Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ESSA Bancorp, Inc. | d273189d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - ESSA Bancorp, Inc. | d273189dex21.htm |

| EX-99.1 - NEWS RELEASE - ESSA Bancorp, Inc. | d273189dex991.htm |

Exhibit 99.2

ESSA Bancorp, Inc.

Acquisition of First Star Bancorp, Inc.

1 | Page

Forward Looking Statements

Certain statements contained in this document that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the proposed merger of ESSA and First Star. These statements include statements regarding the anticipated closing date of the transaction and anticipated future results. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Certain factors that could cause actual results to differ materially from expected results include delays in completing the merger, difficulties in achieving cost savings from the merger or in achieving such cost savings within the expected time frame, difficulties in integrating ESSA, ESSA Bank, First Star, and First Star Bank, increased competitive pressures, changes in the interest rate environment, changes in general economic conditions, legislative and regulatory changes that adversely affect the business in which ESSA, ESSA Bank, First Star, and First Star Bank are engaged, changes in the securities markets and other risks and uncertainties disclosed from time to time in documents that First Star files with its regulators.

2 | Page

Additional Information and Where to Find It

ESSA will be filing a registration statement containing a proxy statement/prospectus and other documents regarding the proposed transaction with the SEC. First Star stockholders are urged to read the proxy statement/prospectus when it becomes available, because it will contain important information about ESSA and First Star and the proposed transaction. When available, copies of this proxy statement/prospectus will be mailed to First Star stockholders. Copies of the proxy statement/prospectus may be obtained free of charge at the SEC’s web site at http://www.sec.gov, or by directing a request to ESSA Bancorp, Inc., Attention – Investor Relations Department, 200 Palmer Street, PO Box L, Stroudsburg, PA 18360 or on its web site at www.essabank.com, or to First Star Bancorp, Inc., 418 West Broad Street, Bethlehem, PA 18018 or on its web site at www.firststarbank.com. Copies of other documents filed by ESSA with the SEC may also be obtained free of charge at the SEC’s web site or by directing a request to ESSA at the address provided above.

Participants in the Solicitation

ESSA, ESSA Bank, First Star, and First Star Bank and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of First Star in connection with the proposed merger. Information about the directors and executive officers of ESSA is set forth in the proxy statement, dated January 28, 2011, for ESSA’s 2011 annual meeting of stockholders, as filed with the SEC on Schedule 14A. Information about the directors and executive officers of First Star is set forth in the proxy statement, dated October 1, 2011, for First Star’s 2011 annual meeting of stockholders as found on First Star’s web site at www.firststarbank.com. Additional information regarding the interests of such participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus when it becomes available.

3 | Page

Transaction Data

| • | Deal value at announcement: $24.2 million (Based on ESSA Bancorp’s closing price of $10.50 per share on December 21, 2011) |

| • | Fully diluted First Star shares: 2,160,502 |

| • | Aggregate deal value to fully diluted tangible book: 84% |

| • | Aggregate deal value to deposits: 7.5% |

| • | Closing anticipated at end of second quarter 2012. |

| • | Immediately accretive to earnings, absent transaction related expenses. Expect accretion of $0.05 per share in the first clean quarter. |

| • | Cost savings of 30% over 2 years |

| • | Fully converted tangible book dilution of 9.5% |

| • | Pro-forma tangible capital-to-tangible assets of 10.74% |

4 | Page

Key Rationales for the Transaction

| • | Enhances ESSA’s franchise value by creating a $1.5 billion bank encompassing Monroe County and the Lehigh Valley. |

| • | Post transaction ESSA will have 34% of its deposits and 53% of its full service branches in Lehigh Valley. No branch closings are planned. |

| • | ESSA’s long –term strategic plan targets significant growth in the Lehigh Valley and this transaction accomplishes that goal. |

| • | Absent an acquisition, meaningful growth in the Lehigh Valley through organic means would be difficult. |

| • | Transaction is immediately accretive to earnings, excluding deal related expenses. |

| • | Dilution to tangible book is projected to be recovered in about 2.5 years. |

