Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SOUTHERN Co GAS | form_8-k.htm |

Third Quarter 2011 Earnings Presentation

November 2, 2011

®

®

2

Forward-Looking Statements &

Supplemental Information

Supplemental Information

Forward-Looking Statements

Certain expectations and projections regarding our future performance referenced in this presentation, in other reports or statements we file with the SEC or otherwise release to the public, and

on our website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are forward-

looking. Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition, economic

performance (including growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions, forward-looking

statements often include words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may," "outlook," "plan," "potential,"

"predict," "project," "seek," "should," "target," "would," or similar expressions. Forward-looking statements contained in this presentation include, without limitation, statements regarding future

earnings per share, dividend growth and EBIT contribution, our priorities for 2011 and the proposed merger with Nicor Inc. Our expectations are not guarantees and are based on currently

available competitive, financial and economic data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our

expectations are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

on our website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are forward-

looking. Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition, economic

performance (including growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions, forward-looking

statements often include words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may," "outlook," "plan," "potential,"

"predict," "project," "seek," "should," "target," "would," or similar expressions. Forward-looking statements contained in this presentation include, without limitation, statements regarding future

earnings per share, dividend growth and EBIT contribution, our priorities for 2011 and the proposed merger with Nicor Inc. Our expectations are not guarantees and are based on currently

available competitive, financial and economic data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our

expectations are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

Such events, risks and uncertainties include, but are not limited to, changes in price, supply and demand for natural gas and related products; the impact of changes in state and federal

legislation and regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy industry

consolidation; the impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified vendors, unexpected

change in project costs, including the cost of funds to finance these projects; the impact of acquisitions and divestitures including the proposed Nicor merger; limits on natural gas pipeline

capacity; direct or indirect effects on our business, financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest

rate fluctuations; financial market conditions, including recent disruptions in the capital markets and lending environment and the current economic downturn; general economic conditions;

uncertainties about environmental issues and the related impact of such issues; the impact of changes in weather, including climate change, on the temperature-sensitive portions of our

business; the impact of natural disasters such as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors which are provided in detail in our filings with the

Securities and Exchange Commission. Forward-looking statements are only as of the date they are made, and we do not undertake to update these statements to reflect subsequent changes.

legislation and regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy industry

consolidation; the impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified vendors, unexpected

change in project costs, including the cost of funds to finance these projects; the impact of acquisitions and divestitures including the proposed Nicor merger; limits on natural gas pipeline

capacity; direct or indirect effects on our business, financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest

rate fluctuations; financial market conditions, including recent disruptions in the capital markets and lending environment and the current economic downturn; general economic conditions;

uncertainties about environmental issues and the related impact of such issues; the impact of changes in weather, including climate change, on the temperature-sensitive portions of our

business; the impact of natural disasters such as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors which are provided in detail in our filings with the

Securities and Exchange Commission. Forward-looking statements are only as of the date they are made, and we do not undertake to update these statements to reflect subsequent changes.

Supplemental Information

Company management evaluates segment financial performance based on earnings before interest and taxes (EBIT), which includes the effects of corporate expense allocations and on

operating margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and

expenses. Items that are not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated level

and believes EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations. Operating margin is a non-

GAAP measure calculated as operating revenues minus cost of gas, excluding operation and maintenance expense, depreciation and amortization, and taxes other than income taxes. These

items are included in the company's calculation of operating income. The company believes operating margin is a better indicator than operating revenues of the contribution resulting from

customer growth, since cost of gas is generally passed directly through to customers. In addition, in this presentation, the company has presented its earnings per share excluding expenses

incurred with respect to the proposed Nicor merger. As the company does not routinely engage in transactions of the magnitude of the proposed Nicor merger, and consequently does not

regularly incur transaction related expenses with correlative size, the company believes presenting EPS excluding Nicor merger expenses provides investors with an additional measure of the

company’s core operating performance. EBIT, operating margin and EPS excluding merger expenses should not be considered as alternatives to, or more meaningful indicators of, the

company's operating performance than operating income, net income attributable to AGL Resources Inc. or EPS as determined in accordance with GAAP. In addition, the company's EBIT,

operating margin and non-GAAP EPS may not be comparable to similarly titled measures of another company. We also present certain non-GAAP financial measures excluding the effects of

our proposed merger with Nicor. Because we complete material mergers and acquisitions only occasionally, we believe excluding these effects from certain measures is useful because they

allow investors to more easily evaluate and compare the performance of the Company's core businesses from period to period. Reconciliations of non-GAAP financial measures referenced in

this presentation are available on the company’s Web site at www.aglresources.com

operating margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and

expenses. Items that are not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated level

and believes EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations. Operating margin is a non-

