Attached files

| file | filename |

|---|---|

| 8-K - HINES GLOBAL REIT FISHER PLAZA CLOSE 8-K - HGR Liquidating Trust | fisherplaza8k.htm |

| EX-99.1 - HINES GLOBAL REIT FISHER PLAZA PRESS RELEASE - HGR Liquidating Trust | fisher_pressrelease.htm |

PURCHASE AND SALE AGREEMENT

between

FISHER MEDIA SERVICES COMPANY,

a Washington corporation

as SELLER

and

HINES GLOBAL REIT 100/140 FOURTH AVE LLC,

a Delaware limited liability company

as BUYER

DATED: November 17, 2011

HOU03:1282498.8

09648-0050/LEGAL22127382.1

23147-0002/LEGAL22147789.3

TABLE OF CONTENTS

Page

ARTICLE 1. PURCHASE AND SALE

1.1 Agreement to Buy and Sell

LIST OF EXHIBITS

EXHIBIT A Legal Description of Property

EXHIBIT B List of Excluded Personal Property and Excluded Permits

EXHIBIT C List of Due Diligence Materials

EXHIBIT D Commercial Real Property Disclosure Statement

EXHIBIT E List of Existing Leases and Security Deposits

EXHIBIT F List of Existing Service Contracts

EXHIBIT G List of Existing Environmental Reports

EXHIBIT H List of Existing Warranties

EXHIBIT I-1 Form of Tenant Estoppel Certificate

EXHIBIT I-2 Form of Landlord Estoppel Certificate

EXHIBIT J Form of Fisher Lease

EXHIBIT K Form of Rooftop Easement

EXHIBIT L Form of Deed

EXHIBIT M Form of Bill of Sale

EXHIBIT N Form of Assignment and Assumption Agreement

EXHIBIT O Form of General Assignment

EXHIBIT P Form of Tenant Notice

EXHIBIT Q Form of Reimbursement Agreement

HOU03:1282498.8

09648-0050/LEGAL22127382.1

23147-0002/LEGAL22147789.3

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (“Agreement”) is made and entered into as of this 17th day of November, 2011 (“Effective Date”), by and between FISHER MEDIA SERVICES COMPANY, a Washington corporation (“Seller”), and HINES GLOBAL REIT 100/140 FOURTH AVE LLC, a Delaware limited liability company (“Buyer”).

RECITALS:

A. Seller owns certain land (“Land”) in the City of Seattle, County of King, State of Washington as more particularly described on EXHIBIT A attached hereto, which is commonly known as “Fisher Plaza.” The Land is comprised of two tax parcels (King County Tax Parcel Nos. 1991200150 and 1991200170) and is bound by Denny Way to the south, John Street to the north, Fourth Avenue North to the west and Fifth Avenue North to the east.

B. The Land is improved with two buildings, one commonly known as 100 Fourth Avenue North, Seattle, Washington 98109 (“Fisher Plaza West”), which contains six (6) stories and approximately 99,488 square feet, and the second commonly known as 140 Fourth Avenue North, Seattle, Washington 98109 (“Fisher Plaza East”), which contains five (5) stories and approximately 194,239 square feet (such buildings together, “Buildings”). The Land is also improved with a subterranean parking structure containing 504 stalls (“Parking Structure”).

C. Seller and its affiliates occupy approximately 120,969 square feet in Fisher Plaza East (“Fisher Occupied Space”), which occupancy is undocumented by any lease or other agreement, given that Seller owns the property. Different office, data center, retail, media, co-location and carrier tenants occupy other space within the Buildings pursuant to various existing leases.

D. Prior to entering into this Agreement, Seller and its affiliates invited certain parties to participate in a confidential process to select (“Selection Process”) an entity to purchase the Property (defined below) and lease back portions thereof. During the Selection Process, Seller made available to Buyer various documents, information and other materials related to the Property and Buyer began its due diligence review of the Property. Seller has selected Buyer to purchase the Property and is entering into this Agreement with Buyer in lieu of other potential purchasers (“Potential Purchasers”).

E. Between its initial selection and finalization of this Agreement, Buyer completed its due diligence review of the Land, Buildings, Parking Structure and other components of the Property to its complete satisfaction. Buyer now desires to purchase from Seller the Land, Buildings, Parking Structure and other components of the Property. Seller desires to sell to Buyer the Land, Buildings, Parking Structure and other components of the Property on the condition that Buyer leases back to Fisher Communications, Inc., a Washington corporation and an affiliate of Seller (“Fisher Communications”), the Fisher Occupied Space, together with such other space and rights at Fisher Plaza as are necessary or desirable for the continued occupation and operations of Seller and its affiliates (which, among other affiliates, shall include Fisher Communications throughout this Agreement) at Fisher Plaza.

F. The parties now wish to enter into this Agreement to set forth the terms and conditions under which Buyer will purchase the Property from Seller and the terms and conditions under which Buyer will lease back to Fisher Communications the Fisher Occupied Space.

NOW THEREFORE, for good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, Seller and Buyer agree as follows:

ARTICLE 1. PURCHASE AND SALE

1.1 Agreement to Buy and Sell

. Subject to all of the terms and conditions of this Agreement, Seller hereby agrees to sell to Buyer, and Buyer hereby agrees to purchase from Seller the following (collectively, “Property”):

1.1.1 The Land, together with all of Seller’s right, title and interest in and to all rights, licenses, privileges, reversions and easements appurtenant to the Land including, without limitation, all minerals, oil, gas and other hydrocarbon substances on and under the Land, as well as all air rights, water rights, water and water stock relating to the Land, and all other appurtenances thereto;

1.1.2 All improvements, buildings, plazas, and other structures located on the Land, including, without limitation, the Buildings and Parking Structure, and all infrastructure and building fixtures located on or in any such improvements (collectively, “Improvements” and together with the Land, “Real Property”);

1.1.3 All of Seller’s right, title and interest in and to all systems, appliances, equipment, machinery, generators, furniture, furnishings, decorations, supplies, above-ground storage tanks located in the Parking Structure (and any fuel therein as of the Closing Date (defined in Section 7.1), except for any fuel in any jet fuel tank used for refueling helicopters) and other personal property, if any, owned by Seller and located on or about the Real Property and used in the operation and maintenance thereof (collectively, “Tangible Personal Property”);

1.1.4 All of Seller’s right, title and interest in and to the following intangible personal property, to the extent any is owned by Seller and freely transferable, which is related to the ownership or operation of the Real Property: all development rights, franchises, certificates of occupancy, soil and other reports and studies, surveys, maps, utility contracts, and data relating to the operation or construction of the Real Property, architect’s contracts, plans and specifications, engineering plans and studies, floor plans and landscape plans (collectively, “Intangible Personal Property”). Seller may retain copies of each of the foregoing items;

1.1.5 The Existing Leases (defined in Section 5.2.3) and any other leases, occupancy licenses or other occupancy agreements affecting the Real Property that may be made by Seller after the Effective Date as permitted by this Agreement (collectively, such permitted agreements and the Existing Leases, “Leases”). Notwithstanding the foregoing, the Existing Leases shall not include, and Seller hereby expressly reserves, that certain Office Space Lease between Seller and LUT, LLC, a Washington limited liability company, dated March 10, 2010 (“LUT Lease”). LUT shall not be considered an Existing Occupant (defined in Section 4.4) as such term is used in this Agreement;

1.1.6 All of Seller’s right, title and interest in and to the Existing Service Contracts (defined in Section 5.2.4) and any other service contracts affecting the Property that may be made by Seller after the Effective Date as permitted by this Agreement (collectively, such permitted contracts and the Existing Service Contracts, “Service Contracts”), subject to Section 5.5.3 below;

1.1.7 All freely transferable Existing Warranties held by Seller (defined in Section 5.2.8); and

1.1.8 All freely transferable land use permits, building permits, variances, water certificates or claims and other certificates, permits, licenses and approvals held by Seller pertaining to the Property or the operation thereof (collectively, “Transferable Permits”). Any of the foregoing items that are transferable, but require a particular transfer process or governmental or other third-party approval, shall not be deemed “freely transferable” (such permits being referred to herein as the “Process Permits,” and together with the Transferable Permits, “Permits”), but shall be considered a part of the Property and transferred pursuant to Section 5.5.4 below.

