Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FNDS3000 Corp | d8k.htm |

Exhibit 99.1

Source: FNDS3000 Corp

FNDS3000 CORP ANNOUNCES FISCAL 2011 THIRD QUARTER RESULTS

Jacksonville, FL (PR NEWSWIRE) — July 21, 2011 — FNDS3000 Corp (OTCQB:FDTC), an international prepaid processing company currently introducing electronic payment solutions to the South African market, today announced its financial results for the third fiscal quarter and nine months ended May 31, 2011.

THIRD QUARTER HIGHLIGHTS:

| • | We project that over $107 million will be loaded onto our prepaid cards over the next 12 months based on the third quarter results. |

| • | We have upped our projected annualized revenue run-rate to $3.21 million based on our June 2011 revenue. |

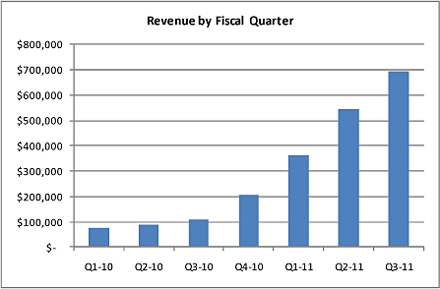

| • | Record revenues for the third quarter of 2011 were $695,000, up from $110,000 in the prior year’s third quarter. |

| • | Net loss for the quarter was $572,000 or $0.01 per share, compared to a net loss of $1,050,000, or $0.02 per share, in the prior year’s third quarter. |

For the quarter ended May 31, 2011, revenues were $695,300, an increase of $585,026 (or 530.5%) from $110,274 for the third quarter of fiscal 2010. The net loss for the quarter was $(572,214) or ($0.01) per share, a decrease of $477,918 (or 45.5%) from $(1,050,132) or ($0.02) per share for the same period in the prior year.

For the nine months ended May 31, 2011, revenues were $1,605,930, an increase of $1,328,547 (or 479.0%) from $277,383 for the nine months ended May 31, 2010. The net loss for the nine months ended May 31, 2011 was $(2,416,262) or ($0.03) per share, a decrease of $879,531 (or 26.7%) from $(3,295,793) or ($0.07) per share for the same period in the prior year.

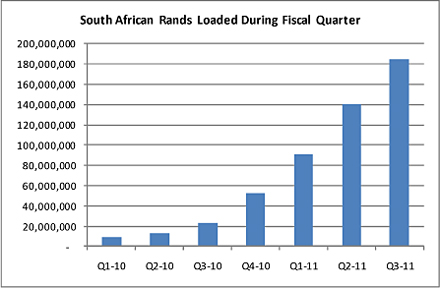

The Company’s Chairman, President and CEO, Raymond L. Goldsmith stated, “Favorable business momentum continued in the fiscal third quarter as we pursue profitability and a cash flow positive position. We have generated double-digit revenue growth for the seventh consecutive quarter and our bottom line has improved over the past two quarters by approximately $482,000 as we continue to implement direct local sales initiatives in South Africa as part of our plan to migrate away from our initial distributor sales model. We also continue to benefit from the transformation of our corporate leadership team at the end of September 2010 that has served to streamline our internal lines of communication and will have reduced non-South African corporate overhead expenses by approximately $1,000,000 by our year-end August 31. The continuing upward trend of our business can be illustrated by the two charts below.

“The South African rands loaded chart gives an indication of future revenue based on the premise that the more rands loaded onto the cards, the more revenue that should be generated. The volume of South African rands (ZAR) loaded onto our prepaid cards jumped 712% to approximately ZAR 184.6 million (approximately $26.8 million in U.S. dollars) over the same quarter last year and 32% over our second fiscal quarter of 2011.

“We are pleased to report that we continue to maintain no debt on our balance sheet. In the third quarter, the Company raised an additional $1 million and our need to secure additional funds to cover operational expenses continues to decrease each quarter as we work towards positive cash flow. We cannot provide a guarantee that we will successfully close any required financing or that such financing, if closed, will be on reasonable terms. However, with approximately $16 million previously raised, we are cautiously optimistic that we will obtain the necessary funding required to grow the Company.”

Goldsmith concluded, “Looking ahead, based on current business trends, we anticipate that both revenues generated and rands loaded onto our prepaid card platform will continue to increase in our fourth fiscal quarter. We will focus on expanding gross margins, improving working capital usage and operational efficiencies, meeting increased demand and enhancing our prepaid card processing platform.”

Detailed information on the financial results for the fiscal third quarter and the nine months ended May 31, 2011 is included in the Company’s quarterly report on Form 10-Q, which was filed with the Securities and Exchange Commission on July 15, 2011.

About FNDS3000 Corp

Headquartered in the U.S. with operations in South Africa, FNDS3000 Corp is engaged in executing a series of international growth initiatives designed to position the Company as a player in the fastest growing payment card segment: prepaid cards. Given that 40% of the adult population in South Africa is currently unbanked or underbanked, FNDS3000’s initial focus has concentrated on offering tailored prepaid card programs and services to business customers in this developing prepaid market, including network branded and closed loop programs that support employee payroll, insurance, medical aid, gift cards, prepaid cellular charges and small-scale international transfer of funds. The Company provides these programs and services through a proven, proprietary U.S. processing platform that has been designed for international and cross border capability. For more information, please visit www.FNDS3000.com.

Forward Looking Statements

Matters discussed in this press release contain forward-looking statements. Investors are cautioned that such forward looking statements involve risk and uncertainties, which could significantly impact the actual results, performance, or achievements of the Company. Such risks and uncertainties include, but are not limited to, the potential loss of our relationships with each of the parties that sponsor our cards and banks that manufacture, issue, and own the cards; the loss of our service providers; security breaches of our electronic information; the inability to raise sufficient capital to fund its operations; and other risks as may be detailed from time to time in the Company’s periodic reports filed with the Securities and Exchange Commission. The Company assumes no obligation to publicly update or revise its forward looking statements even if experience or future events make it clear that any of the projected results expressed or implied herein will not be realized.

Contact:

Joe McGuire

Chief Financial Officer

FNDS3000 Corp

904-273-2702

jmcguire@FNDS3000.com

www.FNDS3000.com