GAAP measure calculated as operating revenues minus cost of gas, excluding operation and maintenance expense, depreciation and amortization, and taxes other than income taxes. These

items are included in the company's calculation of operating income. The company believes operating margin is a better indicator than operating revenues of the contribution resulting from

customer growth, since cost of gas is generally passed directly through to customers. In addition, in this presentation, the company has presented its earnings per share excluding expenses

incurred with respect to the proposed Nicor merger. As the company does not routinely engage in transactions of the magnitude of the proposed Nicor merger, and consequently does not

regularly incur transaction related expenses with correlative size, the company believes presenting EPS excluding Nicor merger expenses provides investors with an additional measure of the

company’s core operating performance. EBIT, operating margin and EPS excluding merger expenses should not be considered as alternatives to, or more meaningful indicators of, the

company's operating performance than operating income, net income attributable to AGL Resources Inc. or EPS as determined in accordance with GAAP. In addition, the company's EBIT,

operating margin and non-GAAP EPS may not be comparable to similarly titled measures of another company. We also present certain non-GAAP financial measures excluding the effects of

our proposed merger with Nicor. Because we complete material mergers and acquisitions only occasionally, we believe excluding these effects from certain measures is useful because they

allow investors to more easily evaluate and compare the performance of the Company's core businesses from period to period. Reconciliations of non-GAAP financial measures referenced in

this presentation are available on the company’s Web site at www.aglresources.com

®

3Q11 Highlights

• 3Q11 GAAP EPS of $(0.04) per diluted

share

share

• Adjusted diluted EPS of $0.02, excluding

approximately $5 million in after-tax costs related to

the Nicor merger

approximately $5 million in after-tax costs related to

the Nicor merger

• Distribution segment EBIT up 27% in 3Q11 vs. 3Q10

• Solid performance at SouthStar

• Wholesale and storage markets remain challenged

• 9-mos 2011 GAAP EPS of $1.78 per diluted

share

share

• Adjusted diluted EPS of $1.98, excluding

approximately $16 million in after-tax costs related to

Nicor merger

approximately $16 million in after-tax costs related to

Nicor merger

• 2011 EPS estimate reduced to $2.90-$3.00

per diluted share, excluding all effects from

the proposed merger with Nicor

per diluted share, excluding all effects from

the proposed merger with Nicor

• Nicor merger process on track

• Positive proposed order from ALJ received in

September

September

• Expect ICC consideration in November

3

Note: Please review the AGL Resources 10-Q as filed with the SEC on 11/2/11 for detailed information. EBIT, Adjusted Net Income and Adjusted EPS are non-

GAAP measures. Please see the appendix to this presentation or visit the investor relations section of www.aglresources.com for a reconciliation to GAAP.

GAAP measures. Please see the appendix to this presentation or visit the investor relations section of www.aglresources.com for a reconciliation to GAAP.

(1) Adjusted net income and adjusted EPS exclude Nicor-related merger costs of approximately $5 million, net of tax.

®

4

Consistent EPS and Dividend Growth

Diluted EPS Growth

Dividend Growth

2011 EPS Guidance:

$2.90-$3.00 per diluted share

Dividend increase of $0.04 approved by

Board of Directors for 2011

Board of Directors for 2011

(1)$3.00 diluted GAAP EPS; $3.05 adjusted, excluding Nicor merger costs. Please see the appendix to this presentation or visit the investor relations section of

www.aglresources.com for a reconciliation to GAAP.

www.aglresources.com for a reconciliation to GAAP.

(2) Estimate excludes all effects from the proposed merger with Nicor.

$2.90-

®

5

5

EBIT by Operating Segment

1%

81%

18%

Annual EBIT by Operating Segment

9-mos 2011 EBIT Contribution

NOTE: EBIT is a non-GAAP measure. Please see the appendix to this presentation or the investor relations section of www.aglresources.com for a reconciliation to GAAP.

Quarterly EBIT by Operating Segment

®

• 3Q11 EBIT increased 27% vs. 3Q10

• Key drivers

• New rates and regulatory infrastructure

programs at Atlanta Gas Light and

Elizabethtown Gas added $9 million of

operating margin

programs at Atlanta Gas Light and

Elizabethtown Gas added $9 million of

operating margin

• Effective O&M expense management; costs

down 2%, due primarily to lower annual

incentive payout accrual

down 2%, due primarily to lower annual

incentive payout accrual

• Customer count stable

• 2.238 million customers in 3Q11 (avg.) vs.

2.235 million in 3Q10 (avg.)

2.235 million in 3Q10 (avg.)

