Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - HGR Liquidating Trust | hinesglobal-ex321x20191231.htm |

| EX-31.2 - EXHIBIT 31.2 - HGR Liquidating Trust | hinesglobal-ex312x20191231.htm |

| EX-31.1 - EXHIBIT 31.1 - HGR Liquidating Trust | hinesglobal-ex311x20191231.htm |

| EX-21.1 - EXHIBIT 21.1 - HGR Liquidating Trust | hinesglobal-ex211x2019list.htm |

| EX-10.3 - EXHIBIT 10.3 - HGR Liquidating Trust | hinesglobal-ex103x20191231.htm |

| EX-10.2 - EXHIBIT 10.2 - HGR Liquidating Trust | hinesglobal-ex102x20191231.htm |

| EX-4.1 - EXHIBIT 4.1 - HGR Liquidating Trust | hinesglobal-ex41x20191231x.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One) | |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-53964

HINES GLOBAL REIT, INC.

(Exact Name of Registrant as Specified in its Charter)

Maryland | 26-3999995 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

2800 Post Oak Boulevard Suite 5000 | 77056-6118 |

Houston, Texas | (Zip code) |

(Address of principal executive offices) | |

Registrant’s telephone number, including area code: (888) 220-6121

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer þ | |

Smaller reporting company ☐ | Emerging growth company ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. ☐ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Aggregate market value of the common stock held by non-affiliates of the registrant: No established market exists for the registrant’s common stock.

The registrant had 262.9 million shares of common stock outstanding as of March 20, 2020.

TABLE OF CONTENTS PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Item 16. | ||

EX- 21.1 | List of Subsidiaries | |

EX- 31.1 | Certification | |

EX- 31.2 | Certification | |

EX- 32.1 | Certification of CEO & CFO pursuant to Section 906 | |

EX- 101 | Instance Document | |

EX- 101 | Schema Document | |

EX- 101 | Calculation Linkbase Document | |

EX- 101 | Labels Linkbase Document | |

EX- 101 | Presentation Linkbase Document | |

EX- 101 | Definition Linkbase Document | |

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K includes certain statements that may be deemed forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements relate to, without limitation, economic conditions that may impact our operations, our ability to effectively liquidate our assets and pay liquidating distributions to our stockholders in the expected time frame or at all, our future leverage and financial position, our future capital expenditures, future distributions, other developments and trends in the commercial real estate industry and our business strategy. Forward-looking statements are generally identifiable by the use of the words “may,” “will,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of these words or other comparable terminology. These statements are not guarantees of future performance, and involve certain risks, uncertainties and assumptions that are difficult to predict.

The forward-looking statements in this Form 10-K are based on our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Any of the assumptions underlying forward-looking statements could prove to be inaccurate. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide distributions to our stockholders and maintain the value of the real estate properties in which we hold an interest, may be significantly hindered.

1

The following are some of the risks and uncertainties which could cause actual results to differ materially from those presented in certain forward-looking statements:

— | Whether we will be able to complete the sale of all or substantially all of our assets as expected; |

— | Unanticipated difficulties, expenditures or delays relating to our implementation of our plan of liquidation and dissolution, which may reduce or delay our payment of additional liquidating distributions to our stockholders; |

— | Risks associated with the potential response of tenants, business partners and competitors to our adoption and implementation of our plan of liquidation and dissolution; |

— | Risks associated with legal proceedings that may be instituted against us and others related to the Plan of Liquidation; |

— | Competition for tenants, including competition with affiliates of Hines Interests Limited Partnership (“Hines”); |

— | Our reliance on Hines Global REIT Advisors LP (the “Advisor”), Hines and affiliates of Hines for our day-to-day operations and the management of our real estate investments, and our advisor’s ability to attract and retain high-quality personnel who can provide service at a level acceptable to us; |

— | Risks associated with conflicts of interest that result from our relationship with our Advisor and Hines, as well as conflicts of interests certain of our officers and directors face relating to the positions they hold with other entities; |

— | The potential need to fund tenant improvements, lease-up costs or other capital expenditures, as well as increases in property operating expenses and costs of compliance with environmental matters or discovery of previously undetected environmentally hazardous or other undetected adverse conditions at our properties; |

— | The amount and timing of additional liquidating distributions we may pay is uncertain and cannot be assured; |

— | Risks associated with debt and our ability to secure financing; |

— | Risks associated with adverse changes in general economic or local market conditions, including pandemics such as COVID-19 (more commonly referred to as the Coronavirus), terrorist attacks and other acts of violence, which may negatively affect the markets in which we and our tenants operate; |

— | Catastrophic events, such as hurricanes, earthquakes, tornadoes and terrorist attacks; and our ability to secure adequate insurance at reasonable and appropriate rates; |

— | The failure of any bank in which we deposit our funds could reduce the amount of cash we have available to fund our operating expenses and other capital expenditures; |

— | Changes in governmental, tax, real estate and zoning laws and regulations and the related costs of compliance and increases in our administrative operating expenses, including expenses associated with operating as a public company; |

— | International investment risks, including the burden of complying with a wide variety of foreign laws and the uncertainty of such laws, the tax treatment of transaction structures, political and economic instability, foreign currency fluctuations, and inflation and governmental measures to curb inflation may adversely affect our operations and our ability to make distributions; |

— | The lack of liquidity associated with our assets; |

— | Our ability to continue to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes; and |

— | Risks related to the United Kingdom's exit from the European Union (“Brexit”), including, but not limited to the decline of revenue derived from, and the market value of, our properties located in the United Kingdom and Poland, which may negatively impact on our ability to sell these properties and the pricing we are able to receive. |

These risks are more fully discussed in, and all forward-looking statements should be read in light of, all of the factors discussed in “Item 1A. Risk Factors” of this Annual Report.

2

Our stockholders are cautioned not to place undue reliance on any forward-looking statement in this Form 10-K. All forward-looking statements are made as of the date of this Form 10-K, and the risk that actual results will differ materially from the expectations expressed in this Form 10-K may increase with the passage of time. In light of the significant uncertainties inherent in the forward-looking statements in this Form 10-K, the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Form 10-K will be achieved.

Item 1. Business

General Description of Business and Operations

Hines Global REIT, Inc. (“Hines Global”) was incorporated under the Maryland General Corporation Laws on December 10, 2008, primarily for the purpose of investing in a diversified portfolio of quality commercial real estate properties and other real estate investments located throughout the United States and internationally. Hines Global raised the equity capital for its real estate investments through two public offerings from August 2009 through April 2014, and through its distribution reinvestment plan (the “DRP Offering”) from April 2014 through August 2018. Collectively, through its public offerings, Hines Global raised gross offering proceeds of approximately $3.1 billion, including the DRP Offering, all of which was invested in the Company’s real estate portfolio.

Hines Global conducts most of its activities through, and most of its real estate investments are held directly or indirectly by, Hines Global REIT Properties, LP (the “Operating Partnership”), which was formed on January 7, 2009. Hines Global contributed the proceeds it received from the issuance of common shares to the Operating Partnership and the Operating Partnership in turn issued general partner interests to Hines Global. The general partner interests entitle Hines Global to receive its share of the Operating Partnership’s earnings or losses and distributions of cash flow.

