Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CLOUD PEAK ENERGY INC. | a11-29072_18k.htm |

Exhibit 99.1

|

|

Investor Presentation November 2011 |

|

|

1 Cloud Peak Energy Inc. Financial Data Cloud Peak Energy Inc. is the sole owner of Cloud Peak Energy Resources LLC. Unless expressly stated otherwise in this presentation, all financial data included herein is consolidated financial data of Cloud Peak Energy Inc. Cautionary Note Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are not statements of historical facts, and often contain words such as “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “estimate,” “seek,” “could,” “should,” “intend,” “potential,” or words of similar meaning. Forward-looking statements are based on management’s current expectations, beliefs, assumptions and estimates regarding our company, industry, economic conditions, government regulations, energy policies and other factors. These statements are subject to significant risks, uncertainties and assumptions that are difficult to predict and could cause actual results to differ materially from those expressed or implied in the forward-looking statements. For a description of some of the risks and uncertainties that may adversely affect our future results, refer to the risk factors described from time to time in the reports and registration statements we file with the Securities and Exchange Commission, including those in Item 1A "Risk Factors" of our most recent Form 10-K and any updates thereto in our Forms 10-Q and current reports on Forms 8-K. There may be other risks and uncertainties that are not currently known to us or that we currently believe are not material. We make forward-looking statements based on currently available information, and we assume no obligation to, and expressly disclaim any obligation to, update or revise publicly any forward-looking statements made in our presentation, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures This presentation includes the non-GAAP financial measures of (1) Adjusted EBITDA and (2) Adjusted Earnings Per Share (“Adjusted EPS”). Adjusted EBITDA and Adjusted EPS are intended to provide additional information only and do not have any standard meaning prescribed by generally accepted accounting principles in the U.S., or GAAP. A quantitative reconciliation of net income or net income from continuing operations (as applicable) to Adjusted EBITDA and EPS (as defined below) to Adjusted EPS is found in the tables accompanying this presentation. EBITDA represents net income or net income from continuing operations (as applicable) before (1) interest income (expense) net, (2) income tax provision, (3) depreciation and depletion, (4) amortization, and (5) accretion. Adjusted EBITDA represents EBITDA as further adjusted to exclude specifically identified items that management believes do not directly reflect our core operations. The specifically identified items are the income statement impacts, as applicable, of: (1) the Tax Receivable Agreement and (2) our significant broker contract that expired in the first quarter of 2010. Adjusted EPS represents diluted earnings (loss) per share attributable to controlling interest or diluted earnings (loss) per share attributable to controlling interest from continuing operations (as applicable) (“EPS”), adjusted to exclude the estimated per share impact of the same specifically identified items used to calculate Adjusted EBITDA and described above. Adjusted EBITDA is an additional tool intended to assist our management in comparing our performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect our core operations. Adjusted EBITDA is a metric intended to assist management in evaluating operating performance, comparing performance across periods, planning and forecasting future business operations and helping determine levels of operating and capital investments. Period-to-period comparisons of Adjusted EBITDA are intended to help our management identify and assess additional trends potentially impacting our company that may not be shown solely by period-to-period comparisons of net income or other GAAP financial measures. Adjusted EBITDA is also used as part of our incentive compensation program for our executive officers and others. We believe Adjusted EBITDA and Adjusted EPS are also useful to investors, analysts and other external users of our consolidated financial statements in evaluating our operating performance from period to period and comparing our performance to similar operating results of other relevant companies. Adjusted EBITDA allows investors to measure a company's operating performance without regard to items such as interest expense, taxes, depreciation and depletion, amortization and accretion and other specifically identified items that are not considered to directly reflect our core operations. Similarly, we believe our use of Adjusted EPS provides an appropriate measure to use in assessing our performance across periods given that this measure provides an adjustment for certain specifically identified significant items that are not considered to directly reflect our core operations, the magnitude of which may vary drastically from period to period and, thereby, have a disproportionate effect on the earnings per share reported for a given period. Our management recognizes that using Adjusted EBITDA and Adjusted EPS as performance measures has inherent limitations as compared to net income, EPS or other GAAP financial measures, as these non-GAAP measures exclude certain items, including items that are recurring in nature, which may be meaningful to investors. Adjusted EBITDA and Adjusted EPS should not be considered in isolation and do not purport to be alternatives to net income, EPS or other GAAP financial measures as a measure of our operating performance. Because not all companies use identical calculations, our presentations of Adjusted EBITDA and Adjusted EPS may not be comparable to other similarly titled measures of other companies. Moreover, our presentation of Adjusted EBITDA is different than EBITDA as defined in our debt financing agreements. |

