded $96,000 of compensation expense which is included in selling, general and administrative expense. We relied on the exemption from registration relating to offerings that do not involve any public offering pursuant to Section 4(2) under the Securities Act and/or Rule 506 of Regulation D promulgated under the Securities Act. We believe that each individual is an “accredited investor” under Rule 501 of Regulation D of the Securities Act and had adequate access to information about us through their relationship with us.

Item 3. Defaults upon Senior Securities

There have been no events which are required to be reported under this item.

Item 4. (Removed and Reserved)

Item 5. Other Information

There have been no events which are required to be reported under this item.

Item 6. Exhibits.

| Exhibit No. | Description | |

| 10.1 | Amendment 1 to Tarsin Acquisition Agreement dated as of Oct 4, 2011 between Consorteum Holdings, Inc. and Tarsin (Europe) LTD (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on November 4, 2011). | |

| 31.1 | Certification of Chief Executive Officer Pursuant to the Securities Exchange Act of 1934, Rules 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 31.2 | Certification of Chief Financial Officer Pursuant to the Securities Exchange Act of 1934, Rules 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 32 | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 101 | Interactive Data Files |

| 21 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CONSORTEUM HOLDINGS, INC. | ||

| Dated: February 21, 2012 | ||

| By: | /s/ Joseph R. Cellura | |

| Joseph R. Cellura | ||

| Chief Executive Officer and Chief Financial Officer | ||

| (Principal Executive Officer, Principal Financial | ||

| Officer and Principal Accounting Officer) | ||

| 22 |