Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NuStar Energy L.P. | d234674d8k.htm |

Exhibit 99.1

NUSTAR ANALYST DAY

New Orleans and St. James, LA

September 21, 2011 |

Statements

contained in this presentation that state management’s expectations or predictions

of the future are forward-looking statements intended to be covered by the safe

harbor provisions of the Securities Act of 1933 and the Securities Exchange Act of

1934. The words “believe,” “expect,”

“should,”

“targeting,”

“estimates,”

and other similar expressions identify

forward-looking statements. It is important to note that actual results

could

differ materially from those projected in such forward-looking statements. We

undertake no duty to update any forward-looking statement to conform the

statement to actual results or changes in the company’s expectations. For

more information concerning factors that could cause actual results to differ

from those expressed or forecasted, see NuStar Energy L.P.’s annual report on

Form 10-K and quarterly reports on Form 10-Q, filed with the Securities and

Exchange Commission and available on NuStar’s website at

www.nustarenergy.com.

2

Forward Looking Statements |

Agenda

NuStar Overview (15 minutes)

Curt Anastasio

4

Storage Segment Overview (20 minutes)

Danny Oliver

11

Transportation Segment Overview (20 minutes)

Danny Oliver

20

Asphalt & Fuels Marketing Overview

Paul Brattlof

31

(15 Minutes)

St. James Terminal Overview (15 minutes)

Kyle Oppliger

38

Closing Remarks and Q&A

Curt Anastasio

52

3

Topic

Presenter*

Page #

* Bios of management team can be found in the appendix starting on page 53 |

NuStar Overview

NuStar Overview

Curt Anastasio

Curt Anastasio

CEO & President

CEO & President

4 |

Spent $136

million on internal growth projects Majority of this spending relates to projects that

will begin generating EBITDA in the last half of 2011 Completed six projects with a total

spend of $28 million and a projected EBITDA multiple of 4x to 6x Spent another $100

million on acquisitions that should yield annual EBITDA of around $20 million

Earned $253 million in EBITDA

Record June year to date EBITDA

Increased NS and NSH distributions in 2nd quarter

NS

distributions

increased

to

$1.095

per

unit,

2%

higher

than

1Q

2011

and

3%

higher

than

2Q

2010

NSH distributions increased to $0.495 per unit, 3% higher than 1Q 2011 and 8% higher than 2Q

2010

45

June 2011 Year to Date

NuStar Energy Highlights

Continued to maintain an outstanding safety and environmental record

superior to our industry peers

Obtained VPP Star Site status at four locations with the goal being the entire

company |

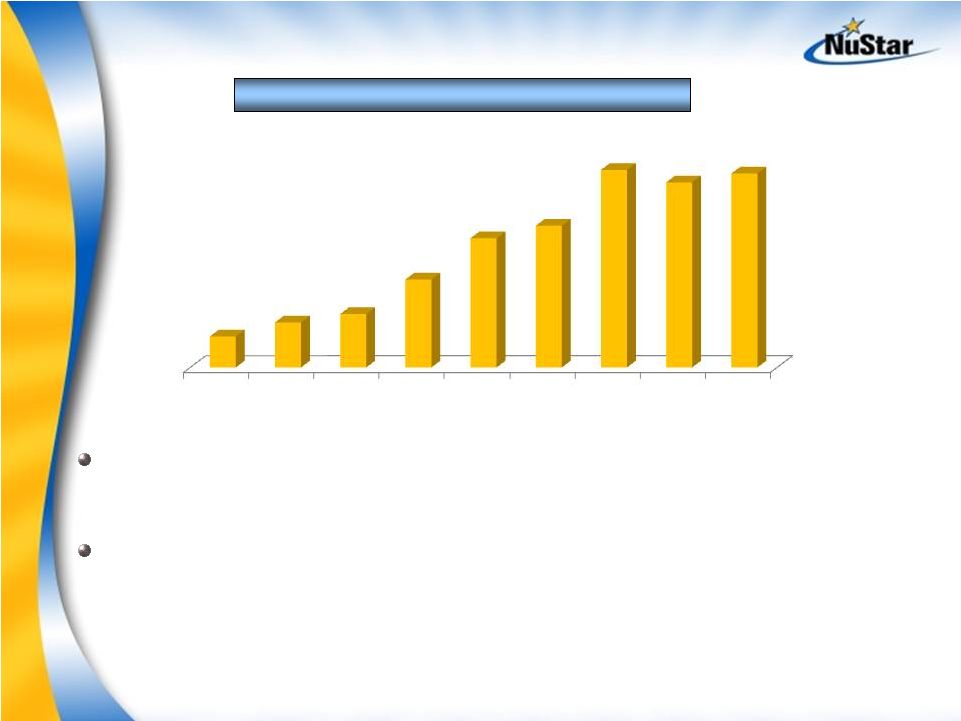

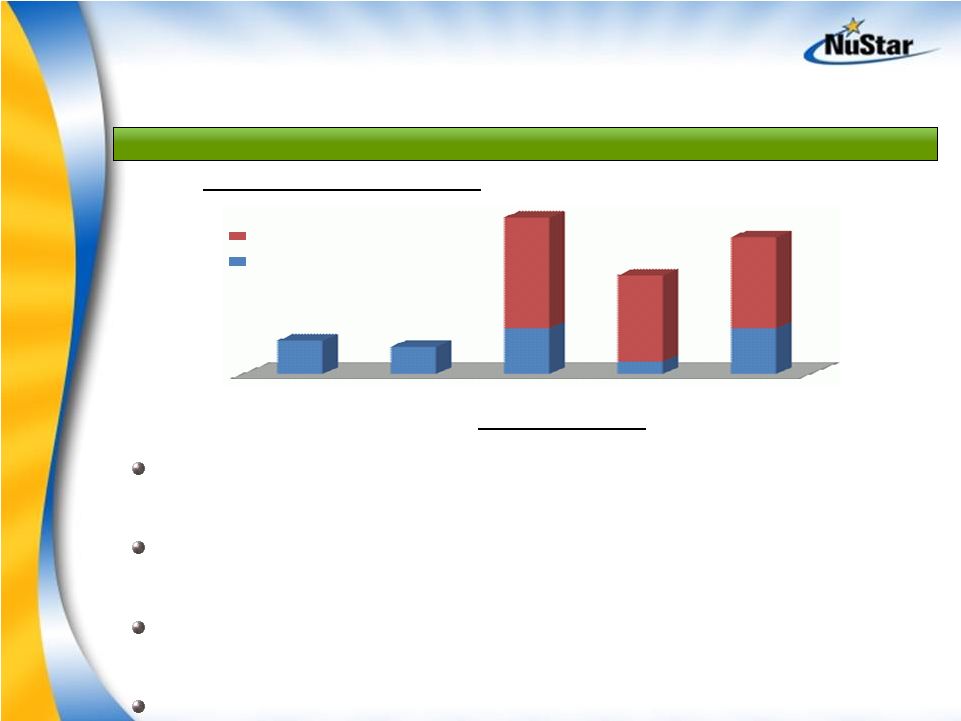

EBITDA ($ in Millions)

6

Continued weak economic conditions causing results in our asphalt operations to

be lower than expected in the last half of the year

Lower pipeline throughputs expected to cause our transportation segment results to be

lower than 2010

2011 EBITDA expected to be comparable to 2010

2002

2003

2004

2005

2006

2007

2008

2009

2010

$77

$112

$133

$219

$322

$353

$492

$461

$483 |

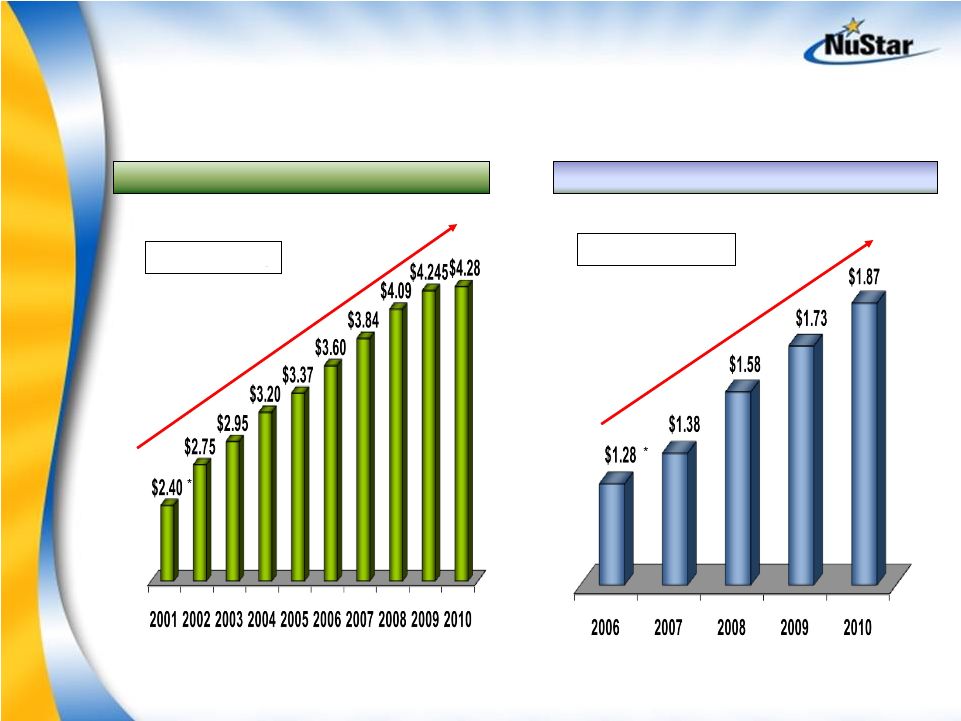

While

distribution growth at NS and NSH has slowed in the past couple of

years…internal growth projects expected to lead to higher distribution

growth levels over the next several years

NS Distribution ($ per Unit)

