Attached files

| file | filename |

|---|---|

| EX-32 - Consorteum Holdings, Inc. | v241169_ex32.htm |

| EX-31.1 - Consorteum Holdings, Inc. | v241169_ex31-1.htm |

| EX-31.2 - Consorteum Holdings, Inc. | v241169_ex31-2.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2011

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ______________ TO ______________

Consorteum Holdings Inc.

(Exact Name of Company as Specified in its Charter)

|

Nevada

|

45-2671583

|

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer

|

|

|

Incorporation or Organization)

|

Identification No.)

|

101 Church Street, Suite 14, Los Gatos, California 95030

(Address of Principal Executive Offices)

(888) 702-3410

(Company's Telephone Number)

(Former Name, Former Address, and Former Fiscal Year,

if Changed Since Last Report)

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) been subject to such filing requirements for the past 90 days.

Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer (Do not check if a smaller reporting company) ¨

|

Smaller reporting company x

|

Indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ¨ No x.

As of November 21, 2011, the Company had 304,147,714 shares of common stock issued and outstanding.

Transitional Small Business Disclosure Format (check one): Yes ¨ No x

CONSORTEUM HOLDINGS, INC.)

FORM 10-Q

FOR THE QUARTER ENDED SEPTEMBER 30, 2011

TABLE OF CONTENTS

|

PART I – FINANCIAL INFORMATION

|

|

|

ITEM 1 – FINANCIAL STATEMENTS

|

3

|

|

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

17

|

|

ITEM 3 – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

22

|

|

ITEM 4 – CONTROLS AND PROCEDURES

|

23

|

|

PART II – OTHER INFORMATION

|

24

|

|

ITEM 1 – LEGAL PROCEEDINGS

|

24

|

|

ITEM 1A – RISK FACTORS

|

24

|

|

ITEM 2 – UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

24

|

|

ITEM 3 – DEFAULTS UPON SENIOR SECURITIES

|

24

|

|

ITEM 4 – (REMOVED AND RESERVED)

|

24

|

|

ITEM 5 – OTHER INFORMATION

|

24

|

|

ITEM 6 – EXHIBITS

|

24

|

2

(A Development Stage Company)

CONSOLIDATED BALANCE SHEETS

|

September 30,

|

June 30,

|

|||||||

|

2011

|

2011

|

|||||||

|

|

(Unaudited)

|

(Audited)

|

||||||

| ASSETS | ||||||||

|

Current Assets:

|

||||||||

|

Cash

|

$ | - | $ | 3,641 | ||||

|

Other receivable

|

- | - | ||||||

|

Deferred finance charges

|

4,227 | 8,394 | ||||||

|

Total current assets

|

4,227 | 12,035 | ||||||

|

Property and equipment, net of accumulated depreciation

|

3,643 | 3,938 | ||||||

|

Total assets

|

$ | 7,870 | $ | 15,973 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current Liabilities:

|

||||||||

|

Bank overdraft

|

$ | 323 | $ | - | ||||

|

Accounts payable and accrued expenses

|

703,593 | 745,478 | ||||||

|

Bank indebtedness

|

148,064 | 158,307 | ||||||

|

Loans payable-short term

|

938,448 | 964,087 | ||||||

|

Convertible promissory notes

|

2,382,226 | 163,235 | ||||||

|

Due to stockholders

|

489 | 523 | ||||||

|

Total current liabilities

|

4,173,143 | 2,031,630 | ||||||

|

Convertible loans payable, net of short-term portion

|

419,651 | 364,062 | ||||||

| 4,592,794 | 2,423,690 | |||||||

|

Stockholders' Deficit:

|

||||||||

|

Preferred stock, $0.001 par value, 100,000,000 shares authorized:8,000,000 issued and outstanding at September 30, 2011

|

8,000 | - | ||||||

|

Common stock; $.001 par value; 500,000,000 shares authorized;304,147,714 issued and outstanding

|

304,148 | 304,148 | ||||||

|

Collateralized shares issued

|

(137,500 | ) | (137,500 | ) | ||||

|

Additional paid-in capital

|

3,223,529 | 3,135,529 | ||||||

|

Accumulated other comprehensive loss

|

(79,053 | ) | (171,509 | ) | ||||

|

Deficit accumulated during the development stage

|

(7,904,048 | ) | (5,538,385 | ) | ||||

|

Total stockholders’ deficit

|

(4,584,924 | ) | (2,407,717 | ) | ||||

|

Total liabilities and stockholders’ deficit

|

$ | 7,870 | $ | 15,973 | ||||

See Notes to Unaudited Consolidated Financial Statements.

3

Consorteum Holdings Inc.

(A Development Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS

|

Cumulative from

|

||||||||||||

|

Inception

|

||||||||||||

|

(November 7, 2005)

|

||||||||||||

|

Three Months ended September 30,

|

Through

|

|||||||||||

|

2011

|

2010

|

September 30, 2011

|

||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

||||||||||

|

Revenues:

|

$ | - | $ | - | $ | 248,290 | ||||||

|

Operating expenses:

|

||||||||||||

|

Selling, General and administration expenses

|

228,357 | 69,742 | 5,153,847 | |||||||||

|

Total operating expenses

|

228,357 | 69,742 | 5,153,847 | |||||||||

|

Operating loss

|

(228,357 | ) | (69,742 | ) | (4,905,557 | ) | ||||||

|

Other expense:

|

||||||||||||

|

Equity in net loss of an affiliated company

|

- | - | (282,474 | ) | ||||||||

|

Impairment of an investment in affiliated company

|

- | - | (78,783 | ) | ||||||||

|

Gain on debt restructuring

|

- | - | 78,684 | |||||||||

|

Interest expense

|

(63,660 | ) | (49,746 | ) | (642,272 | ) | ||||||

| (63,660 | ) | (49,746 | ) | (924,845 | ) | |||||||

|

Net loss

|

(292,017 | ) | (119,488 | ) | (5,830,402 | ) | ||||||

|

Foreign currency translation adjustment

|

92,456 | (46,136 | ) | (79,053 | ) | |||||||

|

Comprehensive loss

|

$ | (199,561 | ) | $ | (165,624 | ) | $ | (5,751,349 | ) | |||

|

Basic and diluted loss per common share

|

$ | (0.00 | ) | $ | (0.00 | ) | ||||||

|

Basic and diluted weighted average common shares outstanding

|

304,147,714 | 97,646,022 | ||||||||||

See Notes to Unaudited Consolidated Financial Statements.

4

Consorteum Holdings Inc.

