Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | d256725d8k.htm |

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | d256725dex991.htm |

Q4 FY 2011 EARNINGS

November 21, 2011

Page 1 of 33

Exhibit 99.2

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Prepared

comments provided by Rob Eggers, Investor Relations Thank you for your

interest in Brocade’s Q4 Fiscal 2011 earnings presentation, which includes prepared

remarks, slides, and a press release detailing fiscal fourth quarter 2011 financial

results. The press release was issued shortly after 1:00 p.m. Pacific time on

November 21, 2011, via Marketwire. The press release, along with these

prepared comments and slides, has been furnished to the SEC on Form 8-K and will be made available

on

Brocade’s

Investor

Relations

website

at

www.brcd.com. |

| Cautionary Statements and Disclosures

This presentation includes forward-looking statements regarding

Brocade’s financial results, plans, strategy and business outlook

as well as worldwide SAN, Ethernet and Federal government IT

spending, which are only predictions and involve risks and uncertainties such

that actual results may vary significantly. These and other risks are

set forth in more detail in our Form 10-Q for the fiscal quarter

ended July 30, 2011 and our Form 10-K for the fiscal year ended October 30, 2010. These

forward-looking statements reflect beliefs, assumptions, outlook, estimates

and predictions as of today, and Brocade expressly assumes no obligation

to update any such forward-looking statements.

In addition, this presentation includes various third-party estimates

regarding the total available market and other measures, which do not

necessarily reflect the views of Brocade. Further, Brocade does not

guarantee the accuracy or reliability of any such information or forecast.

Certain financial information is presented on a non-GAAP basis. The most

directly comparable GAAP information and a reconciliation between the

non-GAAP and GAAP figures are provided in the accompanying press

release, which has been furnished to the SEC on Form 8-K and posted on

Brocade’s website, and is included in the appendix to this

presentation. Please see risk factors on Forms 10-K and 10-Q

filed with the SEC Page 2 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

Agenda

Dan Fairfax

CFO

Mike Klayko

CEO

Prepared comments followed by live Q&A call

Page 3 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Today’s

prepared

comments

include

remarks

by

Mike

Klayko,

Brocade

CEO,

regarding

the

company’s

quarterly

results, its strategy, and a review of operations, as well as industry trends and

market/technology drivers related to its business; and by Dan Fairfax,

Brocade CFO, who will provide a financial review. A management discussion and

live question-and-answer conference call will be webcast beginning at 2:30 p.m.

Pacific

time

on

November

21

at

www.brcd.com

and

will

be

archived

on

the

Brocade

Investor

Relations

web

site. |

Fiscal 2011: Q4 Earnings

Mike Klayko, CEO

Page 4 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Prepared comments provided by Mike Klayko, CEO

|

Executive Summary

* Non-GAAP, please see GAAP reconciliation in appendix

Page 5 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Brocade had an outstanding Q4 FY 11 that helped establish company records

in a number of areas. Brocade generated revenue of $550M in Q4, and $2.15B

for the full year—both company records. Q4 EPS was $.16 on a non-GAAP basis, a $.07

increase

Qtr./Qtr.

and

$.03

increase

Yr./Yr.

For

the

full

FY

11,

the

EPS

was

$.50

on

a

non-GAAP

basis.

The

Q4

and

full

FY

11

results indicate good progress on our long-term strategy.

Looking at this quarter in more depth, we saw 14% growth Qtr./Qtr. in our Ethernet

product revenue, led by strong results from our Enterprise and Federal

customers. For FY 11, Brocade grew our Ethernet product revenue 13% Yr./Yr. and generated

record revenue of $552M, which we believe outpaced the market and resulted in share

gains. We believe Brocade is well- positioned for continued Ethernet

revenue growth with our recently introduced campus LAN products targeted at enterprise

networking

customers,

our

expanding

portfolio

of

Ethernet

Fabric

solutions,

and

our

growing

momentum

in

Service

Provider

solutions

this year.

I will touch on these points in a moment.

Brocade also saw strong performance in Q4 in terms of Storage products revenue,

with 10% growth Qtr./Qtr. and a better-than- expected ramp of our 16

Gbps Fibre Channel SAN products that generated nearly $40M of revenue. The ramp of 16 Gpbs

products

is

a

faster

trajectory

than

what

we

saw

with

the

4

Gbps

to

8

Gbps

transition.

The

overall

end-user

demand

in

Storage

and

interest

in

our

next-generation

products

help

to

validate

the

longevity

we

anticipate

for

our

Fibre

Channel

business,

which

is

driven by strategic initiatives for CIOs such as server virtualization and Big

Data. |

Initiatives to Drive Shareholder Value

Executing to our long-term strategy

Page 6 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| As I mentioned at our recent Analyst Day, we are taking active steps

aimed at increasing shareholder value through a number of key business

initiatives. During Q4 we continued to focus on the fundamentals of our Playbook with the following results:

•Generated record revenues for Ethernet and for the overall company as we

remain focused on our long-term strategy; •Repurchased approximately

$200M of stock in the quarter, which was roughly 9% of the shares outstanding as of the end of

Q3;

•Increased emphasis on the most strategic areas of our business and divested a

non-essential area with the sale of the SBS

business unit;

•Generated record operating cash flow of $206M during the quarter;

•Continued to enforce stringent expense management controls throughout the

company to drive higher profitability; •And, repaid $50M on the term

loan, which reduced the remaining balance to $190M. We

will

continue

to

focus

on

the

fundamentals

of

our

Playbook

as

we

enter

FY

12.