|

|

2 Cloud Peak Energy Profile NYSE: CLD (10/31/11) $22.95 Market Capitalization (10/31/11) ~$1.4 billion Total Available Liquidity (9/30/11) $927 million 2010 Revenue $1.4 billion Senior Debt (B1/BB-) $600 million Market and Financial Overview Company Overview One of the largest U.S. coal producers 2010 coal production of 95.3 million tons 2010 proven & probable reserves of 970 million tons Only pure-play PRB coal company Headquartered in Gillette, WY Employs approximately 1,550 people Adjusted EBITDA1 1 Reconciliation tables for Adjusted EBITDA are included in the Appendix 9 mos. |

|

|

First Nine Months 2011 3 1 Reconciliation tables for Adjusted EBITDA are included in the Appendix. Revenues up 12% to $1.2 billion Adjusted EBITDA1 up to $259 million Asian exports up 47% to 3.7 million tons Cash flow from operations $212 million Strong safety focus In 2Q 2011, successfully bid on West Antelope II LBAs containing 407 million tons of mineable coal (BLM estimate) which along with an adjacent lease controlled by CPE extends the mine life by approximately 12 years. Reduced restricted cash requirements by $108 million to $74 million Refinanced revolving credit facility |

|

|

PRB Has Extensive Coal Reserves 4 Spring Creek Mine – MT 2010 Tons Sold 19.3M tons 2010 Proven & Probable Reserves 329M tons Reserve Coal Quality 9,350 Btu/lb Average lbs SO2 0.71/mmBtu Antelope Mine – WY 2010 Tons Sold 35.9M tons 2010 Proven & Probable Reserves 252M tons Reserve Coal Quality 8,850 Btu/lb Average lbs SO2 0.52/mmBtu Cordero Rojo Mine – WY 2010 Tons Sold 38.5M tons 2010 Proven & Probable Reserves 385M tons Reserve Coal Quality 8,425 Btu/lb Average lbs SO2 0.69/mmBtu 0 100 mi Legend |

|

|

5 Strategy for Growth Focus on operational/financial performance Disciplined approach to capital expenditures Generating liquidity for growth opportunities Build from Existing Foundation North American Opportunities Business Development Grow reserves through LBAs and LBMs at existing operations Optimize demand for low sulfur reserves Evaluate expansion opportunities Target acquisitions building on core operational strengths Aim to increase higher-margin export exposure Develop opportunities through acquisition of reserves, operations or companies Maximize Exports Leverage Spring Creek’s advantageous location and coal quality Optimize export logistics (rails and ports) Recently signed long-term agreement with Westshore Terminal, Vancouver, BC Expand other port options (Great Lakes, Gulf Coast, etc.) |

|

|

6 Low-Risk Surface Operations Highly productive, non-unionized workforce at all company-operated mines Proportionately low, long-term operational liabilities Surface mining reduces liabilities and allows for high-quality reclamation Strong environmental compliance programs and ISO-14001 certified |

|

|

7 Reliable and Productive Operations Procedures and incentives protect equipment Advanced testing supports comparison vs. baseline (vibration, fluid analysis, ultrasound, infrared, etc.) Track component life and degradation to avoid unplanned failures Continuous improvement Strain gauge monitoring Scorecards (operator and mechanical feedback) Preventive Maintenance (change fluids, inspect thoroughly, etc.) Understanding equipment allows for better utilization Example, payload measurement supports better loading procedures leading to tighter distribution and increased payloads on haul trucks Centralized GPS dispatch optimizes truck & shovel productivity Improving Coal Load Per Haul Truck Improved asset utilization 4.0% 3.0% 2.0% 1.0% 2007 2010 Tons 300 280 260 240 220 200 180 160 140 120 |

