Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CenterState Bank Corp | d8k.htm |

Investor Presentation

Second Quarter 2011

Exhibit 99.1 |

This presentation contains forward-looking statements, as defined by Federal

Securities

Laws,

relating

to

present

or

future

trends

or

factors

affecting

the

operations, markets and products of CenterState Banks, Inc. (CSFL). These

statements

are

provided

to

assist

in

the

understanding

of

future

financial

performance. Any such statements are based on current expectations and involve a

number of risks and uncertainties. For a discussion of factors that may

cause such forward-looking statements to differ materially from actual

results, please refer to CSFL’s most recent Form 10-Q and Form

10-K filed with the Securities Exchange Commission.

CSFL undertakes no obligation to release revisions to these forward-looking

statements or reflect events or circumstances after the date of this

presentation. Forward Looking Statement

2 |

Birmingham

Atlanta

Winston-Salem

Tamp

a

Winter Haven

Corporate Overview

3

Correspondent Banking market

Headquartered in Davenport, FL

$2.2 billion in assets

$1.2 billion in loans

$1.8 billion in deposits

Company formed: June 2000

2 Subsidiary Banks

53 locations |

Conservative Balance Sheet

•

Total Risk-Based Capital Ratio -

18%

•

Loans / Assets -

55%

•

Loans with credit protection –

24%

•

15%

of loans are covered by loss sharing agreements with the FDIC

•

9%

are subject to a 2 year “Put Back”

agreement with TD Bank

•

Assets

backed

by

the

US

Government*

–

40%

•

Low Concentration Levels

•

CRE

at

139%

of

capital

vs.

300%

guidance

•

CD&L

at

34%

of

capital

vs.

100%

guidance

•

Operating leverage that is yet untapped

4

*Includes cash and cash equivalents, AFS securities issued by U.S. Government

Sponsored Entities, FDIC covered assets, and FHLB and FRB stock.

|

Opportunistic through the Crisis

5

1)

FDIC

Acquisitions

•

Ocala National Bank

•

Olde Cypress Community Bank

•

Independent National Bank of Ocala

•

Community National Bank of Bartow

3)

New

Fee-Based

Business

Lines

•

Correspondent Banking Division

•

Prepaid Card Division

•

Wealth Management Division

2)

Non

–

FDIC

Acquisitions

•

TD Bank divesture in Putnam

•

Federal Trust Acquisition from

The Hartford Insurance

Company

4)

Strategic

Expansion

&

Management

Lift-Outs

•

Vero Beach

•

Okeechobee

•

Jacksonville |

Reserves / Loans (%)

Credit Cycle Burn Down

Since 12-31-07, 9.3%

of

the loan portfolio balance

has been expensed as a

write down or elevated

reserves.

Credit Quality Trends

NPAs / Loans & OREO (%)

Problem Loan Trends ($MM)

6

Source: SNL Financial

Nonperforming assets include 90 days or more past due.

Florida peers include publicly traded banks and thrifts headquartered in

Florida. Southeastern peers include publicly traded financial institutions

located in AL, AR, FL, GA, MS, NC, SC, TN VA, and WV with total assets between $2 and $5 billion. |

7

NPA Inflows -

Slowing Down |

Building Franchise Value

with Core Deposits

Value of core deposits not fully realized in this low rate environment.

Approximately 103,171 total accounts -

$17,117 average balance per account

Core deposits defined as non-time deposits.

22%

18%

25%

15%

20%

Total Deposits ($MM)

Number of Deposit Accounts

8

DDA and NOW

6/30/10

6/30/11

Change

% Change

Balance

$497MM

$707MM

$210MM

42%

No. of Accounts

45,365

66,930

21,565

48%

2006

2007

2008

2009

2010

6/30/11

Jumbo Time

Retail Time

MMDA & Savings

NOW

DDA

0

500

1,000

1,500

2,000

352

260

448

311

396

10,579

13,191

11,001

12,025

14,998

14,802

32,280

40,822

43,974

54,561

78,874

88,369

0

25,000

50,000

75,000

2006

2007

2008

2009

2010

6/30/2011

Time Deposits

Core Deposits

100,000 |

9

Profitability Metrics

Return on Assets %

(PTPP excluding nonrecurring items and Correspondent Division) Net Interest Margin