We refer to Hines Global, the Operating Partnership and its wholly-owned subsidiaries as the “Company,” and the use of “we,” “our,” “us” or similar pronouns in this annual report refers to Hines Global or the Company as required by the context in which such pronoun is used.

We invested the proceeds from our public offerings into a diverse portfolio of real estate investments. In recent years, we have concentrated our efforts on actively managing our assets and exploring a variety of strategic opportunities focused on enhancing the composition of our portfolio and its total return potential for its stockholders. On April 23, 2018, in connection with its review of potential strategic alternatives available to the Company, our board of directors determined that it is in the best interests of the Company and its stockholders to sell all or substantially all of our properties and assets and for the Company to liquidate and dissolve pursuant to our Plan of Liquidation and Dissolution (the “Plan of Liquidation”). The principal purpose of the liquidation is to provide liquidity to our stockholders by selling the Company’s assets, making payments on property and corporate level debt, and distributing the net proceeds from liquidation to our stockholders. As required by Maryland law and our charter, the Plan of Liquidation was approved by the affirmative vote of the holders of at least a majority of the shares of our common stock outstanding and entitled to vote thereon at the Company’s annual meeting of stockholders held on July 17, 2018.

In April 2018, our board of directors estimated that, in addition to regular operating distributions paid to our stockholders, if we are able to successfully execute the Plan of Liquidation, after the sale of all or substantially all of the Company’s assets and the payment of all of the Company’s outstanding liabilities, we will have made total distributions to our stockholders of approximately $10.00 to $11.00 per share of the Company’s common stock, consisting of three components: (i) the $1.05 per share special distribution paid to stockholders in January 2018 (the “Special Distribution”); (ii) the $0.12 per share of return of invested capital distributions paid to stockholders for the six months ended June 30, 2018; and (iii) the range of liquidating distributions to be made pursuant to the Plan of Liquidation of $8.83 to $9.83 per share, estimated by our board of directors on April 23, 2018, and we have made liquidating distributions of approximately $2.83 per share to date. We have been working diligently to successfully execute the Plan of Liquidation and make final liquidating distributions to our stockholders. Our original goal was to complete the liquidation and make final distributions to our stockholders by July 17, 2020 (24 months after stockholder approval of the Plan of Liquidation). While we have been actively marketing the remaining assets for disposition, the recent spread of the COVID-19 (more commonly referred to as the Coronavirus) pandemic and its impact on the global economic environment has had, and is expected to continue to have, an adverse impact on overall market conditions and our disposition process. At this time, we cannot predict the ultimate impact to our disposition process or timing, but we believe we are proactively positioning our portfolio to best adapt to the evolving circumstances. In light of numerous risks and uncertainties, which include the recent economic uncertainty and disruption related to the Coronavirus pandemic, there can be no assurances regarding when we will complete our liquidation or the amounts of any liquidating distributions or the timing thereof. Further, we can provide no assurances that the aggregate liquidating distributions that are ultimately paid to our

3

stockholders will be within the range of total liquidating distributions estimated by our board of directors in April 2018. If we are unable to complete the liquidation and make final distributions to our stockholders by July 17, 2020, we expect that any remaining assets and liabilities of the Company would be transferred into a liquidating trust as described in the Plan of Liquidation approved by our stockholders in July 2018. In addition, even if we sell all of our assets by July 17, 2020, we may determine not to distribute all distributable cash by that date and may establish a reserve to provide for any remaining obligations and to cover our expenses as we complete our wind down and dissolution. See “Distributions Objectives” later in this section for additional information regarding distributions made pursuant to the Plan of Liquidation.

From January 2018 through February 2019, we paid return of capital distributions totaling approximately $4.00 per share (the “Return of Capital Distributions”), consisting of the $1.05 per share Special Distribution, $0.12 per share of return of invested capital distributions, $0.33 per share of monthly liquidating distributions paid between August 2018 and January 2019, and a $2.50 per share liquidating distribution paid in February 2019. We expect to make the final liquidating distribution on or before July 17, 2020 (24 months after stockholder approval of the Plan of Liquidation). However, there can be no assurances regarding the timing or amounts of any further liquidating distributions, that we will ultimately pay aggregate liquidating distributions within the range estimated by our board of directors when it approved the Plan of Liquidation in April 2018, or that we will make the final distribution on or before July 17, 2020. In addition, even if we sell all of our assets by July 17, 2020, we may determine not to distribute all distributable cash by that date and may establish a reserve to provide for any remaining obligations and to cover our expenses as we complete our wind down and dissolution.

At the peak of our acquisition phase, we owned interests in 45 properties. We sold interests in six properties for an aggregate sales price of $1.0 billion during 2017, 20 properties for an aggregate sales price of $1.7 billion during 2018, four properties for an aggregate sales price of $1.3 billion in 2019, and two additional properties through March 30, 2020 for an aggregate sales price of $379.9 million. As of March 30, 2020, we owned eight properties in our portfolio that include the following investments:

• | Domestic office investments (1 investments) |

• | Domestic other investments (4 investments) |

• | International office investments (3 investments) |

We have no employees. Our business is managed by our Advisor, an affiliate of our sponsor, Hines, under the terms and conditions of an advisory agreement between us, the Operating Partnership and the Advisor (the “Advisory Agreement”). As compensation for these services, we pay or have paid the Advisor asset management, acquisition, debt financing and disposition fees and we reimburse certain of the Advisor’s expenses incurred on our behalf in accordance with the Advisory Agreement. Hines or affiliates of Hines manage the leasing and operations of most of the properties in which we invest and, accordingly, we pay property management and leasing fees in connection with these services. Hines is owned and controlled by or for the benefit of Gerald D. Hines and his son Jeffrey C. Hines, the Chairman of our board of directors. Hines and its 4,500 employees have over 60 years of experience in the areas of investment selection, underwriting, due diligence, portfolio management, asset management, property management, leasing, disposition, finance, accounting and investor relations.

Our office is located at 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. Our telephone number is 1-888-220-6121. Our web site is www.HinesSecurities.com. The information on our website is not incorporated by reference into this report.

Financing Strategy and Policies

We have and may continue to use debt financing from time to time for property improvements, lease inducements, tenant improvements, redemptions and other working capital needs. As of December 31, 2019, our portfolio was 23% leveraged based on the December 31, 2018 appraised values of our real estate investments. Following the sale of two additional properties subsequent to December 31, 2019 through March 30, 2020, which were used to repay debt, our portfolio was approximately 12% leveraged based on the December 31, 2018 appraised values of our real estate investments.

Our existing indebtedness is and any additional indebtedness we incur will likely be subject to continuing covenants, and we are be required to make continuing representations and warranties about the Company in connection with such debt. Moreover, a substantial portion of our debt is be secured by some or all of our assets. If we default on the payment of interest or principal on any such debt, breach any representation or warranty in connection with any borrowing or violate any covenant in any loan document, our lender may accelerate the maturity of such debt, requiring us to immediately repay all outstanding principal.