Now

I

will

cover

other

highlights

for

Q4

and

FY 11 in more detail. |

Network Transformation Creating Opportunities

Brocade: Differentiation through Innovation

Page 7 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| The networking industry is in the midst of a major transformation

necessitated by disruptive IT forces such as enterprise mobility, Big Data,

cloud computing, and virtualization of data centers. We view network transformation as a new business

opportunity and a way to differentiate ourselves by out-innovating the

competition. In fact, I can point to several areas where I believe we are

seizing the innovation opportunities that are available to us, namely:

•Creating the Ethernet Fabric

market through our pioneering efforts in bringing purpose-built solutions for

flatter, faster, simpler networks;

•Redefining

the

economics

of

IT

hardware

acquisition

with

Brocade

Network

Subscription

by

delivering

a

monthly

subscription model that aligns network expense with business needs;

•Driving

the

technology

transition

in

the

storage

industry

with

our

new

16

Gbps

Fibre

Channel

products;

•Challenging

the

status

quo

with

the

new

Brocade

ICX

6610

Switch

in

the

campus

networking

market

by

delivering

innovative

solutions that clearly differentiate themselves against the overpriced and

over-engineered offerings of our competitors. In addition,

we

are

leading

with

the

best

price-performance

100

GbE

routing

solution

in

an

expanding

Service

Provider

marketplace. |

Brocade VDX/Ethernet Fabric Progress and Roadmap

Networks that just work

Page 8 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Looking at the Ethernet Fabric category, we’ve been executing

extremely well to our strategy and delivering on our roadmap since

we

introduced

our

vision

at

our

2010

Technology

Day.

Since

then,

we

have

consistently

delivered

results

such

as

being

the first vendor to ship an Ethernet Fabric solution in January of this year and

reaching the 100 Brocade VDX customer mark in Q2 11.

In

Q4,

we

extended

our

leadership

by

introducing

our

second

wave

of

Ethernet

Fabric

solutions

at

VMworld

just

as

competitors

were bringing their first-generation products to market. Specifically, we

introduced two new Brocade VDX switches, the Brocade VDX 6710 and Brocade

VDX 6730, which added new features, performance, and functionality to this growing product family.

These products are purpose-built to meet the new rigors of

highly-virtualized data centers and private/public cloud

computing.

In

terms

of

customer

adoption,

Brocade

now

has

over

300

customers

who

have

deployed

the

Brocade

VDX

line

of

Ethernet Fabric-enabled solutions, with nearly 20% returning as repeat

customers. |

Ethernet Fabric Case Study

Mission-critical and revenue-generating deployment

at Tier-4 data center

Page 9 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Tissat, a leading data center and cloud services provider in Spain, is a

useful case study for a successful Ethernet Fabric deployment. In support of

its strategic objectives, Tissat deployed our Ethernet Fabric solution inside of its Tier-4 data center, a

level of certification which is only assigned to data centers with less than one

hour of downtime per year. Our solution has resulted in dramatically

simplifying network management, saving costs, and improving network performance for this early

adopter of Ethernet Fabrics. This successful deployment demonstrates that Brocade

Ethernet Fabrics are capable and proven to operate in mission-critical

environments that correlate to our Storage heritage of supporting the most demanding applications

and data centers in the world. |

Challenging the Status Quo in Campus Networking

Advanced technology for dynamic enterprise networks

Page 10 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Moving onto the campus networking market, Brocade is delivering key

innovations in this customer segment that we believe are challenging the

status quo in terms of performance, value, and functionality. Earlier this month we introduced new campus

networking solutions that we believe will reset the price/performance ratio in this

market. Specifically: •

The new Brocade ICX 6610 Switch, a high-performance Ethernet access switch that

combines chassis-like reliability and performance with the flexibility

and affordability of a stackable switch. It delivers five times the stacking bandwidth of the

leading

competitor

while

offering

a

35%

improvement

in

total

cost

of

ownership

(TCO).

•

New high-density 10 GbE options for the Brocade FastIron SX Series that provide

significant performance and scalability enhancements for chassis-based

aggregation and core switching. These blades enable customers to deploy up to 128 ports

of

10

GbE

in

a

single

switch

at

up

to

50%

lower

cost

than

the

leading

competitor.

These new leading-edge products allow us to better participate in a market that

continues to generate more than $13B in revenue worldwide and also position

Brocade well in high-performance segments. |

Ethernet Business Progress

*

Business revenue includes both products and services/support

Outpaced Ethernet market in FY 11

Page 11 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Growing our Ethernet business was a consistent theme throughout FY 11. As

I mentioned earlier, we are executing well in this area with Ethernet

product

revenue

in

FY

11

growing

13%

compared

to

FY

10.

In

terms

of

our

Ethernet

business,

which

includes

products

and

services, Brocade ended Q4 with revenues of $189M, up 11% Yr./Yr.

For the full year, Brocade’s Ethernet business revenue was nearly $670M, a

record performance, and up 11% compared to FY 10. Driving this Ethernet

performance in Q4 was strength in the Enterprise and Federal segments, with the Enterprise business growing 19%

Qtr./Qtr. and 19% for FY 11. The Federal Ethernet business grew 39% Qtr./Qtr,

although it was down 14% Yr./Yr. in a more challenging spending

environment.

We

also

saw

record

revenue

for

our

Service

Provider

business

in

FY

11,

which

increased

33%

compared

to

FY

10.

Finally,

we

have

built

a

solid

foundation

with

hundreds

of

early

adopters

of

Brocade

VDX

switches

and

we

believe

this

will

be

critical

to

long-

term growth in our Ethernet business.

There are several other notable trends in our Ethernet business that’s worth

mentioning: •

One, Q4 was a record quarter in terms of revenue in both our Americas, excluding

federal, and EMEA geographies. In fact, EMEA

improved

its

business

nearly

60%

Yr./Yr.

•

Two, we are seeing some very positive customer trend data such as Brocade acquiring

more new Ethernet customers in Q4 than any quarter before. In addition, we

are seeing great traction in our top 100 accounts, which are foundational for this

business.

We

were

very

pleased

to

see

that

95

out

of

these

Top

100

accounts

made

purchases

in

Q4

with

average

deal

size

per

account

up nearly 20% Qtr./Qtr.