% (excluding Correspondent Division)

Operating Expenses as a % of Avg Assets

(excluding credit costs, nonrecurring items, and Corresp Div)

|

10

Conversions Will Bring Efficiencies

Scheduled for September and December

Five

Completed

since

December |

11

Talent Acquisition through the Crisis

Name

Position

Age

Years in

Banking

Prior Experience

Dan Bockhorst

Chief Risk Officer

48

28

Fifth

Third,

IRNB

Chief

Credit

Officer

-

$800M

Jennifer Idell

CFO of Bank

36

15

Bank of Florida -

CFO

Darlene Bennett

Director of Operations

55

38

SunTrust -Central FL Operations & Technology

Cindy Robbins

Director of Retail

50

33

Barnett

&

Riverside

-

Director

of

Retail

-

$3B

Debbie Harsh

Director of HR

56

35

First Sterling & Colonial

Dave Kopec

Director of Residential Lending

52

28

First Federal S&L and Highland Homes

Brad Jones

Director of Correspondent Banking

46

20

Silverton

-

$5B

Joe Keating

Director of Wealth Management

59

35

Federal

Res.,

Old

Kent

&

Alabama

National

-

$8B

Presidents

Andy Beindorf

Treasure Coast

55

33

Flagship,

Indian

River

National

Bank

CEO

-

$800M

Gil Pomar

Northeast Florida

50

30

First

Union

&

Jacksonville

Bancorp

CEO

-

$600M

John Williams

Okeechobee Region

56

32

Farm

Credit

&

Riverside

National

Bank

-

President |

12

Results of Opportunities Since Crisis

**Results include approximate deposits and number of deposit accounts from Federal

Trust acquisition but does not include net income impact of $46M discount on

performing loans. OFFENSE INITIATIVE

Net Income

since

Inception

Total Deposits /

Assets $M

# of Deposit

Accounts

FDIC Acquisitions

$3,041

$327,981

33,862

Non-FDIC Acquisitions **

$7,696

$341,616

17,922

New Business Lines

$15,679

$362,429

714

Strategic Expansion

($1,150)

$69,233

2,812

Totals

$25,266

$1,101,259

55,310 |

Federal Trust Acquisition

13

Headquarters

Sanford, FL

Year Established

1988

Deposits

$230,000

Loans

$170,000

Self-capitalizing transaction

27% loan discount on selected performing

loans; 0% deposit premium

1 year put back on any past due or

adversely classified loan

Assumption of approximately $5 million of

TruPs at LIBOR + 2.95%

Efficiency achieved as 6 of 11 branches

closed

Dollars in thousands

Selected Deal Terms

Financial Highlights |

14

Federal Trust Loans

Selected SF 1-4

Balances by Origination Year

(Percent of Outstandings, excluding HELOCs)

Selected Residential Loans by Florida County

Selected Loan Criteria:

Loan

portfolio

mix

-

90%

1-4

Single

Family,

6%

HELOCs,

4%

Commercial

No

problem

loans

-

excludes

all

OREO,

nonaccrual

loans,

adversely

classified

for

regulatory

purposes

and

Troubled Debt Restructures

No

past

due

loans

–

excludes

all

loans

60

days

past

due

anytime

during

the

last

12

months

and

all

loans

30

days past due more than 2 times during last 12 months

|

15

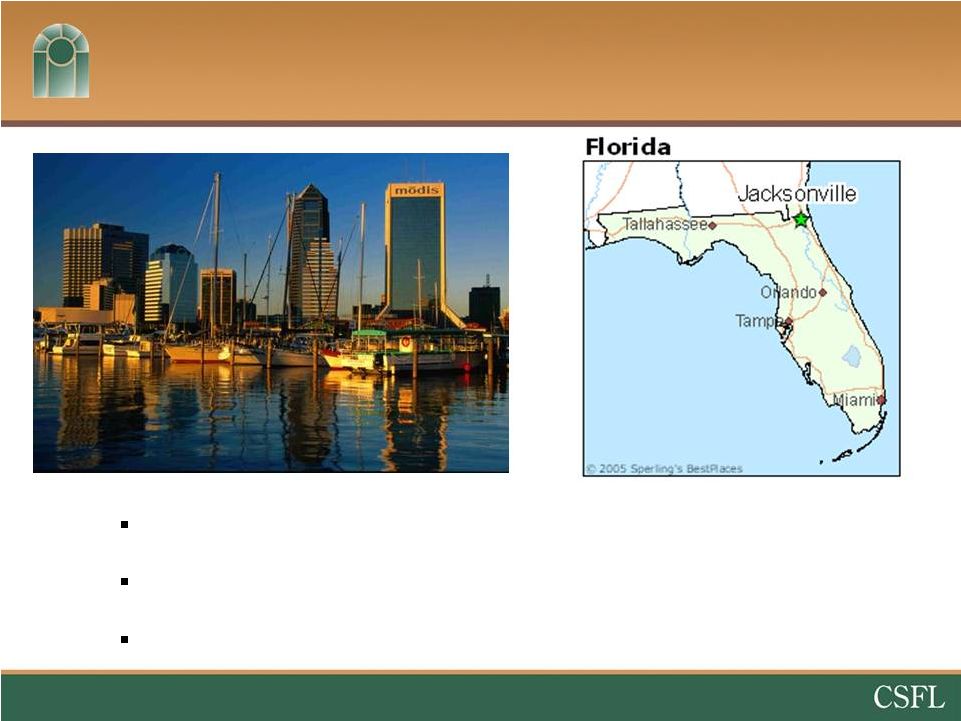

Greater Jacksonville Expansion

Gil Pomar on board as Market President of Northeast Florida

Previously served as President & CEO of The Jacksonville Bank

Worked with CSFL management in the 90’s at First Union

|

Summary

Energetic & experienced local management team taking

advantage of opportunities

NPA inflow rate declining the last three quarters

On the brink of realizing conversion related efficiencies

& operating leverage

Turmoil offers significant organic growth & FDIC

acquisition opportunities

16 |

Investor Presentation

Second Quarter 2011 |

Appendix |

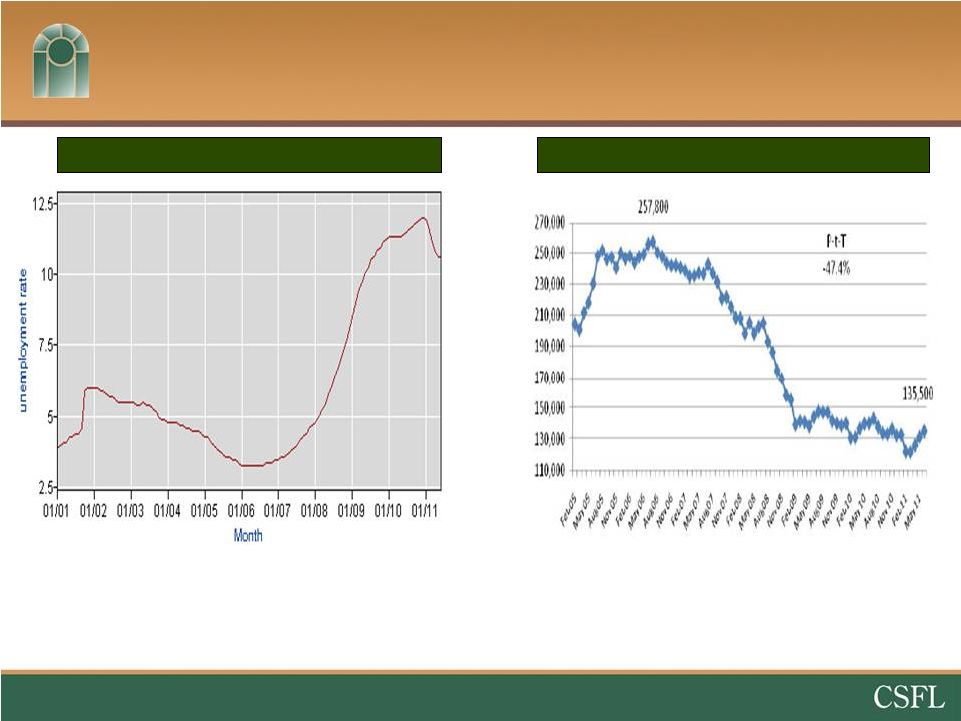

Florida Economy Slowly Recovering

19

Source:

The

Florida

Legislature

Office

of

Economic

and

Demographic

Research

&

US

Bureau

of

Labor Statistics

Unemployment at 10.6%, down from

12% -

eight consecutive months of job

growth after losing jobs for three years

Florida Unemployment Rate

Florida Median Home Price

Median home prices for existing homes

have been essentially flat since

February 2009 (27 Months) with a slight

downward drift |

Birmingham

Atlanta

Winston-Salem

Tamp

a

Winter Haven

Primary business lines

–

Bond Sales

–

Fed funds

–

Safekeeping, bond accounting, and

asset/liability consulting services

Customer

base

–

557

community

banks

Opportunity

–

Bank Clearing & Cash Management

–

Talent Recruiting / M&A

Correspondent Banking Division

Division Contribution

20

($000s, except per share)

2Q10

3Q10

4Q10

1Q11

2Q11

Net Interest Income

$1,319

$1,148

$974

$662

$1,113

Non-Interest Income

7,758

12,358

7,576

4,984

6,305

Non-Interest Expense

(6,740)

(9,249)

(6,689)

(4,978)

(5,732)

Income Tax Expense

(900)

(1,564)

(700)

(251)

(634)

Net Income Impact

$1,437

$2,693

$1,161

$417

$1,052

EPS Impact

$0.05

$0.09

$0.04

$0.01

$0.04

Management

lift

out

from

RBC

(formerly

ALAB)

and

Capital

Markets

Division

of

Silverton

(73 employees) |

Loan Portfolio

(excluding FDIC Covered Loans)

21

Loan Type

No. of

Loans

06/30/11

Balance

Avg

Loan

Balance

Residential

Real Estate

2,918

$262MM

$90,000

Commercial

Real Estate

1,405

485MM

345,000

Construction,

A&D, & Land

584

101MM

173,000

Commercial &

Industrial

1,187

113MM

95,000

Consumer

/Other

2,944

53MM

18,000

Total

9,038

$1,014MM

$112,000

Includes $105MM of loans purchased from TD Bank which

are subject to a 2 year “Put Back”

option .

Total Loans by Type

(%)

Total Loans Detail |

$65,959,000 (6.50% of Gross Loans)

25% of NPLs are current

74% of legal unpaid loan balance

(net of specific reserves and partial charge-offs)

$11,284,000

55% of legal unpaid loan

balance at repossession

date

Residential

Real Estate

$18,951K

(128 loans)

Commercial Real Estate

$29,437K

(76 loans)

Construction,

A&D, & Land

$15,344K

(61 loans)

Commercial

$1,612K

(27 loans)

Consumer / Other

$615K

(39 loans)

22

Commercial

Buildings

(13)

$4,615K

Mobile

Homes w/

Land

(5)

$262K

Vacant Land

(8 parcels of land)

$1,783K

Single Family

Homes (17)

$2,239K

Residential

Lots

(69)

$2,385K

Data as of 6/30/11

Non Performing Assets

(excluding FDIC Covered Assets)

Other Real Estate Owned

Non-Performing Loans |

23

Federal Trust Deposits

Total Deposits by Type (%)

Total Deposits Detail

Deposit

Type

No.

of

Accts

12/31/10

Balance

Avg

Balance

WA

Rate

Demand

Deposits

3,289

$11MM

$3,300

0.00%

NOW

778

18MM

23,100

0.42%

Savings

& MMDA

2,307

118MM

51,100

0.98%

Time

Deposits

3,107

87MM

28,000

2.42%

Total

9,481

$234MM

$24,700

1.44%

Data as of 12/31/10 |