|

|

8 Top 25 Coal Producing Companies - 2010 Incident Rates (MSHA) Source: MSHA. Note: Total Incident Rate = (total number of employee incidents x 200,000) / total man-hours. (1) Cloud Peak Energy has combined Kiewit and Level III Communications data as reported by MSHA. Good Safety Record Indicates Well-Run Operations A portion of all employees’ bonuses is tied to safety |

|

|

9 Export Driven Production Growth Manage production to meet demand Exports to Asia growing as a percent of total production Production from Company Operated Mines (million tons) 90.7 92.8 89.3 90.5 ~ 90.3 ~ 4.5 0.9 3.3 1.6 2007 2008 2009 2010 2011E 93.7 90.7 93.8 90.9 ~ 94.8 Asian Exports North American Delivery |

|

|

10 Powder River Basin Forward Coal Prices U.S. PRB 8800 Btu Coal Price (per ton) Source: ICAP plc $12.00 $13.00 $14.00 $15.00 $16.00 $17.00 $18.00 $19.00 2011 2012 2013 2014 Q4-09 Q1-10 Q2-10 Q3-10 Q4-10 Q1-11 Q2-11 Q3-11 10/31/2011 |

|

|

11 Strong Contracted Position with Upside Potential (tons in millions) 1 Includes production from company-operated mines. 2012 has 83 million tons committed at weighted-average price of $13.44/ton 2013 has 57 million tons committed at weighted-average price of $14.25/ton Contracted Coal - Total Committed Tons (as of 10/31/11)1 |

|

|

$70M New LBAs 12 Liquidity for Growth and Revolver Refinanced Unrestricted Cash $ 438 Revolver, net of Letters of Credit $ 489 Total Available Liquidity1 $ 927 Restricted Cash (collateral for surety bonds) $ 74 $500M Revolver (Baa3- Rating) $ 0 8¼% Senior Notes due 2017 $ 300 (B1 / BB- rating) (10/31/11 yield 6.828%) 8½% Senior Notes due 2019 $ 300 (B1 / BB- rating) (10/31/11 yield 7.024%) Total Senior Debt $ 600 Total Borrowed Debt/TTM Adjusted EBITDA2 1.8x Liquidity and Obligations (as of September 30, 2011) 12 ($ in millions) Positive Cash Generation Cash, Cash Equivalents and Restricted Cash Unrestricted cash Restricted cash ($ in millions) 1 Totals reflect rounding 2 Reconciliation tables for Adjusted EBITDA are included in the Appendix |

|

|

13 Lease Acquisition Strategy Source: Cloud Peak Energy management. Note: Acquired tonnage is not classified as reserve until verified with sufficient technical and economic analysis. Maps not to scale. Cordero Rojo Mine (8425 Btu) Maysdorf II (Tract shown as applied for) Expected bid date 2012 – 2013 Tonnage estimate to be determined by the BLM 1 1 The Maysdorf II tract, as applied for, is estimated to contain approximately 434 million recoverable tons. The BLM determined that certain surface owners met the criteria for being a “qualified surface owner” and set a deadline to obtain surface owner consent, which was not obtained. Accordingly, the BLM is expected to reconfigure the nominated tract to exclude such lands along with other adjustments, that CPE believes would result in a significant reduction of the applied for tonnage. WAII North bid = $0.85 / ton 1 WAII South bid = $0.875 / ton 2 Ridgerunner lease previously acquired – no new acquisition costs Extends mine life by approximately 12 years 1 Based on the BLM’s estimate of 350 million mineable tons 2 Based on the BLM’s estimate of 56 million mineable tons Antelope Mine (8800 Btu) Ridgerunner Lease 80M tons (CPE estimate) South Tract 56M mineable tons (BLM estimate) North Tract 350M mineable tons (BLM estimate) AWARDED Spring Creek Mine (9350 Btu) AWARDED Approx. $0.08 / in place tons Lease modification completed in 2010 Extends mine life by 2 to 3 years Lease modification 48 M tons (CPE estimate) |

|

|

Historic U.S. Coal Supply by Region 14 (million tons) 2010 U.S. Power Generation by Fuel Source Source: EIA Electric Power Monthly (August 2011) Total U.S. Coal Supply up 6% since 1990 Other basins – down 14% CAPP – down 39% NAPP – down 21% PRB - up 137% Source: MSHA/Company Estimates Illinois Basin – down 24% 1990 1995 2000 2005 2010 PRB CAPP NAPP ILL B Other Coal 45% Natural Gas 24% Nuclear 20% Hydro-electric Conventional 6% Other Energy Sources 4% Petroleum 1% |

