Attached files

2011

Third-Quarter Results October 20, 2011

Exhibit 99.3 |

2

Introduction

Unless otherwise stated, we will be talking about results for the

third-quarter 2011 and comparing them with the same period

in 2010

References to PMI volumes refer to PMI shipment data, unless

otherwise stated

Industry volume and market shares are the latest data available from

a number of internal and external sources

Organic volume refers to volume excluding acquisitions

Net revenues exclude excise taxes

OCI stands for Operating Companies Income, which is defined as

operating income before general corporate expenses and the

amortization of intangibles. OCI growth rates are on an adjusted

basis, which excludes asset impairment, exit and other costs

Data tables showing adjustments to net revenues and OCI for

currency, acquisitions, asset impairment, exit and other costs, free

cash flow calculations, adjustments to EPS, and reconciliations to

U.S. GAAP measures are at the end of today’s web cast slides and

are posted on our web site |

3

Forward-Looking and Cautionary Statements

This presentation and related discussion contain statements that, to

the extent they do not relate strictly to historical or current facts,

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private Securities Litigation Reform Act of 1995. Such forward-looking

statements are based on current plans, estimates and expectations,

and are not guarantees of future performance. They are based on

management’s expectations that involve a number of business risks

and uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the forward-looking

statements. PMI undertakes no obligation to publicly update or revise

any forward-looking statements, except in the normal course of its

public disclosure obligations. The risks and uncertainties relating to

the forward-looking statements in this presentation include those

described

under

Item

1A.

“Risk

Factors”

in

PMI’s

Form

10-Q

for

the

quarter ended June 30, 2011, filed with the Securities and Exchange

Commission |

4

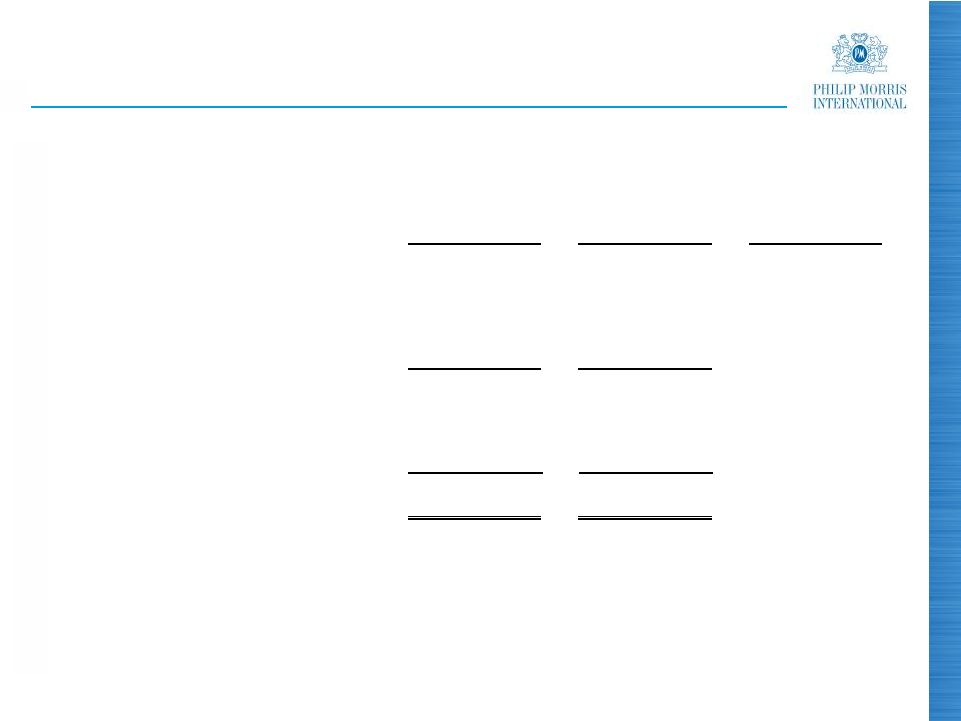

2011 Third-Quarter Results

Outstanding financial performance:

In the quarter, we comfortably surpassed all our mid to

long-term currency neutral annual growth targets even

excluding our business in Japan

Q3, 2011 Results

(a)