NSH Distribution ($ per Unit)

~6.6% CAGR

~9.9% CAGR

* Annualized Distribution

7 |

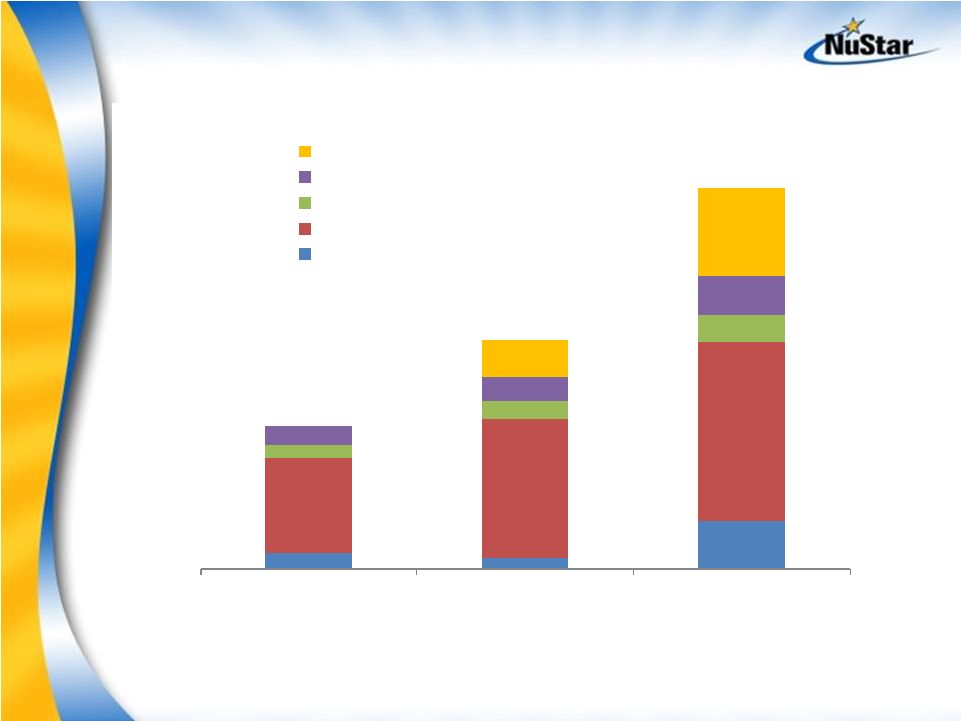

$20

$13

$55

$107

$159

$205

$14

$20

$30

$23

$27

$45

$43

$100

2009 Actual

2010 Actual

2011 Forecast

Acquisitions

Corporate

Asphalt & Fuels Marketing

Storage

Transportation

2011 Total Spending on Internal Growth Projects

& Acquisitions currently projected to be around $435 million

(

Dollars in Millions)

$164

$262

$435

8 |

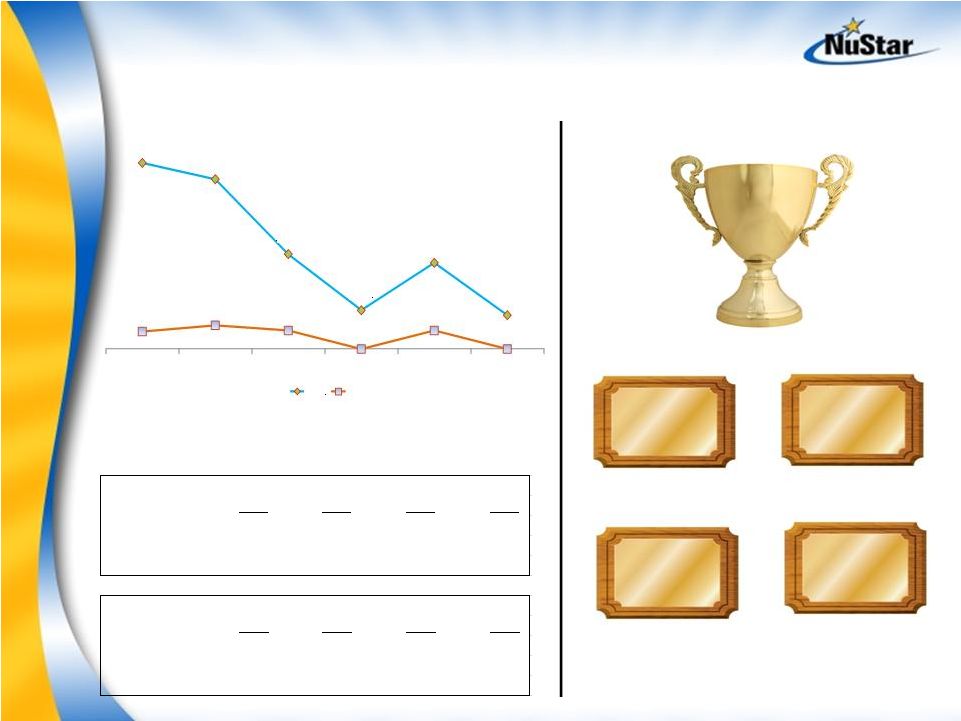

Safety and

Environmental performance in 2011 continues to exceed Industry Benchmarks

NuStar Injury Incident Frequency Rates

*Through August 2011

9

*

NuStar 2011 Safety and Environmental Awards

Industry Benchmarks

Independent

Liquid Terminals

Association

Safety Excellence

Award

Perfect Record

Award -

National

Safety Council

Million

Hours

Award -

National

Safety Council

Safety Leadership

Award -

National

Safety Council

Occupational

Excellence Award-

National Safety

Council

2006

2007

2008

2009

Refineries

1.4

1.6

1.1

1.0

Pipelines

2.2

2.0

1.6

1.9

Terminals

5.6

5.8

6.4

4.6

2006

2007

2008

2009

Refineries

0.5

0.3

0.2

0.3

Pipelines

0.6

0.5

0.5

0.5

Terminals

1.1

1.7

1.8

1.2

TRIR

LTIR

TRIR – Total Recordable Incidents Rate LTIR – Lost Time Incidents

Rate 1.49

1.36

0.76

0.31

0.69

0.27

0.14

0.19

0.15

0.00

0.15

0.00

2006

2007

2008

2009

2010

2011

TRIR

LTIR |

Continued

development of our strategically located storage terminals Primarily Texas City, St.

James, St. Eustatius and New York Harbor Eagle Ford and Other Shale plays

Expansion of bunker marketing, fuel oil marketing and crude oil trading

in certain areas

Feedstock cost and logistics optimization at our Asphalt and Fuels

refineries

Acquisition opportunities in strategic domestic and international

locations

9

Key Growth Areas and Focus

10 |

Storage Segment Overview

Storage Segment Overview

Danny Oliver

Danny Oliver

Senior VP –

Senior VP –

Business & Corporate

Business & Corporate

Development

Development

11 |

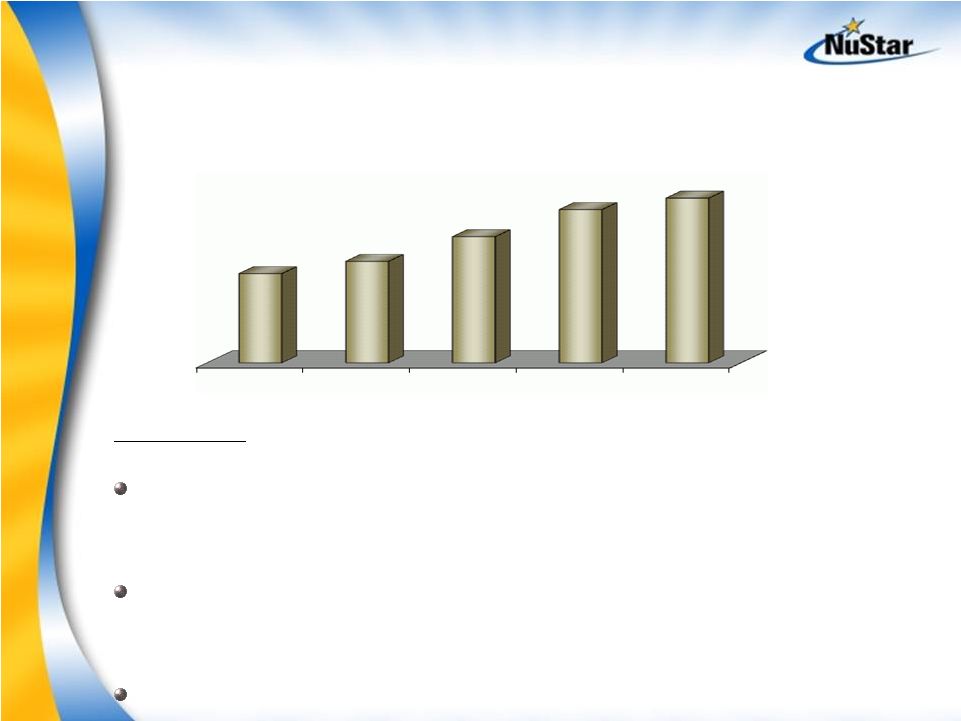

2011 Storage

Segment results should be improved over 2010…. Internal Growth projects continue to

drive increases in EBITDA Storage Segment EBITDA

(in Millions)

2011 Summary

Full year of EBITDA should be realized from May 2010 Mobile, AL terminal

acquisition and St.