4

Distribution Objectives

In order to qualify as a REIT for U.S. federal income tax purposes, we generally must distribute at least 90% of our taxable income (excluding capital gains) to our stockholders. Distributions are authorized at the discretion of our board of directors, which considers the requirements for our qualification as a REIT pursuant to the Internal Revenue Code of 1986, as amended (the “Code”).

We declared distributions of approximately $0.65 per share, per year for the years ended December 31, 2018 and 2017. Approximately $0.45 per share of these distributions declared for the year ended December 31, 2018 were designated as a return of a portion of the stockholders’ invested capital as described further below. Additionally in December 2017, we declared a special distribution of $1.05 per share, described below.

From January 2018 through February 2019, we paid aggregate Return of Capital Distributions to stockholders totaling approximately $4.00 per share, which represented a return of a portion of the stockholders’ invested capital. These Return of Capital Distributions reduced the stockholders’ remaining investment in the Company and were made up of the following:

• | a $1.05 per share Special Distribution declared to all stockholders of record as of December 30, 2017 and paid in January 2018. The Special Distribution was funded with a portion of the net proceeds received from the strategic sale of six assets during 2017. |

• | $0.12 per share resulting from a portion of the monthly distributions declared for the months of January 2018 through June 2018, (approximately $0.02 per share, per month), which were designated by our board of directors as a return of a portion of the stockholders’ invested capital and, as such, reduced the stockholders’ remaining investment in the Company. |

• | Approximately $0.33 per share resulting from the monthly liquidating distributions declared for the months of July 2018 through December 2018 (approximately $0.0541667 per share, per month), which reduced the stockholders’ remaining investment in the Company. |

• | a $2.50 per share liquidating distribution declared to all stockholders of record as of February 13, 2019 and paid in February 2019. |

In April 2018, when our board of directors initially approved the Plan of Liquidation, we reported that if we are able to successfully execute the Plan of Liquidation, then after the sale of all our assets and the payment of all our outstanding liabilities, we expect we will have made liquidating distributions pursuant to the Plan of Liquidation in the range of $8.83 to $9.83 per share of common stock, estimated by our board of directors as of April 23, 2018, which are in addition to the $1.17 return of invested capital distributions previously paid by the Company. As described above, we have paid approximately $2.83 per share of liquidating distributions pursuant to the Plan of Liquidation as of March 30, 2020. In light of numerous risks and uncertainties, which include the recent economic uncertainty and disruption related to the Coronavirus pandemic, there can be no assurances regarding when we will complete our liquidation or the amounts of any liquidating distributions or the timing thereof. Further, we can provide no assurances that the aggregate liquidating distributions that are ultimately paid to our stockholders will be within the range of total liquidating distributions estimated by our board of directors in April 2018. If we are unable to complete the liquidation and make final distributions to our stockholders by July 17, 2020, we expect that any remaining assets and liabilities of the Company would be transferred into a liquidating trust as described in the Plan of Liquidation approved by our stockholders in July 2018. In addition, even if we sell all of our assets by July 17, 2020, we may determine not to distribute all distributable cash by that date and may establish a reserve to provide for any remaining obligations and to cover our expenses as we complete our wind down and dissolution.

Because we have already sold a significant number of assets and we are continuing to sell all of our remaining assets pursuant to our Plan of Liquidation, we determined to stop paying monthly distributions for periods after December 2018. Any future distributable income earned from the remaining properties will be included in future liquidating distributions to stockholders.

Tax Status

We have elected to be treated as a REIT under the Code. Our management believes that we operate in such a manner as to qualify for treatment as a REIT and we intend to operate in the foreseeable future in such a manner so that we will remain qualified as a REIT for U.S. federal income tax purposes. Accordingly, no provision has been made for U.S. federal income taxes for the years ended December 31, 2019, 2018 and 2017 in the accompanying consolidated financial statements. Income tax expense recorded by the Company during each of these years was primarily comprised of foreign income taxes related to the operation of its international properties.

5

Competition

Numerous real estate companies, real estate investment trusts and U.S. institutional and foreign investors compete with us in obtaining creditworthy tenants to occupy our properties, including, but not limited to, Hines Global Income Trust, Inc. (“Hines Global Income Trust”), and other real estate investment vehicles sponsored by Hines. Many of these entities have significant financial and other resources, allowing them to compete effectively with us. Principal factors of competition include leasing terms (including rent and other charges and allowances for inducements and tenant improvements), the quality and breadth of tenant services provided, and reputation as an owner and operator of commercial real estate investments in the relevant market. Additionally, our ability to compete depends upon, among other factors, trends of the global, national and local economies, investment alternatives, financial condition and operating results of current and prospective tenants, availability and cost of capital, taxes, governmental regulations, legislation and demographic trends.

Tenants

We are dependent upon the ability of current tenants to pay their contractual rent amounts as the rents become due. During the years ended December 31, 2019, 2018 and 2017, respectively, we did not earn more than 10% of total rental revenues from any individual tenant.

Available Information

Stockholders may obtain copies of our filings with the Securities and Exchange Commission (“SEC”), free of charge from the website maintained by the SEC at www.sec.gov or from our website at www.HinesSecurities.com. Further, a copy of this Our filings will be available on our website as soon as reasonably practicable after we electronically file such materials with the SEC. However, the information from our website is not incorporated by reference into this report.

6

Item 1A. Risk Factors

You should carefully read and consider the risks described below together with all other information in this report. If certain of the following risks actually occur, our results of operations and ability to pay distributions would likely suffer materially, or could be eliminated entirely. As a result, the value of our common shares may decline, and our stockholders could lose all or part of the money they paid to buy our common shares.

Risks Related to the Liquidation of the Company

There can be no assurances concerning the prices at which our properties will be sold or the timing of such sales.

We cannot give any assurances as to the prices at which any of our properties ultimately will be sold, or the timing of such sales. Real estate market values are constantly changing and fluctuate with changes in interest rates, availability of financing, changes in general economic conditions and real estate tax rates, competition in the real estate market, the availability of suitable buyers, the perceived quality, consistency and dependability of income flows from tenancies and a number of other local, regional and national factors. In addition, environmental contamination, potential major repairs which are not presently contemplated, increased operating costs or other unknown liabilities, including in connection with non-compliance with applicable laws, if any, at the Company’s properties may adversely impact the sales price of those assets. As a result, the actual prices at which we are able to sell our properties may be less than the amounts we have assumed for purposes of stating the estimated range of liquidating distributions, which would result in the amount of such distributions being lower than our original estimate and the timing of the sales of our properties may not occur within the expected time frame. The amount available for distributions may also be reduced if the expenses we incur in selling our properties are greater than anticipated. In calculating our estimated range of liquidating distributions, we assumed that we will be able to find buyers for all of our assets at amounts based on our estimated range of market values for each property. However, for a variety of reasons, some of which are outside of our control, we may have overestimated the sales prices that we will ultimately be able to obtain for these assets. For example, in order to find buyers in a timely manner, we may be required to lower our asking price below the low end of our current estimate of the property’s market value. If we are not able to find buyers for these assets in a timely manner or if we have overestimated the sales prices we will receive, our liquidating distributions to our stockholders would be delayed or reduced. Furthermore, the estimated range of liquidating distributions to have been made under the Plan of Liquidation of $8.83 to $9.83 per share of the Company’s common stock, estimated by the Board as of April 23, 2018 is based upon: (i) the board of director’s estimate of the range of proceeds to be received by the Company from the sale of the Company’s properties pursuant to the Plan of Liquidation, (ii) the amount of indebtedness owed on each property, including any estimated penalties that we expect to incur at the time of the disposition of such properties for early payment thereof and other indebtedness of the Company, (iii) the amount of cash on hand, including net proceeds from sales of the Company’s properties completed prior to the our board of directors’ approval of the Plan of Liquidation, (iv) estimated cash flows to be generated by the continued operations of the Company during the liquidation process, and (v) the estimated expenses to be incurred in connection with the sale of each property and the winding down and dissolution of the Company. We can provide no assurances that the aggregate liquidating distributions that are ultimately paid to our stockholders will be within the range of total liquidating distributions estimated by our board of directors in April 2018.