1.2 Exclusions from Property

. Notwithstanding anything in Section 1.1 above to the contrary, the term “Property” shall not include, and Seller hereby expressly reserves to itself all of the following owned by Seller: (a) any Tangible Personal Property located within the Fisher Occupied Space or otherwise on or about the Real Property in any space occupied by Seller or its affiliates under the Fisher Lease, Rooftop Easement and Storage Space Agreement (all as defined in Section 5.7); (b) any cars, trucks, vans, helicopters or similar vehicles owned by Seller or its affiliates located on, around or outside of the Real Property (including any leasehold interests therein); (c) all of Seller’s and its affiliates’ trademarks, service marks, logos and other marks, trade or business names, and other proprietary information and other similar intangible property, if any (provided that Buyer shall have the right to use the name “Fisher Plaza”, “Fisher Plaza East” and “Fisher Plaza West” as the existing names of the Buildings pursuant to the terms of the Fisher Lease); (d) the Plaza Telecom System, PlazaNet System and any Connection Lines (as each of the foregoing terms are defined in Section 5.5.8 and Section 5.5.9), but only to the extent described in Sections 5.5.8 and 5.5.9; and (e) any of the other items listed on EXHIBIT B attached hereto. Buyer acknowledges that it is the intent of the parties that Seller and its affiliates be allowed to retain all Property necessary for Seller’s or its affiliates’ continued operations at the Real Property in the same manner as Seller and its affiliates operate as of the Effective Date. If any such Property is not expressly excluded herein or has been inadvertently left off EXHIBIT B, the parties shall work together in good faith after Closing to effectuate the foregoing intent. This Section 1.2 shall survive Closing.

ARTICLE 2. PURCHASE PRICE

2.1 Purchase Price

. The purchase price for the Property shall be One Hundred Sixty Million and No/100 Dollars ($160,000,000.00) (“Purchase Price”). In order to timely pay an approximation of the real estate excise tax which is due, the parties agree, for the immediate tax reporting obligation only, that the real property allocation is One Hundred Fifty Nine Million Four Hundred Thousand and No/100 Dollars ($159,400,000.00) and that the remaining portion of the Purchase Price is allocated to personal property. Seller may contest the value of the real property with the appropriate taxing authority. The Buyer’s personal property tax liability shall not be increased from that existing at the Closing unless the parties have mutually agreed upon such change, except as follows. Buyer shall indemnify and hold harmless Seller and its affiliates from and against all costs, penalties and other liabilities that may arise in the event that any applicable taxing authority disagrees with the above personal property allocation. In no event shall the foregoing indemnity obligation be applicable for any personal property tax obligations of Seller with respect to years prior to the year in which Closing occurs. This indemnification shall survive Closing.

In connection with the purchase of the Property, Seller or one of its Affiliates has agreed to pay to Buyer certain Reimbursement Payments as defined in, and under the terms and conditions set forth in, the Reimbursement Agreement defined in Section 7.2.1(l) below. Any such Reimbursement Payments that are made by Seller or its Affiliates to Buyer pursuant to the Reimbursement Agreement shall be treated by the parties as an adjustment to (i.e., reduction in) the Purchase Price, subject to the then prevailing accounting rules and tax regulations.

2.2 Payment of Purchase Price

. The Purchase Price shall be paid as follows:

2.2.1 Deposit. The parties shall open an escrow account (“Escrow”) with First American Title Insurance Company, at its office located at 818 Stewart Street, Suite 800, Seattle, Washington 98101 (in its capacity as escrow agent, “Escrow Agent”). No later than the end of the next business day following the Effective Date, Buyer shall deliver into Escrow Ten Million and No/100 Dollars ($10,000,000.00) by wire transfer of immediately available federal funds to be held by Escrow Agent as an earnest money deposit (“Deposit”). Escrow Agent shall invest the Deposit in any reasonable manner as agreed upon by Seller and Buyer. Any interest that may accrue on the Deposit as a result of such investment will accrue for the benefit of Buyer; provided, however, that if Seller is entitled to the Deposit under the terms of this Agreement, other than for application to the Purchase Price at Closing, then all interest accrued on the Deposit will be paid to Seller with the Deposit. The Deposit shall be non-refundable, except as otherwise expressly set forth herein. If Buyer fails to timely make the Deposit, (x) Seller shall have the right to terminate this Agreement upon written notice delivered to Buyer and Escrow Agent, and (y) neither party shall have any further rights or obligations hereunder, except obligations hereunder that survive termination of this Agreement. The Deposit shall be applied to the Purchase Price at Closing.

2.2.2 Closing Payment. The Purchase Price, as adjusted by the application of the Deposit and any Extension Deposit (as defined in Section 7.1) and by the prorations and credits specified herein, and together with all Closing costs to be paid by Buyer as set forth on Buyer’s estimated settlement statement (“Buyer’s Closing Payment”), shall be paid to Escrow Agent by wire transfer of immediately available federal funds through Escrow no later than one (1) business day before the Closing Date.

ARTICLE 3. TITLE TO PROPERTY

3.1 Review of Title

.

3.1.1 Prior to the Effective Date, Seller provided Buyer with (a) an ALTA Commitment for an owner’s standard coverage policy of title insurance, prepared by First American Title Insurance Company (in its capacity as title company, “Title Company”), under File No. NCS-487994-WA1, having an effective date of November 7, 2011, along with copies of all of the documents referenced as special exceptions therein (“Preliminary Report”), and (b) an ALTA survey of the Real Property prepared by Bush, Roed & Hitchings, Inc. under Job No. 2002249.02 dated August 29, 2011 (“Survey”). Buyer acknowledges that it had the opportunity to review the Preliminary Report and Survey prior to the Effective Date. Buyer does not object to Special Exception Nos. 4, 8 through 11, 14 (to the extent such exception covers all Leases and Occupants) and 15 of the Preliminary Report, both parties acknowledging, however, that Special Exception Nos. 5-7 and 11 have been deleted by the Title Company and will not be included in Buyer’s Policy.

3.1.2 Within one (1) business day after the Effective Date, Seller shall deliver to Buyer an update of the Preliminary Report along with copies of all of the documents referenced as new exceptions therein (“Updated Report”). By giving written notice to Seller on or before the date that is one (1) business day after receiving the Updated Report, Buyer may object to the following exceptions only noted in the Updated Report: (a) any new matters shown on the Updated Report or (b) any material discrepancies between the Updated Report and the information shown on the Survey. Buyer shall not have the right to object to any of the matters deemed Permitted Exceptions pursuant to Section 3.1.2.2 below. If any supplements to the Updated Report are issued after the Updated Report has been delivered to Buyer, Buyer shall have one (1) business day from its receipt of such supplement to object to any new matters shown thereon in accordance with the same limitations as provided above in this Section 3.1.2. The Preliminary Report, Updated Report and any supplements thereto shall be collectively referred to herein as the “Title Report.”

3.1.2.1 Buyer shall be deemed to have approved title to the Real Property as shown in the Title Report unless Buyer timely objects to any title exception as required in this Section 3.1. If Buyer timely makes any such objection, Seller may, by giving notice to Buyer within one (1) business day after Buyer’s objection notice, elect either to remove such objection(s) or not to remove such objection(s). If Seller fails to timely respond to Buyer’s objection notice, Seller shall be deemed to have elected not to remove the objection(s) noted in Buyer’s notice. If Seller elects to remove any such objection(s), Seller shall remove, or otherwise cure to Buyer’s reasonable satisfaction, the title exception in question on or before the Closing Date at Seller’s expense. If Seller elects (or is deemed to have elected) not to remove any such objection(s), Buyer shall have the right, by giving written notice to Seller within one (1) business day after Seller’s election not to remove (or deemed election not to remove), either to terminate this Agreement or to withdraw such objection(s) by giving written notice to Seller. If Buyer does not timely terminate this Agreement in accordance with the foregoing sentence, Buyer shall be deemed to have approved title to the Real Property subject to the title exception(s) in question.

3.1.2.2 Notwithstanding anything herein to the contrary, Seller shall remove on or before the Closing Date (a) any mortgages, deeds of trust or other monetary liens (except as noted in clauses (iii), (v) and (vii) below) encumbering the Real Property and (b) any exceptions or encumbrances to title that are created by Seller after the Effective Date without Buyer’s written consent. The term “Permitted Exceptions” as used herein shall mean (i) the exceptions in the Title Report approved (or deemed approved) by Buyer pursuant to this Section 3.1, (ii) all matters shown on the Survey, (iii) non-delinquent real and personal property taxes, (iv) the Leases, the Fisher Lease and the Rooftop Easement, (v) matters attributable to acts of Buyer and/or its members, managers, partners, directors, officers, employees, consultants, agents, contractors, affiliates and other representatives (“Buyer Parties”), (vi) provisions of existing laws, rules and regulations including, without limitation, building, zoning and environmental laws, and (vii) any non-delinquent lien for municipal betterments and special assessments assessed against the Real Property.