Eustatius terminal project completed in the 4th quarter of 2010 Benefits from St. James

Phase I storage project began July 1 and will continue to be phased in during the

3rd quarter as a portion of the planned tanks are completed 2011 segment EBITDA expected

to be $20 to $30 million higher than 2010 12

2006

2007

2008

2009

2010

$162

$177

$208

$242

$256 |

< 1

Year 1 to 3 Years

3 to 5 Years

> 5 Years

28%

39%

21%

12%

Demand for storage continues to be strong at

NuStar terminal locations

Storage Contract Renewals (% of Revenues)

Approximately 95% of our tankage is currently leased

NuStar continues to enter into storage agreements with large credit worthy customers

Current customers and potential new customers continue to approach us about

constructing new tankage at several of our terminal locations

Looking at terminal acquisition opportunities in domestic and international markets

that are of interest to our customer base

13 |

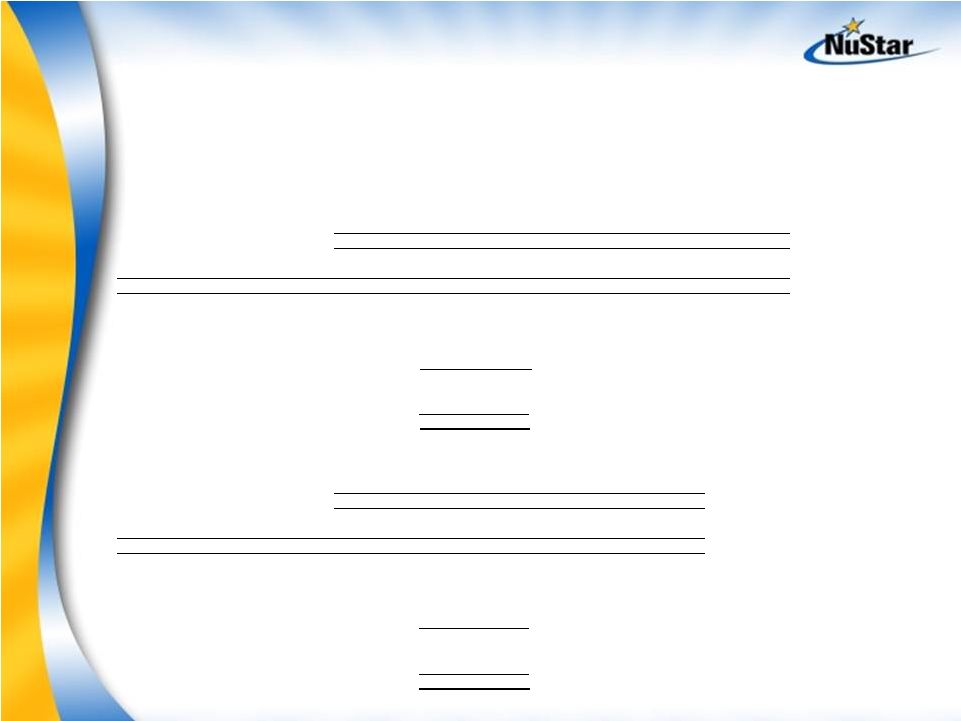

2012 Storage

Segment Internal Growth spending should be higher than 2011 levels

(Dollars in Millions)

Identified

Storage

Projects

>$10

Million:

14

$340

$0

$50

$100

$150

$200

$250

$300

$350

2008

2009

2010

2011

Forecast

2012

Forecast

$128

$107

$159

$205

$120

$220

Projects being evaluated

Identified Projects

St. James Storage Tank Expansion-Phase 1

$89

$4

$130

St. James Storage Tank Expansion-Phase 2

$0

$35

$123

St. Eustatius Tank Expansion

$23

$29

$53

Linden NuTop Tank Expansion

$7

$31

$61

St. James Unit Train Project

$27

$8

$30

EBITDA multiples on these projects should range from 4x to 8x

2011

2012

CAPEX

CAPEX

Total |

Phase I

Completed in 3

rd

quarter 2011

3.2 million barrels of crude oil storage for trading companies

Total cost around $130 million

Phase II

Should be similar in size and cost to Phase I

Most of tankage should be crude storage

Expect tanks to be in-service late 2012 or early 2013

Phase I of St. James, Louisiana terminal expansion

recently completed..Phase II in early planning stages

15 |

Constructing

one million barrels of new storage for distillate service Customer is a large national

oil company Projected CAPEX around $50 million

Expected in-service 4th quarter 2012

Currently evaluating a major expansion project at the St. Eustatius terminal

In the process of constructing new tanks for

distillate service at our St. Eustatius terminal

16 |

Continued

demand for bulk storage in New York Harbor justifies the conversion of the terminal from

a rack marketing terminal to a bulk storage facility

Plan to construct ~850,000 barrels of new storage

Should increase terminal capacity to 1.2 million barrels

Projected CAPEX around $60 million

Expected in-service 3rd quarter 2013

Linden NuStar terminal expansion project

expected to begin in the next few months

17 |

Entered into

an agreement with two subsidiaries of EOG Resources, Inc. EOG is a large independent oil

and natural gas company Proved reserves in the United States, Canada, the UK and

China Project description:

New rail and unit train offloading facilities jointly developed by NuStar and

two EOG Resources, Inc. subsidiaries

Facility will be equipped to handle at least one 70,000-barrel train per day

Two new storage tanks with a combined capacity of 360,000 barrels

Costs and completion dates:

Project expected to be completed and in service early 3rd quarter 2012

NuStar’s share of the costs should be approximately $30 million

Have begun the construction of a unit train

offloading facility at our St. James terminal

18 |

Chickasaw, AL

terminal pipeline connection Connection

to

3

party

crude

oil

pipeline

South Texas Valley System Ethanol

Convert Edinburg and Harlingen Terminals to ethanol blending

Stockton, CA diesel rail loading

Gives customers the ability to load CARB diesel on rail cars

Linden Fuel Oil Conversion (Joint Venture Terminal)

Convert

one

320,000

barrel

tank

currently

in

fuel

oil

service

to

clean

light

products

service

Total spending for these projects should be around $20 million

Several projects with capital spending of less than $10

million per project…were completed in 2011 or should

be completed by end of 2011

19

rd |

Transportation Segment Overview

Transportation Segment Overview

Danny Oliver

Danny Oliver

Senior VP –

Senior VP –

Business & Corporate

Business & Corporate

Development

Development

20 |

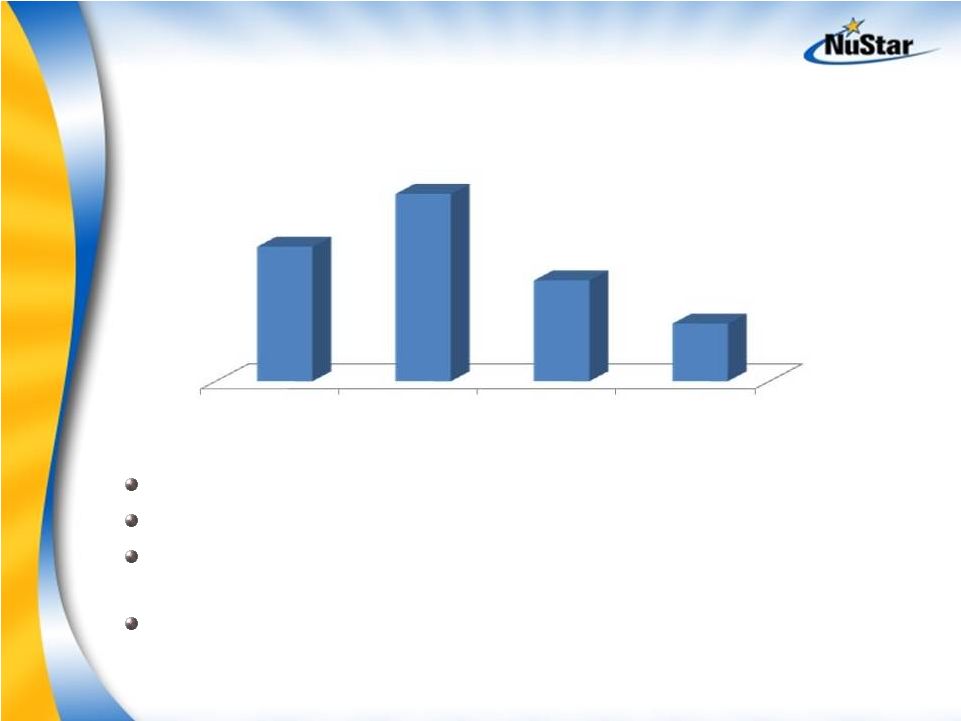

2011 EBITDA

expected to be down due primarily to lower throughputs

Transportation Segment EBITDA

(in Millions)

2011 Summary

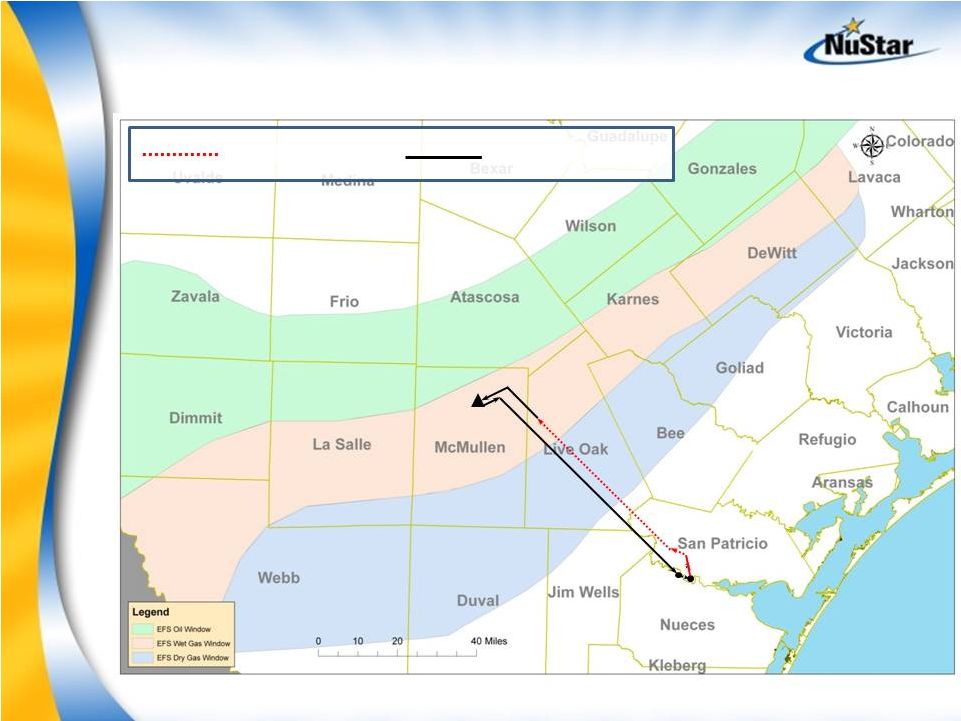

Eagle Ford shale crude project with Koch Pipeline Company completed in

June 2011. Throughput and deficiency agreement for 30,000 BPD

Throughputs projected to be down 7% to 8%. Heavy customer refinery

turnaround schedule and increased export demand for distillates could

negatively impact throughputs on NuStar’s Corpus to Houston refined

products pipeline

Full year 2011 segment EBITDA expected to be $5 to $15 million lower than

2010

21

2006

2007

2008

2009

2010

$170

$176

$186

$190

$199 |

Shale oil Is

expected to provide growth opportunities in the Transportation Segment

Shale

Oil

Growth/Technology

Key shale oil developments are located in NuStar’s Mid-Continent and Gulf Coast

regions, including the Eagle Ford, Bakken, Granite Wash, Barnett, Mississippian and