• Virginia Natural Gas rate case update

• Preliminary rates effective 10/1/11, subject to

refund

refund

• Public hearing currently scheduled for

November 4

November 4

• Final rates expected to be determined in 1H12

6

6

Distribution

NOTE: COG = Cost of Gas

3Q11 Financial Performance Summary

®

9-mos 2011 Financial Performance Summary

7

7

Retail

• 3Q11 EBIT up $5 MM vs. 3Q10

• Reduced transportation and gas costs partially

offset by lower retail price spreads

offset by lower retail price spreads

• Operating expenses lower by $2 million year-over-

year due primarily to lower outside services

expenses

year due primarily to lower outside services

expenses

• Market share and customer count

• Georgia market share is 32% at end of 3Q11

− Year-to-date market share is stable, and

SouthStar has achieved modest market share

growth in Georgia five out of the last six months

SouthStar has achieved modest market share

growth in Georgia five out of the last six months

• Georgia customer count: 482K in 3Q11 vs. 487K

in 3Q10

in 3Q10

• Delta SkyMiles affinity program initiated in Georgia

market beginning October 2011; formerly a

SCANA program

market beginning October 2011; formerly a

SCANA program

• Continue to explore opportunities to

expand service offerings and customer

base across multiple states

expand service offerings and customer

base across multiple states

3Q11 Financial Performance Summary

®

9-mos 2011 Financial Performance Summary

8

8

Wholesale

• 3Q11 EBIT down $52 million vs. 3Q10 due to

lower commercial activity and reduced

transportation and storage mark-to-market

(MTM) gains in 3Q11

lower commercial activity and reduced

transportation and storage mark-to-market

(MTM) gains in 3Q11

• Commercial activity lower by $35 million y/y

• $15 million related to Marcellus take-away

constraints

constraints

• $2 million related to customer bankruptcy

• Remainder due to ongoing low volatility and

tight storage and transportation spreads

tight storage and transportation spreads

• $16 million lower MTM gains/losses on hedges y/y

• $4 million higher LOCOM y/y

• $6 million in economic value at 9/30/11 in

storage rollout vs. $6 million at 9/30/10

storage rollout vs. $6 million at 9/30/10

• Wholesale Operating Margin Components

3Q11 Financial Performance Summary

®

9-mos 2011 Financial Performance Summary

9

9

Energy Investments

• 3Q11 EBIT of $2 million

• Golden Triangle Storage

• Cavern 1 in service (6 Bcf)

- As of 7/1/11, Cavern 1 is 100% contracted, inclusive

of 2 Bcf Sequent contract

of 2 Bcf Sequent contract

- Overall average subscription rate of $0.14

• Cavern 2 under construction (7 Bcf)

- Completion expected in 2012

• Storage values remain depressed due to high supply

of natural gas and reduced demand

of natural gas and reduced demand

• Jefferson Island Storage and Hub

• As of 7/1/11 JISH is 93% contracted with an overall

average subscription rate of $0.19, inclusive of 2 Bcf

Sequent contract

average subscription rate of $0.19, inclusive of 2 Bcf

Sequent contract

• Expansion permit application remains under review

by Louisiana Department of Natural Resources

by Louisiana Department of Natural Resources

• If approved, facility could expand from 7.5 Bcf to

19.5 Bcf

19.5 Bcf

3Q11 Financial Performance Summary

®

9-mos 2011 Financial Performance Summary

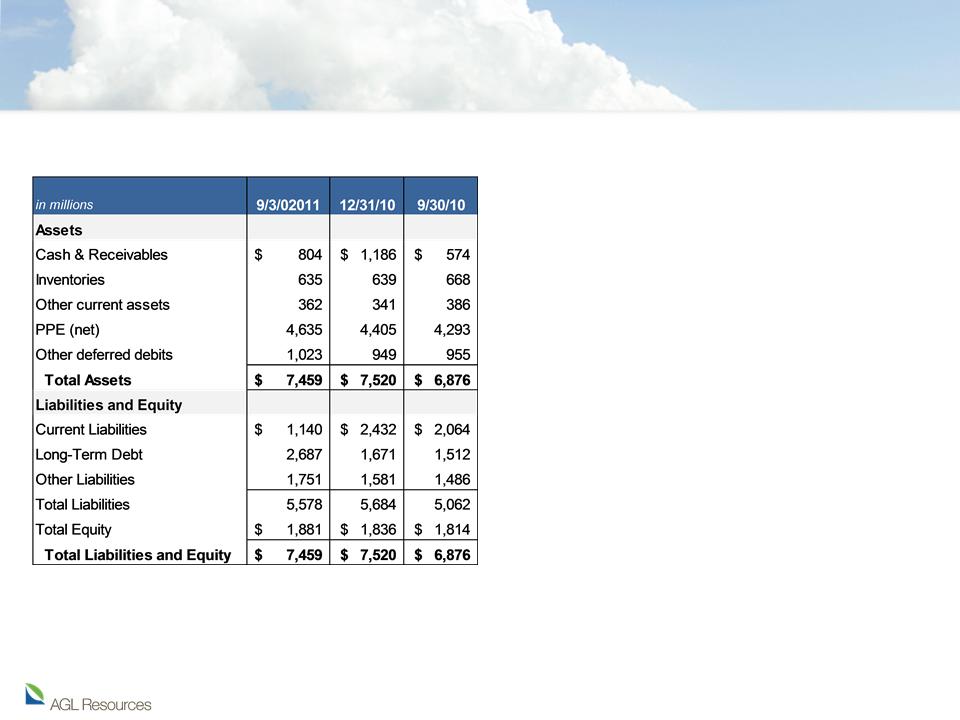

Balance Sheet Highlights

10

• Solid balance sheet with significant

opportunity to fund growth capital

requirements

opportunity to fund growth capital

requirements

• Good access to capital markets

• Company credit metrics support solid, investment-

grade ratings

grade ratings

• Debt financing for Nicor transaction

effectively complete

effectively complete

• $500 million of senior unsecured notes issued

September 2011 ($300 million in 10-yr tranche, $200

million in 30-yr tranche)