(A Development Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

Cumulative from

|

||||||||||||

|

Inception

|

||||||||||||

|

(November 7, 2005)

|

||||||||||||

|

Three Months Ended September 30,

|

Through

|

|||||||||||

|

2011

|

2010

|

September 30, 2011

|

||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net loss

|

$ | (292,017 | ) | $ | (119,488 | ) | $ | (5,830,402 | ) | |||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||||||

|

Equity in net of an affiliated company

|

- | - | 282,474 | |||||||||

|

Impairment in investment of an affiliated company

|

- | - | 78,213 | |||||||||

|

Depreciation

|

295 | 398 | 15,267 | |||||||||

|

Stock issued on reverse merger

|

- | - | 35,579 | |||||||||

|

Gain on forgiveness or restructuring of debt

|

- | - | (385,567 | ) | ||||||||

|

Fair value of options

|

- | - | 158,436 | |||||||||

|

Amortization of debt discount

|

15,938 | - | 15,938 | |||||||||

|

Amortization of deferred finance charges

|

3,624 | 13,695 | 54,619 | |||||||||

|

Impairment of intangible asset

|

- | - | 10,279 | |||||||||

|

Fair value of common shares issued for services

|

- | - | 63,000 | |||||||||

|

Fair value of preferred shares issued for services

|

96,000 | - | 96,000 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Other receivable

|

- | (23 | ) | 8,423 | ||||||||

|

Accounts payable and accrued liabilities

|

(6,599 | ) | 41,480 | 2,969,563 | ||||||||

|

Accrued interest

|

64,819 | - | 251,428 | |||||||||

|

Net cash used in operating activities

|

(117,940 | ) | (63,938 | ) | (2,176,750 | ) | ||||||

|

Cash flows used in investing activities:

|

||||||||||||

|

Capital expenditures

|

- | - | (19,249 | ) | ||||||||

|

Acquisition of investment in affiliated company

|

- | - | (277,102 | ) | ||||||||

|

Net cash used in investing activities

|

- | - | (296,351 | ) | ||||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Proceeds from loans

|

- | 36,050 | 1,881,472 | |||||||||

|

Repayment of loans

|

- | (9,141 | ) | (217,811 | ) | |||||||

|

Proceeds from bank indebtedness

|

- | - | 141,691 | |||||||||

|

Repayment of bank indebtedness

|

- | (9,527 | ) | (16,392 | ) | |||||||

|

Proceeds from issuance of capital stock

|

- | - | 131,074 | |||||||||

|

Proceeds from stockholders' advances

|

- | 41,238 | 1,710,419 | |||||||||

|

Repayment of stockholders' advances

|

- | - | (1,327,888 | ) | ||||||||

|

Proceeds from the issuance of convertible promissory notes

|

114,000 | - | 238,301 | |||||||||

|

Net cash provided by financing activities

|

114,000 | 58,620 | 2,540,866 | |||||||||

|

Effect of exchange rate on cash

|

(24 | ) | 223 | (68,088 | ) | |||||||

|

Net decrease in cash

|

(3,964 | ) | (5,095 | ) | (323 | ) | ||||||

|

Cash, beginning of period

|

3,641 | 9,110 | - | |||||||||

|

Cash, end of period

|

$ | (323 | ) | $ | 4,015 | $ | (323 | ) | ||||

|

Supplemental disclosures of cash flow information:

|

||||||||||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for income taxes

|

$ | - | $ | - | $ | - | ||||||

|

Non-cash investing and financing activities:

|

||||||||||||

|

Fair value of shares to satisfy obligations under loan payable

|

$ | - | $ | 48,000 | $ | 83,670 | ||||||

|

Fair value of shares to satisfy certain liabilities

|

$ | - | $ | - | $ | 180,000 | ||||||

|

Fair value of shares to satisfy obligations to stockholders

|

$ | - | $ | - | $ | 261,539 | ||||||

|

Carrying value of shares issued from treasury stock

|

$ | - | $ | - | $ | 17,835 | ||||||

|

Fair value of convertible notes issued related to acquisition

|

$ | 2,073,646 | $ | - | $ | 2,073,646 | ||||||

|

Fair value of loans payable issued to satisfy certain liabilities

|

$ | - | $ | - | $ | - | ||||||

See Notes to Unaudited Consolidated Financial Statements.

5

Consorteum Holdings Inc.

(A Development stage Company)

STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT)

From Inception (November 7, 2007) to September 30, 2011

| Discount on |

Accumulated Other

|

Retained

Earnings

|

Total

|

|||||||||||||||||||||||||||||||||||||||||

|

Series A Preferred Stock

|

Common Stock

|

Common

|

Collateralized

|

Treasury

|

Additional

|

Comprehensive

|

(Accumulated

|

Stockholders'

|

||||||||||||||||||||||||||||||||||||

|

Shares

|

$ |

Shares

|

$ |

Stock

|

Shares Issued

|

Stock

|

Paid-in Capital

|

Income (loss)

|

Deficit)

|

Equity (Deficit)

|

||||||||||||||||||||||||||||||||||

|

Balance, November 7, 2005

|

- | $ | - | 39,999,750 | $ | 40,000 | $ | (40,000 | ) | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||||||||||||

| - | ||||||||||||||||||||||||||||||||||||||||||||

|

Common stock issued at inception

|

- | - | 24,000,000 | 24,000 | (23,900 | ) | - | - | - | - | - | 100 | ||||||||||||||||||||||||||||||||

|

Common stock issued for cash

|

- | - | 3,200,000 | 3,200 | 12,800 | - | - | - | - | - | 16,000 | |||||||||||||||||||||||||||||||||

|

Net income

|

- | - | - | - | - | - | - | - | 467 | 467 | ||||||||||||||||||||||||||||||||||

|

Ending balance, December 31, 2005

|

- | - | 67,199,750 | 67,200 | (51,100 | ) | - | - | - | 467 | 16,567 | |||||||||||||||||||||||||||||||||

|

Common stock issued for cash

|

- | - | 2,250,000 | 2,250 | 9,000 | - | - | - | - | - | 11,250 | |||||||||||||||||||||||||||||||||

|

Common stock issued for services rendered

|

- | - | 400,000 | 400 | 5,600 | - | - | - | - | - | 6,000 | |||||||||||||||||||||||||||||||||

|

Services contributed by stockholder

|

- | - | - | - | 10,320 | - | - | - | - | - | 10,320 | |||||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (24,960 | ) | (24,960 | ) | |||||||||||||||||||||||||||||||

|

Ending balance, December 31, 2006

|

- | - | 69,849,750 | 69,850 | (26,180 | ) | - | - | - | (24,493 | ) | 19,177 | ||||||||||||||||||||||||||||||||

|

Stockholder contributions

|

- | - | - | - | - | - | - | 6,085 | - | - | 6,085 | |||||||||||||||||||||||||||||||||

|

Services contributed by stockholder

|

- | - | - | - | - | - | - | 2,400 | - | - | 2,400 | |||||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (38,862 | ) | (38,862 | ) | |||||||||||||||||||||||||||||||

|

Ending balance, December 31, 2007

|

- | - | 69,849,750 | 69,850 | (26,180 | ) | - | - | 8,485 | - | (63,355 | ) | (11,200 | ) | ||||||||||||||||||||||||||||||

|

Common stock issued for cash

|

- | - | 10,000 | 10 | - | - | - | - | - | - | 10 | |||||||||||||||||||||||||||||||||

|

Stockholder contributions

|

- | - | - | - | - | - | - | 4,174 | - | - | 4,174 | |||||||||||||||||||||||||||||||||

|

Services contributed by stockholder

|

- | - | - | - | - | - | - | 1,700 | - | - | 1,700 | |||||||||||||||||||||||||||||||||

|

Recapitalization on reverse merger

|

- | - | - | - | (8,015 | ) | - | - | (14,359 | ) | (51,077 | ) | (802,144 | ) | (875,595 | ) | ||||||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | - | - | (30,722 | ) | - | (30,722 | ) | |||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | (999,247 | ) | (999,247 | ) | ||||||||||||||||||||||||||||||||

|

Ending balance, June 30, 2008

|

- | - | 69,859,750 | 69,860 | (34,195 | ) | - | - | - | (81,799 | ) | (1,864,746 | ) | (1,910,880 | ) | |||||||||||||||||||||||||||||

|

Stock cancellation

|

- | - | (23,000,000 | ) | (23,000 | ) | 23,000 | - | - | - | - | |||||||||||||||||||||||||||||||||