3.1.2.3 If, on or before the Closing Date, Seller does not remove or cure any title exception that Seller agreed to remove or cure or is required to remove according to the terms of this Section 3.1, then Buyer shall have the right to terminate this Agreement by delivering written notice thereof to Seller. If this Agreement is terminated as provided in this Section 3.1.2.3, then the Deposit (and any Extension Deposit) shall be returned to Buyer, Buyer shall receive the Liquidated Damages Payment from Seller, Escrow shall be terminated and all documents and funds delivered into Escrow shall be returned to the party that deposited the same (except as otherwise provided herein), Seller shall pay any costs associated with terminating Escrow or cancelling the Title Report, and neither party shall have any further rights or obligations hereunder, except as expressly stated herein. All other elections to terminate this Agreement under this Section 3.1 shall have a similar effect, except that both Buyer and Seller shall equally pay any costs associated with terminating Escrow or cancelling the Title Report.

3.2 Conveyance

. On the Closing Date, Seller shall convey to Buyer fee simple title to the Real Property by a duly executed and acknowledged Special Warranty Deed (“Deed”), free and clear of all defects and encumbrances other than the Permitted Exceptions.

3.3 Buyer’s Policy

. Seller shall cause Title Company to issue to Buyer at Closing an ALTA extended coverage owner’s policy of title insurance insuring Buyer’s title to the Real Property in the full amount of the Purchase Price, subject only to the Permitted Exceptions and those general exceptions and exclusions that are customary in such extended form of title insurance (“Buyer’s Policy”). Buyer may request that Title Company issue special endorsements to Buyer’s Policy. Seller shall furnish to Title Company any documents that Title Company reasonably requires to issue such extended coverage or special endorsements reasonably requested by Buyer; provided, however, that such documents shall be acceptable to Seller, in its reasonable discretion, and Seller shall not be required to incur any non-customary additional obligations, liabilities, or expenses associated with such extended coverage and Seller shall not be required to incur any additional obligations, liabilities, or expenses associated with any special endorsements requested by Buyer. Buyer shall be fully responsible for paying the additional costs associated with any extended coverage and special endorsements that it requests. In no event shall the issuance of special endorsements be a condition of Closing, and Closing shall timely proceed so long as an extended coverage owner’s policy will be issued pursuant to the first sentence of this Section 3.3 and Title Company is irrevocably committed to issue extended coverage, subject only to the payment of the applicable costs therefor and the delivery of the required documents from Seller.

3.4 Seller’s Policy

. Seller shall have the right to request that Title Company provide a simultaneously-issued seller’s policy of title insurance at Closing (“Seller’s Policy”), at Seller’s sole cost and expense which policy shall be subject only to the same exceptions as provided in Buyer’s Policy. Seller shall notify Buyer and Title Company no later than one (1) business day before the scheduled Closing Date if Seller elects to obtain Seller’s Policy. In no event shall the issuance of Seller’s Policy be a condition of the Closing.

ARTICLE 4. CONDITION OF THE PROPERTY

4.1 Deliveries Made by Seller

. Buyer acknowledges that, prior to the Effective Date, Seller delivered, and Buyer has received or was provided access to, all of the materials listed on EXHIBIT C attached hereto (“Due Diligence Materials”). Except as expressly set forth in this Agreement, Buyer acknowledges and agrees that neither Seller nor its affiliates or any of such parties’ directors, officers, agents, contractors, employees or other representatives (such affiliates and parties collectively, “Seller Parties”) make, and have not made, any warranty or representation with respect to the accuracy, completeness, conclusions or statements expressed in the Due Diligence Materials, nor do Seller or the Seller Parties represent or warrant that these are the sole materials that were or now are available with respect to the matters covered thereby, and Buyer hereby waives, relinquishes and releases any and all Claims (defined in Section 4.4.1) against Seller or any of the Seller Parties arising out of the accuracy, completeness, conclusions or statements expressed in the Due Diligence Materials.

4.2 Disclosure Statement

. Buyer and Seller acknowledge that the Real Property constitutes “Commercial Real Estate” as defined in RCW 64.06.005. Buyer waives receipt of the seller disclosure statement required under RCW 64.06 for transactions involving the sale of commercial real estate, except for the section entitled “Environmental.” A completed copy of the Environmental section of the seller disclosure statement is attached to this Agreement as EXHIBIT D (“Disclosure Statement”). A fully executed original of the completed Disclosure Statement will be delivered to Buyer as soon as practicable after the Effective Date hereof. Buyer waives its right to rescind this Agreement under RCW 64.06.030. Buyer further acknowledges and agrees that the Disclosure Statement (a) is for the purposes of disclosure only, (b) is not and will not be part of this Agreement, and (c) is not and will not be construed as a representation or warranty of any kind by Seller.

4.3 “AS-IS” Sale and Release

.

4.3.1 Prior Due Diligence. Buyer acknowledges and agrees that (a) prior to the Effective Date, Buyer and Seller negotiated the purchase and sale of the Property for some time, (b) during such time, Buyer had ample opportunity to review the Due Diligence Materials and to otherwise make any and all legal, factual and other inquiries, studies, reviews and investigations as Buyer deemed necessary, desirable or appropriate with respect to the Property, and (c) Buyer is fully satisfied with its prior review of the Due Diligence Materials, all such investigations and all aspects of the Property. Buyer therefore agrees that its purchase of the Property shall not be conditioned on the results of any of Buyer’s prior or future inquiries, studies and investigations and hereby waives any and all of such rights. Buyer further acknowledges that, during the parties’ prior negotiation, Seller disclosed to Buyer that the outdoor fountain located in the southeast corner of Fisher Plaza is not operational. Buyer agrees that Seller shall not have any obligation whatsoever to repair such fountain and that Buyer shall take the Property, including the fountain, in its current “AS-IS, WHERE-IS” condition as set forth in Section 4.3.2 below.

4.3.2 As-Is” Sale. EXCEPT THOSE REPRESENTATIONS AND WARRANTIES PROVIDED IN SECTION 5.2 BELOW AND ANY OTHER DOCUMENT EXECUTED AND DELIVERED BY SELLER OR FISHER COMMUNICATIONS AT CLOSING, BUYER ACKNOWLEDGES AND AGREES THAT BUYER IS PURCHASING THE PROPERTY IN AN “AS-IS, WHERE-IS” CONDITION “WITH ALL FAULTS AND DEFECTS”, WHETHER KNOWN OR UNKNOWN, AND WITHOUT ANY WARRANTIES, REPRESENTATIONS OR GUARANTEES, EITHER EXPRESSED OR IMPLIED, OF ANY KIND OR NATURE WHATSOEVER FROM OR ON BEHALF OF SELLER OR ANY OF THE SELLER PARTIES, INCLUDING WITHOUT LIMITATION, THOSE OF FITNESS FOR A PARTICULAR PURPOSE AND USE. Buyer acknowledges and agrees that (a) Buyer is a knowledgeable, experienced and sophisticated buyer of real estate, (b) except as otherwise expressly set forth in Section 5.2 below or in any other document executed and delivered by Seller or Fisher Communications at Closing, neither Seller, the Seller Parties nor anyone acting for or on behalf of any of them, has made any representation, warranty, promise or statement, express or implied, to Buyer or the Buyer Parties, or to anyone acting for or on behalf of any of them, concerning any aspect of or condition affecting the Property, the use or development thereof or its fitness or any particular purpose, and (c) although Buyer had access to the Due Diligence Materials, and notwithstanding the representations made by Seller in Section 5.2 below or any other document executed and delivered by Seller or Fisher Communications at Closing, Buyer is entering into this Agreement to purchase the Property based solely upon its own investigation and examination of the Property and upon the representations and warranties made by Seller in Sections 5.2 and 11.17 hereof as qualified therein. Therefore, as of Closing, Buyer assumes the risk of all defects and conditions affecting the Property, whether known or unknown, including but not limited to such defects and conditions that cannot be observed by casual inspection, and Buyer assumes the risk that adverse matters affecting the Property, including but not limited to adverse physical and environmental conditions, may not have been revealed by Buyer’s due diligence performed with respect to the Property or the Due Diligence Materials.

4.3.3 Release. By executing this Agreement, Buyer will be deemed to have (a) made all studies, investigations and inspections that Buyer deemed necessary, appropriate or desirable in connection with Buyer’s purchase of the Property, (b) fully satisfied itself with its review of all such studies, investigations and inspections, the Due Diligence Materials and all aspects of the Property, and (c) approved each of the foregoing and this transaction without reservation. Except as expressly provided in this Agreement, Buyer hereby waives, relinquishes and releases, on behalf of itself, the Buyer Parties and their successors and assigns, Seller and the Seller Parties from any and all Claims that Buyer has or may have arising from or related to any matter or thing in connection with the Property, including, without limitation, any documents provided by Seller or any Seller Party hereunder, any construction defects, errors or omissions in the design or construction of the Property and any environmental conditions affecting the Property, and Buyer shall not look to Seller or the Seller Parties in connection with any of the foregoing for any redress or relief; provided, however, that Buyer is not releasing Seller from any claims arising from Seller’s fraud or intentional misrepresentations (“Non-Released Claims”). The release in this Section 4.3.3 shall be given full force and effect according to each of its expressed terms and provisions and shall apply to all Claims, regardless of whether such Claims are known or unknown, suspected or unsuspected. Notwithstanding the foregoing, the waivers, releases and other matters set forth in this Section 4.3.3 shall not limit Buyer’s right to implead or otherwise seek joinder of Seller with respect to any claims for reimbursement or contribution arising from Non-Released Claims.