•

Three, we are also making great progress in being able to sell Ethernet solutions

into our top SAN accounts. At the end of Q4 we can now point to 60%

penetration of Ethernet sales into our top 100 SAN accounts with more than half of those customers purchasing Brocade

Ethernet products in the quarter. This demonstrates that a majority of our large

SAN customers trust Brocade as a complete networking solutions

provider. |

Leveraging the Power of the Channel

Brocade value proposition is compelling

Page 12 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| We recognize that the channel is also critical to the growth of our

Ethernet business over the long term. We believe we offer our channel

partners

a

number

of

unique

value

propositions

in

the

form

of

the

“Three

Ps,”

namely

roduct

differentiation,

partner

rofitability,

and

account

ull

to

create

demand.

These

value

propositions

have

helped

Brocade

generate

more

revenue through the

channel year-over-year, particularly for our Ethernet products.

In addition, our channel efforts paid off in Q4 with several important industry

recognitions: •Tech

Data,

a

global

distributor

serving

thousands

of

resellers,

named

Brocade

as

their

“Vendor

Partner

of

the

Year”

at

their annual event,

beating out HP, Cisco, VMware, IBM, and others. Tech Data cited two main factors

for awarding Brocade the honor: Brocade’s projected

year-over-year revenue growth of over 30 percent and the growth of our

unique customer count by over 35% year-to-date; •Insight,

a

global

value

added

reseller

with

nearly

$5B

in

revenue,

named

Brocade

as

their

“Partner

of

the

Year”

in

several categories,

including Top Sales and Profitability Partner, Top Partner Alignment, and Top

Insight Values Representative; •Brocade was also honored with the Global

Technology Distribution Council's (GTDC) Silver Rising Star award based on

Brocade’s strong performance in the $100 million to $500 million

category for year-over-year U.S. revenue growth through distributors.

As announced last week, Brocade continues to invest and enhance its Alliance

Partner Network, or APN, program in an effort to make channel partners more

profitable and successful in meeting the needs of our customers. P

P

P |

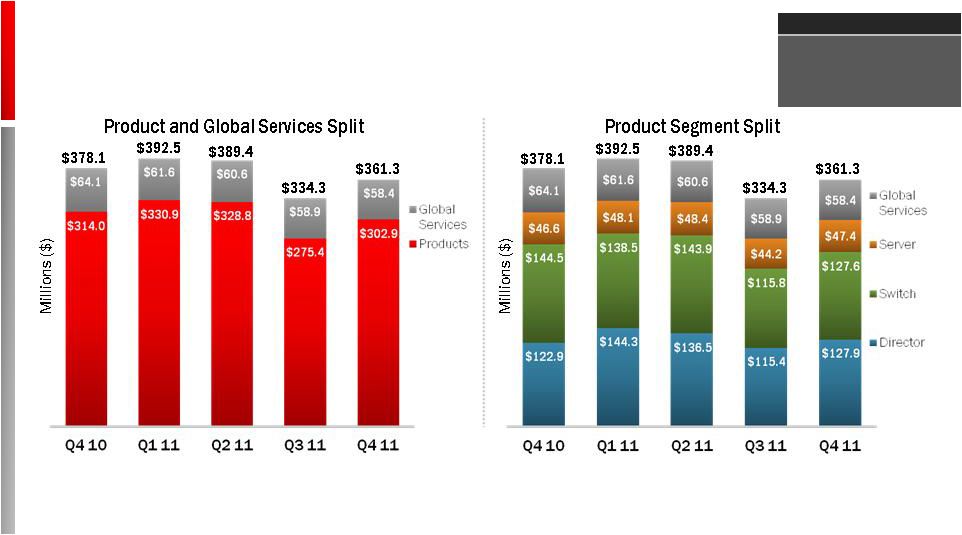

•

Q4 Storage business revenue of

$361M, up 8% Qtr./Qtr.

•

Q4 Storage product revenue of $303M,

up 10% Qtr./Qtr.

•

Director revenue up 11% Qtr./Qtr.

•

Switch revenue up 10% Qtr./Qtr.

•

Embedded switch revenue up 8% Qtr./Qtr.

Storage Business Progress

Strength across all product segments

Page 13 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| A consistent theme and Playbook fundamental is maintaining our leadership

in the SAN market. Brocade accomplished this in Q4 and throughout FY 11 by

delivering advanced solutions that enable our customers to increase performance, consolidate,

and increase business agility. Storage business revenue, including products and

services, was over $361M in Q4, up 8% Qtr./Qtr. We saw a slightly higher

growth rate for our Storage products revenue, which was up 10% Qtr./Qtr. We saw good

sequential

growth

across

all

product

segments

for

Storage

in

the

quarter,

including

our

16

Gbps

products. |

World’s Fastest Storage Area Networks

Page 14 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| One of the drivers behind our strong Storage results was Brocade

seeing a better-than-expected ramp of our 16 Gbps products,

which generated approximately $40M in revenue in Q4. We attribute part of this

strong performance to the fastest, and perhaps the smoothest, qualification

process for any new product portfolio among our key OEMs. To date, EMC, Fujitsu, HDS, HP, IBM,

and NetApp have qualified our next-generation Storage portfolio and made it

generally available to customers. We are also seeing good traction and strong

demand for our Storage products in emerging markets. For example, in Q4

Brocade closed a number of large director deals in these countries and elsewhere,

indicating that the number and size of new data center and storage

networking opportunities remain very healthy. This correlates well with the data we shared at Analyst

Day from industry research and from our own customer survey showing Fibre Channel

to be a mission-critical technology, which will be in demand for years

to come. The results for our Storage business in Q4 as well as the

significant progress we’ve made in transitioning to the next-generation

SAN technology, serve as important proof points to the customer confidence and

reliance of this tried-and-tested data center foundation.

|

•

Record Ethernet revenue for quarter

and year

•

Strong Storage revenue growth and faster-

than-expected ramp of 16 Gbps products

•

300+ Brocade VDX accounts in deployment

•

Record operating cash flow quarter

•

~$200M share repurchase

Q4 2011 Summary

Executing to our long-term strategy

Page 15 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| In summary, we believe that we have created good momentum exiting the

year and look forward to leveraging our position of technology leadership,

new products, and expanding routes to market into the new fiscal year. |

FY12 Playbook

1.

