Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | d249645d8k.htm |

KRATON PERFORMANCE POLYMERS, INC.

THIRD QUARTER 2011 EARNINGS CONFERENCE CALL

November 1, 2011

Exhibit 99.1 |

Forward-Looking Statement Disclaimer

2

This presentation may include forward-looking statements that reflect our plans, beliefs,

expectations and current views with respect to, among other things, future events and financial

performance. Forward-looking statements are often characterized by the use of words such as

“outlook”, “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of

strategy, plans or intentions, including statements regarding our general “outlook”;

our ability to obtain raw materials; costs, timing and plans related to our planned joint

venture with Formosa Petrochemical Corporation and the related facility; anticipated capital

expenditures; anticipated sales volumes or levels of demand for our products; anticipated raw

material price movements and related expectations regarding customer activities. All

forward-looking statements in this presentation are made based on management's current

expectations and estimates, which involve known and unknown risks, uncertainties and other important factors that could

cause actual results to differ materially from those expressed in forward-looking statements.

These risks and uncertainties are more fully described in “Part I. Item 1A. Risk

Factors” contained in our Annual Report on 10-K, as filed with the Securities and Exchange

Commission and as subsequently updated in our Quarterly Reports on Form 10-Q, and include the

following risk factors: conditions in the global economy and capital markets; our reliance on

LyondellBasell Industries for the provision of significant operating and other services; the

failure of our raw materials suppliers to perform their obligations under long-term supply agreements, or our inability to

replace or renew these agreements when they expire; limitations in the availability of raw materials

we need to produce our products in the amounts or at the prices necessary for us to effectively

and profitably operate our business; competition in our end-use markets, from other

producers of SBCs and from producers of products that can be substituted for our products; our ability to produce and

commercialize technological innovations; our ability to protect our intellectual property, on which

our business is substantially dependent; the possibility that our products infringe on the

intellectual property rights of others; seasonality in our business, particularly for

Paving and Roofing end uses; financial and operating constraints related to our substantial level of indebtedness; the

inherently hazardous nature of chemical manufacturing; product liability claims and other lawsuits

arising from environmental damage, personal injuries or other damage associated with chemical

manufacturing or our products; political and economic risks in the various countries in which

we operate; health, safety and environmental laws, including laws that govern our employees’ exposure to

chemicals deemed harmful to humans; regulation of our customers, which could affect the demand for our

products or result in increased compliance costs; customs, international trade, export control,

antitrust, zoning and occupancy and labor and employment laws that could require us to modify

our current business practices and incur increased costs; fluctuations in currency exchange rates;

our relationship with our employees; loss of key personnel or our inability to attract and retain new

qualified personnel; the fact that we typically do not enter into long-term contracts with

our customers; a decrease in the fair value of our pension assets, which could require us to

materially increase future funding of the pension plan; future sales of our shares could adversely affect the market price

of our common stock; our planned joint venture in Asia is subject to risks and uncertainties; Delaware

law and some provisions of our organizational documents make a takeover of our company more

difficult; and other risks, factors and uncertainties described in this press release and

our other reports and documents; and other factors of which we are currently unaware or deem immaterial.

Readers are cautioned not to place undue reliance on forward-looking statements. We assume no

obligation to update such information in light of new information or future events.

Further information concerning issues that could materially affect financial performance

related to forward-looking statements can be found in Kraton’s periodic filings with the Securities and Exchange

Commission.

|

GAAP

Disclaimer This presentation includes the use of both GAAP (generally

accepted accounting principles) and non-GAAP financial measures. The

non-GAAP financial measures are EBITDA and Adjusted EBITDA. The most

directly comparable GAAP financial measure is net income/loss. A

reconciliation of the non-GAAP financial measures used in this presentation

to the

most

directly

comparable

GAAP

measure

is

included

herein.

We

consider

EBITDA

and Adjusted EBITDA important supplemental measures of our performance and believe

they are frequently used by investors and other interested parties in the

evaluation of companies in our industry. EBITDA and Adjusted EBITDA have

limitations as analytical tools and

should

not

be

considered

in

isolation

or

as

a

substitute

for

analysis

of

our

results

under

GAAP in the United States.

3 |

Update

on 2011 Business Priorities Capital Investment

Progress continues on proposed 30 kT Asian HSBC

plant

Engineering and design work ongoing

Drafting of definitive documentation underway

Taiwan Fair Trade Commission has approved the

proposed joint venture with Formosa

Continuing process to secure necessary permits

Earnings Growth

Q3 sales revenue of $402 million, up 20% year-on-year

Q3 GAAP net income of $43 million or $1.33 per diluted

share

Q3 Adjusted EBITDA

of $71 million

Q3 sales volume of 78 kT

Innovation-led Top-line

Growth

Q3’11 TTM vitality index of 14%

Q3’11 TTM innovation revenue up 31% vs. Q3’10 TTM

Q3’11 TTM innovation volume up 13% vs. Q3’10 TTM

4

(1)