September 2011 ($300 million in 10-yr tranche, $200

million in 30-yr tranche)

• $275 million private placement completed in August

2011 ($120 million in 5-yr tranche, $155 million in 7-yr

tranche)

2011 ($120 million in 5-yr tranche, $155 million in 7-yr

tranche)

• $500 million in senior unsecured notes issued March

2011 (30-yr), of which $200 million related to Nicor

transaction

2011 (30-yr), of which $200 million related to Nicor

transaction

• $2.7 billion debt outstanding

• Long-term debt $2.69 billion

• Short-term debt of $17 million

• Debt to Cap Ratio: 59%

• 2011 cap ex estimated at $435 million

®

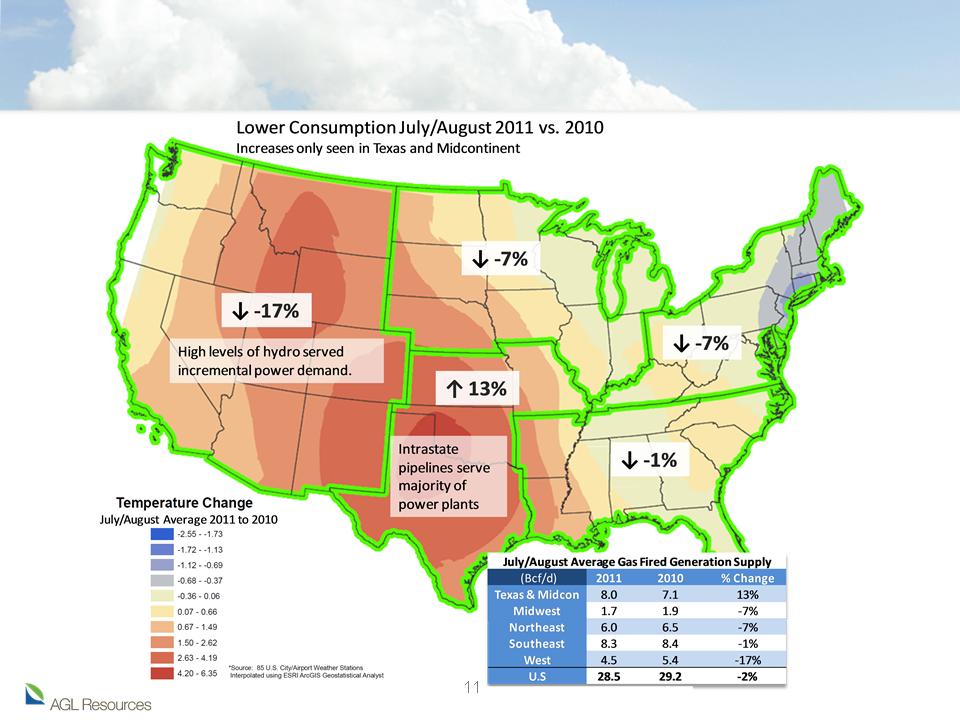

Weather and Gas Fired Power Generation

Consumption estimates from Bentek Energy

Natural Gas Storage Spreads

12

Max Spreads

2009

$1.385

2009

$1.402

2009

$1.035

2009

$0.770

Historical Intrinsic Value of Storage

Delivery Month

Continuous Storage Spreads (Oct/Jan)

• Significant increase in shale gas

production is causing excess

supply and compression of price

spreads

production is causing excess

supply and compression of price

spreads

• Production has increased by almost 5

Bcf/day in past year

Bcf/day in past year

• Flattening of NYMEX curve has

negative impact on storage

optimization values

negative impact on storage

optimization values

• Summer-to-winter spreads down by ~50%

over past few years

over past few years

• 3Q11 impact of reduced storage

spreads approximately $11 million

year-over-year for Sequent

spreads approximately $11 million

year-over-year for Sequent

• 9-mos 2011 impact of reduced

storage spreads approximately $22

million year-over-year for Sequent

storage spreads approximately $22

million year-over-year for Sequent

Source for both charts: NYMEX

13

13

Nicor Merger Update

• Regulatory approval process underway, continue to anticipate closing in before

year end

year end

• All major regulatory approvals received, with the exception of the Illinois Commerce

Commission (ICC)

Commission (ICC)

• Proposed order received from Administrative Law Judge in September

• Expect consideration before ICC in November

• Operations preparing for integration

Dec 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Transaction

Announced

Joint ICC Approval

Request Filed 1/18/11

Secure Regulatory Approvals

AGL Resources and

Nicor Shareholder

Approvals Received

Develop Transition Implementation Plans

Close Transaction

Long

-

Term Financing for Cash

Consideration Complete

Initial S-4 Registration

Statement Filed 2/4/11

Hart-Scott-Rodino

Approval Received

Approval Received

ICC Hearings held

July 19-20

July 19-20

SEC S-4 Registration

Declared Effective

Declared Effective

®

ALJ Proposed Order

Received Sept 29

Received Sept 29

Anticipate ICC

Consideration

Nov/Dec

Consideration

Nov/Dec

14

2011 Priorities

• Close Nicor transaction by year-end 2011

• Develop and implement integration plan

• Continue safe and efficient operations at our distribution businesses

• Complete rate case at Virginia Natural Gas

• Seeking $25 million increase

• VNG customers have not seen an increase in their approved base rates since 1996