|

Assumptions of liabilities and loan on reverse merger transaction

|

- | - | - | - | (105,029 | ) | - | - | - | (105,029 | ) | |||||||||||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | - | 232,841 | 232,841 | |||||||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | (1,158,534 | ) | (1,158,534 | ) | ||||||||||||||||||||||||||||||||

|

Ending balance, June 30, 2009

|

- | - | 46,859,750 | 46,860 | (116,224 | ) | - | - | - | 151,042 | (3,023,280 | ) | (2,941,602 | ) | ||||||||||||||||||||||||||||||

|

Shares issued for market awareness

|

- | - | 3,280,000 | 3,280 | (3,280 | ) | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||

|

Shares issued for cash

|

- | - | 300,000 | 300 | 119,504 | - | - | 11,184 | - | - | 130,988 | |||||||||||||||||||||||||||||||||

|

Shares issued for services rendered

|

- | - | 30,300,000 | 30,300 | - | (137,500 | ) | - | 1,143,200 | - | - | 1,036,000 | ||||||||||||||||||||||||||||||||

|

Shares issued from term note

|

- | - | 1,500,000 | 1,500 | - | - | - | 388,397 | - | - | 389,897 | |||||||||||||||||||||||||||||||||

|

Shares issued to extinguish debt

|

- | - | 27,000,000 | 27,000 | - | - | - | 138,500 | - | - | 165,500 | |||||||||||||||||||||||||||||||||

|

Shares returned to treasury

|

- | - | (15,286,035 | ) | (15,286 | ) | - | - | 15,286 | - | - | - | - | |||||||||||||||||||||||||||||||

|

Options issued

|

- | - | - | - | - | - | - | 158,436 | - | - | 158,436 | |||||||||||||||||||||||||||||||||

|

Forgiveness of debt

|

- | - | - | - | - | - | - | 898,191 | - | - | 898,191 | |||||||||||||||||||||||||||||||||

|

Foreign currency translation

|

- | - | - | - | - | - | - | - | (205,736 | ) | - | (205,736 | ) | |||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | (1,599,348 | ) | (1,599,348 | ) | ||||||||||||||||||||||||||||||||

|

Ending balance, June 30, 2010

|

- | - | 93,953,715 | 93,954 | - | (137,500 | ) | 15,286 | 2,737,908 | (54,694 | ) | (4,622,628 | ) | (1,967,674 | ) | |||||||||||||||||||||||||||||

|

Fair value of shares issued for services

|

- | - | 23,000,000 | 23,000 | - | - | - | 40,000 | - | - | 63,000 | |||||||||||||||||||||||||||||||||

|

Fair value of shares issued in lieu of interest

|

- | - | 1,500,000 | 1,500 | - | - | - | 3,000 | - | - | 4,500 | |||||||||||||||||||||||||||||||||

|

Fair value of shares issued to satisfy obligations under loans payable

|

- | - | 37,498,000 | 37,498 | - | - | - | 46,172 | - | - | 83,670 | |||||||||||||||||||||||||||||||||

|

Fair value of shares issued to satisfy certain liabilities

|

- | - | 61,000,000 | 61,000 | - | - | - | 119,000 | - | - | 180,000 | |||||||||||||||||||||||||||||||||

|

Fair value of shares to satisfy obligations to shareholders

|

- | - | 73,160,999 | 73,161 | - | - | - | 188,198 | - | - | 261,359 | |||||||||||||||||||||||||||||||||

|

Shares issued from treasury

|

- | - | 17,835,000 | 17,835 | - | - | (15,286 | ) | (2,549 | ) | - | - | - | |||||||||||||||||||||||||||||||

|

Shares returned to treasury

|

- | - | (3,800,000 | ) | (3,800 | ) | - | - | - | 3,800 | - | - | - | |||||||||||||||||||||||||||||||

|

Foreign currency translation

|

- | - | - | - | - | - | - | - | (116,815 | ) | - | (116,815 | ) | |||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | (915,757 | ) | (915,757 | ) | ||||||||||||||||||||||||||||||||

|

Ending balance, June 30, 2011

|

- | - | 304,147,714 | $ | 304,148 | - | (137,500 | ) | - | 3,135,529 | (171,509 | ) | (5,538,385 | ) | (2,407,717 | ) | ||||||||||||||||||||||||||||

|

Fair value of preferred stock issued for services

|

8,000,000 | 8,000 | - | - | - | - | - | 88,000 | - | - | 96,000 | |||||||||||||||||||||||||||||||||

|

Foreign currency translation

|

- | - | - | - | - | - | - | - | 92,456 | - | 92,456 | |||||||||||||||||||||||||||||||||

|

Distributions

|

- | - | - | - | - | - | - | - | - | (2,073,646 | ) | (2,073,646 | ) | |||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (292,017 | ) | (292,017 | ) | |||||||||||||||||||||||||||||||

|

Ending balance, September 30, 2011 (unaudited)

|

8,000,000 | $ | 8,000 | 304,147,714 | $ | 304,148 | - | $ | (137,500 | ) | $ | - | $ | 3,223,529 | $ | (79,053 | ) | $ | (7,904,048 | ) | $ | (4,584,924 | ) | |||||||||||||||||||||

See Notes to Unaudited Consolidated Financial Statements.

6

Consorteum Holdings Inc.

(A DEVELOPMENT STAGE COMPANY)

(Unaudited)

|

1.

|

Organization, Development Stage Activities, and Going Concern

|

Consorteum Holdings, Inc. ("Holdings" and subsequent to the reverse merger, the “Company”), formerly known as Implex Corporation, was incorporated in the State of Nevada on November 7, 2005. On April 9, 2009, Holdings changed its name to Consorteum Holdings, Inc.

On June 15, 2009 Holdings entered into an agreement and plan of exchange whereby Holdings acquired 100% of the issued and outstanding shares of common stock of Consorteum Inc. (“Consorteum”) from Consorteum's stockholders, by exchanging 39,999,750 shares of Holdings’ common stock, in a reverse merger transaction. Consorteum is a company incorporated under the laws of the province of Ontario on April 3, 2006. Prior to the agreement and plan of exchange, Holdings had 29,860,000 shares of its common stock, issued and outstanding. At the closing of the exchange transaction, Holdings cancelled 23,000,000 shares of its common stock held by one stockholder. As a result of the exchange, the principal stockholders of Consorteum controlled 85% of Holdings.

On June 6, 2011, the Company entered into an asset purchase agreement (the “Consorteum Purchase Agreement”) with Media Exchange Group, Inc. (“MEXI”) pursuant to which the Company agreed to buy, transfer and assign to the Company, and MEXI has agreed to sell all of the rights, title and interests to, and agreements relating to, its digital trading card business and platform as well as all other intangible assets of the business in exchange for the Company assuming an aggregate principal and accrued interest amount of approximately $2.1 million of indebtedness of MEXI in accordance with the terms of that certain assignment and assumption agreement executed on June 6, 2011. Such rights include, but are not limited to, MEXI’s name, phone number and listing, goodwill and other intangible assets (including its rights to any intellectual property or proprietary technology), as well as the MEXI’s rights under certain licensing agreements.

On November 21, 2011 Consorteum Holdings Inc. changed its name to game2MOBILE International Corporation.

Going Concern Assumption

The Company's consolidated financial statements are presented on a going concern basis, which contemplates the realization of assets and discharge of liabilities in the normal course of business. The Company's negative working capital and accumulated deficit during the development stage raise substantial doubt as to its ability to continue as a going concern. As of September 30, 2011, the Company had a deficit accumulated during the development stage of approximately $7.9 million and incurred a loss of approximately $292,000 for the period.