If we are unable to maintain the occupancy rates of currently leased space and lease currently available space, if tenants default under their leases or other obligations to us during the liquidation process or if our cash flow during the liquidation is otherwise less than we expect, our liquidating distributions may be delayed or reduced.

In calculating the estimated range of liquidating distributions, our board of directors assumed that we would maintain the occupancy rates of currently-leased space, that we would be able to rent certain currently available space and that we would not experience any significant tenant defaults during the liquidation process that were not subsequently cured. The inability of a single major tenant or a number of smaller tenants to meet their rental obligations would adversely affect our income. Tenants may have the right to terminate their leases upon the occurrence of certain customary events of default and, in other circumstances, may not renew their leases or, because of market conditions, may be able to renew their leases on terms that are less favorable to us than the terms of the current leases. The COVID-19 (more commonly known as the Coronavirus) pandemic has caused significant economic uncertainty and disruption, which could negatively impact the financial condition of one or more of our tenants. It is particularly adversely impacting many of our retail tenants (other than grocery tenants), as government instructions regarding social distancing and mandated closures have reduced and, in some cases, eliminated customer foot traffic, causing many of our retail tenants to temporarily close their brick and mortar stores. The weakening of the financial condition of a significant tenant or a number of smaller tenants and vacancies caused by defaults of tenants or the expiration of leases, may adversely affect the liquidation. Some of our properties are leased to significant tenants and, accordingly, may be suited to the particular or unique needs of such tenants. We may have difficulty replacing such a tenant if the floor plan of the vacant space limits the types of businesses that can use the space without major renovation. In addition, the resale value of the

7

property could be diminished because the market value of a particular property will depend principally upon the value of the leases of such property.

To the extent that we receive less rental income than we expect during the liquidation process, or have difficulty selling certain of our properties due to such reduced rental income, our liquidating distributions will be reduced.

If any of the parties to our sale agreements breach such agreements or default thereunder, or if the sales do not otherwise close, our liquidating distributions may be delayed or reduced.

We will seek to enter into binding sale agreements for our properties. The consummation of the potential sales will be subject to satisfaction of closing conditions. When the transactions contemplated by these sale agreements do not close because of a buyer breach or default, failure of a closing condition or for any other reason, such as a potential buyer walking away as a result of the economic uncertainty and disruption created by the Coronavirus pandemic, we need to locate a new buyer for the assets, which we may be unable to do promptly or at prices or on terms that are as favorable as the original sale agreement. We will also incur additional costs involved in locating a new buyer and negotiating a new sale agreement for the assets. These additional costs may exceed amounts included in our projections. In the event that we incur these additional costs, our liquidating distributions to our stockholders could be delayed or reduced.

We cannot determine at this time when or whether we will ultimately pay total liquidating distributions to our stockholders within the estimated range of liquidating distributions estimated by our board of directors because there are many factors, some of which are outside of our control, which could affect our ability to make such liquidating distributions.

Although we have provided an estimated range of liquidating distributions and have commenced paying liquidating distributions to our stockholders, we cannot determine at this time when, or potentially whether, we will be able to make total liquidating distributions to our stockholders in an amount that is within the range of liquidating distributions estimated by our board of directors on April 23, 2018. These distributions will depend on a variety of factors, including, but not limited to, the length of time it takes to implement the Plan of Liquidation, which we estimate could take at least until July 17, 2020, if not longer, the price and timing of transactions entered into in the future, the cost of operating the Company through the date of our final dissolution, general business and economic conditions, and other matters. In addition, before making the final liquidating distribution, we will need to pay or arrange for the payment of all of our transaction costs in the liquidation, all other costs and all valid claims of our creditors. Our board of directors may also decide to acquire one or more insurance policies covering unknown or contingent claims against us, for which we would pay a premium which has not yet been determined. Our board of directors may also decide to provide for any unknown and outstanding liabilities and expenses, which may include the establishment of a reserve fund or transferring assets to a liquidating trust to pay contingent liabilities and ongoing expenses in an amount to be determined as information concerning such contingencies and expenses becomes available. The amount of transaction costs in the liquidation is not yet final, including prepayment penalties with respect to indebtedness on the properties, so we have used estimates of these costs in calculating the amounts of our projected liquidating distributions. To the extent that we have underestimated these costs in calculating our projections, our actual liquidating distributions may be lower than our estimated range. In addition, if the claims of our creditors are greater than what we have anticipated or if we decide to acquire one or more insurance policies covering unknown or contingent claims against us, our liquidating distributions may be delayed or reduced. Further, if a reserve fund is established or assets are transferred to a liquidating trust to pay contingent liabilities, payment of liquidating distributions to our stockholders may be delayed or reduced.

The sales of our assets pursuant to the Plan of Liquidation will not be subject to further stockholder approval.

Following the approval of the Plan of Liquidation by our stockholders in July 2018, our board of directors has the authority to sell any and all of the Company’s assets on such terms and to such parties, including affiliated parties (subject to the terms of our charter), as our board of directors determines appropriate, even if such terms are less favorable than those assumed for the purpose of estimating our range of liquidating distributions. Notably, our stockholders will have no subsequent opportunity to vote on such matters and will, therefore, have no right to approve or disapprove the terms of such sales.

Even if you receive total liquidating distributions within the estimated range of $8.83 to $9.83 per share of the Company’s common stock, there can be no assurance regarding the total return you will realize.

Although we have provided an estimated range of total liquidating distributions of $8.83 to $9.83 per share of the Company’s common stock and have paid approximately $2.83 per share since the date they were acquired, there can be no assurances regarding the amounts of any liquidating distributions or the timing thereof. Your total return will depend on the amount you paid for your shares, the date on which you purchased such shares, and our ability to effectively complete the Plan of Liquidation. Stockholders should consult their financial advisors for more information about their potential total return.

8

Our board of directors may amend or terminate the Plan of Liquidation, if it determines that doing so is in the best interest of the Company and our stockholders.