Adjusted EBITDA is EBITDA excluding restructuring and related charges and

non-cash compensation expenses. (1) |

12%

-5%

Q3'11 vs. Q3'10

Q3'11 vs. Q2'11

Advanced Materials End Use Review

TTM Sales Revenue

Profile

Change in Sales Revenue

End Use Sales

Revenue

US $ in millions

$92

$108

$103

Q3'10

Q2'11

Q3'11

5

29%

AM |

Adhesives, Sealants and Coatings End Use Review

ASC

6

TTM Sales Revenue

Profile

Change in Sales Revenue

End Use Sales

Revenue

US $ in millions

4%

-8%

Q3'11 vs. Q3'10

Q3'11 vs. Q2'11

$108

$122

$112

Q3'10

Q2'11

Q3'11

31% |

Paving

and Roofing End-Use Review 7

TTM Sales Revenue

Profile

Change in Sales Revenue

End Use Sales

Revenue

US $ in millions

17%

2%

Q3'11 vs. Q3'10

Q3'11 vs. Q2'11

$111

$128

$130

Q3'10

Q2'11

Q3'11

P&R

29% |

$94

$79

$61

$35

TTM Q3'11

2010

2009

2008

Emerging Businesses End Use Review

US $ in millions

$19

$20

$26

Q3'10

Q2'11

Q3'11

8

TTM Sales Revenue

Profile

Sales Revenue

End Use Sales

Revenue

US $ in millions

7%

EB |

Innovation-led Top Line Growth

Q3’11 TTM vitality index 14%

Q3’11 TTM innovation revenue up 31% vs. Q3’10 TTM

Q3’11 TTM innovation volume up 13% vs. Q3’10 TTM

Key innovations showing strong TTM revenue growth:

PVC replacement for IV bags up 91%

Roofing innovations up 72%

Protective films up 47%

PVC replacement in wire & cable up 33%

Reactive SBS for printing plates up 20%

9 |

Sales Volume

(Kilotons)

Q3 2011 Sales Volume and Sales Revenue

Sales Revenue

(US $ in Millions)

10

81

82

78

Q3'10

Q2'11

Q3'11

$335

$386

$402

Q3'10

Q2'11

Q3'11 |

Q3

2011 Sales Revenue Walk Q3 2011 vs. Q2 2011

Q3 2011 vs. Q3 2010

US $ in millions

11 |

Q3

2011 Gross Profit and Adjusted EBITDA Gross

Profit

and

Gross

Margin

(US $ in Millions)

Adjusted

EBITDA

(US $ in Millions)

Adjusted

EBITDA

Margin

12

$83

$108

$101

24.7%

28.1%

25.2%

Q3'10

Q2'11

Q3'11

$55

$74

$71

16.4%

19.2%

17.7%

Q3'10

Q2'11

Q3'11 |

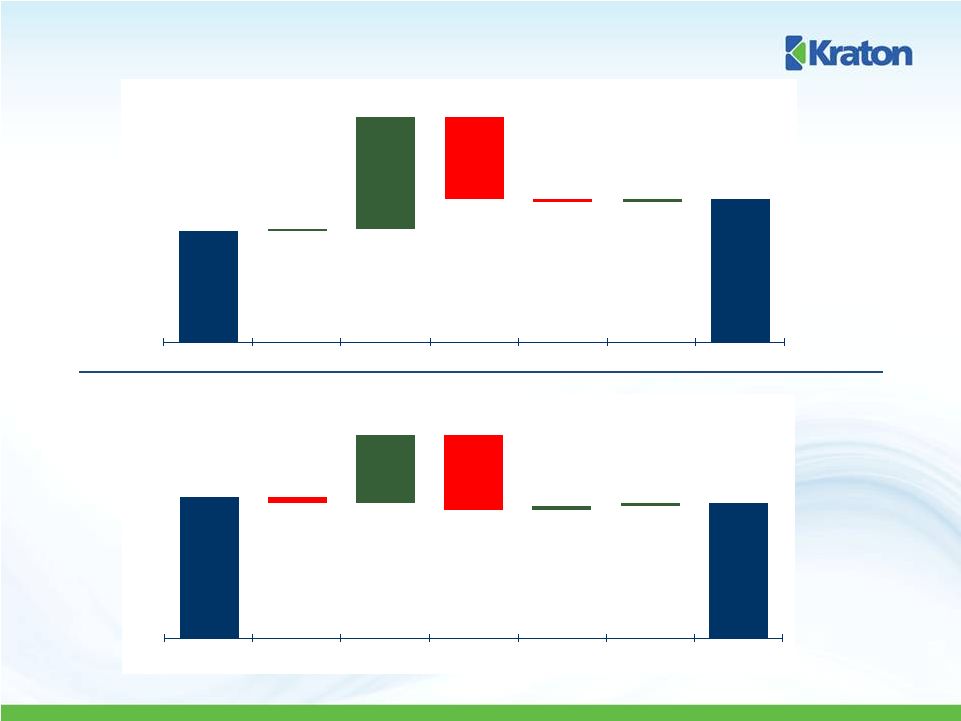

$55

$71

$1

$55

$(40)

$(2)

$2

Q3 2010

Volume/Mix

Price

COGS

R&D/SG&A

FX/Other

Q3 2011

$74

$71

$(3)