5 | Page

Other Transaction Data

| 1) | Consideration is 50% cash / 50% stock and based on the following formula (refer to chart on page 5): |

| a. | 10% collar: A fixed exchange ratio of 1.0665 per share if ESSA’s Closing Price is between $9.77 per share and $11.94 per share. |

| b. | 10% to 20% collar: |

| i. | A fixed price of $12.73 per share if ESSA’s Closing Price is between $11.94 per share and $13.02 per share. |

| ii. | A fixed price of $10.42 per share if ESSA’s Closing Price is between $8.68 per share and $9.77 per share. |

| c. | Over 20%: |

| i. | A fixed exchange ratio of 0.9780 if ESSA’s Closing Prices is above $13.02 per share. |

| ii. | A fixed exchange ratio of 1.2004 if ESSA’s Closing Price is below $8.68 per share. |

| 2) | Walkaways: |

| a. | First Star will have the right to terminate if the ESSA’s stock price declines to less than $8.14 per share. |

| b. | ESSA has right to cure. |

| 3) | One seat on the ESSA Bancorp and ESSA B&T boards. |

| 4) | ESSA has the right to terminate if: |

| a. | the investment portfolio realizes net losses from securities sales or other than temporary impairment write-downs in excess of $4.25 million; or |

| b. | if the aggregate amount of Delinquent Loans equals or exceeds $19.3 million as of any month end prior to the Closing Date. |

6 | Page

Pricing Variations

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|||||||||||||||||||||||||||||

| ESSA Stock |

ESSA | ESSA | Price Offered to |

Breakdown of Consideration In millions $ |

Shares Issued |

Pro- Forma First Star |

||||||||||||||||||||||||||||||||

| Price | Price/ | Share | Exch. | First | In | In | Aggreg. | in | Owner- | |||||||||||||||||||||||||||||

| Change |

Book |

Price |

Ratio |

Star |

Cash |

Stock |

Cons. |

Thous. |

ship |

|||||||||||||||||||||||||||||

| 30.0 | % | 107 | % | $ | 14.11 | 0.9780 | $ | 13.80 | $ | 14.9 | $ | 14.9 | $ | 29.8 | 1,057 | 8.0 | % | |||||||||||||||||||||

| 27.5 | 105 | 13.83 | 0.9780 | 13.53 | 14.6 | 14.6 | 29.2 | 1,057 | 8.0 | |||||||||||||||||||||||||||||

| 25.0 | 103 | 13.56 | 0.9780 | 13.26 | 14.3 | 14.3 | 28.7 | 1,057 | 8.0 | |||||||||||||||||||||||||||||

| 22.5 | 101 | 13.29 | 0.9780 | 13.00 | 14.0 | 14.0 | 28.1 | 1,057 | 8.0 | |||||||||||||||||||||||||||||

| 20.0 | 99 | 13.02 | 0.9780 | 12.73 | 13.8 | 13.8 | 27.5 | 1,057 | 8.0 | |||||||||||||||||||||||||||||

| 17.5 | 97 | 12.75 | 0.9987 | 12.73 | 13.8 | 13.8 | 27.5 | 1,079 | 8.2 | |||||||||||||||||||||||||||||

| 15.0 | 95 | 12.48 | 1.0203 | 12.73 | 13.8 | 13.8 | 27.5 | 1,102 | 8.3 | |||||||||||||||||||||||||||||

| 12.5 | 93 | 12.21 | 1.0429 | 12.73 | 13.8 | 13.8 | 27.5 | 1,127 | 8.5 | |||||||||||||||||||||||||||||

| 10.0 | 90 | 11.94 | 1.0665 | 12.73 | 13.8 | 13.8 | 27.5 | 1,152 | 8.7 | |||||||||||||||||||||||||||||

| 7.5 | 88 | 11.66 | 1.0665 | 12.44 | 13.4 | 13.4 | 26.9 | 1,152 | 8.7 | |||||||||||||||||||||||||||||