|

|

15 Effects of EPA Regulations Cross-State Air Pollution Rule, Utility MACT, coal ash regulation, etc. Generating uncertainty Potential impacts on utilities Accelerated closure of some older/smaller coal fired power plants Installation of additional scrubbers Switch to natural gas Switch to lower sulfur PRB coal Potential unanticipated consequences? EPA’s cost projections for compliance severely underestimated Rise in electricity prices for consumers Impacts electric reliability Brown-outs/black-outs at peak times Potential natural gas limitation due to infrastructure issues Impacts U.S. economy |

|

|

16 Sulfur Content by Basin 16 Source: SNL U.S. Coal Consumption by Region Region % Sulfur PRB 0.3% – 0.4% Rocky Mountain 0.4% – 0.8% Illinois Basin 1.0% – 3.5% Appalachia 1.0% – 3.5% Lignite 0.4% – 0.6% |

|

|

17 New Cross-State Air Pollution Rule (CSAPR) EPA ruling to limit emissions of SO2 and NOx from power stations Replaces Clean Air Interstate Rule (CAIR) More stringent emissions budgets and aggressive implementation schedule Effective January 1, 2012, but subject to legal challenges, may be deferred or delayed, adds to uncertainty Ways to mitigate SO2 and NOx emissions: Switch from high sulfur coal to low sulfur (PRB) coal Fit scrubbers Switch from coal to gas Retire units Approximately 70% of CPE 2011 YTD shipments to CSAPR states |

|

|

Asian Demand Growth 18 Source: EIA IEO 2010 Pacific Rim demand has experienced strong growth that is forecast to continue Thermal coal usage is forecast to grow by one billion metric tonnes over next 10 years Seaborne imports are forecast to supply 100 million metric tonnes of this growth |

|

|

19 Increasing International Demand Supports Powder River Basin 2010 U.S. exports up 36% (60M tons 2009 to 81M tons 2010) Estimated 2011 U.S. exports 100 to 150M tons East 82 to 86M tons West 8 to 9M tons Canada 10M tons Sources: Company estimates |

|

|

Spring Creek — Export Quality Advantage 20 Spring Creek Mine - Montana Coal quality - 9,350 Btu Converts to 4,850 Kcal/kg NAR Premium sub-bituminous coal in the international market 20 4850 4544 Average Source: Company estimates |

|

|

21 Spring Creek to Ridley 1,893 or 2,697 Miles Spring Creek to Westshore 1,591 Miles SPRB to Spring Creek 235 Miles Spring Creek — Geographic Advantage Spring Creek Mine to Westshore ~1,600 miles, approx. 200 miles closer than SPRB |

|

|

22 Brownfield and Greenfield West Coast Port Expansions and Developments Source: Media reports/releases Westshore terminal (Vancouver, BC) current capacity 29 million tons – expansion to 33 million tons expected by late 2012 CPE has agreed on terms for throughput with Westshore through 2023 Ridley terminal (Prince Rupert, BC) expansion from 12 to 24 million tons expected by 12/2011 SSA Marine’s Gateway terminal (WA) – up to 48 million tons, permitting currently underway – mid 2015 Millennium’s Longview terminal (WA) of 5+ million tons, shoreline permit withdrawn, permitting has not restarted |

|

|

SSA Marine’s Proposed Gateway Pacific Terminal Proposed Bulk Commodity Terminal Grain, coal, potash Operational ~2015 Existing industrial site BNSF served Source: Media reports/releases 23 |

|

|

24 Looking Forward Strong reserve holdings in best positioned basin Efficient operations Indexed/unpriced sales provide opportunity for future pricing upside Continued strong contribution from export sales Strong balance sheet provides financial flexibility Significant cash generation Proportionally low, long-term operational liabilities |