At any time prior to the filing of Articles of Dissolution, our board of directors may amend or terminate the Plan of Liquidation without further stockholder approval if it determines that doing so would be in the best interest of the Company and our stockholders. Thus, we have the ability to determine to conduct the liquidation differently than previously described or we may determine not to complete the liquidation.

If there are any lawsuits in connection with the Plan of Liquidation, it may be costly and may prevent the Plan of Liquidation from being completed or from being completed within the expected timeframe.

Our stockholders may file lawsuits challenging the Plan of Liquidation which may name the Company or our board of directors as defendants. As of the date of this report, no such lawsuits challenging the Plan of Liquidation were pending, or to our knowledge, threatened. However, if such a lawsuit is filed, we cannot assure you as to the outcome of any such lawsuits, including the amount of costs associated with defending any such claims or any other liabilities that may be incurred in connection with such claims. If any plaintiffs are successful in obtaining an injunction prohibiting us from completing the Plan of Liquidation, such an injunction may delay the Plan of Liquidation or prevent it from being completed. Whether or not any plaintiff’s claim is successful, this type of litigation often results in significant costs and diverts management’s attention and resources, which could adversely affect the operation of our business and reduce the funds available for liquidating distributions to our stockholders.

We may fail to continue to qualify as a REIT, which would reduce the amount of any potential distributions.

The estimated range of liquidating distributions determined by our board of directors assumes that the Company will continue to qualify as a REIT under the Tax Code during the entire liquidation process and, therefore, no provision has been made for federal income taxes. So long as we qualify as a REIT and distribute all of our taxable income each year, we generally will not be subject to federal income tax. While our board of directors does not presently intend to terminate our REIT status prior to the final liquidating distribution of our assets and our dissolution, pursuant to the Plan of Liquidation, our board of directors may take actions that would result in such a loss of REIT status. To qualify as a REIT, we must satisfy various ongoing requirements relating to the nature of our gross assets and income, the timing and amount of distributions and the composition of our stockholders. There can be no assurance that the Company will be able to maintain its REIT qualification. We may encounter difficulties satisfying these requirements as part of the liquidation process. If we lose our REIT status, we would be taxable as a corporation for federal income tax purposes and would be liable for federal income taxes, including any applicable alternative minimum tax, at the corporate rate with respect to our entire income from operations and from liquidating sales of our assets for the taxable year in which our qualification as a REIT terminates and in any subsequent years, and we would not be entitled to a tax deduction for distributions that we make. We would also be subject to increased state and local taxes. As a result of these consequences, our failure to qualify as a REIT could substantially reduce the funds available for distribution to our stockholders.

Distributing interests in a liquidating trust may cause you to recognize gain prior to the receipt of cash.

The REIT provisions of the Tax Code generally require that each year we distribute as dividends to our stockholders at least 90% of our REIT taxable income (determined without regard to the dividends paid deduction and by excluding any net capital gains). Our liquidating distributions generally will not qualify as deductible dividends for this purpose unless, among other things, we make such distributions within 24 months after the adoption of the Plan of Liquidation. We believe that the adoption of the Plan of Liquidation will be properly treated as having occurred upon its approval by our stockholders on July 17, 2018. Although we anticipate that we will meet this timetable, conditions may arise which cause us not to be able to liquidate within such 24-month period. For instance, it may not be possible to sell our assets at acceptable prices during such period.

In addition, the IRS could assert that the adoption of the Plan of Liquidation effectively commenced prior to July 17, 2018 with the sale of, or agreement by us to sell, certain properties. If such an assertion were successful, we could be required to complete the Plan of Liquidation sooner than July 17, 2020, or otherwise distributions that we make pursuant to the Plan of Liquidation might not be deductible by us, which might result in a loss by us of our tax qualification as a REIT or in our otherwise incurring income taxes.

In such event, rather than retain our assets and risk losing our status as a REIT, we may elect to contribute our remaining assets and liabilities to a liquidating trust and distribute interests in the liquidating trust to our stockholders in order to meet the

9

24-month requirement. We may also elect to transfer our remaining assets and liabilities to a liquidating trust within such 24-month period to avoid the costs of operating as a public company. Such a transfer would be treated as a distribution of our remaining assets to our stockholders, together with a contribution of the assets to the liquidating trust. As a result, a stockholder would recognize gain to the extent that his share of the cash and the net fair market value of any assets received by the liquidating trust was greater than the stockholder’s basis in his stock, notwithstanding that the stockholder would not contemporaneously receive a distribution of cash or any other assets with which to satisfy any resulting tax liability and the Company may have withholding tax obligations with respect to foreign stockholders. In addition, it is possible that the fair market value of the assets received by the liquidating trust, as estimated for purposes of determining the extent of the stockholder’s gain at the time at which interests in the liquidating trust are distributed to the stockholders, will exceed the cash or fair market value of property received by the liquidating trust on a later sale of the assets. In this case, the stockholder could recognize a loss in a taxable year subsequent to the taxable year in which the gain was recognized, the deductibility of which may be limited under the Tax Code. The distribution to stockholders of interests in a liquidating trust may also cause ongoing adverse tax consequences (particularly to tax-exempt and foreign stockholders, which may be required to file U.S. tax returns with respect to their share of income generated by the liquidating trust).

Stockholders may be liable to our creditors for the amount received from us if our reserve fund or the assets transferred to a liquidating trust are inadequate.

Pursuant to the Plan of Liquidation, we intend to dispose of our assets, discharge our liabilities and distribute to our stockholders any remaining assets as soon as practicable. In the event that it should not be feasible, in the opinion of our board of directors, for the Company to pay, or adequately provide for, all of our debts and liabilities, or if our board of directors shall determine it is advisable, our board of directors may establish a liquidating trust to which the Company could distribute in kind its unsold assets.

Any reserve fund or assets transferred to a liquidating trust established by us may not be adequate to cover any contingent expenses and liabilities. Under Maryland law, if we make distributions and fail to maintain an adequate reserve fund or fail to transfer adequate assets in a liquidating trust for payment of our contingent expenses and liabilities, each stockholder could be held liable for payment to our creditors of such amounts owed to creditors which we fail to pay. The liability of any stockholder would be limited to the amount of such liquidating distributions previously received by such stockholder from us or the liquidating trust. Accordingly, in such event, a stockholder could be required to return all such distributions received from the Company or the liquidating trust. If a stockholder has paid taxes on liquidating distributions previously received, a repayment of all or a portion of such amount could result in a stockholder incurring a net tax cost if the stockholder’s repayment of an amount previously distributed does not cause a commensurate reduction in taxes payable. On December 31, 2019, the Company had outstanding liabilities of approximately $670.2 million, of which approximately $537.8 million consisted of loans secured by properties we owned. All of these obligations are expected to be paid in full in connection with the sales of our properties. We may decide to establish a reserve fund or transfer assets to a liquidating trust to provide for any unknown or outstanding liabilities and expenses. We will continuously monitor expenses and any other foreseeable liabilities the Company may incur in implementing the Plan of Liquidation to seek to ensure that an adequate reserve fund is maintained or adequate assets are transferred to a liquidating trust to discharge these liabilities in full.