Niobrara

NuStar’s assets are well positioned to capitalize on the expanding unconventional oil

& gas developments

A

key

strategic

objective

is

to

grow

earnings

from

fee-based

logistics

services

Redeploying existing and/or build new pipelines

and terminals in the shale oil regions

Diversifying customer base and expanding

logistics services for crude oil, condensate

and NGLs through asset modifications,

expansions and strategic acquisitions

22 |

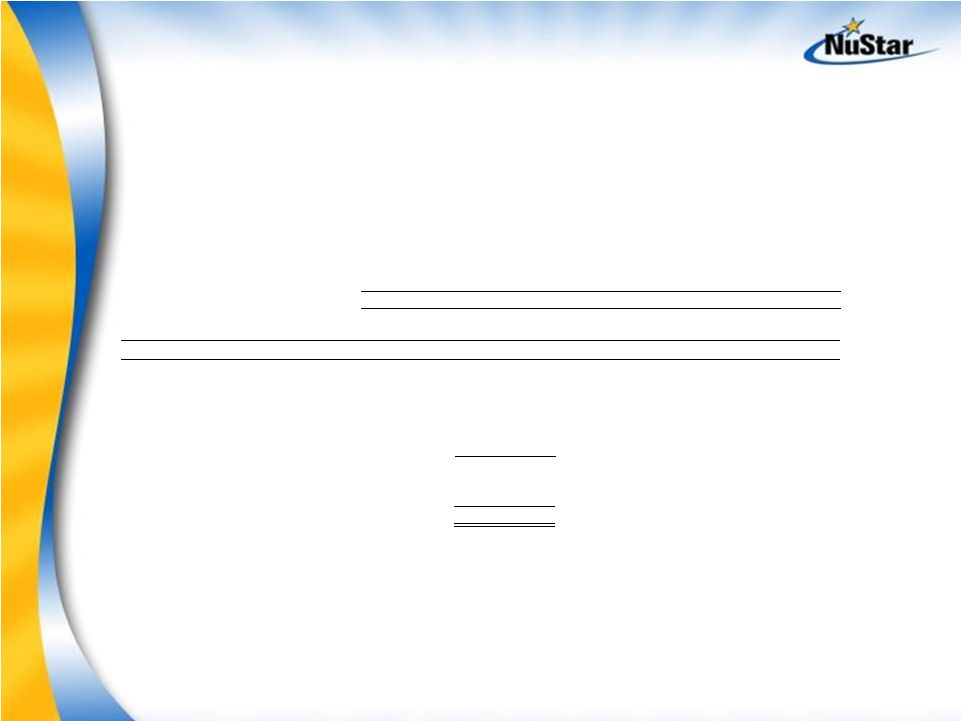

(Dollars in Millions)

23

Expect to spend a record amount

of Internal Growth capital in

Transportation Segment in both 2011 and 2012

Transportation

Projects

>$10

Million:

2011

2012

CAPEX

CAPEX

Total

Three Rivers Crude Supply for Valero

$15

$43

$58

Oakville

Storage

and

16”

Crude

Pipeline

Reversal

$17

$30

$47

North Beach Crude Loading

$5

$8

$13

San Antonio Refinery Crude Pipeline

$16

$5

$21

San Antonio Product Supply Expansion

$2

$11

$13

EBITDA multiples on these projects should range from 4x to 8x

|

NuStar plans to modify existing pipeline assets

and construct new pipeline assets

for Valero in Eagle Ford Shale

Plans call for reversal of an existing 8-inch refined products pipeline

Line moved products from Corpus Christi to Three Rivers

Plan to place in crude oil service after reversal

Projected CAPEX less than $5 million

Placed in service September 15, 2011

NuStar also plans to build 55 miles of new 12-inch pipeline that will connect to

existing NuStar pipeline segments

Expect to move crude and condensate from Corpus Christi to Valero’s Three Rivers

refinery

Projected CAPEX close to $60 million

Should be in service by the 2nd quarter of 2012

24 |

New NuStar Pipeline

Existing NuStar Pipeline

NuStar plans to modify existing pipeline assets

and construct new pipeline assets

for Valero in Eagle Ford Shale

Valero

West Plant

CORPUS CHRISTI

THREE RIVERS

REFINERY

8”

line

12”

line

25 |

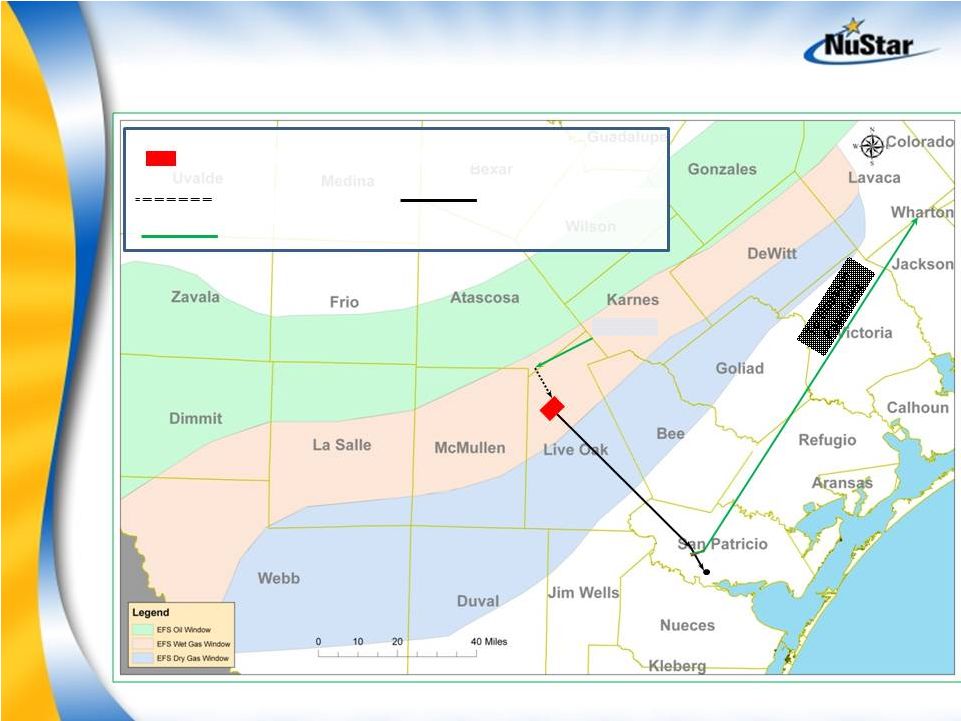

Plan

to develop a new pipeline system in the Eagle Ford Shale as a result of

Letters of Intent entered into in the 2nd Quarter of 2011

In the 2nd quarter of 2011, announced the signing of LOIs with TexStar

Midstream Services and Velocity Midstream Partners to develop a new

pipeline system

TexStar and Velocity both plan to construct pipelines that transport crude and

condensate to Three Rivers, TX

Pipelines should be interconnected with a new storage facility to be constructed at

Three Rivers, TX by NuStar

Plan to connect the storage facility to NuStar’s existing 16-inch pipeline that can

transport 200,000 BPD to NuStar’s Corpus Christi North Beach storage terminal

Both projects expected to be in-service 2Q 2012

26 |

Plan

to develop a new pipeline system in the Eagle Ford Shale as a result of

Letters of Intent entered into in the 2nd Quarter of 2011

NORTH BEACH

OAKVILLE

16”

line

27

Potential New 3

rd

Party

Pipeline

Existing NuStar

Pipeline

Potential New Storage Facility |

28

Pursuing additional projects in the Eagle Ford Shale to

better utilize Houston 12”

line and idle 8”

line out

of Pettus

NORTH BEACH

OAKVILLE

16”

line

PETTUS

Underutilized Existing NuStar Pipeline

8”

line

12”

line

Potential New NuStar

Pipeline

Existing NuStar Pipeline

Potential New Storage Facility |

Plan to

construct a new 3 bay truck rack for crude offloading at our Elmendorf storage facility

and a new 12 mile 8” crude oil

pipeline from the facility to the San Antonio Refinery

Project should reduce transportation costs and unplanned

refinery outages by improving crude supply logistics and crude

quality for San Antonio Refinery

Total CAPEX should be around $20 million

Expected in-service 1st quarter 2012

Constructing a new 8”