• Continue to pursue responsible growth opportunities in retail and wholesale businesses

• Reposition wholesale services to be successful in a potentially prolonged period of

reduced volatility

reduced volatility

M&A

Distribution

Retail &

Wholesale

Wholesale

Energy

Investments

Investments

Policy

Expense &

Balance Sheet

Discipline

Balance Sheet

Discipline

• Increase contracted capacity at Golden Triangle Storage

• Work toward completion of Cavern 2 in early 2012

• Effectively control expenses and focus on capital discipline in each of our

business segments

business segments

• Maintain strong balance sheet and liquidity profile

• Continue to actively manage issues related to energy and environmental

policy and regulation

policy and regulation

®

Additional Resources

15

Company resources

• www.aglresources.com

• Sarah Stashak

Director, Investor Relations

404-584-4577

sstashak@aglresources.com

Industry resources

• www.aga.org

• www.eia.doe.gov

®

Appendix & GAAP Reconciliations

®

9-months 2011 Highlights

17

Note: Please review the AGL Resources 10-Q as filed with the SEC on 11/2/11 for detailed information. EBIT, Adjusted Net Income and Adjusted EPS are non-

GAAP measures. Please see the appendix to this presentation or visit the investor relations section of www.aglresources.com for a reconciliation to GAAP.

GAAP measures. Please see the appendix to this presentation or visit the investor relations section of www.aglresources.com for a reconciliation to GAAP.

(1) Adjusted net income and adjusted EPS exclude Nicor-related merger costs of approximately $16 million, net of tax.

®

18

18

VNG Rate Case Update

• Virginia Natural Gas filed a rate case with the Virginia State Corporation

Commission (VSCC) on February 8, 2011

Commission (VSCC) on February 8, 2011

• Seeking $25 million increase

• Mitigation plan proposes rates to be phased in over three years

• ~$15 million related to Hampton Roads Crossing pipeline construction (completed in 2010),

which has been recovered via AFUDC to date

which has been recovered via AFUDC to date

• ~$10 million related to base operating expenses

• Rates effective October 1, 2011, subject to refund

• Hearing scheduled for November 4, 2011

• Final Commission order expected May 2012

Rate Case Filed

2/8/11

®

Hearings

11/04/11

Rates

Effective

Subject to

Refund

10/1/11

Hearing

Examiner’s

Report

March 2012

Final

Commission

Order

May 2012

Detailed Utility Profile as of 12/31/10

19

|

State

|

Rate

Base (mm)

|

% of

Total |

Authorized

Return on Rate Base |

Est. 2010

Return on Rate Base |

Authorized

Return on Equity |

Est. 2010

Return on Equity |

Customers

(mm) |

% of

Total |

Regulatory Attributes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia

|

$1,312

|

52%

|

8.10%

|

7.26%

|

10.75%

|

9.10%

|

1.5

|

68%

|

Decoupling, Regulatory

Infrastructure Program Rates, M&A Synergy Sharing |

|

New Jersey

|

435

|

17%

|

7.64%

|

7.87%

|

10.30%

|

10.76%

|

0.3

|

12%

|

Weather Normalization,

Regulatory Infrastructure Program Rates |

|

Virginia

|

502

|

20%

|

9.24%

|

8.24%

|

10.90%

|

9.62%

|

0.3

|

12%

|

Decoupling, Weather

Normalization |

|

Florida

|

164

|

7%

|

7.36%

|

5.04%

|

11.25%

|

6.22%

|

0.1

|

5%

|

Negotiated Rates Over

5-yr Period |

|

Tennessee

|

91

|

4%

|

7.41%

|

8.98%

|

10.05%

|

13.45%

|

0.1

|

3%

|

Revenue Normalization

|

|

Total

|

$ 2,504

|

100%

|

NA

|

NA

|

NA

|

NA

|

2.3

|

100%

|

|

Note: Please review the AGL Resources 10-K as filed with the SEC on 2/9/11 for detailed information.