The Company's continuance as a going concern is dependent on the successful efforts of its management to secure additional equity or debt financing. In the event that such financing is not secured, the Company will not be able to satisfy its liabilities. Furthermore, certain debt is overdue and is secured by all assets of the Company. Management is attempting to restructure some of its debt and secure additional financing to satisfy its existing obligations and provide for sufficient working capital to meet its future obligations but there are no guarantees that it will be able to do so.

The accompanying consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the inability of the Company to continue as a going concern.

7

The foregoing unaudited financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information. Accordingly, these financial statements do not include all of the disclosures required by generally accepted accounting principles in the United States of America for complete financial statements. These unaudited interim financial statements should be read in conjunction with the audited financial statements for the period ended June 30, 2011. In the opinion of management, the unaudited interim financial statements furnished herein include adjustments, all of which are of a normal recuing nature, necessary for a fair statement of the results for all the interim periods presented. Operating results for the three-month period ending September 30, 2011 are not necessarily indicative of the results that may be expected for the year ended June 30, 2012.

|

2.

|

Summary of Significant Accounting Policies

|

The accounting policies of the Company are in accordance with accounting principles generally accepted in the United States of America, and their basis of application is consistent with that of the previous year. Set forth below are the Company's significant accounting policies:

|

|

a)

|

Basis of Presentation

|

The consolidated financial statements include the accounts of game2MOBILE International Corporation, Consorteum Inc., and My Golf Rewards Canada, Inc. All significant intercompany balances and transactions are eliminated in consolidation. The merger of Holdings and Consorteum has been recorded as a recapitalization of Holdings, with the net assets of Consorteum and Holdings brought forward at their historical bases and represents a continuation of the financial statements of Consorteum. The substance of the Company’s share issuance and the reorganization is a transaction which results in Consorteum becoming a listed public entity through Holdings’ acquisition of Consorteum's net assets.

|

|

b)

|

Cash and cash equivalents

|

Cash and cash equivalents comprise bank balances and short-term bank deposits with an original maturity of three months or less.

|

|

c)

|

Equipment, Net

|

Equipment is recorded at cost. Depreciation, based on the estimated useful life of the equipment, is provided at an annual rate of 30% based on the declining-balance method.

|

|

d)

|

Impairment of Long Lived Assets

|

In accordance with ASC 360, "Property, plant and equipment," long lived assets to be held and used are analyzed for impairment whenever events or changes in circumstances indicate that the related carrying amounts may not be recoverable. The Company evaluates at each balance sheet date whether events and circumstances have occurred that indicate possible impairment. If there are indications of impairment, the Company uses future undiscounted cash flows of the related asset or asset grouping over the remaining life in measuring whether the assets are recoverable. In the event such cash flows are not expected to be sufficient to recover the recorded asset values, the assets are written down to their estimated fair value. Long lived assets to be disposed of are reported at the lower of carrying amount or fair value of asset less cost to sell. Management has evaluated whether the intangible asset as of June 30, 2011 is impaired. Management cannot ascertain that the carrying value of the intangible asset is recoverable. Accordingly, management has reduced the carrying value of the intangible asset at June 30, 2011 from approximately $10,000 to $0. As of September 30, 2011 the carrying value remains at $0.

|

|

e)

|

Accounts Receivable

|

The Company carries its accounts receivable at invoice amount, less an allowance for doubtful accounts. On a periodic basis, the Company evaluates its receivables and establishes an allowance for doubtful accounts, based on a history of past write-offs and collections and current credit conditions.

Other receivables are recorded at cost and represent the best estimate of the amount recoverable.

|

|

f)

|

Deferred Finance Charges

|

Deferred finance charges represent the unamortized financing costs associated with the issuance of debt instruments and are amortized over the terms of the respective financing arrangement.

8

|

|

g)

|

Revenue Recognition

|

The Company recognizes revenue based on the following criteria: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services have been rendered; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured.

|

|

h)

|

Equity Investments

|

Equity investments include entities over which the Company exercises significant influence but does not exercise control. These are accounted for using the equity method of accounting and are initially recognized at cost net of any impairment losses. The Company’s share of these entities’ profits or losses after acquisition of its interest is recognized in the statement of operations and cumulative post-acquisition movements are adjusted against the carrying amount of the investment. When the Company’s share of losses of these investments equals or exceeds the carrying amount of the investment, the Company only recognizes further losses where it has incurred obligations or made payments on behalf of the affiliate.

Joint ventures are entities over which the Company exercises control jointly with another party or parties. Joint ventures are also accounted for under the equity method as described above.

|

|

i)

|

Income Taxes

|

The Company accounts for income taxes in accordance with ASC 740, "Income Taxes." Deferred tax assets and liabilities are recorded for differences between the financial statement and tax basis of the assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is recorded for the amount of income tax payable or refundable for the period increased or decreased by the change in deferred tax assets and liabilities during the period.

|

|

j)

|

Foreign Currency Translation

|

In accordance with the provision of ASC 830, "Foreign Currency Matters," the Company, who’s functional currency is the Canadian dollar, translates its balance sheet into U.S. dollars at the prevailing rate at the balance sheet date and translates its revenues and expenses at the average rates prevailing during each reporting period. Net gains or losses resulting from the translation of financial statements are accumulated and charged directly to accumulated comprehensive income or (loss), a component of stockholders' equity or (deficit). Realized gains or losses resulting from foreign currency transactions are included in operations for the period.

|

|

k)

|

Comprehensive Income or Loss

|

The Company applies the provisions of ASC 220, “Comprehensive Income.” Unrealized gains and losses from foreign exchange translation are reported in the accompanying statements as comprehensive income or loss.

|

|

l)

|

Earnings or Loss Per Share

|

The Company utilizes the guidance per FASB Codification “ASC 260 "Earnings Per Share". Basic earnings per share is calculated on the weighted effect of all common shares issued and outstanding, and is calculated by dividing net income available to common stockholders by the weighted average shares outstanding during the period. Diluted earnings per share, which is calculated by dividing net income available to common stockholders by the weighted average number of common shares used in the basic earnings per share calculation, plus the number of common shares that would be issued assuming conversion of all potentially dilutive securities outstanding, is not presented separately as it is anti-dilutive.

|

|

m)

|

Use of Estimates

|

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Significant areas requiring the use of estimates relate to the estimated useful lives of equipment, the utilization of future income tax assets and the valuation of stock-based compensation. These estimates are based on management's best knowledge of current events and actions the Company may undertake in the future. Actual results will ultimately differ from those estimates.

9

n) Concentration of Credit Risk

ASC 825 "Financial Instruments," requires disclosure of any significant off-balance-sheet risk and credit risk concentration. The Company does not have significant off-balance-sheet risk or credit concentration. The Company maintains cash with major financial institutions. From time to time, the Company has funds on deposit with commercial banks that exceed federally insured limits. Management does not consider this to be a significant credit risk as these banks and financial institutions have good standing.

|

|

o)

|

Recent Accounting Pronouncements

|

The FASB issues ASUs to amend the authoritative literature in ASC. There have been a number of ASUs to date that amend the original text of ASC. Except for the ASUs listed above, those issued to date either (i) provide supplemental guidance, (ii) are technical corrections, (iii) are not applicable to the Company or (iv) are not expected to have a significant impact on the Company.

|

3.

|

Fair Value Measurements

|

The Company adopted ASC 820 “Fair Value Measurements and Disclosures”. ASC 820 clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or a liability. As a basis for considering such assumptions, ASC 820 establishes a three-tier value hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value:

Level 1 - Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 - Other inputs that are directly or indirectly observable in the marketplace.