pipeline to supply crude

to San Antonio refinery

29 |

One

of our customers has approached us about increasing the amount of refined

products that supply the San Antonio market Total CAPEX currently estimated at

about $13 million Pipeline capacity on the line could be increased by the

start of the 4th quarter 2012

In the early planning stages of expanding the

capacity of our refined products pipeline that

supplies the San Antonio market

30 |

Asphalt & Fuels Marketing Overview

Asphalt & Fuels Marketing Overview

Paul Brattlof

Paul Brattlof

Senior VP –

Senior VP –

Supply & Trading

Supply & Trading

31 |

Earnings from

San Antonio refinery acquisition and improved earnings in Fuels Marketing are

offset by lower Asphalt results

Asphalt & Fuels Marketing

2011 Summary

Weak

asphalt

demand

and

high

feedstock

costs

should

cause

EBITDA

in

our

asphalt

operations to be lower than 2010

April 2011 San Antonio refinery acquisition contributing slightly less than expected

due to higher crude costs

Strong

fuels

marketing

results

in

2011

due

to

the

expansion

of

crude

trading

and

bunker

fuels marketing in late 2010

Full year 2011 segment EBITDA expected to be lower compared to 2010

2006

2007

2008

2009

2010

$80

$111

$127

32

Asphalt

Fuels Marketing

$27

$22

$37

$10

$37

$90

$70

$74

Segment EBITDA ($ in millions) |

33

San Antonio Refinery acquisition expected

to be a solid contributor to our

Asphalt & Fuels Marketing segment

Approximately 70% of refinery production is hedged (spread

between WTI and refined products) over the next three to four

years

New 8”

crude pipeline from Elmendorf should reduce transportation

costs and unplanned refinery outages

by improving crude supply logistics

Expect refinery to generate around $15 million of EBITDA in 2011

Slightly lower than expected due to increased crude costs

14,500 BPD refinery acquired for $41

million plus working capital

YTD Run rates ~11,500 BPD

Processes crude and condensate from

nearby Eagle Ford shale and

other South Texas formations

Produces and sells jet fuel, ULSD,

naphtha, reformate and LPG’s |

2011

Summary Currently market out of four NuStar locations:

St Eustatius

Pt Tupper

Texas City

Los Angeles

NuStar Bunker sales volumes are up 98% since 2009

since adding new marketing operations at Texas

City and Los Angeles.

Dependable and competitively priced supply is key to making a successful Bunker

Marketing operation. Term purchases make up 55% of total supply of bunker fuel

2012 Outlook

Looking to expand in more markets where we can gather our own supply and

effectively penetrate the market

Bunker Marketing –

2011 Looks to be

best year ever

St.

Eustatius

Texas

City

Pt

Tupper

Los

Angeles

34 |

35

Asphalt Operations initiatives to lower

supply costs and improve margins

2011 Summary

Asphalt Demand is down 1.5% thru June on an annualized basis

However, East Coast asphalt prices have averaged $50 per ton premium over

the Mid-Continent and Gulf Coast rack prices

Midwest refiners with lower feedstock costs have incentive to supply East

Coast markets

Asphalt results expected to be lower than 2010

2012 Initiatives

Entered into 10,000 barrel per day Peregrino Crude Oil Purchase

agreement with Statoil. Contract commences December 2011.

Pursuing Heavy Canadian rail supplied crude for Paulsboro and Savannah

refineries

Pursuing asphalt off-take agreements with regional suppliers to create more

flexibility within system to take advantage arb’s |

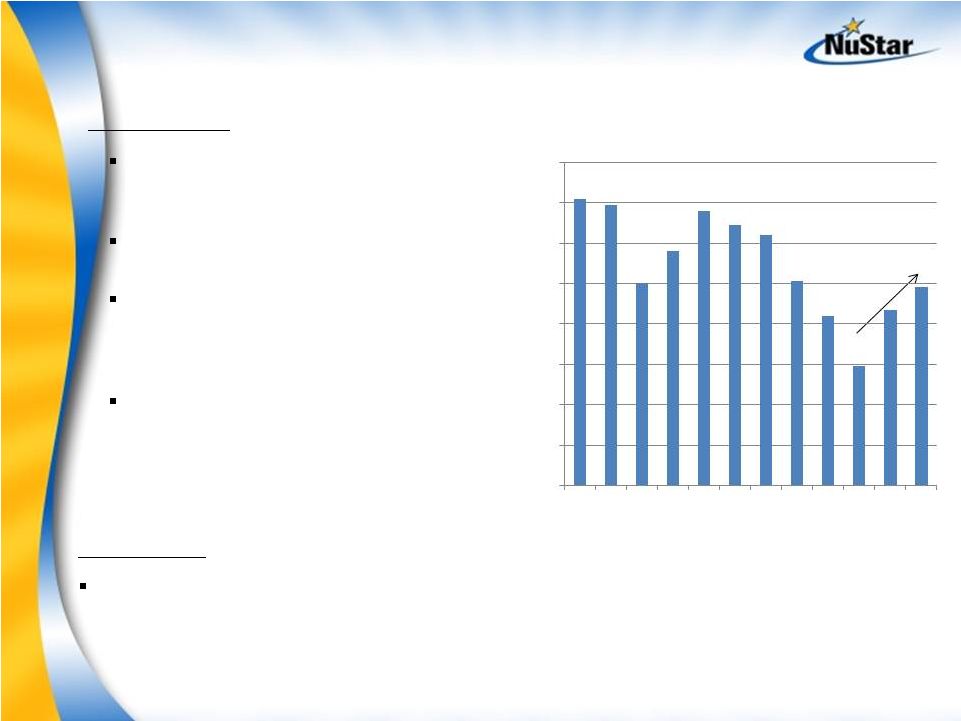

Heavy Oil

Trading – Texas City rail blending

hub has become dependable outlet for Midwest refiners

Texas City has become a dependable rail

outlet for heavy oils from Midwest refiners

-

volumes expected to be up 50% vs. 2010

Midwest refinery utilization is currently

above 93%, providing ample supply of VTB’s

Texas City is a true Black Oil blending hub

gathering heavy oils, asphalts, slurry oil and

other blend stocks to blend into either

bunker fuel, asphalt or fuel oil

Most of the Heavy Oil bought is blended into

Bunker Fuel and sold internally to our Bunker

Marketing Group at Texas City; the remainder

is sold into the Houston area spot market

36

Source: Energy Information Administration

PADD II Refinery Utilization Rates

Year average

80.0%

82.0%

84.0%

86.0%

88.0%

90.0%

92.0%

94.0%

96.0%

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2011 Summary

2012 Outlook

Looking to expand the Texas City concept to our Mobile, AL and Wilmington, CA terminals

|

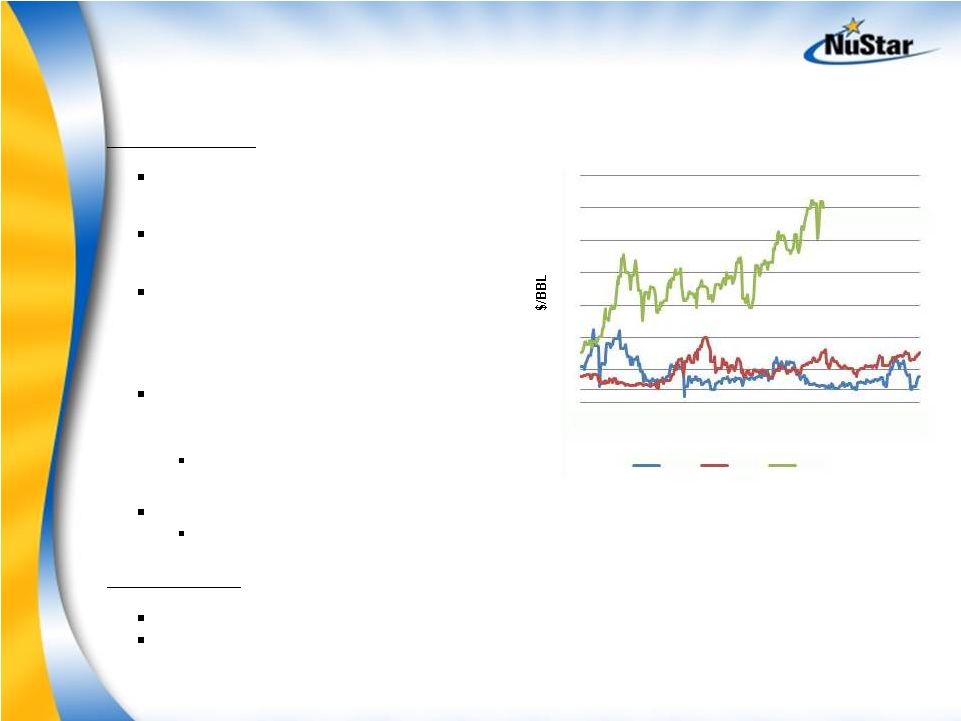

Crude Trading

– continue growing domestic rail

gathering systems at St. James, LA and Texas City, TX

2011 Summary

Brent crude is trading at historically high

premiums over WTI

Gulf Coast Light Louisiana Sweet (LLS) is also

trading at historically high premiums to WTI

Increased production of Bakken crude in

North Dakota and Eagle Ford in South

Texas can be railed to our waterborne

terminals and marketed to gulf coast refiners

St. James is a Hub Terminal located in the

center of the Gulf Coast domestic crude

trading and blending market

Currently can gather up to 10,000 barrels per

day on manifest rail

Texas City is our newest gathering point for Eagle Ford crude

Currently can receive truck and rail up to 3,000 barrels per day

2012 Outlook

Looking for ways to expand volumes at St James into a unit train

Looking to expand truck capabilities at Texas City by adding additional offloading

lanes 37

-

3

8

13

18

23

28

33

1/1

2/1

3/1

4/1

5/1

6/1

7/1

8/1

9/1

10/1

11/1

12/1

2009

2010

2011

9/19 $28.06/bbl

LLS over WTI (Front Month)