®

20

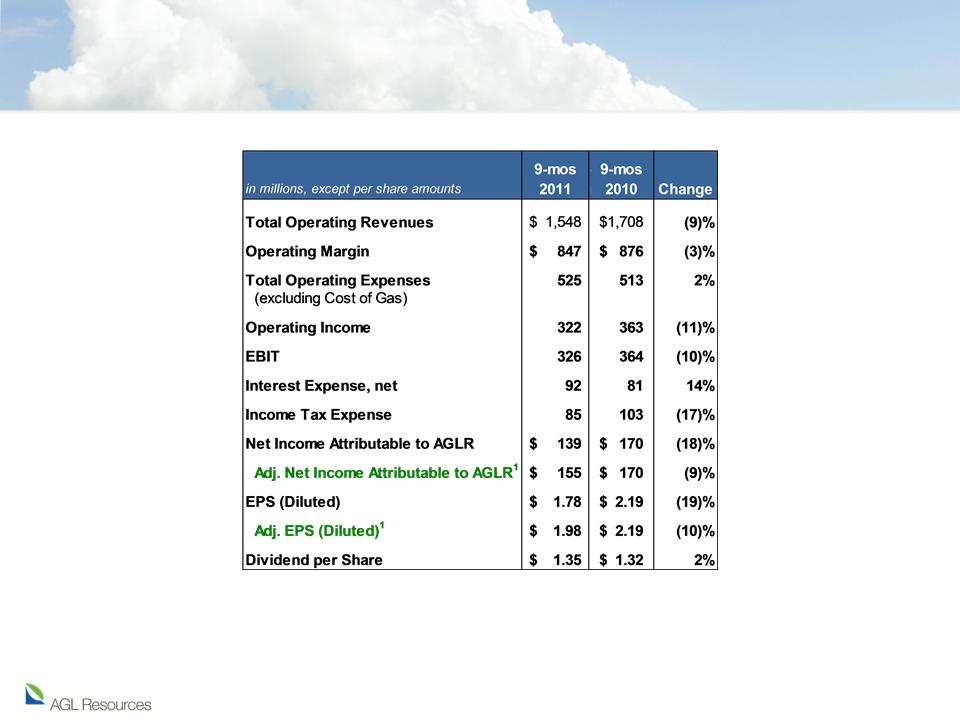

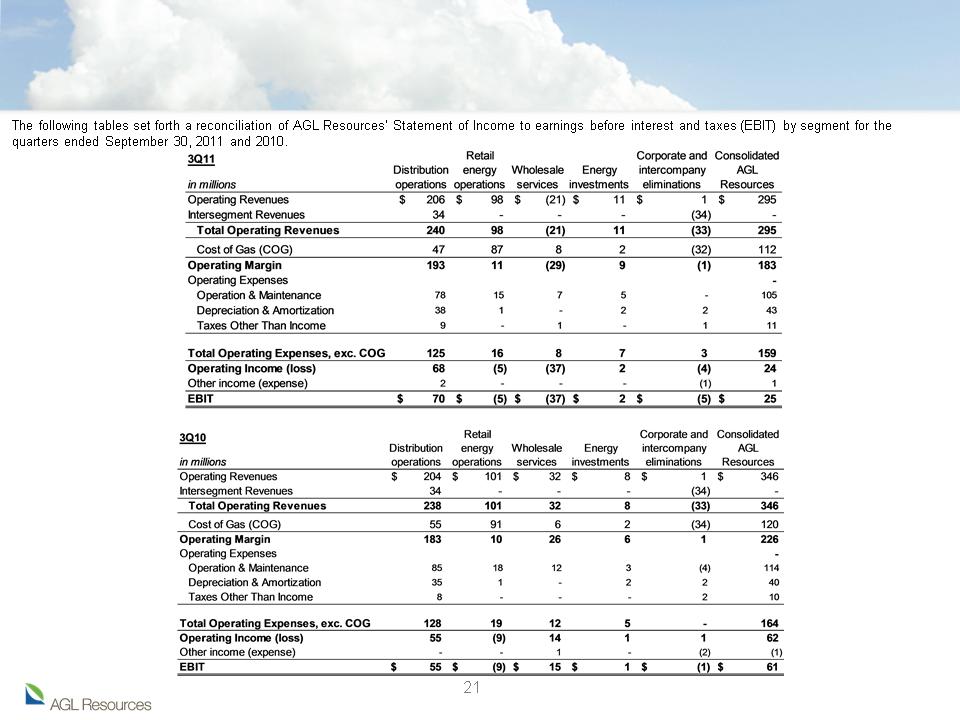

The following table sets forth a reconciliation of AGL Resources’ operating margin to operating income and earnings before interest and taxes (EBIT) to

earnings before income taxes and net income to net income attributable to AGL - as reported and net income attributable to AGL - as adjusted, for the three

and nine months ended September 30, 2011 and 2010.

earnings before income taxes and net income to net income attributable to AGL - as reported and net income attributable to AGL - as adjusted, for the three

and nine months ended September 30, 2011 and 2010.