4.3.4 Buyer’s Knowledge. Without limiting the generality of the release contained in Section 4.3.3 above, and notwithstanding anything in this Agreement to the contrary, neither Seller nor the Seller Parties shall have any liability whatsoever with regard to any matter of which Buyer or the Buyer Parties have actual knowledge (as defined in Section 5.1.4 below) prior to Closing. By executing this Agreement, Buyer waives any such Claims; by Closing, Buyer shall be deemed to have waived any such Claims; and Buyer shall not be entitled to “reserve” any such Claims of which it or the Buyer Parties have actual knowledge at Closing.

4.3.5 Survival. The provisions of this Section 4.3 shall indefinitely survive any Closing or termination of this Agreement.

Seller and Buyer each initial this Section 4.3 below to expressly acknowledge that the waivers, releases and other terms herein have been specifically negotiated and agreed upon and to further indicate their awareness and acceptance of each and every provision hereof.

Seller’s Initials: Buyer’s Initials:

4.4 Continued Access to the Property

.

4.4.1 Access. Buyer and the Buyer Parties will have the right to enter the Real Property, at reasonable times and at their own risk and expense, through and including the Closing Date in order to confirm any existing or to conduct any further studies, inquiries, or investigations or to take inventories, survey areas, monitor conditions, prepare reports and otherwise prepare to take title to the Property, subject to the terms and conditions of this Section 4.4; provided, however, that Buyer’s purchase of the Property shall not be conditioned on the results of any such confirmation or additional studies. Buyer shall not unreasonably interfere with the use of the Property by any existing tenant, licensee or other occupant of the Real Property under any Existing Lease (“Existing Occupants,” which definition shall not include LUT) or any tenant, licensee, or other occupant of the Property under any Lease entered into after the Effective Date as authorized herein (“New Occupant” and together with the Existing Occupants, “Occupants”). Buyer shall not unreasonably interfere with Seller’s or its affiliates’ use of the Property. Buyer shall not conduct any invasive or intrusive testing, studies, or investigations, such as a phase two environmental assessment, without Seller’s prior written consent. Buyer shall provide Seller with reasonable prior written notice (or notice by electronic mail) of its desire to enter the Real Property for such purpose, which notice shall include a description of the activities to be performed and the areas of the Real Property to be accessed during such entry, and Buyer shall coordinate all such entry in advance with Cheryl Mauer, a representative of CP Management I, LLC, Seller’s Property Manager (“Property Manager”), or any other representative that Seller may designate from time to time in writing to Buyer. Seller reserves the right to have Cheryl Mauer or any other representative of Seller or Property Manager present at all times during any such access, and Seller shall use commercially reasonable efforts to have such representative available on the next business day following Buyer’s request during normal business hours. Buyer acknowledges that its access to certain Occupant spaces within the Real Property may be prohibited or limited by that Occupant’s Lease, or may require Buyer to execute a non-disclosure or confidentiality agreement. Buyer agrees that it shall not have access to such spaces unless it complies with such limitations and executes any reasonable non-disclosure or confidentiality agreement as required by the Occupant. As a condition of such entry, Buyer agrees to (a) obtain, carry and provide evidence to Seller of not less than Two Million and No/100 Dollars ($2,000,000.00) worth of commercial general liability insurance with a contractual liability endorsement insuring Buyer’s indemnity obligations hereunder, (b) pay when due all costs of activities performed by Buyer or the Buyer Parties in connection with such activities, (c) restore promptly any physical damage caused by such activities, and (d) defend, indemnify and save Seller and the Seller Parties harmless from any and all liabilities, costs, damages, expenses (including, but not limited to, attorneys’ fees and other professional fees and disbursements), claims, suits, actions, and losses of every name, kind and description by any person or entity as a result of or on account of any actual or alleged injuries or damages to persons or property received or sustained, or any liens filed against the Property (collectively, “Claims”) incurred by or made or brought against Seller or any of the Seller Parties which Claims in any way arise out of, in connection with, or as a result of the acts or omissions of Buyer or the Buyer Parties in exercising Buyer’s rights under this Section 4.4; provided that Buyer shall have no liability for any preexisting condition on the Property that is discovered during Buyer’s inspections, except to the extent that Buyer or any Buyer Party exacerbates any such preexisting condition. Without limiting the generality of the foregoing, Buyer assumes all liability for actions brought by any of the Buyer Parties. The obligations set forth in this Section 4.4 shall survive the expiration or any termination whatsoever of this Agreement and shall survive Closing.

4.4.2 [Intentionally Deleted].

ARTICLE 5. REPRESENTATIONS, WARRANTIES AND COVENANTS

5.1 Definitions

. As used in this Agreement, including this Article 5:

5.1.1 The phrase “to Seller’s knowledge,” means the present, actual knowledge, without any duty of inquiry or investigation other than to review the accuracy of the representation and warranty with Cheryl Mauer, Seller's Property Manager, of (a) Hassan Natha, Chief Financial Officer of Seller and (b) Robert Dunlop, Executive Vice President-Operations of Seller. Such persons have not undertaken or inquired into any independent investigation or verification of the matters set forth in any representation or warranty, including without limitation an investigation or review of any documents, certificates, agreements or information that may be in, or may hereafter come into, the possession of Seller or any of the Seller Parties. Buyer acknowledges that the individuals named above are named solely for the purpose of defining and narrowing the scope of Seller’s knowledge and not for the purpose of imposing any liability on or creating any duties running from such individuals to Buyer. Buyer covenants that it will not bring any action of any kind against such individuals related to or arising out of any representations and warranties made by Seller herein except in connection with any fraud action;

5.1.2 “Environmental Laws” means the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, the Superfund Amendments and Reauthorization Act of 1986, the Resource Conservation and Recovery Act, the Toxic Substance Control Act, and the Washington Model Toxics Control Act, all as amended, or any other similar state, local, or federal environmental law and any rules and regulations promulgated thereunder;

5.1.3 “Hazardous Materials” means any chemical, substance, material, controlled substance, object, condition, waste, living organisms or combination thereof that is or may be hazardous to human health or safety or to the environment due to its radioactivity, ignitability, corrosiveness, reactivity, explosivity, toxicity, carcinogenicity, mutagenicity, phytotoxicity, infectiousness or other harmful or potentially harmful properties or effects, including, without limitation, petroleum hydrocarbons and petroleum products, lead, asbestos, radon, polychlorinated biphenyls (PCBs) and all of those chemicals, substances, materials, controlled substances, objects, conditions, wastes, living organisms or combinations thereof that are listed, defined or regulated as of the Effective Date in any manner by any Environmental Law based upon, directly or indirectly, such properties or effects;

5.1.4 “Exception Matter” means (a) any matters disclosed by the Due Diligence Materials, (b) any matter of which Buyer or the Buyer Parties have actual knowledge prior to Closing, “actual knowledge” meaning anything clearly described in any written document given to or obtained by Buyer or the Buyer Parties in connection with the transactions contemplated in this Agreement, and (c) any waived misrepresentations (pursuant to Section 5.3); and

5.1.5 The phrases “commercially reasonable efforts” and “commercially reasonable steps” shall not impose any obligation to institute legal proceedings or to expend any monies therefor.

5.2 Seller’s Representations and Warranties

. Seller represents and warrants the following to Buyer as of the Effective Date. Each of such representations and warranties shall be deemed remade on and as of the Closing Date.

5.2.1 Due Formation and Authorization. Seller is duly organized and validly existing under the laws of the State of Washington, is qualified to do business in the State of Washington, and has all requisite power, authority and legal right to execute, deliver and perform the terms of this Agreement. This Agreement and all documents to be executed by Seller in connection herewith constitute, or will constitute when executed and delivered, valid and legally binding obligations of Seller enforceable in accordance with their terms. Each individual executing this Agreement on behalf of Seller is duly authorized to do so.

5.2.2 Consent. No consent, approval or authorization by any individual, entity, court, administrative agency or other governmental authority is required in connection with the execution and delivery of this Agreement or the consummation of the transactions contemplated herein by Seller other than those consents, approvals and authorizations that shall be obtained by Seller prior to Closing. As of Closing, the consummation of the transactions contemplated by this Agreement will not result in a breach of, or constitute a default under any agreement or other instrument to which Seller is a party or by which Seller is bound or affected.