Differentiate Through Innovation

2.

Grow Top Line Profitably

3.

Execute on 2011 Investments

4.

Increase Shareholder Value

5.

Be an Employer of Choice

Page 16 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Looking forward to FY 12, we plan to execute on our business strategies

as outlined in our Playbook with the following fundamentals:

•

Differentiate through innovation

•

Grow top line profitably

•

Execute on 2011 investments

•

Increase shareholder value

•

Be an employer of choice

I look forward to reporting our progress on these fundamentals throughout FY

12. |

Q4 FY 2011 Financials

Dan Fairfax, CFO

Page 17 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Prepared comments provided by Dan Fairfax, CFO

|

Key Financial Metrics

*

Non-GAAP, please see GAAP reconciliation in appendix

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Q4 11

Qtr./Qtr.

Q4 11

Yr./Yr.

Revenue

$549M

$546M

$548M

$503M

$550M

+9%

+0.3%

Storage product revenue

$314M

$331M

$329M

$275M

$303M

+10%

-4%

Ethernet product revenue

$143M

$126M

$129M

$139M

$158M

+14%

+11%

Global Services revenue

$92M

$89M

$91M

$89M

$89M

+1%

-3%

Non-GAAP gross margin*

62.2%

62.0%

63.4%

61.8%

62.9%

+1.1 pts

+0.7 pts

Non-GAAP operating margin*

20.2%

17.1%

17.9%

14.0%

21.0%

+7.0 pts

+0.8 pts

Non-GAAP EPS—diluted*

$0.13

$0.12

$0.12

$0.09

$0.16

+$0.07

+$0.03

GAAP EPS—diluted

$0.05

$0.05

$0.05

$0.00

-$0.01

-$0.01

-$0.06

Operating cash flow

$106M

$118M

$114M

$11M

$206M

+1,765%

+94%

Net debt

$624M

$503M

$394M

$374M

$382M

+2%

-39%

Page 18 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| In

Q4

11,

Brocade

generated

revenue

of

$550M,

which

was

up

over

9%

Qtr./Qtr.

and

slightly

above

Q4

10

results.

Revenue

for

FY

11

was

$2,147M,

up

3%

from

FY 10. Storage product revenue grew 10% Qtr./Qtr. driven by good

growth across all Storage segments and a faster-than-expected ramp of 16

Gbps products. OEM inventory was reduced to a little more than one week of

supply exiting Q4, compared to approximately two weeks exiting Q3. This is the lowest level of

inventory held by our OEMs since Q1 09. Storage product revenue represented 55% of

total revenue in Q4, unchanged versus Q3. Ethernet product revenue was up 14%

Qtr./Qtr., achieving a new record for the company, with Federal and Enterprise segments driving the sequential growth in

the quarter. We continued to see good Ethernet growth Yr./Yr. across our customers,

segments, and product offerings. Ethernet product revenue in Q4 represented

29% of total revenue, up from 28% in Q3. During FY 11 our Ethernet product revenue grew 13%, which we believe was significantly faster than

the market growth.

Global Services revenue was approximately $89M, up slightly sequentially driven by

higher support revenue. At the end of September, we completed the sale of

our

SBS

consulting

business

which

reduced

our

professional

services

revenue

by

$2M

and

slightly

increased

services

gross

margins

in

the

quarter.

The

SBS

workforce was approximately 120 employees. Our Global Services revenue represented

approximately 16% of total Q4 revenue, slightly down from Q3.

Non-GAAP

gross

margins

were

62.9%

in

Q4,

better

than

the

guidance

range

we

provided

for

the

quarter

and

up

110

basis

points

from

Q3.

The

higher-than-

expected gross margins were driven by higher revenue, favorable product mix, and

lower manufacturing overhead than anticipated. Non-GAAP operating

margins improved to 21.0% in Q4, driven primarily by the increase in revenue and

lower operating expenses than we incurred in Q3. Non-GAAP EPS on a diluted

basis was $0.16 for Q4. GAAP EPS was a loss of $.01 for the quarter, driven

by the divestiture of SBS and the tax rate impact of using repatriated cash

used for stock repurchase in Q4. The Q4 effective non-GAAP tax rate was 22.9% and effective GAAP tax rate was 110.5%. The higher-

than-usual GAAP tax rate was impacted by repatriating the cash for the share

repurchase. Other Income/Expense in the quarter was ($13.6M), approximately

$3.5M better than Q3 and slightly better than our guidance for Q4. This quarter now

reflects the full benefit of the lower interest rate on our term debt and lower

related amortization of issuance costs and debt discount from the refinancing in

June. During

Q4

we

generated

a

record

of

$206M

in

operating

cash

flow.

We

repatriated

$200M

from

our

offshore

operations

in

a

cash

tax

efficient

transaction

by

offsetting the US income generated against available net operating loss

carry-forwards. Further we paid down $50M of term debt and repurchased

approximately

46.5M

shares.