GAAP Reconciliation

®

GAAP Reconciliation

®

GAAP Reconciliation

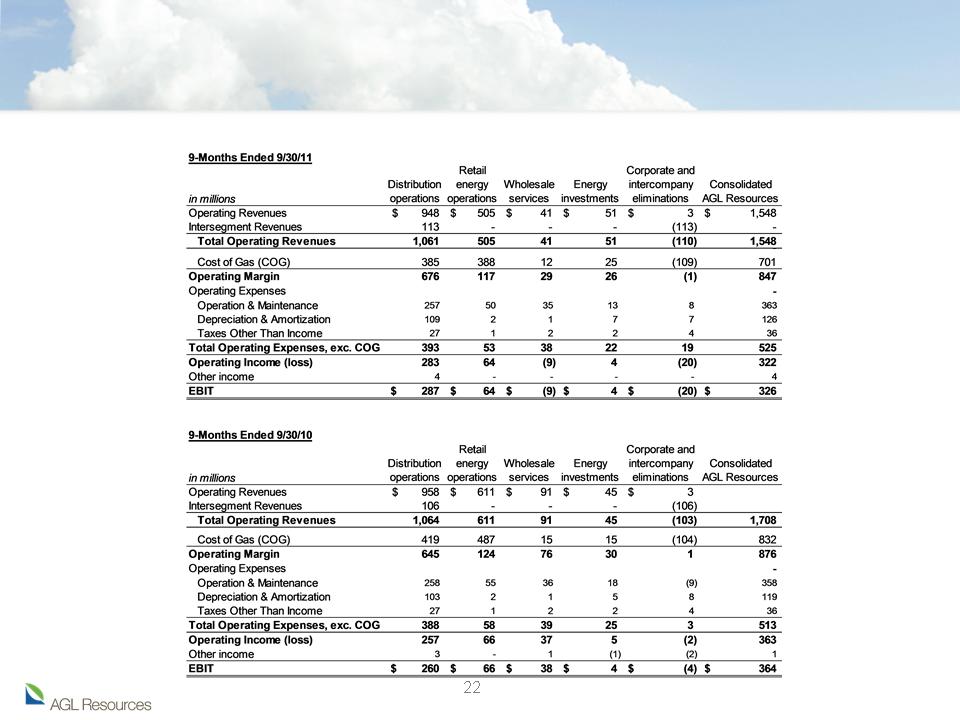

The following tables set forth a reconciliation of AGL Resources’ Statement of Income to earnings before interest and taxes (EBIT) by segment for the nine

months ended September 30, 2011 and 2010.

months ended September 30, 2011 and 2010.

®

23

GAAP Reconciliation

The following tables set forth a reconciliation of AGL Resources’ Basic and Diluted earnings per share - as reported (GAAP) to Basic and Diluted earnings

per share - as adjusted (Non-GAAP; excluding Nicor merger costs), for the indicated periods.

per share - as adjusted (Non-GAAP; excluding Nicor merger costs), for the indicated periods.

®

24

GAAP Reconciliation

Reconciliations of operating margin, EBIT by segment and EPS excluding merger expenses are available in our quarterly reports (Form 10-Q) and

annual reports (Form 10-K) filed with the Securities and Exchange Commission.

annual reports (Form 10-K) filed with the Securities and Exchange Commission.

Our management evaluates segment financial performance based on EBIT, which includes the effects of corporate expense allocations. EBIT is a non-

GAAP (accounting principles generally accepted in the United States of America) financial measure. Items that are not included in EBIT are financing

costs, including debt and interest expense and income taxes. We evaluate each of these items on a consolidated level and believe EBIT is a useful

measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those

operations.

GAAP (accounting principles generally accepted in the United States of America) financial measure. Items that are not included in EBIT are financing

costs, including debt and interest expense and income taxes. We evaluate each of these items on a consolidated level and believe EBIT is a useful

measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those

operations.

We also use EBIT internally to measure performance against budget and in reports for management and the Board of Directors. Projections of forward-

looking EBIT are used in our internal budgeting process, and those projections are used in providing forward-looking business segment EBIT projections

to investors. We are unable to reconcile our forward-looking EBIT business segment guidance to GAAP net income, because we do not predict the

future impact of unusual items and mark-to-market gains or losses on energy contracts. The impact of these items could be material to our operating

results reported in accordance with GAAP.

looking EBIT are used in our internal budgeting process, and those projections are used in providing forward-looking business segment EBIT projections

to investors. We are unable to reconcile our forward-looking EBIT business segment guidance to GAAP net income, because we do not predict the

future impact of unusual items and mark-to-market gains or losses on energy contracts. The impact of these items could be material to our operating

results reported in accordance with GAAP.

Operating margin is a non-GAAP measure calculated as revenues minus cost of gas, excluding operation and maintenance expense, depreciation and

amortization, taxes other than income taxes, and the gain or loss on the sale of our assets. These items are included in our calculation of operating

income. We believe operating margin is a better indicator than operating revenues of the contribution resulting from customer growth, since cost of gas is

generally passed directly through to customers.

amortization, taxes other than income taxes, and the gain or loss on the sale of our assets. These items are included in our calculation of operating

income. We believe operating margin is a better indicator than operating revenues of the contribution resulting from customer growth, since cost of gas is

generally passed directly through to customers.

We present our EPS excluding expenses incurred with respect to the proposed merger with Nicor. As we do not routinely engage in transactions of the

magnitude of the proposed Nicor merger, and consequently do not regularly incur transaction related expenses of correlative size, we believe presenting

EPS excluding Nicor merger expenses provides investors with an additional measure of our core operating performance.

magnitude of the proposed Nicor merger, and consequently do not regularly incur transaction related expenses of correlative size, we believe presenting

EPS excluding Nicor merger expenses provides investors with an additional measure of our core operating performance.

EBIT, operating margin and EPS excluding merger expenses should not be considered as alternatives to, or more meaningful indicators of, our

operating performance than operating income or net income, as determined in accordance with GAAP. In addition, our EBIT, operating margin and non-

GAAP EPS may not be comparable to similarly titled measures of another company.

operating performance than operating income or net income, as determined in accordance with GAAP. In addition, our EBIT, operating margin and non-

GAAP EPS may not be comparable to similarly titled measures of another company.