Risks Related to Our Business in General

A prolonged national or world-wide economic downturn or volatile capital market conditions could adversely affect our results of operations and our ability to pay distributions to our stockholders.

The recent global outbreak of COVID-19 (more commonly referred to as the Coronavirus) has disrupted financial markets and the prolonged economic impact is uncertain. It continues to adversely impact global commercial activity and has contributed to significant volatility in financial markets. The global impact of the outbreak has been rapidly evolving, and as cases of the virus have continued to be identified in additional countries, many countries have instituted quarantines and restrictions on travel. Such actions are creating disruption in global supply chains, and adversely impacting a number of industries, such as transportation, hospitality and entertainment. Some economists and major investment banks have expressed concern that the continued spread of the virus globally could lead to a world-wide economic downturn. The rapidly evolving nature of the pandemic and its impact to the global economic environment will likely have an adverse impact on overall market conditions and the disposition process. At this time, we cannot predict the ultimate impact of it on our liquidation process and distributions to our stockholders.

10

If prolonged disruptions in the capital and credit markets continue for a prolonged period, they could adversely affect our ability to obtain loans, credit facilities, debt financing and other financing, or, when available, to obtain such financing on reasonable terms, which could negatively impact our ability to execute our Plan of Liquidation in a manner that is accretive to our stockholders. See “[t]he recent global outbreak of the Coronavirus has disrupted economic markets and the prolonged economic impact is uncertain. Some economists and major investment banks have expressed concern that the continued spread of the virus globally could lead to a world-wide economic downturn” for a further discussion of the risks related to Coronavirus pandemic and its potential impact on our financial results and the completion of our Plan of Liquidation.

If these disruptions in the capital and credit markets should continue as a result of, among other factors, uncertainty and disruption caused by the impact of the Coronavirus, changing regulation, changes in trade agreements reduced alternatives or additional failures of significant financial institutions, our access to liquidity could be significantly impacted. Prolonged disruptions could result in us selling our remaining assets at lower than expected prices, which could reduce or eliminate the liquidating distributions we make to our stockholders.

We believe the risks associated with our business are more severe during periods of economic downturn if these periods are accompanied by declining values in real estate. For example, a prolonged economic downturn could negatively impact our property investments as a result of increased customer delinquencies and/or defaults under our leases, generally lower demand for rentable space, potential oversupply of rentable space leading to increased concessions, and/or customer improvement expenditures, or reduced rental rates to maintain occupancies.

Our operations could be negatively affected to a greater extent if an economic downturn is prolonged or becomes more severe, which could significantly harm our revenues, results of operations, financial condition, liquidity, and our ability to make distributions to our stockholders and may result in a decrease in the value of our stockholders’ investment.

The recent global outbreak of the Coronavirus has disrupted economic markets and the prolonged economic impact is uncertain. Some economists and major investment banks have expressed concern that the continued spread of the virus globally could lead to a world-wide economic downturn.

The Coronavirus pandemic has had, and is expected to continue to have, an adverse impact on overall market conditions and our disposition process. It has already disrupted global travel and supply chains, adversely impacted global commercial activity, and its long-term economic impact remains uncertain. Some economists and major investment banks have predicted that it could lead to a global economic downturn and many government authorities have imposed shelter-in-place orders, including in the United Kingdom and in many states across the U.S. where are remaining assets are located. Considerable uncertainty still surrounds the Coronavirus and its potential effects on the population, as well as the effectiveness of any responses taken on a national and local level by government authorities and businesses. The travel restrictions, limits on hours of operations and/or closures of non-essential businesses and other efforts to curb the spread of the Coronavirus have significantly disrupted business activity globally, including in the markets where we own assets, and is expected to have an adverse impact on the performance of our investments. In addition, the rapidly evolving nature of the pandemic makes it difficult to ascertain the long-term impact it will have on commercial real estate markets and our investments.

Our tenants operate in industries which are being adversely affected by the disruption to business caused by the outbreak of the Coronavirus. Many of our tenants are subject to shelter in place and other quarantine restrictions, and the restrictions could be in place for an extended period of time. These restrictions are particularly adversely impacting many of our retail tenants (other than grocery tenants), as government instructions regarding social distancing and mandated closures have reduced and, in some cases, eliminated customer foot traffic, causing many of our retail tenants to temporarily close their brick and mortar stores. As of December 31, 2019, we owned four retail properties in the U.S., which comprised a significant portion of our portfolio. If these disruptions continue and the economic downturn is prolonged, it is likely to lead to rent delinquencies and defaults under leases, lower occupancy, or reduced rental rates to maintain or improve occupancy. Any of these developments would likely have a material adverse effect on our financial results and our ability to dispose of our remaining assets. At this time, we cannot predict the ultimate impact to its disposition process or timing.

Yields on and safety of deposits may be lower if there are to extensive declines in the financial markets.

We may hold funds in investments, including money market funds, bank money market accounts and CDs or other accounts at third-party depository institutions. Unusual declines in the financial markets similar to those experienced during the Great Recession, could result in a loss of some or all of these funds. In particular, money market funds may experience intense redemption pressure in such years and have difficulty satisfying redemption requests. As a result, we may not be able to access the cash in our money market investments. In addition, current yields from these investments are minimal.

11

The failure of any bank in which we deposit our funds could reduce the amount of cash we have available to pay distributions and make additional investments.

The Federal Deposit Insurance Corporation only insures amounts up to $250,000 per depositor. It is likely that we will have cash and cash equivalents and restricted cash deposited in certain financial institutions in excess of federally insured levels. If any of the banking institutions in which we deposit funds ultimately fails, we may lose any amount of our deposits over federally insured levels. The loss of our deposits could reduce the amount of cash we have available to distribute or invest and could result in a decline in the value of our stockholders’ investments.

From time to time, we may have a substantial amount of indebtedness. In the event we do not repay or refinance such indebtedness, we could face substantial liquidity issues and the lenders will be able to accelerate the debt and foreclose on the assets securing them, which will materially and adversely affect our ability to make liquidating distributions to our stockholders..

As of March 30, 2020, we had approximately $234.3 million of outstanding indebtedness all of which is scheduled to mature within a year and which, upon final maturity, we will need to refinance or repay. In evaluating our current and projected sources of liquidity to meet the obligations of such debt, we have assessed our available options and have determined that our plan is to refinance these loans or to repay such obligations with proceeds from the sale of assets pursuant to the Plan of Liquidation and available cash on hand. If we are unable to pay our debt at maturity, the lenders will be able to accelerate the debt and foreclose on the assets securing them, which will materially and adversely affect our ability to make liquidating distributions to our stockholders. See Note 4 — Debt Financing for additional information regarding our outstanding debt.

Economic conditions and the credit markets have historically experienced, and may continue to experience, periods of volatility, uncertainty, or weakness that could impact the availability or cost of debt financing.

