Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SCHULMAN A INC | d267342d8k.htm |

Fiscal 2011 Annual Meeting

December 8, 2011

Exhibit 99.1 |

2

Safe Harbor

Cautionary Note on Forward-Looking Statements A number of the matters

discussed in this document that are not historical or current facts deal with potential future circumstances and

developments and may constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements can be

identified by the fact that they do not relate strictly to historic or current facts and relate to future events and

expectations. Forward-looking statements contain such words as “anticipate,”

“estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other

words and terms of similar meaning in connection with any discussion of future operating or financial

performance. Forward-looking statements are based on management’s current expectations

and include known and unknown risks, uncertainties and other factors, many of which management

is unable to predict or control, that may cause actual results, performance or achievements to differ materially from those expressed

or implied in the forward-looking statements. Important factors that could cause actual results to

differ materially from those suggested by these forward-looking statements, and that could

adversely affect the Company’s future financial performance, include, but are not limited to, the

following:

–

worldwide and regional economic, business and political conditions, including

continuing economic uncertainties in some or all of the Company’s major product markets;

–

the effectiveness of the Company’s efforts to improve operating margins through

sales growth, price increases, productivity gains, and improved purchasing techniques;

–

competitive factors, including intense price competition;

–

fluctuations in the value of currencies in major areas where the Company operates;

–

volatility of prices and availability of the supply of energy and raw materials that

are critical to the manufacture of the Company’s products, particularly plastic resins

derived from oil and natural gas;

–

changes in customer demand and requirements;

–

effectiveness of the Company to achieve the level of cost savings, productivity

improvements, growth and other benefits anticipated from acquisitions and restructuring

initiatives;

–

escalation in the cost of providing employee health care;

–

uncertainties regarding the resolution of pending and future litigation and other

claims;

–

the performance of the North American auto market; and

–

further adverse changes in economic or industry conditions, including global supply and

demand conditions and prices for products.

The risks and uncertainties identified above are not the only risks the Company faces. Additional risk

factors that could affect the Company’s performance are set forth in the Company’s

Annual Report on Form 10-K. In addition, risks and uncertainties not presently known to the Company

or that it believes to be immaterial also may adversely affect the Company. Should any known or

unknown risks or uncertainties develop into actual events, or underlying assumptions prove

inaccurate, these developments could have material adverse effects on the Company’s business,

financial condition and results of operations. This document contains time-sensitive information

that reflects management’s best analysis only as of the date of this document. The Company

does not undertake an obligation to publicly update or revise any forward-looking statements to reflect

new events, information or circumstances, or otherwise. Further information concerning issues that

could materially affect financial performance related to forward-looking statements can be

found in the Company’s periodic filings with the Securities and Exchange Commission. |

3

Use of Non-GAAP Financial Measures

•

This presentation includes certain financial information determined by methods

other than in accordance with accounting principles

generally

accepted

in

the

United

States

(“GAAP”).

These

non-GAAP

financial

measures

include:

net

income

excluding certain items, net income per diluted share excluding certain items and

EBITDA excluding certain items, as well as certain non-GAAP supplemental

segment comparison financial information reflecting the operations of A. Schulman, Inc. (the

“Company”) as if it owned ICO, Inc. (“ICO”) at the beginning

first quarter of 2010. However, non-GAAP measures are not in accordance

with, nor are they a substitute for, GAAP measures, and tables included in this release reconcile each non-GAAP

financial measure with the most directly comparable GAAP financial measure. The

most directly comparable GAAP financial measures

for

these

purposes

are

income

from

continuing

operation

before

taxes,

net

income

and

net

income

per

diluted

share.

The Company's non-GAAP financial measures are not meant to be considered in

isolation or as a substitute for comparable GAAP financial measures, and

should be read only in conjunction with the Company's consolidated financial statements

prepared in accordance with GAAP.

•

The Company uses these non-GAAP financial measures to monitor and evaluate

Company performance and believes that they are useful to investors for

financial analysis, particularly with respect to understanding the significance of the ICO acquisition in

the third quarter of fiscal 2010. However, the non-GAAP supplemental financial

information is not necessarily indicative of what the combined financial

results would have actually been had the ICO acquisition taken place as of September 1, 2009, since

such financial information does not reflect any cost savings, operating synergies,

tax synergies or revenue enhancements, and includes certain estimated

additional depreciation amounts and estimates for amortization of the intangibles recorded as part of

the purchase price allocation.