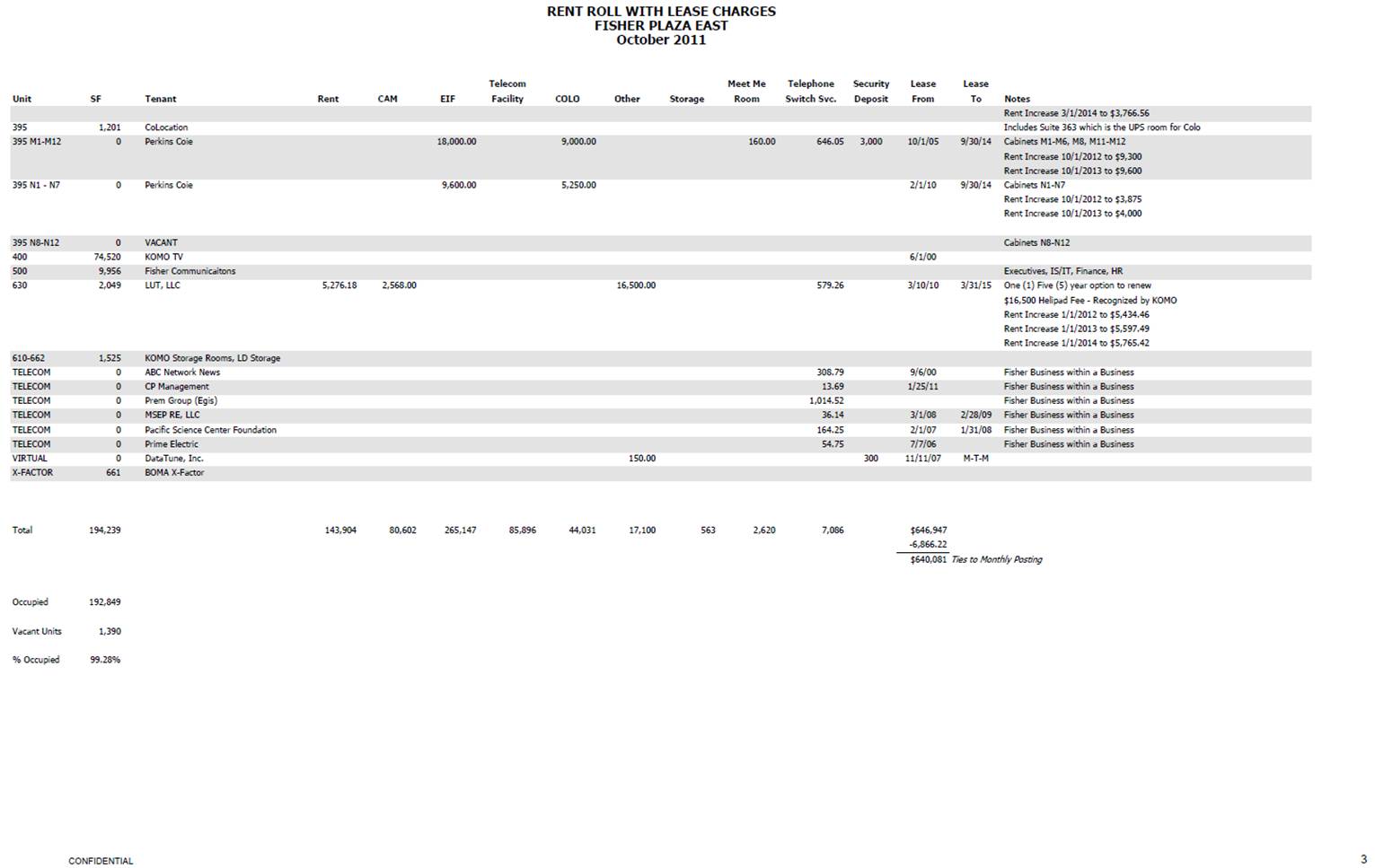

5.2.3 Existing Leases. As of the Effective Date, there are no existing leases, occupancy licenses or other occupancy agreements affecting the Real Property to which Seller is a party except as set forth on EXHIBIT E attached hereto (collectively, “Existing Leases,” which definition shall not include the LUT Lease). Seller has not given to or received from any Existing Occupant under any Existing Lease written notice of default where such default remains uncured as of the Effective Date, and to Seller’s knowledge there exists no continuing Default (as defined in such Existing Lease) under any Existing Lease as of the Effective Date. True, complete and correct copies of all Existing Leases and any amendments thereto were delivered or made available to Buyer prior to the Effective Date as a part of the Due Diligence Materials. The rent roll attached as a part of EXHIBIT E represents, as of the Effective Date, true, complete and accurate information regarding the rent schedule, the amount of security deposits and letters of credit held by Seller and the amount of prepaid rent paid to or held by Seller for each Existing Lease. There are no Leasing Costs (hereinafter defined) payable as of the Effective Date except as set forth on EXHIBIT E.

5.2.4 Service Contracts. As of the Effective Date, there are no management, maintenance, service agreements pertaining to the Property to which Seller is a party except as set forth on EXHIBIT F attached hereto (“Existing Service Contracts”). Seller has not given to or received from any party under any Existing Service Contract written notice of default where such default remains uncured as of the Effective Date, and to Seller’s knowledge there exists no continuing Default (as defined in such Existing Service Contract) under any Existing Service Contract as of the Effective Date. True, complete and correct copies of all Existing Service Contracts and any and all amendments thereto were delivered or made available to Buyer prior to the Effective Date as a part of the Due Diligence Materials.

5.2.5 Litigation; Violation of Laws. Seller has not received written notice of (a) any pending lawsuits affecting all or any material portion of Seller’s interest in the Property, (b) any pending judicial, municipal or administrative proceedings in eminent domain affecting all or any material portion of Seller’s interest in the Property, (c) except as described in the Due Diligence Materials, any violation of any term or condition of any Permit, or (d) except as described in the Due Diligence Materials, any violation of law affecting all or any material portion of the Property, including, without limitation, any violation of any applicable fire, health, building, use, occupancy, or zoning laws or any other governmental regulation.

5.2.6 Environmental Reports. A true and complete copy of the Phase I Environmental Site Assessment referenced in EXHIBIT G attached hereto (“Existing Environmental Reports”) was delivered or made available to Buyer prior to the Effective Date as a part of the Due Diligence Materials.

5.2.7 Environmental Condition. Buyer acknowledges that (a) Seller and LUT have used and stored, currently use and store and will continue to use and store certain chemicals, substances and materials in their operations of the heliport that may be considered Hazardous Materials, including but not limited to fuel and (b) Seller has used and stored, currently uses and stores and will continue to use and store reasonable quantities of chemicals, substances and materials that may be considered Hazardous Materials as are customarily maintained on-site by office, data center/network operations center, broadcast, retail, media, carrier and co-location tenants and as may be reasonably necessary for Seller to conduct all normal operations conducted by Seller with respect to the Property. Except as disclosed in the Existing Environmental Reports, any other Due Diligence Materials or this Section 5.2.7, (a) Seller has not, as of the Effective Date, generated, manufactured, refined, transported, stored, handled, disposed of or released any Hazardous Material on, in, from or onto the Property and will not intentionally take any of the foregoing actions after the Effective Date and prior to Closing, except in compliance with all Environmental Laws (provided, however, that Seller makes no representation or warranty with respect to any of the foregoing by LUT or any Occupant), (b) Seller has not received any written notice from any governmental agency of any violation of any Environmental Laws at the Real Property that has not be corrected, (c) no action has been commenced to Seller's knowledge regarding the presence of any Hazardous Material on or about the Real Property, and (d) no above- or below-ground tanks used for the storage of any Hazardous Material are present on the Real Property, other than those described in the Existing Environmental Reports included as a part of the Due Diligence Materials.

5.2.8 Existing Guaranties and Warranties. To Seller’s knowledge, all of the guaranties and warranties affecting the Property are referenced in EXHIBIT H attached hereto (“Existing Warranties”).

5.2.9 Special Assessments. Except as noted in the Title Report to Seller’s knowledge, no special assessments have been levied against the Real Property and Seller has received no notice of any proposed special assessments that may be levied against the Real Property.

5.2.10 Foreign Person. Seller is not a foreign corporation as defined in Section 1445 of the Internal Revenue Code of 1986, as amended (“IRC”).

5.2.11 ERISA. Neither Seller nor Fisher Communications is an “employee benefit plan” within the meaning of 3(3) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), a “plan” within the meaning of Section 4975 of the IRC, or an entity deemed to hold “plan assets” within the meaning of 29 C.F. R. §2510.3-101 (as modified by Section 3(42) of ERISA of any such plan.