2 |

St. James Terminal Overview

St. James Terminal Overview

Kyle Oppliger

Kyle Oppliger

Vice President &General Manager

Vice President &General Manager

–

–

Gulf Region

Gulf Region

38 |

39

St James Terminal Description

Tanks

28

tanks

Capacity: 8,000,000 barrels

Size Range 36,000 to 680,000

barrels Employees 22

employees

Products

Crude Oils

Land

~ 900 Acres Modes

Served Vessel, Barge, Pipeline, Rail, Truck

•

3 Ship/Barge Docks (2 have vessel capacity)

•

20 Railcar unload facility (Bakken)

•

70,000 bpd Unit train facility ( under construction)

•

2 Truck unload spots

•

Pipelines

•

40”

to Capline

•

30”

to Exxon, Shell and LOOP

•

20”

to Exxon

•

48”

to Locap |

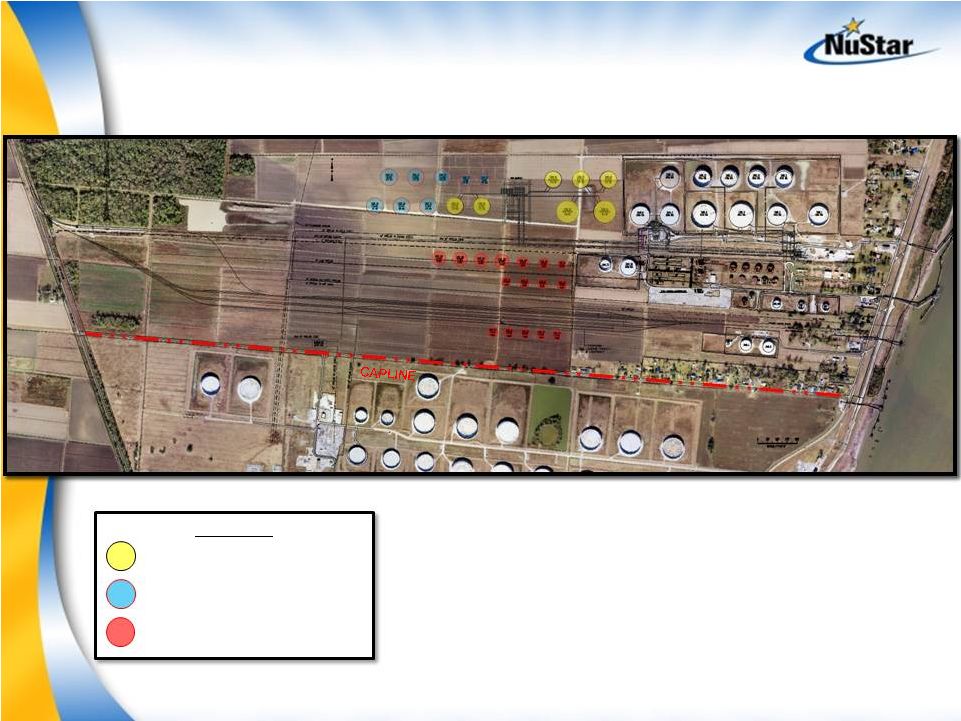

40

St James Schematic

Overview

St James Terminal |

41

NuStar’s Vision and Strategy

Demonstrate excellence in safety and environmental performance,

operations, customer service and community involvement

Develop St. James Terminal into an integrated hub location to

capitalize on opportunities for light sweet crude blending and

heavy crude blending

St James Terminal provides unique market advantages due to

access to key logistics and markets

Grow hub terminal with fee-based business while providing access

to key niche markets for margin-based opportunities

Fee business provides base revenue to support critical

infrastructure improvements with a reasonable return on the

partnership’s investments

Hub customers provide NuStar MS&T with ready access to

trading partners

Vision and Strategy for St James Terminal |

42

Commitment and Focus on

Safety

Achieved 20 years without lost time

incident

Approaching 16 years without OSHA

recordable

Process Safety Management (PSM) –

foundation of safety and operating

programs

Recognized as OSHA Star Site

Voluntary Protection Program (VPP)

Safety and Environmental Performance |

43

Environmental Performance

Reportable spills –

Zero in 2010,

1 in 2011

Zero Notice of Violations

Compliance calendar and audits

Implemented DOT compliance

programs for pipelines

Implemented Pipeline Integrity

Program

Equipment upgrades and

preventive maintenance

programs

Safety and Environmental Performance |

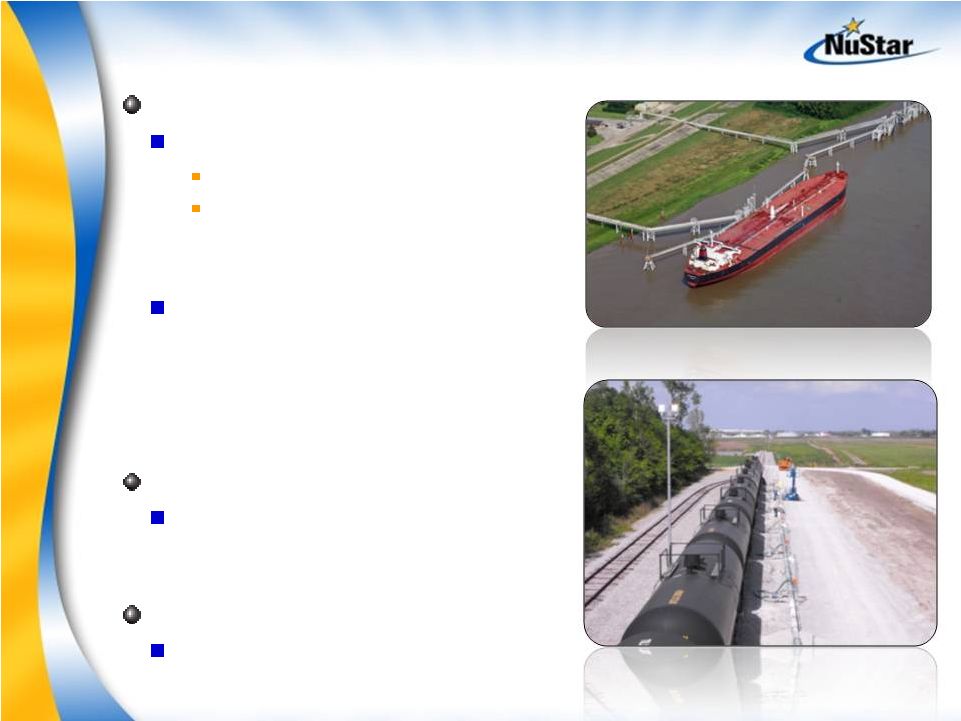

44

Marine Facilities

Two ship docks

Dock 5 w/ 2 –

16”

loading arms

Dock 2 w/3 –

16”

loading arms

ship or barge for crude and fuel

oil

One barge dock capable of

crude and fuel oil and vapor

destruction for crude oil

loading

Truck Receipts

Two metered truck receipt

skids

Rail Facilities

Unload facilities with capacity

of 20 rail cars per day

St James Key Logistics |

45

Valero

Trafigura

NuStar Marketing, Supply and Trading

Statoil

EOG Resources

Current Customers |

46

2006 (Dec) –

Acquired St James Terminal from Koch

14

tanks with 3.3 million barrels of storage capacity

Existing 3

rd

Party blending programs

Valero Marketing and Supply Co.’s refinery crude supply

Koch crude oil and fuel oil blending

2007

–

3

rd

Party

Expansion

(1.5

million

barrels)

Constructed four

new tanks for Trafigura crude oil blending

Designed internal pipeline infrastructure to accommodate future expansion

Upgraded Dock #1 with marine vapor destruction unit

2008/2009 –

Ship Shoal Pipeline Connection Upgrade

Constructed new metering facilities and upgraded pipeline connection increasing

fee- based pipeline revenues and providing greater access to desired crudes

2010 –

Bakken Crude for NuStar MS&T (110,000 barrels)

Acquired idled LaJet Refinery property and storage tanks

Refurbished two tanks to provide crude oil storage

Reactivated

idle

rail

spur

and

provided

20

rail

spots

for

Bakken

crude

oil

receipts

Implementing the Strategy

Completed Projects |

47

2010 –

3rd Party Expansion –

Phase 1 (3.2 million barrels)