•

While the Company believes that these non-GAAP financial measures provide

useful supplemental information to investors, there

are

very

significant

limitations

associated

with

their

use.

These

non-GAAP

financial

measures

are

not

prepared

in

accordance with GAAP, may not be reported by all of the Company's competitors and

may not be directly comparable to similarly

titled

measures

of

the

Company's

competitors

due

to

potential

differences

in

the

exact

method

of

calculation.

The

Company compensates for these limitations by using these non-GAAP financial

measures as supplements to GAAP financial measures and by reviewing the

reconciliations of the non-GAAP financial measures to their most comparable GAAP financial

measures. |

A.

Schulman Milestones – FY 2011

•

Successfully completed Mash acquisition

•

Completed integration of ICO & McCann acquisitions

•

Further

strengthened

management

team

-

Joe

Levanduski

named

CFO

•

Continued realignment of assets to better meet market needs:

restructuring in the U.K

consolidation in Italy, Australia, U.S.

•

Board approved a share repurchase program for $100 million of common

stock and we committed to, and completed, the purchase of $30 million

over the past 6 month

•

Board

approved

an

increase

of

10%

in

quarterly

dividend

to

$0.17

per

common share, representing an annual yield of approximately 3.5%

•

Entered

into

a

joint

venture

with

Argentina-based

Surplast

S.A.

which

expanded our presence in rotomolding in S. America

4 |

A.

Schulman Milestones – FY 2012

•

Continued restructuring in EMEA’s back office operations to better

leverage savings from Shared Service Center

•

Investment of approximately $7 million in Akron plant to add technical

compounding capabilities to facility

•

Final approval obtained to finish building plant in India

•

New lines to be added to address demand

Engineered Plastics lines in China and Mexico

Masterbatch line in Brazil

Specialty Powders line in Mexico

5 |

6

ASI’s Strategy

Effectively Leverage A Core Competence

Effectively Leverage A Core Competence

Distribution

Distribution

–

Use synergies with other business units to achieve widest and most effective

market coverage while providing added value services

–

Leverage procurement of resins at best possible price

–

Capture new sources of polymers from specialty and strong producers

Be the #1 Niche Player Globally

Be the #1 Niche Player Globally

Engineered

Engineered

Plastics

Plastics

–

Lever our successful European model globally

–

Participate in the high value-added niche portion of the EP market and reduce

exposure to commodity market

–

Continue

development

of

sustainable

“Green”

products

Be the #1 Global Manufacturer

Be the #1 Global Manufacturer

Masterbatch

Masterbatch

–

Favored consolidator in highly fragmented market

–

Judicious acquisitions to speed entry into underserved markets and geographic

extension

–

Focus on new, higher margin products/applications

Be the #1 Global Manufacturer

Be the #1 Global Manufacturer

Specialty

Specialty

Powders

Powders

–

In North America, maintain a balanced position between low-cost and technology

leadership with focused R&D

–

In Europe and Asia, further our technology leadership in high-value

compounds –

Judicious acquisitions to speed entry into underserved markets and geographic

extension |

7

Four Key Profit Drivers

»

Gradual market recoveries over time

»

Organic growth

»

Geographic growth

»

Continued leverage of global volume base

»

Seek opportunities for alternate sourcing from

Middle East and Asia

»

Align pricing strategies with purchasing strategies

»

Optimize footprint

»

SG&A leverage

»

Create higher-margin product portfolio

»

Support volume but primary focus on

increased profitability

ACQUISITIONS WILL ALSO PLAY KEY ROLE IN FUTURE GROWTH!

New Products

Continuous

Improvements

Purchasing

Savings/Smart Pricing

Slow and Steady

Volume Improvement

–

Realize

synergies

from

ICO,

McCann

and

Mash

acquisitions

–

Limit growth of SG&A, especially in developed markets

–

Admin optimization |

8

FY11 Financial Highlights

•

Reported net income for FY 2011 was:

–

$41.0

million

or

$1.32

per

diluted

share

vs.

net

income

of

$43.9

million

or

$1.57 per diluted share in FY 2010

•

Excluding restructuring and acquisition-related items*, net income for FY

2011 was:

–

$58 million or $1.86 per diluted share vs. $48.2 million or $1.72 per diluted

share in FY 2010

•

Overall gross profit per pound for FY 2011 was:

•

Cash was $155.8 million at 8/31/11; net debt position of $40.4 million;

approximately $271.6 million of untapped credit lines

•

Days

of

working

capital

were

60

as

of

8/31/11

vs.