|

|

Appendices (Cloud Peak Energy Inc.) 25 |

|

|

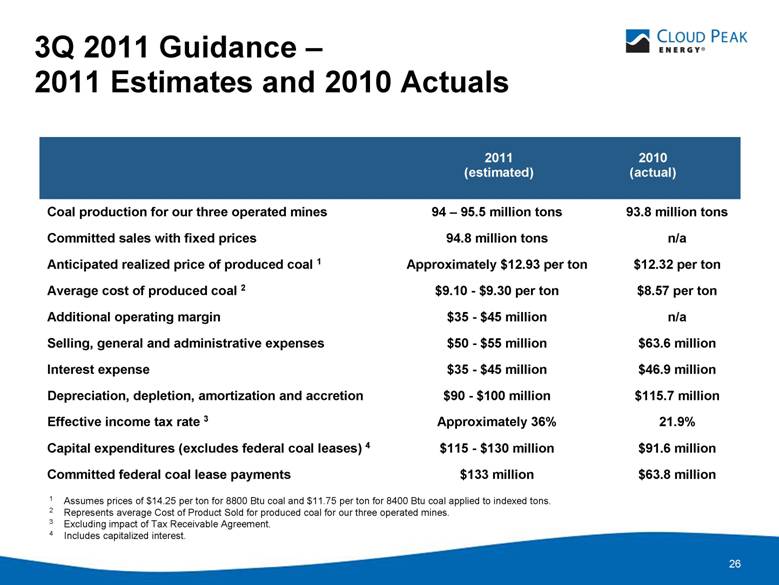

26 3Q 2011 Guidance — 2011 Estimates and 2010 Actuals 2011 (estimated) 2010 (actual) 1 Assumes prices of $14.25 per ton for 8800 Btu coal and $11.75 per ton for 8400 Btu coal applied to indexed tons. 2 Represents average Cost of Product Sold for produced coal for our three operated mines. 3 Excluding impact of Tax Receivable Agreement. 4 Includes capitalized interest. Coal production for our three operated mines 94 – 95.5 million tons 93.8 million tons Committed sales with fixed prices 94.8 million tons n/a Anticipated realized price of produced coal 1 Approximately $12.93 per ton $12.32 per ton Average cost of produced coal 2 $9.10 - $9.30 per ton $8.57 per ton Additional operating margin $35 - $45 million n/a Selling, general and administrative expenses $50 - $55 million $63.6 million Interest expense $35 - $45 million $46.9 million Depreciation, depletion, amortization and accretion $90 - $100 million $115.7 million Effective income tax rate 3 Approximately 36% 21.9% Capital expenditures (excludes federal coal leases) 4 $115 - $130 million $91.6 million Committed federal coal lease payments $133 million $63.8 million |

|

|

27 2010 Average Cost of Produced Coal 1 Represents average Cost of Product Sold for produced coal for our three company-operated mines. $8.57/ton for company-operated mines1 44% 19% 14% 9% 6% 4% 4% Royalties and taxes Labor Repairs and maintenance Fuel and lubricants Explosives Outside services Other mining costs |

|

|

28 Statement of Operations Data (in millions, except per share amounts) Three Months Ended September 30, Nine Months Ended September 30, 2011 2010 2011 2010 Revenues $ 407.0 $ 372.4 $ 1,151.2 $ 1,025.0 Operating income 60.2 64.4 188.8 170.5 Net income 24.6 19.5 146.0 87.4 Net income (loss) attributable to controlling interest $ 24.6 $ (6.6) $ 146.0 $ 20.9 Earnings per common share attributable to controlling interest – basic Net income (loss) $ 0.41 $ (0.22) $ 2.43 $ 0.68 Earnings per share attributed to controlling interest – diluted Net income (loss) $ 0.41 $ (0.22) $ 2.41 $ 0.68 |