Level 3 - Unobservable inputs which are supported by little or no market activity.

The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Cash, bank indebtedness (Level 1), other receivables, due to stockholders, accounts payable, accrued liabilities, and loans payable (Level 2) are reflected in the balance sheets at carrying value, which approximates fair value due to the short-term nature of these instruments.

|

4.

|

Equipment, Net

|

Equipment consists of cost of computer equipment of approximately $20,000, at September 30, 2011 and June 30, 2011, respectively, and related accumulated depreciation of $17,295 and $17,000 at September 30, 2011 and June 30, 2011, respectively.

Depreciation expense amounted to approximately $295 and $398 during the nine month period ended September 30, 2011 and 2010, respectively.

|

5.

|

Intangible Asset

|

As a result of the acquisition of the intellectual property in Media Exchange Group Inc., (“MEXI”) the Company acquired an interest in the rights to a software license with a mobile content delivery platform, CAPSA, and other proprietary software necessary to operate the business. Based on management’s evaluation of the details in the transactions disclosed in Note 12 it was concluded that the asset purchase agreement between MEXI and Consorteum is a transaction consummated between two entities under common control. In accordance with ASC 845-1-S99, Transfers of Non-Monetary Assets from Promoters or Shareholders, the transfer of non-monetary assets to a company by its shareholders in exchange for stock should be recorded at the transferor’s historical cost basis in accordance with GAAP. Accordingly, MEXI’s rights, title and interests to, and agreements relating to, its digital trading card business and platform as well as all other intangible assets of the business, were valued at the historical cost basis of zero.

10

|

6.

|

Bank Indebtedness

|

Bank indebtedness is comprised of a Royal Bank of Canada (“RBC”) demand term loan and an operating credit facility. Starting July 2008, the loan was repayable on a monthly basis at $1,792 plus interest, at RBC’s prime rate plus 2% per annum. The loan was scheduled to mature in June 2013. The loan is secured by a general security agreement signed by the Company constituting a first ranking security interest in all personal properties of the Company and personal guarantees from certain stockholders.

As of September 30, 2011 the demand term loan and the operating line of credit are both in default and demands for full repayment have been made. The Company has been unable to meet any repayment terms and accordingly in 2010 RBC has commenced legal proceedings to recover the full balances due. The legal proceedings have also named an officer and a former officer as defendants under guarantees in writing by both officers acting as stockholders. As of September 30, 2011 the Company has reached a tentative agreement to settle the liability for a total of CAN$158,307 (translated into US$148,064) inclusive of all interest, penalties and costs.

|

7.

|

Loans payable and convertible promissory notes

|

Loans payable are as follows:

|

September 30,

|

June 30,

|

|||||||

|

2011

|

2011

|

|||||||

|

Loans payable, bearing interest at rates between 10% and 18% per annum. Interest payable monthly. These loans are past due, unsecured and payable on demand. Accrued interest of $98,072 and $90,926 at September 30, 2011 and June 30 2011, respectively.

|

||||||||

|

Total Loans payable

|

$ | 964,080 | $ | 992,085 | ||||

|

Convertible promissory notes, bearing interest between 5% and 18% per annum, maturing between December 2008 and November 2012. Interest payable at maturity. The promissory notes are convertible at any time at the option of the holder, into shares of common stock at a rate ranging from $0.01 to 35% discount of market.

|

||||||||

|

Accrued interest of $53,245 and $45,667 at September 30, 2011 and June 20, 2011.

|

$ | 699,508 | $ | 543,235 | ||||

|

Less: unamortized discount

|

$ | - | $ | (15,938 | ) | |||

|

Convertible promissory notes assumed in accordance with asset purchase agreement with Media Exchange Group bearing interest between 5% to 8% per annum, convertible into shares of common stock at a rate ranging from $0.004 to $0.025.

Accrued interest acquired as of July 2011 (acquisition date) totaled $57,447 and accrued interest from July 2011 to September 2011 totaled $28,723.

|

$ | 2,102,369 | $ | - | ||||

|

Less: short-term portion

|

$ | (2,382,226 | ) | $ | (163,235 | ) | ||

|

Convertible promissory notes-long-term portion

|

$ | 419,651 | $ | 364,062 | ||||

11

The Company received approximately $114,000 and $45,000 from the issuance of loans payable during the three months ended September 30, 2011 and the year ended June 30, 2011, respectively.

The Company made principal repayments on loans payable of approximately $0 and $74,000 during the three months ended September 30, 2011 and the year ended June 30, 2011, respectively.

The Company issued 37,498,000 shares of its common stock to satisfy obligations under certain loans payable aggregating approximately $84,000 during the year ended June 30, 2011. The Company did not issue any shares to satisfy obligations under certain loans payable during the three months ended September 30, 2011.

The Company recognized interest expense of approximately $64,000 and $50,000 during the three months ended September 30, 2011 and 2010, respectively.

|

8.

|

Due to Stockholders

|

The amounts due to stockholders are non-interest bearing, unsecured and have no fixed terms of repayment. From inception to June 30, 2011, stockholders advanced to the Company approximately $1.7 million and repaid $1.3 million. In addition the Company issued 73,160,999 shares of its common stock at a fair value of approximately $261,000 to satisfy certain of its obligation to such stockholders. There has been no movement in shareholder loans for the three months ended September 30, 2011.

|

9.

|

Certain Related Party Transactions

|

The Company pays some of the members of its management team through companies owned or controlled by those individuals. The payments are to the Company’s benefit and in connection with its operations, and, accordingly, are not required to be disclosed separately.

|

10.

|

Common Stock

|

The issuance of common stock during fiscal 2011 is summarized in the table below:

|

Number of

Shares of

Common Stock

|

Fair Value at

Issuance

|

Fair Value at

Issuance

(per share)

|

||||||||||

|

Services performed

|

23,000,000

|

$

|

63,000

|

$

|

0.002-0.003

|

|||||||

|

Interest payment

|

1,500,000

|

4,500

|

0.003

|

|||||||||

|

Satisfy obligations under loans payable

|

37,498,000

|

83,670

|

0.002-0.003

|

|||||||||

|

Satisfy certain liabilities

|

61,000,000

|

180,000

|

0.002-0.003

|

|||||||||

|

Satisfy due to shareholders

|

73,160,999

|

261,359

|

0.003-.004

|

|||||||||

There were no common stock issuances for the three months ended September 30, 2011.

Preferred Stock

As of September 30, 2011, the Company has 100,000,000 preferred shares authorized, having a par value of $.001 per share.

On July 8, 2011 the Company’s Board of Directors authorized the creation of 5,000,000 shares of its Series A Preferred Stock, par value $.001 per share with voting rights of 200 to 1 (the “Series A Preferred Shares”). The Series A Preferred carry conversion rights into common stock at a ratio of 1:1.

12

The Company’s Board of Directors authorized the issuance of 5,000,000 shares of the Series A Preferred to Joseph R. Cellura its CEO, as part of his compensation in accordance with the terms of his executory contract. The Series A Preferred Stock was created by a resolution of the Company’s Board of Directors and will be deemed authorized and outstanding and available for issuance upon the filing of a Certificate of Designation with the Secretary of State of the State of Nevada. When issued, the Series A Preferred Shares will be issued under an exemption from registration under Section 4(2) of the Securities Act as a transaction by an issuer not involving a public offering.