5.2.12 Patriot Act.

(a) Seller is in compliance with the requirements of Executive Order No. 13224, 66 Fed. Reg. 49079 (Sept. 25, 2001) (the “Order”) and other similar requirements contained in the rules and regulations of the Office of Foreign Assets Control, Department of the Treasury (“OFAC”) and in any enabling legislation or other Executive Orders or regulations in respect thereof (the Order and such other rules, regulations, legislation, or orders are collectively called the “Orders”).

(b) To Seller’s knowledge, neither Seller nor any owner of more than 10% of the beneficial interests in Seller, nor, to Seller’s knowledge, any beneficial owner of Seller:

(i) is listed on the Specially Designated Nationals and Blocked Persons List maintained by OFAC pursuant to the Order and/or on any other list of terrorists or terrorist organizations maintained pursuant to any of the rules and regulations of OFAC or pursuant to any other applicable Orders (such lists are collectively referred to as the “Lists”);

(ii) is a person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders; or

(iii) is owned or controlled by, or acts for or on behalf of, any person or entity on the Lists or any other person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders.

The above representations and warranties of Seller (other than any Exception Matter) shall survive the Closing Date for a period of twelve (12) months. If Buyer fails to bring any Claim within such time period based on Seller’s breach of such representations and warranties (regardless of when the breach was discovered), such Claim shall be forever barred.

5.3 Incorrect Seller Representation or Warranty

. If Buyer learns before the Closing Date that any representation or warranty of Seller herein is materially incorrect or materially misleading, Buyer shall notify Seller of such incorrectness within one (1) business day of Buyer’s discovery thereof, failing which the incorrect representation or warranty shall be deemed waived. Upon timely receiving such notification, Seller shall have the right to take such action as necessary to render the incorrect representation or warranty correct. If Seller fails to notify Buyer that Seller will take corrective action within one (1) business day of receiving Buyer’s notice, Buyer’s sole and exclusive remedy shall be to terminate this Agreement by giving notice to Seller within one (1) business day after Seller notifies Buyer that Seller will not take corrective action (or the expiration of Seller’s one (1) business day response period if Seller does not respond). If Buyer terminates this Agreement pursuant to this Section 5.3, such termination shall have the same effect as a termination pursuant to Section 3.1.2.3 above (except the last sentence thereof). Additionally, Seller shall pay Buyer, within five (5) business days after Buyer’s written notice demanding payment, the amount of Two Hundred Thousand and No/100 DOLLARS ($200,000.00) as liquidated damages (and not as a penalty) (“Liquidated Damage Payment”) for Seller’s breach of this Section 5.3, which payment shall be in lieu of, and as full compensation for, all other rights or Claims of Buyer against Seller by reason of such breach, and which payment the parties agree represents a fair estimation of Buyer’s potential damages, which would otherwise be difficult to ascertain. If Buyer does not timely terminate this Agreement pursuant to this Section 5.3, the incorrect representation or warranty shall be deemed waived.

5.4 Buyer’s Representations and Warranties

. Buyer hereby represents and warrants the following to Seller as of the Effective Date. Each of such representations and warranties shall be deemed remade on and as of the Closing Date.

5.4.1 Due Formation and Authorization. Buyer is duly organized and validly existing under the laws of the state of its formation, and has all requisite power, authority and legal right to execute, deliver and perform the terms of this Agreement. This Agreement and all documents to be executed by Buyer in connection herewith constitute, or will constitute when executed and delivered, valid and legally binding obligations of Buyer enforceable in accordance with their terms. Each individual executing this Agreement on behalf of Buyer is duly authorized to do so.

5.4.2 Consent. No consent, approval or authorization by any individual or entity or any court, administrative agency or other governmental authority is required in connection with the execution and delivery of this Agreement or the consummation of the transactions contemplated by this Agreement by Buyer. The consummation of the transactions contemplated by this Agreement will not constitute a breach of, or constitute a default under, any agreement or other instrument to which Buyer is a party or by which Buyer is bound or affected.

5.4.3 Patriot Act.

(a) Buyer is in compliance with the requirements of the Order and other similar requirements contained in the rules and regulations of OFAC and in any enabling legislation or other Orders.

(b) Neither Buyer nor any owner of more than 10% of the beneficial interests in Buyer, nor, to Buyer’s knowledge, any beneficial owner of Buyer:

(i) is listed on the Lists;

(ii) is a person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders; or

(iii) is owned or controlled by, or acts for or on behalf of, any person or entity on the Lists or any other person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders.

5.4.4 Buyer Affiliation. Buyer is a limited liability company having Hines Global REIT Properties LP as its sole member. Hines Global REIT Properties LP is the operating partnership for Hines Global REIT, Inc.

5.5 Seller’s Covenants.

5.5.1 Estoppel Certificates. Seller agrees to request estoppel certificates from all of the Existing Occupants substantially in the form of EXHIBIT I-1 attached hereto (or in such other form as an Existing Lease may require) within two (2) business days after the Effective Date. Seller shall use commercially reasonable efforts to obtain completed estoppel certificates from Existing Occupants generating or that will generate, collectively with Fisher Communications under the Fisher Lease, at least eighty percent (80%) of the rental revenue of the Property (the “Threshold Estoppels”) (except that Seller shall have no obligation to pay any sums to any Existing Occupants in connection with its efforts). Upon Buyer’s request, Seller shall provide updates on the status of the estoppel certificates. If Seller is unable to obtain such estoppel certificates from Existing Occupants by November 29, 2011 (unless Buyer has extended the Closing Date to December 15, 2011 in accordance with Section 7.1 below, then by December 15, 2011) after using the efforts described herein, then Seller may complete and execute estoppel certificates at Closing as “Landlord,” substantially in the form of EXHIBIT I-2 attached hereto, for such Existing Occupants (but not for the Existing Occupants listed on Schedule 1 of EXHIBIT I-1, unless Seller has extended the Closing Date to December 30, 2011 pursuant to Section 7.1 below) and, in this event, such “Landlord” estoppels shall be deemed Threshold Estoppels.

5.5.2 Leases. From the Effective Date until the Closing Date, Seller shall comply with the terms and conditions of all Existing Leases in all material respects. From the Effective Date until the Closing Date, Seller shall not execute any additional lease, occupancy license or other occupancy agreement or amend, modify, renew, extend or terminate any of the Existing Leases in any material respect without the prior approval of Buyer, which approval shall not be unreasonably withheld or conditioned, provided that Seller acknowledges that it shall be reasonable to withhold consent if Seller’s proposed action does not fit with Buyer’s preferred leasing parameters, financial standards, or anticipated use of the Property after Closing. Buyer shall be deemed to have approved any proposed additional agreement or lease modification if it neither approves nor rejects the same within one (1) business day after Seller’s written notice to Buyer requesting the same. If Seller executes any such additional agreement or modification without Buyer’s approval or deemed approval, Buyer shall have the right, as its sole and exclusive remedy, to terminate this Agreement effective upon written notice to Seller, whereupon such termination shall have the same effect as a termination pursuant to Section 3.1.2.3 above (except the last sentence thereof). Additionally, Seller shall pay Buyer, within five (5) business days after Buyer’s written notice demanding payment, the Liquidated Damage Payment. Notwithstanding anything herein to the contrary, Seller shall have the right to execute any document necessary to reserve to itself at Closing the LUT Lease, including any assignment, modification or subordination agreements necessary to effectuate the same, all as more particularly described in Section 5.6 below.

5.5.3 Service Contracts and Warranties. Buyer may request, by giving written notice to Seller delivered within two (2) calendar days of the Effective Date, that any of the Existing Service Contracts that can be terminated on sixty (60) days’ notice or less be terminated as of Closing to the extent possible. Buyer shall assume all Existing Service Contracts that cannot be terminated upon sixty (60) days’ notice or less and all other Existing Service Contracts not identified in Buyer’s notice to be terminated. Seller shall use commercially reasonable efforts to cause any Existing Service Contract identified by Buyer to be terminated upon the Closing or as soon as possible thereafter (and this Section 5.5.3 shall survive Closing if necessary for the foregoing purpose). Seller shall assign its interest in any assignable Service Contracts (not terminated pursuant to the foregoing sentences) and any assignable Existing Warranties to Buyer at Closing and Buyer shall assume Seller’s obligations thereunder. To the extent any such assignment requires the consent of the other party to the Service Contract or Existing Warranty, Seller shall use commercially reasonable efforts to obtain such consent prior to the Closing, but a failure to obtain such consent shall not be a Seller default under this Agreement. If any such consent is not obtained prior to the Closing, Seller agrees to use commercially reasonable efforts to help Buyer obtain such consent after the Closing Date (and this Section 5.5.3 shall survive Closing if necessary for the foregoing purpose). If Seller must pay any consideration as a condition to the termination of any Service Contract requested by Buyer (including any termination fee of more than One Thousand Dollars ($1,000.00)), or as a condition of any consent necessary to assign a Service Contract or any Existing Warranty hereunder, Seller shall have no obligation to incur any such expense or pay any such consideration, unless Buyer agrees to reimburse Seller for such expense or payment.