|

|

29 Statement of Operations Data (in millions, except per share amounts) Revenues $ 1,370.8 $1,398.2 $1,239.7 $1,053.2 $ 942.8 Operating income 211.9 255.0 124.9 102.7 88.9 Income from continuing operations 117.2 182.5 88.3 53.8 40.5 Income (loss) from discontinued operations — 211.1 (25.2) (21.5) (2.6) Net income 117.2 393.6 63.1 32.3 37.9 Amounts attributable to controlling interest: Income from continuing operations 33.7 170.6 88.3 53.8 40.5 Income (loss) from discontinued operations — 211.1 (25.2) (21.5) (2.6) Net income attributable to controlling interest $ 33.7 $ 381.7 $ 63.1 $ 32.3 $ 37.9 Earnings per share – basic Income from continuing operations $ 0.98 $ 3.01 $ 1.47 $ 0.90 $ 0.68 Income (loss) from discontinued operations — 3.73 (0.42) (0.36) (0.05) Net income $ 0.98 $ 6.74 $ 1.05 $ 0.54 $ 0.63 Earnings per share attributed to controlling interest – diluted Income from continuing operations $ 0.98 $ 2.97 $ 1.47 $ 0.90 $ 0.68 Income (loss) from discontinued operations — 3.52 (0.42) (0.36) (0.05) Net income $ 0.98 $ 6.49 $ 1.05 $ 0.54 $ 0.63 Year Ended December 31, 2010 2009 2008 2007 2006 |

|

|

30 Balance Sheet Data (in millions) Cash and cash equivalents $ 437.6 $ 340.1 $ 268.3 $ 15.9 $ 23.6 $ 19.6 Restricted cash 74.3 182.1 80.2 — — — Property, plant and equipment, net 1,322.1 1,008.3 987.1 927.9 719.7 703.7 Total assets 2,263.0 1,915.1 1,677.6 1,785.2 1,781.2 1,723.3 Senior notes, net of unamortized discount 596.0 595.7 595.3 — — — Federal coal lease obligations 292.0 118.3 169.1 206.3 67.6 79.0 Asset retirement obligations, net of current portion 171.2 182.2 175.9 164.2 159.1 161.0 Total liabilities 1,554.3 1,383.9 1,232.1 800.0 1,446.2 1,433.5 Controlling interest equity 708.1 531.2 252.9 985.2 335.0 289.9 Noncontrolling interest equity — — 192.6 — — — September 30, December 31, 2011 2010 2009 2008 2007 2006 |

|

|

31 Reconciliation of Non-GAAP Measures — Adjusted EBITDA (in millions) Nine Months Ended September 30, 2010 2009 Net income $ 24.6 $ 19.5 $ 146.0 $ 87.4 $ 175.7 Interest income (0.1) (0.2) (0.5) (0.4) (0.6) Interest expense 6.8 11.4 27.5 36.2 38.3 Income tax (benefit) provision 52.2 14.7 (2.0) 30.2 (0.3) Depreciation and depletion 24.3 26.0 58.5 75.2 83.4 Amortization 1 — — — 3.2 — Accretion 3.0 3.4 9.4 9.9 12.0 EBITDA 110.8 74.8 238.9 241.7 308.5 Expired significant broker contract 1 — — — (8.3) 0.1 Tax Receivable Agreement expense 22.9 19.7 19.9 19.7 19.9 Adjusted EBITDA $ 87.9 $ 94.5 $ 258.8 $ 253.1 $ 328.5 Three Months Ended September 30, Nine Months Ended September 30, Trailing Twelve Months 2011 2010 2011 2010 1 The impact of the expired significant broker contract on the Statement of Operations is a combination of net income and the amortization expense related to the contract. All amortization expense for the periods presented was attributable to the significant broker contract. |

|

|

32 Reconciliation of Non-GAAP Measures — Adjusted EBITDA (in millions) Nine Months Ended September 30, 2010 2009 Year Ended December 31, 2010 2009 2008 2007 2006 Net income $ 117.2 $ * $ * $ * $ * Net income from continuing operations * 182.5 88.3 53.8 40.5 Interest income (0.6) (0.3) (2.9) (7.3) (3.6) Interest expense 47.0 6.0 20.4 40.9 38.8 Income tax (benefit) provision 32.0 68.2 25.3 18.1 11.7 Depreciation and depletion 100.0 97.9 89.0 80.1 59.3 Amortization 1 3.2 28.7 46.0 34.5 35.0 Accretion 12.5 12.6 12.8 12.2 10.1 EBITDA 311.3 395.6 278.9 232.3 191.8 Expired long-term broker contract (8.2) (75.0) (71.7) (72.5) (72.8) Tax Receivable Agreement expense 19.6 — — — — Adjusted EBITDA $ 322.7 $ 320.6 $ 207.2 $ 159.8 $ 119.0 1 The impact of the expired significant broker contract on the Statement of Operations is a combination of net income and the amortization expense related to the contract. All amortization expense for the periods presented was attributable to the significant broker contract. * For 2009 and prior periods, Cloud Peak Energy reported discontinued operations. Accordingly, for such periods, net income from continuing operations is the comparable U.S. GAAP financial measure for Adjusted EBITDA. |