61

days

at

the

at

the

end

of last year.

* Please see the end of this presentation for the reconciliations of GAAP versus

non-GAAP financial measures. 13.9 cents vs. 14.7 cents last year. Had the Company owned ICO

at the beginning of fiscal 2010, would have improved by approximately 4% from FY 2010 –

|

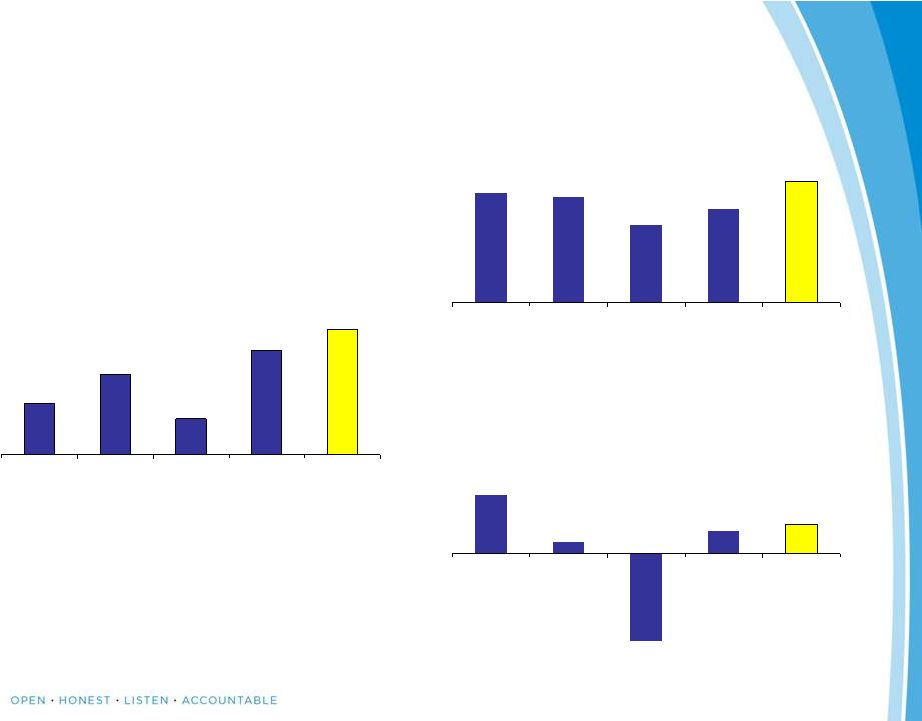

9

Actions taken before & during recession have improved net

income while protecting liquidity

Net Income from Operating Activity

$23.8

$37.2

$16.5

$48.2

$58.0

FY2007

FY2008

FY2009

FY2010

FY2011

Net Debt / (Net Cash)

$82.8

$16.1

($123.6)

$31.9

$40.4

FY2007

FY2008

FY2009

FY2010

FY2011

Pounds Sold

1,856.2

1,784.1

1,309.8

1,587.7

2,048.4

FY2007

FY2008

FY2009

FY2010

FY2011

20

Dollars in millions & excluding unusual items |

10

Non-GAAP to GAAP Reconciliation

FY2011

A. SCHULMAN, INC.

Reconciliation of GAAP and Non-GAAP Financial Measures

Unaudited

(In thousands, except per share data)

Year Ended August 31, 2011

As Reported

Asset Write-downs

Costs Related to

Acquisitions

Restructuring

Related

Inventory Step-up

Tax Benefits

(Charges)

Before Certain

Items

Net sales

2,192,955

$

-

$

-

$

-

$

-

$

-

$

2,192,955

$

Cost of sales

1,907,409

-

-

-

(607)

-

1,906,802

Selling, general and administrative expenses

206,406

-

(1,429)

-

-

-

204,977

Interest expense, net

5,531

-

-

-

-

-

5,531

Foreign currency transaction (gains) losses

1,595

-

-

-

-

-

1,595

Other (income) expense

(1,720)