On July 8, 2011 the Company’s Board of Directors authorized the issuance of the 4,000,000 shares of the Company’s Preferred Shares to Joseph R. Cellura, the Company’s CEO, as part of his compensation in accordance with the terms of his executory contract.

On July 8, 2011 the Company’s Board of Directors authorized the issuance of the 4,000,000 shares of the Company’s Preferred Shares to Craig Fielding the CEO of Consorteum Inc., a wholly owned subsidiary of the parent company as part of his compensation in accordance with the terms of his executory contract.

The 8,000,000 preferred shares were valued at $0.012 on the date of issuance and as a result the Company recorded $96,000 of compensation expense which is included in selling, general and administrative expense.

Warrants

During fiscal 2009, the Company issued 4,140,000 warrants having an exercise price of $0.001 per share of common stock, expiring December 31, 2011. Such warrants were issued to stockholders pursuant to an equity offering.

During fiscal 2011, the Company issued 2,067,184 warrants having an exercise price of $0.015 per share of common stock, expiring in May 2006. Such warrants were issued in connection with an issuance of a convertible promissory note amounting to approximately $124,000.

During the three months ended September 30, 2011 the Company issued 325,000 five year warrants having an exercise price of $0.025 per share of common stock. Such warrants were issued in connection with an issuance of convertible notes amounting to $114,000. The Company determined that there was no intrinsic value associated with the granting of these warrants associated with this convertible note.

Options

On September 19, 2009, at a meeting of the Board of Directors, the Company granted 2,500,000 stock options pursuant to the stock option plan established by the Company.

The Company has a commitment to issue 500,000 stock options to a private investor as a bonus for a loan, and a further 50,000 stock options to an individual as a finder's fee which commitments were made on January 12, 2010. As at June 30, 2010, these options have not been issued. These stock options granted have been replaced by the issue of common shares in an equivalent number at the then current market price of $0.003 per share during fiscal 2011.

The unissued options are excluded from the stock option activity summarized below.

13

Stock option activity as of September 30, 2011 and for the year ended June 30, 2011, respectively is summarized as follows:

|

Options

|

Weighted

Average

Exercise

Price

|

Weighted

Average

Contractual

Terms

|

Aggregate

Intrinsic

Value

|

|||||||||||||

|

Outstanding at June 30, 2009

|

-

|

$

|

-

|

-

|

||||||||||||

|

Granted

|

2,500,000

|

0.15

|

||||||||||||||

|

Exercised

|

-

|

-

|

||||||||||||||

|

Expired

|

-

|

-

|

||||||||||||||

|

Outstanding at June 30, 2010

|

2,500,000

|

0.15

|

2.48

|

$

|

-

|

|||||||||||

|

Granted

|

-

|

-

|

||||||||||||||

|

Exercised

|

-

|

-

|

||||||||||||||

|

Expired

|

-

|

-

|

||||||||||||||

|

Outstanding at June 30, 2011

|

2,500,000

|

$

|

0.15

|

1.48

|

$

|

-

|

||||||||||

|

Exercisable and vested at June 30, 2011

|

2,500,000

|

$

|

0.15

|

1.48

|

$

|

-

|

||||||||||

|

Granted

|

-

|

-

|

||||||||||||||

|

Exercised

|

-

|

-

|

||||||||||||||

|

Expired

|

-

|

-

|

||||||||||||||

|

Outstanding at September 30, 2011

|

2,500,000

|

$

|

0.15

|

1.48

|

$

|

-

|

||||||||||

|

Exercisable and vested at September 30, 2011

|

2,500,000

|

$

|

0.15

|

1.48

|

$

|

-

|

||||||||||

There were no stock options issued prior to June 30, 2009.

The fair value of stock options granted was estimated at the date of grant using the Black-Scholes options pricing model. The Company used the following assumptions for determining the fair value of options granted under the Black-Scholes option pricing model:

At September 30, 2011 and June 30, 2011, respectively, there is no unrecognized expense associated with the issuance of stock options.

|

11.

|

Legal Proceedings

|

In 2010, the Royal Bank of Canada commenced an action in Toronto, Canada against a subsidiary of the Company to recover amounts allegedly due under bank indebtedness totaling $158,307. Two of the Company’s stockholders guaranteed the bank indebtedness, and the Royal Bank of Canada has joined these two individuals as defendants in the legal proceedings and is looking to these parties as part of the recovery process.

During the year ended June 30, 2011, a Consorteum Subsidiary had been involved in a number of litigation proceedings with the bank, and has reached a tentative agreement to settle the liability for a total of CAN$158,307, inclusive of all interest, penalties and costs. As of September 30, 2011, the Company reduced the value of the total liability to $148,064 to reflect the change in the exchange rate between the US Dollar and the Canadian Dollar.

|

12.

|

Acquisition

|

Asset Purchase Agreement- Media Exchange Group, Inc.

On June 6, 2011, the Company entered into an asset purchase agreement (the “Consorteum Purchase Agreement”) with Media Exchange Group, Inc. (“MEXI”) pursuant to which the Company has agreed to buy, transfer and assign to the Company, and MEXI has agreed to sell all of the rights, title and interests to, and agreements relating to, its digital trading card business and platform as well as all other intangible assets of the business in exchange for the Company assuming an aggregate principal and accrued interest amount of approximately $2.1 million of indebtedness of MEXI in accordance with the terms of that certain assignment and assumption agreement executed on June 6, 2011. Such rights include, but are not limited to, MEXI’s name, phone number and listing, goodwill and other intangible assets (including its rights to any intellectual property or proprietary technology), as well as the MEXI’s rights under certain licensing agreements.

On June 6, 2011, the Company and MEXI entered into an amendment agreement (the “Amendment Agreement”) to the Consorteum Purchase Agreement pursuant to which the parties agreed, among other things, that the obligations of the Parties to consummate the transactions contemplated by the Purchase Agreement is subject to (i) the approval of the Board of Directors of each of the parties, and (ii) the completion of the assignment of the Assumed Liabilities (including receipt of all the necessary consents of the holders of all outstanding indebtedness of the Buyer).

14

On July 14, 2011, the Company completed its due diligence and finalized the asset purchase agreement with MEXI.

A majority shareholder of MEXI and the former Chief Executive Officer, Director and Chairman of the Board of MEXI ( who resigned on June 3, 2011) organized the asset purchase agreement with MEXI.

On July 8, 2011 the former CEO of MEXI assumed the position of the Chairman and Chief Executive Officer of Consorteum Holdings, Inc. and in accordance with the Board of Director’s authorization, was issued 4,000,000 shares of Consorteum’s Preferred Shares as part of his compensation in accordance with the terms of his executory contract.

Based on management’s evaluation of the details in the transactions disclosed above it was concluded that the asset purchase agreement between MEXI and Consorteum is a transaction consummated between two entities under common control. In accordance with ASC 845-1-S99, Transfers of Non-Monetary Assets from Promoters or Shareholders, the transfer of non-monetary assets to a company by its shareholders in exchange for stock should be recorded at the transferor’s historical cost basis in accordance with GAAP. Accordingly, MEXI’s rights, title and interests to, and agreements relating to, its digital trading card business and platform as well as all other intangible assets of the business, were valued at the historical cost basis of zero.

Accordingly, the Company has accounted for the assumption of the $2,073,646 of the indebtedness of MEXI (principal and accrued interest as of July 2011) and is included in convertible notes payable in current liabilities and the corresponding debit has been accounted for as a distribution in stockholders’ deficit.