A substantial portion of our outstanding indebtedness bears interest at floating rates based on the London interbank offered rate (“LIBOR”). In July 2017, the United Kingdom's Financial Conduct Authority, which regulates LIBOR, announced that it will stop compelling banks to submit rates for the calculation of LIBOR after 2021. It is not possible to predict the effect of these changes, other reforms or the establishment of alternative reference rates. The discontinuation or modification of LIBOR could result in interest rate increases on our debt, which could adversely affect our cash flow, operating results and ability to make distributions to our stockholders at expected levels or at all.

If we are unable to repay or refinance our debt, we cannot guarantee that we will be able to generate enough cash flows from operations or that we will be able to obtain enough capital to service our debt, fund our planned capital expenditures or pay future distributions at expected levels or at all. In such an event, we could face substantial liquidity issues and might be required to sell some of our assets to meet our debt payment obligations. Failure to repay or refinance indebtedness when required could result in a default under such indebtedness. If we incur additional indebtedness, any such indebtedness could exacerbate the risks described above.

Lenders may require us to enter into restrictive covenants that relate to or otherwise limit our operations, which could limit our ability to make distributions to our stockholders, to replace the Advisor or to otherwise achieve our investment objectives.

When providing financing, a lender may impose restrictions on us that affect our distribution and operating policies and our ability to incur additional debt. Loan agreements we enter into may contain covenants that limit our ability to further mortgage property, discontinue insurance coverage, or make distributions under certain circumstances. In addition, provisions of our loan agreements may deter us from replacing the Advisor because of the consequences under such agreements and may limit our ability to replace the property manager or terminate certain operating or lease agreements related to the property. These or other limitations may adversely affect our flexibility and our ability to achieve our investment objectives.

We have acquired, and may continue to acquire, various financial instruments for purposes of “hedging” or reducing our risks, which may be costly and ineffective and may reduce our cash available for distribution to our stockholders.

We have, and may continue to enter into foreign currency forward contracts or similar hedging or derivative transactions or arrangements, in order to manage or mitigate our risk of exposure to the effects of currency changes as a result of our international investments. Similarly, we have, and may continue to enter into interest rate swaps and caps, or similar hedging or derivative transactions or arrangements, in order to manage or mitigate our risk of exposure to the effects of interest rate changes due to variable interest rate debt that we may have. No hedging strategy can adequately offset all of our risk related to foreign currency and interest rate volatility and protect us completely from loss. Any of the derivative and other hedging transactions that we have

12

entered into and that we may enter into in the future may not be effective in mitigating risk in all market conditions or against all types of risk (including unidentified or unanticipated risks), thereby resulting in losses to us. Further, engaging in derivative and other hedging transactions may result in a poorer overall performance for us than if we had not engaged in any such transaction, and our Advisor may not be able to effectively hedge against, or accurately anticipate, certain risks that may adversely affect our portfolio.

Our success will be dependent on the performance of Hines as well as key employees of Hines. Certain other investment vehicles sponsored by Hines have experienced adverse developments in recent years and there is a risk that we may experience similar adverse developments.

Our ability to achieve our investment objectives and to pay distributions is dependent upon the performance of Hines and its affiliates as well as key employees of Hines in the identification and acquisition of investments, the selection of tenants, the determination of any financing arrangements, the management of our assets and operation of our day-to-day activities. Our board of directors and the Advisor have broad discretion when managing our investments and determining the timing and terms of any asset dispositions. You will have no opportunity to evaluate the terms of transactions or other economic or financial data concerning our disposition activity. We will rely on the management ability of Hines and the oversight of our board of directors as well as the management of any entities or ventures in which we invest.

We may not be able to retain our key employees. To the extent we are unable to retain and/or find qualified successors for key employees that depart from the company, our results of operations may be adversely impacted. Our officers and the management of the Advisor also serve in similar capacities for numerous other entities. If Hines or any of its key employees are distracted by these other activities or suffer from adverse financial or operational problems in connection with operations unrelated to us, the ability of Hines and its affiliates to allocate time and/or resources to our operations may be adversely affected. If Hines is unable to allocate sufficient resources to oversee and perform our operations for any reason, our results of operations would be adversely impacted. We will not provide key-man life insurance policies for any of Hines’ key employees.

Terrorist attacks and other acts of violence, civilian unrest or war may affect the markets in which we operate our operations and our profitability.

Terrorist attacks and other acts of violence, civilian unrest or war may negatively affect our operations and our stockholders’ investments in our shares. Certain of our real estate investments are located in areas that may be susceptible to attack. In addition, any kind of terrorist activity or violent criminal acts, including terrorist acts against public institutions or buildings or modes of public transportation (including airlines, trains or buses) could have a negative effect on our business. These events may directly impact the value of our assets through damage, destruction, loss or increased security costs. We may not be able to obtain insurance against the risk of terrorism because it may not be available or may not be available on terms that are economically feasible. Further, even if we do obtain terrorism insurance, we may not be able to obtain sufficient coverage to fund any losses we may incur. Risks associated with potential acts of terrorism in the areas in which we acquire properties or other real estate investments could sharply increase the premiums we pay for coverage against property and casualty claims. Additionally, mortgage lenders in some cases have begun to insist that specific coverage against terrorism be purchased by commercial owners as a condition for providing loans.

The consequences of any armed conflict are unpredictable, and we may not be able to foresee events that could have an adverse effect on our business or our stockholders’ investments in our shares. More generally, any terrorist attack, other act of violence or war, including armed conflicts, could result in increased volatility in or damage to, the United States and worldwide financial markets and economy. They also could result in a continuation of the current economic uncertainty in the United States or abroad. Our revenues will be dependent upon the payment of rent and the return of our other investments which may be particularly vulnerable to uncertainty in the local economy. Increased economic volatility could adversely affect our tenants’ ability to pay rent or the return on our other investments or our ability to borrow money or issue capital stock at acceptable prices and have a material adverse effect on our business, results of operations, cash flows and financial condition and our ability to make distributions to our stockholders and the value of their investment.

We may be subject to litigation which could have a material adverse effect on our business and financial condition.

We may be subject to litigation, including claims relating to our Plan of Liquidation or operations, offerings, unrecognized pre-acquisition contingencies and otherwise in the ordinary course of business. Some of these claims may result in potentially significant judgments against us, some of which are not, or cannot be, insured against. We generally intend to vigorously defend ourselves; however, we cannot be certain of the ultimate outcomes of claims that may arise in the future. Resolution of these types of matters against us may result in our payment of significant fines or settlements, which, if not insured against, or if these fines and settlements exceed insured levels, would adversely impact our earnings and cash flows. Certain litigation or the

13

resolution of certain litigation may affect the availability or cost of some of our insurance coverage which could adversely impact our results of operations and cash flows, expose us to increased risks that would be uninsured and/or adversely impact our ability to attract officers and directors.

Our business could suffer in the event the Advisor, our transfer agent or any other party that provides us with services essential to our operations experiences system failures or cyberincidents or a deficiency in cybersecurity.