Net

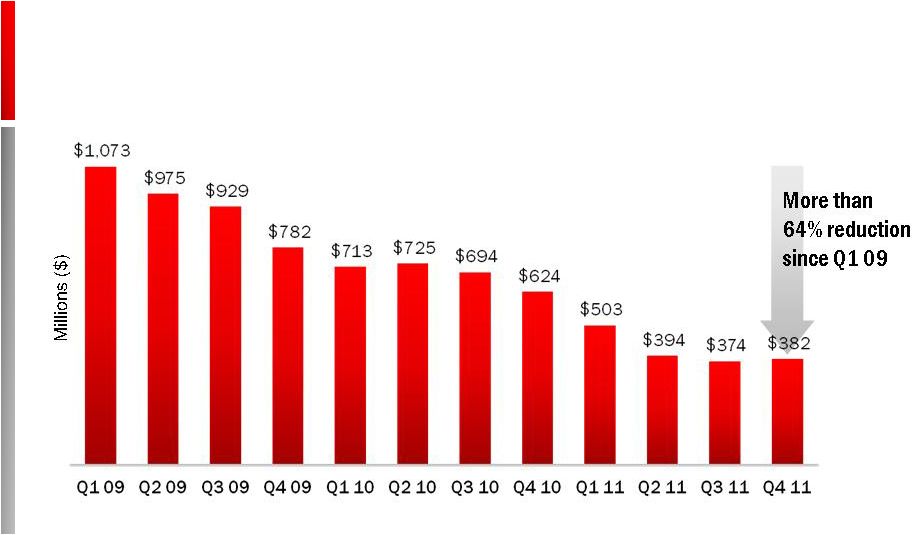

debt

was

$382M

exiting

2011,

down

from

$624M

at

the

end

of

fiscal

2010.

Weighted

average

diluted

shares

were

486M

in

Q4,

down 24M from Q3. We will see the full EPS benefit of the Q4 share repurchase in

our Q1 12 outlook. |

Total +11%

Enterprise

Service Provider

Federal -29%

Total Ethernet Business Revenue

Record Ethernet Business Revenue in Q4 11 and FY 11

23%

FY 11 Yr./Yr. Compares

Page 19 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Looking at our Ethernet business, including hardware and

Ethernet-based support and services, Q4 revenue was $189.2M, up 11% Yr./Yr. and

up 12% from Q3, achieving the largest Ethernet revenue quarter in the history of the

company. Ethernet business revenue for FY 11 was a record $669.8M, up 11%

compared to FY 10. From an Ethernet product segment view, we continued to see

good growth with both our fixed form-factor and chassis products in the quarter.

Sequential

revenue

growth

in

the

quarter

was

led

by

the

Brocade

FCX

stackable

switches,

up

36%

Qtr./Qtr.,

and

Brocade

MLX

router

chassis,

up 21% Qtr./Qtr., with both product families achieving record revenue in Q4. We

also continued to see good growth with Brocade ADX Layer 4–7 product

revenue in Q4, which was up over 55% Yr./Yr. As we drill down into the

Ethernet business details in Q4, we are pleased with the Yr./Yr. growth in our Service Provider and Enterprise

segments. Q4 revenues from Enterprise and Service Provider businesses collectively

were up 18% Yr./Yr. and up 8% sequentially, showing continued

growth

across

our

product

portfolio

and

customer

base.

Our

Enterprise

business

generated

record

revenue

of

$108.1M

for

Brocade

in Q4 and record revenue of $390.1M for FY 11 on growth of 19% Yr./Yr. Our Service

Provider business continued to perform well in Q4, generating

$47.2M

in

revenue

and

also

achieved

record

revenue

of

$182.4M

in

FY

11

with

33%

growth

Yr./Yr.

From a geographic viewpoint both EMEA and Americas, excluding Federal, were up

quarter-over-quarter, while APAC and Japan were both lower. Our Q4

Federal Ethernet business was $33.9M, up 39% from the previous quarter, reflecting strong improvement in Federal orders in

the quarter and was down 14% Yr./Yr.

We continue to be pleased with Ethernet Fabric-enabled Brocade VDX product

revenue, which grew 16% sequentially. We now have over 300 Brocade VDX

customers as Mike had mentioned previously and have generated more than $15M of revenue this year from this important new

product family. We believe we are in a leading competitive position and expect

these products to drive meaningful growth for us during FY 12. Total

converged networking product revenue in Q4, including the Brocade 8000, FCoE blades for Brocade DCX backbones, Brocade VDX

switches, and Converged Network Adapters, was up nearly 200% Yr./Yr.

|

Total SAN Business Revenue

Total -1%

Support -4%

Products 0%

FY 11 Yr./Yr. Compares

Page 20 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Looking at our Storage business, including hardware and Storage-based

support and services, Q4 revenue was $361.3M, up 8% sequentially and down 4%

from Q4 10. Storage business revenue was $1,478M in FY 11, slightly lower than the $1,490M reported in FY

10. We saw end-user demand for our storage products increase 8% Yr./Yr., which

was offset by approximately a one and one-half week reduction in OEM

inventory levels during the year. I

want

to

spend

a

minute

discussing

our

OEM

inventory

metric.

In

the

past,

we

have

provided

OEM

inventory

turns

measured

on a

consolidated basis across all products in recognition of the significance of OEMs

to our historical selling models. This metric provided the estimated

number

of

weeks

of

product

shipments

that

could

be

fulfilled

from

inventory

held

by

OEMs

regardless

of

product

family.

With

the

relatively small OEM contribution to our Ethernet revenue and changes in sales

focus for our Ethernet products, we will now report OEM weeks of inventory

solely on our Storage business. This new metric will be based on OEM Storage inventory and estimated Storage

business revenue going forward. We believe that this updated metric will help

provide improved visibility to the inventory position at our OEMs and

eliminate the impact from any material changes in segment mix. For comparison purposes, Q4 inventory levels were a little

more than one and one-half weeks using the new metric based on only Storage

business revenue as compared to just over one week under the old metric

based on overall company revenue. Demand for Storage products was greater

than expected in our seasonally strong Q4 and resulted in Storage product revenue of $302.9M

in the quarter, up 10% sequentially. We experienced good growth across our

Director, Switch, and Server product segments in Q4. Demand for our 16 Gbps

portfolio of products was higher than expected for the quarter, as end-user interest was strong and all the major

OEMs

are

now

qualified

and

shipping

product.