The following Unaudited pro forma consolidated results of operations have been prepared as if the acquisition of Media Exchange Group had occurred as of the following period:

|

For the three

months ended

September 30, 2010

|

||||

|

(UNAUDITED)

|

||||

|

Net revenues

|

$ | - | ||

|

Net profit (loss)

|

$ | (356,216 | ) | |

|

Net profit (loss) per share from continuing operations

|

$ | (0.00 | ) | |

|

Weighted average number of shares - Basic and diluted

|

97,646,022 | |||

15

13. Subsequent Events

Acquisition Agreement- Tarsin, Inc.

On October 4, 2011, Consorteum Holdings, Inc. (the “Company”) entered into an Acquisition Agreement (the “Agreement”) with Tarsin LTD, a company organized under the laws of the United Kingdom (“Seller”), whereby the Company purchased 100% of the issued and outstanding shares of Tarsin, Inc., a Nevada corporation (“Tarsin Subsidiary”), from Seller for a total of 100,000,000 shares of the Company’s common stock issued at a deemed issuance price of $0.12 per share. Until such time as the Company has a market capitalization equal to or greater than $100,000,000, the shares received by Seller are entitled to anti-dilution protection for certain dilutive issuances, not including issuances to employees, consultants, lenders, or other goods or service providers. Pursuant to the Agreement, Seller further agreed to, on or before December 30, 2011, grant to the Company an exclusive, royalty-free, worldwide perpetual license to use, distribute, and sell its CAPSA Mobile Platform technology in consideration for $500,000 from the Company. The Company is further obligated to provide or procure working capital to Tarsin Subsidiary as follows: (1) $750,000 no later than January 1, 2012, and (2) an additional $500,000 no later than June 1, 2012. The Agreement contains customary representations, warranties and indemnification rights and obligations of the parties. The description of the Agreement set forth above is qualified in its entirety by the full text of the Agreement, a copy of which is filed herewith as Exhibit 10.1 and is incorporated herein by this reference.

On November 4, 2011, Consorteum Holdings, Inc. (the “Company”) entered into Amendment No. 1 (the “Amendment”) to the Acquisition Agreement (the “Agreement”) with Tarsin (Europe) LTD, a company organized under the laws of the United Kingdom (“Seller”). Pursuant to the Amendment, the Company purchased 100% of the issued and outstanding shares of Tarsin, Inc., a Nevada corporation (“Tarsin Subsidiary”), from Seller for: (1) a total of 24,500,000 shares of the Company’s common stock issued at a deemed issuance price of $0.10 per share; and (2) a cash payment of $3,000,000 to Seller as follows: (i) $200,000 no later than January 30, 2012, (ii) $800,000 no later than March 31, 2012, (iii) $1,000,000 no later than July 31, 2012, and (iv) $1,000,000 no later than December 31, 2012. Further, the Company also paid in full the existing outstanding balance owed by Seller on its line of credit established with NAT West in the total amount of $90,000. Until such time as the Company has a market capitalization equal to or greater than $100,000,000, the shares received by Seller are entitled to anti-dilution protection for certain dilutive issuances, not including issuances to employees, consultants, lenders, or other goods or service providers. Pursuant to the Amendment, Seller further agreed to grant to us an exclusive, worldwide perpetual license to use, distribute, and sell its CAPSA Mobile Platform technology in consideration for a 12.5% royalty fee calculated on future net revenues from the use of the CAPSA Mobile Platform technology. The Company is further obligated to provide or procure working capital to Tarsin Subsidiary as follows: (1) $300,000 no later than December 31, 2011, and (2) an additional $250,000 no later than March 31, 2012 and (3) an additional $1,150,000 no later than December 31, 2012.

16

FORWARD LOOKING STATEMENTS.

Our Management’s Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking (within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”)). Forward-looking statements are, by their very nature, uncertain and risky. These risks and uncertainties include international, national and local general economic and market conditions; demographic changes; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other risks that might be detailed from time to time in our filings with the Securities and Exchange Commission (“SEC”).

Although the forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report and in our other reports as we attempt to advise interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

As used in this Quarterly Report, the terms “we,” “us,” and “our,” shall mean Consorteum Holdings, Inc., and our current subsidiaries Tarsin, Inc. (“Tarsin”), Media Exchange Group, Inc. (“MEXI”), and Consorteum, Inc., (“Consorteum Sub”), collectively, unless otherwise indicated.

OVERVIEW

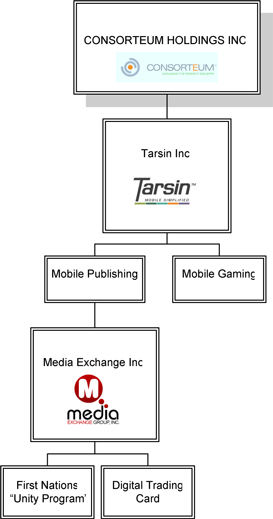

We are a holding company incorporated in the State of Nevada, with three separate wholly owned subsidiaries. Although each of our subsidiaries has its own specific market focus and has developed its own business plans, they all share a common theme that has at its core, the delivery of digital media across diverse payment transactional platforms that are rapidly converging due to advances in smart phone mobile technology.

17

As each of our subsidiaries is described in further detail below, the overall synergy of our sales strategy relies on the unique capability that each of our subsidiaries contribute. Consorteum Sub will continue to launch its initiative with the First Nations, but is hsown organizationally as reporting under the Media Exchange subsidiary.

In June 2009, we closed an exchange agreement with Consorteum Sub, pursuant to which we became a holding company and our business was conducted through Consorteum Sub. On June 6, 2011, we acquired the digital trading card business and platform, as well as all other intangible assets of MEXI. Finally, on October 4, 2011, pursuant to an acquisition agreement with Tarsin LTD, a company organized under the laws of the United Kingdom, we acquired Tarsin, as well as an exclusive, worldwide perpetual license to use, distribute, and sell the Capsa Mobile Platform technology (“CAPSA”) of Tarsin LTD.

Consorteum Sub brings together its experience in the payment processing and financial transaction markets. Recent advances in technology have enabled smart phones to develop custom applications that will allow the phone to process payments, conduct banking transactions and emulate the traditional role that Automated Teller Machines (ATM) machines now play. We intend to leverage our expertise in mobile applications development to target new opportunities to provide traditional banking and payment services to our customers.

MEXI will initially focus on reaching the 18 to 24 year old market with the introduction of mobile applications for sports and music. We intend to leverage Tarsin’s relationships with 19 of the largest mobile carriers in the world to promote MEXI’s Digital Trading Card and mobile music jukebox. As the mobile applications are adopted by this technically savvy crowd, we hope to promote our entire spectrum of products and brand ourselves as the premier provider of mobile applications in sports betting, entertainment, and financial payment services. As the college student graduates, we can continue to deliver a wide variety of services and products tailored to specific markets. In essence, we have the opportunity to organically grow our customers and expose them to our brand for life.

18

Tarsin has established capabilities in the mobile handset market which we can use to ensure cross functionality of our mobile applications across a wide variety of handsets. The ability to deliver next generation services to all customers depends on our ability to develop an application that is agnostic to the type of smart phone deployed. The CAPSA platform was developed with the specific purpose of deploying rich multimedia content across diverse handsets. We intend to leverage the initial traction that Tarsin has gained in the mobile sports betting and casino gaming vertical to monetize its applications in branded partnership relationships.