Net

Revenues

+15.7%

Adjusted OCI

+23.7%

Adjusted Diluted EPS

+33.0%

(a)

All financial growth rates exclude currency. Net revenues and OCI growth rates also exclude

acquisitions Source: PMI Financials |

5

2011 EPS Guidance

Business outlook further improved, fully compensating

recent unfavorable currency movements

Allows us to narrow our 2011 reported diluted EPS

guidance range to $4.75 to $4.80 (upper half of previous

range)

Compared to our adjusted diluted EPS of $3.87 in 2010,

this translates into improved growth rates of

approximately 17.5% to 19.0% excluding currency, and

approximately 22.5% to 24.0% at prevailing exchange

rates

Source: PMI forecasts |

6

PMI Organic Cigarette Volume Growth

(%)

Source: PMI Financials

2011

2011

4.4

0.5

0

5

Q3

YTD Sept |

7

PMI Brand Performance

% Volume Growth vs. Prior Year

Q3, 2011

YTD Sept, 2011

Marlboro

3.9%

0.5%

L&M

3.9

2.9

Bond Street

6.8

2.2

Fortune

10.1

9.0

(a)

Philip Morris

1.8

1.0

Parliament

16.2

9.9

Chesterfield

7.0

0.4

Sampoerna A

22.8

11.7

Lark

44.1

15.3

Dji Sam Soe

12.1

10.3

(a) March through September

Source: PMI Financials |

8

Marlboro

Market Shares

Market Shares

YTD

Sept,

2010

YTD

Sept,

2011

Variance

Asia

(a)

6.2%

6.5%

0.3pp

EEMA

(b)

5.6

6.1

0.5

EU

18.1

17.9

(0.2)

LA&C

13.8

13.5

(0.3)

Total

(a)(b)

8.8

9.0

0.2

(a)

Excluding PRC

(b)

Excluding duty-free

(c)

Also excluding the USA

Source: PMI estimates

(c) |

9

Marlboro

Market Shares –

LA&C Region

Market Shares

YTD

Sept,

2010

YTD

Sept,

2011

Variance

Argentina

23.2%

24.0%

0.8pp

Brazil

6.7

7.0

0.3

Colombia

3.7

4.7

1.0

Mexico

48.9

51.8

2.9

Source: PMI estimates |

10

PMI Market Share Developments

(%)

Top 30 PMI OCI Markets

(a) Adjusted

for

Philippines

pro

forma

Jan-Feb

2010

Source: PMI Financials and estimates

(a)

34.9

36.3

32

35

38

YTD Sept, 2010

YTD Sept, 2011 |

11

2011 Third-Quarter Results –

by Region

(a)

Excluding currency and acquisitions

Source: PMI Financials

Q3, 2011 Results

Asia

EEMA

LA&C

EU

Net Revenues

(a)

+39.1%

+11.2%

+8.3%

+2.2%

Adjusted

OCI

(a)

+75.1

+13.8

+9.0

+3.1 |

12

Japan

Source: PMI Financials, PMI estimates and Tobacco Institute of Japan

PMI shipments up 47.1%:

-

Higher 2011 market share

-

Payback in Q3, 2010, for Q2,

2010, distributor inventory build-

up

September C-store consumer

off-take share slightly above

30%, compared to around

26% pre-crisis

Retention share only

measurable in Q4, 2011, or

Q1, 2012

Industry volume decline not

expected to exceed 15% this

year |

13

Indonesia

PMI volume up 22.5% in

Q3, 2011

Record market share of

31.2% in Q3, 2011

Indonesian economy

remains strong and

consumer purchasing

power is increasing

Government expected to

continue to implement

plans to simplify excise tax

structure

Source: PMI Financials and PMI estimates

2010

2011

Other

Marlboro

Dji Sam Soe

Sampoerna A

29.2

31.2

(%)

PMI Market Share

Total PMI

11.2

12.1

7.9

7.7

5.7

7.2

4.2

4.4

0

35

Q3

Q3 |

14

Russia

Market share up slightly to

25.8% QTD Aug, 2011,

behind:

-

Parliament

in premium

-

Chesterfield

in mid-price, and

-

Bond Street

in low-price

segment

PMI volume down 3.5% in

Q3, 2011, due to:

-

Distributor inventory adjustments

-

Lower total market

During Q4, 2011, Russian

Parliament expected to

approve new manageable

road map for excise taxes

Source: A.C. Nielsen, PMI Finance and Russian Ministry of Finance |

15

Turkey

PMI volume up 21.6% in Q3,

2011

Strong share gains driven by:

-

Parliament

in premium

-

Muratti

in mid-price, and

-

L&M

in low-price

Total market had stabilized,

but recently announced, very

large ad-valorem excise tax

increase expected to be

disruptive

A more balanced excise tax

structure is needed

Source: PMI Financials, PMI estimates and A.C. Nielsen

Premium

Mid-price

Low-price

41.8

45.7

(%)

PMI Market Share

Total PMI

19.2

21.2

5.9

6.5

18.0

16.7

0

50

Q3, 2010

Q3, 2011 |

16

Germany

Source: PMI Financials and PMI estimates

Q3, 2010

Q3, 2011

L&M

Marlboro

Other

(%)

PMI Market Shares by Segment

Germany had benefited

from more robust market

volume trends this year

Q3, 2011, total German

market volume:

-

Cigarettes +0.3%

-

Fine cut +3.8%

PMI share gains in both

cigarette and fine cut

segments

Price increase in Q2, 2011.

Next tax step in Jan 2012

20.3

2.7

10.3

5.6

6.4

35.2

14.7

4.6

Cigarette

Fine Cut

21.1

1.3

9.2

5.6

7.3

34.9

14.2

4.6

Cigarette

Fine Cut |

17

France

Great momentum in a

stable market

Cigarette share gain of

0.4pp to 40.4%, driven by

premium Marlboro

and

Philip Morris

Strong growth in fine cut

segment since launch of

Marlboro

in Feb 2011

Cigarette price increase of

€0.30/pack this month

Source: PMI estimates

Q3, 2010

Q3, 2011

40.4

Philip Morris

Marlboro

Other

(%)

PMI Market Shares by Segment

25.9

6.8

8.2

5.7

12.7

25.2

6.3

Cigarette

Fine Cut

25.7

7.7

5.7

13.3

40.0

19.0

6.6

Cigarette

Fine Cut |

18

Spain

Very high unemployment

driving decline in cigarette

industry volume of at least

15% in 2011

Pricing situation was

resolved in September:

-

Marlboro

back to previous

level of €4.25/pack

-

L&M

raised to €3.75/pack

Source: PMI estimates |

19

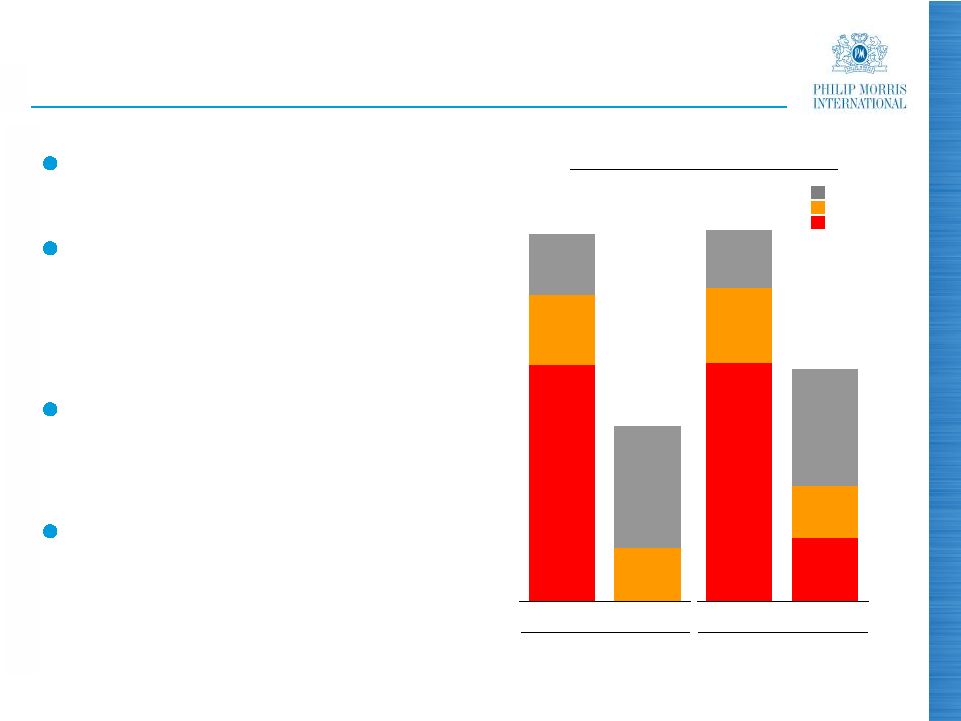

Pricing

The pricing environment

continues to be very

favorable

In 2011, PMI has

implemented or announced

price increases in:

-

Asia: Australia, Indonesia,

Philippines

-

EEMA: Algeria, Russia, Saudi

Arabia, Ukraine

-

EU: France, Germany, Italy,

Poland, Spain

-

LA&C: Argentina, Brazil,

Canada

Source: PMI Financials

($ mio)

Q3

Q1

Pricing Variance

Q2

449

453

341

617

292

564

1,082

1,634

0

900

1,800

2010

2011 |

20

Costs and Margins

Adjusted OCI Margins

Third-Quarter

2010

2011

(a)

Variance

(a)

Asia

37.6%

47.4%

9.8pp

EEMA

45.1

46.2

1.1

EU

53.0

53.5

0.5

LA&C

32.7

32.9

0.2

Total

44.2

47.3

3.1

(a)

Excluding currency and acquisitions

Source: PMI Financials

Stable tobacco leaf prices

Moderate cost increases offset by productivity savings

that will surpass $250 million in 2011 |

21

Excise Taxation

Excise tax structures have improved and several

countries have adopted multi-year tax plans

Most governments appear to have understood that large

excise tax increases are disruptive and do not improve

revenue generation over mid to long-term

We expect some VAT increases in 2012, but these should

be manageable

Every year, some governments introduce disruptive

excise tax increases. This happened last week in Turkey

and additional surprises remain possible |

22

Plain Packaging

We oppose such measures because:

-

No sound evidence it would reduce consumption, smoking

incidence or youth smoking, or provide any other public health

benefit

-

Undermines public health objectives by lowering prices and

increasing illicit trade

-

Violates intellectual property protections and breaches

international trade obligations

We therefore do not believe that plain packaging

regulations should be widely adopted

We are vigorously pursuing several legal avenues to

challenge the Australian Government’s plain packaging

proposal |

23

($ million)

+22.1%

Currency

Free

Cash

Flow

(a)

(a)

Free cash flow equals net cash provided by operating activities less capital

expenditures Source: PMI Financials

($ million)

+25.6%

Currency

2010

2011

2010

2011

9,000

2,253

2,830

214

0

1,000

2,000

3,000

Q3

Q3

7,373

478

0

3,000

6,000

9,000

YTD Sept

YTD Sept |

+10.3%

+20.3%

$3.08

$1.84

+17.4%

2008

Aug

Sept

Sept

Sept

2011

+7.4%

24

Dividend Increases Since Spin-Off

(a)

(a)

Dividends for 2008 and 2011 are annualized rates. 2008 annualized rate is based on

a quarterly dividend of $0.46 per common share, declared June 18, 2008. The

annualized rate for 2011 is based on a quarterly dividend of $0.77 per common share, declared September 14, 2011

Source: PMI Financials

2008

2009

2010

2011

+67.4% |

25

Share Repurchases and Dividends

During the third quarter, PMI spent $1.4 billion to

repurchase a further 21.2 million shares

Since the March 2008 spin:

-

Over $20 billion spent to repurchase nearly 400 million shares at

an average price of $50.81 per share

-

Over $14 billion paid out in dividends

-

Nearly $35 billion returned to our shareholders

Source: PMI Financials |

26

Summary

Outstanding third quarter:

-

Organic volume growth of 4.4%

-

Strong market share momentum and favorable pricing

environment

-

Adjusted diluted EPS, excluding currency, increased by 33.0%

-

2011 reported diluted EPS guidance range narrowed to $4.75-

$4.80, with improved business outlook offsetting recent

unfavorable currency movements

-

Compared to an adjusted diluted EPS of $3.87 in 2010, this

corresponds to an increase of approximately 22.5% to 24.0% at

prevailing exchange rates, and approximately 17.5% to 19.0%,

excluding currency

20.3% dividend increase in September demonstrates our

focus on shareholder returns and our belief in a bright

future

Source: PMI Financials |

Questions & Answers

2011 Third-Quarter Results |

28

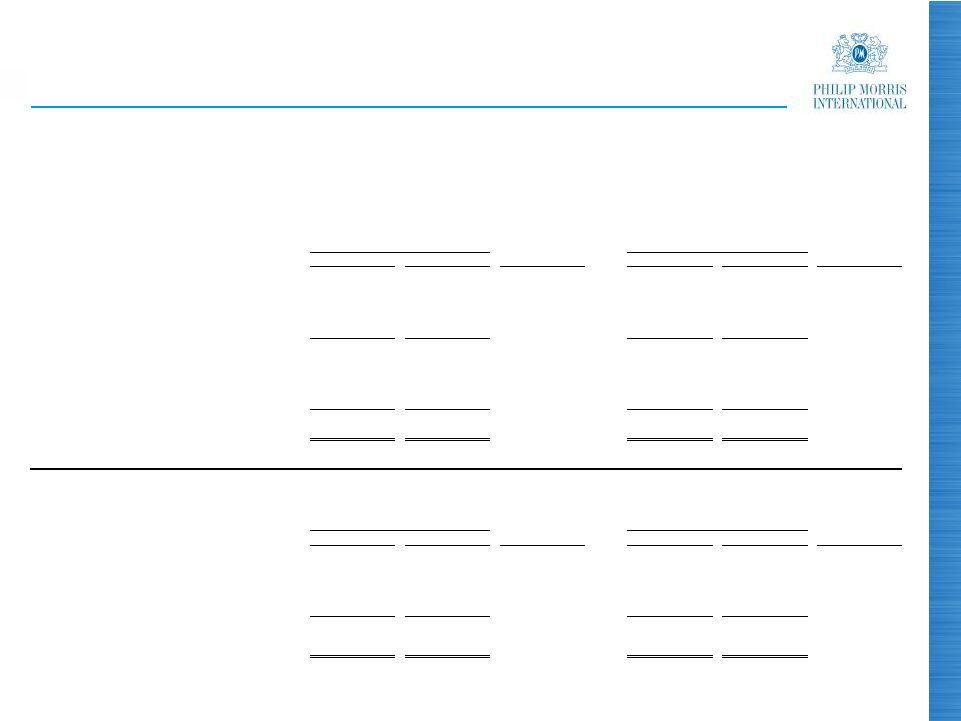

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Quarters Ended September 30,

($ in millions)

(Unaudited)

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

8,155

$

5,649

$

2,506

$

321

$

2,185

$

-

$

2,185

$

European Union

7,045

$

4,906

$

2,139

$

17.2%

2.2%

2.2%

4,921

2,711

2,210

89

2,121

13

2,108

EEMA

4,184

2,288

1,896

16.6%

11.9%

11.2%

5,143

2,344

2,799

248

2,551

2

2,549

Asia

3,629

1,796

1,833

52.7%

39.2%

39.1%

2,487

1,640

847

39

808

-

808

Latin America & Canada

2,078

1,332

746

13.5%

8.3%

8.3%

20,706

$

12,344

$

8,362

$

697

$

7,665

$

15

$

7,650

$

PMI Total

16,936

$

10,322

$

6,614

$

26.4%

15.9%

15.7%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

1,262

$

105

$

1,157

$

-

$

1,157

$

European Union

1,113

$

13.4%

4.0%

4.0%

925

(32)

957

(13)