Revenue

for

16

Gbps

products

was

nearly

$40M

in

Q4.

Our

Server

product

group,

including

embedded

switches

and

Server

adapter

products

(HBAs

and

Mezzanine

Cards),

posted

revenue

of

$47.4M, up 7% from Q3 and up 2% Yr./Yr. Embedded switch revenue was up 2% Yr./Yr.

while our Server adapter product revenue was down slightly Yr./Yr.

|

Revenue: Routes to Market,

10% Customers, Geographic Splits

Page 21 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| In Q4, Brocade had three customers (EMC, HP, and IBM) that each

contributed revenue of at least 10% of the total company revenue. These three

customers contributed 41% of revenue in Q4, down from 43% in Q3 when we had the

same

three

10%

customers.

Other

OEMs

represented

21%

of

revenues

in

Q4,

versus

18%

in

Q3,

driven

by

higher

revenue

contribution from HDS and Dell. Channel and Direct were 38% of revenue in Q4, a

slight decrease from 39% in Q3. The mix of business based on ship-to

location was 62% domestic and 38% international in the quarter, reflecting a slight

shift in mix to domestic revenue from Q3. |

Revenues and Non-GAAP Gross Margins*

* Non-GAAP, please see GAAP reconciliation in appendix

Page 22 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Q4 non-GAAP Company gross margins of 62.9% were above the range of

61.0% to 62.0% provided for the quarter. Gross margins improved 110 basis

points quarter-over-quarter driven by better Storage product and Global Services gross margins in

the quarter. Gross margins were higher by 70 basis points Yr./Yr. on improved

product margins, including progress on our Ethernet product margins

initiatives. Q4 Product non-GAAP gross margins were 64.7%, up from

64.5% in Q3 and 63.9% in Q4 10 driven by improving margins for both Ethernet

and Storage products. Q4 Ethernet non-GAAP gross margins were 49.1%, down slightly from 49.7% reported

in

Q3 and up 130 basis points from 47.8% reported in Q4 10. The Ethernet gross margin

improvement year-over-year was driven primarily by a more profitable

product mix. Q4 Storage non-GAAP gross margins were 72.8%, up 80 basis points from 72.0% in

Q3 and up 160 basis points from 71.2% in Q4 10, driven by a favorable product mix.

The Q4 impact on overall non-GAAP gross margins from higher Product

gross margins was approximately +25 basis points. With consolidation of our

supply chain nearly complete and the continued blending of Ethernet and Fibre Channel technology in

our converged products and Ethernet Fabric switches, we believe individual product

family gross margins are becoming less meaningful and relevant to management

and investors. We will begin highlighting our Product gross margins during our earnings

calls going forward and will provide you color on the segment and product mix

dynamics as they relate to the changes in overall Product gross margins. The

blended Product non-GAAP gross margin target for FY12 is 63% to 66%, which assumes roughly

two-thirds Storage mix and one-third Ethernet mix of total product revenue.

We have been operating within or better than that target each of the past

five quarters. Global Services non-GAAP gross margins were 53.4% in Q4,

an improvement from 49.5% reported in Q3, due to the sale of SBS

during

the

quarter,

higher

support

revenue,

as

well

as

lower

support

spending

in

the

quarter.

The

Q4

impact

on

overall

non-

GAAP gross margins from higher sequential Global Services gross margins was

approximately +65 basis points. |

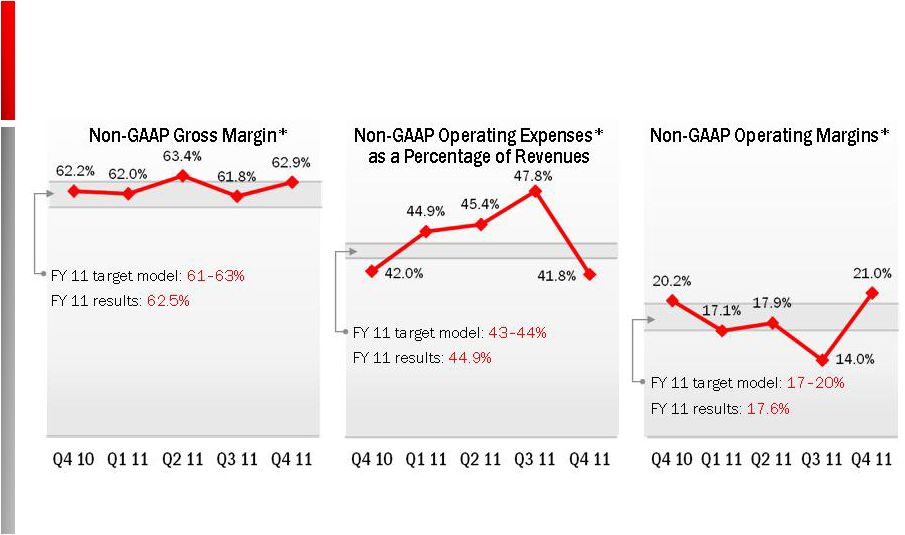

Operating Performance vs. Target Model (FY 11)

*

Non-GAAP, please see GAAP reconciliation in appendix

Page 23 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Company non-GAAP gross margins were 62.9% for Q4 and 62.5% for FY 11.

Gross margins for the year were relatively flat compared to FY 10 and near

the top of the target range of 61% to 63% for FY 11. On a non-GAAP basis,

total operating expenses were 41.8% of revenues in Q4 versus 47.8% in Q3. Operating expenses

on a dollar basis decreased $10.3M from Q3, demonstrating our ability to manage our

expenses very tightly and our commitment to driving higher levels of

productivity. Headcount was down 226 sequentially, which was primarily

driven by the sale of SBS (120 personnel) during the quarter. The majority

of headcount savings from that divestiture was captured in our Global Services gross margin results.