The Advisor, our transfer agent and other parties that provide us with services essential to our operations are vulnerable to damages from any number of sources, including computer viruses, unauthorized access, energy blackouts, natural disasters, terrorism, war and telecommunication failures. Any system failure or accident that causes interruptions in our operations could result in a material disruption to our business. A cyber incident is considered to be any adverse event that threatens the confidentiality, integrity or availability of information resources. More specifically, a cyber incident is an intentional attack or an unintentional event that may include, but is not limited to, gaining unauthorized access to systems to disrupt operations, corrupt data, steal assets or misappropriate confidential information, such as confidential stockholder records. As reliance on technology in our industry has increased, so have the risks posed to our systems, both internal and those we have outsourced. In addition, the risk of a cyber incident, including by computer hackers, foreign governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and instructions from around the world have increased. The remediation costs and lost revenues experienced by a victim of a cyber incident may be significant and significant resources may be required to repair system damage, protect against the threat of future security breaches or to alleviate problems, including reputational harm, loss of revenues and litigation, caused by any breaches. There also may be liability for any stolen assets or misappropriated confidential information. Any material adverse effect experienced by the Advisor, our transfer agent and other parties that provide us with services essential to our operations could, in turn, have an adverse impact on us.

Risks Related to Investments in Real Estate

Geographic concentration of our portfolio may make us particularly susceptible to adverse economic developments in the real estate markets of those areas.

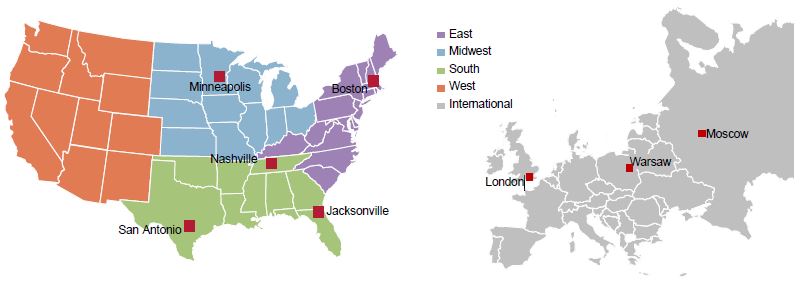

In the event that we have a concentration of properties in, or real estate investments that invest in properties located in, a particular geographic area, our operating results and ability to make distributions are likely to be impacted by economic changes affecting the real estate markets in that area. Therefore, stockholders’ investment in our common stock will be subject to greater risk to the extent that we lack a geographically diversified portfolio. For example, based on the December 31, 2018 appraised value of the real estate investments in which we owned interests as of March 30, 2020, approximately 25% of our portfolio consists of our property located in London, England, 20% of our portfolio consists of our property in San Antonio, Texas, and 18% of our portfolio consists of our property in Minneapolis, Minnesota. Consequently, our financial condition and ability to make distributions could be materially and adversely affected by any significant adverse developments in those markets. Please see “Item 2. Properties — Market Concentration.”

Industry concentration of our tenants may make us particularly susceptible to adverse economic developments in these industries.

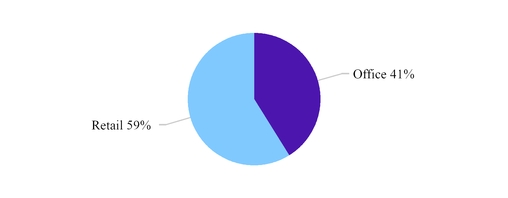

In the event we have a concentration of tenants in a particular industry, our operating results and ability to make distributions may be adversely affected by adverse developments in these industries and we will be subject to a greater risk to the extent that our tenants are not diversified by industry. For example, based on our pro rata share of space leased to tenants as of March 30, 2020, 52% of our space is leased to tenants in the retail industry, 11% is leased to tenants in the finance and insurance industry, 6% is leased to tenants in the healthcare, and 6% is leased to tenants in the hospitality industry. Please see “Item 2. Properties — Industry Concentration.”

14

We depend on tenants for our revenue, and therefore our revenue is dependent on the success and economic viability of our tenants. Our reliance on single or significant tenants in certain buildings may decrease our ability to lease vacated space.

Rental income from real property constitutes a significant portion of our income. Delays in collecting accounts receivable from tenants could adversely affect our cash flows and financial condition. In addition, the inability of a single major tenant or a number of smaller tenants to meet their rental obligations would adversely affect our income. Therefore, our financial success is indirectly dependent on the success of the businesses operated by the tenants in our properties or in the properties securing loans we may own. Tenants may have the right to terminate their leases upon the occurrence of certain customary events of default and, in other circumstances, may not renew their leases or, because of market conditions, may be able to renew their leases on terms that are less favorable to us than the terms of the current leases. The weakening of the financial condition or the bankruptcy or insolvency of a significant tenant or a number of smaller tenants and vacancies caused by defaults of tenants or the expiration of leases, may adversely affect our operations and our ability to pay distributions.

Generally, under U.S. bankruptcy law, a debtor tenant has 120 days to exercise the option of assuming or rejecting the obligations under any unexpired lease for nonresidential real property, which period may be extended once by the bankruptcy court. If the tenant assumes its lease, the tenant must cure all defaults under the lease and may be required to provide adequate assurance of its future performance under the lease. If the tenant rejects the lease, we will have a claim against the tenant’s bankruptcy estate. Although rent owing for the period between filing for bankruptcy and rejection of the lease may be afforded administrative expense priority and paid in full, pre-bankruptcy arrears and amounts owing under the remaining term of the lease will be afforded general unsecured claim status (absent collateral securing the claim). Moreover, amounts owing under the remaining term of the lease will be capped. Other than equity and subordinated claims, general unsecured claims are the last claims paid in a bankruptcy and therefore funds may not be available to pay such claims in full. In addition, while the specifics of the bankruptcy laws of international jurisdictions may differ from the U.S. bankruptcy laws described herein, the bankruptcy or insolvency of a significant tenant or a number of smaller tenants at any of the international properties we may acquire, may similarly adversely impact our operations and our ability to pay distributions.

Some of our properties may be leased to a single or significant tenant and, accordingly, may be suited to the particular or unique needs of such tenant. We may have difficulty replacing such a tenant if the floor plan of the vacant space limits the types of businesses that can use the space without major renovation. In addition, the resale value of the property could be diminished because the market value of a particular property will depend principally upon the value of the leases of such property.

We may suffer adverse consequences if our revenues decline, since our operating costs do not necessarily decline in proportion to our revenue.

We earn a significant portion of our income from renting our properties. Our operating costs, however, do not necessarily fluctuate in proportion to changes in our rental revenue. As a result, our costs will not necessarily decline even if our revenues do. Similarly, our operating costs could increase while our revenues stay flat or decline. In either such event, we may be forced to borrow funds to cover our costs, we may incur losses or we may not have cash available to service our debt.

Due to the risks involved in the ownership of real estate investments and real estate acquisitions, a return on an investment in Hines Global is not guaranteed, and our stockholders may lose some or all of their investment.

By owning our shares, stockholders will be subjected to significant risks associated with owning and operating real estate investments. The performance of their investment in Hines Global will be subject to such risks, including:

• | changes in the general economic climate; |

• | changes in local conditions such as an oversupply of space or reduction in demand for real estate; |

• | changes in interest rates and the availability of financing; |

• | changes in property level operating expenses due to inflation or otherwise; |