970

EEMA

856

8.1%

11.8%

13.3%

1,309

104

1,205

2

1,203

Asia

690

89.7%

74.6%

74.3%

255

-

255

-

255

Latin America & Canada

244

4.5%

4.5%

4.5%

3,751

$

177

$

3,574

$

(11)

$

3,585

$

PMI Total

2,903

$

29.2%

23.1%

23.5%

2011

2010

% Change in Reported Operating

Companies Income

2011

2010

% Change in Reported Net Revenues

excluding Excise Taxes |

29

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Quarters Ended September

30, ($ in millions)

(Unaudited)

(a) For the calculation of net revenues excluding excise taxes, currency and

acquisitions, refer to previous slide Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

1,262

$

(11)

$

1,273

$

105

$

1,168

$

-

$

1,168

$

European Union

1,113

$

(20)

$

1,133

$

12.4%

3.1%

3.1%

925

(16)

941

(32)

973

(1)

974

EEMA

856

-

856

9.9%

13.7%

13.8%

1,309

(5)

1,314

104

1,210

2

1,208

Asia

690

-

690

90.4%

75.4%

75.1%

255

(11)

266

-

266

-

266

Latin America & Canada

244

-

244

9.0%

9.0%

9.0%

3,751

$

(43)

$

3,794

$

177

$

3,617

$

1

$

3,616

$

PMI Total

2,903

$

(20)

$

2,923

$

29.8%

23.7%

23.7%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(a)

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(a)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

1,168

$

2,185

$

53.5%

1,168

$

2,185

$

53.5%

European Union

1,133

$

2,139

$

53.0%

0.5

0.5

973

2,121

45.9%

974

2,108

46.2%

EEMA

856

1,896

45.1%

0.8

1.1

1,210

2,551

47.4%

1,208

2,549

47.4%

Asia

690

1,833

37.6%

9.8

9.8

266

808

32.9%

266

808

32.9%

Latin America & Canada

244

746

32.7%

0.2

0.2

3,617

$

7,665

$

47.2%

3,616

$

7,650

$

47.3%

PMI Total

2,923

$

6,614

$

44.2%

3.0

3.1

% Change in Adjusted Operating

Companies Income

2010

2011

2010

2011 |

30

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Quarters Ended September 30,

(Unaudited)

2011

2010

% Change

Reported Diluted EPS

1.35

$

0.99

$

36.4%

Adjustments:

Asset impairment and exit costs

0.02

0.01

Tax items

-

-

Adjusted Diluted EPS

1.37

$

1.00

$

37.0%

Less:

Currency impact

0.04

Adjusted Diluted EPS, excluding Currency

1.33

$

1.00

$

33.0% |

31

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation

of

Operating

Cash

Flow

to

Free

Cash

Flow

and

Free

Cash

Flow,

excluding

Currency

For the Quarters and Nine Months Ended September 30,

($ in millions)

(Unaudited)

(a) Operating Cash Flow

For the Quarters Ended

For the Nine Months Ended

September 30,

September 30,

2011

2010

% Change

2011

2010

% Change

Net cash provided by operating activities

(a)

3,053

$

2,417

$

26.3%

9,568

$

7,856

$

21.8%

Less:

Capital expenditures

223

164

568

483

Free cash flow

2,830

$

2,253

$

25.6%

9,000

$

7,373

$

22.1%

Less:

Currency impact

214

478

Free cash flow, excluding currency

2,616

$

2,253

$

16.1%

8,522

$

7,373

$

15.6%

For the Quarters Ended

For the Nine Months Ended

September 30,

September 30,

2011

2010

% Change

2011

2010

% Change

Net cash provided by operating activities

(a)

3,053

$

2,417

$

26.3%

9,568

$

7,856

$

21.8%

Less:

Currency impact

236

515

Net cash provided by operating activities,

excluding currency

2,817

$

2,417

$

16.5%

9,053

$

7,856

$

15.2% |

32

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS

For the Year Ended December 31,

(Unaudited)

2010

Reported Diluted EPS

3.92

$

Adjustments:

Tax items

(0.07)

Asset impairment and exit costs

0.02

Adjusted Diluted EPS

3.87

$

|

2011

Third-Quarter Results October 20, 2011 |