From the Effective Date until the Closing Date, Seller shall not amend any of the Existing Service Contracts or become a party to any new service contracts without the prior approval of Buyer, which approval shall not be unreasonably withheld or conditioned, and Seller further covenants that any new service contracts shall be terminable on not more than thirty (30) days notice. Buyer shall be deemed to have approved any proposed amendment or new contract if it neither approves nor rejects the same within one (1) business day after Seller’s written notice to Buyer requesting the same. If Seller executes any such amendment or new service contract without Buyer’s approval or deemed approval, Buyer shall have the right, as its sole and exclusive remedy, to terminate this Agreement effective upon written notice to Seller, whereupon such termination shall have the same effect as a termination pursuant to Section 3.1.2.3 above (except the last sentence thereof). Additionally, Seller shall pay Buyer, within five (5) business days after Buyer’s written notice demanding payment, the Liquidated Damage Payment.

5.5.4 Permits. From the Effective Date until the Closing Date, Seller shall not terminate, allow to lapse or amend in any material way any of the Permits without the prior approval of Buyer, which approval shall not be unreasonably withheld or conditioned; provided however, that if any such action is necessary for the continued operation of the Property, such action shall be deemed approved and Seller further covenants not to voluntarily terminate any existing Permit. Buyer shall also be deemed to have approved any proposed termination, lapse or amendment if it neither approves nor rejects the same within one (1) business day after Seller’s written notice to Buyer requesting the same. If Seller terminates, allows to lapse or amends any Permit without Buyer’s approval or deemed approval, Buyer shall have the right, as its sole and exclusive remedy, to terminate this Agreement effective upon written notice to Seller, whereupon such termination shall have the same effect as a termination pursuant to Section 3.1.2.3 above (except the last sentence thereof). Additionally, Seller shall pay Buyer, within five (5) business days after Buyer’s written notice demanding payment, the Liquidated Damage Payment.

All Transferable Permits shall be transferred to Buyer by a General Assignment at Closing pursuant to Section 7.2 below. With respect to the Process Permits, Seller shall take commercially reasonable steps to obtain all necessary approvals and take commercially reasonable steps to transfer the Process Permits to Buyer on or before the Closing Date, provided that failure to obtain such approvals or complete such transfers shall not be deemed a Seller default under this Agreement. Instead, if any such approvals are not obtained or transfers completed prior to the Closing, Seller agrees to use commercially reasonable efforts to help Buyer obtain such approvals and complete such transfers after the Closing Date or to help Buyer obtain new or replacement permits if such approvals cannot be obtained or if such transfers cannot be completed (and this Section 5.5.4 shall survive Closing if necessary for the foregoing purpose).

5.5.5 Other Encumbrances. Except as authorized herein, after the Effective Date, Seller shall not cause or create any new encumbrances that may affect title to the Property after the Closing Date.

5.5.6 Operation and Maintenance of Property. Between the Effective Date and the Closing Date, Seller shall (a) operate the Property in substantially the same manner in which Seller operated the Property immediately prior to the Effective Date (although Seller shall not have an obligation to purchase, lease or install prior to Closing any capital improvements or to incur other expenditures not incurred in the ordinary course of business unless required by any of the Existing Leases), and (b) maintain the Property in substantially its present order and condition, reasonable wear and tear excepted and subject to casualty and condemnation.

5.5.7 Insurance. Until the Closing, Seller shall keep the Property insured against fire, vandalism and other loss, damage and destruction to the same extent as it has customarily insured the same. Seller’s insurance policies shall not be assigned to Buyer at Closing; Buyer shall be obligated to obtain its own insurance coverage from and after Closing.

5.5.8 Plaza Systems. Buyer acknowledges that Seller and its affiliates currently provide, as a convenience, to various Occupants in the Buildings (a) certain telecommunications services to accommodate such Occupants’ telephone, facsimile and similar needs and (b) certain wireless network services to accommodate such Occupants’ wireless needs. Various equipment, lines, infrastructure and other appurtenances thereto are installed in both Buildings to provide such telecommunications services (collectively, “Plaza Telecom System”) and various equipment, lines, routers, infrastructure and other appurtenances are installed in both Buildings to provide such wireless services (collectively, “PlazaNet System”). Seller shall have the right to continue providing both services to Occupants’ after the Closing Date for a period of up to twelve (12) months (“Transition Period”) in order to provide reasonable notice to Occupants that such systems will be shut down and to provide a reasonable opportunity for Occupants to secure replacement services. The foregoing shall not impose any obligation on Seller to continue providing either service, and Seller may elect, in its sole discretion, to discontinue providing either or both services to any or all Occupants at any time after the Closing Date. Seller shall also have the right, but not the obligation, to continue using one or both of such systems during and after the Transition Period for the business operations of Seller and its affiliates until such time as Seller and its affiliates no longer require use of such systems. If Seller elects to continue providing one or both of such services to Occupants after Closing or elects to continue using one or both of such systems after Closing, Seller shall remain responsible for operating, maintaining and repairing the Plaza Telecom System and PlazaNet System (as applicable) until the same are completely shutdown, at which time Seller shall not be required to remove either system, but shall be allowed to leave both systems in place (or, at Seller’s or its affiliates’ election, to decommission and remove the same). Seller acknowledges that both services produce only nominal income after deducting the operational costs associated with the same; however, Buyer agrees that in consideration of any continued operations of such services for the convenience of the Occupants and Seller’s continued responsibility therefor, Seller shall be entitled to retain any such income earned during any Transition Period. This Section 5.5.8 shall survive Closing

5.5.9 Project Cabling. Seller and Buyer hereby acknowledge that portions of the building management control systems for the Buildings and security system for the Project utilize structured cabling located within the premises demised by the Fisher Lease (“Security Lines”). Additionally, certain Existing Leases authorize certain Existing Occupants to use cabling installed and used by Seller or its affiliates throughout the Project (to the extent used by Existing Occupants, “Connection Lines,” and together with the Security Lines, “Shared Lines”). The parties shall reasonably cooperate with one another in good faith to reroute Security Lines outside of the Premises demised by the Fisher Lease and to identify and separate any Connection Lines from those lines, cables and other conduits that will continue to be used by Seller and its affiliates after Closing as soon as practicable after Closing (but in no event later than six (6) months thereafter, unless Seller has failed to reasonably cooperate in good faith with respect to the rerouting and separation, in which case, the six (6) month period shall be extended as reasonably necessary to complete such work). The parties acknowledge that it may be more cost effective to install new lines for either or both of the foregoing purposes. The parties shall equally share in the actual, out-of-pocket third party costs of rerouting and separating the Shared Lines (and/or installing new lines); provided, however, that Buyer shall bear the first Ten Thousand and No/100 Dollars ($10,000.00) of such costs and Seller shall bear the next Forty Thousand and No/100 Dollars ($40,000.00) of such costs. Until the earlier of six (6) months after Closing (unless Seller has failed to reasonably cooperate in good faith with respect to the rerouting and separation, in which case, the six (6) month period shall be extended as reasonably necessary to complete such work) or such date that all Shared Lines can be rerouted and separated (or new lines installed), Seller shall indemnify Buyer for any Claims that arise out of any damage to such Shared Lines to the extent caused by Seller and its affiliates; provided, however, that if Seller or its affiliates cease use of any Connection Lines at any time, Seller shall notify Buyer of the same (which notice shall include sufficient detail regarding the location of the applicable Connection Lines as to make them readily identifiable by Buyer) and Buyer shall immediately become the owner thereof and responsible therefor. Any Connection Lines that will be used by Seller or its affiliates after Closing shall be retained by Seller until Seller ceases use thereof. All other Shared Lines that will not be used after Closing by Seller or its affiliates shall immediately become the property and responsibility of Buyer.