Net income attributable to AGL Resources, as adjusted and Basic and Diluted earnings per share, as adjusted are non-GAAP measures and exclude

transaction costs related to the proposed merger with Nicor. We believe these financial measures are useful to investors because they provide an

alternative method for assessing the Company’s operating results in a manner that is focused on the performance of the Company’s ongoing operations.

The presentation of these financial measures is not meant to be a substitute for financial measures prepared in accordance with GAAP.

transaction costs related to the proposed merger with Nicor. We believe these financial measures are useful to investors because they provide an

alternative method for assessing the Company’s operating results in a manner that is focused on the performance of the Company’s ongoing operations.

The presentation of these financial measures is not meant to be a substitute for financial measures prepared in accordance with GAAP.

®

25

Additional Information

Additional Information

In connection with the proposed merger, AGL Resources has filed with the SEC a Registration Statement on Form S-4 (Registration No. 333-

172084), as amended, which is publicly available, that includes a definitive joint proxy statement of AGL Resources and Nicor that also constitutes a

prospectus of AGL Resources. AGL Resources and Nicor mailed the definitive joint proxy statement/prospectus on or about May 10, 2011 to their

respective stockholders of record as of April 18, 2011. WE URGE INVESTORS TO READ THE DEFINITIVE JOINT PROXY

STATEMENT/PROSPECTUS CAREFULLY, AS WELL AS OTHER DOCUMENTS FILED WITH THE SEC, BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT AGL RESOURCES, NICOR AND THE PROPOSED TRANSACTION. The joint proxy statement/prospectus,

as well as other filings containing information about AGL Resources and Nicor, can be obtained free of charge at the website maintained by the SEC

at www.sec.gov. You may also obtain these documents, free of charge, from AGL Resources’ website (www.aglresources.com) under the tab

Investor Relations/SEC Filings or by directing a request to AGL Resources Inc., P.O. Box 4569, Atlanta, GA, 30302-4569. You may also obtain

these documents, free of charge, from Nicor’s website (www.nicor.com) under the tab Investor Information/SEC Filings or by directing a request to

Nicor Inc., P.O. Box 3014, Naperville, IL 60566-7014.

172084), as amended, which is publicly available, that includes a definitive joint proxy statement of AGL Resources and Nicor that also constitutes a

prospectus of AGL Resources. AGL Resources and Nicor mailed the definitive joint proxy statement/prospectus on or about May 10, 2011 to their

respective stockholders of record as of April 18, 2011. WE URGE INVESTORS TO READ THE DEFINITIVE JOINT PROXY

STATEMENT/PROSPECTUS CAREFULLY, AS WELL AS OTHER DOCUMENTS FILED WITH THE SEC, BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT AGL RESOURCES, NICOR AND THE PROPOSED TRANSACTION. The joint proxy statement/prospectus,

as well as other filings containing information about AGL Resources and Nicor, can be obtained free of charge at the website maintained by the SEC

at www.sec.gov. You may also obtain these documents, free of charge, from AGL Resources’ website (www.aglresources.com) under the tab

Investor Relations/SEC Filings or by directing a request to AGL Resources Inc., P.O. Box 4569, Atlanta, GA, 30302-4569. You may also obtain

these documents, free of charge, from Nicor’s website (www.nicor.com) under the tab Investor Information/SEC Filings or by directing a request to

Nicor Inc., P.O. Box 3014, Naperville, IL 60566-7014.

The respective directors and executive officers of AGL Resources and Nicor, and other persons, may be deemed to be participants in the solicitation

of proxies in respect of the proposed transaction. Information regarding AGL Resources’ directors and executive officers is available in the definitive

joint proxy statement/prospectus contained in the above referenced Registration Statement and its definitive proxy statement filed with the SEC by

AGL Resources on March 14, 2011, and information regarding Nicor directors and executive officers is available in the definitive joint proxy

statement/prospectus contained in the above referenced Registration Statement and its definitive proxy statement filed with the SEC by Nicor on

April 19, 2011. These documents can be obtained free of charge from the sources indicated above. Other information regarding the interests of the

participants in the proxy solicitation are included in the definitive joint proxy statement/prospectus and other relevant materials filed with the SEC.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, or a

solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

of proxies in respect of the proposed transaction. Information regarding AGL Resources’ directors and executive officers is available in the definitive

joint proxy statement/prospectus contained in the above referenced Registration Statement and its definitive proxy statement filed with the SEC by

AGL Resources on March 14, 2011, and information regarding Nicor directors and executive officers is available in the definitive joint proxy

statement/prospectus contained in the above referenced Registration Statement and its definitive proxy statement filed with the SEC by Nicor on

April 19, 2011. These documents can be obtained free of charge from the sources indicated above. Other information regarding the interests of the

participants in the proxy solicitation are included in the definitive joint proxy statement/prospectus and other relevant materials filed with the SEC.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, or a

solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

®