$35

$(39)

$2

$2

Q2 2011

Volume/Mix

Price

COGS

R&D/SG&A

FX/Other

Q3 2011

Q3 2011 Adjusted EBITDA Walk

Q3 2011 vs. Q2 2011

US $ in millions

Q3 2011 vs. Q3 2010

13 |

Impact of Monomer Volatility

$568

$537

$805

$976

$918

$632

$707

$781

$849

$863

$1,046

$1,005

$810

$712

$894

Q1 08

Q2 08

Q3 08

Q4 08

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

$636

$664

$1,054

$932

$190

$501

$865

$998

$949

$1,034

$1,024

$885

$1,068

$1,318

$1,308

Q1 08

Q2 08

Q3 08

Q4 08

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Quarterly Impact of FIFO vs.

Estimated Current Replacement Cost

Gross Profit per Ton at Estimated

Current Replacement Cost

Gross Profit per Ton at FIFO

14

$5.2

$11.9

$22.3

$2.3

$9.3

$12.8

$13.3

$7.3

$14.7

$1.7

$8.1

$49.8

$32.1

$34.3

Q1 08

Q2 08

Q3 08

Q4 08

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

-

-

-

-

- |

Q3

2011 Financial Overview US $ in Thousands except per share data

Three months Ended

Three months

Ended

Three months Ended

9/30/2011

6/30/2011

9/30/2010

Sales Volume (Kilotons)

78

82

81

Sales Revenues

$

401,993

$

386,428

$

335,442 Cost of Goods Sold

300,539

278,033

252,561

Gross Profit

101,454

108,395

82,881

Operating expenses

Research and Development

6,703

6,966

6,125

Selling, General and Administrative

25,838

27,912

24,819

Depreciation and Amortization

16,689

15,604

13,027

Earnings (loss) of Unconsolidated Joint Venture

595

(880)

81

Interest Expense, net

6,288

5,915

6,127

Income Before Income Taxes

46,531

51,118

32,864

Income Tax Expense

3,438

4,141

4,828

Net Income

$

43,093

$

46,977

$

28,036 Earnings per Common Share -

Diluted

$

1.33

$

1.44

$

0.88 Adjusted

EBITDA

$

71,063

$

74,199

$

54,947 15 |

US $

in millions Cash at quarter end of $46

million.

Net Debt-to-Capitalization

ratio of 37.9% at quarter end.

Net Debt to TTM Adjusted

EBITDA was 1.5x at 9/30/11.

(1)

Net debt is equal to total debt, less cash and cash equivalents.

Balance Sheet

16 |

Selected 2011 Estimates

Working capital (excluding cash) as a % of revenue

~ 30%

Capital spending

$65 to $70 million

Interest expense

(1)

~$30 million

Research & development

~$28 million

SG&A

~ $105 million

Depreciation and amortization

~$63 million

Book tax rate

(2)

~9%

17

Includes accelerated write-off of debt issuance costs associated

with the debt refinancing of $5 million. The estimated book tax rate is based on certain facts and circumstances that

may change. In particular, an increase in the release of the valuation allowance to

reflect the benefit of tax net operating loss carryforwards in the fourth quarter of 2011 or

some future period would result in a lower effective tax rate in the period of the release and

a higher effective tax rate in future periods.

(1)

(2) |

APPENDIX

November 1, 2011 |

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

(1)

The EBITDA measure is used by management to evaluate operating performance.

Management believes that EBITDA is useful to investors because it is

frequently

used

by

investors

and

other

interested

parties

in

the

evaluation

of

companies

in

our

industry.

EBITDA

is

not

a

recognized

term

under

GAAP

and

does

not purport to be an alternative to net income (loss) as an indicator of operating

performance or to cash flows from operating activities as a measure of liquidity.

Since not all companies use identical calculations, this presentation of EBITDA

may not be comparable to other similarly titled measures of other companies.

Additionally, EBITDA is not intended to be a measure of free cash flow for

management's discretionary use, as it does not consider certain cash requirements

such as interest payments, tax payments and debt service requirements.

(2)

Adjusted EBITDA is GAAP EBITDA excluding restructuring and related charges

and non-cash compensation expenses.. (3)

The restructuring and related charges were recorded as Selling, General and

Administrative expenses. US $ in Thousands

Three months

Ended

Three months

Ended

Three months

Ended

9/30/2011

6/30/2011

9/30/2010

Net Income

$

43,093

$

46,977

$

28,036 Add:

Interest expense, net

6,288

5,915

6,127

Income tax expense

3,438

4,141

4,828

Depreciation and amortization expenses

16,689

15,604

13,027

EBITDA

(1)

$

69,508

$

72,637

$

52,018 EBITDA

(1)

$

69,508

$

72,637

$

52,018 Add (deduct):

Restructuring and related charges

(3)

308

(93)

1,864

Other non-cash expenses

1,247

1,655

1,065

Adjusted EBITDA

(2)

$

71,063

$

74,199

$

54,947 19 |

KRATON PERFORMANCE POLYMERS, INC.

THIRD QUARTER 2011 EARNINGS CONFERENCE CALL

November 1, 2011 |