5.6 Buyer’s Covenants

. Buyer acknowledges that Seller is reserving to itself at Closing the LUT Lease, assigning the LUT Lease to Fisher Communications and subordinating the LUT Lease to the Fisher Lease, such that the LUT Lease will become a sublease of the Fisher Lease; however, Seller confirms that the portion of the Property demised by the LUT Lease is being transferred to Buyer as part of the Real Property and then being leased to Fisher Communications. If requested by Seller, Buyer shall promptly (and, if requested, before the Closing Date) execute any and all reasonable modification or subordination agreements between Fisher (or its affiliates) and LUT to effectuate the foregoing. Buyer further agrees that, if Seller does not request any such agreements, then in the event that the Fisher Lease is terminated for any reason before the expiration of the LUT Lease, Buyer shall not disturb LUT’s occupancy under the LUT Lease and shall execute all documents necessary to allow such continued occupancy under the same terms and conditions contained in the LUT Lease, so long as LUT is not in default under the LUT Lease beyond any applicable notice and cure periods. This Section 5.6 shall survive Closing.

5.7 Leaseback of Fisher Occupied Space

. As a material part of Seller’s willingness to sell the Property to Buyer, Seller has required that Buyer lease back to Fisher Communications the Fisher Occupied Space and the other space and rights at the Real Property described as follows: (a) exclusive possession of the heliport located on the rooftop of Fisher Plaza East, (b) the right to continue using the existing dishes and antennas on the rooftop of the Buildings that Seller and its affiliates have located thereon as of the Effective Date and the right to install such additional satellite dishes and antennas as Seller and its affiliates may reasonably require to accommodate their future operational needs, all without interference from future users of such rooftop space, (c) the right to continue using parking stalls in the Parking Structure, (d) the right to continue using storage space in the Parking Structure for Fisher Communication’s and its affiliates’ continued storage needs and the housing of refueling and support facilities associated with the heliport, and (e) the ability to maintain naming rights over Fisher Plaza and the Buildings, all as outlined in the Fisher Lease, the Rooftop Easement and the Storage Space Agreement (all defined below). For the foregoing purposes and in full satisfaction of the foregoing obligation, Buyer and Fisher Communications shall enter into (x) a lease at Closing in the form of EXHIBIT J attached hereto (“Fisher Lease”) to lease back the Fisher Occupied Space and to grant the rights described in clauses (c) and (e) above, a memorandum of which shall be recorded at Closing in a form mutually agreed upon by the parties (“Fisher Lease Memo”), (y) an easement at Closing in the form of EXHIBIT K attached hereto (“Rooftop Easement”) to grant and protect the heliport and rooftop rights described in clauses (a) and (b) above, and (z) a separate agreement to use the storage space described in clause (d) above, the form of which is attached to the Fisher Lease (“Storage Space Agreement”). Neither party shall make any modifications to the form of Fisher Lease or the form of Rooftop Easement attached hereto after the Effective Date without the prior written consent of the other party hereto.

ARTICLE 6. CONDITIONS TO CLOSING

6.1 Seller’s Conditions to Closing

. Seller’s obligation to close the transactions contemplated by this Agreement is conditioned on all of the following, any or all of which may be waived by Seller in writing, at its sole option:

6.1.1 All representations and warranties made by Buyer in this Agreement shall be true and correct in all material respects on and as of the Closing Date, as if made on and as of such date, except to the extent they expressly relate to an earlier date and except for those already qualified by materiality that shall be true and correct in all respects; and

6.1.2 Buyer shall have delivered Buyer’s Closing Payment and all of the documents required to be executed by Buyer into Escrow as required, and Buyer shall have performed in all material respects all of its other obligations hereunder required to be performed by the Closing Date, and complied with all conditions, required by this Agreement to be performed or complied with by Buyer at or prior to the Closing.

6.2 Buyer’s Conditions to Closing

. Buyer’s obligation to close the transactions contemplated by this Agreement is conditioned on all of the following, any or all of which may be waived by Buyer in writing, at its sole option:

6.2.1 All representations and warranties made by Seller in this Agreement shall be true and correct in all material respects on and as of the Closing Date, as if made on and as of such date, except to the extent they expressly relate to an earlier date and except for those already qualified by materiality that shall be true and correct in all respects, and except to the extent of any Exception Matter;

6.2.2 Seller shall have executed and delivered all of the documents required to be delivered by Seller hereunder into Escrow, and shall have materially performed all of its other obligations hereunder required to be performed by the Closing Date, and complied with all conditions required by this Agreement to be performed or complied with by Seller at or prior to the Closing;

6.2.3 Buyer has received (a) evidence that Seller has sent notices of termination on all Existing Service Contracts required to be terminated pursuant to the terms of Section 5.5.3 (provided that that actual termination may occur after Closing) and (b) confirmation that Seller has sent termination notices to terminate any property management agreements for the Property in effect as of the Effective Date (provided that actual termination may occur after Closing);

6.2.4 Buyer has received estoppel certificates from the Existing Occupants listed on Schedule 1 of EXHIBIT I-1 or has otherwise received Threshold Estoppels in accordance with the requirements of Section 5.5.1 above or Section 7.1 below; and

6.2.5 Title Company shall be irrevocably committed to issue Buyer’s Policy and Title Company is irrevocably bound and committed to issue extended coverage, subject only to the payment of the applicable costs therefor and the delivery of the required documents from Seller.

In the event of the failure of any of Buyer’s conditions to close hereunder, Buyer shall have the right to terminate this Agreement and such termination shall have the same effect as a termination pursuant to the last sentence of Section 3.1.2.3.

ARTICLE 7. CLOSING

7.1 Closing Procedure

. The transaction contemplated in this Agreement will be closed (“Closing”) in Escrow by Escrow Agent on December 1, 2011 (“Closing Date”); provided, however, Buyer shall have the right to unilaterally extend the Closing Date to December 15, 2011 if Buyer has not received the Threshold Estoppels upon delivery of written notice to Seller and Escrow Agent no later than November 29, 2011 and payment of the Extension Deposit as required below. Upon receiving such notice, Seller shall open a separate escrow account with Title Company and notify Buyer thereof (which may occur by email). Buyer shall thereafter deposit an extension fee into such separate account in the amount of Twenty Million and No/100 Dollars ($20,000,000.00) (“Extension Deposit”) by the end of the next business day following Buyer’s receipt of Seller’s notice, which Extension Deposit shall be non-refundable except as expressly provided herein and shall represent additional consideration for Seller’s extension of the Closing Date. Failure to timely make such Extension Deposit or otherwise timely close shall constitute a material breach of this Agreement. The Extension Deposit shall be considered separate and apart from the “Deposit” for all purposes hereunder, but shall be applicable to the Purchase Price at Closing. In addition to the foregoing, Seller shall have the right, upon delivery of written notice to Buyer and Escrow Agent, to unilaterally extend the Closing Date to December 30, 2011 if Seller has not been able to obtain estoppel certificates from the Existing Occupants listed on Schedule 1 of EXHIBIT I-1; provided, however, that if Seller sooner obtains such estoppel certificates, Closing shall occur as soon as practicable thereafter. Notwithstanding anything in this Agreement to the contrary, if Seller has extended the Closing Date and made the efforts required herein to obtain estoppel certificates from the Existing Occupants listed on Schedule 1 of EXHIBIT I-1, then Closing shall occur on December 30, 2011 regardless of whether Seller has obtained such estoppel certificates. If the transaction contemplated by this Agreement fails to close by the Closing Date (as may be extended as noted above), this Agreement, and all of Buyer’s rights with respect to the acquisition of the Property, shall terminate, the parties shall have the rights and obligations as provided in Article 9, and upon request, Escrow Agent shall return to the parties, respectively (except as otherwise provided herein), the documents and funds deposited into Escrow.

7.2 Deposits into Escrow

.

7.2.1 By Seller. At least one (1) business day prior to the Closing Date, Seller shall deposit into Escrow (except as noted below):

(a) The original Deed in the form of EXHIBIT L attached hereto, duly executed by Seller and acknowledged;

(b) Two (2) original counterparts of a Bill of Sale in the form of EXHIBIT M attached hereto, duly executed by Seller, with respect to the Tangible Personal Property, if any (“Bill of Sale”);

(c) Two (2) original counterparts of an Assignment and Assumption Agreement in the form of EXHIBIT N attached hereto, duly executed by Seller and acknowledged, with respect to the Leases and Service Contracts (“Assignment and Assumption Agreement”);

(d) Two (2) original counterparts of a General Assignment in the form of EXHIBIT O attached hereto, duly executed by Seller, with respect to the Intangible Personal Property, Existing Warranties and Transferable Permits (“General Assignment”);

(e) Two (2) original counterparts of the Fisher Lease, executed by Seller and acknowledged;

(f) Two (2) original counterparts of the Fisher Lease Memo, executed by Seller and acknowledged;

(g) Two (2) original counterparts of the Rooftop Easement, executed by Seller and acknowledged;

(h) Two (2) original counterparts of the Storage Space Agreement, executed by Seller and acknowledged;

(i) An affidavit that satisfies the requirements of Section 1445 of the IRC, and the regulations thereunder;