We have spent the past two years validating our business models for the First Nations project and the My Golf Rewards program. The lack of capital to launch these programs has forced us to curtail our sales and marketing activities and to focus on identifying other opportunities in which we could compete for market share and generate revenue. The recent acquisition of MEXI and Tarsin add two critical operating companies that will become the foundation for evolving our marketing strategy. Tarsin is now positioned to become a leading developer of mobile gaming on cross platform applications. The CAPSA platform facilitates our ability to develop mobile applications and can be leveraged into many different market verticals. MEXI brings together a strategy of providing digital media to mobile applications. Consorteum Sub brings expertise in the financial payment transaction industry which will be key strength as we monetize our product offerings in the future. We anticipate that in 2012 we will integrate the individual capabilities of all three subsidiaries to deliver to market a series of mobile applications in the gaming, entertainment, sports and mobile financial solutions industries.

19

LIQUIDITY AND CAPITAL RESOURCES

We had $0 cash at September 30, 2011. Our working capital deficit amounted to approximately $4.2 million at September 30, 2011.

During the three-month period ended September 30, 2011, we used cash in our operating activities amounting to approximately $118,000. Our cash used in operating activities was comprised of our net loss from continuing operations of approximately $292,000 adjusted for the following:

|

|

·

|

Amortization of debt discount of approximately $16,000;

|

|

|

·

|

Fair value of preferred shares issued for services of $96,000;

|

|

|

·

|

Amortization of deferred finance charges of approximately $3,600;

|

|

|

·

|

Depreciation of approximately $300;

|

Additionally, the following variations in operating assets and liabilities impacted our cash used in operating activity:

|

|

·

|

A decrease in our accounts payable and accrued liabilities expenses of approximately $6,600;

|

20

|

|

·

|

An increase of accrued interest of approximately $65,000, resulting from the issuance of assumed loans as a result of an acquisition;

|

During the three-month period ended September 30, 2011, we generated cash from financing activities of approximately $114,000, which consists of the proceeds from the issuance of convertible notes.

During the three-month period ended September 30, 2010, we used cash in our operating activities amounting to approximately $64,000. Our cash used in operating activities was comprised of our net loss from continuing operations of approximately $120,000 adjusted for the following:

|

|

·

|

Amortization of deferred financing of approximately $13,700;

|

|

|

·

|

Depreciation of approximately $400;

|

Additionally, the following variations in operating assets and liabilities impacted our cash used in operating activity:

|

|

·

|

An increase in our accounts payable and accrued liabilities expenses of approximately $41,500, resulting from slower payment processing due to our financial condition.

|

During the three-month period ended September 30, 2010, we generated cash from financing activities of approximately $58,600, which consist of the proceeds from the issuance of loans and due to stockholders offset by principal repayments on such debt amounting to approximately $18,700.

There are no significant commitments for the purchase of capital assets or intangible assets, or for operating leases.

The Company may continue to face significant uncertainty relating to liquidity and intends to continue to search for additional sources of working capital, and to actively search for collaborative partners. Many of the existing contracts and initiatives require capital expenditure by Consorteum to move forward and management anticipates that delays will continue if funds are not available.

RESULTS OF OPERATIONS

|

Consorteum Holdings, Inc.

|

||||||||||||||||

|

RESULTS OF OPERATIONS

|

||||||||||||||||

|

Increase/

|

Increase/

|

|||||||||||||||

|

Three Months ended

|

(Decrease)

|

(Decrease)

|

||||||||||||||

|

September 30,

|

in $ 2011

|

in % 2011

|

||||||||||||||

|

2011

|

2010

|

vs 2010

|

vs 2010

|

|||||||||||||

|

Revenues:

|

$ | - | $ | - | $ | - | 0.0 | % | ||||||||

|

Operating expenses:

|

||||||||||||||||

|

Selling, general and administrative

|

228,357 | 69,742 | 158,615 | 227.4 | % | |||||||||||

|

Total operating expenses

|

228,357 | 69,742 | 158,615 | 227.4 | % | |||||||||||

|

Operating loss

|

(228,357 | ) | (69,742 | ) | (158,615 | ) | 227.4 | % | ||||||||

|

Other expense:

|

||||||||||||||||

|

Interest expense

|

(63,660 | ) | (49,746 | ) | (13,914 | ) | 28.0 | % | ||||||||

| (63,660 | ) | (49,746 | ) | (13,914 | ) | 28.0 | % | |||||||||

|

Net loss

|

$ | (292,017 | ) | $ | (119,488 | ) | $ | (172,529 | ) | 144.4 | % | |||||

|

NM: Not Meaningful

|

||||||||||||||||

21

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses primarily consist of consultant fees related to marketing programs, which consists mostly of business development and advertising expenses, as well as other general and administrative expenses, including payroll expenses, necessary to support our marketing plans and our operations. and legal expenses and professional fees.

The increase in our selling, general, and administrative expenses during the three month period ended September 30, 2011 when compared with the prior period is primarily attributable to increased expenses, mainly compensation expense and professional fees, associated with the July 2011 acquisition.

Interest Expense

Interest consists of interest payable pursuant to stated rate on interest bearing indebtedness.

The increase in interest expense during the three month period ended September 30, 2011 when compared with the prior period is primarily due to the issuance of new convertible notes in addition to the convertible notes assumed from the MEXI acquisition.

GOING CONCERN

The Company has incurred losses since inception and the ability of the Company to continue as a going-concern depends upon its ability to develop profitable operations and to continue to raise adequate financing. Management is actively targeting sources of additional financing which would assure continuation of the Company’s operations and pilot programs. In order for the Company to meet its liabilities as they come due and to continue operations, the Company remains solely dependent upon its ability to generate such financing.

There can be no assurance that the Company will be able to continue to raise funds in which case the Company may be unable to meet its obligations. Should the Company be unable to realize on its assets and discharge its liabilities in the normal course of business, the net realizable value of its assets may be materially less than the amounts recorded on the balance sheet. The audited Consolidated Financial Statements do not include adjustments to amounts and classifications of assets and liabilities that might be necessary should the Company be unable to continue operations.

The current market conditions and volatility increase the uncertainty of the Company’s ability to continue as a going concern given the need to both curtail expenditures and to raise additional funds. The Company is and has experienced negative operating cash flows and needs to invest in continuing pilot projects and operating partnerships which cannot be met from existing cash balances. The Company will continue to search for new funds and for new collaborative partners for the projects but anticipates that the current market conditions may impact the ability to source such funds.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 (“Exchange Act”) and are not required to provide the information under this item.

22

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures.

As of September 30, 2011, the end of the period covered by this report, we conducted, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”)) in ensuring that information required to be disclosed by us in our reports is recorded, processed, summarized and reported within the required time periods. Based on that evaluation, the Chief Executive Officer and Chief Financial Officer concluded concluded that, as of September 30, 2011, our disclosure controls and procedures were ineffective at the reasonable assurance level in timely alerting him to material information required to be included in our periodic SEC reports as a result of the material weakness in internal control over financial reporting discussed below. Management’s assessment of the effectiveness of internal control over financial reporting is expressed at the level of reasonable assurance because a control system, no matter how well designed and operated, can provide only reasonable, but not absolute, assurance that the control system’s objectives will be met.

Management’s Quarterly Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Exchange Act Rule 13a-15(f). Our internal control system is a process designed by, or under the supervision of, its principal executive and principal financial officer, or persons performing similar functions, and effected by our Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. GAAP.

Our internal control over financial reporting includes policies and procedures that pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect transactions and dispositions of assets; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with U.S. GAAP, and that receipts and expenditures are being made only in accordance with the authorization of our management and directors; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our consolidated financial statements.

Because of our inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.