|

|

33 Reconciliation of Non-GAAP Measures — Adjusted EPS Three Months Ended September 30, Nine Months Ended September 30, 2011 2010 2011 2010 Diluted earnings (loss) per common share attributable to controlling interest $ 0.41 $ (0.22) $ 2.41 $ 0.68 Expired significant broker contract — — — (0.11) Tax Receivable Agreement expense (benefit) (0.38) 0.64 0.33 0.64 Change in net value of deferred tax assets1 0.58 0.18 (0.96) 0.18 Adjusted EPS $ 0.61 $ 0.60 $ 1.78 $ 1.39 Diluted weighted-average shares outstanding 60,644,759 30,600,000 60,606,112 30,600,000 1 Related adjustments to our deferred tax assets, net of valuation allowance, as a result of the increase in tax agreement liability are recorded through income tax expense. |

|

|

34 Diluted earnings (loss) per common share attributable to controlling interest $ 0.98 $ * $ * $ * $ * Diluted earnings (loss) per common share attributable to controlling interest from continuing operations * 2.97 1.47 0.90 0.68 Expired significant broker contract (0.09) (0.49) (0.41) (0.44) (0.44) Tax Receivable Agreement expense 0.57 — — — — Change in net value of deferred tax assets1 0.16 — — — — Adjusted EPS $ 1.62 $ 2.48 $ 1.06 $ 0.46 $ 0.24 Weighted-average shares outstanding 34,305,205 60,000,000 60,000,000 60,000,000 60,000,000 Reconciliation of Non-GAAP Measures — Adjusted EPS Year Ended December 31, 2010 2009 2008 2007 2006 1 Related adjustments to our deferred tax assets, net of valuation allowance, as a result of the increase in tax agreement liability are recorded through income tax expense. * For 2009 and prior periods, Cloud Peak Energy reported discontinued operations. Accordingly, for such periods, diluted earnings (loss) per share attributable to controlling interest from continuing operations is the comparable U.S. GAAP financial measure for Adjusted EPS. |

|

|

35 Other Data Three Months Ended September 30, Nine Months Ended September 30, Trailing Twelve Months 2011 2010 2011 2010 Total tons sold (in millions) 1 24.4 25.1 70.2 70.4 93.8 Average revenue per ton 1 12.91 12.36 12.88 12.31 12.75 Average cost of product sold per ton 1 9.17 8.36 9.12 8.41 9.10 1 Represents only the three company-operated mines. |

|

|

36 Other Data (in millions) Tons sold – company owned and operated mines 93.7 90.9 93.7 90.7 88.2 Total tons sold– Decker mine (50% share) 1.5 2.3 3.3 3.5 3.6 Tons sold from all production 95.2 93.2 97.0 94.2 91.8 Tons purchased and resold 1.7 10.1 8.1 8.1 8.1 Year Ended December 31, 2010 2009 2008 2007 2006 |

|

|

37 Tax Receivable Agreement (“TRA”) Difference: 85% to Rio Tinto 15% to Cloud Peak Energy Inc. Difference between “with” and “without” tax benefit estimate accrues to the parties with 85% going to Rio Tinto. This estimate is booked on the Cloud Peak Energy balance sheet as a liability. The TRA was created at the time of the IPO to share tax benefit of step up in asset basis as a result of the IPO Cloud Peak Energy Inc. Balance Sheet (in millions) September 30, 2011 TRA Liability 180 $ Cloud Peak Energy Life of Mine Model 2011 2012 2013 2014 2037 2038 2039 Revenue $ xxx.x Costs (xxx.x) Capex (xxx.x) Cash Flow (xxx.x) Tax Calculations with step-up without step-up Income $ xxx.x $ xxx.x Tax Depreciation (yyy.y) (zzz.z) Taxable Income aaa.a bbb.b Tax Rate x.x% x.x% Cash Tax Payable $ yyy.y $ zzz.z |