Constructed 7 tanks for Trafigura and Statoil for crude oil storage

Infrastructure upgrades include improving pipeline connectivity and reactivating

an idled marine ship dock

Storage tanks went into service in July / August 2011

Storage capacity of the terminal has grown from 3.3 million barrels in

December 2006 to ~ 8.0 million barrels after the Phase 1 expansion

project

Implementing the Strategy

Current Projects |

48

2011 –

3rd Party Expansion –

Phase 2

Project currently in development to provide additional storage

opportunities to refining and trading companies

Expect new tanks to store crude oil and fuel oil

Additional Storage Expansion

Customer interest remains high and facility has property for additional

storage expansion

New Rail and Unit Train Offloading Project for EOG

Facility should be able to handle at least one 70,000 barrel train per day

Implementing the Strategy

Future Opportunity |

LEGEND

Current Construction

Future Heated Storage

Future Non Heated Storage

Implementing the Strategy

49

NUSTAR |

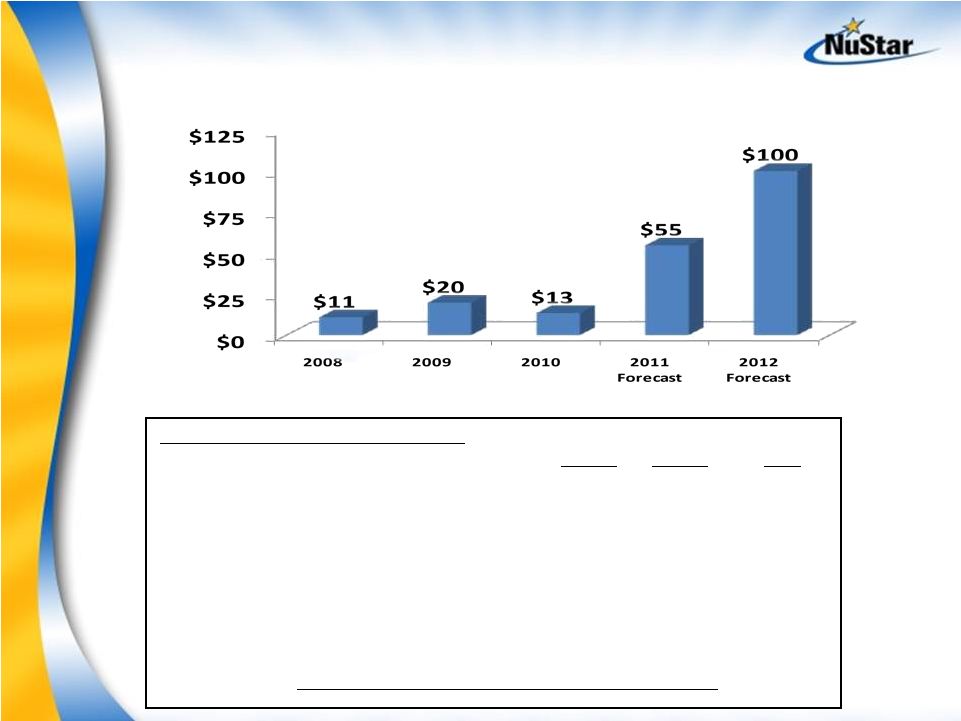

50

Implementation of Strategy

NuStar St. James Terminal EBITDA

($millions)

2012 EBITDA could be double 2011 results |

51

Terminal acquired from Koch in Dec 2006

Employees naturally embraced NuStar’s culture and have

demonstrated excellence in safety, environmental, community

service and customer satisfaction

Implementation of hub strategy has more than doubled the total

storage capacity of the facility and current project plans schedule

through 2012 could quadruple the storage capacity

Integrating NuStar MS&T into the hub terminal landscape has

created niche rail pipeline opportunities to capture emerging

Bakken crude play

Future remains bright at St James with high customer interest and

opportunities to continue storage expansion, and expand our unit

train rail capabilities.

A Bright Future for St. James |

Closing Remarks

Closing Remarks

and Q&A

and Q&A

Curt Anastasio

Curt Anastasio

CEO & President

CEO & President

52 |

Management

Management

Team Bios

Team Bios

53 |

Management

Bios Management Bios

Curt Anastasio, CEO & President

President and CEO of NuStar Energy L. P. (NYSE: NS) and NuStar GP Holdings,

LLC (NYSE: NSH)

Anastasio has been President of NuStar Energy L.P. and its predecessors since

December 1999, and he assumed the position of CEO of NuStar GP Holdings, LLC

in 2006.

Prior to becoming President of NuStar GP, LLC in 1999, Anastasio held various

positions in supply, trading, transportation, marketing, development and legal.

He has 22 years of industry experience.

Curt serves on the Board of the National Association of Publicly Traded

Partnerships and as a Director of the San Antonio Branch of the Federal Reserve

of Dallas.

In addition to participating in various volunteer activities, Curt serves on the

Board of Trustees of the United Way of San Antonio and Bexar County, and is

the communitywide United Way Campaign Chairman for 2011. He also serves as

a board

member

of

the

San

Antonio

Medical

Foundation

,

Southwest

Research

Institute, Texas Biomedical Research Institute, Alamo Area Council of the Boy

Scouts

of

America,

and

the

Economic

Development

Foundation

–

all

in

San

Antonio. In addition, Anastasio belongs to various professional organizations and

has lectured and written on legal and business topics.

Curt received a Juris Doctorate degree from Harvard Law School in 1981 and a

Bachelor of Arts degree, Magna cum Laude, from Cornell University in 1978.

After graduation, he practiced law in New York City.

54 |

Management

Bios Management Bios

Steve Blank, Senior VP -

CFO & Treasurer

Chief

Financial

Officer,

Senior

Vice

President

and

Treasurer

of

NuStar

Energy L.P. In this position, he is responsible for corporate finance,

external reporting, accounting, budgeting and forecasting, investor

relations, risk management, tax, treasury and credit.

Before that, Steve held a variety of positions with Ultramar Diamond

Shamrock and Valero Energy in New York, London and San Antonio,

including Director, Planning and Development (1980-83); Assistant

Treasurer –

Corporate Finance (1983-90); Vice President of Investor

Relations

(1991-95);

Vice

President

–

Information

Technology

(1996);

and

Vice

President

–

Finance

and

Treasurer

(1996-01).

Before joining Ultramar Diamond Shamrock in 1980, Steve worked for

two years with National Westminster Bank in New York.

Steve received a BA in History from the State of University of New York in

1976. He went on to obtain a Master’s in International Affairs, with a

specialization in Business, from Columbia University in 1978.

55 |

Management

Bios Management Bios

Rick Bluntzer,

Senior

VP

-

Operations

Rick Bluntzer, Senior Vice President of Operations oversees NuStar Energy

L.P.’s extensive pipeline, terminal, international and asphalt & fuels

refining operations. Additionally he oversees NuStar’s engineering,

information systems (operations) and procurement organizations.

Rick began his career with Valero Refining Company in 1976, serving in

various operating and management positions until 1997, when he became

a part of Valero’s refinery acquisition team.

Rick joined the Valero L.P. organization after the Valero/UDS merger and

held various senior operating and management positions, contributing to

the success and transition of today’s NuStar organization.

56 |

Management

Bios Management Bios

Brad

Barron,

Senior

VP

-

General

Counsel

57

Brad

Barron

serves

as

Senior

Vice

President

and

General

Counsel

of

NuStar

Energy L.P. and NuStar GP Holdings, LLC, both of which are headquartered

in San Antonio, TX. As such, he provides legal counsel on all major

transactions, assures compliance with securities laws, provides legal

counsel to the boards of directors and principal officers, manages real

estate and right-of-way issues, and oversees health, safety and

environmental compliance.

Prior to joining the company, Mr. Barron was with Valero Energy

Corporation. Mr. Barron began his legal career with Vinson & Elkins LLP

and continued in private practice until he joined Valero in 2001.

A committed volunteer, Mr. Barron is also active in the San Antonio

community. He serves on the boards of directors of the Witte Museum,

Alamo Bowl and Family Service Association, and he previously volunteered

as

a

board

member

of

the

Boys

and

Girls

Club

of

San

Antonio.

He

also

serves on the Texas Tech Foundation Board.

Mr.

Barron

holds

a

B.B.A.

from

Texas

Tech

University

and

a

J.D.

from

the

University of Texas School of Law. In addition, Mr. Barron holds a M.L.A.

from St. John’s College. |

Management

Bios Management Bios

Paul

Brattlof,

Senior

VP

-

Supply

and

Trading

58

Paul Brattlof leads NuStar Energy L.P.’s Marketing, Supply and

Trading organization, which includes products trading, crude supply &

trading, heavy fuels trading bunker marketing and asphalt marketing.

Under

Mr.

Brattlof’s

leadership,

this

organization

capitalizes

on

opportunities to optimize the use and profitability of the company’s

worldwide portfolio of assets, manages risk as NuStar diversifies its

business, and enhances the company’s competitive position when

pursuing acquisitions.

Mr. Brattlof has more than two decades of experience in cash

markets, futures markets and derivatives trading. Previously, he

served as Vice President of Trading for Valero Energy Corporation,

where he worked for 10 years. Prior to that, he spent 11 years with

Kerr-McGee Refining and two years with Mieco, a Long Beach-based

trading company. A graduate of Rice University, Mr. Brattlof holds a

Bachelor of Arts degree in Managerial Studies.

|

Management

Bios Management Bios

Mike

Hoeltzel,

Senior

VP

–

Strategic

Planning

&

Economics

Senior Vice President for NuStar Energy L.P., responsible for developing

strategic plans, refinery planning, market analysis, and project

evaluations

Joined NuStar in February 2007 with 30 years refinery experience.

Valero Energy's Corporate Development Department from 2000 to

2007.

Primary

responsibility

was

valuation

of

refinery

acquisitions

during

this period of growth from 6 to 19 refineries.

Also supported growth of

Valero

L.P.

during

2002-2006

when

M&A

opportunities

for

both

companies were developed in a common department.

Worked in

CITGO's Corpus Christi refinery from 1991-2000 in various

Project Management, Planning & Economics, and Strategic Planning

positions.

Worked in Kerr-McKee's Corpus Christi refinery from 1977-1991 in

Project Management and Planning & Economics positions.

Worked for Exxon in Oil Production from 1971-1973 and Dupont from

1973-1977,

project engineering assignments with both companies.

Graduated from Oklahoma State University in 1971 with BS and MS

degrees

in

Mechanical

Engineering.

Also

received

MBA

from

Corpus

Christi State University (now Texas A&M Corpus Christi) in 1983

59 |

Management

Bios Management Bios

Danny

Oliver,

Senior

VP

-

Marketing

and

Business

Development

60

Danny Oliver, Senior Vice President of Marketing & Business Development

for NuStar Energy L.P., oversees the company’s commercial activities for its

pipelines

and

terminals

business.

Previously,

he

served

as

Vice

President

of

Product

Supply

&

Trading

for

NuStar

where

he

was

instrumental

in

building

the company’s successful trading operations from the ground up. He brings

nearly

20

years

of

industry

experience

–

the

majority

of

which

was

spent

trading energy commodities.

Prior to joining NuStar in 2007, Mr. Oliver spent 10 years at Valero Energy

holding management positions in Product Supply & Trading where he helped

to build a world-class refined product trading organization and played a key

role in the company’s aggressive acquisition of refinery and logistics assets.