Operating expenses for FY 11 were 44.9% of revenues, just above our target range of

43% to 44% for FY11. Non-GAAP operating margins were 21.0% in Q4, an

increase from Q3 as well as Q4 10, and better than our expected range,

driven by higher revenue, higher gross margins, and reduced operating expenses. Operating margins for FY 11

were 17.6%, within our target range of 17% to 20% for FY 11.

|

Balance Sheet and Cash Flow Highlights

* Adjusted EBITDA is as defined in the term debt credit agreement

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Q4 11

Qtr./Qtr.

Q4 11

Yr./Yr.

Cash from operations

$106M

$118M

$114M

$11M

$206M

+1,765%

+94%

Capital expenditures

$46M

$23M

$27M

$26M

$20M

-23%

-56%

Free cash flow

$61M

$95M

$87M

($15M)

$186M

–

+206%

Debt payments

$30.2M

$39.7M

$58.9M

$12.3M

$50M

+307%

+66%

Cash, equivalents, and

short-term investments

$336M

$416M

$466M

$473M

$415M

-12%

+24%

Senior secured debt

$960M

$919M

$860M

$847M

$797M

-6%

-17%

Adjusted EBITDA*

$126M

$114M

$121M

$91M

$138M

+51%

+9%

Stock repurchase

$0

$0

$0

$10M

$201M

+1,898%

–

Senior secured leverage ratio

1.93x

2.01x

1.86x

1.87x

1.72x

-8%

-11%

Covenant

2.5x

2.5x

2.5x

2.5x

2.5x

–

–

Fixed charge coverage ratio

1.66x

1.79x

2.26x

2.29x

2.63x

+15%

+58%

Covenant

1.25x

1.5x

1.5x

1.5x

1.5x

–

–

As of October 29, 2011

Page 24 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Cash

generated

from

operations

was

$206M

in

Q4,

up

significantly

quarter-over-quarter

due

to

improved

shipment

linearity

in

Q4, resulting in DSOs of 41 days, higher overall revenue, and profitability, as well

as the typical cash flow pattern for the company, which is seasonally

stronger in Q4. Total capital expenditures in the quarter were $20M, versus $26M in Q3.

Cash, equivalents, and short-term investments were $415M, down $58M from Q3,

reflecting the cash used for the share repurchase and term debt retirement

in the quarter that Mike mentioned. Our cash and equivalents are up $79M from Q4 10. In

Q4, we reduced our term debt principal by another $50M and our term debt loan

balance is now $190M exiting the year. We now have $178M remaining of our

Board-authorized stock repurchase program. Adjusted EBITDA in the

quarter was $137.8M, which was a significant increase from the Q3 level of $91.3M. The Senior

Secured Leverage Ratio of 1.72x and the Fixed Charge Coverage Ratio of 2.63x are

both well within the covenant requirements of our term credit agreement.

|

Strong Cash Flow—Reducing Debt and Repurchasing Shares

* Cash, cash equivalents, and short-term investments

Page 25 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| With the strong operating cash flow of $449M that the company generated

during FY 11, I am pleased that we have been able to reduce our term debt by

over $160M or nearly 46% this year, repurchase over 48M shares to significantly

reduce the shares outstanding as we enter FY 12, and grow our cash balance by

approximately 24% year-over-year. Our top priorities for cash going

forward are to maintain a prudent balance sheet in the face of continued macro

economic

uncertainty,

reduce

our

term

debt

and

opportunistically

repurchase

stock. |

Q1 2012 Planning Assumptions and Outlook

IT market conditions

•

Uncertainty around macro economic conditions

•

IT spending is growing but at slower pace

•

Federal spending will be seasonally down

Brocade business

•

Planning for annual growth rate of 2–5% for storage

•

Impact of SBS divestiture (lower revenue,

higher margin) to Global Services

Other P&L items

•

Full EPS benefit of Q4 share repurchase

•

Structural tax rate assumes no R&D tax credit

renewal in 2012

OEM inventories

•

Expect to remain relatively flat Qtr./Qtr.

* Non-GAAP, please see GAAP reconciliation in appendix

Financial Outlook

Q1 12

Revenue range

$530M–$550M

Non-GAAP gross margin*

62.0%–63.0%

Non-GAAP operating expenses*

44.0%–45.0%

Non-GAAP operating margin*

17.0%–19.0%

Other income/other expense

($13M)

Non-GAAP tax rate*

25%–27%

Fully diluted shares outstanding

465M–475M

Non-GAAP EPS*

$0.12–$0.14

Operating cash flow

$50M–$70M

Capital expenditures

$20M–$23M

Free cash flow

$27M–$30M

Page 26 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Looking forward to Q1 12, we contemplated the following in setting our

outlook: •The current macro environment and economy continue to show

uncertainty, especially within the Eurozone countries. •IT spending is

growing but at lower levels than anticipated in early calendar 2011.

•We

saw

greater-than-expected

demand

for

16

Gbps

products

in

Q4,

but

continue

to

plan

our

Storage

business

around

expected

long-term

industry growth rates of 2-5% per year.

•We expect Federal spending to be seasonally weak in Q1 and are cautious as we

enter the quarter ahead of Federal budget uncertainity. •The recent

flooding in Thailand has not impacted Brocade directly, but we continue to monitor the potential impact to our partners and the

broader supply chain.

•We expect to see the full impact of the divestiture of SBS, which will reduce

our professional services revenue by another $3M in Q1. •We expect to

see some increases in operating expense dollars, driven primarily by our annual employee cost of living increase, but

anticipate holding headcount relatively flat at Q4 levels.

•Exiting

Q4,

OEM

inventory

was

a

little

more

than

one

and

one-half

weeks

based

on

Storage

business

revenue.

Exiting

our

Q1,

we

expect

OEMs to continue to hold approximately the same level of inventory going into the

weaker part of the year for them. •We

expect

to

see

the

full

EPS

benefit

of

the

$200M

share

repurchase

in

our

Q1

results

and

anticipate

using

more

of

our

available

cash

for

debt reduction.