| 5.0 | 86 | 11.39 | 1.0665 | 12.15 | 13.1 | 13.1 | 26.2 | 1,152 | 8.7 | |||||||||||||||||||||||||||||

| 2.5 | 84 | 11.12 | 1.0665 | 11.86 | 12.8 | 12.8 | 25.6 | 1,152 | 8.7 | |||||||||||||||||||||||||||||

| 0.0 | 82 | 10.85 | 1.0665 | 11.57 | 12.5 | 12.5 | 25.0 | 1,152 | 8.7 | |||||||||||||||||||||||||||||

| (2.5 | ) | 80 | 10.58 | 1.0665 | 11.28 | 12.2 | 12.2 | 24.4 | 1,152 | 8.7 | ||||||||||||||||||||||||||||

| (5.0 | ) | 78 | 10.31 | 1.0665 | 11.00 | 11.9 | 11.9 | 23.8 | 1,152 | 8.7 | ||||||||||||||||||||||||||||

| (7.5 | ) | 76 | 10.04 | 1.0665 | 10.71 | 11.6 | 11.6 | 23.1 | 1,152 | 8.7 | ||||||||||||||||||||||||||||

| (10.0 | ) | 74 | 9.77 | 1.0665 | 10.42 | 11.3 | 11.3 | 22.5 | 1,152 | 8.7 | ||||||||||||||||||||||||||||

| (12.5 | ) | 72 | 9.49 | 1.0980 | 10.42 | 11.3 | 11.3 | 22.5 | 1,186 | 8.9 | ||||||||||||||||||||||||||||

| (15.0 | ) | 70 | 9.22 | 1.1301 | 10.42 | 11.3 | 11.3 | 22.5 | 1,221 | 9.2 | ||||||||||||||||||||||||||||

| (17.5 | ) | 68 | 8.95 | 1.1642 | 10.42 | 11.3 | 11.3 | 22.5 | 1,258 | 9.4 | ||||||||||||||||||||||||||||

| (20.0 | ) | 66 | 8.68 | 1.2004 | 10.42 | 11.3 | 11.3 | 22.5 | 1,297 | 9.7 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (22.5 | ) | 64 | 8.41 | 1.2004 | 10.10 | 10.9 | 10.9 | 21.8 | 1,297 | 9.7 | ||||||||||||||||||||||||||||

| (25.0 | ) | 62 | 8.14 | 1.2004 | 9.77 | 10.6 | 10.6 | 21.1 | 1,297 | 9.7 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

7 | Page

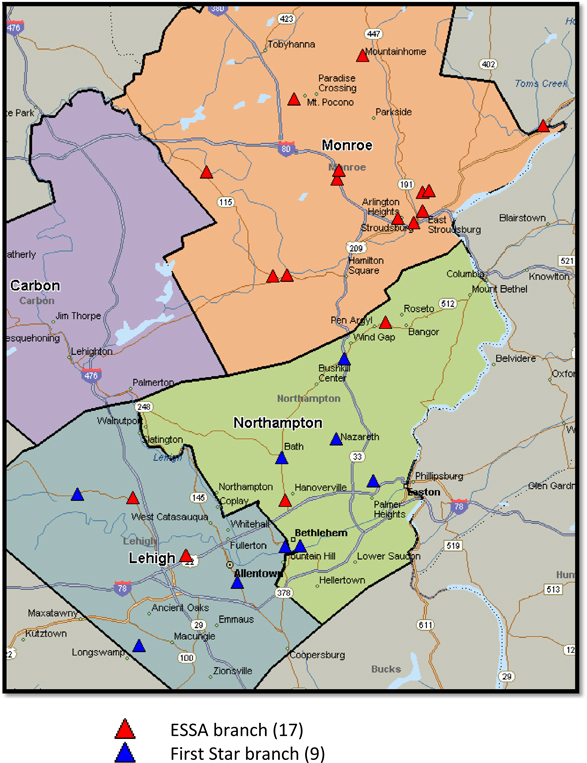

ESSA and First Star

Branch Map

8 | Page