He

previously

worked

at

Enron

Corp.

in

the

International

Trading

division

where he was responsible for the company’s worldwide MTBE and Methanol

trading activities, and also held several positions at Kerr-McGee Refining &

Marketing in products scheduling and accounting,

with an emphasis in

reporting and analyzing trading activities.

Mr. Oliver graduated from Texas State University with a B.B.A. in Accounting.

Committed to the community in which he works and lives, Mr. Oliver

currently serves on the boards of directors of San Antonio Sports and the

Harmony Ridge Association. He is also actively involved with his church and

the United Way of Bexar County. |

Management Bios

Management Bios

Kyle

Oppliger,

VP

GM

-

Operations

61

Kyle Oppliger serves as the Vice President and General Manager of the

NuStar Gulf Coast region. As such, he manages all aspects of the

region’s operations, maintenance, capital projects, safety and

environmental compliance, quality assurance and security initiatives for

NuStar terminal assets in Texas, Louisiana, Alabama, Georgia and

Florida. He brings over 15 years of experience in refining and

terminal operations. Prior to joining NuStar in 2006, Mr. Oppliger

spent 10 years at Valero Energy holding leadership roles in operations,

planning and economics and laboratory departments. He has played a

key role in the aggressive integration and development of acquired assets

in NuStar’s Gulf Coast region. He previously worked for

Phibro and Basis refining companies, and prior to working in the refining

industry, Mr. Oppliger worked as a chemist in research and

development.

As a committed volunteer, Mr. Oppliger has been active in communities in

which NuStar does business, including United Way organizations throughout

the Gulf region. Additionally he has been active in youth mentoring

programs, Big Brothers & Big Sisters and Boy Scouts of America.

Mr.

Oppliger

received

his

undergraduate

degree

in

Chemistry

from

Sam

Houston State University and his Master’s degree in Business from University

of Houston. |

62

Appendix

Appendix |

63

Reconciliation of Non-GAAP Financial

Information: EBITDA

(Unaudited, Dollars in Thousands)

The following is a reconciliation of net income to EBITDA:

2002

2003

2004

2005

2006

2007

2008

2009

2010

Net income

55,143

$

69,593

$

78,418

$

107,675

$

149,906

$

150,298

$

254,018

$

224,875

$

238,970

$

Plus interest expense, net

4,880

15,860

20,950

41,388

66,266

76,516

90,818

79,384

78,280

Plus income tax expense

395

-

-

4,713

5,861

11,448

11,006

10,531

11,741

Plus depreciation and amortization expense

16,440

26,267

33,149

64,895

100,266

114,293

135,709

145,743

153,802

EBITDA

76,858

111,720

132,517

218,671

322,299

352,555

491,551

460,533

482,793

Note: 2005 and 2006 EBITDA are from continuing operations.

Year Ended December 31,

NuStar Energy L.P. utilizes a financial measure, EBITDA, that is not defined in United States

generally accepted accounting principles. Management uses this financial measure because it is

a widely accepted financial indicator used by investors to compare partnership performance. In addition, management

believes that this measure provides investors an enhanced perspective of the operating performance of

the partnership's assets. EBITDA is not intended nor presented as an alternative to net

income. EBITDA should not be considered in isolation or as a substitute for a measure of performance prepared in

accordance with United States generally accepted accounting principles.

|

64

Reconciliation of Non-GAAP Financial

Information: Storage Segment

The following is a reconciliation of operating income to EBITDA for the Storage

Segment: 2006

2007

2008

2009

2010

Operating income

108,486

$

114,635

$

141,079

$

171,245

$

178,947

$

Plus depreciation and amortization expense

53,121

62,317

66,706

70,888

77,071

EBITDA

161,607

$

176,952

$

207,785

$

242,133

$

256,018

$

Projected incremental operating income range

$ 11,000 -

20,000

Plus projected incremental depreciation and

amortization expense range

9,000 -

10,000

Projected incremental EBITDA range

$ 20,000 -

30,000

The following is a reconciliation of operating income to EBITDA for our St. James,

LA terminal: 2007

2008

2009

2010

Operating income

10,785

$

10,226

$

14,079

$

14,045

$

Plus depreciation and amortization expense

5,011

5,564

6,866

6,175

EBITDA

15,796

$

15,790

$

20,945

$

20,220

$

The following is a reconciliation of projected annual operating income to

projected annual EBITDA for our St. James, LA terminal: Projected operating

income 21,512

$

Plus projected depreciation and

amortization expense

7,296

Projected EBITDA

28,808

$

Year Ended

December 31, 2011

Year Ended December 31,

The following is a reconciliation of projected incremental operating income to

projected incremental EBITDA: Year Ended December 31,

Year Ended

December 31, 2011

(Unaudited, Dollars in Thousands)

NuStar Energy L.P. utilizes a financial measure, EBITDA, that is not defined in United States

generally accepted accounting principles. Management uses this financial measure because it is

a widely accepted financial indicator used by investors to compare partnership performance. In addition, management

believes that this measure provides investors an enhanced perspective of the operating performance of

the partnership's assets. EBITDA is not intended nor presented as an alternative to net income.

EBITDA should not be considered in isolation or as a substitute for a measure of performance prepared in

accordance with United States generally accepted accounting principles.

|

65

Reconciliation of Non-GAAP Financial

Information: Transportation Segment

The following is a reconciliation of operating income to EBITDA for the

Transportation Segment: 2006

2007

2008

2009

2010

Operating income

122,714

$

126,508

$

135,086

$

139,869

$

148,571

$

Plus depreciation and amortization expense

47,145

49,946

50,749

50,528

50,617

EBITDA

169,859

$

176,454

$

185,835

$

190,397

$

199,188

$

The following is a reconciliation of projected decrease in operating income to

projected decrease in EBITDA: Projected decrease in operating income

($ 5,000 -

15,500)

Plus projected incremental depreciation and

amortization expense range

0 -

500

Projected decrease in EBITDA range

($ 5,000 -

15,000)

Year Ended

December 31,

2011

Year Ended December 31,

NuStar Energy L.P. utilizes a financial measure, EBITDA, that is not defined in United States

generally accepted accounting principles. Management uses this financial measure because it is

a widely accepted financial indicator used by investors to compare partnership performance. In addition, management

believes that this measure provides investors an enhanced perspective of the operating performance of

the partnership's assets. EBITDA is not intended nor presented as an alternative to net

income. EBITDA should not be considered in isolation or as a substitute for a measure of performance prepared in

accordance with United States generally accepted accounting principles.

(Unaudited, Dollars in Thousands) |

66

Reconciliation of Non-GAAP Financial

Information: Asphalt and Fuels Marketing

Segment

(Unaudited, Dollars in Thousands)

Asphalt

Operations

Fuels Marketing

Operations

Asphalt and Fuels

Marketing

Segment

Operating income

53,977

$

36,884

$

90,861

$

Plus depreciation and

amortization expense 20,164

93

20,257

EBITDA

74,141

$

36,977

$

111,118

$

Asphalt

Operations

Fuels Marketing

Operations

Asphalt and Fuels

Marketing

Segment

Operating income

50,710

$

9,919

$

60,629

$

Plus depreciation and

amortization expense 19,463

-

19,463

EBITDA

70,173

$

9,919

$

80,092

$

Year Ended

December 31, 2007

Year Ended

December 31, 2006

Asphalt

Operations

Fuels Marketing

Operations

Asphalt and Fuels

Marketing

Segment

Asphalt and Fuels

Marketing

Segment

Asphalt and Fuels

Marketing

Segment

Operating income

76,267

$

36,239

$

112,506

$

21,111

$

26,815

$

Plus depreciation and

amortization expense 14,182

552

14,734

423

-

EBITDA

90,449

$

36,791

$

127,240

$

21,534

$

26,815

$

Year Ended December 31,

2009 Year Ended December 31, 2008

NuStar

Energy

L.P.

utilizes

a

financial

measure,

EBITDA,

that

is

not

defined

in

United

States

generally

accepted

accounting

principles.

Management

uses

this

financial

measure

because

it

is

a

widely

accepted

financial

indicator

used

by

investors

to

compare

partnership

performance.

In

addition,

management

believes

that

this

measure

provides

investors

an

enhanced

perspective

of

the

operating

performance

of

the

partnership's

assets.

EBITDA

is

not

intended

nor

presented

as

an

alternative

to

net

income.

EBITDA

should

not

be

considered

in

isolation

or

as

a

substitute

for

a

measure

of

performance

prepared

in

accordance

with

United

States

generally

accepted

accounting principles.

The following tables reconcile operating income to EBITDA for asphalt operations

and fuels marketing operations in our asphalt and fuels marketing segment:

Year Ended December 31, 2010 |

67

Reconciliation of Non-GAAP Financial

Information: Acquisitions

(Unaudited, Dollars in Thousands)

San Antonio

Refinery

Turkey

Total

Projected annual operating income

17,000

$

1,000

$

18,000

$

Plus projected annual

depreciation and amortization expense

2,500

1,800

4,300

Projected annual EBITDA

19,500

$

2,800

$

22,300

$

Year Ended

December 31,

2011

Projected operating income

13,000

$

Plus projected depreciation

and amortization expense

2,000

Projected EBITDA

15,000

$

The following is a reconciliation of projected annual

operating income to projected annual EBITDA for our 2011 Acquisitions: The

following is a reconciliation of projected operating income to projected EBITDA for the San Antonio Refinery acquisition:

NuStar Energy L.P. utilizes a financial measure, EBITDA, that is not defined in United States

generally accepted accounting principles. Management uses this financial measure because it is

a widely accepted financial indicator used by investors to compare partnership performance. In addition, management believes that this measure

provides investors an enhanced perspective of the operating performance of the partnership's assets.

EBITDA is not intended nor presented as an alternative to net income. EBITDA should not be

considered in isolation or as a substitute for a measure of performance prepared in accordance with United States generally accepted

accounting principles.

|