•From

a

tax

rate

perspective,

we

plan

at

a

structural

rate

of

25%

to

27%

non-GAAP,

assuming

that

the

Federal

R&D

Tax

Credit

will

expire at

the end of December 2011. If the Tax Credit is renewed for Calendar 2012, we

would expect our structural rate to be reduced by 2 to 3 points. Discrete

events can impact our tax rate from time to time. However we do not provide guidance on such events due to the inherent

uncertainty of their timing. |

Prepared Comments and Live Conference Call

Jason Nolet

VP of Data Center

and Enterprise

Networking

Dan Fairfax

CFO

John McHugh

CMO & VP of

Marketing

Ian Whiting

SVP of WW Sales

Mike Klayko

CEO

Dave Stevens

CTO & VP of

Corporate

Development

November 21, 2011, 2:30pm

Page 27 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

| Prepared

comments provided by Rob Eggers, Investor Relations That concludes

Brocade’s prepared comments. At 2:30 p.m. Pacific Time on November 21

Brocade

will

host

a

webcast

conference

call

at

www.brcd.com.

Thank you for your interest in Brocade. |

Appendix and Reconciliations

Page 28 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

Net Debt: Defined as Total Debt Less Total Cash

Decreased by nearly $700M from Q1 09 to Q4 11

Page 29 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

Quarterly Net Income (Loss)

GAAP/Non-GAAP Reconciliation

(In Thousands)

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Net income (loss) on a GAAP basis

22,227

26,918

26,079

1,937

(4,324)

Gross margin adjustments:

Stock-based compensation

3,179

2,860

4,167

4,234

4,345

Amortization of acquired intangibles

14,466

14,466

14,466

14,466

14,090

Provision for (benefit from) certain pre-acquisition litigation

–

–

–

(14,334)

–

Legal fees associated with certain pre-acquisition litigation

243

77

216

92

59

Total gross margin adjustments

17,888

17,403

18,849

4,458

18,494

Operating expense adjustments:

Stock-based compensation

22,096

17,046

18,363

16,733

15,326

Amortization of acquired intangibles

16,190

16,190

15,023

15,023

14,476

Legal fees associated with indemnification obligations and other

related costs, net

(666)

124

–

–

–

Restructuring costs and facility lease losses, net

1,059

–

–

–

–

Loss on sale of subsidiary

–

–

–

–

12,756

Total operating expense adjustments

38,679

33,360

33,386

31,756

42,558

Total operating income adjustments

56,567

50,763

52,235

36,214

61,052

Original issue discount and debt issuance costs of debt related to lenders

that did not participate in the refinancing

–

–

–

25,465

–

Income tax effect of adjustments

(14,049)

(17,208)

(17,037)

(17,657)

22,018

Non-GAAP net income

64,745

60,473

61,277

45,959

78,746

Page 30 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

Q4 2011 Cash and Debt Covenant

*

Adjusted EBITDA is as defined in the term debt credit agreement

** Cash, equivalents and short-term investments

Page 31 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

Adjusted EBITDA and Sr. Secured Leverage Ratio

Consolidated Senior Secured Leverage Ratio

Q4 FY 10

Q1 FY 11

Q2 FY 11

Q3 FY 11

Q4 FY 11

$ Thousand

Actual

Actual

Actual

Actual

Actual

Consolidated Net Income (Loss)

$22,226

$26,918

$26,079

$1,937

($4,324)

plus

(i) Consolidated Interest Charges

$22,202

$21,546

$20,745

$42,066

$13,483

(ii) Provision for Federal, state, local and foreign income taxes payable

$5,432

$0

$0

$0

$45,446

(iii) Depreciation and amortization expense

$51,532

$52,522

$51,712

$51,220

$50,898

(iv) Fees, costs and expenses incurred on or prior to the Acquisition Closing

Date in connection with the Acquisition and the financing thereof

$0

$0

$0

$0

$0

(v) Any cash restructuring charges and integration costs in connection with the

Acquisition, in an aggregate amount not to exceed $75,000,000

$0

$0

$0

$0

$0

(vi) Non-cash restructuring charges incurred in connection with the

Transaction, all as approved by Arrangers $930

$848

$779

$687

$580

(vii) Other non-recurring expenses reducing such Consolidated Net Income

which do not represent a cash item in such period or any future period

(in each case of or by the Borrower and its Subsidiaries for such Measurement

Period)

$574

$175

$1,735

$136

$13,035

(viii) Any non-cash charges for stock compensation expense in compliance

with FAS 123R and amortization of the fair value of unvested options

under the Acquired Business’ employee stock option plan assumed by

the Borrower $25,275

$19,906

$22,530

$20,969

$19,670

(ix)

Legal fees and expenses relating to the Borrower’s indemnification

obligations for the benefit of its former officers and directors in

connection with its historical stock option litigation $22

$15

$0

$0

$0

Minus

(i)

Federal, state, local and foreign income tax credits

$0

$5,717

$612

$10,300

$0

(ii)

All non-cash items increasing Consolidated Net Income (in each case of or by

the Borrower and its Subsidiaries for such Measurement Period)

$2,212

$1,995

$1,992

$15,408

$1,024

Consolidated EBITDA

$125,981

$114,218

$120,976

$91,307

$137,764

4 Quarter Trailing Consolidated EBITDA

$497,098

$458,465

$463,371

$452,483

$464,266

Consolidated Senior Secured Debt

$959,491

$919,312

$859,983

$847,031

$796,782

Consolidated Senior Secured Leverage Ratio (x)

1.93

2.01

1.86

1.87

1.72

As defined in the term credit agreement

Page 32 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |

Thank You

www.brcd.com

Page 33 of 33

Brocade Q4 FY 2011 Earnings

11/21/2011

©

2011 Brocade Communications Systems, Inc. |