-

-

-

-

-

(1,720)

Asset impairment

8,150

(8,150)

-

-

-

-

-

Restructuring expense

8,117

-

-

(8,117)

-

-

-

Curtailment (gains) losses

-

-

-

-

-

-

-

Total costs and expenses, net

2,135,488

(8,150)

(1,429)

(8,117)

(607)

-

2,117,185

Income from continuing operations before taxes

57,467

8,150

1,429

8,117

607

-

75,770

Provision for U.S. and foreign income taxes

15,782

-

38

874

209

65

16,968

Income from continuing operations

41,685

8,150

1,391

7,243

398

(65)

58,802

Income (loss) from discontinued operations, net of tax of $0

-

-

-

-

-

-

-

Net income (loss)

41,685

8,150

1,391

7,243

398

(65)

58,802

Noncontrolling interests

(689)

-

-

-

(102)

-

(791)

Net income (loss) attributable to A. Schulman, Inc.

40,996

$

8,150

$

1,391

$

7,243

$

296

$

(65)

$

58,011

$

Diluted EPS

1.32

$

1.86

$

31,141

31,141

Weighted-average number of shares outstanding - diluted |

11

Non-GAAP to GAAP Reconciliation

FY2010

A. SCHULMAN, INC.

Reconciliation of GAAP and Non-GAAP Financial Measures

Unaudited

(In thousands, except per share data)

Year ended August 31, 2010

As Reported

Asset Write-downs

Costs related to

Acquisitions

Restructuring

Related

Inventory Step-up

Tax Benefits

(Charges)

Before Certain

Items

Net sales

1,590,443

$

-

$

-

$

-

$

-

$

-

$

1,590,443

$

Cost of sales

1,357,575

(69)

-

-

(3,942)

-

1,353,564

Selling, general and administrative

expenses 179,821

-

(6,814)

-

-

-

173,007

Interest expense,

net 3,665

-

-

-

-

-

3,665

Foreign currency transaction (gains) losses

884

-

-

-

-

-

884

Other (income) expense

(2,425)

-

-

(44)

-

-

(2,469)

Asset

impairment 5,668

(5,668)

-

-

-

-

-

Restructuring expense

5,054

-

-

(5,054)

-

-

-

Curtailment (gains) losses

270

-

-

(270)

-

-

-

Total costs and expenses, net

1,550,512

(5,737)

(6,814)

(5,368)

(3,942)

-

1,528,651

Income from continuing operations before

taxes 39,931

5,737

6,814

5,368

3,942

-

61,792

Provision

(benefit) for U.S. and foreign income taxes (4,419)

127

6

1,198

1,036

15,448

13,396

Income from

continuing operations 44,350

5,610

6,808

4,170

2,906

(15,448)

48,396

Income

(loss) from discontinued operations, net of tax of $0 (239)

237

-

-

-

-

(2)

Net income (loss)

44,111

5,847

6,808

4,170

2,906

(15,448)

48,394

Noncontrolling interests

(221)

-

-

-

-

-

(221)

Net income (loss) attributable to A. Schulman, Inc.

43,890

$

5,847

$

6,808

$

4,170

$

2,906

$

(15,448)

$

48,173

$

Diluted EPS

1.57

$

1.72

$

Weighted-average number of shares outstanding - diluted

27,976

27,976

|

12

Non-GAAP to GAAP Reconciliation

Q4 & FY2011

A. SCHULMAN, INC.

Reconciliation of GAAP and Non-GAAP Financial Measures

EBITDA Excluding Certain Items Reconciliation

Unaudited

(In thousands)

2011

2010

2011

2010

Income from continuing operations before taxes

8,213

$

8,671

$

57,467

$

39,931

$

Adjustments (pretax):

Depreciation and amortization

9,861

9,957

40,274

27,380

Interest expense, net

1,393

968

5,531

3,665

Asset

write-downs 6,225

37

8,150

5,737

Costs related to

acquisitions 553

1,498

1,429

6,814

Restructuring related

costs 2,338

2,817

8,117

5,368

Inventory

step-up 324

1,406

607

3,942

EBITDA excluding

certain items 28,907

$

25,354

$

121,575

$

92,837

$

Three months ended

August 31,

Year ended

August 31, |